tv The Exchange CNBC April 26, 2024 1:00pm-2:00pm EDT

1:00 pm

javc-2 or zero trust, the one that benefits from that, leidos. new management came in, they're in a sweet spot of everything defense. all they need now is to get into an erm program >> that does it for "halftime. "the exchange" starts right now. happy friday, everybody. courtney, thank you very much welcome, everybody, to "the exchange" for a friday i'm tyler mathisen, and i'm in for kelly evans. another day, another hotter than expected inflation read. the fed's key pce data showing that inflation ticked a little bit higher in march from the previous year but held steady from february. stocks managing to shake, shake, shake that off with all three major averages higher at this hour yields, though, under a bit of pressure as market expectations for maybe two interest cuts this year rose a bit.

1:01 pm

our economist isn't fully convinced and says while unlikely, some of the data doesn't necessarily take hikes off the table. he'll tell us why. with costs still climbing, we have "three buys and a bail." inflation insulation edition plus, the three names one trader says can weather the storm and the one she's staying away from, despite climbing 17% this week plus, deal with it, the message from china's xi to secretary of state antony blinken, saying for bilateral relations between the two countries to improve, the u.s. needs to look at china's development in a positive light. a lot to get through today let's start with the market action and dom chu >> very much the taylor swift shake it off market. we have seen session highs at this point in just the last couple of moments. the dow up to 38,302, half a

1:02 pm

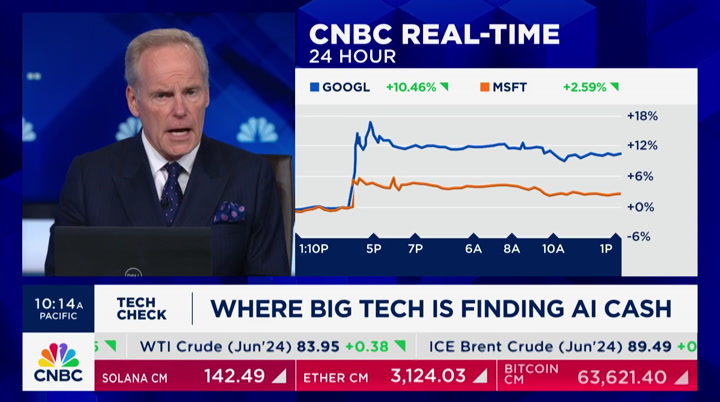

percent to the upside. the s&p 500 is at 5109, up about 60 points, we were up 64 points at the highs we just saw maybe in the last two to three minutes we were still up 25 points at the lows of the session so far now, we were at 5109 for the s&p. the level that sometraders wer watching is 5125 that is on the upside for the 50-day average price on a rolling basis. so keep an eye on that level the nasdaq composite pacing the advance. big tech a big part of that story, up 350 points to the upside 15,961 i'm going to show you now a slate of stocks, including the reason why is that tech trade is so phenomenal. alphabet shares, up about 10%. goldman sachs on the financials up 1 f.5%. chipotle, catcaterpillar, tract supply, all up

1:03 pm

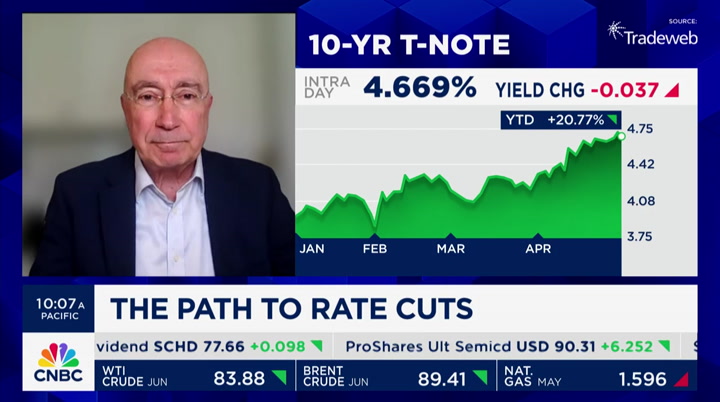

all five of these stocks at one point today set record intraday highs. so keep an eye on that big trade in technology. and then the rates picture has within very volatile this week, given some of the data the ten-year note yield, we started off the week just a hair below 4.65, and we are not far from there right now, about a 4.67%. despite the ride that we have seen, tyler, those ten-year note yields and inflation proxy and everything else that goes into it is relatively stable at the beginning of this week versus the end of it. we'll see if that sticks back over to you >> virtually where it began. thank you very much, dom sticky inflation forcing the market to dial back expectations of rate cuts this year our next two guests scaled back their expectations, seeing just one cut in the cards likely, and likely toward the end of the year one of them says more cuts are

