tv Fast Money CNBC April 26, 2024 5:00pm-6:00pm EDT

5:00 pm

earnings. >> the bar was high for meta. >> now it's back on maybe that same trajectory that it was on before yeah, its after big tumble, but it had really started outpacing some of those other names before. >> we hadn't even started talking about apple. ap apple's next week. >> we don't talk about apple it's like bruno. >> apple saw a rally that's going to do it here for us on "overtime". >> "fast money" starts now. >> live from the heart of new york city's times square, this is "fast money." here's what's on tap, a roller coaster week ending on a high note as the nasdaq surges more than 2%, and lost in its best week of the year does this prove the market doesn't really care about slower growth and persistent inflation. it's simply all about ai and tech we'll debate that. plus, intel on the out, the semi stock plunging to more than ten-month lows, even as the rest of the chip stocks catch a bid. and later, goldman glistens,

5:01 pm

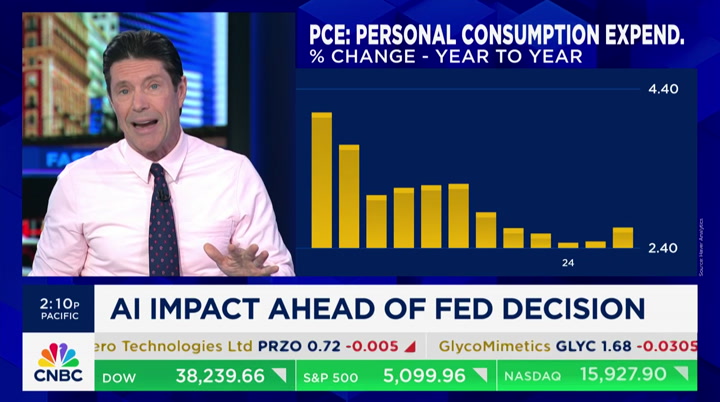

chowing down on chipotle as the restaurant chain claims further into record territory. ai'm melissa lee coming to you live from studio b on the desk, tim seymour and julie beal we start with the two letters that might mean more for the market than anything the fed does, ai the s&p closing friday with solid gains climbing back towards the 5100 mark posting its best week since last november the nasdaq doing better up over 4% since monday and the dow ending a second straight week in the green. those gains come as a slew of economic data should have spooked investors. the fed's favored inflation gauge staying sticky commodity prices on the rise with crude, brent, and copper all higher but all that could not put a damper on the artificial intelligence parade. alphabet surging to a record high after showing progress in its ai ambitions

5:02 pm

microsoft also climbing as ai boosted its cloud sales and nvidia, the poster child of the business jumping more than 6% today as it appears to be the beneficiary of all of this ai spend. the stock's 15% gain this week was the best since last may. does this action prove that ai matters more to the market than maybe the fed? tim, what do you say >> temporarily, mel. it's a fascinating question and at times it does there's no question on a week, you can also look week over week, part of that nvidia performance is that semis closed on the last week it looked like they were about to break lower they had underperformed. it's no question that when you hear google's investment in ai and which translated into obviously a big upswing for the company in terms of the performance but also the numbers underlying were fantastic, and they talked about ai enhanced search results increasing engagement, and they had the 400 basis points of margin improvement. they're op margin was some of the best

5:03 pm

there's reasons why those google numbers were so good i don't think they were all ai, but they went out of their way to talk about the massive investment in ai and so, sure, you know, philosophically and secularly, when we think about that first big nvidia print, the question that the analyst community had, especially in tech, was this the beginning of a massive capex boom that's going to be ushered in by ai so far so good, no question about it i guess i just think that the fed is still the most important variable for markets and i think it was a -- we can dice and slice, we'll talk about some of those dynamics, but i think the data this week was better. i think gdp was actually better. p, ce today was very benign, and i think the fed reigned supreme. >> yeah, karen, what do you think? >> i don't know, i guess i disagree a little bit. >> nice. >> okay. >> so i think that for this slim number of stocks that are very much in this very ai-centric, it definitely does matter, and it

