tv Worldwide Exchange CNBC April 24, 2024 5:00am-6:00am EDT

5:00 am

it's 5:00 a.m. here are your "five@5. the s&p coming off its best day inning two months. a big boost coming thanks to tesla. shares firing on all cylinders ahead of the opening despite reporting its biggest drop in q1 revenue in more than a decade. we are going to dig into those results. heading to the president's desk the senate signing off to sell the popular app, setting the stage for a big legal fight. plus this week's earnings

5:01 am

parade meta takes the big tech baton. we're going to look at the key metrics you need to watch. boeing expected to report in just over two hours as the aerospace giant continues to face a bumpy road ahead around production issues and succession questions. it's wednesday, april 24th, 2024 and you're watching "worldwide exchange" right here on cnbc ♪ good morning welcome to "worldwide exchange." we're coming to you live from cnbc london. thanks so much for being here with us. let's get you ready for the trading addai head we check on the tech stock futures with the s&p and nasdaq. the s&p has seen its best day since february the douceting its streak to four straight days. taking a look, a bit of a mixed

5:02 am

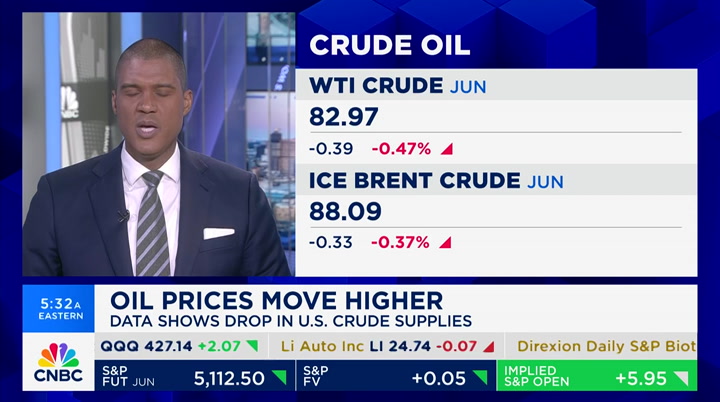

picture. the s&p solidly in the green right now. investors getting more fresh momentum with another big day of earnings on tap. we get results from at&t, ford, boeing, meta, and ibm just to name a few the bond markets slipped a bit durable goods data, that's out later this morning right now we see the benchmark 2-year pulling back. it pulled back just about six basis points this morning. we also want to get a check on oil. data showing a surprise. a positive sign for demand take a look at the oil demand. we continue to see oil trading lower. wti, the u.s. benchmark trading evenly at $82 a barrel

5:03 am

brent crude at about $88.11 per barrel that's your morning setup. now to your big money mover today. what is it we're talking about tesla. it's soaring despite a dismal start to the year. the first quarter profit pluchlking revenue dropped 9%, representing a vehicle decline in delivery r. margins were cut by more than a half from a year ago tesla says they'll speed up production of models that's something elon musk talked about on the earnings call. >> these new vehicles, including affordable models, will use aspects of the next platform as well as our current platforms and we'll be able to use the same manufacturing lanes so it's not contingent on any new factory or massive new production line. it will be made on our current

5:04 am

production lines much more efficiently. >> so elon musk also sharing new details about plans for a dedicated robo taxi ride-hailing network. it would operate its own fleet and let other services use their own, which he compares to airbnb tom, good morning. good to see you. looking at shares right now, the shares are off despite double-digit misses. you say the actual earnings number, they're just background noise. they're not all that important i want to ask you, the model 2, is that the game-changer is that what's pushing the stock higher this morning? >> 100%. people like me who are bullish on the stock can finally take their paper bags off their heads. but, yeah, basically all the expectations coming into the quarter, there were some news articles coming out of reuters

