tv Making Money With Charles Payne FOX Business March 28, 2024 2:00pm-3:00pm EDT

2:00 pm

funds trying to recuperate monies rightfully owned by a user base. banks are allowed to operate on fractional reserves. you bring a dollar, they might lend 10% on hand and fdic insurance a certain amount. they had contracts that said they wouldn't do that. so no they don't get any points for that. taylor: for for your insight. this was a big day. we were waiting for the sentencing. i think a lot of people in the crypto space had moved forward but this is certainly a moment in time. jackie: sets an example for other people out there, this is budding industry and relatively new. sean: political contributions did not save the day. justice was served. thanks for letting me with you. taylor: happy easter. money with charles payne starting you right now.

2:01 pm

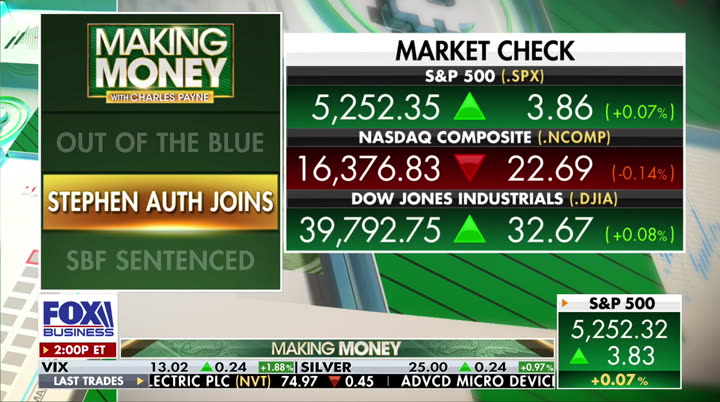

charles: i'm charles payne, this is "making money." s&p headed for the best quarter since 2019? is it getting too giddy. all the bears are now bulls. what will happen with the fed? they seemed to have pivoted themselves so many times they are boxed into a corner. meanwhile wall street legend stephen ought with us he called the stock market, called the stock market ahead of everyone else. it is getting a little lonely. everyone is too bullish maybe. 69 judgment day for sam bankman-fried, disgraced silicon valley wunderkind. got 25 year sentence. is that enough? love to hear from you. tweet me @cvpayne. my take on silicon valley not learning their lesson. watch out folks, there are more sam bankman-frieds in the pipeline. all that and more on "making money."

2:02 pm

♪. charles: so just like the phrase black swan event, you hear that a lot with the market. remember that is supposed to be something that is unique, rare, no one is prepared for it! all of sudden the term out of the blue is being tossed around. out of the blue, out of nowhere, something unexpected. something happens without any prior knowledge yet we're hearing out of the blue. certainly we heard this week on a webinar from the top strategist at jpmorgan. the exact statement went something like this, quote, it just might come one day out of the blue. this has happened in the past. we have had "flash crashes." so expect the unexpected seems to be contradictty. listen there is something to the notion that investors are getting a little bit cocky and maybe we should get some warning signs. look at this, significant spike consumer expectations where the stock market will be. this is near record high stuff. so everyone at this point kind of believes the stock market is going to be up. it might be a positive but it

2:03 pm

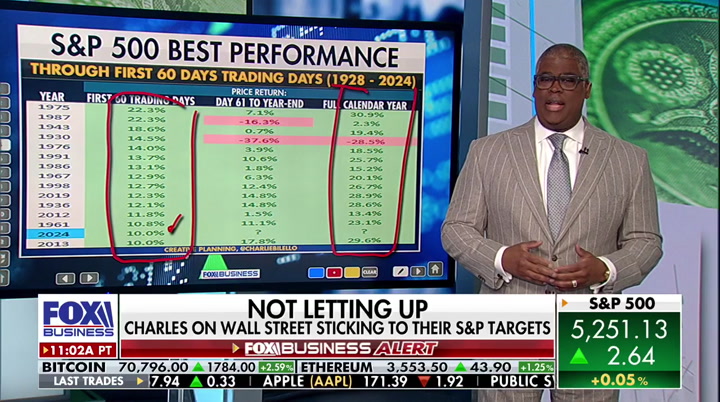

could also hurt. nevertheless you understand why the crowd is excited this is what people will understand intuitively even if they don't know wall street history. markets go from strength to strength. look, this is an amazing start. after the first 60 days of trading since 1928, if the market is up big like this, believe me we're up big right now, look what happens for the full calendar year? not bad, up average of 30% and almost always works but this move is just of course more than just following the herd, it is following the data. ironically, sort of of iron ironic, wall street and federal reserve already made negative assumptions about the economy. with that in mind, remember the out of the blue come men i mentioned a moment ago, that was from jpmorgan. they're looking for the market to go to 4200. they're way off. they have not changed it. sometimes you hear anxiety this some of these warnings.

