tv Making Money With Charles Payne FOX Business April 22, 2024 2:00pm-3:00pm EDT

2:00 pm

if you have the fundamental desire to make money, serve people, build something you can find away to do it. i was here at 6:00 a.m., guys, to get set up for this, there were already people here networking, drinking coffee. this place is popping with the desire to do something great. larry: i love the energy, i love the optimism. brian, great reporting. you see the markets, the dow is up 416 points in the middle of session as we kick it off today. we'll send it over to charles payne. charles: thank you very much. great, great showdown there. folks good afternoon, i'm charles payne. this is "making money." breaking right now while stocks are rebounding today make mo mistake there are chinks in the armor, folks. the drivers of this market that seem invincible seem most vulnerable. kim fisher is here with several reasons why this is still a bull market. it is earnings season.

2:01 pm

it is high gear this week. four of those names are reporting. one of the best in the industry, beth kindig will break it all down. gary k. who took profits before the big swoon want to know if he is ready to buy again. financial reserve, recognizes surge in policy uncertainty in nancy davis, mike kantrowitz, what is next for the market. will it be rate hikes or rate cuts? my take on google reaction to employee moment, is this a watershed moment for esg other pushing back on esg. all that and much more on "making money." ♪. charles: all right, so we're in a rough patch, right? what does that mean for the stock market? well, let's face it the first test of 2024 is upon us. the swoon you think speaks for itself. higher for longer is the issue. everyone is sort of concerned about right now. financial releases, we're in

2:02 pm

earnings season. really haven't been that great to be honest with you. then of course the swoon which i said speaks for itself. you can see already, you could argue are we already a bit oversold? certainly down here at these levels where we were back in october. you see the market bottomed and we started to take off. some ways, maybe, maybe, we're just a little bit oversold here. the problem this looms large, the 200-day moving average. if things keep going the way they have been going, it is not inconceivable we go down to test that. obviously we don't want that to happen. we'll see what happens. a lot of earnings now, big pce report on friday. not really the stock market. interesting thing. didn't get a lot of press, $112 billion coming out of money market funds. the experts say it was because of tax day. you go to look at the data, only 15 billion of that came from retail. i'm not so sure people were

2:03 pm

selling money markets on the last day, the last day before tax day to pay their taxes. i think something else is going on here but more importantly where is this money going, right? because everyone is saying $6 trillion it is going to go this, it is going to go here. global fund managers we know what they're loading up on, bonds, big time, they're buying bonds, just as bonds are getting crushed. they also like material names. japan is a favorite. industrials. talking materials and industrials a lot own this show. so i feel pretty good about that. still it is interesting that bond bet is really, really intriguing to me. here is something that is interesting. so, down six straight days, but here's a more interesting part. we've been up five consecutive months. this is a really great work here. what suggests that anytime a five-month winning streak is snapped ironically it ends up becoming a buying opportunity. it happened many times. one month later the market is up 2%. next three months later, quarter

2:04 pm

later it is up 4%, a end of the year, a year later typically up 10%. if you can ride the bumps maybe you can make some money. my first guest happens to be a market historian among other things. he agrees with this. he is still a bull own the market. joining me fisher investments founder, ken fisher. thanks for joining. i have some observations for you, first and foremost start with the notion this is a bull market? >> it is a bull bull market. the reality has been three straight weeks off the top. bull markets die with a whimper, not with a bang. bear markets accompanied by recession, have a slow steady start at the beginning, not a steep plunge. this is a steep plunge off the top. this is an attempt at a correction as you said earlier. charles: one note that you have here americans are too fixated

2:05 pm

on america. what does that mean? >> well, when you look at the global world, you see several things. one, this concept that so many people have wrongly had that the market was only about "the magnificent seven" or the fab four or whatever you want is just wrong, when you look at how many countries around the world have nothing to do with tech hit all time global highs this year. there is also fixation on the fed and inflation and interest rates but the reality is, when you look overseas, europe in particular, you see that their inflation, which went up higher, faster as a rate, has actually fallen faster and is now lower than in america. if you think about inflation it is always ends up getting averaged out around the world and the pessimism in america about america is missing the optimism from overseas.

