tv Fast Money Halftime Report CNBC April 22, 2024 12:00pm-1:00pm EDT

12:00 pm

chinese yuan which has gained in adoption is mager >> as for earnings, definitely going to heat up tonight sap and nucor before we get into the mix with big industrials tomorrow. let's get to the judge in the half. >> a appreciate it, carl. thank you. welcome to the "halftime report" i'm scott wapner. front and center the losing streak for stocks and the big week ahead. the investment committee debating where the markets might head from here. trying to get a little bit of a bounce today. we're on a three week losing streak for the s&p down six straight days. mkm roth says not confident a low has been formed even if a bounce is likely. i guess, joe, we knew it was only a matter of time before there was going to be some pay back for this higher for longer interest rate idea and, you

12:01 pm

know, the market was acting as if there wasn't going to be anything to pay for that. i guess we learned our lesson last week and culminating on friday. >> we did and we were able to break below that critical area from early -- from late february off of the nvidia earnings and now you're getting a little bit of a bounce. i mean, this is squha of a weak bounce. i still think sentiment is selling rallies and i think that was reflected the entirety of last week. but i do believe understanding that we're coming into what is really, really a critical week in terms of further price deterioration i'm not so sure just looking purely at technicals and understanding you're going to get 38% eps growth from the mag seven, i'm not so sure that there is that much down side ahead of us. i think that the market is trying to find a little bit of an area in which we could bottom from. i'm not telling you that the up side is going to look anything

12:02 pm

like the up side that you got from the fall into january and february, but i do think the market is trying to bottom here. >> jenny, how do you see things here? do you have a feeling on how much more of a correction might happen, if one at all? i mean, you know, people are echoing what joe has said, you know, markets oversold, it's due for a pretty good bounce, you know, today's price action is not, you know, all that great, it looks like it's hard to get anything going so maybe we need to work through some stuff but that's your gut telling you when the s&p is down 5.5% from the recent high, nasdaq has been the epicenter unless you want to go as far as the russell and say, well, 8.5% off its high is the obvious place to look because rates have backed up, that's the place you would find it more acute. >> i think it's what you said, we're working through some stuff and that's going to take time. it's interesting i just put up on twitter this morning x.

12:03 pm

if you look at the way the earnings are going to be growing throughout the year the pull back makes sense. in the first quarter the top ten stocks were responsible for 37% of the earnings growth in the s&p 500 the other 493 were responsible for negative 3%. here we come on, you know, the next earnings season and that differential narrowing. what we're going to see is that the top ten stocks are going to be responsible for roughly if it comes in in line 24% and the other 493 will be responsible for 6%. so the gap between the have and have not's in terms of earnings growth is narrowing. by the fourth quarter that's going to reverse where the other 493 should be responsible for 18% of earnings growth and top ten 10%. so as we get there, scott, we have to work through it. and valuations have to reconcile. to me 21 times did not make sense and that's what we're doing. we're coming back to what are we at now 19ish times. that's a more reasonable thing to work off of. in terms of your question is

12:04 pm

there more down side, sure, everything always overshoots, we could get back to flat on the year. i wouldn't be surprised if we end the year in the up high single digits, 10% range, but to get there it can't be a straight line. >> it remains to be seen if the overall markets valuation was too stretched, earnings season is just about to get going. we got a third of the s&p companies reporting. if you want to take be issue with mega cap valuations, we can have that debate if you look at where we are versus the ten yer historical average in some cases we are well ahead of places we've been in the past, in some cases we are not. alphabet today is below 22 times, ten year average is just below 23 times. meta today just below 23, historical average is near 26. amazon is much lower. i mean, it's not like apple is so egregious. it's not like nvidia is, either, and we are working through some of that. >> i agree with everything you

12:05 pm

said. i mean, how could i disagree? they're facts. here is what i would say, the market overall is where it is because you pull forward the narrative, you pull forward the action of the fed cutting rates and now to the point you make in the introduction is we're still adjusting to the fact that maybe we are not going to have any rate cuts this year. then you have to assess will the ongoing level of monetary policy then contribute to a decline in the economy which we're starting to see. you take a look at truck inventories, for example, they are 20% of sales. that typically leads to a 20% cut in reduction. to the bigger point about mega cap tech earnings, yes, you have to pay attention to where the levels are in the pe, as i do, and i think meta which is one of my biggest positions, google and microsoft as well, i think they're cheap if you are looking longer term but what got us the last part, so what concerns me and i said in this show last

12:06 pm

monday the next 25 points for met at that is down not up, but what got us here is that similar to what we saw with netflix in front of the earnings, analysts tripping over themselves to have the highest target on the street, particularly during the quiet period when the companies aren't talking, when there is no new information. the goal from multiple expansion again. that's the damger as we go into earnings, but my view why we're seeing such a muted bounce today, not only because we have big and important earnings coming, not just from those but also caterpillar but pce. >> well, pce is on friday. >> exactly. >> we have kind of an idea of where we're going to be on that. >> the risk is to the upside for the market from a lower pce because we are all convinced now that right now that inflation is going to continue to either firm or move higher. >> once you get a bad number, it depends what you're reading. the pce doesn't necessarily suggest that.