2:04 pm

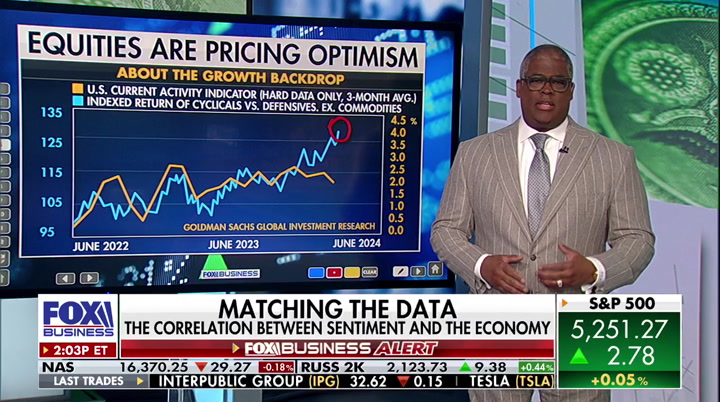

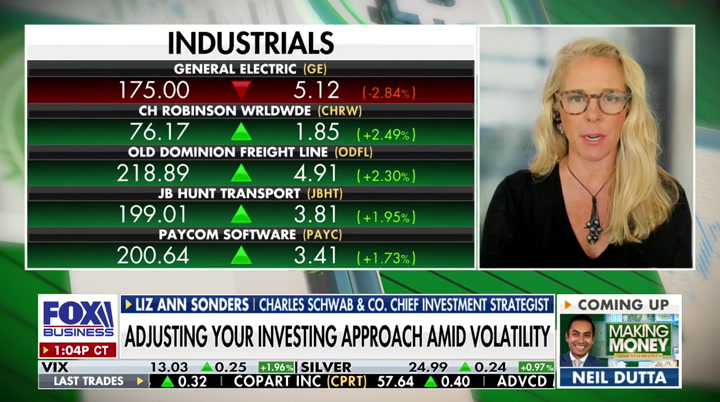

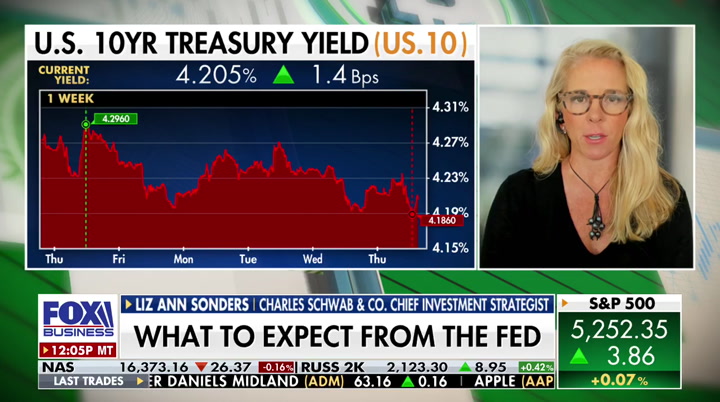

wall street at one prays, the federal reserve at one place, the data is getting better. the work is the work. maybe jpmorgan led into this for emotional reasons, whatever it is but they have not adjusted their market. the market is adjusting to the economy at least from the economic data we're seeing right now because take a look at this, folks, these are the cyclical stocks versus defensive stocks, cyclical, defensive, not including commodities. i got to tell you my first guest and her colleagues wrote a note on this march 15 data is matching strong hard economic data. i want to bring in charles schwab and company chief investment strategist, liz ann sonders. you said cyclical names outperformed defensive names, how does that inform how people should be approaching investing right now? >> everybody investor is different so there is not one cookie cutter answer. we launched sector views or relaunched after two-year

2:05 pm

hiatus, for vast majority, large majority of reasons, we had outperformed bias towards cyclical sectors like energy, materials, financials and that's where performance has been strong. i think it reflectings pickup in economic growth corroborated today by the upward revision to gdp and maybe putting in rear view mirror about recession and that is supported by cyclical sectors. aside from sectors we're advising investors be factor oriented if you're honing in on certain sectors. best characteristics. they say you still want to stay up in quality because this is a period of uncertainty with regard to fed policy, geopolitics, et cetera, you want to stay up in quality. this is not a time to go down to the quality spectrum. charles: listening to what you just said, thinking about the last time we heard from jay powell, he is saying we may have a moment or moments like this. ultimately the economy is going

2:06 pm

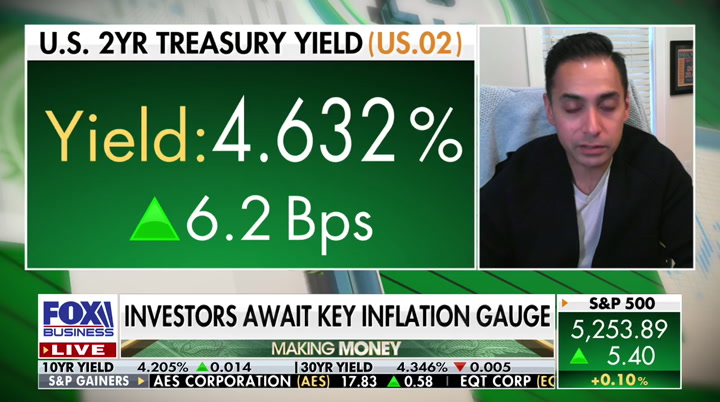

where they think it will justify three rate cuts. do you think there will have to be a point sometime soon where the fed acknowledges what the markets are telling us? >> well, so, right now actually, in light of governor waller's comments last evening which were a bit more hawkish, you have seen in terms of fed fund futures markets less than three fed cuts expected. that is lower than so the so-called dot plot. powell says the dot plot does nothing have to do with the policy path. we have taken four rate cuts out of the mix since the beginning of the year and moved start point to june or july. that's a moving target which is is based on the data obviously why things like tomorrow's pce report and next week's jobs report remains key to those expectations. charles: i like for the last year, and we should have you will at answers tomorrow after

2:07 pm

we get xy, z, this or that and we have almost always more questions. let me ask you this. essentially everything is up. the s&p is up. the stock market is up. world markets are up. oil is up. copper is up. they usually don't all move together. how do you decipher a message typically you can almost say okay if stocks are up and these are up it, does this point to maybe a certain underlying giddiness where people this is everything rally, if that is the case does that add extra risk? >> well keep in mind your blue bar there, that is bond yields. >> right. >> which means bond prices have gone down. it is not an everything rally in the sense that treasurys on a year-to-date basis from a price perspective are negative. clearly when you see it across commodities, when you see it across the equity market, see a higher trend in yield it reflects a stronger growth backdrop.