2:06 pm

charles: right. also ma market corrections are common in the second quarter of a presidential election year. i shared that chart several times on the show with the audience. now to go to what to expect in general, right? i try to do this all the time, just a reminder, every, these 5% moves are going to happen every 1.1 year. what we've seen recently was probably overdue but what do you make where the money is going? all this cash that poured into the bond market, do you think that's a smart move? >> well first, are you trying to say stocks can be volatile sometimes? charles: occasionally they go down, ken [laughter] >> gee, i wish somebody told me that a long time ago. the other thing however, i'm not going to argue against your bond point, exempt you said all, of course that is not true. if you think of it as all going to one place. charles: sure. >> one of the thing that happens when the market fall as lot in a hurry as it did this time, a lot

2:07 pm

gets out and goes. >> bank deposits. you can see that just simply in the last few weeks, fred data coming out of the st. louis fed bank deposits which had been more or less steady before have gone up sharply because fundamentally, if you sell in a hurry you don't necessarily know where you want to go in a hurry. it take as longer downturn to reallocate the money. charles: that's a great, great point, ken. one of the reasons i like bringing you on, you've been there, you've seen this, you guided so many people to economic prosperity. so just, again, a word, i got 30 seconds, just what you're telling folks who still grab you, see you outside, call you up, whatever, hey, ken, i'm still concerned, exactly what do you say to them just point-blank? i see these dips as opportunity but some people see them as a reason to get out. >> presidential election years are overwhelmingly bullish. presidential election years,

2:08 pm

foal second years of the a presidential term that were down, since bottom of great depression of 1932, have always been positive average of 15.7%. it is a bull market, enjoy it even though stocks are volatile. charles: i would be willing to pay to make a lot of money. ken, appreciate you. >> thank you always. charles: she ya, folks the stock market as i was saying experiences a 5% pull back every 1.1 years. we had this real blistering pace in this market. it is easier to argue this was overdue. in fact my next guest says it is healthy. long view economic ceo, economic strategist, chris watling. i will bring this chart back up again. to put this in focus for folks, right? 5% every 1.1 years. i guess what people worry about how quickly this 5% can become 10% and 15%. how do you know when in the midst of the 5% pullback that it is not going to morph into one of these more treacherous

2:09 pm

pullbackses? >> it is difficult to know for sure but you need to think about the macro environment and where we're going with liquidity and interest rates. of course the fed is pushing back on rate cuts. the reality i think what the market is wanting to do to bully the fed to bring rate cuts on the table. charles: right. >> it will work wonderfully. the macro is fine. couple of small issues. basically it is fine. add to rate cuts, it is a wonderful environment for rate cuts and equity macro. charles: when you say though, a lot of folks street on the say it is cathartic. what is the difference between a healthy 5% pull back and unhealthy 5% pull back? >> when i think we about healthy pullback, you start getting into sector rotation. you can feel it with the market right now it is trying to rotate away from tech. it is what ken said about new highs in other parts of the

2:10 pm

world. i noticed a headline on my phone earlier, ftse closed at a high today. charles: nothing to do with the accent? >> that's right. something like that. charles: yeah. >> i'm not bias but i just thought it is kind of interesting that the world is broadening out. rate cuts are good for broadening of global stock markets. charles: right. >> we're so narrow on certain stocks. charles: let me ask you this, goldman, right, goldman saying overvalued to the macro. we're 40% overvalued. it is hard not to argue that the market may be overvalued to traditional valuation metrics. how much, how important is it that these thing come back for you, or do you see, an opportunity like people are saying i want it to come down a little bit more. often they miss the opportunity to buy? >> i think valuation tools are great if you're thinking on five years. i mean we remember alan greenspan 1996, i think it was

2:11 pm

september. rational exuberance. market sold off 3% around went up for for years. charles: yeah. >> valuation tools are not good market timing tools. charles: yeah. >> so i wouldn't lean on them too much. think about macro flows and rates. charles: i want to say october 19th, we'll see, you have to check me on that. i wrote a big piece on greenspan over the weekend. volatility, the big volatility. here is what is interesting. listen the vix, i don't know. it has been down for a long time. we haven't had this volatility. when it got above 20 and went above 21 okay everyone is saying now volatility is back. we didn't close there. in fact now we're below 18. how concerned should we be it will become more of a volatile ride? >> i think it will be a bit of volatility but it is a short-term story. the macro in a good macro environments you tend to get typically lower volatility. the spikes are not as high, they're not as enduring, et cetera, et cetera. charles: right. >> yes, i don't think this correction is done yet, completely finished.

