tv Worldwide Exchange CNBC April 22, 2024 5:00am-6:00am EDT

5:00 am

5:01 am

package. what it means for the global markets and investors. wedged into the foreign aid is the tiktok ban proposal. ahead of the senate vote, we ask what company would buy what's become a social media mainstay? salesforce $10 billion deal fizzles out. it is monday, april 22nd, 2024. you are watching "worldwide exchange" here on cnbc. good morning. welcome to "worldwide exchange." thank you for being withes us. we check with the stock futures with the s&p on pace for the biggest monthly drop since 2022. we have seeing futures in the green. the dow would up 25 points

5:02 am

higher. this is after a rough week for wall street which saw the s&p fall 3% and post the worst week since march of 2023. nasdaq falling more than 5.5% last week. that worst week since november of 22. you within tech, a closer look at the magnificent seven. we are talking about $950 billion in market value lost. nvidia losing $300 billion in value or more than the enter market cap of amd. apple, microsoft, amazon wiping out $100 billion of value just last week. sliding stocks on the pop of bond yields. the benchmark ten-year yield at 4.65. it it has risen 40 basis points in

5:03 am

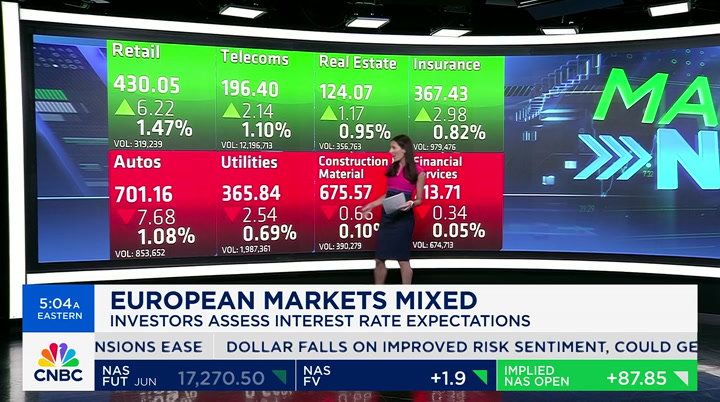

november. we are looking at commodities and oil with the worst week since february. look at oil right now. it is under pressure once again. right now, wti crude is trading at $82.50 a barrel. brent crude is down 1%. it is trading at $86.40 a barrel. time to see how europe is shaping up with silvia amaro with more. >> frank, we are seeing investors with more appetite for risk assets today. in today's session, i would highlight the ftse 100 trading higher by 1.3%. this was a different message from what we saw at the end of last week. we also are seeing green over in france, germany and spain. what we are noticing is investors are setting aside the geopolitical concerns from last week and they are more focused on the upcoming data and

5:04 am

earnings. when it comes to data, we get pmi and european data from germany. let's take you to the sectors to understand the picture. we have retail trading higher by 1.5%. we saw brokers upgrading the forecasts for the sector. that is contributing to the positive momentum there. we havehave telecoms trading hi. real estate is sensitive to ca. we have deutsche bank and barclays reporting as well. it will be a very busy week for investors, frank. >> a busy week for investors. silvia, thank you. we turn attention back to

5:05 am

wall street. investors are waiting the busy week of earnings season. 29% of the s&p and 30% of the dow are set to report with mega cap tech being in focus. it is a big week for industrials and transports. with the s&p on the pace with the biggest drop since december of 2022. do they have what it takes to bring stocks back to life? we have seema shah with us. we have a big question for you, seema. will earnings take the market around? do earnings have the power? >> good morning, frank. it is an important week. before the last couple days when we had the controversy with the fed, i think we will look to the earnings season to shore up the growth expectations and realistically, you may go through a bit of time in the coming weeks.

5:06 am

if it can reassess, earnings should return to the upward trend. >> i want to ask about tech specifically. how important is the quarter for the tech and a.i. boom and productivity? there was research out on friday. when you look at five of the magnificent seven, they are forecast to see 64% growth. the rest of the s&p is 495 and that would be 6% lower if you take those out. in your mind, how important is this earnings season when it comes to the mega cap tech names? >> the names continue to dominate the market. if they do not do well, they will send the market down for the time being. for the tech companies, we have the expectations which are lofty. they do need to meet the lofty expectations. you will see the challenges for

5:07 am

the s&p 500. if you are looking out for the next six months and you see the economy is not racing to recession, but a downshift in growth, but the rest of the s&p 500 should join in the rally and you should see a broadening. for now, not just for each earnings season, but the tech results are important. >> we have important reports coming up. gdp and inflation as well. in your vonotes, you say the fe is eager to cut. what makes you think the fed is eager to cut despite the rhetoric? >> they are being challenged by the inflation narrative. disinflation seems to run out of steam at this point. what we are hearing fromm the fd is they want to extend the economic cycle. not focus on bringing down inflation specifically. they want a clear balancing act.

