tv Mad Money CNBC April 22, 2024 6:00pm-7:00pm EDT

6:00 pm

>> great having you, courtney. knick game tonight? >> knicks are going to blow it out, man. going to be great. >> man. >> macy's should be trading at least $23. letter m. >> thank you for watching "fast money." it was great to have you. "mad money" with jim cramer, though, starts right now. stick around for that. my mission is simple, to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere, and i promise to help you find it. "mad money" starts now. hey, i'm cramer. welcome to "mad money." welcome to cramerica. other people make friends. i'm just trying to make you a little money. my job not just to entertain, but to put it all in context. so call me at 1-800-743-cnbc newsom. tweet me @jimcramer. not all rallies are created equal. today's move and the nasdaq pole

6:01 pm

vaulting 1.1% did feel better than the kind of run of the mill rally because it was as broad-based as you can get. and that's a terrific sign of staying power. but we had a real thicket to get through. let's parse what happened today and figure out if the market can keep rebounding, because it's not clear to me that it will. first we came in with minus 5.46%, not as negative as it was a couple of days, but still a coiled spring. you know i fall the sbf's religiously. you have many down days, you can almost count on a bounce. i like to look at a year's worth of the oscillator, we bounced on levels in august last year at almost the exact same readings, and then the market roared until this three-week sell-off. it's weird that the market can still bounce because it means there are rationality to things, but not every oversold bounce has staying power. in august and in early october did not in retrospect indicate a true bottom. matter of the fact, things went right back to being awful.

6:02 pm

so maybe it is a bit of cold comfort. second, the nasdaq 100 started out marginally higher today than 948. it plummeted, dropping from 17182 to 17010. it then billed at 1115, very mysteriously and started its way up. this move did break a key pattern that we've had for weeks. when the market opens up and starts going down and stays down. nothing in particular happened to turn things around. but the bond market seemed tame. oil wasn't rung. unusual for this market. the fact is buyers came in because stocks got low enough to tempt it. the s&p never went negative. but the real sells, carnage in the nasdaq. third, this was really interesting. the market shrugged off the reversal of verizon after avrp an up opening. the stock initially rallied 3% in the before market trading. then when the regular market bell range, it was appreciably down from the premarket levels.

6:03 pm

verizon a sickening decline as we realize there were customers -- >> sell, sell, sell, sell, sell, sell. >> and the cash flow disappointed. [ booing ] >> almost every line item came in weaker. [ crying ] there could have been a lot of negative read-throughs, it could be a sign of weakness for apple, but none of those came up. if the market was looking for a reason to sell off, verizon falling 4.6% could have been an easy one. but it didn't happen. absence of a negative. when tesla goes down, it tends to hurt everything related. today $2,000 on the price of three of their five model, and it's continued travails around layoffs and departures, actually rallies among its big competitors for gm. ford led the entire s&p with a 6% gain. ♪ hallelujah ♪ >> why? the takeaway people still want cars, but they dent want teslas. we own ford for the charitable trust. you can join the cnbc club ahead of wednesday's big club meeting

6:04 pm

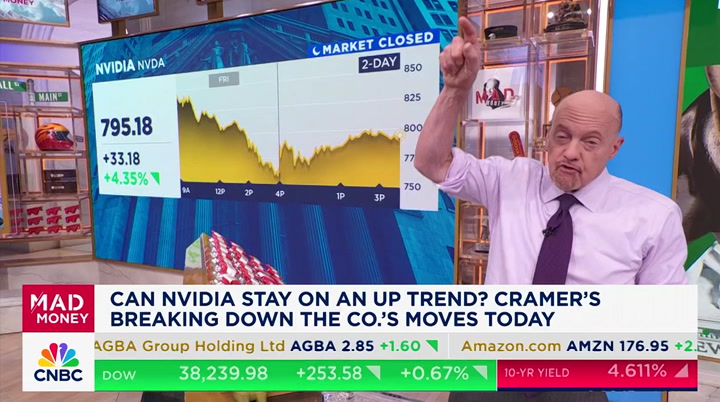

to find out more. the long story short is ford has the best nonelectric lineup including hybrids, popular internal combustion engines and the f-150 truck line, the greatest selling truck line in history. and that's where the money is going. by the way, ford someone of the cheapest stocks today. when you see that kind of action, the market is willing to buy cheap. fifth, speaking of buying cheap, the financials, you seen that? it is very impressive move. you can see the stocks of jp morgan and bank of america, they've come roaring back. but nothing comes close to american express with a 13.advance last friday after a kbert that was initially a disappointment before people reassessed. it was almost up another two bucks today. six, nvidia, the stock bounced. now listen to this. don't laugh. this company has lost more than $300 billion in market capitalization almost a straight line. it's hideous stock as any decliny recall, down 10% alone

