tv Power Lunch CNBC April 24, 2024 2:00pm-3:00pm EDT

2:00 pm

good afternoon. welcome to power lunch. glad you could join us. the big story is earnings, major companies reporting results and we have reporters breaking down the results and reviewing the ones coming up. we will have three names. we are just 24 hours away from one of our favorite days of the year, the stock draft, a

2:01 pm

great lineup of guests, our color commentator will join us with some names to watch. let's get a check on the markets. in the green but the dow jones barely hanging on with the s&p 500 up by .14% and the nasdaq up by one third of 1%. small moves for the major averages that some big names in individual stocks with tesla jumping more than 10%. up almost 12% now. this is the vision of elon musk or the future of the company with more on that coming up. >> texas instruments jumping on its results, making the chip sector, hasbro jumping even the revenue fell because margins improved and so did profitability hilton gaining on a raised outlook but lower revenue for masco, down, worst day in a year and a half. boeing and tesla, we are in

2:02 pm

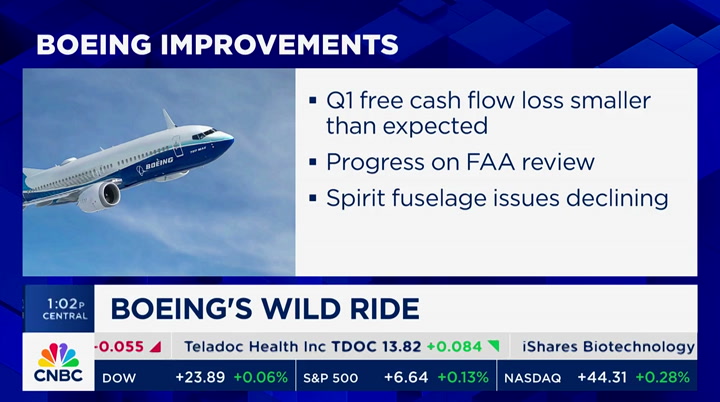

washington with boeing, and interview we had with the ceo, dave calhoun. >> reporter: when you look at boeing shares, the main question on wall street, they are building a bottom, how much worse can things get? many on wall street leave they cannot get worse and pointed to the first quarter as an example. they lost a lot of money. the loss was less than expected but they still lost a lot of money. within that, there are some things boeing bowls, but if you just would look at and say free cash flow in the first quarter, the law smaller than expected and they are making progress on the faa review and the spirit fuselage issues appear to be declining. we spoke about that with dave calhoun this morning. >> it is more about whether it is low or not. wildly sporadic. we are trying to sync up our supply chain this will begin to steady as we get to the second

2:03 pm

quarter. and then it will be all about how many perfect uselages do we get from spirit. that will be the constraint an opportunity and i am confident we will get there. >> reporter: that raises the question, is this the ow for monthly production on the 737 max? not at 38 per month, well below that, wall street believes they will make progress and perhaps that starts in the second quarter. they are keeping free cash flow guide in terms of the guidance to hit $10 billion annually in free cash flow by the end of 2026. those are the reasons why, if there is enthusiasm for shares of boeing stabilizing, that is the reason why. >> there is enthusiasm for tesla with the stock soaring. often the case when talking about elon musk and tesla, not about the court of the numbers that the story line about what is coming up.

