tv Fast Money Halftime Report CNBC April 26, 2024 12:00pm-1:00pm EDT

12:00 pm

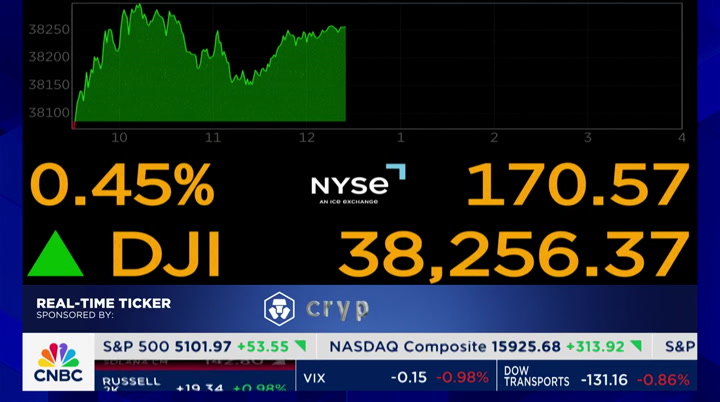

and we will get consumer names like mcdonald's. >> times. >> more on how the consumer is doing and how they're dealing with higher sticker prices. >> so have a good weekend. rest up because next weekend is almost as busy as this one was from an earnings standpoint. let's get to the half. thank you. welcome to the halftime report i'm courtney reagan. this hour, alphabet and microsoft deliver in a big way and doubling down on their tech trades so joining me for the hour, we have josh brown, jim and steve weiss. we have a big show ahead we will give you a quick check on the market here on this friday things are looking fairly green. dow jones industrial is higher by four-tenths of a percent. s&p 500 up by a percent and the nasdaq leading by 2% we will get all into alphabet and microsoft in just a second

12:01 pm

obviously, that's a big story of the day. we have big trade alerts in tech specifically we have josh and jim all hitting the button today, but in different areas. josh, you just bought netflix here down about 2%. why did you buy it what are you seeing here is this trade? is this investment tell us what you are seeing. >> right now it's a trade. i've done this before with netflix. when this stock blew up in, i think, april of 2022, it was, i think, like one of the best buying opportunities for a large cap growth name of the year. and it took a while. it wasn't like a v-shaped recovery i don't know that we'll get a v-shaped year. once again, the stock is blowing up because the quote, unquote long-term shareholders here continue to embarrass the brand. i can't believe that we saw reaction like we did about them reducing the subscriber

12:02 pm

guidance it is such a childish metric to begin with it is people that don't own a business think that that's like an important thing when in reality, the company is telling you focus on revenue, focus on operating margin the subscriber thing will be up and down those are no longer the kpis i think that's what a mature company should be telling the street and that's what they had to say. so i gave it a week. i let it settle out. i wanted to see if the stock would hold its support and that's exactly where it's trading. i can't see the screen give me like a three-year or even a one-year chart. take a look at this gap higher from the january earnings report, which was spectacular, by the way, just as this earnings report was. you see how perfectly the buyers came in right where that gap took place so i think support should hold it is not a long-term investment here i just want to trade the overblown reaction i do have a stop loss.

12:03 pm

i may not be in the stock if it continues to sell off. but i think watching the buyers come in where they did, i think the stock is okay here it's not that they're not going to tell you how many subscribers they have. it is that they will tell you about the big milestones, not the noisy quarter to quarter data and anyone that actually runs a business will tell you the number of clients is not a number like it's a vanity metric, but revenue and operating margin, those are the numbers that really matter. and i think people will get over it, and i think the stock should be okay. >> veryinteresting you own netflix. what do you think of this one? >> i bought it earlier than josh did. he laid it out perfectly very ar arti articulately it's still not a big position. but, look, you know, what i think is a longer-term play is

12:04 pm

because you're seeing the competitors fall by the wayside, right? so they were always the best, always the strongest now that mote around them has increased because nobody can match their spending disney will be a winner in it, but that's it. you have got those two in terms of what josh says about subscribe numbers, i'm glad they don't have -- they don't report them anymore when apple got them reporting their numbers, those metrics, it didn't matter to the stock and it shouldn't matter here as a matter of fact, if you sold the stock at any point, you made a big mistake. focus on the business, as josh says, focus on the longer term, right? there are plenty of kpis one of them being, of course, price. >> sure. >> so subscribers are -- you know, they come and they go. there will be less turn again because there aren't that many competitors to go to to me, it is a good holding with

