tv Mad Money CNBC April 25, 2024 6:00pm-7:00pm EDT

6:00 pm

he wanted to say gold fields for the win. >> good job, evan. >> kristen >> xle i think both in term office hedging geopolitics and inflation, as well as the free cash flow generation of these companies. >> steve >> meta. >> guy >> my man e.t. told me exxonmobil >> thanks for exxonmobil >> thanks for watching "fast." "mad money" starts right now my mission is simple to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere and i promise to help you find it. "mad money" starts now hey, i'm cramer. welcome to "mad money. welcome to cramerica other people want to make friends, i'm just trying to make you some money my job is not just to entertain but to educate and teach you to call me at 1-800-743-cnbc or tweet me @jimcramer. it takes a special kind of stock to do well when the economy's slowing. while inflation just won't quit.

6:01 pm

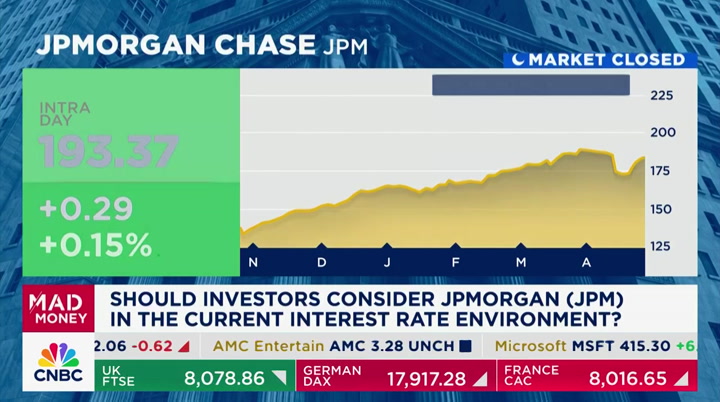

we got this weak gross domestic product number, just 1.6% growth anemic and a surging inflation number connected to the gdp up 3.7%. bad combo. which is why the dow tumbled 375 points s&p lost .46%. nasdaq dropped .64%. i've got to tell you it was much uglier at one point today. the dow was down almost double where it went out. as we heard all day about the slower growth and higher inflation and that meant the dreaded term stagflation and that environment is toxic for stocks >> the house of pain >> on top of that one of the market's greatest leaders meta platforms got crushed today. i mean, just annihilated not because of its earnings which were stellar but because it committed a huge amount of spending most of it directed toward generative artificial intelligence what's bad for the meta goose, though, is good for the nvidia and broadcom gander, which is up 29 points and 37 points

6:02 pm

respectively as they're going to get a huge chunk of capital expenditure budget i still believe in meta, more on that later in the end this decline was all about a slowing economy mixed with persistent inflation which drove up bond yields and brought sellers out throughout the day who can win in this environment? are we done? we just fold up shop no we just have to work harder. let's look at today's sparse winners. first, two of them right in our faces. let's talk about microsoft and alphabet, both of which are flying in after-hours trading. microsoft beat the estimates for every major line item with 17% revenue growth, which is incredible 20% earnings growth. that's looking growth. their azure cloud business growing nicely again much better than expected. ♪ hallelujah ♪ their integration of artificial intelligence seems to be helping them sell enterprise software, which is microsoft's bread and butter these ai workloads are incredibly strong for them and they are seeing stability even in the pc market yes, it's stabilizing. nice quarter as for alphabet, wow, they

6:03 pm

finally did it it was a magnificent set of numbers. no wonder the stock was so strong searching youtube core business were much better than expected they finally broke out some numbers for youtube and they were spectacular ai business incredible google cloud was great growing at 28.4% clip. up with the other big boys authorized, get this, $70 billion buyback on the strength of share count directly boosting the earnings per share and hallelujah ♪ hallelujah ♪ a dividend so it's only 20 cents. doesn't matter it's a great sign and the market loves it unlike meta while they did say they'd be investing heavily in their ai business they also said they'd be expanding margins as they do so, which is why alphabet still gets credit for its great results. i haven't seen a quarter like this, i can't even recall one, where they delivered on everything we wanted it's like they listen to the show next there's merck all right. the secret here is keytruda. it's the most revolutionary anti-cancer drug in history. key keytruda's sales came in at 6.9 billion. one quarter.