2:12 pm

we're bouncing but volatility will not do what it did in 2022 i think. the macro doesn't support that. charles: liquidity is a big factor of the market. a lot of folks are worried about the reverse repo program. i read your note. you have concerns about it as well. on its way to zero. what happens there? >> i think that is what the market might be anticipating. market is saying hold on liquidity will dry up. market looks forward, participates, it needs to bully the fed stop pushing back rate cuts. pull them forward. when they do release all the money market fund you're talking about earlier. tons, trillions of dollars of that, could go from bonds into equities once you start cutting rates. charles: i'm always in the camp the markets love bullying the fed. they get away with it every time. >> they're good at doing it. thank you. charles: folks, seems to me that, this market is getting sort of slammed here. obviously there are opportunities here, right? we love when the market gets slammed especially david nelson. here is the good thing, he has

2:13 pm

two new stock picks. get out a pen and pad and get ready to make some money with david. ♪. hello, ghostbusters. it's doug. we help people customize and save hundreds on car insurance with liberty mutual. we got a bit of a situation. [ metal groans] sure, i can hold. ♪ liberty liberty liberty liberty ♪ in theaters now.

2:15 pm

2:16 pm

2:17 pm

a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okathe future is here.for. we've been creating it for more than 100 years, putting the most advanced technology into people's hands. generation after generation. tool after tool. again and again. bringing you the most reliable network of authorized sales and service dealers. always moving forward. we lead. others follow.

2:18 pm

♪. charles: all right, my next guest puts it simple, folks, he says stocks will stop going down when yields stop going up. it's clear though that the upward bias in yields is a thing to stay at the moment. in fact for me we get around 4.7, this area has become very, very scary. i think ultimately we may fill this gap here at 4. that will be the test. if we don't hold there and pull back, mabel point chief strategist david nelson will be right. david, this move is so interesting. there were so many times the coast was clear this year on bonds. we came into the year with yields really going down. i don't think anyone thought january 1 we would be here right know. >> this market reminds very much of the last quarter of 2018. back then we were breaching 3% in 10-year yields. now as we approach 5% there is more incentive foreinstitutional capital to pull money out of the

2:19 pm

market. each stairstep forces insurance companies, pension plans, endowments, to fixed income. it can match future liability other than a stock. put it in a corporate bond, lock in the yield. remember they're not sellers. they buy it, they hold it to the end. charles: right, right. you costill, who knows, 10, 20 years, whatever, bonds could be, we went into projected secular bond bear market they could still lose on the principle. >> not if they hold it to the end. they get their money back. that is what you're doing writing to an insurance policy. charles: i'm seeing this particular which with pensions. it is kind of frightening to me, already, there is, if you took away corporate buybacks there would be no buyers for stocks, really. americans are not buying enough stocks. foreigners buy more than americans. we have two guests talk about how attractive foreign markets are. there are several reasons we need -- >> part of the reason the market is holding in today, rates are kind of relatively benign right

2:20 pm

now. charles: let's talk about some other things here. you also point out in the last month what worked out are names with dividends. dividends are really starting to shine. we sigh that with the sectors. the only two sectors that are up, energy, utilities. both have big-time dividend-payers. the question is, is this a foxhole or is this somewhere where people should carve out real longer term -- >> maybe the dividend part that could blow up in your face because as rates rise, the dividend may -- i don't think that is the case within energy. energy i think will hold up. charles: utilities you're not buying? >> i own in there but i think you want to be in some specific names. constellation energy is a great name going into nuclear. it is very specific. charles: talk about a couple great names you like here. more funding foreukraine. the geopolitical issue gets worse, not better, general dynamics, the chart speaks for itself. your next move is a breakout here. what distinguishes this, say over a lockheed or a raytheon.

