tv Power Lunch CNBC April 26, 2024 2:00pm-3:00pm EDT

2:00 pm

2:01 pm

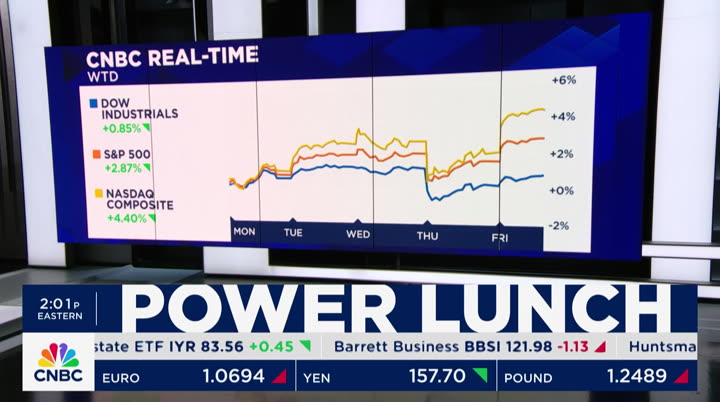

yesterday. boosted by earnings by microsoft and especially google. alphabet up more than 10% today, as you see right there we'll have more on those results coming. >> and what we're seeing here is that today's game is really pushing alphabet into the $2 million market cap along with microsoft and nvidia all the major averages set to end this week with gains the nasdaq up more than 4% you can see that big drop yesterday morning and then that steady rebound yesterday and into today's session we'll keep our eye on that, tyler. >> all right let's start with a number helping to clear the way for this rally after yesterday's worrying gdp report. the markets seemed to like what they saw in this morning's pce that's an inflation number steve joins us now with a little bit more what did they like and you started to explain this in the last hour or two, and i'd love to hear you continue. what is the difference between pce and cpi and all these other

2:02 pm

different inflation numbers, and why does the fed like pce? >> all right i'll start there the cpi is the consumer price index. the pce is the personal consumption indegindex, the def they use for figuring out the real spending. some of the differences are less weighted in the pce. there is other elements for the wholesale price index like service indexes. the fed just thinks it's overall a better indicator of inflation. but i think you ask what the market saw it is also what they didn't see. the markets dodged the bullet this morning, tyler. they were saved by a couple hundredths of a point. higher for the first quarter that surprised markets yesterday was more concentrated in january than it was in february and march. here is the data we were up 0.32% in march. february, just a little bit, one basis point.

2:03 pm

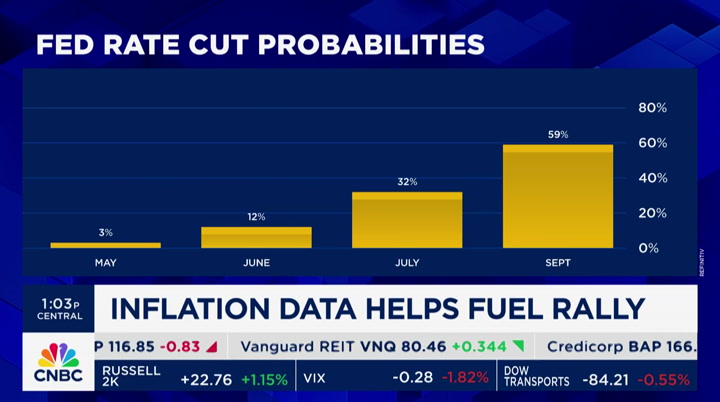

and january five basis points and 0.5% for the month that was the big number. the markets should be relieved the march number was not 04. we knew january was bad. that was actually the worst month, so it was a little further in the rearview mirror just because it was bad doesn't mean it was good the headline went the wrong way. and progress, you can see clearly there, it has stalled. so there wasn't much change in the outlook, the already diminished outlook for fed cuts. better on the june cut still likely to lose, and it will take a strong downdraft in inflation over the next couple months for july to come through. now residing in september. if you add in now the beat on consumer spending, better spending, sticky inflation, now you have this growing course of those who say the fed may not get a window to cut it all this year or maybe just once and may not need to cut since the current rates do not at least in the numbers we're seeing now,

2:04 pm

tyler, weigh much on the consumer or growth in aggregate. obviously some people are feeling the pinch of those higher rates out there. >> you know, the markets -- people don't say it. the market seems to have stepped over inflation numbers and seems to have stepped over the fact that bond yields have risen up a bit even though they're down just a bit today. >> tyler, i like the idea of stepping over. what are you talking about that they're stepping over? i like what you're talking about. i think that's true. look, it is fascinating to me. i set this whole week up on friday i said, folks, there is going to be an amazing and interesting tension this week between the inflation numbers, which could be to the high side and the growth numbers and the earnings numbers. and these things seem to be balancing out, tyler i think we're going to finish the week in the positive but you have this push and pull you have had very a for long time now and it looks like just barely