2:04 pm

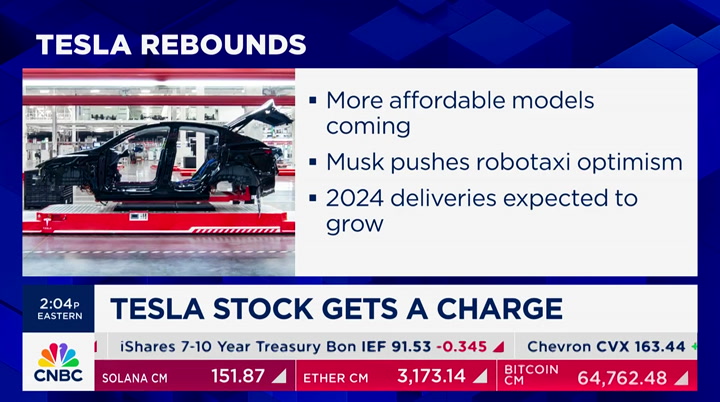

>> reporter: he told the story. he told one tesla bowls are rallying behind, if you believe that tesla can take where they are right now and improve, look at what he told people during the conference call yesterday -- he said they need to do something in terms of volume, improving over the next couple of years. he says we have more affordable models coming. he did not tell us what the affordable models will be, are they brand-new models were simply tweaks on current models? more models that are affordable which pushed the stock higher. he talked about robo taxi optimism at 2024 deliveries, not growing as fast as they did in 2023 at 30%, they are expected to go higher. last year, they delivered 1.81 million and the estimate now is for 1.9 million. elon musk was asked, will you get 1.81? he said yes, they expect to grow deliveries in 2024.

2:05 pm

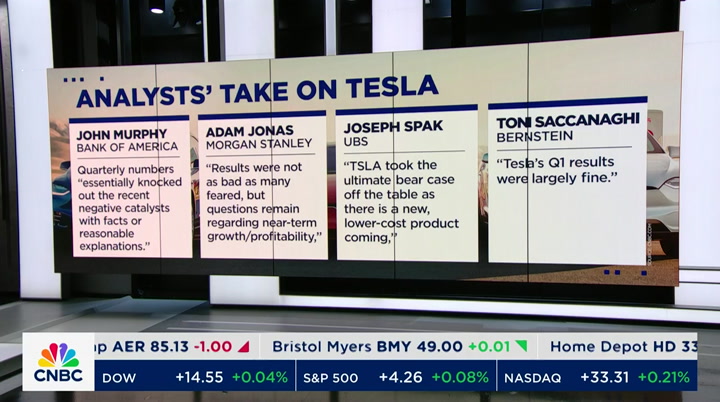

shares of tesla, keep in mind revenue was down 9% in the first quarter, that is the biggest year-over-year decline in revenue for tesla since 2012. the story is something people embraced after hours. >> thank you for setting up for us as analysts have mixed feeling about the first-quarter results from tesla. highlighting some of the calls on the street. bank of america thinks this is the start of a turnaround. john murphy raised his rating to a buy from neutral, price target $220. morgan stanley also relatively bullish with an overweight rating, but other analysts not ready to go with tesla. bernstein reiterated the underperform rating and is skeptical about their shift towards autonomy and robo taxi. ubs is on the sideline with a

