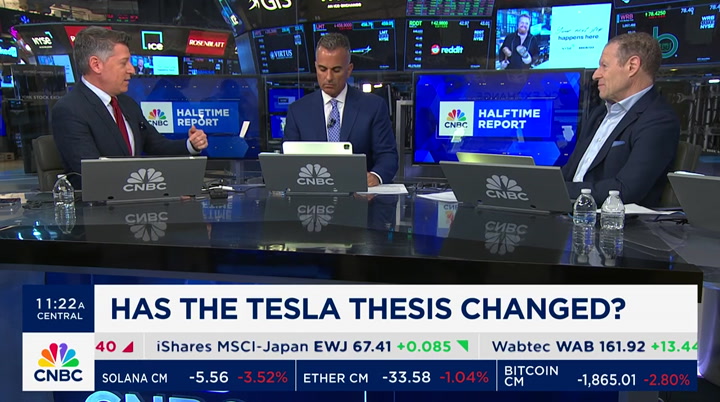

tv Fast Money Halftime Report CNBC April 24, 2024 12:00pm-1:00pm EDT

12:00 pm

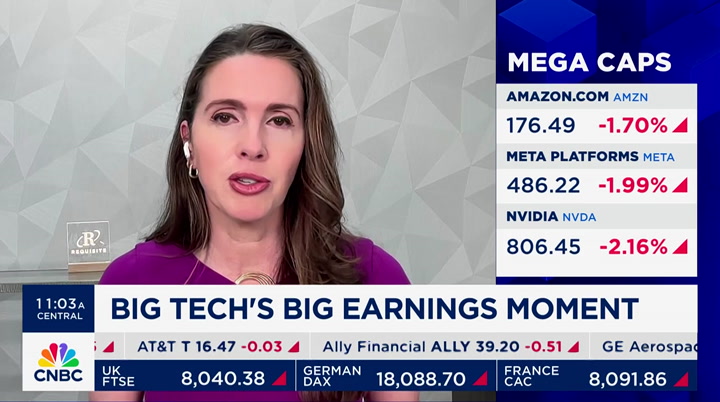

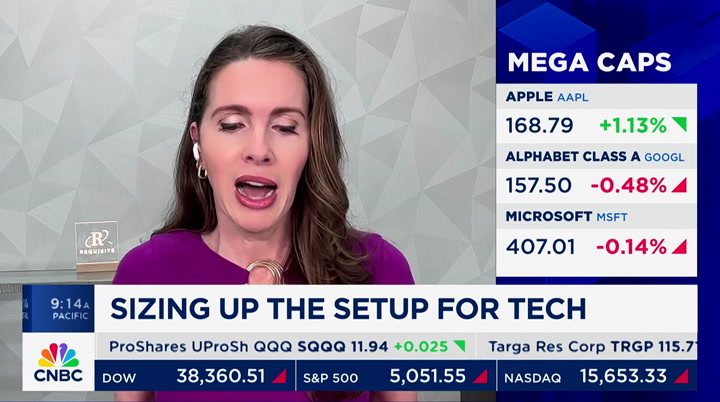

real this time >> and the diversity of the deals. you have venture backed, private equity backed, you have companies with a lot of debt, companies that are profitable, those that are unprofitable, meeting that demand. so we'll see if this one also has the same fate. >> yeah, it's going to be an exciting week on that front and on earnings as we move into tonight. let's get to the judge carl, thanks welcome to "the halftime report." i'm scott wapner front and center this hour, big tech's big moment. meta kicking off earnings for the heavily owned group today. we're going to ask the committee whether they'll live up to the hype and help stabilize stocks overall. joining me for the hour, bryn talkington, joe terranova, steve weiss. we take you to the markets first. check out how things are going we're giving a little bit back today across the board we are red i want to set the stage for the start of the most important earnings reports obviously mega cap tech. i don't want to go deep yet on meta i want to look overall, because expectations are high. they have to be. i want to read you where

12:01 pm

earnings expectations are for mega cap tech coming in. this is unbelievable you want to know how important these are? mag seven earnings on aggregate are expected to rise 40% in q1 revenue is expected up 13% versus 2.3% for the rest of the s&p. the rest of the s&p is expected to see a 3.1% decline in earnings >> sounds like last quarter. that's exactly what happened last quarter and let me tell you why it's so critical that these mega cap companies deliver, and this relates to the market itself on monday i said, i felt as though the market was bought bombing, and one of the reasons i felt it was bottoming, i didn't think there would be followthrough selling because you had strength in financials you had strength in health care. you had strength in industrials. the market holds its 100-day moving average we now rally up to the 50-day moving average here's the handoff it's got to come from mega cap

12:02 pm

earnings to get through that 50-day moving average to restore price above the 50-day moving average. financials, industrials, health care, they did their work. now it's incumbent upon the mega caps >> the bar, though, bryn, is so high, isn't it if you look at year-over-year eps growth expectations for mega caps just to try to continue to layer for our viewers just where expectations have gone from a pure earnings and sales standpoint, but eps growth expectations, nvidia 400%. amazon, 169. tonight's meta, nearly 100% year-over-year earnings for q1 >> on the other side of that, look at apple. they will have declining revenue and earnings on that chart you just showed. i think you will continue not only to see a dispersion with the mega caps of amazon, meta, facebook, microsoft and nvidia crushing it, i think meta