2:08 pm

maybe slight improvement outside of the u.s. the u.s. has a much better growth profile which helps to explain the things like the move higher in the dollar. so for now the data is very supportive of all of those bars. that doesn't mean it is going to last in perpetuity. charles: right. >> but that is largely a reflection of stronger growth. charles: i just think, maybe that bonds, bonds are in a holding pattern. they to me actually should be higher considering the yields. before i let you go, you were talking in the u.s. we have these elections coming up. emotions are running very, very high. how does that influence the market? >> well don't let your own emotions regardless whether it is about the election or anything else affect your investment decision making. i think now is probably as good a time as any whether think based on past mistakes you might have made, your own history, judge your financial risk tolerance and emotional risk tolerance have a wide gap between them or a narrow gap between them. but trading around your own

2:09 pm

emotions, especially tied to an election and this is going to be a emotional year as it relates to the election i think is a fool's errand. i would be really cautious trading around the election. charles: thank you. i hope you don't mind if we bring you back to remind the audience of that between now and election. liz ann, thank you. >> thanks, charles. charles: my next guest sees inflation trending lower over the coming months and unemployment rate to average below 4% for the fourth quarter. we have sam stovall. the unemployment number 3.9%. it is up two basis points. no one had that estimate last time out. sounds like powell would pounce. if he come in there, maybe the fed with some emergency cuts. you don't see the probability of a getting a little higher than 4%? >> hey, charles, good to talk to you again. our expectation is that yeah, we will hit 4.1% but it won't be until the first quarter of 2025.

2:10 pm

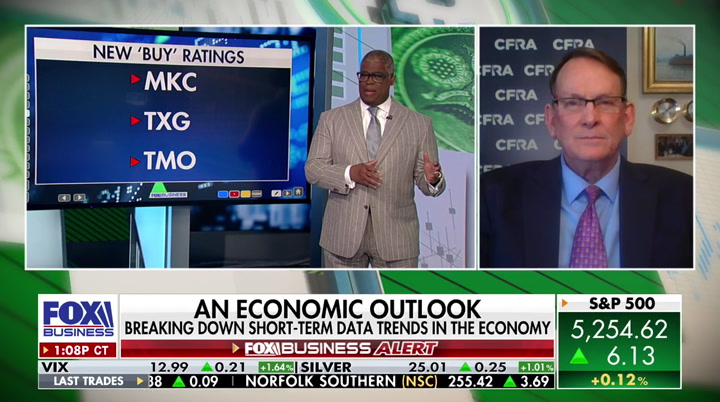

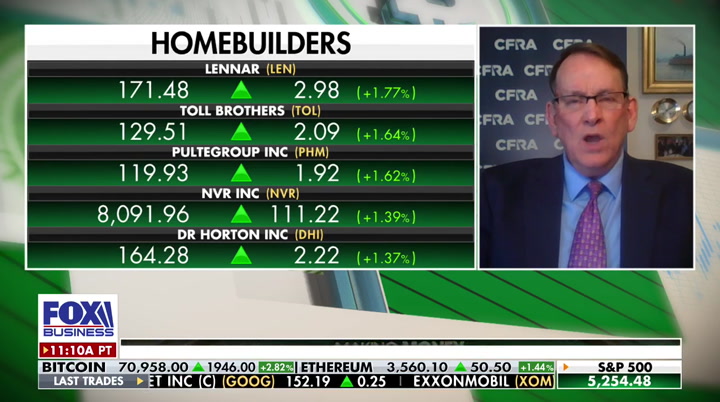

so our expectation is, yeah, we're likely going to be creeping higher. as you know, that is a forecast based on what we know now but we could find it more people come into the workforce or at least attempt to, and as a result see a pickup in the unemployment rate. so you have to look at it from two perspectives. unemployment being the people who are losing their jobs as well as those who are reentering the workforce trying to find jobs. charles: so from a sector point of view, i know that you, we just had this discussion with liz ann, you also, you're leaning more defensive than cyclical? >> in the near term. cyclical, i mean i still, we still have overweight recommendations on communication services, financials and technology because our analysts look 12 months down the road but i'm also a believer that prices lead fundamentals and looking at our technical research arm

2:11 pm

called lowry research we are finding a bit of improvement in some of the defensive areas. i think as you had said because a lot of investors are getting a bit worried that this market is stretched. we are looking at the 11th strongest first quarter since world war ii and of those top 15, 13 of them have experienced declines intrayear which average ad little more than 11%. so, we could see a tactical resetting of the dials. so with that in mind some people are of moving into the more defensive areas for the near term. charles: i got to tell you, sam, i work with a lot of individual retail investors and just the, just right now if they don't make money every single day i'm not sure many of them are going to survive an 11% pullback. let's talk about some of the, some of your new buys. we have got a minute to go. really intriguing stuff here. starting with mccormack. they had a great earnings

2:12 pm

report. what is interesting the numbers were not necessarily great but notion people can't go to restaurants anymore. they got to took at home and that should benefit mccormack. >> true. if you wanted to add spice to portfolio, pun intended you can go to mccormack. here is a stock we think will return to positive year over year changes in earnings in the second half of this year. next year we think they will be posting double-digit earnings gains and they will benefit from their heavy reinvestment primarily in brand marketing. >> all right. 10-x genomics, i never heard of this stock. txg for those listening on the radio. txg, 10x genomics. a life-size and tool company. a group we're thinking beginning a turn around the second half of this year. it is beaten up with the most

2:13 pm

recent earnings report but we think it is overdone. we upgraded it to a buy recommendation. we're looking for revenues to grow 10% year-over-year and key products launches. charles: sam, thank you very much, my friend. appreciate it. >> always good to talk to you, charles. charles: same here, thanks. mymy next guest raised his year-end forecast on the s&p 500. we'll talk to the top strategist at oppenheimer why is he bullish. next. ♪. trading at schwab is now powered by ameritrade, giving traders even more ways to sharpen their skills with tailored education. get an expanding library filled with new online videos, webcasts, articles, courses, and more -

2:14 pm

all crafted just for traders. and with guided learning paths stacked with content curated to fit your unique goals, you can spend less time searching and more time learning. trade brilliantly with schwab. business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. it's the go-tos that keep us going. the places we cheer. trust. hang out. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. powering more businesses than anyone. powering possibilities.

