tv Worldwide Exchange CNBC April 23, 2024 5:00am-6:00am EDT

5:00 am

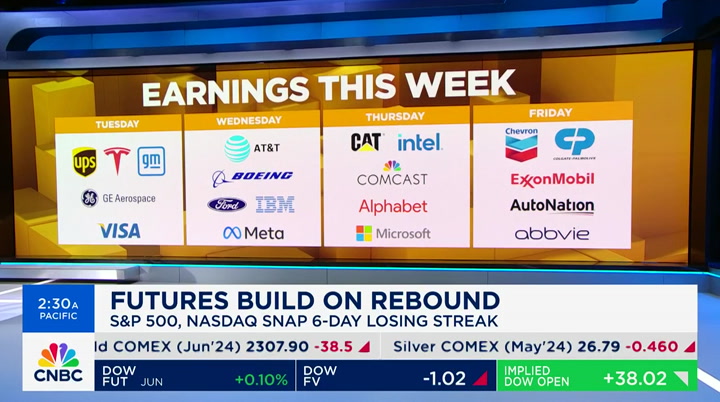

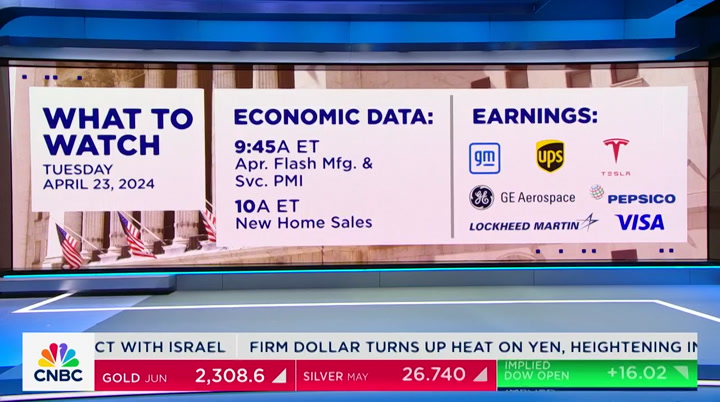

it is 5:00 a.m. here at cnbc global headquarters and here is your "five@5." futures are working to keep momentum after snapping a losing streak. a wave of reporting today with tesla looking at the list of problems. u.p.s. reports with the shipping giant expected to report a profit decline. we will tee up the numbers to watch. another day and another

5:01 am

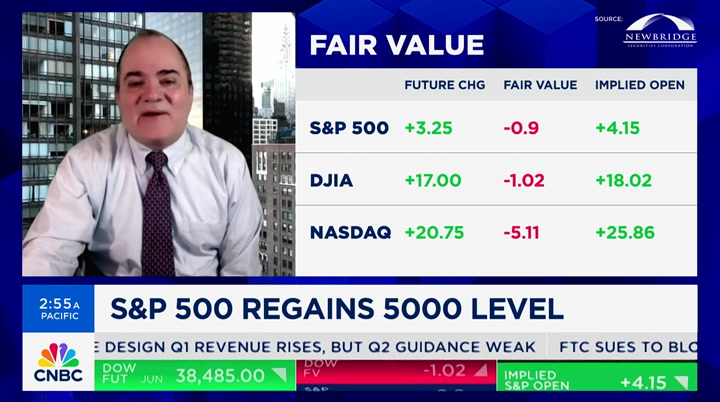

challenge for boeing. the clock is ticking on tiktok as the senate prepares to take up the bill to ban the app. it is tuesday, april 23rd, 2024. you are watching "worldwide exchange" here on cnbc. good morning. welcome to "worldwide exchange." thank you for being with us. let's kickoff the u.s. stock futures. in the green across the board. it looks like the dow would open up higher. the nasdaq is the best performer in the pre-market. the s&p and nasdaq snapping the six-day losing streaks. the key to the market action today is the flurry of earnings from gm and u.p.s. and lockheed martin and pepsi and many

5:02 am

others. tesla reports after the bell today as the company faces pressure with the store hovering at the lowest level. year to date, down 40%. we will have more on tesla coming up. we are checking the bond market as investors watch for several reports this week, including the fed preferred inflation gauge pce. we are looking at yields ahead of that at 4.63 for the ten-year yield. still trading at the highest level of the year. the two-year yield touched 5% yesterday. it is just under that as we are looking at it right now. we are watching the oil market as tension in the middle east are easing. look at oil right now. we are seeing oiling moving higher up .50% for wti and brent crude. wti trading at $82.25. brent crude is over .50% trading