12:03 pm

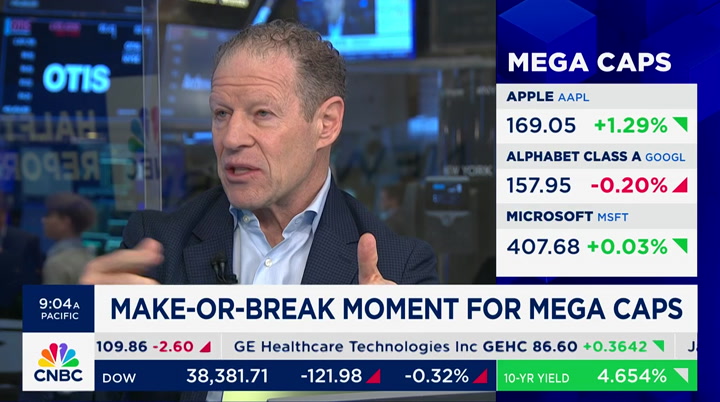

tonight is setting up -- and we'll talk about it later -- but this is going to deliver the goods. i think microsoft and amazon will also deliver the goods. and so i think you're setting up where these multiples and the growth we have last year in stock appreciation is going to be warranted and will help lift up the rest of the market. to your point about these six names versus the other 494, i think once we get into the second and third quarter of the year, the other names, the other names in the s&p from a revenue and earnings, are going to start to pick up i think this is just a q1 year over year. i'm about the negative earnings growth >> weiss, are we going to meet the moment if you look at the mega cap, we're not here without that, obviously. nvidia is up 100% in six months. meta is up 66% in six months amazon, alphabet, 39%, 29.5%, respectively microsoft, 24% we can take apple out for now. it's irrelevant to our

12:04 pm

conversation the question is, are they going to live up to the hype so to speak? >> i believe they will, actually i think that meta and microsoft -- i don't want to say definitely but a much higher probability on meta. microsoft you always have the enterprise spend and there's a wait and spend, the capex spends they can absorb in a.i., et cetera i think they should. of course a lot of that would be based on cloud, and we've seen recent acceleration of cloud growth that's critically important to microsoft, and then we get to google and amazon. we won't talk about those now. but without a doubt, they're critically important to the market because they've been the backbone of the market we used to have those conversations, can the market move up without apple? and my view is always, yes can the market move up without these mega cap companies, the group of them? i would say, no, because there's such a large percentage of the s&p. >> maybe it's better meta is --

12:05 pm

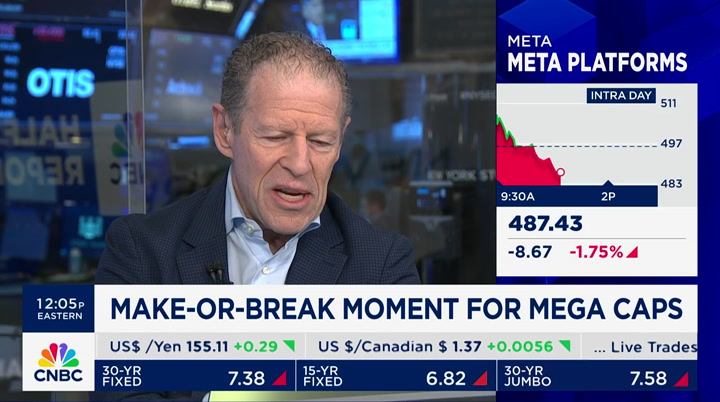

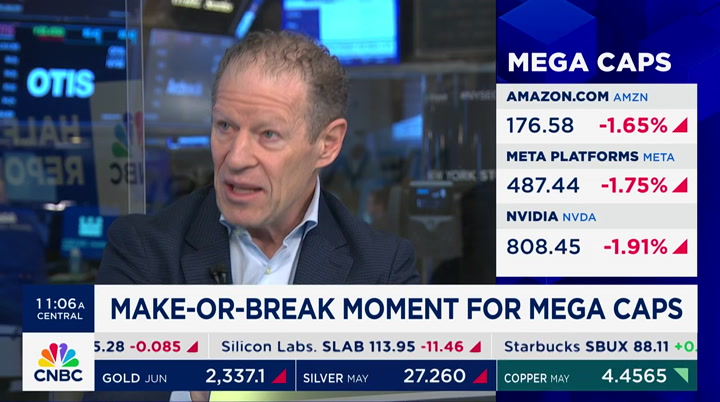

>> without a doubt >> if you're bullish and, you know, you're expecting big things from the big caps -- >> right >> -- that this thing hasn't really disappointed anytime lately and the expectation is, ever since them got fit like gerstner told them to do, the stock has been an absolute juggernaut. >> here is what i'd say. if you take a look at -- there's not a lot of confidence in the market now the day has a few more hours to trade. you take a look at meta today, the stock peaked at 508. the reversal now to where it is. so it's trading now at 487 that intraday volatility, and we're talking about percentage points that obviously are small relative to the gains and relative to the share price, but nonetheless, it shows that not everybody is so sanguine about the report today that will come out. and i think that's good. >> okay. i can go with that if you look at where the stocks

