tv Squawk Box CNBC April 22, 2024 6:00am-9:00am EDT

6:00 am

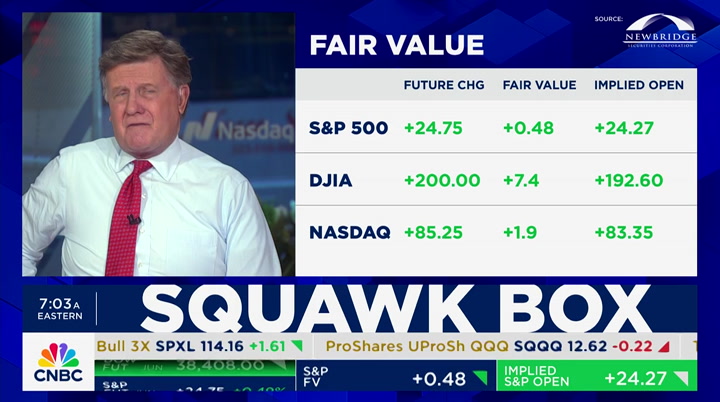

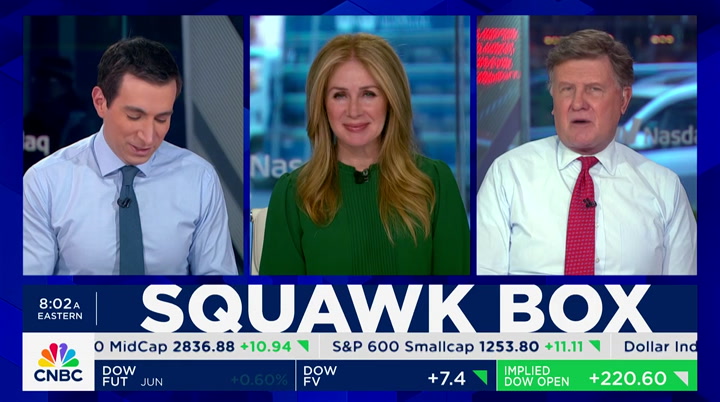

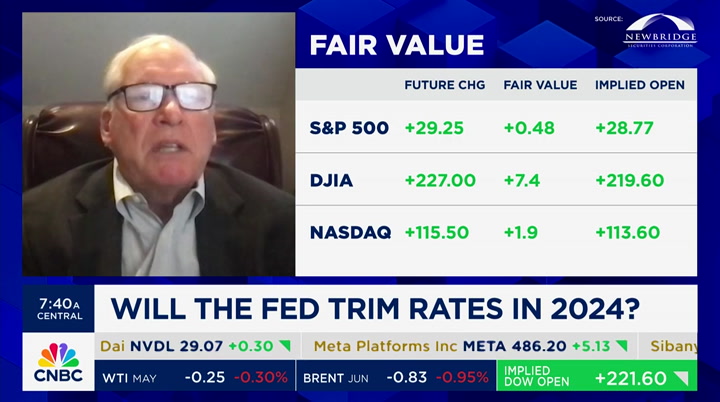

and tesla making movies ahed of the issues in china. it is monday, april 22nd, 2024. "squawk box" begins right now. good morning. welcome to "squawk box" here on cnbc. we are live from the nasdaq market site in times square. i'm becky quick along with joe kernen and andrew ross sorkin. here we are. together. >> who is missing? >> nobody. we're all here for the first time. >> really good. really good. >> let's look at what is happening with the u.s. equities. you will see some pretty

6:01 am

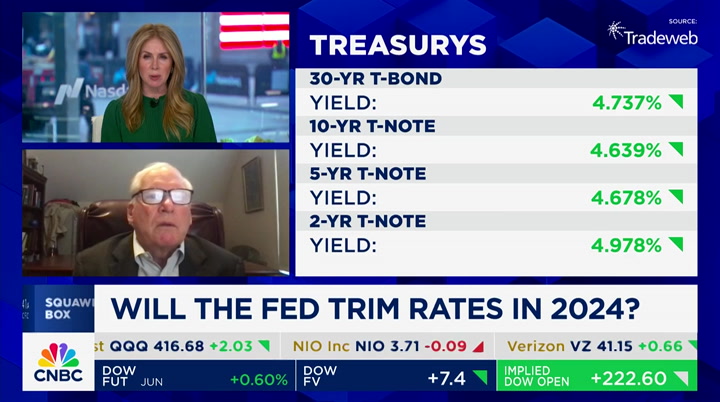

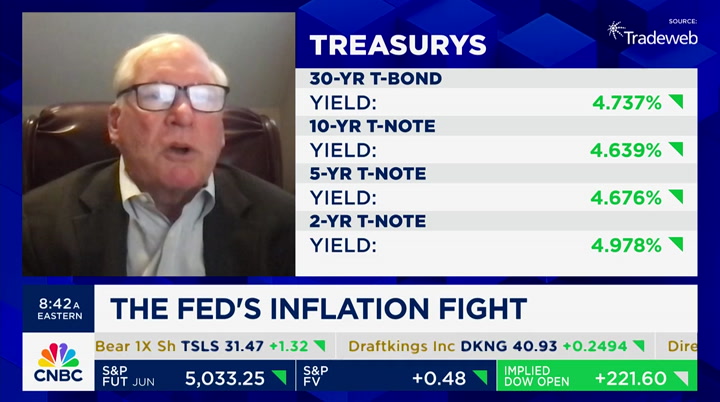

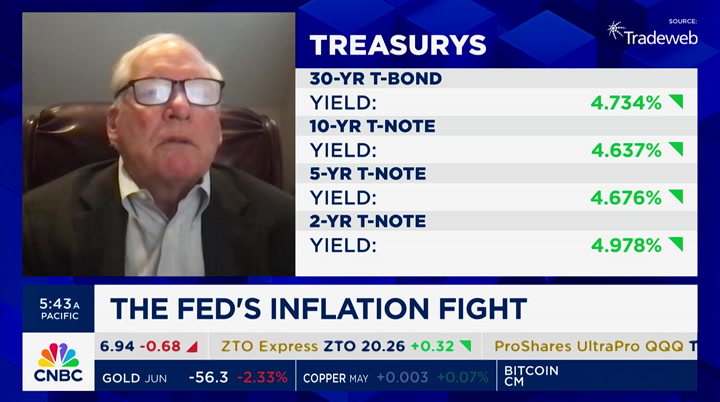

significant green arrows. it looks like the dow futures are indicated up by over 160 points. nasdaq futures indicated up by 115. s&p futures are up 27. of course, this is coming after a rough week last week. you are now talking about the s&p on track for the worst month since december of 2022. you have the s&p back be low 5,000. we are watching this closely. this has all been happening with treasury yields picking up. you will see it looks like the ten-year note is all the way up to 4.658%. two-year note at 5%. this is a significant run in the bond yields and that's been responsible for the april pullback we have seen in stocks. the april pullback has been responsible for erasing the gains for the first quarter of the year. we saw the highs on march 28th. you are talking about the s&p at

6:02 am

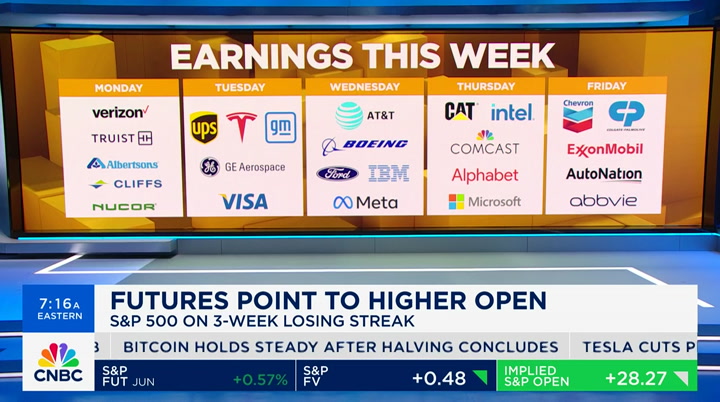

5.5% from the record close. we have been watching crude oil prices which has been picking up on concerns in the middle east. you see it is down 31 cents for wti. let's look at bitcoin as well after the cryptocurrency completed the fourth halving on friday evening. cut the rewards by the miners by half. we are looking year to date at bitcoin up 55%. this morning, up by close to 2%. $65,927. on the squawk agenda, we have a lot going on. a few points of note. march durable goods orders are due on wednesday. on thursday, we get the first look at gdp in the first quarter. then on friday, the fed inflation gauge with core pce. we will hear from verizon before the opening bell and the firsti

6:03 am

ceo. we hear from gm and visa as well as tesla in the afternoon. we while talk about it. on wednesday, at&t, boeing, ford, ibm and we hear from meta and then on thursday is caterpillar and microsoft and comcast. on friday, we will hear from chevron and exxonmobil. there will be a lot of numbers to chew on. we can figure out what is going on. >> how far from toyota? >> in terms of the market cap? >> on tesla. >> yes. >> tesla is still the most valuable car company. if it drops another few dollars, it would put toyota. >> it has been written now. "do interest rates matter" now? >> yes. >> we will see. >> they he have been down.

