tv The Exchange CNBC April 25, 2024 1:00pm-2:00pm EDT

1:00 pm

dividend yield >> jim >> general motors. if you're in the stock, it's generating a lot of cash that will come back to us shareholders both in the form of dividends and buybacks >> interesting we heard in tesla and ford the markets are still lower, but at least off the session lows. we'll see what the rest of the afternoon holds. "the exchange" starts now. ♪ ♪ courtney, thank you very much welcome, everybody, to "the exchange." i'm tyler mathisen in for kelly evans. she'll be back in a couple of weeks. here's what's ahead. a tdp surprise and not a good one, the economy slowing but inflation stubborn we're hearing the words, stagflation, stocks are sinking, but two guests say it's not as bad as it seems. they're here to tell us why. meta down big amid weak revenue guidance and big ai spending plans so did that set the tone for

1:01 pm

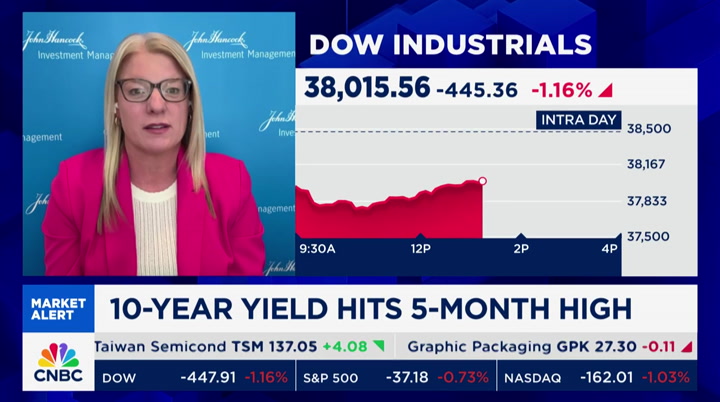

alphabet we'll talk about that. and that's one stock defying the selloff today. you're looking at it, up 6%. up 600% in a year. one of our guests called it a top pick so we invited the ceo to join us, and he will for an interview, just ahead. we begin with today's markets and the not so pleasant markets and dom chu. >> not so pleasant, but a lot more pleasant than they were a couple hours ago take a look right now. what we are seeing right now is the dow down about 1 to.25% the broader s&p 500 back above the 5,000 mark it was below that level earlier this morning we're off about three quarters of 1%. and the nasdaq, the epicenter of the downside, is down about 1% the nasdaq, 15,432 down 170 points to give you some perspective, at the lows of the session, the

1:02 pm

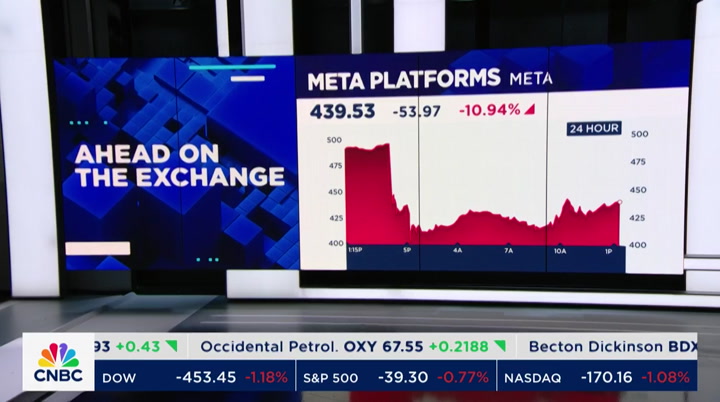

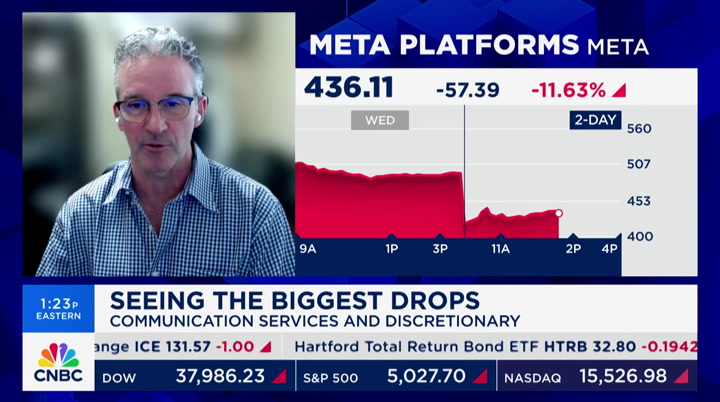

nasdaq was down almost 2.3%. now down 1%, so at least a dip buying at the time being let's take you to the epicenter trade, mega cap technology, the so-called magnificent seven type stocks the only one in the green so far today is nvidia. so microsoft, alphabet, amazon, all down roughly 2% or 3% or so. alphabet and microsoft report earnings after today's closing bell the epicenter spoke of the day is the meta platforms. down about 11%, was down 15% just a few hours ago meta platforms on the heels of that disappointing outlook but it's not all fear, uncertainty and doubt. tyler, take a look at these names. check out newmont corps, chipotle and union pacific