2:05 pm

the growth and the earnings numbers are trumping the negative on the side here of fewer rate cuts and a little bit higher inflation. >> it seems to be that way, that the market is comfortable with what it's getting in the data that it's seeing steve, have a great weekend. >> you too thanks. all right. let's turn back to the markets right now, which are rebounding following yesterday's sizable selloff. here on yesterday's selloff is the ceo of strategy asset managers tom, am i right here that the market seems to have replayed passed some of the data that might be otherwise worrisome, higher interest rates, fewer interest rate cuts this year, inflation proving harder to get down to the 2% level, even though it's in the 2.3, 2.5 area. >> well, thank you for having me one of the things we look at as an active manager, some of the signals from the earnings reports that are coming out right now, take microsoft and

2:06 pm

google and meta. we cover most of those magnificent seven stocks, but the data we see on the economic side is still quite strong the economy is doing well. we see the labor market still being pretty tight inflation numbers are sticky around the 3%. but we see a strong market going right ahead of us. >> even here, being more specific about it, you had personal spending rising 0.8%. more than what we saw for the wages of a rise of 0.5%. but the personal savings rate fell pretty significantly here what does that tell you about where consumers are putting their money and where there might be investment opportunities? >> you know, contessa, we're telling our clients right now to be wise with where they have their money. for example, we counseled our clients as an active manager would on taking advantage of savings rates being at 5%. however, as you know, interest rates will eventually start to

2:07 pm

come down, and we have to find smarter places to move your money. for example, on the active management side, we will counsel our clients into going into technology sectors, maybe the health care sectors, industrial sectors, any of the sectors that really have pricing power right now. but we do -- we do, you know, try to take the -- take our clients into areas of strength. >> a couple of real larger holdings well, the ones in the most customer accounts. >> i could say some of the larger holdings would include something like a google, a microsoft on the technology side we like intuitive surgical. >> a robot surgery. >> right that's another strong one for us we like constellation energy grants, which is a nuclear power plant company. >> why do you like that? >> energy is important i mean, it used to be a dirty word but if you see all the data scepters that we have out there sucking up all the energy, you

2:08 pm

have to find alternative sources to, you know, to feed the supply that's in these data centers constellation energy is one of those companies that can help out. >> the theme that runs through constellation energy, intuitive surgical and of course the big eyes, microsoft, meta, amazon that you own is the exposure and the way they will capture the potential of artificial intelligence. >> it is the big theme right now. ai is so important if you don't incorporate ai into your company, you're going to be left behind. ai has been a drive earnings efficiencies for all companies, especially companies in the industrial sector like a cbj or maybe intuitive surgical, taking advantage of the health care opportunities there to make surgeries more efficient. >> but is that a question now that portfolio managers and financial advisers are going to have to be able to explain to clients now, is, okay, so you like consumer goods. or you like this particular

2:09 pm

biopharmaceutical services company. but here is how ai plays into the future of their business are they going to have to understand the potential for these companies to grow based on ai >> i think -- i think just as we adapted to using a cell phone years ago or just evolved in the technology sector, ai has been transformative it's allowed companies to become, as i said, more efficient. but if you -- if you look at the advantages of using this type of technology down the road, we -- we need to continue to lead as the united states, being an innovator in these areas and ai spending in the united states alone is about 7 times more than any other country in the world at this point. that's a really staggering figure because we want to be first. we want to be leaders out there. and ai is going to shape our technology and innovation out there. >> talk to us a little bit about meta if you would. we had our stock draft last

2:10 pm

year i'm sure you know about it but it was the first choice. it was the first pick off the board yesterday. people had been a little bit critical of meta based on, i guess, a forward forecast and the idea that they are going to have to do a lot of capital spending associated with ai. i see capital spending as a good thing. it means they're investing in their business it may not help them next quarter or the next couple of quarters but in the long run, you want companies to be investing in the technologies that they think are going to benefit. >> i agree i think the capital expenditure item for meta was necessary. i think that zuckerberg saw things in the future that still remain competitive we have, first of all, we own facebook we have clients from facebook. we have former clients that were in facebook. we have owned the stock for a long time. we believe in the direction of ai and that just shows that capital expenditure that meta did was necessary to remain competitive.

