tv Committee for a Responsible Federal Budget Holds Tax Policy Summit CSPAN March 28, 2024 3:47pm-4:42pm EDT

3:47 pm

at 2 million miles, accident free drivers, and we hold everything from campbell's soup and nabisco and we were hazmat endorsed, called explosives, poisons, chemicals. we were out for a month at a time and worked for 23 years for warner enterprises out of omaha. and when we retired, it was because they finally gave a raise, what it was for everyone under the one million mark, and we had 1, 2, 3, 4 and one 5 million miles driver, and they didn't give us a raise, so he got angry and quit. but for women that don't believe

3:48 pm

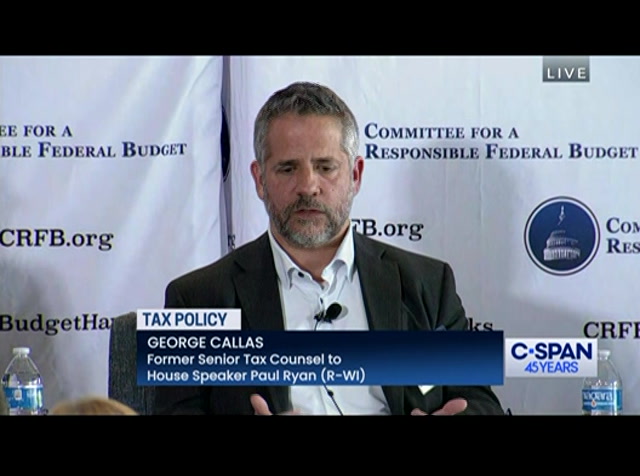

announcer: we will take you live now to a discussion on changes in tax policy including the benefit expirations of the 2017 tax cut law. live coverage on c-span. >> we have four veterans of offices and committees that have written some of the tax laws including the tcja itself. we will have a lot of perspective on what the legislative process is likely to look like next year when lawmakers realize, we have a different talk slow this year. for the conversation we have alex brill. george callas. aruna kalyanam. and anna taylor. i wanted to start by talking

3:49 pm

about the way the last panel started which basically the idea is, if you want to fully extend the whole tcja for another 10 years, it'll cost you in the bar park of $3.5 trillion -- all part of $3.5 trillion. inflation is high and we should be focused on responsible policy and the budget deficit. so the plans that we heard basically set a target of, let's try to make it cost nothing compared to the current baseline and make difficult decisions along the way. most of the plans involve a tax rate that is higher than the one that prevailed for the last few years. is that how people on capitol hill are going to approach this question when they face it next year? we can start with aruna if nobody wants to jump and. >> -- wants to

3:50 pm

jump in. >> let's dive right in. in all honesty, you can't let the perfect be the enemy of the good. sometimes the good is as good as it can be or just whatever can get 60 votes, frankly. what can get you across? i think there's a little more pressure on we are can you actually find compromise -- where can you actually find compromise? you have got to start with that sort of baseline. i think back on a couple of experiences i had on capitol hill where literally a smaller number of members -- this was several people here -- a supercommittee trying to deal with our deficit.

3:51 pm

same baseline, same group of people. the question that was asked from the previous panel, are we talking spending? tax cuts, tax increases? how can we put these all together? we went for that math problem, and it was very hard. even with 12 members. >> it didn't work. >> it did not work. i believe it failed just before thanksgiving. which meant at least it didn't ruin any of our holidays at that point. it is a tale as old as time. i would say i think that deficits, inflation, interest rates are far more -- they feel a lot more like kitchen table issues than they have in the past. i don't know if the people in this room would agree. there is more discussion about that. people are actually paying attention, where my taxes going

3:52 pm

this year? people are paying closer attention. there are decisions lawmakers can easily make in terms of representing some of the philosophies you discussed. talking about deficit neutral, are we going to try to reduce the deficit with what we are doing here? some of that comes from everybody holding hands and making a choice to as a baseline, are we going to look at current law? are there other things we can look at to even make whatever policies we look at actually raise more revenue compared to what we have decided we will look at our baseline again. i actually don't think anyone of those number one topline sort of issues,