5:05 am

they were going to shelf it. there were fears they would not have any new models. not only is the model 2 happening, but it ee actually going to be accelerated by making the cars at existing facilities instead of new facilities to be built so a lot of those fears that came into the print that were so -- people were so worried have completely evaporated. if anything now, folks are looking at an accelerated pace. >> so, tom, i want to ask you, because the way you phrase it, the fact is in your mind, building the model 2 on an existing platform, that's a good thing. others have said that's not really a good thing because you're not creating a unique vehicle. very quickly, that's fine in your mind? >> yeah, i think so because for me that car was never going to be about its own profitability for me it's about selling economy. we just need more teslas on the road. >> you don't have full conviction on that one

5:06 am

but you're like, eh, it's okay to be fair i heard executives say to be competitive with china, they have to strip out all the bells and whistles and they would be popular. soundses like elon musk might be taking a page out of your book. you are a bull it implies more than 75% upside. you are more bull usual. give me a sense when it comes to the model 2, to the robo taxi, the optimism of the business what's the most important thing? >> 60% is efd. mega packs is about 10% and less than 10% is actually the cars. >> the model t is a game-changer but it's your thesis for a 294 price target >> no, no, no.

5:07 am

the car itself is not a game-changer, but the fact it can sell as an ev, that makes it a game-changer now the software is proven. >> got it. it's increasing the capacity okay, i understand there i want to get to robo taxi so our phil lebeau has been very vocal about self-driving being many years away. analysts have said we're years away from that some have said a decade away from that. in your mind, when is it re realrea realistic to see these robo taxis on the road. will they be full ride or in a loop it's certainly easier to have an autonomous vehicle go in a loop or track and we see that more for industrial and supply chain. >> i want to differentiate sfd from robo taxi it's an amazing product on the road where you're driving the car and it assists you robo taxi, i do believe, it will

5:08 am

be 100% level 4. it is far away from now, no doubt about it a decade away. they'll have to re-engineer themselves to allow it to happen but make no mistake, they're happening. the reason for my bullishness is it isn't going to happen right around the corner, but it's going to happen way down the road it's a big transformational event you discount back the revenue stream and the software business and you get tremendous value from this product. >> you know, just for the audience, tom, you said level 4. not level 5. level 4 is the highest what does it mean from a practical sense? >> level 5 is like science fiction. get that out of your mind. it's not going to take you anywhere you want to go. level 4, it's driving you, on the road, on a dedicated path. geo-fenced. >> this is a business network,

5:09 am

not the sci-fi channel, tom. great to see you tom narayan from capital markets. time for a look at your other big money movier we're going to start with shares of mattel after they reported narrow less than expected profits. mattel's ceo telling our jim cramer last night he remains very optimistic about future growth opportunities. >> we're executing on our 1 billion dollar share program we expect to outpace the industry in game share and reaffirm guidance for the year, and the plan for the year is to emphasize strong cash generation and return to top line growth in 2025. shares of visa increasing by

5:10 am

8% processing transactions by 11% the company also reiterating its full year revenue guidance shares of visa up just over 2.5% we're looking at shares of texas instruments. revenue guidance coming in above expectations as slumping demand for analogue and semiconductors finally showing signs of easing. sales did fall from the prior year shares of t.i. up 7.25%. time now for our top corporate stories. silvana henao has those. good morning. >> good morning, frank the senate passes the tiktok ban bill the bill now goes to president biden who said in a statement immediately after the passage that he will sign it today once signed, tiktok's parent company bytedance would have

5:11 am

nine months to sell, though, that could be extended tiktok has signals it will file a lawsuit to block the legislation, and shares of several social media competitors getting a bump in the premarket on the back of that development. meanwhile the approval of that tiktok bill coming as part of a larger package that will also provide billions in foreign aid. that includes roughly $60 billion for ukraine aid, $26 billion for israel, and $8 billion for taiwan and indo-pacific security. president biden says once signed the u.s. should begin sending weapons and equipment to ukraine this week, frank. >> all right, silvana, thank you very much. coming up, we've got a lot more ahead on "worldwide exchange" including one word investors have to know today first, tech catching a fresh bid from investors as of late. what famed investor howard marks told me about the continued