1:03 pm

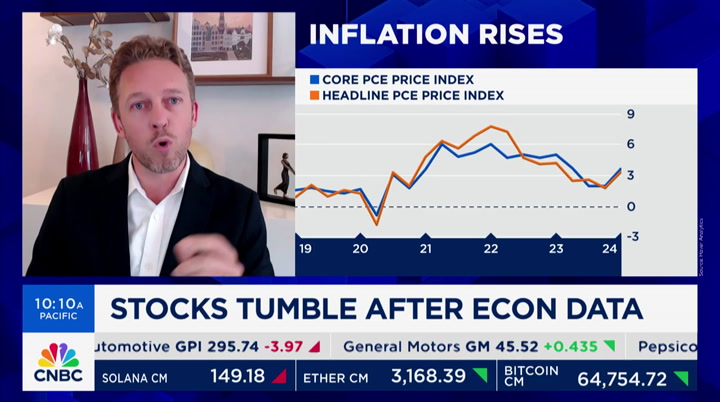

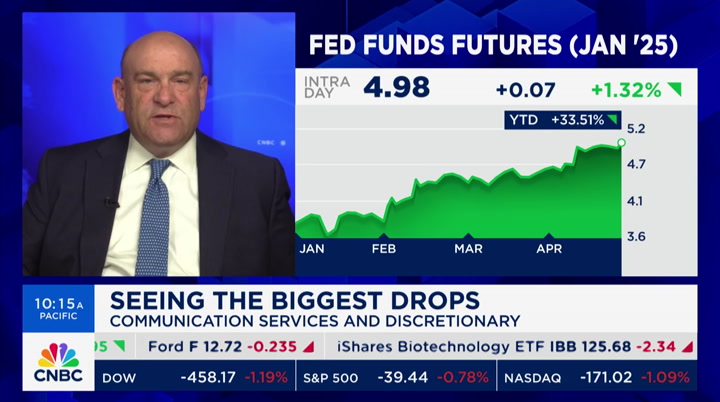

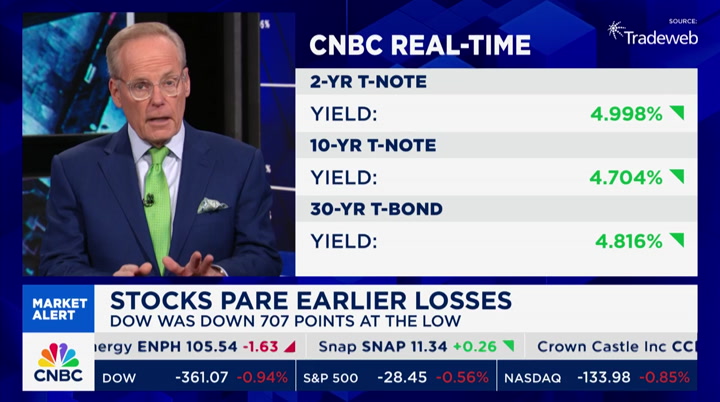

newmont on the gold trade, in the green. in an otherwise down take, tyler, some positivity to end things on. back over to you >> we're grateful to you for that, dom. thank you very much. yields on the move as well on the back of that gdp report with the two and ten-year hitting five-month highs let's check in with rick santelli for that. hi, rick >> indeed, warmer inflation, cooler growth. i can weigh in on these numbers and give you personal opinions where i think growth is going to go or inflation will be, but the numbers today were disappointing on growth, and they were warm on inflation, period. 1.6 is not 2.5% as expected and less than half the look at 3.4 consumption on the weak side the price index jumped from 1.6 to 3.1 what everyone was talking about was the core pce price index

1:04 pm

quarter over quarter metric that jumped from 2% to 3.7%, 0.3 hotter than expectations 1.7% hotter than the rear-view mirror it's hard to ignore those numbers. if you look at intraday of two-year note yields, you can see they jumped on the number. they moved all the way up to 5.0 to the high yield. but keep in mind, we have had a handful of violations of 5% on intraday basis, but we have yet to close above 5%. so we really want to watch that, especially if you're a technician that same level would equate to 4.67% in the tens, and it looks like we're going to close above that closing yields are the most important technically. it's like a roller coaster you can go up and down, but it's where you get on and get off that counts. and two-year note yields, clearly shows you what i'm talking about. we've been nudging against the 5% on a closing basis, haven't quite arrived at that spot yet