3:53 pm

we have to have corporations pay more, i don't think any single one is going to govern. for a lot of politicians on the hill, it is about, are voters going to face tax increases? that's their number one priority. how do we ensure we don't get voters tax increases? you do have a lot of staff thinking through progressivity and neutrality and the important pieces to the puzzle. but thresholds? they don't want to be held accountable for massive tax increases on individual voters. >> i think we assume the voters are on a current policy baseline? >> right, i think, yes, there are a lot of individual voters at the kitchen table saying, if you don't extend this, my taxes go up. >> what do you make of that,

3:54 pm

george? many look back at the expiration of the bush tax cuts. you had a fight between, should we extend all of this or most of this? people were very explicit in many of those conversations. should we think about the baseline here as an added $3.4 trillion over the next 10 years, in the negotiations start from there? >> there's a worse case scenario -- worst-case scenario from a deficit perspective because that number includes an assumption of making all the offsets permanent. some of those offsets will have political opposition. the salt cap, they forget the mortgage interest deduction is set to go back up. if you don't think there are real estate interests, thinking about how to deal with this. there are other things

3:55 pm

to expire. personal exemptions and so forth. they will come back. many think we should have an additional tax credit and a bigger standard deduction. the worst case scenario is the six-point whatever trillion dollars it is to make the tax cuts permanent but would it expire? this dynamic makes the discussion and the magnitude more complicated than the bush tax cuts. you can't just say we are going to pick an income level and make it permanent for people earning under that level and expire it for people making over that income level. that is effectively how we resolved the bush tax cuts. but they were only tax cuts. there were no offsets in play. so you could just negotiate an income threshold. it was a dial based on the

3:56 pm

politics. i hear people say this -- we will make everything permanent for people below x dollars. i don't know what that means. are you going to impose a cap on people hundred $400,000 -- under $400,000? it's not that simple. there will have to be a much more complicated negotiation. there's going to be organized opposition extending the offsets in addition to what we do with the tax codes. that leads to i think -- it's a three-dimensional chess game. not a simple discussion, not the relatively simple discussion the bush tax cuts were. >> anyone more optimistic on that? >> i wish i was not as pessimistic but i do think the challenges are very

3:57 pm

significant. we framed it a moment ago with respect to which baseline do you want to buy into? that's going to play a huge role in this debate. there will be an argument advanced by some people that say extending the tcja costs zero because they are on a baseline that it costs zero and that is going to be their worldview. the notion it could be worse, there could be people who come and say i believe that extending the tcja actually costs zero in my baseline and those guys in 2017 got to cut taxes and i want to cut taxes, too. that tax cut was perfect and wonderful and i'm going to make it even better because i will make it even bigger. we could imagine someone who might say i'm going to make that great tax cut even better and even bigger. [laughter] i don't know if that person will have a voice but if they do, that is going to be part of this conversation. >> that actually sets up

3:58 pm

where i want to go next. we are trying to figure out what's going to happen next year. it's unavoidable to talk about election outcomes. it will heavily drive what policy is made next year. if there is a republican sweep, trump, house and senate, donald trump is running on a substantial tax increase same we are going to have a 10% tariff on all imported goods. what does that negotiation look like? will it be that big revenue raiser and shape the tax code along with thea >> dynamic -- along with the tcja? >> that dynamic makes it even easier. he will argue, i've got this other revenue coming in. if we didn't need to worry, now we don't need to worry about the cost.

