tv Squawk on the Street CNBC April 22, 2024 9:00am-11:00am EDT

9:00 am

uses, but you can use cash, right? >> you can use cash. >> did you see that. >> i did see the article. >> did you think about me when i read that? do you ever think about me? >> happy passover. >> thank you. thank you. >> thanks, tom. >> make sure you join us tomorrow. "squawk on the street" coming up right now. ♪ good morning, welcome to "squawk on the street," i'm carl quintanilla with jim cramer and david faber. mideast tensions ease, the house passes some foreign aid, and we get set for a third of s&p market cap to report earnings this week. our road map is going to begin with stocks aiming to rebound following the s&p's worst week of the year, investors gearing up for that headline. tesla is slashing the prices on several of its vehicles.

9:01 am

that's hoping to boost sales. the stock is on pace for what would be its seventh straight day of losses. it's down 20% in this month alone. and the house passing legislation over the weekend that could lead to a ban of tiktok in the united states. let's begin with the markets after last week's tech selloff. you now have 29 of the nasdaq 100 components down 20% or more below their 52-week highs, more than 3/4 of the ndx falling from such highs. friday, the equal eight s&p, best day in a few years. >> you know, we saw something really interesting on friday, super micro, down 25%. that's an analog to nvidia. nvidia has much higher intellectual property. that's because it announced when its quarter is coming and this is the first time in so many quarters they have said, hey, we're doing better than expected. it's similar to what happened to broadcom.

9:02 am

broadcom, on april -- i'm sorry, march 8 -- said the same thing. they did not preannounce. go back to that period, the unemployment number that friday, that's the first time that powell got it wrong, big wrong, and interest rates shot up. i think this move is largely interest rate-driven move. it could be reversed by earnings, but only if the ten-year stays at 4.6% or 4.7%, and i don't know if that's going to happen. >> well, okay. >> i mean, i think it's bonds. i think that we all think it's stock, but the high multiple stuff is what's going down, and that's controlled by bonds. >> you just think that as long as -- what's the level, as long as we stay above 4.5%? >> we can't go above 4.7%. if we do, every stock is going to be hurt. if you look at nvidia, that's the poster boy for the decline, and carl, nvidia is the king of a.i., so what this really is, it's a revolt against a.i., because the stocks -- amazon not being felt that badly. alphabet is not being felt that

9:03 am

badly. none of the users of nvidia. but nvidia is the metaphor for a company that got too high. >> worst day on friday since 2020. we talked about the cover on friday, jim, and how they argue that competition is on the way. >> you go back to march 8th. that was the day where the stock opened up 5% and finished down 5%, which is a terrible island reversal. but that was the top of nvidia. and the top came when powell lost control of the narrative, because powell had been saying, look, don't worry. employment's going to show some slowdown. added more that friday. that was the peak. if you look at that peak, it actually came a day before, because what happened is it didn't close there, and that's by closing prices, but that's been the story. it's interest rates. i wish i could tell you there's more to it, but interest rates are what's in control here. >> although this ubs downgrade of what they're calling now the

9:04 am

big six is about, in terms -- is about earnings. >> well, that was -- thank you for nothing. these stocks have had a major decline, and what you have to try to do is figure out whether they bounce and go back down or just go bang down. if you looked at nvidia at 6:00, it was up 17. that would have been the kiss of death. you cannot have these stocks open up big. the s&p oscillator i follow went up a little on friday because we saw a dramatic increase in the procters and the wells fargos. lower multiple. >> right. well, procter, though, has never had a particularly low multiple. >> procter did have a very good number rise, and the market ignored it initially. stock opened down 3.25%. it's not 40 times. it has great earnings. >> yep. >> and i think that we know

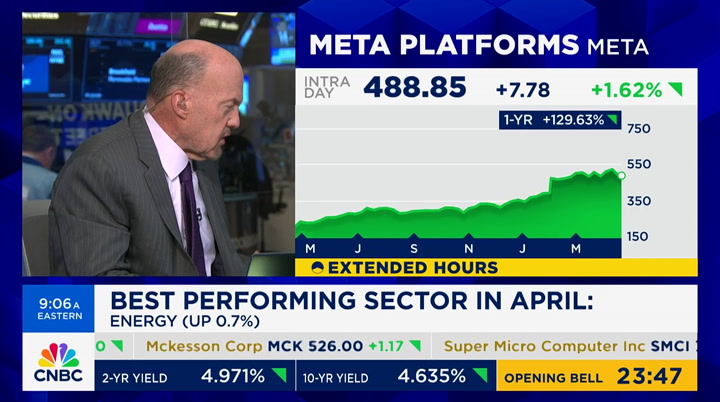

9:05 am

what's not going down is the two high multiples, meta and alphabet. >> i know. we're past that period we talked about a lot that lasted a couple weeks where everyone was wondering whether they were facing an kexistential crisis ad then kind of moved on from it. it always has been consistently cheap, alphabet. at least compared to its growth rate, in part because of the other bets and how much money they've been spending on everything else and the fact that they aren't seen as having the same amount of cost discipline or the concern about efficiencies, perhaps. it's always traded sort of more cheaply than the group. >> it has, but how many companies can get away with -- one of the positive notes was saying the whole point was cfo. let's say we're dealing with any other company, they didn't have a cfo, we would be saying, what the heck? alphabet has a unique set of assets, and youtube is the one that's consistently not talked about, but you can bet that if you broke up this company, it would be worth a lot more than

9:06 am

it's selling for. >> well, meta and, i guess, alphabet, by extension, getting some chatter today because it looks like this tiktok forced sale is going to move at least to the senate, and i think it was -- it's evercore today or wedbush says that meta is the most likely beneficiary. >> you take away the 15 to 20-year-old -- they go right to reels. the advertisers love reels. reels is the way you reach the people you can't reach through linear tv. david, linear tv is not really signifying any great strength here that i can tell. >> no. a lot of sound and fury signifying nothing, actually. >> wow, you're going right there? shakespeare? >> it's never too early for shakespeare. >> i didn't think frank holland over in london, they -- they

9:07 am

disavowed shakespeare. >> why? was there a problem with him? >> i watched shakespeare when i was at nvidia. they have no problem reproducing things. by the way -- >> yes? >> what would happen if you could reproduce your parents? this is a new thing that i'm hearing. crazy stuff. you record your parents, you can have them talk to you if they've passed on. >> well, i'm -- i've said this many times. you're never going to disappear. or i. we'll -- we could be uploaded in some fashion to the cloud, and then recreated or at the very least, to your point, yes, our avatars will exist on forever. it will be like superman when he went to see marlon brando. remember the crystals? remember the origina original "superman"? >> okay. >> kal' el. >> don't forget who you are,

9:08 am

where you are. >> i thought you were going up river in "apocalypse now." >> i see your brando and raise your tesla. you mentioned existential crisis earlier. well, i mean, what else is there to think about here? >> i guess the fact that apparently, if it only drops another 20 points, its market cap may be exceeded by that of toyota should toyota maintain its current market value. >> that is 100% wrong. it has to drop 27 points. >> 27 points. >> yes, david. >> the number is around 20. >> thank you, carl. i actually had not focused on toyota's market value being that high. >> toyota is really good ev. >> tesla is still tenfold that of gm or ford. >> the street was looking for 5,000 cybertrucks a week, and we have had a recall of 3,878.