1:05 pm

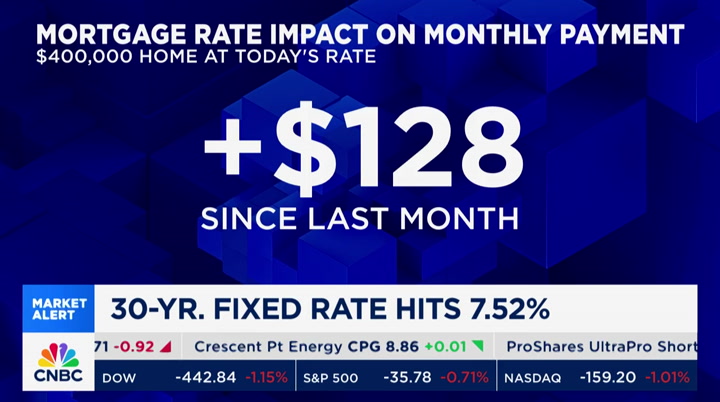

tyler? >> interesting metaphor, where you start and finish that matters. yields are spiking, sending the rate on the 30-year mortgage higher, too. and diana olick has the move >> yeah, the average rate took a big leap after that inflation data this morning. 7.52% is the new rate, according to mortgage news daily, the highest since early november april has been ugly to say the least. at the end of march, we were 6.91%. so what does that mean for buyers in the spring market today? say you're buying a $400,000 home right around the national median the monthly payment today is $128 more than it was just one month ago. that's if you have solid credit and are getting average rate even with small rate moves, some people on the margins will now no longer qualify for that mortgage consumers were clearly worried about rates that they would go higher we saw it in the pending home sales data for march rates were mixed in march below

1:06 pm

and above 7% but not this high. we saw sales pop over 3% higher, which was unexpected it may be because buyers wanted to get in before rates went higher smart move we are now seeing a larger share of home buyer supply for adjust about rate mortgages which can be fixed up to ten years still considered riskier loans home builder stocks had solid earnings last week not so much today. tileer >> how much do rising rates help the home builders in the sense that they have maybe more flexibility to come in with inducements, incentives for buyers >> well, it's the difference of how much does it help the builders or the stats? the stats don't like it, but the builders have the ability to buy down mortgage rates and are doing it to about 5.7% that incentive was really getting buyers in the door, and they reported much stronger than

1:07 pm

expected earnings, and they said they were seeing more traffic, although a tiny bit slow at the beginning of april so the builders, it puts them in a sweet spot sense there's so little existing supply >> diana, thank you very much. weaker than expected gdp data, hotter than expected inflation, raising concerns about stagflation and economic growth two of the next guests say the economy is not as bad as these numbers suggest. joining me now are my two guests, and cnbc senior economics reporter steve liesman with us. steve, how surprised were you that gdp growth came in only at 1.6%, down from 3.4% people thought it might slow up, but maybe not that much. >> yeah, it was dmaeefinitely a surprise when you dig a little deeper, you don't see the weakness that

1:08 pm

everybody is afraid of in fact, you may be getting just the weakness that you wanted if you were hoping for a soft landing. when you look at the gdp, you see that consumer spending did slow a bit you see there was actually a decent pop back in business spending that was a good number there but then look what happened with inventories and trades add those two bottom numbers on the left together. it took off 1.1% it was a big surprise on the inventories. ly tell you, tyler, the second quarter forecast was raised, because of an inventory build in the first quarter. now we have had two negatives in a row. that's not the problem i wouldn't be trade thing market down based upon the weak economic growth numbers. what i would be concerned about are the inflation numbers. that's where the big surprise is tomorrow, tyler, is a big morning where we look at the march pce report and the big question is going to be, was the overshoot in inflation in march or was it from upward revisions in january and february?

1:09 pm

that's going to be a big question tomorrow morning. >> let's move on now, because steve just mentioned it, greg. i want to get your take on inflation here, because i'm in a little bit of a hard time parsing out what you think compared with thenumbers the numbers were sort of, i guess, quarter over quarter higher than people expected. but you don't seem to think that inflation was as bad as those numbers seem to suggest. >> yeah, i certainly think that the stagflation narrative that's going on right now is misled we still haven economy that is quite robust so there is growth in the pipeline, so no growth is not really the question. with regards to inflation, i think steve highlighted the key factor that we have to look at in tomorrow's data, where we'll get the monthly data in terms of inflation. we'll have to see how much of that extra pop in the pce data in the first quarter was due to higher numbers in january and february let's not forget, january and

1:10 pm

february data was extremely noisy. i think there was very little signal in that data. we had some reset effects for internet crisis, for health care crisis, for utilities crisis, and then we had a pop in the financial services fees, which is a reflection of a strong stock market in the first quarter. those are not the types of inflationary concerns that i would have so we'll see how strong the march month over month print is for pc inflation based on first principles of an economy that's gently cooling, of more pricing sensitivity and less pricing power, we'll get more disinflation over the coming months and i'm not concerned about the pop we saw in the first quarter >> my notes from you say on the inflation front, price pressures eased modestly in q1, with headline inflation cooling year over year to 2.6%. that's not the headline number that everybody is talking about today.