5:04 pm

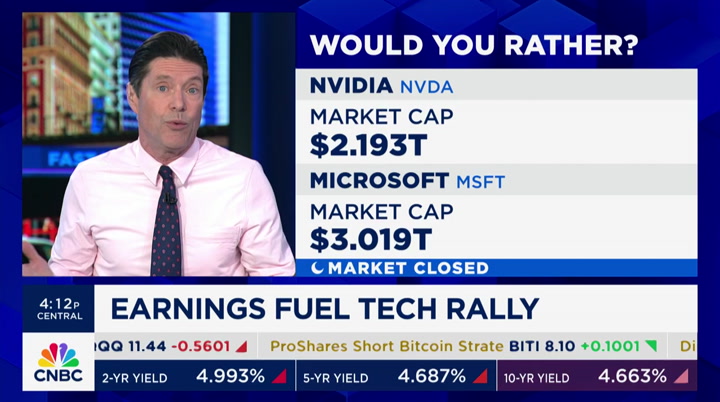

doesn't matter -- none of the other things matter. they are in great shape financially. they don't have debt issues. they don't worry what interest rate costs are that doesn't matter to their business at all. they're sort of somewhat isolated from the fed situation. >> right >> the if rest of the market, i think the fed is still very much in play, and that's important. certainly if we look at like the iwm, it's had a tough time, and so i do think it does matter for the rest, but these suck all the oxygen out of the room, right? they're the biggest high flyer they're the biggest companies. these are huge numbers it started with those meta numbers just on the ai spend that were really, you know, kind of mind boggling, and then you saw, of course, yesterday with microsoft and with google that -- i don't know what inning we're in, but i do still feel like there's a lot of runway left to go in this ai story. it's interesting to me, we were talking a little bit in the green room about microsoft versus nvidia now, and you know, they trade at the same multiple

5:05 pm

now, and that makes me think i should probably have more of a microsoft bet and less of an nvidia bet, because at 35 times earnings with microsoft earnings that are going to be potentially more recurring, it seems certainly the co-pilot model is that, we know that we have a windows upgrade at some point later this year. i don't know exactly when that's going to be. that would be a catalyst as well that to me seems potentially it is expensive, though, you know, just as a value -- 35 times is expensive, but 35 times with that kind of revenue and a potential catalyst there is, i don't know, it feels a little bit more secure to me than 35 times what are giant lumpy numbers. >> right >> also huge margin, but it seems -- i don't know, less certain to me. >> well, for some reason there's double ordering, there's inventory bills in terms of these chips. if some players decide not to spend as much for macro reasons, then their sort of business

5:06 pm

might be a little bit lumpier than microsoft, which will be a little bit more stable, so maybe that is what you're paying for that's an interesting self, would you rather. >> i'm ready to get into that. >> did you see how happy she was with the would you rather? i haven't seen you glow like this in years. >> it's an excellent would you rather >> of course >> and i will pose the question to you. >> the ladies are allowed different, i think, rules than the men. >> of course >> it's obvious. >> so i think karen actually agrees with tim more than i thought you were going to agree with him when you first said that you disagree, so i think that's probably what taim was saying the market is just these handful of stocks. these are the names that matter. so the fed is not raising, though that's where it would become different. if the fed actually was going to -- if now all of a sudden it's in the calculus, the fed's going to raise one more time, i think that would be the most important thing that would happen, so i do believe -- >> would these stocks go down? >> yes, these stocks would go

5:07 pm

down, but when you talked about gdp and worry about growth or slowing growth, there was no slowing growth in the names that karen, you know, just talked about. that tim just talked afbout there's no ability to have that -- for you to say let's overlay that slowing growth, what does it mean for microsoft? it means that microsoft is still growing. it's still ai, so you're right, that's the most important thing in the room right now. when you drill down, if the fed decides that now when we hear from jay powell and now it's looking like, hey, we're not only not going to cut, but we're still thinking about raising, that's a different dynamic that i don't think the market has digested just yet, and obviously the more ai spend the better it is for nvidia. i still think i'd rather be buying nvidia than microsoft. >> did you hear that >> yeah. >> to karen's would you rather. >> could i add one little thing, monday we will get some important news, right? we're going to see the quarterly

5:08 pm

refunding right? and that has a potential to -- >> right spike further, right? >> then that could really royal the markets. >> this whole notion that things can keep chucking along just because we have the handful of stocks leading the entire market farther, you may think that's horrible you may think that's a fine thing, but for what it is right now, if ai spend is going to b lift instead calendar year 2024, which is what these giants have said, and there's some expectation that it could still have the momentum going to calendar year 2025, which is bank of america's base case scenario at this point, then maybe things can keep chugging along, if there is the spend of billions of dollars in this- amongst these handful of stocks. >> yeah, but i don't think anyone is really cheering the idea that the market being extremely narrow is a positive thing for the long-term outlook, right? if you think about it, what's more important about the rates is the fed's ability to create a soft landing think of it as the fed needs to deliver the soft landing baby,