9:09 am

i think i'm calling that below expectations. >> cutting prices in china, again. germany. postponing the trip to india and his meeting with modi. lee matches some of those price cuts in china, jim. that was down premarket. >> has it occurred to anyone that maybe he has to advertise? >> he's -- you know what? a year ago, when we sat down for our interview, right after the annual meeting, he had said he would start to advertise, but they never really followed up. >> never did. >> he -- but he did say they would consider doing it. i remember, because it was sort of newsworthy, and i followed up with a couple of questions, but then, nothing. >> nothing. you would think that next sixers game, he would have cybertruck ads. good numbers in that one. >> would that have been the game? >> that would have been the game. >> yeah. >> meanwhile, the uaw gets a victory at this volkswagen plant in tennessee, moving on to mercedes in alabama. >> perfect. that's the whole reason why they went there. remember, if you talk about why

9:10 am

did they move there, which was, of course, totally inconvenient versus michigan and, well, it was to avoid precisely this. ford reports this week. ford is an inexpensive stock. remember, ford and gm, if you get out the nonfinancials in the s&p, they're right there at the bottom. they're hideous. and they need to show they think their stocks are cheap. gm has done a better job because it has that monster buyback, but ford's cheap, and i hope it's not cheap for a reason. >> the reason being? >> that it's doing poorly. remember, they have i.c.e. and they have hybrid. they have the f-150. >> lightning. >> the f-150. the lightning. >> and their core legacy business is 90% financed. >> exactly. well, i mean, that's a pretty good business. as long as you can get people to buy. >> right. >> i happen to think that ford is the -- my travel trust owns

9:11 am

it. has it been a disappointment? i don't know. is nothing a disappointment these days? have you seen, carl, the percentage increases of a lot of the techs this year? they're, like, 1%. i mean, you could be doing better in the two-year. in the two-year, david. the two-year has a high multiple. >> there are plenty of people who have taken advantage of that. >> what do you think about the 5% two-year coming? we got a slam bang auction coming up, man. see that? got the two-year, which people think is going to yield 5%. we have a ten-year. that one's got a whole -- i'm sorry. the ten-year is to hold, but you have a two-year. you have a five-year. and we have a seven-year. so, you're looking at a gauntlet there of tuesday being two-year -- david, why is tuesday different from any other day? because the two-year is going to go to 5%. that's why. >> you think it will? we're going to be focused, again, once again, on auctions the way we were not that long

9:12 am

ago. >> like 1996? >> well, there is this concern overall, as you well know, that at some point, we may hit an air pocket, given the overall concerns about $34 trillion or more in overall debt. and the interest costs for the budget in terms of what that's going to mean. >> it's march 8th again. i'm telling you, march 8. that was when rates started -- when people realized the fed had no control. they were still talking about cutting. that turned out -- that was ill advised. >> it wasn't based on the movements in treasury market, per se, as much as it was the economic data. >> yes. well, i mean, we got a number that showed with 100,000 extra jobs barely any wage growth on march 8. that was the time to tighten. instead, they're talking about cutting. could you be more wrong? >> whoa. really? could you be more wrong? you're already going there? >> that was a book i've been totally in praise of. >> yes, you have, of powell. >> turned out his view was much ado about nothing. >> wow. with friends like this --

9:13 am

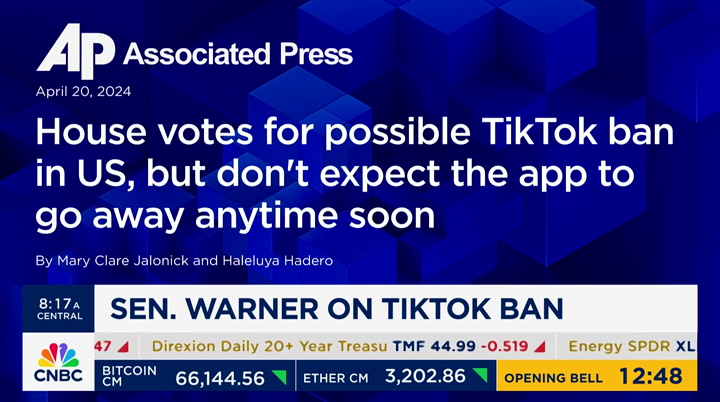

>> you want me to say "merry wives of windsor"? if you prick us, do we not bleed, you clown? >> we're going to get a gdp number on thursday and pce, friday. just part of our very busy week setting up. a closer look at tiktok following the house passage of that legislation that could force a sale or ban the app in the u.s. bunch of news today. verizon, truist, salesforce, kegoni, t some calls on cisco, amazon, and apple when we return.

9:15 am

you've got xfinity wifi at home. take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

9:16 am

9:17 am

functionaries of the communist party of china. >> i understand, but even with this significant bill, the timeline is such that it doesn't take it away as a risk for the election, and it seems the u.s. government is so limited in so many ways when it comes to these election influence efforts. >> the timeline of getting -- it's a complicated transaction. to give it up to a full year, i think, just from a business standpoint, makes sense. >> that's senate intel committee chair mark warner yesterday on "face the nation" after the house did pass legislation that could ban tiktok in the u.s. unless bytedance sells its stake in the app within nine months. the bill now goes to the senate, jim. >> yeah. look, i think that the information and the evidence, not there. i think that there's an understanding from chinese hacking that you can not trust china in any way, shape. the chinese hacking has accelerated.

9:18 am

david, the -- it's almost unstoppable. so, here is a form of chinese influence that, let's just say, could be -- could be, but there's no real hard evidence. but if you think that you want to maybe cut down on cyberattacks, maybe you go after them here. >> that is certainly the case being made by those who believe the app should not be allowed to operate in the u.s. as long as it's part of an overall chinese company. bytedance, an incredibly successful private company that -- that, by the way, makes enormous profits in china itself through its apps there, competes with the likes of alibaba, actually has a value that is far above that of the public market value of alibaba, just to put it in perspective, at least based on the last round, and if you even put a multiple on some of the numbers i hear in terms of the profitability of bytedance. i say that because there are

9:19 am

those who say, well, you know what? even if they were to close down the u.s., it wouldn't impact the company as much as you might think. >> right. >> although the value, obviously, you could argue is quite high for tiktok, given its p popularity in the u.s., and then we come back to this process that was outlined a bit by mark warner and that very well may be very close in terms of actually playing out here, which there is a hope somehow that bytedance would be able to sell the u.s. -- by the way, the bids that may be existing from mnuchin's group or bobby kotick or something he would put together are for all of the tiktok outside of china. it would be similar to what was done four years ago or the attempts that were made four years ago. >> organiacle? >> no, you would buy europe. it would be tiktok, you know, sort of the english language, australia, buy a lot of it. but the question, of course, becomes whether the chinese would allow it to occur. i brought up the idea that,

9:20 am

well, could you buy it without the source code/algorithm? sure. you get a user -- you put a lot of really high-powered engineers together to try to recreate it in some way, but you need that source code, at least for some period of time. it's just not clear the chinese are going to let it happen. >> what are they trying -- what's the goal of the influence? it's not clear to me who's more anti-china, biden or trump. >> goal of what influence? >> if you want to try to influence the american people, what are you influencing them towards, rfk jr.? >> just sow and create dissent. we'll just have everybody hate each other, it's probably pretty effective. >> i don't think that it needs tiktok's help. >> that may be the case, jim, but there is a very firmly held belief amongst those who advise some of these senators and who are involved -- have been involved in this process that the data does go back to china,

9:21 am

despite, of course, the continued protestations of tiktok itself, which says, absolutely not, and has moved so much of its data to oracle's servers, for example. >> right, right. >> and it spent an enormous amount of money to do that. one reason why the u.s. business is not nearly as profitable as it might otherwise be, because they've been spending so much on capex related to this effort to try to convince the political authorities that, in fact, they are not a back door to china. >> it's just a message. >> you can't do it. you can't send it to anybody. there's always this believe based on the chinese actions you were just talking about, that they'll always find a way. >> they've found a way through every method we have, so maybe punish them on tiktok or blackwell or nvidia, but we don't have a lot to punish them with. we could boycott their stuff. >> this thing could get done really soon, right, carl? >> feels like it's almost all the way there. >> you want to know what to do?

9:22 am

buy meta. don't outthink this. buy meta. zuckerberg, coming to town, really, for the time 100? >> nice. >> we don't know for certain. >> you going to corner him? >> of course. if he doesn't corner me first. >> exactly. we will get cramer "mad dash" and countdown to the opening bell. one more look at the premarket as a consequential week kicks off. i'm not an actor. i'm just a regular person. some people say, "why should i take prevagen? i don't have a problem with my memory." memory loss is, is not something that occurs overnight. i started noticing subtle lapses in memory. i want people to know that prevagen has worked for me. it's helped my memory. it's helped my cognitive qualities. give it a try. i want it to help you just like it has helped me. prevagen. at stores everywhere without a prescription.

9:23 am

9:24 am

9:25 am

some nasdaq 100 gainers. you'll see nvidia coming off the worst day since 2020. drawdown now 22% off the all-time high. that's the worst drawdown since late '21, early '22. opening bell is coming up in five minutes, and don't foet, rg just listen to and follow the "squawk on the street: opening bell" podcast.

9:26 am

9:27 am

9:28 am

the opening bell is brought to you by nuveen, a leader in income, alternatives, and responsible investing. all right, let's squeeze in a "mad dash" before we get to the opening bell and start trading here for the week. let's talk a little bit apple. >> yeah, lot of tepid defense. the stock, obviously, broke down at $165. a lot of people talking about that's the end of the technicals, therefore it can't rally. morgan stanley comes out and says, don't worry about it. volatile market, tricky set-up, but they think the march quarter will be good, but the guide will be bad.