6:04 am

>> what did jamie dimon say? 8%? >> he has been spot on. he has been consistent. >> he has. that seems like it would be significant. news from washington. on saturday, the house passing the series of bills to provide aid to israel, ukraine and taiwan along with the bill that would force china's bytedance's tiktok. emily wilkins has more with us. do you clock in on saturday? >> reporter: you have to be paying attention. you have to stay on top of it. it was a working weekend for congress. you are not alone. the house passed that $95 billion foreign aid bill for ukraine, israel and indopacific and attached to that had a couple of things. most importantly, it could lead to tiktok being banned in the

6:05 am

u.s. if they don't divest from parent company bytedance. they could finalize the bill on tuesday. the house has approved the foreign aid piece and the tiktok piece of the bill with the key endorsement from maria cantwell. the threat of the ouster of speaker mike johnson is still on the table. marjorie taylor greene called johnson a lame duck and said he should resign. johnson might survive a vote. several democrats said they would support keeping him in the speakership because he was willing to bring ukraine aid to the floor. republican michael mccall said johnson is in good shape. >> the stock in mike johnson has gone way up. the respect for him has gone up because he did the right thing

6:06 am

irrespective of his job. that garnered a lot of respect. >> reporter: johnson has at least one more week as speaker because lawmakers are back in districts and won't be back until the week after. >> thanks, emily. i saw one headline which was a cnn headline. who knew that mike johnson was going to turn into churchill. it's weird. he is getting support from places and less so from others. i think he's solid. what do you think? >> i think the democrats will jump in. >> in this particular moment, unfortunately -- for kevin mccarthy, nobody was calling him churchill at the time -- >> he wasn't doing exactly the same. we have to do this with ukraine

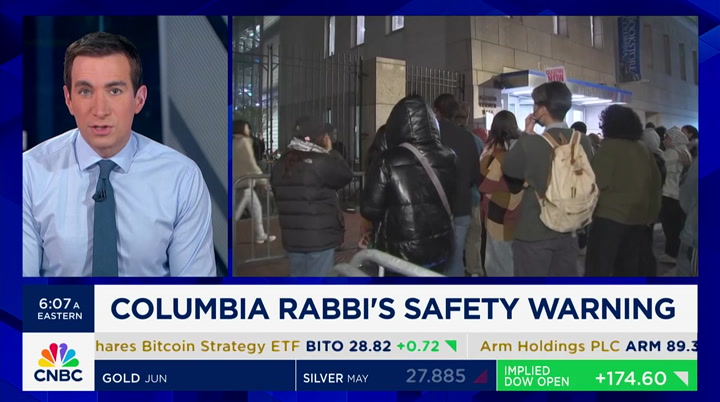

6:07 am

and for every one artillery shells fired, there are ten russian shells coming back. this is just going to stave off just in time. what is the end game? it will stave it off again, but you wonder the end game. >> that's the conundrum. let's talk about this. dire warning from the columbia university rabbi to jewish students over the weekend. the rabbi sending a message by whatsapp urging jewish students to go home and not return to campus because of extreme anti-semitism. it is the site of israel protests. students waving israeli flags should be the target of terrorists. the mayor getting involved in the statement saying he was horrified and disgusted by the

6:08 am

anti-semitism spewed at and around columbia and telling the university to reach out to the nypd to get involved. this is a private campus nn nypd is not on campus unless asked. all classes will be held virtually today to deescalate. we will talk about this in the 8:00 hour. we will talk to rabbi david ingber. of course, columbia business school has one of the most famous alumni in the world. warren buffett. a lot of famed wall street alumni all over. you could go down the list. we'll see whether they end up speaking out about what is really happening on this campus. just to see the images. we'll talk about this later. you would never think you would see this inamerica. >> no words.

6:09 am

>> there aren't. >> no words. i'm at a loss. it's not the only thing that has me confused. dazed and confused. >> a lot of confusing things. we'll come back and talk about what is going on in the world and the pullback of the big tech. 76 of the nasdaq 100 are 10% or more off the 52-week high. tesla on the list. phil lebeau will join us with the moves tesla is making. what does it mean for the future of the cpaomny? "squawk box" comes right back after this. >> announcer: this cnbc program is sponsored by baird. visit bairddifference.com.

6:10 am

6:11 am

i can't believe you corporate types are still at it. just stop calling each other rock stars. and using workday to put finance and h.r. on one platform. tim, you are a rock star. using responsible ai doesn't make you a rock star. it kinda does. you are not rock stars. (clears throat) okay. most of you are not rock stars. oooh. data driven insights, and large language models. oh, that's so rock roll. it is, right. he gets it. yeah.

6:12 am

her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

6:13 am

welcome back to "squawk box." tech stocks taking it on the chin in the last month. s&p technology index down 9%. 29 of the nasdaq 100 are now down 20% or more from the 52-week highs. joining us right now to talk tech stocks is stephanie link with hightower. are you saying everything is on sale and you should buy it or are you saying the knife is falling and i'll keep letting it fall until i want to catch it?

6:14 am

>> the expectations are still high, andrew. i think we have a couple of good looks at the bigger names in technology. i own amazon. i like that name a lot. i own apple. i like that name a lot. i know it is controversial especially as numbers are coming down, but i think both stocks offer good risk/reward into the prints and i will be long on both of them. i like bm very much. they are turning the company around into software and consulting and services and recurring revenue is going on the way up which is good. they are an a.i. play as well. i like lam research. that stock has come down a bit. i think semi cap equipment is interesting. you need seven times the memory for a.i. the fab equipment is recovering. i can pick and choose within tech. i will say i'm underweight the

6:15 am

sector relative the benchmark. i think there are other areas in the market. energy and financials and industrials will put up good numbers. >> we will talk to phil lebeau in a moment about tesla. that stock is sttaking a real shellacking is the technical term. >> i never like it when margins are going down in any company. that is happening in the last year or year and a half for tesla. that is a big problem. not only that, but as competition and hybrids taking share against ev pure plays. toyota has done amazingly well in this front and that's the way i would go at this point. i think we pulled forward a lot of the expectations in terms of ev demand. i think you want to be careful in that space. the valuation is still too hard for me to get my arms around it, andrew. >> in terms of the quote/unquote

6:16 am

a.i. play in terms of how you do that in last few years is to buy nvidia. at this point, you want to own either them or one of the other chipmakers or is there another play? google? microsoft? >> you want to have a.i. exposure. you can own nvidia. everybody owns nvidia. i have never really made a ton of money when everyone is on the same side of the story. i own broadcom. i mentioned lam research and how it is important to the memory side. i own snowflake. it is down 30% from when they reported earnings, but i do think a.i. is only as good as the data you put into it. these guys do that in size and scale. they have a new ceo. it is a prove-me moment for the company. i do think the setup is

6:17 am

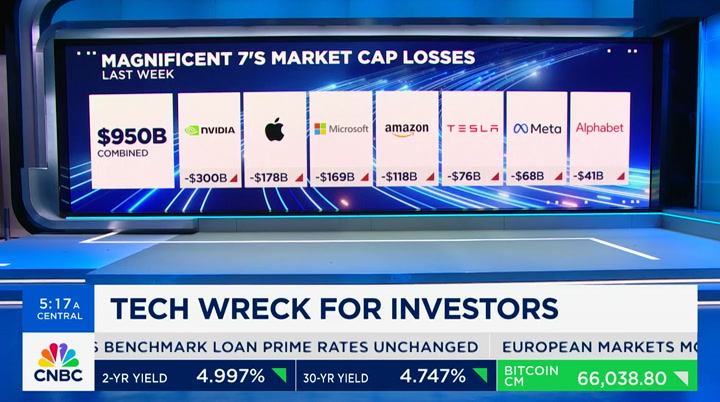

interesting. maybe it is off the radar screen versus a pure play like nvidia. >> stephanie, the moves last week was violent. the tidal shifts taking place. $950 billion in market cap loss from the magnificent seven. nvidia losing $300 billion. that is more than an entire amd. we're 5.5% from the all-time highs from the s&p 500. do you think this pullback continues or do people stop and look at earnings and look at the great economy and say we hold here? >> well, i think technology has competition, becky, on terms of earnings and other sectors reporting very good earnings. that's one of the reasons why i think you have seen a broadening out in the marketplace. since october of last year, we had fits and starts along the

6:18 am

way. we are seeing many more names and many more sectors participating because you mentioned the economy is growing at 2.9%. we had the imf increase growth to 3.2% for global growth. china coming in at 5.5%. i think earnings can be better than expected in different sectors. i'm overweight energy. i think the numbers will be good. i do think there is a place in the portfolio for tech. they are more vulnerable. we just have to step back. we are 5% from the highs in the s&p 500 in a month's time. we are also up 30% in the last 16 months. we have had a heck of a run. long-term average, as you know, for the s&p 500 total return is 7.5% to had a good run of it.

6:19 am

now is the time when you see other companies take the spotlight beyond tech. >> okay. stephanie, we will see. lots to look at over the week and a lot of monthnumbers comin. thanks. coming up, tesla slashing the price of some models as well as the full self-driving mode. it is hard to get used to it. phil lebeau will have an update after the break. we will talk to eric rosengren about the economic data this week and the potential impact of the fed's rate path. "squawk box" coming right back.

