tv Bloomberg Markets Asia Bloomberg June 14, 2023 11:00pm-12:01am EDT

quote

11:00 pm

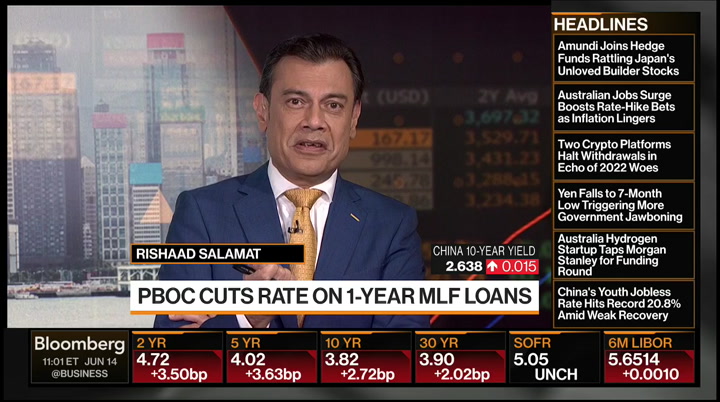

11:01 pm

11:02 pm

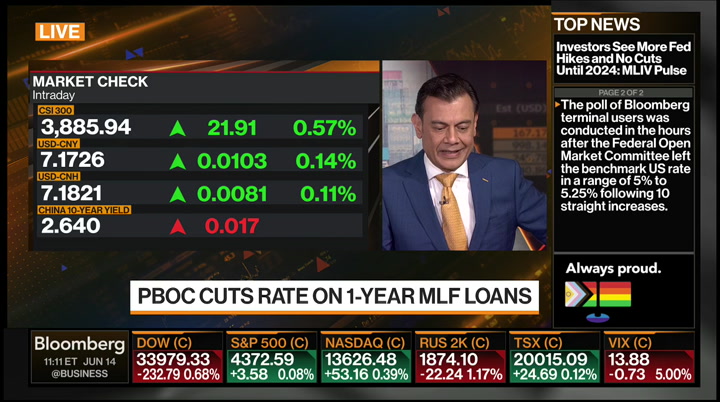

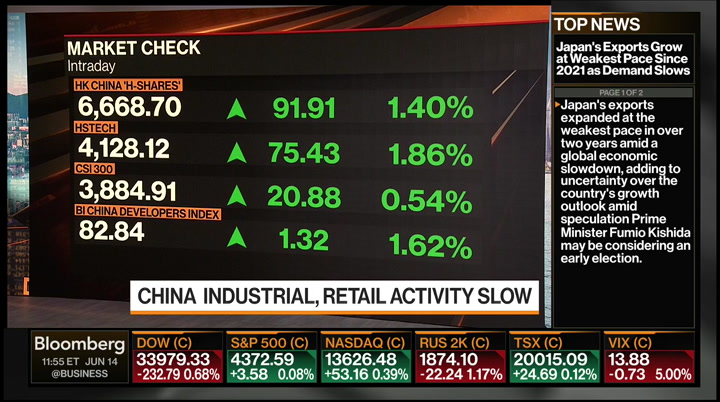

keeping an eye on the ball -- aussie bond market, we have a case we have not seen since 2008, 8 reflection of the asportation of bond they. >> and also china there and indeed we have that 10 basis points cut in the medium-term. that -- does that move the needle at all, we will find out. that was also a confirmation of the inherent weakness that we see in china's economy. this has also been reflected in a veritable avalanche of data that we had as well, including industrial production which was actively in line with expectations, but gains base effects, we had an lockdown last time this year. retail up just set -- 12.7 percent, weaker than expected. property contracting where it was not before. this is making itself felt in