5:08 am

it is a pivotal time for them. if they get enough rationale, the idea of inflation/disinflation narrative is reassessing itself. i think you could see that as a green light for the fed cuts. i have to say there is a lot of uncertainty about the timing. we expect the first cut in september and then followed by december. the election makes that complicated. >> a lot of people are saying the election will complicate matters. first cut in september. seema shah, thank you. >> thank you. >> for more on the trading day ahead, go to cnbc pro at c cnbc.com/pro. we have more to come, but tesla is showing no signs of easing as elon musk reignites the global price wars.

5:09 am

on to the senate after the house passes aid in billions to ukraine, israel and more. what you need to know next. and later, buried in the aid package is a possible u.s. tiktok pban. what bytedance is saying today dialwho would buy the soci mea platform? we have a very busy hour when "worldwide exchange" returns.

5:10 am

what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. my name is oluseyi and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport. food isn't just fuel to live. it's fuel to grow. my family relied on public assistance to help provide meals for us. these meals fueled my involvement in theater

5:11 am

and the arts as a child, which fostered my love for acting. the feeding america network of food banks helps millions of people put food on the table. when people are fed, futures are nourished. join the movement to end hunger and together we can open endless possibilities for people to thrive. visit feedingamerica.org/actnow welcome back to "worldwide

5:12 am

exchange." we are turning to washington where house speaker mike johnson defied the faction of republicans over the foreign aid packages which included $60 billion for ukraine. johnson may be fighting for his job as the lawmakers step up to push him out. brie jackson has the latest from washington, d.c. with the story. brie, good morning. >> reporter: frank, marjorie taylor greene signalled she will move forward with the effort to remove speaker mike johnson from his role. >> on this vote, 311-112. the bill is passed. >> reporter: the u.s. is one step closer to delivering much-needed aid to help ukraine after the house passed the $95 billion aid package saturday. a move praised by ukrainian president zelenskyy in the interview on "meet the press." >> translator: i would like to say thanks to the congress bipa.

5:13 am

thanks to speaker johnson and president biden. it is important. >> reporter: the measure provided money for israel, taiwan and more than $6$60 billn for ukraine. it received pushback from republicans. they were upset that speaker johnson worked across party lines to get the job done. >> i think every american in the country should be furious. >> reporter: johnson now faces the threat of being removed from the speakership by members of his party. >> the pressure cooker is at a high local maximum because he has taken away every leverage we had to do something on the border by sending $100 the billion overseas. >> reporter: democrats and some republicans are vowing to vote for johnson to remain speaker. >> when the motion to vacate is threatened every week in the

5:14 am

congress, that is being abused. >> reporter: house speaker johnson is standing firm saying he has a job to do and he's not going anywhere. meanwhile, the senate is expected to vote on the foreign aid package as soon as tuesday. frank. >> brie jackson in d.c. thank you. time to talk about the investor package with teina fordham. joining me here on set in london. tina, great to see you in person. >> likewise. great to have you in london. >> picking up with the foreign aid package and the $60 billion to ukraine. you went meme on us. you said f-around and find out when it is stalled. what do you think of the

5:15 am

weekend? >> thanks for reminding me of that. it is appropriate. i have to say, frank, today is a good day. it wasn't looking like the u.s. would pass this aid package. i understand it is not popular with a lot of house republicans, but a majority of americans are supportive. majority of congress is supportive. this is not just about helping out good causes. this is about the geo strategic calculus that the u.s. and allies is operating in here. this is a major breakthrough. i have a smile on my face. >> i want to go to a bigger part of the global economy. the oil market. something we have been watching closely and oil prices spiked on the news that israel will respond on the news of the attack. oil prices are down 3% if you look at brent. does this oil market signal the

5:16 am

situation in your mind or is it detached from the possible list and geopolitical situation? >> the oil price is probably the most traditional indicatorof geopolitical risk in the markets. it has been extraordinary that we have seen so little in terms of an oil price risk premium reflected since the uptick in geopolitical risk in the middle east. that reflects an important change which is the advent of u.s. energy independence. back in 1974, with conflicts in the middle east, the revolution in iran after that, triggered the u.s. recession. that mechanism is not the same anymore. that is not to say that geopolitics is not having an impact on the investment environment. >> are you saying the risk is not priced in? >> i'm saying it is not reflected through the oil price channel.