2:21 pm

>> one, you're getting two for one. one it is a defense stock. just look around the planet. every corner of the planet is a geopolitical hot spot. you're getting their aerospace division, corporate jets. their newest jet. charles: corporate jets? >> corporate jets. this is what ceo want to buy. the g-700 was just certified by the faa the cabin is to die for. this thing travels just below mach one. that is a serious speed advantage. these are home run, home run jets. this is what they want to own. no shortage of demand for these corporate jets. i haven't seen one in person yet but i can't wait. charles: i think taylor swift has a couple of g-5s, i think she was in indonesia. with this one she could have a concert anywhere, make it to the next kansas city super bowl, huh? 30 seconds, do omc. >> what you were talking about before, value and dividend paid

2:22 pm

off. this is an industry some would say is dying, advertising. at least their type of advertising. those have moved to artificial intelligence, omni assist program, helps everybody in the food china improving the work flow, improving the work flow and cost advantage. less than 12 times earnings, 8% cash flow yield, 3% dividend this is what is working. charles: it is beautiful. holding really nice, goes down to the 50-day, always takes a stand. my man, seeing you. if you get a chance to check out the cabin i want to go with you, right? folks, what is the true state of our economy. stay tuned a stunning report from the federal reserve no one is talking about but us. we'll be right back. ♪.

2:23 pm

(the stock market is now down 23%). this is happening people. where there are so few certainties... (laughing) look around you. you deserve to know. as we navigate a future unknown. i'm glad i found stability amidst it all. gold. standing the test of time. after last month's massive solar flare added a 25th hour to the day, businesses are wondering "what should we do with it?" i'm thinking company wide power nap. [ employees snoring ] anything can change the world of work. from hr to payroll, adp designs for the next anything.

2:24 pm

after advil: let's dive in! but...what about your back? it's fineeeeeeee! [splash] before advil: advil dual action fights pain two ways. advil targets pain at the source, acetaminophen blocks pain signals. advil dual action. we love being outside, but the sun makes our deck and patio too hot to enjoy. now thanks to our new sunsetter retractable awning, we can select full sun or instant shade in just 60 seconds. it's 20 degrees cooler under the sunsetter and we get instant protection from harmful uv rays and sun glare. for pricing starting at less than $1,000, transform your outdoor living space into a shaded retreat your family will love! when you call, we'll rush you a special $200 discount certificate with your free awning idea kit! you'll get your sunsetter for as little as $799. but, this is a limited time offer! for over 20 years, sunsetter has been the bestselling retractable awning in america! call now for this free awning idea kit packed

2:25 pm

with great awning solutions that will let you enjoy your deck or patio much more often. plus, get this $200 discount certificate that will bring you your sunsetter for as little as $799. but this is a limited time offer. call now! sunsetters are backed with up to a 10-year limited warranty! more than 1 million families in america own and love their sunsetter. now, you too can discover why “life is better under a sunsetter...” it's like putting an extension on your home. and talk about options: choose motorized or manual and for just a little extra, add led lighting for evening enjoyment. there are so many incredible styles to choose from in our free awning idea kit. get a custom-built awning, without the custom-built price! call now to get the whole sunsetter story. you'll get this free awning idea kit. plus, a $200 discount certificate and there's no obligation. with sunsetter, you'll create the ultimate outdoor living space. perfect for entertaining friends. call now for your free awning idea kit,

2:26 pm

2:27 pm

charles: you know the biggest guessing game is the state of our economy. now the fed just released their latest update on financial stability and i want you to think first what the overview is, what they're trying to achieve of the report reviews vulnerabilities affecting the stability of our financial system related to valuation pressure, borrowing by businesses households, financial sector leverage, funding risk and also highlights several near

2:28 pm

term risks if realized could interact with these haver vulnerabilities this is critical report from the federal reserve. some of the things that stood out to me, stock prices are too high. also that commercial real estate is starting to deteriorate even more, even more, folks. they pointed out household debt was modest. relative to gdp this is interesting statement, relative to gdp, concentrated among prime rated borrowers. that shows we're in a bifurcated economy, the haves, have-nots. it is underscored there. another place we see sort of the haves, have-nots, leverage in the financial system, they say the banking system is okay, nevertheless, some banks, small banks, continue to face sizable valuation losses on their fixed assets. remember that's what took down silicon valley. of course we get down to funding risks. everything seems okay, exempt this line stood out to me a