6:04 pm

that's up 24% which is astonishing as merck just keeps finding different types of cancers that can be treated by this thing of course drug patents don't last forever, which is why merck's been buying up new medicines to combat both cardio and immunelogical disorders. this stock which gave you a 3% gain today, might be perfect for the given moment given how it raised revenues and margins. i've got to go out on a limb here a little bit and rob davis is so great, the ceo but i think they could make a lot of cancers chronic diseases that would otherwise be fatal. fourth you've got to take a look the aunion pacific here's a railroad -- this had been this and now it's this. >> all aboard. >> mainly because it's so much better run now that ceo jim venn is run the show. he started as a brake man 40 years ago. the board picked him, protege of the late hunter harrison who practiced what's known as precision scheduled railroading, psr. this is a method of railroading that makes moremoney by gettin the trains to run with maximum

6:05 pm

efficiency yes, trains on time. even in a slower economy they still can deliver an excellent self-help story. hence the 11-point rally it was spectacular that is the real deal. fifth we've been bemoaning the performance of the gold miners versus the underlying commodity but newmont reminded us not all gold companies are created equal. last year newmont bought newcraft and i thought it would be another sad sack gold deal almost all of them were bad. no, it was able to produce much more gold than expected, lower costs, and that's how you outrun the economic sbrak drop, faster revenue growth and lower expenses gives you a 12% rally so much was good here from the return ofhigh yielding chinese customers, they're back, to the fact that the repeat rate here is 30% higher than it was in 2019 there are some powerful sector themes that can trump the noxious backdrop, and travel fits the bill.

6:06 pm

remember the travel statistics previous friday, well, it's looking at royal caribbean's got the same great thing going speaking of the resurgence of the chinese consumer we heard from boston scientific, great medical device company, that the china market's now roaring with strong double-digit growth for seven of their eight business units. who would think that china's coming back for some companies this company, by the way-s prolific it launched 90 new products to give you an astonishing 13% growth rate. what i like best about boston scientific it's just crushing the rest of its cohort with ease and they're doing it through pure innovation, something that can't be contained by slowing gdp growth here's one i don't talk about enough dover. i knew dover as a sleepy industrial company, which means frankly i didn't know it at all. the new dover's reinvented itself moving aggressively into get this, some companies are so darn smart they moved into clean energy, engineers products for the data center, aerospace and biopharma. all four verticals are in insane bull market load analysts are just now catching up to the reality that dover's a

6:07 pm

very strong company. the sales are coming in at the high end and by the way, they're not promotional and they're humble that's a nice combo. how about carrier? speaking of humble we've had the ceo on a bunch of times. his company's located in palm beach. not bad, huh you might think this heating ventilation air-conditioning business would be hostage to the broader economy. you would be wrong commercial hvac was never so interesting. astounding mid teens thanks in large part to the need to cool down those, yes, data centers. i mean, they'reputting them up and these guys are cooling them off. 280 basis points of margin improvement. closed on a key acquisition of v spin european which makes the heat pump business europe desperately needs more heat pumps to adjust to a warmer climate. they're much better for the sky. carrier sold three non-core business lines fourth on the way out. puts them in a great place to be able to acquire something. or even better how about a monster buyback? ♪ hallelujah ♪

6:08 pm

caterpillar missed on revenue. you think it must be hurting heavy machinery, though you'd be wrong there too. united rental star of the show equipment rental company fleet productivity and the sale of used equipment both were terrific so many people have asked me if there is an investment in the baltimore rebuild. the answer is united rentals they're doing almost everything about it i'm saving best for last chipotle every line of chipotle from expenses to revenue, same-store sales to earnings, was better than expected. the reason demand they have what people want now, how do you know that? how about because you know that chipotle has this limited time only, ltl. so hard to say limited time only. offering of chicken al pastor. the company's urging its associates to not order chicken dishes for themselves because there isn't enough left for the customers. that's incredible. now, the most impressive statistic, california put through a steep minimum wage boost to 20 bucks. chipotle had to put through a 6%, 7% price increase to pass on the cost

6:09 pm

do you know the sales weren't even dented? i mean, holy cow that's extraordinary when we're looking for reasons to buy a stock in this environment we want companies to generate constant self-help. chipotle does it by improving through-put. how many people they can serve every 15 minutes is how they measure it, especially at lunchtime. it gets better and better. now i know how they're going to get to $4 million average unit volume because they are surging. that kind of self-help is the antidote to the big picture worries i heard about all day today which made me feel like oh maybe it's not worth picking stocks that would be wrong too. i expect the bond market will be our enemy for a little bit it's probably going to get worse. i'm not even ruling out stagflation. i'm not even saying the magnificent seven will never ride again i am saying this always, like at the end of the show you know what i say, there's always a bull market somewhere. and even when this market's down it gives you some pretty darn good stocks to buy >> the house of pleasure >> jonathan in california.