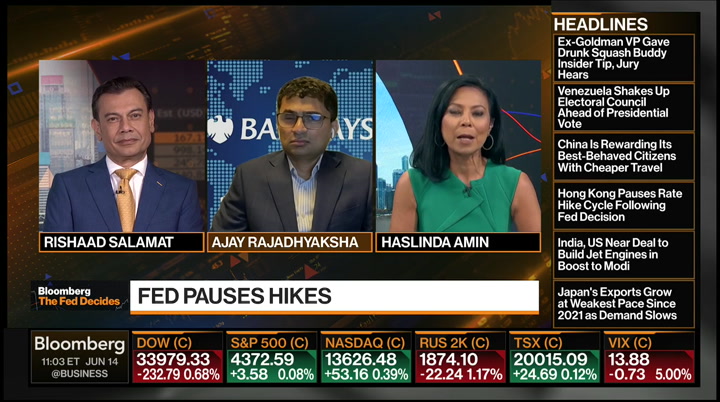

11:03 pm

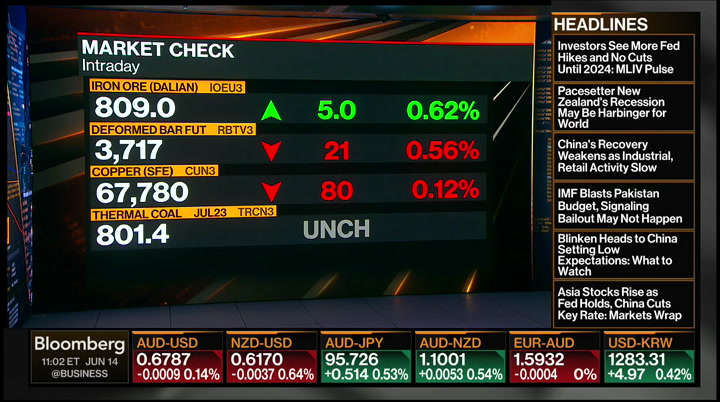

the bond market and its benchmark indexes for equities. perhaps this will increase further pressure on to authorities in beijing to and gender stimulus. we see again therefore these equities in china, and see in white yuan there, it had weakened initially and continues weakening. as far as commodities go, certainly weaker, china means last demand. which means lower prices. big evidence there particularly as we see steel in that deformed bar future down due to chinese weakness continuing. >> let's get back to the fed hitting pause, leaving rates unchanged for the first time in 15 months. jerome powell also signaled more hikes and as the inflation rate stays above target. >> the risks of overdoing and

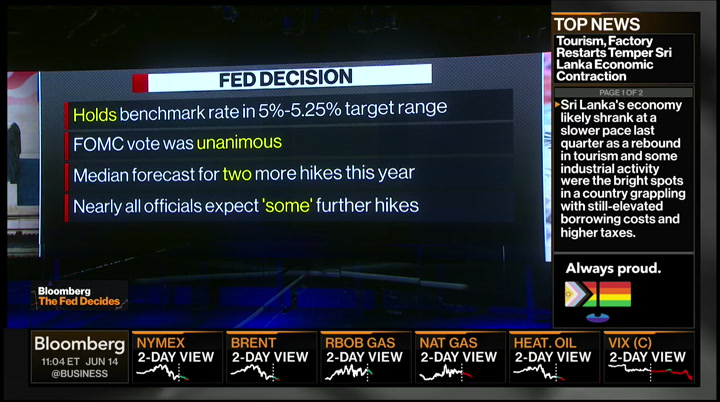

11:04 pm

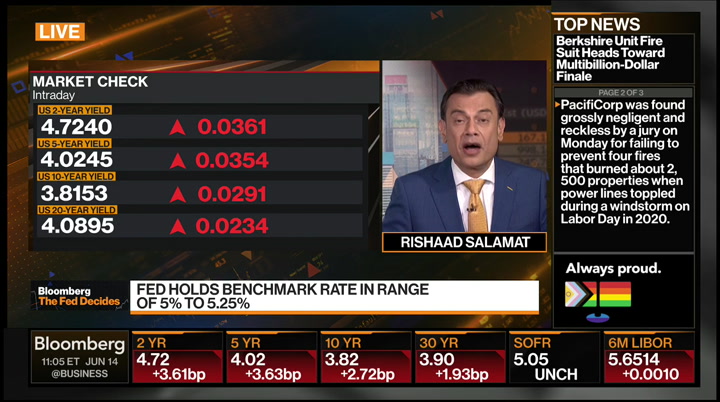

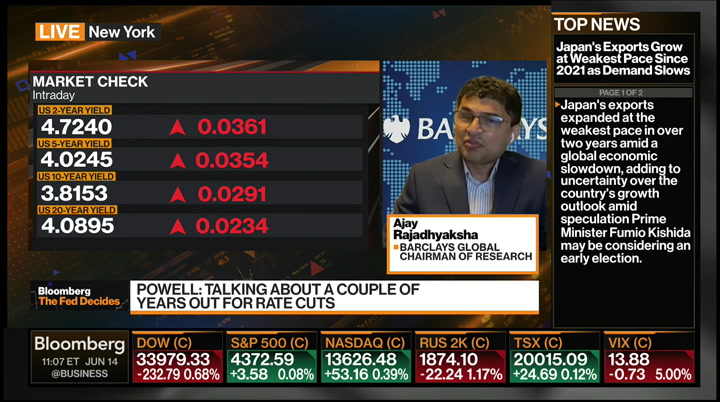

under doing it are close to being balance. i still think and my colleagues agree that the risk to inflation is still to the upside. it will be appropriate to cut rates at such time as inflation is coming down. really significant. and again we are talking about a couple years out. as anyone can see, not a signal person on the committee wrote down a rate cut this year. >> let's get an insiders perspective, with our global chairman of research at barclays. no surprise, powell stood back. but moving the dot by 50 basis points, how much of a surprise was that? >> that was a surprise. the market was pressing in maybe one more hike at best. and they went out of their way to put into. the recent it was a surprise was because a lot of times, we had that called by the way, but a