3:59 pm

that only furthers the potential the system is facing additional cuts. >> singh you see were heavily -- >> since you were heavily involved in the writing of the tcja can you talk about the way that doug trump white house interacted with congress? it was congress driving the bus on most of the structures. what is the negotiation going to look like if donald trump is saying i want these big tariffs, wanting to cut taxes a lot? how do republicans in congress, not thrilled about a high tariff policy, how do they respond to that? >> it will be interesting to see because i think in 2017, you had a situation. and you are right, tcja was driven by congressional republicans. despite some folks saying, they rushed it through in seven

4:00 pm

weeks, as a staffer, i was like, i spent seven years on what eventually became the tcja. at one point it was supposed to be revenue neutral but from a policy perspective, it was years in the making. it was long predating donald trump even running for president. he did have sort of high-level types of things but under the hood it was really congress. it was enacted in december of 2017. 2018 is when trump started imposing a bunch of tariffs. it is absolutely true there are people who are around the trump white house who will presumably be back if there is a second term who believe philosophically that we should rely less on internal practices and more on external tariffs. 10 i've heard people -- and i've heard people make

4:01 pm

the 1850's as a good model of public finance because it would increase our self-sufficiency. that's a real thing. those of us who are budget wonks, understand how the rules work, we know you can't use an executive action that can be done away with at the stroke of a pen as an offset for a statue. there's a problem there. but i don't think donald trump sees that nuance, and i think they absolutely did want the tax cut to be deeper on the individual side, and the previous panel talked about maybe not having the rate cuts as deep as they were in the tcja . there absolutely was a view from the white house -- i don't know if congress picked up on this at the time -- that they wanted a deeper individual recut so they could absorb -- rate cut so people could absorb what. that's how they look at things.

4:02 pm

that context has to be in people's minds if trump is president again and how they are going to approach this. >> that creates fiscal space on the legislative perspective. >> there is a discussion about these policies matching up on the ledger. it is a really crazy world. where you have tariffs on everything at walmart, the number of people that shop at walmart, using that to offset higher income rate reductions, number one, the distribution of that willbe just atrocious to begin with. people are paying attention. i know people trace -- i know people track the

4:03 pm

the price of eggs. $1.99, $2.99. 10% across-the-board, on everything, that is going to just -- i think people are going to see this and realize what is going on. >> i agree with what you said. >> [indiscernible] remember what the donald trump folks think, the distribution, distributed onto foreign producers. we are cutting taxes on americans and raising them on foreign producers. that's what i believe. but i agree with everything you just said. >> it's helpful to think about, who were going to be the policy leaders and the treasury officials that are going to be in the room? and what philosophies are they bringing with them to that table

4:04 pm

? >> politics on tariff policies are not clear-cut, across political parties. when you had him implement his tariffs the last administration, he had democrats on both sides of the issue and republicans on both sides of the issue on the hill. it's an area that does not cut cleanly across parties. >> let's talk about a scenario of a democratic sweep, biden is re-elected, house and senate, democrat majority in the house, a narrow one. i'm struck by the way that biden talks about the tcja. he doesn't want to extend all of it. but depending on how you take him, he might be extending three quarters or more of the tcja. then he has additional tax cuts for lower and middle income earners he would like to extend.

4:05 pm

democrats also have a wish list of revenue raising measures they would like on corporations. there's a bit of a duplication issue -- talk about if you have democrats were able to write their own tax bill, almost all of the members have to pass a, what kind of outcome does not produce in 2025? >> the first thing i would say is, there's muscle memory within the democratic caucus on how to do these bills. they've done a lot of big bills over the last few years. while this is a difficult undertaking to be sure, it is one there's a little bit of an ability there to build off of the successes they've had recently. two, i think they have a lot of substance already prepared. you have the president's budget.

4:06 pm

it includes a lot of follow-ups from the build back better and reduction act process. those proposals have been largely vetted with members and scorekeepers on the hill. they are not starting from scratch. it is still obviously a humongous undertaking but they have a leg up. they've been working on these proposals for a number of years. >> i would agree they are experienced and prepared with a roster of policies. i would also say the framework in the sweep scenario is starting from tcja. and that baseline. that will be there framework. then they will be saying, we want to make it better. we want to do this at the top. we want to do this with the corporations. that will in many centss --