1:11 pm

what's the difference? >> that is what happens when you look at data through different angles the pop that we saw in terms of the quarter over quarter annualized reading of 3.4% in the first quarter is just that, quarter over quarter we saw an acceleration in inflation. but if you look at the longer term trend, we're still on this disinflation trajectory. you have headline pce that is hovering around 2.5%, 2.6% in the first quarter. year over year, relative to what prices were last year, and you have core inflation that'sed to 2.9% both are record lows since q1 of 2021 that's the point which inflation took a turn for the worse. we're getting back to those more sustainable levels, closer to the fed's 2% rate. >> emily, let me get you to jump in here. it says in my notes, stocks are likely selling off because of the inflation element of the gdp report certainly smells of stagflation

1:12 pm

with weaker growth and hotter inflation. that's exactly the opposite, it seems to me, of what greg is saying >> yeah, and i think greg makes a great point, there is a twist to the story around stagflation. in addition to what greg mentioned, i would point to initial jobless claims coming in at 207,000 we look at an unemployment rate that remains below 4%, so the labor market are strong right now. the markets i think are spooked by the fact that it's taking a long time to get to the 2% inflation target from a market perspective, we are seeing a potential rotation play out into more cyclical areas of the market. energy and value stocks that were not caught up in that fed pivot momentum paid that resulted in massive multiple expansions on the technology side particularly. so investors should consider leaning into those areas of the market, because it looks like we're in a period where the path to inflation here is bumpy in terms of getting it back down.

1:13 pm

>> is the market, emily, overreacting to these numbers? >> potentially first of all, you know, when you get gdp reports, they don't usually move markets this month. it's a month-old report, heavily subject to revision. we'll find out what those are later. but i think markets are ultr sensitive to the inflation backdrop today so as the day has gone on and economists, great economists like greg and others have really dug in the numbers, it turns out that growth isn't all that bad i think the challenge now is how the market is going to digest this new environment where cuts are being taken out. and that's really the challenge, as bonds go up, yields, stocks fall those correlations increase. where are investors to turn in this difficult macro backdrop? >> so steve, tie this all up for us, make a little reference to consumer spending, 2.5%, which was slower than the previous quarter. but also the idea of why this

1:14 pm

puts the fed, because on the one hand, you have a maybe slower than anticipated economy, which would argue for maybe more -- a stimulative approach on the part of the fed and on the other hand, you have potentially, though greg disputes this a bit, a higher inflation number, which would say you have to stay higher for longer >> yeah. so tyler, guys in the back, we have a chart on real domestic final purchases, that should ease concerns about the growth number this number takes out -- there it is. it's hard to see in that right hand most number or bar there a dramatic slowing of the economy. what you see there is an easing, really from two quarters before it that were the hot numbers that were much more than expected this, without those two hot numbers, would be a pretty good result so i think you look at that, and that should ease your concern. that looks at the core of the

1:15 pm

economy, the business and consumer spending side they're okay, and i would not be surprised or displeased to see them cool a bit more to get down and relieve some of the inflationary pressure. as for the fed, i think story is they'll wait and watch this. they will beinterested in how these numbers, as greg said, parse out tomorrow do we have a january/february inflation problem, or is this also a march problem that's something the fed will want to see. but right now they're dug in with this idea that they have the right rate to bring inflation down i don't think they feel as a committee they need to twogo hie here so this means higher for longer and rate cuts are probably into the fall at this point there's still a july possibility if we get some really good numbers, and greg is right, that we had a lot of noise in the beginning of the year. but it's higher for longer, later rate cuts. but i think cuts are still a

1:16 pm

possibility here is what we are seeing is a lot of noise at the beginning of the year. >> greg, i'm going to give you the last word. >> steve is right. we have to look at the jub underlying pace of growth. emily pointed out the fact that the labor market is the key pillar of economic activity. that's still sustained but we are still seeing evidence we are moving in the right direction of disinflation. policymakers will be much more cautious as we are as economists because they're working on a policy play by play type of approach, which is risky in this environment. but they're likely to err on the side of caution and delay rate cuts until they are sure inflation will not reaccelerate. i don't think it will. >> greg, thank you very much emily, steve liesman, appreciate it coming up, our next guest says he didn't get what he expected from meta's earnings, but he's still a buyer he'll tell us why and where he

1:17 pm

expects the stock to go. and there's one ai stock up 600% over the past year, and no, it's not nvidia we'll reveal the under the radar name powering higher despite the selloff. we mentioned it yesterday, that's your big hint and let's take a look at rubrik. shares up 21% in its pub llic debut. we'll be right back. and when i got there, they have the sushi- this is clem. like sushi classy- clem's not a morning person. i'm tasting it- or a night person. or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace. you need clem. clem needs benefits. work with principal so we can help you help clem with a retirement and benefits plan

1:18 pm

that's right for him. i'm short but i'm... i'm confident. you know? let our expertise round out yours. you've got xfinity wifi at home. i'm take it on the goi'm with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile!