6:10 pm

jonathan >> caller: boo-yah, jim. >> boo-yah, jonathan what's up? >> caller: first time, long time >> all right i like that >> caller: my best friend and i are huge fans. and you've even inspired me to start a "mad money" group chat >> put me in it. my executive producer is trying to get into the group chat she's struggling what's up? >> caller: my question is what impact could future fed interest rate adjustments have on the broader banking sector and should we buy, sell or hold jpmorgan >> jpmorgan's terrific the stock is down very big jamie dimon of course came on and he had some negative things to say i've got to get that guy to cheer up he's got like a -- what's with him? but charlie scharf doesn't need cheering up. that's why i suggest you buy wells fargo, which is the exact right bank for this environment. the one that you -- and get me on that chat i'm very good. i mean, i have 2.1 million people who hate me on twitter, but it's all right kevin in my home state of new jersey

6:11 pm

kevin. >> caller: hi, mr. cramer. how are you? >> i'm good, kevin what are you up to what are you, on the garden state parkway? where are you? >> caller: yeah, i am. yeah i just got to pull over. is this still a good buy on arm semiconductor? >> i'm so glad you asked me that because renee hawes has told me periodically jim, you forget how good we are, you forget what we're doing. i'm going to throw arm in. i was waiting for it to get to 80 to rerecommend it it's at 97 so kevin, here's what to do. i would buy a quarter of a position here and every five down until it's finished that's how i would buy it i think arm's great. renee hawes is great the data center is great and they're in that big-time companies generating self-help are the antidote to what's ailing this economy and i think you need to stay on the lookout for those names while the bond market remains the enemy how about that chipotle? don't order the chicken because you've got to say something for

6:12 pm

customers. the bar baa co..a, that's supposed to be very good "mad money" tonight. glimmer of green in todaytion ugly tape, what stood oud in the company's quarterly report then from trash to treasure could wm be a winner for your portfolio? don't miss my post-earnings exclusive. and there's no tractor without a tractor. let's speak to agco. stay with cramer >> announcer: don't miss a second of "mad money." follow @jim cramer on x. have a question? tweet cramer hashtag mad mentions send jim an e-mail to madmoney@cnbc.com. or give us a call at 1-800-743-cnbc miss setngomhi head to madmoney.cnbc.com.

6:13 pm

to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow!

6:14 pm

6:15 pm

i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

6:16 pm

even on a tough day some stocks just can't be stopped take tractor supply the retailer focused on recreational farmers ranchers gardeners and anyone else who might need a six-foot-tall rooster. this stock's been on fire ever since the marketwide buyoff last fall found its footing a few weeks after i recommended it early october. up 43% from its late october lows and that includes a nearly 3% gain today after the company reported a stellar quarter these guys delivered modestly better than expected sales which translate the into a substantial 11 kraerntings beat off $1.72 basis. it's taking market share, putting up solid transaction growth and seeing real strength in big ticket items. even bretter management sounds confident about the rest of the year even though they didn't raise their full-year forecast so can the stock keep climbing are we back into the territory of a constant positive comp

6:17 pm

store sales? let's check in with hal lawton, president and ceo of tractor supply, get a better read on the quarter. mr. lawton, welcome back to "mad money. >> hey, jim, how are you thanks for having me on the show >> i'm glad you're here, hal i get a sense of optimism from you. we've been thinking about this as an economy that people want to go services looks like there's a goods tailwind coming and i think your company has a long history of bumping up the comp store sales. could we be back into that mode? >> jim, thanks for the vote of confidence first love to give a shout out to our 50,000 team members who just every single day live our mission and values and are committed to serving life out here to your point, we've been facing really for the better part of nine months now the headwind where consumers are spending more on services than they are on goods combine that with disinflation over the last six months in our categories, we've been kind of

6:18 pm

navigating through those headwinds and really offsetting it with market share gains but to your point, as we look on the horizon there's another quarter, maybe two ahead of us on that, but we can really begin to see light at the end of the tunnel now against those headwinds and we look forward to getting back to at a minimum kind of neutral market conditions >> well, i think i know you'll do it. you're adding some stores. but something else, hal, i know is working i know there was a change in migration during covid what i was surprised to see was that you're still saying that the move to rural has legs what's going on? >> rural america is alive and well and growing and really leading in many ways in this country. if you look at population outflows out of cities, to your point, they spiked heavily in 2020 and 2021. but they've continued, albeit to a lesser absolute number, but net we're still seeing significant migration out of urban america and most of that

6:19 pm

migration or a lot of it is going into rural america we would push for two reasons for that one is affordability of housing. we all know interest rates right now. housing prices and if you're a millennial and you're looking to buy a home, rural america is really the most affordable place for you and secondly, it has similar characteristics from a kind of life out here being able to live a clean life, raise your fruits and vegetables, chickens all those sorts of things that the millennial generation really appreciates. you know, they can find that in rural america. the good news is that's where tractor supply is. that's where our stores are. that's where the customers we serve. and we continue to see the tailwind from that trend >> i think that's one of the reasons why i'm so confident about you. the other thing is you mentioned you dropped something that i think is a great metaphor for your company chickens the number of people who regard chickens as pets, now, we know big ag likes to slaughter

