tv Street Signs CNBC April 24, 2024 4:00am-5:00am EDT

4:00 am

that's all for this edition of "dateline." i'm andrea canning. thank you for watching. [theme music] welcome to street line to street signs i'm frank along with civil silvia amaro. >> we've updated our launch of new models expect it to be more like 2025 if not late this year. >> shares are slumping after the

4:01 am

luxury giant warns profits could plunge as much as 45% in the first half on the back of double-digit sales declines in q1. and tech stocks lead gains in early european grade. demand boosts chipmakers. an earnings miss sends volvo cars toward the bottom of stoxx 600 as luxury brand pulsar waits but he's optimistic. >> we have a really balanced portfolio. we're relying on ev sales. we have a lineup of different propulsion technologies. of course, we have fuel electric cars, so that gives us a much greater landscape in which to p

4:02 am

play. good morning, everyone we start today's show with new data out of germany. let me share it with you we're getting in the new figures. they came in at 89.4 that's an improvement from the expected number, which was 88.8, and it's also an improvement we had seen in the prior reading which was 87.8 the bottom line at this stage is we're seeing a bit of an improvement when it comes to how businesses in germany are feeling about the outlook and the prospects of the german economy, but, of course, there's still quite a lot of question marks for this part of the european economy in the context of, for instance, yesterday, we saw driven pmis painting a picture where services was still quite strong, but manufacturing was still struggling

4:03 am

but let's digest these latest numbers with our next guest. he's head of economic forecasts. good morning to you. good to have you on the show first and foremost, i just would like you to outline for us what is this latest data telling you. we were seeing an improvement in terms of how german businesses are feeling. what else are they telling you at this stage? >> yeah, good morning. yeah this is the first consecutive rise the third consecutive rise that we've had. that's good news that means germany is starting to recover, is leaving the period of weakness that we had in the third quarter, the fourth quarter and the first quarter this year. the good news about that is it is about all of the service factor the business climate has improved that is to say that part of the

4:04 am

expressway that's related to private consumption. on the other hand that's more than we got yesterday. the manufacturing industry and the construction industry, thet they're not improving. if you look at the numbers of the incoming orders or the assessment, it's still very bad in these industries. >> now, in yesterday's wake of pmi data, there were a lot of comments that perhaps we should watch out what happens to energy costs. is this a concern for german businesses at this stage do they expect energy costs to go up in the latter part of this year >> i mean what we have seen in the last couple of months is that energy costs were going down, especially the prices for electricity and for gase not only for consumers, but also

4:05 am

for the industry this is something as far as we can see it at the moment that is going to continue in the next couple of months this is clear. i mean if you compare energy prices in germany to energy prices in other regions in the world, they are much higher than elsewhere, and this is, of course, something, which is -- which is putting a track on competitiveness on german manufacturing firms. >> so you're mentioning german manufacturing. i want to ask you is the visit and tough talk, is that factored into this report or do you expect it to show up on the next one, and some of the competition from china, accusations of dumping, how does that factor into the numbers that we're seeing >> there are a lot of structural changes going on at the moment for the german manufacturing industry

4:06 am

on the one hand, this is china, of course, which is not only, let's say, a country that is producing immediate goods. chinese firms are producing immediate goods which is competing with others. it's going on in terms of digitalization, robotization, electric vehicles. all these things are dramatically changing in the landscape of the german industry, and it's not clear at the moment if the german industry is really managing this structure of change, if they're deciding to stay in germany to produce here or if they're looking for locations elsewhere. something that we've seen, for example, in the chemical industry, which is, of course, one of the consequences of the

4:07 am

high energy costs in germany in chemistry, we see they have been relocating their business elsewhere. chemical industry has gone down. the only area where we've seen employment has gone down this is one of the signs of at least a relocation of firms. >> you mentioned a structural change when it comes to the economy of europe, germany included i want to talk about technology. we saw a very strong report of s.a.p. yesterday and a company named alpha in the nation of germany. give me a sense. when it comes to technology, how do people compete with german technologies, how do they compete on a global scale? >> this is definitely one of these structural changes going on when we compare germany to the u.s., what we often don't see in