4:07 pm

they will be talking about holding onto a large chunk of tcja tcja and changing the distribution from there. >> the previous panel talk about, how do you shape tax policies around a proclamation of $400,000 or less will not say tax increases? i think all four of us can hold hands and agree that puts our bed -- cuts are very bad. >> some tax policy, if you owe an extra dollar -- >> yeah, it doesn't hit here, anyone of those cliffs, there are such perverse effects. even when we looked at house republicans, i don't

4:08 pm

think the bill went to the floor. it was bananas. legitimate actual bananas. like $100,000, the marginal rate. [indiscernible] [laughter] i think about, all of those things are going to be tough. i would have to agree with anna here. there a greater comfort with finding areas to raise revenue. one sort of key point here is a number of republicans, we are seeing it with respect to the smith bill currently sitting in the senate. have republicans that do not believe any tax cuts should be offset. meanwhile democrats -- everyone knows the old addage,

4:09 pm

don't text me, text that guy behind the tree. there's a greater comfort level with offsetting tax cuts. and finding those offsets. you can talk about increased transparency on things like that but imagine more puzzle pieces to try to put the puzzle together vis-a-vis an exercise that doesn't allow process [indiscernible] >> part of the reason there's a book as there are policies that joe manchin and kyrsten sinema rejected. they will not be in the senate next time around. the democrats have this menu that's developed. i'm wondering how many of those things they will be able to take off the menu if they have literally 50 democratic senators. are we talking about raising the corporate tax rate? a higher global minimum tax rate? some sort of millinery wealth tax? is it actually -- what parts are realistic?

4:10 pm

>> i have not seen updated scores on some of those things. there's a big chunk of revenue to be had in the international space. a lot of congressional democrats highlight important policy that needs to be implement if given everything happening globally. that would be a place they would obviously look. i definitely hear congressional democrats saying i don't know why the corporate rate is 21% when we were talking about 25% right before tcja happened. is 25% or somewhere around there a competitive global rate or not? let's have a conversation about that. you have the president's new proposal -- there's revenue in all of these pieces that there would be a conversation about it within the democratic conference. >> these things were not tapped

4:11 pm

into. the moment was there. i would say kind of cleaning a little bit on what alex said, there's a big mix of stuff going on. george said it. we are trying to stave off revenue raisers as well as maintain cuts. you shine a fresh light on not just what was in tcja, but looking at broader elements of the code. these action-forcing events are not limited to those with shelf lifes. >> i was going to mention manchin and sinema, i don't know the particulars of the dynamic, but you get one or two members who are the heatshield for other members who also have problems with some of the policy options and are perfectly happy to keep

4:12 pm

their mouths shut so they don't have to take the heat on it. if manchin and sinema want to take the heat, let them, but you might find, a lot of these things, it was not that they only had 49, they might not have had 45. >> let's talk about some sort of split government. there are several different formats in which we could have a split government. maya said at the beginning of this conference, often, the way those negotiations go, the republicans get the tax cuts they want and the dems, what they want, and you compromise by running up the bill in terms of deficit impact. is that what is going to happen? we have a split government next year? >> i think that the world's changing a little bit . maybe this is my eternal optimism shining through. everyone knows me as an

4:13 pm

optimistic person. house republicans are in a very different place. you don't have to pay for tax cuts, for extensions. if anybody is not paying attention, house republicans have been offsetting tax cuts and extensions of expiring tcja tax relief with revenue rates -- they did it last june in committee and used ira credits to pay for it in a partisan context and then in the smith widens deal, it goes to the northern chamber. [laughter] but when they knew they could not use green energy credit and a bipartisan context, it's interesting

4:14 pm

to me, house republicans had been building muscle memory regarding you do pay for tax cuts and you do pay for extensions and i've heard in the context of this current tax package, there were 200 plus house republicans saying behind closed doors, we need to offset this stuff. senate republicans are not in the same place necessarily. but in a divided government scenario, that's going to make for a really interesting dynamic, if house republicans continue to feel like we have to worry about deficits, interest rates, inflation, etc. democrats are going to be and whatever place the rn. it could be interesting. >> the inflation reduction act reduced the deficit significantly to 30 something billion dollars. >> depending on how much the tax credits actually cost. >> right. the decision the policymakers