2:15 pm

the day you get your clearchoice dental implants makes every day... a "let's dig in" day... mm. ...a "chow down" day... a "take a big bite" day... a "perfectly delicious" day... - mm. [ chuckles ] - ...a "love my new teeth" day. because your clearchoice day is the day everything is back on the menu. a clearchoice day changes every day. schedule a free consultation.

2:16 pm

2:17 pm

after getting not so pleasant news from my physician. i was 424 pounds, and my doctor was recommending weight loss surgery. to avoid the surgery, i had to make a change. so i decided to go with golo and it's changed my life. when i first started golo and taking release, my cravings, they went away. and i was so surprised. you feel that your body is working and functioning the way it should be and you feel energized. golo has improved my life in so many ways. i'm able to stand and actually make dinner. i'm able to clean my house. i'm able to do just simple tasks that a lot of people call simple, but when you're extremely heavy they're not so simple. golo is real and when you take release and follow the plan, it works. her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”.

2:18 pm

you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. ♪. charles: so back in december my next guest actually had the highest target, 2024 target on the s&p. it was 5200. well as it turns out we're enjoying the best start to a new year since 2019. everyone including the optimists have to go back to the drawing board. oppenheimer asset management chief investment strategist, john stoltzfus. you were the most optimistic. the market surpassed your expectations. have you adjusted your target? >> yes we did, charles, thanks for having me on the show. last week we raised the target to 5500. it suggests about a 5% run-up

2:19 pm

from where we are now to the end of the year and we think we might likely have to ratchet that higher as we move through the year. charles: so we've been talking in the show about you know, where do you want to be, right? because it's good, we have overall the market is going to be higher. do you want to be cyclicals, do you want to be defensive? where are you now, mostly allocating your resources in the stock market? >> charles, we remain overweight u.s. while having some representation internationally because of valuations and what we're seeing with central banks there but in the u.s. predominantly diversified across the sectors within the s&p 500 but with emphasis on technology, consumer discretionary, communication services, industrials and financials and the only thing that we really kind of hesitate a little bit about is even though it is

2:20 pm

performing nicely today would be real estate and the uts, mostly because they can be a bond proxy should the bond market get a little nervous about the fed. charles: so with 5500 we have made this big move, you know, some people would argue that we're due. what kind of, what kind of pullbacks are you looking for here and would you be buying those dips? >> well, the way we look at it we think that when we've seen these markets pull back and the environment that we're in right now, generally we look for babies that get tossed out with the bathwater. that could be the better performing sectors that we expect for the year will perform the best as well as within individual equities looking to see what might be available and right now we're very pleased to see the mid-caps performing better than they performed in quite a while. charles: right. >> and we see some interest in

2:21 pm

the small caps though i think they're still at risk with the fed still at some distance from actually cutting interest rates. >> yeah i mean small cap value is absolutely on fire. i know you manage a dividend portfolio. you prefer the dividend growers over the high yielding stocks. i think this is really critical lesson here for the audience. why is that? essentially, i guess these, what we would call the aristocrats? >> well it is the aristocrats but we actually have our own proprietary group of stocks that we invest in. charles: sure. >> we prefer those and we're pleased we prefer those, they worked out very well but what we're looking for, we're looking for total returns. we want some stream of income because we like to get paid while we wait. on the other hand we prefer to invest in stocks that are well-positioned either growth,

2:22 pm

value or garr growth, what looking for better than their peers growing their dividends from a historical perspective, 10, five, three years out. charles: you want your cake and eat it too. you want the yield and company to grow. that is the cautionary tale, right? xyz with a 10% yield. the stock is falling apart, balance sheet is in tatters, and it is ticking time bomb. i think that will be more important this year, i feel as yields do come back folks will go back to the some dividend names they skipped last year. >> we think so too. charles: congratulations. got you down to 5500. i hope to bring you back soon, we'll talk 6,000. >> thank you, charles. great to be on with you. charles: don't forget, host, i'm hosting "unbreakable investors." it is a town hall, april 2th, 2:00 p.m. eastern. the last two why standing room

2:23 pm

only. it is a blast. what we have on the drawing board is phenomenal. you want to be here in studio asking questions directly. go to eventbrite.com. you search charles payne. get your free ticket and i will see you april 24th. if the fed has pulled off this sort of immaculate landing, why would they be cutting rates? that is a question i have for one of the street's top economists. that's next. ♪. (grandpa vo) i'm the richest guy in the world. hi baby! (woman 1 vo) i have inherited the best traditions. (woman 2 vo) i have a great boss... it's me. (man 1 vo) i have people, people i can count on. (man 2 vo) i have time to give (grandma vo) and a million stories to share. (grandpa vo) if that's not rich, i don't know what is.