12:05 pm

best in class. >> advertising advertising, too i'm sorry. i just wanted to add to his point, as advertising rises as a percentage of the revenue mix here, the number of subscribers is not relevant to that. so why wouldn't they tell the street to focus more on overall revenue? if the business was going to be 100% subscribers and the only way it was going to grow was how many people are subscribing each quarter, that would be a different story. that was the state of the company three years ago, and now it's not so, of course, the more important metric is going to be overall growth and revenue and how profitable it is. >> right, of course. encompassing more of how they're generating the dollars you didn't buy more netflix. but you did buy meta oh, you did. on the quarter you're not discouraged by the investment in ai you like it? >> no. look, again, to josh's point, if

12:06 pm

you run a business or as my former caddy karl said, scared money don't make money you have to invest to generate return you have google, microsoft, meta have the wherewithal to invest large sums of money to be leaders in this space and extend their lead they're already leaders. so why wouldn't you? so to me, it's asinine to sell the stock because they're investing in their business. and the largest shareholder in the business is making the investment, that being zuck zuckerberg to me, i bought it at 416. i thought it was way, way overdone selling it. they had a great quarter the guidance is pretty good going forward. because they're increasing cap backs for the right reasons, they will be exponential in terms of gains going forward why wouldn't you do it >> it's a lot of your trading colleagues felt it was overdone because the quarter was strong

12:07 pm

you have to invest in ai for the future that's a huge opportunity. >> now here's what i will tell you. it is a super sized position what i mean by that, it is irresponsibly large at this point. >> okay. >> so my core position stays, and this will be, you know, at some point i've already got a gain on it but i think my gain could be dramatic for me here. >> jim, you press the buy button on nvidia. nice price action today, up 5%. >> yeah. we have a meaningful pullback. it's found its footing it's going higher. i continue to think the valuation on this name is actually quite inexpensive i know at mid-30s some people may look agast at that remember the earnings growth for the next few quarters is likely to be well above 30% folks, it don't last forever comfortable adding it here courtney, for the record, i'm not adding big positions here because i do think this market overall is choppy. we're still adjusting to higher interest rates

12:08 pm

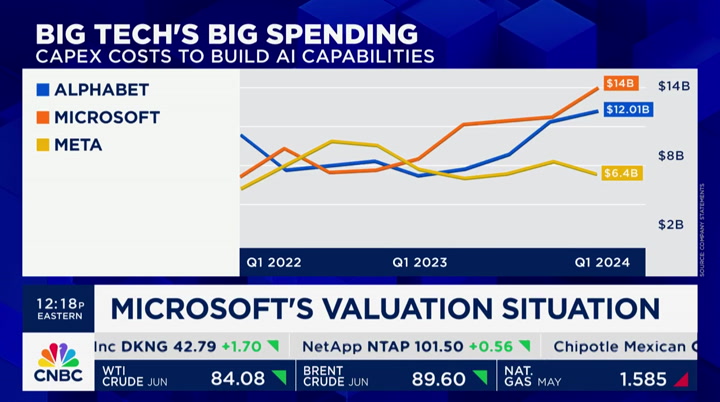

from year to year end, we will look at this price level on nvidia and feel it is a good entry point. >> you're with us and you own nvidia we're sitting at, what, 66 right now? >> yeah. we'll talk about it in a second, but just to kick it off. when i listen to google, microsoft, meta, google 90% cap x year over year microsoft 50%. tesla is going to buy 50,000 h-100s meta the same. what that tells me is they're still buying nvidia. i think jim is spot on and great to add to that position because it's over its 50 day it's bouncing at it. when their numbers come out, listening to these trillion dollar companies talk about the cap x spend, they're still going to nvidia. so i think nvidia will have another blow-out quarter and we got the stock back over a