6:20 am

6:22 am

6:23 am

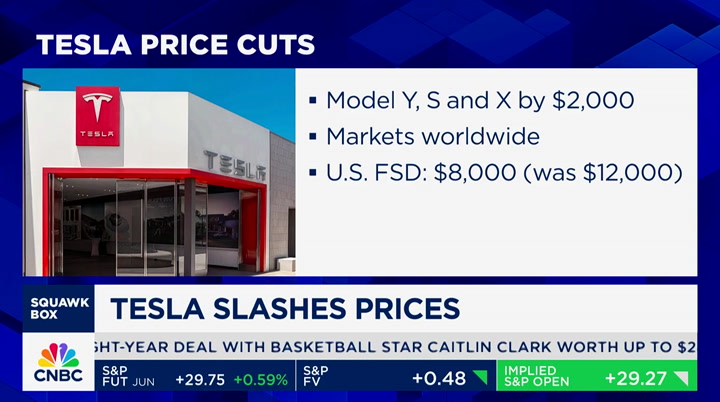

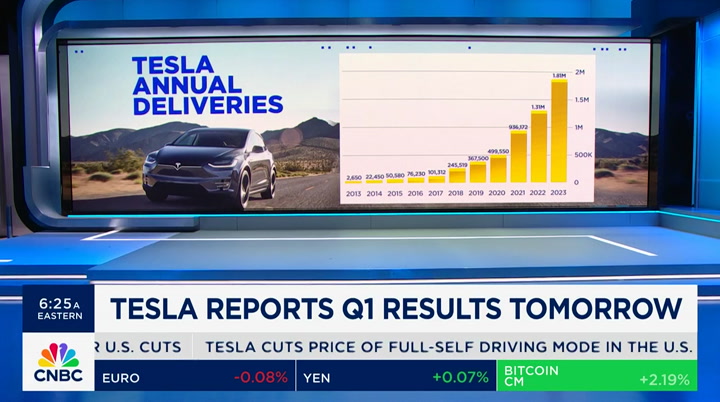

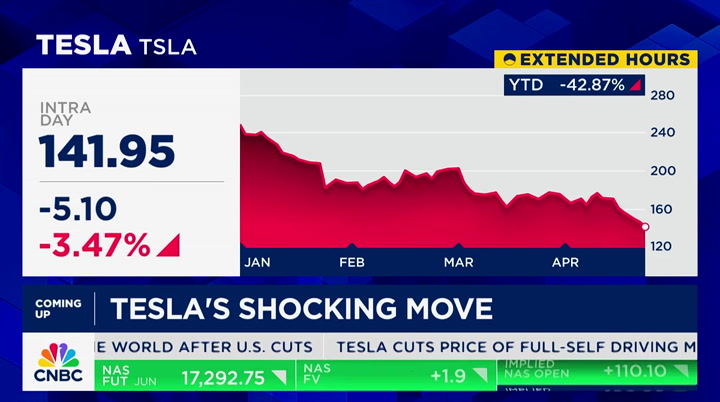

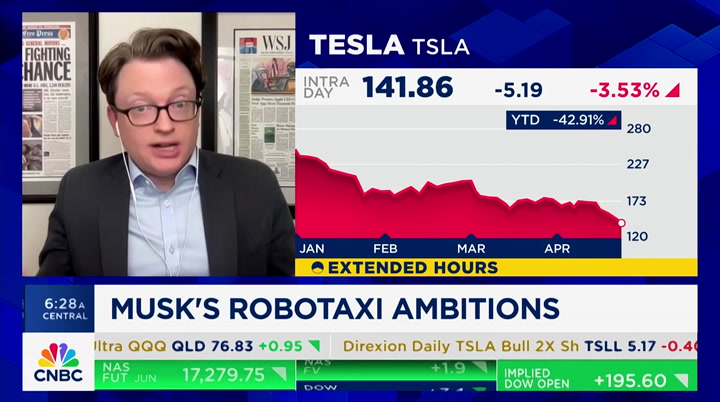

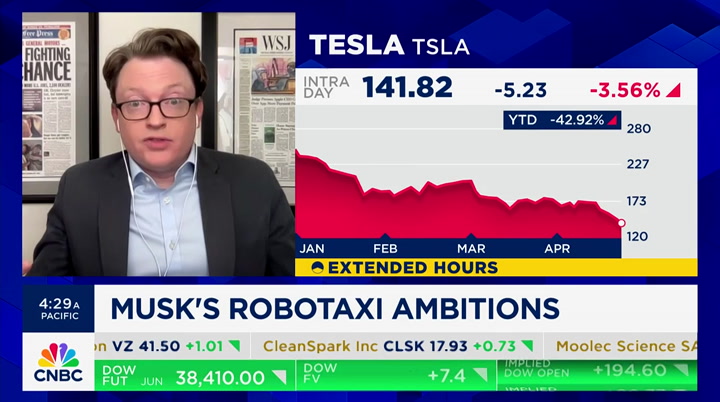

conspiracy theyorists. analysis of security spending for ceos was from $1.2 million for bob iger and more than $1 billion from stepane bancel. tesla registered $2.4 million for musk's security last year with the additional $500,000 spent in the first two months of the year. tesla, as we have been reporting, slashing prices on several vehicles and in several global markets, including the united states, which is dealing with slow sales and rising inventory. we have phil lebeau with more. you can tell us what we need to see in tesla and toyota for that them to switch. not that far on market cap. >> reporter: they are very

6:24 am

close, joe. we will show you the two-year chart at the end of the report of tesla and what is happening. look at the decline since last july. teaser there if you want to see how much it dropped. the news on friday here in the u.s. and then we saw it confirmed in other markets worldwide. cutting models y, s and x by $2,000. they are dropping fsd fto $8,00 from $12,000. we know the numbers will be poor compared to tesla in the past. they need to see it. the estimate is for a profit of 49cents a share. if it comes in shy of that, that's not driving the stock lower. by the way, we expect the first year-over-year decline in revenue in four years of $25

6:25 am

billion picture expected in rev. the focus on the conference call and guidance. gross margins in the first quarter down 15.9%. i talked to a number of others who said it could be down 14.5%. that will not move the guidance lower. it is the guidance for the second quarter and specifically what elon musk says about small car bproduction plans. in terms of deliveries, the small car does matter. the growth trajectory in terms of annual deliveries is driving the stock the last six or seven years. people are saying they will grow annual deliveries. the delivery estimate for 2024 is just under 1.9 million vehicles. they delivered 1.81 million last year. if you look at shares of tesla

6:26 am

over the last two years, look at what i was talking about if you go back to july. it is hard to see here. the stock has been cut in half. it is down to $143. it was up to $290. something like that last july. as you mentioned, guys, they are coming close as the stock continues to fall and the market captain continues to fall in te of the most valuable car company. the issue is the conference call. what does elon say about the robotaxi. it has to be more than this is going to unlock the future or quantum leap. i think people would like to see benchmarks thrown out in terms of when beyond the unveil. when do we see it, in his opinion, put in production and into service. >> phil, do i misunderstand

6:27 am

this? to have a robotaxi in the wild would be at level five. >> reporter: correct. >> no human intervention. they are not there. do you think they will announce tech that gets them there? >> reporter: that is a huge jump, andrew. >> is it a dream? >> reporter: it is a leap of faith to say definitively -- 2027, i'm throwing that out there -- or 2028, the driver will be completely out of the car. if you are a tesla owner, you turn it into a robotaxi. you are part of the taxi network. when you are not using it, it toodles off and gives people a ride from point a to point b. that is a huge leap from where they he are right now in terms of technology. >> i just wonder do we need to change the narrative, phil?

6:28 am

evs. the time isunless it is tesla. now, i don't know. tesla might not be qualitatively different from the rest. you still have the charging station problem and mileage problem. >> reporter: they're still king of the khill. >> it is not panacea. >> reporter: in terms of the ev market -- are you saying the bloom is off the rose completely with the evs and let's look at the small niche part of the auto industry? >> i was shocked by 2050 that the biden administration numbers at 12%. >> reporter: you are talking about total number of vehicles on the road, joe? there are 280 million vehicles on the road.

6:29 am

a car sold today is likely still on the road, not all of them, but a good chunk is still on the road in 2040 to 2045. they last longer. >> 14% of total sales is all they were expecting by then. it's crazy. >> reporter: i'm not sure. i have not seen that statistic. 14% of annual sales will only be evs? joe, you are looking at 9%. you are saying over the next 25 years, it will grow? >> i'm saying that's what the report said. i'll send it to you. >> reporter: i'm not familiar if the report is talking total vehicles on the road, which i could see 14%. 300 million vehicles out there or if they are talking annual sales. >> andrew, there is a saying. you can hit bookmark -- >> yes, you can. >> -- if you see something on

6:30 am

twitter. if you hit bookmark, you can save it there. i have it. >> amazon, you can hit the button and they deliver it straight to your door. >> we are doing a new segment. how to tech help. >> i got it right here, phil. coming up, big week for big tech earnings. we hear from ma,et alphabet and microsoft. we will have it for you straight ahead. don't go anywhere. >> announcer: executive edge is sponsored by at&t business. next level moments need the next level network. usiness, you ne. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network.

6:31 am

i sold a pillow! the future is not just going to happen. you have to make it. and if you want a successful business, all it takes is an idea, and now becomes the future where you grew a dream into a reality. the all new godaddy airo. put your business online in minutes with the power of ai. your shipping manager left to “find themself.” leaving you lost. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire

6:33 am

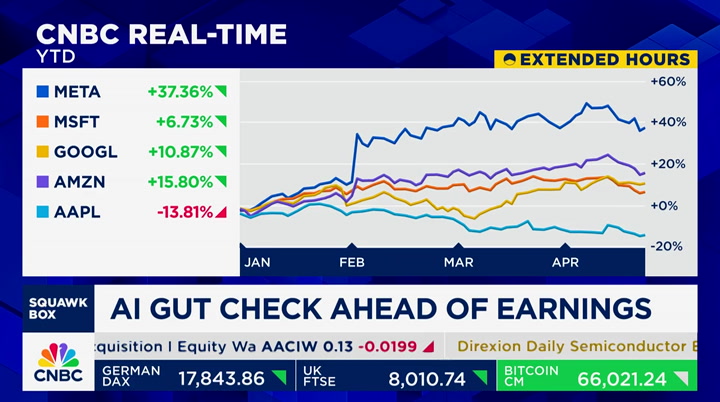

good morning. welcome back to "squawk box." we are live from the nasdaq market site in times square. the futures are up. they picked up in the last half hour. dow futures up 180 points. the nasdaq futures up 110. s&p futures up 27. of course, it comes after a rough week last week for the markets. s&p right now on track for its worst month since december of 2022 giving back half of the gains the markets booked in the first three months of the year. the s&p down 6% from the all-time highs. quarterly results starting to pour in from the biggest names in tech. it is happening this week. all eyes on it. steve kovach is here to tell us where to look with a.i.