2:24 pm

(vo) the key to being rich is knowing what counts. it's odd how in an instant things can transform. slipping out of balance into freefall. (the stock market is now down 23%). this is happening people. where there are so few certainties... (laughing) look around you. you deserve to know. as we navigate a future unknown. i'm glad i found stability amidst it all. gold. standing the test of time. you always got your mind on the green. not you. you! your business bank account

2:25 pm

with quickbooks money now earns 5% apy. (♪) that's how you business differently. intuit quickbooks. ♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya helps you choose the right amounts without over or under investing. so you can feel confident in your financial choices voya, well planned, well invested, well protected. everyone say, “space pod.” cheese. [door creaks open] [ominous music] (♪) [ding] meanwhile, at a vrbo... when other vacation rentals are just for likes, try one you'll actually like. (♪) is bad debt holding you back? ♪ the only limit is the sky ♪

2:26 pm

♪ it's our time ♪ ♪ you don't want to miss it (just a little bit louder) ♪ ♪ it's our time ♪ ♪ you don't want to miss it ♪ ♪ it's your moment in the spotlight ♪ all your ambitions. all in one app. low fixed rates. borrow up to $100k. no fees required. sofi. get your money right®. everybody wants super straight, super white teeth. they want that hollywood white smile. new sensodyne clinical white provides 2 shades whiter teeth and 24/7 sensitivity protection. i think it's a great product. it's going to help a lot of patients. - [speaker] at first, just leaving the house was hard. - [speaker] but wounded warrior project helps you realize it's possible to get out there

2:27 pm

- [speaker] to feel sense of camaraderie again. - [speaker] to find the tools to live life better. - [narrator] through generous community support, we've connected warriors and their families with no cost physical and mental health services, legislative advocacy, career assistance, and life skill training for 20 years, and we are just getting started. only at vanguard you're more than just an investor you're an owner. that means your priorities are ours too. our retirement tools and advice can help you leave a legacy for the ones you love. that's the value of ownership.

2:28 pm

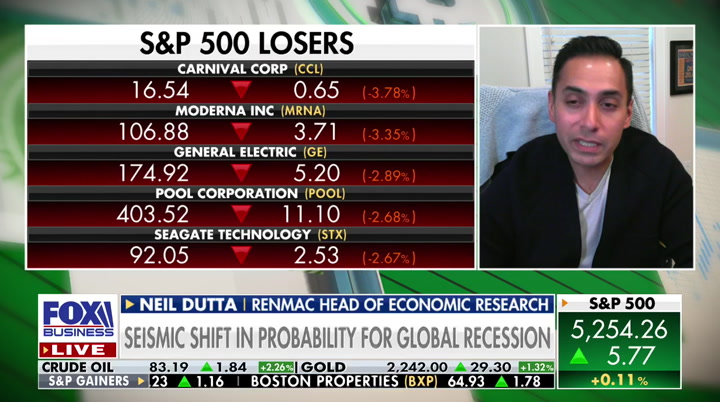

charles: yesterday federal reserve governor chris waller gave a speech to the economic club of new york, it was titled, there is still no rush. meanwhile absolute strategy research allocation survey revealed size i can shift for the probability of global recession, now under 50%. this is the first time in two years if that is the case, here in america, it would mean powell probably pulled off an immaculate landing but why would he still be in a rush to cut rates? let's bring in economic research neil dutta. you were i think in the two or three rate cut camp but at this point why would the fed risk it because there are little signs of inflation flaring up here and there? why wouldn't they let this drift

2:29 pm

to the finish line and then declare victory? >> well, charles, thanks for having me on. inflation is a lagging indicator and so if you're waiting for it to be 100% resolved you've likely waited too long. so i think, and powell's been very clears about this, they are going to start cutting before consumer price inflation is at 2%. that year-over-year number is going to be above 2% at the time they're first cutting but i think it's important where the trajectory of inflation is and i think the main distinction between powell and waller is, is that waller was spooked by the last couple of month. powell was not. i don't think the story really changed for powell as much as it has for waller. so i think that's an important kind of distinction that's worth monitoring for investors. charles: so if there was a movie version of this, paul newman would play jerome powell, essentially, "cool hand luke" in all of this. you pointed out some positive

2:30 pm

themes that are working. i want you to talk to the audience about them. i want to remind folks, newell, you've been spot on. calling well the economy for last couple years. central bank easing, global inflation easing, these are positive tailwinds, right? >> well absolutely, charles, thank you. i mean i think for investors the important thing is, we're talking about at the end of the day, right we're talking about how much is the fed going to cut and how much is the economy going to grow. fundamentally that's a fairly good backdrop for risk appetite, right? you mentioned global activity. if you look at manufacturing, purchasing manager surveys from around the world they're generally moving up and to the right. business confidence is on the mend. you mentioned recession risks, one of the things that will happen as a result of that, is that companies are going to spend more money on plant and equipment. remember that last year business

2:31 pm

equipment spending in the united states was basically negative in real terms. that's not going to happen this year. so you're going to see more sort of corporate investment, more global activity, and at the same time, you will see the fed cutting rates because inflation is likely to moderated from here. charles: right. >> i think that's important. remember, the u.s. was an outlyer, charles. if you look at january and february around the world, canada, lower than expected inflation. europe, generally lower than expected inflation. the uk, lower than expected inflation. so that kind of speaks to this residual seasonality idea that powell has been talking about. you don't want to put all your eggs in this basket but look at the data this morning. inflation expectations have been coming down even though gas prices have moved up. i think there is an important signal there. i'm pointing that data out only because, a couple of years ago, powell was using university of michigan inflation expectations

2:32 pm

as a way to rationalize going 75 bps, right? charles: i remember that day. yeah. i remember that day. a lot of people were surprised because i think the survey is like 500 people out of 40 million, 50 million. before i let you go, on the service side, there is an couple of intangibles right? wages, california, next week on monday, fast-food workers in california making $20 an hour. these kind of things are happening all over. these are the kind of inputs the fed has no control over but obviously if you're talking about service inflation it adds to the pressure, doesn't it? >> yeah, i mean yes you would think so, that some of that increase in wages is going to get passed on into what you pay for food, for fast-food. you would also expect to see maybe workers getting their hours cut or laid off all together. i mean there is some anecdotal evidence of that happening. as the data this morning show, generally speaking corporate