4:08 am

germany is there's a lot of technical progress that's going on, but the progress that is going on in germany is in the kind of industry which is not very visible because we produce machinery and other goods, whereas, the u.s. is more concentrated on the things consumers are in the end using and where we all see, okay, this is coming from the u.s but we never see the things coming from germany because they're using other industries. >> i want to ask you you talked about the structural change there's a question whether automakers will stay in germany or produce in other places do ceos, companies feel confident that they can grow their tech-growing businesses not only in germany but where there's less regulation? >> this is something we can measure, that we can see

4:09 am

we can con pete in the world, in u.s., and china. this is something i can't tell you. if we look at the moment where this industry fair is going on, when you see what germany companies are using and developing there, occupational intelligence and technology, we can be optimistic that germany is also competing here with other markets. >> we have to leave the conversation there, but thank you for your time. that was timo wollmershauser, head of the economic forecast at ifo. tesla accelerates after musk says production of new

4:10 am

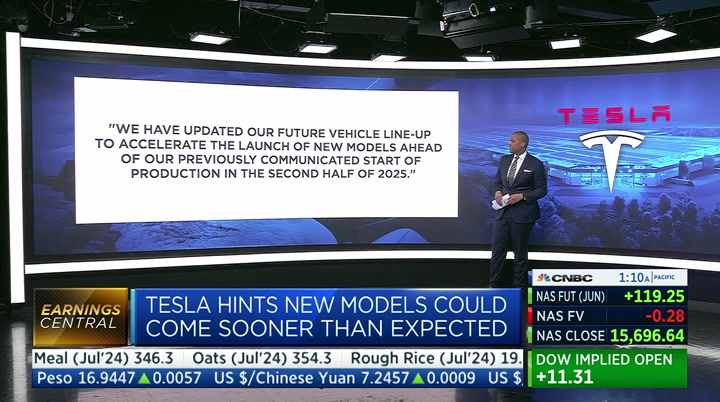

affordable ev models could begin sooner than expected with declines across the board. revenue missed, profits missed, earnings missed. it's the first time the firm has posted three straight top and bottom line estimates in a robey the widest margin since before the pandemic back in april of 2019 still investors appear to focus on one line. we're showing it to you here hinting that new models could come sooner than expected. they said we've updated our future vehicle line up to ex accelerate the launch. of new models ahead of our previously communicated start of production in the second half of 2025 they're looking at the much prompted robo taxi deutsche bank said such a pivot

4:11 am

would be thesis-changing musk explained when customers may be able to get their hands on the new range. >> we've updated our vehicle lineup expect it to be more like early 2025, if not late this year. these vehicles including former models will use aspects of the new platform as well as the current platform it will be made on our current production lines much more efficiently. >> investors will be watching to see if tesla can stick to the timeline in the meantime, they can only go on the fundamentals the operating margin fell by half in a year global inventory nearly doubled in the space of a quarter, plus there's very little visibility

4:12 am

on what these new affordable models actually will be. musk told investors, focusing too much on the cars, that's the wrong approach >> really we should be thought of as an ai robotics company if you value it as an order company, you have to -- it's the wrong framework. if you ask the wrong question andquestion, then the right question is impossible. for more head online to cnbc.com. coming up on the shows, issuing a stark warning for the first time as chinese shoppers turn their back on gucci we'll take a close look at the numbers up next.

4:13 am

what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. when we started our business we were paying an arm and a leg for postage. i remember setting up shipstation. one or two clicks and everything was up and running. i was printing out labels and saving money. shipstation saves us so much time. it makes it really easy and seamless. pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers.

