tv Fast Money CNBC April 23, 2024 5:00pm-6:00pm EDT

5:00 pm

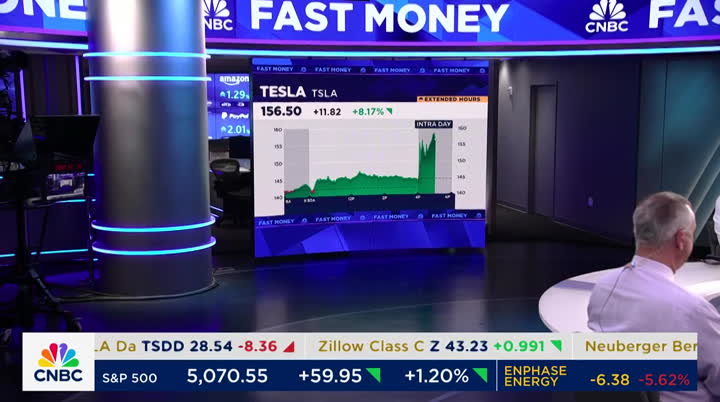

enterprise company at scale, so, what do they do in results, what do they do on guide, how aggressive are there they, when so many other companies are facing pressures in the meantime, we had the major averages finishing the day higher, two days in a row now. can that continue? that's going to do it for us here at "overtime. >> “fast money” starts now. live from the nasdaq market site in the heart of new york city's times square, this is "fast money. here's what's on tap tonight a tesla triutriumph. shares soaring on hopes for new models and better than expected margins. is this what the stock needs to get back on track? plus, not so gucci the parent company of the luxury fashion brand seeing shares tank is this a sign that even the highest in consumer is starting to crack and later, we're counting down to meta earnings. the home builders lay a strong foundation, and goldman sachs posts a record close for the

5:01 pm

first time in more than two years. i'm courtney reagan in this evening for melissa lee, coming to you live from studio b at the nasdaq on the desk tonight -- tim seymour, karen finerman, dan nathan, and guy adami. we got to start off with tesla taking off on q-1 results. shares actually soaring. this is despite a miss on the top and bottom lines investors seemingly excited that the new models may be coming sooner than expected if the gains hold tomorrow, it will be tesla's best day since seethe hasn't had a lot of best days lately phil lebeau joins us now to break down the results phil, what happened here in this report >> well, it's what they said in the indication of new models that are coming, more affordable-priced models that is exactly what the street wanted to hear the street didn't want to see what they saw for the first quarter you and let's go over those numbers. none of these numbers are good any way you look at it, this was an ugly quarter for tesla. earnings miss, 45 cents a share, the street was expecting 51

5:02 pm

cents. revenue, down 9% year over year. the worst since 2012 it fell short of estimates coming in at $21.03 billion. operating margin of 5.5% negative free cash flow of $2.53 billion. yeah, it was ugly. any way you look at the first quarter. but then, tesla put out its future outlook, which is, you know, not always the clearest, but this time, they were pretty clear, saying they will accelerate new model launches including more affordable vehicles leave that to your interpretation whether or not you see one coming in at $25,000 or just more affordable than we see with the model 3 right now start of production likely in the second half of 2025. but it's clear, when you read the note from the company, in the earnings release, it is clear they are moving quickly to roll out newer models. by the way, delivery growth, notably lower in 2024 than 2023. and i think last year, the delivery growth, something like

5:03 pm

18%, 19%, notice that's not total deliveries, it's delivery growth so the street is expecting 1.9 million vehicles to be delivered this year. we'll see if that's the case we'll see how second quarter develops here. we know what the first quarter was when it was down 8.5% year over year. guys, back to you. >> phil, i don't mean this to be a trick question, because it's hard to predict mr. musk, but any indication what we might hear on the conference call? >> well, i think people -- one of the main questions is going to be, how many vehicles are you looking at in terms of a accelerating the development of when you say more moderately-priced vehicles, are we talking something substantial? they plan to incorporate the current existing lineup of vehicles as they roll out the newer ones they want some clarity that's what the analysts are going to be looking for. by the way, with regard to robo-taxi, there is one sentence in the release at the bottom in