2:33 pm

profit margins, the fast-food sector notwithstanding, corporate profit margins are high and that should suggest that even if you do see some of these supply chain pressures, companies have a little bit more room now to kind of absorb that and wouldn't have to pass the price on. charles: right. >> the fast-food example was a good one but that's not necessarily indicative of the overall economy. charles: sounds good. hey, neil, thank you very much, my friend. appreciate it. >> thanks, charles. good to be with you. charles: i want to bring in the head of technical and macro research strategas, a baird company, chris varrone. before we talk markets your thoughts on this macroeconomic debate because it is a debate? every day, inflation is not dead, oh, man, recession is around the corner. it is confusing. >> on the economic trajectory and paths forward for inflation i will take the market's opinion over my own any day of the week. i look at the pro-cyclical signals from the leadership sectors of market, consumer

2:34 pm

discretionary, financials acting particularly well this is particularly true in europe where sue owe all the consumer names break out. i think it is the market's way of telling us the economy is probably okay here. look at the groups in 2022 that were most penalized by the runaway inflation, chemical stocks, small cap restaurants, they're all acting pretty good hire. i think in terms of what the market's interpretation of both growth and inflation, status quo is pretty good the base case. charles: with that in mind the market accepted pretty nicely the fed would not cut seven times or six times, accepted three times with the other, other factor being that the economy would be strong enough for these bottom lines. so does it matter if the fed cuts how many times the fed cuts right now in terms of the stock market rally? >> i think the reaction of the bond market the last several days would suggest particularly in light of the waller's comments, this is powell's fed, not waller's fed.

2:35 pm

charles: somebody better tell waller. >> when you look 10-year yields going back to 4.20, they have really treaded water over the past month despite hotter inflation prints. you look at some of the global yields. they want to go lower. german tens, swiss tens, bullish positioning in bonds make sense there are central banks out there that want to cut. i think that is the message of the bond market is. charles: government spending fiscal spending typically in an election year. this week, america sliding towards chinese style capitalism which is ironic because the next day janet yellen slammed president xi of china using subsidies to turbo charge domestic manufacturing in key new industries. that is president biden's re-election spiel. >> a little pot calling the kettle there, huh? charles: exactly. strategas you are well-known,

2:36 pm

best known permanent con necking geopolitical events with what is happening. are we okay with new form of capitalism, chinese style capitalism? >> why don't we ask gold? gold new all-time high here. it is clearly parts of the market that seem to be unsettled by it. now what i think people are expecting is it will ultimately manifest itself in higher interest rates. we have a saying at our shop, nostalgia is not an investment strategy,. charles: what about past is prologue? >> there is nostalgia for return of the bond vigilantes. i think we'll get the gold vigilante here. gold is sending as you message this is probably unsustainable path over the long run. charles: we'll pull up a chart this started after the freight global financial crisis where global central banks started to be net buyers of gold and every single year they bought more and more. in the last couple years they bought so much i'm saying they're bracing for apocalypse, look at that chart. what are they bracing for?

2:37 pm

what do these central banks know we don't know? >> i would generally say the central banks don't know anything you and i don't know. that is what the market knows that we care about. if you look kind of where the demand in the physical gold market has come, it has come from emerging market, china in particular. if you look at the paper market in gold it is actually pretty light. we look at the flows every day. you're not seeing inflows into things like gld, gdx would suggest there is a crowd here. charles: chris, always pleasure. >> far too long. charles: my next guest went against the grain and went up being right again. that is why he is a legend, stephen auth, on wall street. listen to his latest forecast and you want to hear it next. ♪

2:40 pm

you know, when i take the bike out like this, all my stresses just melt away. i hear that. this bad boy can fix anything. yep, tough day at work, nice cruise will sort you right out. when i'm riding, i'm not even thinking about my painful cavity. well, you shouldn't ignore that. and every time i get stressed about having to pay my bills, i just hop on the bike, man. oh, come on, man, you got to pay your bills. you don't have to worry about anything when you're protected by america's number-one motorcycle insurer. well, you definitely do. those things aren't related, so... ah, yee! oh, that is a vibrating pain.

2:42 pm

♪. charles: so my next guest was all in on the goldilocks plus. now looks like consensus is shifting his way and he is okay with that at least for now. want to bring in federated hermes cio stephen auth. congratulations. you were definitely going against the grain when we had these conversations a while back. i know you're contrarian. you're getting a little antsy everyone is jumping on the bandwagon here? >> almost every day someone caves and goes bullish, you know

2:43 pm

a lot of people i respect doing that. charles: right. >> i don't like when the room gets crowded. so we had a big meeting on monday back at federated hermes kind of going through everything and the problem is this for the bear. you've got everything working against you. the economy, we always said it was an asynchronous recession, rocky landing. that is the becoming the view now but the economy is clearly lifting, not declining. >> right. >> earnings have reflected higher in the second quarter for a row. we have the back half much better, particularly outside "the magnificent seven." charles: right. >> you got the fed trying to go from, for a while the fed's policy was don't make the same mistake as the '70s fed. now he is trying to stick the landing this going to be supportive on any sign of softness. that's positive. rates are going lower. we don't think as much as the market thinks. one or two cuts we've got for this year. still it is going lower, not higher and valuations outside of the big leaders in the market

2:44 pm

are not really that bad. charles: i want to put some of these observations and concerns on the screen so the audience can see that, what you and your team talked about. you already covered some of these things. i think what is really intriguing on this fed policy, right? forget about arthur burns. move over paul volcker, i'm going for the maestro. >> yeah. charles: forget about being volcker 2.0, i want to be the maestro 2.0. that is confidence. >> he is trying to stick the landing. he has got inflation working in his favor. it is already peaked out. we're going to see a number tomorrow, it will be kind of in the high 2s, maybe 3. i think three is kind of his informal target anyway. >> right. >> whoever decided two was the right number? there is too much downside from two. charles: what about the broadening out? i think yesterday at the close about 80% of the s&p was over the 200-day moving average. i think on one hand that's great, you are starting to say where are the opportunities?

