tv Fast Money CNBC April 25, 2024 5:00pm-6:00pm EDT

5:00 pm

set. the next generation. >> absolutely. >> the next generation of financial wizards. she said she's a grouwnup, she is, carrying that cake >> she got to see her hero, charlotte flair, at stock draft today, so, been working out. >> all right, that's going to do it for us here at "overtime. >> "fast money" starts now live from the nasdaq market site in the heart of new york city's times square, this is "fast money. here's what's on tap tonight another earnings palooza al alphbet, microsoft we're digging into the big movers and bringing you all the trades. plus, the great yield surge. ten-year treasuries hitting their highest level since november as expectations for rate cuts are pushed further down the road are we heading to a real credit crunch, and what could it mean for the markets? and later, gold glistens

5:01 pm

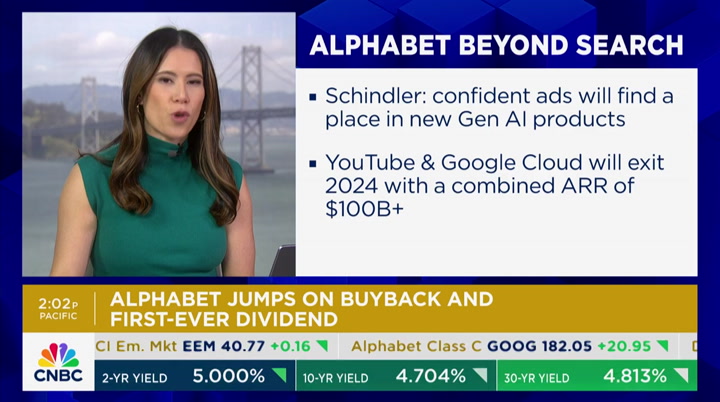

the headlines driving the moves and the impact on all the miners i'm melissa lee, coming to you live from studio b at the nasdaq stocks ended the day in the red, but making a big comeback from their worst levels of the day. the dow down 700 points at the lows, ending the day off less than 400 the nasdaq down my that are 2.3% at its lows, closing down just over half a percent. the losses coming after a softer than expected gdp report, but already, it's looking like we are in for a big reversal tomorrow shares of microsoft and alphabet soaring. go google's parent adding more than $300 billion in market cap after announcing its first ever dividend and a $70 billion stock buy-back let's get more on the numbers with deirdre bosa. >> hey, mel. the call is still under way. the q&a should be beginning soon no surprise, the ceo spent a lot

5:02 pm

of time talking about his a.i. strategy i want to highlight how the company says it's navigating generative a.i. in search ads, its cash cow he says he's encouraged by what he's seeing so far, including an increase in search usage the chief business officer went a little further, saying that ads are, indeed, finding a place in gen-a.i. products and confident that the opportunity will expand. he also made a point to tell investors that google isn't just search ads anymore he noted that youtube and cloud will have a combined run rate of over $100 billion, suggesting that growth of those units will increase, as well. now, he's also keeping efficiency front of mind, investors loved this he noted head count growth, which was a reduction year over year, and monetization he listed a number of paths to make money but it is probably google's first ever dividend that is most exciting to investors at the moment and could help relieve some

5:03 pm

potential anxiety around increased a.i. spending. i think they were just talking about capex numbers. i'll check them out and bring them to you. >> all right, keep us posted how much did a 14% pop do you think, guy, is the dividend and buy-back versus the rest of the quarter? >> i think the buy-back -- $70 billion is not insignificant, but in the scope of the market cap, it's not a huge deal. i think the dividend is a big deal get a new class involved but the quarter's very good. and i, you know, margins where i look at, the first thing, and operating margins of their net revenue were up 37.7%. the street was looking for 33% good their them. so we talked about the potential to break out of those prior all-time highs now, we're markedly above it what happens tomorrow? well, at least you have a place, i think, to trade around in the form of that prior high. and, in fact, the breakout, we were waiting for it in google on valuation and a number of things is manifesting right now good for them. it's a good quarter.

5:04 pm

>> i would agree with that i think there's a lot to like. you have the dividend and share buy-backs, but one of the questions we had coming in was really around how gen-a.i. was going to affect the search business and so, i think the results actually answered that, at least for the short-term so, i think when you look at the dividends, share buy-backs, the overall earnings story, and answering some of those questions around delivering on gen-a.i. today, as well as investing for the future that's how the market is reacting today. >> more people using that search tool, that is very positive. no more existential threat >> look, i think the existential threat was over -- overplayed in terms of at least, you know, some of the clumsiness of some of the releases in terms of at least, you know, the new product base and really the lack thereof. this company continues to execute in their core business if you look at the revenue, the top line, i think, it was 16% sequentially better than people

5:05 pm

had expected, up from 13.5 a year and a half ago. it's a kind where i think, really, again, their core business is executing as it was. and as we saw with meta and as we wanted with google at different times in the last four, five years, the cost effi efficiencies, the ability to generate free cash flow has been a big driver for a company that people said, hey, look, your core business is highly, highly cash flow generative i think this dividend is very important, and another $70 billion, as guy pointed out, is a big part of it i don't think this is half of that performance we started to get details, you can kind of see how the stock rallied. but of the top three, four of the megacap seven, i think this is the one that really has the most argument in favor of where it can go in terms of upside >> plus, when you look at it, though, there's a lot of allege rilt algorithms that read reports, and if you see buy-back, algorithms like that