5:09 pm

and a, right now it's an epi epidural it's nice, it's helpful. really helpful, but the fed still has to do the hard work of giving us this soft landing baby and that actually is much more complex. it requires so many more components of the economy, right? i think that's the real challenge is how good is the rest of the economy and right now earnings have been pretty mixed, right and guidance has been pretty tentative outside of ai. for the long-term health and viability of this market, you need to see a broadening, and you won't really get that just on the back of ai. >> i mean, soft landing baby, as cute as that baby may be, i don't know if the baby's coming. i don't know, tim, you sound like you might actually think that baby is going to be delivered by that magical stork known as jerome powell, but i don't know given the data that we saw this week. >> i've learned many times in my marriage and from my wife is that i have no right to even opine on the birthing process, okay and when you get into epidurals and things that i will never

5:10 pm

experience, i'm probably going to stay away from that, even though it's a very interesting metaphor i do think that the fed, their ability to, you know, ease this economy down the road of where they have had to significantly change monetary policy in a very short amount of time is extraordinary, and we all recognize, i would reiterate, i thought this week in terms of the economy if you look at the consumption spend and that gdp number was in line with the last few quarters if you look at real rates, this is probably something we're going to talk about. the bottom line here is the economy is part of the story the economy is in very good shape. the consumer has a job, so it makes it -- you know, it's certainly very important for the mega cap tech companies, and back to karen's would you rather it's interesting because as you started to say that -- and we actually flashed those forward p/e numbers. those numbers move around a little bit, we know, that but

5:11 pm

ultimately when you consider the growth that nvidia has but more importantly the inherent margin in their business, it's so much more attractive to me. i would think at this point because microsoft is just out of their own success this multiple has really moved higher, wouldn't nvidia be so much more interesting? i realize they're not going to grow at this rate, but right now that is so much more growth for the money, and the margin. >> but evei think the market prefers a steadier stream, even if it's less money over time, it will get a higher valuation than a lumpier stream that even that lumpier stream is more money i think the market likes that sort of not certainty but i think the market values that higher. >> that's fair, but ultimately aren't semiconductors -- >> look at streaming versus hardware apple itself is that same sort of analogy. >> they should be easing into a business where they're not going to be the only game in town. it is going to smooth out. growth is going to slow. it's going to be smoother. it's going to be more cyclical, it's going to be more

5:12 pm

predictable. but it's going to be at a higher rate and higher margin and therefore deserving of a higher multiple. >> you'd rather nvidia. >> i'd much rather nvidia. >> you own nvidia now? >> i own nvidia. >> i thought i was going to be able to buy it chaerp. i think this is again back to the fed and the markets. microsoft didn't close on the highs. a lot of stuff gave back a little bit of ground those are great headlines. next week we've got a fed meeting, a payroll number on friday, a lot of dynamics for the macro that i think could change how good everybody feems. where were we last friday? >> you see a pullback in the markets. you see a pullback in nvidia but you see rates going higher, you still buy nvidia >> yes, i think ultimately -- and there is a bid below nvidia less than there is a bid -- it's got more of a bid to it on a dip than the market does right here. >> i think the market is going to pull back i'm staying with i think we're going to test that 200 day which is 4690 in the s&p

5:13 pm

very rarely do you tap the 50 and then not go through the 100, down to the 200 to test the 200. i feel as if -- i've been positive on the market i feel as if even the bulls would like a status check on the market because i'm not saying this is going to be a long-term test, i think we're going to test it and rebound. >> it was a little bit sur surprising we finished so strong on the week going into another week where there's so many potential tape bombs, julie. plenty of reasons to de-risk going into the weekend. >> yeah, i think going in front of us, there's definitely a lot of data that could point in the wrong direction, and so i'm surprised, but i think there is a lot of conviction around certain names, some earnings have been really, really positive, and i think that that's given people more conviction that, you know, the underlying economy is looking good, but i still see that there are real pockets of weakness throughout, right? if you look at consumption spending where we are in terms of services spending is in line where we are in terms of good

5:14 pm

spending is still ahead of where wehistorically have been and so if there's a pullback on that, we're going to feel it in the economy pretty meaningfully. >> the japanese yen hitting a new 34 year low against the dollar the country's central bank signaling it intends to keep policy easy. let's bring in jim bianco, he runs bianco research do you think there's intervention on the -- i feel like i ask this every week, but do you think the boj will do something about this and that we could see some sort of snap rally? >> i don't think they will i mean, they obviously can, and i think that the reason that they won't intervene and why they've allowed it to go to a 34-year extreme is they know it doesn't work, and they've tried it in the past, and now it's been 20 years since they've tried it, but every time they've tried to intervene, it works for about a day and a half, and then they stop intervening and the market goes right back to where it is. besides, if you're going to intervene and try and force a