5:12 am

caution around the max 7 that he has. plus fresh results on boeing details on what has the aerospace giant in hot water with regulators now. later, let's make a deal the acquisition on the ibm agenda to help it rise in the clouds we have a very busy hour ahead when "worldwide exchge t returns. make sure you stay with us

5:13 am

were you worried the wedding would be too much? nahhhh... (inner monologue) another destination wedding?? why can't they use my backyard!! with empower, we get all of our financial questions answered. so we don't have to worry. empower. what's next. business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

5:15 am

welcome back to "worldwide exchange." the nasdaq higher for a second straight session with a rally largely being led by the 2% gain from the max 7, which got an even boost after the close with the surge in tesla i spoke with famed investor howard marks who runs oaktree management despite enthusiasm for tech this week, he is still sounding a note of precaution. >> i just think in our business in general, there is no room for certainty as twain would say, and that extends to the magnificent 7 as well. i must say when i was listening to your question, every bubble ensues from widespread conviction everybody believes, a, they bid the beneficiaries of a up to the move it turns out it's overdone. >> all right let's get reaction to that and

5:16 am

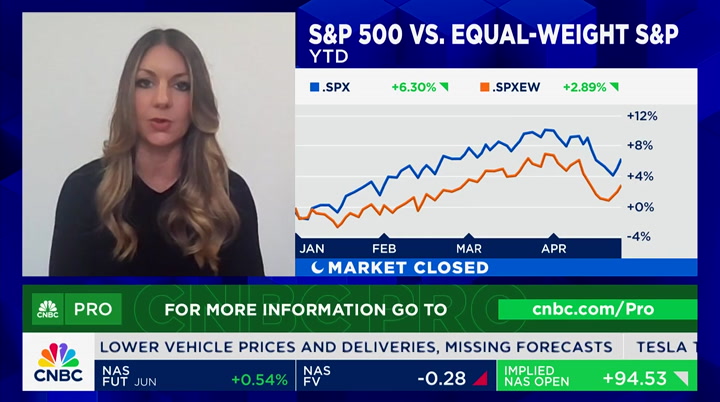

discuss the broader markets. hannah, good morning from london good to see you. i'm going to get into it what did you think of howard marks' comments? i know you, too, are looking for cracks in the mag 7. >> i think the really important thing for us here is the re reality. if you're looking at the max 7 who performs well in the past two years, may not be the best performers going forward we've seen cracks in a number of names including tesla. one can find expectations from here if you look at the expectations if you focus on valuations and durability of earnings growth. >> so as you say that, by the way, howard marks was responding to a question i asked him about a stat we showed on the show yesterday that the max 7 in our forecast received 40% year over year earnings growth while the

5:17 am

rest of it is expected to see a 3% decline as you say that, how are you not deeply into the magnificent 7 with the rest of market seeing a decline? >> well, we do hold microsoft and alphabet we've been long-term beneficiaries in the growth of those companies. if one looks outside the magnificent 7, it doesn't have to be the stock that has earnings growth here if you have a look at it, maybe you're not seeing the same levels i think if you have a chance to look outside of those seven, there's some great opportunities and companies that are not getting the headline, haven't been dominating the market to buy into the more reasonable valuations and still get good earnings growth. >> you know, speaking of, you actually talked to us in your notes about unitedhealth care. i'm looking at the charts though month to date, it's down 1.5%.

5:18 am

you say this is a valuation play just explain this to me with this kind of stock decline is there enough of a valuation discount in your mind to accept this kind of a stock decline from a company like this >> this is a great question, frank, and, actually, unite health group is a leading discount they're trading in almost a decade, about 7% cash-free yield. it's showing actually 17% compound earnings growth over the past decade, which is far, far in excess of your average company. if you think about the scale of barriers entry and finding the name simply because it's out of favor at the moment, there's a

5:19 am

bit of political noise going on, combined with the valuation and the earnings potential of this company, indeed, it's done exceptionally well long term we think it's pro e providing a very good entry point into this name. >> all right hannah gooch-peters. we've got to leave the conversation. coming up on "worldwide exchange," oracle setting up ofed in one area previously pril motivating the company to relocate when "worldwide exchange" returns. returns. stay with us at enterprise mobility, we guide companies to unique solutions, fr of mobility experts. because we believe the more ways we all have to move forward. the further we'll all go.