5:06 pm

another thing, investment. meta got hit for investment, will they? they own search. 90% of search, they still have that how many other a.i. guys and girls are coming for their basket their search right now, they're not worried about it, they're still top of the hill >> the question is, was meta yesterday the -- i don't want to say the exception, because we have three data points, but three of the sort of mag seven that are heavy a.i. plays, right, and meta was the one that faltered, alphabet and microsoft so far look okay >> right >> we don't have the conference calls yet. >> faltered in the sense of the spend and the guide. >> right, and the stock -- the stock reaction >> that's right. and the stock reaction, because the quarter, in a vacuum, was -- i thought it was extraordinary we talked about that last night. obviously, that facebook move was very facebook specific now -- and facebook's not a problem on valuation, we've had that conversation. flip side of the coin is, g google's still fine here microsoft is the one, we're going to talk about it in a

5:07 pm

second, you start to say, hmm, this is interesting. i get why it's rallying. but to answer your question, clearly, the facebook quarter was predicated on the spend, and probably to a large extent, the runup that it had. >> probably wrongfully so, because no one understand what metaverse was when they got slammed. then they had the year of efficiency, and now talking about investing in a.i i think they should be given a pass with a.i., because no one -- the runway to actual profits and revenue on a.i. is potentially -- >> the road map is clear at this point, than the roadmap for profits for metaverse. >> exactly the challenge was, when you talk about that type of spend, without clarity and exactly what it is, and it's just generically, i don't want to say generically, but a general a.i. statement, i think that's what the market reacted to, so, the quarter itself was strong, but then guidance is what obviously it sold off on >> it's interesting just to see what does meta do with the backdrop today, a very different earnings environment, where core

5:08 pm

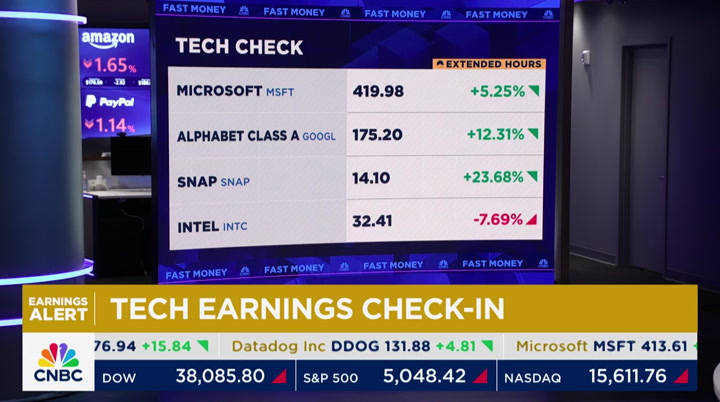

business, which meta, as i said, delivered on i think there's a different interpretation of -- you could certainly have a different interpretation of what they told you on costs, and, hey, stay the course, we're going to spend some time. we may not see full outcome or certainly output from some of these investments for a few years, so, interesting, you know, 1% move, you think maybe it might like it a little bit more, so, maybe we can't say that the environment's that different today, but i think there's going to be a -- a bit of a reassessment of meta. >> yeah. we might still be hit by a capex headline that we do not like, right? i mean, that is still possibly to come. and we've been down that road before >> no question about it. and they've been beaten up on the back of exactly that but -- this, again, my interpretation, i think the street is getting more comfortable with the fact, they're actually operating much better tim said that. and the evaluation is still okay, so -- and when they put cash to work in the form of a buy-back, there's a lot to like here. microsoft shares are popping after the company reported a beat on the top and the bottom

5:09 pm

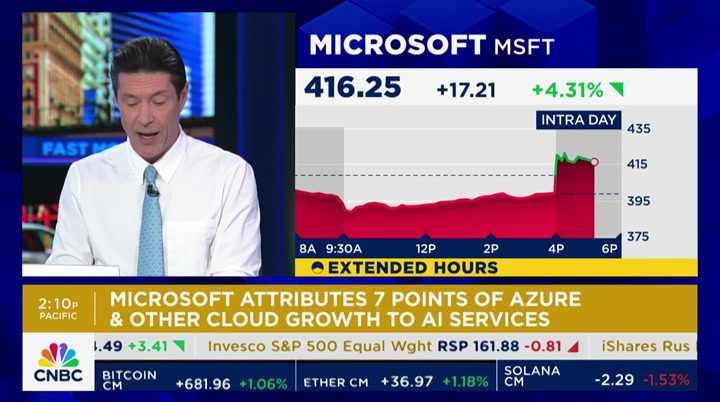

lines. steve kovach is with us now. >> yeah, melissa, it's all about microsoft's azure cloud growth here it continues its acceleration. after slipping dramatically over the last two years microsoft reporting azure revenue growth of 31% and a chunk of that, 7 percentage points, coming specifically from artificial intelligence running on its cloud that's up from six points in the december quarter so, the story here is, a.i. is increasingly important to helping reaccelerate azure growth beyond that, of course, beats on the top and bottom lines, total revenues are up 17% from the year ago quarter what's not here in the report, details on co-pilot. the a.i.-assistant microsoft is selling. satya nadella saying co-pilot is part of a new era of a.i. transformation the call is going to kick off here, and we'll be listening for guidance and co-pilot. and of course, like we're