6:05 pm

on friday. the stock mounted an advance today, but not enough to erase friday's games. it went from being the star to goat of the game and i'm not talking about the greatest of all time. we've learned from multiple pieces of research today, that nvidia, the business is doing quite well. now i think the stock finally got cheap enough to start tempting people. i don't want to make too much other than nvidia because all high multiple stocks came roaring back today. but if nvidia couldn't rally today, it would have been a horrible sign. luckily, it didn't happen. i don't know how much staying power nvidia stock is going to have, though, tomorrow. because after the close tonight, cadence, a very close partner of nvidia guided down for both sales and earnings. and that is surprisingly bad. >> the house of pain! >> i need to dig deeper in this to see the impact of nvidia. nvidia is doing quite well. i don't get it. meta and going al lift by banning tiktok. we don't know what it will do,

6:06 pm

but it's darn good news for our companies. now a good job designing this reels. he was involved with it apparently every step of the way. and that will cause his numbers to jump. so i got to tell you, that stock could be very interesting again, even though it reports this week. salesforce was talking coming from about -- $12 billion. some argued this potential purchase price would demonstrate a lack of discipline and get beaten up for it. salesforce was going back to its old ways, spending like a drunken sailor. the deal's not happening. the company is much more disciplined than the critics thought. so the price jumped. now there are a bunch of counters to all these positives. first of the trusted and the oscillator is trust and it should be. that means we're going to go up and down and up again and down again before we reach a good level for an advance. it looks like a w. we could be ten days before we get punished or even less. but the punishment will come. i think we need to be ready for that. after a couple of days, you got

6:07 pm

to want to reposition with more cash. i will explain that on wednesday's club meeting too. because we're going to do that. second we have a bunch ofbuy auctionsthis week. the bonds very much in control here. the only reason we could bounce today is we had a tame bond market. i would be stunned if bonds don't move to two years, five years, seven years all of which are normally ride. on friday, then we deserve to keep going higher. but i think it's a mighty tough gauntlet to run through. kind of like that one with clint eas eastwood. very hard. third, today's bounce might be because nothing happened in the middle east this weekend. absence is negative. i don't think that is the case. if you want peace in the middle east, but history says that's a bad wager. if a stock goes down 5% and up 5%, you do not get back in. a lot of people seem to be confusing that you're still down. we had a lot of stocks that went

6:08 pm

down a great deal last week. they're going to have to climb back great deal to be above where they are. down are down 5% you got to go back more than 5. it's a tall order. let me give you the bottom line here. very mixed picture. i think the positives do outweigh the negatives, at least for this moment. history says it won't last. so be ready for another decline. raise some cash. when is it going to go back down? i don't know. probably should go up first. but there is just a lot to worry about, and i don't want you to think or get complacent. let's go sharon in minnesota. sharon? >> caller: boo-yah, jim. >> boo-yah. >> caller: i'm a club member, and i have a question about -- i know that ulta got hit. but do you think elf is a buy, holder or sale? >> el san francisco a high multiple stock that didn't used to be, and yet it was up today. so i first of all, sharon, thank you for being a member of the club. i hope to see you wednesday at the club meeting. but elf is good.

6:09 pm

other than the sharp pattern, which is not that good. we spoke less than ten days ago and things are really, really strong. i would like you to be in that stock. let's go to trey in texas. trey? >> caller: jim, i rage canceled my auto policy on notice of an 8% premium increase. only to discover a lapse in coverage can be far more detrimental. my new 90% higher ratepayered with effective anger resolution classes has really put a strain on my budget. as insurance companies are doing far better than i am, i wanted to see if you think i should buy progressive here? >> yes, the answer is absolutely yes. not just because of the anger management thing, which is really something i don't know a thing about. you'd have to help me with that. but i will tell you this. the progressive is doing incredibly well. by the way, they are the most ai-oriented of all the insurers. interesting, isn't it? they price really, really well. listen to me. i think the positive for the moment in this market that outweighs the market, cadence

6:10 pm

took my breath away. history says it won't last any way. "mad money" tonight, what's driving the nasdaq's recent downturn with microsofts s a dr on friday? then netflix? no chill. after thecompany's post earnings decline, i'm examining the bull and bear case for the company. and gold had its worst day since february 2023. i'll sit down with the ceo barrick cold to get a sense of the action. how about that? so stay with cramer. ♪ don't miss a so effected "mad money." follow @jimcramer on x. have a question? tweet cramer, #madmentions. send jim an email to madmoney@cnbc.com. or give us a call at 1-800-743-cnbc. miss something? head to madmoney.cnbc.com.

