tv Squawk Box CNBC April 25, 2024 6:00am-9:00am EDT

6:00 am

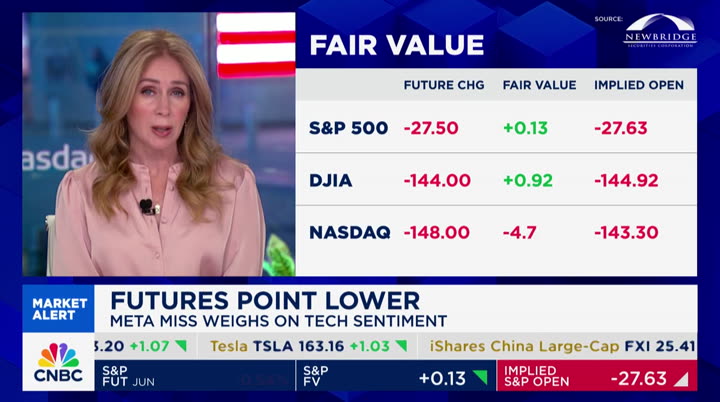

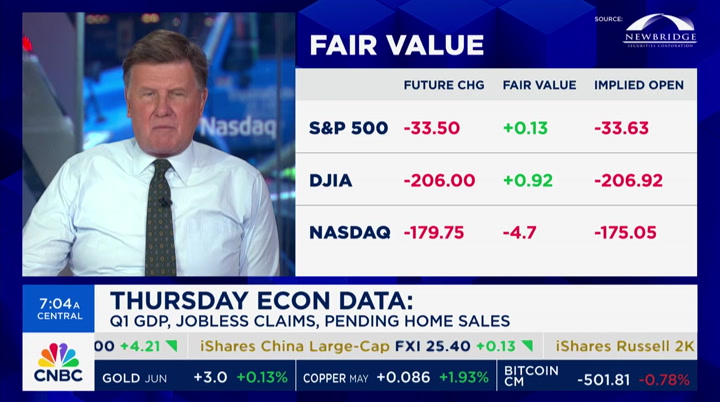

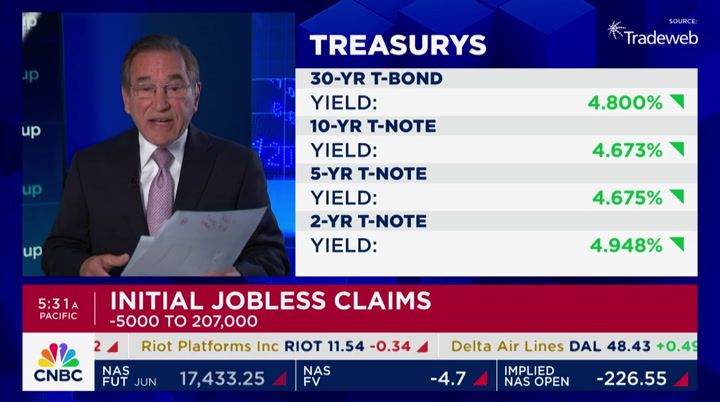

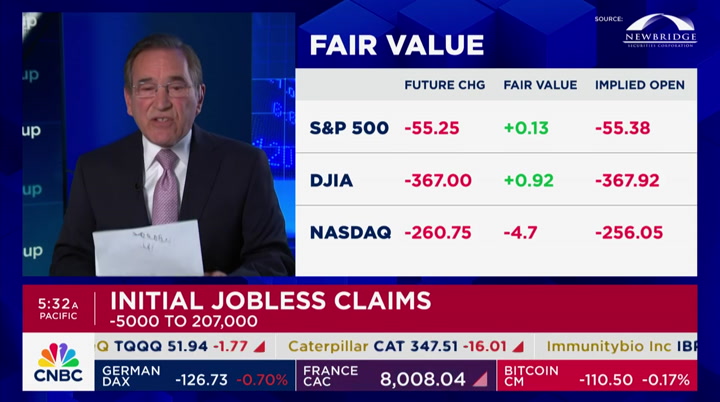

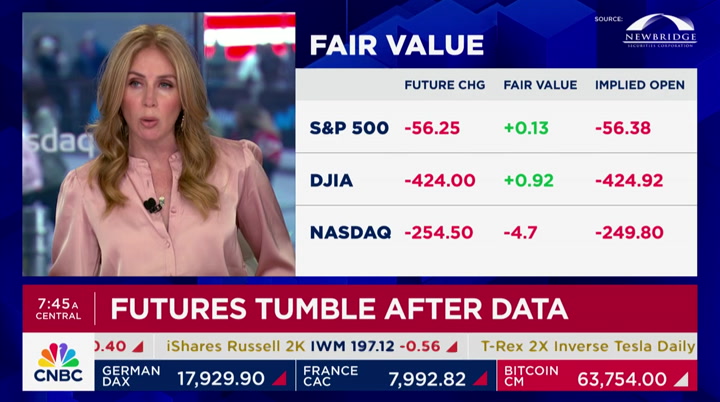

"squawk box" begins right now. good morning welcome to "squawk box" here on cnbc we are live from the nasdaq market site in times square. i'm becky quick along with joe kernen and andrew ross sorkin. let's take a look at what is happening with the u.s. equities there is pressure taking place this morning after earnings reports that disappointed last night. right now, you see the dow off 145 points s&p futures tdown 27. nasdaq down 145. a lot of that from meta. we will talk about that in a moment we have a slate of companies reporting this morning we will get you the numbers. the ten-year yield is 4.64