5:10 pm

saying, increases in capex, as well >> we'll be looking for the overall guidance for the next quarter and the full year in microsoft's call, as well. we certainly have been down the road where we see it afterhours, stock is acting well and we get hit with it. initial take on the quarter? >> i think azure, and that pivot, we started to see last quarter. it wasn't much it gave the bulls a chance to say there was some inflection point. and this is a serious inflection point, at least, when you want to see where a lot of the real growth is coming from, the fact that a.i. is seven points of that growth. you have a dynamic also with $8.5 billion in share buy-backs, the act of the company to actually -- to at least support the share price, support earnings in a lot of different ways every segment, including commercial cloud, up 31%, that was a beat the operating margin gained 175 basis points that's pretty extraordinary, and again, if you wasn't to buy a higher multiple for microsoft, which i've seen at 34, 35 times

5:11 pm

even with these numbers, you have to believe in a margin. >> piper sandler out with a note just moments ago, saying azure a.i. crosses the $5 billion run rate in terms of the business, that's a sizable contribution here >> i mean, steve just said it, steve kovach just said it, it was all about -- once they saw that reacceleration in azure, 31%, that was off to the races the other numbers are what they are, but tim makes the point, and again, 34, 35 times next year's numbers, you're paying for that growth. again, we said it 100 times, microsoft, one of the top five, if not three most important companies in the world, without question but you're absolutely paying up for it in this environment >> is it worth it for this environment? given the uncertainty for stocks, given treasury years at 4.7% in a world where rates might not come down? >> that's going to be the question going forward, because really it is priced to perfection, but i think what the market is rewarding right now is in 2023, it was all about, you could just mention a.i., and your stock would all of a sudden react very positively. i think right now, it's, do you have tangible gains and tangible

5:12 pm

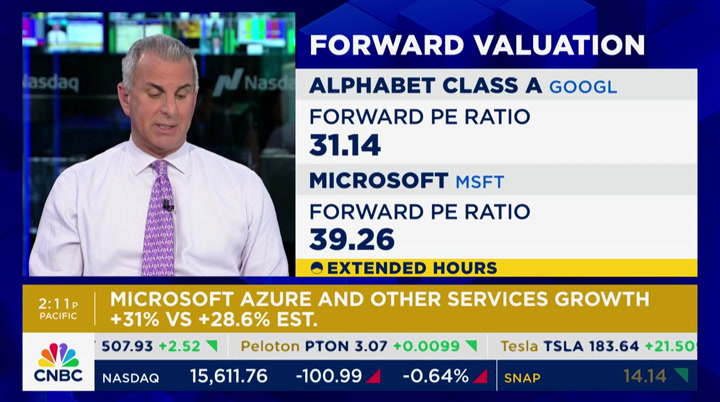

productivity and results in your earnings today, not just some promise of the future, and so, i think where the stock market sees that, it will be rewarded certainly short-term >> last quarter they had highest quarterly profit in two years. this was a show-me quarter they showed you. it was all about azure if azure beat, the market was going to be up post close for microsoft. it -- let's see what happens tomorrow when they settle in but you could make the case, by itself market cap, that they had the most to prove. >> microsoft >> microsoft and this is a great test for them -- i don't like where steve had mentioned that a.i. went from -- up to 7% part of that growth versus 6%, you would have liked to see a little more traction, but it's going in the right direction. >> in terms of big seven, whatever you want to call it, but so far, the names that have reported, are they going to be defensive in this environment at these multiples? have they proven -- has alphabet and microsoft, pick on those two in particular, because we have

5:13 pm

the results tonight, are they going to be defensive? >> i think they're defensive when you have these kinds of numbers. i don't know how defensive you can be at some point and i think defensive for megacap tech stocks -- the kind of growth we're seeing, from these companies, it's mid teens, it's high teens, for multiples, you know, if you are looking at price to earnings growth, peg ratios, you know, there's -- different appetite for different levels of valuation, but they are defensive, they have proven defensive in the past. but where have we come from? and what we started to see in the last three weeks to month when the market's running in into, -- causing people to reassess -- the nasdaq overall, if you want to do a ratio chart of the qqqs to the spy, nasdaq has not made new highs you've seen a lot of, you know, pretty negative price action the only one that seems to be clearly making new highs, to me, is google, or alphabet, and i think that's something to watch, but i don't think that these stocks are bullet proof. at some point, valuation

5:14 pm

matters. >> i would agree with that i think valuation and fundamentals matter. i think the component, though, that is about, you know, a flight to safety, really focusing on quality, is the fact that these balance sheets are so strong so, when you have that free cash flow generation, these are going to be the stocks that are immune to a lot of the inflationary pressures, which the market will reward, but if you don't follow through on earnings, we've seen it, a lot of companies have been punished >> 100%. the valuation suggests -- they've become defensive, because as money pours in, that valuation grows. it is a defensive play and we'll talk about rates later in the show, without question. that is going to be a huge component going forward. i don't think the market is paying enough attention to it. >> for more on microsoft and alphabet, let's bring in gene munster. gene, what's your initial take on -- you pick, microsoft or alphabet >> we'll do google, and one piece, usually, when you're listening to the calls, i just got off the call, you can pick up some context and look at the stock and see why it's moving,

5:15 pm

and their cfo said a minute ago they expect to continue to invest in a.i. infrastructure and a.i. talent, and expand margins throughout 2024. now, well, that may have been part of the street expectation of that, in my mind, was a positive, given, obviously, what we've seen and heard over the last 24 hours. and so, i was surprised to not see the stock higher on that they are doing it both, google is not only aggressively investing, and it was aggressive they spent 21% more in capex in the march quarter than -- than analysts had expected, and despite all that, the stock continues to move up so, i would have expected that comment from ruth to have been an incremental positive. i was picking up some of the chatter on the desk as you were talking earlier, and i think this piece around search, what they are doing, the fact that search growth accelerated, the expectation was 11%, 14% growth in search, that's 58% of their