12:06 pm

are off of their most recent highs -- >> right >> -- it's not like they're ramping into the numbers >> no. >> a little bit of a different story. so meta is down 7.5% since april 8th, you know. not that long ago, okay. the stock has come in a bit. >> yes >> maybe that takes a little bit of the pressure off. i don't know >> as i said that, and just to finish that thought, it's really dictated, i think, by quants, number one, you can see it 1 to 1 between rates, yields on the 10 year, and how the stock trades and that's tech overall. that's market overall. so i'd say that it's sort of there's no noise here, right, in terms of the company i haven't heard any analyst say they're going to miss. i haven't heard any analyst do anything over the last month but raise their price target without any fundamental reason to do so. >> one of the key things is, can you maintain the level of growth

12:07 pm

that the company has now reset to particularly from a sales standpoint julia boorstin certainly watching that as she waits for this report like the rest of us in overtime. continuing this revenue growth >> yeah, that's absolutely right, scott after meta blew past expectations last quarter, it is expected to continue to accelerate its revenue growth now to 26% in the quarter, and that's anticipated to be 96% growth in earnings per share now meta is expected to benefit from tail winds, from reels, from the advantage of the a.i. tools driving results for advertisers as well as a solid digital ad market as well as some early revenue coming from messaging. but meta shares are up about 132% in the past 12 months they're up about 40% year to date so analysts are starting to note that expectations are very high. jpmorgan writing, quote, first quarter ad checks were solid and meta is emerging as an a.i.

12:08 pm

leader among ad names, but comps are getting tougher through 2024 now a.i. will certainly be top of mind on today's earnings call after meta's a.i. assistant rolled out just last week, and we will also be listening to see if there's any commentary or any answers to questions on the impact of a potential tiktok ban that might drive up meta's user engagement scott? >> julia, i appreciate that. we'll see you in "overtime." joe, you own it. worst year ever in '22 best year ever in '23. let's see what happens now in '24. >> let's see what happens this evening. as i said with my initial remarks, this could be the near-term catalyst for the market i agree with you i like that meta bats leadoff here that's a good thing. it could be a scenario similar to netflix where expectations are exceedingly high, some sort of surprise delivered in the earnings conference thereafter, and the stock doesn't respond accordingly to really strong earnings what does that mean to the

12:09 pm

market that means we delay advancing further when we kind of sit in this consolidation area. does it change what meta is? absolutely not last quarter they delivered a $50 billion buyback, they introduced a dividend. this is a company that is gaining market share on social media. x is in decline. snap clearly from a val situation standpoint and certainly from a revenue standpoint is not an alternative in social media to meta, so with reels, with instagram, with whatsapp, gaining market share through a prime position they focus on cost deficiency. the business is going to be good for the duration of '24. could they stumble tonight yes. if they do, the market stumbles with it. >> who, weiss, has more pressure on it this week, taking meta out of it, because you're going to get alphabet and microsoft tomorrow -- who has more pressure on it i know what's happened of late in terms of the narrative around alphabet stumble after stumble related to a.i. rollouts, whatever the the stock, though, has done well >> it has. >> it's outpaced microsoft over

12:10 pm

the last 12 months despite all of that noise in the marketplace. >> yeah. yeah, and, actually, a great buying opportunity to take advantage of when we had all the noise about the launch of a.i. i would say, look, it's still clearly on alphabet is where the pressure is, because that's where, i think, the dagger is lining up, because those that said, hey, i'm going to sell it because they botched the rollout, they're not going to be competitive in a.i., they have to prove them wrong. so i think it's clearly them microsoft is not without pressure, though, because they're viewed with open a.i. partnership. i view them as the leader in a.i., so they have to show at least a nice uptake there. if you do come back to meta, meta has the easiest view, and nothing is easy, but the easiest road to a.i. impacting their business because it's instantaneous unlike microsoft who has to go through the

12:11 pm

enterprise buying cycle, right there's no enterprise buying cycle with consumers there is on the ad side, but it's the easiest pathway to showing the impact of a.i., and they are an innovator taking advantage of it. >> bryn, you own microsoft, also, right? jefferies says the market has been lowered pointing to shares are flat since the last print and the multiple is also compressed by some 6%, therefore, the bar is lower. do you buy that? >> yeah, that sounds reasonable. i think that they're going to -- they're expected to have 16% revenue growth, 15% earnings growth i think satya and amy hood are the best combo as ceo/cfo. they were a lead investor on rubrik and on open a.i they have invested in some of the most exciting startups out there. we know we have to figure out about co-pilot whether it's the app on your phone or within the enterprise of outlook.

12:12 pm

i think that over the next few years as an owner of a company, everyone is going to have that co-pilot on their employees' desk tops. it creates so much efficiency. i think between satya and amy, excitement about azure and co-pilot, i think another solid read and microsoft is a top name to own by investors. >> here is a good one for you. i will ask everybody the same question, too. you guys buyers on dips, these companies, the stocks go down this week? that's a central question right now whether there's going to be enough support around the names that have pulled back of late in the last week or so as the stocks have come in. dip buyers are going to save the day. they've done it the last couple of days. they've picked up a number of names. meta goes down, are you buying that down? >> meta goes down, would buy the dip. alphabet goes down, would buy the dip. microsoft goes down, would buy the dip. >> what about you, weiss