5:21 am

5:22 am

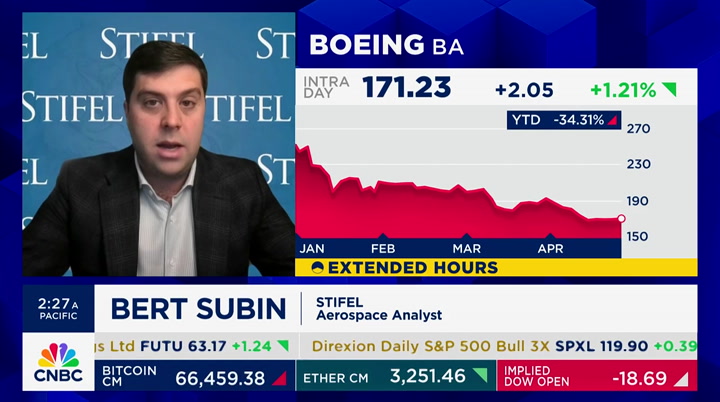

all right. welcome back to "worldwide exchange." boeing is looking at claims by one union that the giant retaliated against two pleas who argued the company should reevaluate its engineering work in its 787 and boeing jets they have zero tolerance for retaliation and encourages employees to speak up when it has an issue. meanwhile they'll give spirit aerosystems money to continue they continue their talks. the values come ahead of boeing's release investors will focus on production issues in the wake of that early january door plug incident involving one of its jets the stock is down 30% since

5:23 am

then there's also management questions after ceo dave calhoun announced last month he's going to step down this year without naming a successful. i'm going to get into it you have a price target of boeing for 260 you say in the near term it's going to be changing what do you say about a company that has not found its new ceo. >> first of all, thanks for having me on the program you hit on obviously a lot of the points of uncertainty that we're currently wading through the buy rating is really a function of where the demand equation sits right now. if you look at where backlog is, we actually expect to hit an all-time high in the first quarter of 2024. so while we're currently dealing with what we deem to be temporary production challenges, the demand for airlines is very strong boeing continues to have a dominant position on wide bodies, and we think there's an opportunity for them to start

5:24 am

gaining more share in narrow bodies over time our view has been you have to look past the, you know, sort of this quarter or the next quarter and the quarter after that but the furtherer you go out in time, the production numbers start to improve you know, the backlog for this company is well north of half a trillion dollars so there's a lot of potential with this organization. >> okay. that's quite the narrative you're saying let's discount this next fiscal year pretty much and look beyond it. i want to ask you when it comes to the stock price, do you think boeing has bottomed and if they require spirit aerosystems, is that going to bring a positive to investmenters or a negative >> i think right now we're in the process of looking at negative numbers i think there's potentially some more to come after the first quarter earnings, but then you're probably getting into a position where expectations are more realistic and then it

5:25 am

becomes a potential for them to outperform you know, the spirit acquisition comes up a lot the reality of it is relative to boeing size. it's not tremendous. right now the complexity is trying to figure out what to do with the airbus assets and airbus facilities and that's leading to a delay in that process. >> by the way, when you say trying to figure out with airbus, it's trying to separate out the airbus system as they try to purchase it you're the aerospace expert. walk me through this we're talking boeing, a company with serious production issues looking to buy a company with serious production issues and then separate from one of its largest customers. that's a positive? is there a way that can be positive >> the better way to look at this potential acquisition of spirit is boeing needs to get its arms around the supply chain and the largest supplier is spirit air systems and there's