5:16 pm

business that, of course, addresses this narrative, and their ceo was quick to point out that their search generative experience, that's their lab, where they're testing some of this generative a.i. within search, they say that it is performing to their thesis, which is, the more that people use generative a.i., the more actual old school search they do at the same time, and so, this seems to be lining up pretty well against the bear case on google, so, that was my takeaway, felt good about search and felt great about where margins are. >> so, you're saying, gene, alphabet has indicated they will spend -- they spent more already on -- on -- >> a lot more. >> and they're going to spend even more, but still going to expand margins, and that's different than what we heard from meta yesterday. >> very different. they had this big step-up from just under $9 billion in capex in the december quarter to $12 billion, in the march quarter, and ruth said to expect it to be up and -- up a little bit and

5:17 pm

roughly the same, so, we don't know she did say up, but she also talked about roughly the same, so, i don't think there's this negative surprise around margins, and -- related to, or the capex spend, and it does speak to, i mean, they -- they grew capex 91% year over year in the march quarter, so, they are putting the accelerator to the floor on trying to build the in infrastructure, and i just want to point out this unique dynamic around a.i. more broadly, and this impacts a lot of companies, they're doing the spending with this capex, but also, they're seeing the revenue growth. we saw in azure, google cloud, acceleration of revenue growth so, this is pretty unique, when you're seeing this paradigm shift, and both of those are moving in the right direction. i did bury the lede, melissa, as i thought about what i saw in the google and microsoft capex numbers and microsoft's, as i look forward to may 2nd, when apple reports their quarter, this is going to be their first quarter where they talk about a.i. in a more substantive context. they have never really brought

5:18 pm

it up in prepared remarks, so, i suspect -- i suspect they're going to talk about a major, or a significant increase in capex related to a.i i would view that as a positive, but i think investors should just have the right lens going into apple's print what we're seeing here, apple's going to have to take that same path, because they want to compete in a.i., too >> all right, gene, let us know what comes up on the conference calls. gene munster >> thank you >> so, we're hearing everybody say they're going to increase spending on a.i., does that necessarily mean we should transfer that market cap -- i'm exaggerating, to nvidia? >> if you -- >> that's what it felt like today. >> that's exactly what happened today. the early weakness in nvidia was actually then -- was bought and the strength of it manifested, well, it's on the back of everything facebook said last night. so yes of course, the problem is, and we've been talking about this for awhile, you know, that march 8th, friday march 8th reversal actually wound up being very important.

5:19 pm

you saw how low nvidia traded down to, i think it got down to $735 obviously, it's bounced. but keep that in mind, because i think technically, we may be looking at a bit of a broken stock here >> i also think it's not just about semis or vidia, it's the broader story in terms of who would benefit. the market knows this, and these stocks have been rewarded. everything from electrical equipment to utilities to energy, more broadly, data centers, i think you have to kind of look across the board and say, regardless of what happened with meta or what happened with google and microsoft, you're going to see continued flows and continued demand and that's going to be a really important topic for earnings this season. all right, coming up, a lot more earnings action to bring you, with shares of intel and snap making moves. the details from the quarters next. plus, mining maneuvers the latest on bhp's offer for anglo american all that when "fast money" returns. this is "fast money" with

5:20 pm

melissa lee, right here on cnbc. 'e renew formulations of 7 moisturizers and 3 vitamins. for all your skins, gold bond. we really don't want people to think of feeding food like ours is spoiling their dogs. good, real food is simple. it looks like food, it smells like food, it's what dogs are supposed to be eating. no living being should ever eat processed food for every single meal of their life. it's amazing to me how many people write in about their dogs changing for the better. the farmer's dog is just our way to help people take care of them.

5:21 pm

5:22 pm

you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. and i lost 172 pounds on golo. when i was a teenager i had some severe trauma in my life and i turned to food for comfort. i had a doctor tell me that if i didn't change my life, i wasn't gonna live much longer. once i saw golo was working, i felt this rush, i just had to keep going. a lot of people think no pain no gain, but with golo it is so easy. my life is so much different now that i've lost all this weight. when i look in the mirror i don't even recognize myself. welcome back intel's down 8.5% despite an

5:23 pm

earnings beat. the disappointing guidance to blame for the selloff. kristina partsinevelos has more on the results >> the guidance leaves investors waiting each and every single time even on the earnings call, which is going on right now, the ceo reiterated, our target model is reasonable, conservative, if we can move faster, and do better, we will. so, he's obviously trying to hype up the crowd, it's going to get better in the second half. i was able to catch up with the cfo just about maybe 20 minutes after the earnings crossed and we spoke about the three product lines. pcs, data centers, as well as their networking and edge. all three categories were suffering from the seasonality that you often see in q-1. he warned that specifically for pcs, we would see the same thing happen in q-2. for servers, the common line, a.i. is taking all the money, you know, and any type -- he didn't use those words, i'm paraphrasing right now, but you know, any non-a.i. business is suffering, and he pointed to other players in the industry, and i could think of texas instruments, tsmc that also warned of that i did ask about specifically the