6:34 am

>> the fun starts this week. it is like a two-week big tech earnings thing. meta on wednesday and microsoft and alphabet on thursday and amazon next week. i want to look at the names and through the lens of a.i. which is not a big business for any of them yet. here is what i'll call the a.i. gut tech. you have meta partnered with google to power new investversion of the a.i. chatbot. it is using meta apps. meta's a.i. chief is teasing a better version coming soon. you have microsoft with the copilot sales. listen for those numbers there. and the azure cloud has

6:35 am

reaccelerated lately. and alphabet is including a.i. researchers into the broader a.i. unit deep mind. next week starts off with amazon. not much consumer facing with a.i., but hosting a lot of a.i. activity just like microsoft. with apple, really not much of the a.i. story right now, but expecting that to come at the developers conference in june. more of the concern right now is the declining sales for apple, especially in china. shares are the only one in the group down 14% on the year. guys. a lot going on. >> what will happen with tesla this week? >> oh, man. >> do you have a view? >> for what? >> tesla. tesla. everybody is freaking out. >> i think phil put it nicely. will they ditch this model 2 for the robotaxi initiative?

6:36 am

i remember elon musk saying there will be a million robotaxis next year and that was five years ago. this august event is what people are looking at for tesla. >> keep the dream alive. >> this is what it will be like one day. >> steve, thank you. nice to see you. coming up this morning, the house voting to authorize foreign aid for israel over the weekend. we will talk about the potential impact of the funds on the war right afr isteth.

6:38 am

switch to shopify and sell smarter at every stage of your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify.

6:39 am

welcome back. the wall street journal detailing the biden administration push to contain the crisis in the middle east. joining us now for the latest is mic michael o'hanlon at the brookings institution. we are trying to read this as a deescalation after what happened. this was a massive escalation with israel not allowing the u.s. know about the attacks on damascus and iran doing what it has never done. directly attack israel. what is the fallout this morning? >> becky, good morning. as you say, everybody is setting new precedence, especially iran with the massive scope with more than 100 missiles. it is incredible how well the

6:40 am

defense systems of the countries have worked. biden said take a win. israel is not going to think that way. they have to say we have to show iran or anybody attacking us will suffer. it is more of a psychological effect israel is after. there is room for negotiations about how many targets are struck and where they are located. originally, israel is thinking of tattacking in a number of places in iran. president biden persuaded israel if he got through one or two military installations, or nuclear facilities, you have proven to iran you could strike the nuclear facilities. that is enough of a message. it allows iran to stand down. it was a good decision. it is not the last step in the

6:41 am

process. >> we are not talking about deescalation, but temporary pause. how do you see this playing out? >> i think this is the end of the particular chap tur. chapter. it is not any need israel needs to do anything beyond the original attack. we need to see if hezbollah gets involved in the fight. those are the two biggest questions. on gaza, i think the israelis will do something around rafah. that is the area in the strip where they have not done any counter military pursuit of leadership. hamas leaders are still free and unaccounted for and hamas infrastructure in the area is in tact. i think israel will do something. the question is for how long and when and with what weapons. i hope they show restraint. there is the bigger political question of what do they set up

6:42 am

in the aftermath? the united states with the u.n. resolution last week to recognize the palestinian state. there is no end game as to what comes. i expect the military operations w will wind down this spring. i have no idea what is coming next on the political front. >> the aid bill that was just passed by the house this weekend and will be taken up by the senate this week -- how does that change the calculus? what does it snmean? >> it doesn't answer many questions. it allows the worst-case scenario alleviated in ukraine. it doesn't answer the question of how the political end game is revolved with gaza and doesn't answer the question do we believe in the ukrainian counteroffensive to liberate more territory? i tried to explore what ukraine might need to have a realistic or small chance of a successful counteroffensive. they need to build up a couple

6:43 am

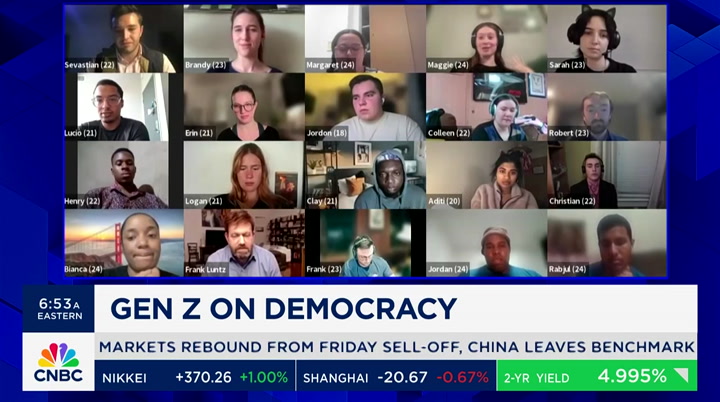

hundred thousand more troops in the military to try to breakthrough the russian lines and evenncircle the russian lin in crimea. that is one example of how it might be done. using the principles of military planning and they need a couple hundred thousand more troops than they have. they lowered the age to 25. they are nowhere near the numbers i talked about. it is not clear they still have a plausible rprospect of pullin that off. we should give them one more try. the chances of success are modest. >> michael o'hanlon, thank you. this is serious stuff. this is not ending. thank you. >> thank you. coming up on the other side of the break, we take you inside the focus group of 18 to 24-year-olds for a look at how they view capitalism and socialism. it is eye opening.

6:44 am

frank luntz will be with us. later, verizon is set to report. we will have the interview with the ceo hans vestberg. "squawk box" returns after this. when it comes to investing, we live in uncertain times. >> announcer: this cnbc program is sponsored by baird. visit bairddifference.com. others can deflate with a single policy change. savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com.

6:47 am

6:48 am

south sought after. >> capitalism encourages the exploitation of people. i think capitalism supports people who are already at the top. >> i'm the son of cuban refugees. i understand firsthand the dangers of socialism and link to au authortarianism. >> we have frank luntz here with us. it was incredible. i watched a large portion of it. were you surprised by the language? >> the language i was surprised. not surprised by the conclusion. young people are always to the left. when use words like exploitation or corruption or greed, those send off bells to me. i'm warning washington, d.c. that all of this anger and all this frustration with the

6:49 am

economy -- it's not good. no, it's not working for them. you better pay attention to this because these young people are not just running off politicians, that's easy to do. >> here is the question. is the answer -- when you say the government needs to be watching and folks in congress and senate need to be watching -- there is a view that to make it work for the american people better than it is today, the answer is not necessarily capitalism, per se, but it is and may be more socialistic. we need more money in the hands of these people. how do you do that? >> the key for them is that road and that opportunity and that direction. all they are asking for is a fighting chance. if they see washington behaving in ways to deny them that chance and tax them so much and regulate them so much. the litigation. all of these things happening to

6:50 am

capitalism is undermining our faith. in the focus group, itself, they want to know it is a level playing field. they want to take us back, i hate to use this phrase, but s,d a chance to move ahead. family businesses they admire. the big corporations not so much. >> right! and i wish that the business community also paid attention. >> reagan said that only one generation at a time can understand that capitalism is what works, and we can't pass it down through our genes to our next generation. >> but we have to teach it. >> that's what i mean. that's what he said. >> and our schools, in colleges they teach socialism. they tell the students that you're not getting a fair shake. >> did they teach what socialism -- socialism and communism are not the same thing, but sometimes one results

6:51 am

in the other, they usually result in about 10 or 50 million people dead. i mean, we've tried this. we haven't done it right yet. is it the same old excuse? we've tried socialism, we just haven't done it right yet, frank? >> no, because i'm separating the politics. it's easy to get agitated. >> i don't want to get agitated. i just had two weeks off. >> this speaks to some of this. let's show the audience this. you asked a question about what america needs more of, meritocracy or quality, and i thought that was actually an interesting thing. a majority said they would choose quality. take a look at this. >> meritocracy has its place, and i think that people are often rewarded for how hard they work, but i don't think equality is the right word. i think we should be talking about a third option, which is equity because equality i think involves bringing some people down and brings other people up.

6:52 am

if we get everybody to the same starting place we really could have a shot at meritocracy being very fruitful for people. >> i think we can thrive under a meritocracy. i think it's inherently not fair if we were to do that at the place we are now. everyone needs to be at the same starting point. >> that's an interesting conundrum, we are all not at the same starting point, and the chances of that ever happening are nil. >> exactly, and the challenge here, our country is based on the idea that you do more, you get more. you do better, you make better. and this is challenging that exactly. in the end, i look at this as an entire generation that's been educated to have resentment, to have a sense of denial and it's now coming through in how our young people respond. >> let's show everybody the final question that you asked this group, and it is this. you asked -- i don't know if we can flip that board back again before we go because we do want

6:53 am

to show that. i don't know if the folks who have that videotape can put that in the prompter for us, but the question, if i recall it, was about democracy, and the role of democracy and really whether democracy is in danger effectively of failing. let's show that. >> a lot of it stems from the fact that we're constantly fighting with each other and we're not even trying to solve the issues that everyone sees. our democracy is not going to kond to stand if we continue to fight the party lines. >> i think about like january 6th, when we're talking about politicians straight up lying to people about election fraud, things that are critical to our democracy, the foundation of america making those things unstable, making it so that we question, have faith in our election system, i think that is extremely dangerous. i think that is dangerous to the very core of our democracy. >> i trust them. these are not dumb people.