6:01 am

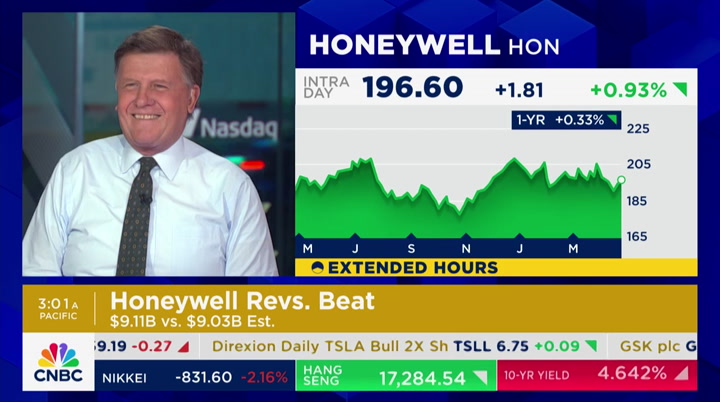

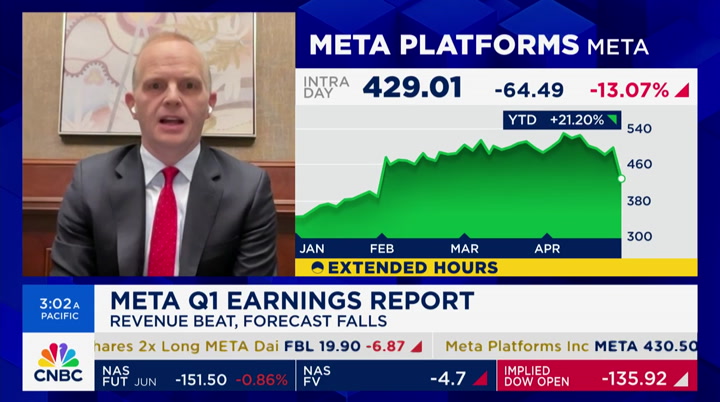

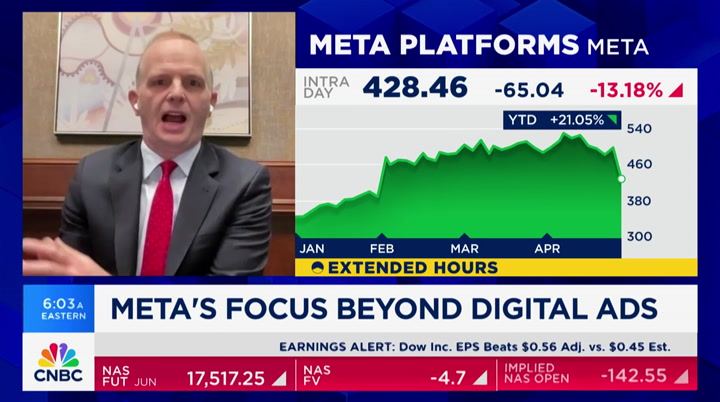

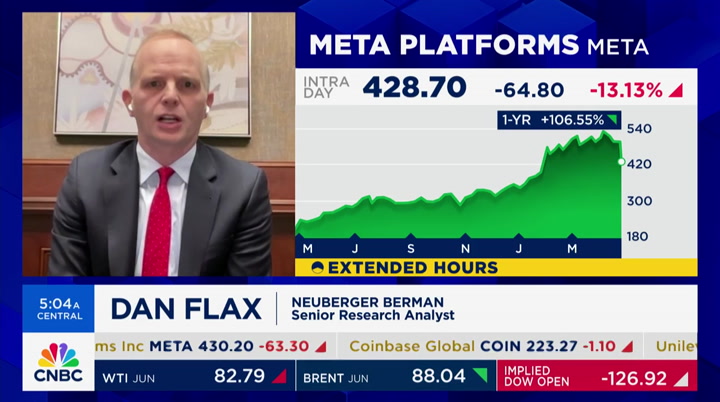

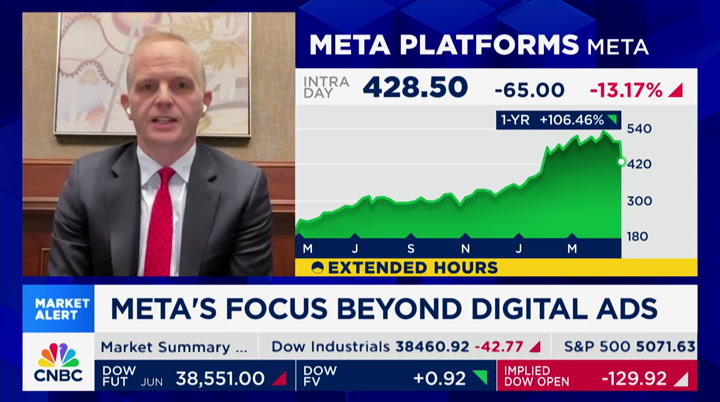

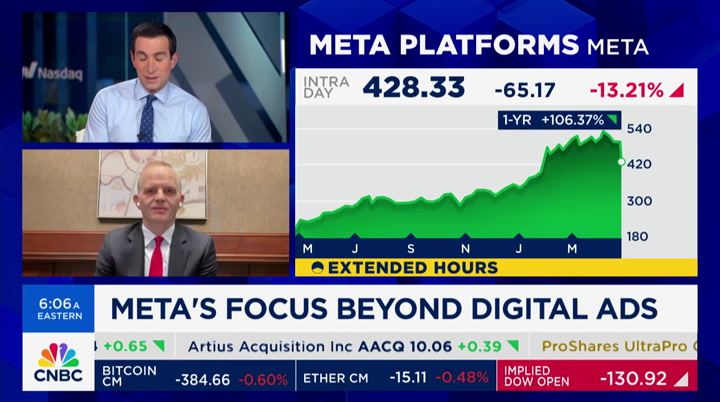

the two-year yield at 4.22 joe. honeywell is out with the first quarter profit of $2.25 a share. revenue $9.11 billion. the forecast was $9.03 billion a little bit better than expected look at -- let's get to meta he did not change it to a.i. they are still spending more on the metaverse or part of the a.i. spending? who are they who are you? >> it is part of the metaverse shares of meta plummeted after the company issued a light forecast is overshadowed what was better than expected first quarter results. i want to bring in dan flax. it was a fascinating call. in many ways, mark zuckerberg called it. a lot of volatility around the stock in what he calls these

6:02 am

type of periods when they invest in this stuff. the question is whether investors and like them investing in this stuff, dan, and the market spoke last night. we have seen this movie before, perhaps. >> good morning, andrew. we have seen this movie before with the transition to stories they have done well with reels in the last 24 months. what we see in a.i. makes sense from the investment standpoint it will take time to monetize and revenue growth while strong and moderate over the course of the year it is the right strategy they are laying the foundation for future growth and we have to see how the next several months and 2025 play out. >> is this a different perspective that you have than you might have had or other investors had two or three years ago when they were investing heavily in what was described as the met thhametaverse >> a.i. and investments they are

6:03 am

making in the data centers is one example are a little bit different. if i contrast it with the metaverse and devices, the devices are really about trying to build products and build a new platform beyond the mobile era where apple and googlioglha been dominant. this is delivering a riecher experience for users as it were to get more functionality. on the other side with advertisers as well. that is directly related to their core business and i think it makes sense of course, there are elements of a.i. in the metaverse. metaverse will take much longer to build out >> a lot of what i think mark is trying to do here is to, as you said, create a platform that isn't reliant on android or apple, but the question is can effect toively take control of t

6:04 am

back so much of what they're doing has to work effectively on top of these other platforms >> i think in the future he is still and meta is still going to need to build and be successful on top of other platforms. if they are able to did o that, though, and the track record is strong on their platform with the users and advertisers to create value they had success with small and medium businesses globally i expect that to continue. that is how the technology industry and broader ecosystem works. >> dan, i guess part of the question people have is you can see the real base case and reasons that microsoft is doing this spending because there's a huge potential market and huge market for use cases when it comes to business.

6:05 am

use case is when it comes to the consumer are a little harder to find your way around at least ones you can monetize and maybe they need to lay that out more i do realize when it comes to advertising and what they have been able to deploy is advertising which outshines competitors. it may be a tough case with the monetizing >> i think for the consumer and the distinction you make, becky, is correct in terms of the enterprise you can invest we will see with microsoft and azure tonight. it is generating quantifiable revenue. with meta, it will take time it will manifest in a different way. you will see user metrics continue to remain healthy you will see more and more engagement with video and more

6:06 am

immersive experiences. the ability to tease out exactly how it is being monetized with the generative a.i. will be tougher. i think the end result will be a healthy user base and durable growth for the advertising business again, it will take a little bit of time. >> finally, when do you think there will be advertising built into all this? on the engagement with llama in the past two weeks built into instagram and facebook, i'm playing with it more i'm genuinely -- i don't think everybody is doing that. >> you think it will be in six months >> i do. >> you are good at early adoption and using it. >> i think what will happen is more people will use it to create generative images of their families they will edit videos. i think it will keep you in this in a way and that is part of the goal, dan, to keep you on the

6:07 am

platform the question is, is this cokeepn you on the platform or new ways to sell advertising. i have meta glasses. when will they feed me advertising? that is interesting from the revenue perspective. >> i think on the glasses, andrew, it will take a few years for them to infuse significant advertising there because the user experience has along way to go to mature with glasses and those devices to optics. it needs to get better on the core business, i expect in the coming months and next year, generative a.i. to tr contribute to the user experience and they are building tools to help monetize which drives revenue for facebook. >> dan, thank you. >> thank you ibm shares are lower this morning. the company reported earnings of $1.68 a share. that was 8 cents better.

6:08 am

revenue lower than expected and the software revenue and ck consulting revenue below expectations the company announced it is acquiring hashi corp for $35 a share. the deal had been rumored since tuesday. i think the stock is doing better if it was hashishcorp we need to give more color than what we have i read your story. can we talk about it at the end? >> sure. let's tell everybody the immediate news ford shares are higher this morning after earnings of 49 cents a share which beat estimates of 42 cents. revenue lighter than expected. sales of trucks offset losses in the electric vehicle segment the company maintained gooid an guidance and the capital spending on the electric vehicles is that what you want to dig

6:09 am

into >> it is up a little the notion is they didn't do worse than what was possible in ev losses. the ev loss for the quarter was $1.3 billion operating loss they sold 10,000 evs do the math. for every ev the company sells, it is losing $130,000. it is not getting fafarley said is not there >> the losses in the ev unit with the $1.3 billion here the company still has huge profits from big f-150 gas guzzlers bizarre. >> it's what we have seen. >> he said it will be profitable soon i don't know how

6:10 am

i think at one point, one of the guys at ford said watch out, elon we're coming they said that not too long ago. we're coming, but losing $130,000 for every single person who walks off the lot. the dozens of people who are buying. >> if you have $10,000 in sales, it is not profitable it could be down the road. they are doing what meta did after the metaverse spending and say we are reining things in >> besides the f-150, your favorite thing hybrids. that offsets the weakness in the ev you know what i look forward to every day? >> what? >> the squawk planner. it is a highlight for so many viewers who are marking

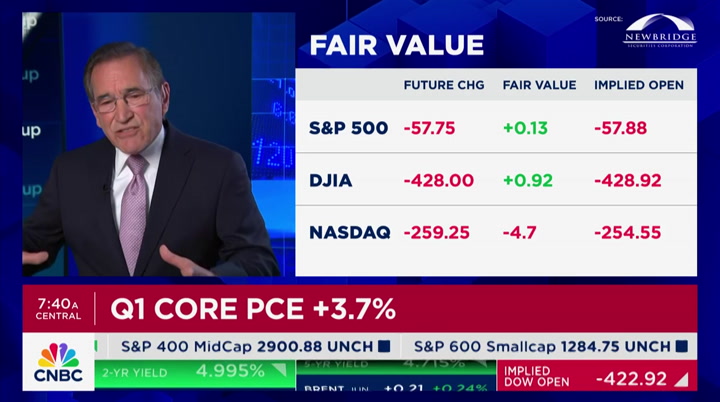

6:11 am

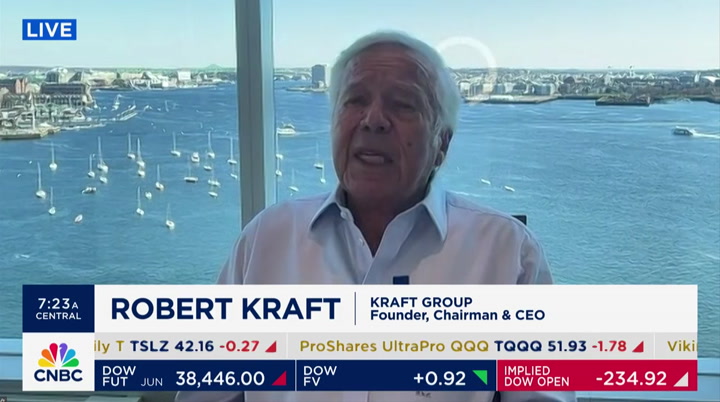

their calendar look at the data here is the key economic data we are getting. weekly jobless claims is coming up the first read on gdp in the first quarter all at 8:30. the number to beat is growth rate of 2.4% that would be down from 3.4% in the prior quarter. on the earnings calendar, we hear from caterpillar and merck and comcast. after the closing bell, we hear from alphabet and microsoft and intel. coming up, the protests expanding on college campuses. house speaker mike johnson is threatening to pull federal funding. those details are next. huge lineup ahead. including long time tesla investor ron baron and robert

6:12 am

kraft. he is talking about something much more important than the patriots some people think there is nothing more important than the patriots this is important. bob's efforts here. ftc chair lieina khanill we with us. "squawk box" will be right back. >> announcer: this cnbc program is sponsored by baird. visit bairddifference.com. at mor anley, old school hard work meets bold new thinking. (laughter) at 88 years old, we still see the world with the wonder of new eyes, helping you discover untapped possibilities and relentlessly working with you to make them real. old school grit. new world ideas. morgan stanley.

