tv Worldwide Exchange CNBC April 25, 2024 5:00am-6:00am EDT

5:00 am

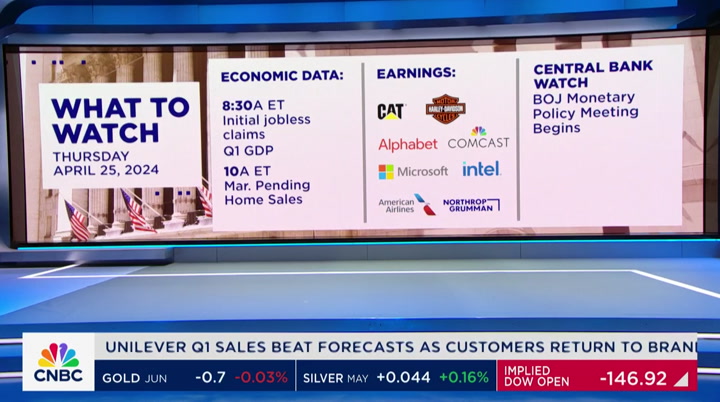

it is 5:00 a.m. here at cnbc global headquarters and here is your "five@5." we start with tech in trouble. nasdaq looking to snap a three-session streak futures are under pressure across the board. the meta mess. stock sinking in the pre-market and looking to wipe out $200 billion of market value at the open. and then ibm big blue getting hurt with the worst day since 2021. a mega global mining tieup

5:01 am

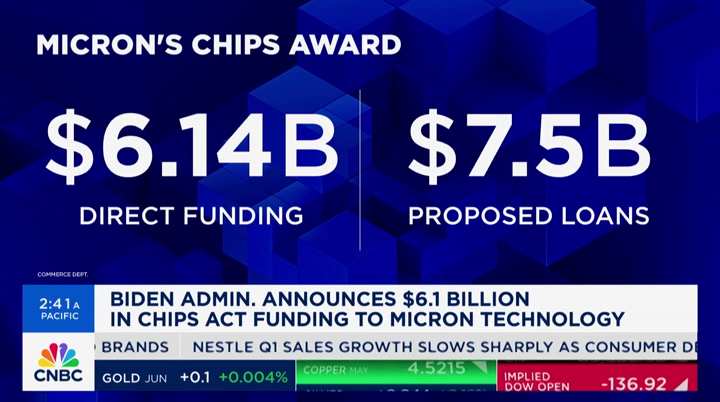

in the works on the back of surging copper demand. later, the white house announces another multibillion dollar award to another giant. it's thursday, april 25th, 2024 and are you watching "worldwide exchange." good morning thank you to much for being with us before we get start ed, a quick news alert the biden administration announcing a $6.1 billion funding agreement with micron under the chips and sciences act. the deal will be in support of the construction of the facilities in new york and idaho. micron investing $125 billion into the projects. president biden will be in syracuse, new york today we will have more this later in the hour look at micron shares down