6:11 pm

after last month's massive solar flare added a 25th hour to the day, businesses are wondering "what should we do with it?" bacon and eggs 25/7. you're darn right. solar stocks are up 20% with the additional hour in the day. [ clocks ticking ] i'm ruined. with the extra hour i'm thinking companywide power nap. let's put it to a vote. [ all snoring ] this is going to wreak havoc on overtime approvals. anything can change the world of work. from hr to payroll, adp designs forward-thinking solutions to take on the next anything.

6:12 pm

her uncle's unhappy. from hr to payroll, adp designs forward-thinking solutions i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

6:13 pm

when i was your age, we never had anything like this. what? wifi? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity.

6:14 pm

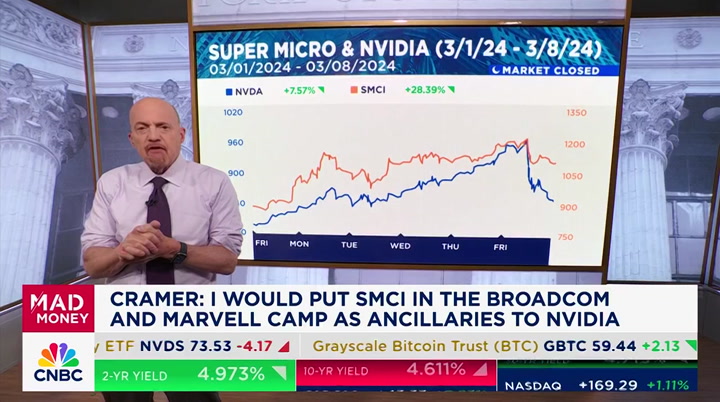

♪ here's one for you. how does a stock lose a quarter of its value in a single session as super microcomputer did last friday, down to 713. we can rely on the reason given to us by journalists that the company failed a preannouncement of such surprise. it's done in the last seven-day quarter. i get that. somehow people have been holding the data center and artificial intelligence stalwart ever time when the quarter will be reported. i think it's shareholders got somehow addicted to it. some blame the decline on the singing aftereffects that taiwan semi's cautious guidance gave us, a chance to pull in the whole tech sector. i'll give them that. but i don't think either of the reasons explain what happened to

6:15 pm

super micro. isn't it a fact, i think they're purely intellectually lazy thing. there is a reason the high-priced earnings to multiple have been getting hit over and over. because bond yields have been soaring ever since we realized that the fed was likely wrong. predicted we would get at least three rate cuts this year. this is a market that's become way more hostile than richly valued growth stocks because that's what happens when inflation is stubborn and interest rates don't seem like they'll go down any time soon. some get hit harder than others, though, because they might not have much of a competitive mode, even though it seems that they do. for example, super micro's partner with nvidia providing solutions for the world's best chip maker. but it's not an essential part. micro's become integral to because it makes products that will help customers using nvidia's ultra fast chips. proprietary relationships like cadence which reported this

6:16 pm

evening. cadence makes software that helps nvidia design chips. synopsis offers design on solutions. they help build the complicated supercomputers that are nvidia's mainstay. i know people think it's a chip company. when you put them all together, it's a super computer. these are very different from supermarket, which i put more in the tech belt camp as important ancillaries to nvidia, okay, essentials and ancillaries. but there is one thing they have very much in common. they peaked on the same day. they peaked on march 8th. it's impossible to overstate that day. and nvidia $948. nvidia is now 7955. that's a pretty big declines. if you google march 8 shares of marvell tech were selling off where the weaker old tech business couldn't be offset by the strength in the new optical pluming that is needed for accelerated exiting and generative ai.

6:17 pm

down by weakness networking and storage, which are a real downturn. there is no signs of those bottoming. at least not yet. confirmed by taiwan semi just last week. when we had marvell ceo matt murphy on the show just last week, he didn't sugarcoat it, although i got to tell you, he was justifiably proud of the linkage to nvidia. that day's shortfall from marvell along with broadcom's failure to do what super microwas supposed to do reiterating the forecast instead of raising reviewed the cause for a brutal day for all things tech, including n nvidia. but that's wrong too. forget marvell tech. march 8th was the day we got a stellar employment report. we created 275,000 jobs. we learned the economy is much, much hotter than expected. so the fed that has no reason to cut interest rates any time soon which is why the yields shot up. for me, that's why tech peaked a month and a half ago. think about it. it just makes so much sense.