9:29 am

bank of america, on the other hand, says, expecting a strong q2, but the guide could be lower. and then, wells fargo, signature pick. i read this piece. there's nothing good about it, but they like it. david, put them all together and you got 24 times earnings, 24 times earnings and 29 times earnings. david, you mentioned proteccter earlier. this is a company that needs to sell at a lower multiple if the bond market doesn't behave. i keep coming back to the bond market, only because i think if you get a 24 times earnings and a decent guide, which i don't expect them to do, you can hold where they are. i still think you can go to $160 without a problem. >> you do? >> yeah. >> we're getting closer and closer to june, when we will get at least what we expect will be some significant information about their plans when it comes to generative a.i. >> everyone's so bullish about that meeting, and i don't think that's the way to look at it. i think you have a new phone, the 16, and that's what i care about. the vision pro, david, has disappeared from the narrative. i think that's a shame.

9:30 am

that's a business-to-business product that they seem to think is a consumer product. very important. but you know, this is, again, a defense based on nothing. and i don't like that. there's nothing here that makes me want to buy apple. >> let's get the opening bell here and the cnbc realtime exchange. at the big board, amplify etfs and samsung asset management, celebrating the launch of the amplify samsung etf. at the nasdaq, hashicorp, launching the cloud. >> you know what else wants to do that is salesforce? by not having informatica, you're not going to include that in the platform. >> you want to talk salesforce? >> i was using a segue from the nasdaq. i thought it was cool, actually. >> i'll turn to you in terms of salesforce overall and the fundamentals of the company, but of course, we did see the stock of salesforce decline pretty dramatically early last week on reports that it was in talk to

9:31 am

buy informatica. it's a public company, although controlled by private equity. informatica comes out this morning and says, we're not talking, although informatica's policy is not to comment on market rumors and media speculation, the company announced it is not currently engaged in any discussions to be acquired. salesforce is rebounding. there's part of the statement -- they also came out with just an update on their business and financial conditions as well in terms of saying that business continues to be very strong, and thigh will discuss first quarter results on may 1st. but again, they shared that with us. salesforce is rebounding, jim, on that news. >> well, i think that we had a bunch of activists who were really gladdened by the fact that marc benioff, ceo, was saying everything about not spending a lot of money, about putting cash back in, trying to keep the stock-based compensation lower, from $10 million down to $6 million.

9:32 am

this would have been a different narrative, and i think the fact that the stock's only up 5 is terrible. i mean, it fell 30. >> it did fall more appreciably. it did. there was a belief, i think, amongst -- that would not be large acquisitions. this would have been a fairly large one. not nearly as large as their biggest, which was slack of a number of years ago, but not small. >> no. >> now, the analysts who wrote about it last week after the reporting that they were deep in talks seemed to find a strategic rationale for it, though. it wasn't as though it was out of the blue. >> well, look, i think it's been great at finding corrupt data. i remember pulling them aside and them telling me, we would have seen the wells fargo fraud, because we were able to demonstrate exactly how it occurred on a repeated basis. no one else made that claim. that wells fargo fraud was conceived to be impossible to

9:33 am

find, and informatica spotted it by looking at a pattern, and they weren't even in on the deal. >> i'm reading the barclay's desk. "while there might be some investors that are still aggravated that crm tried to make a meaningful acquisition after so much pushback, others will be happy to see they had some price sensitivity in their acquisition strategy." >> it's like, hey, let's show people we have discipline. >> it very much feels that way. the early reporting was the stock was above where they perhaps wanted to -- what they were willing to pay for it. but again, one of those situations where the markets learned about something, and obviously, it never happened, and so the stocks have readjusted a couple of times here, but to jim's point, salesforce has not taken back all the losses that seem to be, perhaps, a result of concerns amongst investors that he was -- that benioff and the management team were once again on an acquisition spree. >> my understanding is it's doing well. the bellwether for this week, i think, will be the one that poke aren't focused on enough, which

9:34 am

is, you've got servicenow. and servicenow is on wednesday, and we have every indicator that servicenow is doing very well, so the question is, will the bond market allow that stock to move higher? i keep coming back to the bond market, because i don't want to lose sight that the market peak came when we thought that there was going to be more rate cuts. and i know it seems almost pedestrian to focus on that, but it is the best prism to look at these high-multiple stocks. >> yeah. now, we'll present the same evening that ibm does, which is also getting a little bit of a curtain raiser on the tape today. >> i do think that the difference between ibm and the rest remains the fact that it has a price earnings multiple below 20, so therefore, can rally. in the same way that i find that there are industrials that have plus -- that are plus 20%, 20 ep, that are going down, and then there's ones that have below 20, and they're going higher. you know? it's about whether -- it's about inexpensive stocks that are less

9:35 am

affiliated with the bond market, let's put it that way. >> we should hit verizon earnings, guys, because it is one of the names, at least, we should take a look. there it is on monday. we got it this morning. it was -- it's being well received. the stock is up 1.8%. you can see it right there. said simply, consumer better than expected, business, maybe not, but consumer, more important than business. therefore, stock up be. >> i love that. >> you like that? we can move on now. >> well, there you go. >> right? >> we do have actual numbers, which i thought was important. there were numbers. >> the actual numbers? you want numbers? i'll give you numbers. okay? i can do that too. total revenues, $33 billion. that was below consensus. wireless service revenues, though, $19.5 billion. that seemed to be a bit above consensus. ebitda and line, that was $12.1 billion. and as i said, strong consumer

9:36 am

wireless performance seems to be what is driving the stock this morning. they simply lost fewer subscribers than had been anticipated. only, what -- yeah. net loss -- postpaid net losses of $158,000 beat expectations, and they were able to raise price and push that through to a certain extent, but there is a slowdown in business and a bit more ebitda weakness in business. so, business segment continues to be a bit of a drag, but overall, a positive response, given those consumer numbers. they seem to be -- this is another quarter where verizon has made some progress. >> okay, so, this stock was up a buck and a half when they reported. now it's up 60%. i mean, is that good? >> i don't know. you're the stock expert. you tell me. >> to me, carl, the essence, still, even though it's antiquated, is to makemoney. >> i see. >> and that -- >> so, the green arrows are the

9:37 am

good ones? >> yeah, but as that gain goes lower, i find it not as good as when the gain goes higher. now, that's not really talked about with verizon, because it's a bond. >> it is a bond. i like the 20-year verizon. a lot of people hold it for a long period of time. it's bone of those names that yu can imagine in many portfolios doesn't go anywhere, in part because of the dividend. that gives you a sense. the stock is up 21% for 20 years. >> the deficit -- >> you did get a dividend. that's not total return we're showing you, to be fair. but when you talk about what the aim is of investing, i don't think you want to own that name over the last 20 years after how about att? is that similar, or do you think that's not as much of a bond? maybe that's a junk bond? >> at least we got some -- at least the capex guide doesn't change over at verizon, jim. >> no. >> there you -- oh. there it is. 20 years versus the s&p. >> well. >> not good.

9:38 am

>> no. no. when i hear what carl just said, i worry about cisco, which was downgraded. >> jpm note. >> i thought that was -- wow. they're basically saying, one-quarter bounce from splunk. they bought splunk. david, campus network has always been negative for cisco. >> i don't know what you're talking about. campus network has always been negative? >> they have a thing -- >> cisco has a thing on college campuses? >> no. >> on campuses of corporations? where they hook everything up? >> correctobismol. >> and corporate campuses are getting downsized or erased? >> cisco doesn't even have a headquarters, really. but it's san jose, marginally. i'm just reading that's -- well, that business is the business that has not been that good. i was hoping that people would say that the new cisco, which is far more oriented towards cybersecurity, might be attractive. because the deal with splunk is accretive.

