tv The Exchange CNBC April 23, 2024 1:00pm-2:00pm EDT

1:00 pm

>> i like wisdomtree india pmi is at 14-year highs, growing gdp at 7%, fast nest the world >> dow is up near 250. s&p 500, up almost 57 points we'll see what the last hour brings "the exchange" is now. scott, thank you very much welcome to "the exchange," everybody. i'm tyler mathisen in for kelly evans. here's what's ahead. busy hour in stock for you stocks higher, yields lower, investors digest mixed economic data business activity in april grew at the slowest pace so far this year, while new orders fell for the first time in six months companies also scaled back jobs for the first time in almost four years but manufacturing input costs hit a one-year high. services demand remains strong what does this mean for the fed? our economist also make the case for a july interest rate cut

1:01 pm

meanwhile, home sales the highest read since september, as builders pull back on prices, and offer incentives we old 'll talk to the ceo of h hughes holdings. and tesla, the stock hitting a 52-week low yesterday. but one shareholder finding a few silver linings and a vote of confidence for elon musk what has her bullish, coming up. before we get to that, let's get to dom chu for a check on the market action. >> oh a strong folio lineup to yesterday's rally, a solid 2% above the levels that we saw just on friday so a two-day bounceback for the markets overall. the dow up about 240 points, half of 1%, 38,480 the s&p 500 is at 5,066, up 56 points, north of 1% gain, and it's been a positive day even at the lows, we were up 17

1:02 pm

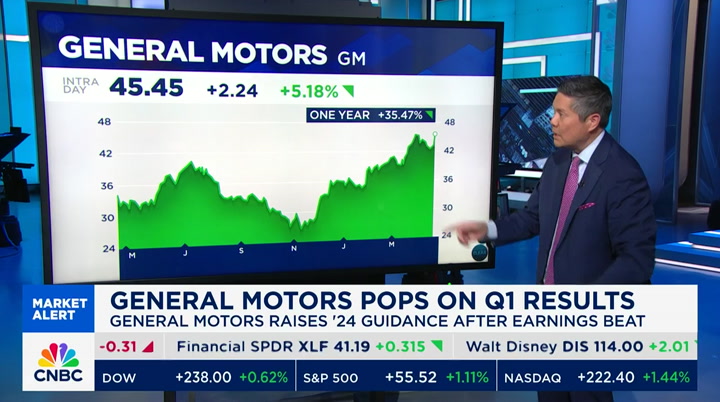

points in the s&p, up roughly 61 at the highs so tilting toward the higher end of that range. the nasdaq composite, pacing the advance off 1.5%, 225 points, or 15,675, the last level for the nasdaq index three earnings movers headlines, among the many two generals out there general motors first, up 5%. the automaker comes out with better profits, better revenues and boosts its full-year revenue forecast thanks to better sales of trucks and suvs the other general we're watching is a former general known as ge aerospace. the aerospace side suis it 6.5% today, raising their full-year forecast more companies are servicing their airlines and jets more because there's not as many new jets to buy.

1:03 pm

so demand helping to drive ge aerospace up 6.5%. and spotify, a massive move higher, up roughly 16.5%, off the highs of the session so far. the streaming audio and podcast company, better than expected earnings results and revenues, adding subscribers again and gave a forecast for monthly active users that came in ahead of some expectations and spotify up 16%. ty, back over to you >> dominic, thank you very much. with just one leak left until the next meeting, chair powell striking a somewhat hawkish tone on inflation last week, pushing rate cut expectations out even further. but our next guest says that a july cut is still in the cards joining us now, chief u.s. economist at bnp, along with cnbc's senior economist reporter steve liesman. gentlemen, welcome to both of you. carl, let me begin with you. are you seeing signs of a

1:04 pm

somewhat slower economy, and is that one reason why you're still predicting a july rate cut >> well, i think we are seeing some moderation in the pace of economic activity. i will be -- my own team's forecasting about 2.7% growth in q1 so still a robust pace, but cooler than what we saw in the prior two quarters but i think what we need to focus on at the moment, you know, it's very well advertised and well discussed in economic circles, including from the fed, that we're in the midst of some degree of a labor supply shock, which means that given, you know, two sources, one immigration, another is labor force participation, we have a lot more workers, we have a bigger economy than we realized. so we have to accept some of that frothier economic data, with not the same perception of what the inflationary consequences will be so a prime example of that, if