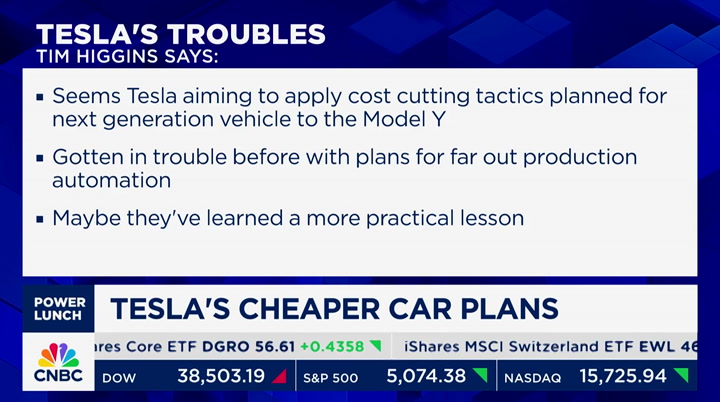

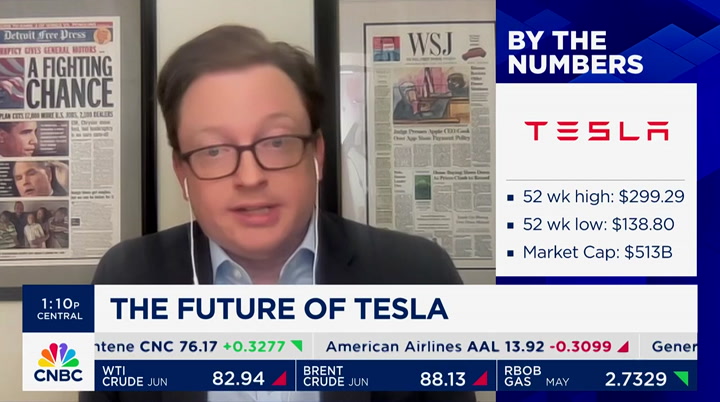

2:06 pm

neutral rating, saying tesla took the ultimate bear case off the table as there is a new lower-cost product coming. joining us to talk about tesla, tim higgins, with the wall street journal, he literally wrote the book on elon musk and tesla with "power-play." it seems like musk sort of steady the ship in the conference call. >> yes, classic performance by elon musk, showed up to play if you will. giving relief to supporters that he is still in charge and looking to the future. analyst point out there are still concerns about the core business and where things are going. if you are a true believer and a fan of tesla, a fan of the vision for the future from elon

2:07 pm

musk, a lot to be excited about. >> what about his big fat pay package? >> that was one of the questions top of mind for people yesterday and he was asked about that. he says, on one hand, tesla is on a pathway to creating driverless cars ith or without me, the momentum is here, maybe not as quickly without him but he thinks it is going in that direction. the bigger question that super fans have, what can tesla become beyond that? is it a future with human robots called optimists? the exciting future that he predicts. he is saying, without him, not so sure tesla can do that. the push, the last-minute push, when he can talk to shareholders before they re- approve his package that was struck down by a delaware judge earlier this year, the big financial package, essentially lobbying for that. and a suggestion that, if tesla

2:08 pm

is making free cash flow, there could be a buyback in the future. the goal of getting 25% control of the company is what he wants and he will stay to do the robots and the ai that he envisions. >> it is interesting, the language that is used around fans of tesla is, you just sai , believers. there is this brand of elon musk, the cult of elon musk. when we saw the report, yesterday, a disconnect between what was being reported and what the stock was doing. elon musk lays out his vision for the future, but, as phil pointed out, he says there is lower priced models, where are the specifics? does it matter where he says where the specifics are as long as he is there and guiding the ship?

2:09 pm

>> reporter: interesting question. these calls will lie a lot about his tone and the fact if he sounds happy or sad. if he is not optimistic about the future, we have seen shareholders get nervous. he came sounding optimistic and i think we are seeing that as result. >> do all those investors, are they rely on the mercurial nature of elon musk? >> for some, absolutely. helping today is the suggestion that this is just not robot taxis and a future years away, some experts predict, there is some way forward of some sort of product that can continue to fund the the interim before the next thing. this idea of a lower-priced vehicle, details are scant. is it just a tweak to the model y? a new product?

2:10 pm

we don't know. that is a challenge, this is a mottled interim vision that has been laid out. >> is their intention within the company, let me put it this way, to you, which is the more important thing for tesla to do? solve the robo taxi issue or come in with a lower-priced car that has more mass appeal than their current offerings? >> reporter: the robo taxi is a thing years and years away. to survive, they need to generate cash to bridge to that future. understanding what the interim is is critical. they have to have something to sell. elon is facing a three-body problem, credible competition in china that is eating her lunch, a consumer base and the u.s. that maybe is not necessarily sold on electric vehicles and is going towards

2:11 pm

hybrid technology. and elon musk himself, who has a habit in the last few years of being material and some investors he is distracted with x, or x a.i., and wanting reassurance he is fully vested in the idea of making tesla the next level that has been promised over the last few years . >> thank you. moving on to the next big earnings report, meta will report after the bell. let's get to julia. >> reporter: after they blew past expectations last quarter, shares are up 40% year to date and up about 130% in the past 12 months. the pressure is on for meta to keep accelerating revenue growth and expected to grow the top line in the quarter by 26%, 96% growth in earnings per share. that growth is expected to come from tailwinds from the advantage of ai tools, from a