5:15 pm

market the size of the yen dollar exchange rate to a level, it's not going to work it shouldn't work. you need to change your policies you need to change your economics if you want to stop this decline in the yen. >> so the $4.5 trillion carry trade estimate round about in stocks and bonds, that's safe in your view? >> yeah, i think it is if that is still the extent of the trade. i think the trade is probably a lot less than it was, you know, say three or four years ago, especially pre-covid because before this period, there was a lot of young strength, and then that should have probably shook a lot of those people out. if you're in that trade now, the weak yen is going to definitely make it work for you, and there's no reason to be fearful of it. >> hey, jim, it's tim. let's take the next step outside of the buying power for the japanese consumer, abroad, et cetera, et cetera, and balance of payment dynamics for japan that are significant on a

5:16 pm

global stage what does this mean in your view >> keep in mind that the japanese are the largest buyers of treasury securities in the world, not the chinese the japanese are, and if their currency is continuing to weaken like it has been, you always want to be invested in the stronger currency, so that would on balance be pushing money towards u.s. dollar and of course then into u.s. treasuries and even though that's happening, yields are continuing to go up, so it really tells you about the underlying weakness that we've seen in the bond market you've got the largest foreign buyer in the world with an excuse to be buying it, and yet, we're still seeing bonds sell off, and we're still seeing yields go higher. >> jim, i want to pivot you to next week in terms of qra on monday, and then also the fed meeting, you know, how do you see this all playing out i mean, in terms of the positioning for qra and also for the fed meeting. >> there's a lot of news next

5:17 pm

week monday is the quarterly refunding announcement we all remember november it produced, you know, when the treasury came out and said we're going to buy less notes and bonds skpshand more bills and i sparked a huge rally in bonds. they've played that card i don't know if they can play that card again because now at least everybody's looking for that, and it's going to be really hard to really surprise everybody. they still have to fund the def deficit. they can't come out and say we're going to sell as many bonds as everybody thought the qra might be a volatility event. wednesday's the fed meeting. they're not going to do anything the announcement of the fed, what the fed does is going to be a non-event. it's going to be about the press conference and whether or not powell says anything about being more hawkish, and don't forget friday is payrolls, payrolls for 250,000 is what the guess is down from 303,000. in the last dcouple of month ths payrolls have been beating again. it stokes the idea of a strong

5:18 pm

economy and stickier inflation. >> great to speak with you, thank you. >> thank you >> jim bianco of bianco research we've heard some language from fed speakers in the past week or so that a fed hike is not the base case scenario, but that is something the fed is ready to do should the data warrant it if chairman powell says something to that effect, how do you think stocks would react >> well, i think stocks would react poorly i'm not sure he needs to do that no matter what he's seeing because as jim pointed out, we kind of have a sense, and we even got this in the pce, the fed knew what this data was going to look like they're probably going to adjust their statement on the economy from solid to, you know, something less than solid. >> is that an official statement? >> it could be i think we're at a place here where the fed has certainly telegraphed to the market that we could possibly not have any cut this is year if they change the rate hike, it's a very different story.

5:19 pm

>> i thought there was actually a little cover for the fed today, right so you had two things. you had gdp, a little cover there i think, and then you had a slightly hotter -- just slightly, which is a cover for them to do nothing i don't think it's enough for them to hike that i think is not necessary. >> they're probably going to cut qt in half, right? so that's the -- in effect that is still easing, right so if you're cutting qt in half, that is dovish by its nature, so maybe we'll get some answers to that because i'm a firm believer in they have to adjust qt before they do anything >> is that priced in do you think qt is -- >> i think to a certain extent when you say that you've already pushed off all cuts. people don't realize that's equivalent when it was full steam it was equivalent to tightening by a point, 25 basis points by cutting it in half, you're down to 1/8. if you're looking at that, that is easing, and that's the first step before they actually cut. coming up, a burrito

5:20 pm

blowout. >> oh, boy >> wchipotle trading at market highs. we'll digital into what the big move higher means for the fast food trade. tesla hitting the brakes, what they're watching and what it could mean for the ev giant right after this >> announcer: this is "fast money" with melissa lee right here on cnbc and risk-reward analysis,artg help make trading feel effortless. and its customizable scans with social sentiment help you find and unlock opportunities in the market. e*trade from morgan stanley

5:22 pm

you've got xfinity wifi at home. help you find and unlock opportunities in the market. take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

5:23 pm

welcome back to "fast money. tesla shares taking a leg lower after the national highway safety administration found a critical safety gap in its auto pilot system phil lebeau joins us to break down the details this concerns a recall, right, of vehicles already with the auto pilot update? >> yes, right. >> 2 million vehicles had been recalled by tesla in december, and while the term recall is used, it was an over the ai air software update meant to address inadequacies in terms of how auto pilot works when it comes to interacting with the driver, alerting the driver about potentially dangerous situations they did the recall in december. the complaints haven't stopped in fact, there's still being a flurry of complaints and that