6:18 pm

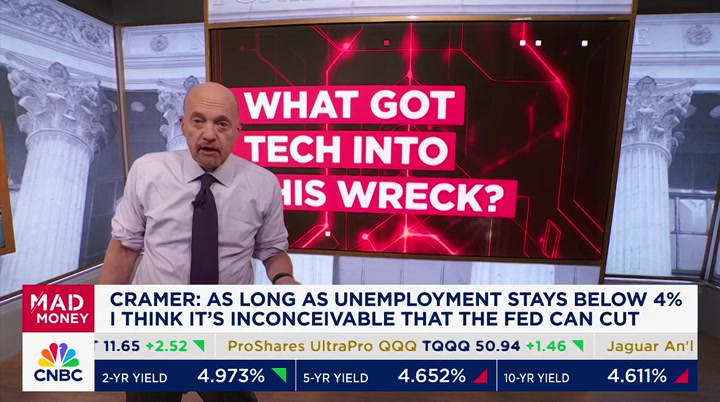

so let's explain what happened with that week to put everything in context, because that's when this market changed its stripes, starting with tech. first department's nonpayroll report is the single most important report we get from anywhere. that report came out the day that nvidia peaked. the stock was up 5% in early trading and then finished down more than 5%. that is one of the ugliest island reversals i have ever seen. that's a technician's nightmare, have a gap up, a crash down. that almost always heralds at least a few days if not weeks of declines. in nvidia's case it's been more than six weeks. i don't see an end to it. given that super micro's stock is joined at the hip, it peaked on the same day. but if you were to focus on tech, you would have missed a host fed officials have been talking about how they would be more ready to cut rates if the economy ever looked like it was going to get weaker. get. this we get a red-hot job market with higher wages. that makes them much less ready to cut rates.

6:19 pm

you can also get they were dead wrong. that's what stinks, dead wrong. i know that the price we get is very important. so is the consumer price index. and everybody talks about the one the fed looks at. everything stems from the labor report. as long as unemployment stays below 4%, it is inconceivable to think they cut rates. word is the fed should never have committed to any rate cuts at all let alone the three that they did, at least the dots said. dots. give me a break. just as important, as long as so many people have jobs, consumer spend willing stay elevated. as we heard on friday. people keep buying homes too, pushing up the cost of shelter. no one is hunkering down at 3.8% unemployment. no one. when you surprise the fed that badly, you get what i think is a double whammy. we need the fed to be ready to fight inflation to preserve the value of financial assets given that inflation is still a bit above their target. but they spent months talking

6:20 pm

about rate cuts, which makes them actually i think seem clueless. worse, from the bond market's perspective, it makes the fed seem weak, which is why we've had a bondmarket rout for weeks masked by the flight to route quality. so why did super microget oh politic rated last friday? it's the bonn market. the action in bonds makes us feel like boats for paying up for any high multiple stock, not just tech. we're seeing high multiple drugs eli lilly, because it's got a high-priced earnings multiple. that's it. not just the generative ai stocks. those are always overvalued. that's the most hallowed high multiple area and the most dangerous when long-term interest rates fly up. in the end, the reason super microwent down, everything to due with unable to find their footing. that's what's so important about this week. if we could get adjusted to the

6:21 pm

new level or if we're going down to 4.5%, believe me, super microstock would have kraeled. here is the bottom line. interest rates, not earnings are what's in control right now. we bounlsed today because rates were calm. that's what's happening. we want to believe that earnings can blow away the bond market. but in reality, it's the other way around. we just forget that's the case after decades when rates only seem to go lower. even though we just went through the whole process last summer. it's awful hard to get used to the new normal, isn't it? "mad money" is back after the break. coming up, investors hit pause on netflix after earnings. should home gamers belief the plot twist, or is there more to the story? cramer breaks it down, next.

6:22 pm

to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow!

6:23 pm

♪♪ something amazing is happening here. the next era of ai has arrived. cdw data engineers are helping organizations harness the power of ai with intel core ultra processors. the power to run workloads faster means greater performance. giving your team a better shot at success. make amazing happen. cdw. ♪♪

6:25 pm

all right. we got talk about the market surprise in the negative reaction to the netflix quarter where the stock tumbled 9% last friday. to me, the quarter looked pretty darn good. yet the stock's in full-blown correction mode here, down more than 13% from its 52-week high a couple of weeks ago. netflix, say it ain't so. how did this happen? this is the most popular stock in the market to most people. first, let me set the stage by explaining what happened here, and then i'll walk through the

6:26 pm

good and bad examples because that's the best way to formulate your own opinion. i'm trying to teach you into understanding how people think on wall street so you can make up your mind yourself. in terms of what happened, they added 9.33 paid users again. that's a surprise. wall street was looking for less than six million. biggest first quarter subscriber additions since covid first hit in the first quarter of 2020. revenue came in higher than expected, up nearly 15% year-over-year. and an acceleration versus the previous quarter. [ applause ] seems to be converting past users. their advertising keeps improving ♪ hallelujah ♪ and they keep putting out great content that resonates all over the world. >> house of pleasure. >> best of all, netflix earns 5:28 per share, up 83% year-over-year when the analysts were only looking for $4.52.