5:02 am

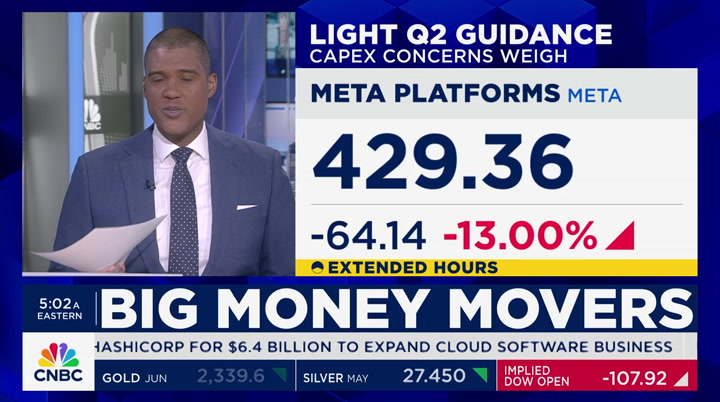

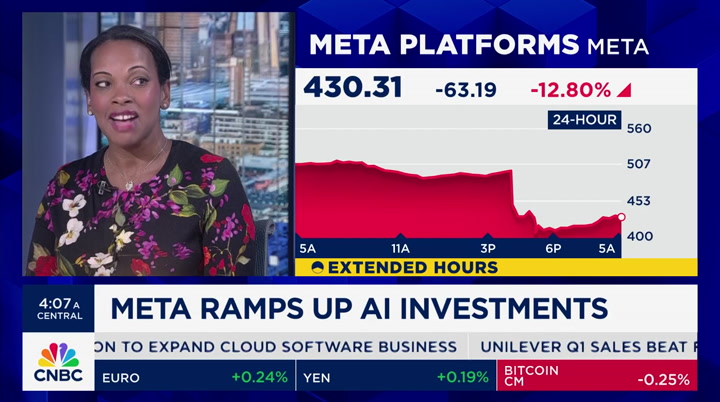

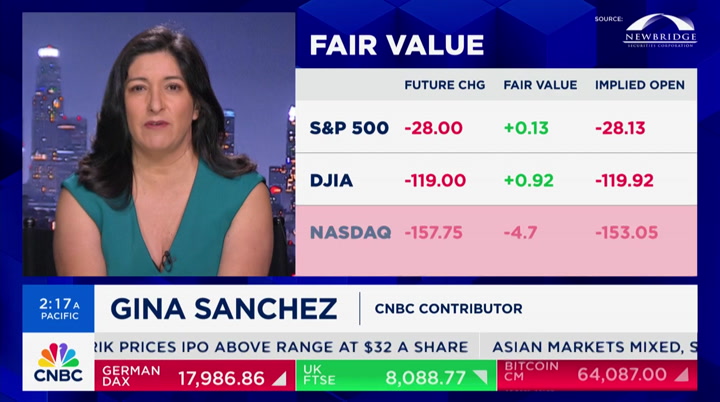

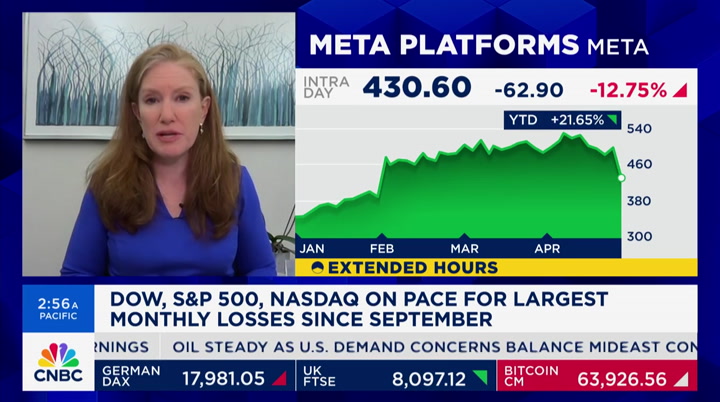

over .13%. turning back to the trading day ahead and the check of the futures after a mixed session for stocks dow snapped the four-session win streak and you can see all three are in the red this morning nasdaq is down 1%. the s&p down .50%. you see the dow looking like it would open over 100 points lower. of course, the big story is big tech meta platforms sinking ahead of the market open. you see shares down 13%. much more on that in a moment. dragging the dow lower is ibm. set for the worst day in two years. announcing a $6.4 billion deal with hashicorp look at the mega cap tech

5:03 am

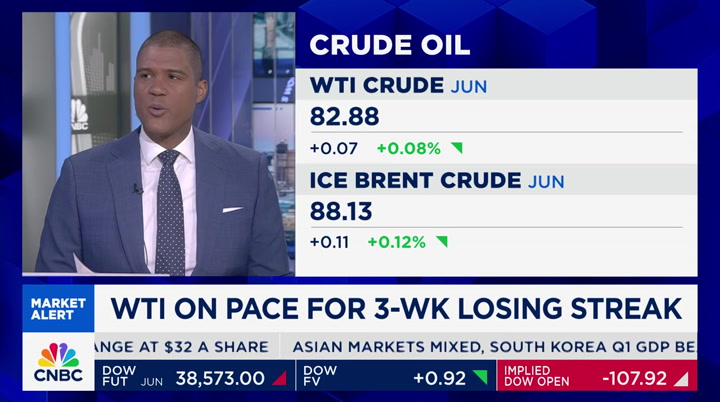

opening. alphabet is down 3% followed by amazon down 2.5% we are talking more about meta and the rest magnificent seven in a second. the ten-year treasury yield is ahead of the first read on the first quarter gdp. look at the benchmark at 4.64. you see the two-year yield pull back right now at 4.92% we are looking at energy and oil on pace for the first down week in the last four look at the oil market this morning. we are seeing it higher right now to flat. wti is trading at $82.90 a barrel brent crude is trading belo bebel bebel below $88.15 a barrel. we go back to the biggest money mover this morning that is meta platforms