5:24 pm

foundry business, because that posted a loss, $2.5 billion in q-1. last year, the whole year, they lost $7 billion. so, you can see that they're off to a rough start they warned this was going to be a peak year for losses for the foundry business and lastly, he said their margins were going to improve, so, i said, does that mean job cuts and he chuckled, said, no, we really believe that things are going to improve in the second half and pointed to mobile eye. their business is down 48% year over year. >> so, trust us, things will get better in the second half -- >> precisely it's a very back half thing. asml was very similar. few chip names are going that way, like, really putting all the pressure on the second half of the year, blaming cyclicality in q-1 and q-2 >> how do you interpret this >> i value having kristina here, because it seems to me like we've heard this story before, and i'm not sure what we heard that was new that was so bad and i own a small piece of this company, very, very small,

5:25 pm

fortunately, but what i heard was, we didn't think anything good was happening in the short-term when i heard a company reiterate, go out of their way to say, we're actually -- q-1's the bottom we're going to see growth from here on out, i mean, that's the headline right here. >> but the guide was light is q-1 the bottom or q-2 >> the cfo is saying, we see q-1 as the bottom, and that, to me, on top of the fact they're talking about 200 basis points of margin improvement, talking about their $500 million in sales, their gaudy a.i. chip -- i just think this response is interesting. i'm also someone that said, every time this company opens their mouth, stock goes lower. and this is a perfect example of that >> seems like they have a credibility issue. if you hear that from my other company -- >> yes, i'm reading the tape in a vacuum and i like those headlines. >> the tape is the tape and the tape is telling you something. >> maybe do a few more push-ups this time. >> every single time poor pat, who is going to be on

5:26 pm

the call tonight -- >> will he >> i'll enjoy watching him do two push-ups their data center is a disaster. it's 18% year over year lower. i'll say this. client computing, that was actually pretty good, up 30% it's the guide kristina said it that second quarter guide scares a lot of people. and till mentioned, they see 300 basis points of improvement in margins. the market is saying, you might see it, we don't believe it. >> also, it's, what, 64% of revenue comes from pcs, right? so, i think that's -- that's what they have that others don't have, and that's probably what's dragging them down in an overall market where everyone's looking for them to push a.i >> kristina, thank you >> they're going to say pc a.i going to be the guiding force and the chip, which is $300 million in the second half >> we'll see how the market reacts to that kristina, thank you. coming up, more on all the mining moves and the big jump in ewmont. and action to bring you,

5:27 pm

shares of snap after reporting de details of their quarter that's next. you're watching "fast money," live from the nasdaq market site in times square. we're back right after this. even space age technology can't prevent accidents at work. so talk to your agent about workers's comp insurance from pie, or visit pieinsurance.com. safety first, then pie insurance.

5:29 pm

5:30 pm

welcome back to "fast money. major moves in the mining world today. anglo american confirming it received a takeover offer from bhp with results the bid could be almost $39 billion, but reuters reporting the offer might not be sweet enough. anglo closing the day up 17%, its best day since march 2020. newmont seeing its best day since april 2020 the world's largest gold mining company reporting a huge beat on the top and bottom lines this morning. >> say it, the a in my clam. i know you were dying to -- put it up in the screen. finerman is back there in ec tell the people what's going on. listen stan druckenmiller, three months ago, he was getting out of some stocks, buying mining stocks now, it's all coming to play the mining stocks have completely underperformed, but now they're starting to figure out, you know what, there's something going on here.

5:31 pm

layer on the fact that copper is breaking out, and i understand why anglo is saying no thanks. >> yeah, you have copper breaking out to the upside going back to the picks and shovels of a.i. and what's required there in newmont, you have sol id beas in terms of production and cost. so, if we see continued upside in gold, because i think the interesting thing about gold is, when you look at the conditions of a strong dollar, high rates, that's not supportive of high gold prices. so, anything that would change that, you could see further upside, which would be a tailwind >> i think the operational beat is the most important thing here i think the miners have been held back over the last six to nine months. people feel they don't have the operational leverage to the higher gold price. the fact they actually have a lot of drag from inflation so, the fact that they had better free cash flow at newmont, and it's led to better cash flow, we can all price in what higher gold prices are. this is the part of it that i do think, there's just a lag effect in terms of the analyst community finally saying, my average gold price for '24 is

5:32 pm

going to be 2,300 bucks. and that will follow through to mechanical upgrades. gold miners watch gold prices go a lot higher and stayed stuck in the mud for this operational reason if there's an m&a bid to the market, that's even better let's talk about copper, other things that are being mined. other pgms, prices are going higher, and i think that's, you know, you talk kristen about the break in terms of the historical correlation between a higher dollar and higher rates, and it's actually very, very friendly to miners >> and they're going after pot ash, the coal, as guy said, copper, these are all the renewables, these are all the ev this is all where the puck is going, so, that's what they're trying to bring in but newmont's been doing the heavy lifting. so, if you look at the gdx, it's 12% of the gdx and newmont is up 30% for the month. so, to guy and tim's point, i think gold miners have caught up, and maybe they have a little more room to run coming up, we're digging into today's market action