5:24 pm

has prompted nhtsato now say, you know what, we've closed down our investigation that was l looking into auto pilot. now we're opening up a new one looking at whether or not the recall that was put in place did the job. if it didn't do the job, what needs to be changed in order to better alert drivers about auto pilot when it's not functioning or to make sure that auto pilot is functioning the way that tesla has told regulators it will function. and one important note here, melissa, auto pilot is separate from fsd, full self-driving. that is a subscription service you pay for. think of auto pilot almost as an advanced cruise control system, if you will, that you see on a number of different vehicles, not just teslas but all brands, and so that's the -- that is the thing to focus on here we're not talking about full self-driving technology. >> how should we think about the cost to tesla?

5:25 pm

because that's usually how you think about the impact on a software company you think about the cost of the recall, if you bring in the physical car, over the air it seems like it would cost very little is there really very little impact on tesla? >> in terms of cost, i'm not sure it's going to have a huge impact, no tnot a material one where you say look at the impact of this over the airsoft ware update that's being done here. where there is a cost here, melissa, is glyou not only have this investigation by nhtsa, but you've got other entities, government agencies that are looking into auto pilot, the way it is marketed, the way that it is presented to drivers, and ultimately, the question becomes whether or not auto pilot, which there are many people who believe that auto pilot is a real asset to tesla, separate from everything going on with full self-driving. there are a number of people saying it's a real asset, but is it also now potentially going to come back and bite the company,

5:26 pm

you know, to a certain extent, if there has to be a larger fix to these problems. >> right phil, thank you. phil lebeau. >> you bet >> it's a big week for tesla in general. >> yeah, it feels like there's a tremendous amount of headwind. it feels as if they're in the same sort of spot where apple was with china, and then with our government picking on apple too, it seems like there was a whirlwind of just negativity about tesla. then you had ron baron on our network saying the stock has bottomed you brought up an important point. this doesn't really cost them to do an over the air the way a traditional recall would be. i think if they just have to harness that $28,000 vehicle and not just talk about robotaxi talk about real margins, talk about really having the bandwidth to produce those cars, the analysts are only looking at it as robotaxi, full self-driving there's other parts to this story. >> the low cost vehicle, julie

5:27 pm

is what analysts are geeked out about. it's not this talk about robotaxi which costs, i don't know what, we'll bring in i don't know what, and nobody can quantify that including tesla at this point but a low cost vehicle gets you into certain markets where it's not operating right now. >> yeah, absolutely. having seen byd overtake them in terms of market share is a pretty meaningful moment for them, right, where byd has been able to construct a low price car. the big challenge with tesla, it's not even what's happening in their production. it's just their valuation, right? when you're thinking about 60 times forward earning and toyota is a 10, it's really hard for me to understand why there's that much software that is worth six times that i think that's really the primary headwind is they have to be able to demonstrate a level of profitability that is very tough when you're building cars. especially low priced cars. >> right, and you are in toyota. >> i'm in toyota i agree with julie, i don't think the valuation happening in

5:28 pm

tesla for a long time. the issue now for people that are just talking about valuations also is the company is effectively and the events around the company have reset near-term expectations for long-term growth, so you've got a dynamic here where they tried to change the conversation in that earnings call about product developments being fast forwarded. not second half of '25 that's the dynamic the shares rallied 24% off the bottom let's be clear, bad news was priced in. bad news going into those numbers was largely priced in, and the stock responded pretty interesting way. this headline after hours on a p friday thrkis is not your drive for how you're making your investment decision on tesla >> there's a lot more "fast money" to come chipotle charging higher, the fast food favorite trading at a fresh all time hay. we dive into the sizzling performance and what it could mean for other chains next plus, why buy intel?

5:29 pm

the semi stock can't seem to get out of its own way, but is there any upside here? we'll sit down with an analyst who says there's still reason to be positive on this battleground name you're watching "fast money" live from the nasdaq market site in times square. we're back right after this. awkward question... is there going to be anything left... —left over? —yeah. oh, absolutely. (inner monologue) my kids don't know what they want. you know who knows what she wants? me! i want a massage, in amalfi, from someone named giancarlo.

5:30 pm

and i didn't live in that shoebox for years. not just— with empower, we get all of our financial questions answered. so you don't have to worry. i guess i'll get the caviar... just kidding. join 18 million americans and take control of your financial future with a real time dashboard and real live conversations. empower. what's next.