6:20 pm

chickens little ag, meaning people who go to tractor supply, i know that's where we got our chickens, they are treasured. this is a new world where people understand animals and love them how did that happen? >> yeah, jim, chickens are really the new third pet out there. one in five of our neighbors club members owns chickens and we have 34 million members in our neighbors club program. it's a category that's been on an incredible tear continuing into this year, it's attracting new customers we're seeing them attracted to new breeds, organic feeds. and most importantly, it creates a-of-a-kind retail theater in our stores. customers come in all day long looking to see the chickens. even if they're not buying chickens themselves or perhaps their food for chickens that day, they're buying other things in the store but one in five of our neighbors club members now, which is the

6:21 pm

vast majority of our customer base, partake in the category. to your point, they think of them as pets they name them they take care of them that way. it's really been a great new source of growth for us over the last five years or so. >> to continue the analogy, when you buy a chicken you've got to build a lot of different things. but most certainly a fence because the foxes love to get in there. but also, you mentioned the feed you have to create a backdrop for them there's a lot of different things that they want. and i don't know where else to get any of it other than a tractor supply >> to your point, we really have been the enabler of the poultry category and the poultry passion in the united states no one does it like we do. we are a one-stop shop for the category you can start with your chickens to your point, very low ticket on a chicken maybe three bucks, four bucks, depending on the breed you're getting. but then once you're in the category you're buying your coop, your waters, your heaters, your feeders, all that

6:22 pm

your fweeeed on an ongoing basi. but what the customer gets out of it is the joy of the hobby plus obviously eggs every single day for them and their family and friends. >> now, how i know you also is a merchant and i don't know how many people go to tractor supply like i do where i buy my clothes how fashionable are you going to be this spring for garden season >> i'll tell you, we've got a lot going on in the apparel area for gardening. this year in addition to our mainstays, carhart, columbia, wrangler, eriot, muck boots, all those sorts of things which people need for their spring outdoor clothing, we've also got some great new products this year from martha stewart and eddie bauer. and the martha stewart program has received rave reviews. and we're very excited about it. but you know, jim, across the whole garden category that's apparel, garden tools and now our 500 garden centers that we've built over the last four

6:23 pm

years, you know, we are ready for spring >> well, good, because i'll be at your store in another four weeks. i don't want to plant too early. it always goes bad if i do that, hal. hal lawton, president and ceo of a tractor supply if you haven't been to a tsc store, you're in for a real treat. thanks for being on the show >> thanks, jim >> "mad money's" back after the break. >> announcer: coming up, waste not want not earnings are in. see if this stock can turn trash into treasure. next

6:24 pm

- "best thing i've ever done." that's what freddie told me. - it was the best thing i've ever done, and- - really? - yes, without a doubt! - i don't have any anxiety about money anymore. - great people. different people, that's for sure, and all of them had different reasons for getting a reverse mortgage, but you know what, they all felt the same about two things: they all loved their home, and they all wanted to stay in that home. and they all wanted to stay in that home. - [announcer] if you're 62 or older and own your home, you could access your equity to improve your lifestyle.

6:25 pm

a reverse mortgage loan eliminates your monthly mortgage payments and puts tax-free cash in your pocket. call the number on your screen. - why don't you call aag... and find out what a reverse mortgage can mean for you? - [announcer] call right now to receive your free no-obligation info kit. call the number on your screen.

6:27 pm

everybody's freaking out about that weak gdp number this morning. last time we got one of the best unofficial barometers of the economy when wm, waste management reported. we produce massive amounts of trash. that's why i always like to follow wm's results. they help take the pulse of the economy this time they right small revenue miss but thanks to management's big push for efficiency which boosted their margins wm still delivered a huge 25-cent earnings beat offer $1.50 basis. full year forecast they lowered revenue outlook while -- reported softer sales better profitability. the market sure liked it what do we make of the results, though let's talk with jim fish he's the president and ceo of wm, who joins us now jim, this was quite an impressive effort because i know you as being levered to home building, levered to some

6:28 pm

construction we've had a slowdown in those and yet you still delivered great numbers and the market applauded it how were you able to do that >> well, look, jim, i think certainly home building affects us a little bit. the industrial segment of the economy affects us a little bit. but as we said at the beginning of the year, this year was going to sound a lot like last year where we weren't so much focused on volume growth, we were focused on the middle of the p & l, which was going to be cost control through automation and optim optimization we're focused on our sustainability growth initiatives and we're focused on pricing. so while volume was maybe a little bit soft, maybe 50 basis points soft from where we expected, we're really doing well on the middle of the p & l. >> let's talk about some things i have been talked about with you. let's talk about the rng facilities we once went to a fillup station in camden, new jersey but this is different this is big business now your renewable energy business >> it's $500 million in ebidta once we get it fully built out