5:04 am

strong first quarter results doing little to prop up the stock. it is looking to shed $200 billion at the open. shares down 13% right now. investors really appear to be focusing on the weak guidance as it leaves the year of efficiency behind mark zuckerberg telling shareholders to hang in there with risky bets like artificial intelligence >> we typically don't focus that much on the new areas until they reach significant scale because it is higher leverage to improve on other things before these products are at scale. you enter the period where i think smart investors see that product is scaling and there is a clear opportunity there before the revenue materializes >> joining me here in london

5:05 am

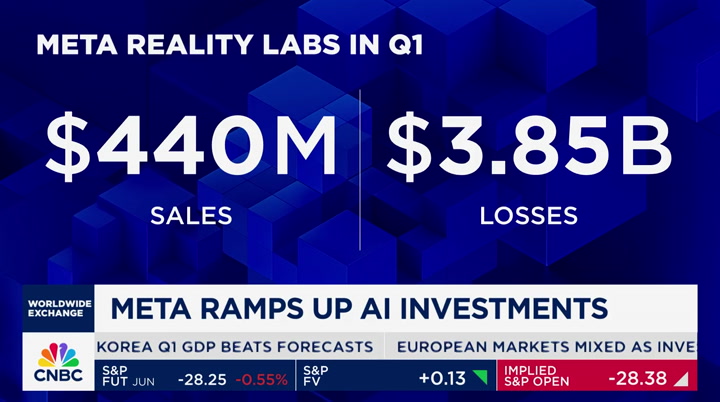

with the deeper dive into the quarter is sarah kuntz meta shares down 13% we have seen it fall more than 13% in heextended trading the fast they have soft cap ex guidance and revenue guidance is overblown or are investors reacting appropriately >> i think it has to do with the chain. mark zuckerberg wore a chain and nothing is the same. i think a.i. is expensive. it makes sense that investors are nervous about that because the reality is last time zuckerberg went on one of the tangents in the metaverse was not good the difference is there is a "there" there. they have the data which you cannot overstate the importance. i think that this bet is going

5:06 am

to payoff. >> people are scared when you have eps doubling year over year it is hard to be scared with that revenue growth. it is on the soft guidance on the increased spend. you said the chain thing, hilarious. the company took off with mma, but the chain is derailing that. we have to track that. he dipped into the metaverse is when the trouble started looking at the numbers loss of $8.5 billion. >> i think he should give it up. we see apple with the vision pro which will not happen. the market has not embraced this technology no matter who is selling it to them i like to see them get more from the metaverse. when you look at the thnumber, t is a weird pet project >> i want to talk about

5:07 am

something less sexy about other things ads is a miss. meta gets 98% of the revenue are people not focused on that >> it is a global problem. not a meta problem people are buying ads to place against content. content on social media is not necessarily brand friendly you have the massive unrest and it is not surprising that people are saying maybe we are not going to advertise next to some of this stuff. i don't think that is a huge indicator of anything. >> is it a indicator of magnificent seven performance? growing business for microsoft and meta >> amazon could be the winner here what they are advertising is product listing ads. you are not advertising against

5:08 am

social content. >> a lot to breakdown with magnificent seven. you have to come back before i leave london sarah, thank you that chain comment, thank you. moving on. let's get a check of the other big money mothvers ibm on track for the first day since 2021 the company announcing it will acquire hashicorp for $6.5 billion. shares of ibm down 8%. service is lower with the massive earnings beat. revenue growing by 24% and the transactions of $5 million doubling the ceo says artificial intelligence is now the fastest selling in company history catch bill mcdermott this morning at 9:00 a.m. different story with

5:09 am

chipotle shares are popping this morning. the fast food chain beating earnings revenue brian nichol speaking out yesterday. >> we are seeing every transaction of sub 50,000 to north of 150,000 we see strength in the business with every income cohort and customer in chipotle >> niccol adding in terms of the international expansion, it has the ability to increase the sales. and now we have the corporate stories with silvana henao at cnbc hq >> good morning, frank more trouble for apple in china. preliminary data showing apple has lost its title as the country's biggest smartphone seller in the first quarter.