2:12 pm

solid digital advertising market and early revenue coming from messaging. analyst are bullish, 86% have a buy or overweight and 11% have a hold, jpmorgan saying, first quarter was solid and meta is emerging in an ai leader in advertising names. comps get tougher through 2024. ai will be top of mind on the earnings call after -- the other big topic, the law that president biden just signed forcing a sale or ban of tiktok.a we will see if mark zuckerberg has anything to say about that. >> we will grappled with tiktok in a few minutes. do you think analysts on the call will press meta about how they can give it and react and try to take advantage? >> reporter: a number of analysts have laid out how much

2:13 pm

meta would benefit , instagram and its core platform, would benefit from increased engagement if the time spent on tiktok were to go away. tiktok is the most popular app in terms of time spent for mac americans. if that went away, no doubt meta would benefit in terms of engagement and ad revenue. they have already laid out a lot of those numbers. i don't know if there is an expectation that meta would need to pivot to take advantage of that. there may be questions and i think meta will avoid saying anything very specific especially because tiktok will be clear that they will challenge this in the courts. no doubt, if tiktok went away , meta would benefit. >> imagine what you could do with those hours spent on tiktok , pick up litter on the highway. >> i need to figure out tiktok, i want to be an influencer ,

2:14 pm

one of my goals in life. >> trust me, you are, just not on tiktok. let's get a quick power check on the positive side, hasbro up 12%. on the negative side, teledyne down 12%. that is your power check. the right back trading at schwab is now powered by ameritrade, giving traders even more ways to sharpen their skills with tailored education. get an expanding library filled with new online videos, webcasts, articles, courses, and more - all crafted just for traders. and with guided learning paths stacked with content curated to fit your unique goals,

2:16 pm

2:17 pm

2:18 pm

grade, moody's says the outlook is negative. >> stocks are mixed after a mostly positive start today as higher rates appear to be offsetting relatively strong earnings. nicknames include meta and ibm, said to report after the bell. our next guest is watching key consumer names and expect earnings to grow outside the biggest tech companies as the year progresses . jim, good to see you. a broadening of the market growth and results, does that continue? >> absolutely we are seeing two things, a broadening but a lot of dispersion within sectors. look at all the beauty and the slowdown they saw, versus the costco with great comps, or flat volumes with the procter & gamble. it will be a lot more pressure on investors to find the

2:19 pm

winners. >> do they have -- those that are winning, do they have anything in common? >> i think there is a little bit of a trend of trading down and consumers looking for value. as the pent-up savings is finally going away, particularly among the lower and middle class, that will create some difficulties and different dynamics than we have seen the last couple of years. >> where are you looking for opportunities, if you think the middle buyer, the middle consumer, is looking for better bargains? >> two ways, choose the providers that are winning the brands. an easier way to do it, not be worried about where is the consumer spending, but is the consumer spending? the answer is, absolutely yes. amazon, it does not matter what product you purchase, as long as your purchasing, they are a winner. the cost to deliver that, down

2:20 pm

$.45 year-over-year in the fourth quarter, they are widening the moat around the business by lowering costs. mastercard is another great example, visa reported last night and amex last week, the consumer is continuing to spend. the mastercard of the world are happy. you don't have to check it was a winner or loser. mastercard is a real winner in that example. >> why are some consumer product companies or consumer oriented companies, nike, ulta, pepsi, why re they struggling with organic growth while others are doing well? what is the difference or the distinction? >> a backlash against those companies that raised prices aggressively over the last couple of years. constellation brands is a great example, much more muted in raising prices and some 8% depression growth versus procter & gamble or pepsi,