1:05 pm

we could just look back to the last jobs report, 300,000 on non-farm payroll seems like a very hot number, but nonetheless, average hourly earnings in that report moving to a post recession, post pandemic low so that tells you there is this rebalancing that's happening in the economy. so we shouldn't take those activity data points at face value. >> steve, do you see the labor market as carl does? >> i think it should be slowing. it's surprised us month after month here, tyler. but about the july rate cut, we can still get there. forgive this tease, i'm not paid additional money, but i'm interested in what your home builder has to say later on. because a key to getting to the july cut is what happens to home prices and i'm reading a report now by capital economists that says, all signs still point to lower shelter inflation. you remember the shelter -- >> and they've got to get that >> i don't see how we get there

1:06 pm

without -- austinan goolsbee reported his comment about we can't get to lower inflation without the housing. that's a third of the cpi. it's still a decent jump, and if we can get there, we have oil prices coming a bit off the boil if we get there, we will -- reap the name, is that the right word >> i like it i get it >> but in any event, we'll have just barely got there, because the fed wants a couple months to get the confidence i think they ought to be cutting here, because they said they wanted 2.6% on inflation on the year, they're getting 2.8. why wouldn't you cut something if all you're doing is overshooting your inflation target by 0.2? >> carl, i want to come back to you and get your thoughts on housing. but i want to break away

1:07 pm

two-year notes up for auction and rick santelli has the numbers. rick >> yes we just auctioned off $69 billion two-year notes, a record size never, ever had an auction bigger than that, and the yield at this action was 4.898, half a basis point than the one-issued market lower yield, higher price. the government's the seller, higher prices are good the grade i gave for this auction was a b plus let's go through it, shall we? other than the pricing, which is the most important issue in a price well, we see that the bid-to-cover was right spot on with ten auction average of 2.66 dealers took 15.1, spot-on, ten auction average. here's the ones that made a bit of a difference. 66.2 on indirects. that's the best since june of last year, and directs at 18.7 was the weakest since june of last year, balanced out b plus as you look, we are currently at

1:08 pm

this very moment making new two-year low yields on the session. the big drop, of course, was 10:00, 8:45 central, 9:45 eastern, when we saw some of the s&p global pmis come in on the weaker side, especially on the services so yields extended normally, that's not a good thing. all the concession was already in the bowl before the auction, but investors still stepped up now, tomorrow, we have five-year, another record all-time size auction at 70 billion. we finish off, of course, with seven-year notes the package reference size, 183 billion, but despite the record size, investors seem to be happy to gobble down those two-year notes. >> that's what i want to ask you. i'm no expert on this, rick, but when you say numbers like $69 billion of two-year notes, tomorrow, $70 billion worth of five-year notes, these are mammoth numbers that indicate the financial state of this

1:09 pm

country, which doesn't seem to smell that good to me. but the market is digesting these slugs of cash very easily. >> we take it one auction at a time i agree, these numbers are huge. just consider this, for the month of may, with coupon issuance, we're looking at nearly $400 billion of issuance. so the issuance is going to remain large, because we keep on spending now, just because this auction goes well doesn't mean the next one will but ultimately, it's all about crowding out, because whether it's the government or corporate america, 2024 is going to have a lot of rollover and we'll have to find a home for lots of new paper. >> thank you, rick rick santelli reporting there. carl, let me turn to you in light of what rick just reported what is your view on it? the market does seem to be swallowing up these large slugs of issuance very comfortably, and as rick points out, it does it until it doesn't.

1:10 pm

>> it seems to be taking it in stride for the moment, as you cross into record large auctions, it does raise some concerns about, you know, where the ultimate clearing price will be i know you wanted to talk about housing, so we can go right there. >> i do. >> if we look at where ten-year treasury yield is trading, or settling, that's a key driver of where mortgage rates are going i think a new reality is setting in with home buyers that we're not going to go back to those pandemic lows any time soon, given very soft landing in the economy, persistent inflation pressures, which are trending lower but taking some time to move there and that means elevated mortgage rates, with a 7 is the first number opposed to 2 during the pandemic housing affordability, after course, gets squeezed considerably by that, by some metrics, housing is the least affordable since the early 1980s.

