tv The Exchange CNBC April 22, 2024 1:00pm-2:00pm EDT

1:00 pm

they had great earnings and we'll have 6% yield and ten times sfo. >> staying with that commercial real estate play and joe t.? >> tough to find strong, positive momentum in the market right now. patience is probably the best position, but goldman sachs is one name in which you will find strong positive momentum. i think it continues to put. >> see you on the closing bell. "the exchange" continues right now. thank you, scott. we will see you on the bell, indeed. meantime, welcome to "the exchange." i'm tyler math eson in for kell, van, and you have pce and it could be a market-moving week big time. if there is say pullback the market tells us why and where he's looking for opportunity. plus speaking of pullback, some of the semi names are in a bear market, but our analyst sees strength ahead and soon. he tells us when, why and which names he sees best positioned across the chips universe right

1:01 pm

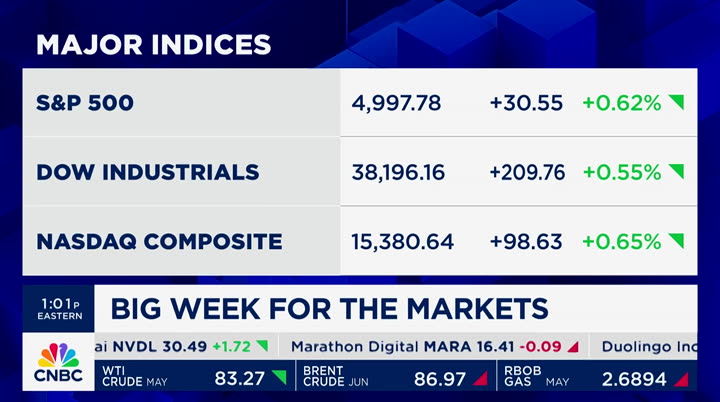

now, and on this earth day, a special three buys and a maybe esg edition. the acronym may be divisive, but the returns our guest sees for these names may make you a buyer, but we begin with today's markets and bob pisani at the new york stock exchange. hey, bob. >> hello, tyler. we are essentially at the highs for the day and it's been a good day, two to one advancing to declining stocks and yields are stable and that's a big help to the markets and let's take a look at the major indices and the s&p 500 a fairly narrow trading range and just at the highs of the day and the dow industrials with a 200-point trading range and the high point was right at the open and we had a mid-morning slump and we recovered. same with the nasdaq, started positive and went negative and now we see up 0.6%. the important movers to watch are the semiconductors and see if we're getting a bounce and that's exactly what's happening and nvidia was $900 six trading sessions ago and the horrible close on friday and you see the

1:02 pm

move here to the upside. taiwan semi was down several days in a row here after poor guidance last week and it was 147 or so and now it's 128, but recovering. texas instruments, micron also on the upside. dow leaders tend to be financials and defensive stocks. i've been commenting on the banks and they're having the biggest ones and they're having a nice little run and goldman's been strong and j.p. morgan has been strong and bank of america has been strong and wells fargo has had a new high and defensive stocks are not leadership groups and procter & gamble have been okay and they had the earnings last week and they've been up since then and johnson & johnson were up early last week and trading to the upside, as well. big names, there have been big names that you all know and love. tesla down again today and it's down 40% this year and that is very close to a 52-week low and let's play it just about. apple, believe it or not, this year's not far from a 52-week low and 1% or 2% away and boeing

1:03 pm

is down more than 30% and also near a 52-week low and what i'm excited about is the ipo market and we had a bunch last week that are holding up well. rubric down here at the new york stock exchange should be trading this thursday and that's a big data security company and that's going to raise a lot of money and close to $700 million and we also had an announcement just this morning about another ipo that you all know and viking, this is the viking cruise company and they are set to start trading may 1st and that's on the ipo and this is scheduled 44 million and 21 to 25. you do the math here, tyler, that is close to a billion dollar ipo at the midpoint. we're getting several weeks in a row when we get a billion to 2 billion in ipo money raised and that's what we do prior to covid and you get 50, 60 billion. 2024, at least april really looking pretty good.

1:04 pm

>> back to you. >> thank you very much. our next guest says the outlook for the economy and corporate america are strong and even sees's rate cut delay as a positive because it keeps more dry powder for the future which can lengthen the market cycle. for more we are joineded by john porter, cio and head of equity at newton investment management. john, good to have you with us. among the other thing, why don't we start with the interest rate argument here. you're putting your positive hat on and it's all good. why? >> i wouldn't necessarily say it's all good, but it's generally pretty favorable because you have to look at the reasons why the rate cut's been delayed and a lot of it is because the economy continues to be so strong. we're looking at a first quarter gdp print we'll see later this week and it will approach 3%. the market is not exactly demanding rate cuts to fuel economic growth.