12:13 pm

>> they're all my positions, those three. if they went down substantially, i would upsize for a trade i'm not looking to add exposure. they're pretty significant if i didn't have a full position, i absolutely would buy the dip particularly on meta and google because i believe they're cheap relative to the market and their growth rate. i would say microsoft is fairly valued at this level, but, nonetheless -- >> it's fairly valued as the multiples come in. >> it has. if i weren't full, i would buy. >> microsoft really matters. it's a $3 trillion company it's the largest in the s&p 500. i know you didn't say that it's the largest company in the s&p 500. the second largest, apple is going to stumble like we think we'd better get something good for microsoft. >> i think people would agree with that. bryn, the same question, this

12:14 pm

idea of buying the dip if you have an opportunity to add to the positions on pullbacks, would you do it >> like steve, i own a ton of tech tech and energy are my two biggest holdings theoretically, i would buy the dip. i think it's very unlikely microsoft even has a dip google, on the other hand, i don't own it but i wouldn't buy it with google, i still don't like the leadership scenario. who runs this company? is it sundar or sergei and larry? the other companies, it's very, very clear who the visionary is, who the leader is, how they're executing. i think with google the top-level structure is very unappealing to me because i think that leads to an inability to make really important decisions, and i think one of the most important times within the technology companies >> but the stock -- the stock performance would suggest otherwise, though, right as we said, this goes towards the narrative not necessarily

12:15 pm

matching up with the fundamental performance of a stock, right? year to date alphabet is up 13%. over the last year, it's up 50 where is the real problem, i guess is what i'm getting at that's a broader question to everybody, not you, but those who want to criticize alphabet, even the gerstners of the world, right? he criticized it he sold it and he saw the stock pull back, and then he bought it >> sure. when information changes, we have the right to change our mind when i'm underwriting an individual company, if i'm not going to buy one of my etfs and will buy an individual company, it comes down to the leadership, right? that's why i don't own google. i don't know who runs this company. and so i can tell you mark zuckerberg, elon musk, tim cook, satya and amy, i can tell you who is running it and what they're doing. you can't do that with google. for me, with my strategy that eliminates it from my portfolio. >> so let's talk tesla

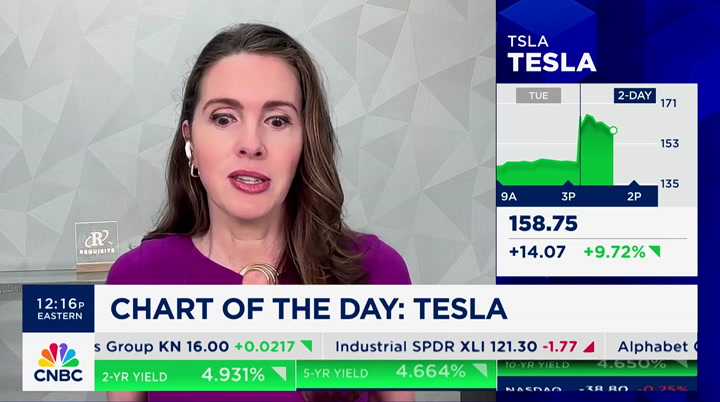

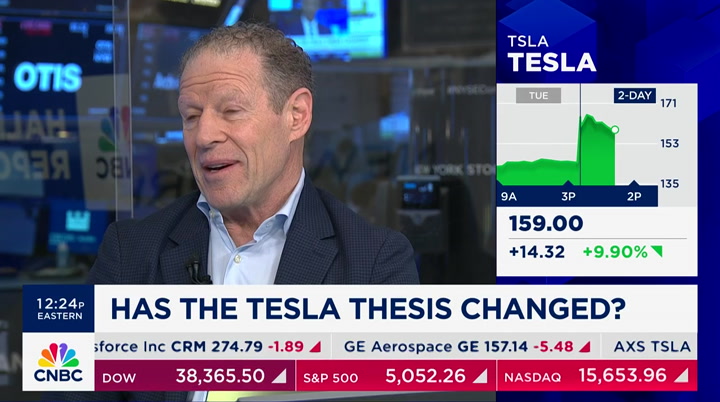

12:16 pm

bryn, i'll start with you. we made it our chart of the day, obviously, on the back of earnings it is higher it's not like the earnings report was great it was far from it but this idea of what musk talked about about the production of affordable new evs by early '25 is what has jump started the stock today, so you'll take the leader of this company at his word, i suspect the market seems to be >> yeah, well, you and i talked about this on "closing bell" yesterday, and i said, the sentiment and the bearishness on this stock, right, not the company, on the stock, was so loud, it was deafening if i was short the stock, which clearly i'm long, i would not be short this name going into the earnings print if they do even less, the stock is going to pop. that's exactly what happened i thought it was a very good earnings call. elon was like the adult in the room to me it was quintessential elon he had good analogies about elevators and horses and flip

12:17 pm

phones, and, to me, what i wanted to hear is, i don't want to hear about robotaxi, the cyber cab, but they're able to build the cheaper car on the same manufacturing line, and i'm going to say use the same chassis. i don't know if evs have a chassis -- that's my word -- use the same theoretical chassis for the $20,000 m.dodel as for the caps you got the inference that was the case you want to have the short-term case in line with the growth within the current business along with the future excitement around the innovation. and so i think that's what made the stock pop, and now we're going to start finding a floor on this name and weapon see if other investors start to come into the name as the stock itself, which was broken, will now find a floor, and then i think move higher with this refocus on building out cars that are affordable for everybody. >> guys, you were worried about the shift in strategy, if you want to call it that,