9:39 am

but -- >> these are not networking office campuses. >> well, i mean -- well, david, that's a simple way to look at it. >> i'm a simple man. >> yeah, well, it says jpmorgan, campus networking still facing problems. splunk is accretive. and yet it didn't matter. and i think, you know, you go spend a lot for splunk, get gary steele, splunk has good cybersecurity, and this is a guy just brushing it off. same old, same old. that's jpmorgan. didn't matter what they did. i don't know. that's why i came back to campus no networking, but david's talking about columbia or something. >> oh, no, let's not do that. we'll leave that to the other show. >> geez. >> what? we don't have time. we're all business, frankly, which leads me to paramount, guys. >> now we're talking. >> that's my business. can't help it but be my business. >> satellite business? like a -- like do you drive an uber? >> no, i'm not following -- one of those other things that all they do is follow that thing

9:40 am

endlessly. >> it's like a hobby. >> the news on thursday night, friday morning, i wasn't here friday, and that sent the stock up was that sony might want to join apollo in its potential bid to acquire all of paramount. >> had you been working, you would have killed paramount that day. it's like killed kenny. >> they killed kenny. faber killed paramount. >> they kill paramount every day here. >> but kenny always comes back. >> yes. >> just wanted to make sure. he always comes back. all right. here's -- listen. what i am aware of is that the special committee, which is obviously tasked with, right now, the exclusive bid that they have received as we've gone into some detail on from skydance in partnership with both red bird and potentially kkr, smaller partner as well, that's what the special committee is spending a

9:41 am

lot of its time on. they haven't heard from sony at all. take that for what it's worth. if you were sony and you were very much interested in being the majority owner in a joint bid with apollo, chances are you would reach out to this special committee, wouldn't you? and they may. they may still doll that. >> you're telling me that sony, which was the sole reason that stock bounced, has not contacted the special committee? >> that's exactly right. >> the stories last week smack of fantasy. >> the stories last week said they were talking about doing it but didn't specify that a bid had been submitted, and no such bid has been submitted as far as i'm aware and as far as the people that i speak to are aware. i would point out that in the past, when, you know, i've covered seony and the potential for it to engage in some sort of acquisition, the u.s. sony may want to do something, but it's got to get permission from the japanese sony, and that

9:42 am

permission is not always -- that acquiescence is not always forthcoming. >> does sony america have the money to do it? >> no, they're solely owned by japan. they need their japanese headquarters to say, go for it. >> okay. >> and in this case, it's unclear whether that's going to be the case. so, you can have a situation where sony u.s. would love to do something, but japan says, no. we're not putting the capital out for that. i don't know. but all i can tell you at this point is that -- that there has not been a bid received. there has not been any contact between sony and, again, the special committee that is working on and looking at and is tasked with a very difficult job, by the way, that i went into some detail that describing, right? they've got to figure out what the value of skydance is. they've got to figure out and check -- and do due diligence on skydance and all the cost savings that the ellison

9:43 am

skydance group says they're going to bring to the fore, and they've got to make some sort of decision about what paramount's shares are worth with the status quo. it's hard. and they're going to have all these shareholders that are ticked off regardless because they get headlines that say, hey, we might pay $29 billion for this thing. people back into math and say, why wouldn't we want to take a far higher stock price? it makes life a lot more difficult for the special committee. >> why can't andy jassy say, look, i want in nfl, so get jim nance and company. i want march madness. i want the masters. and i also get some really good soccer. why doesn't he want that? >> meaning, what? amazon buying paramount? >> well, i'm just saying that andy jassy has said, my thursday night nfl and the friday -- the black friday were the two most impactful things that have

9:44 am

happened for prime. >> i think andrew posed that question to jassy the other day, and jassy response was, we're happy with our content offering at the moment. the question might have been about mgm library. >> they bought mgm, and frankly, if amazon wanted to strike, they might be more interested if they really wanted to in buying warner bros. discovery, but they're not going to. >> it's a -- >> by the way, the regulators are not going to allow them. last i heard, the regulators are suing them for being anti-competitive overall. tough environment in which to go out and make a large acquisition. >> i think when you look at the value of sports, it just seems to increase everday. i mean, i think that we work, obviously, for comcast. i think you're going to see numbers for the olympics that are going to say, holy cow. i mean, maybe sports are more -- even more important than we thought. that's what i think that -- look, andy's a smart guy. and i know he's not going to do

9:45 am

anything stupid. but i also know that he loves the nfl. >> we are going to get comcast earnings on thursday. speaking of some of this, jim, regarding m&a and regulators, aci out with a small beat, i think, 54 over 51 with an amended divestiture plan on kroger. >> look, this is one i think that they -- this is about costco, walmart, and kroger. and kroger, by the way, has had a huge run here, because they had a great -- just a great quarter. albertson's, not as clear. kroger, david, how often have you seen a situation where kroger just doesn't need to buy albertson's? >> they'd like to, though. >> well, i think that they're -- there are issues, but they've got -- they have to, remember, put anything spin off with a really well capitalized. >> right. i mean, their point is that the divestiture package, and by the way, again, they saythey're even improving it, would have created a true competitor, would

9:46 am

have been well capitalized, as opposed to some of the deals we've seen in the past and this continued fear of antitrust regulators that you're not creating a real competitor when you do these divestitures, and their argument has also been, we don't compete against albertson's. we compete against walmart and costco. they are the largest competitors. we would be more able to compete and more likely to lower prices or make the experience better for consumers, rather than being on our own. >> robbie mcmullen has made this point over and over again, which is -- by the way, no layoff of union jobs. the president is a union president. but i think that the stock, kroger, acts like they can beat costco and walmart by themselves. but when you look at the pricing of the -- like, i don't know, 25% of kroger is below these guys, but you're just up against a different crew, and you have to realize that it's up to the antitrust regulators to decide who the real competitors are, and i hope that they're -- i think they've done a pretty good job. >> speaking of workforce

9:47 am

reductions, nike cutting about 740 jobs. this notice going out in beaverton. a "journal" piece, jim, that takes donahoe to task for not just lack of innovation, but turning their backs on the w wholesale model in favor of an economic model that didn't materialize. >> if you want a bottom in nike, it was that piece. that piece was the sum of all fears, nike. and i think nike is a great company. the stock has been a total loser, and yet they come in now with a negative article. i find that's bottom >> you do? >> yeah, i do. >> you're a buyer on the "journal" trashing them? >> yes. period, end of story. >> okay. that's as good an indicator as any. >> there was nothing in there that i didn't know. when you put it all together, it sounds like nike's lost its way. i'd like to lose my way like nike. they, by the way, made a pretty good sign up the other day. >> caitlin clark. >> yeah.

9:48 am

12 million people. think of the numbers of who watched. i want a caitlin clark shirt. >> did "the journal" put a $28 million -- >> is that the number? >> it was ten figures. >> how many men will buy those? i bet you a surprising number. first time. people thought it was going to happen years ago. >> you don't need men to buy them. you just need women to buy them. >> well, you think that brunson's more exciting than she is? >> no, i never said that brunson was. >> okay. i rest my case. >> but -- yeah. but it's going to be good when we beat you guys again tonight. it's tonight. >> take a look at the bond market this morning. we're in a bit of a blackout window ahead of the fed's next decision on may 1. ten-year was still climbing a little bit before the open. lost about 4.64% as we're still nine points shy of s&p 5,000. don't go way.

9:49 am

[thunder rumbles] ♪ ♪ ♪ ♪ the biggest ideas inspire new ones. 30 years ago, state street created an etf that inspired the world to invest differently. it still does. what can you do with spy? ♪ ♪ [thunder rumbles] ♪ ♪ [busy hospital background sounds] this healthcare network uses crowdstrike to defend against cyber attacks and protect patient information. but what if they didn't? [ominous background sounds] this is what it feels like when cyber criminals breach your network. don't risk the health of your business. crowdstrike. we stop breaches.

9:51 am

9:52 am

more signals this morning that the tensions in the middle east have at least been capped and with that crude back below 83, brent hovering around 86.5. we'll keep our eye on oil volatility. gasoline futures are about the lowest in about a month. wel t 'lgestop trading with jim in a minute. s&p 4992.

9:54 am

you're probably not easily persuaded to switch mobile providers for your business. but what if we told you it's possible that comcast business mobile can save you up to 75% a year on your wireless bill versus the big three carriers? you can get two unlimited lines for just $30 each a month. all on the most reliable 5g mobile network—nationwide. wireless that works for you. for a limited time, ask how to save up to $830 off an eligible 5g phone when you switch to comcast business mobile. don't wait! call, click or visit an xfinity store today. norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc.