6:29 pm

we're building 20 plants we've got five of them that will come online this year. but it is a great business it's business that is really enabled by first of all the gas coming out of landfuls we capture it and turn it into a renewable natural gas. and then the credits we were able to sell, these rent credits, is enabled by the fact we have a fleet that's 75% natural gas. so the way it works is you burn the fuel and that enables you to generate a credit which you can then sell to a third party >> i've got to tell you i think that that -- another thing, the sustainability you're doing is incredible you're making money again on recyclables. that's been a terrible business. >> it's up and down. i mean, that business, you know, is somewhat dependent on commodity prices but we've changed some contracts so that it derisks it a bit for us but we're happy with where our commodities are now. you remember a couple years ago everything we were selling, particularly cardboard warksz all going to china, and now

6:30 pm

that's changed and most of it's staying in the u.s some of it is going overseas but a lot of it's staying here and that's been helpful for us as well so that business is a good business for us this year. it's not driving the lion's share of the earnings, though. we today said we'd be $100 million better than we thought we'd be a quarter ago. and 15 of it comes from those sustainability businesses. 85 of it comes from just the core solid waste -- >> solid business. you're doing something, i'm not quite sure what you were doing before because i should know but you're talking about customer lifetime value i mean, i've always thought that you've considered that but this is a newer business model for you? >> well, it is it's taking customer lifetime value and really using that as one of the key metrics in our data and analytics process for pricing. and it should be, right? you're not going to price increase a customer that you've just missed their service. so we want to make sure that the

6:31 pm

customer is happy. we always look at pricing as being a very small part of that customer's overall cost structure. waste services themselves are a small part of the overall cost structure. but certainly understanding the customer analytics is an important aspect of pricing. >> how have you been doing in a tight labor market with all the technology you have to take the place of a person just in case you can't find one >> so if you'd asked me five years ago what -- there's been a lot of discussion today about, you know, the slower growth in the economy and of course a couple weeks ago about maybe high honer inflation sounds a little like kind of stagflation in the textbook. if you'd asked me five years ago what are you going to focus on, i would have told you we're going to focus on exactly what we're focusing on right now, which is reducing our labor dependence, to your point. we've been a very labor-dependent business and so how do we use technology to reduce that labor dependence?

6:32 pm

but in a low-impact way. we're not doing any big reductions re just take advantage of attrition. and when we have relatively high attrition in some of these jobs, some of these trade-type jobs, if somebody leaves and we've been able to squeeze efficiency out of that position then maybe we don't need to refill it so that's one of our big initiatives that's helped with that margin growth that you saw. >> also your repairs, how do you keep repair costs down that helped with margins big >> i think part of the repair problem that we've seen over the last couple years is we just weren't getting the trucks i mean, the supply chain was pretty tight, so we weren't getting the trucks and now we are that's helped with it. at the same time we've got process chains we're putting into place you combine those two and repair and maintenance looks a lot better >> you announced a sustainability deal. it's a partnership with major league baseball. i think this is important because a lot of people don't regard you as part of the sustainability portion of the country. but ever since you came in it's

6:33 pm

been a huge factor for you do things like this matter in terms of city contracts? why do it? why do you need to have people think of you as sustainable? >> sustainability is a huge part of our business. and it has been for a long time. this renewable natural gas piece is relatively new. but recycling's been a big part of our business for decades. probably two decades and we've just really started to tout that. maybe we weren't talking about it as much now we are the golf tournament of course has helped with that the wm phoenix open has been zero waste for 12 years in a row. and now this partnership with major league baseball is adding to that. we're excited about it i'm a big baseball fan i think you are too. >> yes, i am >> my astros aren't doing quite as well as your phillies >> we just beet up on the white sox. that was easy. we face the reds and suddenly it's hard. what do you see in the economy right here we feel some mixed signals ourselves. >> i wouldn't say -- there's no

6:34 pm

panic button to push i think our volume is a little bit soft we said we would be kind of 1% organic volume growth for the year originally. today we said probably more like half a percent so call it a 50 basis point drop in that. not in any way time to push the panic button i do think there still is inflation in the system. and i've said that for a while i know fomc came out in december and said there would be three rate cuts. and i kind of questioned that. not that i'm an economist. but as a businessperson seeing there was still inflation in our business i was a little suspect of that. and now it looks like there's not going to be three rate cuts, there might be one >> you're dead right the way i looked at it, exactly like you the economy had a huge head of steam and suddenly decided urban to put -- saying they're not going to raise rates i think that let ib flation creep back it's a shame because you have to hire a lot of people and you need to see your costs not go up in order to do what you need to do this was a great quarter