12:07 pm

>> no. agreed. >> as powell even said last week in his remarks, he sort of front ran where pce is going to be. pce is injure friend. cpi has been your enemy. >> without question. look, i keep saying this, the federal reserve wants the reason to cut rates. if your investment thesis is i need to buy stocks because the fed is going to cut rates you're looking at the wrong thing. the fed ultimately will deliver something that pivots monetary policy into more accommodative policy, whether that's on the balance sheet or whether that's on an actual rate cut. but that is not the premise of why you're buying stocks. you're buying stocks based on the revenue growth and if the guidance comes in this week better than expected then you have to raise the estimates for 25 and 26 and i think the jury is still out on that and there's still areas of the market -- that's why when i say the market appears to be bottoming to me it doesn't look to me like we're

12:08 pm

having broad based universal selling. health care is performing ridiculously well. we haven't spoke about merck on this show for quite some time. they are $127 right now, look at the financial performance. goldman sachs it's up at 410, pressing towards an all time high. and energy is holding really well. maybe what we're witnessing where the market looks like it's running in place is a little bit more about rotation than anything else. >> i think that's exactly where it is, it's rotation. if you look at friday, dvy was up 1.56% when the market was down, you know, shy of 1%. that rotation was kind of crazy and i think it's to yourpoint, joe, we need to look for revenue growth and the leadership in revenue growth is shifting. >> jenny, maybe it's nothing more than these are just little trades that you could find opportunities in in the market and they're not really long term investments but that's probably just enough to get us through this period. >> don't you think that one of

12:09 pm

the reasons why we got to the peak was the narrative that rates are coming down? that we started the year looking for six cuts and then we were still looking for three until recently. undoubtedly in my mind that was the reason that we got to where we were. >> but i also think we got to where we are on the explosive growth from nvidia and the semiconductors and the ai. >> let me make one more point, jenny, and i will turn to you, but countering that we've seen earnings growth come down from 7% to 2.7%. so in spite of that, you know, because -- >> it's never been about the overall earnings growth of the s&p. >> it should be. >> it's been about the earnings growth related to generative ai, the semiconductors and the companies that are most benefitting. >> what does caterpillar have to do with ai and that move? >> let's go back. when you said didn't we get there because the fed was going to cut, yes, and that goes to

12:10 pm

your earlier point -- >> not entirely but undoubtedly played a role. >> a huge role. they pulled the narrative forward. that's it. i think the narrative for the whole year remains in place which is why we may end up perfectly well. >> which is why after you work through this period if it remains just a little period of pull back, people are still bullish figuring that, again -- keep your eye on the ball. cuts are coming, economy still looks pretty good. now, maybe the economy isn't as good as people want to make it out to be under the surface maybe it's not. wise points to certain metrics and others point to other things that maybe would suggest that. ubs today their strategist not an analyst down grades the big six, we've stripped out tesla from that conversation based on the magnitude of the pull back it's had and its market cap doesn't make it one of the mag seven, they say the momentum is collapsing in these names.

12:11 pm

expected to decline from 42% to 36%. the engine of the stock growth is maybe stipg a couple of beats. it needs to get a bit of a tune up before it can reset to a degree. >> and if in fact that is what is going to be reported then we are going to have to do more work in this bottoming process that i believe we are in, can price deteriorate further? absolutely it can. i'm not going to sit here and pretend that if we have earnings that are perceived to be disappointing for the mag seven that the overall market is not going to feel the wrath of that. >> of course it is. >> maybe they're not going to be disappointing, meta is wednesday, alphabet and microsoft is thursday. they haven't disappointed yet. apple doesn't report for a bit. so enough to, you know, quote, unquote, wroer about that. nvidia is not for a month. we are talking about a month before we even hear from nvidia and, you know, doubt that earnings report at your peril,