4:15 pm

made when enacted was to cut the deficit. tcja, obviously not fully paid for, included significant revenue increases to pay for part of it. it is something that will be a part of the conversation, as difficult as it may be. we should not discount they will try and do the best he can to offset at least part of the package -- they can to offset at least part of the package. >> there were a few areas of consensus on the last panel that are very far from being areas of consensus on the hill, there are least favorite provisions that experts say, we could raise some revenue. is there any chance of revenue raising areas being -- some curtailment of that in the drawing of this bill? >> i could imagine some limits

4:16 pm

on that. i do think of the notion that republicans will be open to entertaining offsets in general, they will not be interested in offsetting $4 trillion worth of tax cuts. but there will be some openness. that kind of refinement -- what karl was talking about in his plan, are open for discussion. but that's a provision that had a lot of support. we can all agree -- i will agree with the previous panel about the sentiment around 199 cafe. i don't think lawmakers would. >> on the other side of that, when those provisions were being crafted unpacking this remembers, members were like, what? [laughter] who actually gets this? oh, okay -- going through that exercise, people, certainly, democrats i

4:17 pm

worked with were like, this feels like a getaway. it's not been a long time. a number of those members said to me, i just want to tell you -- i don't like this. [laughter] i just want to point back to when anna was saying at the beginning. how do you thread the needle without raising taxes on your people? >> not putting something into effect and repealing it. >> or allowing something to expire, you know? ? the dragon here is very complicated. -- the jargon here is very complicated. >> what about salt? this is a big revenue losing provision. it's also pretty regressive, mostly aimed at higher earners and high-tech states. if you represent long island and congress, you have to act like you want to bring the salt deduction by court are -- or are

4:18 pm

democrats going to make this an actual priority? >> i'm definitely not speaking from my former new york boss here, but it is a hard issue. while it is something that you are a budget nerd, you are looking at the cost ledger on who gets the most benefits from it, that's one thing. when you are talking to teachers and firefighters in long island who do get hit by it, that's another thing. even though the dollar value on a ledger is much larger on the high income end of the spectrum, there are more voters on the lower income end of the spectrum who are hit by this. we do hear about it from those people. it is a tough issue. there was a significant negotiation that happened on this issue during bbb and the inflation reduction act.

4:19 pm

there has not been a resolution. i don't know what the resolution is. i think there are really strong, genuine feelings from both sides. >> it's definitely a very tough issue. i remember, we certainly care a lot. i remember what he description table looks like versus, again, the democratic members said, is it possible to adjust these benefits geographically? [laughter] which is amazing. i love the creativity there. but at the end of the day, this matters. this really hits people -- people who actually, like, it hits them in a way, whether or not it is appropriate to hit them that way. that's beyond looking at just the table. >> we have an audience question about the $400,000 pledge.

4:20 pm

legend no tax increases for taxpayers under $400,000. approximately knee -- approximately 90% of the public you are exempting there. i remember when we had obama running for president in 2008, back then it was $250,000. it has moved up. if you have two very senior correspondence, that household should not be at the top of who should not face tax increases. especially they have high real estate taxes and the feds are on top of it. if that shapes this negotiation, that takes so much of the possible revenue raising off the table. we have talked about the difficulty of even designing the compliance of the $400,000 cap because of complexity here. i assume that pledges will have to be broken by either party

4:21 pm

that revises this tax law. you have to design some households with unusual situations, $300,000 households, that will face tax increases. how does it work to break the news to people that someone will have to pay more in tax? >> so, no way, back when the bush tax cuts were resolved, they expired and extended for two years, extended at the end of 2012, many republicans in congress could not vote to extend a portion of them before the end of 2012. this is the contortions -- explaining something to be able home. they could not do it before the end of 2012. because that would be increasing taxes on people. that's why the vote was like on january 2. the day before the congress expired constitutionally january 3. at that point, taxes had automatically gone up.

