tv Mad Money CNBC April 23, 2024 6:00pm-7:00pm EDT

6:00 pm

home all the time on the way home, that's all i meant morgan stanley breaking out here >> and guy >> tim gets better looking every show letter c, courtney thank you for being here >> thank you for having me thank you for watch gt "fast money. my mission is simple. to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere and i promise to help you find it. mad money starts now. >> hey, i'm cramer. welcome to mad money. i'm just trying to make you a little money. my job is not just to entertain, but to educate. call me or tweet me at jim

6:01 pm

cramer. suddenly we have brown chutes everywhere and that is a good thing. remember we are on the lookout for a slowdown that would justify the defensive position that we don't need any more rate hikes. when we get brown shoots, the opposite of green shoots, wall street laps it up. the fed might win the fight against inflation. that's what the dow gave and that nasdaq pole voted 1.9%. >> that was easy. >> it's been hard to parse this economy. the numbers on march 8th for so steaming hot that it felt like the fed was blindsided because they been talk about multiple rate cuts this year. and you don't do that when the job market is booming. anything that makes the fed looks stupid hurts its ability to maintain price stability paired with the fed really wrong? when wall street came on the possibility of rate cuts and the fed joined them we start getting actual signs of a weaker economy. it makes sense. they're doing their job. it was followed by another hot set of numbers for march. the benchmark u.s. tenure has

6:02 pm

gone up by more than 50 base points since the february report making it more expensive to borrow money which tends to slow down most of the economy except parts of tech that would equal secular growth not bound by little fed rate hikes or cuts for that matter. they have weakness. what we do in your weakness in the economy? you buy it and that's what we sold today. how do you know if there is a slowdown? it is not easy. we've had some very big tells of late. fourth-largest trucking company -- commerce company, transport company solid feathery but the business shrunk in march and the company's total operating revenue dropped. world leaning owner of logistic where steak was less apologetic. we heard a much more bullish

6:03 pm

story. in that interview, we were told that there was only weakness is on the california. a month later there's weaknesses in seattle, new jersey and savannah. savannah, georgia, that supposed to be where the best region is. put it all together and fancy rates for these warehouses are going higher. even e-commerce isn't safe and that. big deal. then we heard the story from carmax. they cut prices of used vehicles. that's the market taking care of business. it makes autoload a lot more expensive. snap-on helps small business owners with fresh new tools and really weak numbers. that's genuine surprise from a reliable company. the retailer talked about a really big gain about how

6:04 pm

things would get better, i think one day they will. higher rates and her lack of new homes for sale have hurt the business and the stocks. anything home related had been quite strong. the stock got clobbered. this fabulous dealmaker which saw it go down in price. first time i've seen that in a while. the price declines were stark. signaling the broad weakness and construction heavy machinery. we will talk to the ceo later but in this year even as there are many good things about it, people had amiss too. top of that we've had the collapse of express. it's agreed to close 95. if only so they don't have a lot of empty storefronts. we even have to restaurant chains. along with the over waste dairy

6:05 pm

in the u.s. red lobster with 650 locations is also disastrous. you can get shrimp promotion for $20. it took a beating. they just hired restructuring and we're playing it back. i don't know. you can see this is anecdotal. the brown chutes are one-off situation. real estates, small business, payne, frank, still, there's almost a pattern here. it's easy to argue that the economy is coming. that's a mosaic. today we have something different. we have empirical brown chutes in the form of the s&p global flash u.s. composite purchase. an aggregate number and it was so weak that i think it actually put a near-term fed rate cut back in the table. huge buying today. the anticipated it could be a rate cut. it's just so one point. listen to this. u.s. business activity continue

6:06 pm

to increase in april but the rate of expansion slowed. the latest rise in output was the smallest in the air today. reduce rates of growth and falling orders in both manufacturing and surface. wow. that's a forest of brown chutes. it could be inflation where business slows down the prices keep flying. listen to this bit of news. rates of inflation generally east at the start of the second quarter with input costs and output prices raising less quickly as the composite level input. that's what we wanted to see if are going to get a fed rate cut. this report showed for the first time a reluctance in hiring. get this comical, a number of survey respondents indicate that they had held off on backfilling positions. as a result, employment decreased for the first time since june of 2020. end quote. if you want to be inflation, you need outpaced for hiring