5:04 pm

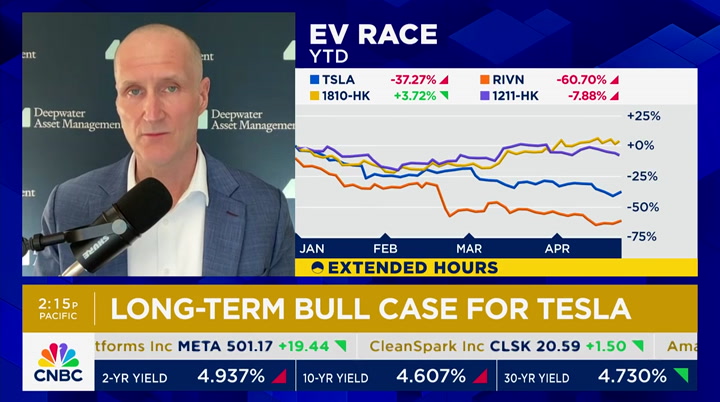

terms of the development of robo-taxi, saying they will continue the development of this remember, august 8th is when they have said, we will unveil the robo-taxi, or give more details regarding that no doubt, that conversation will happen to a certain extent tonight during the call, but i think most of the call's questions will focus on the development of these newer models >> awesome phil, thank you very much. keep us posted on what you hear. all right, let's trade this one. dan -- i mean -- why is this stock higher okay, so, maybe we have an acceleration of the new vehicles, but everything else is kind of a mess >> yeah, and it likely is just because going into the print, it was down 30% in the last, you know, five, six weeks. think about the magnitude of this selloff in market cap terms, given everything we've known since their q-1 delivery estimate that came out, and it was a massive miss, and i think a lot of investors just said, you know, shoot first you ask questions later. when you look at this report, phil just said it, the quarter was not good and there's nothing that leads you to believe they're going to

5:05 pm

be turning the tide from a fundamental standpoint this quarter in q-2 and maybe not even in the back half of 2024. so, to me, it just seems like, you know, stock is bad in the print and it's releasing this call hasn't started yet this stock could be down in an hour or so just go look on twitter, the bulls are eating themselves alive right here, the q crowd doesn't have to do any of the work, because they have turned on each other. >> stock's higher, but down 40% so far this year, and to your point, we're going to hear a lot more on the call karen, what about the negative free cash flow, does that bother you? >> well, i'm not long, so it doesn't really bother me that much but there are so many things to not like here. and it seems like what's happening, don't look at this, let's distract you and talk about the things we know you want to hear you want to hear about a lower priced model i think phil said it was second half of '25, that's a long way

5:06 pm

off. as dan say, you know, the bigger event is in 24 minutes, which is the conference call, and sort of anything can happen, i mean, they have sort of -- they haven't been wildly bullish in the last few weeks about anything, really certainly -- the stock -- investors haven't, but i don't think the company has, either, so, i don't know i think -- it seems to me very odd this communication of, we are getting rid of the lower priced car, right, this is maybe three, four weeks ago, and we're going all-in, robo-taxi, i don't know if this is -- are they pulling back on that, because that's what they think that's what the street wants to hear, or is that the direction they're going? that will be important on the call >> yeah, phil said there was just one line in the release about the robo-taxi. tim, i mean, delivery growth notably lower this year than last year. >> no surprises on that, and i think we priced that in. the headlines are pretty shocking it's their first year over year quarterly decline in revenues in

5:07 pm

four years and it tells you this is the growth company with the growth multiple that doesn't grow model 2 lives, so, it's a little bit, dan's right, let's listen to the call, it's the hocus pocus, nothing up by sleeve, there's something going on over here i this i nk that's exactly whats going on here. th they're cutting prices, they cut prices more over the weekend the one thing that the analyst community can look at in terms of margins is where the software adoption, the fsd adoption, because it's very accretive to margins, they're cutting prices there, too what does that mean? it might be positive for overall margins, but i just think that there was not any expectation here that's why a 6% is kind of a -- a, you know, let's call this a relief rally. i don't think -- and we discussed this probably for the last three months. certainly since we got the delivery cuts and some sense that the numbers were going to be so poor, is that there's not a lot of great news for tesla

5:08 pm

until we get, as we said tonight, into the second half of '25. >> guy, when you look at the chart, we're so far off from even recent highs. >> yeah. >> is there a trade here >> i don't think we're getting there to recent highs, number one, but we did hold a support line, i think carter worth talked about it last night, over the last week or so, we traded right down and bounced off a level that we should bounce at in terms of levels, this is just another bounce that we've seen a number of times over the last six to nine months just for context, in terms of free cash flow, the street was looking for positive $650 million, it came in at obviously negative $2.5 billion. that's a pretty wild swing and margins were not good. margins continue to deteriorate. what the street took away is the fact, oversold condition, yes, robo-taxi, maybe faster than people expect, and i think that maybe the fact they didn't sell any bitcoin played into this, as well

5:09 pm

no reason to be overly enthusiastic >> dan, what about the reduction in the labor force, some of the executive turnover, any of that cause for concern as we look forward? >> well, the reduction in labor force is good if you are shipping less cars that's good. right-size that. the problem is that over the last year or so, over the last couple years, they've had a lot of really senior leadership turn over a couple of the gentlemen who left in the last month or so had been there for 18 years or something like that. so, when you think about this, and this is going back to the tesla bulls and some of them are starting to say, okay, wait, this guy was the ceo of a company that just a couple weeks ago was $600 billion market cap company. he's the ceo of spacex, the highest valued private company in the entire world right now, right? and you think about twitter, you think about the other things that, we don't even know what's going on it doesn't make any sense anymore. this company is facing an existential crisis as it relates to their own infrastructure. that doesn't mean about the shift towards evs, okay? but this is the first year that we've seen, tim's point, we're