5:17 am

we see it in gold and we see it in risk appetite. now, obviously, we're back to risk on. we see it in sentiment and treasury yields. also, there is a feedback into election sentiment. >> you have clients in the u.s. and overseas as well. most of your clients are convinced this election in the u.s. is over. that trump will win. if you look at the latest nbc news poll, it is neck and neck. trump is in the lead, but it is well within the margin of error. how should investors view this with the other things going as we mentioned with the middle east tension and the passing of the funding to ukraine and other foreign countries? >> we never had so many front-row geopolitical spectacles at once. we have tensions in the south china sea and philippines. there is no peace deal, but

5:18 am

subsideing of the risk and the russia issues. russia has been pounding hard on ukrainian territory. that is all still live >> bottom line, does it matter to investors who wins the election? does it matter with portfolio managers or asset classes? >> it depends where you are located. u.s. investors are sanguine about the trump 2.0. it is a different story in the rest of the world. not just europe, but asia where the u.s. has security allies. this surprises american investors that i talk to here who think the race is wide open and don't think a trump 2.0 would be so bad for their portfolios. it is the security relationship that really matters to europe and middle east as well which still relies on israel and asia.

5:19 am

a lot at play here as you mentioned the statistical tie. we have a 3% to 5% margin of error. it is not about the national polls. americans don't get focused on this. they are exhausted by politics. until september, this has room to fluctuate. >> safe haven assets like gold. i thought you were going to say f-around and find out. >> i'm trying to be better behaved. >> the lowest level in the election this 20 years. >> the double haters. >> tina, thank you. great to see you. >> thank you. coming up here on "worldwide exchange," opening statements set to begin in former psintrede trump's hush money trial. we have the details when "worldwide exchange" returns. stay with us. the road to opportunity. is often the road overlooked.

5:20 am

5:21 am

5:22 am

welcome back. turning our attention to the soft commodities and cocoa which is the key ingredient in chocolate. it is trading at an all-time high after the rally spiking 300% over the last year. we will get to that mystery in a moment. chocolate makers have raised prices with easter in recent weeks, but chocolate demand increased 9% from q4 to q1 according to hershey's and

5:23 am

others. the crops in west africa has had a shortfall. i spoke with the executive director who will present at the meeting in brussels this week. he cited plant disease and el niño as the reason for the shortfall. there is no clear cause and that is raising concerns over the fall harvest and the mystery is what traders say is keeping prices elevated. >> the major issue today is i can't tell you exact reason why the crops have failed in the way they have this season. as i can't be categoric about the reasons and can't tell if it will happen again. >> hershey was concerned about the rising prices of cocoa

5:24 am

prices. it is the tightest cocoa market in 50 years. you can see other cocoa makers are trading lower. commoditytraders are seeing a bull market in another soft market which is coffee which has risen 25% in last month. that is due to the shortage of crops in vietnam with less rain and higher temperatures. the coffee market is literally three times bigger. time for the check on the other headlines with nbc news' frances rivera in new york. rising coffee prices is something that concerns you and our audience. >> i know. jump start our day. let's get started with the headlines, frank. within a matter of hours, opening arguments will begin in the criminal hush money trial of trump. the former president has pleaded not guilty of 45 counts of falsifying business records. mr. trump said he is willing to testify in the case. if convicted, he faces up to

5:25 am

four years in prison. to an ongoing campus controversy here in new york city. at columbia university, protests continue despite mass arrests. a campus rabbi warned jewish students to stay away from the school for the time being. the university president has said all classes will be remote to deescalate. jewish students do report feelings of being unsafe in columbia, but protesters say they areobjecting to the war in gaza. 50,000 people lined up in d.c. this weekend to wall the boulevard turn into the f1 race. it featured retired red bull driver who sped between capitol hill and the white house in a car that can hit a cool 200 miles an hour. it is part of the series of events at u.s. cities designed to bring the lightning fast cars closer to the fast growing american fan base. you are up to date, frank.