2:29 pm

little bit, structural vulnerabilities persist at money market funds, mutual funds stable coins. money market funds? didn't we put trillions of dollars into that. then you go into a different part of the report i have to share with you, because it is a salient risk to the financial sector, right? persistent inflation, still 72% are saying inflation, it hasn't gone anywhere, forget what the numbers say. this is shocking show, right now policy uncertainty, people just don't know what is going on. gone from 24% to 60%. we got a little bit of relief from commercial real estate as a risk. a little bit relief in the banking sector stress. in terms, imagine that, banking uncertainty, policy uncertainty with the federal reserve. we see what the street is starting to look for. remember we started out, seven, six rate cuts. now more likely we would have zero hikes or zero cuts rather and maybe some hikes. my next guest says that the

2:30 pm

sharp decline in anticipated rate cut is actually got to be the fed's worst-case scenario. bring in quadratic interest rate volatility, etf portfolio manager, nancy davis. i know powell desperately wanted a soft landing. by now do you think he might have made a mistake, the fed made a mistake in telegraphing all those rate cuts? >> yeah, definitely. the fed is really backing off of that. they're pivoting from their pivot, right, charles? they're trying to back it off because the data has been really strong. i think regular people still feel a lot of inflation in our day-to-day lives. i think you said it well. it is really a story of the have and have-nots right now. charles: you also mentioned, periodically this word comes up, stagflation, potential of it, maybe bubbling up here, what is it, what would it mean for investors? >> so stagflation is definitely not great for investors. it is a very dirty word.

2:31 pm

it is essentially, a made-up word that happened in the '70s and '80s when you had high inflation but low growth and stagflation has historically been a disaster, a la, 2022 when both stocks and bonds sold off together. stagflation is bad for code. credit spreads are incredibly tight, when you have a bond, money market fund, money market fund all governments it is probably fine, but if it has a lot of short duration credit, credit can get hurt. just because something is short duration other in a money market fund doesn't mean it is not taking risk. all investing is risk. charles: fed stability report, when you look at it, does it make a greater case for rate hikes or rate cuts? >> oh, i think the fed is really trying to back off the number of cuts that was priced in. i think everybody at the start

2:32 pm

of '24 it was a question how many how quickly. now we're in a really different environment where the fed sort of, people are unsure what the fed policy is going to be. as we talked about last time on your show, the balance sheet is still a huge wild card that investors should be focused on. charles: so the fed, federal government owes 34 trillion. that number is growing faster and faster. at this point it is, it feels to a degree many have become none shall ant about the whole thing. national debt is soaring greater than gdp, when does this become the problem? people like you always point it out, we've been talking about it a long time but again the public seems not to care anymore? >> yeah. i mean it is definitely, the fed is sort of telegraphing, you know, there is a lot of risk out there. stocks are very expensive. credit spreads are very tight. there is a ton of debt and higher for longer environment has got to be bad for really all asset classes. there is no safe haven.

2:33 pm

i think that is one thing i really like to stress to people. gold is going up. higher for longer environment, something like gold, i know the gold bugs will send me a lot of hate mail soon or tweets, i will get a lot of hate for this but there is no dividend, right? if you have higher for longer inflation, not necessarily the best thing. so there is a lot of asset price appreciation that's happened and i think it is a question of when things turn in these various asset classes but inflation protection is really cheap because everybody thinks it's not a problem in the future. charles: yeah but it is hard if you really look at the numberses note believe, even the fed at mitts it is consistently persistent and has not budged in terms of being a worry for everyone, at least the professionals. nancy, thank you very much, i appreciate it. >> thank you, charles. charles: see you soon. my next guest is pointing out

2:34 pm

momentum stocks have never been a larger weighting on the market. of course we know that's a double-edged sword, it could be. i want to bring in piper sandler, chair chief investment strategist michael kantrowitz. i have this momentum chart. you put this momentum chart, everybody used it. i saw it on fitch. this chart is amazing. folks don't realize, momentum at an all-time high. we're going back to 1929, so i guess there is always reversion to the mean is sort of what we expect on almost any sort of asset, although i hate to see what the mean is here. now that we see momentum stumbling a little bit, what are you anticipating? >> it is important, charles, to kind of understand what is in that momentum portfolio. it is very different than what we saw in '99 and 2000, even though the number was not that high on the chart. today at the core, the stocks in that portfolio are generally highly profitable, they have good balance sheets, they have got generally good free cash