6:27 pm

much higher than expected. that's the number we really care about on the show. on top, management gave excellent guidance for the quarter quarter. so why the heck did the stock sell off like crazy on friday? there were a couple of real culprits here. first, even though the second quarter guidance looked great, the four-year revenue growth forecast might have seen a bit lacking. the mid point of implied was a tiny bit below what wall street was looking for. i think wall street would have been fine with it if netflix reported on wednesday, but the full year forecast suggests the accelerated growth is coming to an end and the market is becoming a lot less forgiving of tech stocks. a the same time, management refused to raise their full year precash flow forecast which suggests things will be worse in the second half because they just reported a free cash flow beat for the first quarter and said good things about the second quarter. so you're always trying to piece it together. you have good and good but the numbers are the same, that means the second half is not going to be that good. i don't agree with that, but that's the way people think.

6:28 pm

making things really bad, netflix is now getting hit by currency fluctuations. ee my god, it's like procter & gamble. procter pulled out of this, but for example, the class of the argentine peso down 75% versus the dollar hit them particularly hard. their 15% revenue growth would have been 18% if averargentina hadn't fallen apart, but they did. it is a real overhang. [ booing ] i think the thing that really spooked, that really spooked shareholders was the fact that starting next year, this is so important, i got get this right, netflix plans to stop providing quarterly numbers for average per share member. that's what we used to live on. that was our oxygen. management basically said they're making so much money that membership growth is no longer the best indicator of netflix's future growth. as president and ceo greg peters put in the conference call, and i'm quoting here, historical simple math that we all did,

6:29 pm

member of numbers times the monthly price is increasingly less accurate in capturing the state of the business, end quote. netflix will keep reporting for the next three quarters, but starting with 2025, over. i think with management, i agree with them. i agree with them. netflix is entering a new phase, true, where the earnings are what really matters here. but i still think it was kind of a boneheaded move. because when you start hiding the old key metrics, and people regard it as hiding, it empowers the skeptics who think they have something to hide, even if they're not and thinking about the overall totals in the new world. with that in mind, let me walk you to a pair of duelling analysts, one of them upgraded netflix, the other downgraded. laura martin, at needham, upgraded the stock from hold to buy citing the company's global scale and potential for price increases and added revenue growth and even the possibility of using generative ai to bolster business. she thinks they can use it to buy back stock and raised her full year revenue in earnings

6:30 pm

estimates for 2024 and 2025. i like some of martin's arguments better than others. the generative ai argument is a little nebulous. she says as a tech first company, netflix be better at taking advantage of ai than other media companies. seems reasonable. but i have no idea if it's true. the rest seemed a lot more compelling. this is about price increases and wringing more money out of ad-supported business. a the end of the day, netflix should be able to deliver much better earnings in cash flow. how about the bears case? from ria rips who downgraded from buy to hold and slashed her price target. all right. her view centered on the idea that netflix has pulled forward with the password sharing crackdown and knows reduced subscriber disclosures will add to the uncertainty. told you. she believes the advertising business will take some time to develop. and given how much the stock has run over the past year, she recommends looking elsewhere for

6:31 pm

upside. basically she says the stock is too expensive and we don't have evidence that their modernization plans are working. i'm not as impressed with those arguments. first, is it really a bad thing that they're cracking down on password sharing? it's been effective? are we really supposed to be worried that the lower priced ad supported offering has proven to be popular and help drive some of the best member growth since the pandemic? i say good. r it's means there is a lot more room for growth here. as for the stock being too expensive, just kind of act cheaper. i'm more inclined to side with the bulls than bears on netflix. because last thursday night, we saw a company that is simply doing much better than expected at its core business of selling subscriptions and quickly building a strong supplemental business selling advertisements. i think the business keeps growing which is a good thing, not a reason to go bearish. most importantly, i see a business that's become much more

6:32 pm

profitable than anyone could imagine just a few years ago. i can remember when netflix only traded on subscriber growth, and it was an open question if the company could ever turn a profit. a decade ago, many skeptics still argued that the business was destined for bankruptcy. oh, boy. am i glad that's not the case. let me give you the bottom line here. netflix may have sold off hard because they'll stop providing quarterly subscriber numbers starting next year, which does feel ominous. actually, i'm not worried because this company has pivoted from a pure growth story to a profitable growth story and going forward profitability is what you should be watching. that's why i'm siding with the bulls here and sticking with netflix, noyp that it's gotten substantially cheaper, despite reporting an excellent quarter. and believe me. do not these people deserve the benefit of the doubt? let's go to greg in illinois. greg? >> caller: jimmy chill, an electrifying with boo-yah. thank you, jim.