1:20 pm

dow down 450 and basically stable at that level, at least for the time being meantime, meta beat on the top and bottom lines this morning. that's good. but with shares down more than 10%, somethings that investors worried, and we kind of know what it is our next guest held his buy rating but says today's report was a bad recipe for meta. joining us now is rob sanderson. rob, thank you for being with us today. what was the nit to pick in meta's report today? >> it's the commentary on spending outlook a rare move for meta to raise

1:21 pm

their operating expense guidance they brought the low end up, and they're spending -- trying to spend another $3 to $5 billion in cap x so there's a big spending cycle, you know, this is not a new message per se they've been talking about elevated spending levels for some time. the difference is that, you know, the company was putting up material upside and raising guidance the past several quarters, and the bad recipe is higher expenses on only endline result and that's the correction we are seeing today. >> this is kind of a theoretical question should or shouldn't the market look at this as a vote of confidence in what meta is pursuing and doing, and something that, in the long-term, is going to pay big dividends for the company, even if in the short term it means that it calls into question profitability forecasts for the next four, five quarters

1:22 pm

>> that would certainly be the bullish lens for long-term investors to look through. don't forget, the company is spending about one quarter of their profits on reality labs and this vision could build up the metaverse. so that's not a message that's been too favorable with investors. and here we have another potentially large spending category that really is theoretical with a lot of excitement and promise but there's not a lot of, you know, roi, or ways to justify, you know, at this point what this might look like over time >> when you look at -- let's set aside these very pointed and seemingly reasonable concerns about meta and you look at the current operating business how do you evaluate that and their advertising? and the fact that they seem to be not a stealth winner, but simply a big player in the world of ai? >> yeah, the core business is

1:23 pm

very impressive, tyler to grow 27% at the levels of advertising revenue they're doing is unprecedented google is growing at half this rate or so when they were at comparable levels of scale so it's very impressive. they've done a fantastic job of utilizing technology, and ai is a big part of the story as to how they're getting better content ranking and relevance and ad matching and tools for advertisers. a lot of the stuff that's really working iscreating value that's why we're seeing a pretty sharp acceleration in the topline growth over the past several quarters it's a very positive story there. you know, the longer term on the ai, whether they're a winner or not, they look better positioned than others. google being the core example, where the jury is sort of out as the consequence of ai and interactive with all these agents might have on the search

1:24 pm

business but for meta, this looks like powerful technology that can enhance their value proposition without a lot of downside risk >> let's note for the record you have a buy rating and a price target of $555 alphabet, what are you looking for in its report? >> i think we're going the see stability in the search market is the biggest point that investors are looking for. the reits on search advertising look healthy this quarter. we're expecting a deceleration in youtube, just coming off a strong nfl cycle in the fourth quarter. we have a lot fewer games in the first quarter, so that's natural there. the questions are going to be, again, on spending outlook and their ai strategy. they've had some product wonders obviously, well publicized on the gemini launch. you know, investors are certainly going to be interested

1:25 pm

in management's view in correcting the course here and bringing better technology to market >> rob, thank you very much for your time today. we appreciate your analysis of meta and google, as well, or alphabet as well thank you so much, rob >> thank you the market may not like meta's cap x bump, but the move has implications for adjacent names. christina has more on that >> the bump in meta's capital expenditure in 2024 would further increase in 2025 obviously has investors worried. you talk t about mobtnetizing a, but this bodes well for hardware names. we start with nvidia zuckerberg posted on instagram in january it would have roughly 350,000 chips by the year end. this week also elon musk said that tesla's currently using about 3500 h-100 chips that's almost at that 40,000

1:26 pm

mark with clients adding another 50,000 by year end all of that means money in the pocket of the ceo of nvidia. tesla and meta are indicative of strong demand for ai servers as of q4 last year, meta was about to be a 10% contributor to total revenues, so shares are up over 4%. and then arista networks, contributing 21% of 2023 revenue. so meta is spending on arista. the shares are also up and then pure storage, storage for data centers they had a 10% customer in 2023. that's assumed to be meta. and then broadcom and meta work closely together on custom networking chips and lastly, meta promised to use amd's new mi-300 chip, they were discussing this at amd's last

1:27 pm

event, which is a competitor to nvidia, which could also bode well >> a lot of spending on that infrastructure we'll have a lot more coverage of today's selloff ahead. let's get some show and tell, where we show you a chart and tell the story shares of southwest airlines down 9% after posting a wider than expected loss in the first quarter. ceo bob jordan saying earlier that the company has a lot of work to do to get back on track. we had a strong first quarter, despite the financial results. we had record operating revenues, record passengers, record member adds but we have a number of markets in the -- across our network that are just not performing so we're taking action and further optimizing, we're cutting four cities, and we're