5:33 pm

5:36 pm

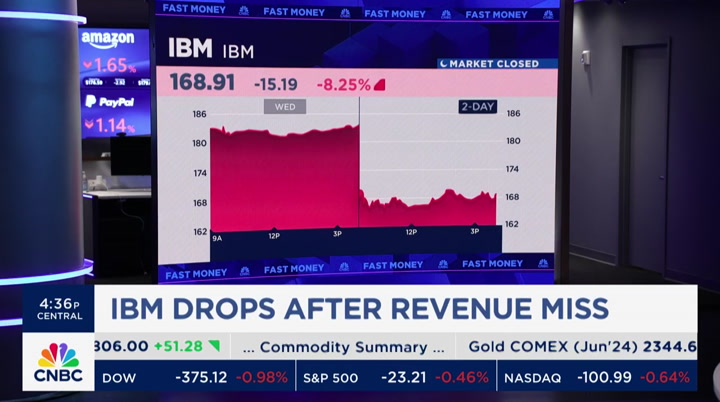

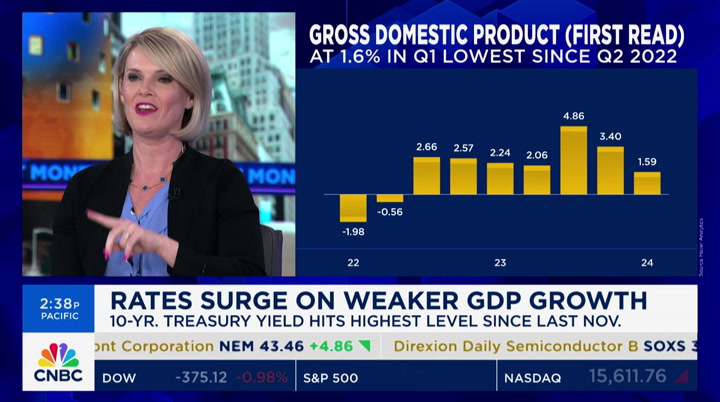

welcome back to "fast money. stocks closing well off the lows of the session, but still down after gdp data came in well below expectations the s&p and nasdaq ending three-day winning streaks. rubrik debuting on the new york stock exchange today. shares closing more than 15% higher than its opening. shares of ibm down more than 8% after missing on revenue last night. the stock's worst day since 2021 and shaved nearly 100 points off the dow. and microsoft shares are still higher by about 4% the call just kicking off. we'll bring you all the details as soon as they cross the tape. rates surging after that gdp report the benchmark ten-year treasury yield hitting its highest mark since november.

5:37 pm

>> that after the inflation component of gdp showed an acceleration the s-word comes back -- >> are you allowed to say that >> stagflation >> oh, that -- i didn't know where she was going with that. >> maybe the other s-word, too depending on how -- >> typically what happened there is, she'll reference the s-word and one of us morons would say it >> bowling pin >> i know. >> fourth quarter gdp last year was 3.5% it was half of that this year. on the back of which pce was probably 2%, it came in, what, 3.7 or so? that's not good. that's the story of the day. i get all those things this is the biggest story of the day. now, we'll see tomorrow if pce verifies that or -- whatever word you want to use, but the bond market is telling a story, so -- i'll say again, 4.7, rates are going higher from here >> yeah, it's difficult to really understand this data, because you have -- i would say most of us are suffering from

5:38 pm

confirmation bias, where you look into the data, and what you want to see, you will see, so, even with the inflation data, you had strong consumption, you actually had really strong consumption numbers, which would be supportive of gdp you could point to imports and how that impacts gdp overall but we have used car prices that are falling, we have new tenant rents that are down. there are disinflationary forces that haven't appeared in the data so, the thing tomorrow is going to really be, are we going to see revisions in january, february, or is this going to look like a reacceleration in march? that's different than something balanced over the quarter. >> what's your guess >> well, bad news being bad news for bonds meaning bond prices sell off, yields go higher, can be the fact that in the economy is showing signs of weakness and inflation isn't going lower, and the pce component showed enough zest to it to say that inflation is very much a factor, but you add that to a week where we've seen record treasury supplies, especially in five years, that

5:39 pm

adds up to,again, slower economy means the government selects less money, people read into the fundamentals, as credit investors of the u.s. government and yields start to go higher, when supply is also added to that so, that's the story right now and i think yields can't go a whole lot lower even if you started to see a major flight to quality on lower data. >> so, to have stagflation, you need high unemployment, and we've seen employment hoarding right now. so, what breaks that back? what turns that over where you start to see people -- not just lay off in the megacap tech, but in the everyday cyclical businesses we haven't seen that yet next month, we're going to hear the fed talk about neighbor cutting qt so, that's easing, in effect, that's a little bit under the hood, but it's still easing. >> yeah. where do you see rates go from here >> i think by the end of the year, we should see anywhere in the ballpark from ten-year between, like, 3.80% and 4%. we see that p coing down a little bit but i think ultimately, you need

5:40 pm

to see, what really matters here, is the disinflationary forces so, the fed is not going to move, unless you see several months, and we're far away from that, so we do anticipate that we'll see some cuts within the second half, but the data has to come through >> what is your scenario where you see rates going higher from 4.7% >> the current scenario. issuances, the market is going to demand a higher yield to buy our debt, which they will, but at a higher yield, and the fact that inflation is still a problem. so, the fed can control -- they can cut rates all they want. >> so, in today's action, right, we had yields, you know, i don't want to say close at the highs -- >> more or less. >> pretty much up there, right, we saw the market turnaround, mainly because stocks turned around does that mean we are okay with higher rates that we are okay with 4.7%, only if they go higher, you know, should there be a problem? >> it's a fascinating time, because i think we're in the middle of earnings season, and i think this is a lot more important. i think the fed weighs as the heaviest piece of what's going

5:41 pm

to guide the market's next move. but i think what we had seen for the last couple weeks is, you are selling a rip. so, let's see what the market does tomorrow. i'm not -- i'm just not so sure. i think higher rates are not good for equities, and the fact there's been resilience up to 4.70, until there's not. shares of snap on the move the conference call under way. we'll bring you the latest next. why merck is moving higher, and bristol meier is sitting at five-year lows that's right after this.