1:11 pm

that puts a lot of pressure on the sector because of the supply chain disruptions during the pandemic, we still see a lot of activity in the pipeline. so if we compare kind of under construction to completions, we see that there's still a lot of residual activity. but at some point later this year, that starts to rebalance, for example, the construction sector might be a less reliable contributor to employment gabs of course, there's lots of knock-on outside the construction sector into specialty contractors and retailing, furniture, et cetera, et cetera. so there could be a compounding effect there but it's inflation and 3 x or disinflation and 3 x, i should say. act one was goods inflation. bravo. we have gone full circle act two is the shelter inflation story, and we're still in the middle of that, but these, you know, the trend has been lower and home prices are an important driver of the direction of shelter inflation.

1:12 pm

so my own team thinks we'll see further disinflation on that front over the course of the year a big chunk of the cpi, so it absolutely matters >> steve, last word here carl points out that maybe there is some disinflation in housing. but you've still got very strong demand for housing new homes are selling really very briskly and that will tell you that demand is high, supply is not that great so where is the relief that needs to happen in housing and shelter costs to bring inflation down >> i've become skeptical that's going to happen. if you lower prices, you bring a whole bunch of people back in. you lower the mortgage rate, you bring a bunch of people in there's all kinds of supply off the market right now that could come back into the market >> it's off the market because -- >> people don't want to trade their 3% mortgage for a 7% mortgage they might trade it for a 6% that could have some impact. but the decline in housing inflation will be something that's much more mechanical in

1:13 pm

that rents have come down, and that's one of the ways that they impute housing costs i'm even wondering, tyler, if the fed needs to be able to pass housing inflation instead of monetary policy. they have, you know, as austan goolsbee described it, he said we have one tool that's a screwdriver and we tighten or loosen, and that's it. some people drink that for breakfast. >> yeah, screwdriver thank you very much. carl, thank you, as well rate cut concerns leave markets on edge, but the recent pullback has eliminated froth. he's president of potomac wealth advisers mark, good to have you with us >> good to be here >> so you see the possibility that this little blowoff of the

1:14 pm

steam is a good thing for equities >> absolutely. i think it's a little test that investors go through it sorts out investors that aren't committed to the names they open. and i think the valuations, while they didn't drop dramatically, it was a three-week scare, and last friday was a wakeup call we think that the economy is still in tact for growth growth, strong gdp, strong employment, strong wage growth as i was listening to the conversation you had about the fed and rates, we just think it's a strong economy. we think there will be rate cuts eventually, not as early as july as we heard. this economy is very, very strong travel is strong consumers are strong we saw the numbers from gm i just think we keep going forward from here and stocks present an opportunity in that environment. >> could this little rise in interest rates -- maybe not so little -- that we have seen over the last couple of months, could

1:15 pm

that be setting up a bond rally later this year, whether an investment grade bonds, treasuries, whatever >> we're thinking it will, and we're hoping it will for those people who are invested appropriately. if you are truly a moderate risk investor at a station in life, you're a little older, bonds have always served a purpose pension funds need them, and you recall when rates were so low, you were almost forced to go outside your pension funds and risk profile and they struggled. we think the ten-year, closer to five than it is four right now, present askew upons five than it is four right now, present askew upon coupon oppor, but a reversal of the horrible losses we saw a year ago so a bond portfolio is going to be rewarded. if you can get a coupon, some capital gain, and mid-high single sij it digits relative t stock market near an all-time high, a lot of investor also

1:16 pm

make that choice >> mark, you also like some tech stocks however, if i'm understanding you correctly, you like investing in technology stocks through etfs, which does at least one thing that is very good, and that is it insulates you from a massive decline in an individual name, whether that individual name is, for example, a tesla or a palo alto or others >> right and we've seen a rotation of those bad drops. you remember two years ago, facebook went through them >> yes >> went through that correction. so it's -- it's unforeseen, and when it happens, it's quite severe what we say is if we truly believe in this sector, whether a tech company, tech evenibled companies, we think it's here to stay it it's a secular macro trend we have great research firms to rely on to pick the underlying companies inside the etfs.