1:04 pm

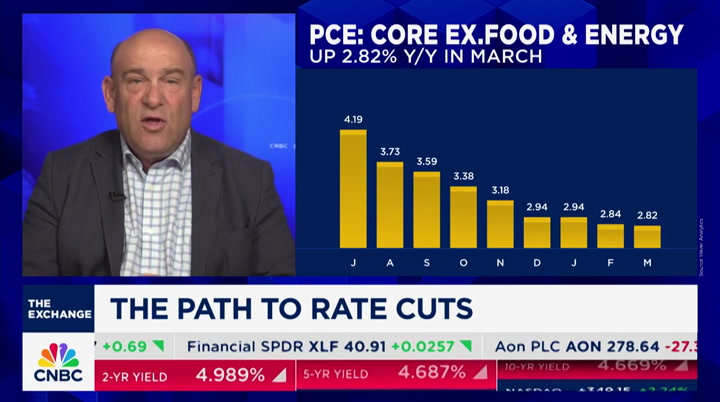

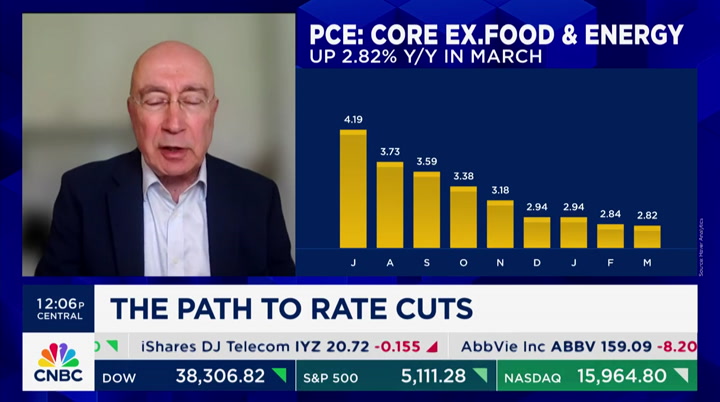

needed joining us now are my two guests and cnbc's senior economics reporter steve liesman joins us, as well. steve, let me begin with you take us through this morning's numbers, tell us why they are the favored measure of the fed, and why i feel as though some of the momentum in the reduction of inflation has been quelled we don't have as much momentum >> yeah, i think you're right to feel that way, tyler it is really backed up by the data the fed follows the pce because they think it's a better gauge of overall inflation in the economy. it de-emphasizes economy, has more medical care in it. we could have an argument over it some people like the cpi better. what happened this morning is we dodged a bit of a bullet it wasn't as bad as it could have been.

1:05 pm

we knew yesterday that the quarterly inflation number was higher than had been expected. we wanted to know this morning when it was higher we learned it was more in january than it was in march and so it's a little bit more in the rear-view mirror and where we thought we had an outside inflation number, which was in the january turn of the year data that we had a little bit less, just a touch in february. and not much more in march look, just because it wasn't as bad as it could have been doesn't mean it's good, you're right. momentum has slowed when it comes to inflation the headline ticked up the core went sideways so that momentum has stalled and all of this means the fed has less confidence with which to cut rates. july, not really happening september now is really the only place where we're over 50% on those probabilities, tyler >> i would like you to respond to what steve said, and my initial question, i note in my

1:06 pm

notes, my view is that the preponderance of evidence is that inflation remains on a downward of trend. tell me about that preponderance of evidence and why that downward trend has kind of stalled. >> well, you would expect a downward trend to stall as we reach the target we've come down a lot there the peak and we expect the decreases in inflation to stall as you get closer to that 2% target and because monetary policy works with a lag, i do believe that the fed should start decreasing rates now, you know, i do expect that they will decrease rates this year, probably only once but i think higher rate cuts are called for, and i think the bond market is already telling us that today, the bond market's actually the yields are down, despite this evidence that maybe inflation did not come down as much as we had hoped further more, i'm very concerned