6:15 am

you've got xfinity wifi at home. take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

6:16 am

house speaker mike johnson is calling on columbia's president to resign if she cannot bring order to the campus he is threatening to pull federal funding for schools that don't create safe environments for jewish students. he hinted the national guard could step in if the violence is not stopped. >> we met with the president and top officials before we came out on the steps here. we encouraged her to take immediate action and stamp this out. our feeling is they have not acted to restore order on the campus this is dangerous. this is not free expression or first amendment. they are threatening and intimidating >> the speaker's appearance was met by boos and heckling of the crowd. he paused his remarks and said enjoy your free speech

6:17 am

the pro-palestinians evncampmen was set up yesterday protests also he rerupted on the campus of new mexico at albuquerque. police got involved in protests with some campuses and arresting 73 people at the university of southern california in los angeles and 34 people at the university of texas in austin. it seems like these issues are stepping up close to the end of the school year. >> it is a shame for people who wanted to graduate columbia. i guess we don't need to run a sound bite these tents are set up next to the kick ball where jason was located? >> we talked to him right after. >> they must have stopped

6:18 am

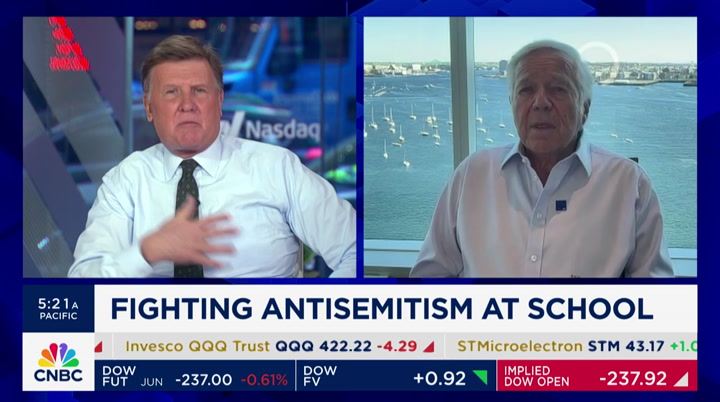

playing kick ball. all those whackos. >> they shutdown the yard. you needed a student identification >> it is happening >> we have talked about how students protest in general. what is different about this is i read a letter posted online from the jewish students at columbia here is what they have been hearing in terms of the protests hamas make us proud. take another soldier out we say justice, you say how. burn tel aviv to the ground. hamas, we love you we support your rockets. hamas, give them hell. those are chants that's different from peaceful protests. >> there were a lot of business leaders who watch this broadcast and robert kraft has taken

6:19 am

action we will see what influence that has on columbia. the truth is and i have been on the phone with him all week, most executives in america as businesses want to do nothing and say nothing. everybody remains silent this is where you hire your employees. this is the culture of the next generation of all these businesses >> protesters. >> yes you know, everybody talks about their responsibilities to society and responsibility to do something. all of the people watching this broadcast this second could do something. they hire from columbia and hire from the universities. i know last time we got into the debate whether you should hire from these places. you know, bill ackman said he would not hire some of the kids. larry summers said that is a mistake. these kids are naive we are past the point of naive for anyone involved in the protests it is past the point of naive.

6:20 am

this has been going on for a long time. we are no longer talking about the protests that were being made on october 8th or 9th the level of vitriol or anti-semitic speech. the innocent students will be harmed from this all of the other students from columbia and other universities who also say nothing and sit in the corner and say i'm gonot gon to do it in any other environment, in any other environment, gays, blacks, you name the minority group, people would be screaming from the rooftops about the way this is going on. >> the ceos are only too happy to weigh in on all those progressive media safe issues. bill ackman when we had him on,

6:21 am

i said, bill, you have been enabling this. i'm not going to say the "s" word he copped to it. he said you are right. i watched a lot of stuff go through. it comes home to roost, andrew if you are going to instill a lot of these progressive notions, it is not just this it goes across the board we have seen a slow seat in the academia it is an echo chamber. how can it be every college like this it is a sick and sad situation get the masks off. you will not not hire people if you don't know who is at the demonstrations in the first place. i can understand why biden doesn't say anything really solid because he has to win michigan he has all -- where is the ceo up for re-election is he worried about customers? >> i hear it all the time. >> when michael jordan said

6:22 am

republicans buy snsneakers, too. all of the woke companies did not care what they did to the right. now it comes home to roost. >> it is not about the right. >> it was back then. >> it's about guns. >> it is anti-semitism that is through the whole country. >> i understand. it has come back to roost. >> they will tell you -- because they think their customers will come for them and boycott their companies. >> not just the kids broader. employees are going to make a problem for them all of these folks who have some moral center, but don't know what to do with it are saying if i want to say something, but i can't. that, to me, is a sad state of affairs of where we are in america today. the leaders of the business world which will pay all of these people money eventually are not willing to say enough.

6:23 am

we're not doing it this way. >> it is a powder keg right now. you remember -- >> andrew, you are right >> you don't remember the '60s netanyahu is not finished. they are thinking what to do in the remaining bastion where hamas is what will happen them? what environment will we live in at that point? once the fuse gets lit, how do they go to usc and university of texas austin and high schools now. i'm confused where it came from. i guess we have been lulled into a false sense of security who these colleges are hiring. >> under the radar the point i'm making, it is not just universities. >> the kids -- i don't know, they are ideolistic.

6:24 am

>> there is a need for education. people need to understand what is happening here. >> who doesn't know what happened on october 7th by now >> i don't know. >> the point being made if you said this about any other -- african americans, you would never work in academia again if you said that. they are saying that they are saying that. >> that's what i'm saying. i don't understand nothing more to say. >> what about mike johnson no federalfunds for colleges that allow this to go on >> a lot of these are private institutions >> it is an interesting one. i don't know that one is harder for me. i'm more of a private sector guy. i know you think i'm not >> public money moves debate. >> we're wrapped in a riddle the surrounded by a conundrum.

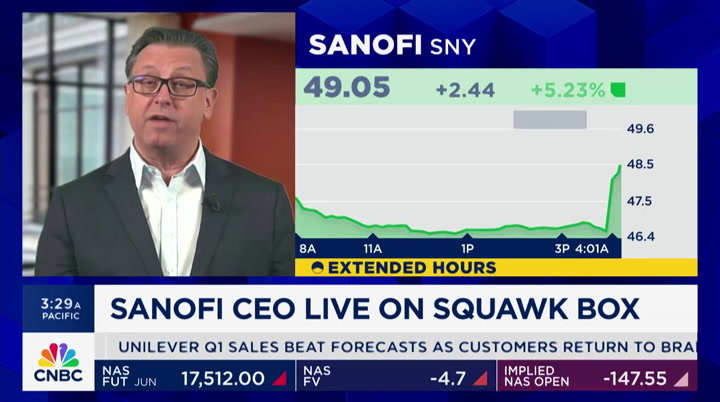

6:25 am

shares of sanofi are rising after beating expectations the ceo will join us after the break. and on may 4th, warren buffett will hold court at the berkshire kahathaway annual meeting. if youant wto submit a question, send them to us and we will ask them during the meeting. "squawk box" will be right back. when it comes to investing, we live in uncertain times. some assets can evaporate at the click of a button. others can deflate with a single policy change.

6:26 am

savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com. -unnecessary action hero ... the nemesis. le-it appears that despite myay to isinister gold efforts, employees are still managing their own hr and payroll. why would you think mere humans deserve to do their own payroll? because their livelihoods depend on it? because they have bills to pay? hear me now, paycom! return the world of hr and payroll to its rightful place of chaos or face a tsunami of unnecessary the likes of which you have never seen!

6:27 am

6:28 am

6:29 am

paul, thank you for being here why don't you talk about what happened with the numbers. profits were down with the effects. >> you know, it has been a great start to the year for us we are happy with how things are progressing. the pipeline is continuing to evolve news flow is building. performance is strong and we have been working toward this year for some time this was forecast to be one of the tougher quarters and as we get deeper into the year, we hope to gather more momentum >> it looks like the market reaction is pretty good. 5.25% increase in the shares this has been a big part of the story that you have been trying to get through to investors. you shocked investors when you talked about how you were going to be making investments for the long haul. do you feel like you are getting confidence back from the same

6:30 am

investors? >> this is the truth we said we would double down on science. we said we would accelerate the number of programs in phase three. 90% of the pipeline is first in class or best in class you need to do that. that work takes time we have been at it for a little white now. while now. we are going into full launch mode we don't have loss of excl exclusivity ahead of us. as we get into the launch mode and we're doing that now generating $10 billion in new sales from launches by 2030, you will see real momentum shift in the great company. >> are you seeing that momentum on the ground right now? the numbers you talk about after 2030 is fantastic. people want to see the numbers right now. where do you see the most? >> you know, we launched a drug

6:31 am

for vaccine for rsv and hemophelia a we are executing really well we are doing things that have never been done before near normal life with hemophilia a. 90% reduction of rsv we are doing things breathtaking there is more to come behind it. i said we have been ought it for some time. where we are right now is really at the beginning of the very impressive period for the company. >> paul, thank you for your time that stock up 5.25%. we really enjoyed hearing the story as it develops we love to have you back again >> i look forward to it. >> he said the stock will work it will be something to watch.

6:32 am

keytruda merck earning $2.07 per share compared to 1.88 $1.88. merck raised full-year guidance with oncology drugs and vaccines helping drive sales growth they breakout a lot of the metrics. keytruda sales a quarter here $6.95 billion. $6.95 billion. up 20% just do the math that was a launch and drug and certainly one of the biggest drivers of what is happening it explains that rising stock price. that is almost a $30 billion a

6:33 am

y year when whene come back, new rs for airlines requiring automatic cash refund over delays and cancellations. we will bring you the redetailsf how this will work. later, backlash against the ftc vote to bann non compete we have lina khan in the 8:00 hour what it means to you as the employee and the fight overall of it. as we head to break, a look at the s&p winners and losers power e*trade's easy-to-use tools, like dynamic charting and risk-reward analysis, help make trading feel effortless. and its customizable scans with social sentiment help you find and unlock opportunities in the market. e*trade from morgan stanley

6:34 am

with powerful, easy-to-use tools, power e*trade makes complex trading easier. react to fast-moving markets with dynamic charting and a futures ladder that lets you place, flatten, or reverse orders so you won't miss an opportunity. e*trade from morgan stanley ♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya helps you choose the right amounts without over or under investing. so you can feel confident in your financial choices voya, well planned, well invested, well protected.