5:10 am

shipments falling 6.6% in the period compared to a year ago. apple now in third place in terms of market share in china behind brands honor and huawei. microsoft backed data company pricing the ipo at $32 per share above the expected range and on the back of the offering, the company now being valued at $5.6 billion it is set to begin trading at the new york stock exchange today under the symbol rbrk. shares of anglo america are surging in london as bhp makes a $39 billion offer for the company. a deal would create the world's biggest copper miner with 10% of global output. it would give bhp more access to potash in australia, frank >> looking at shares up over 12%. silvana, thank you very much

5:11 am

we have more to come here on "worldwide exchange," including the one word that investors have to know today, but first, more on big tech as black eye and why jim cramer says surging bond yields are not helping the situation. pushing past meta and investors get set for microsoft and alphabet after the close today. and we are looking at the $6.5 billion bet for micron by the biden administration we have a very busy hour still ahead when "worldwide exchange" returns. stay with us it's all the things that keep this world turning. it's the go-tos that keep us going. the places we cheer. trust. hang out. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. powering more businesses than anyone. powering possibilities.

5:13 am

my name is ashley cortez and i'm the founder of the stay beautiful foundation when i started in 2016 i would go to the post office and literally fill out each person's name on a label and now with shipstation we are shipping 500 beauty boxes a month it takes less than 5 minutes for me to get all of my labels and get beauty in the hands of women who are battling cancer so much quicker shipstation the #1 choice of online sellers go to shipstation.com/try and get 2 months free

5:14 am

welcome back. you see the u.s. stocks in the red there on the board the nasdaq down 1% the dow is looking like it would open more than 100 points lower. the biggest pre-market laggards on the nasdaq 100. meta and o'reilly and trade desk and alphabet on the board. let's see how europe is shaping up with silvia amaro here with me we were talking about earnings in europe as well. >> it is a very busy day to give you an idea, we have more than 300 companies reporting. i want to give you the highlights we heard from deutsche bank

5:15 am

which posted a 10% rise in the first quarter net profit to 1.5 billion euro the german lender saw the net revenue grow with the investment inflows reaching $1 billion. and nestle with the miss on the forecast the swiss consumer giant backed the full-year outlook for 4% of sales. when it comes to the pharma pace, astrazeneca was looking for a profit when it confirmed the full-year guide and and revenue hit $12.7 billion. in the luxury space, hermes reported a better than expected 17% jump in the first quarter

5:16 am

revenue despite the slightly softer traffic in china. deutsche bank highlights the reporting so far this morning, but you see with hermes shares, showing a busy day this is the start of the thick of the earnings season in europe >> you had two big bank earnings it was a very busy day thank you. we turn attention back to the u.s. and wall street jim cramer weighing in to the stock market turmoil suggesting it may be time to raise cash as investors look to other sectors of the market outside of stocks. >> the bond market has gotten so compelling to so many people, that they want to buy some of the bonds. they need to sell stock to swap equities they have to raise cash to buy bonds. you need buyers to come in because so much is for sale.

5:17 am

for many, that means cash the stocks to be able to sell and buy. >> joining me now is gina sanchez. good morning i want to get your take on what jim cramer said. the bond market is creating competition for the equity market right now. >> yeah. i do think it is a real issue that you cannot ignore, particularly when you still have segments of the stock market whose price to earnings ratio have not priced in the fact that expectations for fed rate cuts have gone from six to four to two. that's a big difference. that suggests that dividend yields will continue to have competition. looking across the stock market, there are stocks that are vulnerable >> you say there are stocks that are vulnerable you mentioned the cuts from six

5:18 am

to four to two magnificent seven is also moving from six to two. if you look back to april 16th, it feels like it was forever ago. jay powell said rates will stay as high as they need to be if these stocks are supposedly not as sensitive to interest rates, why are they declining more than the general market during this time >> i actually think they are sensitive to interest rates. these are the highly valued stocks to the stock market generally. you also get some of the best growth the big challenge is where you have high valuation and not necessarily great growth profile. you look at apple for mexample. it is really hard to get excited about apple at this the valuation at this point in time.

5:19 am

if you compare to nvidia, that is trading at roughly the same price to earnings for much, much better growth. why would you take apple now the competition within the magnificent seven is going to get fierce you see tesla dropping out i think it is the mag six now. tesla is struggling to maintain its mantle because now you have margins meeting lower price competition and abandonment of the low-priced tesla that creates a challenge for high pe stock. s>> we are all struggling with the fed. we have gdp reporting today and expecting to show a slowdown and pce coming up tomorrow it is expected to show a decrease in your mind, are these market

5:20 am

movers i just mentioned what jay powell said on april 16th, are these market movers? >> you know, it is jay powell who has preempted what is coming he set the stage for higher for longer the fed funds futures have adjusted what has not adjusted is the broad multiple across the stock market and that is why you are seeing quite a bit of blood in the streets at moment. >> gina, thank you colorful language. blood that streets a lot of people are scratching their heads. gina, thank you. for more on what is driving the markets and trading day ahead, head to cnbc pro at cnbc.com/pro coming up on "worldwide exchange," throw out the $50,000 price tags because at the

5:21 am

beijing auto show, we very broad appeal that's where we find our eunice yoon >> reporter: thank you, frank. elon musk elonhoped to revisit e idea of the affordable ev. he is not the only one more in a few minutes. with gold and copper prices pushing towards all-time highs, u.s. gold corp is advancing its environmentally friendly gold and copper mining project and creating american jobs in mining friendly wyoming.