5:03 am

at $87.50 a barrel. we will have a report with steve sedgwick at the world energy congress coming up. this is our latest look at dp gold as geopolitical concerns are easing. it fell 2% yesterday. we will continue to see gold pull back a bit. trading close to the record high. that's the set up. let's see how europe is shaping up as the trading day gets under way. silvia amaro is here with me. we are seeing a lot of green after the eurozone pmi numbers. >> we are back to fundamentals, frank. it seems to be the earnings season with a lot of european companies reporting. with that in mind, we are seeing all of the major boards trading in the green. i would highlight the important pmi figures from the eurozone and out of the uk.

5:04 am

they both showed improvement with business activity across the continent. we are still seeing manufacturing struggling at this stage. i have to tell you about the ftse 100. the ftse 100 here in the uk has crossed above the 8,000 mark. it has to do with the weaker currency and the investors have seemed to choose more defensive parts of the market in the likes of shell, astrazeneca and so on which has been driving the market here in the uk. we are monitoring the tech space. at this stage, the tech sector is out performing the rest of the market by 2%. here, frank, it has to do with some of the earnings with s.a.p. beating the forecasts and also what is happening stateside. we are waiting to hear from big tech later this week.

5:05 am

>> we call football soccer. silvia made a face when i called it soccer earlier. thank you, silvia. turning attention back to the markets which rebounded from the selloff. nasdaq and s&p snapping a six-day losing streak ahead of the busy week of earnings. r one strategist said it is not over yesterday. jpmorgan chase's kolanovic said market concentration has been very high and positioning extended which is typically a red flag. it is all adding to the downside risk. he has had a low-end target for the s&p at 4,200. that is a drop from monday's close of 16%. let's get another perspective here with skylar montgomery.

5:06 am

great to see you. >> thanks for having me. >> he is a big voice on wall street. i want to get your take on what he said. he hit on a number of points. the number i want to start off with is concentration. if you look at the mag seven, that is expected to have 40% earningsing growth. does he have a point about the concentration? >> there is a point about the concentration and the fact you cannot have a broad equity rally in the s&p if you don't have participation in the stocks. it is less concerning when you think about the broadening of the growth outlook. you know, that growth outlook broadening means the earnings in the other companies expand further. that is what you have seen this year. last year was about the big stocks. you can see more of a broadening. >> are there any sectors you think can help drive the market? you said we are not moving

5:07 am

higher with tech taking leadership. is there one step you think can help a possible rally? >> something we have been talking about is more global growth optimism and more of a bottoming in china. you have seen stimulus come through. last year was a very unique recovery in terms of consumer driven. it is more of a regular recovery with manufacturing. you see a bottom there. we like sectors more related to the commodity rebound and energy in particular is one example. >> i want to go back to the note for a minute. we had a guest on yesterday who said something similar. if you look at the s&p price to earnings in the 12 trailing months of over 22. the prior year was over 18. we have seen valuations get extended. in your mind, are they too e extended for the market to

5:08 am

rally? >> valgs valuations are a trick. we actually see expensive markets tend to get more ex expe expensive. to get that expansion or price increase, you need earnings to come up. the positive thing is earnings have backed up the pe expansion. if you get that to continue, you will see more surprise to the upside. >> you mentioned higher for longer rates. they have been higher for longer. many expected a rate cut already. the 88% chance of a cut in september. yesterday, we have had no cuts which would be a bullish sign. that would be a great thing because the economy is strong. does the stock market need at least one cut to have another strong year or can it move higher without it? >> i think it can move higher without that. we are having a wobble now. you have geopolitical tensions as well as higher interest

5:09 am

rates. i would not put it all down to higher interest rates. throughout the year, you had that dovish bet recede and the growth outlook with equities rise. it makes it harder because you have a comparison of the 5% treasury yield. >> thank you. great to meet you in person for the first time. time for the check on the top corporate stories with silvana henao. >> frank, good morning. more trouble for boeing as it tells employees it expects a slower increase in production and deliveries of new versions of the 787 plane. citing supplier shortages of a few key parts. boeing has slowed delivery and output of the 737 planes.