1:07 pm

about the national debt and the cost of servicing that debt. and even though i know it's not in the fed's mandate, i think there will be growing pressure on the fed to decrease rates so that the government can roll over some of this debt if they reduce that fed funds rate, i do not expect longer term rates to go down. i expect them to remain at about the same levels, maybe even closer to 5% but i would say that would be a good thing, because it will make the yield curve normalized and become upwards sloping >> mark, let me just follow up on something you just mentioned. and this is one of the reasons, if i'm understanding it that you believe the fed should cut rates and should do it in a series, in other words, more than just one over the next let's say year or so, is because you are concerned about the amount of debt service cash that the federal government has to pay at these higher rates to service the federal debt. you lower those rates, the debt

1:08 pm

service comes down, and that frees up more money for other things like defense or human health and other things. >> well, you're correct that i'm concerned about that however, the fed is probably going to ignore that because as asaid, that's not in their mandate. they're going to say let the government reduce the debt, do it on the fiscal side rather than monetary side but i think the fed will face pressure to do something >> mark, let me turn to you and get your view on interest rates and the numbers that came out today. you're in the probable rate cut camp, but have recently said, and sort of reiterated just a few hours ago the idea that well, there's a long shot possibility, maybe that they would even raise interest rates, though that is not your base case >> yeah, thanks, tyler, thanks for having me. it's not our base case our base case is for the fed to cut rates once this year

1:09 pm

we think that given the reacceleration of inflation we got in the first quarter and the still strong prints we saw in march, we think that we are on a trend down on inflation, it's gradually going to come down later in the year, and in that case, the fed will be allowed to -- or will be able to cut rates. but we don't think it will be able to do that more than once this year. >> what are you seeing, mark, in terms of the economy we had a gdp number yesterday that some people were disappointed by. where are you on the current health of the u.s. and the global economy for that matter >> so we think the global -- the health of the u.s. economy is still very good. the overall economic activity is still strong it's true that gdp yesterday printed lower than expectations by quite a margin actually with

1:10 pm

the 1.6% growth rate but the underlying demand is still very strong. a lot of that weakness came, was reflected in strong imports, was reflected in de-stocking and so we think that if you look at the overall demand, it's still pretty strong. in fact, it hasn't changed much from the pace we have seen in the third and fourth quarter of last year, where we had remarkably strong growth this, together with the monthly profile of consumption that we got this morning, tells us that they still is quite a bit of momentum as we go into q2. so we think there is some support here on consumption in the second quarter for the outlook further down, we see some gradual slowing and returning basically back to trend growth towards the end of this year, but a resilient economy until then >> steve, react to what you just

1:11 pm

heard, and one of the questions i would have is, why on a day when inflation came in a little, little tiny bit higher than expected would yields decline as he pointed out >> well, i mean, first of all, yields have come a long way in the past month so or so, so there's plenty of room to come down what i was saying earlier, the market was braced for the possibility that extra inflation could have shop up in march. and while they're right, we did have a higher number in march than we would have liked, it was still not the number -- i went into the numbers, tyler, with a simple metric in my mind 0.3% was good, and 0.4% was bad, and it came in at 0.3% so that was okay i'm really interested, though, in what economists and forecasters are doing for the second quarter we're going to report our fed survey data on monday. but i am seeing some numbers,

1:12 pm

tyler. if you can believe it, north of 3% it may be because of what was just discussed we've had two quarters of inventory drawdown we might have an inventory build. we had a big negative shock when it came to terms of trade. it was minus 0.9%, so almost a full percentage point. that may be something that comes back but i'm seeing numbers -- i think goldman just put out their tracking forecast at 3.5 atlanta fed just started gdp at 3.9% i get what mark is saying about hey, this weakness has to come eventually, but at least in the initial drawing of the second quarter outlook, i'm not seeing much weakness and i didn't see much in the first quarter, either >> let me put on your chief investment officer hat and talk about a couple of the areas you like financials, biotech, ibm, and verizon. >> first of all, i agree with what steve just said