2:45 pm

is anything cheap out there? >> lots of things are cheap. charles: really? >> financials are cheap. they're trading cheap. charles: okay. >> the entire value index is trading at 17 times. international stocks are kind of laggards, they're trading 14 times. emerging market are trading 10 times. small cams are cheap trading relatively to large caps. small cap value you mentioned is cheap relative to everything else. charles: even the ones have that been hot are cheap relatively. >> everything else is cheap. that is where we're overweight. so, and if i look at it, it is very sensible that the mag-7 have led here. they have led us in the earnings recovery. charles: right. >> remember they were also down big back in 2022 when the fed first started hiking. a part of their updraft is just coming out of that. charles: right. >> yeah, their earnings have led. they have led the market. the back half the earnings lead. as i ask the summer interns how

2:46 pm

many months away is the back half. they do the math, steve, it is six months. that is roughly how much time you need to discount something in the market. it wouldn't surprise me if this broadening out which we have started to see at least on a relative basis in the first three months of this year could start to accelerate as we get to the back half of the year. charles: no. it, i think, i'm a contrarian as well. my thing it is, all the pieces feel almost too good to be true. your marching orders, hang in there, buy the dips and rest of the year should be okay. >> we're in a secular bull. you don't sell rallies. you buy the dips. if we get a dip we'll be very happy. charles: right. >> we'll buy more. charles: sounds good. >> charles, thank you. >> great seeing you. all right, folks, sam bankman-fried as you know by now sentences to 25 years in prison. do you think that is enough? tweet me a @cvpayne. most are saying hell no. i agree. we'll be right back.

2:47 pm

♪. the virus that causes shingles is sleeping... in 99% of people over 50. it's lying dormant, waiting... and could reactivate. shingles strikes as a painful, blistering rash that can last for weeks. and it could wake at any time. think you're not at risk for shingles? it's time to wake up. because shingles could wake up in you. if you're over 50, talk to your doctor or pharmacist about shingles prevention. hi, i'm katie. i live in flagstaff, arizona. i'm an older student. i'm getting my doctorate in clinical psychology. i do a lot of hiking and kayaking. i needed something to help me gain clarity. so i was in the pharmacy and i saw a display of prevagen and i asked the pharmacist about it.

2:48 pm

2:50 pm

(vo) what does it mean to be rich? maybe rich is less about reaching a magic number... and more about discovering magic. rich is being able to keep your loved ones close. and also send them away. rich is living life your way. and having someone who can help you get there. the key to being rich is knowing what counts. (inspirational music) - [narrator] wounded warrior project helps post-9/11 veterans realize what's possible. with generous community support. - aaron, how you doing buddy? - [narrator] we bring warriors together and empower them to become stronger inside and out.

2:51 pm

2:52 pm

charles: sam bankman-fried sentenced to 25 years in prison for his multibillion dollar fraud. do you think it's enough? getting a ton of responses. brandon say, hell no. he'll do a few years country club time. carrie says, absolutely not. what a joke. he literally destroyed lives and families. our own kelly o'grady is outside the courthouse for the incidentsing. tell us what sam banman freed and the judge had to say. >> reporter: well, sam said i'm sorry, charles, and the judge said is, i don't believe you. and it's interesting, the responses that you just read, because i think in this case what we're hearing is 25 years for a man who's just 32 is kind of what looks like throwing the book at. now, i want to say though it's rather surprising that bankman-fried even spoke at all a given his dismal performance during the trial. he tried to show remorse in his remarks, but he was really

2:53 pm

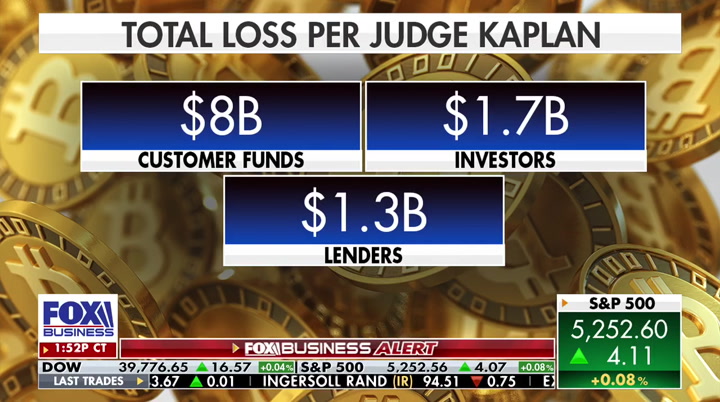

monotone when speaking, never admitted fault. of course, that's a very important fact as he will likely be filing if an appeal. i also want to zero in on this question of loss. the defense claimed that there was none, the victims are going to get their money back during bankruptcy, but the judge flat out rejected that argument. the prosecution said, after all, you know, they think $550 million won't be able to be clawed back. judge kaplan went with the whole $10 billion, 8 to customers, 1.7 to investors and. 3 to lenders. i actually just spoke with a former prosecutor, he shared with me that a new york law is all about intent. it doesn't matter if people get their money back, it's about what sam's intent was, and that was to defraud here. so whether bankruptcy was able to recover that, a completely separate issue. zoom out, what does this say to the crypto iustry? attorney merrick garland sred this statement. quote, there are serious consequences for defrauding customers and nervous. anyone who believes they can head their financial crime

2:54 pm

behind wealth and power or shiny new thing they claim no one is else is sport enough to understand, should think twice. we've seen the resurgence in bitcoin, and a lot of folks are arguing, well, this could send a message that we are getting rid of bad actors. we are boeing to be a safer place for you to invest -- going to be a safer place to invest. for now, sam bankman-fried is looking at 25 years, and i did my best, charles. we got a lot of vocal fans out here. charles: yeah, you did absolutely fantastic. kelly, thank you very much. let's bring in cybersecurity lawyer he's a saw garver. just your initial thoughts because, again, this is highly motional for a lot of people, for a lot of reasons. this is far more than a crypto story. >> i agree, charles. i agree with your reporter too, 25 years for a young guy does seem like throwing the book with, but it's definitely and definitively not enough time for