4:14 am

go to shipstation.com/tv and get 2 months free. business. shipstation. the it's not a nine-to-five of online proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

4:15 am

4:16 am

they're down to 4.5 billion euros in line with a company esty mountain that was issued last month charlotte joins us now. >> very interesting to see this. just remember months ago they warned their sales would be lower in the first quarter, that it would fall by 10% led by gucci because when we talk about kering, we talk about gucci. they make two-thirds of the operating profit so the numbers came along the lines that they had warned about, but this is the next level of warning that the operating income would plunge. the manager said, look, we knew things would be tougher in 2024. the chinese consumer not buying luxury as much yet the rebound is not happening there. typically the pinch from inflation. things look particularly tough for gucci. that's the question. is it the gucci shoe

4:17 am

they have a new creative director, new initiatives, acceleration of the brand. up until now they had given the benefit of the doubt they have put things in place to make a better future there's a question mark. we see some of the other brands down 6% as well. others are down 6% so across the board for all of them, they're decreasing what we saw from the other luxury player last week, lvmh, they did have some growth in north america and europe as well here again the market is starting to wonder is the turnaround going to be put in place by getting enough or looking at the brands and what's in place so far is actually not enough the stock is down more than 4% and this morning 8% on the back

4:18 am

of these warnings. >> what a stark development. there's a lot of questions for gucci. >> yes, there is we're bringing in the front manager. we're glad to bring you in here. >> good morning. >> there was a lot of hope about the luxury sector. in your hope you said they would continue to see stronger sales others said full luxury or not is that it gucci and others, they're not full luxury or prestige? >> firstly the entire organization is going through a reorganization going back to a trend growth of 6% to 8% that's not happening across all

4:19 am

brands or geographies. there are two things they're trying to do to elevate the brands, cater more to an inelastic high-end shopper and have more pricing power and there's a dine change that's gone along as well there are a few kering and gucci factors that have gone into play here against a wider backdrop which is slowing, but still quite positive as you mentioned, lvmh showed growth last week even brands that should report later today, for example prada and mmontclair should show growth there are collections not fully

4:20 am

yet in stores yet. they should comprise some of the sales going forward and that should drive further the momentum the jury is out. >> you don't want to quite say it it's not full luxury, but you believe it's on its way there. i want to go back to inelastic high-spending consumers. does that include traveling consumers like chinese consumers? is kering just not seeing it when it comes to high next worth, chinese consumers >> it's a really interesting trend. the returning chinese traveler today is of a different ilk than perhaps prepandemic where a lot of groups were taking place and consumers were spending money on lower ticket items today china is made up of h high-end individuals

4:21 am

aramis has been a receiver of this, even montclair it's not clear the products are yet to be a bigger part of the company's collection it's not resonating quite so much the chinese consumer today is much more discerning than they were five years ago. they're more brand-savvy and trend-savvy, and that's affecting the bifurcation that we're seeing that has strong brand versatility versus those trying to acquire it. >> svitek, i'm going to ask you here from what you've seen overall at kering, is it enough because it looks like it's not just a gucci problem. they seem to have difficulties across their brand do you think what they have put in place will be happening eventually >> i think a place to bare

4:22 am

particular emphasis on gucci because that really drives the majority of their segment profits, here i think they're going to be at trough margin based on their profit warning, gucci markets should hit about 25%. that's a 25-year low for that brand. historically they have peached as much as 41% and while nobody is expected them to go back to that any time soon, it's not unfeasible they could deliver that in the size of gucci as for the other brands, it's interesting that the kering brands are suffering from some degree some are not doing to badly. that is the one brand that's still registering ground with still potential to accelerate

4:23 am

from here, but it does appear as if the company's reliance on soft luxury has made it more vulnerable >> we're focusing on the numbers because they have disappointed however, we have seen kering's stock and the broader sector in europe over the last months. i was just wondering if there's any potential change here for a turnaround could we see this stock actually outperforming in the near future given that so much of the bad news has been priced in? >> that's exactly the question the market has been asking, is this last cut, the latest cut the deepest? is it perhaps the last i think all of that will depend on the top line inflection and whether the new designer's collections really start to resonate with consumers, whether they generate brand heat that is somewhat of an

4:24 am

intangible where we need to wait and see because the products aren't yet in store. the last turnaround is a little different because they came in with a certain aesthetic what kering is trying to do with gucci right now is to make it more timeless and less design-specific, which does mean it could be that the pace of recovery will be more brandful i think the question is whether the shares are fairly valued for what is to be a tepid outlied in the new yearing and they would trade at 20 to 21 times the earnings that compares to lvmh four times. are we closer to an inflection both on the top line as well as