1:13 pm

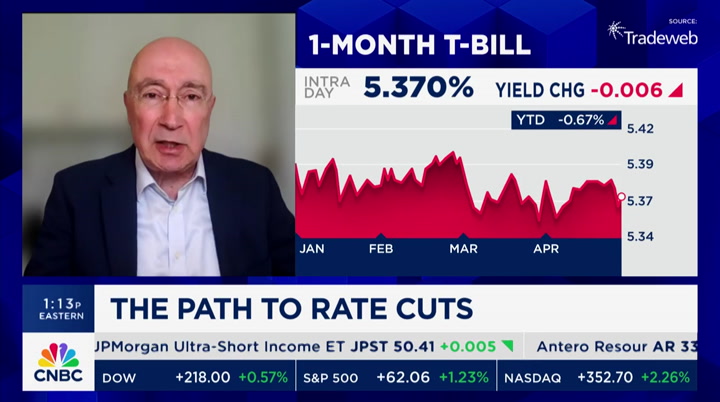

i expect second quarter gdp growth to be much better, and as mark pointed out, one of the reasons we saw a weak numbers is because of those net exports but yes, i have been taking advantage of what's been going on in the market one thing i've been doing is buying a lot of t-bills. i continue to buy them and roll them over, because i believe the fed is giving us a gift by keeping rates this high. even though i believe rates shouldn't be that high, but i'm taking advantage of that with excess cash that i don't have as strong a conviction for. but i'm taking advantages of selloffs in the market, and i have put money to work in the xlf and xpi, which tracks biotech companies. i do like ibm and verizon, and i would point out that these are two stocks that are very much like bonds they pay very generous dividends, but unlike bonds, those dividends grow over time both companies have been

1:14 pm

increasing dividends every year for a long period of time. and even though you haven't seen much of it, they do give you the opportunity of getting some capital gains over the long run. >> vahan, thank you very much. have a great weekend have a great weekend, fellows. now to technology. alphabet and microsoft shares popping after both companies beat on the top and bottom lines. the tech giants emphasizing the growth of their respective ai businesses, but that does come at a big cost. microsoft's capex jumped 79% steveco vak joins us with more >> we were talking about the montization stories, and it's clear what we heard yesterday, it's the very early days, not a lot of disclosure, just some promising nuggets of information showing both companies could be on the cusp of something big

1:15 pm

here microsoft, ai sales showed up in the azure cloud unit, printing 7 points to the revenue growth, up from 6% quarter over quarter but that's where the ai story ends at microsoft. there's lots of mushy talk from the ceo on co-pilot, but at the end of the day, we have no idea how well it's selling. he did throw us something here and said a handful of companies that bought at least 10,000 subscriptions for co-pilot as for google and alphabet, the ceo shot back at the idea google's core search business was under threat from chat bot search ends. he said -- >> he said google will monetize ai through subscriptions and cloud, just like microsoft is doing. one other interesting argument not related to ai necessarily, he said youtube and google cloud

1:16 pm

combined will have a $100 billion run rate this year his way of saying alphabet's more than just selling search ads. >> what do i get if i subscribe to one of these ai services, what is the one from microsoft >> microsoft is co-pilot >> and google -- >> so there's consumer versions that just regular people can sign up for on an individual basis. >> for free? >> there's a free version, a paid version is $20 a month. by the way, openai has a similar product that it offers by itself and that is also what google is trying to do is offer these subscriptions. on the enterprise level, that's where the real money is. big businesses coming in, tens of thousands of people coming in i just showed you that wall of companies buying, multiply 10,000 by $30 a month. that's why there's so much

1:17 pm

enormous interest how well co-pilot is selling. >> thank you very much coming up, china warning the u.s. of a downward spiral as secretary of state antony blinken meets with china's president xi the tone of this trip is very different than janet yellen's. higher for longer has had banks to pull back on lending and non-bank lendors are stepping in. we'll talk to one ceo with a front row seat of it all "the exchange" returns after this [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is.

1:18 pm

1:19 pm

if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an

1:20 pm

energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. welcome back to "the exchange." secretary of state antony blinken meeting with president xi jinping today of china. final day of the visit there secretary blinken stressed the need to avoid misunderstandings, while president xi brought up the importance of china's economic growth and stressing that the way china grows matters. this as the u.s. and china are walking a fine line between cooperation and competition as disputes grow over trade, geopolitics. so let's bring in our experts to discuss where things stand and

1:21 pm

where they might go from here. joining us now is the managing director of long view global, and nicholas lardy is a senior fellow at the peterson institute for international economics. nicholas -- or nick, may i call you? welcome to both of you, but nick, it seems the u.s. is trying very hard to thread a needle between actions that are meant to be corrected or encouraging or punitive, and language that is meant to be conciliatory can they do that >> well, i think so far the administration has been able to do that. they're very tough on the economic front, tighter and tighter sanctions. more and more tariffs. but they're getting the meetings between president xi and president blinken, the secretary of the treasury and others have met their counterparts in beijing. so the geopolitical atmosphere has improved a bit, but at the

1:22 pm

same time, the administration is announcing tighter and tighter restrictions on the economic and technical exchange with china. >> what does it tell you that china has been receptive, as you say, to meetings with secretary yellen, secretary ramando, now secretary blinken, what does it tell you they're trying to do here >> well, i think they want to have a stable relationship with the u.s., and they're hoping they can get some modification in the u.s. economic policy towards china. i don't think they're going to have much luck, at least in the short term the administration is pretty hard over on restrictingchina' economic growth and access to technology >> one of the issues that was discussed here apparently during the conversations is chinese aid to russia that would be potentially lethal aid that could go to russia in its war against ukraine.