5:10 am

don't miss cnbc's exclusive interview with boeing ceo dave calhoun tomorrow at 9:00 a.m. the ftc is suing to block tapestry's $8.5 billion it takeover of capri holdings. that would put coach and michael kors and kate spade under one roof. the ftc says the combined company would harm shoppers and employees. tapestry and capri say they will fight for the deal to go through in court. reuters reporting that china recently got access to banned nvidia super chips. the chinese universities and research institutes got access to the chips through resellers despite the u.s. expanding the ban on the sale of the technology to china last year. nvidia tells reuters there is no indication of any of its

5:11 am

partners violating export rules while super micro and dell say they are investigating further. frank. >> zsilvana, thank you. we have more coming up, including the one word investors have to know today. first, we get you ready for u.p.s. results due out in 0 min 30 minutes. we will ask what brown can do for you. and the big money movers and double trouble for steel producers ahead of the open. later, former president donald trump set to see a bump from the social media company despite the stock's rocky start. we have vea ry busy hour when "worldwide exchange" returns. stay with us.

5:13 am

i don't want you to move. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

5:14 am

welcome back. time for the big money movers. cleveland cliffs missed earnings and estimates. the steel producer is buying back 1.5 million shares after the separate repurchase program last quarter. on the earnings call, they highlighted the earnings in the sector which resulted in challenges in other sectors. for more on the quarter, catch the ceo on "closing bell" at 4:00 p.m. dafrjts share. sales of nucor are seeing

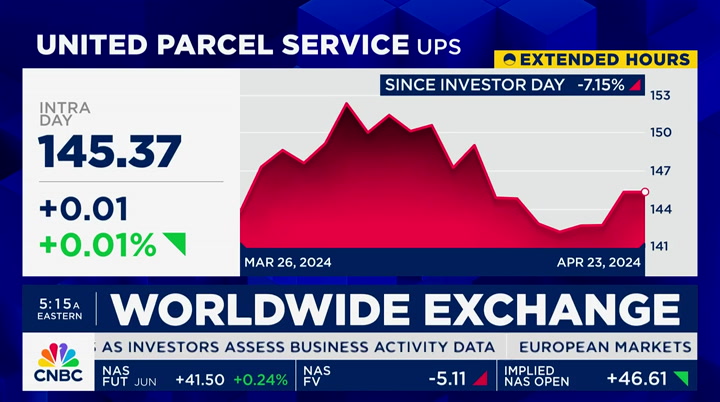

5:15 am

lower selling prices. shares down 6%. and cadence issuing weak guidance with strong q1 results. that included the backlog of orders. it reflects the timing of shipments which were launch laulast week. shares down 6%. shares of u.p.s. this morning. the stock is falling 7% since the company's investor day when the q1 profit could be lower than expected. profits could fall 5% year over year. margins are a key metric. estimates have that coming in at below 6%. another key area to watch is the contract with the u.p.s. and postal service. we know it is a five-year deal.

5:16 am

one fedex previously held. there are issues with the deal and how it fits with the u.p.s. plan of higher margin freight. joining me now is conner cunningham. i'll start where we left off with the contract with the u.s. postal service. how do you view that? how does that fit in with the plan of better and bolder and higher margin freight? >> that's a good question. i would just say that fedex doesn't necessarily miss the contract. at the end of the day, u.p.s. and fedex are desperate for volumes at this point. you know, it's more about a density play than anything else. for u.p.s., it is something they didn't have before. they will fill up planes which should allow more pricing power than in the past. it is not going to be a huge

5:17 am

deal. it is a volume play at the end of the day for u.p.s. >> more of a volume deal. important to note, u.p.s. has out performed the market with a number of other factors. one of the things that caught my ear was fedex will not miss it and u.p.s. needs the business. carol spoke about the business after the teamsters negotiations. where does that stand? >> it is tense. both these players and usps is looking for volumes as well. there is a debate around the pricing war. what i would just say is that all of the players in the market given volumes, need price to remain high. that should keep the floor relatively in the same sector.