6:35 pm

at one point the stock was down. i was screaming how is that possible it was such a beautiful quarter. and of course the stock finished exactly as it should you've been a great steward of the shareholders it's just been nothing but up since i've seen you. congratulations. >> thanks very much. good to see you, jim >> good to see you, jim. that's jim fish, president and ceo of wm. "mad money's" back after the break. coming up, this company helps feed the country feed your need for good research cramer goes farm to tv when we return

6:39 pm

farm equipment agco's stock has been trading sideways for some time during this period the company's made some big moves under the surface in order to make its business more attractive they've embraced precision agriculture, doing more retrofitting of existing equipment and management is working very hard to cut costs make the company more efficient. is that enough to overcome this difficult tape let's go straight to the source with the chairman, president and ceo offi agco. >> how fun to be on the floor of the stock exchange >> we talk about ukraine, brazil it's great to have you here. and i think it might do us all good to start with the fact that a tractor is no longer an analog device it's a digital device and you're the leader >> absolutely. there's so much technology on our combines, the machine that harvests the crop. there's 43 computers on that all kinds of intelligence. sensing the ground, sensing the crop, making sure the machine can optimize its own performance. >> so if you have that then theoretically what would happen is you cut the amount of

6:40 pm

fertilizer you use and you also don't waste a lot of water >> exactly you're trying to minimize the amount of inputs used while maximizing the amount of yield gained how much crop can be grown on every square inch of the ground. >> before you took the job the company got some great name plates some of those name plates are priceless worldwide. and yet they stayed where they were you are now rolling out fent which is by far the best name. how's that going >> fent is the name that farmers know as the best of the best it's for the most demanding farmers. it had historically been a european brand and mostly about tractors we expanded it to be full line, tractors, planters, sprayers, combines, and taken it worldwide. step by step we're allowing only the very best dealer locations to carry this fendt brand. it's premium it's the best. we want to make sure it's matched with the best of the dealer network we're growing steadily we're already growing from 2021 to this year -- 2023

6:41 pm

to 1.5 billion reached our target two years ahead of schedule. so it's growing, growing steadily great appreciation by our farmers who've tried it. >> a lot of times people want to know what are you levered to, is it interest rates, the price of crops? is it how some governments subsidize? is it to china what are the big factors right now? >> the biggest thing is the price of grain if you look at what's the highest correlation it's really about that interest rates matter and higher interest rates are a bit of a headwind because many people finance their large equipment. but the bigger factor is what the grain prices are, which turns directly into profitability for the farmer >> you were the first one that told us that 13% of the world's calories would be taken off line because of ukraine something -- look, it's a horrible war and we know that but it didn't jack up the price of commodities other than at the very beginning how'd that happen? is more global market than we realize? >> well, it stabilized essentially, two things happened one is new routes were found and new customers were found so the ukrainian grain wasn't

6:42 pm

able to get out through the natural sea ports at the same rate, but they found a lot of land corridor to get out and secondly, russia that was restricted from selling to some of their customers found new customers. china, north korea, africa so the world reshuffled. >> all right now, agco is known as a farmer-first company cnh and deere, not to play devil's advocate, they're a farmer first company what's the difference? what are you guys doing that you think you can take share >> we think we're the most farmer first company in the industry it's different than being a product focused company. a product focused company comes onto the lot and says tell me about your tractor, what do you like, what do you not like a farmer focused company says tell me about your crops, your profitability, what are your pain points. and then we solve all the problems with machinery, data services and those type of things it's helping us rewire how we think, make us more innovative and make us serve the farmer better. >> is that how you came up with the -- all the different

6:43 pm

technology that's in -- you're meeting their needs? >> exactly by understanding their pain points we find the lowest cost way to have the machine be able to solve that problem for them automatically. that's why we just closed on the biggest ag tech deal in the history of the industry -- >> the triple deal >> we just closed on it april 1st. we announced it last fall but regulatory approval took to april 1st, which is exactly what our plan was it allows now agco's tech assets plus this to become the world leader in precision ag solutions for the farmer for the mixed fleet. essentially what that means is we're going to serve every farmer all around the world regardless of what brand they have so most of our competitors design technology for their brand but not for everybody else we serve our brands of equipment, fendt, mass yeerks ferguson, but then we retrofit technology onto other people's equipment. so a farmer might have a 5-year-old brand x or 8-year-old brand y. we'll upgrade that equipment