5:10 pm

seeing year over year revenue declines and delivery decline, and they've never faced that, because they've owned the market now, in one of their biggest markets which is china, they have competition from everywhere and a year ago, if we said that on this show, people looked at you, they'd call you an idiot. and you know what? byd is shipping $20,000 cars and tim's point is a great one their $35,000 car is getting into the 20s because of their price cuts and that's why the margins are going where they are. so, to me, it seems uninvestable if you think of this as an auto company. you probably have plenty to say on what gm just reported >> i was going -- gm, they have also kind of cautioned on margins maybe in the second half of the year because of rising ev production and deliveries, but gm was up 4.5%, gm that actually beat and raised, great output, and it does look like -- we know there's competition, it's just interesting. i'm not here to tell you gm is the major competition for tesla here we've said there's been this

5:11 pm

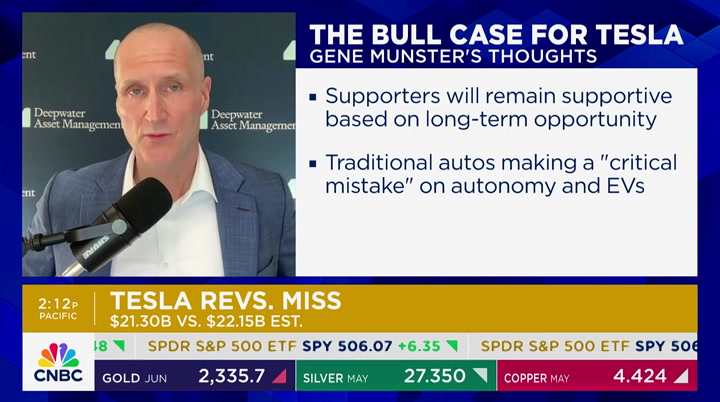

dynamic where people think gm and ford, certainly a toyota, are more game on in hybrids, but either way, it does highlight where you've got obviously a traditional oem where you've got a real revenue, but a real margin story, in a company that's never been more from fitable in gm, and that's the name i think you stay long we could talk about that or we could not, either way, that's a company where i think the trend both with the chart and the fundamentals is on your side. >> we have a little bit more on tesla results, let's bring in gene munster gene, great to have you here what are your thoughts here? we know the conference call hasn't kicked off, so, still a lot of questions percolating, but what's top of your mind here >> well, i think what it's come down to, there's a question, is tesla smoke and mirrors or is it substance? and i think the results this quarter are going to give evidence for the smoke and mirrors camp to this this is just another car company and i think that there is really

5:12 pm

to be gained i think one thing to be gained is that margins are declining, but they're not plummeting they did a little better than expectations, still on the decline. they're going to survive they have $26 billion in cash, but this ultimately comes down to, do you believe if you believe that the future is going to be hybrid cars and it's going to take a long time, 20 years, to get to full electrification, stock's not going anywhere if you believe electrification is going to accelerate for multiple reasons, and you believe in the concept of autonomy and robo-taxi and they're going to get this out, tesla is the best positioned company to deliver on that future around autonomy and electrification. this is a big market $2.5 trillion market and so, i think that's what this ultimately comes down to as the panel has said, stock -- it's going to move based on what happens on the earnings call at

5:13 pm

this point some commentary. i still think the street numbers are coming down for 2024 and delivery so, that could pressure the stock tomorrow but ultimately, this company's going to survive to see this next generation vehicle and to see fsd and see the rising tide of electrification, so, i'm still a shareholder, i'm still opti optimistic, and i just believe in what they're doing from an innovation standpoint. >> do you think the stock movement is justified, based on what we got on the release when everything else was pretty crummy >> no. it's understandable. you can reason why it's up, because people are so desperate for any good news, and given the reuters reporting more recently that they're canceling this initiative on the 2025, the fact they're moving it up, that is a directional positive, but again, i think 2024 is a throwaway. stock could keep going down, it could be flat. if you, again, believe in a future of electrification, tesla

5:14 pm

is the best-positioned company, but as far as this result, my guess is that stock problem fades in the next two weeks, finds its ground and starts to rebound closer to '25. >> gene, it's tim. can we reframe the investment rationale, if we're talking about fair value, growth versus something, and i can appreciate the dynamics here, which they are so far ahead, it's a technology company, but it does get back to that juxtaposition to, they're not gm, but at the same time, they are an auto company. can you talk about that multiple in tesla and why you can stand behind that? >> so, i believe that this should trade at a similar multiple ultimately to apple i think what they're doing around hardware and software, autonomy as a service, justifies that type of a multiple. and when you -- right now, the multiple, stock is going down because earnings are going down. on a revenue multiple, i think that is justified. investors tend to look more at