5:18 am

my guess is carol will continue to drill down on that and focus more on the market in general. >> you call her carol. i have to call her ms. tome. to your point about volumes, i'm looking at the u.s. domestic package segment. the most important for u.p.s. generally is the driver of the company. last quarter, volumes were down 8% and pricing up barely. .1%. what does that say to you about the ground business and you mentioned that volume coming from the postal service? does that help on the pricing side? it will help on the volume side. >> it has been a brutal year for u.p.s. again, when you are looking at the stock, you are mostly looking at the second half as you talked about at the beginning of the show. overall operating income is down

5:19 am

40% in the first quarter. it will get slightly better in the second down 20%. it will ireflect in the second half with the teamster deal. that will be supportive of everything in general. >> conor, you mentioned the u.s. economy. u.p.s. has made a number of acquisitions in the last year and a half. they bought a returns business and grown a data business. are you expecting to hear more about that as a big growth driver going forward? >> for my standpoint, it seems they don't want to be leveraged to the consumer market. they will grow into healthcare and returns business which will tuck in acquisitions to have long-term growth potential as

5:20 am

they look to outgrow the market. >> an interesting transition and quarter for this company. conor cunningham, thank you. ahead on "worldwide exchange," key leaders gathering into the netherlands for the world energy congress talking about oil prices. our steve sedgwick is there. actually holland. with the best and brightest minds. steve. >> reporter: look, the oil price is calm. brent at $87. wti over $82 there is a roar about the energy transition and energy trilemma. esne a reality check? we will discuss on "worldwide exchange" when we return. icy hot.

5:21 am

5:22 am

[disconcerting stomach gurgle] not again. maybe i should get this looked at? [suggestive stomach gurgle] zocdoc? [talkative stomach gurgle] you're right, i bet they deal with this all the time. dr. finley really puts you at ease. let's do it! you've got more options than you know. book now. clem's not a morning person.

5:23 am

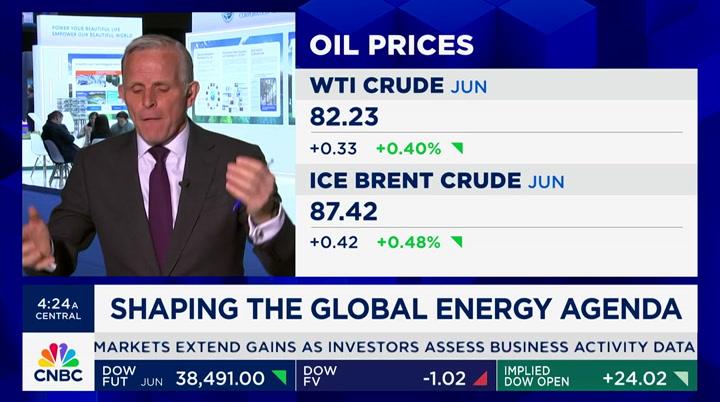

or a... people person. but he is an “i can solve this in 4 different ways” person. you need clem. clem needs benefits. work with principal so we can help you with a plan that's right for him. you know what i'm saying? let our expertise round out yours. welcome back to "worldwide exchange." as investors assess the risk of geopolitical tensions in the middle east, some of the top minds in the oil and energy industry are in the netherlands for the annual world energy congress. that's where we have steve sedgwick who joins us now. good morning. >> reporter: frank, good to see you. we can talk about the energy prices in the middle east next. this is an industry which has a calm back drop. look at the rise of oil. it is calm on brent at $87.50. wti at $82. yes, it is up from the lows, but you think what has been thrown at this, two wars, one in the middle east and one in europe.

5:24 am

the industry is grappling with the speed of the transition. down at exxon or the saudi energy minister, they are all talking about transition. those are saying the energy transition is missold. you have to get real with the investors and you have to get real with the populations of the cost. it will not mean cheaper energy. jpmorgan chase put out a piece called "reality check" on the transition. on wind and solar alone, between 2024 and 2030, will require $3 trillion. that is half a percent of the global gdp. that is wind and solar alone. we are all talking about a.i. nvidia and a.i. yet, the cost in terms of energy from the technology companies is huge. how about this? amazon, apple, alphabet and meta

5:25 am

consumed more electricity in 2022 than coluombia. st that's extraordinary. >> that's um i want to pick up for a moment. i'm looking at the price of oil. it has calmed down. it is negative in the red for the month of april despite the number of military actions and other things. give us a sense as you talk to people there were oil prices up today, how big of a concern is middle east tensions? >> reporter: it is a huge concern. iran is the most important producers and exporters of oil on the planet. they did not target the oil producing to rfacilities is meaning they are breathing a

5:26 am

sigh of relief. when we saw the strikes on israel, it was not an extreme reaction. we might have had $100 years ago. the fact that both actions have avoided escalation means the market is calm. that is extraordinary given everything at the moment. the speculation in the market is long, but they are expecting tightness in the supply in the summer. that is when we could see prices moving higher from here, frank. >> steve, great reporting. we have our own personal boxing day. i'm in your chair. you're out in the field. we are reversing rolls. inside joke. i wore my sneakers at the wall. >> trainers. >> always a pleasure. thank you very much. coming up, new headaches for tesla as it rolls out results. the legal trouble now facing the