2:21 pm

flat. the repercussions of the price increases over the last couple of years is coming home to roost. >> consumers are increasingly looking for good value and where they see that value eroding, they are not buying? >> there is a pocketbook issue around affordability. when you have to make those hard decisions, now is the time. a couple years ago, when you had pent-up savings, that was not as big of an issue. >> how are you playing ai these days? >> the hardware side is what everybody's chasing. there is the next stop on the train, who will be the beneficiaries of using ai in their business? we own a company, i think it plays in a couple of ways, first of all, drug discovery will be sped up. they have a proprietary database of all the prescriptions written that will be the source material for discovering new things, new

2:22 pm

compounds which still need to run three clinical trial and that is the other side with iqvia, a company facing headwinds from biotech spendin , and inflation headwinds as contracts they wrote a couple years ago at lower costs are now seeing higher costs, that washes through and the ai benefit should start to hit iqvia over the next couple of years. i don't think the market is appreciating that. >> thank you. coming up, more --

2:25 pm

save time marketing with constant contact. with email, sms and social posts all in one place. so you still have time to make someone's day. start today at constantcontact.com. welcome back to power lunch. stocks slightly lower but bond yields are moving higher. let's get to the latest on the bond market. >> reporter: let's start at the beginning, the revisions took some of the fun out of the number, generally as expected with negative revisions, meaning last month was downgraded pretty much in every category. as for the next big variable, five year note auction, 70

2:26 pm

billion, biggest number ever, middling demand by investors, unlike the record yesterday for two years, 69 billion. shorter maturities seem to be much deeper. tomorrow, we finished with 44 billion in seven-year notes. on the five year chart, at 1:00 eastern, rates lower than now, now about 465, they have gone higher. bond maturities, 10 year note, 20 and 30 year bond, leading the entire curve higher. the 10 year note yield today is trading above yesterday's high yield which were about 4.65. twos to ten spread, now -28, least inverted in three months and that is important because many believe that the pc number on friday, they generally come out as expected keeping the two year note expected -- more

2:27 pm

aggressive and we have not been able to close above 5%, giving some investors confidence in the steeper yield curve ultimately is probably focusing on supply and debt. tyler? >> solar stocks lower following lower earnings from enphase >> one of the worst performance and yesterday after they missed 41 results on the top and bottom line and gave week quarter to guidance, but the ceo did tell me that quarter of one was the bottom in terms of the supply issues. the market has been oversupplied and to correct that, enphase has been under shipping product into the channel, which means the demand site looks artificially very low because they're selling was to work through that excess inventory. the company said this current quarter is the last quarter when they will under ship. in the second half of this year,

2:28 pm

the fourth quarter, the revenue numbers will align with the underlying demand. that is on the supply side. the demand side, even though they will start to matchup in the second half of the year, the demand side is harder to predict because it is so tied to interest rates and, who knows what the fed will do, that is a big wildcard. things in europe are looking better they said. cautiously optimistic is what the wall street analysts are saying but the stock is down 5% and now 50% since last year. >> they work through this inventory issue, but, when they come back to a more normalized sales pace, seems their estimates were still below? >> reporter: that is right, the $400 million in revenue, that is well below the more than $700 million in revenue they were earning just a year ago. it is starting to go and now be a level playing field in terms of the supply and demand side matching, it is well below because, when rates were so

2:29 pm

low, easy to sign up for solar, but that is no longer the case. >> thank you. let's get a news update. arizona lawmakers expected to vote on an attempt to repeal a controversial abortion ban today for the third time in three weeks the state supreme court allowed the near-total banned from 1864 to be upheld earlier this month, gop representatives in arizona state house, where they have a narrow majority, have prevented a repeal of the law from advancing. mike johnston says he will all for the resignation of the columbia university president during a visit to the campus as she is a weak leader, he says. palestinian protesters formed an encampment on campus last week, columbia will finish out the academic year remotely for concerted concerns. a requirement today for dairy cattle moving between states to be tested for bird

2:30 pm

flu, the direction from the usda is a day after they said it found bird flu virus particles and some samples of pasteurized milk. the milk supply is safe based on information currently available. >> that is attention-getting and rather concerning. kate, thanks. the banon tiktok passing the senate , people will have nine months to the best. is this the end of tiktok? we will discuss when power lunch returns. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams]