12:12 pm

at least what you've been taught, i guess, over the last couple, two or three earnings reports. >> we learned that in february. >> right. we will have to see. what's the point you want to make? >> the point is it's hard for people to think about going from 42% earnings growth to 16% and thinking it's not disappointing. that's not disappointing that's normalizing. why would it be disappoint to go say, hey, nvidia used to grow at 60%, they're growing at 30%. that's fantastic. >> why would that be disappoint sng. >> if you look at the stock appreciation -- >> pull it forward, starting point it today -- >> it would be disappointing if you are talk being 42% to 16% and assume that the stock price wasn't going to have a commensurate correction. i mean, let's be honest. >> it should run up. okay. follow me with this. so nvidia ran up, it ran up why? earnings growth was 100% or 60%. >> earnings growth has been incredible. >> now it's kind of reasonable for what it is. it does not need to sustain that level of earnings growth forever

12:13 pm

to still have a very successful case in front of it. >> sure, but the difference s you know, the narrative around it or at least the thinking was you could deal with that in a declining interest rate environment. if you are going to have more pressure on the markets due to higher for longer interest rates then everything needs to get some level of relating. it took a while but maybe last week and certainly the tail end of that was the beginning of that process. >> but i would also say that the relating came in the explosive earnings where it drove up the denominator bringing down the overly high valuation on a lot of these. i think they're set. this goes to what you were saying before with apple at 23, amazon at 20, whatever they were, they are all in the low 20s now, those are reasonable. when you're trading at 60 times you need 60% earnings growth. when you are trading in the low 20s 16% earnings growth is okay. i think that's where the ubs strategist is interesting. all they're really saying is these are still good companies but we don't expect the magnitude of performance

12:14 pm

leadership. the magnitude of growth is slowing. fair enough. >> the other point is that so far any pull back from these names of any degree has been bought. you have had people step in and buy the dip. our bill baruch is doing just that, a member of the investment committee, he joins us today via skype. so you bought more tesla and you bought more meta. why don't you start with meta first because it's approbo to the conversation we're having here, it is the first of the mega caps to report this week. again, tesla is tomorrow but it's been skripd out of the mag seven. >> yeah. remember a couple weeks ago i announced this meta buy, we did not own it at the time and it's sitting in our bottom ten. basically we bought in around 520 as a new position, i'm increase that go significantly to now that we are he below 500, so it's right in the middle of the pack, it's not in the bottom ten of about 40 names right now. i think they could have a good report, i like what their

12:15 pm

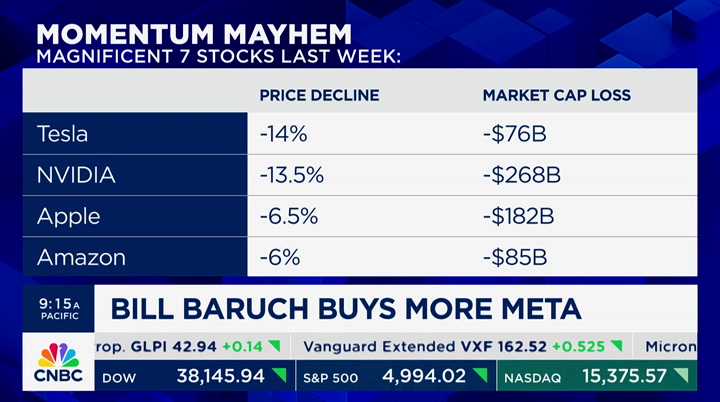

partnership is and the directions heading with google. we have meta's ai assistant integrates realtime search results with google and bing. we are talking about innovation they're heading down the right direction. if this is a great report from meta i want to make sure it impacts my portfolio properly. >> do you feel like when you look at the mega cap correction if we are in the midst of that and it's hard to deny that we would be when you look at the declines last week, for example, of 6% for a meta or 6% for amazon, 6.5% for apple, 13.5% for nvidia, microsoft obviously pulling back along with alphabet, too. what's your gut tell you about where you think these stocks are going to rerate at? >> i think we've seen last week was really the thick of a rotation, a correction, however you want to look at it, but at the same time our method is to do the small things right, over and over, stick to your plan and

12:16 pm

this is something that we were prepared for. you know, rates move very quickly, i think stocks and just in tech especially as you go out long duration tech assets seeing the speed in which the ten year moved, the two year back above 5% that definitely shook things. then you have just overall profit taking i think that came in, too, ahead of these big earnings reports. this was something we were ready for, we brought down our tech exposure between february and april, brought it down by 10%. some arguments, you know, the real tech sector itself we were around 50%, we are below 40% now, too. we are prepared for it and we are using this as a bit of opportunity to go shopping. >> so you went shopping for tesla as well. i want to hear your explanation for this because you could certainly make a credible arguments that, you know, the stock is broken and the story may be, too. if you want to focus on repeated price cuts in the face of, you know, the street thinking, well, they're done doing that and then