6:07 pm

slow. that's in keeping with the brown shoes that i'm talking about. although, there was no brown sheep from nvidia because there's a slide in the tesla which is a massive increase in the number of chips use presumably for carts. i've been worried about services being too hot, okay? something that is obviously a problem. most of the weakness i've seen came down to manufacturing. the report says, quote, the reduction in workforce numbers was centered on services where employment decreased to the largest extent since mid-2020. this is it. get this. the report goes on to say, quote, excluding the opening wave of the covid-19 pandemic, the decline in services staffing levels in april was the most pronounced since the end of 2009. holy cow. that is the great recession. >> the house of pain. >> the house of pleasure. >> listen, the more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the

6:08 pm

global financial crisis. while. really bad news for the economy. remember, we need bad news for the economy because that's what cools off inflation. that's what brings us rate cuts. let's think this through. we have a host of companies we know are doing well. texas instruments tonight, by the way, s&p is later in the show. you will love it. earnings have become spotty. we know there's no let up in traveler housing. put up some very strong numbers today. the bottom line, when you come by the anecdotal evidence with the empirical in my report you can see them right now at this moment, the brown chutes are infecting the green and that is exactly what we need for the fed to justify cutting rates. so, of course, it happens, right? everyone has given up on the possibility of a rate cut. ryan and washington, ryan? >> this is ryan.

6:09 pm

>> welcome to the show. what's going on? what's happening? >> do you think there is more upside for amazon? >> yes, absolutely. why not? amazon is the great equalizer. amazon web services going to be incredibly strong. amazon advertising is on fire. i want to go to my namesake in georgia. jim? >> hey, good afternoon, jim. booyah. >> booyah back. >> i hope you're doing well. >> could not be better. >> great. great. glad to hear that. what are your thoughts about this acquisition between kroge ? >> i think the government will block it because there reeling from the safeway deal. the one where people ave other stores and it became a hagg way. [ laughter ] so, they're not going to do that deal. anyway, right now the brown

6:10 pm

chutes are affecting the green shoots. we are in favor of brown chutes. we want rate cuts. it it's exactly what we need for the fed just by cutting rates just when everyone had given up. isn't that exactly the way it works? mad money tonight. s&p such as lights down and i'm learning more about what's working for the software giant. nobody's interested about it for me but you want to be interested because it's really good. on the other side of the coin, newport is milking reporting last night. we are investigating a buying opportunity that was a warning for what's to come. mattel is trying to find its footing as post-barbie movie world. stay with cramer. >> do not miss a 2nd of money. follow at jim cramer on ex. have a question? tweet cramer. give us a call at one 807 43

6:11 pm

6:14 pm

♪ today all the newly hated tech stocks came back with a vengeance and it was the german enterprise software from powerhouse that led the way. last night they reported a seemingly okay quarter but this year's 5%, why? the cloud numbers were excellent. i think this company has a great story to tell about how they will be a big winner from artificial intelligence. they've infused ai and their whole product suite. don't take it for me though. earlier today a chance to speak with the ceo christian klein. i love what he said. take a look. >> welcome back to mad money. >> yes, it's great to be back.

6:15 pm

hi, jim. >> i got to tell you, you crossed it. it's not just on cloud, he also crushed it on ai. there's so much to talk about. first, i want you to tell me about the new business. the amount of new business you brought in is extraordinary. and one quarter, incredible. >> yes, absolutely, jim. i mean, we counted 64% net new customers in our base and weird gaining further market share. our backlog is up 28%. amounting to 42 billion and that gives the company a lot of resiliency and as i said, we are expanding market share. >> once you bring the men, they love your suite. i mean, it looks like you could bring in someone finance and they'll take you to human resources. it's terrific strategy. it's working with the huge number of your customers. >> yes, absolutely. i mean, land and expand is the core of our strategy. when we are talking about the core processes of our