1:05 pm

admittedly inflation isn't coming in quite as fast as market participants are expecting in the beginning of the year and inflation does continue to improve and the outlook is when not if when we'll see rate cuts and i don't mind seeing them delayed because that provides fuel into later this year and into 2025, even. >> the assumption is that they're coming. how many, who knows? but they're coming and the market seems to be willing to tolerate that. among the things you say, thoughts from john. small-valuations are relative to large cap at least a 15+ year low. it's been this way for a long, long, long, long, long time. so j wowhy would i think that anything will change and the smalls will have their day in the sun? >> that's a good question. why should anything change? until you see the fundamental backdrop change nothing will

1:06 pm

change. part of why the large caps are driving their narratives earning and the small caps have been lagging and certainly the last five or six quarters, large-cap stocks have outgrown large cap stocks by more than a thousand basis points per quarter on a year over year basis and as long as that continues, the large cap is where the money will flow in the market. we see's broadening out of the economy and the broadening out of the market and possibly happening in the second half of the year based on current forecasts. small-cap earnings should be growing faster than large caps in the second half of 2024 and if that plays out, particularly where valuations are, we think small caps are poised for quite the catch-up rally of earnings improvement to be the driver. >> two sectors are energy and small-cap healthcare. explain. >> in the small cap world i see innovation happening in small cap health care particularly when i compare it to technology. down in cap, the small-cap

1:07 pm

technology companies aren't driving the innovation and we're certainly seeing that led by the mega-cap companies and on the health care side the small-cap companies is where the innovation exists and we're seeing the new products come out of the small cap health care companies and they're having to dip down to make acquisitions to fuel their own growths. the other area i like is energy. i've liked energy for a while. i think energy is very attractive because of the capital of discipline we're seeing from companies. it's a new know venvironment an they're going to dividends and share repurchases and not speculative investments in the ground. at the same time the strong economy we're seeing is improving the supply picture while -- pardon me, the supply picture will continue to be constrained and the setup for energy in 2024 is very attractive. >> john porter, thank you very much. we'll have you back soon.

1:08 pm

appreciate it. john porter. the vanex semiconductor is down, and 16% off its 52-week high and it's not the only chip name seeing some weakness right now. nvidia and micron all down over 9% since last week. our next guest says this downturn is pretty common this time of year and while the sector is dented, he's not deterred. for more, here we are joined by vivek aria semiconductor analyst at b of a securities. vivek, good to have you with us. >> thank you, tyler. thank you for having me. >> why are you less worried about semis? >> yes. i think volatility is par for the course of the semiconductor sector. we've had 10 to 12 loss corrections in the sector, but the stocks index has compounded 26% annually which is two times

1:09 pm

what the s&p 500 has done, so it is a volatile sector and it does very well in q1 and q4, but as we get into q2, that's when just before earnings that happens to be this bout of volatility. in fact, april, the month april is down eight over the last ten years and the month of may has been up in the last nine out of ten years and more importantly, when you look at the growth leader in the space which is nvidia. the addressable and the pipeline is extremely strong and most importantly the stock's valuation at 25 times next year's numbers is exactly where the stock has troughed. the last three times it went through this kind of volatility. we think that volatility is par for the course of the sector and the growth leader is doing extremely well right now. >> and so you like nvidia, but what about other names in the semi area that you like, as well and some that you might avoid?

1:10 pm

>> sure. so i think the analysis really starts with where can we trust the spenders? so if i look across all of the different end markets and the spenders that are investing the most heavily are all in the data center because they are in early phases of building out their large language models or building out their cloud infrastructure. we think we are just a year or two of what is probably a two to four-year cycle and nvidia is a topic and also a name such as broadcom and marvel and amd, and i think a number of these names benefit because they're all exposed to different parts and some are doing better on the computing side and some are doing better on the memory side and some are doing better on the networking side and all three of those sides have to essentially come together to help the cloud customers build out this infrastructure. >> are there winners,

1:11 pm

potentially, in areas that are not tied to data centers. we all hear about the data centers and that's but one area of sales opportunity for semiconductor companies. are there other areas, other companies that could see growth? >> yeah, tyler. and you might hear us talk about the three semis, clouds, car complexity and these are three places where there is a building growth in the sector so cloud computing we just discussed and i think the next interesting area is chipmaking and names such as kla, applied materials and synopsis, and i think these names are levelled to the secular growth and designing and these chips are manufacturing the high-end industries and cars. i know there's a lot of concern about base of ev adoption and if you look at an average car that sells globally, it is the cost