12:18 pm

suggestions, and maybe even some from the company itself that it was a robotaxi-type future rather than a lower priced vehicle as they've been continuously cutting prices and losing some market share in markets like china so you'll take musk at his word. it's not so much -- some would suggest, well, given the history, okay, maybe we should pay attention to what they do not what they say. because we've been burned before you know what i mean >> i think you're 100% right, and that's where my irritation would have been on the robotaxi, now call it a cyber cap. but when they're saying that on the same chassis, on the same manufacturing line -- i'm sorry, on the same manufacturing line that they already have, they're going to be able to build these cheaper cars that makes sense, right? one of the things that is, like, under talked about is the manufacturing marvel that they are able to pull off at tesla as a company. if they can take the design of

12:19 pm

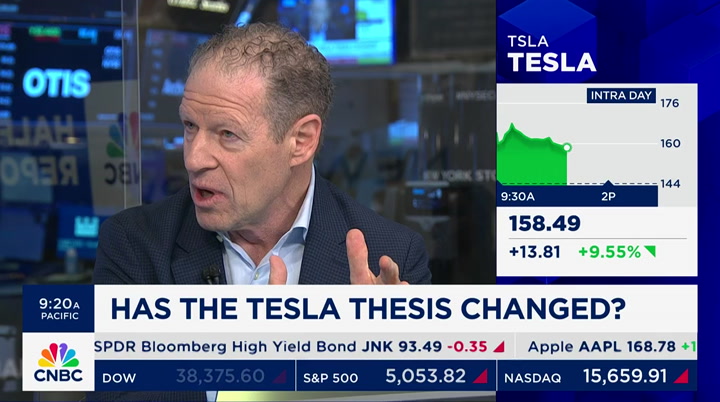

the cyber cab but put it in a $25,000 car, and, listen, don't forget, the other big automakers are pulling back on evs. so we're going to end up having more evs longer term, tesla will continue to be in pole position. i do think with china, once again, you have to have an expanding user base because i know their market share will shrink, but you need to have just more chinese buyers in general buying evs i think tesla will get their fair share outside some of the other names. >> weiss, bryn sort of hit it on the head the stock was poised for a bounce, right? it's been getting killed >> she is a brilliant call going into the quarter, expectations could not have been lower, as evidenced by what the shares have done over the last, well, since the beginning of the year. i did cover half the position in the quarter. don't ask why i didn't cover up the other half the setup was as good as you could possibly want. if i weren't short, it's

12:20 pm

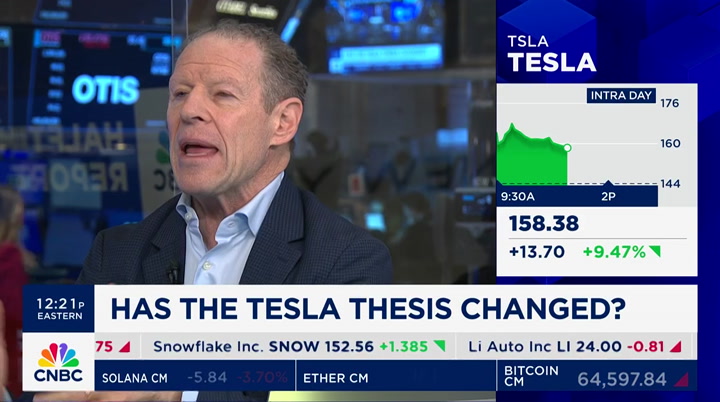

possible i would have bought it, because odds are the stock would have lifted. the fundamental story is elon sat in the room with the cfo and said, what can we say that's going to -- that's going to hit everybody's hot button, put their fears aside, and have those announcements not really take place, the productivity of those announcements, for a few quarters or a few years or a decade, and let them hang on to the dream. if you're going from facts, a company that had negative free cash flow this quarter, they're seeing their market share erode in china china continues to be in it, and bryn highlights this, in fairness to her, last night. i saw her comments great comments great spot china remains a risk at 20% where the government doesn't want foreign players no matter the historical relationship. >> let's be fair we've seen this movie before it's going to be up to investors

12:21 pm

at this point to decide what they want to do, what they want to believe, what they're willing to wait for, where they think the focus is, et cetera, et cetera, et cetera. >> i think there's a danger in relying on credibility it was just a few weeks ago that he thought robotaxis, the cyber cab now, were going to drive it. and he tweeted out, whatever date, waymo has been a taxi for decades. we don't know if it will be a profitable business. >> he has had an incredible ability to prove the naysayers, the haters -- >> without a doubt >> -- the short sellers. in some respects, everybody wrong because the stock over a longer period of time has done amazingly well >> he's one of the top entrepreneurs of all time. i don't have to restate my bear

12:22 pm

case on it i'll figure out what to do with the west at this point it's a nuisance. i think the tide has turned from a sentiment standpoint >> let's give the last word to you. now i feel like you're in a really interesting position here the rebalance is coming up i'm not going to press you to say anything that you can't for compliance reasons, but a stock that before yesterday looked broken, to say the least, and had theoretically lost all of its momentum, gets a 10% lift today and maybe in the process of jump-starting that momentum again. that remains to be seen. you're going to have to make a decision on the rebalance before you have the thesis played out that, okay, maybe momentum is back take me through the thought process on what you're able to