5:31 pm

5:32 pm

welcome back to "fast money. chipotle continuing its blowout run, up another 2 h% t. is up 9 and almost 40% already this year the record coming just ahead of mcdonald's earnings, they report tuesday before the bell. those shares down nearly 8% year-to-date could chipotle's gains be a sign of strength for other restaurants or are they too different for mcdonald's which seems to be the case in terms of their clientele. i'm going to the man with the coupon, the man who goes to chipotle at night and things are out. >> and i'm a fair guy. i need to point out that the last couple of times i've been to my neighborhood chipotle, they've been well stocked and very polite, by the way. >> apparently the chicken al pastor has really caused a chicken shortage, chipotle

5:33 pm

management is asking its employees to not have chicken with their meals, save chicken for the customers. >> well, i think there's -- pastor is lovely, i'm more of a traditional guy, but i do think that the multiple here is a combination of the fact that you've got stored growth, real growth and you've got multiple expansion, and you're seeing economies of scale they've been well-rewarded for the loyalty program. it is working. ai stock or fast casual. are you kidding me 40% this year on top of a massive move last year, speechless, valuation, you know, what could i say it's tough >> it is tough i mean, they've done an extraordinary job, just the growth of the multiple the growth of the margins and the growth of the multiple i mean, both growths are historic and crazy good. the only one that comes remotely close, i think of it as steve's dominos, they also seem to be very early and -- in digital and really run an efficient company.

5:34 pm

not ofthat the others don't, but the multiples reflect they just aren't as good. >> when you look at chipotle, they're international. that's where you think the growth can really come from. they have a minute amount of stores that's located outside of the united states. they're in canada, but that is a huge expansion possibility for them the problem i have and i think the ceo addressed it in an interview is that you only have one person you get clogged up. so there's lines so he's talking about having those parallel lines where you're doing multiple at one time, and i think these are all efficiencies that he's bringing, and then don't forget about the stock split, 50 for one. >> all right julie, which fast casual fast food stock are you looking for in terms of the best moest vibrant read on the consumer, if you will next week is a very big week we just put up the board of

5:35 pm

mcdonald's, starbucks, dominos all reporting next week. >> i think probably mcdonald's to get a better sense of the low income consumer. they are the ones right now feeling the biggest pinch from inflation. i think they can speak pretty well to that it's a very clear dem photographic for them starbucks for me is more of a situation of how things are happening in china and what we should expect from that market and how that consumer is but for sure mcdonald's to understand what's going on with the low income consumer is pretty important right now >> all right ko coming, the chip maker plunging almost 20% we'll talk with an analyst who says this semi stock is still a buy. goldman's golden game, taking it to brand new all-time highs. we'll get more on the forecast for the financials right after this >> announcer: missed a moment of "fast", catch us anytime on the go, follow the "fast money" podcast. we're back right after this.

5:38 pm

5:39 pm

three-week losing streak snap seeing rejuvenated digital ad growth. american airlines shargs dropping as boeing delivery delays forced the carrier to reduce long-haul international service. the airline expecting three of its most expected 787 dreamliners to arrive before the owned. year, and truth social parent trump media shares jumping 8% today. ceo devin nunes earlier this week asking lawmakers to investigate potential stock manipulation of the company's shares and bitcoin, that dropped again today closing out its fourth straight week of losses. it is on pace for its first negative month since last august. intel, hitting its lowest level since last june. it is now down over 35% this year making it the second worst performing stock in both the s&p as well as the nasdaq 500. pat gelsinger saying the gave a

5:40 pm

soft demand forecast for q2. one bull is buying what intel is promising. his firm still thinks things will pick up in the second half of the year. so you believe him you believe intel? >> well, look, this has been a roller coaster ride. last year we were on an island recommending this. saw it go to 50 and now back down we overstayed our welcome, but i think that people try to complicate this story. it's so pc driven it's not even funny. it's over half the revenue, and pc has petered out we think they pick out in the back half. intel is a funny beast when they're beating numbers they sound like geniuses and then when things don't happen it's a pile-on this is probably an overreaction a lot of thaeir peers are rallying right now you want to think about buying, gross margins potentially troughed, when gross margins start to get better, the stock follows.