6:44 pm

with a retrofit solution and make that machine more capable it can now have sensors and automation and intelligence to be able to do something automatically. that's what we call retrofit this business is going to be the market leader in the world for mixed fleet retrofit technology. >> so when are you doing self-driving >> we're already -- we showed it last year in the field we're going to be showing it again this summer. next year we're coming out with our first autonomous retrofit kit, making an existing tractor autonomous and then we've declared by the 2030 point we'll have autonomy all the way through the cropping cycle from planting, spraying, harvesting and so on that's where we're heading in order to get there you need to automate all the things the operator does in the cab today >> but is it a necessitying given the fact that a lot of people's view of what jobs they want has changed that may not be a job that people want. and the only solution may be autonomy >> labor is a challenge, and so autonomy is a solution that is going to be attractive to some farmers. but even the journey to get there, automating all the complicated tasks, that helps

6:45 pm

every farmer so even the farmer that may not want autonomy in the future, they can still want to drive themselves, by automating a complicated feature the machine can do the job better than they can. so on the path to getting to autonomy we're adding probably more value than the autonomy stuff itself the big value is automating the features and helping the machine do a great job >> and last thing how's the american farmer doing? >> well, these last two or three years were really great. now they're okay but when you go from great to okay so fast, okay doesn't feel okay and so you know, agco is probably going to have the second best year in our history. farmers, their sentiment isn't very good right now. we've come off a few hot years things are cooling down a little bit. but you know, we're working really hard to make sure that we can provide low-cost solutions that give them a one, maximum two-year payback to make their farming more profitable. >> i think your company should be -- your stock should be more levered to the farmer and equipment you're seeing. selling but right now people look at it and say what's the

6:46 pm

price of corn, let's sell agco it's not as easy if that's what you think just get out of the space the wrong way of looking at the company. that's eric hansotia, chairman and ceo of agco. great to have him in person. i like all the things you're doing. >> thank you >> "mad money's" back after the break. >> announcer: coming up, hit us with your best shot. an electrifying fast-fire "lightning round" is next. ♪ you were always so dedicated... ♪ we worked hard to build up the shop, save for college and our retirement. but we got there, thanks to our advisor and vanguard. now i see who all that hard work was for... it was always for you. seeing you carry on our legacy— i'm so proud. at vanguard, you're more than just an investor,

6:47 pm

you're an owner. setting up the future for the ones you love. that's the value of ownership. you founded your kayak company because you love the ocean- not spreadsheets. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire [♪♪] your skin is ever-changing, take care of it with gold bond's age renew formulations of 7 moisturizers and 3 vitamins. for all your skins, gold bond.

6:49 pm

switch to shopify and sell smarter at every stage of your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify. it is time it's time for the "lightning round" on cramer's "mad money. buy buy buy sell sell sell --

6:50 pm

play until this sound and then the "lightning round" is over. are you ready skee-daddy time for the "lightning round" on cramer's "mad money." start with brian in pennsylvania brian. >> caller: hey, jim. thanks for taking my call. >> of course what's up? >> caller: i really appreciate the advice you give us home gamers every night it really keeps things in perspective, especially after certain days in the market if you know what i mean >> oh, yeah. people panic all the time. it's really crazy. how can i help in. >> caller: well, jim, a couple nights ago i thought you were spot on with your comments about luxury goods maker tapestry and luxury goods company capri you but i've had my eye on another luxury goods company and i've recently opened a small position in it this one has a current dividend yield of 5 1/4% and i'd like to know your opinion. should i expand my position, hold or sell movado group? >> it never really does anything you get that yield decent level i feel it's neither here nor there at that place. let's go to david in

6:51 pm

pennsylvania david. >> caller: hey, jim. dave here. how's it going >> go birds. what's happening >> caller: i got turned on to this stock about eight weeks ago. and after the earnings i bought in my question is is it a long-term play i just don't know. >> it's an e-commerce play i don't know enough about. i know ebay. i know shopify i know amazon. i've got to do work on that one. i've got to learn more about it. let's go to gianni in wisconsin. >> caller: i've got my underage son gianni here on the line. >> i want to start by giving you a big, big boo-yah >> right back at you >> caller: i want to know what you think about -- what does it look like? >> which one is that

6:52 pm

>> caller: new scale power >> oh, it's small nuclear reactor. i want you to do this. just go buy ge they have it as a division they're not making any money with it. i don't want you to lose any money. and that, ladies and gentlemen, is the conclusion of the "lightning round." >> announcer: the "lightning round" is sponsored by charles schwab coming up, are you a believer when it comes to this stock you're either in or out. cramer explains. next