12:17 pm

maybe the shiftfrom the lower cost vehicle to the robo taxi idea and just real questions about where the trajectory of this company goes from here. >> yeah, absolutely. the story is in pain right now but that's something that we all know. it's been in the head liens, it's an emotional name whether you love it or you hate it. i think right here we're heading to this earnings report and for a lot of tech names it's not about what you did for me it's about what you are going to do for me. a lot of this bad news has been flushed out here. yes, it's falling, i don't like biology falling knives, i don't usually step in and make a statement so i go increase just a bit. it was the bottom ten of our holdings and, you know, added about 25% to it. i want to make an impact at this level, dollar cost average in. we hit a trend line. if you go back to the march 2020 low, this is the trend line into that march 2020 low at 140.

12:18 pm

yes, back about a month and a half ago when i did add in the 190s on the show, i said 160 was my line in the sand but we've seen a relative correction in overall tech assets which allowed me to be patient with the name coming in a bit. i want to add it ahead of earnings. they may miss but what they are talking about in the future is going to be driving this stock. tsm, netflix, asml, they were solid quarters, the reason why all turned lower was because of how they looked at the guidance and some of the moves they made. >> one of my problems with technical analysis is trend lines don't mean squat if the fundamentals of a story change. >> absolutely. i'm not -- i'm not arguing with that. i'm taking a calculated position here. we own it, it's in the bottom ten. if i own this name i should be adding to this 140. i'm not saying, viewers, load up on this, it's not bottom ten, have increased the exposure with

12:19 pm

cash we have at 25%. a significant position here. the fundamentals are not looking good. everything has been flushed out of this name. that's what i'm looking at as a trader, as an analyst and the rotations we've done, small things we've done, the names we wrote up, the names we trimmed, it's given us this opportunity to be patient without the performance we have this year and say let's lean into a little bit of a stake into this earnings report. >> i appreciate you coming on. i will see you back on the desk soon. let's talk about apple in terms of dip buying. morgan stanley today, airing woodring sticks with it. he cuts his target. says he's still overweight, he weighted with 210, the surprise starting at 165 now, a slice come down on the target. you have this june event wwdc looming. maybe there is not going to be a

12:20 pm

whole cavalry of negativity getting ahead of an event like that. bofa names it as its top pick for the year. what do you think here? >> look, it's very difficult for me to be able to offer commentary on apple because i'm conflicted personally and what i see in the rules based strategy. the rules based strategy is incorporating technicals and to your point before fundamentals can change and technicals might not reflect it or technicals can change and the fundamentals remain the same. i'm not so sure that in the case of apple it's not a scenario in which the technicals have deteriorated and i don't know if the fundamentals are consistent with that. i don't know that the fundamentals while the revenue growth is slow, while china is a headwind i don't know why it's concurrent with the type of technical deterioration you're seeing. i have to acknowledge technically the stock looks like

12:21 pm

it has negative momentum that's nor certain. on the fundamental side in june i would be surprised if apple didn't deliver on ai. i expect that they will. >> two weeks ago the stock looked like it was getting its mojo back. it was at 175 based on the one day announcement where you had -- you had the best stock performance for apple in something like that year based on the announcement. >> you did and there was clear enthusiasm and i was part of that enthusiasm surrounding the premise that now ai is going to finally be introduced by apple into the products that it's giving to its consumers. hopefully in june you get more information on that but the runway is long until june and during that period really technicals are what ultimately is guiding me and they don't look good for the stock. this he don't. >> buying the dip, looking at something that's come down a bunch and saying i'm go going to add to my position, that's what kevin simpson has done and he joins us now. good to see you.

12:22 pm

it's about 4% allocation for you now, you started buying at 184, you bought more as its stock fell to 174, last week you bought more at 165 and that's where it currently sits. take us through the thinking here. >> we like the long term thesis of apple because of its cash flow generation, headlines can be exciting if we mention the word ai and we have the carnival, the fair, the big day next month where i think they will introduce it, but it's the cash fle for us. if you remember back around thanksgiving we sold the position around 190. we love apple we just don't always like the price that it trades at. we bought a little in the low 180, a bit more in the 17 0s, on friday there was an opportunity to get in at 165 which we did. we have a 1% allocation we can add to and that we will because to joe's point we don't think we've called the exact bottom here. we like the stock down here, we think it's a good name to accumulate and we will buy more on weakness. now, one thing you don't want to