4:22 pm

not because congress voted to raise them but they had automatically gone up. then they could say, now we are cutting your taxes. not raising them. as silly as that sounds, those were the machinations the house and the senate had to go through to resolve the bush tax cuts in the period between new year's eve and when the congress expired january 3 to get it done. we know they will do things that silly to get around that problem. >> i think it also puts a lot of focus and pressure on non- individual provisions. what is exempt from the $400,000 cap? the corporate income tax. it's a really important conversation. it will spear energy to non-individual provisions. >> also the question of, how do you define the fudge?

4:23 pm

are you going through and looking at it line by line? ok, if we make this change, this deduction, that tax increase, that was done, but there is also a child tax credit -- if you look at distribution of the whole package, there is no tax increase. it's going to be in the eye of the beholder, in terms of how you determined that. >> there's a whole world also in there, like excise taxes. i'm sorry, we cannot touch gas taxes or the way that we need to, tobacco taxes,other areas . mariajuana -- marijuana becomes legalized at the federal level. at the end of the day, we have seen it on the hill, but even before then, if people don't get together and

4:24 pm

agree and get whatever majority they need to get something done, you know, i think there's a will to do it. now i am wearing my optimism. >> either finance or looking at some income bracket that doesn't raise taxes on average for people in this bracket, it takes us back to the conversation we had in 2017 about the tcja. it raised taxes between 5% and 7% of households or something. but the democrats and the press beat republicans over the head with that. this household is facing a tax increase, this household is facing a tax increase. i imagine seeing a lot of that. joe biden said no one would pay a tax increase in that bracket but here's this family. and this family. i assume that's the way that politics go. >> thank you for mentioning that we got beat over the head. [laughter]

4:25 pm

others did estimates and they were in the mid to high single digit percentages of the portion of people -- mid to high percentages of the portion of people. your standard deduction. besides the misleading political attacks, there is the issue of a line on my return and i see that but i don't see how the rate cut effects so there are tax tables. i don't see the rate cuts but i

4:26 pm

see the salt cap or the schedule a. the perception is not the reality. >> to take it back to the bigger picture, that is a factor that cuts in favor of democrats being cautious. we have another audience question. does the full extension freak out markets and cause a fiscal crisis a la liz truss? interest rates are high. does that create political pressure? more spectacular situations create pressure like we saw in the u.k. is that something on the radar for any of you? subtle or not-so-subtle ways the interest rate environment is affecting these negotiations. >> it goes back to the question of the baseline. what is the wall street baseline for this? what are they expecting? are they spitting it to be fully --

4:27 pm

if the market was expecting it to be fully offset, they would freak out. i don't think it is there baseline that is going to be fully offset. i think -- a lot of dollars between fully offset and $4 trillion but somewhere in there i think it is going to be -- the market is going to be expecting something costing about what it is going to cost. to the extent the market or the economy were things are in different place when we are reaching the end of 2025, this opens the door for this kick the can policy where if there is a lot of uncertainty one could temporarily extend it and continue to work on that issue. >> i was recently looking at some of the messaging post 2010 when the decision was made to do the short-term extension. there was a of talk from politicians -- we have gone through the great recession and

4:28 pm

we went through so much uncertainty. let's do another short-term extension to keep things stable. it will be interesting to see what the economic environment looks like when we get into next year. >> the various pressures create a lot of households on the code in order to generate revenue. that does not involve raising the statutory rate in the u.s.. is that something that ends up part of this because the revenue is needed? >> absolutely on the table. house republicans will see some of that as being on the table.

4:29 pm

i don't think they would go for anything remotely approaching the biden proposals. i think does it have to be 21 with 20 one or 23 be the end of the world? on the international stuff i think republicans don't like profit shifting. they don't like hearing stuff is moving overseas instead of being here. well they might not like pillar two and the dynamics around that, there are international revenue raisers, anti-profit shifting, loophole closing type things that might appeal to house republicans if they are trying to help individuals and families and small businesses. >> i think democrats took a very serious look at doing something in this space on the inflation reduction act and came close to doing it. it is a timing question. early to mid summer.