2:31 pm

and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow! how's the chicken? the prawns are delicious. oh, i have a shellfish allergy. one prawn. very good. did i say chicken wrong? tired of people not listening to what you want? it's truffle season! ah that's okay... never enough truffles. how much are they? it's a lot. oh okay - i'm good, that - it's like a priceless piece of art. enjoy. or when they sell you what they want? yeah. the more we understand you, the better we can help you. that's what u.s. bank is for. huge relief. yeah... ♪ you founded your kayak company because you love the ocean- not spreadsheets. you need to hire.

2:32 pm

i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire business. mat it's not a nine-to-fiveon. proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

2:33 pm

welcome back to power lunch tiktok is a step closer to getting banned in the u.s. because president biden signed into law a bill that requires the chinese parent company, bytedance, to sell tiktok within nine months or be banned in the united states. tiktok said, "this unconstitutional law is a tiktok ban, and we will

2:34 pm

challenge it in court." our next guest testified before congress supporting the tiktok ban. ivan is ceo of barefoot security, a cyber security expert. great to talk to you. so, let me ask you, when you testified before congress, what did you tell them about tiktok you thought was concerning enough to deserve a ban in the united states? >> some of the findings we presented, tiktok has a lot of information on people who never use tiktok and did not suspect tiktok would be collecting the information. >> how do they get it ? >> one of the most common ways is through tracking pixels, we

2:35 pm

touch on websites that we use every day, like when booking a doctors appointment or finding something online, banking online. >> you are saying tiktok is giving information about us even if we don't download tiktok or we never go on the platform, and school other people's videos? >> that is correct. that was one of the findings that startled a lot of people, the amount of data collected on people who never use tiktok . >> what is to stop tiktok from continuing to do that if the app is banned? is disabled? if you don't have to have tiktok on your phone to be subject to data theft, how is a ban going to fix that? >> very bit question. by the way, something that can

2:36 pm

help solve the broader problem, not just a tiktok problem, something called the roposed act that will ban transferring america's data to companies controlled by china and russia and those type of states. that could prevent this overall problem that we face when our data is being collected. >> what if you have bytedance saying it is valuable enough, this u.s. business, we don't want to see it banned, or i am presuming a court let's this law stand, should that -- should that be the case, if they divest of tiktok , does that solve the problem? >> it is a step in the right direction with tiktok only . yes, let's say they divest and

2:37 pm

there is a new control of the company. this means, the data will still be collected but will be collected and sent to the mothership, that is in america, it has to follow american rules and not the communist party. after that, putting the controls , security controls and governance controls in place to make sure the data is safely stored, there is no back door, no digital gremlins, the back doors and windows are shut and everything is secure. and people are vetted. people with access to our data do not send it back to china or other places. >> tiktok has said repeatedly they have never , not once, shared user data with chinese government officials. how do we know whether we can believe them at all? how would

2:38 pm

we ever know? >> that is a very good question. first thing, by chinese law, any company that is nder their jurisdiction, in this case, bytedance , has to disclose any information of data that they have, they have to disclose it to the authorities. >> if the authorities ask? >> correct. having reports by journalists which have been confirmed that information collected by tiktok was used to spy on them, including geolocation and tracking journalists. >> do you see problems beyond tiktok with other social media platforms and the data isway -- in the way data is

2:39 pm

collected? >> not just tiktok or big tech from china, but a broad problem, and what i personally believe, companies that collect data need to have very clear rules to follow. secondly, be held accountable. just like executives have personal responsibilities when it comes to following financial laws. or they can go to prison if they do not follow the rules. >> ivan, fascinating saga and we will be following it, hopefully with you. less than 24 hours wait on this cnbc stock draft, forget the nfl draft, the real thing is here tomorrow at 2:00 p.m. eastern, coming up, we speak with tim about strategy come of the stocks that are in play, and more. back in two.