12:09 pm

thousand if the stock participates in it as well. >> alphabet hitting a new all-time high after announcing its first ever dividend as well. we've got some ownership here around the desk. i guess, josh, let's start with you. what did you like about the quarter? there was so much really to pick from here. >> so there is two things here, courtney i want to talk about the optics, and i want to talk about the actual fundamentals. the optics around alphabet have been horrendous in recent months i'm a long-term shareholder and i had thought earlier this year that alphabet had the potential to be the best performing of the megacaps i thought this and amazon. i still do but this company has had repeated embarrassments with their generative ai outputs. and it became like a meme on social media we don't have to rehash all the things that happen everyone knows now they have these employee

12:10 pm

protests disrupting key executive offices. they have sit-outs, walk-outs. they have tents. it almost looks like a college campus in terms of both like the way people perceive what's happening inside of the company. so by the way, i think heshe's n of the best. what she had to establish on this call was the fact that this is actually not a kindergarten for random science experiments and it is not a social justice exercise it is a business focused on profitability and making money for shareholders and that's exactly the way the street took what she laid out. and this is really important ruth is moving up to this newly created position of president and chief investment officer, which alphabet has not had in the 20 years it's been public. they announced that last summer. they're still trying to find a cfo who is going to replace her. but she will be over seeing the

12:11 pm

other bets, which has been a cash drain, let's face it, historically but i think when they announced that they put a bottom into the share price, now with them announcing the first ever dividend and taking the buyback up by another $70 billion, that's the clincher. and the timing really helped because doing this on the heels of meta, giving the impression that the spending was getting out of control again made alphabet look even better than it otherwise would have. and i don't think it was timed that way, but i do think it helps. that's the optics. on the numbers, it is undeniable it is a gigantic company, still finding 15% year over year revenue growth, which is the fastest growth rate since 2022 a massive earnings blow-out. and we know that the overall advertising spending environment has improved you know how you know it improved because even snapchat, which is run backwardsly, managed to have

12:12 pm

an upside corner so you have a tailwind from ai you have a tailwind from mad spend. and you have a sense that the company is here to make money for shareholders again that combination was delicious that's why the stock is trading the way she is. >> jim, you were talking about this as we were previewing it. you didn't jinx it after all this is a big holding for you. >> yeah, it is my biggest tech holding. i'm very happy with it i think it would not be up as much if not for the dividend announcement which should have taken a page from meta's play book that draws in a whole new class of investors that look for dividends. i go back to about two months ago when they had that image generator issue with the pope and all that sort of stuff at the time, the stock sold off. others said it as well look, go back to february of 2023 when they first rolled out bard and it had a mishap with something about celestial

12:13 pm

orbits i don't remember what it was but it answered a question wrong. and the stock got sold off hard. that was an incredible buying opportunity. at the time in february that we had this generator, this image generator issue, i said the same thing. others did as well this is a buying opportunity, and it proved to be that even quicker this time. the end of the story here is there is a lot of irons in the fire for google. obviously, a lot of them revolve around ai, but basically the basic serve business google web services. yes, all these things are enhanced by ai, but they all have intrinsic business growth. >> i was impressed by the youtube revenue. jim mentioned it up 21% that was better than expectations google cloud look at what they did in all their segments. >> what's remarkable and unprecedented in terms of history, apple didn't even

12:14 pm

accomplish it, to have this kind of growth on this size revenue base microsoft did. meta did think about how outstanding that is and how difficult it is to grow at that rate when you have got such a large revenue base to begin with look, this is a slightly bigger position than meta for me. i almost doubled down. i had a big position a when it was in the 130s, when people were saying they're done jim and i had such a disaster. there is one google. this is it to think google wouldn't fix that and learn from that mistake going forward, that was a fixable issue. it was not a shot to the heart they don't really know what they own. they puked it creating opportunity. frankly, that's the advantage for me of not being benchmarked. i don't think tech has to be this, i'll take a slightly out sized bet and be slightly 1%

12:15 pm

above or i can't have a position larger than 3% i'm just there to make money or in some cases lose money. but frankly, this is one that will keep going and going. >> today, you guys are making money. the stock sitting at 172 a lot of price target upgrades, too. we've got to move on to microsoft because this is also an impressive report this is one of your holdings what did you make of the quarter? >> so i think they are like the best combo from a ceo/cfo out there. i thought what he said was so important. he's like, as it relates to ai, he said we are continuing to ai dmom ratize expertise across the workforce. i sit in our business every day. things that took a long time are just so much more efficient. and, so, i wanted to hear about co-pilot, and i was hoping they did not talk about it in the beginning. he did not disappoint. it was in the second sentence of