2:11 pm

>> tom, thank you very much. appreciate it. >> thank you, tom. thank you, contessa. bond yields a big deal in the stock market, pulling back today following the pce report and after hitting five-month highs yesterday and contributing to the stock selloff for more on the economy and the bond market, let's go to chicago and rick santelli. >> indeed, thank you a lot of big numbers yesterday gdp, some of the pricing mechanisms within. and of course today's income spending is inflationary numbers. and we have jerome snyder. what do you see in the numbers yesterday and today? >> obviously from a headline perspective, gdp was at the 1.5% range. overall, we think the growth of the economy is still being stimulated by the impulses still from savings although declining from the consumer ultimately that probably warrants higher rates for longer as the fed will probably continue to contend next week and to see them begin to

2:12 pm

recalibrate to this higher inflation regime as supported by recent data, including this morning. >> yes this meeting comes quick, tuesday and wednesday. now i am hearing more of a refrain from stagflation and base rate cuts that doesn't go along with yours see if you can diffuse that in a short paragraph. >> the fed will recalibrate to the data we think those cuts are likely at the latter half of this year and maybe gets pushed into 2025. the rate cuts will be a lot less ultimately what we have seen over recent days is yields have moved higher the opportunity has recalibrated to really get closer to what we are at money market rates. so said differently, the yield curve has become increasingly more attractive for investors. >> and that seems to go along with my sources. my sources are looking at the markets in general and saying there is an asymmetric feeling

2:13 pm

among investors. when you have growth and sticky inflation that the amount of movement and equities to the downside or rates to the upside has been less than expected. they're thinking when you start getting better data on inflation, the move will be much larger your thoughts? >> i would urge investors no t to overthink the situation right now. they need to break their bonds they have been at the front of the yield curve. they need to be thinking about what's the new environment for higher rates and specifically the yield has done a 6% to 8% type of return in fixed income is actually pretty attractive right now especially when you consider the a symmetry you just eluded to the risk is potentially there. but take what has been given to us, which is the recalibration, the higher growth. >> the more i'm listening to you, sources tell me the best trade is a steepening yield curve. it sounds like it goes along with your plan short rates most likely will be slowly moving lower. but the long end might bring

2:14 pm

things like spending and debt and supply. >> right we have to think about the shaped yield curve in terms of premiums investors should simply command more premium it is not necessarily there for 10 years and beyond. >> do you think term premium will expand again? >> it is very likely in the interim, find very good ways to diversify portfolios. >> excellent jerome, always a pleasure to talk to you. thank you for joining me in chicago. contessa, back to you. >> so informative. thank you, rick. biden versus business. lawsuits against the biden administration piling up as they ratchet up regulation across the board. we'll discuss. plus, check out shares of alphabet now surging in the announcement it will pay dividends to the shareholders for the first time ever. it is up almost 10%. we dive in when ow lch"perun" returns.

2:17 pm

count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. you've got xfinity wifi at home. and environmentally fr take it on the goe. with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

2:18 pm

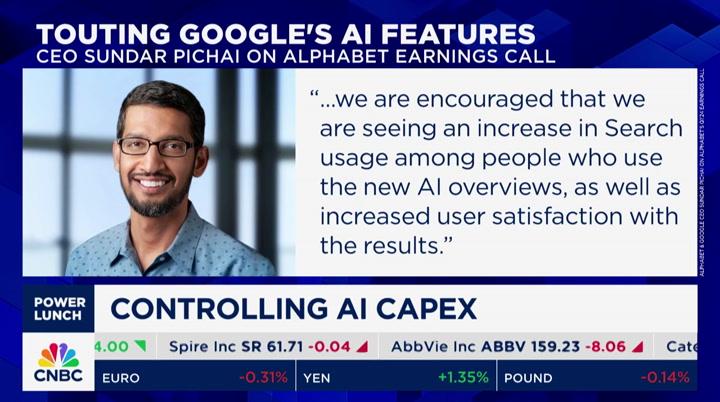

♪ halfway through the big tech earnings season. meta, alphabet and microsoft all posting beef capital expenditures meta's intense spending send the stock plumeting. while alpha got a bump, the google parent and microsoft are both preparing to spend to build out their ai businesses. steve joins us to break it down. we have apple next week. this cap x spending, though, it seems to be -- i mean, it is the common thread among all these big tech companies reportings earnings it represents some of the gambling companies, small startup companies that say, look, we've got to go all in if we want first mover status that's exactly what mark zuckerberg said on the meta