5:22 am

5:24 am

exchange." some automakers are backing out on the evs those in china are looking for a race to the bottom our eunice yoon is live from the beijing auto show. it looks like you are having a good time, eunice. >> reporter: i am, frank tesla is not at this show, but like elon musk, his chinese rivals are stressing the importance of affordable evs i spoke with the founder of nio. it will target more conscious budget families. it will be launched in the third quarter and delivered in the fourth quarter and priced at $30,000. cheaper than the model y the hometown rival, xpeng, their

5:25 am

ceo said 20,000 ev is on the horizon. it will be launched in june. byd, known for the $9,000 car, launched affordable models $16,000 car and $12,000 model. this is highlighting an issue flagged by the treasury secretary janet yellen who came here earlier this month when she criticized china for overcapacity in several industries, including the car industry at the auto show alone, there are 278 evs and hybrids. global data told me there are 139 ev brands in china alone and automobile mobility creates excess capacity is as much as 25 million units. >> wow that's a lot of capacity

5:26 am

that is what people are talking about. i want to ask that you are on the ground there, eunice, what is getting the most buzz and what do you hear about the apple rival? >> reporter: the answer is fone in the same. the xiaomi is $27,000 and like apple, the idea behind it is to get the xiaomi smartphone users into the evs and have this seamless technology experience the company's founder said so far they have 76,000 orders for the 100,000 target for the year. he kind of was trolling apple a bit saying 52% of the buyers so far are iphone users

5:27 am

suggesting that people might want to make a switch. >> eunice, i notice they really like smooth jazz at the beijing auto show. they are blasting it right now also, there are things for sale. you got me a t-shirt at disneyland are you able to get me an affordable ev? is there a way to get me one >> reporter: the music is because they are trying to get us out of here that's their nice way of saying get out of here. here, it is 6:00 >> that's what we do, too. eunice yoon at the beijing auto show thank you. as we head to break, we are watching shares of tesla they are capping off the best day since january of 2022 with the more than 14% gain isterday. its up .25% right now. we'll be right back after this break.

5:28 am

5:29 am

her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. when we started our businesst's uncalled for. we were paying an arm and a leg for postage. i remember setting up shipstation. one or two clicks and everything was up and running.

5:30 am

i was printing out labels and saving money. shipstation saves us so much time. it makes it really easy and seamless. pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers. go to shipstation.com/try and get 2 months free. it is 5:30 a.m. in the new york city area 10:30 here in london loot a lot more onahead on "worldwid exchange." investors sound the alarm on big cash piles going toward artificial intelligence investment for meta. now the three-day win streak at risk. futures are in the red across the board. up next, on the docket, microsoft and alphabet

5:31 am

we tee up the metrics you need to watch it is thursday, april 25th, 2024 you are watching "worldwide exchange" here on cnbc welcome back to "worldwide exchange." i'm frank holland coming to you from cnbc london let's get you the check of the u.s. stock futures all three indices in the red right now. the dow would open just over 120 points lower the big story this morning is tech and meta sinking ahead of the open and wiping out $200 billion of market value ahead of the open this comes after the first quarter results topped estimates, but numbers are overshadowed by weak guidance and updates on a.i. and the metaverse.