6:54 am

in fact, i think they're very articulate. i may disagree with them, and the things aisli'm looking at r now, and you and i were talking off air about the minnesota timber wolves, here's a great can example, the owner sells the team to new people. >> marc lore for those who don't know, also a-rod. >> and that new owners have done a fantastic job. by 20%, which is a huge number, the fans want the new owners to own the team and yet the old owner is saying, oh, no, no, no, now that we're doing well, i want the team back. that's crap, and i'm using very careful language here. this is why people have come to distrust capitalism. when they've come to distrust the system because the old owner thinks he can steal it back, he's going to try and the fans are saying no way. so my question to people watching right now, are you paying attention? are we going to make sure that the system works for everybody, and do you believe in some sense

6:55 am

of integrity and honesty that when you make a commitment you follow through. >> did you see anthony edwards on saturday night? you did? >> yes. >> i had the timberwolves. >> it's a great team now. >> 76ers. >> frank, we want to thank you very, very much. appreciate it, thank you for coming in. coming up, we're going to dig in to the move in bitcoin after friday's having echvent. that's next. plus, verizon set to report. we'll come right back.

6:59 am

having on friday, fourth ever. checking on the price of bitcoin now, it is up, and joining us, kathleen brightman. there's nobody that -- welcome, it's good to see you, kathleen, but there's no one that didn't know that the having was going to occur, so i'm a little bit surprised, although there had been a little bit of a pull back. but i'm a little bit surprised that you're seeing this much buying interest. one thing is for sure, though, if you are trying to buy bitcoin for these new etfs, it's harder to buy them now, right? >> yeah, i suppose so, and i agree with you, it is kind of silly that this is a meme that's been very popular. oh, the having is going to make the price go up. but ultimately it's a market that trades on mow mettics and you have to do the memes, right? >> got to do that. i'm using your numbers here, so 900 new bitcoins used to be created. now there's 450, and how many do

7:00 am

we need for ets in your view? is there an estimate for the demand that is now being generated by everyone being involved, all the blackrocks of the world? >> yeah, so i mean, one way of looking at it is the amount of bitcoin issued in every block is a security budget. it's set independently of how much security is actually provided so you can kind of look at it as it's set to create too much inflation until it creates too little security, which is kind of an interesting fluke of its design. what we saw over the weekend is that bitcoin's fees rose preci precipitously associated with this new project on it, a project bringing meme coins which are really popular right now to bitcoinland, so even though the actual reward for minting a new bitcoin or mining a new bitcoin was halved, transaction fees were really high, buyers made a lot of money, but fees tend to be

7:01 am

cyclical in bitcoin land, whereas obviously rewards are more set in stone. it's an interesting market for that reason alone. >> we only got about 30 seconds left, i think, kathleen, or maybe less. this is the first time we've had a having where it's happening at an all-time high, and it's always result ined in some pret good momentum for the months after a having. will that happen again? because we're already -- we've already had a move with the etfs or whatever it was? >> yeah, i think it's -- it's funny, it's not a large sample set of data to go on. it's only happening three times. definitely there's a lot more sophisticated actors. one would hope that the bitcoin market would be less susceptible to these self-fulfilling properties or memes. it also seems to ride very heavily on momentum or people are staying on the internet. it's obviously a lot of retail participation in the etf market. yeah, i think you know, it will probably go up because people think it's going to go up.

7:02 am

i think it should have also been accounted for well ahead of time so yeah. >> you can't go anywhere and not hear about it at this point, so i don't know what that means either, but kathleen, thank you. >> thank you. >> okay. okay. it is just now after 7:00 a.m. on the east coast. you're watching ""squawk box" here on cnbc. i'm andrew ross sorkin along with joe kernen and becky quick. it is the busiest week for earnings season with seven of the magnificent seven and one-third of the s&p 500 ready to report quarterly results outside of earnings. key factors to watch include gdp and the fed's favorite inflation gauge. pce. "the wall street journal" reporting that deal talks between salesforce and informatica have stalled. salesforce was reportedly considering buying the company for $10 billion in what would have been one of salesforce's largest acquisitions. nike set to sign an eight-year deal worth up to

7:03 am

$28 million with basketball star caitlin clark beating out a adidas, under armour and puma. nike's offer includes a signature shoe and given all the debate that we had just last week about how much caitlin clark was going to get from the wnba, $76,000 a year. it's nice to see a $28 million pay package ahead of her from nike. >> we're in an interesting place the wnba right now. >> they're finally getting the viewership. >> the draft, 3 million people watching the draft. >> yeah. >> and once again, you know, i got -- i fell in love with the caitlin clark phenomena. if i had seen more of south carolina, there's no way i would have bet on iowa for that. did you see -- >> it was unbelievable. unbelievable game. >> that center. >> yeah. >> dominant. i think there may be more really good players than just caitlin clark. checking the futures, taking a

7:04 am

look right now, up 191 points. we've had a couple of rough week weeks, probably not because we were out, becky. an andrew tried. >> it was really just last week. >> last week. you gave it the old college try, but we were down about 5% now. >> it was momentum. it was momentum play, technology. anti-momentum. >> i have delusions of grandeur. >> you do. you do. >> let's get to kristina partsinevelos. >> let's start with amazon, still a top e-commerce pick according to goldman sachs. they point to a resilient consumer but more so this year's size and dominance of amazon as a platform versus etsy and ebay. they believe amazon web service wills benefit from the migration to the cloud and increase in ai platform. ap apple earnings out, may 2nd, bank of america more optimistic with earnings estimates than most on the street, even though we do expect lower iphone sales

7:05 am

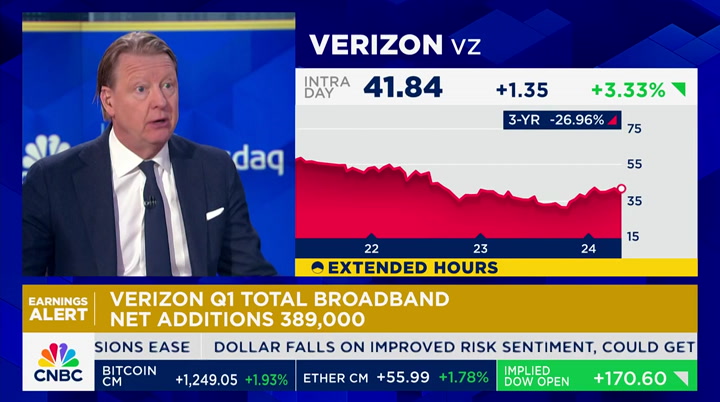

expectations, they suggest that $1 billion of apple vision pros are just not priced into the stock right now. they see gross margin benefits and services. jpmorgan not as positive on networking name cisco. they moved to neutral rating with a $53 price target. it's trading at 48.10 right no it's the medium term that worries them, driven by a slow down in networking. they think that right now dell is actually better positioned to benefit from ai trends than cisco. guys. >> thanks, kristina, we've got a big guest here, holy cow. in person. >> this is hans vesper we're talking about. he is joining us right now because verizon's first quarter results just out this morning. the company actually beating estimates by $0.03 with adjusted

7:06 am

quarterly profit of $1.15 a share. the stock up by 2.4%. the chairman and ceo is here to talk more about it. thanks for coming in. >> thank you, great to be here as usual. what happened? numbers were better than the street was can expecting even though the revenue was in line. >> what we are focused on is service revenue, continued momentum since the second quarter last year. now our service revenue growth was up 3.3% compared to a little bit over 1 hlast year in first quarter. continue with our offerings that are really sounding well with our consumers, and then on the business side, on the wireless, we have been growing all the time. our broadband business, we're almost almost 400,000 new net adds for the quarter, three, four quarters right now. actually, 18% more broad subscribers in one year.

7:07 am

all our businesses, our strategy's working actually and we had our challenges in '22. we didn't really perform. we did a lot of changes in the team, how we're offering products to our customers. so it was a good quarter, continued good momentum for us. >> subscriber base, broadband subscribers up 389,000. as you mentioned, i think it's been five quarters in a row now of about 400, just north of 500 or 400. what do you have to do right now to get those subscribers is part of it the streaming services that you guys have been pretty aggressive about partnering up with. >> we have exclusive distribution services. i think what we have for the consumer side is very clear plan, which actually offering to our customer different type of network solutions. right now we're running netflix and max, only us can do that. really working well with our customers.