2:43 pm

big day is almost here, 2024 cnbc stock draft tomorrow at 2:00 p.m. eastern time in the studio and studio a as well. it includes 16 time nathan's hot dog eating champion joey chestnut, that qualifies him to pick stocks. the washington commanders knew running back, austin ekeler. eddie george. jillian michaels. mtv's nev schulman. that is the lineup. for a quick preview of the events and the

2:44 pm

names on the board, the mel kiper of the stock draft, tim seymour. >> one of the greatest event in sports and markets, i am excited to be part of it. >> we give the contestants a list of how many stocks from which they can choose? not all 2000. >> 50 or so stocks. clearly. a broad swath of economy and the market. it does seem like the draft this year will be dominated, much like the nfl draft, but quarterbacks the sexy part of the market, chips, nvidia, every year is a slightly different tone and i expected to be alive and well. >> what the winners typically do , they hit a home run.

2:45 pm

you have to have that -- the game theory says, when you get two choices, or three -- >> two. game theory, on some level, as a former retired athlete moving into the booth, about finding the most bombed out stocks that i thought could have an inflection point. almost so bad they are good, like boeing, down almost 40%, free cash flow dying but i think they will have a percent to 10% in free cash flow yield in 2025. exciting picks. every team in a win now mode, which means you go for the names that will give you the best combined performance against the other teams. it is an important combination of fundamentals meet technicals meet momentum meets, you have to stay as smart as the pack.

2:46 pm

ladies dominated last year. it is exciting. >> in my world this would be begging for, at least, squares to bet on which team would come out on top. you could even parlay it and say who will have the over-under kind of thing. we are not licensed for that, but maybe we could be in the future. >> i would do side bets, but we have to be careful of being banned from cnbc forever. everyone will have a slightly different approach to how they are picking these stocks. this is a group of teams that are athletes, from the entertainment world, it is a

2:47 pm

fun event that is rooted in reality of where the market is right now. >> you made the point, boeing is so down it is painful to watch . last year, i thought one of the participants, it was a player, they made a brilliant move in picking pellets on. -- peloton. i was wrong. if you had the first pick, who is your quarterback from usc? >> no obvious caleb williams, even a united healthcare, they are a five tool athlete. this is a company that is a growth company which has pulled back and locked. if they haven't rallied 15% off those numbers last week, i almost was a this is a no- brainer. i like boeing and you have to consider bitcoin, the dynamics which have had gold and bitcoin

2:48 pm

moving in the last six to nine months. to say the mega cap to stocks are to be counted out is crazy. if you think about the move nvidia had last year, they already had a big run and another big run up its sleeve. if we are in an environment where people are worried about growth, we have seen rotation in the market over the last couple of days from value to defensive growth. there will be obvious picks, names people want to own because their names people want to own. >> apple shares have gone lower, maybe that provides opportunity. nvidia has been hogging the oxygen. >> should be great. texas instruments higher on a rosy forecast, lifting other

2:49 pm

2:50 pm

2:52 pm

three stock lunch. today, we have a few earnings related movers. here, we have jerry castellini, chief investment officer with capital management. up first, we have texas instruments, moving higher. the chipmaker recorded first quarter results that topped wall street estimates, but the guidance for q2 is really what is moving the stock here today. what is your trade on texas instruments? >> i am a buyer in this one. it is great to see this market, the semiconductor market beginning to broaden. it has been 7/4 since texas instruments actually forecasted a higher forward growth rate in the quarterly sales revenue. so, this is a big move, let's say, in the part of the market that ti dominates, which is the analog side. not going to get a lot of attention from the ai crowd, per se. but, it is an important milestone. and when you think of semis in

2:53 pm

general, you have a powerful case that the entire marketplace is going to broaden out here. partly because of ai and partly for cyclical reasons and this is just part of the beginning for them. so, it is important to own these types of things early. >> let's move on to bio jen, they recorded a first quarter profit that topped estimates, cost-cutting efforts taking hold, and sales for the alzheimer's drug came in higher than expected. your take on biogen? >> i am a seller. this has just been one of the hardest areas of medical research of all-time. we have been looking for a solution for well over 30 years. they got past the fda and it is the only one on the market. we only buy through a couple months of disease progression, and my fear is this is a