2:35 pm

flow yields. of course there is speculation at the fringes but in general these are some of the best companies in america that are in that portfolio. so we're not expecting an unwind like we saw post-2000. charles: so would that mean dips are buyable? >> well, i mean it's, a lot of these companies, also largest companies in the s&p 500 as well. charles: right. >> so dips are buyable. i would say what we've been recommending for investors, two investors for the last month is, if you're going to fade some of these names, avoid some that are more expensive and embrace those that have higher free cash flow yields, which is a pretty big chunk of that portfolio. a lot of these are cheap. they're not that expensive. charles: that's a great point. i had your free cash flow chart. i didn't put it up here. i hope folks look that up from you. impact of various levels of rates. we're looking right now. we're heading towards 5%.

2:36 pm

above 5% a big pe hit. inflation rebound. we're right below there now though. how do you manage a portfolio heading toward an area where there is certainly going to be more risk? >> one of them as rates go up higher for longer is good for the quality theme that you and i have talked about for, for many quarters, almost a couple years now. higher for longer is good for higher quality. not so good for small cap, some deep value, lower quality names. so stick with those parts of the market that have been working. if yields stay higher, it will just continue to, like you said, bifurcate the economy and that, those companies that are holding in best are those generally larger which is again part of that momentum story as well. charles: mike, has the fed boxed themselves in again? the transitory thing really got under powell's skin. you know, he retired the word at

2:37 pm

one of those fomc, q&a sessions and hot the collar, possibly three rate cuts in 2024, the pace of inflation has picked up. i wonder if they're between a rock and a hard place? if we get hotter than expected pce number on friday will the fed have to come out to talk rate hikes? >> i don't think we'll see that from the fed. i still think the next move from the fed is a cut, not a hike. the powell never said we would cut six or several times win the market was expecting at the beginning of the year. charles: no. >> the way he is speaking and laying out what he is looking at, if we see some softer labor market date that, that could open the window. we're four 1/2, almost five months into the year. things have radically changed from the beginning of the year. in three months we could shift again. i'm not, i'm not so concerned what the fed thinks they're going to do or the market thinks what the fed is going to do. it is all data dependent.

2:38 pm

that is the world we're living in. charles: certainly is. i like it when the street is not anticipating rate cuts. that makes it a really big positive surprise when they happen. we won't need six or seven. mike, thank you so much. great work as usual. i appreciate you letting us share. thank you. >> thank you, charles. charles: the nasdaq of course has gotten pounded particularly the nasdaq 100. is it now oversold? up 1.7% now we're going to break it down, and if so, what do you want to own? we'll be right back after this. ♪. were you worried the wedding would be too much? nahhhh... (inner monologue) another destination wedding?? why can't they use my backyard!! with empower, we get all of our financial questions answered.

2:39 pm

so we don't have to worry. empower. what's next. well done, viv. you got the presents, the balloons and the raptor cake. now, how about something to put a smile on your face? aspen dental provides complete, affordable care with dentists and labs in one place plus free exams and x-rays for new patients without insurance... and 20% off treatment plans for everyone. quality care at a price worth celebrating. it's one more way aspen dental is in your corner.

2:41 pm

2:42 pm

even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity.

2:43 pm

charles: sew i've always cautioned investors that any stock that can rally 5% one day, 10% in the session, right, you love it when they're going up, right? they're rockin' and rollin'. they can also fall 5% or 10% in a session. sometimes you have to ride out these moves, particularly if you're a long-term investor. they get crazy and volatile in you want to own some of these names again if you want to reach maximum gain. my next guest took a ton of profits on a slew of these