12:16 pm

his remark he's talking about how it is driving better business outcomes for every role in every industry this is one of the unique plays of the megacaps that you have this huge company that is already starting to monetize all down the vertical of what amazon does -- of what microsoft does i think the cloud growth, they hit $35 billion, up 23%. so they're operating on all cyli cylinders. i think it's just getting started. i think 3, 4, 5 years from now, this will be a whole new revenue for microsoft. >> jim, you own this name, too but you have a smaller position. anything you hear make you want to get bigger there? >> well, i liked everything i heard. i'm not going to rush into the name right now at this valuation, i think it's fairly valued. look at that valuation difference between google, roughly 20 times earnings, and

12:17 pm

it's just not the name i want to put more money to work in. google i already mentioned is my largest position, so i will not add there. folks i said a moment ago that nvidia in the mid-30s, i'm comfortable with that. i'm not taking anything away from microsoft i'm not saying it's going down from here. i'm just saying it is the not the name i want to add incremental volume to. >> it is all about the cloud for you for microsoft? >> yeah, it is about the cloud it's about them being the market leader they will be -- look, everybody that's astute and has the balance sheet will make money in this, right? think about what they have there. a huge installed base, a huge return revenue that deserves a premium. i understand where jim is coming from i don't disagree that it's full value here as a holder, i'm not selling any because they will grow into the valuation and then some. the recurring revenue, that's a

12:18 pm

whole other growth area for them in terms of step growth they generated over the years yeah, i love it. it's phenomenal. you point out their spending isn't all thatmuch different than meta's. google's spending is not all that much different in ai than meta. >> exactly because there is ptsd there. because in prior cycles, they have spent way too much. you know, irrational spending. now this is riggsal spending. >> okay. you mean like on the metaverse, things like that >> exactly. >> josh, you are not in microsoft. why not? >> i have plenty of exposure to microsoft. it is thelargest company in th world. it's huge in the s&p 500 so it is not not in microsoft. it is not overweight relative to an overall market weight portfolio. >> all right fair enough. >> great company great stock.

12:19 pm

nothing negative to say about it. >> it was a big week this week but also really big next week. we have amazon reporting next tuesday. josh, you do own amazon. what are your expectations there? >> look, this is the one for me. i got -- i think this one will break out and build a brand-new shareholder fan base it's a situation where basically you had a leadership change pretty much at the worst possible time. bezos hands the company off to jassi who effectively built the cloud business and is probably one of the best operators anywhere but the timing was just awful. so it was a really rough two-year period. i think they now have figured out what the street wants. they figured out what they want to do business-wise. they have taken their lumps in streaming and a lot of different areas. but this is when i think you really want to be here amazon's last four operating

12:20 pm

income growth rates year over year so this starts with q1 2023. plus 28%, plus 132%, plus 343%, plus 267%. please think about the size and the enormity of those numbers for operating income growth. you will not find that amongst any of the other companies we just spent the last 19 minutes talking about. they're expecting earnings growth next year that's higher than any other magnificent seven stock. even nvidia only expected to have 21% next year so this is a premium business. not selling it at a high multiple relative for its own industry expectations are fairly low. the stock has rebounded but has not been making new highs like microsoft and nvidia have relative to the 21 days. and i think that this is the one. if they could continue on the stretch they have been on, the

12:21 pm

stock will get higher and i remain long, and i want to see this thing through. >> theirs are on 3%. maybe some anticipation for what we'll hear before we run out of time here, i want to go to apple because that also reports next week on thursday josh mentioned low expectations for amazon potentially from some i imagine you might feel the same from apple. really hasn't done much from the other magnificent seven. what are you looking for from the quarter that it will report thursday >> yeah. i think where microsoft, google and i agree, i think amazon also will have a microsoft, google type stock reaction next week. apple will not i don't think much is -- i don't think the stock is going to move that much out of the earnings. i really think that we, as investors, need to get a real sense of when is that refresh cycle going to really ramp up where we just feel so compelled that we need to go trade in our iphone 13 or 14 or 15 because