5:42 pm

it's payback time. all these years, you've worked hard. you fixed it. you looked after it. maybe it's time for your home to start taking care of you? if you're 62 or older and own your home, a reverse mortgage can put more money in your pocket by eliminating your monthly mortgage payments, paying off higher-interest credit cards, and covering medical costs. you paid down the mortgage, invested in your home. i guess, you could say, your home owes you. just eliminating the mortgage payment freed up a lot of cash for us. the fact that we're still in this home, means so much. i get to go do what i want when i want. our customers' homes are taking care of them, maybe, your home could do the same for you. call aag and get your free info kit. call this number.

5:43 pm

5:44 pm

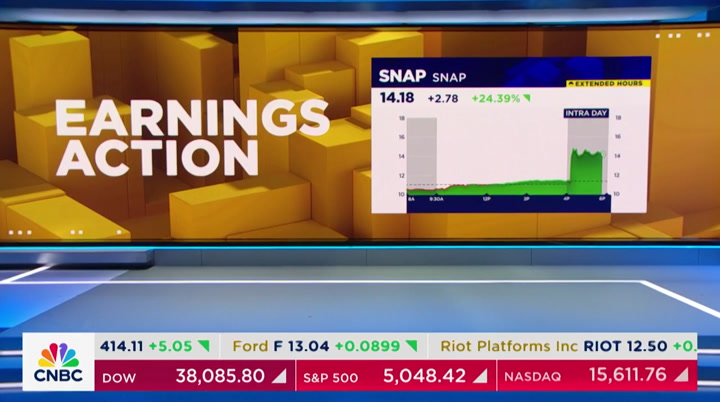

take your business to the next stage when you switch to shopify. welcome back to "fast money. we've got an earnings alert on snap shares are soaring afterhours on a surprise q-1 profit. the conference call just getting under way. julia boorstin is here with the latest >> yeah, those shares just soaring in a way we haven't seen snap shares move higher in the past two years, after earnings results. snap's ceo talking on the call, just moments ago, about how they've been working to accelerate and diversify their revenue growth, that is indeed working, with revenue growth accelerating in the quarter to

5:45 pm

21%. up from just 5% revenue growth in q-4 the company's second quarter guidance also ahead of expectations on every metric spiegel saying their a.i.-driven ad tools are growing to grow engagement and to ad revenue snap announced its subscription service hit 9 million subscribers, triple the number last year. that's driving revenue in this other revenue segment. that revenue up 194% in the quarter. plus, for the first time, snap gave its full year operating expense outlook between $2.43 billion and $2.53 billion, that indicates that spending on a.i. and infrastructure is stabilizing. i'll be talking about all of this and more with snap ceo evan spiegel coming up tomorrow morning in "money movers." back over to you >> julia, thank you. yeah, i mean, it's always up 20% or down 20%. >> flip a coin i have never seen anything like this i don't think it's a compliment,

5:46 pm

in terms of people being this far offsides in terms of their expectations what's most important for snap is not just that they beat in terms of the revenue number, 21% versus 13% expected. adjusted ebitda was expected to be down about $68 million and they came in up plus 45. the profitability is significantly different than people had expected, and this is something that is absolutely the driver here. >> interesting to hear them say that spending on a.i. in infrastructure is sort of stabilizing now, as the others, everybody else is ramping, which is a real contrast >> it's interesting what tim said you could drive a truck through their guidance, which is one of the reasons -- >> that's the problem. >> this is only in looking back. it makes sense that snap had this quarter, because the facebook quarter was really good so, actually makes sense that snap had a good quarter. if you start to connect the dots, the only thing that really hurt facebook was the spend. not that i connected those dots

5:47 pm

last night, bdoes no good tonight. with that said, arpu >> average revenue per ewer. >> a lot of things to like here. and their road to profitability is getting a lot closer. >> but the -- the whole tiktok headlines should have been a tailwind to snap we didn't see that happening so, just looking on a technical basis, if you go back to february, where it fell off a cliff from $17.50 all the way down to the lows, it's retraced more than half of that so, if you look at where it's trading post-close, look for that $17.50 and that's where you trade it is. hopefully it holds. meantime, tale of two pharma stocks merck and bristol myers head in opposite directions. bristol myers dropping to its lowest levels since 2019 after it reported a quarterly loss after an acquisition the company announcing it will lay off more than 2,200 employees as part of a plan to cut $1.5 billion by 2025 merck, meantime, gaining nearly

5:48 pm

3%, fueled by top and bottom line beat. strong full-year guidance and 20% year over year growth in its cancer drug keytruda investors are looking, or sifting through health care, really, and looking for the values >> and listen, keytruda up 20% year over year, that's huge. it's not a cheap stock, but it's by no means an expensive stock, especially when compared to eli lilly. i get it, they are in different businesses in terms of glp-1, understood, but when you're talking about merck, which trades at half the market cap of lilly, and does about $17 billion more revenue, $68 billion versus 51, you can understand why merck's rallying here >> and that's one of the major themes we've been watching we like health care, we like some of the broadening out of the rally, away from the glp-1 drug makers, so, i think that's what merck has shown here with keytruda and the 20% increase in sales year over year, so -- it's the market saying that there are other diseases and other conditions to treat, and we