6:35 am

6:36 am

solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow! dow's caterpillar releases results. earning $5.60 a share for the first quarter. that was above the street expectation of $5.14 revenue did come in below forecast, but the company is saying the first quarter lower sales volume was mostly offset by favorable price realization

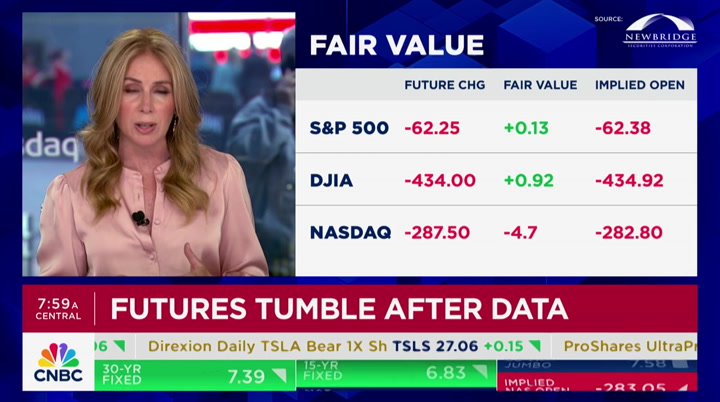

6:37 am

caterpilla best performing dow component. that may be with the huge gains of the stock over the course of the year also looking at what is happening with the company with execution and $1 trillion federal spending windfall in all of the areas for caterpillar we will continue to see what happens. if you look at the reaction overall on the street to the earnings from last night and today, little bit of a disappointment dow futures are indicated off by 180 points nasdaq indicated down 150. s&p futures off 30 points. andrew. time for the executive edge. let's talk about the biden administration requiring airlines to provide cash refunds when flights cancels and

6:38 am

disclosure of fees and bag chec fees earlier in the booking process. the rules require cash refunds if the departure is more than three hours or six hours for international passengers who are entitled to refunds. passengers haggle to get the cash you would call and wait on hold. the rules take effect in six months the issue is the enforcement of this you will have a problem and magically within seven days, you should look at your credit card bill and all of a sudden, the money should be refunded to you. >> if it is canceled or delayed? >> if it is canceled, they are supposed to send the money if there is a delay, it would be sent to you. >> if you wait it would not be a full refund. >> thequestion about all this is it is supposed to work so you

6:39 am

don't have to call the airline they are supposed to do it the real question is how will this be enforced and if you see the department of transportation which put this in place fines the airlines and what other steps they take to ensure the airlines do this there will be a cost i would be curious with the cost i'll speak to phil lebeau about what it may do to airline ticket prices, but in the next six months, what cap ex will be moving them to coordinate. you have to build systems so the money can get back to you. >> you might be able to drive them to another bailout. >> i would also say if this works, it should change behavior not by customers, but by the airlines all of the oversold routes where they know they are making it so difficult to begin with and they may have to say that route, we

6:40 am

6:41 am

with gold and copper prices pushing towards all-time highs, u.s. gold corp is advancing its environmentally friendly gold and copper mining project and creating american jobs in mining friendly wyoming. with a proven management team and board, a tight share structure, and a solid cash balance, u.s. gold's portfolio of world-class assets are creating american growth and homegrown strategic metals as the us moves when you own a small business future. u.s. gold corp. every second counts.

6:42 am

120 seconds to add the finishing touches. 900 seconds to arrange the displays. if you're short on time for marketing constant contact's powerful tools can help. you can automate email and sms messages so customers get the right message at the right time. save time marketing with constant contact. because all it takes is 30 seconds to make someone's day. get started today at constantcontact.com. helping the small stand tall.

6:43 am

6:44 am

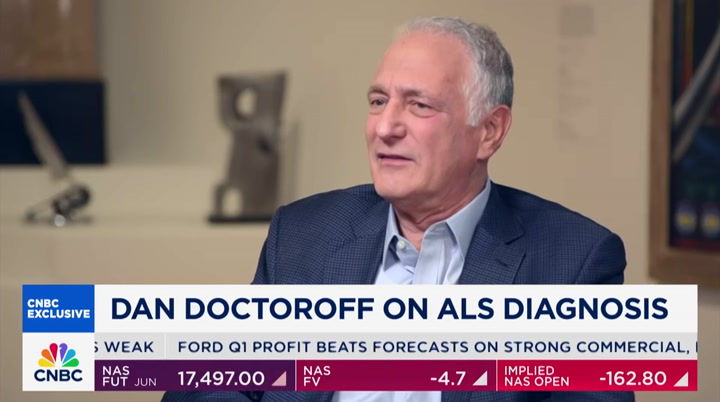

and city bikes thanks to dan doctoroff. he was diagnosed with als two years ago. i spoke with him at the whitney museum >> i was a maniac. >> a maniac? >> i drove people incredibly hard they knew that i loved them. that brought loyalty both ways >> dan doctoroff rose to prominence in new york when he tried to bring the olympics to the city. >> give us the chance and we will make you proud. >> ultimately, new york lost to london >> what i learned was even when you lose, you can win. >> that original bid ultimately laid the foundation for the future of new york city that we

6:45 am

see all around us today. the high line, hudson yards, the shed, and the whitney museum now downtown >> my time at city hall was the most glorious part of my career. we transformed the city after 9/11 >> in the urbanist, those who worked with doctoroff over the years, write about his impact. including michael bloomberg. >> i have a question for you this is michael bloomberg in the foreward in the book for all dan has accomplished, what stood out is those who do the best by doing the imaginable and possible we can see him all around us you had this team that is genuinely devoted to you in a very special way

6:46 am

a lot of folks in the world want to be leaders. you demonstrated it. i'm curious what you think it is you have done to motivate these people to incentivize these people and make these people feel like they can walk through walls on your behalf >> i don't think it was on my behalf i think it was the team. we had great people and people who i recruited and people who are energized by the ability to get things done. >> doctoroff is now fighting als and dedicating this chapter of his life to finding a cure for als for everyone >> you were diagnosed with als in 2021. >> that's why i can't talk >> how are you >> you know, i am doing so much

6:47 am

better than i thought i would be at this point in time. when i was diagnosed, something flipped in me. i was always future focused. now, i live day-to-day i don't think about the course of the disease the only thing i think about that's future focused is eliminating als. >> just take me inside your head for a second when you first learned this wha you thought and how you think about it every single day. i know you say you don't think about the end. i'm curious what that feels like >> i've been remarkably happy since i was diagnosed. what i discovered facing this

6:48 am

fatal disease is that there are only two things in life that matter it's relationships and having purpose. i'm fortunate that i have both >> doctoroff founded target als in 2020. there is a new book out. "the urbanist" which is on sale today. i remember when dan was diagnosed and i visited him several years ago. i will say he is doing much better than i think he antic anticipated. i'll admit, i anticipated. his ability to raise this money and to try to find a cure -- i think he knows he may not be

6:49 am

able to find a cure for himself, but for everybody else is something and his impact on the city is quite something. >> i think his state of mind is a beautiful thing. to say all that matters is the relationships and the purpose in life that's an incredible message to all of us. >> the mind shift and i think so many people in life, the mind shift of being future focused and he was somebody like that. we know a lot of people like that i include myself in that being present now versus thinking about the next thing is and his ability to be present and think about that not just in terms of als and target als, but with his family and everything else is very special >> that's inspiring. >> it is inspiring the book is a cool book. it speaks volumes about dan and

6:50 am

volumes about new york city. coming up on the other side of the break, we will talk former trade michael froman will be with us "squawk box" comes back right after this ny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

6:51 am

6:53 am

welcome back to "squawk box. secretary of state antony blinken is meeting with chinese officials in shanghai today. he's working on solving some key issues between the u.s. and china that threaten the stability of both countries. joining us right now is former u.s. trade representative michael froman, the president of the council on foreign relations and we welcome him to the table. so, set the table, if you will, for these discussions.

6:54 am

how much influence and what kind of progress do you think that antony blinken can even make as it relates to some of the economic issues, but also the issues that we're seeing around the world as it relates to iran and russia and what kind of pressure or leverage the chinese will or will not have on any of these issues on our behalf. >> i think secretary blinken and the whole administration has to do whatever they can to put pressure on all these issues, we have to have a certain degree of humility over our capacity to influence chinese behavior, particularly when it comes to economic policy. china's economy is facing tremendous headwinds, they have decided to go down the road of export-led growth, precisely at a time when the international environment will close off markets to them. there is a real train wreck coming here, where this is the next generation of trade conflict, whether on evs or other products they're building too many of for the u.s., for europe, for china, for the rest of the world. >> can i throw in tiktok,

6:55 am

because i think that will come up in the discussion, between them across the waters how do you think that changes the dynamic at all, if it does meaning what the u.s. is doing as it relates to tiktok, how the chinese view that, see that and to the extent that creates more friction or not? >> i think it probably complicates the conversation secretary blinken wants to have with the chinese about having the chinese treat american companies better, precisely at a time that congress acted against a specific american company. but i think that the jury so to speak is still out on that the law has passed president biden signed it. there is likely to be litigation and it is very unclear at this point exactly how this is going to play out. >> do you think the chinese, when that happens, do the chinese say to themselves, those americans, they're terrible? or do they say, maybe we actually have to rethink how we do things? >> i think -- i think it is probably more the first. i think they -- sometimes they try and dismiss it as election year activity, but this is

6:56 am

broader than election year activity i think it is the protectionism on steel and aluminum, the concerns about electric vehicles, or issues around tiktok these are areas where there is bipartisan consensus, likely to be on the agenda for some time, it has been on the agenda for some time, and, you know, for years we warned the chinese that their tremendous growth was made possible by a benign international environment. and that international environment became less benign, which it has, it would be much more difficult for them. and that's what has happened. >> in terms of iran, in terms of russia, what does that conversation even look like? >> i think the u.s. warns them very -- in very strict terms about what they're doing to support russia's effort against ukraine, and russia's effort to militarize its economy very early on in the ukraine conflict, they made it clear they did not want to see lethal products crossing over from china into russia. as far as i know, what china has done instead is boost the dual

6:57 am

use products, which has allowed russia to rebuild its economy into a militarized economy. >> we got to run, but how direct are the conversations? there is one person on the other side of the table and the other. is it friendly, unfriendly is there a tension in these rooms? >> i think this administration made these kconversations very direct, and instead there is advance warning, they tell the chinese, we are going to impose tariffs, this is why we're doing it, this is what it means, we are going to raise concerns about your support for russia and your partnership with iran it is a direct set of conversations. >> thank you for helping to explain all of this. thank you very much. we have a big lineup ahead long time tesla -- he's a tesla investor, he's a tesla bull, maybe we don't put words in his mouth given the 40% sell-off in the stock, but i have a feeling he might still be bullish. ron baron. new england patriots owner robert kraft and ftc chair lina khan "squawk box" will be right back.