11:05 pm

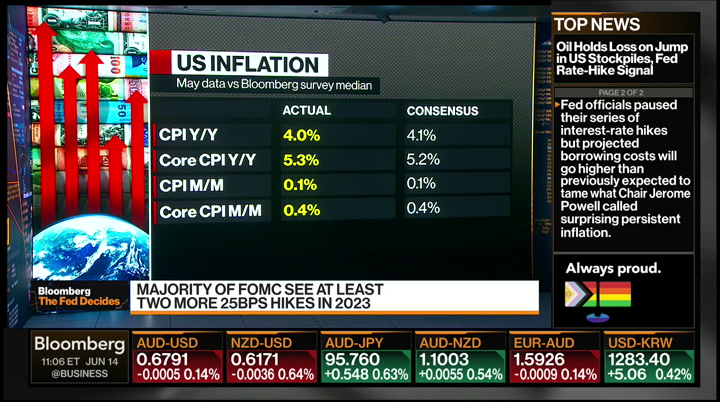

lot of times the fed is trying to surprise markets to the upside. if there is inflation then why stand back. if you had not had that speech to wednesday's ago right before this, i think the fed would have gone today. >> how many more hikes do you think, some are suggesting one, another two, might we see a more hawkish fed? >> i don't think it is out of the question. i was watching a program earlier and i noticed there has been a bunch of sector plays who came back and said that we are not down, the bank of canada, the swiss national bank, the united kingdom had horrible inflation data yesterday, it was not the u.s. bond market moving. and i don't think they can rest easy at all. they just pushed up core

11:06 pm

inflation by 30 basis point. it's not a question, they will do tomorrow what is more than two out of the question, no it is not. >> are they doing the right thing, i mean, a pause is a good idea, to take stock of what is happening. but there is the danger they will make a mistake here. and i think the former president of the chicago fed said everything boils down to one question, what kind of policy mistake are you most comfortable making? >> it depends on how you to find -- defined this. there up by 120 basis point, the peak for most people. that would put the jobless rate below 5% from a historical standpoint, that is very very very low. meanwhile, starting from 20 to

11:07 pm

anyone, inflation models have blown them out of the water, they have been wrong and wrong and wrong some more. they can't keep being wrong and blaming everything on the russia ukraine more. they are turning to focusing on current data and current data says they should ease. >> but this is another trend, you look at longer-term trends, which might change this whole inflation story to one that is structural here. the three d's, deglobalization, decarbonization and demographics, all three are all inflationary. so, how do you deal with that as structural shifts become harder and harder to deal with and hence we get that word, sticky? >> i think of those three d's, the greening of the economy and

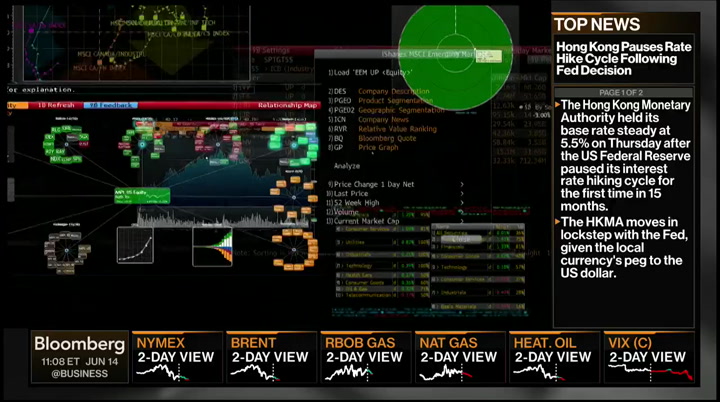

11:08 pm

carbon controls, and the demographics, they are all quicker moving than the first one. did globalizing is not showing up in some time. not so long ago, chinese exports were absolutely killing it. that is not a case where you can move quickly out of china. i think we should be comfortable with a higher inflation basis, it's beyond their control. it is very hard to do that when it come from the top down. i want to lose 20 pounds of the start of the year, and i lose 10 and then i say, well, you know what, i am changing my goal. now i only want to do 20. that is why you lose. you cannot do that right now. so if you want to perspire to an average of 3% going up from one to have to percent, coming down, stopping before you hit two, if

11:09 pm

they do that, they won't, if they do that they are losing out to inflation. >> we don't need powell to tell us that we are far from 2%. what is your restrictive rate, 655 has been pointed out to us. >> we have to think about the pace of the hiking cycle, and how long it will stay there. all three things matter. i think the level needs to be around 557. but more importantly they need to stay there for 9-12 months at least. that is what i would worry most about. next year is an election cycle. if you do have all this turned negative, even though on the jobless rate, there will be

11:10 pm

difficulties. and the question is whether they buckle to quickly under coming into quickly. >> i just wanted to turn your attention to the dollar in yields, where they headed >> i think the bond market is reasonable price at this point, the -- they keep being shown as willing to appraise the market from time to time, which is why the yield curve isn't being murdered. the dollar obviously, it had a brief moment in the sun, but there are not that many alternatives right now. it's nonsense. the united states is the cleanest sure, but the laundry is full of really do -- 30 shirts. the u.s., i am telling you, there might be an limit of

11:11 pm

hyperbole, but the united states and the dollar absolutely is benefiting from this. that is not changing. >> china, confirmation today about the weakness of the economy, how weak is it and how it is -- is it at the moment informing you of your positioning at barclays? >> it's very weak. for the first quarter, the first numbers absolutely surprise us to the upside. i was prepared to ignore concerns in china because i thought they would be strong. and it surprised me how quickly activity picked up. but just in may the data has dropped off a cliff. turns out it was a brief flash in the pan. nothing for the chinese economy to brag about. i know you're going to get a

11:12 pm

little bit of a bounce back the second half, but they have structural drives, local government in debt, overinvestment in property, there demographics are not good. those are going to continue to weigh down. and i don't think the government is prepared to do the kind of credit that they did in 2016. it's disappointing. >> just a last question here. the ecb decision is out and we expect to five basis points for a hike, very quickly, you know, what is the deal for them? >> i think they will be careful to emphasize that they are nowhere close to death. they will keep say that the next meeting remains wide open and she well, i'm telling you, have a wary eye on the u.k.