1:12 pm

is about $35,000 and the amount of semiconductors in it is only 2% and only $700 and look at every feature the consumer cares about, whether it's safety, security and we think over a long period of time as much as it is cyclical, we do think that automotive semiconductor are also positioned extremely well outside of the data center and cloud computering area. >> does witness, for example, tesla cutting the price which is a sign that they need to juice up their sales. does that worry you at all here? >> yeah. for sure. i think last year global auto production was up 9%. we saw 30+ percent growth in evs. this year auto production would probably be flat and the growth in evs is probably not going to be more like 15%, 20%. as much as tesla has not grown this year and the growth rate has been challenged and the growth rate outside of china is

1:13 pm

doing very well and that's the important thing about the semiconductor industry and these are companies that are exposed to the global market not just the u.s. market. so for, let's say a tesla that may or may not be doing well, you have the secular adoption of semiconductors across hybrid and across traditional scars because every consumer cares about safety, security and infotainment. it's not just evs and outside of that is adoption and look at customers outside of the u.s., as well. it's a global industry and valuations are more reasonable and nxp trading at 14 times next year and i think it's extremely compellingly valued. >> vivek, thank you so much. vivek arya. disney could be taking a page from netflix and meaningful stream profits and how much

1:14 pm

upside he sees ahead for disney. we have the action, the story and the trade on gm, lockheed and philip morris international. before we head to the break, check out shares of wolfspeed surging 14% on the reuters report that activist investor janna partners is urging the company to explore a potential sale and other alternatives and it is up 4% this year and up more than 10%. "the exchange" is back after ts "e chgeon >>hiisthexan" cnbc.

1:15 pm

1:16 pm

business. mat it's not a nine-to-fiveon. proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now.

1:17 pm

welcome back to the exchange, everybody. if netflix's history is request indication, disney will do just fine. our next guest says the percentage of netflix users may have dropped, but the company did add more than 8 million members in north america over the past year. meanwhile, revenue up 17% in the first quarter and he sees meaningful streaming profits ahead for disney, as well. joining us now with more on the new streaming playbook is ben swinbern, head of u.s. media research at morgan stanley. welcome. >> the password sharingdoes not seem to have dented netflix all that much which must hearten some of the other companies that are considering doing this. >> yeah. i would say financially, tyler t has worked out well. a couple of years ago netflix

1:18 pm

wasn't growing and one of the ways they talked about accelerating growth is that over 100 million around the world weren't paying for it effectively and by the looks of their results for the last year they've had a lot of success converting a lot of those users into paid subscriptions or extra members and you read the results yourself. the best north american net ads quarter that they've had since 2015 was reported last week. so it seems like it's working really well for them. >> would you say that those great net ads that they had in the first quarter came largely from the password crackdown or was it organic? how would you sliver that up? you get the import of my question? >> yeah. of course, and it's an important one. i think netflix is about a year in it. it literally started really implementing paid shares about a year ago now. so we know that the impact and the benefits to net ads probably

1:19 pm

peaked a year ago and they've been moderating since. when you look at 2023 and 2024 thshgs is a couple of years now that netflix will add somewhere around 30 million members a year. that is well beyond page sharing. some of the content they had in the first quarter and the problem as an example demonstrates that the core part of the product is in the market and one of the things we've written a lot about is everybody in streaming is raising prices so the market's become less competitive for netflix as the leader and i think that's upon had helping them, as well. >> does it help that netflix is doing away as the subscription numbers as the featured metric. does that take the pressure off some of its competitors because they don't have to measure up to what benchmarks off of what netflix is doing? >> it's not a bad point at all. this will happen next year, right?

1:20 pm

probably this time next year will be the first quarter netflix will report without giving us a specific member number and they'll give us qualitative number around it, and i think over the long term this is the disclosure shift that you may see adopted around the industry and streaming is maturing, particularly in the u.s., and i think what netflix is focused on, their north star is revenue and profits and i think that is the north star around the industry. so this could be the beginning was shift in disclosure over time across the sector. i don't have any expectation that it will change anywhere else any time soon, however. >> we have all of these streamers. we have the netflix and your disney and your warner brothers and your comcasts and peacocks and all of them. in the end, five years from now, ben, how many real winners are there likely to be and which will they be? >> netflix is pretty clear. i don't think we're making a lot