9:55 am

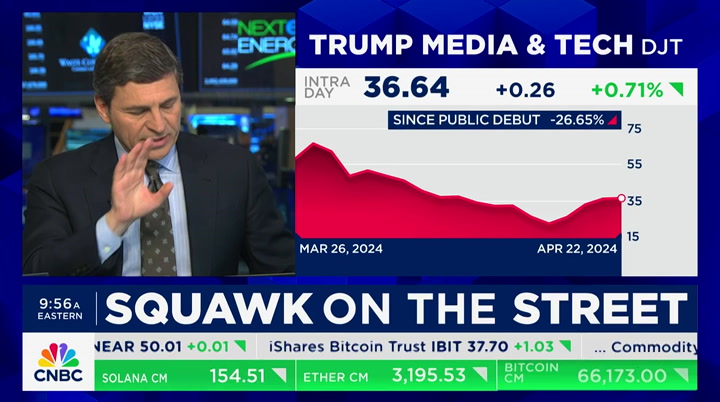

mobile savings are calling. visit xfinitymobile.com to learn more. doc? let's get to jim and stop trading. >> hilarious piece in "the new york times" about ken griffin attacking djt and the ceo, former congressman, he says that donald trump's media business is a loser and what's interesting is that if you remember, ken griffin got caught up with the game stop. here he is going against another one that's heavily shorted. i guess he can't stay away from controversy. you have to hand it to him. >> newness? >> no. you have to hand it to citadel. ken griffin saying this thing is basically a joke. i don't know, david. >> yeah, listen, it is, though, a potential -- it is a potential nest egg of enormous wealth for

9:56 am

donald trump himself who made the point many times, 78 million shares, 40 million behind that, roughly he is arguing with his partners about whether the 10% they own is theirs or not. >> the fundamentals speak for themselves. citadel for its part what a business they have. >> yeah. >> what a business they have. >> their own business. >> they run very differently than does, for example, millennium which is all separate teams. they have separate teams but they orchestrate the leverage for each of them and, obviously, shared data. he's done an incredible job is all i need to say. >> the best there is. no doubt about it. by the way, mega donor to the republican candidates, but favored nikki haley. i think this is one we have to keep track of because if they are able to break up the lockup, then suddenly michigan, arizona, the seven states, the

9:57 am

magnificent seven, there must be one, i have barrett gold on tonight. gold down big today. a lot of people worry why haven't the gold stocks -- with the price of gold. we'll ask mark bristow. >> worst day of the year. >> amazing. >> we'll see you tonight. >> "mad money" at 6:00 p.m. eastern time as we watch the marks eaof betahd ausy week. dow up 66. don't go away. bringing you an elevated experience, tailor-made for trader minds. go deeper with thinkorswim: our award-wining trading platforms. unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly.

9:59 am

what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow!

10:00 am

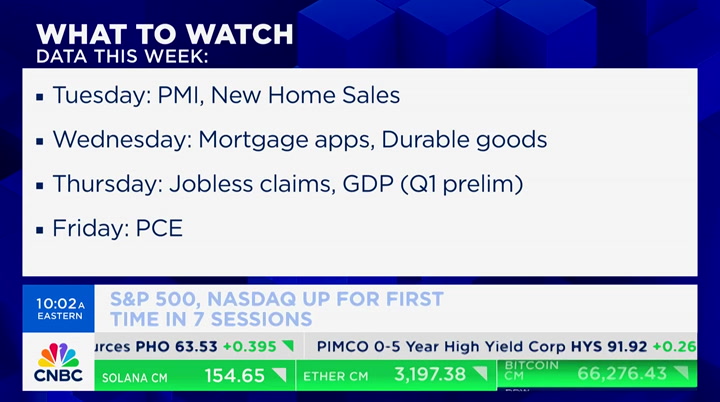

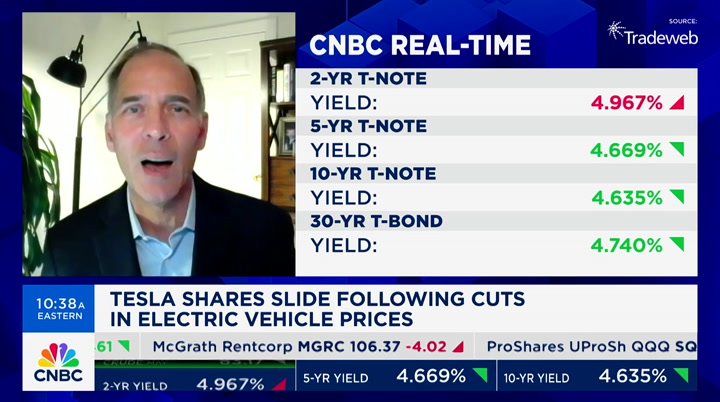

good monday morning. welcome to another hour of "squawk on the street." i'm sara eisen with carl quintanilla and david faber, live for you as always from president post nine of the new york stock exchange. stocks trying to rebound after last week's down week. the nasdaq going for three quarters of 1% after tech was hit particularly hard last week and dow up about 80 points. treasuries right now the yield

10:01 am

back up continues. higher yields across the board. ten-year 4.635, the 2-year 4.65%, this has been some of the source of the selling when it comes to equities lately. 30 minutes into the trading session here are movers we're watching. verizon on the move. the telecom giant beating profit estimates and reporting fewer than expected subscriber losses but the stock is down 2%. shares of tesla continuing to decline, hitting new lows. the ev maker announcing price cuts in several key markets around the world ahead of earnings tomorrow. more on that story coming up. cardinal health today the drug contributor one of the biggest losers on the s&p following news the rs unit will not be renewing their distribution support and

10:02 am

get first look at that. wall street consensus in the low 2s. we'll get at least 2% growth, very solid following that 3% -- 3.4% number on last quarter. and then pce, not so mysterious because there are inputs from march and cpi and ppi, we'll get the gdp number on thursday, but the expectation is -- and it's all about core -- we'll see a 0.3% month over month increase, and that will take core to 2.7%, which is a step down from the 2.8% and so the bulls will tell you, look, pce is more in line with where the fed's target is

10:03 am

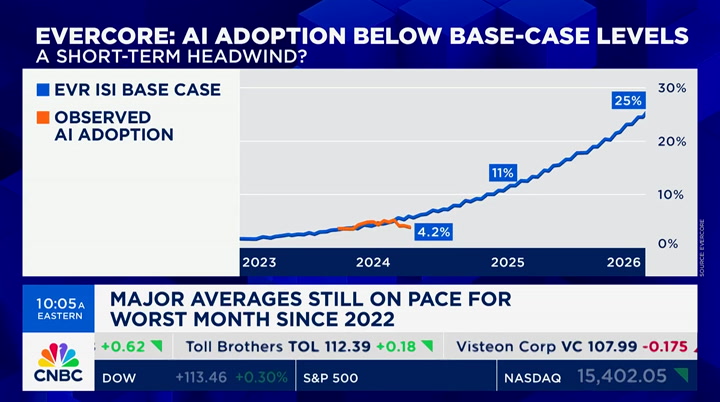

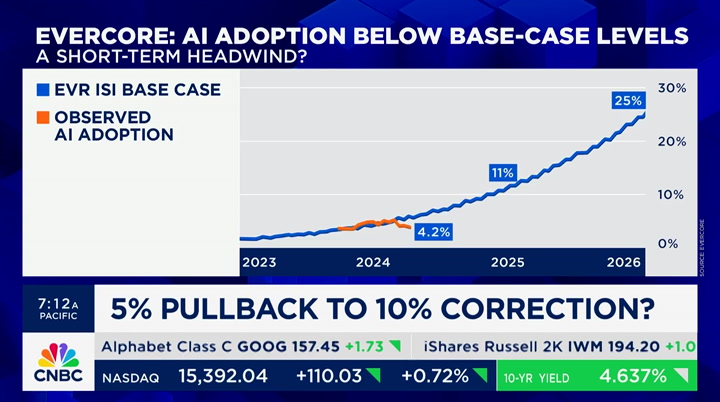

and going in the right direction. let's not get too spooked about ppi being a little firmer lately. that's what we're watching this week major. >> we have to wait all week to get the pce number on friday. >> exactly. you know, in the meantime, it is earnings season and we'll get a lot of key numbers and commentary which i always like. one of the areas increasingly that macro strategists are writing about and looking for in the earnings releases which is super interesting, it's just ai. and how it's being used and adopted and how it's producing goods and services. and so evercore isi did a big note on this and a deep dive. here's the job they said, actually every industry exposed to artificial intelligence. they were looking at the different kinds of jobs that would be exposed. finance at the top, share of each job by ai, by industry. it's early in the adoption curve and they did this whole -- they

10:04 am

tracked the census bureau every two weeks asking companies about their adoption and has found there was a little bit of a -- little bit of a tick down in the last few weeks and they said that's interesting because it kind of jives with what's happened with the market lately. overall there's a still adoption curve and it's just they look at it relative to electricity in the 1800s and the internet in the 1990 and show it takes time, but it's, obviously, transformational. >> yeah. i'm glad to hear that. there's a reason we speak about it as often as we do. i don't hear many argue the alternative. you don't hear the argument it's not going to be transformational very often, do you. there are some out there, but i -- we talk to business leaders they're almost uniform in their belief this is a moment on a par with, as you said, even electrification, certainly the internet. >> right. the question is what do you take