4:25 am

a margin as we could be, and i think for that we need to see a few months of the new designer's collection really resonating with consumers, particularly chinese consumers who are more sensitive to newness and information than any other cohort in order to assess that. >> we've heard from a lot of luxury players that they're still feeling the pinch and they're not expecting as much. a lot of these luxury players are hiking their prices. they have hiked their prices quite aggressively and a lot of them saying it will stay at that level. is there a plan to get it back, that those luxury items are now so expensive it doesn't have that inspirational bias anymore? i'm afraid we lost the connection we'll have to leave the conversation there no doubt a very interesting

4:26 am

sector to follow not just off the back of kering results, but also in the broader context of what is happening in china and the overall demand there. charlotte, thanks for your% report, however. in other news, in other corporate new this morning, i want to take you to the chipmaker space. this is after asmi lifted its revenue forecast in the second quarter over chinese demand as well as a jump in sales of logic and foundry equipment. the company expects second quarter revenue of up to 700 million euros up from 600 to 640 million. and just a quick look to take a step back. they're saying what is happening overall across the sector? and we are seeing shares across all the major chipmakers here in europe moving higher this morning. i would highlight infineon shares are currently higher by about 6.4%, and asml up by 2.5%.

4:27 am

in other corporate news this morning, volvo cars has reported an 8% increase in quarterly core operating profit that was held by easing costs and higher volumes fully electric cars made up 21% of overall sales, up from 18% in the same period last year with competition in the chinese car market remaining robust. so no news when it comes to that but speaking earlier to cnbc, the ceo jim rowan said he's confident in the mix. >> we have a nice lineup of different propulsion technologies we have a plug-in hybrid technology it allows us to satisfy those parts of the world that are changing slower to electrification than others.

4:28 am

see that quite starkly in the u.s. the west coast is taking longer as well as the interior. that's fine. we have the technology to support the customers in that region europe is developing quickly to ev. still ahead on "street signs," the co-founder of oak tree management howard marks tells me the era of ultra-low interest rates is just now coming back. we're going to bring you that interview coming up next ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even

4:29 am

a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com. shipstation saves us so much time it makes it really easy and seamless pick an order print everything you need slap the label on ito the box and it's ready to go our cost for shipping, were cut in half just like that go to shipstation/tv and get 2 months free what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. switch to shopify and sell smarter at every stage of your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every sale from every channel.

4:30 am

4:31 am

4:32 am

kering shares slump after the luxury giant declares profits could plunge after a double-digit decline in the first quarter. tech stocks look at the numbers. jpmorgan's ceo jamie dimon says the economy looks like it's headed for a soft landsing, but howard marks says investors should not expect a return to ultra low rates. >> my thesis is we're not going back to rates of 0 or a half or 1. i think that is an unnecessary stimulus, and i don't think permanent stimulus is a good thing. i think interest rates should most of the time be set by the free market. welcome back to "street