1:23 pm

do you sense any progress on this front >> we'll have to see, tyler. as you say in your opening here, this is the major part of blinken's visit here, to deliver a tough message on russia. you'll recall at the beginning of this conflict, the u.s. was very clear that lethal aid to russia could trigger secondary sanctions. for the last two years, china has not delivered anything that can be identifiable as lethal aid. but what we have seen is china sending to russia things like microelectronics, machine tools that helps them to back fill their defense industrial base, but the u.s. is growing increasingly concerned that it is helping russia on the battlefield in ukraine so blinken was there to deliver a tough message that either get this together or there will be some additional sanctions that's going to be brought to the fore,

1:24 pm

particularly here on chinese banks which could bring all sorts of chaos into the market >> so nick, let me pose sort of a college essay question to you. compare and contrast this visit of secretary blinken with that of secretary yellen a few weeks ago. >> well, i think there are a lot of similarities. secretary yellen was asking for some adjustments in chinese industrial policy, talking about overcapacity in certain industries, leading to large exports, which potentially could be adverse for the united states blinken is also conveying a message that's asking china to change its policy, just like secretary yellen in this case, restricting a broader range of exports to russia china has not violated any official sanctions, but the u.s. is raising the ante, saying even normal trade has to be more

1:25 pm

restrictive, because it might indirectly contribute to russia's war-making capability as you already noted, china has not sold any military equipment, direct military equipment to russia but now we're asking them to tighten out even more. >> how big a danger is the relationship -- how much danger is embedded in the u.s./china relationship specifically, there's a lot of talk about pressure the south china sea, pressure against taiwan how dangerous is this relationship these days, or is it a little less dangerous than it was two years ago, four years ago? >> that's a good question, tyler. let me try to answer it this way. i think it is more managed than it was a year ago, but the dangers and the risks that things can go bad are still there. but listen, i think that the administration has to be given a

1:26 pm

lot of credit here, because what you're seeing with the yellen and blinken trip is this attempt to really put in place this managed approach so you have a situation where high-level dialogue is taking place on real issues of concern, on both sides. and a real clear expression of the consequences that may come if these things are not addressed. i think that is the essence of what a managed relationship will look like. it's not going to take out the risk necessarily, but at least we are talking about the consequences on both sides and it is being made very clear here >> nick, i have a hard time phrasing this with nuance, so i'm just going to say it i'm just going to blurt it out has the biden administration's approach to china, ie, keeping tariffs in place, fundamentally thereby embraced, endorsed, or shown that trump got it right

1:27 pm

when he put those tariffs on >> well, i think you're absolutely right a lot of people thought early on biden might back off on the tariffs and undo some of the things that trump put in place, but he's done the opposite he hasn't taken away any of the tariffs and added a lot more, and he's added a great deal more in terms of technology restrictions so, he has basically doubled down on the trump restrictions of course, it's been very popular with both parties. so i don't think it's likely to change any time soon >> do you agree with that, that biden's actions have implicitly said trump got it right? >> well, i think if you talk to the administration, what they would say is that what they have tried to do differently is really bring allies and partners into this, reduce some of the tariffs that were being placed on allies and partners

1:28 pm

but on balance, i agree here, i think the approach here using tariffs to try to change the behavior of china has remained in place >> thank you very much have a great weekend, gentlemen. appreciate your time today we would like to see you again coming up, a special "three buys and a bail" edition to hedge inflation. include thing name that our trader says gets going when the going gets tough and she's a buyer. but first, we're going to look at financials but play out a knew non-bank names here here's another mystery chart this name has been a big outperformer this year we'll tell you which one it is, and the other names like it to watch. we'll be right back. ♪♪ something amazing is happening here. the next era of ai has arrived. cdw data engineers are helping organizations harness the power of ai with intel core ultra processors.