4:30 pm

2022. there was a big fight happening in the du about how they were going to move forward with pillar two compliance. at that point it scared congressional republicans a little and said we don't want to go first. we are not sure what is going to happen. now we are past that. you see the rest of the world moving. you will see congressional democrats saying not only is it a place you can look for revenue, it is a place where they want to act from a policy perspective. it will be a priority in the conversation next year. >> and corporate interest are going to come up and talk about what they are facing paired multinationals are going to be able to talk to representatives about what they are facing when they are doing business in other countries. what is working, what is not. i think it is a moment that is very ripe for revisiting. i think past democrats voted on

4:31 pm

it. >> what direction does the corporate input push in terms of the structure of the policy? >> personally i think you're going to have to see what uptick in other countries looks like. what does it mean for those economies? what does it mean for u.s. investment in foreign countries? and see how this is shaking out. you have a lot of these major tax changes coming online in the next year, 2, 3. i talked to my colleagues that sit in foreign countries and they tell me these are policy changes switzerland or singapore are all considering just looking at things. they know -- how they are going to change and be nimble in their own economies to react to this global agreement. those things are going to play out. u.s. companies are doing business in those areas. also headquartered here. have to reevaluate and see what is the right direction. >> i want to talk about the

4:32 pm

spending side. the questions we had the last panel, should spending be part of the conversation as we are figuring out what to reauthorize in the next year. some of the past negotiations have had that structure including the supercommittee. is that something you see getting roped into this? is there going to be a demand from the republican side that if we are going to do this tax reform there is something we are going to have to do on the spending side. >> this is a little too cheap and easy but irs funding was worked in on some of these areas. great revenue wager and 20 billion was cut back. i think certain types of spending -- that is a politically driven decision that was made to include that.

4:33 pm

in an omni deal or omni framework. >> negotiation was technically spending types included in the ira. there was spending cut in the ira. >> cut foreign aid. >> to that point, we are talking about potentially if we are doing what was recommended, trying to raise 3 trillion over the budget window or if it is not that, talking about one trillion relative to current policy, are there spending changes on that scale? if you take another 10 billion -- first of all you probably lose revenue when you do that. really substantial spending changes going to get roped into this. >> there are separate conversations. some people on the other panel

4:34 pm

said they do. there's only so much congress can sign off on one legislate of package and negotiate through. i've always seen the tc j resolution and the for lack of a better term grand bargain type of trade as separate negotiations should don't forget the debt limit expires at the beginning of 2025 with extraordinary measures that is going to push us somewhere in the middle of 2025 but not far enough to do the tc j at the same time and a spending conversation will happen as part of the debt limit increase. my sense is they are probably separate conversations. >> there is a process question too. you could imagine a scheme whereby multiple committees are reporting out policies getting wrapped together. absent that there is the nature of the structure of congress and the way committees are structured. it seems hard to coordinate across committees that one

4:35 pm

committee is doing a spending thing over here while the maids -- the ways and means committee is doing and other thing at the same time. the ira would be an example. it becomes much more difficult. >> a little bit of a dissonance comes from members that have voted for 10% across-the-board cuts. when those boards fail, they go back to their districts and bayard every ribbon-cutting ceremony. that is a reality. if we are talking about putting these things in and 10% of appropriations is not going to get us anywhere near what you are talking about. in that world, do people actually want to do this? if you are talking big spending, social security, medicare, it is tough. very tough. >> i agree. i just don't -- we are in an environment right now where the small $80 billion tax pockets we are trying to get over the