1:31 pm

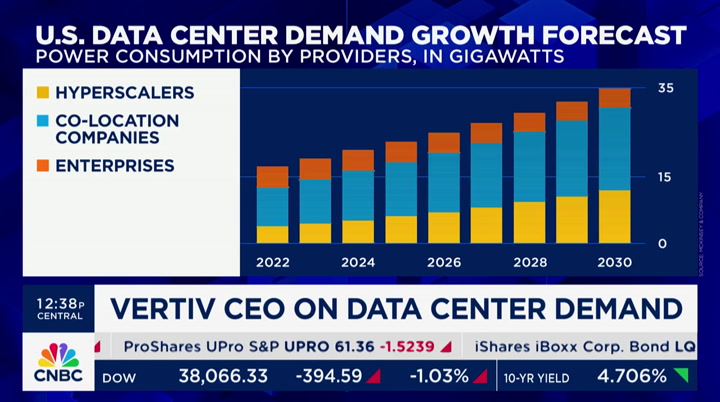

the dow 707 points, it's come back by about half of that to 439, or a 1.1% decline here's some of the movers this hour caterpillar, one of the biggest drags today. the equipment manufacturer crushed but light sales sent the stock plummeting victoria's secret with a sale rating with competitive pressure shares are down nearly 4%. and on the flipside, you have your chipotle, up 6%, topping estimates. 7% rise in same-store sales. that one just can't be stopped it is up above $3,000 a share. coming up, vertiv is one of the companies that should benefit on aggressive spending on ai infrastructure that is a bright spot today, up

1:32 pm

8% the ceo joins us live and exclusively next when "the exchange" returns in two minutes. (traffic noises) (♪♪) the road to opportunity. is often the road overlooked. (♪♪) at enterprise mobility, we guide companies to unique solutions, from our team of mobility experts. because we believe the more ways we all have to move forward. the further we'll all go.

1:33 pm

hey you, with the small business... ...whoa... you've got all kinds of bright ideas, that your customers need to know about. constant contact makes it easy. with everything from managing your social posts, and events, to email and sms marketing. constant contact delivers all the tools you need to help your business grow. get started today at constantcontact.com constant contact. helping the small stand tall.

1:35 pm

welcome back, everybody. vertiv holdings, a maker of cooling systems for data systems, up 7% today after beating on the top and bottom lines for the first quarter. shares on a monster run over the past year, up more than 640%, thanks to the ai boom. joining us now in an exclusive on "the exchange" is vertiv's ceo giordano albertazzi. welcome. good to have you with us and congratulations on the numbers you reported yesterday those numbers were very strong you're a kind of quiet player behind the scenes in this ai boom explain what you do and why your company is so central to what's happening in ai. >> well, first of all, thank you for having me today here what we do is we power and cool

1:36 pm

the world's data so every -- behind everything we see digital, there is a data center indeed, there is a myriad of data centers around the world where everything digital is created. we have servers, there are servers in those data centers that require power and that require cooling, because they generate a lot of heat everything from the grid to the chip, power transmission and power distribution, power management is something that we do as well as the thermo chain that manages the heat that is created. so without us being able to cool it on the power side, without people like us, without us, the data center would not exist. >> so let me ask you an elementary school question, why is data so hot why does it get so hot

1:37 pm

>> that's simply because you have a lot of power going into chips and other electronic components, and that is the power needed to compute. and when chips compute and other electronic components work, that generates heat >> and then another elementary school question for someone who doesn't understand this, like me, would be, okay, so you have a data center with all of these hot servers that are generating electricity with chips and they're generating heat, why can't you just throw more tonnage of hvac into the equation, more air conditioning? i assume what you do is far, far more complex and involved than just blowing cold air into a building >> it is more complex than that, indeed but it is the entire end-to-end cooling and thermal management but what happens in -- what is

1:38 pm

happening with the i.t. change, the ai acceleration, the artificial intelligence is a transition from traditional cpu based servers to gpu, which have a much higher density. and that density makes them more faster, it makes them faster and more suitable for ai >> yeah. >> but that generates more heat, and it's more difficult than to extract that heat and to handle it that's where we come to play and everything that is then downstream from that getting that heat. >> so vertiv, you've had an incredible run, 600% gain in the stock market of the past year. let me ask you two questions when you hear a report like today's from meta, or was it yesterday? saying we're going to be investing heavily in data centers, does your pulse quicken?

1:39 pm

>> we have been in the data center industry doing power and thermal for multiple decades, and we are very, very close to all the big players, and every player in the market so we have a very strong and clear view of what's going on. so clearly, this part of an acceleration of the data center that we very strongly participate in, and yes, when that news comes out, it reinforces our view of the market >> so let me conclude with a question that i know all ceos hate to answer, but i'm going to ask it any way, revenue guidance for the year was $7.54 to $7.69 billion. that's for your fiscal year this year how big do you think this company can be in terms of revenues in five years >> we have given that last investor day in november an indication of growth between 8% to 11% in the next few years

1:40 pm

and that's based on a certain evolution of the market that we serve, and ai. so we believe that's still a very good projection for us. let's see what the acceleration will be. >> 11% over five years would be close to a doubling, if my math serves me right. thank you so much for your time today and explaining some concepts this elementary school student didn't understand. >> thank you very much still ahead, meta dragging down tech today. it has been a real topic dejour, shaving more than 100 points off the nasdaq 100 pinterest also lower we'll hear from a trader that says the big tech week pricing hasn't even started yet. at wn hexcngth'she"t ehae" returns. it's basically tennis for babies, but for adults. it should be called wiffle tennis. pickle! yeah, aw! whoo!