5:15 pm

revenue growth than they do at earnings growth. so, if you -- just to put it all together, if you build a case they can grow revenue at 20%, 30%, 40%, as they come out of this trough and do a seven multiple on that, the numbers you can get to a stock that's doubled where it is today, so, that's where i get it, is a belief that the growth is going to reaccelerate and why do you believe growth is going to reaccelerate i think it's an undeniable truth we're on electrification >> gene, it's karen, thanks for being on today what do you think the math is around robo-taxi how do you think about it? what is the model there? >> so, it's pretty powerful. if, again, you have to believe, it's like a religion if you believe this is going to get out, i happen to be in the camp that i think they will eventually get this out. i think by the way, lyft and uber, they're in big trouble if, in fact, tesla does get this,

5:16 pm

because -- i think they -- that's a whole different topic, but as far as the impact, but we have -- they're going to do, call it 2 million vehicles, more or less, if you get to just for easy math, a million robo-taxis, a lot of those are going to be tesla-owned, they are going to own their on taxis some will go to third parties. if you get to that million and assume about three rides per day, you effectively can double the operate income i was just talking about the importance of revenue, but i think that is the math so, that's about $10 billion per year, they did last year $9 billion in operating income. that's with a million robo-taxis the beautiful thing about it, it's a waterfall factor. as you continue to add the cars, the impact to the robo-taxi fleet continues to compound. >> gene munster, thank you so much for joining us. we'll check in with you when the call starts. dan, going to give you the final word here, tesla shares up 8%.

5:17 pm

>> yeah, i you this it's going lower. listen, if you are buying this thing for robo-taxis in two or three years, push that expectation out. the other thing is uber and lyft, we spent the last five years litigating the fact, those companies can't own the cars it's a disaster. if you think the economics suck already on rideshare, have the -- >> that's a financial term, by the way. >> yeah, but -- i'm sorry, we have connor over there it's a family show here. but my point is, gene and i -- i love gene and i love his work and i love his optimism, i just don't believe that you will be buying this stock -- i think robo-taxi could be huge five, ten years from now, but if they own a million of their own c cars -- i just don't believe that's a good business >> he's an e van jellist, you're not. the nasdaq leading the gains, up over a percent and a half today. the s&p rising for a second straight day, while the dow is up four days in a row.

5:18 pm

jamie dimon speaking at the economic club of new york earlier today, saying the u.s. economy is unbelievable and booming, but warning the stagflation could re-enter the market and current geopolitical situation is more complicated than it's been since world war ii he had some advice for whoever wins the election in november. >> i want the next president, whoever it is, to put the other party in their cabinet that's what i'd like to see. so, if it's biden, he puts some republicans in his cabinet, if it's trump, he puts some democrats in his cabinet i would like to see practice fissioners go back to government, not me, but you -- you know, to go help, you know, and serve. >> karen, you were at the event. >> i was >> what did you think of the comments >> he was pretty feisty. it's interesting you don't get a lot of economists to clap, but they seemed to like that bipartisan, you know, which is something he's been talking about for a long time. more optimistic than his letter

5:19 pm

sounded. the economy is doing pretty well so -- you know, i love jpmorgan, love jamie dimon -- >> i know. >> i'm long. >> people pushing him, probably, to be that next president. >> he said only if he's anointed >> there you go. >> he might be >> i know, exactly >> don't put it past any of us. coming up, we'll get more on tesla's quarter when the conference call starts later this hour. 11 minutes from now. and even more earning movers on deck texas instruments and visa on the move after reporting. plus, gucci's not so glamorous report the parent company forcaecastina major drop in operating profit so, is it time for the retailer to tighten its belt? we'll debate when "fast money" returns. >> you're watching "fast money" here ocn here ocn 'lbe right back. meets bold new. (laughter)

5:20 pm

5:22 pm

her uncle's unhappy. i'm sensing an. underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. welcome back a few more earnings results after the bell let's start with texas instruments. kristina partsinevelos has the numbers. >> texas instruments often considered a bellwether for the chip space, given its exposure today's earnings report shows q-2 revenue, as well as eps

5:23 pm

guidance that falls in line with estimates, which is a bigger deal for t.i., considering expectations were so low going into this. that's why the stock was down 3% as of the close on the year. many calls for a bottom. and that appears to be the case in q-1 yes, it was a beat, but revenue decreased 16% year over year industrial down 25%, auto down, low single digits year over year coms equipment down. personal explectronics the only one up on the earnings call, the cfo warns, quote, don't expect a significant or even any drain on inventory for q-2, implying inventory amounts will remain high but investors are optimistic, shares up 6% maybe on this bottoming out process and the guidance that came in line >> kristina, thank you