1:21 pm

of news here by describing them as a winner. >> got it. perfect. they're like the dodgers. they'll be good every year. >> i'll go with the yankees, if you don't mind. >> we think disney is quarters away from meaningful profitability and warner brothers max also kind of knocking onthe door of an annual profitability for their business, as well, but after that the rest of the players are still losing lots of money, so i think after we get through those call the two to three real question marks for me. >> i appreciate the clarity of the call and ben swinbern, morgan stanley. we'll see you soon. >> thank you. >> appreciate it. >> coming up, two things are getting more expensive and that is chocolate and luxury homes and buyers of both are still paying up and we'll dig into that next. from larry fink to bob iger and the anti-woke backlash has some

1:22 pm

of wall street's most recognizable names and beefing up personal security. the responses from fringe groups anacvid tists deter sustainable investing and we will discuss that. pus, an accredited university that's transformed adult lives for 75 years. you're not waiting to win, you're ready to succeed again at umgc.edu. when it comes to investing, we live in uncertain times. some assets can evaporate at the click of a button. others can deflate with a single policy change. savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com.

1:25 pm

welcome back to "the exchange," everybody. cocoa prices are hitting a record making it one of the hottest commodities by far. for more on the spike, here is frank holland. what's happening in cocoa, frank. >> good afternoon, tyler from london. cocoa the key ingredient in chocolate is having somewhat of a mysterious rally. it's up 300% over the last year, of course, that's raising the cost for major chocolate makers who also raised consumer prices. still, u.s. chocolate demand increased about 9% from q4 to q1 with 5% increases in both europe and asia for the same time period. the primary reason for the spike is a shortfall in west africa where just about three-quarters of all cocoa supply is grown over two seasons. the spring harvest which is under way right now is forecast to have a 10% shortfall according to the international cocoa oergd. i spoke with the executive director. he cited aging farmers plant disease and climate change as some of the factors and however,

1:26 pm

there isn't a clear-cut reason and that mystery is what continues to push prices higher. >> the major issue today is i can't tell you exactly the -- i cannot put my finger on the exact reason why the crops have failed in the way that they have this season, and as i can't be categoric about the reasons that they failed that means i can't be categoric about whether it will happen again or not. >> and this cocoa rally has had a big impact on companies. hershey's was downgraded ahead of upcoming earnings on concerns about margin due to rising cocoa prices. you can see other chocolate makers and their stocks are down year to date. citi put out a note saying we are seeing the tightest cocoa market in the last 50 years and r right now i've spoken to commodity traders and there is another one, coffee is up 25% over the last month and this time it's a lot less mysterious and it's due to unseasonably dry and warm weather in vietnam. however, the key here, tyler, the coffee market is literally

1:27 pm

three times the size of the cocoa market. >> a lot of beans at stake here. so where in africa is most of the cocoa grown or the cocoa beans? is it west africa? central africa? where? >> it's west africa mostly concentrated in ghana and the ivory coast. i spoke to the international cocoa organization and they mentioned the factories and these are longstanding factors and the issue with farmers being older and not enough care when it comes to the plants and adequate resources to ward off disease. nobody can pinpoint why this is leading to the shortfalls this time, and the questions are about the upcoming harvest in thefall that's twice as large and it's profitable for the farmers and the questions are, are we going to see another cocoa shortfall and if we do, will prices continue to rise and will people continue to buy independent i don't know, tyler? can you live without your chocolate? >> i can live without it, my wife and her mom probably could not. they need a little hit in the

1:28 pm

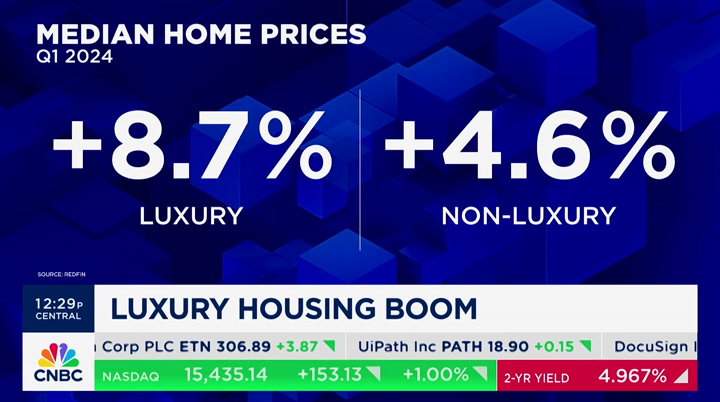

afternoon many days. frank, good to see you. frank holland in london for us. >> good to see you, tyler. >> frank mentioned the chocolate company hershey has held up better than the rest of them and that's one of the reasons why mai capital chris grisanti, a good friend of the program likes it. he told us the company has managed to keep profits flat even though cocoa prices have risen fourfold, combined with the tailwind when cocoa prices come down make this stock a buy for him. it's a tale of two real estate markets. while the broader housing market is suffering from high rates and low inventory, the luxury market surging. who? all-cash buyers and more supply coming on. robert frank has more on that story. cash is king, robert. >> cash is king, tyler. now more than ever. real estate sales falling 4% nationwide in the first quarter, but luxury real estate saw the