11:13 pm

experience. the two economies are not that far apart. the united kingdom's inflation profile is in shambles and that is a function of the last month of inflation data. >> always good to have you with us, great insights. global chairman of research at barclays. so had this hour, a conglomerate in its last stages of a billion-dollar as that selloff. we speak excuse way to their ceo about the sale, the portfolio and the asset landscape. >> the hong kong set to launch with counter trading. a closer look at this model with their cohead of equities product of element on its way up next. -- product development up next.

11:15 pm

11:16 pm

>> we have equities buoyed up and take apparently leading the gains on the hong kong market. we sawtek do exactly the same thing on wall street as well. looking at course of hstech and hank sang because they trade on one platform and one company is very much in the frame for that. yvonne man joins us. she is at the greenwich economic forum. it on. -- yvonne. >> there are about to roll out a very exciting program, the hong kong dual counter trading set to roll out on monday. physically giving investors a choice now whether you can use the hong kong dollar or another currency to trade and settle for 24 companies from the hong kong

11:17 pm

chance, alibaba, tencent and the like. joining us now from the form is brian roberts, the cohead of equities product develop it. congratulations on the new role. -- development. congratulations on the new role. you have been very involved in this outlook -- develop and and we want to know what your outlook is, because we have seen previous models fall flat. >> we appreciate you having me here today and excited for the economic forum to shortly kick here as well. but we are excited for the launch of this hong kong dollar concert initiative, it is a bit of a mouthful. it is an exciting initiative and it has been months and months of work not just here at the exchange but really across the market to really bring this program out. as you mentioned, we have 24 hks listed companies which will be listed alongside their hong kong

11:18 pm

dollar training counter. it is important because it will bring more choice to investors and it will allow them to continue to trade in hong kong dollar if they like, or trade in raymond b, and one of the cargo parts of this initiative is supporting the internet sanction -- internationalization of this. this is important, this is a journey, not a one day destination but we are excited for this to come to market. >> it was like the first large, it was slow and then it picked up. in terms of estimates and the percentage of turnover, for rmb and hong kong dollar do you have any targets? >> we are doing this with a long-term. again, this is one initiative of many that we have ruled out over many years, stock connect, share bond connect, all of these

11:19 pm

supporting the internationalization of rmb. as it becomes more widely used in the global market, this initiative, along with all the other ones i have mentioned will continue to gather steam overtime. >> the you have any numbers in terms of how much of a boost may turn over, short-term and long-term? >> we do look at different things along those lines but i think again for us, it's not necessarily what we are expecting it's more around continuing to support the rmb national. >> what is a success for you, is it the right mix for the other factors? -- for the other factors? >> we have the 24 companies that will be listing the counters here. we are also whirling out what i think is an interesting program,

11:20 pm

dual counter market-making programs, we have nine marketmakers from around the world which will be providing liquidity for both the hong kong dollar and the rmb counters for these companies. this is something -- the first time we will have a market-making program for stocks listed on hks. we had other programs but we now have in stocks. longer-term for us, this is kind of day one. we want to continue to see more and more companies this both in hong kong dollars and rmb counters and we are going to continue to support that and -- support that and see more companies settling with securities and will counters. we see more moneymakers coming

11:21 pm

into the fall. where we want to see is the inclusion of rmb counters in southbound stock connect as well. and those are activist discussions -- and we are having active discussions on those. >> that was happening last year. where are the discussions now with china? >> there active. we are having active discussions with our counterparts over there. we are working to make that reality. different things that we will have to do operationally on both sides to enable investors to be able to trade rmb counters. >> are there any hurdles, what is the hold up? i don't think that there is necessarily any kind of particular hurdles, i think it is more around whenever you do these kind of programs they take time and they take enhancements and we need to be able to make sure that we do that in a thoughtful way to make sure that when southbound is enabled it can be done efficiently both from a trading and substance. >> i was going to talk about equity trading because it drops below that 100 billion-dollar hong kong dollar mark. since may. do you think that there is any

11:22 pm

reason for that, other ways that the exchange can boost that? -- are there ways that the exchange can boost that? >> this initiative will add another dimension of liquidity to our equity spot. when you look at the softness happening in cash equities in hong kong over the last weeks. part of this is global macroeconomic conditions playing a role. hong kong is unique in seeing some self -- is not unique seeing softness. while there is softness in the cash equity market we operate a very vibrant and diversified market. our etf market is going strong. we are up 27% this year, year over year. trading 1.8 billion u.s. dollars a day this year, on top of significant growth we expensed last year around 50%. and that the equity derivative space went from strength to strength, we are up 7% year-to-date. we are trading over 40 billion

11:23 pm

u.s. dollars in value a day. very deep, very liquid markets that we operate on. so we are not really just dependent on one particular segment of the market. >> i was going to ask you to put on your etp hat, given crypto, is it time for the exchange to jump on the bandwagon and maybe actively list crypto etf's are crypto futures -- or crypto futures? >> we do have crypto etf's list, -- listed. tracking bitcoin and etherium. those launch last year on the back of hong kong government, the sfc putting out a were conducive regulatory regime for crypto assets and digital assets in general. i think that is important, seeing what has transpired in the crypto space last year.