12:23 pm

say. >> the anticipation is killing me. >> what you're comfortable talking about. >> the stock right now is 27% below its 200-day moving average. so the momentum is still clearly negative on the stock. >> for sure. one day doesn't a massive reversal make. >> it's down 42% year to date. that's a lot of price damage i like what bryn has outlined, and i think bryn would agree with the following statement i don't think bryn is looking for a big move in the stock in the near term. i think bryn is looking over the course of time for this stock to recover. and, candidly, if you were to ask me personally how i feel after last night's earnings, just in terms of what's my disposition towards tesla, i would say i'm extremely neutral. i think someone who is short is going to be disappointed because they did enough to buffer the down side potential, and i think someone who is long, okay, they lifted the stock, there's still

12:24 pm

a lot of technical damage and the free cash flow was negative. that's a big story i think in the near term, i would characterize this as extremely neutral. in terms what have will occur on tuesday, we'll see what the rules do >> you've been able to make money being short this stock -- >> without question. >> you just can't overstay your welcome. >> good point. >> people who have overstayed their welcome have been run over and backed up over >> shorts are always a trade anyway, you can't have ego about it that ego led me to keep half in the position shouldn't have we have the earnings setup we have stocks on the move we'll do it next >> announcer: are you following "the halftime report" podcast?

12:25 pm

what are you waiting for follow "the halftime" podcast now. a future where you grew a dream into a reality. it's waiting for you. mere minutes away. the future is nothing but power and it's all yours. the all new godaddy airo. get your business online in minutes with the power of ai. trading at schwab is now powered by ameritrade, unlocking the power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab.

12:26 pm

when i was your age, we never had anything like this. what? wifi? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity.

12:27 pm

12:28 pm

intention, i wanted to see it settled because the market is not really buying dips it was a small position. didn't buy a lot was looking like a star for about five minutes for two days >> it's not a massive position, you want to file >> close, but, no. i also want to think about what not talking about subgrowth subs will be. i think that obscured the story, that's all the stock would trade on when apple reported, it did nothing. so i think it's still the winner i think it's a great stock growth this year versus last in terms of revenue, earnings will be strong.

12:29 pm

analysts did the stock no favor by, again, jumping over themselves without a fundamental reason to do so. i hope we don't see a replay in the meta report. i'll add to it again >> you love vertiv, for good reason hit an all-time high they beat, raised their high >> the stock has doubled since i bought it in november. and, as i've said the last few times, i haven't been add to go it because at this level it's expensive. now they've set the bar higher, scarcity of value, they are, to me, the safest way to play a.i. growth because they're the tool belt for the data centers, and data center growth is just monstrous. so, yeah, i like it. management is great. >> joe, you have some decisions to make as well on texas

12:30 pm

i thought it was down. maybe it's not my bad >> texas instruments was added to the etf -- >> i think i'm thinking of something else, my bad >> -- at the end of january at $160 coming into the earnings report, the momentum was flat. if you look at the stock even after today a year-on-year advance of zero. i think there's a nice read-through here, for the semiconductor industry analog devices and you'll see the strong performance there it looks like at the industrial equipment makers have finished working down their inventorsies. it's the most diversified with their customer base and the products that they're delivering on and there was finally a degree of confidence, confidence that was injected into the earnings call, so i think it's more of a larger setup for semis overall that you might have some confidence we're going to hear good things. >> i think i meant teladyne.

12:31 pm

12:32 pm

(traffic noises) (♪♪) the road to opportunity. is often the road overlooked. (♪♪) at enterprise mobility, we guide companies to unique solutions, from our team of mobility experts. because we believe the more ways we all have to move forward. the further we'll all go. at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result.

12:33 pm

we never lose focus on the life you want to build. it's time for wealth solutions as sophisticated as you are. it's time for corient. at pgim, finding opportunity in fixed income today, helps secure tomorrow. our time-tested fixed income suite, backed by over 145 years of risk experience, helps investors meet their goals. pgim investments. shaping tomorrow today. icy hot. ice works fast. ♪♪ heat makes it last. feel the power of contrast therapy. ♪♪ so you can rise from pain. icy hot.

12:34 pm

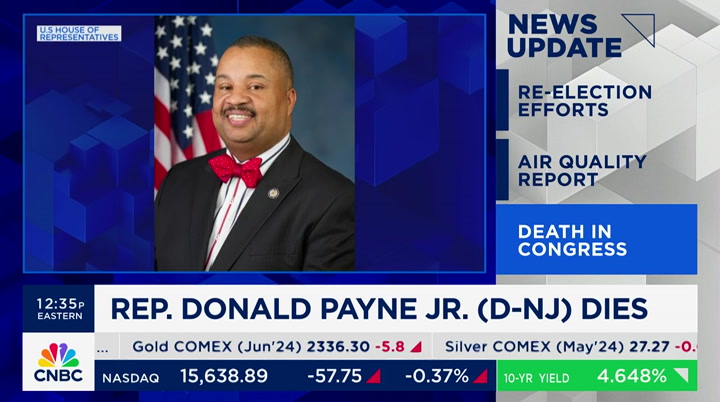

welcome back to "the halftime report. i'm kate rogers with your news update president biden signs a bill that could see tiktok banned in the u.s., his re-election campaign plans to keep using the platform a campaign official told nbc news that it was using tiktok to engage with voters the new law gives tiktok's parent company bytedance nine months to sell the app or face a ban in the u.s. making january the earliest of when a ban could start. 131 million people in the u.s., almost 40% of the population, are living in areas