2:19 pm

call he said we have to spend so much money in order to bet out these ai capabilities and by the way, we're not entirely sure how we will monetize it right now we will do the same play that we did with stories and reels, get the users addicted to it, using it every day and then we will stuff adds in there that wasn't enough to placate investors. it was different in alphabet and microsoft last night microsoft had an interesting answer to this capex problem right now demand is outstripping the supply of ai capabilities. we will spend oodles and oodles of cash on this. >> when they say demand is outstripping supply, does that mean companies are going to them saying here is how we think ai could help us. and google says we don't have the application to put that in but we could invest and build it >> sort of it's mostly happening in the cloud, especially with open ai

2:20 pm

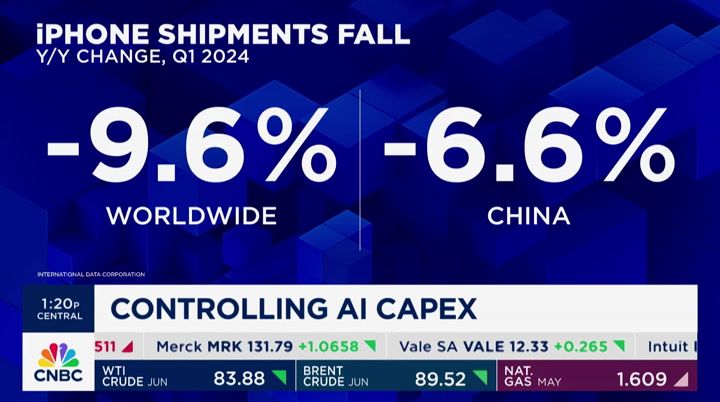

because of the relationship between microsoft and open ai. when people go to open ai and use their technology for their own apps, for their own services, for their own chat bots, so much is running on the microsoft azure cloud. next weekly will get a different story. amazon will probably be caulking about capex. in fact, they announced it yesterday. probably to get ahead of the negative reaction meta had but they're also being very aggressive with their buildout apple is a completely different story. we don't know where they fit into this ai picture how much of that is going to ai or other projects. and then, you know, from the consumer-facing side what do they have coming up for artificial intelligence? but in the near term, everyone is looking for apple it won't be an ai question it will be what's going on in china. we have so much data about how iphone sales have just plummeted in china it was down 13% in the december

2:21 pm

quarter. it's looking bad this quarter. trending -- we already see analysts trending their analysts for the june quarter so the question is what catalyst can reinvigorate. >> what kind of product can they bring in >> we'll find out june 10th. >> we spoke last hour about alphabet and microsoft with subscription models for their ai products chat gpt has something similar is it inevitable that meta -- and i don't know it well enough. does meta have anything with a subscription attached to it? >> not in the same way they're doing stuff in the eu. >> is it evidentable >> again, it is enormously expensive to run this stuff. they're not talking about that. >> that's a way to monetize that let's increase engagement and advertisement. ai search, which they said we're already seeing evidence of that ai search. okay, great. more engagement means more chance of trends i want to talk about nvidia.

2:22 pm

all this capex we're hearing about, consider that just cash going in that's all nvidia -- not all, but a lot of it is nvidia. all this talk we hear about people nervous about building on ai just fantastic news for nvidia >> and we have to wait until the 22nd of may. >> patience is a virtue. >> all right next week is national small business week. please join our free, no subscription required, free virtual small business play book event thursday, may 2nd. experts will examine the future small business in america. meet entrepreneurs to share strategies of overcoming obstacles to achieve success and how you can do it, too scan the qr code to register or visit cnbcevents/sbp we'll be right back.

2:24 pm

the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. your shipping manager left to “find themself.” leaving you lost. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire morikawa on 18.

2:25 pm

m he is really boxed in here.. -not a good spot. off the comcast business van. into the vending area. oh, not the fries! where's the ball? -anybody see it? oh wait, there it is! -back into play and... aw no, it's in the water. wait a minute... -alligator. are you kidding me? you got to be kidding me. rolling towards the cup, and it's in the hole! what an impossible shot brought to you by comcast business.