2:44 pm

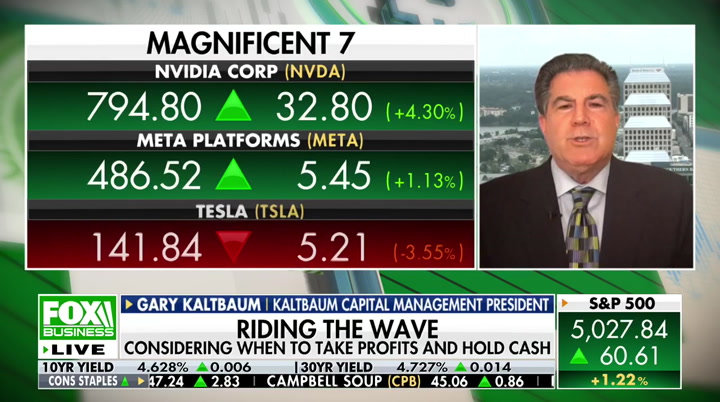

names. march 8th he took profits and sitting on a ton of cash. kaltbaum capital management, gary kaltbaum. gary, s&p 500 index, just about every single name were above their 50-day moving average. now obviously 10%. that seems to be over sold. i'm sure you're starting to look. when do you start to pull the trigger and start buying? >> keep in mind we were selling those highs as it was coming down. i came into this week thinking it is about oversold as i seen. when you see nvidia drop $84 on a friday, and super micro 220 you know they can bounce. we're getting that today. for me the other part of the equation is the rest of the market. i was noticing money flows in the financials things like that and you never expect much out of them but they're having a very strong day today and actually leading the markets, helping the

2:45 pm

tech toe bounce even more. so as i see it, it is now earnings season. we don't know if you will get a netflix which cracks to the downside or american express that jumps to the upside. we sit back, we wait. we look for the strongest earnings reports with the best reaction and then, start diving in again but right now we're sitting on a lot of cash and happy about it. charles: i had this conversation with david nelson earlier in the show. in the last month there are only two sectors up, energy and utilities. they have goat a lot in common. they have a lot of names that pay big dividends. the question was, is that a foxhole, a temporary foxhole or could they be a place where you start to buy? are you looking at some of these other areas outside of tech to buy some stocks? >> well, as i said financials, you have, wells fargo breaking into new highs. goldman sachs almost there. so, we've done financials in the past. we really haven't done utilities. we have no problem with oils either. we're a big believer in

2:46 pm

whatever's going we'll go with it but utilities are just really slow tortoises and not sure i touch them. there are a couple of names. i think david mentioned one, constellation, ceg, that's strong. that is the exception to the rule. so for me i love the higher beta. that is where we park our carcass most of the time. that's where when things are going right, as you know, we jumped on nvidia right on the breakout at 505. i think we made in the 70s on that. those are the things we're looking for. they are companies that have 100%, 200%, 300% earnings and revenue growth and we'll do the best we can to find them going forward. i can promise you, there will be plenty more because in technology there is nothing like productivity gains and new inventions coming forward. same for medical also. charles: yeah. this is just the tip of the iceberg, no doubt about that. >> oh, yes. charles: nasdaq 100, holding a key level right now. this is a key level. it was resistance a while back.

2:47 pm

then it held as support and now is reversing at least right here today. at what point do you feel comfortable when you see that happening? do you need a couple of days to watch to make sure it is confirmed? >> yeah. you need confirmation. you need more than one day and i think the nasdaq 100 was down 950 points last week and the other thing its when you can break it apart, the top eight names are 40 some odd% of it and with apple and tesla full bear market not good news. the really only name now on the strong is it google. amazon second, and the rest pretty much have weakened. so we'll wait and see. i think earnings can dictate, if some of these companies with markets oversold, with names oversold, if earnings come out much stronger than expected i expect some five and 10% gaps to the upside. we'll see if they're buyable at the time. remember these companies are fantastic. they are category killers. they have been doing something

2:48 pm

right for ages. they're creating wealth beyond the beyond. jobs beyond the beyond. those are ones with he try to look for. charles: no doubt about it. this is not 2000 for sure. gary, thanks a lot, my friend. appreciate it. >> thank you. charles. charles: all right, folks, my "unbreakable investor," "the quiz show" edition town hall happening this wednesday 2:00 p.m. eastern. you can still join. here live in person, in new york city, in the studio, asking questions and learning a lot. i'm going to impart so much information with you. here is what you do. go to eventbrite.com, search charles payne, get your free ticket. i see you in a couple of days. it will be a lot of fun. make sure to check out the new season of my "unstoppable prosperity" podcast. download foxbusinesspodcast.com or where you get your favorite podcast. investors are gearing up for a week of tech earnings. where should you watch how they perform, i can think of no one better than beth kindig to help

2:54 pm

charles: don't look now but the mag seven is getting scorched, their losses are matching almost the willful russell 2000 index, it's clear the earnings resulting guidance are going to blow away elevated expectation for a lot of these companies. my next guest is probably the best when it comes to this particularly long-term investing, joining me i owe lead tech analyst, beth, last time you and i spoke you talk about lightning up positions even your favorite names i was surprised that listen, they come down a lot are you surprised like a name like nvidia is falling.