1:17 pm

we think investors are well suited to avoid, as you referenced earlier, a palo alto, which dropped 30% practically in one day. and that's devastation to a portfolio or if you have overweighted that name that's why we like to diversify that risk. >> make the case for financials, you like the xlf >> we likemega cap banks, and we like non-bank financials. we're still staying away from community and regionals. one of the reasons we like the mega caps is their cost of funds is so low, they are attracting dollars. they're online gathering machines, and that creates a de facto a disadvantage for small and regional banks which have to pay more for deposits. so for the mega cap banks, they will continue to improve and also have strong capital markets, trading activities. they're well diversified away from concentrations in real estate risks so we think there are going to

1:18 pm

be winners in the financial sector, the larger banks, and the challenge is going to be on those smaller regionals where wuf to be very careful if you are picking an individual name >> mark avolon, thank you very much we appreciate your time today. all right. coming up, new home sales rebounded nearly 9% last month we'll ask the howard hughes ceo how his company is dealing with growing demand and where he's seeing the greatest opportunity. plus, we're in the thick of earnings we'll get the action, the story, and the trade on visa, boeing and hilton, ahead of results that's hilton head "the exchange" is back after this to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented.

1:19 pm

1:20 pm

1:21 pm

on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity. welcome back to "the exchange," everybody sales of newly built homes saw their biggest monthly increase since 2022 in the month of march. diane a olick joins us now >> sales not only made a big jump in march, up 9% month to month, but hit the highest level sense seventh. february's numbers were revised down by almost as much as the march gain builders did lower prices close to 2% year over year, and supply is coming down but this is more about mortgage rates. in march, rates bounced around 7% now, we're solidly above 7%, nearing 7.5%

1:22 pm

i spoke this morning with the ceo of pulte, which beat on the top and bottom lines, raised guidance for revenue and margins, and did not lower home prices but is aggressively buying down mortgage rates brian marshal told me today's higher rates are already having an effect. >> the one note that we are seeing is new traffic that's coming into the sales offices, albeit on just a limited few number of days it has moderated just a tad. we think that's the consumer's reaction to the most recent uptick in rates. we're going to watch it. >> stocks of the big builders had been falling sharply as rates rose, but today's news has the home building etf moving hirer. rates are down slightly this week >> diana, thank you very much. meantime, with the 30-year well above 7% and the fed expected to hold rates steady, my next guest expects demand for new homes to

1:23 pm

keep climbing, new homes that is, calling 2024 a golden age of home building. join us now is ceo of howard hughes holdings, david o'reilly. welcome. you call this the golden age of home building. what contributes so that assessment >> well, we have demand that's outpacing supply we see new home buyers, average age 35, entering the market with its millennials, delayed household formation. about 12,000 people a day are turning 35, and retires wanting to move near their children and grandchildren driving demand we saw increased guidance from pulte, and it's that unique confluence of strong demand, no supply, because there's no resale inventory, and large public builders with a meaningful -- that are driving the results. >> that is an important advantage is the ability to

1:24 pm

offer that kind of purchase assistance to people who need it i am blown away by where you are today. it's called tarabalast it is a new development in the phoenix market 37,000 acres you plan to build 100,000 home there is >> 100,000 homes and 55 million square feet of commercial space in the next 40 to 50 years this will be a city when we're done about a size of st. louis we just closed contracts on the first 500 homes, and we're under negotiations for builders for the next 500 lots later this year it's incredibly exciting there's pent up demand, and phoenix is in half the growth and relatively affordable compared to many other cities. >> what do people want today in a new home or a new home community development? i know they want the sun belt, but take it from there >> walkability they need connectivity to