2:26 pm

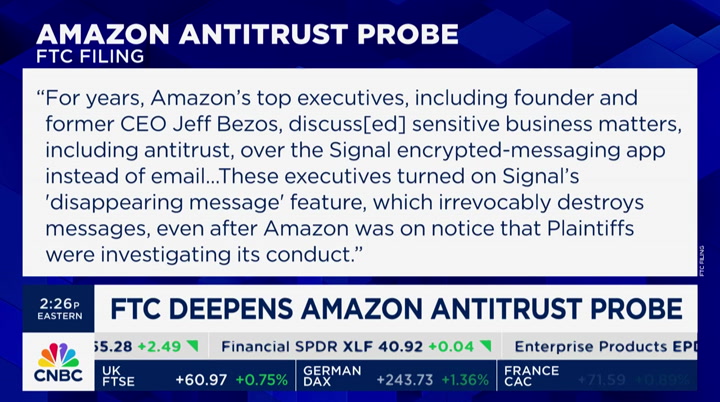

federal trade commission today accusing top amazon executives of using encrypted messaging apps to delete what could have evidence in the agency's case. kate has the latest from san francisco. hi, kate. >> hey there, tyler. in a new motion filed today, the ftc says for years that amazon top executives including founder and ceo jeff bezos discussed business matters over the signal encrypted messaging app instead of e-mail and then turned on the app's disappearing message feature which ir revocably destroys messages even after amazon was on notice the ftc was investigating its conduct. they do claim this interference with the possibility to investigate, the court is now looking for more information about what amazon executives

2:27 pm

told employees about how and when to use this app amazon calling the claims baseless and says that amazon voluntarily discussed and disclosed employees' limited signal use to the ftc years ago and thoroughly collected conversations from its employees' phones and says the ftc has a complete picture of amazon's decision-making, including 1.7 million documents. the ftc first opened this investigation into amazon back in 2019. it was the same year amazon executives did start using the encrvncrypted app this is not the first time, guys, excuse me, federal agencies have complained about these apps the doj alleged that google encouraged employees to use even krapted apps the fbi voiced concerns over wall street using signal and

2:28 pm

other encrypted apps. >> i don't know the law here but my assumption is unless and until you are alerted by counsel or law enforcement to retain communications, there is no obligation on a company or an individual's part to do so. >> that's right. the ftc opened this case in 2019 and did say they knew that discovery would be part of this and that they were obligated to hold on to these messages. but this signal and encrypted apps are increasingly common i would say in silicone valley among tech companies and that auto delete retention is really getting on the wrong side of regulators they have been frustrated time and time again when a variety of cases, not just amazon, that they are not able to get what could amount to evidence but there are big implications if, you know, amazon were found to have tampered with potential evidence, deleted evidence and there are -- down the road it could end up with potential doj

2:29 pm

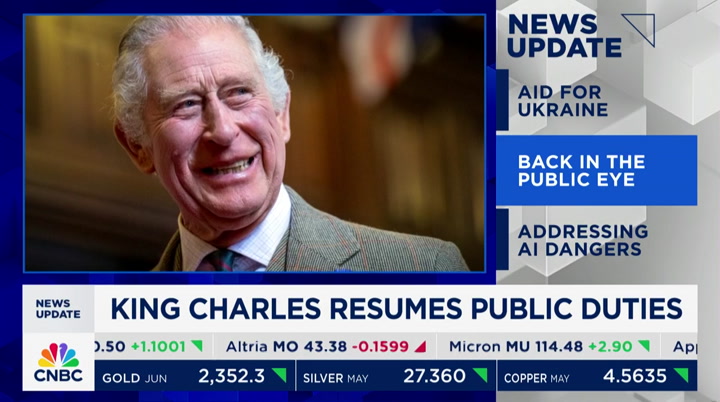

implications. >> kate, thank you very much we appreciate it. >> let's go to seema for a news update. >> the u.s. announcing the purchase today of $6 billion worth of weapon for ukraine. the biden administration says the purchase will include vehicles, intercepters for air defense systems and counter drone systems. earlier this week, the president signed a bill into law providing billions of dollars to help ukraine in its war with russia after it had been solved for a half a year. king charles will resume his public duties for the first time since his cancer diagnosis almost three months ago. buckingham palace announced his team is encouraged by the 75-year-old king's recovery, but did not disclose further details. it comes as his daughter-in-law kate middleton is being treated for cancer. pope francis will participate in a g7 summit on ai in italy

2:30 pm

he will warn against the dangers of ai and sent a call for global regulations. the june meeting will bring together world leaders from the u.s., britain, france, italy, canada and japan contessa, even the pope weighing in on ai. >> yeah. seema, thanks. ahead, we're ending the week with a bang. deluxe earnings edition of three stock lunch. we'll get the story. i can't promise i will sing the actual song, but it sure is in my head when we return investment professionals know the importance of keeping their clients on track. sometimes they need help cutting through the noise, to ensure fresh investment ideas keep flowing, and to analyze the market from every angle. at allspring, we deliver the unexpected, by relentlessly exploring where others don't.