5:24 pm

guy, you find that one kind of interesting? all revenue segments are lower, disappointment there quarter coming in in line, but shares up 6% >> expensive stock probably north of 30 times now makes sense technically, if you look we talked about this in the fall, traded down $148, a low that we made two years prior, but this stock has be nowhere since the fall of 2021 it's been sideways to slightly lower ever since second quarter guide wasn't particularly great i think, again, like we're seeing with tesla, to compare, a relief rally in the stock that i guess people are trying to find value in i think it's expensive >> doesn't seem like the stock is down much in the lass -- well, i guess five years >> if you think about where we were kind of right in the middle of a lot of supply chain dynamics, especially with auto, especially around chips. this was a nightmare for the auto space part of that, i think is where just texas really lost that period it's obviously not at all giving you any of the a.i. boom

5:25 pm

it's a company that i think trades more like a commodity, and it actually is as cyclical as chips often is, this one is that. meanwhile, visa moving higher after reporting a top and bottom line beat after the bell. let's go to kate rooney with those details. >> hey there, court. visa's really shrugging off any concerns about a slowing economy and inflation. the beat was driven by strong payments growth. the ceo calling it stable consumer spending. the consumer is looking good, according to visa. also reiterating its guidance, looking for double digit revenue growth revenue grew about 10% in the quarter, payments volume was up 8% cross-border volume was up 16% that tends to be a gauge of international travel, so, that was strong u.s. volume was up 6% year over year international payments, meanwhile, that volume was up 11%. highlighted some renewed cobranded airline agreements alaska, for example, a credit card with robinhood.

5:26 pm

visa and mastercard announced a $30 billion settlement with merchants during the quarter and agreed to cap interchange fees, those are the card swipe fees. attorneys fees and other expenses provided in that settlement, those will be paid from an existing fund in the litigations crow account no mention of any sort of impact on earnings, court back to you. >> yeah, that was a big discussion during the quarter. kate, thank you so much. dan, what do you think about visa >> definitely impressive when you think about some of the things we might have heard from jpmorgan, american express, wells fargo, about some softening demand, but it wasn't anything, i think, that was driving the action in those stocks last week, you would have looked to see if transaction volume was like slightly softer here this stock sold off 7.5% into the prohint. i don't think it's such a ringing endorsement, i don't know >> karen >> well, i think this company has been just a powerhouse for years, and it trades at a decent multiple to the market, but i

5:27 pm

think it deserves it, and there's nothing in this release that would make me think, all right, now is the time to sell it they have an extraordinary business i'm not fully sure of what the impact of those new -- the new charge -- the new caps and charges will be, but i also did like the -- the cross border, that's good earnings for them, right? >> i was thinking so >> i was just going to say, they cut client incentives. this was a number where they, you know, it does show underlying strength in their core business, as we've all said, and you can look at the year over numbers on process transactions up 11%. i think the consumer is in a healthy spot, but it is -- you also -- a day when you had pmis that were very mixed, and if you look at the services side of our economy, this is a place where i think people are starting to get some concern. coming up, lacking in luxury gucci's parent company expecting a sharp drop in one key metric more on how they dropped the bag, that's coming up next.

5:28 pm

plus, goldman sachs setting a record close, as the stock continues its climb. so, will the bank bump continue? we'll debate that ahead. you're watching "fast money" live in new york city's times square square we're back right after this. with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo

5:30 pm

5:31 pm

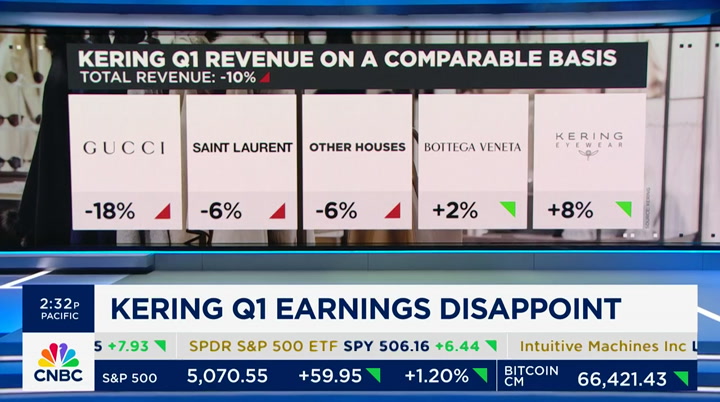

welcome back to "fast money. the tesla conference call is just getting under way the stock is up by 8%. we'll see if we can hang onto that we'll bring you all the headlines as we get them. but first, shares of french luxury good giant kering dropping after it expects a 40% decline in the first half of 2024 gucci, which is the company's biggest revenue maker, saw sales decline 18% due to weakness in china. karen, you've been watching this name, i mean, this is very interesting, and lvmh's results were okay, but not great >> they were good enough, right? after the concern. when kering dropped a bomb six weeks ago, whenever it was, said our revenues are going to be down by 20%, i think it was, gucci actually came in a tiny bit better, but there's been a lot of discussion about kering