1:41 pm

♪♪ these guys are intense. we got nothing to worry about. with e*trade from morgan stanley, we're ready for whatever gets served up. dude, you gotta work on your trash talk. i'd rather work on saving for retirement. or college, since you like to get schooled. that's a pretty good burn, right? got him. good game. thanks for coming to our clinic, first one's free. with gold and copper prices pushing towards all-time highs, thanks for coming u.s. gold corp is advancing its environmentally friendly gold and copper mining project and creating american jobs in mining friendly wyoming. with a proven management team and board, a tight share structure, and a solid cash balance, u.s. gold's portfolio of world-class assets are creating american growth and homegrown strategic metals as the us moves towards an electrified future. u.s. gold corp. to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets.

1:42 pm

1:44 pm

welcome back to "the exchange," everybody stocks lower on a double whammy of disappointing data and earnings, but pairing losses right now, dow down just 364 that makes it kind of a down day, but a rather more routine one than we saw earlier in the day. the s&p 500 off about a half of a percent. and the nasdaq down -- i'm going to have to come over here, down 0.86%. breanna, can you see that? yields not touching levels since last move. the two-year back above 5% briefly, while the ten-year hovers at a little more than 4.7, raising mortgage rates, as well coming up, just about 15 minutes away from the start of this year's stock draft nine new competitors facing off against the depending champ, the wwe superstar charlotte claire this year's number one pick goes to wnba two-time mvp breanna stewart, one half of money

1:45 pm

machines and here is with strategy you're working with karen finerman, a member of our team have you guys talked about strategy going in? >> we have talked, and i'm not sharing anything >> not anything? >> huh-huh >> the history of these contests is you have to swing for the fences, you have to go for one that's going -- last year's big one was nvidia this year, who knows >> we're going to go big with both of our picks. >> do you have the first pick in this draft, do you do a lot of investing on your own? do you someone that help use with it? >> not on my own i have a financial team that helps me, but something that i'm interested in, so it's cool to be here and be on the other side of it a little bit >> we're going to have some someone. i'm thrilled to have you here, with all that's happening in women's sports, women's basketball, and you're a big part of it welcome to new york by the way this is your second year here. we're getting excited about the draft. "the exchange" will be right back

1:46 pm

1:47 pm

1:48 pm

my metabolism has fired up. i have a trust in golo 'cause i know it works. golo isn't like every other program out there, and i'm living proof of it. (announcer) change your life at golo.com. that's golo.com. welcome back stocks retreating from their lows after the dow fell more than 700 points as data and

1:49 pm

earnings wayeigh on the index. according to our next guest, he says the big tech repricing hasn't transpired yet. joining us now is a ceo and cnbc distributor. jeff, great to see you is today, in light of what meta did, in light of ibm, take apart -- set aside for now caterpillar, is today a transformational day, a day of demarcation in some sense? >> i think it is it depends on what lens you're looking through, but when you talk about your nfl draft or the stock draft, there's more than one round. so we are just in the first round. if you look at nvidia or metapmeta, for example, there's 484 different etfs that own nvidia vti, as well as sma, they have over 200 million shares of

1:50 pm

nvidia just in those two etfs. so it's fascinating we had three weeks of volatility. and the vix is under 20, so there hasn't been panic the market but when you see some relal bansing here, ty, and you see some gaps on the chart, which is going to happen in nvidia, down to $680, even to 68, down to 400 in meta, that's the price i'm talking about. i'm coming up for air. in the bigger picture, we're seeing the s&p 500 only down 4%, and you saw that bounce once again today. >> let's talk about the fact you have some improvement in the major indexes over the last couple hours does that tell you anything? >> it does it speaks to the volumes that there's so much cash on the sideline one thing it doesn't tell me, the rates, the ten-year note, i cut my teeth in the business trading 30-year and ten-year futures in chicago at 4.7%, there's been a lag effect, almost a dislocation

1:51 pm

i think this bounceback could be a little misguided dow to the fact we're just moving money oh, facebook is going to spend $5 billion more on ai? all that goes into chips purchases. you know and i know that's not true there's people involved, buildings involved, a variety of expenses that go to that cap-exfor facebook or meta when you see intel up 1.5%, amd up 1.5%, this is an opportunity to put more protection i own puts at some moment in time as we get further down, i will be selling puts to add to exposure. right now, i'm a little apprehensive and using the bond market to get rid of the apprehension >> what looked like it could have been not a catastrophic day -- >> a disaster. >> now it's looking really rather more like a pretty routine run of the mill day. where -- go ahead. >> that's right. we're conditioned to that. we buy this dip. i think going back to the last