11:24 pm

it's good to see hong kong as a whole coming together to put in really strong relate -- regular tory frameworks around crypto assets and digital assets because that is what we need more of. we don't need less of that. we need more of that kind of regulation into the market and we will continue to support it and we are hopeful that we will see more crypto etf's and more futures coming down. and build out the ecosystem for asia. -- building out that ecosystem for asia. >> head of equities development here at the greenwich economic form. back to you guys. >> indeed, we have a lot more on the way, looking at the estate of corporate philippines and a direction to that data dump that we had earlier from china. here -- you are with bloomberg. ♪ introducing j.p. morgan personal advisors.

11:25 pm

11:27 pm

>> welcome back. the asia index under pressure by chinese stocks in particular, bucking the trend. we have the pboc cutting its one-year mlf by 10 basis points as expected, also adding liquidity by 37 billion yuan. in the aussie market we see in versions for threes and tens for the first time since 2008. that was because of employment data coming in wait longer than expected. exclusively coming up from the philippines largest and oldest conglomerate. this is bloomberg. back in the day, sneaker drops meant getting online to wait in line. now with xfinity mobile... ...we get the fastest mobile service and can get the freshest kicks asap. i got this. save hundreds a year over t-mobile, at&t and verizon

11:28 pm

11:29 pm

when you show generosity of spirit to someone. and you want people to be saved and to have a better life, then you don't stop. we have been able to reach over 100 million people impacted and affected, and at risk of hiv. the rocket fund takes all of the work that we're doing, all over the world, and looks at the most effective ways, to get resources to them, to get services to them. the idea that we have saved five million people's lives, it's overwhelming. it's everything. rishaad: the philippines market

11:30 pm

in the doldrums down by .5 to 1%, manila composite, we are seeing dollar strength playing out against the peso, 56 is the handle right now. you will know why in the second, and about 10 or 15 seconds while you're looking at it. it is a country rocked by a 6.2 magnitude earthquake 11 kilometers southeast of hukay. this has rocked the northern part of the country, and our next guest is right there, is he not? and he would've felt it. haslinda: that is right, let's get an update from the man himself, president and ceo of the ayala group, good to have you with us. i hope you were safe there. front and center what is key to ayala is its fundraising.

11:31 pm

we know you have raised 60% of $1 billion targeted, and wondering where are you with the rest? what other assets are you looking to sell? >> we are 60% of the way there. we have a target of about $1 billion. we have lined up a bunch of assets where in some cases we are more passive, end of the cases we went to rationalize at the portfolio a little bit. we are confident by the end of this year we will be at or close to the $1 billion target. haslinda: so what will you be doing with those assets, with the proceeds? you have targeted some of those emerging businesses like health care for instance. is that where the money will be headed? >> some of it will be retorted -- headed toward health care and other growth businesses. some of it might go through our

11:32 pm

more established businesses. remember, this is a country that might grow 6% this year. i was looking at the growth rates in the next five years we will be in the order of 6%, 7%, 8%. in a five-year period you will have an economy that grows 30% today. that is growth we would like to take advantage of. haslinda: anymore plans to raise further funds if that is the case? we heard from the finance ministers saying it will meet his growth target for the year? >> the funding at the operating company levels is pretty much said. ayala is in good shape funding was, we continue to raise funds by liquefying towers. if there is one area that will probably need more funding it is

11:33 pm

a renewable energy company, just because it is growing so quickly. the company this year is launching a wind farm. it just launched a wind farm in lagos -- laos, which is sending energy to vietnam. it just launched the largest in australia. the company will continue to grow, and that will probably need more capital from us. rishaad: i just -- we have heard the finance secretary talking earlier saying the company is still maintaining and committed to 5% of gdp to be spent on infrastructure. how do you benefit from that, and how are you benefiting from that? >> rishaad, we are a country

11:34 pm

that is short infrastructure, and if we really are going to grow 6%, 7%, 80% over the next five years or so, we will need all of the infrastructure we can get. it is in the newspapers now, we are part of this consortium to redevelop the airport. it is a big consortium. it evolves six of the largest conglomerates in the country, plus the gip, which is a huge infrastructure firm globally. we put a bid to the government and said, look, let's fix the airport precisely because we think the philippines, at these growth rates we could hit middle income status, upper middle income status fairly soon. we have got to take advantage of that. we have got to open up our company -- country, allow for more tourist to come in here. the whole world is flirting with

quote

11:35 pm

a recession, and we are looking at with rates of 6%, 7%, maybe 8%. the philippines will distinguish itself in a world that might be slowing down? -- down. rishaad: they have often

11:36 pm

better insync educational system will address that, so it is both of those things. rishaad: bong, you purged credit suisse deleter efforts. what m&a plans do you have for the next 12 months?