1:25 pm

nature they need great amenities, community centers that offer those conveniences that they may not be able to afford in a home, that is modestly shrinking recently home sizes over the past four to five years have come down 8%, 10%, but they're still double where they were in the '80s and '70s we're still over 2,000 square feet on the average size of a new home so if we can give them great trail systems, great schools and amenity base that is, you know, far outpacing our competition, we think these communities will continue to thrive >> do the me lennials, go the gen-xors want the same thing that the 55 plus people want >> they do the younger generation of millennials are looking for more environmentally friendly homes those that are more green, as well as finding within that community that third place to work they work at their office and at home, but that third place

1:26 pm

really is important. whereas, the retires, those that are turning 65 that are largely boomers and very wealthy, given the housing runup, are choosing to live near their children and grandchildren. so by de facto, they want those same things, because their children are those that are seeking those amenities i just mentioned. >> forgive me for not knowing, i know you build and operate developments you have the sea port in new york and other things, but you're an enormous land owner, as i understand it do you then sell off parcels of land to other builders for them to build and operate developments or what >> that's exactly right. we sell the residential land to our home builder partners, mostly large public and private builders we take that capital and use it to build the amenities that we need, office buildings, apartment buildings, shopping, dining, theater, arts, et cetera that's ourself fulfilling cycle.

1:27 pm

the more money we earn from selling it to home builders and that goes on and on for decades. >> do you have any concerns about commercial real estate everybody seems to be wringing their hands a little bit about it i don't mean to paint commercial real estate with a broad brush, but offices have been a weak spot >> simply, and it's been a bifurcation of office buildings with the haves and have-nots those that are class-a space and offer short commutes for their employees continue to outperform whereas the far-flung surface part two and three story tilt construction will continue to suffer we benefited that our office portfolio is contained within our communities. and the woodlands alone, our portfolio has increased occupancy over the last several quarters, because we offer less than a ten-minute commute for those that live and work in the

1:28 pm

woodlands. and that benefit is really materialized into some great results for us >> final quick question here, your long-time chairman of the board, bill akman, is just stepping away from the board he's been there for, i don't know, 14, 15 years what has he meant to the company snp >> he's been our driving force he created the howard hughes news corp ration 14 years ago, and has been instrumental in creating this platform over that time period. he may be stepping off the board, but i'm certain he will remained involved going forward. >> he will be a big shareholder, so he will remain involved thank you, david come back any time >> my pleasure thank you. coming up, tesla shares up 2% ahead of its earnings report. can they boost investor confidence is elon musk an asset or a problem? we'll big into that. plus, meta set a new

1:29 pm

spending record for lobbying last quarter, we'll sdiscuss whn "the exchange" returns after this you founded your kayak company because you love the ocean- not spreadsheets. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire

1:32 pm

exchange." this is your cnbc news update at this hour. during testimony in donald trump's hush money trial, former national enquirer publisher david pecker testified his arrangement with trump and former lawyer michael cohen was an agreement among friends, not in writing pecker also testified how any stories about trump or the 2016 election were to be given straight to him and needed to stay secret. the justice department just announced a $138.7 million settlement over the fbi's mishandling of assault allegations against former usa gymnastic team doctor larry nasser about $1 billion has been set aside to compensate hundreds of nasser's victims x is launching a tv app today as it makes its push into video. the app includes features like a

1:33 pm

trending video algorithm, and cross device compatibility users can start watching on one device and then continue on another. the x team plans to monetize the app later. i was just talking about x and their forrays into video with steve covak. >> it seems to be a growing venue for people to consume content. it's a way my son consumes most of his video content, apart from the knicks games bertha, thanks still ahead, we'll trade tesla and boeing ahead of those results. but before we do that, let's get a check on a name that's already reported, jetblue sinking. weaker than expected revenue guidance thanks to weakness in latin america. the ceo telling cnbc the airline is pulling off the right levers to get back on the path to

1:34 pm

profitability, but it will take some time to get there hexcng%.own about 16 "t ehae" will be right back after this. ice works fast. ♪♪ heat makes it last. feel the power of contrast therapy. ♪♪ so you can rise from pain. icy hot. [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