10:05 am

from that as an investment theme and who are the winners and losers of that? the evercorp note mentions big firms will have a better shot than smaller firms because it requires a lot of investment as it changes. >> enormous amount of computing power, the key thing. >> productivity on the job front. >> and also here's the adoption curve, actually, and i showed you a little bit in the orange line. >> yep. >> based on the census bureau a little bit of a -- it's trending lower in the last few weeks. again, they say, though, certainly on track for -- by 2025, 11% of companies to have adopted it and used it to produce goods and services. we're on track for that still even if we've had a few bumps in the road. an out of consensus view here was higher income jobs most impacted. again, in positive ways because increasing productivity should help, right, should help the top finance jobs if it can do 35% of

10:06 am

your job, then you can get paid more, right, and then you can -- >> that's nice way to think about it, although you also can make the argument that there will be a number of significant number of jobs that will simply be eliminated. >> right. we're not going into that one yet. in the meantime, you know, we monitor the sound bites and commentary from companies on -- as to how they're seeing the economy because, again, the outlook is a little bit cloudy right now. i thought hans from verizon on "squawk box" this morning sounded pretty upbeat. listen. >> we had actually our strongest year in consumer net adds in q1 since 2018. it's a quarter when we see with what's happening around us, inflation, high interest rates. we have our best first quarter in 2018 on the consumer side. >> that sounds good. albertson's, we delivered another solid quarter amidst a difficult industry backdrop and characterized the headwinds the

10:07 am

grocery store sector is facing, cycling significant prior year food inflation, lower government assistance for our customers, declining covid related income and the increasing mix of our pharmacy and digital businesses which carry lower margin. still doing well in that environment. truist cfo the big bank, overall loan demand does remain muted but they say they're enkoirnlgds couraged by the consumer growth pipeline and balances late in the first quarter. this was another theme, weaker loan growth even though banks say we're not in recession and things look good, loan growth is not necessarily where you would expect it to be in this economy driven by lower confidence and also higher financing costs has to play a role there too. >> muted loan demand and deposit cost pressure for sure. meantime, s&p is coming off a six-day losing streak breaking below 5k. the nasdaq off the worst week since november of '22 and then

10:08 am

tech coming off the worst week since the pandemic lows of march 2020. our senior markets commentator mike santoli is here with a closer look at this selloff and the odds it worsens. >> yeah. a lot of worsts there three weeks after we couldn't say enough about how persistently strong the rally was. there's a little bit of a recoil effect we're tracking. i think the first one is the short term setup. all of those kind of -- the measures of the straight line declines we had last week got the market pretty oversold. you have all these sort of technical conditions building up that say okay we have the makings for a really strong snapback fast. i don't think today is what you're looking for which is this kind of indifferent little lift by half a percent. the first test to me is, do we get another intraday selloff. every day last week we traded positive for part of the day and finished lower. that shows you there was a sort of mechanical thing into options expiration. the other thing is where are we in time based on the levels of

10:09 am

the s&p. february 21st where we closed last week, the day of the -- after the close nvidia blowout earnings report. what's changed since then? well, 10-year treasury yield 30 basis points and earnings estimates are higher so therefore the p/e is a little bit lower. just under 20 times right now. nobody's definition of strong. but it seems as if we have had a little bit of reset of expectations going into this heavy week of earnings. probably a net positive. the question is, did we kind of break that self-fulfilling good news cycle we were in, which was, we can have a strong economy, we can have immaculate disinflation, fed easing, and an earnings upturn and don't have to pay anything for it. you still don't know if that's the case. bond market still a little bit kind of dictating the action there to see if we can stop being concerned about that. final point is, i'm very much on alert for the idea of strong economy, unstoppable consumer, that narrative, to kind of overshoot a little bit. to have a little bit of evidence

10:10 am

that says maybe everybody got too excited about how much momentum this economy has. the economic surprise index is rolled over a little bit even as bond yields have gone up. i'm not just saying we're in trouble but we can moderate that sense for a little. >> people made note of the bofa cfo last week. we are still in the belief q3 may be the turning point for consumers. you can see that slowing now. >> right. so you are starting to see a little bit of an undertoe and that would act as a moderation on this idea that the fed is going have to chase this economy with higher for longer. we'll see if it that does play out. 10% pullback in the s&p would get you back to 4800. that was the all-time high going back to january 22nd. it wouldn't be crazy to have the market say was that for real or not. in 2013 we made a first new high in 5 1/2 years, and it totally checked back to that high level a couple months later and then went off to the upside.

10:11 am

>> i feel like the biggest debate i hear right now on the equity market is the bond market and are these yields going to stay this -- where are we going to be in a year from now? >> exactly. >> earlier in the year everyone was confident we would be lower in a year from now. >> yeah. >> not feeling so confident right now. i guess it really depends, a, on the inflation trajectory, but almost more importantly now with this bumpy road to 2% on how much the economy can hold up. >> it's completely that. i think what bond market has done is, it successively administers the test can the economy handle this. turns out we didn't have much of an interest sensitive economy. how about now, 4%, 4 1/2. it does have that sense of searching for a pain threshold. what i still think is relevant, though, is you have had these yield driven corrections in the stock market over the last couple years but not as if yields have to retrace back to the lows before the market has corrected. they have to stop going up and settle back into a range.

10:12 am

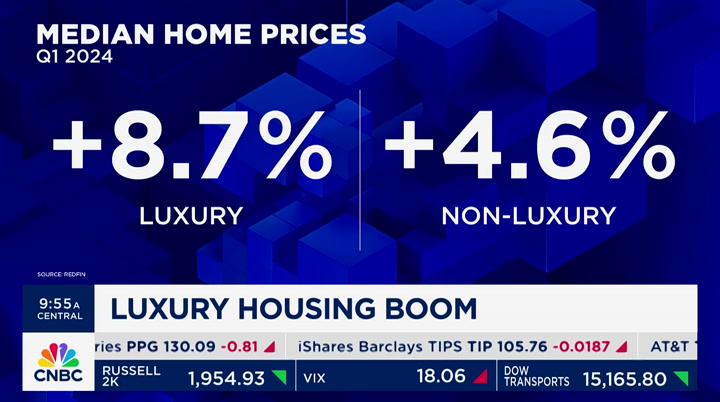

because, you know, let's remember, we were under 2% yields a couple -- at the previous highs of the s&p in early 2022 before the fed started hiking and we're at the same level right now. >> the other interesting thing to contemplate if that chart was right from evercore 11% of the market has -- companies have adopted ai by the end of 2025, what does that do for the real economy? what does do it for inflation? what does it do for the bond market? >> yeah. i wonder if we can see it in productivity numbers or at this point it's just an obligatory investment binge. everybody has to say they have it and we'll see later. we all remember when they -- every company put their website address on their tv commercials and said that they were online. >> i think the internet was deflationary. >> it absolutely was, yeah. that's the hope. >> mike, thank you. >> yeah. >> as we head to break, here's our road map for the rest of the hour. shares of tesla continue to lose

10:13 am

their charge. the ev make announced slashing prices of its cars ahead of earnings tomorrow. we have new details. >> the house passes legislation that could ban tiktok in the united states. the next steps from here and what's at stake for the company, and its users. >> it's a tale of two housing markets. the broader market suffering high rates, low inventory but another key area is surging. big show sllhe a"sawti aads quk on the street" continues after this break. the all new godaddy airo helps you get your business online in minutes with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo

10:14 am

10:15 am

the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

10:16 am

ubs getting bearish on tech names downgrading what they call the big six tech stocks, 34r5 amazon, alphabet, amazon, microsoft and nvidia. quote, investors attribute the run in mega cap stocks to animal spirits and the impact of ai and however our work indicates that surging earnings momentum fueled this upside. unfortunately this momentum is collapsing with the big six eps growth expected to decline from 42% to 16% over the next year. we'll see if that's true this week. >> meantime one notable tech name not on the list is tesla. shares continue to drop, touching a new 52 week low in today's session and several analysts cut their target going into tomorrow's report. jpmorgan to a street low 115, deutsch cut from 189 to 123, barclays from 225 to 180, wedbush's dan ives said the moment of truth has arrived for tesla and elon musk and, quote,