5:32 pm

being in disarray, and then, henri pinot, the son, actually, bought a controlling stake in caa, which seemed like a very odd sort of distraction -- >> right >> right, and so, there was enough upheaval in the company and people were getting fairly concerned. i think that this is a very gucci-specific problem >> okay. >> and so, to me, i mean, lvmh didn't trade down on these results at all, so -- i think -- lvmh's quarter was good enough and i think we're starting to see more chinese travel. i think the gucci -- gucci is not speaking to their customer right now. >> the chinese market is fairly polarized between appetite from gia -- >> gucci's in the -- >> guy actually switched over to tom ford, that might have been kind of the problem for them >> that was it >> back in the day

5:33 pm

>> he's not responding >> i -- >> that was gucci -- >> i have nice -- as a matter of fact, i have a nice pair of shoes on right now >> nice gucci loafer not loafers. it's one >> you see what happens here >> i know. >> i'm always -- i sit here, i'm drinking my water. always the target of their abuse. >> all about you >> all about me. i'll say this real quick i think karen's right. this stock has been a disaster for the last 3 1/2 years so, this is stock company specific for sure. you would like to make some correlation in terms of the consumer, i don't think that's necessarily what's going on here look at a long-term chart, it's probably down 65% from its all-time high. >> if you're thinking about china and thinking about the numbers we're hearing, bloomberg had a story out that iphone orders are down 19%. that's a high end aspirational purchase for most chinese. and so, again, it goes from super luxury to aspiration am, kind of mid-market sort of stuff. china is a disaster. we know it and some of these brands are

5:34 pm

doing better with those dynamics than others. >> yeah, the chinese piece is very interesting. coming up, the bank trade. goldman sachs continuing its surge. can the run continue and how should you handle financial sector that's coming up next. speaking of earnings, we're looking ahead to meta results. how options traders are logging into the name ahead of the report, when "fast money" returns. missed a moment of "fast?" catch us any time on the go. 'rba rhtft ts.st money" podcast. 'rba rhtft ts.st money" podcast. wee ckig aerhi a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow!

5:37 pm

welcome back to "fast money. stocks continuing their rebound. the dow jumping 263 points for its fourth day of gaining in a row. the s&p up 1.2% and the tech heavy nasdaq up more than 1.5% ibm reportedly nearing acquisition of cloud software provider hashicorp, which could be announced in the next couple of days. hashicorp surging 20% on that report and shares of spotify cranking higher, up more than 11% and notching its best day since 2022, after results came in above expectations this morning. that stock up 62% this year after recently raising streaming prices and laying off 17% of its

5:38 pm

work force dan, what do you think of spotify? >> pretty astounding, when you consider just how poorly netflix acted to that huge subscriber beat this is a company that beat paid subscribers 14% in the quarter they have basically 240 million. think about this, total subscribers, 615 million we can't look at so many digital companies across the world that have that many subscribers here, so, they're cutting costs, raising prices, and the margins are getting better >> and you can make playlists. you don't have to put all your songs in one >> for context, i was telling courtney that i have 867-song spotify playlist she said, that's not a -- of course it's a playlist >> you divide it by -- >> it's a library. it's a library >> that's not a play list. >> let's get it down, because, i mean, we do this in stocks, let's do it in music >> when you do your next ironman -- >> might do one, by the way. you know me, i like to be --

5:39 pm

>> you can listen -- >> all deprivation you have flown with me i stare straight ahead >> how do you listen to spotify on your 8-track? >> really tricky >> goldman sachs with a new record close today, passing its previous best set back in november of 2021 the company posted a monster earnings beat last week, and up 10% this year. so, are the banks the next area for investors to dive into i know it's not as exciting as tech, but what do you think, tim? >> well, it's certainly been the place to be over really some, from that inflection in the market, it's been a combination of a strong er economy, less labor market erosion as long as we have payroll numbers hold where they do, i know the money center banks were disappointing in terms of the net interest income, but you know, goldman sachs, first of all, it's a combination of them doing it on both sides of the -- you know, offense and defense,

5:40 pm

should we say. there's a two-way player here, you have a dynamic where you have across the entire platform, dead capital markets really coming back. you see actually their ability to give back capital, but on the cost side, a 60.9 efficiency ratio puts them near the top of where they've been, so, i think you're staying in this bank trade. let's now remember, the market overall has had a decent couple of days. on friday, it felt like these were places you wanted to take profit goldman's hardly cheap, and it's been such and extraordinary relative value play. goldman, as usual, has been the class. >> i want to be in the money center banks they are somewhat of a different animal, much more trading-oriented and advisory work they trade the same multiple, jpmorgan and goldman i would rather be there. i like also their positioning, when you look at them versus