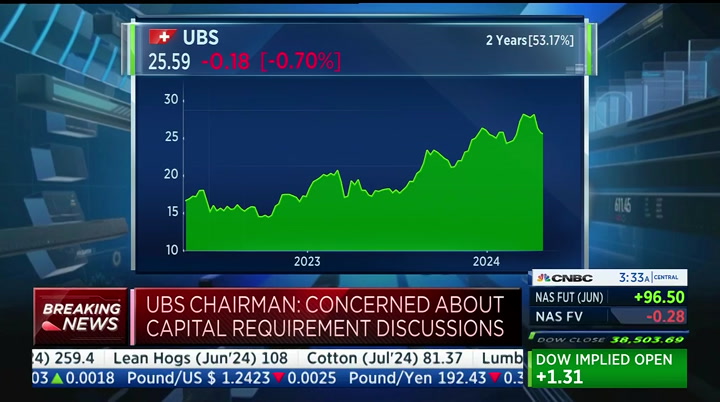

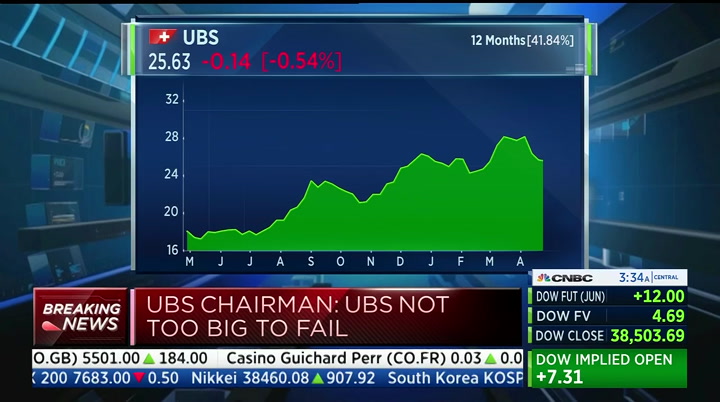

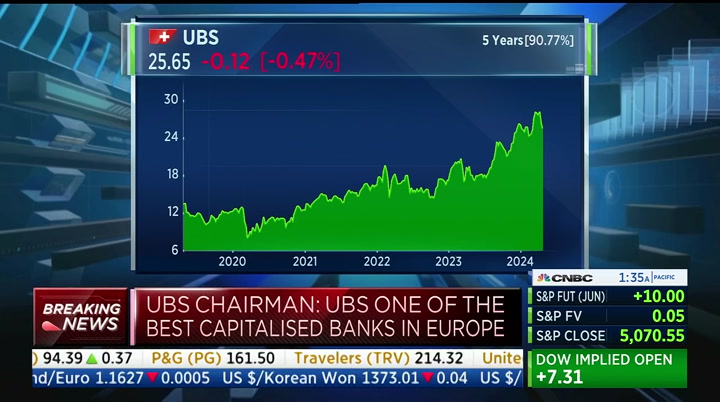

4:33 am

signs. we're just getting some flashes from ubs let me share those with you. the ceo has said there are difficult decisions ahead as we restructure credit suisse. he also said we'll need to part ways with some colleagues. let me just remind you earlier this week we had reports that ubs was preparing a couple of rounds of layoffs as they continue this reintegration process with credit suisse in other flashes that we're getting, the ubs ceo said 2024 is shaping up to be pavtal year, ubs to begin commissioning legacy platforms in the second half of the year the ceo also said the merger of the swiss bank enthe itys should occur before the end of the third quarter. so perhaps a bit of a change in language here, becauses the last time we spoke with the ceo, he

4:34 am

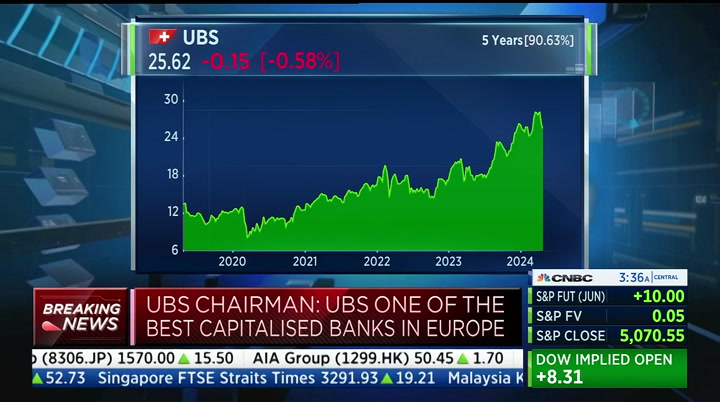

said this could be final issed in the second quarter. now he's saying before the end of the third quarter nonetheless, the next couple of months this is for context for you. us chairman on the other hand also said we plan to increase dividends by a mid teens percentage amount in 2024. ubs is not too big to file it's one of the best capitalized banks in europe. this is a very important comment, frank we had this report from switzerland, the too big to fail report that basically suggested the regulators could force ubs to have even stronger capital just to prevent further issues in the future, prevent another credit suisse 2.0 basically, and now they're reinforcing what they already said before, that they're very strong. >> they talked about raising the