5:27 am

5:28 am

business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

5:29 am

5:30 am

we layout the metric to watch and if the ev maker can reverse the stock skid. the senate is preparing to take up the bill to potentially ban tiktok as they deal with new headaches from european regulators. it is thursday, april 23rd, 2024. you are watching "worldwide exchange" here on cnbc. welcome back to "worldwide exchange." i'm frank holland coming to you from cnbc london. we pick up with the stock futures with the s&p and nasdaq snapping the six-day losing streaks yesterday. the dow is hitting the high of the morning. looking like it will open 40 points higher. nasdaq is up over .25%. key to the market action today is the flurry of earnings due from gm, u.p.s., ge, lockheed

5:31 am

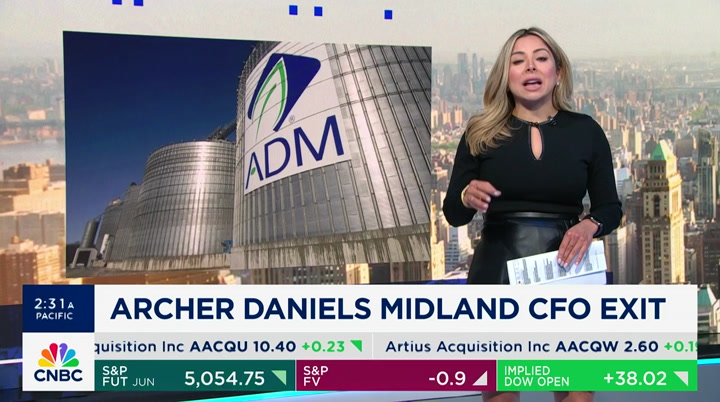

martin, pepsi and visa and tesla. we will have more on the ev maker coming up. let's get a check of the corporate stories with silvana henao at cnbc hq. >> good morning. united health paid a ransom to hackers. in a statement to cnbc, united said a ransom was paid as the commitment to do all it could to protect patient data. they are investigating the incident with law enforcement and several cybersecurity firms. a specific ransom amount was not specified. archer daniels ceo said he will resign in september as the company faces an investigation by the doj around the accounting practices. he was placed on leave in january following the document request by the s.e.c.

5:32 am

adm said current and former employees have received subpoenas from the doj in recent months. and tesla's troubles showing no signs of relief. the ev maker being sued by a former employee claiming he did not receive enough notice before being laid off. the employee says tesla acted intentionally and deliberate indifference and disregard to the rights of employees. tesla announced it was cutting 10% of the global work force last week, frank. >> silvana, thank you. we will stick with tesla. investors are preparing for the earnings after the bell today as the company is facing pressure with the stock falling. the chart right there and the stock is at the lowest level since january of last year. down 50% the last two years. the stock down 40% this year. second worst performing in the

5:33 am

s&p 500 with concerns of price cuts and product issues continue to mount. phil lebeau has more on what to watch with the results. >> reporter: when tesla reports after the bell today, the street is focused less on the specific number and more on the specispecific outlook for the robotaxi. they are expected to show a lower gross margin as well as a drop in operating profit. what is the guidance for the second quarter and the rest of the year and specifically what is the plan for rolling out the small car and robotaxi? tesla's full self-driving technology allows the driver to take the hands off the wheel, but it is a long way from autonomous driving. elon musk said tesla must change frequently and transitions with a fleet of robotaxis would be

5:34 am

massive. we will see what his plans are when the company reports after the bell later today. frank, back to you. >> thanks, phil lebeau. for more on what to watch, let's bring in jeff kilburg of kkm financial. he is a cnbc contributor and tesla shareholder. jeff, good morning. i'll pick up where phil left off. you are looking toward the earnings call more than the actual results. you want more information about the company's a.i. efforts and that robotaxi. >> that's right, frank. it is the number two or second worst stock in the s&p 500. tesla is the number one most hated stock on the street. i love hated stocks. it is not a contrarian play. it is the purest a.i. play out th there. we will see elon musk's feet held to the fire.