6:58 am

matching your job description. visit indeed.com/hire at corient, mat wealth management beginsn. and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are.

6:59 am

7:01 am

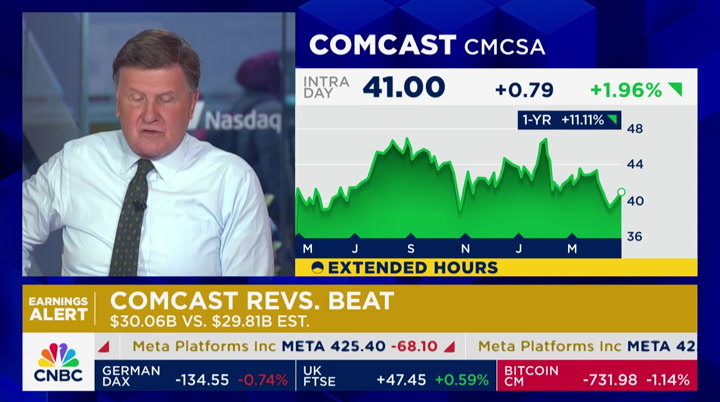

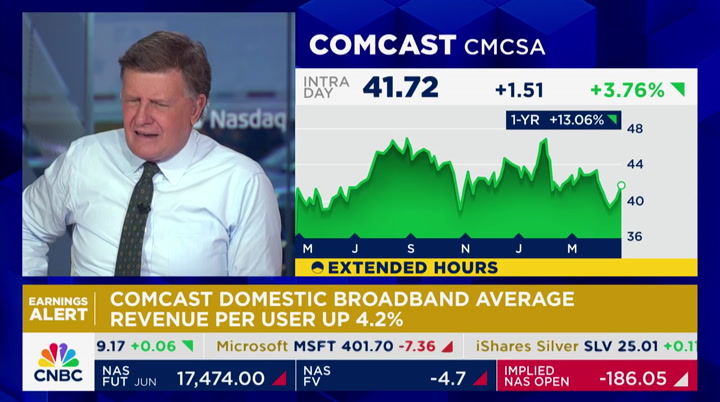

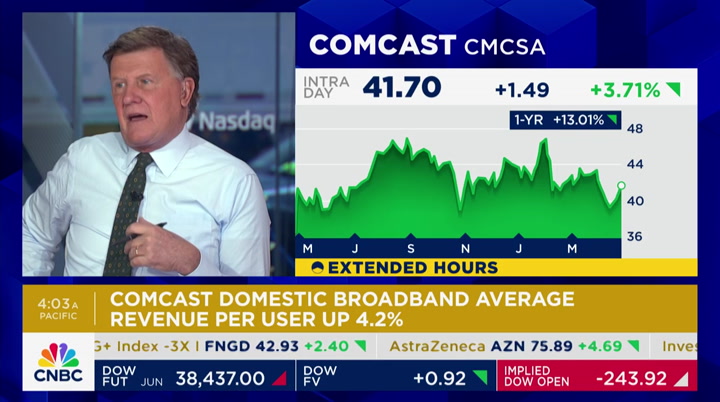

our parent company comcast just out with earnings the expectations that analysts had and there are a myriad of expectations, not just what we normally do for a company in terms of the top and bottom line, but let's look at those two -- those two components, consolidated revenue was 30.1 billion. and that was about $200 million ahead of the consensus of $29.88 billion. adjusted earnings per share, which may or may not be the best thing to use with comcast with all the cash flow and ebitda numbers, such a varied and multifaceted company, but just to look at it, $1.04 was 5 cents above the street consensus of 99 cents a share. if you want to know what kind of growth that was, adjusted

7:02 am

earnings per share, almost 14% free cash flow growth may be more representative, that was up 19.4%. and you can -- where do you want to start theme parks continue to do well. i didn't know that the outsiders was -- i'm sorry, the holdovers was one of ours too, one of universal's. but "oppenheimer," "holdovers," a lot of hype for "oppenheimer" and exciting slate according to the company for this year including "the fall guy. who's in "the fall guy"? >> ryan gosling and emily blunt. >> ever since he was ken, i find him more -- he's an attractive man. adjusted ebitda $8.2 billion,

7:03 am

that was up 1.3% andrew, we were -- we kicked this around because we were on tv >> we're in the tv business. >> kind of >> yeah. >> business news with cable news with the ticker. but video and comcast says again and again, they're not going to chase unprofitable business. but what was the number again? it was over 400,000, down -- domestic video customers decreased 487,000 to 13.6 million and that's been -- that's the cord cutting that people worry about and -- >> but at the same time, peacock is up 55%. >> that was good that was after that unbelievable nfl football -- that football game. >> the football "oppenheimer" as the most paid one movie in peacock history. >> you're not in a boat with

7:04 am

a -- going like that you do want the streaming business to try to go up quicker than the -- >> the economics of the streaming business will ever be as good as the cable business. that's the fundamental question. you can have the axis going this way and this way. >> can we hope >> we can all pray. >> we can hope and pray. >> hope and pray hope and prayers hope and prayers >> right now, the shares are reacting positively. >> yeah, that's good >> but, you know -- 13.6 million, how many half -- >> here's the other piece of good news that i think is fair to say, some of the folks who are leaving the traditional cable bundle are not just buying in by peacock, they're buying in by youtube tv, which is a bundle, they're buying into the hulu live product, which is a bundle so there is this sort of movement around where people are looking almost for the interface and the truth is a lot of the

7:05 am

folks who have been subscribed through the bundle have been getting it at a discount that's the er pother piece. you've seen them discount heavily because there have been moments where, you know, i shouldn't say this, if you call up your cable provider right now and say i'm thinking of leaving for youtube tv, all of a sudden, they'll say, okay, used to be a $90 product, we'll sell you for the next 24 months or 12 months for $30. so, and this goes back to profitable subs versus unprofitable subs. >> during the pandemic it was broadband, just so you know. arpu, average revenue, was up 4.2% highly competitive market. but subs flat basically. broadband subs were relatively flat year over year domestic broadband revenue grew by 3.9% but you wonder how that growth, where -- growth is going to be theme parks, growth is going to be movie studios

7:06 am

wireless business, wireless was up quite a bit and i guess there is some growth out there, but you definitely saw part of the -- of the great pandemic performance was when everybody was adding -- getting wired up and that's not happening. stock is down from 60 something. but up today >> and american airlines just reporting. phil lebeau has the numbers. hi, phil. >> this is a miss on the top and bottom line. in the first quarter for american airlines, a wider than expected loss of 34 cents a share. the street was expecting a loss of 29 cents a share. revenue just shy of estimates coming in at $12.57 billion. the metrics within the first quarter, operating margins 0.1%. free cash flow of $1.37 billion. and the passenger revenue per seat down 4.9% compared to first quarter of last year cost per seat mile excluding fuel, up 3.2%. now for the important part that a lot of people are focused on

7:07 am

the guidance for the second quarter, eps guidance, 115 to 145 the street estimate is 118 for the second quarter q2 capacity up 7 to 9% for the full year 2024, eps guidance of 225 to 325 and i think that the consensus is somewhere in the 240 range. that's on the lower end. the midpoint is above the consensus and the free cash flow guide stands at $2 billion for the full year. that's a reiteration of what they said previously we will be talking exclusively with american airlines ceo robert isom coming up in half an hour lots to discuss. not only the results for q1, the guidance, what is going on in terms of acceptance of boeing aircraft, we know what is happening with boeing, and we'll talk to him about the new dot passenger refund rules something i know you'll be interested in hearing about. andrew, back to you guys >> okay, phil lebeau, thank you.