4:35 am

minimum reserve requirements for banks in the u.s they're saying if banks had enough reserves and especially in the united states, if they had insurance when it comes to deposits, here with ubs it's about integration with credit suisse, redundancredundancies, costs. we've got to remember this is one of the largest bank acquisitions we've ever seen globally so the reverberations still being felt, but obviously very important comments from sergio amati and he was saying there's room in italy at least and europe in general needs larger banks. so kind of doubling down on his original statement, u be not too big to fail, but a big bank in his mind is what europe needs. >> they said before they hope this to some extent inspires certain moves in europe, but we know the difference when you compare europe with the united states when it comes to this, it's a lot harder to see it

4:36 am

across the board it is a very big player that we now have in europe and clearly regulars are keeping a close eye. >> united states has the most capita per any nation in the world. they have three times the banks any european nation has. they have twice as many as the uk has so a lot more banking competition there. maybe that's what people are concerned about. with ubs being so big, they could swallow up some of the smaller banks. right now we're looking and the shares are down just over half a percent. >> we have the ubs chairman speaking at this moment. let's try to listen to what he has to say. >> organic growth. it cements our status as the preem neglect global wealth manager and as the leading swiss universal bank, and it boll

4:37 am

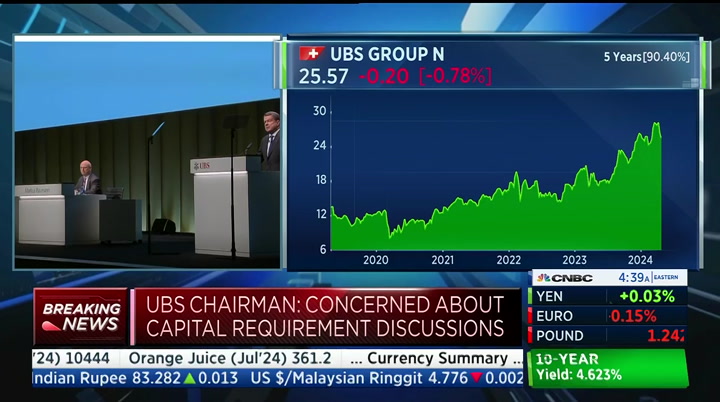

sters our banking. moving forward, success is key to realizing this acquisition. we have already made significant progress, but there is still a long way to go i assure you we are committed to working trans parentally and with speed throughout the integration. our chief executive officer sergio amati will provide more details about our integration efforts and what lies ahead. balancing the interest of our stakeholders is essential to success. we must be humble and take nothing for granted. complacency has no place at ubs. naturally our space has given rise to a new debate about how banks should be regulated in

4:38 am

order to guard against similar situations in the future the various postmortems by regulators and expert bodies have formulated specific recommendations in the areas of supervision, stress testing, liquidity, and accountability. we endorse many of these recommendations including those contained in the federal council's recently published report on banking stability. however, let me be clear we are seriously concerned about some of the discussions related to additional capital requirements additional capital is the wrong remedy let me explain why our own observation of credit suisse's predicament leads to two main conclusions first, there can be no regulatory solution for a broken business model that is the read the board of directors have held to account by their shareholders.

4:39 am

secondly, trust can just not be regulated. it was not two low capital requirements that led to a rescue over the weekend. they have significantly increased over the past 15 years. they have bolstered the resilience of the world's largest banks and the safety of the financial system the capacity increased around 20 times since the global financial crisis of 2008 at our firm it now exceeds $200 billion. our ability to acquire credit suisse under scores that the regulatory framework was not the problem. this view is supported by various experts both international and domestic i've seen how countries large

4:40 am

and small succeed, both i in my home country and switzerland have gotten by through hard work the solution found for credit suisse in march last year is a test maryland to switzerland's sensible and pragmatic approach. on march 15th, they posed for the financial system. >> the ubs chairman speaking there at the bank's agm, and i would highlight the quote, we are seriously concerned about some of the discussions related to additional capital requirements, this on the back of the too big to fail report in switzerland. clearly ubs is concerned about this issue, but let's wait and see what ends up being the requirements from lawmakers and regulators in switzerland. just on a programming note, we know ubs will be reporting in early may. let's see what further detail we'll get from the bank, frank. >> very strong words from the