1:29 pm

biggest increase in three years and that's the tale of redfin and it is driven by rates and supply. mortgage rates above 7% have put homes out of reach for most buyers and healthy buyers are buying with all cash. that's the highest in at least a decade. in manhattan, cash deals accounted for a record 68% of all sales and all of that cash is pushing up prices and luxury home prices went up 9% in the quarter and that was twice as fast as the broader market. higher prices are drawing more buyers. number of luxury homes for sale jumped 13% in the quarter and that compares to a 3% decline, and there's more inventory there and the market was prof dense rhode island followed by virginia beach and it was the strongest sales growth by the

1:30 pm

luxury homes and where the wealthy are putting her money and cnbc.com/insidewealth or use the qr code for your phone. tyler? >> seattle doesn't surprise me. austin doesn't surprise me. we know what's going on in those markets, but providence, rhode island surprises me. maybe they're selling in newport and providence is part of newport or virginia beach, for that matter. >> providence, remember, this is a percentage price increase so it may not mean that it's a sort of hot luxury market from a sales volume point of view, but prices have gone up among that top 5% of homes by price. so that's how you define luxury in that market. so it just could be that a lot of homes are getting up to that price and those at the top have seen you can get a small number of deals in providence that can push that higher, but again, it's interesting how dispersed -- and new york, by the way, had a 10% decline in

1:31 pm

prices. so we think the usual wealth hot spots is coming from the outer markets right now. >> very interesting. >> robert frank, thank you, sir. let's go to courtney reagan for a cnbc news update. >> president biden renewed u.s. commitment to ukraine in a phone call today with president volodymyr zelenskyy. a according to the white house, biden assured to pass the supplemental package and signs it into law. potentially contaminated ground beef. they warned this weekend products produced in march and shipped nationwide may be contaminated with e. coli. the items in question were produced march 22nd and have a use date of today. check your packaging. e. coli can cause food poisoning and other gut infections. and the rock 'n' roll hall of fame has announced the latest group of inductees and artists include mary j. briej blige,

1:32 pm

cher, a tribe called quest, and the induction ceremony will be held on july 19th in cleveland, ohio. >> my wife will be thrilled that cher has made it. >> it's been a long time. >> thanks, court. >> coming up, we have cars, cyber security and cigarettes. we have the action and the story and the trade ahead of reports from general motors, lockheed martin, philip morris, earnings exchange is next. and don't miss the 2024 cnbc stock draft featuring wwe superstar charlotte flair, nba champion kenny smith, the jet, the wnba champion breonna stewart and more. that's this uraythsd 2:00 p.m. eastern on "power lunch."