1:29 pm

1:30 pm

1:31 pm

welcome back to "the exchange," everybody financials one of the best performing sectors in 2024 so far, but it's not the banks seeing outsized gains this year. dom chu joins with us that story. >> so it's financials with technology, as one of the best performing, in fact, the third best performing sector in the

1:32 pm

s&p 500 so far neck and neck race with tech and financials over the past year, it's up roughly 27%, and since the november lows, it's almost been a straight line higher, but for over the course of the last couple of weeks or so. you talked about the idea it's not just about the banks in financials check out the most heavily weighted stocks in the inde indecision overall you look at these names, and look at the other ones up there. berkshire hathaway, visa and mastercard drive a lot of the action, and specifically, check out some of these top performers in the past year-to-date period. three stocks in familiar are among the best performers, each up 20% so far in the first part of the year. check out progressive, allstate, and hartford what do they have in common? maybe it goes without saying, they're all in insurance, and among the best performing financial stocks

1:33 pm

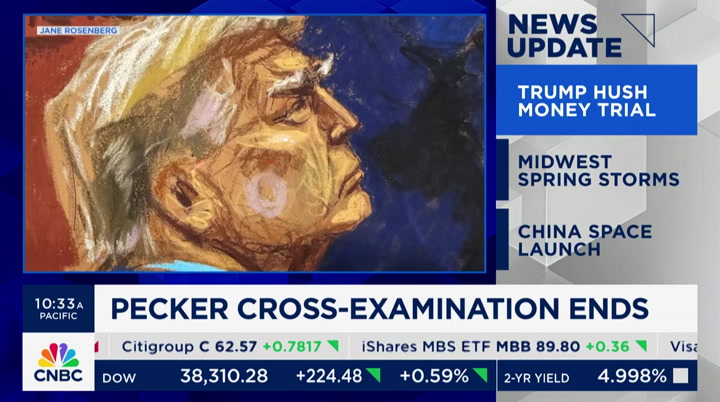

so keep an eye on the insurance companies. it's not just about the banks in the financials >> dom chu, thank you very much. pippa stevens now with a cnbc news update. former president trump's lawyers finished their cross-examination of publisher david pecker this afternoon. on redirect by prosecutors, pecker confirmed that he bought the story of former playmate karen mcdougal alleging an affair with trump to influence the election he added the purpose was to acquire lifetime rights so no other news organization could publish it 21 million people are at risk from iowa to texas for severe storms. the storms are forecasted to bring hail, flooding and possible tornadoes in oklahoma, storms caused damage this morning with a tornado watch in effect. the worst of the storms is expected to continue into saturday china ralaunched an aircraft

1:34 pm

to replace a crew. the mission is the country's 13th to space. tyler, back to you >> thank you very much coming up on "the exchange," as banks limit lending amid higher for longer, could private credit be in a sweet spot for longer we'll talk to one player who says private credit will be the place to be for commercial real estate the ceo of preach tree group will join us to make his case. and investors getting rocked to their core lately. pce can't seem to cool investors may want to find a little insulation from hexcng is ck "t ehae"ba in two minutes.

1:35 pm

nice to meet ya. my name is david. i've been a pharmacist for 44 years. when i have customers come in and ask for something for memory, i recommend prevagen. number one, because it's effective. does not require a prescription. and i've been taking it quite a while myself and i know it works. and i love it when the customers come back in and tell me, "david, that really works so good for me." makes my day. prevagen. at stores everywhere without a prescription. (♪♪) iconic brands speak for themselves. we are so excited to welcome you to our community. today is all about you. (♪♪) (♪♪)

1:36 pm

♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya provides tools that help you make the right investment and benefit choices. so you can reach today's financial goals and look forward to a more confident future. voya, well planned, well invested, well protected.

1:37 pm

1:38 pm

comes to commercial real estate. our next guest says this is providing a huge opportunity for private credit, especially as rate cut expectations fade just a bit. greg friedman is ceo of peachtree group, a private equity firm that invests in and lends to commercial real estate. greg, welcome. good to have you with us >> thank you, tyler. >> let me understand, you have two businesses, private equity business where you own commercial real estate among other businesses, and then a private credit business where you are lending, mostly to whom? commercial real estate developers >> that's correct. we're typically lendsing to developers, regional ownership groups that own commercial real estate across the u.s. >> they need money because, in part, as i understand it, the traditional lending sources have been restricted, either by regulation or capital, so that they don't have the money to lend, am i right on that >> that's right. so if -- >> so you're exploiting a gap