6:16 pm

customers, finance need to interact with payroll. sourcing needs to interact with finance. when you demand supply, it's good if it is connected to your commerce. it all needs to be tightly integrated and this is what the s&p is delivering. >> i think it wouldn't happen unless they loved s.a.p. i have this image of people coming in and they love you and they mention these other things and they say, look, it wouldn't happen. let's say they didn't like it. you would be one piece of the puzzle and that would be the end. >> absolutely. yes, customers are loving and i guess they love the new s.a.p. even more. we are offering a very flexible platform. there's no login. we are providing choice. the matter which you are wanting in, our platform is enabling all of these hyper scaler infrastructures. if you have structured and nonstructured data where harmonizing the data layoff and

6:17 pm

on top we are infusing ai into the business process of our customers, always taking the best technology which is out there in the market. >> that was my next question. you talk about however discussion is now ai. every discussion including your own internal. can you tell us about how you are repositioning people ou're keeping headcount the same but you are making decisions that sounds like you are taking people who may not be as productive and replacing them with ai and bringing in big strategists. you're doing what jensen huang said you are not -- said could happen. do not cutting back, you're getting better. >> absolutely. it also speaks to the credibility of sap that we are not only sharing with our customers how business will ai will help them to be more productive we're doing it internally at s.a.p. no matter if you are developing, we can produce code at a highly automated rate to increase productivity after 40

6:18 pm

to 50%. if you are in sales and in preparing for customer meeting, there's automated content creation. there's helping to configure the ideal at the right time. if you're in finance or commercials, you actually can get help by screening contracts automatically with ai. we are infusing ai everywhere. this helps us to grow the business in a significant way while to your point we are keeping it flat. >> there's a pervasive sense it's come over because the stocks have been bad that ai is something that is fanciful. it smacks of fiction. i'm listening to someone who is a 700 billion cloud market, dominates so much of consulting in this country, i mean, in this world, you are saying that ai is important. it's real and it's being put in right now. >> yes, we have 30,000 customers were already using

6:19 pm

business ai. we are embedding ai right into the business processes of our customers. when you are doing travel and expansion we can automate the expense management by up to 70% like we did with giovanni, one of our key customers. are we actually putting our digital assistant on top. this is our new user experience. 80% of the most heavy use transactions in the system are getting completely automated via our digital assistant, jewel. ai is real and we have a high adoption already amongst our customer base. >> i'm so glad you're saying this. i got to put this thing in. i've got a put page to this note and that it's not helping. you say you work and travel, finance, supply chain, procurement, it's going to happen and it's happening right now. >> exactly. we have customers that are like apple or something when they do

6:20 pm

sourcing, they do sourcing with thousands of suppliers. how to pick the best supplier from equality, from a cost, but also from a sustainability perspective. all these companies want a more sustainable business going forward. sourcing is key. with ai, we can help them to source wide suppliers. again, to your point, when you're in finance anyone analytics, how can you do decisions on where to produce at the lowest cost. this is all what we are now empowering with ai to also help our customers to make starter -- smarter decisions. >> i want to make sure, they have a vision in the world that you are not necessarily changing and taking out people and putting in machines. i want this point clear. you are getting more productive, you're of the same headcount, is not one of those things where people say oh, my god, s.a.p. comes in, they fire one third of the people, it's the opposite. you upgrade the table. you take away the jobs that are repetitive and not that helpful

6:21 pm

and you bring in big thinkers. is that true? >> absolutely. i tell all of our customers, a technical move to the cloud. what we need is the world's best architects. we need process experts. we have 400,000 customers. we know how the best business is run in the world and we need to share these best practices to infuse it into our software so that we are not only migrating systems to the cloud but we are changing the way how business is run to transfer them and that is key in these other skills which are needed. your point, there are repetitive tasks in the company which we can completely automate and of course, we need less people and that's a transformation that we are driving internally at s.a.p. >> this is just what i want to hear. i knew you would tell it to us

6:22 pm

straight. it's not like you are working -- look, nvidia matters. it's not like you're working for one of these companies, you are working for your clients and you are saving your clients money and you are making them better and you are using artificial intelligence and that is how i'm going to position as a peak is that the right way. that's how stock goes up real good. your delight. you always are. thank you for choosing mad money. it means a lot to me that you were on our show. >> thanks for having me. >> good to talk to you. then money will be back after the break. coming up, calling all metalheads. cramer sits down with the man of steel fresh off earnings next.