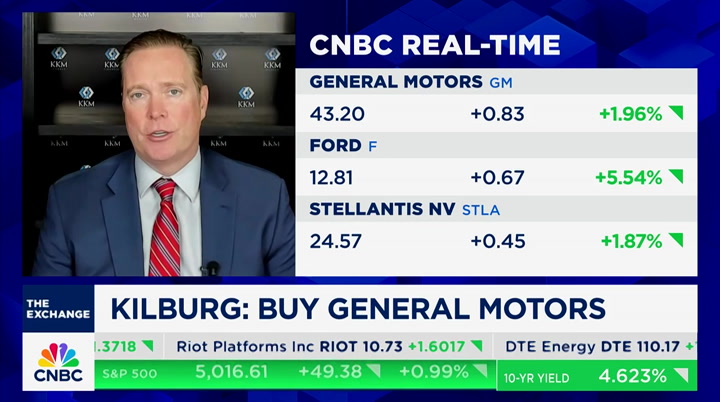

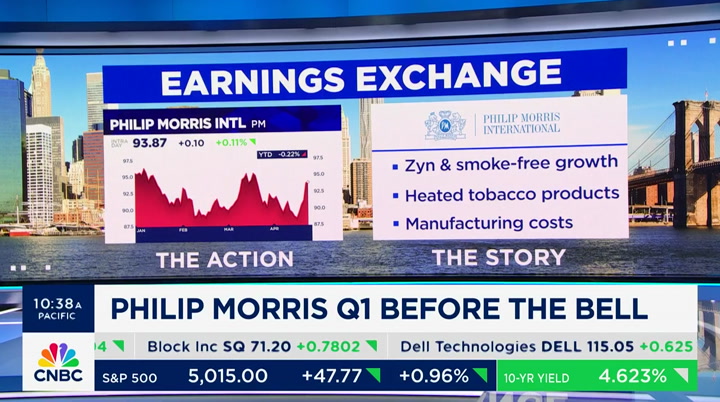

1:35 pm

welcome back. earnings season is in full swing and we will look at general motor, lockheed martin, and philip morris in today's earnings exchange. they come out tomorrow before the bell. here is k.k. financial founder and ceo and a cnbc contributor. jeff, welcome. good to have you with us. general motor, and eight-day losing streak similar in the rear-view perror. deutsche bank says it is best positioned into earnings with strong pricing, sustained cost-cutting, forts, but deutsch watching spending on the more speculative ev and cruise programs. what's your view on gm here? >> tyler, i agree with what

1:36 pm

those analysts are talking about what they're going to see from the perspective of what's the uncertainty in china and what are they doing with the slowdown in ev, but i want to be a buyer here of gm and that's due to the fact it's had a great year to date and there's still more room to run. it's still down about 25% and by and large about a 4.7 times forward p-e ratio it's not that expensive. so i think there's opportunity here, but we really are going to be focused and it's critical not just for gm and it's for ford and all of the motor companies understanding how are they going to handle the slowdown in ev and more importantly, how are they going to grapple and digest the china uncertainty? i know ford, as well. about two years ago it was trading up over $65 and here in the mid-40s it seems to be offering a discount. >> it's 36% six months and it's been a healthy gainer here. >> yes, sir. >> let's move on to lockheed

1:37 pm

martin shares flat to start the year despite geo-political tensions and delays in f-35 deliveries and a new air defense contract with the u.s. military as some of the key factors to watch. how would you trade lockheed into earnings? you'd kind of think that a defense company of this scale would be a market winner so far this year. it has not been, up 1%. >> that's right. i think if you look at the environment we're up geo geopolitically. if you think about it, this is a blue chip essential defensive name and this guy yield 3% and it's got a low-risk profile and you look at the year 2022, ty, when the s&p 500 moving lower and this was able to find some investors to come into the marketplace and with 4.8. i like the defense contract and

1:38 pm

it has room to run. if you look on a relative strength index measurement it's above 70. it's interesting to see the all-time high of 508 dollars and not that much higher and you think the amount of money we're spending not just as a government and lockheed martin moves higher. >> finally to philip morris and the shares are slightly lower so far this year, and stiefel, has the nicotine pouch and other smoke-free products and the heated tobacco business. >> what a way to put that. heated tobacco. what would you do here with philip morris? >> well, the heated tobacco, aka smoke-free tobacco which is actually, ty, about one-third of revenue now for all of these tobacco companies, but i'm a little bit negative on philip morris due to the fact that the technicals are rolling over. i know there is optimism because they will be able to sell. they bought from altria that was

1:39 pm

a $3 billion price tag and the heated tobacco and smoke-free tobacco and that will ramp up in late 2024 and potentially 2025 when it is more rolled out domestically, but reit now if you look at the stock for three years it's flat and it's gone nowhere and this is not where i want to put my money and i can't come up with a pun right now to give you something, a zinger for philip morris and i'm taking this and putting it on the ashtray. no, thank you. >> thank you very much. jeff killborn, k.k.f. financial. the dow is up 233 at the high and there you see it higher by 317. s&p and nasdaq also near highs as you look down at the ticker there and it's been a rough month for tech. recent history may not repeat itself with four of the magnificent seven reporting this week. we will look at how big tech has matured since the 2220 sell-off and what that could mean for shareholders like you next.

1:43 pm

it's been a bit of a tough month for the mega-caps. four of the biggest tech stocksed in the red for april and could it be an opportunity for a bounceback? deirdre bosa takes a look for today's tech check. hi, d. >> hi, tyler. for tech investors that are feeling nervous about the recent sell-off, free cash flow is the key metric to watch this earnings season and it is to pay down debt, reinvest in business or return capital. and mega-caps have more of this than ever and this looks at the free cash flow at the end of 2021 versus now for the big six and it could raise the potential for a dividend or buyback boost that could underpin results in the coming week. wall street loves dividends and buybacks. typically, tech companies reinvest for growth and that's changing and meta surprised the street by issuing its first-ever

1:44 pm

dividend leading to speculation that google might do the same. b of a is forecasting that apple will re-up its buyback and increase the dividend by 5%. mega-caps have put the cash piles to work by acquiring companies and the current regulatory environment has been tough tore get deals done and we've seen that and that could be more reason to return cash to shareholders. it's counterintuitive, tyler, because you don't think of tech as returning capital to shareholders. >> amazon has been an unlikely buyback candidate. what's changed there? >> it's bezos day-one mentality when you invest back into the business. amazon has not been consistently profitable. it is hard to imagine an amazon, and under andy jassy, maybe more of a possibility and you're looking at the big six and you can see that amazon is the only