2:54 pm

company where that is kind of the only gross engine they have. will he and others will be coming out with a new version or somewhat similar to this. so, you have upcoming competition, and you have ust a very difficult overhead with their patent portfolio. my inclination is to let it go here. partly because i would rather be looking at a therapeutical solution that is much more powerful than the one they have. be like jerry, final name here, chipotle reports after the bell, it has seen some earnings revisions recently pointing to an earnings beat. shares are up about 28% so far this year. what do you think of chipotle? >> i mean, you said chipotle, so i am going to start with how often i go to the restaurant itself. >> [ laughter ] >> i love their menu, i think it is fantastic, and so do all of its shareholders. the concept here is that it is hard to find a thing in what

2:55 pm

these guys have been able to a compass. they have a great demographic, they have an updated menu, they have been be -- beating -- and this is a 20% topline growth. we are very impressed with it. but with that said, when you throw on top of it, this massive shortcut they are going to do that will bring the stock back down to a regular person spying, kind of like their menu, all of those things are in the stock today. i worry that they might not, today, be as enthusiastic against expectations. so, my feeling is, hold this stock. listen closely to what they say the trends are in the second half of the year, then decide if you want to own a business that is trading over 40 times their service. >> jerry, thank you so much for joining us, jerry castellini. >> eat the food, keep the stock. be sure to follow and listen to "power lunch" on yr ou favorite streaming service.

2:59 pm

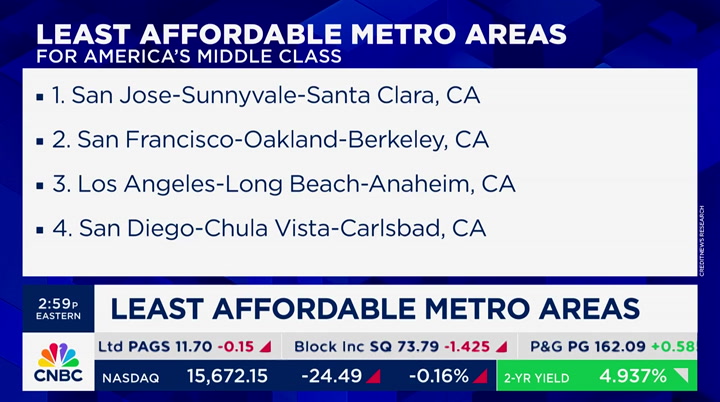

it says right here we only have 90 minutes left in the show, but i know better. we have 90 seconds left in the show, so let's get with it. a recent credit news study tallied america's least affordable metro areas for the middle craft -- class and unsurprisingly, four of the top five are in california. the top five least affordable metro areas are san jose, san francisco, los angeles-long beach, and san diego in the golden state, followed by honolulu, hawaii. and then, oxnard, california, seattle, boston, new york, new jersey -- where we are -- in bridgeport, connecticut, rounding out the top 10. >> this is interesting, to afford a house in san jose, you would have to make $468,000 a year. that is crazy.

3:00 pm

speaking of affordability, millions of american workers could soon become eligible for overtime pay. the white house finalized a rule raising the minimum salary threshold to qualify to 40 hours a week in a workweek to start, with people earning a little less than $44,000 a year would be eligible. soak of the good news for that. the employers probably fighting that. >> and thank you so much for watching "power lunch". be sure to tune in for the stock draft tomorrow at 2:00. thank you so much. welcome to "closing bell". scott walker live from the new york stock exchange. this comes from a countdown to meadows earnings report, the first of the big names to deliver q1 results. big question, can they deliver enough to keep the scouts -- stocks surging? we have doug clinton coming up in just a little bit. in the meantime, your scorecard with 60 minutes to go in regulation and it looks like that major averages unable to get much going for most of the day today.

35 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11