1:37 pm

exchange," everybody tesla shares higher ahead of this afternoon's earnings, so will today's result bs enough to bolster investor sentiment after another price cut? phil joins with us a quick look. hey, phil. >> reporter: hey, tyler. much of what we'll hear this afternoon is going to -- the movement of the stock will depend on what we hear from elon musk during the conference call with that said, when it comes to the q1 results, people will be focused on, a, do they hit the market in terms of earnings share. the estimate is 51 cents a share, and revenue, expected to come in at 22.15 billion that's the estimates that are out there right now. having said that, the conference call is really what's going oh drive the stock after hours. three things in particular one, what's the robotaxi plan? two, is the small cart still expected and finally, what guidance do they give regarding annual

1:38 pm

deliveries most believe it will be 1.9 million vehicles delivered they did 1.81 million last year. so they give us any kind of specificity regarding guidance for 2024 remember, the last time that they talked about deliveries, they said they would be marketedly lower so as you take a look at shares of tesla versus general motors, and yes, general motors over the last year has outperformed tesla shares keep in mind that the focus is going to be on that conference call and that's going to be the determining factor, tyler, in terms of what we see shares of tesla do if there's not a whole lot of specificity, if it's the typical elon musk, what we often hear from him, which is robotaxi is great, it's going to change the world, i'm not sure it's goiing to do much to move the stock higher >> let's find out from somebody who owns the stock our next guest thinks it will be

1:39 pm

lack lackluster nancy tingler joins us now nancy, welcome good to have you with us i have to say that i am skeptical that a robotaxi is a savior for this company. >> i think the market agrees with you, tyler. listen, this is a ceo who -- >> not that the company needs savioring. >> well, right, but it has been a bumpy patch to be show this is a ceo who drives in chaos and it bothers everyone around him when i first got into the stock, it doubled, like 2018, '16 maybe, it doubled. then he started smoking pot on the joe rogan shoe, sleeping on the factory floor, people were quitting out so i took a double and it's up

1:40 pm

5 550% since i sold it so you have to suspend your logic and look at the ways the company could pivot. this is a pivot point. margins are shrinks, self-inflicted, still has over 50% share of the ev market but i think you want to look at things like the mega battery business, which is utility grade batteries growing at 50% a year. >> don't underestimate that in other words. this is not just a car company >> it's trading on that. but it's a tech company. >> back to the robeeo -- robotaxi, does it have to have a driver in it if it doesn't and a taxi has a mall function, even if they can't navigate around some construction, they're going to become very unpopular with other motorists -- >> very quickly. >> -- and town councils very last >> i live in scottsdale and i commute a third of a mile.

1:41 pm

every morning -- >> a whole third of a mile >> it is rigrigorous but i see a wemu car every single day coming and going. so they're all over the place. i've seen them run red lights, difficulty in parking lots but the data is getting better and better most all of them do not have a driver so to be the second adapter in this spectacular space will be an advantage for tesla >> you like the stock? >> if it sells off today, and we have low expectations, even if it doesn't, we're going to be adding to it it's not a major holding we acquired it in january of last year at $104 a share. we sold it in the low to mid 200s i'll be adding to it in here, because i think three to five years, you'll be glad you owned the stock. >> let me switch gears i read one of your notes you seem a little put out with jay powell >> don't tell him. >> i just did, i'm afraid.

1:42 pm

>> i am so tired of the flip-flopping. i've been at this over 40 years. i've never seen a more hapless, dissatisfactory fed chairman now we're in the mode where the market is not listening again and paying attention to earnings but we are starting to see a slowdown in some of the industrial names they're beating on earnings but lowering guidance. so i think they're going to cut this year, but i'm still drawing an analogy to the '90s where fed chairman greenspan cut three times, let it ride after aggressively raising rates in '94. >> i think of this moment, as in a very polite, measured version of jim cramer's famous rant, they know nothing! they know nothing! what are they thinking you remember well, i'm sure. >> i do. but what bothers me the most is their models don't work. and yet they keep repeating them, so there was an article in "the wall street journal" i referenced in my notes, i can't remember the title, where -- oh,

1:43 pm

"why is the fed always wrong about inflation? chairman greenspan was aware that fiscal spending was inflationary he went to congress and when they grilled him, he said, stop spending money >> nancy, great to see you i really commiserate with that third of a mile commute. nancy tingler, appreciate it cnbc pro ran a screen and found six s&p 500 stocks that tend to rise when tesla shares fall. ebay and wells fargo are among them for the full list, go to cnbc.com/pro coming up, the house passing the measure that could result in a tiktok ban here in the u.s but bytedance showing it's not going down without a fight a very expensive fight we'll dig into big tech's lobbying spend, next