7:08 am

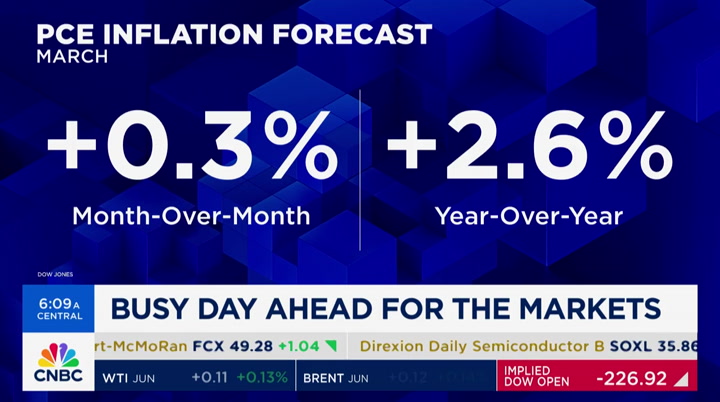

appreciate it. joining us now to talk earnings season in today's gdp data, gabriela santos, chief market strategist for the americas at jpmorgan asset management i'm just excited because at the top of the show, i was pretty sure it was 2024 and it is. but you've got a whole little thing built around so i can remember 2024. it is going to be in your view a 2024 year. >> economy >> go over what -- what is the first two? >> so, 2% real growth. 0 recession in base case. >> 0% chance of a -- >> no, that's where sometimes it gets confusing 0 recession in the base case doesn't mean 0% recession risk at any time, it is 15%, 20%. we feel like it is around there, it has come down over the past few months the rest of it is 2% pce inflation toward the end of the year and 4% or lower on the

7:09 am

unemployment rate. and i think this is really important to anchor the conversation because one of the narratives right now in the market causing some angst in april is we keep going back and forth in this narrative ping-pong of soft landing, hard landing, no landing. maybe there is a little bit more upside to growth, a little more upside to inflation, but you're still rounding down to that 2024 and i think we'll get some more data today, with gdp, with the two handle, tomorrow, pce, also a two handle and hopefully that helps to calm some of the interest rate volatility we have recently seen on this as well as some of the recent market volatility, equity market volatility. >> one of your other points, we're still -- going to sound weird, we're still high for longer not higher for longer. >> yes >> you're saying that we may not get the cuts as soon as -- or as many cuts, but no hikes in your view. >> that's right. i think two letters make all the

7:10 am

difference and that was really -- >> the er. >> and that was really the fed pivot in december. it was just that it was saying, look, just really was the last rate hike, we see risks as more balanced, we see the diffusion of inflation has come down, inflation expectations are anchored. that's enough now. the next move, it is inclined to be a cut, not tomorrow but that's the next move and that makes a difference. it gives you -- it gives companies, consumers, investors more more visibility about the cost of capital and as a result unleashed a powerful rally there for five months. >> we seem to be, and someone complained yesterday, we don't talk about bitcoin when it goes down, we do when it goes down. it has been -- it is down again today, we're in a risk off environment right now. are we not the dow is called down triple digits meta is going to take the nasdaq down are we in a risk off phase and how much further does it go? we hit 5, do we hit 10 >> yes, so, i think just to put

7:11 am

in context those really -- that really powerful rally for five months there came with very low volatility interest rate volatility, equity market volatility, that was abnormally low we had gone 279 days without it 2% pullback. it is much more shall we say normal to have 5% corrections three times during the year, 10% intrayear as well. so far normal behavior, shall we say. in terms of is it over, is it going to get worse, i think what is macro driven and that's affecting more of your cyclical area of the market, i do think that calms down, if we do get that two handle on gdp and pce but then there is a separate issue going on, which is much more micro and focused on earnings and a very high bar that was set there for some companies, and i don't think we're out of the woods quite yet as earnings last night showed. let's see overnight. we get two more important ones but that is a very microstory,

7:12 am

much more focused on that concentration risk that we had been warning about and it is clearly an important issue here this week. >> you're a financial person you do use the term middle east and you say still worth monitoring but really only in the context of oil we just spent -- we just decided to fund another 90 billion how about -- look at what it is for. ukraine is still scary the middle east still scary. taiwan, still scary. any of these things ever going to come home to be something really scary for the stock market >> i do think we're in a period where we left behind very low geopolitical risk environment we had been in for decades and we are in a more heightened geopolitical risk environment. and that has huge implications longer term. for example, we are in an era of more defense spending and that's very much true, not just here in

7:13 am

the u.s., but in europe, in japan, and other parts of the world, and that's led to a very strong recovery for aerospace and defense companies. with industrials here in the u.s. and also in europe. one of the top sectors last year we're also in an environment where there is more diversification of supply chains, also huge implications for countries that are winning, like mexico, like india. so there is a longer term read through. thi i think in terms of shock for the market, it is commodities and oil. >> gabriela, thank you. coming up, adena friedman on the state of the markets, companies investing in a.i., also quarterly results we're coming right back. trading at schwab is now powered by ameritrade, unlocking the power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools,

7:14 am

including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab. this is our future, ma. godaddy airo. creates a logo, website, even social posts... in minutes! -how? -a.i. (impressed) ay i like it! who wants to come see the future?!

7:16 am

my name is oluseyi get your business online in minutes and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport.

7:17 am

nasdaq first quarter results out this morning profit at 63 cents a share compared to estimate of 65 cents revenue, slightly above wall street forecasts joining us now, nasdaq ceo and chair adena friedman how are you? >> fine, how are you >> thank you for -- you're already here >> i'm always here >> you're already here but thank you for coming you're on our set. if you had to characterize the quarter overall, was it similar to last time you were on, would you say, the previous quarter? tougher operating conditions should be better >> there is a lot going on inside of nasdaq and we're proud of the results with hewe had7% overall growth and lower volatility in the markets. when you look at our solutions businesses, where we really have been transforming the company, we had 13% growth on our solutions businesses, and that

7:18 am

includes 10% growth in our fintech division where we have regular tech, risk management and financial crime technology that business grew 23% we had stellar growth in index with 38% core growth in our index business and we crossed over $500 billion in assets under management this quarter in our index franchise. super exciting about the overall performance of the company, even with a muted ipo backdrop. >> how long have you been ceo now? >> 7 1/2 -- about a little over 7 years. >> a lot of the things you just talked about were not part of the company 7 1/2 years ago, were they? >> that's true we have been really growing in terms of -- >> where you needed to nothing is happening in -- when it gets quiet, in terms of trading, and when the ipo market is as you call it muted, are you happy that you did these other things. >> we're very happy. not only is it great to have a diversified platform where you

7:19 am

can grow in different market conditions, but we also have much more impact with our clients. we're now going to banks and saying we can help you solve some of your biggest challenges. they want to be able to provide capital to the markets, and get deposits into their banks. but they have to manage crime out of their systems, manage risks in the market, manage a lot of regulatory burden and we're their partner to do that we have better impact and an interesting growth profile that business, our fintech division grew 10% this quarter. >> there has been some talk about extending the trading day, even 24 hour trading days. where do you come down on that what do you think? >> it is interesting to see how demand is starting to come in from all over the world, particularly for nasdaq listed companies. so, what we have been doing inside our businesses, we have been expanding the distribution of our data to the entire world. so that's been a growth driver for us to get data, real time market data in the hands of broker dealers and brokers,

7:20 am

retail brokers all over the world as well as driving indexes and index products to exchange -- we list our index products all over the world. that kind of helps satisfy some of the investor interest but we also operate, you know, our systems are open 16 hours a day. and the markets are technically open 9:30 to 4:00, but we open our system for trading at 4:00 in the morning and we stop at 8:00 going to 24/7 is a different proposition. >> that's crazy. would there be no more opening bell, no more closing bell how do you do percentage changes? >> i think there is no law -- there is a lot of operational challenge that comes from 24/7, even 24/5 trading. just technically we provide technology to other markets who trade that way we know how to do it, we know what it takes, operationally, you have to be ready to respond in any given moment and with companies, it is different than it is with commodities companies have earnings. >> you have stuff you want back when there is not an active

7:21 am

market. >> and there is an entire infrastructure in the mutual fund industry that ties to that 4:00 closing price so, if we were -- if there were a shift more towards global trade, you know, 24/7 or 24/5 trading, we have a lot of chang we have to introduce and a lot of institutional investors like to go home and have dinner so, how do you make is so that it is not just about retail. retail, it is good to give access to retail investors, but it is much better if you have a very vibrant liquidity environment. >> a big issue is some sort of market shakedown and nobody is around to say, okay, how do we put this -- >> i think that's important too. what if you're a company ceo and at 3:00 in the morning something happens to your stock? you have to think about all of those things we had conversations with our clients about it but we're not kind of moving in that direction right now i think we're still evaluating it. >> at this point, have you used a.i. for anything that has increased your productivity at the nasdaq >> okay.

7:22 am

>> is it when will that start, or -- >> i'm going to answer for her. >> okay. >> and then last but not least, i mean, isn't the nasdaq like the perfect home for every one of these startup -- these smart kids that andrew interviews constantly at all these a.i. companies. they're all coming here. >> any company, we want them all. >> if a.i. is a million different facets >> we look at a.i., as we say, on the business, how do we make the company more productive, a.i. in the product, and how do we make our products deliver more productivity to our clients. so we have a really great announcement this quarter where we basically launched a co-pilot tool inside the antifinancial crime division that automates all the investigative -- a lot of the investigative work that they have to do on potential bad actors, that cuts down the time of that investigation by 90% it is a huge productivity gain to the clients, and we just rolled that out globally this week now, we also put our first a.i.

7:23 am

driven order type on the market a couple of weeks ago, s.e.c. approved, a.i. driven order type that helps increase bill rates and on the business, we have been rolling out the pilots as well as the q coding pilots within our development organization and the microsoft 365 co-pilot across our entire team we're seeing productivity gains from it as well. my view it is a revolutionary technology >> so, you rolled some stuff out this week. you didn't ask me to ask you that i would have if you told me to ask you that question, i would have. >> we're sometimes very excited to talk about it >> one potential quick curveball, just because we have her here in the next hour, i'm curious, you assume you have in y -- do you have noncompetes? >> i wasn't surprised, it was discussed for a while. i personally feel like our company has a lot of ip.