5:41 pm

bank of america and that held of maturity jpmorgan got it so right rates seem to be staying higher for longer i like it here, but i liked it going into earnings and it's down from there. >> if goldman is making new highs, morgan is going to play a little catchup morgan still off of the 2021 highs. both had really good quarters. and again, like some of the issues you saw in the money centers and some of the things, the held to maturity this is the craziest thing did you see in the article this morning, rate hike bets are starting to work their way into the futures markets here, right, in the options markets and that's not something that anyone had on their bingo card. what are some financial institutions that are going to do okay in that? i would rather be in some of the investment banks, especially if it's signaling better than expected economy, because a lot of that pent-up demand for the ipos, that's where goldman and morgan should benefit. coming up, a trio of fast

5:42 pm

5:45 pm

welcome back to "fast money. let's jump back in on tesla. the stock is higher than we were before, by more than 9% as this conference call continues. gene munster is with us again to dig into the details gene, tell us what you've been hearing. >> elon started the call by saying the timing, to giving more context on the timing of this next generation vehicle, still unclear if it is -- has a steering wheel or a robo-taxi, but he said expect it early in 2025, or potentially late this year i think late this year, the probability of that is slim to none, but that did cause shares to move from being up about 8% to up about 9.5%, so, the market liked that quick context, again, there was talk a few weeks ago that this whole initiative was going to be paused, and now they're talking about this being accelerated,

5:46 pm

and so, i think that has been the pivotal point on the call so far. >> all right, giving us a timeline, though maybe unbelievable you got the believers out there. thank you, gene. >> thank you. moving onto pulte group. the home builder beating those earnings and revenue estimates seeing a boost in demand for housing shortages in the united states those continue ceo telling cnbc earlier today that the company is also at attracting new buyers by offering lower mortgage rates. take a listen. >> the most powerful tool that we have right now is our forward mortgage rate commitments, and, in fact, that's what we're offering is our primary national incentive. right now, new home buyers can obtain a 5.75% 30-year fixed rate, which is a really incredible deal for buyers >> 30-year fixed rates are hovering near 7.4% tim, are you still in pulte? >> no, and i guess i'm someone that's been at least critical of this last, you know, 20% or so

5:47 pm

in the home builders i get where the home builders are in a great position to be feeding into that demand i get where they can take some of the bite out of the mortgage prices and find other places to price it in. i just think we're in an environment where ultimately higher rates are going to continue to be an issue. i just think the move in the home builders overall since that inflection, when rates topped back at 5% back in october, you've had, you know, over a 60% move in home builders, and i just -- i don't want to buy that >> fair enough onto pepsico shares closing 3% lower despite a top and bottom line beat product volumes coming under pressure, as consumers push against higher snack and drink prices, and as the company deals with quaker oats product recalls. karen? >> i haven't owned this in awhile i mean, they always do a great job, but it trades at a little bit of a premium to market multiple not crazy. i guess i just feel like if inflation abates -- inflation was helpful to them.

5:48 pm

they could raise prices more than prices went up. so, i feel like we're on the other end of that, so -- no position here. >> okay. coming up, less than 24 hours until meta's first quarter report we'll take a deep dive into the option pits to see how the traders are positioned just ahead of the print. and here's a sneak peek at the cramer cam jim is chatting with the ceo of nucor. catch that full interview at the top of the hour on "mad money. but we've got a lot remo "fast" coming up in two minutes

5:49 pm

she runs and plays like a puppy again. his #2s are perfect! he's a brand new dog, all in less than a year. when people switch their dog's food from kibble to the farmer's dog, they often say that it feels like magic. but there's no magic involved. (dog bark) it's simply fresh meat and vegetables, with all the nutrients dogs need— instead of dried pellets. just food made for the health of dogs. delivered in packs portioned for your dog. it's amazing what real food can do.

5:50 pm

5:51 pm

and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. let's get one more check on tesla, trading near after hours highs here still on pace for its best day since january 2022 what do you think about the action here afterhours we thought maybe it would two down, but actually -- >> listen. if you are buying this stock on e lon's guidance about the model 2, you should probably be neutered -- >> whoa. >> wow >> there's nothing that he has said that he's guided to in ten years about any of these cars, any of the products, any -- full self-driving, any of this stuff,