11:37 pm

m&a capability in-house, and our hiring of this gentleman represents of that. rishaad: which -- haslinda: which sectors? would it be in real estate, telecom? what are you looking out? >> you have to assume we would look at anything that is attractive that is already in our existing business segments. in real estate, for example, or in energy or in health care or logistics. things that we are already in obviously we would look at. things that we are not already in we would probably be more cautious. we would probably be more measured, stuff that we are already in, that we would look at automatically. not that we would do it, but we would look at all opportunities that come our way. rishaad: it sounds like you are

11:38 pm

more in favor of acquisitions, which brings me nicely to say which parts of the business are weaker and need something like that and which of the ones going great? >> our core businesses are doing fine. if you look at our four core businesses, they could all do transactions of their own. bpi just bought robinson pasta has several months ago. they will all do what they want to do in the ordinary course of business, and they will grow by themselves. the more nascent businesses, we will probably try to bulk up also. that is true for health, also true for logistics. they will try to bulk up either by raising capital and going

11:39 pm

internally or by electing other assets. health care and logistics are highly fragmented industries in the country, and there is room for consolidation. rishaad: absolutely, obviously infrastructure again would you look at just six, a key component there. are you at the moment -- you are obviously looking at the macro picture within the philippines, but when it comes to m&a, are you looking up broad? how do you expand also internationally? >> the most international of our businesses is acen, a renewable energy company. more than half of the pipeline is offshore, australia, vietnam. that is a natural international play, and it is a function of opportunities.

11:40 pm

there are a lot of opportunities offshore. the local landscape is also looking quite in distressing -- interesting. i think we will grow domestically and internationally. especially acen. rishaad:ayala's net income came up strong. is that pace of profit growth sustainable? >> alaya in the first quarter was up 61%. is it sustainable? maybe not, but we will try to maintain a good growth rate. we are already at pre-covid levels, which for us was a key benchmark. we would like to accede to exceed pre-covid levels, but for that to happen most or all of our businesses have to be hitting it on all cylinders. right now, it is still a mixed bag.

11:41 pm

bpi is doing great, ayala land so much better than vice chair. acen, so much better than last year. steady, steady, but i am looking at this year and saying this could be a solid year for us. haslinda: why do you think investors are not in into the story? take a look at stocks, down 6% year to date, underperforming the benchmark, which is down 2%. down 6% for ayala. what would it take for shareholders to buy into the story, and what are you doing to increase shareholder value? >> i just came back from an investment road trip in london, and the feedback we got was the tone in the country is pretty good. what investors want to see is they want to see some concrete steps on the part of our

11:42 pm

government to really try to capture this positive tone, to build on this positive tone. frankly, a refurbished leg of the airport might be one of those concrete steps. now for the company itself, all we can do is make sure that we continue to do the basic day-to-day stuff well, we continue to make sure that our operating companies are number one or number two in their segments, and that is true for all of our core businesses. we have to make sure our smaller and more nascent businesses grow. we have to make sure we are responding to this new market to, that we are taking advantage of technology, that we are becoming more digital, becoming more mass consumer-based. we have to show we are adapting to an economy that will be very exciting and the next few years. that will take some time, but i

11:43 pm

suspect if we do our jobs right, obviously we cannot control the market, but if we do our jobs right the market will recognize the value that we have. rishaad: a question here about the business imperative at the moment is perhaps esg. how are you informing your business and shaping your business by that philosophy? do you have plans to go carbon at any stage? >> we announced a carbon that zero target for 2050 back in 2021, and this year we are going to the painstaking exercise of preparing a roadmap for each of our business units. that is easier said than done. it is especially challenging for the bank, because you have to realize the bank as all kinds of clients and all kinds of segments doing all kinds of

11:44 pm

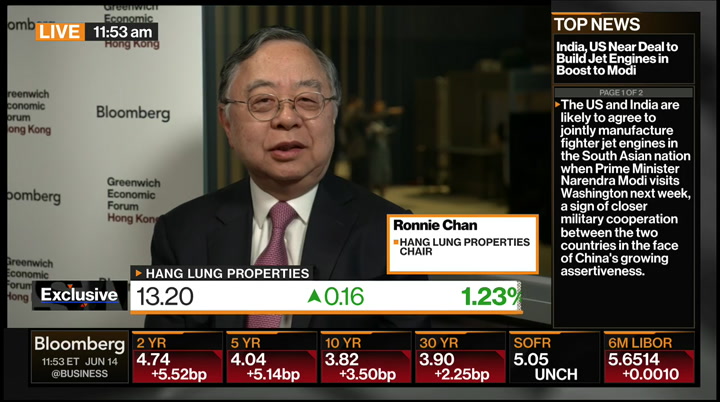

things. very difficult to impose esg requirements overnight on the bank's borrowing clients. that is probably the biggest lump we have to address over time, it is work in progress. we are looking at all of the standards. we are working with some of the best advisors in the world. this is something our chairman and former ceo put right at the top of the list in terms of priorities. we intend to be a leader in esg in this country. haslinda: always a pleasure, in person . president and ceo of ayala group. the greenwich economic forum in hong kong, are just speaking exclusively. ronnie chan will give his outlook for the property sector. that is next. this is bloomberg. ♪

11:45 pm

you got this. let's go. gobble gobble. i've seen bigger legs on a turkey! rude. who are you? i'm an investor in a fund that helps advance innovative sports tech like this smart fitness mirror. i'm also mr. leg day...1989! anyone can become an agent of innovation with invesco qqq, a fund that gives you access to nasdaq-100 innovations. i go through a lot of pants. before investing carefully read and consider fund investment objectives, risks, charges, expenses and more in prospectus at invesco.com.