12:23 pm

see is for the stock to continue to go down to perpetuity, that wouldn't be great. >> what are you thinking about the nasdaq's correction, pull back, you can call it whatever you want, but friday was a bit of a wake-up call for people. >> yeah, not looking at the nasdaq specifically but at the s&p 500 i think we're only 5% off the highs and we always expect 10% pull backs to be a regular occurrence with the market behavior, we didn't see anything for five months, it was straight up every day. so nothing would surprise me in terms of another 5% draft down simply because we've been a little bit ahead of our skis. we priced everything to perfection and we can clearly see with inflation and then the results in the behavior of the fed in terms of their commentary we are not in that same perfect mode we were hoping for. another 5% pull back is normal, it's wealthy and we will continue to be buyers. we have 10% dry powder right now. >> next time i see you i will go

12:24 pm

through a number of other moves that you have but i want to move on. we have stuff to get to. i appreciate you coming on about apple. that's kevin simpson joining us. you saw that intraday chart from the s&p 500 it's right there. so we've recovered a bit here and we're at the high looks about just the highs of the session, about 27.3 points or so, trying to get 5,000 back on the s&p, dow is if good for 173 as well. i want to get to one more move before we take a break because it buys into the tech story not buying dips is asml, you sold it. >> i did. i sat with the earnings and wanted to think about t i didn't want to react to it immediately on the earnings. stock came down substantially while i didn't sell at the bottom, not all that far from here candidly and the reason being is is that it's a different market. i have such tech exposure between meta and microsoft, alphabet as we talked about and also amazon, we can quibble

12:25 pm

whether it's retail, whether it's tech, i look at it as tech because aws drives it. and then i've got vertiv and taiwan semi. if i look for the one i love least, i think has the most time to recover that's asml. now it's a complete show me stock. i was right that the quarter was going to be disappointing, so was the rest of the street. everybody thought it was a show me quarter. this he didn't show me so now i have until they report the third or fourth quarter to get back in the stock if i choose to do so. it's more portfolio positioning than specifically this. netflix, conversely, i don't know if we will get to it later in the show -- >> sounds like you want to get to it now. >> i do because it's on my mind. look, i said i'd buy it last week and i didn't, didn't sell what i have, it's a small position but now i have to think about, okay, this he did away with reporting subs, which is what apple did five years ago,

12:26 pm

but, i don't know, i don't think the market can get to increase my exposure. >> you thought if they miss the stock was going to come in, little did you know that they would blow it out of the water -- >> change the rules. exa exactly. exactly. again, i'm not interested in increasing my exposure, if anything my exposure is my equity exposure is pretty much nothing. >> let me take a quick break. we will hit stocks on the move today including verizon, the worst performer out of the dow ghnorit w. cisco and salesforce and many more dmams as well. they respons with phone calls... and they don't 'circle back', they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team.

12:27 pm

12:28 pm

you've got xfinity wifi at home. with reliable 5g connectivity. take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today. if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now.

12:29 pm

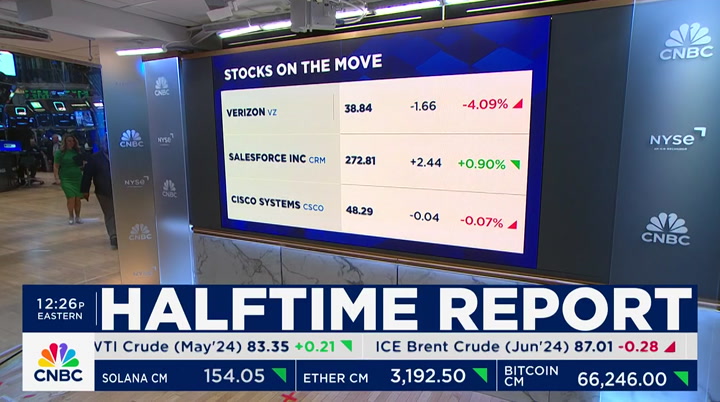

all right. we are back. some committee stocks on the move today we want to trade, starts with verizon, down 4%. jenny they reaffirmed the full year guidance, did post fewer first quarter sub losses, it is the worst performer in the dow today. >> right. so i think it's down 4% because they missed on cash flow and that probably startled people a little bit, but it doesn't really impact the longer term story that can happen for a variety of reasons, pull forward, pushed out, whatever. i think what's important for me as an investor, you as an investor to focus on is the fact that the stock trades at eight times earnings, has a 6.85