1:39 pm

in -- >> exactly if you look at the commercial real estate, banks make up 50% of the lending market today. unfortunately, banks are broken today. they have a lot of regulatory pressure, they're not able to lend at the same levels they were once able to lend at. most of the loans for commercial real estate is coming from the regional banks that have been under heavy pressure that's opening up a gap for us to fill, to step in and provide those loans. and in a lot of cases, we're partnering with banks helping to convert their exposure to limit them >> so you not only would lend to a borrower, but would you buy loans from a bank? >> we would. we do buy loans. this year alone, we have bought close to $250 million of loans since the end of last year till now. as a firm, we bought over 250 first mortgage loans, we bought a bunch during the pandemic, as well as during the great financial crisis

1:40 pm

we bought over a dozen loans in the last five months >> so as you look as a lemdnder at all of the opportunities that might come across your desk in commercial real estate, tell me where the strong and weak points are. when you get an application from a loan from a data center, you go check, boom, great, we're going to make money, some other kind of commercial real estate, check, boom, great commercial retail development, i have to look at that one segment it out for me. >> sure. commercial real estate is a huge industry when you look at it, and there's different segments office is going through a lot of stress, we're not as bullish on the office segment but across the different segments like multifamily, hotels, industrial, you know, we're looking at making loans typically to projects that are going through some type of transition so these are experienced

1:41 pm

operators, developers, owners of assets, where we're looking to provide financing so that we can help them, you know, bridge from taking -- if it's a construction loan or acquisition loan, we're going to improve the performance of that asset, and once they stabilize it, they're going to take it out with permanent debt. today, just given how bad the credit markets are and there's not as many lenders as there once were, we're providing a bridge capital to allow when a loan is maturing you have over a trillion dollars of loans maturing between now and the next 12 months and in a lot of cases borrowers can't find another bank to take out that loan maturity so we're stepping in and providing that capital to bridge them for the next couple of years until the markets normalize. >> i heard data center mentioned once this week on cnbc, i've heard it a hundred times

1:42 pm

tell me about what you're see thing that particular area, and what the buzz is around data centers, and your business and how involved you are in financing lending. >> sure. within data centers, we're not that heavily involved. you look at the type of projects we're financing, it's primarily multifamily industrial, you know, self-storage, hotels we don't do a lot in data centers, but it's a big industry and obviously benefitting from the ai boom and everything else that's happening right now >> i have to just observe, i think america must be the only country that has created multiple billionaires based on the fact that we have too much junk >> right >> and we need storage units to store all this stuff i want to ask you, your company began basically in the hotel world, or that was a big part of the core of your business for a long time. tell me how hotels are doing right now. >> yeah. so hotels are performing well for the most part. they recovered extremely well

1:43 pm

from the pandemic, obviously, it was the hardest hit prototype. it's -- in most cases, hotels are back or above prepandemic levels and the hotel industry benefits from the fact that there's just a lack of new supply coming into our industry because of the impact of covid, as well as just the impact of the credit markets where it's hard to get a construction loan today. so demand is way outpacing any new supply, and the fundamentals are really strong across the lodging space today. >> thank you very much good fortune to you. >> appreciate it, tyler. coming up, intel sinking on lower than expected revenue forecast, on pace for its worst since 2002 somebody picked it in the stock draft yesterday. we'll hear from the ceo, next.

1:47 pm

exchange," everybody time now for a little show and tell, where we show you the chart and tell you the story intel lower on a revenue miss, disappointing second quarter guidance management. expects a recovery in the second half thanks in part to the pc refresh. that's not the only thing driving demand the ceo sat down with john forte and addressed how intel is meeting ai demand. >> overall, our view is that the story for the last several quarters has clearly been the gen ai and accelerator story, largely becoming the consumer of budgets and the focus and power, so on. we're seeing a more normal cycle as we look forward and have gotten all of those signals from our partners and channel partners, as well. and so we see some recovery in that business. we saw that in the first quarter already. and for us, our story is also one of an improving product

1:48 pm

line and with our granite rapids, we have a better product that's more power performance, and it's also the opportunity to stabilize and regain shares while as part of our unique opportunity. all right, folks, still to come, today's "three buys and a bail." our trader shares names she thinks can withstand the heat of e ysant.inflation, and one that shsa cno "the exchange" will be right back shi- this is clem. like sushi classy- clem's not a morning person. i'm tasting it- or a night person. or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace. you need clem. clem needs benefits. work with principal so we can help you help clem with a retirement and benefits plan that's right for him. i'm short but i'm... i'm confident. you know? let our expertise round out yours.