2:32 pm

if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. business. and environmentally it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning.

2:33 pm

the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. all right. i believe we have a news update coming to us from julia boar steen. is that where we're going right now? i guess we're not doing that right now. so bear with me. i misheard even better, deluxe three stock lunch. we have three key movers making headlines today. we will give you the story and the trade on each. our trader today is ava. but let's first go to julia for

2:34 pm

the story on snap. here's where i got confused. we are going to julia first, but we weren't supposed to introduce her first. here you are, julia. take it away. >> here i am, and look at that stock chart. that counts as a news update that stock is up 20% on better than expected results and guidance for the first time, snap gave full gear expense outlook which showed moderate expense growth this year. all of this driving a number of upgrades and positive analyst notes. hsbc saying it is upgrading snap to buy due to, quote, the broad-based recovery and global advertising demand and pricing, with the social advertising industry proving a main beneficiary. i spoke about advertising demand take a listen. >> businesses are using digital advertising to really efficiently drive more demand.

2:35 pm

and i think, you know, overall, the economy has remained healthy. the consumer has remained confident and still spending so i think, you know, it is a constructive backdrop for the advertising business >> he also stressed that all of the company's investments in ai improvements to their add tools and recommendations is all paying off you can find my whole interview on cnbc.com. guys, back over to you. >> awesome thank you, julia ava, what is your trade on snap? >> i agree it's a buy i'll explain we haven't owned it because they were struggling with monetization, just like whatsapp is so it is very easy to monetize reels or tiktok, but hard to monetize messaging that's what they were targeting. now i like it because it looks like new advertising strategies it's becoming more and more efficient. i also like the fact that before

2:36 pm

today's call they were down 88% since their covid-19 highs that's a big drop. i also like the fact that their revenues have gone from $1 billion to $4 billion in five years. that's 4x. that's a great number. i don't like they're still not producing. we'll see if the tiktok ban ever happens and if that ends up helping snapchat i want to mention that back in 2020 in the event tiktok and that's double the user base of snapchat i'm not sure what we will see now, though, because instagram reels was getting launched back then and we didn't have youtube shorts back then so we will see how that plays. >> you are a buy, but would you buy here at this level when it is up 27% on the day >> great question. i think not. with wait for a good entry point. and also, it is a macroeconomic

2:37 pm

discussion when gdp growth is coming down and inflation is still, do you want to be in such a high growth company, such a speculative growth company so i would wait to get into it in a few weeks, if i see a better entry point or even in a few months. >> all right let's move on to exxon mobile. the stock is under pressure after a mixed quarter. shares down 3% p pippa stevens has the story here. >> although revenue did beat expectations, net profit came in at $8.2 billion, down 28% year over year. largely thanks to weak national gas prices, which fell 30% during the first three months of the year as well as not as strong refining margins. still cfras telling me the quarter was all in all not bad and nobody was expecting the same blockbuster results from the last year.

2:38 pm

some of the stock reaction counsel the news, especially after the stock hit a record high earlier this month. one bright spot was exxon's operation. production grew at higher than expected levels, reaching more than 600,000 barrels of oil. earlier today, the ceo telling cnbc, guyana will go down as one of the best deep water investments in the history of the industry that's why chevron also wants in the oil giants are locked in a dispute over whether exxon has a right of first refusal saying it is not a play, perhaps, but protecting the value. meantime, chevron's ceo telling cnbc, they are confident in the interpretation of that joint operating agreement. >> thank you what is your trade on exxon mobile right here. >> i do like oil in this market with the tensions in the middle

2:39 pm

east but i don't like the company their chemical sales came down their be is 1.5 times their peers. the total enterprise value to revenue is double their peers, so a relatively high price and i think that there are much better competitive companies in that category. so that's a great company. they are better priced, relatively speaking. and they're also targeting the green energy market, which is a high growth market with higher margins, especially when it comes to sustainable aviation category i would sell x and buy six to six. >> that's why i love ava she says, i just don't like the company. she says it clearly. good for you final name is colgate. stock rising today >> all right there is a reason why the shares hit a record high today. they hit the earnings trifecta

2:40 pm

profit beat, revenue beat and forecast raise it was driven in large part by sales growth in all of its key operating positions if you strip out the effects of acquisitions. so the company known for not only its name sake toos paste, b but also hill's pet foods which now makes up 22% of all of colgate sales. you saw growth in unit volumes also pricing as well with the notable exception being continued volume softness in the china market now, the key for many consumers staples companies and their investors is whether they're able to withstand inflationary pressures and still be able to get consumers to pay higher prices for their products. that looks like it is the case for colgate-palmolive.