12:22 pm

they're all very high end to begin with and i just don't think that will be this quarter. i think as an investor, i still call there is really not much option premium on apple, so i don't sell calls against it. sit. it is a little stuck in the mud. i think the s&p will outperform it this year they will get their act together and delight the consumer i mean, apple's consumer rating i think is 100%, so they will get there. i just don't think it will be this quarter. >> it will definitely be one to watch along with a number of others next week. coming up next, an energy drop and a pharma flop committee stocks making big moves in today's sessions. the trades on exxon mobile and much more. "halftime" will be right back. stick with us. ♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings.

12:23 pm

voya helps you choose the right amounts without over or under investing. so you can feel confident in your financial choices voya, well planned, well invested, well protected. new projects means new project managers. you need to hire. i need indeed. indeed you do. when you sponsor a job, you immediately get your shortlist of quality candidates, whose resumes on indeed match your job criteria. visit indeed.com/hire and get started today.

12:24 pm

norman, bad news... whose resumes on indeed mati never graduatedria. from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. doc?

12:25 pm

12:26 pm

that natural gas prices were incredibly low of course, they can always go lower, but they're pretty close to zero. i do think as the global economy continues to pick up, side note, there are signs of that. like there are real green chutes in europe that you will see natural gas prices increase as well i don't want to go too tangential here. exxon is 5% off its all-time high it could give a little back here it's all right the multiple here, 3% dividend yield. buying back shares like crazy, yeah, that's likely to go higher and crude oil prices are going really well. i don't see much going on here. >> okay. you're hanging on to this one. pfizer reports on wednesday. the stock hitting new 52-week lows in today's session. josh, you are in this name >> i am. this is -- this is a beaten up value stock trading at 11-year

12:27 pm

lows lost market capital already. very unpopular, very uncool. nobody is talking about the company. nobody wants to admit they own it i totally get that this is out of character for me, but i think there is too much value here to ignore and i think the c-gen acquisition that they made last year will start paying off by the end of this year and they will see attitudes change pretty quickly. so that's the bet i've made. we'll see what happens. >> higher but just marginally so abbvie falling. >> i will step back for a moment i really want pfizer to work i want josh to be encouraged as a value investor, and i fear this experience is not doing it for him. josh, i'm rooting for you, baby. >> thank you, jimmy. >> i really mean it. on abbvie, this was not a bad quarter. this has recently been a source of funds and it's had a good three-year run here.

12:28 pm

first off, being on top and bottom lines, it raised guidance we talked about humera hanging in there nicely and some of its new drugs doing well good dividend yield. don't worry about the price drop this was a good earnings report. >> and minor anglo american rejecting the takeover bid that's good news after the bell. what is your reaction to this one? >> yeah. so bhp really they do copper and iron the stock has been terrible this year the stock is down about 18%. this acquisition, i believe, is about them wanting to by anglo's copper and they summarily rejected it because copper is hitting fresh two-year highs if you want to look at a pure play look at sdf it is up 8%. as copper continues to be the key metal in the energy transition, we are going to continue to have these supply

12:29 pm

imbalances where we have too much demand and not enough supply i think it relates to bhp. it is in the penalty box because of the iron. if they want to go take a second bat at anglo, they will have to do it much higher. they want a more pure copper play, and i don't know how quickly china will recover that's what you need iron to go higher. >> a lot of angles to that story. let's get the headlines with sima. >> here's a news updatement donald trump's hush money trial continues with the defense team cross-examining david pecker earlier today, pecker testified that the nat"national enquirer"a not going to pay for stormy daniels story. and that former trump attorney michael cohen said the main concern was the harm that could have been done to the editor-in-chief's reputation. president biden joining howard stern this morning for a live interview while they focus mainly on the

12:30 pm

president's life story, he did make some news for the first time saying he would be happy to debate donald trump. the trump campaign responded on social media saying, quote, okay let's set it up. andrew tate ordered to stand trial on charges of human trafficking, rape and forming a criminal gang to sexually exploit women. his brother also charged tate's legal team says it will appeal the ruling. that's the news update "halftime report" will be back after this

12:31 pm

clem's not a morning person. or a... people person. but he is an “i can solve this in 4 different ways” person. you need clem. clem needs benefits. work with principal so we can help you with a plan that's right for him. you know what i'm saying? let our expertise round out yours. happy mother's day! some things never change. like a mother's love. get something as timeless as a mother's love at harryanddavid.com. life is a gift. share more.