4:41 am

chairman saying no regulatory solution for a broken business model. clearly trying to create some headlines, create a narrative that they're not only necessary, but they won't fix the problem or prevent another problem definitely trying to put a narrative out there. >> they're saying credit suisse was a broken model they've been repeating that line and that's what we're getting from agm. >> clearly the company trying to instill confidence in shareholders, looking at a cut work force, save 12 billion euros on a deep commitment there. we're going to move on traders have been reducing their trades on fed easing over the past months saying fewer than 50 basis points of cuts this year that's according to lseg data. i caught up to ask what he expected the rate cut path to look like. >> one day we'll take rates down to something moderate and

4:42 am

sustainable. i think that's in the 3s >> it was up half a percent and it's zero most of the time my thesis is -- i've published a thesis under the heading of sea change in a memo of 2022, and my thesis is we're not going back there to rates of zero or a half or one i an unnecessary thing. >> joining us to keep things going, our next guest. good morning great to have you here we just heard from howard marks.

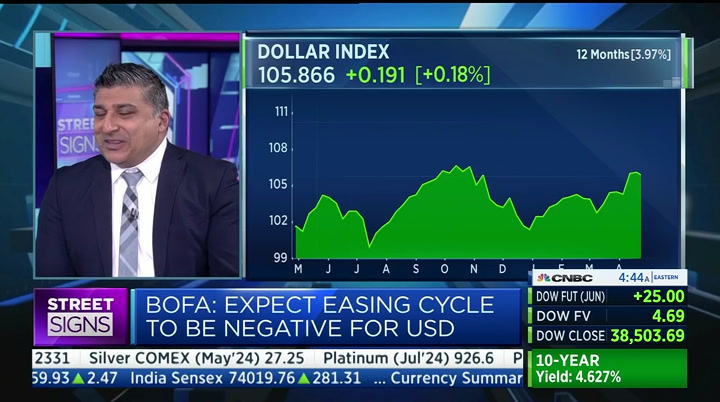

4:43 am

we're not going back to the days of easy money. right now i want to talk about the greenback. they say it's overvalued first off, why is the dollar overvalued we continue to see strength in the u.s. economy >> it's something that's been longstanding for the dollar. we've been tracking it for at least ten years now. the reasons are that you have a large fiscal deficit, a large currency account deficit one of the keys put into it is productivity was low in the u.s. and, therefore, on a relative basis, the dollar has been significantly overvalued that puts it at a disadvantage against our major currency partners about the strength of the dollar from donald trump and how that may be impacting the consumer in terms of the fed fund rate in terms of the correlation -- correlation to fed funds rate, this is all about the dollar theory if you're looking at the market where the fed funds is high and

4:44 am

u.s. interest rates are rising, that generally is a period of dollar exceptionalism. it means that the economy is growing strongly, that the market -- the economy needs higher rates conversely, when the economy starts to slow, we see a weakening of the cycle and, therefore, the dollar comes under pressure. >> what you're calling the dollar has gained 10% on the yen year to date and it's infl influencing the decisions. you think it's too little, too late >> this has been a favorite pastime, trying to figure where it is. we've had 145, 150, 155. and we're popping in there at the moment the correlation between dollar/yen is a very strong one, a very long-standing one you've got two central banks that are polar opposites of the policy scale the bank of japan is normalizing

4:45 am

but at a very slow pace. the fed is going to be slower than slow. at least according to the bank of america we think a december rate cut but the relative path of rate is probably the most important driver for the dollar/yen at the moment. >> i would like to get your thoughts on the new trend. that is the u.s. markets are starting to price in a little bit more of a chance of a hike stateside. what are the chances of that, and what could that do to the greenback? >> that's not the scenario for bank of america. we think the rate cuts will start in december. look, it's strong. we're using the phrase dollar exceptionalism there seems to be a second wave of industrial revolution or i.t. revolution going on in the u.s the productivity story is quite strong that's challenging the consensus whether they need to cut rates

4:46 am

and powell has been on the wrong side of this narrative it's very rare for an economy to slow down to a large extent if you've got unemployment and immigration flows coming into the u.s. economy will they hike rates as i say, it's not a central scenario at a minimum, they will continue as they have been to price out rate cuts. >> there's a lot of talk about the difference in speed between the fed and the ecb. are you in the camp that expects parity later this year >> no, i don't we've highlighted some of the risks. a lot of that will be around the geopolitical story, but our forecasts are for a weaker dollar into the end of this year as the fed finally starts to cut rates and signals to the market that they're prepared to do more in 2025. we're starting to get better news from the european economy we've had the iphone numbers that are stronger than expected.