6:24 pm

6:25 pm

6:26 pm

indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire did the stock of new quarter get crushed today with the stock plunging 9%? the best steelmaker in the world where corded results and after numbers back in march earners -- earnings came in and they were thinking 355 to 365. unusual. they're usually conservative in the pulmonary guidance and it beats the number. not this time. not a fan of the stock forever. since before the show began. i saw the winter and the

6:27 pm

company's been a voracious buyer. somethings help them put up tremendous earnings-per-share numbers over the past year. did the market overreact or is there something worrisome going on here? leanne is the chairman president and ceo. welcome back to mad money. >> thanks, jim. i appreciate you having me. >> leon, i'm mystified like a lot of people. i'm mystified because, one, you guys are rarely that much off in the short period of time. two, when i read through what went on, i don't see a lot of weakness and yet you decided to say that next quarter's going to be weak too. if you hadn't, i would've said it's ridiculous of the stock is down. >> well, i would tell you i also agree it's ridiculous the stock is down given our long term view, a long-term capital allocation plans. as you mentioned we don't take missing lightly. i would tell you over the last 10 years or 40 quarters there's only been three other times that we have not hit our guidance range or above.

6:28 pm

it something our team takes seriously. we will continue to work through it. it wasn't from an operating performance standpoint. all three operating segments came in at or above what we expected them to come in at. it came in the form of corporate eliminations which is one of our keys for earnings. 20% of our overall products stay within the new quarter. they shifted inside divisions across 40 states, hundreds of locations. hundreds of millions of dollars transferring every day inside of newport. you have to eliminate those profits. it's not going to come back out where he gets sold in the coming weeks and coming quarters. we will see that come back and rebound. it's estimating that we've got to get better at estimating what those hits are going to be and framing data for our shareholders. >> that's talk about the steel product segment. it's expected to have moderately decreased earnings as compared to the first quarter of 2024. that's because average selling prices, which are lower, partially offset by increased

6:29 pm

volumes. if volumes offset enough, the answer is no. it makes me feel that perhaps something is wrong with the economy that you would have a decline. >> yes, look, fair question. you are seeing a moderation of historic highs of 21, 22, 23. our products group has made new court an incredible amount of money. prior to the pandemic, a great year for them would become a man, maybe six, 700 million. today, a good quarter is $1 billion. are coming in at five or 600 million for the quarter, man, they're still robust earnings out there and the prices have stabilized. we've not seen a lot of movement over the last 90 days. what i would tell you is i am comfortable with where we are at while prices are moderated, we are seeing some strength as we look towards the back half of the year. we think u2 will be lower.

6:30 pm

products have been one of our strongest most resilient robust performers and if you look at the overall construction industry, it's 50% into that. it's flat year-over-year. from a volume standpoint, pricing is softer. it's moderated. this is not time to throw the baby with the bathwater. we think 2024 will be a good year. >> how much should we look at operating rates? the company increased. the old days i used to look at operating rates and say they really defined how well nucor could be doing. those are good operating rates. >> yes, they are great operating rates. the other part of that, with our variable cost in our variable model we can ramp up and down quickly. it something you know well but it provides an incredible opportunity for us to meet the market where it's at, for us to

6:31 pm

meet demand where it's at and if it's not we can scale back slightly. the other side as we get a lot of questions or on the flattening of the cost curve. there are many of our product groups like the launch products that generate incredibly robust returns even it 60, 75% utilization rates. we are getting more refined as we think about how we operate and our customers and the connection to supply is getting better. we are seeing a higher high and a lower lobe of the curve is coming together and the variability is coming -- lessening. >> okay, besides that one, i'm looking at data center infrastructure. i love the stock and eat and win big in the data center. i love the stock of eden. you acquired a manufacturing data center infrastructure. are you ever to flood the zone and be much bigger that's just a toehold? if that's the case, that's another business that has no economic sensitivity.