5:49 pm

should continue to watch that. coming up, the picks are in, and that means it is time to grade the 2024 stock draft how does karen's lineup rate against the field? we'll dig into that, next. and here's a sneak peek at the cramer cam jim is chatting with the waste management ceo catch full interview at the top of the hour on "mad money. meanti, refa meyin two. liken" with social sentiment help you find and unlock opportunities in the market. e*trade from morgan stanley

5:51 pm

business. help you find and unlock opportunities in the market. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. (announcer) enough with the calorie counting, carb cutting, diet fatigue, and stress. just taking one golo release capsule with three balanced meals a day has been clinically proven to repair metabolism, optimize insulin levels, and balance the hormones that make weight loss easy. release works with your body, not against it, so you can put dieting behind you and go live your life. head to golo.com now to join the over 2 million people

5:52 pm

who have found the right way to lose weight and get healthier with golo. welcome back to "fast money. the picks for the 2024 cnbc stock draft are in new york liberty basketball star breanna stewart partnering with none other than our own karen finerman, their team money machines had the first pick in the draft this year. they took meta in the second round, they were hoping for warner brothers discovery, but kenny "the jet" smith got that stock first. so, they pivoted to draftkings so, karen, meta was the worst performer on the s&p 500 today, but that factored into why you picked that first. >> it did. it was a game-time decision, because going into today, that was not what was going to be our first pick, but given the dramatic response to the earnings, and, you know, i'm thinking that they deserve the benefit of the doubt, maybe this is our opportunity, let's take it >> tim was a color commentator today.

5:53 pm

>> how did he do >> he was already. but i was going to ask tim -- >> oh, no -- >> he was great, as usual. >> i think all right is good enough sometimes around here i thought karen did a great job. again, that stock draft is one of the great events in sports and markets all wrapped up into one. and karen had to do what happens and will happen tonight in the nfl draft. in your war room, you adjust on the fly, you try to trade up, maybe someone takes one of your picks, and i thought they did a great job. i mean, karen, we know, loves meta we know this is a company that on some weakness she would be buying more, so, that's what they did she's up 1% in the afterhours. in drafts of draftkings, instead of wbd, there are many people that thought that warner brothers is going lower and lower and lower. it's certainly been a broken stock, a broken company. kenny "the jet," i thought he did a great job today. he made a lot of sense he's betting where his career is, i mean, at the end of the day, this is a guy that's on

5:54 pm

tnt, doing a great job there >> he picked warner brothers >> so, i'm not surprised, but it was a little bit of gamesmanship, and i don't know whether he snuck in late into the contest so he could actually, you know, edge her out, we'll have to figure this out. there might be some controversial behind the scenes here >> a lot of allegations of wrongdoing and being conflicted and that stuff in this draft, so, it was very juicy. karen, in terms of the earnings tonight, you, of course, are an owner of alphabet, what did you make of this quarter >> very delighted to see this quarter. a little bit surprised, as well, certainly, you know, the big buy-back, that was nice, the dividend, that was interesting and good, but clearly it was just the underlying -- guy touched on it, the margin improvement. i've been watching you from the control room, which is really fun. i suggest you do it at least one time but a lot to like, and it's not surprising, given how meta talked about how much spend they were doing that the cloud providers that sell compute were going to have good quarters, so, makes sense. >> yeah, and in terms of microsoft, are they proving that

5:55 pm

they deserve this valuation? >> mostly-ish, yeah. i mean, it's interesting, though, the comparison of the pe multiple for google versus microsoft, still too wide in my opinion. >> all right were those your real -- i mean, were there other stocks on the board that you were thinking about picking? >> yes there was. tesla, for the turnaround story there. >> yeah. >> that was one of them that you kind of had to consider. and i think google, but it wasn't really high enough up there, and then sort of an outlier, first solar >> yeah. that's another sort of one of these battered stocks that could see a huge pop in the next year. karen, that was fun today. >> super fun >> i love doing it with th number one pick herself, breanna stewart. >> exactly that was very exciting >> go liberty. >> thanks, karen >> thanks. see you tomorrow. up next, final trades.

5:56 pm

5:58 pm

5:59 pm

well invested, well protected. another check on tonight's earnings still holding strong in terms of the gapes gains from microsoft d alphabet microsoft is up 5%, but we're still waiting the guidance, and that could be really key the company said that about 60% of fortune 500 companies now use co-pilot, and that it is seeing acceleration in the number of large azure deals. snap, by the way, is up 23%, and intel is struggling. time for the final trade tim seymour and guest? >> yeah, i have a friend here, evan, the son of our set super visor nancy, and it's family day at cnbc.

6:00 pm

he wanted to say gold fields for the win. >> good job, evan. >> kristen >> xle i think both in term office hedging geopolitics and inflation, as well as the free cash flow generation of these companies. >> steve >> meta. >> guy >> my man e.t. told me exxonmobil >> thanks for exxonmobil >> thanks for watching "fast." "mad money" starts right now my mission is simple to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere and i promise to help you find it. "mad money" starts now hey, i'm cramer. welcome to "mad money. welcome to cramerica other people want to make friends, i'm just trying to make you some money my job is not just to entertain but to educate and teach you to call me at 1-800-743-cnbc or tweet me @jimcramer. it takes a special kind of stock to do well when the economy's slowing. while inflation just won't quit.

20 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11