5:26 am

been the quality for years by bringing that in-house and essentially consolidating its supply chain, that would demonstrate they're taking an actionable step toward improving the supply chain that's the way we're looking at the deal now the airbus portion of it, obviously it introduces a lot of complexity. >> quite a bit of complexity there. something else that seems to be a bit complex is the ceo's complex. ceo dave calhoun announced he's stepping down. this is a big and integrate company to not have a clear leadership or clear succession plan. >> i think they did have a clear succession plan and it changed stephanie polk was indicated to be the next ceo. i think that is changing in terms of an external hire, and that makes sense the way we're looking at it,

5:27 am

that's the big catalyst we're watching i think once we get the new ceo, things will start to come. by year's end, it will be faster i think the investor favorite is larry cole so some uncertainty there. until that clears that's sort of the rationale why we think it will be choppy. >> if it does end up being an internal target, does that change your rate >> yeah. if it's an internal candidate, you'll have a more difficult rhetoric for sure, because i think the idea is you need to think about the process toward, you know, fresh start and a fresh look. >> i think a lot of people would like a fresh start, bert ceo dave calhoun is going to be coming up on cnbc to discuss earnings he'll be joining cnb can

5:28 am

5:29 am

life's daily battles are not meant to be fought alone. - we're not powerless. so long as we don't lose sight of what's important. don't be afraid to seize that moment to talk to your friends. - cloud, you okay? because checking in on a friend can create a safe space. - the first step on our new journey. you coming? reach out to a friend about their mental health. seize the awkward.

5:30 am

5:31 am

dismal quarterly results phil lebeau is standing by with what elon musk is saying that has investors piling back in to buy stock. meta and its ai investments. it's wednesday, april 24th, 2024, and you're watching "worldwide exchange" right here on cnbc. ♪ welcome back to "worldwide exchange." i am frank holland coming to you from cnbc london thanks so much for joining us. let's get you ready for the trading day ahead. we're going to get a check of the u.s. stock futures we're seeing nasdaq in the lead up over half a percent, moving higher off the tesla results right now the dow fractionally lower, the s&p close to the flat line we'll be talking about tesla in just a moment. investors are set to get momentum with another big day of earnings on tap. we get results from meta, atnt,

5:32 am

ford, boeing, and ibm just to name a few treasury yields are taking higher the benchmark is trading 4.63, pulling back a few basis points. the 2-year pulling back. it very briefly touched the 5% yield mark yesterday, again, pulling back about six basis points this morning. data showing a drop in oil we're seeing the oil market continues to be under pressure, falling just a bit from earlier levels right now wti crude down just to half a percent, trading below 80 bucks a barrel brent crude down taking a bit lower right there trading close to $88 a barrel. that's your morning setup. time for one of your morning's big money movers shares are soaring this morning despite first quarter profit and revenue dropping

5:33 am

our phil lebeau joins us from the cnbc newsline. good morning it seems like investors are looking at numbers you're probably going to hear this a few times this morning. more on the road ahead sorry to throw the pun in. >> we've heard it in the past few hours. you have to realize what the investors are focused on is how does tesla reinvigorate growth they do that through a new modelle. let's go over the numbers for the first quarter. any way you look at it, an ugly quarter. profit down 9% -- or profit down 45%, excuse me revenue down 9% year over year by the way, that revenue drop, the biggest year over year drop since 2012 negative free cash flow of $2.5 billion. we know the story time and again. the volumes are drying up, and that's hitting the profit of tesla. how do they reinvigorate that, by bringing out lower priced,

5:34 am

more affordable models they say they will start accelerating their plans for that with production starting likely in the first half of next year, potentially even at the end of this year, though, when you talk with everyone in the auto industry, almost everyone says the same thing. it's highly, highly unlikely we see production starts this year. we still don't know what we're talking about or what elon is talking about when he says more affordable priced models are we talking about a variation on the model 3 or the model y, which will strip down the costs and, therefore, potentially bring in new buyers? that's one idea. here's elon musk talking on the conference call last night about their vision for more affordable priced models. >> these new vehicles including more affordable models will use aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the