7:24 am

we provide opportunities for our executives to build that ip inside of nasdaq and therefore we feel like we should have some period of time where we're protected as they -- if they were to go out into the world. >> do you have executives making less than $150,000, though if that's the limit -- usually those types of jobs you're making more than that. >> i would say we have noncompetes not across our entire employee base, but with a certain employee set my view is that ip protection is something to be considered as you're managing the movements of your team. i also understand that -- >> i think the new reality -- >> i think this targets in a lot of ways people who are making less money who are being held captive to something somebody who walks into a hair salon, and i say this because every hairdresser i've known complains about this, you walk into a hair salon and you have to sign a noncompete right away. >> i say you have to be reasonable we're very reasonable in giving

7:25 am

our employees the opportunity to go seek employment somewhere else if they want. and our noncompetes are quite rt going forward. >> do they not know who you are. >> i'm glad i don't have that ear piece in my ear. i'm enjoying the conversation. >> we have to go thank you. >> great, thank you very much. still to come this morning, american airlines ceo on quarterly results. and the upcoming summer travel season and then, long time tesla investor ron baron on the recent moves by tesla to cut jobs and slash ev prices. "squawk box" will be right back. >> announcer: time now for das latoy'afc trivia question. what city was the first host of the nfl draft? the answer when "squawk box" continues. - hip-hop! - limping! mmhmm! medical bills! uh-huh! - pancakes! - cash! who pays you cash when you have medical bills? grrr! no idea. [tapping] gap! the gap left by health insurance? who pays cash to help close that gap? aflac!

7:26 am

oh, aflac! get help with expenses health insurance doesn't cover at aflac.com pictionary?! when it comes to investing, we live in uncertain times. some assets can evaporate at the click of a button. others can deflate with a single policy change. savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified

7:27 am

portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com. [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen.

7:28 am

100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com. >> announcer: and now the answer to today's aflack trivia question iccias the first host of the nfl draft? the answer, philadelphia it hosted the event in 1936.

7:31 am

welcome back american airlines releasing results moments ago. straight over to phil lebeau who joins us now with a special guest. good morning >> good morning, andrew. robert isom, ceo of american. >> good morning. >> wider than expected loss. people look at first quarter, but then they look at the full year your reaffirming guidance. you knew the first quarter would be rough

7:32 am

what do you look at as you look out into the summer and into the fall >> thank you for being here, on your birthday. >> our first quarter, we expected the loss, it is exacerbated by the run-up in fuel prices. we weren't able to recapture all of that. as i look to the remainder of the year, we're in a much better position in terms of dynamics in the industry and capacity and so we're going to be projecting a strong second quarter. and a full year that hits our original guidance. >> one of those dynamics you announced was in the last half hour, you're modifying how many boeing aircraft you're taking this year obviously because of the production problems, both at the max and the dreamliner how much does this impact what you're planning for this year? >> not much for us remember, we spent almost $30 billion on new aircraft to get to the point we're at right now. we have the youngest fleet in the industry i'm proud of that. we have taken delivery of so many aircraft. this year boeing will be off by seven aircraft from where we projected. we built in safety factors for that we're going to be reducing a bit in terms of capacity

7:33 am

but it is not going to have a material impact. >> may not have a material impact are you frustrated by what you're seeing with boeing and what you -- you're not really sure what the future holds >> my message to boeing hasn't changed since the last time we talked let's get your act together. deliver, first focus on the banks. get aircraft that are quality, at first and foremost, and safe. >> have you told this to dave calhoun or stephanie pope who runs commercial airplanes? >> i told that to everybody i talked to at boeing. right now, it is more about their actions, not about what they say i'm confident over the long run they'll get their act together we have an order for max 10s those don't come until 2028. by that time, i'm confident. if they don't get it together, we'll make sure we're protected. we'll have the capacity to make sure that -- right now, one of the things we're doing this year is we have a fantastic regional operation that is funded by

7:34 am

embry aircraft, that supplier has been incredibly reliable and i'm very proud of that fitting in very well with our network plans. >> the dot passed and announced new consumer protection rules yesterday. specifically regarding cash refunds. but the rules, some look at these rules and say, it is not entirely clear when somebody will get a refund or is entitled to a refund. how much will you have to modify your operations, day to day, as you incorporate these rules. >> well, our philosophy and our focus is on making sure we run the most reliable airline possible that delivers for our customers day in and day out if the new -- with the new rules, we're matching up in terms of making sure we deliver. now, that said, there is a lot of gray areas out there. and we really need to make sure we understand what those are i don't -- with weather, and with maintenance, those are safety issues for us i want to make sure that we have the right motivations out in the field. there is also a lot of other

7:35 am

parties that play a role in terms of making sure the air system works well. and whether it is the faa and air traffic control, whether it is, you know, rocket launches or, you know, how we handled medical diversions, there is a lot of gray areas that we have to make sure don't have an impact that wasn't intended. >> is there an immediate cost impact this summer as you start to put the rules in place? >> no, for most of the rules we already do them and quite a bit more just this past year, we refunded over $2 billion to customers i'm confident that we really have what we need going forward. but it is just the gray areas that we have to have definition around. >> real quick, small business, still remains strong in terms of bookings, right? >> as i take a look out into the summer, and the remainder of the year, demand is strong across the board. small businesses especially, that is really fueled american since the pandemic corporate travel is coming back as well. and i'm really pleased with what i see going forward.

7:36 am

>> robert, thank you very much always good to be down here at the american headquarters. back to you. >> thank you very much we should tell the audience not to go anywhere ron baron will be with us. we have new england patriots owner kraft group founder and columbia grad bob kraft will join us, also the founder of the foundation to combat antisemitism so much to discuss with him. plus, ftc chair lina khan will join us following its vote to ban noncompete agreements. "squawk box" returns after this.

7:39 am

welcome back, everybody. our guest right now on set joining us is long time tesla investor ron baron of course, he is the chairman and ceo of baron capital, and, ron, we always look forward to these conversations with you got a lot of ground that we want to cover obviously we want to talk tesla. but i know you had a few thoughts right off the top about some things we have been talking about on the show this morning. >> i was watching the program this morning and it is totally

7:40 am

inspiring. and doctoroff and robert kraft has been a friend of mine for a long time. thank you for being sensitive to people who are jewish. having so many jews on your program in one day must be amazing. and so, one of the things i'm admiring on bill ackman and mark wellen and one of the things that i guess people don't always realize is that, you know, when i go to temple, there is security when i walk around the security, i have to have security. when i go to my golf club, i have to have security. it is just hard to comprehend. i never felt threatened before in my life i feel threatened now. it is really uncomfortable but i'm optimistic and in 1930s, when hitler came to power, there was nothing like people standing up right now, like they are, nonjewish people standing up, so, i'm always optimistic person and always a hopeful person and i think things are, at the bright side,

7:41 am

people are standing up to protect everyone's rights, not just ignoring it. >> are you getting involved on any of these levels? >> not the way robert is what i did -- i do the best i can. if someone is a pro hamas supporter, i fire them someone wants to sue me, that's fine so, we do social searches before we hire someone and try to have influence on any organizations that i'm involved in and one of the things i did is that we right after october 7thi reprinted my rabbi's sermon and sent it to over 600,000 people, just so people can see how it affected jews. that's this thing. anyway, that's -- i came here to talk about stocks, not politics. but thank you for giving me a chance to be part of this program today amazing program. >> thank you for letting us know how you feel about these things

7:42 am

too. why don't we jump right in and look at the markets and maybe specifically tesla tesla captured everyone's attention. you've been probably the longest tesla shareholder and one of the most outspoken bulls out there on this. you are a huge believer in elon musk i think you just came back from a trip to visit both spacex and tesla. >> yeah. so, about the markets first, briefly about that, we're long-term investors, we visit companies in which we invest, we study the businesses, look at the opportunities. but we're long-term when you see the performance of the stocks that we invested i started in the business in 1970 and i was living in my friend's basement, i was in debt. 1982, started baron capital, had 10 million under management with an m and now 1982, 1992, 100 million, now 43 billion and we made our clients 44

7:43 am

billion in profits since we started. and i'm hoping that we make a double in the next five or six, seven years and we'll make a double again, five, six, seven years after that i am 80. so, not that many people who are 80, i guess buffett does, mummer did. also very interesting, i was listening to your interview with charlie munger, 34 days before he died. and you said, charlie, do you have a bucket list and he said, yes, i do, becky and you said, what is it he said, well, and he's 99 at the time, well, i've always wanted to catch a 200 pound tuna, but, you know, i'm not quite as strong as i was four years ago. he's 99. so, it is encouraging. >> less than two weeks before he passed so he was up to the very end. >> i am long-term all the way in everything we're doing and i asked you, you know, to not introduce me as a tesla bull, because that sounds --

7:44 am

>> we didn't know that i made that up. >> please make me an investor. i am incredibly bullish about the opportunities for tesla, but i don't want people to think this is the only thing he does, one way. >> but it is the largest holding, to be fair. tesla is your largest holding, spacex is your second largest. you have a long list of investments, but these two, because you got in so early, are your two largest holdings. >> we have 400 investments and the top 30 represent about 56, 57% of our assets. and by being a long-term investor, you can actually do quite well and our -- it is hard for most people to do better than the stock markets. i recommend people do passive investing and if you did that, that's a good way to hedge against inflation. so inflation makes everything cost twice as much every 14, 15 years, 4%, 5% a year, sometimes it get downs a little bit. it is 4%, 5% a year for my whole lifetime and so the way you hedge against that is investing in both

7:45 am

businesses and long-term, 98%, 97% of our assets beat the market 96% up 20 and 45% are the top 1%, that's baron partners fund, the number one fund in the united states. we invested in tesla in -- i met him in 2010. >> elon musk >> elon musk i was introduced to him. would you like to meet him, yeah, i would like to meet him i read about him with electric cars and space and so i met him. 2010, comes to my office, and he's unshaven, 37 years old at the time, unshaven, just made $100 million in pay pal, didn't have to work anymore but working like crazy, unshaven, baggie cargo pants, clogs, hair all over the place and talking about how he wants to have electric cars. and i was hoping he was going to be successful but i thought it

7:46 am

wasn't likely and in my lifetime, 50, 60 car companies have gone bankrupt 2010, continue to study and work on it, became public, i didn't invest in it, and now it is -- for four years, you know, kept visiting and talking and finally i'm convinced i should be investing. and in 2014, they were doing 40,000 cars a year and he told me, visiting him in his factory, sitting in a corner, with mike lippert who works with me, and we were there for two hours, 2 and 1/2 hours and i was really prepared, so we're talking about all these things and then mike says, i got to go, i got another meeting, see you tonight, i can't believe i'm leaving this meeting, most interesting meeting i've ever listened to. he leaves and catch up in the hotel, he says -- i said, mike, at least you were smart enough to own tesla he said i don't own it anymore