6:32 pm

>> yes, look, i couldn't agree more. we've been in for a while now. our acquisition a couple years ago and services, today's announcement more recent announcement with southwest data products and by the way, welcome to our hundred and 47 newest team members there that joined the family. really exciting opportunity for them to continue to leverage the strength. we have a new data center processing group where we will be able to provide a holistic solution to the hyperscalers and co-locators. nucor already has incredibly strong and durable relations with. you will see nucor move into this trend heavily. >> the last question, i'm going to go back to this, is there any chance at that the next quarter could be better than anything? i asked that because the miss was not a huge mess. it was just some things that broke down in the end. i looked at it and said listen,

6:33 pm

i'm not seeing a big decline in pricing. i know if the economy gets soft, everything goes weak but if the economy stays the same there's a chance you guys could do better than the current guidance. >> look, here's what i would tell you. the demand picture out there is still strong. we are seeing a lot of segments with the data centers, advanced manufacturing, cold storage, the digital economy, the hardening of the grid, the three pieces of legislation, chips, and i.r.a. is all starting to flow through. i would tell you that the investment strategies for the long-term, your viewers and our shareholders have made a lot of money because we invest for the long term. we are not guiding to one quarter or the next results. we're looking for the long-term performance and i think our best days are still in front of us. i look forward to the future of

6:34 pm

nucor. >> i couldn't agree more. i spent all day racking my brain and reach the same conclusion ahead of this interview which is that you don't get a chance to buy nucor unless there is a bit of a discrepancy. otherwise it's going to be straight up, it has been since 1980s, the mid-80s. i'm with you and i'm glad you came on the show because you clarified a lot of stuff. thank you. >> thanks. appreciate you having me. >> that is leon, chair president and ceo. you don't get a break. i spent most of the afternoon with jeff who works with me for the travel trust thinking maybe we got our chance. i'm thinking maybe we did. mad money is back after the break. [♪♪] your skin is ever-changing, take care of it with gold bond's age renew formulations of 7 moisturizers and 3 vitamins.

6:35 pm

for all your skins, gold bond. - "best thing i've ever done." that's what freddie told me. - it was the best thing i've ever done, and- - really? - yes, without a doubt! - i don't have any anxiety about money anymore. - great people. different people, that's for sure, and all of them had different reasons for getting a reverse mortgage, but you know what, they all felt the same about two things: they all loved their home, and they all wanted to stay in that home. and they all wanted to stay in that home. - [announcer] if you're 62 or older and own your home, you could access your equity to improve your lifestyle. a reverse mortgage loan eliminates your monthly mortgage payments and puts tax-free cash in your pocket. call the number on your screen.

6:36 pm

6:38 pm

>> what's it going to take for mattel to break out of its range of high teens and low 20s. a blockbuster barbie movie couldn't do it. overall, sales continued the post pandemic downturn while the toil maker -- toymaker had to deal with cost pressures. they're talking about sales this year being comparable to 2023 but meaningful earnings growth, is that enough? let's check in with the chairman and ceo of mattel. welcome back to mad money. >> hello. great to be here with you. >> one of the things that is certain is that this was a quarter where we had significant growth margin expansion. you're making a ton of money. can you make even more money, i want to put this right but the sales don't have the growth but maybe we shouldn't care for now. i don't know what to do.