5:35 am

we want to know about the model 2. the $22,000 car they were creating. in the event of the reuters rumor is correct that they are scrapping the model 2, that will stop people giving elon the benefit of the doubt. if they scrap the model 2, that will be damage to his reputation and how he moves forward. i do believe this elon. i believe in tesla. the stock has the ability to move 23% higher at 177. i think there is a ton of opportunity here in the stock price just like when it was on discount sale in january of 2023. >> all right. jeff, you are hitting us quite a bit. you called it one of the most hated stocks on wall street. you got that from the cnbc stock sc screener. i notice you meant to reference that. i want to come back to the model

5:36 am

2. a lower-cost option to evs. is the thought from the reports that the model 2 is scrapped for the robotaxi? are you happy about the robotaxi? >> we knew about the robotaxi. to have this stock resume or stop the free fall, means the ho model 2 is the issue. they have been gathering the data and they can flip a switch. >> elon musk deciding to postpone the trip to india. do you think that is a big deal or not? we had an analyst on yesterday who says elon musk needs to be in india to grow the customer base and supply chain. >> i think it is a big deal. i think it is a big deal for the first time in some time he is prioritizing tesla. it is a focus he had obligations

5:37 am

he stated. he has a lot going on. they laid off 10% of the work force. they are focused to stem the bleeding in the stock price. it was a great decision to stay here and try to get his house in order. >> let's get a little bit technical. you are saying with tesla under 150, it is trading at 143 right now, this is an attractive entry level. we are looking at the charts right now. down 40% year to date. why is under 150 an attractive level when it is under pressure with china and lower deliveries and price cuts? >> you have to look at the drawdown. if you look at the last five years, the stock is up 700%. short-term, this drawdown is an opportunity to sell puts. we love using options to define our risk. i have been long since last january of 2023. i have been up at 185. here at 142, it offers

5:38 am

opportunity to be over extended. the index has been a great measurement to understand from a quantitative investment, but sentiment. you have an opportunity here. 23% higher is the 50-day moving af average. i see the stock getting back to the $225 level. that is a lofty goal. it is very plausible. >> i'll call you jeff kilburg, tesla bull. thank you. >> cheers. coming up, congress' push to ban tiktok. latest on where the key vote stands and the issues the social media app is facing in europe. more on "worldwide exchange" returns. stay with us.

5:40 am

5:41 am

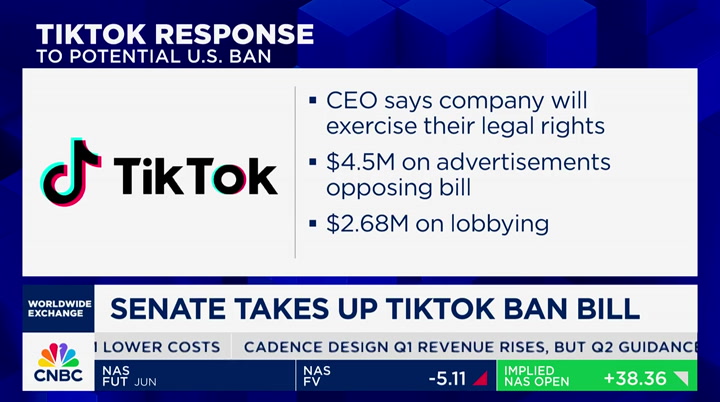

welcome back. regulators in europe are weighing the suspension of the tiktok light program. in the post on ads, the feature pays users to spend time on tiktok is toxic and addictive. especially when used by children. they are looking to see if the app has broken any eu laws. in the meantime, there will be a storage issue with tiktok and oracle. the company's vice president said oracle did not lobby for the house bill to force bytedance in the meetings.

5:42 am

law make imakers are preparing tiktok. we have emily wilkins with more on the vote. emily, good morning. >> reporter: good morning, frank. senators are set to start voting today on the bill that would offer the ultimatum to divest or be banned in the u.s. the vote is set for 1:00 p.m. today to see if they are miss t passing the bill today. it is likely to pass when the final vote does come due to concerns of the data of the chinese government accessing bytedance. the senator who chairs the committee as well as the republican counterpart on the committee both support the

5:43 am

measure. so does chuck schumer and mch mitch mcconnell. tiktok could get up to a year if the president decides to grant an extension. it could be years before the bill goes into effect as any law is likely to get tied up in court. tiktok's ceo vowed the company will exercise their leave rights. they spent $4.5 million on advertising opposing the bill and $2.6 million on lobbying in the first quarter of the year. the bill could ban other social media companies and you mentioned oracle, frank, the data is center for tiktok users. at this point, it seems like a lot of the lobbying and pressure on lawmakers just hasn't offset the security risks. it will be interesting to see