4:47 am

french, german, and italian pmis are stronger than ever before. the euro people economy is a bit better than it has been for quite some time. >> thank you very much for your time and for your insight. still to come here on this show, seb posted a first quarter slide. we're going to speak with the ceo first here on cnbc flight. cirkul is your frosted treat with a sweet kick of confidence. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul is your gateway back home. so what is cirkul? it's your water, your way. cirkul, available at walmart and drinkcirkul.com.

4:48 am

hi. i'm wolfgang puck when i started my online store wolfgang puck home i knew there would be a lot of orders to fill and i wanted them to ship out fast that's why i chose shipstation shipstation helps manage orders reduce shipping costs and print out shipping labels it's my secret ingredient shipstation the number 1 choice of online sellers and wolfgang puck go to shipstation.com/tv and get 2 months free

4:49 am

my name is oluseyi and some of my and wol favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport.

4:50 am

welcome back to "street signs. let's look at some banking news. the swedish bank seb topped the profit forecast in the first quarter with net profit up 1.2% to 9.5 billion krona i'm very pleased to say we have the ceo joining us now johan torgeby, it's very good to see you this morning first of all, you've beat some of the expectations here today shares are, however, moving

4:51 am

slower could you start by outlining where is the positive momentum coming from? >> good morning and thank you for having us on i think this is a very solid financial quarter, but the interesting bit is a complete change in narrative around banking and particularly swedish headquartered banks. what's happened now after two years of increasing interest rates, we've had low activity in the economy, but very strong fin financial tailwind now it's changing where we have a much more positive sentiment around our clients but we get financial headwind concerns as interest rates are now expected to be flat or falling in the near term. the phenomenon when the interest rate goes up is people kind of forget the other bits of banking. so fees and commission, to your question, and also nfi, the trading of securities, commodities, fixed income, fx.

4:52 am

all of those performed well and beat expectations whilst the nfi, of course, the bill balance sheet expectation of this bank is now in for a different narrative in the coming year or years than we've seen over the last two. >> without forgetting some other important metric, i do want to focus on the net interest income because we heard the central bank saying they might be in a position to start cutting rates as early as may. so in a couple of weeks' time really ultimately what is the outlook for net interest income for the rest of the year if we see the bank basically cutting rates >> i think we'll see a gradual normalization of a very elevated level we've experienced over the last two years, so it's clearly a negative a bank like us, we have a lot of assets on the balance sheet that is interest-bearing, and when rates go down, those will generate less income but i do wand to divide between beta and alpha this is beta we cannot control the

4:53 am

stockmarket or interest rate level. we need to do everything we can, the alpha, to make sure we're relevant for the clients our economists agree with what you just said, so that's spot on to our view that it's likely we get the first cut in may and then we will have both the mortgage sides, the lending side, and the deposit-taking side, trying to finding a new equilibrium over time, i foresee, as rates will not stop there. they might go down further. >> i do want to ask you, were you listening earlier when we heard the ubs chair at the a fw m speak about higher capital requirements and what he believed would be a negative impact on banks and trust would not be regulated do you have any thoughts >> i did not hear about that this day is a bit crazy from 6:00 in the morning, but i can reflect on what you just said. i think there's a difference now in capital requirements, let's say attituded around europe, but

4:58 am

4:59 am

5:00 am

it's 5:00 a.m. here are your "five@5. the s&p coming off its best day inning two months. a big boost coming thanks to tesla. shares firing on all cylinders ahead of the opening despite reporting its biggest drop in q1 revenue in more than a decade. we are going to dig into those results. heading to the president's desk the senate signing off to sell the popular app, setting the stage for a big legal fight. plus

24 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11