5:32 am

meta is lagging ahead of the open ibm is in second place down more than t81% and zebra technologies the bond market here with the ten-year trading below the highest number since november. look at the benchmark at 4.64% we see the two-year note which hit 4.92%. that's the set up. let's turn back to the big movers we heard from meta and tesla microsoft and alphabet report today. microsoft is up 40% over the past year on enthusiasm over the push into generative a.i. with the investment in openai and the features for windows copilot alphabet is picexpected to get

5:33 am

boost from a.i. and ad spending. joining me is the cio portfolio manager at northstar asset management good morning from london i'll get right into it what are your expectations when it comes to earnings for alphabet and microsoft do you believe there is anything from the meta earnings we see as a read into the earnings >> it is going to be a very interesting day for earnings after meta's disappointing outlook. one of the things we are watching and it will be a little bit different for microsoft versus google. microsoft has continued to power ahead with 30% growth in azure the issue is can they continue the momentum they have seen a big pull from a.i. come through with the cloud with the staff of applications and the github and copilot

5:34 am

we saw 6% contribution from a.i. applications microsoft is more about can they continue with the high costs you know, they have guided to the spend that they have been investing in a.i. and it is not going to be the a.i. spend which is lineal and ramp up in cash. less read through meta >> if you don't mind, we had a guest here in europe who said to be a leader in a.i., you have to be a leader with the hyper scale of business. microsoft and google are both expected to show strong growth with the cloud business. how important is that growth we saw meta with great results eps doubled year over year, but

5:35 am

the invest m ment in a.i. is as important for growth >> they are important. i think the difference is for microsoft a.i. is an enabler for google, the cloud business can pick up growth and show growth from a.i. on the contributions with the gpu here. deaffinitely the cloud growth is important here >> okay. let's talk about ad spending for a moment meta posted a miss when it came to the ad. >> referee: ad revenue it is a big part of the business for microsoft. should investors be concerned about the digital ad spending market and outlook >> it is a bigger issue for google oand alphabet what happens is can they continue their low comp from last year. we are expecting 12% growth in the ad spending and ad business.

5:36 am

can we see that? that would give some comfort to investors that the search business is not getting disrupted by a.i you know, meta pointed to slowdowns from china that's something to watch as well we would expect alphabet to keep pace with what meta posted here as well. >> one other thing i want to bounce off you, since april 16th, jay powell said rates will stay higher as long asunder performed. the stocks are a bit more immune to rate pressure we see a steeper decline from them what do you make of that >> the tech stocks when you talk about microsoft and google have excellent balance sheets we are not worried about interest costs rising for the companies and pressuring the

5:37 am

profitability. that is not an issue the issue is the multiple. here is where microsoft is more based on the multiple that microsoft is tradingat 35 time pe that's a little bit more on the sensitivity from rates less so far google alphabet is a story of what is going on in their business and disruption in the search business >> all right nimrit kang, thank you preview of microsoft and alphabet earnings after the bell today. coming up after the break, micron is set to receive billions from the chips archact. first the big money movers ford is moving higher with the strength of the commercial unit with the offset of ev losses it is lowering estimates and raising the adjusted free cash flow outlook.

5:38 am

whirlpool is increasing prices by 5% in north america due to sticky inflation and cutting 1,000 jobs to expand profit margins shares down 20% in the last year and 30% off the 52-week high align technologies beating first quarter estimates and growing revenue by 6% thanks to the asia pacific region. shares up 5% right now we'll have more after the break. stay with us o find a doctor when? what about zocdoc? so many options. yeah, and dr. xichun even takes your sketchy insurance. xi-chun, xi-chun, xi-chun! you've got more options than you know. book now.

5:40 am

tamra, izzy, and emma... they respond to emails with phone calls... and they don't 'circle back', they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team. let our expertise round out yours.

5:41 am

welcome back turning to news from washington. the biden administration announcing micron is latest recipient of funding from the chips and science act. megan cassella is joining us with more. >> reporter: president biden is heading to syracuse, new york to announce the micron deal they are set to receive $6.1 billion. that money will help build out the factory in boise, idaho and in new york. the focus on production of memory chips in exchange, micron is investing $125 billion in the two sites over the next 20 years officials estimate the public and private funding should create 20,000 jobs in

5:42 am

construction and manufacturing and indirectly support another 50,000 jobs along the supply chain. as part of the announcement, the biden administration will announce hubs in new york to meet the training needs in the semiconductor sector and announcing hubs across the country. places where we need more workers. micron's award is the seven pth th award congress has more to dole out from the original $39 billion pot of money with the amount of money starting to dwindle, we expect the next wave to be smaller in size and going to smaller suppliers along the supply chain. gina raimondo told cnbc the focus from here is focus on chemicals. all of the input products we need to build chip manufacturing in the u.s

5:43 am

frank. >> again, announcing that micron is the latest to receive the funding from the chips act how does this fuel the growth in the u.s. >> re >> this announcement is focused on memory chips and specific to high bandwidth these are crucial in training a.i. systems and large language models the more we can build out memory for the systems, that means it can cover more of what the user wants. they will be designing and producing those in the boise plant and producing those in a major way and manufacturing in a major way in syracuse. official says this is a crucial step to bring a lot of a.i. development to the u.s >> our data team has been crunching the numbers. chips act funding has just been run out. is there a second chips act program to support investments