4:36 pm

finish line is not even able to find momentum at least not yet. i find it very hard to believe we are in an environment next year where it is possible to do a massive tax bill and a massive spending package at the same time. it seems really difficult. >> even if it is not literally the same time, you're talking with the debt limit process. they might need to be done in the same year conceivably depending on what the price is for the debt limit increase. >> unless they don't do them in the same year which is really bad because they both need to be done next year. >> you could have a relatively clean debt limit increase. >> or you kick it a few months down. you could do something like that. >> i think that was a suitably depressing conversation. i appreciate all of you pouring as much cold water as possible on this. thank you for your insight. [applause]

4:37 pm

>> i will try to be fast. in addition to the booth, we are unveiling our brand new told your own tax extension simulator. i encourage. we have laptops and not ipads but the non-apple version of ipads i encourage you to use. my colleague designed the whole thing. if you see him, tell them head is awesome -- tell them it is awesome. head straight down the hallway. we have cocktails and build your own tax extension. thank you.

4:38 pm

>> this evening on q and a, columnist rob henderson author of troubled discusses what it was like growing up in the u.s. foster care system. the hurtles he overcame and what he learned about class divisions in america all obtaining degrees in psychology from yale and cambridge university. >> the vast majority of students were raised by both of their parents whereas where i grew up, i mentioned these close friends i had. none of us were raised by birth parents. a lot of single mothers or people being taken in by grandparents. my friend was raised by a single

4:39 pm

father. that mirrors the statistics overall. >> watch the q and a interview with rob henderson at 7:00 p.m. eastern on c-span, c-span now or online at c-span.org. >> do you solemnly swear that in the testimony you are about to give will be the truth, the whole truth and nothing but the truth so help you god? >> saturday, watch their american history tv series congress investigates as we explore major investigations by the u.s. house senate during our history. each week authors and historians. we will examine the impact and legacy of key congressional hearings. this week the 1912 special senate committee investigating the sinking of the titanic. witnesses testified about ice warnings that were ignored. the inadequate number of lifeboats. for treatment of passengers.

4:40 pm

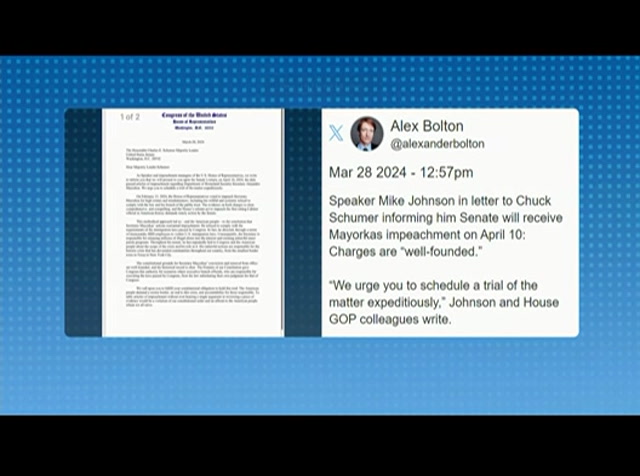

will find out what congress did about it and how changes impact to travel on the seas today. watch congress investigates saturdays at 7:00 p.m. eastern on c-span two. >> an update now on the impeachment of homeland security alejandra mayorkas. alexander bolton is reporting house speaker mike johnson has sent a letter to senate majority leader schumer that house managers are planning to present the articles of impeachment to the senate on april 10. that could potentially trigger the senate trial process to start the next day. the letter says the charges are well-founded and goes on to state we urge you to schedule a trial of the matter expeditiously. capitol hill producer craig kaplan report senator schumer has replied saying in part as we have said previously after the house impeachment managers present the articles of impeachment to the senate, senators will be sworn in as jurors for the trial next day. senate president pro tempore will preside.

4:41 pm

>> c-span is your unfiltered view of government. we are funded by these television companies and more including charter communications. >> charter is proud to be recognized as one of the best internet providers. we are just getting started. building 100,000 miles of new infrastructure to reach those who need it most. >> charter communications supports c-span as a public service along with these other television providers giving you a front row seat to democracy. [applause] >> thank you all and good evening. kaplan, thank you for the beautiful words and one more round of applause for the high school

14 Views

IN COLLECTIONS

CSPAN Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11