7:08 am

it's also saving for our customers. we just stacked new editions and value for our customers, and that's how we expand our average revenue per user. just continue that, more innovation. the team has innovated good on the consumer side. on the business side, we have been taking share for a very long time. we're number one on large enterprises. we're number one of s and bs and the government when it comes to wireless. we have a very solid position in the market. this a quarter $12.1 billion. >> can you give us any guidance in terms of what you expect broadband growth to be this year or wireless growth >> i think what we have said, on the broadband side we like being around 400,000. you optimize your capital, how you deploy it. we like that number. when it comes to growth on wireless, we are going to be

7:09 am

positive this year on consumer net adds. consumer this year is going to be positive. we had actually our strongest year in consumer net adds in q1 since 2018, and that's a quarter when we see what's happening around us, inflation, high interest rate. we actually have our best first quarter since 2018 on consumer si side. >> we've been talking to you for years abouted g the growth of a what would happen with fixed line wireless. folks would have wireless, broadband to the home. bypassing cable, we have a unique interest in this. i think a lot of people do. where are you really on that product? >> the product is resonating extremely well with the market. it's easy to install as you install it yourself. takes you five minutes of broadband at home, and it works in any type of setup in the house or in residential, so it's -- so the rollout is going

7:10 am

really well, and that's when we turn on our band that we bought two years ago. then we see an opportunity in every market. >> but not yet. >> we see it right now, of the almost 400,000 unit adds this quarter, the majority comes from fixed access. fie i it's not only for consumers. think about that. historically we thought the idea of 5g to the home as broadband was mainly a consumer product. today we sell to small and medium businesses. >> and you can get enough throughput for a small business? >> we guarantee 300, so it's an extraordinary great experience. our mps skyrocketing on fixed access. >> if you're getting so many subscribers right now, broadband and beyond s that a reflection of a strong economy? you say despite inflationary costs. what do you see just in terms of the health of consumer? >> first of all, i see the same

7:11 am

thing that everybody skpraeds what you are reporting here every morning. first of all, our product, wireless and broadband is so important for every individual, for every organization. our product is moving up. secondly, our segmentation and having products all the way from low income families to some more advanced plans on broadband and wireless means we can address the whole market. i think that's -- and then our quality of customers is the highest in the market, so so far we haven't seen any impacts on our customers' payment regiments. they are stable. which is probably a bit different from other consumer brands, but i think the strength of the product, the strength of verizon's customer base, and the segmentation. >> one thing you and the other telecom companies are all pretty aligned on is pushing back against some of the federal regulations to give access to lower income consumers at price caps for your product.

7:12 am

where does that stand right now? >> so there is the program acp, which is the government is a subsidize for low income families. it seems like that will not renew. we have plans, we have fios that is efficient for low income families. we have the full breadth of prepaid wireless that is also addressing that. we will continue to address that opportunity and see that everyone in this country regardless of who they are should have access to wireless and broadband. >> but you don't want the federal government to push you to do that. >> no, this is segmentation for us. i have products for all types of individuals, organizations on wireless and broadband. i mean, we are number one in this market by far, and our job is to see that we address all the opportunities in the market, and that we do. think about it, we build a network once and we want as many profitable connections on top of it to get the best return on invested capital. that's what we're doing. >> hans, we want to thank you

7:13 am

for coming in. shares up by 3.25%. >> okay. coming up, a big week for earnings. we're going to talk markets after the break. tesla cutting prices for many of its cars as it deals with falling sales and weaker demand for electric vehicles. we'll have more on that story straight ahead as well. do not go anywhere, "squawk box" coming right back.

7:14 am

7:15 am

i don't want you to move. matching your job description. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

7:16 am

♪ let's talk markets now ahead of the busy week of tech earnings. an sta sha am roe sew is chief investment -- it would be nice to get 10 h%, will we? >> i don't know if we're going to get there, joe. the reason i say that is we came into the month of april with a technical backdrop. we've quickly corrected that. what was in overbought conditions for stocks is shaping up to be oversold for stocks. >> that quick? >> that quick. in the beginning of april you couldn't find any investors that were bearish on stocks and now

7:17 am

the percentage of bears is outpacing the bulls. i think we got a pretty quick technical correction, and with almost 3.5 to $4 trillion of money markets on u.s. household's balance sheets i think investors will be looking to step in. >> i don't know if fundamentals are ever coincident with what happens. we've got plenty of reason to explain 5% in terms of inflation fears, rate cut hopes. i don't even -- you know, there's some people saying 2025 now. >> right. >> and they say until we get the first cut. how do we know there's going to be a cut and not a hike at this -- so there's plenty of -- does that shift to allow us to make a bottom at only 5%? >> i'm really glad you bring up the fundamentals because there has been a repricing, specifically in yields, and i actually think that's very constructive. so when i look at yields today, i mean, we've moved, you know, almost 100 basis points since the beginning of the year. not quite, but what that means is that the market is now more

7:18 am

in line with the fed's thinking. the market is more in line with where we're seeing growth and the market is more in line with inflation expectations. what i like about the ten-year at these levels is it's actually trading above the implied fair value by some models. you know, we've now priced in maybe a rate cut, if that, so i think the market is exactly where the fed wants it to be right now. so if the ten-year treasury yield can pause around current levels, that's another reason to say that equity market probably presents good value. >> someone pointed out we're up 30% or so even after this pullback in the s&p over the past 18 months. why is bearish sentiment, why was it rekindled so easily with only a 5% pullback? why aren't people more in love with this market? >> yeah, i think a lot of people were optimistic on the markets because of the rate cuts. you know, that was a big narrative going into the year. there's another reason to be optimistic about the equity

7:19 am

markets, even without the rate cuts, you have resilient growth. we get gdp growth for the first quarter this week, and we're looking for about 2.5% increase in the fourth quarter gdp. that's a reason to be optimistic on the market, but for those, you know, previously in the bullish camp, they were looking for rate cuts. >> bear sentiment right now has been increased enough to where you think we make a bottom before a further pullback, before another 5%? >> i think you always need a cad list, and for this week in particular, obviously we've got the big tech earnings to look forward to, and i like that the reset we've had in some of those valuations as well. the other catalyst i'm looking for is actually this friday, which is a core pce number. clearly the last few inflation prints, that's what's stoked the bearish sentiment. if you look at the core pc, the big distinction between that print versus the other inflation print is you have a lot less housing exposure. versus 30, 32% in the core cpi basket, here you have about 15 or 16% exposure.

7:20 am

and by the way, last week we've got the new tenant rent index that registered at 0.4% year-over-year increase versus, you know, it was running at 12% some years -- a couple of quarters ago. so i actually think that core pce number if it comes in in line with expectations of 0.3 month over month, that could be your catalyst to say we have had enough of a correction. >> what happens if it's hotter? >> well, then, i do think, becky, that there's more downside to go. although i'm encouraged by the pickup in the bear sentiment, the reason i say investors are looking to buy this pullback gradually, is you do have a lot of length from systematic investors. the commodity trading advisers they're just about near max long. hedge funds, they've add add lot of growth and net exposure, if we do trade down because of a core pce miss, then i think you have more of a technical unwind. so you know, look, investors

7:21 am

still are sitting on those money market funds, and i think a lot of investors have their strategic allocation, but they're underweight equities quite significantly, so we've been waiting for this all year for the opportunity to get back to strategic allocation, and i think that's what this pullback is about. you don't need to buy it all here right now, but gradually buying the dip is what i would do here. >> anastasia, thank you. >> thanks so much. good to see you. tesla shedding more than $70 billion in market cap last week. over the weekend, elon musk announcing price cuts in a number of major markets including china and germany. we'll talk about that move, the stock, and elon musk's price war right after this. and then founder and ceo of operation hope, john hope bryant joins us for a wide-ranging interview from politics to the wonomy. weill cover it all. "squawk box" will be right back. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen.

7:22 am

why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

7:24 am

at 88 years old, we still see the world with the wonder of new eyes, helping you discover untapped possibilities and relentlessly working with you to make them real. old school grit. new world ideas. morgan stanley. welcome back to "squawk box," shares of tesla hitting a 52 week low falling about 40% this year. the company cutting its model y, x, and s vehicles. tesla slashing prices in china and germany. according to "the wall street journal," the company may be losing potential buyers, mainly democrats. joining us now is tim hagueans, wall street journal business columnist. let's talk about what we might hear from elon musk tomorrow when he does his earnings call later in the afternoon, which i

7:25 am

think is the much-awaited moment where we may find out where this is all headed. you have a take, which is that you believe that democrats may not be buying the teslas. i was going to say that may well be true. the other side of this is you oftentimes hear that republicans aren't buying evs. i don't know if you think they're not buying evs, they're not buying teslas either? >> that's the dilemma. that's probably the challenge that elon musk has right now. for years democrats have been the biggest kind of canohort of electric car buyers, and that has been the biggest cohoert of buyers for tesla. when we started to see last fall elon's more controversial comments regarding immigration, regarding that infamous tweet that some saw as anti-semitic or at least amplifying that kind of vitriol, his kind of public battle against dei. you started to see consumers,

7:26 am

democrat, pulling back, which it could be very troublesome this year, you know, in a very hot political year when evs have been very much polarized. we've seen republicans traditionally have been for every five democrats buying an ev, only two republicans have been buying an ev here in the u.s. >> tim, are you surprised that ev buying in the united states has become political? i mean, you can see a clear distinction between red states and blue states, and europe, by the way, it is not like this. in parts of asia, it is not like this. >> yeah. historically it's really been this way. you go back ten years ago when the obama administration was saving general motors from bankruptcy, the idea of the volt was going to be the future of kb gm. it was very easy during that presidential cycle for republicans to talk about the volt being the obama mobile and

7:27 am

tasked it as a political wedge in that election. you started to see some improvement when car makers's focused on the performance of the vehicle and frame it as not just an electric car but the best car. that resonates with buyers. they aren't buying an electric car, they're buying a tesla. that has been increasingly important in the u.s. for the mind-set of the buyer. >> tim, you've been following elon musk and tesla for a very long time, and we're going to be hearing from him tomorrow afternoon, lots of various expectations about what we're going to hear. we talked to phil lebeau earlier, the biggest, of course, is this announcement about a robotaxi. the question i asked him, for a robotaxi to work you have to be at level 5 autonomy, which means no human intervention at all. how far is tesla from truly level five, no human intervention ai in the car? >> well, we haven't seen it so