2:55 pm

>> it is surprising but that the buying opportunity at key levels, the reason for this a.i. is the best multi generational activity for investment in our lifetimes because it will contribute 25 trillion to gdp there will be very few players, this is very different than mobile.com where there are many players that took time to consolidate route the gate very few players and they will be concentrated on semiconductor so not only did nvidia selloff but they took a pretty big hit and we welcome that we want a key late at lower levels given the immense opportunity that semiconductors are presenting right now. charles: i'm going to bring up the smh chart in a moment. but i want to talk to you about the upcoming earnings reports getting assessment of whether it would be wise to own them before or after, let's start with microsoft. >> microsoft in the earnings report on most interested this

2:56 pm

week that is because it was about whether for cloud, now it's our bellwether for a.i. software azure reported six points of a.i. revenue that doubled from the previous quarter at three points that may seem small but were talking 74 billion-dollar segment and overall that helped by two points very feel companies are accelerating all eyes on microsoft it will tell us the health of the a.i. software market and very excited about that report. charles: the bellwether for a.i., where does that leave m meta. >> meta is transitioning in wall street loved it last year for the year of efficiency, were looking for signals that this company is moving into a full-fledged a.i. stock in adobe average revenue per user and its accelerating what wall street will want to know is that accelerating because of low comps coming from the trough or exhilarating because of a.i., it's probably because of a.i. what we want is the united states and canada coming in big

2:57 pm

this quarter. charles: google and apple but? >> also but is interesting we have mixed segments going on. youtube and search trying to carry this company google cloud can be hit or miss, right now were on the sidelines with google and we want to see it sort itself out to where the a.i. story impacts a little bit more clear with meta and microsoft. charles: have to ask you tesla it's not a lot they have been here before. is it becoming attractive to y you. >> for me i'm in the margins boat i want to see tesla's management team get on the call tomorrow and i want to hear them talk about when will margins bottom the a.i. impact may be a couple of years out the a.i. problem is very complex is not going to be the first one out the gate like a simple ad software system like facebook or meta it's going to be a couple years out left to get on the

2:58 pm

call and tell investors when the margins are going to bottom. charles: what is the robo taxi thing i think that's a little corny to put that in the forefront right now. >> is a little corny because what they could be doing is prioritizing the lower-priced vehicle that everyone is waiting for in there's rumors that they put that on pause for the robo taxi and that's not what we want to see in the economy considering average sales are coming down due to weak consumer. i think they could come out and talk about that lower-priced unit and that would be encouraging to wall street and instead they're doing the opposite and very expensive projects that will not return any any full revenue for a long time. charles: maybe they can borrow the meta memo, people want something now, thank you so much, great stuff, always appreciate it. i want to pick up unwanted these names that we just mention the tesla name the shares have taken

2:59 pm

it on the chin. let's face it elon musk and long-term investors have been here before, they've always bought the dip and done well. in an article in the journal that suggest democrats are the reason for tesla's woes, apparently according to the article all used air loads, could not stomach a purchase amid the ceos fault outburst. i'm personally glad elon musk bought twitter and i love that he defend the first amendment but i always like it less about a ceos policy personally, of course it's a lot worse when publicly traded companies had been to the mission to esg ndi, here's the good news more and more companies are starting to push back against that they are understanding on a massive ship that is happening among the public and they don't like that,

3:00 pm

boards need to make sure esc g is no longer part of the energy and think about the public pressure and a lot pushing them on their boards ironically the cool tech names are not even caring about it. the focus is on making money and many were shocked last week, speaking of big tech, google brought the hammer down and they fired 20 employees for state to sit in with the contract with israel. there is something to the notion of going walking going broke, take it look at this years behind me take a look at this year's shares of starbucks behind me there is a time and place for everyone behind me but the idea to bending to popular for the french elements is not good for business you can see the and some anyways. i'm glad were pushing political ideology and focusing on making money. charles: so true don't let the tailwagging dog everybody is allowed there opinion and if you don't like the company that you're working out then

22 Views

IN COLLECTIONS

FOX Business Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11