5:44 am

so far >> there's a lot of talk about that we hear chips 2.0. it is a difficult thing to get congress to sign on to something where you allocate more money where we have not proven the first pot has been successful. that is the argument we are hearing. i heard the term irresponsible thrown around if we don't do more the risk is if we just dole the money out, but don't shore up the investments, maybe they won't become sustainable or do enough we are not doing enough to bring semiconductor manufacturing back here it is a big fight. that's the argument we're hearing. >> megan cassella with the la latest great to see you thank you. coming up here on "worldwide exchange," more on the big stock story of the morning meta a number of changing calls this morning. if you miss "worldwide

5:45 am

exchange," check us out on spotifory other podcast apps. more "worldwide exchange" coming up right after this. what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com.

5:47 am

with gold and copper prices pushing towards all-time highs, u.s. gold corp is advancing its environmentally friendly gold and copper mining project and creating american jobs in mining friendly wyoming. with a proven management team and board, a tight share structure, and a solid cash balance, u.s. gold's portfolio of world-class assets are creating american growth and homegrown strategic metals as the us moves towards an electrified future. u.s. gold corp. welcome back time for the morning call sheet. we have more on the stock story of the morning meta a number of firms cutting price targets on the back of earnings. we start off with goldman sachs lowering the price target from 555 to 500 per share jpmorgan chase lowering from 550

5:48 am

to 4 480. we have stifel cutting down to 500 per share. and betterrnstein is pushine stock on gm higher which is up 1%. key bank upgrading sherwin williams to overweight it should focus on the volume recovery shares up .50%. time for the global briefing we start in japan with the yen hitting the 34-year low against the dollar the greenback breaking above the 155 yen level for the first time since 1990 that is fueling more speculation the government could move to shore up the currency while the bank of japan is holding the

5:49 am

two-day policy meeting it would wrap up the intervention by the boj. and bhp makes a $39 billion offer for the company anglo american it would give bhp more access to potash in australia. you can see shares up 11%. bhp falling 3% several big european companies reporting earnings today. deutsche bank posting the highest quarterly profit in 11 years as the investment bank out performs nestle is looking at lower shares with higher sales and astrazeneca moving lower as well. and coming up on "worldwide exchange," the one word every

5:50 am

5:51 am

norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. life's daily battles are not meant to be fought alone.

5:52 am

- we're not powerless. so long as we don't lose sight of what's important. don't be afraid to seize that moment to talk to your friends. - cloud, you okay? because checking in on a friend can create a safe space. - the first step on our new journey. you coming? reach out to a friend about their mental health. seize the awkward. it's totally worth it. welcome back time for the "wex wrap-up. we start with ibm on track for

5:53 am

the worst day since 2021 after missing revenue expectations the company announcing it is buying hashi corp for $6 million. apple losing the titgtle of biggest smart phonemaker in china. microsoft's management company rubrik is set at an ip of $32 a share walgreens will start working with drugmakers to bring cell and gene therapies to the u.s. it will join the specialty pharmacy with alliance rx. and ryan gosling proving be just ken is k-enough with nearly

5:54 am

9million streaming viewers the best viewership since 2021 that was funny may the fourth be with you true moo is launching blue milk. the first time you can sample the notorious drink outside disney world that is next saturday, not this saturday here is what to watch today. we get jobless claims with gdp figures and home significants. we get reports from microsoft and caterpillar and comcast. the bank of japan kicks off the two-day policy meeting today investors get ready for the busy day of earnings look at futures here they are in the red. the dow is hitting the low of the morning. it would open up 150 points