7:28 am

far. we haven't seen the tests of it. we haven't seen these vehicles out in the real world. to me, one of the -- to me and other experts, one of the red lines here for judging if this technology is real is when tesla starts to take a legal liability for these vehicles, if the vehicle is driving itself, then tesla should be liable, according to a lot of experts. right now auto pilot, fsd, these are essentially glorified cruise controls. i'm not saying they're not impressive, but they cannot drive the car and the company even says so. the company says the driver needs to monitor. the driver is in charge. that at the end of the day is the dividing line. >> the technology that's on a cruise, for example, or some of the waymo vehicles include lidar, which is effectively a laser system with radar and other things. elon musk has avoided those technologies for a while saying he believes it can be done with cameras. do you believe that the tech and the rig, if you will, of

7:29 am

technology that exists in the car, on the car needs to change to be able to get to level five? what do you think the cost of that is if it has to? >> the biggest party debate here in silicon valley for years has been this question. elon makes the argument that humans just have eyes, so essentially the camera can be like the creyes of a huchlman. the challenge is that the lidar, the radar, other sensors they put on their vehicles essentially helps the vehicle in these edge cases. the concern is that when they launch these vehicles that the humans are not going to be tolerant of a robot car crashing. if you or i were to crash in a bad situation, maybe it wasn't our fault. it maybe was our fault, humans are going to be more understanding. if your toaster attacks you, you're not going to trust it. >> tim, it is a longer

7:30 am

conversation, i imagine we may get to have it with you later this week. we'll see what happens when we do hear from elon musk and tesla tomorrow afternoon. thank you for joining us this morning. >> thank you. coming up, a new nbc poll on who voters trust when it comes to handling the economy. then later in the prom, former boston fed president, eric rosengren is going to join th to discuss the fed's rate pa, sticky inflation and much more. "squawk box" will be coming right back. we never lose focus on the life you want to build. it's time for wealth solutions as sophisticated as you are. it's time for corient.

7:33 am

a new poll from nbc news found that more voters trust donald trump than president biden when it comes to handling their top concern, that's inflation and the cost of living. only 11% of respondents named jobs and the economy as the most critical issues facing the country compared to 23% who said inflation. overall, the nbc poll found that biden appears to be catching up to trump's lead. it found that trump lead biden by two points in a head-to-head matchup which was lower than his five-point lead in january. the poll does have a margin of error of about 3%. up next, operation hope's founder, chairman and ceo john hope bryant joins us for a wide ranging interview. and later, stocks on pace for their biggest monthly drop since 2022 as technology tumbles ahead of a very busy week for earnings. katie stockton will join us to talk technicals. quk x"ilbeig bk.

7:35 am

dude, what're you doing? i'm protecting my car. that's too much work. weathertech is so much easier... laser-measured floorliners up here, seat protector and cargoliner back there... nice! out here, side window deflectors... and mud flaps... and the bumpstep, to keep the bumper dent-free. cool! it's the best protection for your vehicle, new or pre-owned. great. but where do i---? order. weathertech.com. sfx: bubblewrap bubble popped sound.

7:36 am

welcome back to "squawk box," last hour we spoke with frank lunds about how gen z views capitalism, take a look at this. >> our country is based on the idea that you do more, you get more. you do better, you make better, and this is challenging that exactly. in the end, i look at this as an entire generation that's been educated to have resentment, to

7:37 am

have a sense of denial, and it's now coming through in how our young people respond. >> for more on this and so much else, let's bring in john hope bryant, founder, chairman, and ceo of operation hope as well as a cnbc contributor. he's got a new book out called "financial literacy for all," we'll talk about that as well. nice to see you, sir. >> nice to be here. >> you've talked about meritocracy for a long time, but you've also talked about equality, equity. one of the things that is discuss instead this focus group is this idea of equity that everybody needs to start now, some of the folks said, at the same place because everything is so out of whack to begin with that they're never going to get up. that's at least the underlying message of that. what do you think of that? >> i think frank is a good guy by the way, the guy who did the survey. >> a but, here it comes. >> i hear it. >> first collected like a capitalist, right, and the

7:38 am

ladder is broken, but we don't all start at the same place. that's just ridiculous, and of course we can't have time on this session to go into the great history of this country where 10% of all land was districted to people who don't look like me, that was the homestead act and it goes on and on up to 1913 which was the fha red lining community. the fact that we are somehow all fair and equal is factually, mathematically incorrect. what he is correct on is the perception that the ladder is broken. that's one of the reasons i wrote this book. i think capitalism's image is bad. i think -- and capitalism's branding is bad, and that's capitalism's problem. and the 1% has to empower the 99%. if you work hard, play by the rules, do the right things, stop at red lights, respect your elders you can have a shot at going from the bottom to the top, just like me because as you know, i was homeless for six months of my life. as you know, i lived in compton,

7:39 am

15502 south fray lee for six months of my life. my mother had a high school education, my dad too. i sit here as i guess top 1 prerng which meant i got role models, mentors, not just because i was smart. somebody opened the door for me and kept it open. doug mcmillon, the ceo of delta said the guy is smart, but let's open the door. >> let me ask you a separate question. after the murder of george floyd. >> yeah. >> we went in this country and in corporate america -- >> by the way, women went through the same thing, by the way. >> through a major dei movement, right, around corporate america, there's a complete ecosystem now around dei, and yet, it appears that the dei ecosystem is being dism dismantled. you can look through -- there was a big story about it, s.e.c. filings by companies. dei being removed from the topic

7:40 am

du jour in those filingsment what do you make of that? >> it's mathematically stupid. >> which is stupid? >> dismantling of it. take the moral issue out, i think will is a moral issue. i mentioned it briefly in my remarks. take the ethical issue out. there are four authoritarian nations who want to take our place in the world, china, russia, north korea, and iran, and they're working every day to knock us off, and everybody wants to be american but americans. the math says we have the first generation over 65 in our lifetime, those are white people who have done well who are trying to retire. the math also says that social security won't be able to pay 100% of their returns by 2034 or something like that. the math also says that today black and brown people and women and poor whites are half of this population and growing and no

7:41 am

one taught them capitalism or free enterprise. you take those numbers alone -- >> but that's something that -- that's something you actually agree with frank on. he thinks that capitalism and free enterprise should be taught in schools and that it's not being right now. >> by the way, this book is a culmination of "squawk box." me coming hiing here and talkint this has main streamed the issue. the color is not black and white today, green, and we've got to save the largest economy in the world to be the super power in the world, and if we stop- de and i is almost like research and development for the future economy. so it's stupid to stop it. >> is dei and meritocracy at odds? let me ask you maybe directly that way. one of the things that's happened in the past two weeks, harvard university and a number of others now have replaced, have brought back the s.a.t.

7:42 am

there was an argument that had been made that the s.a.t. was racist, that the s.a.t. was actually preventing minorities from getting opportunities is and giving universities the opportunity to make their own choices about meritocracy, and then studies were done on the s.a.t. and you're now seeing harvard and others -- i know some people disagree with those studies -- suggesting actually that the opposite was happening, that it was making meritocracy less valuable. >> another one of my first public board i screwed up something and didn't know when i screwed it up, and i got a call from the s.e.c., and i was -- i did it innocently, but no one had given me a briefing book on a public board. no one had said, here's the memo. i'm a pretty smart guy but it's what i didn't know that i didn't know that was killing me but i thought i knew. once i got the memo, i never did that again. it's not about -- the s.a.t. is not racist. credit scores aren't racist, but

7:43 am

it's an and conversation, not an or conversation, and sometimes you need some additional context around the conversation because some people just never got the memo on how this system works and some people come from a different cultural background. once again, i think we're shooting ourselves in the foot. >> it doesn't help anybody, even the people that are benefitting you hope from dei itdoesn't help them if there's this stigma or even an unfair criticism that they're not there because of -- >> i could care less about a stigma -- give me a cash loan, give me a line of credit. >> i've heard them say didn't earn it. do you want to be in a position where people -- >> not one ounce of my self-esteem depends on your acceptance of me. joe, you started it. i want to finish it. now, i love you, that was one of the craziest things you've ever said. there's been pushback on progress since reconstruction. abraham lincoln did it and was

7:44 am

assassinated because he wanted to give blacks the right to vote. >> it's not my criticism. andrew brought it up. >> i'm not picking on you burt you've got to listen, i'm going to do this quickly. they stopped reconstruction within two years of 40 acheers and a mule, then covers did. >> don't gaslight me. >> he brought up the article that says dei is under attack because it impugns the people that it's meant to help sometimes. >> no, it doesn't. no, it doesn't. i believe in the james brown version of affirmative action. open the door, i'll get it myself. but i don't mind somebody opening the door. i thank them for it. tony rexler cracked the door open and said you are not going to close the door on my foot until john comes through. i thanked him. somebody helped you, somebody helped becky. somebody helped andrew. >> let me ask you this -- >> i love you, joe. >> we're going to talk about what's happening at columbia university in the 8:00 hour, you can say what are you talking about, how are these things connected. one of the things that happened

7:45 am

in this focus group was the idea that those in capitalism that are successful effectively are the oppressors. we've worked into this sort of oppressor, oppoppressee framewo in life, those who have got success have done it on the backs of others. i'm curious how you think about that. it's important. that framework is now being used i would argue at columbia university over the weekend as it relates to anti-semitism in this country. >> i think we start getting in these petty arguments we're going to start shooting ourselves in the foot. we got to realize that we live in a capitalist democracy. we have to realize it's never a super power and economic power at the same time, france, britain, i mean, just name it, germany, at the same time, super power, but when france ignored the least of her god's children, they got into trouble. all i'm saying is we need -- people say they hate rich people.