5:35 am

same manufacturing lanes as the current lineup it will not involve a new factory or production line it will be made much more efficiently. >> the big question will be what will this do for deliveries, especially as you look out into '25 and '26. the growth rate for deliveries, which was up 38% last year, it's not going to be 38% this year. it will be notably lower in the words of tesla though, elon musk did say, frank, during the conference call, that they do expect deliveries this year to increase compared to last year. last year the delivery total was 1.8 million vehicles frank? >> i've got another big question for you. we had a guest earlier who said he believes it can get to level four, a step below level 5 how realistic is the idea of a robo taxi any time in the near future you've been one of the most

5:36 am

educated and sobering voices on this. >> on paper it makes a lot of sense and opens up the possibility for driving much greater growth and profit on paper. the question becomes how realistic is it that tesla's technology, which is vision-based, camera-based, and using the camera technology that tesla has developed, how quickly can that come to market? they say it can happen very quickly. my guess is when they give us the robo taxi unveil in august, they will likely put out some type of a timeline out there, i don't know, '26, '27, '28 where they start to put this in geo-fenced areas those are driverless vehicles but it's in a geo-fenced area. that's likely where we will see the start of robo taxi for tesla. the question becomes when and

5:37 am

where. >> all right a lot of questions, i think, there. looking at tesla shares up over 10.5%. phil lebeau, always great to talk to you. time to have a check on some of this morning's top corporate stories. silvana henao with those stories. good morning once again. >> good morning. shares of hashicorp higher a deal could materialize in the next few days though hashicorp and ibm both tell c nbc, they do not operate on speculation they jumped 23% compared to ibm's 2% increase during the same period. in washington the ftc banning employers from using noncompete contracts to prevent workers from joining rival firms. the measure marks the first time

5:38 am

the agency has issued a mandate on how companies compete in more than 50 years. the chamber of commerce will reportedly sue the ftc this week before the regulation goes into effect in august. and oracle says it's planning to move its world headquarters from austin, texas, to health care epicenter nashville, tennessee speak yesterday, oracle chairman larry ellison says oracle is new to the health care scepter, but has the moral responsibility of helping with the problems. others are currently based in nashville, frank. >> that's really interesting i don't think big tech and nashville. we'll see. it started in austin a couple of years ago, and now look at it. coming up here on "worldwide exchange," maneta looking to ke

5:39 am

5:41 am

5:42 am

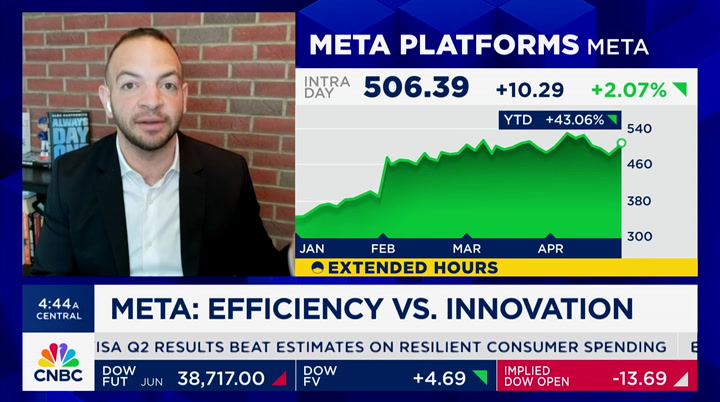

year the big question now is whether meta can sustain that balance between cost-cutting and data and a.ani, and metaverse. alex, good morning hello from london. looking at the stock chart right now, meta shares up 40% year to date what are you listening to and looking for, and what do you think can keep this momentum going? >> it's run up so much on the year, right? up 43% on the year, $1.26 trillion market cap. so where is the room for meta to blow out earnings to the point where it can keep growing? it's going to be tough to find it could go up 26% it might be aing positioning thing where it's going to say, we've done the advertising thing and now you can look at us more