5:44 am

how this plays out not just today and tomorrow, but going forward with the lawsuits and what happens there. frank. >> really a lot going on here, emily. not surprised this bill could potentially land in court. a lot of money on the table here. one thing is the voting process kicks off at 1:00 p.m. they will try to have a vote today. you say if and when the vote happens. could this be held up in the senate? >> reporter: this is not just tiktok lawmakers are voting on today. it isis the $95 billion funding bill for ukraine and israel. there are lawmakers who have concerns about the foreign aid and they are looking for potential amendments to be added or get a vote on amendments. that's just normal senate procedure. we see it with most legislation that goes forward. under the rules that are expected to be passed, the

5:45 am

latest this bill could be passed is wednesday night. >> emily wilkins live in d.c., thank you. coming up, new trouble for apples in the second largest economy with the most critical devices. if you miss us, check us out on spotify or other podcast apps. more "worldwide exchange" coming up after this.

5:48 am

exchange." time for the "morning call sheet." key bank downgrading sunnova. the solar market remains challenging due to the lower energy prices and higher financing. shares down 2.5%. jpmorgan chase upgrading roblox and raising price target to $48. this is an attractive entry point for a company growing by 20% and ramping up revenue streams and advertising. shares right now up 3.5%. wells fargo raising the target on disney to $141 from $12 $128. it will focus on sports streaming being is suppositive. time for the global briefing. we are watching shares of

5:49 am

renault after the 2% increase of sales thanks to the finance business with the drop of turnover. renault is sticking to the policy of stable prices as it prepares to launch ten models this year. shares are down 1.5%. the wall street journal reporting the u.s. is drafting sanctions on several chinese banks threatening to cut them off of the financial system after increased concerns with china's relationship with russia which accelerated the war with ukraine. the trade relationship is a focal point of antony blinken's trip to beijing this week. more trouble for apple in china. data shows iphone sales fell 19% in the first quarter and falling to third behind huawei. this follows analysis showing global iphone shipments fell 10% in the first three months of the year. apple shares down .50%. coming up, we have the one

5:50 am

word that every investor needs to know today and the recent wave of rocky trading is not rattling our next guest's optimism aroundsftocks. more "worldwide exchange" coming up after this. [ employees snoring ] anything can change the world of work. from hr to payroll, adp designs for the next anything. and when i got there, they have the sushi- this is clem. like sushi classy- clem's not a morning person. i'm tasting it- or a night person. or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace. you need clem. clem needs benefits. work with principal

5:51 am

so we can help you help clem with a retirement and benefits plan that's right for him. i'm short but i'm... i'm confident. you know? let our expertise round out yours. when i was your age, we never had anything like this. i'm short but i'm... i'm confwhat? wifi?know? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day.

5:52 am

5:53 am

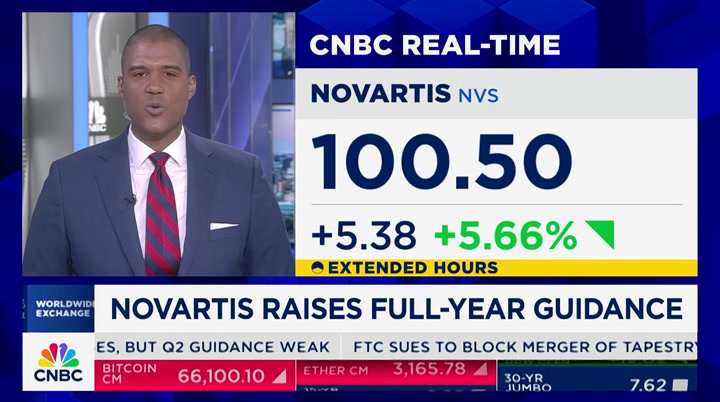

welcome back. time for the "wex wrap-up." boeing expects a slower increase of production and delivery of the dreamliner. the company officials citing shortages of a few key parts. reuters is reporting that china got access to banned semiconductor chips from super micron and dell through resellers despite the ban last year from the u.s. shares are popping from novartis after better than expected first quarter results. net sales are expected to grow by high single digits. the ceo will have more coming up at 11:00 a.m. eastern time. moving on. cleveland cliffs missing earnings after buying back 1.5 million shares. shares of nucor under