12:35 pm

with unhealthy air pollution levels that's according to the american lung association the organization's report found that americans had more, quote, very unhealthy or, quote, hazardous air quality days than at any other point in the survey's history and cited the effects of climate change, such as increasing wildfires, for the findings and democratic congressman donald payne jr. has died. the new jersey democrat was hospitalized earlier this month after he suffered a heart attack new jersey governor phil murphy said in a statement that payne embodied the very best of public service. congressman payne was 65 years old. scott, back over to you. >> kate, appreciate it kate rogers. we do have a news alert, green light capital just releasing its quarterly shareholder letter leslie picker has it and is with us from post 9 david einhorn writing to investors. >> in my hand, a lot of new picks this quarter actually, and some comments on the markets as well we'll get to those first he kind of reiterated the

12:36 pm

sentiment he shared with you in an interview where he said the stock market is fundamentally broken he talks about there are so many investors that don't care about valuation, namely passive index funds, can't figure out valuation, most retail and those who choose not to care about valuation, referring here to various technical strategies, and any trading strategy with short-term holding periods the result is a very small proportion of trading volume today that try to identify which stocks are undervalued to buy for an intermediate or long-term investment period. however, from their perspective, this is an opportunity it allows them to invest in areas they see opportunities that he calls are ridiculously cheap. as for the picks this is a very interesting trade. they said they had a strong quarter in macro which added 3.1% net fees and expenses and

12:37 pm

largely it's based on early in the quarter they established a new large position by selling december 2024 sulfur futures at the time the market expected the fed to cut short-term rates between 1.5% and 1.735% this year as we know, that has shifted, and it shifted in a way that benefited his trade. he still beliefs this was unlikely for futures, however, they've trimmed the position to take some profits in the meantime gold also a significant contributor, he said solb, that's essential chemicals business and they established a medium-sized position in penn gaming with a play there they also established a position in hp inc. with the believe the a.i.

12:38 pm

revolution can help this technology upgrade cycle roivant sciences, a small position in class a shares of liberty global as well and a medium size macro position to benefit from higher copper prices another kind of interesting macro play additionally in terms of portfolio management, they decided to sell immediately after the new york community bancorp result was announced end of january i leave you talked about it in your interview >> he told me about that as well as gold. these are new and interesting positions. just back to this underscores the point he was trying to make all along about value investing and what he does here at the top of the letter. again, not that value investing is dead, because he suggested it's a great time to be a value investor, there aren't that many anymore because the value investing industry, not value

12:39 pm

investing, the industry is dead as a result of passive investing, the proliferation of passive etfs and the like, but he obviously believes it's a good time to be a value investor or he wouldn't have any individual names because he wouldn'table able to find any. >> 3.1% contributor from the macro bets overall, the fund returned 4.9%. that was a very significant contributor for them in the first quarter, and i kind of analogize that had to what we saw with pershing where those who have grown up in the equity business with relatively concentrated portfolios, with the two of them at least, value investing, doing really well in macro investing betting on contrarian, at the time, thoughts that ultimately pay off. >> he's been on a good run leslie, i appreciate it. leslie picker. fresh committee moves to tell you about first, tughoh, senior markets

12:40 pm

commentator mike santoli with commentator mike santoli with his "midday word." savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a ped company offering a diversified portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com. [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

12:42 pm

so the first time i ever seen a golo advertisement, risks, charges expenses and more i said, "yeah, whatever. there's no way this works like this." and threw it to the side. a couple weeks later, i seen it again after getting not so pleasant news from my physician. i was 424 pounds, and my doctor was recommending weight loss surgery. to avoid the surgery, i had to make a change. so i decided to go with golo and it's changed my life. when i first started golo and taking release, my cravings, they went away. and i was so surprised. you feel that your body is working and functioning the way it should be and you feel energized. golo has improved my life in so many ways. i'm able to stand and actually make dinner. i'm able to clean my house. i'm able to do just simple tasks that a lot of people call simple, but when you're extremely heavy they're not so simple. golo is real and when you take release and follow the plan, it works.

12:43 pm

all right. we are back. our senior markets commentator mike santoli is at post 9 for his "midday word," and in the words of the famed and i think late boxing referee mills lane, let's get it on. because tonight you have meta to start it all up. >> and hesitating ahead of that makes some sense we had 100-plus s&p points in two days 9 you give a few of those back along the way. i think meta itself is showing it's not necessarily sure of whether to believe the longer term trend or the fact it's trapped under its own 50 day moving average and have expectations gotten too high 50/50 on the s&p is getting worn out, that spot on the field. we hit it and it was where you launched in later february, it served as some support along the way. i know it was a target to get to

12:44 pm

and end. i find it interesting we're sort of waiting here if there's a decisive move. i don't think you got the washout that says it will be a self-sustaining bottom that we just go back to the highs. >> sure, maybe the test comes over the next 48 hours >> it could happen pretty fast >> that has happened in past quarters where the most percent of theable profitable companies can dictate the narrative. is it the healthiest nvidia has the move of 2.5% the last couple of weeks you know, $40 billion swing in market value every day for no reason probably not that's what we have. >> all right i'll see you on "closing bell. we'll take it to the final bell. tracking the trades next