5:43 am

as an ai stock and that might be the story you need to sustain growth stockmarket. >> you know what the year of efficiency, it sounds like a line george constanza would say on "seinfeld. the stock measure up 43% year to date meta is still spending very big on ai. we are starting to see the fruits of that labor i don't know if you've been on instagram, metaand ai on instagram. not great, but you know where to find it and use it the capex was $5 billion and now it's $37 billion how do we react. do we need to see in your mind commentary from me to to justify the cap? >> you need to keep spending to remain competitive in ai it not only got an upgrade, but

5:44 am

a standalone upgrade a llama 3 trained on ten times more data and 100 times more compute. every single one of these nvidia chips costs about the amount of an audi, and meta is supposed to have 650,000 by the end of the year so this stuff is costly. investors may not love the fact that they're going to be spending more, but they have to understand the broader story, and that that is going to be the airy meta is going to be competitive, it's an area of new growth they might end up coming in line with expectations on costs, but even if it's a little higher, the company should give it more patience as it pursues the ai strategy. >> another big issue we're seeing higher for longer rates. how do you see that part of their ad business. they were disproportionally hit

5:45 am

with higher rates. >> the ad business has really come back in a lot of ways this year, and that's why they're expected to do 26% more ad river knew this year that quarter, that's an incredible increase. you talk about $36 billion in revenue in the quarter that's unbelievable. that being say, if we have higher for longer rates, we might end up seeing advertisers pull back because they're being pressed by their teams to say, hey, is every single dollar we spend something we can get an o.i. on? that's going to come up. the pressure is going to come from the cfe, and there's a potential there that does impact meta's bottom line >> all right we've got to leave the conversation there meta shares are up alex kantrowitz, always great to see you. a bullish call on airbnb

5:46 am

5:48 am

5:49 am

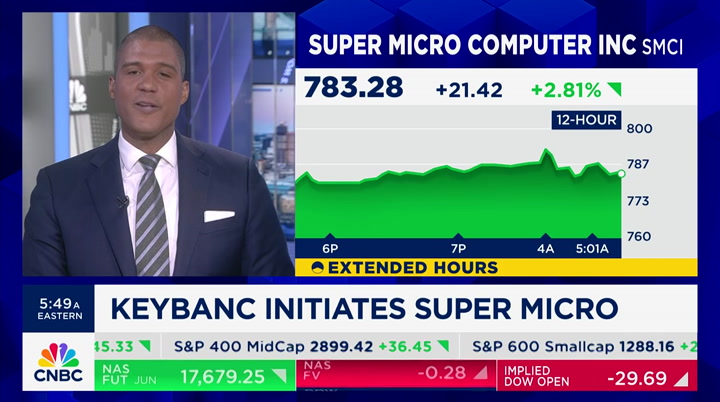

potential lost of sponsored listings and amortizization. citi upgrading its sell on serious. the stock is being more balanced shares of serious up just about 3.5%. and keybanc with a sector rate weighting while shares are currently trading well in line with its infrastructure peer, it believes faster growth premium is needed in the near term shares are up just over 2.5%. time for a global briefing we're watching shares of kering after they warned stocks would plunge they're working to revive chinese demand for product sales. you see kering shares down more than 8%. considerably a better picture for volvo cars

5:50 am

operating earnings did mist forecasts because of lower revenue and losses at its polestar business. volvo shares up just about a quarter of a percent right now. and roche says it will return to sales growth as the eye drug rises roche is betting on increased market share in the weight loss drug arena with its recent $2 million purchase shares of roche just over 2.5%. coming up on "worldwide exchange," we have the one word every investor needs to know today. plus markets need to keep the win streak going while our xt gstneue the selling may not be done, at least not yet. we'll be back right after this break.

5:51 am

her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials.