2:41 pm

hence, the record high. >> don, the consumer likes it. does the investor like it? ava? >> i think it is a hold. i like it in this market given the macroeconomic conditions we just mentioned i think in a couple weeks, investors will be happy to own it it is a slow and steady company. the s&p went up 300% since 2008. no, this company went up 300% since 2008, when the s&p more than doubled at 660% so it is not going to make you rich, but it is a great defensive play. >> thank you for your perspective. all righty coming up, regulation nation tensions between business groups and regulators increasingly playing out in court we will discuss that when we return

2:42 pm

2:43 pm

can't prevent accidents at work. so talk to your agent about workers's comp insurance from pie, or visit pieinsurance.com. safety first, then pie insurance. ♪ (upbeat music) ♪ ( ♪♪ ) with the push of a button, constant contact's ai tools help you know what to say, even when you don't. hi! constant contact. helping the small stand tall. [thunder rumbles] ♪ ♪ ♪ ♪

2:44 pm

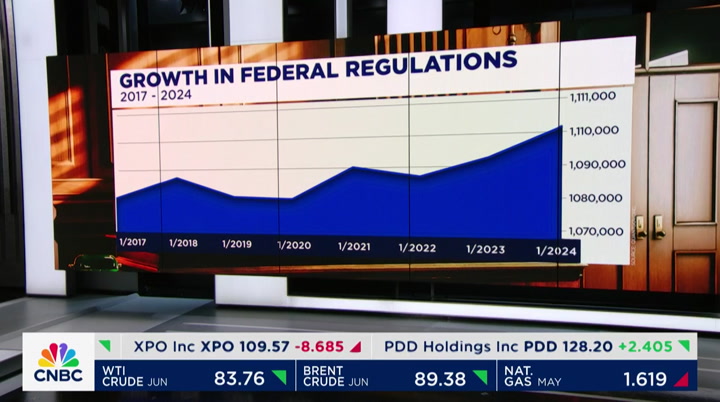

the biggest ideas inspire new ones. 30 years ago, state street created an etf that inspired the world to invest differently. it still does. what can you do with spy? ♪ ♪ [thunder rumbles] ♪ ♪ earlier this week, the chamber of commerce sued the federal trade commission over its non-compete ban, and that's just one of the many lawsuits business groups have filed against the biden administration megan joins us now to explain why we're seeing a surge in legal action against the administration hi, megan. >> hey, contessa so banking and business groups

2:45 pm

tell us they're pushing back against what they see against regulatory over reach. the chamber of commerce filed 15 lawsuits against the obama administration in its first term and then just three against trump. but they expect to file at least 22 lawsuits against biden by the end of this term they're not alone either the american bankers association signed on to four lawsuits against biden bank regulators in the last 18 months or so after not suing any for the last decade these come as total regulation has increased under biden, according to one metric from george mason university. they say they're choosing to sue when they see agencies acting outside the limits of their authority. >> we went from a time where we would argue about a particular regulation to a period where the concern is about the direction as a whole and the sustainability of the system >> now, the white house says it is fully confident that agencies

2:46 pm

are acting within their authorities. and they say their goal is to help workers and families. but the business groups say that when every administration can simply rewrite the rules the way they want to, it amounts to whiplash and nobody benefits. >> megan, thank you very much. now a news alert on the justice department's case against google again, the intersection of government and business. >> that's right. google has now filed a motion for summary judgment in the antitrust case against its ad tech business that was brought by the department of justice this filing just within the past hour year. what google is essentially doing is making four arguments that suggest the government has simply failed to prove its case. they're asking the judge now to throw out the case we'll see whether the judge agrees with the arguments. there are basically four arguments here one is that the market definition that the department of justice is using is essentially a made-up argument that would make google look

2:47 pm

better if they used a different definition also the percentage of market is lower than the threshold required by this particular court. they're saying that this basically will turn private companies into public utilities if this approach to antitrust is taken. they're saying in terms of the way the government calculates damages to the government here, they say that calculation is essentially bogus because the government did not buy services directly from google we'll see whether those arguments hold water with the judge in this case we might get a ruling here maybe by the summer. the case is expected to go to trial in september so presumably before then. the judge has a couple of options, tyler she can throw out the entire case she can modify, limit and restrict the case. we'll see what she does here but this is google's bid to get the whole thing thrown out of court. >> meantime, shares of paramount lower for the second straight day amid reports it is making progress towards a merger with

2:51 pm

♪ welcome back to "power lunch" everybody global and sky dance media are reportedly making progress now on a deal that would merge the media companies and buy out the controlling shareholder of paramount. but matrix asset advisers is slamming sky dance's bid to merge and has written a new letter to paramount sports, stating their belief that a deal would not be in shareholders' best interest. the new article is out that addresses one key hurdle that may be standing in the way of completing the deal. joining us now is alex sherman -- so, we're not going n' go to alex sherman because we dot have him yet we're going to take a break. and if we have find him -- just like yesterday, kenny was missing. but we'll get to him, you watch.