6:33 pm

nelson, he knows, no and bob eisner is the man. although bob is pushing media stocks down, i'm seeing jpm and price targets on 140 and 145 as of last week. i want to take my kids to disneyland you. buy hearing and with committee get back to 124 where we were a couple of weeks ago? >> first of all, i commend your enthusiasm, which is really terrific. and that matters, okay. and that definitely matters. you're completely wrong. understand, disney just has been on a one-way trip to the danger zone since nelson peltz was no longer involved. the stock goes down pretty much every day. i managed to sell off when nelson didn't get on. i felt if nelson got in that boardroom, we would have a shake-up and discipline. i've been proven right. but i'm going to agree with you on this. i loveto go to disneyland. i love to go to disney world, but my kids don't want to go with me and i think it would be really creepy if i went by myself. i'm not worried about netflix.

6:34 pm

this company has pivoted from a pure growth to profitable growth story and profit is what you should be watching. hey, i've got so much "mad money" ahead, it's crazy. gold has shined this year. why is barrick gold stock lagging? what is that about? i'm sitting down with the ceo to get a better commodity. apple and tesla, i'm going the tell you if they have more in common than you think. and of course all your calls rapid-fire in tonight's edition of the "lightning round." so stay with cramer. college, down payment for house, i started the club for you. the investing club is about allowing you to be in control of your own life. >> get invested. join the club today. go to cnbc.com/joinjim.

6:37 pm

6:38 pm

gold prices up 13%, barrick stock is down 9%. wall street has been very worried about higher production costs. but as i mentioned a few weeks ago, the stock is trading as though nobody beliefs these higher gold prices can stick. the precious metal got slammed today but still in the 2300s, for heaven's sake. barrick is set to boost production while getting costs under control as the year goes on. this is a pretty good buying opportunity with the stock down 4%. we've got mark bristow on a real good day. yes, dr. mark bristow, welcome back to "mad money." >> hey, jim. how are you? >> mark, i got to tell you, you got to buy back. i think it's a heck of a lot cheaper to mined goal buying back your stock than it is to mined goal by taking big machines and getting it out of the ground. i'm coming to you. i know you have the best properties and know costs better than anybody. >> jim, as you say, 15% rise in the gold prices last year, another 15% year to date.

6:39 pm

this year in retrading below what we were trading this time last year, it doesn't make sense. but there is a model here that, you know, if you've taken the ride on the physical, you need to rotate some of that back into the equities, because you get the gear. and we yield a dividend. so it's a good story. it's all upside for us. and as you and i have discussed many times, we've done nothing to damage the per share value of our business. >> nothing at all. i'm thinking the other way actually. i'm thinking that people refuse to give the miners any credit because they see costs that go up and instead they just rather buy the bullion or the gld. they don't see the upside to the actual miners. but haven't there been prolonged periods where the miners have just excelled as gold kind of crept up? >> you know, jim, if you go back

6:40 pm

to 2011, you'll remember the conversations we had then where the gold price was going up, the costs weren't inflating, and lots of our peer group went and bought things. but, you know, we and randgold at the time really invested in our future. we're in exactly the same boat today. gold prices have gone up. we're at the peak of our costs. we've all been through cost inflation. we're driving those costs down. we've got ten years ahead of us of production. we'll work through the cycles. and right now, if you look at the gold price, we're sitting at a $400 margin. to where we were just a few months ago. and that translates to other a thousand dollars on the margin of our production costs. >> okay. let's look at that. maybe i'm unfairly picking carlin, but carlin is big. it's very expensive to mine

6:41 pm

there. would that be something that's going to drop? are we at peak carlin with 1400? >> you know we put those two sets of assets together, the new bonds and the barrick assets there was a lot of work to do. a lot of investment in stripping, in development, in getting those businesses back where we have a rolling ten-year plan. so looking forward now we see those costs slowly coming down, as we deal with the slower input costs or the lower input costs as well as better efficiencies. and we've always said this year was our low point in nevada. and from now, we grow the production out over the next five years. >> okay. so someone locking at your prices like your drc, your ivory coast, tanzania, these things cost very little. chile costs very little. why spend so much money in the united states?

6:42 pm

>> this is the world's biggest gold endowment. in nevada, if you look at gold rush, we just commissioned the first real gold mine that was permitted in the last 20 years in america. and what we've brought back to nevada is the fact that we can mine. and when you find things in the carlin train that come in large boxes. >> i see. >> and so, you know, we are investing heavily. we are -- in fact on thursday, we're cutting the ribbon on the new gold rush mine. we are developing the four-mile mine. these are big gold mines. and i've got no doubt that we'll find more, jim. >> how about environmental regulations, costs in the united states? everything costs more here than it does everywhere else. >> you know, if you work like we