2:55 pm

a variety of reasons, and the judge pointed them out related to bankman-fried. he likely will do this again, he's not trust or worthy. but also it doesn't set the right tone for regular rating crypto on the whole, and that's what a lot of attorneys and people in the field are so concerned about a because there's not enough legislation or regulation in the united states related to crypto as it stands. and so this -- far this process of regulation by enforcement, it's just not enough. and seeing this sentence though it does loom large is simply not sending the the right message for wrongdoers. charles: we think about some high profile cases,ny madoff, of course, got 150 years, and he was 70. so the idea that this guy's going to get old in prison, he'll still be young enough to play paddleball or whatever's hot at that time. jeff selling got, i think, 24 years. michael mil ken even, i think, got a bigger number. i think there have been a lot

2:56 pm

bigger sentences, but i think the question now is how do people go about getting their money back? >> it's going to be a lengthy process. and when you speak about comparing these sentences, sure, there are different amount as of money in play. and here it's about a ten, a dozen billion dollars which is still a very large amount of money, but it's not as a much compared to madoff and some of the other fenders. but these people have been suffering for years, and they are continue to suffer because we don't know where that money's going to come back from or what the freeze going to do. it's very confusing for the victim here. charles: i've got to tell you, i think even today he played us for suckers or or attempted to when he said he let his team down. this guy was the architect, and he had some is serious help. it was sophisticated. these back door systems were set in place to rob billions of dollars without people being -- without anyone noticing until, of course, it got to this level

2:57 pm

of egregiousness. so i just hope that,s or you know, maybe the trail doesn't end here. he had some smart, bigtime, deep-pocketed backers. he had some is very influential people. he dropped 40 billion in congress. i hope somehow, some way the law continues to go down this trail. >> we have to catch up, and this is the problem with cybersecurity, with data breaches, with crypto, and that's right back to merrick garland's statements. we are smart, we are investing, we know we have to be careful with our money, and we need those protections coming from the industry as a well. so crypto should be safer. we need to make it safer, and even to though it seemed like a hiney, new thing that -- shiny, new thing, it's something that bankman bankman fried just moved the money around. charles: yeah. this is crime 101. goes all the way back to time. and, by the i way, i hope next time we don't let the criminals write the laws. great seeing you or really

2:58 pm

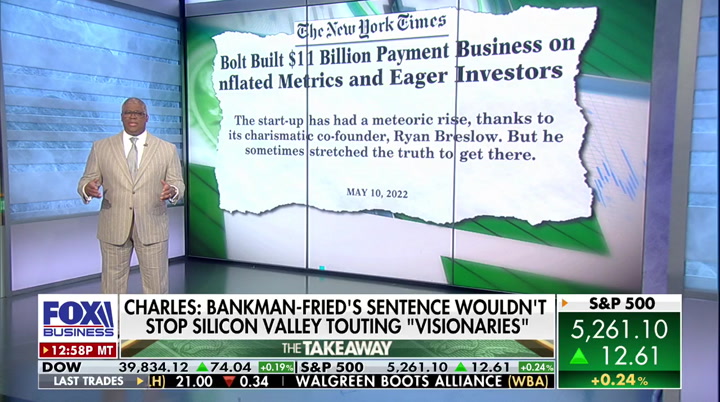

appreciate you on this topic e. >> thank you. charles: all right, folks, i think sam bankman-fried deserved 110 years, and there should, as i was just saying, be a much deeper investigation into the venn isture capitalists and others who helped his meteoric rise. there was nothing special about sbf, the person. yeah, he's got an extraordinary the family and, of course, the smartest venture capitalists in silicon valley got behind him, but why? i mean, really. what they did was give him a stamp of approval, and that opened doors. it's a well-worn approach. it's been with done over and over again. with that approach you raise a lot of money, right, on the private side, and you make a lot of noise. you get a lot of publicity. you get celebrities involved, the media ca involved. how many people did -- times did people fawn over this guy? and at some point, it takes a life are of its own. hollywood had a similar approach in the 1990s. they called it the star system -- 1960. they would create per we see

2:59 pm

thats for folks. you could be a soda jerk, and and they'll put -- pull you out and give you a fancy name, you didn't even have to be an actor, and they'd make them stars. this sbf verdict and sentence, i don't think, is going to stop it. on may 10th, 202, "the new york times" wrote a glowing article about a guy named brian brislowe. take a look at the headline. $11 billion payment business on inflated metrics and eager investments. the start-up has had a meteoric rise thanks to its charismatic cofinder, but he sometimes stretched the truth to get there. [laughter] the same new york times cheered when donald trump got slammed for $500 million for exaggerating about his real estate values, and there were no victims. fast forward to last year, a different headline. ex-ceo subject of an sec probe p. listen, brian's got other

3:00 pm

things in the -- ryan's got other things in the hop orer. i'm not saying whether he's a good guy or bad guy, but i'm leery of the same profile, the same people, the same look, the same visionary stuff, right? they're all into effectival true theism. i'm tired of the american public being ripped off and, sad to say, right, it did not stop today. so my warning to you with whenever you see one of these guys, one of these hipsters and he looks like a modern day hippie and everyone's saying he's a genius, take a step back. look at the financials, look at a everything and pay attention, pay attention. because the people who are supposed to be doing this for you have let you down over and over and over again. and i don't know that it's -- i don't think it's, i don't think it's a mistake. i think manager's wrong there. manager's wrong there. well, here's liz claman where nothing is ever wrong. [laughter] liz: thank you. charles: you got it. liz: yeah. remember the whole bitcoin jesus thing in. [laughter] charles: don't get me started.

36 Views

IN COLLECTIONS

FOX Business Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11