1:52 pm

ten years we have been conditioned to buy the dip i think it's very normal you see a 10% correction every year or so you see 3%, 4%, 5% corrections i think this correction in the process, the way we look at markets, everything is so exaggerated. the reaction to facebook, exaggerated. the movement higher in the last five months, s&p 500 being up 25%, exaggerated i think we have to be calm, be resolute, but understand the market has the ability to move lower as the vix potentially goes above 25. >> we would wish you were here today because i know some people you know or admire are here. eddie george, great running back >> he's the best >> great guy and austin ekeler of the nfl, now with the commanders. they'll join us for the stock draft. jeff, thanks very much >> that does it for the exchange the stock draft is up next you know the music that can mean only one thing melissa lee making the annual appearance for the stock draft

1:53 pm

e'alstbe ready to go shs mo on the clock. we'll be right back. things that work better together. like your workplace benefits and retirement savings. presentation looks great. thanks! thanks! voya provides tools that help you make the right investment and benefit choices so you can reach today's financial goals. that one! and look forward, to a more confident future. that is one dynamic duo. voya, well planned, well invested, well protected.

1:54 pm

ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com.

1:55 pm

1:56 pm

by melissa lee glad to have you in the house and thrilled to have our teams back in the building with us >> a strong sell-off today, well off the session lows dow is down by .8% s&p 500 is down by less than a percent. a number of sectors trying to make comebacks including information technology as well as materials and utilities >> this type of market action, by the way, is exactly what stock pickers kind of look for a little bit of a blow off, a retreat in prices. getting high value names maybe at a cheaper price than they have been in recent times. that's exac late what we're going to do today. our participants have done their research, picked their names, and tim seymour will be here to br help us break down the stocks. four competitors also in the studio starting with the defending champion, charlotte flair, brianna stewart is here and getting assistant from karen finerman

1:57 pm

leiv shulman is here, along with heisman winner eddie george, and joining us remotely, another great running back, austin ekeler, now with the washington commanders, the team i grew up with kenny the jet smith from inside the nba as well as ose pearlman, joey chestnut, he eats more hotdogs in one sitting than jillmj jillian michaels has had in her entire life. we're excited about this next contestant and comedian, drewsky. it's take your kids to work day, and we have many young fans here, and they love drewsky. >> and as we mentioned with us here on set for the entire show to help us break down the top picks here, tim seymour, but before we can draft, we have to set the stage because the markets are having a big down day. one-two punch for the markets. >> and a combination of that along with higher rates which at some point, there's that day when equities respond.

1:58 pm

i think we're in the middle of the busiest part of earnings season we have the most important companies in terms of market cap, the leadership they meant to this market last night, meta didn't do them solid. if you think about what we have coming tonight microsoft arguably is the one that sets the tone, the balance across ai, software, and the broader tech space >> and microsoft and alphabet, which are going to report tonight, they're down and trying to come off session lows, so what do you think we're looking for tonight as they're also on the board for being picked >> it's fascinating how investors are thinking about this sector now. in a time of rising environments, sometimes mega cap tech is defensive. you get growth, you get it at a reasonable price i think in the case of microsoft, this has certainly been one of the front runners in the ai space in terms of those benefitting now. microsoft in terms of azure and as goes azure and the greowth

1:59 pm

side of this business is going to set the tone for tonight. >> let's get to the draft. before we begin, we want to get to dom chu for a quick reminder of how it works. >> the draft will consist of ten teams picking a total of two stocks over two different rounds now, there are 60 assets on the board. that is 57 stocks alongside three interesting plays. commodity wise you have oil, gold, and bitcoin as well. maybe you want to take your big tech staples like meta or apple or microsoft many of those names very much in play now, if ai is your game, we're not talking allen iverson, we're talking artificial intelligence. nvidia had a huge gain over the past couple years but who knows if it has more room to run or if you want something with more risk, maybe a recent hot ipo like reddit, those shares up 20% or so. they have been volatile. whatever they choose, the team

2:00 pm

will be the best average appreciation, that's their performance, between closing today and the friday right before next year's super bowl on february 7th, 2025 that contestant will be crowned the 2024 stock draft champion. ty, melissa, tim, that's the state of play, the rules of engagement >> it's time now to get things started with -- there's the sound. the first overall pick in the 2024 cnbc stock draft, for that, we go over to brianna stewart of the new york liberty along with her stock picking partner, karen finerman fast money trader. brianna, what do the money machines take with the first pick >> i feel like i should have an envelope here. with the first pick we're selecting meta it's an easy choice for us, and when there's a player like mark zuckerberg out there, we want him on our team. >> all right, karen, wha

37 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11