6:43 pm

do in the rest of the world and bold your license to operate, you can manage these things, as we've proved. and we've got the governor. we've got the republicans and the democrats at our opening on thursday. that's great. >> that's about the only thing -- well, look, i want to tell you something. this is why i thought of you and i'm so glad you're on. costco has gold. i don't know if you remember costco. >> yeah. >> but every morning we go in, we try to buy. they run outof it constantly. there is no doubt in my mind that gold is on people's mind just as much as bitcoin. it's just different people. and i have never seen. you ask costco, they never said they had a product they cannot stock for. so nobody has left the idea that gold has a greater store of value than the u.s. dollar, have they? >> no. and i think that's -- you know, what we see here is that the gold prices, the only currency that reflects the decline in the

6:44 pm

u.s. dollar, because its peer group is beating it on the downside. >> i'm glad you said that. look, i'm a big believer in gold. i'd love it to be the stocks. i can't own stocks. i default to the bullion. but i'm glad to hear that really are on the cusp. when can we come out to see this thing in action? >> well, i think this quarter. with the gold price where it is at the moment, you've got another whack of margin. and on top of that, jim we have big expansion project, organic expansion. we didn't buy them. we found them in barrick. so we are pointing to 30% increase in our gold equivalent production after the end of the decade. and that's before we bull our mines that we're still going to find. >> oh, my. i'm stand a believer. i think people don't like the stocks. sometimes they love the stocks and sometimes it's this way.

6:45 pm

but i am so thrilled that you're coming on, and it's going to be so big in nevada. i thought it had to go up to don donilon, sorry, leave you that with your mosquito spree. that's mark bristow, president and ceo of barrick gold, go-o-ld g-o-l-d. the gold miners are going to come back. coming up, hit us with your best shot in an electrified fast fire "lightning round" is next.

6:48 pm

even if you live in a bubble, you can't stop workplace accidents. so talk to your agent about workers's comp insurance from pie, or visit pieinsurance.com. safety first, then pie insurance. "lightning round" is sponsored by charles schwab, trade brilliantly. ♪ it is time! it's time for the "lightning round." >> saying the stocks, say buy,

6:49 pm

buy, buy, sell, sell, sell, the latest sound -- [ buzzer ] >> and then the "lightning round" is over. are you ready, skee-daddy? the "lightning round" with cramer. brendan in new jersey. brendan? >> caller: hey, jim. so i just heard about this company. i have no idea what it does, and i think i should go all in. upstart. what does it do and should i go all in? >> that's a good way to start. do a little more homework maybe than just that. this is a bank holding company. it uses artificial intelligence. and i got to tell you, i don't like it. there are so many good banks. what about jp morgan discount? when you look at upstart versus jp morgan, my stunning conclusion given the fact you don't know that much about it is jp morgan is a burbank than upstart. who knows? >> harry in new york. harry? >> caller: mr. cramer, proud alumnus of the u.s. naval academy class of '88.

6:50 pm

>> wow! thank you for serving. i wish we could go down there for veterans day. how can i help? >> caller: i would love to know your thoughts on a california-based pharmaceutical company. it developed medication for chronic viral infections, and they have a product neffi seeking fda approval. top hit january with just over $6 by the end of march. it it's been tumbling down to $8.21. >> let's say, i got to tell you. these stocks that do -- other people are not going to like this. but anyone that does immuno, i got to tell you, i am four square behind. and i know that this is a speculative stock, but this is what we need more pharma companies to do. so i salute you and i salute that company. now we're going charles in illinois. charles? >> caller: good afternoon, jim. i value your opinion. >> thank you. >> caller: tell me if i should buy more, hold what i have or sell my shares in sgh.

6:51 pm

>> this company missed its quarter by an element that was so big that i cannot countenance recommending it. i can only countenance selling it. yeah, i'm not kidding. i think it's that bad. let's go to donny in illinois. don? >> caller: hello, jim. >> hey, don. >> caller: within the last week or two, you have spoken well of embridge. as an 80-year-old, i've been looking at it. and everything seemed good, but there was some analysts who expressed a concern. that's the term they used about its ability to maintain a stiff dividend and service its debt. >> see, i just don't see that. i've gone over the cash flows multiple times. we've spoken to the company multiple times. i think it does have the cash flows. knew is just -- you can say jim, embridge has bagged you before, but it hasn't. and i think greg is a good operator. i'm not going against them. i'm just not.

6:52 pm

let's go to david in new york. david? david, you're up. david? wow. >> caller: yes. >> david, there you are! how you doing? >> caller: i'm doing fine, jim. thank you. really enjoying your show. >> thank you. >> caller: on valuations, should would be heading to noaa met electronics? >> i am shocked they went back down to 80 again. we had jeff markle on the show. i think he tells a great story. by the way, a lot of companies that are doing that colonoscopy too doh have ai. he said he has ai and the only one. others do too. but that doesn't make medtronic less attractive. it has many different wheels. lots of good devices at work. devices have been down for a couple days, but i think they'll start going back up again. and that, ladies and gentlemen, is the conclusion of the "lightning round." [ buzzer ] >> the "lightning round" is sponsored by charles schwab.