12:45 pm

12:48 pm

♪ welcome back kevin simpson joins us now, capital wealth planning. he's always active in the market, and you are once again that's why we love having you. you bought jpmorgan, more of it. we talked about the financials earlier a little bit tell me why. >> i thought jpmorgan's numbers were solid i know the market was expecting something else and sold off, but it gave us an opportunity to get into a stock we consider best of breed, 10% cheaper and that's also indicative of the broader market sell-off we saw last week. you talked to the team earlier about buying dips within mega tech, but there are other

12:49 pm

opportunities during earnings season to take advantage of pullbacks. jpmorgan was one of those opportunities. >> the stock has had a huge run. i know it's down lately but it's been one of the better performance. you bought tjx >> a brand-new position, scott, a name that did incredibly well post-covid and settled out the earnings and revenues leveled off. looks like they're on a trajectory back up to the upside incredible balance sheet, $4 billion in free cash flow over the past 12 months we love that dividend yield is 1.6%, so not the highest dividend, but they've been increasing that at a clip of about 11% over the past five years. we love dividend growth and it has a little bit of a benefit potential for a strong consumer in an up economy, and if the consumer does step down, and we heard jassy talk about that with amazon, they benefit as an off brand marketer

12:50 pm

and if there's any peter lynch in me in terms of just driving past the parking lot at home goods is always full, and that has to mean something am. >> dimon yesterday talking, in his words, how unbelievable the economy is even in a recession, the consumer is still in a good yon it's part of the strategy of how you do, you know, what you do in terms of coverage calls, things like that. so give us a little clue here. >> we could have always rolled the option up, scott but we did allow half the position to get called we still have conoco phillips, marathon petroleum, both of which we like a little better. this was half a position that was called away. we still own 3% in chevron they report earnings on friday it's going to be a big testament to what we think about them moving forward because candidly, the last quarter were a disappointment to us, and it was reflected in the stock price.% they've been a beneficiary of all the horrific acts taking place in the middle east, the price of oil going from $70 up

12:51 pm

to $835, gave us an opportunity to trim something we were overweight in because energy has performed so well over the past five months. so it's not a criticism of chevron. we still own it. but it never hurts to take profits. if you get strength in these markets, you trim a little bit, if you get pullbacks, you add the quality. we're going to see volatility for the rest of the year if you're active and just with nuanced trading, you can exit 2024 with good returns >> appreciate the update kevin simpson, we'll see you soon >> thank you got your earnings setup straight ahead straight ahead don't go anywhere. tamra, izzy, and emma... and they don't 'circle back',

12:52 pm

they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team. let our expertise round out yours. the all new godaddy airo helps you get your business online in minutes with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo

12:54 pm

welcome back the stock, we have other companies reporting. many of them are in the joe t. united rentals, lam research, after the bell >> united rentals. we want to know that federal and private projects are still there. the growth is significantly benefitting uri also the equipment rental rates, you want to see them remaining high. case of service, options implying a 5% move, where are we on corporate i.t. spending i think service now is going to be able to overcome any deceleration there what's important to understand is, what's the margin effect on the spend that they currently have as it relates to generative ai and lam research, look, we heard

12:55 pm

from kla corporation already each of these stocks have pulled back a little bit in the last few days not very much in the earnings report to indicate you're going get a lift let's hope we get better news from lam research, that the significant sales decline of 2023 is beginning to reverse itself and the memory chip market's coming back >> still up 13.5% year-to-date is lam >> semi equipment. >> we'll step away and come back with "finals" next ♪ ♪ the biggest ideas inspire new ones. 30 years ago, state street created an etf that inspired the world to invest differently. it still does. what can you do with spy? ♪ ♪ [thunder rumbles] ♪ ♪

12:56 pm

12:58 pm

let's talk about some more stocks that are in the news, important today. chipotle, that's yours >> that's a company that just does not disappoint. they have pricing power, they rise prices, people keep paying for it they've won the hearts, minds and bellies of gen-z >> and yours visa, they had earnings, right, bryn >> yeah, we had a beat on

12:59 pm

revenues and earnings. we all know the financial ecosystem. what i like about the stock is 57% of the revenues are international. and people are going to see lots of swiping at the paris olympics visa and master card were recent adds to the xlf. so people go back into financials from a flow of funds, visa will be a beneficiary >> brian, the ceo of chipotle is going to be on tonight don't miss that. before that, "closing bell." i'll see you at 3:00 eastern with adam parker and anastasha am rma ammarosa bryn, give me a final trade. >> uranium we have a supply shortage here the etf has been basing in the 50s. it's a good entry point. >> okay. steve weiss? >> meta. a penny for a pound.

1:00 pm

i think they th're going to bea the corner >> goldman sachs, i still think there's more upside ahead. soz we're still in the red across the board, but we'll have an interesting finish as we take you up to that meta release and tell you what to watch for you'll hear from shareholders, as well. "the exchange" is now. see you at 3:00. ♪ ♪ we'll be there with you, scott. thank you very much. welcome to "the exchange," folks. i'm tyler mathisen in today for kelly evans. here's what we have on the docket the bull market has room to run, and the recent volatility has presented great opportunity. that is according to one of our guests today he's here with what makes him so optimistic and the three names he likes right now boeing's loss may have been smaller than expected, but it was an ugly quarter. we have the latest on earnings and how quality control issues are being handled at that big

44 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11