11:46 pm

11:47 pm

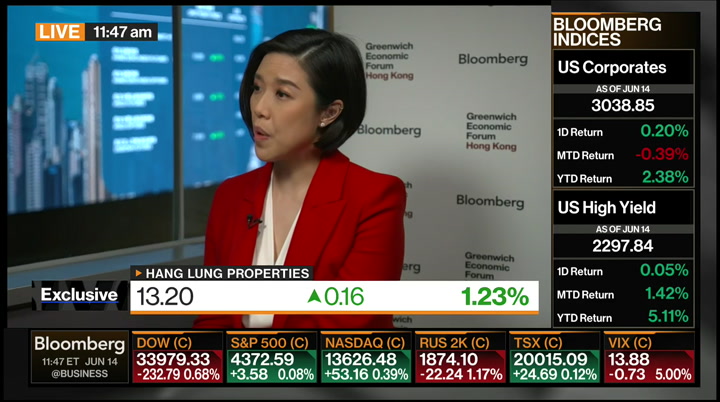

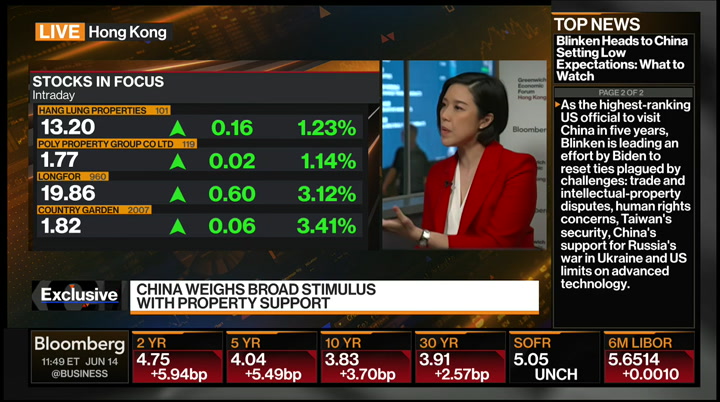

market is poised for a new record high. there has been a lot of interest especially from foreign investors, and goldman sees india holding his own even if chinese talks were to do well. india under pressure. rishaad: just checking in on hong kong 15 minutes before they go for their lunch break, and a quick check on the hang seng and copy companies -- property companies in particular. looking at sunac, one of the biggest gainers. it has a winding up threat cleared up by a court decision, and propelling that stock and helping some of these others as well. hang lung and focus too, about 1.23%. the greenwich economic forum where the ceo of the company joins us now as well. if on -- yvonne.

11:48 pm

>> we have the properties chair joining us right here at the hong kong exchange. obviously there is a lot of buzz in hong kong now. we have this event happening, and things are opening up. your outlook for the market? >> it should be ok. over the next one or two or three years. it is good. >> we just had a fed meeting that sort of surprise the market, the fed may not be done tightening, there may be two more hikes to come. can this does market withstand higher rates? >> the rates are one issue to consider, it is not the only one. the interest rate has not been that high. such events always happen. i do not think it will impact things too much. >> what about commercial

11:49 pm

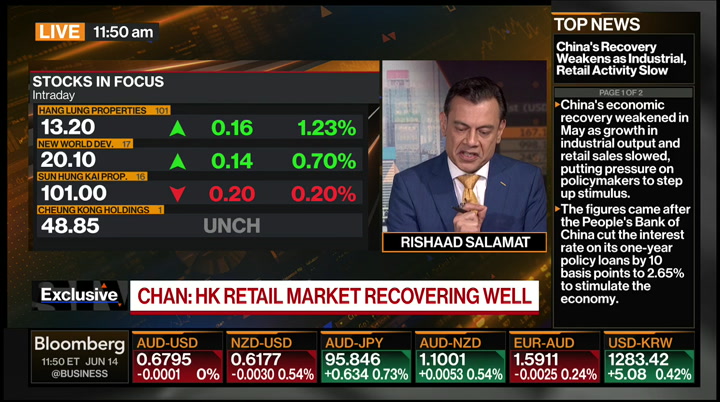

property? there seems to be a bit of a lull here. do you see signs of recovery in the commercial side? >> the retail side is recovering quite well, but if you are talking about the office side, i think that gradually it should be ok, but for the time being it is under pressure. >> you think the retail side of things, can that actually offset what you see in the office space? this reopening we have seen in hong kong, there are a lot of concerns about china and the consumption concern. as an operator of luxury malls, are you concerned about this? >> in china we do have a lot of it, but in hong kong i think retail is recovering well. offices are still a little weak. we prefer to go with two engines. right now we have one.