12:33 pm

we're back on "halftime. finances among the top performers this year that got us thinking where are the biggest opportunities in the space right now. let's get to it. >> in 2024 so far, in fact, entering today's trade, it was the third best performing sector in the s&p 500 financials after just energy and communication services so we'll see if that trend plays out. over the last year, you can see the sector is up 28% and the banks, those stocks are a big part of that story if you take a look at the relative valuation of these banks, called price to tangible

12:34 pm

book value how much do you pay in stock price for every bit of tangible or holdable book value, if you will, in many of these stocks. check out some of the bigger, more heavily valued ones you can check out bny melon. jp morgan chase considered by many to be the gold standard 2.2 times tangible book and fifth third bank on the regional side 2.1 times contrast that to the lower valuations on a price to tangible book basis here look at citigroup shares, which maided a discount to their book value. 70 cents on the dollar there citizens financial and goldman tasachs at 1.4 as well one of the measures traders and investors look for right now it seems there is an

12:35 pm

interesting development here with a tale of two banks happening. courtney, back over to you. >> thank you so much, don. everybody on the committee had some financials ownership. let's start with you what do you like here? why do you like it >> goldman number one, first and foremost, look, look at what the stock has done stocks hit a new high. it is trading great. but the palace intrigue about david solomon faded into the distant because he's done a great job. you can't disassociate stock performance with the ceo and this is all without the equity markets being really open for ipos this is without mna resuming the record uphill, you know, in penetration because of more and more deals as companies are flush with cash in your balance sheets so when rates come down, that's when you start to see it really explode. if this is the appetizer in terms of performance stock, i'm

12:36 pm

ready for the main course. i can tell you as somebody who does business with goldman, they stand alone on the street and competitors that i talk to, competitors of goldman also say it i get covered better by goldman than any other firm. and we will have equal balances at other firms it is amazing. >> jim, you have a number of financial holdings. >> and i would define them all as big so you are talking citi group, jp morgan, black rock. i agree about the strength of goldman sachs. but the overarching comment i'm making here is in the financials, i want to be in the big banks. i don't want to be in the regionals. we all know the problems they're facing i don't find the risk/reward potential there appetizing to me where i look at the big banks and see the multiples that don was just talking about and also including low earnings nul multiples. you did mention that ipos have been slow. they're starting to pick up.

12:37 pm

in the meantime, the fixed income issuance market has been strong all year. there is just loan growth. that interest income we know has been held back by what's going on with the fed. that will eventually be pureed, eventually there is a lot to like in the larger segment of the financials. >> yeah. i guess i'd say the high margin of businesses like ipos and like mergers and acquisitions, we have only seen a hint of it. they haven't kicked in the pipelines are full that's the high margin that will really drive earnings revenues. >> josh, you own jp morgan it is one of the stocks you love you hold it fondly >> yeah. i have been in this stock forever. there is nothing new to say here i actually want to pitch a much smaller financial. >> oh, okay. >> it is a software company that's hiding amongst the financials the company is called toast.

12:38 pm

tost is the ticker it is not in the s&p financials because the market cap is only $12 billion. they will report i think the second week of may it will be a profitable quarter. they just started reporting profitable quarters in the middle of last year. and i really think that from a -- like when you are thinking about financials and you ask yourself like where is the real opportunity, it is going to businesses that have not digitized and have not gotten sophisticated about payments and payroll and all of these really mundane things but that become really important, and that's what toast has done. they now have 100,000 restaurants on the platform and pretty much every month they're announcing a new major enterprise deal. sometimes with a hotel chain that has tons of restaurants, et cetera so this is my financial idea that i'm the most excited about. it will definitely be volatile, but from my perspective, you

12:39 pm

talk about a tam it is $126 billion in gross value on their platform last year that number should go higher as they keep signing restaurants. so i like tost. >> it looks like they're listening to you up about 2% on shares of toast. coming up next, this week's stand-out stocks four big moves from four committee names. mieado tseras tde cong up next