2:53 pm

2:54 pm

2:55 pm

as i promised you -- welcome back to "power lunch," we have alex sherman now to talk about paramount and the potential deal there. and bob bakish, the ceo there might be removed there as ceo. what can you tell us, alex >> so, i alluded to this in the story i wrote yesterday for cnbc.com paramount has a huge -- coming up with charter communications it's, sort of, the last major hurdle to evaluate the company, if it in fact moves forward with the deal to merge with sky dance media. the problem is that bob back, who has privately backed the -- not a good deal for all shareholders it only benefits national red stone, which is -- he's in charge of this negotiation with charter. i think sherry redstone, who is

2:56 pm

on the board at paramount and is the controlling shareholder, has been increasingly frustrated she may want to make a move before the negotiation happens to put leadership in place that she trusts more. >> well, if she's the -- if she is the, quote, controlling shareholder, wouldn't it be within her right to make such a move and remove bakish, who is opposing the deal? >> it would be, but there's several awkward scenarios that go along with this one, that deadline for charter is april 30th. so, you would be making a change, potentially, if this, in fact, does go through -- and i'm not sure it will you would be making a change way down the road in that negotiation by suddenly pulling the leader of the company. also the special committee of paramount global is supposed to evaluate all options, not just skydance one of those options is a stand

2:57 pm

alone go forward strategy. you're saying, hey, look, one of these accounts forward that you have as a negotiating tool to try to get the best deal for paramount global, we're basically taking that off the table if we're going to make a ceo change and not replace him with anything. so, look, this is a sticky situation at this point. >> then you have matrix asset advisers writing another letter saying, you are not acting in the interest of all -- and all is in all caps -- shareholders here and they really lay it down on the line, throwing down the gauntlet about sherry redstone being the beneficiary, nobody else they're saying, no, no, you also need to look not only at this stand alone option but at this apollo/sony option as well >> if there are three options, it's one, skydance, exclusive talks, ends may 3rd. skydance wants an extension on that to be determined

2:58 pm

two, this apollo deal. apollo has offered a full takeout of paramount global, which would in fact benefit all the shareholders in the near term because the shareholders would get a premium on the deal. or three stand alone, remove bob bakish you eliminate route three, that's one negotiating -- off the table. sherry redstone wants to do this skydance deal. she's wanted to do it for months if she gets her way, it won't matter because bob bakish is going to be out as ceo and david ellison is going to be in if the skydance deal is done. >> skydance also is backed by kkr and red bird is red bird the one that has the relationship with jeff zucker? >> and jeff shell, the former nbc ceo, would be the president of the new company, if, in fact, that deal gets agreed to

2:59 pm

>> let's move on to kenny smith, who yesterday on our air talked a good bit about the warner brothers discovery future. he chose it as his stock, saying that if wbd gets the nba rights, which are subject to negotiation right now, that's going to power warner brothers discovery. let's listen to kenny. >> i'm going with the warner brother discovery for this reason once they get the nba contract again, their stock is going to rise and they also -- think about it. they're going to -- they have the best show on television, "inside the nba. they need -- their stock will go up you cannot negate the fact that once they get the nba license once again, they will skyrocket. >> i do not dispute kenny's view that "inside the nba" is a great television show with great chemistry. but i do wonder whether just

3:00 pm

getting the nba rights is going to be enough to power that stock. we've got about 25 seconds >> right look they already have the nba rights, and that's -- so, yeah, it's an overhang on the stock. the question is how much do they have to pay to renew those nba rights it's going to be more, which isn't good news for shareholders we'll see if the benefit of getting the nba rights can benefit the cable networks >> got to leave it there thanks, alex appreciate it. thank you for watching "power lunch. >> cloezing bell starts right now. and welcome to "closing bell," everybody i am brian sullivan, in for scott once again and we are live here at the new york stock exchange. we begin this friday, folks, with stocks rallying the major averages now on course for weekly gains, in fact their best gains of the year hard to believe but true investors shaking off another hotter than expected inflation read index on total spending, known as the pce, ticking higher in march. that is pushing wall street'

0 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11