5:41 pm

>> you overstayed your welcome so it's back to where you were before what happened to pcs when the stock was at its height to now did you just get -- did you get that call wrong? i'm just trying to understand did that market turn suddenly, and that was -- >> yeah, it did, what happened with pc's is we actually had some channel restocking. people went back to work, things sta started to pick up, and obviously we only work three days a week now. so i think it lost a little momentum. >> just three in the office. >> i work six, but i think that what's going to happen is we later in the year start to see pcs pick back up again there's an expiration ofport for windows. that should be a corporate catalyst, and intel benefits we've been pounding the table on like nvidia and like a few of the names that are a little more pure, dell, in hardware, and this has been the one that round tripped. >> ben, put into context, you frame the pc business, data centers where there's been massive erosion and they've been

5:42 pm

beaten up over and over again. should we care about that anymore? and ultimately w, when we hear e company yesterday saying, we think largely the business has bottomed it gets back to that credibility issue. do they not have credibility i guess it's clear they don't have credibility. >> you can't cut gross margin and have anybody -- this stock just trades -- when gross margin gets like it does and goes down, the stock's not going to work. if we're in the trough, it will. now, servers also are a big part of the business. they miss the accelerator trend like nvidia. they do have a new one that if anything happens there, it's a bonus. they have sierra forest and another server that are ramping, should have better sales in the back half with better asps, and that drives sequential growth. but no one believes now because gross margins went down, the execution isn't crisp. once that picks up in the back half, though, and we have some catalysts because servers do seem to bottom, it does seem like they have the best chip for ai, the best cpu for ai servers,

5:43 pm

and they could benefit, but obviously right now it looks bleak, but this has usually been the time to at least trade it. >> in the break, we were talking about how not many of your clients own intel. they abandoned intel after that disastrous call on foundries and the loss that the company was going sto see, what does management need to communicate to con rinse invvince investorse is an upturn >> well, look, they've cut gross margin the last two or three quarters, two quarters and that's obviously -- i just keep harping on it you can't be doing that. that's the signal of execution that's the signal that you're loading your factories and actually selling stuff, and you just don't have credibility when you keep cutting it. but the other thing ta is the there's a lot of people that don't believe in the ai pc who cares, what are we going to be doing ai on the pc, i think

5:44 pm

there will be a halo effect on the ai that drives up servers from the edge as well as pcs, and i think the windows cycle helps. when they beat numbers and there's channel restocking, all of a sudden they'll look bril brilliant. just see the last half of last year >> right. >> ben, when you look at it, is there a chance it's more -- you just addressed it in your last sentence, wu is there a chance that nvidia with its partnerships builds more to take away from intel with their pcs, intel, revenue is 58%, as you said it's over 50, right it's 58% is pc centric, but is there a chance that gpus are really where the puck is going and they'll lose on that front too? and then one little add-on, is there a need for new management? so instead of melissa saying, hey, what do they have to say? is there a need for a new person >> well, let's talk about the gpus, so they missed it in

5:45 pm

servers, ask tnd they're gettin board late there is some upside there i think the whole ai trend can help the whole server market you might need servers closer to where the data is once we start using it but on the pc side, nvidia's strategy is a little bit more sell to gpu, their cards, i don't think they're going to actually make a cpu, butt i fee that qualcomm is getting into the business we expect them to have a little bit of traction. intel really in corporate is the standard, and i think once that picks up dell will sell a lot too. and they'll do a little better. >> thank you, it's great to see you. i was going to say have a good weekend, but you're working tomorrow >> half day. goldman sachs still glowing after its results, should you keep banking on the names in this game. plus, another jam packed week of earnings on tap. we're laying out an options trade and one pharma name seeing outsized gains this year the details when "fast money" returns.

5:48 pm

5:49 pm

since its big earnings beat. it gained nearly 6% this week, making it goldman's best week since last december. is this a sign of strength in the big banks? julie, what do you think >> ook, this new management team has really been focused on getting their return on total equity up. i think investors have been hesitant because investment banking had been soft, but frankly, if you look at earnings results, it was pretty close to perfect. there's clearly a turn happening in investment banking. we're starting to see ipos and most importantly, i think, private equity is starting to get ready to actually get involved in terms of actually doing transactions i think they're really well-positioned in that now the management team has some credibility supporting it. >> in terms of certainly their capital markets business, a little volatility goes a long way. my voice just did peter brady. it happened. >> it's actually exciting to possibly be going through those changes this late in life. i think the multiple is noing to get too excited about, but the recovery in certainly debt

5:50 pm

capital markets in an environment where i think that's a very active place and will continue to be i don't -- look, i'd love goldman as a company i don't know that you need to chase that one banks, the entire space has done very well. city bank, bank of america and jpmorgan, the money centered banks are a little more diversified. i still like citi bank here. i think they've got more room to close the gap on valuation to their peers. >> if rates go higher, rates stay around 4.7, then what anything change? >> i don't think anything changes with the big banks if things are smooth and high, that's fine. volatility is not as fine. >> since tim did sort of a would you rather, but not really. >> would you rathering >> i'm going to go a different route. >> using would you rather, though, that's aggressive. >> i did a very soft hands, very derek jeter hands. wells fargo has that $2 trillion asset cap still on it. that's -- it's performed very well, but once that gets lifted, i think that could be the next leg higher for wells fargo

5:51 pm

>> coming up, another huge week of earnings on deck, and we are homing in on one pharmacy stock making waves how you can thtip e scales with options. that's next. of hats. my restaurants, my tattoo shop... and i also have a non-profit. but no matter what business i'm in... my network and my tech need to keep up. thank you verizon business. (kevin) now our businesses get fast and reliable internet from the same network that powers our phones. (waitress) all with the security features we need. (aaron) because my businesses are my life. man, the fish tacos are blowing up! so whatever's next... we're cooking with fire. let's make it happen! (vo) switch to the partner businesses rely on. tamra, izzy, and emma... they respond to emails with phone calls... and they don't 'circle back', they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma.