6:39 pm

your buying back all the shares, you're making a lot of money for people of growth, what do we do? >> well, we're off to a good start of the year with significant growth margin expansion and strong improvement and cash flow with positive consumer demand and improving trends. we are executing on our $1 billion share repurchase program and just bought $100 million of shares in the quarter. we expect to benefit from and greater efficiencies and cost savings. importantly, we expect to outpace the industry and gain share and reaffirm guidance for the year and the plan for the year is to emphasize profitability, gross margin expansion and strong cash generation and return to growth in 2025. >> let's go over to top line growth. i would think that would have to come from mattel's upcoming

6:40 pm

film slate. you could disabuse me of that but i would think that that is a great wave to look at milestones on the way to 2025. >> absolutely. we have a clear strategy to continue to grow our toy business and expand our entertainment offering. we look to gain shares this year. we have incredible drivers on the toy side of the company and, of course, we talked about our entertainment strategy where we currently have 15 movies and development, a thriving television business, a growing digital part of the company that is growing with more games that we are looking to produce and self publish and consumer product and merchandise, location-based entertainment with the first part that we expect to launch at the end of this year and another one that we announce that we are launching outside of kansas city in 2026. you're going to see more and more execution on our entertainment strategy in addition to very song toy

6:41 pm

performance that is growing share. >> i listen and i say to myself why are you buying back stock if you have all these great growth opportunities. that seems like you should put every dollar towards the growth. >> our location priority is about driving organic growth. first and foremost. where are also looking to find opportunities for acquisition of where we can accelerate our growth opportunities and, of course, share buyback program is another elements of our capital management priorities were we believe we are below where we think are worth. we may take advantage of that opportunity and by our share. >> let's talk about what is hot. i think it's clear that you divided into dolls and vehicles and i want to talk vehicles. vehicles still make your ton of money. >> hot wheels is an incredible

6:42 pm

brand. we just had our six consecutive record year last year and we expect to grow again this year. we are growing that space to expand our collective serious both at mass retail and mattel creation are direct consumer side. he brought in distribution globe eakly. we are accelerating growth and have a very strong show on netflix right now that is a top 10 program and 69 countries already. we expect hot wheels to continue to grow this year and drive another strong year for the vehicle category overall. it really is a great execution of our ay book, driving brand purpose, consumer centric innovation, cultural relevance and franchise mind-set. >> in front of me, i don't have the usual array of barbie dolls. is that because there are other areas that are doing better? i just have the wrong things in front of me? >> barbie is such an incredible brand. it's an incredible canvas. the number one doll globally

6:43 pm

with over 550 basis points of market share in the category and the number one property in dolls and continues to expand. we could not be more excited about barbie's trajectory. more segments we're launching this year, we expect more shelf space in the second quarter. there are more offering for adult collectors. we are engaging the nor -- core kid audience with new content. there's a partnership we announced earlier this year. we published a new mobile game we were released later this year and all in all, a great brand celebrating his 65th anniversary this year with multiple activations and incredible opportunities down the road to grow. >> you have great margins, the free cash flow is extraordinary. the logical question would be someone would ask me, jim, like all those things but you don't

6:44 pm

have good sales growth. want you wake me when you have's good sales growth. what do i say to someone like that? critic? >> our plans for this year is to have comparable sales for 2024. this is in the context of our expectation for the industry to decline, albeit less than last year and in an industry where we return to growth in 2025 with improving trends. in that context, we expect to continue to gain share, outperform the industry and focus on incredible brands and innovative products and at the same time, continue to position the company for long-term growth, both for profitability. >> if i go to kansas city next year, what am i going to see? >> well, the parks we're launching now have an incredible offering of mattel brands, different executions, different rides and attractions. the part where launching arizona this year will have 11

6:45 pm

attractions based on 10 brands of mattel. it's another form of engagement where we continue to look to touch and reach and engage fans of all ages all over the world. >> but you've not invited us. what is that about? >> [ laughter ] of course. we talked about it before. how we as a company involved and we now think of people who buy our product much as consumers but as fans that have an emotional relationship with our brand. in that regard, we stand out in the market that is looking for big franchises, big brands and we opened one of the strongest portfolios in the world and children and family entertainment. that really opens up opportunities for the company to expand outside of the toy aisle. we love the toy business and we see significant opportunities for growth in the toy category but the opportunity for mattel is to take on incredible brands and extend our business outside