1:50 pm

if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an

1:51 pm

energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. welcome back, everybody. the feds preferred inflation gauge rising slightly more than expected last month. but worry not. we've got three names that will be just fine and one that might not be in a special three buys and a bail inflation edition here with those picks is gina sanchez. hi, gina how are you? >> i'm good. how are you? >> why don't we start with eli lilly. deutch watching demand for mounjaro looking down the pipeline for potential alzheimer's and heart failure treatments

1:52 pm

are they going to keep paying for these weight loss drugs? >> what's interesting is the underlying medicine behind both of those drugs just went through a phase two trials to prove efficacy for sleep apnea the reason that's a big deal is because sleep apnea opens up part d insurance coverage. one of the biggest challenges people have had is getting access to insurance coverage for these very expensive weight loss drugs. and this could be a real game changer. >> this could be a game changer. so i assume you like this. this would be in your buy. but there are people who believe that truly these drugs, the gc1 or whatever they're called, could literally break the bank of the united states >> you know, i think there is some truth to that i do think that the pricing is extraordinary. and the glp1 aganists, the

1:53 pm

hormone they're replicating, they have incredible benefits. the question is do those benefits offset in terms of other costs down the road by reducing diabetes, by reducing heart disease and other, you know, problems that come with obesity. >> yes. >> will that pay for itself in the long run there are some skeptics out there for sure but the reality is the demand is there. the demand is absolutely there. >> in other words, does the cost get offset by the savings that might come by the improvements in health that you might see from these drugs and thank you for bailing me on out on the glp-1. >> glp-1 aganists. key bank focused on commercial demand as summer is approaching. do you know what happens in

1:54 pm

summer it gets out and you need air-conditioning. >> it does get hot this one is -- obviously its stock price is a little hot right now, but if you look at its growth expectations, it's massive as you go into the summer and you look at the organic growth that they have been seeing as a company. very strong, stable margins. and, you know, to add to the number of times you see data center today, their customers include data centers they include schools they include hospitals so industrial centers. so this is a really, really, you know, inflexible segment of demand that needs to maintain cooling. >> so can we just say love train, the ojs remember that song, "love train. we're getting on the "love chain". >> edison international. guggenheim warning about payoffs. the wild fire claims you like?

1:55 pm

>> we like edison for a few reasons. not just because it has decent growth expectations and it is defensive. it is a utility defensive going in to summer also, it has a really strong margin sorry, a really strong dividend at 4.4% yield. we own this in our dividend growth strategy. and, you know, it is not just about defending against inflation. but also, if inflation is high, it means yields stay high. it means the fed isn't going to come and bail the market out you have to have stocks that pay good dividends to battle against the higher yields that are out there. this is one of those. >> all right let's go for our bail now, a stock that everybody used to love to love now not so much. it is tesla down more than 30% this year despite a post earnings surge this week calling it a very tumultuous start to the year as cost cuts, ai and new launches all come

1:56 pm

into focus how does inflation hurt tesla here >> so inflation was actually a big component of why tesla is disappointing. they effectively gave up on their mass market car that they were going to be building. and because of that -- and partially because they couldn't make economics work. the inflation was getting in the way of creating an affordable tesla for the markets. and they're effectively seeding that entire market to cheaper evs like chinese evs and that's a big deal. that's a disappointment for the outlook on tesla and a lot of the huge, huge valuations you have behind tesla is that they were going to continue to grow and continue to dominate so it really does put a dent in that expectation so does it really deserve the massive valuation that it has been given, you know, by tesla files the world over

1:57 pm

well, that's being tested right now. >> i guess we heard a lot from mr. -- from elon and others about the robotaxi would you prefer to see them invest more in an affordable cost competitive car than in a robotaxi i can only imagine how angry drivers in new york are going to be when they get behind a robo taxi that gets a little confused. >> yeah. so -- so here's what i'll say. i don't know that anybody has necessarily thought about this but when you think about costs of developing any kind of automated technology, the one that's used the most often is, quite frankly, when we fly autopilot is massively used and very safe, but it is extremely expensive. and i think that that expense has yet to be considered in terms of how much tesla has to expend to make their technology safe. >> all right thanks a lot, gina have a great weekend that does it for "the exchange."

1:58 pm

been a great week. power lunch is next. contessa brewer getting ready. i'll see you and her on the other side of this quick break others can deflate with a single policy change. savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com.

2:00 pm

0 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11