12:30 pm

dividend yield, should grow earnings in the low single digits like 3% next year, 5% the year after that. so if you are in verizon for the right reasons, which is to make a ted gee return, that's totally in the cards still. if you are putting 6.85% in your pocket and seeing the shares grow in line with earnings, an extra 3%, i will take 9.85% total return over the next five years anytime and i think this earnings report has no impact on that trajectory. >> joe, i remember when this news broke, you were on the show with salesforce apparently in talks with informatica. you did not want them to do that deal, you said they had gone through this period where they had done a bunch of deals, investors were tired of it including yourself which is why you didn't want this deal to happen now apparently it is not. stock it up albeit slightly on that news. what do you think? >> i'd like to hear from sales force that they are not going to

12:31 pm

pursue any other deals now that informatica has said they are not for sale. >> i characterize all of that correct, right, you're tired of the deals? >> the last several years they've moved away from being the serial acquirer. they've disbanded the m&a division, it was exploring and getting all of these activities and focused on the bottom line, on the company, on cost efficiency, they focused on their presence in artificial intelligence and it's one of the reasons why the stock had such a dramatic advance from 200 to above 300 in the fall into the early part of this year. i just want salesforce to stick to that, have that priority focus. if there is a small deal that could beaccretive and additive to the company i'm fine with that, but i don't want to see the big deals. i don't want to see that type of free spending from salesforce

12:32 pm

because what they have been doing over the last 18 months is working and when it's working stay with it. >> weiss, you're looking at this stock. >> i am. it's got to come down a little bit more, again, i don't want to increase my market exposure but they're growing bottom line at 20% and every company that we talk to, i would be hard pressed to think of an exception, uses salesforce or they're integrating salesforce. they have no peer in what they do. i'm like joe, though, i mean, they used to make acquisitions when they were growing and now with the side of this it's not going to be accretive anymore. the culture of destabilization when you acquire a big company hurts. i'd rather them focus on the task at hand. >> cisco gets cut from neutral to overweight, price target goes from 53 to 62. they called the valuation is inexpensive sets up a good near term but the medium term is muted. >> one week ago when i was on we

12:33 pm

were talking about the fact that bank of america had upgraded that. that's fine. what i like about the down grade is the downgraded price target is $53 which would imply over 10% upside from here. cisco is a tricky one, as old school as it gets, trading at 13 times earnings, really limited low single digit earnings growth it had, but if there is an enormous boom in ai spending that has to flow through to cisco and as you increase your networks, everything, that benefits cisco. i think that those earnings estimates could be low. i also just think it's funny within a week to see two analysts have different opinions. >> top picks at bank of america today, joe, both kla and applied materials which you own both. kla price target is 850 and the amat price target is 222. i don't know if we can show both. a picture of both. >> semi equipment companies that last week declined in the wake

12:34 pm

of asml falling short on orders, so there's three semi equipment companies, lamb research, applied materials, kla corp., these are the three all stars in the semi equipment space. logically it looks as though with this pull back here it's the right spot to buy them but you're just relying on t technicals there. you need to hear form ans that what we witnessed from asmo is not also affecting them and that suggests that investors must wait to hear what is delivered in earnings. i would not be stepping out and doing anything right here. >> let's get to contessa brewer who has the headlines for us today. >> hi, scott. the trump hush money trial adjourned for the day, opening statements were delivered by both sides, prosecutors say this is a case about criminal conspiracy and cover up, the defense insists nothing criminal happened. former "national enquirer" chief david pecker the first witness called. his testimony is expected to

12:35 pm

continue tomorrow. the supreme court is weighing how far cities and states can go to police homelessness. the board is reviewing an appeal from a group of homeless people in oregon who challenged local laws banning sleeping in public which they say violates the eighth amendment ban on cruel and unusual punishment. and tom brady is about to be in the hot seat. the retired nfl legend will be in netflix's first ever live roast called the greatest roast of all time. tom brady hosted by kevin hart. it will make history for being the first live roast on any platform to air unedited and uncensored. the roast will stream life on may 5th. presumably, scott, not something i will watch with the children. also who would put themselves at the center of that? you want to be first? i don't know. >> a good roster, too, by the way. >> going to be awesome. >> thanks. up next, betting on the next up next, betting on the next bi

12:36 pm

trading at schwab is now powered by ameritrade,g th. bob pisani joins us next. unlocking th e power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab.

12:37 pm

12:38 pm

investment professionals know the importance of keeping their clients on track. sometimes they need help cutting through the noise, to ensure fresh investment ideas keep flowing, and to analyze the market from every angle. at allspring, we deliver the unexpected, by relentlessly exploring where others don't. allspring, follow the insight.