7:47 am

i said, you don't own it, after you just listened to -- are you crazy? he said i sold it before we got here i said i got to own it and the stock tripled and then it doubled again and i still didn't own a share for the next three years to 2014 to 2016, after the stock had gone up seven or eight times, the next four years, we invested $400 million and then we made about -- we made right now about $4 billion we had made $5 billion, and we made about $4 billion right now. we sold about a quarter or a third of our stock, about three years ago, and priced $220 a share, now $160, and at that time, had it gone from 40,000 cars a year to 600,000 cars a year and now doing 1.8 million so business is three times bigger. >> i remember when you sold a few years ago, you sold that stake, you did it because you were worried about the portfolio being too heavily invested in one particular stock

7:48 am

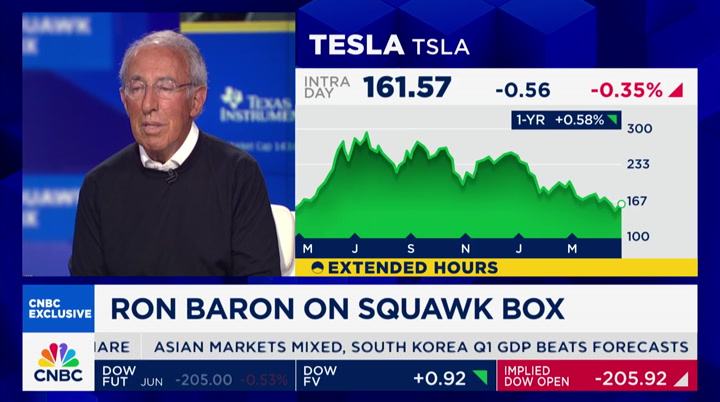

>> up 20 times, yes. >> up 20 times do you hit that point again? do you have to trim more because you now have $3 billion, what did you say $4 billion $3 billion as of 3:31 today. it must be $4 billion. >> it is around -- i don't know, it is around $3.5 billion, $4 billion, something like that the. >> it wasn't that you didn't believe? it was too big of an investment? >> yes, yes. at some point, i think spacex is going to be -- i think we'll make 20 times in spacex over the next 15 years. i think we'll make it quadruple in the next six or seven and can it be too big? sure so i'm always watching >> just because you're managing other people's money. >> but i do think that we're going to get a lot more money to manage, therefore it is going to get diluted down by the new money coming in. always thinking about how large the position should be, yes. >> what do you think right now the stock came out, the earnings this week came out, it was a

7:49 am

disappointment for the quarter it was the worst cash flow quarter that the company has seen in its history, but the stock was up 12% because elon started talking about what he sees in the future and the idea of bringing out cheaper cars to go through these things where do you stand on the -- what the company should be valued >> i know joe is not a big believer in electric cars. he likes his porsche but i think all the cars will be electric and i think the hybrid is a holding off action so automobile companies don't have to lose money on the electric cars but the electric cars i think is going to be all the cars 10, 15 years from now i think hybrids, i know you love hybrids, that's not going to last either. they're too expensive and not effective enough and they're not going to be part of the mix either it will be all electric. and so what i think is going to happen is that the reason the stock is down is not because of the quarter. the reason the stock is down -- >> the stock is up because of

7:50 am

the stuff that he says. >> the stock is down so much. >> it is down 35% year to datdate up 1% over the course of the last year. >> yeah. not so exciting to be up 1% in a year when everything is, you know, the market is so strong. so, you know, i don't rich and m not poor but i'm not making, i haven't made a lot of progress last three years like a rubber band i'm going to catch up again. what i think about the reason stock is down is people are concerned he was going to abandon the idea of having a low-cost car and go all-in to robotaxis. the reason stock is down and then, there was a report in reuters that said he's canceling this new factory that's going to make robo cars, make low-cost cars, $25,000 cars, competition from china only one company in china profitable, by the way byd.

7:51 am

buffett's company. wa warren's company m ford loses, everyone loses on this it's interesting talking yesterday about motors motors in the car cost $5,000 a car. that's what normal, these 100-year-old kpips we companies we can make a motor for $1,000. >> you need a battery. >> combustion cars, stagnant business becomes and used to operating the way they've always operated they don't look for new ways to operate, operating, oriented towards making things cheaper. he can do things for $1,000 others cost $5,000 amazing. if you want to be an, a gasoline car company. i'm pointing out that people get entrenched and do things without trying to make things better,

7:52 am

cheaper, faster all the time warren -- munger said show me incentives i'll show you how people act that's the idea. incentive. what's the incentive for someone 55, 60 -- got to get off this. the idea, that's the reason stock is down. >> what's the reason it's going to go up >> going to go up huge. >> when? >> now now is the bottom. what they're doing is going into robotaxis and going to make the low-cost cars. they're making the low-cost car except excess capacity make 3 million, make it 1 million 8. extra cars, existing facility, no more capital, not make direct cars as cheaply as before, expected to. overall, they have to do 5 million new cars. >> and robotaxi question that is future of this company and a lot of value is reliant on that. >> uh-huh. >> the question, what do you think genuine timing of a robotaxi relying on cameras

7:53 am

only the question, can you do it with just cameras relative to what waymo and cruze have done, using radar, lidar and the rig that lives on those vehicles? >> we have a small investment cruze to see what they're doing and waymo, their cars are $250,000. >> because of all the sensors and -- >> trying to take cost out for us, basically, advantage we have right now at tesla, they have -- sold 6 million cars. 3.5 to 4 million are collecting data data is valuable doubling the amount of compute every 90 days. >> i don't disagree. a timing question how quickly you can actually put them into the wild >> i was just in california. i was -- last sunday in vale, what they're doing with a.i.,

7:54 am

capital spending sunday in monday in spacex in last with engineers, finance people. afternoon went to tesla with the autonomous driving people and also the compute people. then afterwards, ron, nice to see how -- unbelievable. the first 11 versions were, had to be designed so they had to code every single thing that happened. >> right now all a.i. >> impossible. therefore weren't making progress two, three years. and now what's happened, version 12, all of this enormous amounts of data, compute to figure out -- humans can't do it -- compute to figure everything out. now you're on the verge with autonomous driving in your car said, okay show me. we do the few hours, couple, three hours. before i go back to new york i say, okay. i want to see how it works go into a parking lot get into the car and i have an analyst with me and then they had the

7:55 am

compute person and they had al, you know, investor person. sitting in the car where you want to go i want to the see steve jobs' house. okay punch in the address get into the car car drives around. by itself. all we did punch it in drive around in the parking lot. goes to the road traffic going both ways. it looks both way looking for entry to get in. gets an entry. pulls in, makes left-hand turn drives right behind cars in front of us. stop sign. car stops, goes. second car stops, goes pull up to the stop sign car looks both directions, make as right-hand turn just drives. all of a sudden it's a pedestrian crossing the street the car stops to let the pedestrian cross the street. the pedestrian, i don't know if i was set up in this pedestrian waves and then the car starts going again then it pulls up and make as left-hand turn and then goes in front of steve jobs' house a nice house just a house, though

7:56 am

i was expecting "a house!" a house. stopped in front of the house. that house and -- he doesn't wife does. house next door and then looks like three quarters acre for a sale next door for $15 million and we go back drove all by itself. all by -- >> take me to steve jobs' house. >> all by itself what's going to happen is that i thought the idea had been that you are going to sell a lot of cars so as a result of that once they have those cars there you'll sell autonomous driving he said the other day negotiating to sell autonomous driving for some other cars, too. no one has a compute, no one has the data. >> that's the long-term thing. tesla is everywhere. >> if making cars. make $7,000 in profit a car selling $35,000 minus the credit >> timing? give me timing the whole game >> now. >> now >> it's now. you think it's forever this is how much you'll make

7:57 am

making $7,000 in profit a car for a car that they sell for -- do you have time how much time we got here? >> running short on time about four minutes. >> i say "now" you believe -- honestly they're going to announce, robel oh taxis available now? >> talking about in august '08. $20,000 car make $40,000 $50,000 a car a year had a million cars, 2 million, 5 million, make hundreds of millions. >> i believe promise of the company and amaziamazing. i ask the question about timing, a view those vehicles are not comparable yet to what waymo or the others are doing those guys can't even do it in some cities. most cities, in fact. >> robo, certainly its moment in autonomous. >> for the government approval that comes with it >> takes a while for all of those things to happen two, three years for everything. make hundreds of billions of

7:58 am

dollars a year on that business. hundreds of billions not including battery, a.i., robots. >> and stop for that pedestrian, that was big when you told me it did that hadn't, a problem. ron, right you were surprised it stopped -- >> yeah! >> did you have your foot on the brake covering >> nothing. >> total believer in, ready to go. >> sitting next to the guy. >> you weren't driving. >> nobody was driving. >> and before you get to spacex quickly. tesla's pay package for elon musk a huge center of controversy, delaware court overwrote it vote on shareholders saw another article i just read said even if you vote on it again it could be brought back to court how would you resolve this >> well, i think that the class action lawsuit for someone who had ten shares of something. >> yeah. >> lawyers wanting $5 billion? that's crazy. so the way it seems to me is, a

7:59 am

contract that was arranged and arrived at and agreed to, and how do you go back on a contract that isn't fair. the only reason the company is surviving, good night slept on the floor under his desk for -- let me go to space xvrmt. >> let's do it running real short. >> ingesting 2014,s to 16, tesla. 2017 on invested $900 billion in spacex both $2 billion 3 partnership, $650 million of that make double in 2027, when we go public 2030 i think make another double and then 2030s i think can make five times again thinking about 20, 30 times your money. they have the only way you can get to space for nothing well, not for nothing. it's $20 million costing us now. about to cost $6 until to get to space. cost others $100 million, $200

8:00 am