12:40 pm

12:41 pm

icy hot. hi, i'm jason and i've lost 202 pounds on golo. so the first time i ever seen a golo advertisement, so you can rise from pain. i said, "yeah, whatever. there's no way this works like this." and threw it to the side. a couple weeks later, i seen it again after getting not so pleasant news from my physician. i was 424 pounds, and my doctor was recommending weight loss surgery. to avoid the surgery, i had to make a change. so i decided to go with golo and it's changed my life. when i first started golo and taking release,

12:42 pm

my cravings, they went away. and i was so surprised. you feel that your body is working and functioning the way it should be and you feel energized. golo has improved my life in so many ways. i'm able to stand and actually make dinner. i'm able to clean my house. i'm able to do just simple tasks that a lot of people call simple, but when you're extremely heavy they're not so simple. golo is real and when you take release and follow the plan, it works. welcome back we're checking the investment committee's portfolios and highlighting big winners this week up double digits this week,

12:43 pm

vertiv what do you make of what's going on with the action >> vertiv. and i have worked my fingers to the bone trying to get josh to buy. >> okay. >> unrequited love look, i bought this in november. it more than doubled the reason i bought it is because i was looking for data centers and ai in terms of the tool belt rather than doing to the sum. it is the others that are directly it. this is it it's got scarcity value in terms of what they do as a company, standing alone which is the cooling racks and other, you know, tools or equipment that's required for data centers so, you know, particularly data sceept centers using gpus which are the advanced ai chips is -- they run high and data centers now three stories tall for ai versus being one story tall so you need a lot more of them and they're the ones that make them

12:44 pm

that's why i bought it i don't think it's cheap i'm saying that for a while. but i also think i will sell it because it will keep going in the scarcity value it gives you a premium valuation. >> that's an impressive move. >> good earnings. >> on paper, that's the best week in three years reporting earnings on monday can it keep up the momentum? >> i think it can. this is one of those semiconductor companies we don't talk about much. this is a semiconductor company highly focused on the automotive industry it is relatively attractively priced we know automobile production is actually cranking right now. the problem is it is for a lot of internal combustion vehicles, as opposed to electric vehicles. how that balances out, i think we will find that the shares are too cheap even more that ev pullback that we've seen again, very attractively priced. it's been a winner in the four years i've owned it. of course not as well as some of

12:45 pm

the ai chip companies. but i do think there is more room to run here. >> okay. on pace to break a four-week losing streak. >> yeah. i mean, palantir was an ai company before ai was cool this is without a doubt-- ther is no other software company that has the scale of the military contracts i think it is a misunderstood company because that's what most people think it still does they continue to get big awards from u.s. and u.s. friendly countries. but really what i'm excited and why i bought the stock is what they do on the commercial side within their ai platform, they have been doing ai boot camps. last quarter that was up 70% year on year their commercial revenue was up 30%. the earnings three cents last quarter. i think this is early day for them they're hiring a sales team to go after the commercial traffic. they're so trusted earnings come out in 9 or 10 days i think this is one to watch that has more update.

12:46 pm

>> shares up 3% here today josh, you have a big one matterport, congratulations on this move. >> yeah. courtney, this is the worst investment i have made in the last ten years i'm down let's say i hold it until the deal closes. >> okay. >> i get $5.50 mixed between cash and stock in costar my average cost is $10.63. i'm looking at my lots now i'm down in all of them except for one. my highest print was $19.94. so this is a 50% loss for me even if i hold it until the deal closes the good news is i think they did the right thing for the company. congratulations to rj on finding a solution because this was not going to make it as a stand-alone stock. i bought it in 2021. the world has changed.