5:52 pm

that should lead anybody to believe that he's going to be -- >> why does everyone keep believing? >> i will say this, i mean, ultimately, talking about profitability for a company, i mean, he's -- i agree, he's done a lot of this, i just said that. it's a company that at least over time has actually more than delivered on going into, you know, call it the mass production of the idea so -- i agree, this isn't a reason, i think this is short covering, i think this is a dynamic where there's been so much bad news priced into this we knew this number was going to be awful it was set up for a relief, but model 2, whenever that's going to be, i wouldn't be holding my breath >> we're up 11%. we were up 8%, guy, at the beginning of the call. >> move probably continues, short of him dropping some bomb in the rest of this call, unless it's over by now, but again, rallies in the stock for the last six months have been sold this is not unlike what we've se seen over the last six months. you are finding a spot not to buy it but sell it into strength. meanwhile, there is still

5:53 pm

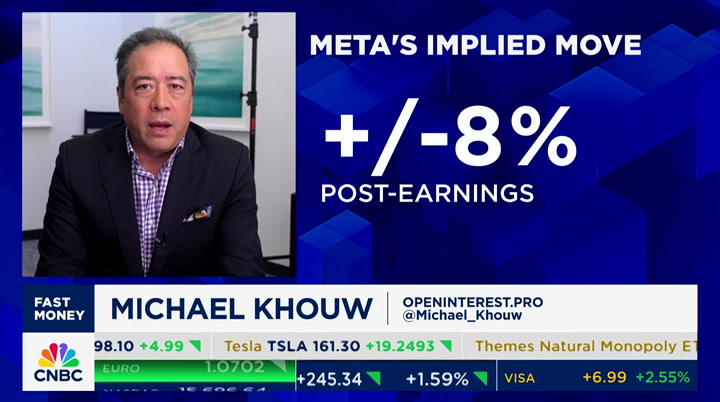

plenty more big tech on deck this week with meta set to report tomorrow. we wait for a final senate vote on a bill that could ban tiktok in the u.s., and potentially put billions of dollars up for grabs in digital ad spending that vote could happen tonight options traders expect a big move in meta when the results cross the wire mike khouw is with us now with a way to play the print going into meta results hey, mike. >> hi there. yeah, so right now, the options market is implying a move of about 8% by the end of the week, after they report earnings that's actually consistent with the historical average, in fact, pretty much spot-on, as it turns out. today, we saw calls outpacing puts, pretty significantly that's actually been the trend over the course of the last 10 and 20 days, so it seems like the sentiment is actually quite bullish going into the print i think one way you could look to play this actually is by selling a put spread, so, collecting money by selling the 495 puts and then hedging that

5:54 pm

by buying the lower strike 475 puts when i was looking at that earlier today, you could collect almost $9 from that trade. that's a thrade that would have been profitable about 60% of the time the last ten years or so. >> all right, tim, what do you make of the possibility of this vote also impacting the trading of shares of meta? >> if you remember the day last week where we heard apple is running into problems in china and getting kicked off in terms of some of the app store and the dynamics that were around their control, and their censorship in china, and meta traded down, too, because the discussion is obviously people backdoored their way into instagram, whatever the tiktok conversation is very meta-positive. ultimately, though, this is a stock that i think is really going more on free cash flow, a valuation dynamic, the fact they are well-positioned in a.i., one of the few that's really

5:55 pm

executing now. i think they have everything good to say. some of the best numbers in megacap tech tomorrow. >> meta up 40%, the exact opposite, pretty much, of what we've seen from tesla so far this year. what do you make going into the print? >> i think tiktok's already fully priced in. >> really? >> yeah. i think this is happening at slow motion, and we're really at the finish line. i think if it doesn't happen tomorrow, if -- then we'll see the stock trade down, like to tim's point, i think they've got a lot of momentum, aside from tick tiktok, the year of efficiency continues, so -- i like it >> when you say fully priced in, do you think they will be the biggest beneficiary if the tiktok ban goes through? >> i do. i don't know if they'll be sold, i don't know if tiktok will be sold, but meta will be the biggest beneficiary, yes. coming up next, final trades

5:59 pm

tonight miss the cnbc stock draft this thursday at 2:00 p.m. eastern. karen finerman has the number one overall pick with her team, money machine. she's partnered with theeanna s liberty. you won't want to miss that. it's time for the final trade. tim? what is your final trade >> i would first like to say, congrat congratulations, and for the trade down, walmart. >> all right nice pick there, tim or connor. karen? >> yes, i'm going home with the girl that brought me meta the m in my helm trade earnings tomorrow. >> love it dan? >> just one day i would like to go home with you >> whoa! >> the girl -- you take melissa

6:00 pm

home all the time on the way home, that's all i meant morgan stanley breaking out here >> and guy >> tim gets better looking every show letter c, courtney thank you for being here >> thank you for having me thank you for watch gt "fast money. my mission is simple. to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere and i promise to help you find it. mad money starts now. >> hey, i'm cramer. welcome to mad money. i'm just trying to make you a little money. my job is not just to entertain, but to educate. call me or tweet me at jim

23 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11