1:45 pm

name on the graphic that doesn't offer a buyback or dividend. there you go. jassy seems more responsive to wall street. you know, he gets on the earnings call. that's something that bezos hadn't done in many, many years. he talks a lot about efficiency and who knows? free cash flow, bring it back there. it was negative in 2021 and now it is positive so who knows? it could be next. >> educate me a little bit here. we are, i guess, prone to say that the ai race is between two or three players, google, alphabet, microsoft, maybe amazon, but i keep hearing meta sneaking in there, that they may be a real up and comer. am i wrong or right about that? >> you are absolutely right about that. they're taking different strategies and microsoft exploded with chatgpt and amazon is doing a bunch of different

1:46 pm

things that are less clear to investors, but meta came out really swinging last week by just incorporating gen ai and the llama large language model into its family of apps. we're at this phase, tyler where last year we kind of looks at the picks and shovels of the ai race and who actually is using it in applications and that is what we'll be looking for next next few weeks and meta leapfrogged ahead by putting it into the existing product which has a distribution of millions of use ares and it's been developing its old open, and i bunch of different developer, but absolutely meta is a contender. >> deertirdre bosa, thank you v m much. >> could its recycling efforts turn around and that and three other friendly stocks to buy on this earth day. that's next.

1:47 pm

icy hot. ice works fast. ♪♪ heat makes it last. feel the power of contrast therapy. ♪♪ so you can rise from pain. icy hot. when you need to prepare for unpredictable adventures... (gasp) you need weathertech. [hot dog splat.] laser measured floorliners front and rear. [drink slurp and splat.] (scream) seat protector to save the seats. [honk!] they're all yours! we're here! hey, i knew you were comin'... so i weatherteched the car! can we get ice cream? we can now.

1:48 pm

kid proof your vehicle with american made products at weathertech.com. you're probably not easily persuaded to switch k mobile providers for with am your business.ducts but what if we told you it's possible that comcast business mobile can save you up to 75% a year on your wireless bill versus the big three carriers?

1:49 pm

you can get two unlimited lines for just $30 each a month. all on the most reliable 5g mobile network—nationwide. wireless that works for you. for a limited time, ask how to save up to $830 off an eligible 5g phone when you switch to comcast business mobile. don't wait! call, click or visit an xfinity store today. if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. ♪ ♪ welcome back to "the