6:53 pm

6:54 pm

6:56 pm

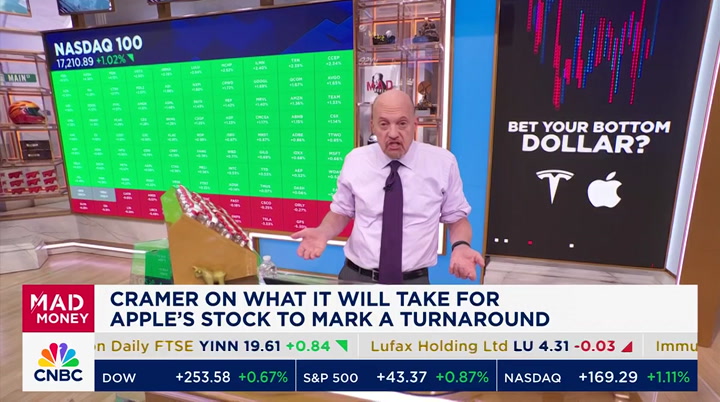

♪ are tesla and apple two peas in a pod? can their stocks find a bottom after spending months in the peapod of pain? >> the house of pain! >> you don't have to wait long for 'fess la which reports tomorrow. second worse in the s&p. we have to wait a week for apple. it doesn't give us the numbers meant the the 2nd. i think there is great difference between the two actually. tesla shares are owned largely by individuals.

6:57 pm

>> a long with a few vocal fund managers. those individuals know only one thing. when the stock was much higher, they thought tesla wasn't up stock. now that it's a down stock, they're selling it. i know that sounds real silly, but there are a lot of homegrown traders that make silly decisions as a habit. it's a habit we're trying to break at the cnbc investing club. they're horrendous shareholders because they don't really want to know what's going on. they're not interested in self-driving cars or cheaper models. they're only interested in getting out before we learn the truth. if the truth is tesla is still making money, they'll come right back. if he has nothing but driving car plans, robos, taxis and that fails, so musk will too. apple is mostly owned by big institution money managers. those institutions don't look at stocks as an up or down endsity. they look at notti pads, not watches air pods, not vision pros. if you just look at iphone

6:58 pm

sales, mostly a disappointment. and a statement about for the weakness. they'll talk about the developers conference in june and the launch of a new fund in september. but who knows if that can take off without an ai tie-in. still, i think the big industries are looking to buy apple because they're looking forward to the two events. i expect their interest will remain tend unless the company can announce their growth in the rest of the world is acce accelerating faster than china. i'm thinking brazil, indonesia, india. if they present that and give an analysis about sticking the revenue stream is, for service, i think the stock could bottom somewhere slightly below here why. is apple okay if it disappoints while tesla is not? i think wall street ropresuming tesla will have a miss is if it has a loss. i'm talking about cathie wood or ron byron will call it an amazing buy opportunity most likely, they can draw a line in the sand and make it work, but not up here, because tesla is

6:59 pm

feeling mightily like a car company with the wrong product line, electric vehicles, when everyone who wants one seems to have one another. very low price-to-earnings multiples. apple does have a reverse and it's a buy, not sell. there is no pulling a rabbit out of a hat here. just an incrementally better product that gives institutions a reason to buy this high quality company with a stock that now sells at a lower multiple than we've gotten used. to it's a slim read, i know. but apple does make a lot of money. it just doesn't grow as fast as we like. some say there is no growth at all. if you think there is no iphone refresh ahead, the stock would absolutely be a sale at below market multiples on declining earnings. i could see it trading down to 120 in that scenario. fortunately, that's not the scenario we live in. here is the real difference between apple and tesla. the institutions who own apple would not let the stock fall that low. they would find some way to justify pay mortgage than that price. those institutions don't care about tesla at all. worst case scenario, apple, you can buy apple 160 and scale. in i would do it every five

7:00 pm

points, getting bigger as you approach the 130s where i think 2 longs will make a stand based on next year's earnings estimates. not pretty. it's always good to know the parameters of a stock, a stock that you advocate owning and not trading. i like to say there is always a bull market somewhere. i promise to try too find it just for you right here on "mad money." i'm right now on last call, sputtering out, something that has only happened four times in tesla's history just happened again. race against time, will tiktok's fate be sealed by the senate tomorrow? we have a preview. a massive high speed rail breaking ground, finally. will you get your money's worth? call it salt on the table. president biden raising fresh questions on the prospect of tax hikes for everyone. nailed, is a surge in rates slamming the door on one of the hottest sectors of the market? and it is a mini

22 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11