12:39 pm

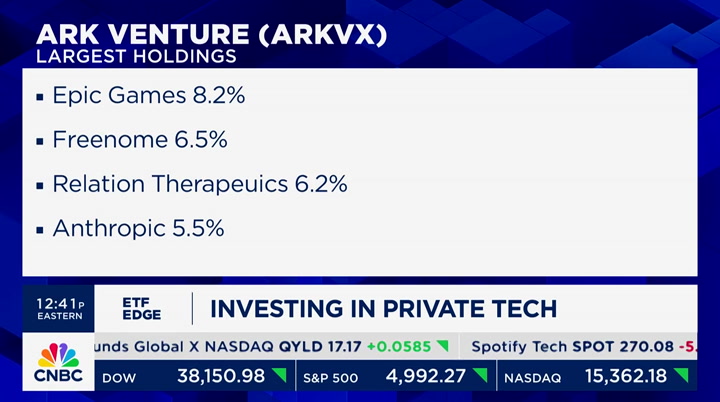

we are back. let's get to bob pisani now. >> there is intense interest in trying to access the shares of tech companies that are still private, like spacex and openai. a closed end fund recently began trading on the nyse and is trading at rather large premium to the net asset value, but are there other ways to access private tech equity. let's talk with brett witten the chief futurist at arc investment. you and cathie wood launched the arc venture fund in 2022. this is an integral fund that invests in private tech companies like spacex and openai and also public companies like coin base and robinhood. you published a paper claiming it is a superior way to invest in private companies. can you explain why it's superior. >> an interval fund allows you

12:40 pm

to invest daily or at the underlying value of the assets in the funds and then you can redeem on a quarterly basis. so it allows for efficient allocation to liquid assets like venture innovation companies. >> with an interval fund you can buy at any time at the net asset value and you can sell to the company at a set time on a quarterly basis, is that right? that's how it works? >> yeah, exactly. and so it's the right product for exposing yourself to less liquid assets like venture-type companies. so as opposed to a closed end fund structure where you may be investing $100 but there's only $25 of underlying exposure into n. that investment so you're buying $25 per $100 in interval fund allows you to buy the amount you invest is identical

12:41 pm

to the value of the underlying exposure. >> it addresses the problem of trading at a premium or discount to the net asset value. you're always buying at the net asset value, is that correct? >> exactly. exactly. and that's why we chose that fund structure because we think it's the better way to get access to venture exposures for every day investors. >> right. so why does the fund own both private and public companies? you own public companies like coin base, for example. >> yeah, so the public part of the book is intended to allow us to meet quarterly redemptions. so we maintain a public part of the book for kind of liquidity purposes but the majority of the exposure is in private venture companies like openai and spacex. >> just quickly explain why can't we just solve this whole problem and just float an etf with these private shares

12:42 pm

underneath them? what is the problem with doing that? >> yeah, with an etf, which, you know, we think is a great wrapper for public equities you wouldn't be able to accommodate exposures to venture products. you can't buy or sell a private company on a daily basis to meet the redemptions and demands on an etf basis. >> okay. thank you. much more coming up on how to invest in private tech equities. that's coming up on etf edge at 1:10 p.m. eastern time. brett will be joined by forge global which recently launched an invest i believe index of private tech companies, also joining us is data trip. that's etf edge at cnbc.com. still ahead, we're going to get the set up on some key earnings this week and we will do that next. s&p still good for 26. just shy of 5,000. be right back.

12:43 pm

[alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com. so this is pickleball? it's basically tennis for babies, but for adults. it should be called wiffle tennis. pickle! yeah, aw! whoo! ♪♪ these guys are intense. we got nothing to worry about. with e*trade from morgan stanley, we're ready for whatever gets served up. dude, you gotta work on your trash talk. i'd rather work on saving for retirement. or college, since you like to get schooled. that's a pretty good burn, right? got him. good game. thanks for coming to our clinic,

12:44 pm

first one's free. business. thanks for coming it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. it's the go-tos that keep us going. the places we cheer. trust. hang out. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. powering more businesses than anyone. powering possibilities.

12:45 pm

the stock market does. in fact, most people don't find them all that exciting. but, if you're looking for the potential for consistent income that's federally tax-free. now is an excellent time to consider municipal bonds from hennion & walsh. if you have at least $10,000 to invest, call and talk with one of our bond specialists at 1-800-217-3217. we'll send you our exclusive bond guide, free with details about how bonds can be an important part of your portfolio. hennion & walsh has specialized in fixed income and growth solutions for 30 years, and offers high-quality municipal bonds from across the country. they provide the potential for regular income are federally tax-free and have historically low risk. call today to request your free bond guide. 1-800-217-3217. that's 1-800-217-3217.