1:50 pm

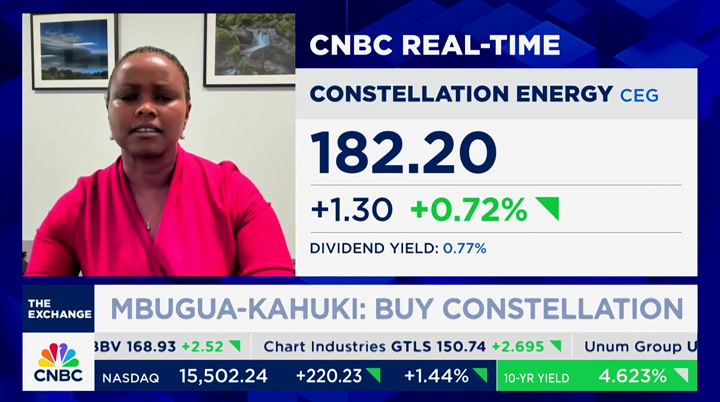

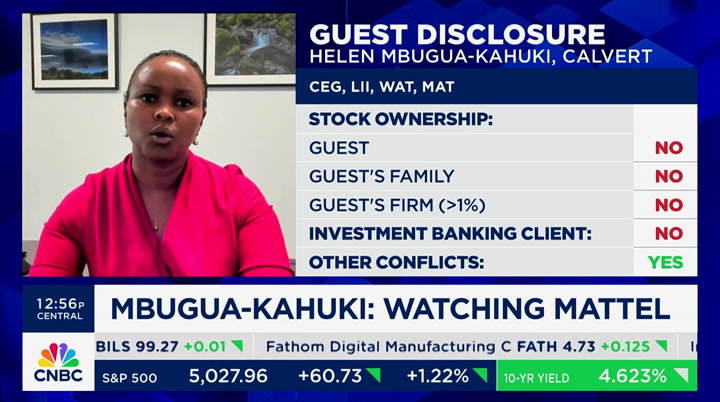

exchange." once a hot buzz word on the street, esg investing has become a target of sort of anti-woke activists who say it makes companies misuse capital leading to lower profits. the backlash has gotten so bad that some xexecutives have had o increase theirpersonal security details. the financial times reporting black rock's ceo, larry fink, has become the target leading them to triple the security spending last year. we're going to look at nonetheless some of the names make strides in esg today. a special edition of three buys and a bail that we're calling three buys and a maybe. the maybe is the name that's not on my next guest list of sustainable companies, but is, however, making big process in sustainable practices. joining us now for more is helen buguakohko, the research at research management, a big investment company. helen, welcome. good to have you with us. why don't we start with constellation energy. i guess it's a little bit

1:51 pm

surprising that your lead off stock would be an energy company. why? >> thanks for having me and happy earth day to you. so we actually view nuclear energy as one of the most important as sits for decarbonization of the sector. so nuclear perceptions have changed quite significantly especially following the ira act of 2022, which created new production tax credits or ptcs for existing nuclear plants. we believe that constellation energy has a high strategic asset base that will get more valuable because of the growing demand from these incentives, and has been driven by the current technology trends such as ai too in particular. so data sensors, in particular, they need 24/7 power, so nuclear is perfect given that

1:52 pm

it runs all the time. and solar, wind, which tend to be energy sources. that means they're not constantly available or predictable. and then lastly to the point that you made earlier, just the strong capital allocation starting with constellation energy. many clean energy companies are trying to raise capital to grow. but constellation is actually holding the substantial capital to shareholders and a form of dividend or stock buybacks. >> what is it that has caused, i mean, i take your point there is demand that is going to require a tremendous amount more electric power than we are generating today. but what is it that has taken a very controversial production source, nuclear, and made it one that is acceptable to

1:53 pm

socially responsible investors? what's changed? >> i think the fact that nuclear actually has resolutions close to zero emissions. and then it is also the fact when it comes to product safety, any issues around nuclear safety tends to be baited. if you look at them actually in terms of analysis, they actually have less upheavals or issues around product safety than even wind and solar. so i think the whole idea of responsible investors is taking a step back and really thinking critically about nuclear power and the pros and cons, which is something we do. we have been responsible investing for 40 years, but really taking on a nuance approach when we look at the sectors or the trends of companies in particular. >> interesting. let's move on to our second stock here, and that is lennox international. climate control products company up slightly so far this year. what makes you lean towards

1:54 pm

this one? >> the reason why we like lennox is because it's a leader in energy hvac products. it lowers energy use and carbon emissions. so climate control is actually a key pillar of global adaptation for economies and populations. as buildings account for about one-third of emissions, energy emissions. so elements of the ira will actually benefit the like of lennox, such as the electrification of heating, such as heat pumps. so the ira provides tax credits to a point of sales rebates. this can equal, you know, thousands in savings around high-efficiency hvacs. and then also we like lennox because it's a pioneer in hvac equipment recycling, which is also positive for the environment. >> let's move on to the final

1:55 pm

buy, shares down about 9% this year for waters corp. testing the equipment of forever chemicals. they are common in consumer products. you say this could be a key growth driver as more municipalities and others require testing of those chemicals. they're in everything including the artificial turf surfaces. >> i simply agree with everything you say. this month alone, they act in two ways where it is a new drinking water standard, and two forever chemicals as substances. one of the other things why we like waters corp., it's a u.s. company. it has a base in massachusetts, but they also have a global

1:56 pm

scale. we are seeing new zealand and the likes of australia, and also specifically u.s. states, they start to set up some sort of control around this pfas issue. and waters corp. has been investing heavily. ways to test, we think it is well positioned to take advantage of this testing, especially given the global footprint that it has. >> and we ask you to give us the name, a top pick for a company that's not on your sustainability list, but you see making progress, and you chose the maker of barbie, mattel. what potential do you see there? >> i think barbie's story kind of pivots. it takes us away from emissions. another environmental topic that we're keen on is the whole

1:57 pm

idea of plastics. so the issue with plastics is it's not biodegradable or doesn't biodegrade. and so the toy industry though is one of the highest plastic intensity industries in the consumer goods specifically. and so mattel -- i like mattel because it's a turnaround story that we like in -- it's >> can you recycle barbie? can you recycle barbie, melt her? >> it actually does. one of the key things about them that i thought was interesting, they have this mattel takeback program that also includes barbie. you can actually send back your old barbies back to mattel. >> all right, send back your old barbies. helen mbugua-kahuki, thank you very much for your time. power lunch is next. i'll join her on the other side

1:58 pm

2:00 pm

22 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11