11:50 pm

you mentioned about luxury retail, luxury retail on the mainland is doing very well. i was just there at the board meeting there. we had a record year in 2020 one and another in 2022. i hope we have another record year this year. >> given what we have seen during covid with a lot of wealth headed to singapore while hong kong was shut in some ways, or you seeing signs of the capital coming back into the city? and are there still more measures needed in the property market in hong kong to boost demand? >> first of all, people do not move out of hong kong because of real estate prices only. i was just with a senior former officials in singapore who were together in europe, and we all agree there are limits the size

11:51 pm

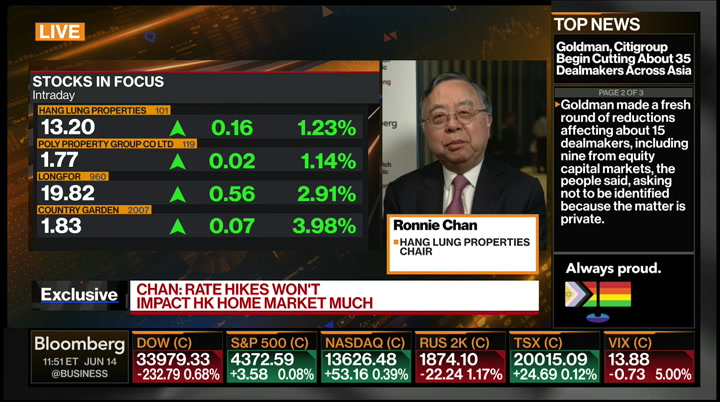

wise as well as many social issues. hong kong does not have a monopoly on social issues. everywhere does, singapore included. i think the move toward singapore, perhaps we are at the tail end of it. i do not see what people should move out of hong kong to wherever. to me it is a dumb decision. rishaad: ronnie, i want to get a sense of this. you were saying i am witnessing something today in the kingdom that reminded me of what happened 30 or 40 years ago in china. what are you referring to here specifically? >> first of all, it is a nice misunderstanding. i was speaking in saudi arabia, so the kingdom refers to saudi arabia. what i see there today reminds

11:52 pm

me of what happened 30 or 40 years ago when china opened up. china as always -- has not always been an open economy. until a few years ago, you have to have agencies or companies, institutions to sponsor you to get a visa. nowadays i was taken by surprise , you just punch in and bingo, you are there. the whole country is opening up, and there are a lot of big projects going on there. that reminded me a bit perhaps on a small scale of what happened to mainland china when they opened up the market 30 or 40 years ago. rishaad: and of course, running -- ronnie, saudi arabia and chinese ties are growing. what is hong kong's role? is it primarily as an interlocutor?

11:53 pm

>> hong kong is an outward looking economy that will always benefit wherever. china, russia may be different than hong kong, but those things that china does externally it be beneficial to hong kong, so i am excited. >> have you learned of any concrete deals that could benefit the city here? >> i have a young lady who wanted to go with me last month. because of some mishaps, and she cannot join me last trip, but this is -- this would have been her third trip in nine months, so people are truly serious about it, looking to it. for example, hospitality, hotels, tourists, there is a big market for it. rishaad: we have a very quick

11:54 pm

one, you are building homes and houses in an exclusive part of hong kong. how much will they be going on sale for? they will reportedly be eye watering the -- wateringly expensive. >> i do not know. we are still in the planning stage, so i cannot tell you a number, although it is an interesting phenomenon that soon after we bought the piece of land i have half a dozen to one dozen wealthy people from wherever, including the mainland of china who are wanting to buy a unit, so the more they show interest, the more reason to up the price, but it is what the market will bear. we will see. we are two or three years away from really praising it, so we will see. >> i wanted to ask you about the

11:55 pm

china property market. retail is positive, but the macro picture does not look too good. the 16 point plan sounded promising but did not do enough to turn it around. what else is still needed? >> i think confidence is important. in a market economy, how people feel is critical. >> how far could you go? >> if prices are good, why not? >> on the commercial side? >> always on the commercial side. residential only as a complement our retail space. >> always good to have you. the property chair joining us here at that greenwich economic forum. rishaad: a quick look at markets as we have the lunchtime break

11:56 pm

nearly upon us for hong kong, looking at the weakness intranet being evident in some ways by the scott we saw it. on top of that, we are looking at the data earlier, retail sales -- a tough base effect as well. the industrial production number in my with expectations, but investment feeling it for the time being. we have got a lot more coming up right here with more visits to the greenwich economic forum and bloomberg "daybreak: middle east" coming your way next. ♪ things like changing tax rates or filing returns. avalarahhh ahhh

11:57 pm

get help reaching your goals with j.p. morgan wealth plan, a new tool in the chase mobile® app. use it to set and track your goals, big and small... and see how changes you make today... could help put them within reach. from your first big move to retiring poolside and the other goals along the way wealth plan can help get you there. j.p. morgan wealth management.

11:58 pm

we moved out of the city so our little sophie could appreciate nature. but then he got us t-mobile home internet. i was just trying to improve our signal, so some of the trees had to go. i might've taken it a step too far. (chainsaw revs) (tree crashes) (chainsaw continues) (daughter screams) let's pretend for a second that you didn't let down your entire family. what would that reality look like? well i guess i would've gotten us xfinity... and we'd have a better view. do you need mulch? what, we have a ton of mulch.

12:00 am

44 Views

IN COLLECTIONS

Bloomberg TV Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11