5:54 am

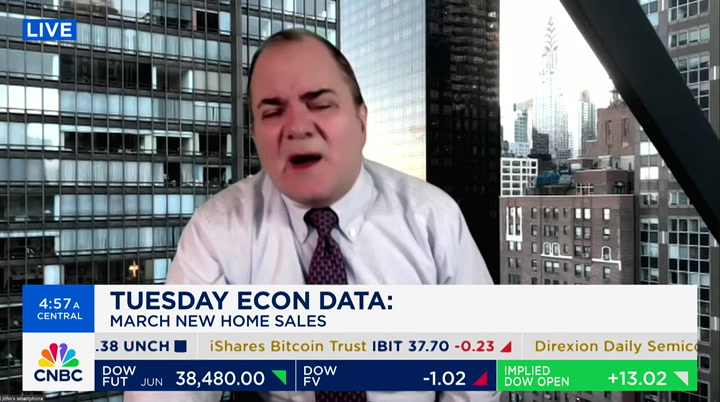

pressure with the further decrease in sales after falling 7% in the first quarter. former president donald trump is expected to receive a bonus of $1.95 billion. the company set aside the shares for trump if the stock met a benchmark. the price of trump media technology is $35.45 a share. we get april flash manufacturing pmi at 9:45 a.m. this morning and that is followed by the march home sales and reports from lockheed martin and pepsi and vtesla and visa al reporting today. joining me now is john stotzenfus. what is your "wex" word of the

5:55 am

day? >> context. keep everything in context. how's that? what we mean by that, frank, historical context. context in terms of the r relationship in terms of asset classes and the federal reserve in the pause. whereas the question is in an election year. it's complex, but it is working out. if you use context, you can right-size expectations and be surprised. >> john, earnings for q1 with 70 companies reporting, revenue is up 4%. we have seen 8% of companies reporting. put it in context.

5:56 am

earnings are up 9% so far in q1 with so many companies left to report? >> we think so. we have been looking for dramatic changes in the economy in terms of the sustainability of the current expansion. within that, how does it reward company and revenue and earnings growth? it is important to see that near double digit. you have several double digit ru results so far in earnings. it includes consumer disc discretionary up. earnings up 66.688%. with that type of thing going on and energy earnings up 16%, suddenly you have the idea that maybe things are better than the bear case. we think the economy is key.

5:57 am

>> only 8% of tech companies reporting so far. we have a long way to go with tech and communications . coming up later today, we have u.s. manufacturing pmi. the estimate is 51.9. a tick below what we saw last month. put it in context. pmi above 50 -- go ahead. >> pmi above 50 indicates expansion in that area. pmi manufacturing was lagging services for quite a while. i think it was 16 months or so. all of a sudden, it turned positive a few months ago. you want to watch that. at the same time, we're a consumer society. it moves between services and manufacturing. ing manufacturing looks good with what lies ahead.

5:58 am

it is not a locomotive hea headlight, but sunlight. >> i know you don't do stock picks for us. according to your note, you see upside if enn energy. where is the upside coming from with the geopolitical tension, where is the upside coming from? >> i think the strength from energy is the fact that the bridge between where we are right now in terms of dependency on fossil fuel is a long bridge. the story for energy when it comes to fossil fuel is likely fossil fuel for longer. the infrastructure in alternatives is still not there to give you the scale and economics you need to move into the new world. coming into the year, people thought i was crazy when i was looking for better prices on oil. it worked out.

5:59 am

we saw a jump. it is still up from where it was at the start of the year. >> john, oil is up 14% year to date. thank you very much. great to see you. looking at the futures which are in the green across the board. "squawk box" is coming up next. have a great day. good morning. tension rising on college campuses over palestinian protests. now major donors are rethinking support. details straight ahead. new report says apple iphone sales fell 19% in china in the first quarter. that stock trading lower in the pre-market. busy morning ahead. u.p.s., pepsi, gm and lockheed martin all in the next hour and a half. it's tuesday, april 23rd, 2024.

6:00 am

another palandrone. 4/23/24. "squawk box" starts right now. good morning. welcome to "squawk box" here on cnbc. we are live from the nasdaq market site in times square. i'm becky quick along with joe kernen and andrew ross sorkin. here we go. let's look at the equity futures. things are muted after big gains yesterday. the dow futures are up 20 points. s&p futures up 5. the nasdaq indicated up 30. then you have treasury yields which continue to hang in there at the higher levels. t two-year note is 4.98%. the ten-year yield aftet 4.62%. let's talk abo

29 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11