10:17 am

the clock has struck midnight for musk to lay out a plan for the future. adam jonas, street high target of 310 asks if it's time to bring back old habits and, quote, sleep on the floor of the factory again. let's bring in phil lebeau to help us talk through the headlines ahead of tomorrow's print. down seven in a row would be the longest losing streak since december of '22. >> and i'm not sure, carl, we're going to see an end tomorrow after the company reports its q1 results. i know we've said in the past the numbers are not as important as the conference call but that really is the case. we know tomorrow that the numbers for q1 we're going it see a big drop in automotive growth margins. huge hit, first time in four years we'll see a year over year decline in revenue. all of that said it's what elon musk says during the analyst call with regard to two subjects that's going to get the most attention. first of all, the small car call it the model 2, whatever you want to call it, is that

10:18 am

completely on the back burner or is this a case where he's going to say we expect to have that, 25, 26, 27, that's still the case, which would be bullish for those who believe in the near term that tesla can rebound from this, and then what happens with robotaxi. they are going to be unveiling it on august 8th, but does he give us more details in terms of will it be geofenced in a small area when they roll it out, when will they roll it out, to what regard, how great will it be when they first roll it out. is it going to be a small sample size which many believe it will be in a geofenced area or does he think he can roll this on a wide scale let's say in 27, 28, when is it going to be? it can't just be what it's been in the past quarters from elon musk which is, full self-driving is great, everybody loves it, the future is here, 1 million robotaxis on the road. he's made a number of these statements, he said he's the boy

10:19 am

that cries fsd. it has to be details. it has to be more than that. >> that's asking a lot. it is hard to imagine in some ways, phil, he can be convincing, mr. musk, but hard to imagine is he going to really give us that level of detail that you would seem to indicate is needed for my believers to actually joint flock, so to speak? >> my gut in covering this company, strictly opinion, i don't think we get that level of detail. i think he's going to talk about his belief that the full self-driving technology, their ai software, along with all of the video they take in from the millions of teslas out on the road, all of that together, makes this a robotaxi in the future a possibility. but i don't think that's going to be enough for the street. david, i really don't. i think the street is saying, we need some more specificity here. it can't simply be it's coming and it's going to be great. >> is this why he postponed the

10:20 am

meeting with india's prime minister? he was supposed to be there, wasn't he? >> well, i think he's got a lot on his plate. he was supposed to be there. it's not just the full self-driving. it's the fact that this is a company, sara, that is facing immense pressure, especially on the cost side, and that -- i don't think that's going to end any time soon. look, lee auto out of china cut its prices today. when does it end in china in terms of the price cuts. everybody i've talked to who is an expert in the field of chinese evs they do not see it ending any time soon. that raceses the question if you're tesla that was your largest market, how much further do you have to cut prices over there and by extension we know what's happening in the u.s. and in europe in terms of price pressure because evs are -- they're on the outs right now in terms of favorability of consumers. >> finally, phil, we do know what elon musk told employees about the workforce reduction but what about some discussion about efficiency and the idea

10:21 am

that core business gross margin ex-credits would be protected? >> well, we'll find out tomorrow. i mean, the expectation on the auto gross margins excluding zero emission vehicle credits is 15.9%. i talked with a couple analysts who said a do not be surprised if it's lower than that. that brings up the question, how much lower does it go? and i know that there are some analysts who are more bearish than others. adam jonas believes look, when you look at it all in totality, tesla still has a ton of advantages, including elon musk himself and his vision for the future. the question for investors is, how much do you buy in and say i'll take a leap of faith right now that whether it's robotaxi, whether it's model 2, whatever it is, we'll get through this rough patch and at some point tesla will grow again. >> all right. phil, a lot of big, open questions tomorrow. thank you for the setup. phil lebeau. after the break, the house

10:22 am

passing legislation that could ban tiktok in the u.s. we'll head live to d.c. on what comes next. a programming note as we head to break don't miss transportation secretary pete buttigieg has construction begins on a multimillion-dollar high-speed rail project from vegas to southern california. he wl iniljo us on "money movers" in the next hour. don't go away.

10:25 am

pbz. welcome back to "squawk on the street." morgan stanley trimming its target on apple from 220 down to 210 and expect apple to slightly top expectations in its earnings report forecasting revenue guidance for the quarter to come in below expectations. bofa does take the other side and calls apple a top pick for the year with a, quote, rich catalyst path. they see the stock going to 225 a share. >> let's turn to a developing story still in washington, d.c., the house passed a series of foreign aid bills set to send billions to israel, ukraine, taiwan and more but wedged into the package as well was a potential ban on tiktok. let's get to emily wilkins who has the latest to tell us when this will hit the senate.

10:26 am

>> hey, david. yeah, as you said the house passed this potential ban on tiktok over the weekend and it was part of the larger aid package and yes, it now goes to the senate. they are expected to begin votes for this on tuesday and they could wrap up votes for this on tuesday as well, might be wednesday, we'll see exactly what it is. and remember, this bill is a little bit different than previous iterations of the tiktok bill. the biggest change is that it would be a longer time for tiktok to find a new buyer and have it divest from its parent company byte dance. original bill gave it six months the new bill gives it as little as nine months but could give it up to a year depending on whether or not president biden would give it an extension. and at this point the bill does have good support within the senate. you saw a lot of bipartisanship in the house, of course, and then you saw a key senator maria cantwell chair of the committee overseeing tiktok and she came out with an endorsementfor the house bill but, of course, even if legislation that does not

10:27 am

mean that the battle over tiktok is over. the company's ceo said there will be legal action on the table if congress did wind up passing something. you have a couple lawmakers who think he has a case to make. listen to what congressman ro khanna said on abc over the weekend. >> i don't think it's going to pass first amendment scrutiny because i think they're less restrictive alternatives. we could have made it a crime to transfer americans' data to an adversarial nation or foreign state interference. to just ban 170 million americans or engage in speech and livelihood -- >> a tiktok spokesman said in a statement that tiktok was important because it was used by 170 million americans. they also pointed to the economic benefit. the number of small businesses that use tiktok, the amount that has been raised and brought to the u.s. economy via the app. that's a really big case that they've been making throughout

10:28 am

this entire push putting their creators forward and, guys, we'll be seeing exactly what happens to this bill when it comes to the senate tomorrow. >> emily, in a way it doesn't matter, does it? >> it's up to the chinese. when secretary janet yellen was in china a few weeks when i went with her they brought that up and their concern is that the u.s. is using issues of national security to try to squash successful chinese companies in the u.s. ultimately won't any sale, even if the bill does pass and president biden signs it, be shut down by china? >> i mean, we definitely have to see what courts do here. tiktok has been successful in a number of its lawsuits against other state rules, i'm thinking of the one in montana that tried to have a tiktok ban that got struck down. you have lawmakers pointing out here that it's not like -- tiktok is different from some of the other apps just because number one, of the tie to byte

10:29 am

dance and they say we're not against tiktok, we're fine having tiktok in the u.s., it needs the break between tiktok and the parent company. that's been the thing that lawmakers have been emphasizing here. >> i guess i was referring to the sale more, that they would stand in the way of a potential sale to usa group of investors, say to bobby kotick. >> it seems unlikely based on what we've heard and i assume you heard as well when you were in china that they would allow it should that ban take place and then that -- during that interim period, you're right. >> it would stoke some pretty intense trade tensions on the chinese front. >> emily, thank you. >> they ban all of our social media apps. >> absolutely. >> thanks. we'll turn to you on any development. six days of back-to-back losses for the s&p and the nasdaq's worst week since november 2022. our next guest isn't concerned arguing, quote, prospects are good. we'll discuss it.