7:46 am

no, they don't. you hate rich people until you become rich. what you hate is a gamed system. >> right. >> you hate a system that you think is rigged against you to suc succeed, and i think that we have a responsibility -- that's why i call it the civil rights issue of this generation. the issue is not in the streets anymore. it's in the suites, and i believe there needs to be a new constituency in the suites that is opening the door for free enterprise and opportunity for all on a reasonable basis, on a fair basis. i think joe and i would 100% agree on that. i'm not talking about somebody who's stupid or dumb. my mother was brilliant. she just didn't have a formal education. there are a lot of people like that who just need a shot. i think we're arguing about the wrong things and the wrong ways and the wrong places. we need to be trying to figure out how do we get the bottom to the top before we're all speaking mandarin in 20 years. i'd love to come back on and have a proper debate about the business plan for america, which i will publish in a couple of weeks, which will lay out the math of why de and i debate is

7:47 am

ridiculous. the math is undeniable. >> the invitation is out, and we hope to have you back for that conversation. >> i do. and joe, you're one of my favorite people. >> gaslighting. >> the book is called "financial literacy for all," we appreciate you being here and participating as always. it's good to see you, sir. >> thank you. we should also mention john's got an op-ed on our website right now on this very topic on cnbc.com. the tale of two real estate markets, robert frank will join attoight after the break with th sry. "squawk box" will be right back.

7:48 am

- so this is pickleball? - pickle! ah, these guys are intense. with e*trade from morgan stanley, we're ready for whatever gets served up. dude, you gotta work on your trash talk. i'd rather work on saving for retirement. or college, since you like to get schooled. that's a pretty good burn, right? harry & david makes mother's day easy. share a gift, made with love, with the mom in your life. choose from hundreds of stunning baskets and towers. it's the perfect way to say thank you - for everything. harry & david. life is a gift. share more.

7:49 am

norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling.

7:50 am

7:51 am

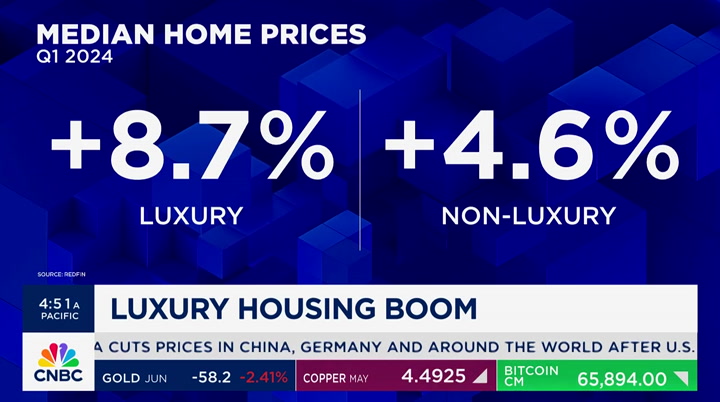

falling 4% nationwide, but luxury real estate saw the biggest increase in three years. the tale of two markets is being driven by rates and supply. mortgage rates above 7% have put homes out of reach for most buyers, but wealthy buyers are paying cash, about half of all luxury homes were bought with all cash in the quarter. highest in at least a decade. in manhattan cash deals hit a record 68%. all that cash is pushing up prices. luxury home prices soared 9%, twice as fast as the broader market. higher prices are also drawing more buyers. the number of luxury homes for sale jumped 13% in the quarter, that compares to a 3% decline in the rest of the housing market. so you actually have inventory at the top, market with the fastest luxury price growth was province, rhode island followed wou by virginia beach.

7:52 am

seenl seattle and then austin. you can read more in the inside wealth newsletter for a lot on where the wealthy are investing. >> anything that -- any activity is good. is is it not? >> yeah. i mean, you are just talking to john about inequality. you have a situation now where homeowners are seeing their price appreciation growth, but you are not getting equity and buying in to homes new. and so that is even wired now when you look at sales at the top where people can exit a home because they will pay cash for their next home. so you have a much more liquid market at the top than you have where the rest of the market is frozen because no one wants to get out of their -- >> what is happening as a result of the lack of mobility? do you think a couple years from now we'll realize nobody has moved and what that means?

7:53 am

>> the studies of mobility which take a look at -- you know, you look at decades. basically say that it has been flat. it hasn't decreased. there were some studies that ten years ago showed a decrease. it hasn't. it remained flat. and what we have seen about inequality, inequality shrank. but now it is growing a little bit again and that is because of the stock market until recently has had such strong performance. >> and i'm talking about physical mobility. you are unwilling to sell your home. >> absolutely. >> because it will cost you too much to go somewhere else. the idea that people are not going to go take that job across the country. or they won't- >> and it is a logjam. >> and that has created areas of labor shortages where i think normally america is known for its labor mobility. that is what we have, better than europe. americans are more able to move than europeans.

7:54 am

and so i think that is where you have pockets of the country where the labor shortage sch more dramatic than other parts because people don't want to move. and i think companies are seeing that. i think that is why remote work has survived as long as it has because it is one solution. housing is -- higher rates are trapping people in their homes. >> and the supply of housing should have been increased because of the demand that usually matches. and it hasn't. we've had the supply problem for much longer than you would think. >> higher rates, lower prices has not happened this time. and we saw that shelter was one of the big reasons that we had an increase in the cpi. and if you look at new york, you look at the major cities, rents are still very high. they are not going up as high as fast, and prices are still going up. because there is zero supply especially in the middle to bottom. >> robert, thank you. and when we come back, oil markets apmid tensions in the

7:55 am

7:56 am

it's time. yes, the time has come for a fresh approach to dog food. everyday, more dog people are deciding it's time to quit the kibble and feed their dogs fresh food from the farmer's dog. made by vets and delivered right to your door precisely portioned for your dog's needs. it's an idea whose time has come. ♪♪

7:58 am

welcome back. let's get a check on the oil markets. right now it looks like crude oil is town by about 8 cents. for the week 2.75%. $83.06 a barrel. but year to date, still up by about 16%. joining us now is the global a head of commodity strategy at rbc capital markets. and there is so much to talk about. things that are impacting the global energy markets. maybe we start though with the foreign aid bill that the house passed over the weekend. but that has major implications not just for the middle east but ukraine and russia as well. >> i think it is a very significant bill. two things we're watching. we've seen the increase in attacks on russia energy strzok

7:59 am

by ukraine since the start of the year. the position of the ukrainians, if we don't get money and weapons from the west, we'll defund the energy atm. white house not 4happy about that. so with the aid going to ukraine now, will ukraine essentially say okay white house, we'll cease our attacks on russian energy. so we're watching that. second yissue, the sanctions on iran and calling the white house to have to implement sanctions and also penalizes ports that take iranian crude shapements. so the question is, is the white house going to go forward if this bill passes as expected and actually have to start taking iranian volumes off the market. >> so let's back this up a bit. we've talked about how the white house was trying to push ukrainians not to attack those russian oil installations because the white house doesn't want to see oil prices go

8:00 am

higher. that is a difficult thing to face in any environment, but particularly in an election year. same story held true with iran. they have not played more hardball because they didn't want to see iranian oil not get shipped out for the global market. >> this has been a limiting factor on u.s. foreign policy in both these instances. in the case of russia, we have essentially allowed russian oil to stay on the market. that is what price catch was designed to to, enable russian barrels to flow to egypt. same thing with iran. iranian exports are at a five year high. so the question particularly on iran with congress now saying to the white house we want to see a significant reduction in iranian crude exports because what this money is funding in the middle east, will the white house go along with this or will it basically say we have a waiver 180 days, and we're concerned about tightness in the oil market. so a tough choice for the white house come summer.

8:01 am

>> so combine that with the attacks that we saw from iran launching for the first time, direct attacks on israel last week, where do you think that puts oil prices in the next six months or so? >> the interesting question is, are we done. essentially is this latest dust up between iran and israel the peak of tensions in the middle east or is more potentially going to come. i think for now both israel and iran have signaled they do not want a direct war at this stage. iranians are happy to fight it through proxies. that does not mean the middle east is going to work through the period. but for now they are saying we'll focus on other issues, we'll focus on the fundamentals. that still means that we have support for oil prices around this level. the question is as we get into summer and peak driving demand, is it going to be a situation or a back above 90 for brent, $4 a gallon for retail gasoline

8:02 am

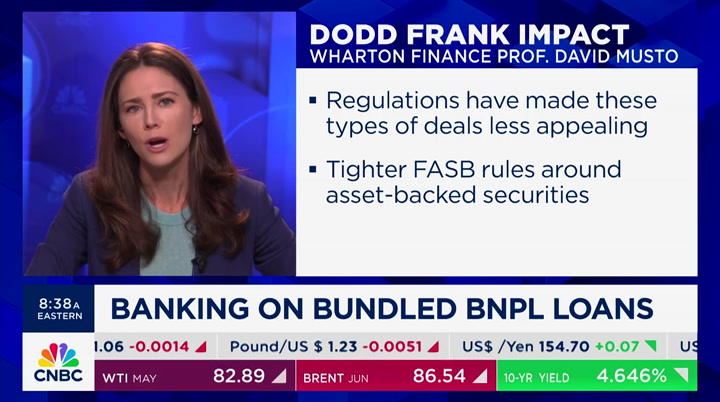

prices, and does this administration go back to the spr. they have signaled to try to bring prices down. >> and thank you very much for joining us today. just after 8:00 a.m. now. you're watching "squawk box." i'm joe kerr in that along with becky quick and an through ross sorkin. we're at full strength this morning. two of us well rested. >> i'm well rested. i had the weekend. >> low 80s isn't bad. >> and among the top stories, tesla shares falling in the pre-market, the company slashing car prices in a number of countries as it battles for ev market share. speaking of tesla, carmaker set to help headline a big week of earnings. very busy week. also reports from meta, alphabet and microsoft in the next two days. and a $95 billion aid package

8:03 am