6:53 pm

6:54 pm

6:56 pm

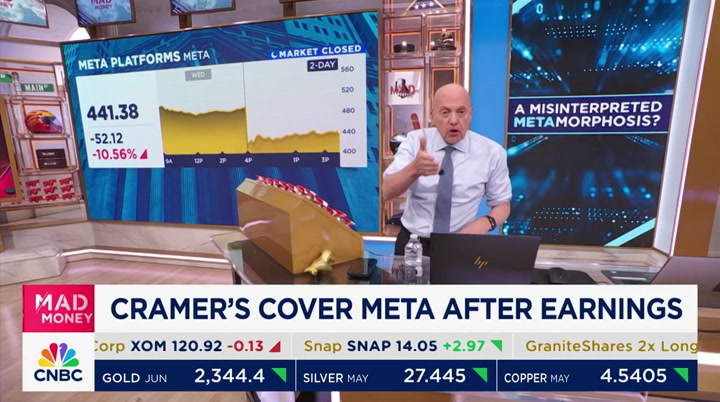

when it comes to meta platforms, down more than 10% today, you either believe or you don't. i'm a believer which is why we're sticking with the company. in fact, we told cnbc investing club subscribers today that if we weren't restricted we would have bought some for the charitable trust when it opened. last night meta blew away the numbers. astounding 27% growth rate, much better than wall street was looking for. ad revenue growth also accelerated 27%. for all this you only had to pay 22 times earnings. looked like a steal. so why did the stock plummet today? because in tech the forecast is all that matters and people didn't like how meta's outlook showed a market deceleration in revenue growth, only talking about 18% at the mid-point of the second quarter revenue forecast but more important, people didn't like what mark zuckerberg had to say on the conference call after explaining why he thinks artificial intelligence will make meta into a powerhouse, as it has with microsoft, as it has with google, zuckerberg decided to end his year of tight expenses and return to the era

6:57 pm

of aggressive spending because of the ai opportunity he believes i'm going to quote him, we should invest significantly more over the coming years, end quote. he talked about, quote, a multiyear investment cycle before we're fully scaled, end quote. the ai business, well, it's going to be profitable not now but later. oh, i got it lose money now, make money later. that's why people sold the stock. now meta's planning that 35 to 40 billion dollars in capital expenditures this year when they'd previously said they'd only do 30 to 37 billion zuckerberg explained why this is an issue for shareholders. quote, we'd historically seen a lot of volatility in our stock during this phase of our product playbook where we're investing in scaling a new product but aren't yet monetizing it volatility, you know what? in this business that's code for going down there. that's what freaked everybody ut op that's why the stock went down o'so hard to which i said wait a second. as i told you at the top, shouldn't we believe in this man

6:58 pm

who's given us some incredible performance over the years especially when the stock's more than doubled over the past 1 months many doubted stuckarberg when he personally worked hard on reels, his tiktok knockoff that i actually found better to advertise than tiktok itself when he first started monetizing reels in 2022, made a couple billion bucks. this year it should make 27.5 billion, next year 412.8 billion. that's morgan stanley numbers. that's assuming there's no tiktok ban but it's going to get banned if the chinese company doesn't sell it to i adomestic operator should we give up on stuckarberg now he's writing a lot of checks to broadcom and nvidia for the equipment to power his amb ambitions? that expenditure is the reason both stocks roared today what does stuckarberg have to say about this quote, historically investing to build these new scale experiences has been a very good long-term investment for us and investors who have stuck with us and the initial signs are quite positive here too, end quote

6:59 pm

he says we're entering, i'm going to quote again, this period where i think kind of smart investors see that product is scaling and there's a clear monetizable opportunity here before the revenue materializes, end quote. he also reminds us the same drill with reels and instagram stories were handled jointly and made you a ton of money. >> the house of pleasure now, stuckarberg didn't say he was actually banning meta's recent push for efficiency he called it a focus, even as he continues to lose a giant gob of money on knebelous reality labs, this time 3.8 billion. that humongous spend will continue but you know what? i don't care we rank the stocks in the charitable trust as part of our ongoing work for the cnbc investing club earlier this year we downgraded meta from 1 to a 2 and sold stock at 490 you know what we said to do today? we said buy it back. we wanted to trade back to 20 when we said buy it. and we will.

7:00 pm

because zu zuckerberg has earned our trust and he sees an opportunity to monetize generative ai i'm getting right with zuckerberg you should too i like to say there's always a bull market somewhere, i promise to try right now on last call, intel shares tanking. investors losing even more money. you will hear excessively tonight from the ceo. 44%? a huge capital gains tax hike proposal has flown under the radar until now. the revenge of inflation. a critical report looming over the market tomorrow. we will show you how to prepare. disrupting defense. how billionaire lucky just how did the industry's biggest player and lucky will be here.

0 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11