1:44 pm

1:45 pm

ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com. we really don't want people to think of feeding food like ours is spoiling their dogs. good, real food is simple. it looks like food, it smells like food, it's what dogs are supposed to be eating. no living being should ever eat processed food for every single meal of their life. it's amazing to me how many people write in

1:46 pm

about their dogs changing for the better. the farmer's dog is just our way to help people take care of them. ♪ when you own a small business every second counts. save time marketing with constant contact. with email, sms and social posts all in one place. so you still have time to make someone's day. start today at constantcontact.com.

1:47 pm

let's give you a quick market check the dow up 302 points right now, about three quarters of a percent, sitting near its session highs. we will keep an eye on that for you. with the fell acceleration i and a tiktok ban, technology lobbying has ramped up this year hi, emily. >> yeah, you're absolutely right. this tiktok bill, that intense hearing we had on kids only safety, no shortage of issues for tech lobbyists so far in 2024 a lot of the numbers reflect that, particularly for meta. they set a new record for lobbying within the first three months of 2024, spending over $7.6 million according to lobbying disclosure documents. for comparison, they spent $4 million each quarter last year the increase, they said, was

1:48 pm

less about policy and more how employees got bonuses this year. they spoke to lawmakers and the white house about issues including china and ai and other tech giants like xexxon, google, apple, spent millions lobbying the government in that quarter though that does match roughly their last quarter when you look at what they are lobbying on, it's the data privacy bills that has gained momentum with a new bipartisan bill seeking to give consumers more r data and requiring companies be more transparent with how they handle user data. tiktok also had a mayor quarter for lobbying, spending $2.68 million in the first quarter of 2024 and senators are about to take that first vote on the bill that would ban tiktok in the u.s.

1:49 pm

unless it divested from bytedance. >> there are two votes here, one is to table that tiktok motion, the other is to move forward with it, all part of the procedural stuff that goes on, on capitol hill all the time what can you tell us about that provision, that tiktok bill? and as i understand it, if the tiktok part of this goes down, the other parts, namely funding for ukraine, israel, and south china area, taiwan and so forth, that gets stalled as well? >> well, this is really the fascinating thing about congressional process. it's so complex. the house divided this bill into four separate votes, but the senate's not they're saying okay, everyone at the same time, you have to vote on that $95 billion foreign aid to ukraine and israel and vote on tiktok and all these other provisions so they are wrapping it up in a big percentage

1:50 pm

so the hope there is, some republicans might be convinced to come along with funding for israel and this potential tiktok ban. but lawmakers are not getting the chance to identify what they do or don't like about this package. on the other hand, it will probably make it more likely for this package to go likely fo this package to go through and wind up passing today or tomorrow. >> thank you, emily. straightened me up. coming up, rates, regulators and reaction we have the story trade on visa, boeing and hilton ahead of tirhe earnings "earnings exchange" is next.at t p the counter... and choose any car in the aisle... even manage your rental right from the app. swing by to see one more customer... [audience cheering]