12:47 pm

i shouldn't have held it i did. but it is probably the best resolution they could have found. don't congratulate me. i want to wear a bag over my head just talking about it. >> all right well, good for them. but, yeah, i see what you are saying because the stock is sitting at $4.74 right now that's all right you win some, you lose some. >> straight ahead, more than a third of the s&p said to report, e mmtethcoite breaks down the key names to watch coming up next one prawn. very good. did i say chicken wrong? tired of people not listening to what you want? it's truffle season! ah that's okay... never enough truffles. how much are they? it's a lot. oh okay - i'm good, that - it's like a priceless piece of art. enjoy. or when they sell you what they want? yeah. the more we understand you, the better we can help you. that's what u.s. bank is for. huge relief. yeah... ♪

12:48 pm

[alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

12:49 pm

12:50 pm

12:51 pm

name in the energy space things have been going well in the operations of this company they recently announced a new contract for one of their rigs at a $500,000 per day day rate, which is very high what we're looking for is some indication that their 11 cold stacked idle rig also be put back on the market i've been waiting for this kind of linus from the peanuts cartoon waits for the great pumpkin. if you get that reference, you're my kind of person, or 6 years old, or 60 years old what we are hoping for on this conference call is that we get some indication that might be coming soon. >> fair enough and we've got diamondback energy, this is tuesday after the bell bryn, this is one of yours >> yes, and i definitely get the linus charlie brown reference. so the street -- the estimates are for revenues and earnings, up 9% and 8% this stock, you would think it was a tech stock it's up 32% year-to-date

12:52 pm

best in class management that has excellent execution. they have capital discipline they're raising their different dents in direction, free cash flow, strong balance sheet so this is just like the poster child of a company that continues to execute i don't think there will be surprises in the earnings, but it is up 32% all year-to-date. so maybe it takes a breather >> that is a good turn you take the name off, and it looks like a tech trade. "final trades," it's already 'lbeig bk.inupomg wel rhtac the future is not just going to happen. you have to make it. and if you want a successful business, all it takes is an idea, and now becomes the future where you grew a dream into a reality.

12:55 pm

trading at schwab is now powered by ameritrade, giving traders even more ways to sharpen their skills with tailored education. get an expanding library filled with new online videos, webcasts, articles, courses, and more - all crafted just for traders. and with guided learning paths stacked with content curated to fit your unique goals, you can spend less time searching and more time learning. trade brilliantly with schwab.

12:56 pm

hey you, with the small business... ...whoa... you've got all kinds of bright ideas, that your customers need to know about. constant contact makes it easy. with everything from managing your social posts, and events, to email and sms marketing. constant contact delivers all the tools you need to help your business grow. get started today at constantcontact.com constant contact. helping the small stand tall. tamra, izzy, and emma... no one puts more love into logistics than these three. you need them. they need a retirement plan. work with principal so we can help you with a plan that's right for your team. let our expertise round out yours. at pgim, finding opportunity in fixed income today, helps secure tomorrow. our time-tested fixed income suite, backed by over 145 years of risk experience,

12:57 pm

12:58 pm

welcome back weiss, you sold out of your bitcoin position, why? >> whi bought it because of expectations of etfs and a better marking power of black rock and fidelity. and then the halving, that i didn't count on. so if i want to own it going further, i've got to believe there's a lot more interested,

12:59 pm

so i don't i bought it under $30,000, and it's been a great trade. >> congratulations on that before we get to the "final trades," a shoutout to josh brown, whose firm was just named the number eight best advisory firm in america by "usa today. congratulations. reynolds announcing it's opening a new office in manhattan beach, california so congrats to josh brown and the team let's get to the "final trades." josh, kick us off. >> i'll just reiterate, the netflix selling was overdone i'm now in the name. >> bryn? >> yeah, the nasdaq has been stuck in a range bound i like geq you get capital appreciation >> weiss >> the department of defense is 10 to 15 years behind in technology in that all their initiatives now, whether it's

1:00 pm

javc-2 or zero trust, the one that benefits from that, leidos. new management came in, they're in a sweet spot of everything defense. all they need now is to get into an erm program >> that does it for "halftime. "the exchange" starts right now. happy friday, everybody. courtney, thank you very much welcome, everybody, to "the exchange" for a friday i'm tyler mathisen, and i'm in for kelly evans. another day, another hotter than expected inflation read. the fed's key pce data showing that inflation ticked a little bit higher in march from the previous year but held steady from february. stocks managing to shake, shake, shake that off with all three major averages higher at this hour yields, though, under a bit of pressure as market expectations for maybe two interest cuts this year rose a bit.

8 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11