6:46 pm

of the toy aisle and participate in business verticals that are driven by franchises and big brands which is what we bring to the table. >> it makes sense to me. what can i say, i've got to see it with my own eyes. that would be my trigger to think under 20, you've got a bye. i want to thank you. it's always great to see you, buddy. thank you. >> thank you. >> mad money is back after the break. >> [music] i enrolled in umgc because i became very passionate about emergency management. the professors were great because they've had several years' experience in the field. they've seen emergency management hands-on. i'm able to learn from their experience and really make a difference. i picked university of maryland global campus because you get so much more out of it than just a diploma. >> learn about our more than 125 online degrees

6:47 pm

6:48 pm

hey you, with the small business... ...whoa... you've got all kinds of bright ideas, that your customers need to know about. constant contact makes it easy. with everything from managing your social posts, and events, to email and sms marketing. constant contact delivers all the tools you need to help your business grow. get started today at constantcontact.com constant contact. helping the small stand tall.

6:49 pm

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient. holder, before we get to

6:50 pm

tonight's lightning round a reminder that you're not going to want to missed the next monthly meeting. it's happening tomorrow at noon. i want you to join so much we have a limited time offer happening right now. you can take advantage of it and get the exclusive member benefits at cnbc.com/flash club. and now, it is time for some of the [ inaudible ] . and then the lightning round is over. are you ready? i'm going to start with frank in ohio. frank? >> k, jim, i bought the stock over year and half ago because i like high yield paying dividends. i can reinvest in them. i want to add more cash to my position. >> i like ppr -- pvr the beer more than i like ppr the oil company. let's go to and in maryland.

6:51 pm

ann. >> jin. tell me what's good about enterprise products. >> it's got the best network of fraction aiders in the country. it's also the best run. i can't say enough positive things. let's go to eric in georgia. eric? >> good evening, mr. cramer. >> of course. nvidia has invested in their capital equipment. >> i've been waiting for someone to bring the stock up. why? when i was in nvidia for the great conference they talked about this company endlessly. i think you have a real winner. the stock went up around the conference and does come right back down. i meant to do a segment about it. sometimes that happens. anthony west virginia. >> go, birds. i need your blessing. >> i will give you my blessing. i think ellen g is terrific.

6:52 pm

because the president has decided to, let's just say, put things on hold for others, this guy is a winner. it's by. let's go to stafford. oh, my god, i don't know if it's going to be picked up. stanford and california. >> hey, jim. how are you doing today? >> all right. are you doing? >> good thing. i wanted to know your thoughts on casey's general store. >> oh man, hidden gem. hidden gem. love the pizza there. that is a winner and it should be bought. it's not that expensive given its growth prospects. i wish they split the stock there. now are going to gregory in california. gregory? >> hey, jim. i'm looking forward to the monthly meeting tomorrow. >> were going to smoke you. i met you at the annual. you were terrific. >> oh, you did.

6:53 pm

i dropped over hundred 60 bucks in the past couple of weeks before covering on some of the last two sessions. no worries. i've retained my club membership. i'm still up over 40%. thanks. >> well, no problem. >> what stock is that? >> broad calm. >> brought come. it's ridiculous it went down. jesus. it's almost as good -- i said that because sometimes my life -- wife listens. that is the conclusion of the lightning round. >> the lightning round is sponsored by charles schwab. get an expanding library filled with new online videos, webcasts, articles, courses, and more - all crafted just for traders. and with guided learning paths stacked with content

6:54 pm

curated to fit your unique goals, you can spend less time searching and more time learning. trade brilliantly with schwab. >> university of maryland global campus is a school for real life, one that values the successes you've already achieved. earn up to 90 undergraduate credits for relevant experience and get the support you need from your first day to graduation day and beyond. what will your next success be?