5:52 pm

5:53 pm

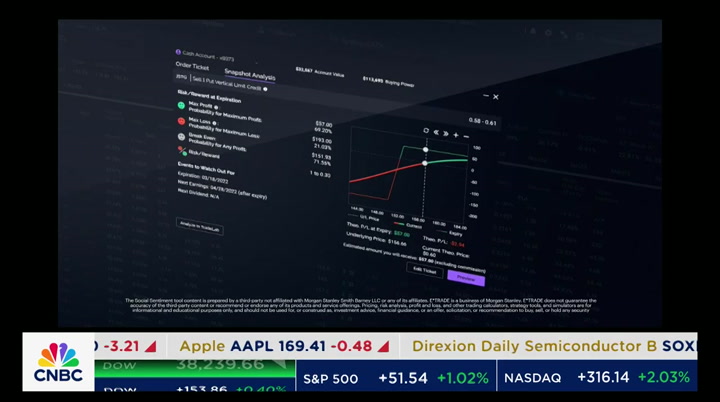

business. it's not a nine-to-five rig proposition.eam. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. welcome back to "fast money. earnings season is just kicking off. we've got a huge lineup of names reporting next week, paramount, amazon, and apple all on the calendar let's bring in mike khouw for a look at what the options hits

5:54 pm

are expecting in terms of applied moves. >> apple which has actually averaged about 6% over the last eight reported quarters, they reported only 4% amazon which has averaged moves of about 8% over that same period implying a comparable move of about 7.7% starbucks, which actually doesn't move that much usually, 3.9 % implying a move a little bit larger, 6%, and lily, of course the big pharma stock, 6% average, also implying very close to that right now there we saw actually that the calls were most accurate as of may 3rd, trading about 235 it's priced for it too, about two and a half times as much as the other big pharma companies i think people might want to consider hedging this one by buying the june put spread that would cost about $11 or 1.5% of the stock price. >> what do we think about eli lilly here, tim? >> i think their numbers going to be ridiculous, and the question is what's in the price? >> good. >> yes. >> i think they're going to be

5:55 pm

strong and these trends are getting better, and there's a broadening base, and their pricing has held up. it's just going to be on the guide. i think it's probably going to hold up. >> yeah, julie >> i agree, i think it's a foregone conclusion that this is going to be a very strong quarter and i think it's a function of understanding the stability of the pricing and how that plays into their guidance. >> what dif revenues aren't quie as strong because they can't make enough? >> that's an okay thing, right i think because it's not -- we always talk about is it a sale delayed or denied? i would think absolutely delayed. so that's okay >> right >> that will be an okay thing. >> yeah, do you pay for lilly versus others? >> yeah, i think lilly has been best in breed. >> best in breed in terms of all pharma stocks or best in breed in terms of weight loss? >> weight loss yeah, weight loss. that's a good way to phrase it

5:56 pm

when i look at a pharma stock, i think do they have a weight loss drug you're not going to get that explosives earnings. >> you have two companies -- >> what? >> effectively you've got novo and lilly that are being rewarded here. it's an interesting week no, you're right, but i think there's only two choices right now that are really the leaders at least in the mega cap pharma. it was a week that also highlighted the weakness in people like bristol-myers and pfizer. >> exactly >> all right, mike khouw, thank you. up next, final trades.

5:57 pm

at morgan stanley, old school hard work meets bold new thinking. to help you see untapped possibilities and relentlessly work with you to make them real. to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow!

5:58 pm

6:00 pm

>> chinese internet, jd.com, making a move. >> karen >> yes, the intel makes me think not intel, dell. a lot of the same underlying things could happen and have been happening, good execution there. >> steve. >> sofi trading back above its 50 day and in after hours it's above its 100. >> thanks for my mission is simple. to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere and i promise to help you find it. mad money starts now. hey, i'm cramer. welcome to mad money . i'm just trying to make you a little money. my job not just to entertain but to teach you. call me, 1-800-743-cnbc or tweet me at jim cramer. if you took your cue from the action i

4 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11