12:46 pm

it is heavy, aside from kicking off mega cap tech we have cadence design today after the bell, nucor, ameriprise, jenny, we have some tomorrow that are in your wheelhouse. what do you think about these? >> cadence is the one that's very interesting to me. this is obviously a software semiconductor ai play. it's had a phenomenal run here over the last 18 months. now we're seeing a little bit of an earnings acceleration, stock is in somewhat of a precarious position. options implying a 5% move which is a pretty big move post earnings for this company. i'm looking here if you get the washout, this is a name that on the washout given strong fundamentals you want to buy, i need to see a little bit of

12:47 pm

further price deterioration before you step in. >> nucor or ameriprise which stands out. >> ameriprise you will get the stronger results here. the sentiment is more bullish towards a lot of these financial services companies than clearly it was in the last 12 months. on nucor you are looking for a little bit of a revenue contraction, somewhere around 15%. >> jenny, tomorrow you have freeport and jetblue before the bell. >> jetblue first, what i'm looking for on that call is finally a path to profitability. right now analysts have them breaking even in 2025, pre-pandemic in 2019 they earned $1.90. they should be able to at some point get back to a dollar. if they do it's trading at seven times earnings. what i want to hear tomorrow is we have the noise out of the way, here is where we're going and when we're going to get there. they better some out strong tomorrow. freeport is really interesting. if you look at earnings estimates from analysts they are all over the place. some analysts have 2.35, 43

12:48 pm

cents next year, some with 3.60. this is a long term booming demand story. as data centers power ai it's going to require an extra 1 million metric tons of copper by 2030. so what i want to hear from them is just them talking about how huge that demand is seeing copper prices up more, evs take up four times more than ice engines, it's just a cool long term story. it should be a great quarter. >> we will take a break. within we come back mike santoli is with us for his midday work next.

12:51 pm

12:52 pm

it's sort of indifferent i think the boringness of the morning action just in the narrow range and stress evident is probably in the positive and it shows you there wasn't this self-reinforcing mechanical unwind that needed to continue today because last week's action could have told you that. so far no deep fade in an intraday rally and we'll see if that lasts and the market breadth is positive today and one thing that maybe people have to be prompted to notice is the bond market has been nothing for a week and yields are flat and if it goes down enables the stock market to get its feet under it. again, there's a lot to prove and it's got to be up 3% before you're turning the tide on everything. >> it just seems it took the market a little bit of time to catch up to the bond market in terms of what the bond market was telling us about higher for longer and the stock market in some sense was, lick, talk to the hand until it couldn't anymore. >> look, the stock market was

12:53 pm

going to focus on the market to a fair degree and it's going to anticipate earnings and it's going to say the economy's good and why am i going to sell for that reason for as long as may be possible. >> so the yield has to go to a certain threshold and stay there before you're convinced that you have to recalibrate and there's a way that you describe what's going on and it's just a messy, messy rotation and it's getting hit and the rest of the market is up there and banks are up more than 1%. i'll see you over the next hour and that's mike santoli and i'll see you after "the closing bell "qwbell" "we'll do finals next.

12:54 pm

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient.

12:59 pm

i hope you'll join me at "the closing bell" today at 3:00 eastern time and we'll see if the bounce for stocks holds today. s&p trying to take back 5,000 and we'll see what transpires over the next hours, gabriela santos and king lip on tech will be with me. i hope you will be a too. >> weiss, you have something for me? >> taiwan semi, while i'm not putting into the market this is cheap. >> jenny harrington? >> my year-end contrarian play was sl green and last week, buried amongst the horror of the week when the stock was down 10%

1:00 pm

they had great earnings and we'll have 6% yield and ten times sfo. >> staying with that commercial real estate play and joe t.? >> tough to find strong, positive momentum in the market right now. patience is probably the best position, but goldman sachs is one name in which you will find strong positive momentum. i think it continues to put. >> see you on the closing bell. "the exchange" continues right now. thank you, scott. we will see you on the bell, indeed. meantime, welcome to "the exchange." i'm tyler math eson in for kell, van, and you have pce and it could be a market-moving week big time. if there is say pullback the market tells us why and where he's looking for opportunity. plus speaking of pullback, some of the semi names are in a bear market, but our analyst sees strength ahead and soon. he tells us when, why and which names he sees best positioned across the chips

31 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11