6:57 pm

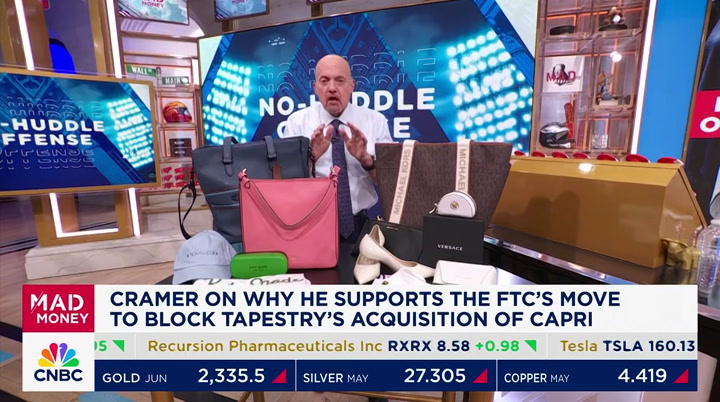

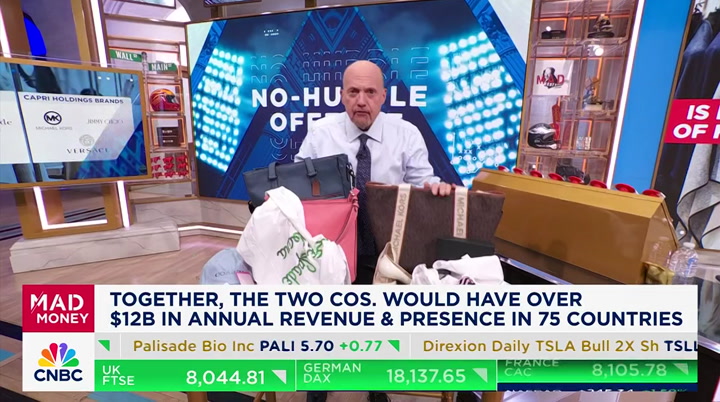

tapestries $8.5 billion acquisition of capri is anticompetitive. when the parent company of coaching kate spade merges with the parent company of versace and jimmy choo and michael kors, i'm sold on the idea that it is indeed bad for the consumer that i know i've been a major credit to the ftc in recent years because it feels like they want to block every deal especially when it involves a big company even a company like amazon that said everything in its power to give consumers lower prices. you know what? some deals do deserve to be blocked and i come around to the idea that the tapestry type is one of them. the ftc uses some hyperbolic language in its release. the proposed merger threatens american consumers of the benefits of tapestry and head- to-head competition. the agency adds that the deal, quote, threatens to eliminate the incentive for the companies

6:58 pm

to affect wages and workplace benefits. they go into great detail about how they attempt to dominate the so-called accessible luxury category are for real. i'm not enough of a fashionista to understand this business. this stuff, frankly, i'm not calling it my style but people do buy these things. i hate to see them having to pay more than they should for these things. i say it's a travesty to buy the stuff at any price. i'm not exactly the key demographic. why my son in the ftc on the soma? they're going after a merger that's trying to do something anticompetitive. let me put it this way. why do they want to buy capri? they cut labor costs by laying people off. i do take out arrival that competes for shelf space. i like the deal precisely because it would eliminate fears head-to-head competition on many important attributes

6:59 pm

including price, end quote, like the ftc says in its release. i mean, come on, we are talking about stuff that i guess is kind of exactly like in a subtle way. what am i supposed to do here? argue that it won't have an impact to the lawyers why argue that will have an impact to potential shareholders? i may be the most sincerely insincere man in north america even for me, that is what i call pretzel logic. who would -- that's from a member of my staff. whatever by this? not only that, i was hoping the tapestry would create this colossus by continuing to buy up additional brands. the commission says the tapestry has no plans to stop acquiring companies. this deal is not likely to be tapestries the last. it will give them leverage to make more in the future. to which i say, you betcha.

7:00 pm

i'm not in favor of monopolies, okay? i'm in favor of higher stock prices for you, the shareholders. that can often put me at odds with the ftc. sometimes that's exactly what should be blocked and he not? i accept the verdict. the prosecution does not rest. for once, i think they're right. i promise try to right now on "last call." the decisive vote that could been tiktok coming in just hours. one of the senators who helped determine the fate will be here. of the economy's secret sauce. new detail reveals what may be the real source of our strength and it is probably not what you think. a tidal wave of earnings. we will show you the biggest takeaways of your money. housing affordability slipping even further. open the door for all you new buyers out there. rocking college camp

28 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11