5:55 am

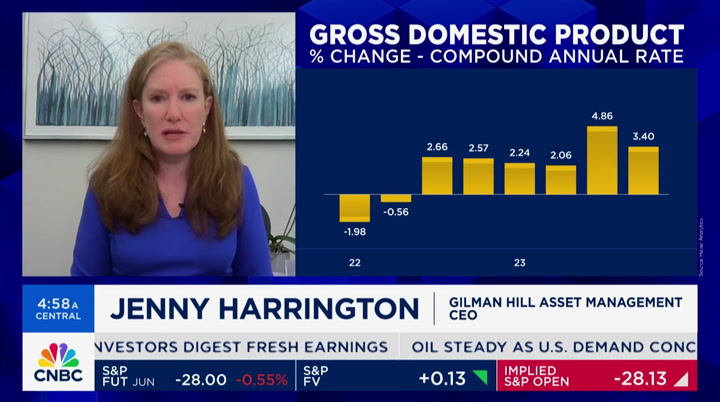

lower at the open. nasdaq futures are dragged down by the stock of the morning which is meta. it is showing revenue guidance miss and a lot of concerns with the growth of a.i. driven expenses mark zuckerberg telling analysts on the call that he is not concerned with monetization. meta is set to wipe out millions at open. we have jenny harrington here with us. meta is the stock story of the morning. what do you think of the results and mark zuckerberg's comments which brought the stock lower and the mag seven trade? >> i think we are seeing reconciliation and reckoning the numbers were fantastic the problem is the story which is mark getting real we need to spend i have been wondering the last

5:56 am

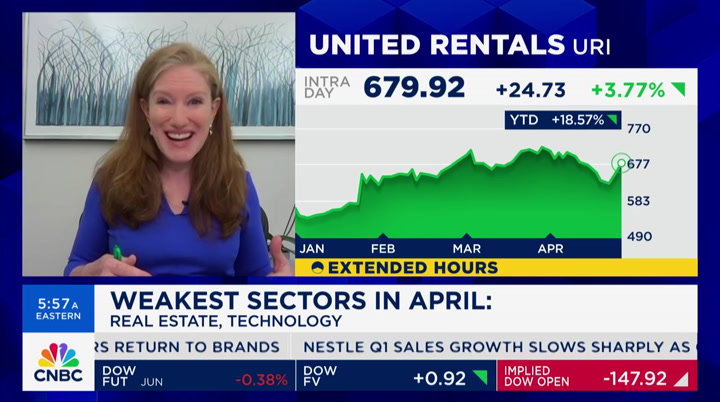

quarter with everyone was talking about a.i. was mentioned. i'm exaggerating here. the more time the company was able to mention a.i. in the conference call, the more the stock went up. i wonder if we will see more between meta and what reports next is investors asking a.i show me the money. where is it coming from? in the case of facebook, meta, the numbers of the past quarter were incredible, but they are saying it takes a lot of spend that's not the money investors want to see with the premium valuations >> jenny, you talked about the wex word of the day. rotate you are rotating your portfolio? >> we are not rotating portfolio. we are seeing rotation in the portfolios for example, in our growth portfolio, we have meta down 12% pre-market we also have paradigm.

5:57 am

you have a company down 7% year to date and guess what as of last night, that is looking like they reported good earnings and that is up 8% today. united rentals that is looking up 6% today. as of last night i'm seeing rotation within the portfolios equally interesting in our equity income strategy, we see ibm looking down 8% because -- by the way, i'm annoyed with everybody picking on ibm they beat on earnings and those were great they came in with better margins. again, they used a.i. a lot because there was enthusiasm in that maybe too much you see ibm down >> we will pivot away from a.i let's go to the report coming up

5:58 am

today. 2.2% for gdp what do you think the possible deceleration means for the market does it mean to a selloff or has jay powell set up the narrative of rates will stay higher for longer. >> rates higher for longer i think a higher read would be negative for the market. we need some cooling we need to see some cooling in growth something the higher rates are starting to impact frank, i have to finish my last sentence whirlpool and western union is up today back to gdp. i'm looking for a negative number i want the rate cuts this year >> people want the rate cuts this year. it is less clear we have to wait for the gdp report jenny harrington, thank you.

5:59 am

one quick look at the futures before we let you go looking like the dow hitting the low of the morning looking like they open about 150 points lower right now that will do it for us we have "squawk box" coming up right now. good morning more protests erupting on college campuses house speaker mike johnson threatening to pull federal funding and hinting of the national guard. meta shares are tumbling we will tell you why investors are pulling back new rules requiring airlines to auto mamatically issue refun over vouchers. it's thursday, april 25th, 2024.

6:00 am

"squawk box" begins right now. good morning welcome to "squawk box" here on cnbc we are live from the nasdaq market site in times square. i'm becky quick along with joe kernen and andrew ross sorkin. let's take a look at what is happening with the u.s. equities there is pressure taking place this morning after earnings reports that disappointed last night. right now, you see the dow off 145 points s&p futures tdown 27. nasdaq down 145. a lot of that from meta. we will talk about that in a moment we have a slate of companies reporting this morning we will get you the numbers. the

28 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11