5:52 am

“the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

5:53 am

5:54 am

that would force tiktok's parent company to sell the app or face a potential ban in the u.s the bill now goes to president biden who said in a statement immediately after passage that he will sign it today. the approval of that package will provide billions in foreign aid including roughly $60 billion for ukraine aid, $26 billion for israel, and $8 billion for taiwan. visa is reiterating its full year revenue guidance. shares of via visa up over 2.5%. texas instruments shares are up about 7%. and bloomberg is reporting that rubric, the security company backed by microsoft is 20% oversubscribed

5:55 am

it's looking to sell shares at 28 to $31 a share each the market, rebounding looking to extend its run with the s&p and the dow now less than 4% from record highs. taking a look at future, bit of a mixed picture now. we're seeing the dow looking like it would open 40 points lower. the s&p basically flat it's the nasdaq off of its lows but up under half a percent. joining me now is craig johnson, chief market analyst good to see you. how is your day shaping up what is your w.e.x. word of the day? >> my w.e.x. word of the day is "relief. number one, the middle east is not getting worse at this point in time. it seems to be settling down number two, at this point the market is due for a relief rally at this point. and, number three, we are not seeing earnings getting weaker at this point in time, so you're

5:56 am

getting a little bit of a relief that this earnings season is not as bad as it looked like it with us going to be when they started reporting earnings a week or so ago, frank. >> you're saying it's not asd bad as it could have been. eps up 3%. revenue up 10% you're saying this is going to give investors the confidence to invest there was a b.o.a. note out yesterday saying some climates were pulling money out of individual stocks. >> yes, rank and after going down like six days in a row, it's about time we get a little bit of a relief rally, and i think that's exactly what we're getting at this point in time, the thesis we were talking about is the high-level trading range we think this relief rally probably will carry on for the

5:57 am

s&p 500 probably at about 51-25, and thin we think it will ultimately stall out we're going to test the consolidation range, frank, over the next couple of months, which we think is 4600 to 4800 range look for a more meaningful rally at that point. again, further consolidation until we get done with the election in november, frank. >> just for cob text for the audience, you have been consistent you haven't raised it like a lot of other people have at 50-50, about 20 points below where we're at right now, so you're sticking with that thesis i want to talk about some of the bigs one of them is morgan zanly. i thought that was pretty interesting. morgan stanley nation potential investigations there at the same time, i want to go back to the b.o.a. float are you bullish on this one name in particular or is it financials in general that you see having an upset?

5:58 am

>> frank, we're overweight in financials at this time, and the reason we are, we're seeing a lot of profit-taking we talk about those going from mag 7 to ag 7. the money needs to go somewhere. financials is a great place to go if you look at what's happening with some of the investment banking businesses at this point, two bad years, not likely to get a third so you see stocks like morgan stanley definitely starting to pick up. like them, like the jpmorgans of the world. >> okay. all right. one of your other picks, a fertilizing company. why is that your pick out of curiosity? >> when you look at nutrien, it looks like an interesting stock.

5:59 am

ready to unfold. >> short and sweet craig johnson, good to see you as always. one more quick look at the futures right now. it's kind of a mixed picture right now. we're seeing nasdaq in the green gets a boost off tesla earnings. the dow looking like it would open -- off of its lows, it would open 30 points lower that's going to do it for us we've got "squawk box" coming up right now. good morning, stesla shares climbing because elon musk said ev models could begin sooner than expected after there was some concern yesterday that maybe the robo taxi would preempt that other move. the senate passing a foreign aid bill that also includes the divest of banned tiktok. we'll tell you what happens next. and key reports to watch

6:00 am

today we're going to hear from boeing and at&t this morning meta platforms, ford and ibm after the "closing bell. it's wednesday, april 24th, 2024 "squawk box" begins right now. ♪ good morning, everybody. welcome to "squawk box" right here on cn we are live from the nasdaq market site in times square. i'm becky quick along with joe kernen and andrew ross sorkin, and here we go this morning. let's check things out you're going to see a mixed picture right now when you're checking out the u.s. equity futures. dow futures are off by 30 points, s&p up by 3 points we shoals auld

13 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11