10:31 am

10:33 am

welcome back to "squawk on the street." i'm seema moody with your cnbc news update. opening statements are under way this morning in donald trump's hush money trial between the prosecution and defense, they are expected to last just over an hour. a source telling nbc news that former "national enquirer" publisher david pecker will be the first witness. they say he's a central figure in the claims from women who said they had affairs with the former president. >> columbia will hold classes virtually today. the decision announced this

10:34 am

morning comes ahead of the jewish holiday of passover. columbia's president said in the announcement school leaders will work today to discuss ways to bring an end to the crisis. and president biden is mav marking earth day today by announcing $7 billion in federal grants for residential solar projects. the epa announcing 60 recipients today in low and middle income communities. carl, back to you. >> thanks so much. take a look at bitcoin headed higher after the crypto currency completed the fourth halving that cuts the rewards earned by miners in half. crypto related stocks like coinbase and micro strategy moving higher. despite the gains, jpmorgan says bitcoin is an over bought territory and could decline in the near term after surging to the record high. needham had a similar take saying the halving would have, quote, a limited impact, if any, on stocks like coin and robinhood. but all that said the crypto is, of course, a big outperformer on the year so far. stocks are rebounding today

10:35 am

after selling off last week, and our next guest isn't concerned about the headwinds writing, quote, the u.s. economy is performing well and prospects are good. moody's analytics chief economist mark zandi joins us now. the reason the concern is the economy is too good which is going to make it hard for the fed to adjust rates back to normal and keep inflation from coming back down to 2%. >> you mean, sara, that growth is too strong? that's what you're worried about? >> too strong, wages too strong, it's fueling the demand and services crisis, and it creates a predicament. >> no, i don't think so. we'll get a read on that this week. we're going to get gdp, that's the value of all the things we produce, kind of the top line for the economy on thursday for the first quarter. we'll see. my sense is looking at all the monthly data it's going to come in around 2%ish give or take. 2% down the fairway, that's

10:36 am

consistent with the committee's potential rate of growth, stable unemployment and continued moderation in inflation. so, yeah, you know, the economy zigs and zags. you go through that and look at the trend, and it feels pretty good to me. >> you said importantly there that inflation continues to moderate so that's your expectation even though we've seen in firmer readings and concerns about rent not coming down, concerns about services, prices and places like insurance not coming down, restaurant spending, you expect that to all come back, what, to 2% this year? >> yeah. more or less, yeah. i'm really not that concerned about it. i mean, i think a lot of what we observed in the first few months of the year is this persnickety measurement issues, seasonal adjustment and other measurement issues. i don't want to go down into the weeds but motor vehicle insurance and repair is the vestige of what happened during the pandemic and the vehicle industry and the collapse of the

10:37 am

vehicle industry and the surge in prices. you know, each thing has its story, but, you know, you can debate each one of them but when you look at it together just feels like a lot of measurement. here's a fundamental thing. i mean, if you try to get to underlying inflation, distracting from the reads of the data, you have to look at core inflation excluding the owners equivalent rent. that's the implicit cost of owning a home, which in the best of times difficult to measure. given this time what's going on in the housing market, impossible to measure. that's at target. that's been at target for nine months, nine months. my sense of it is we're already there. that will shine through in the next few months as these measurement issues iron themselves out. >> why not cut sooner, if that's the case? >> that would be my view, right. i mean, i think the fed has achieved its mandate. it has to conduct policy to

10:38 am

reach full employment, check, the unemployment rate sub-4%. we've been there over two years. the inflation, the top line number isn't quite back to where it needs to be, but as i articulated we're clearly headed in that direction. you ask yourself oh, kay, if you achieved your mandate why do i need a 5.5% federal funds rate target. there's debate as to what equilibrium rate is, that monetary policy is neither restraining or supporting growth so maybe it's not 2.5%, maybe it's not 3, 3.5, but it'slower than 5%. why take the risk of breaking something in the economy. if i were king for the day i would say we should be cutting rates. >> so the market now thinks one rate cut this year will come in the fourth quarter. you think something breaks? you think that's a risk of a harder landing? >> that's a risk, sara.

10:39 am

it's not my baseline. i think the economy can navigate through, but why take the chance of doing that. here's the other thing. we're now -- it's getting complicated by the election. it may turn out that data would argue for a rate cut in september. say the next couple three months we get cpi numbers and inflation numbers consistent with my view of things, and it says okay, we should cut rates, but okay, september the election is in november, we know this is going to be a contested race. does the fed want to get wrapped up in all of that. probably not. you know, whether they cut or don't cut is the political decision, but the tougher political decision would be cutting interest rates until teeth of the presidential election. there is a meeting right after the election but would you cut then? because wouldn't you be accused of playing politics? one rate cut in december feels about right to me if nothing breaks. that's the problem with not moving more quickly. now you're in the middle of the

10:40 am

election season and makes it difficult to make a pure economic decision. >> they don't pay any attention to all that. >> sure. yeah. >> right. >> mark zandi. >> in the context of this election. >> just noise. >> what election? there's an election? >> there's an election. >> thanks, mark. >> yeah. after the break the former cohead of citi's global m&a division, where does deal making stand right now? it's not another mgemoayerr nd that's for sure. when are the deals coming?

10:43 am

10:44 am

another monday where really not a lot of deal announcements. here to give us a read on where things stand is mark shaffer, head of global m&a at citigroup had that job almost 15 years, now a managing partner at advisory firm consell lo financial. long-time guest of mine and, obviously, you've been doing this longer than i have and been covering it and that's really saying something, mark. >> thank you for aging me, david. >> you're welcome. given that enormous wealth of perspective you have, where are the deals? are they coming? we came into this year, i would argue, with a lot of optimism and other than a couple of those big oil deals, it seems like it's been pretty sparse. >> i think that's right. the numbers are up and the quarter about $800 billion, give or take, up substantially over q1 last year. don't forget that '23 was the lowest volume number in ten years. we have to balance it a little bit. i think when you get behind the numbers, heavily skewed towards mega deals, ten of about 25% of

10:45 am

the volume, 60% u.s. related and by my account about four of the nine industry groups were down, so quarter over quarter, i don't think you can say this is a broad-based recovery at this point. i agree with you. i think it's better than it was last year off the low base, but i would not call this a broad-based recovery at this point. >> you know with our last guest talking about the election looming, you've got a very stringent antitrust regulatory authority. i could -- is that going to mitigate the potential for deals this year or is a relatively strong economy and even with our pullback in the markets a relatively strong market going to actually instill the confidence that gets deals done? >> it's a mixed bag, right. we have geopolitical issues that are threatening. 40% of the world will have an election this year. macro economic is, as you say, is somewhat mixed. cpi is sticky so rates are going to be higher for longer.

10:46 am

you started thinking there would be seven cut, went to three, now maybe we get one or two. i think those are legitimate headwinds. i think the flip side of it, though, you have to look at the things that are positive. there's a tremendous amount of money on the sidelines both strategic and in the private equity universe. private equity deals are lower in terms of total -- up in volume but the one piece of the market that is definitely concerns me is notwithstanding the volume increases, transactions were down quarter over quarter. you have to look at it that way. i do believe that activism has stayed pretty strong, admittedly shifted to more of an operational event as opposed to let's do breakups, et cetera, but still very strong and that will be a tailwind. >> what about something we talk about every day ai. when we see these transformational types of moments in terms of technology they can sometimes also lead to companies choosing to do things

10:47 am

they might not otherwise do and/or consolidation. is that in your opinion going to be thes day. >> >> i do. i sort of believe jamie dimon -- you saw jamie dimon's piece on the steam engine, electricity, internet, computing age. i believe this is one of those multigenerational changes that are going to be tremendously impactful. i don't think it's just producers and the consumers. it's -- and i don't cthink it's the chips and the vertical horizontal application laryer. we don't hear as much about how much power we need in this country. that implies ap upgrade to the grid, hundreds of billions around the world when you think about broader electrification centers or data or ev. this is tremendously impactful. idc says $500 billion plus spend big '27. something like $11 trillion over time economic impact. so i do think this is completely -- this really is in

10:48 am

that special category of major change, and so what does that ultimately mean? if you think about the industrial age on, always when this massive change comes, they called it creative destruction, you're going to have major consolidation waves. i'm a little bit less sanguine on the prospects for this year and i do believe over the next two to five years, short of major government regulation to stop it, wear going to see major consolidation and that would be good for the m&a market. >> you're building a new business essentially consello. i'm curious from your perspective how you see ai playing into that? do you need as many analysts in the past? are you able to higher fewer people to build out the same abilities? >> like a lot of people we're looking at it. i think it will have significant ramifications for our business. some are talking about, you know, some of the mundane tasks that the younger bankers would do, we can take that away. i also think it's going to do

10:49 am

more things thinking about, you know, idea generation, and nepg that regard and making things like taking a presentation, making it an s1, will become a hell of a lot easier in an ai world. it will impact the advisory business as it impacts the broader economy. >> regulation, i'm curious, we talked about it, we talk about it all the time. when at citi did you advise on the albertson's deal? another deal that's in the cross hairs of regulator, not unexpectedly. what impact is that having on ceos and their willingness to continue to do deals? >> it's interesting. it's a headwind. you look at the first quarter, ten deals north of $10 billion, there were they were 25% of the volume. in the conversations we have and we're a very heavily large cap focused, very strong ceo, c-suite, my partner built this business two years ago, we're investment advisory, but the piece that i see, whether or not

10:50 am