1:52 pm

1:53 pm

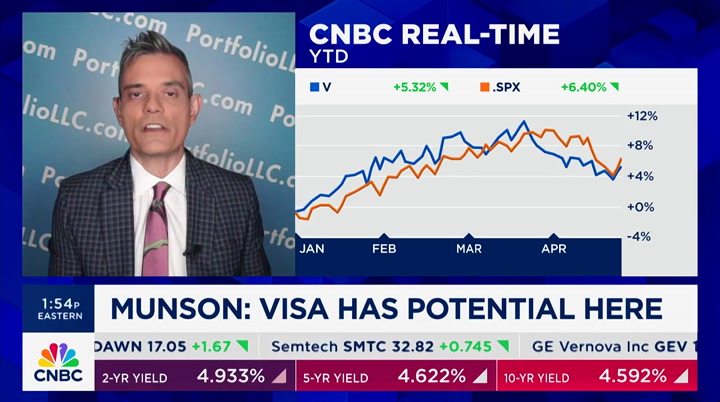

on your wireless bill versus the big three carriers? you can get two unlimited lines for just $30 each a month. all on the most reliable 5g mobile network—nationwide. wireless that works for you. for a limited time, ask how to save up to $830 off an eligible 5g phone when you switch to comcast business mobile. don't wait! call, click or visit an xfinity store today. ♪ welcome back, everybody. we'll look at visa, boeing and hilton in today's earnings exchange here to do it is lee munson. lee, welcome good as always to see you. we'll start off with visa, shares currently on a four-week losing streak. consumer spending, higher rates, alternative payment platforms are what's in focus here how would you play visa now? >> it's a market performer,

1:54 pm

lagging the s&p. buyback, great dividends are great. we understand the competition. visa is doing a lot of infrastructure building out mexico for payments. they just did acquisition in brazil when i see that going international and trying to acquire, i get nervous visa, everybody is waiting to see if management doubles down on guidance that's going to lead them to high double digits revenue growth for the rest of the year outside of that, 25 plus forward pe and not a lot of, let's say, news that's going to spark the stock up i think to be fair, it's amazing that a company this size can produce revenue growth the way they can i would just say, i hate when analysts say this, market perform, i would rather buy an index fund. >> all right let's move on to boeing, down more than 30% this year. troubled company, troubled stock. this report is going to reveal the impact of that alaska air door plug blow-out barclays watching the fallout, including regulation on max

1:55 pm

production and ceo dave calhoun's planned departure at the end of the year. lots and lots of moving parts, literally here what would you do with boeing? >> not to mention, tyler, that on monday, one of the high-up executives said we're going to have a problem on the dreamliner because there's a couple parts they need to complete. so, we're not just in 737 max territory, we have the dreamliner they can't push out here is my issue, last two years they have been hitting about 500 planes delivered per year. last year about 525. i think this is a value trap number one let's say we got over the 737 problem. we have the best environment in the world. this decade, not this year, this decade in aerospace. it's heart breaking to see a great american company not being able to execute. i feel this is a value trap. i would rather buy it this year when i see planes getting delivered and hopefully air bus

1:56 pm

doesn't eat their lunch between now and then. >> let's pause for a moment and learn dave calhoun will join "squawk on the street" to discuss the company's results. that's tomorrow in the 9:00 p.m. eastern hour it's a cnbc exclusive you do not want to miss that. finally, lee, let's move on to hilton shares on pace to snap a seven-month streak of gains. my sue hoe expecting softer revenue per available room that's rpo what they call it noting higher income travelers and asia specific region as catalysts as the travel trend continues. what do you like or dislike about hilton, lee? >> all that news is out there about the return of high-end travel i find this is a fascinating stock. these little hotels that are around major universities, right? boring it's like a peter lynch chat bot is chirping in my ear saying, do

1:57 pm

you have a company that has a really -- something boring and profitable going on? i don't think this is about the return of business travel or high end i think this is about over 500 units that they're going to be adding to their 7,500 units that they have right now of these properties that are going to be moneymakers. also, they're delving into the lower end which hilton hasn't done before with their spark line that's just started and liv smart that's like an extended worker housing and all that. so i think a lot of the great things about hilton coming down have nothing to do with what mizuhu is talking about. it's about this lower end they protect. >> love the hotel. good brand, good value proposition. lee munson, thank you very much. lee is with portfolio wealth advisers that does it for "the exan."chge seema mody will be there i'll see her in a moment

2:00 pm

♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya provides tools that help you make the right investment and benefit choices. so you can reach today's financial goals and look forward to a more confident future. voya, well planned, well invested, well protected. ♪ hi, everybody. welcome to "power lunch. alongside seema mody, i'm tyler mathisen welcome. glad you could be with us on a tuesday. ahead on the program, the huge week for earnings continues today with tech, energy, autos, airlines, consumer staples we'll break down all the key reports. plus, further, a new report from ubs warning 45,000 retailers are at risk over the next few years we ask the analysts which names are on the chopping block and which will remain strong but first, let's take a look at where markets are trading right now. we

26 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11