5:26 am

>> frances, thank you. coming up here on "worldwide exchange," adding to the tesla war of worry. what our next guest said the stock had fallen another 42% this year. we will be right back with that story on "worldwide exchange." they are playing great. meanwhile, i'm on the green and all i can think about is all the green i'm spending on 3 kids in college. not to mention the kitchen remodel, and we'd just remodel the bathrooms last month. with empower, i get all of my financial questions answered. so i don't have to worry. so you're like a guru now? oh here it comes— join 18 million americans and take control of your financial future with a real time dashboard and real live conversations. empower. what's next.

5:27 am

when i was your age, we never had anything like this. what? wifi? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online.

5:28 am

5:29 am

"worldwide exchange." stocks looking to shake off another tough week. right now, futures are working for some fresh momentum. speaking of tech, a big week with earnings with four of the magnificent seven members on tap. will the results mark a turning point or more bumps and bruises? and potentially banning tiktok as the bill moves in congress. the latest if the lawmakers will get the legislation over the finish line. it is monday, april 22nd, 2024. you are watching "worldwide exchange" here on cnbc. welcome back to "worldwide exchange." i'm frank holland coming to you from cnbc london. we pick up the half hour check with the stock futures with the s&p on pace with the biggest monthly drop since december of 2022.

5:30 am

you can see futures are strong in the green. dow is looking like it would open up 160 points higher. the nasdaq is up .50%. you see the s&p firmly in the green as well. this after what was a rough week for wall street. the s&p fell more than 3% and had the worst week since march of 2023. it was worst for tech and nasdaq falling 5.5% last week. the worst week since november of 2022. nasdaq is now riding a four-week losing streak. this is coming off the heels of popping bond yields. we start with the 4.65% on the ten-year yield. that is putting pressure on the equity market. we are looking at oil as welcomwelclwell. wti is trading at $82.70 a barrel. easing off the lows from earlier today.

5:31 am

similar for brent crude d down .75%. trading at $86.65 a barrel. that's the head up. let's turn to the tech and four of the magnificent seven get set to report this week. meta, alphabet and microsoft. the stakes could not be higher after ugly days which fall the sector falling 7%. the worst week since march of 202. a 2020. 29 of the nasdaq 100 are 20% from their 52-week high. look at some of the biggest pullbacks in the space. amd is off 35% from the high. intel off 33%. palo alto off 27%. adobe is also off 27% with nvidia off 22% in bear market

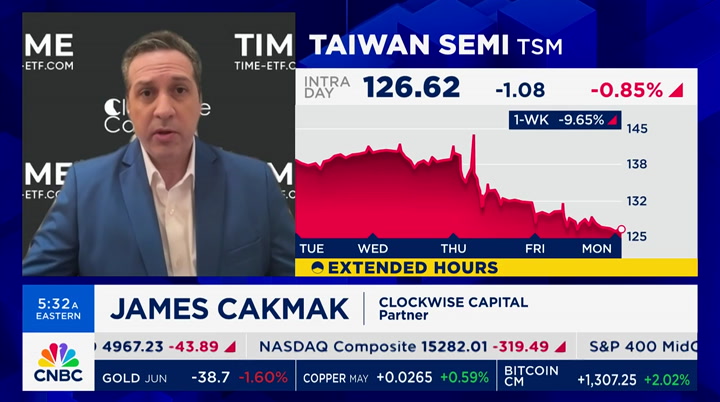

5:32 am

territory. joining me now is james cakmak. >> good morning, frank. >> i want to talk about earnings season coming up. we are hitting on stocks well off the highs. how important is earnings season not only for the market, but for tech? fact set came out with a report with five of the magnificent seven stocks are supposed to be 60% higher. if you look at the s&p, earnings decline at 7%. lay it out for us. >> i think what we saw over the last week with a couple of bellwethers reporting. taiwan semi and netflix reported. i think we saw estimates which got ahead of themselves. not so much estimates, but ex-pee expec expectations. the estimates came in line if not better in many of the cases.

5:33 am

at the end of the day, it was a sell the news situation which showed a lot of what we have seen actually as of late has been more multiple expansion driven and higher estimate revision driven. that poses the question if that trend is sustainable. the one good thing i would say is we had a huge set of expectations on friday where the floor fell out from under us and that poses a better omen for this coming week with four of the magnificent seven reporting. >> okay. you are saying a lot of this is due to multiple expansion. higher for longer environment. we hit on the ten-year yield at 4.6%. one thing is the magnificent seven stocks were supposed to be resistant to the higher for longer environment with the strong cash balances. why are those stocks under pressure right now?

5:34 am

>> just take netflix for example. you had the multiple from four to five times sales to eight times sales. they have been raising estimates. the multiple is expanding as fast as the rate if not faster. we are coming into the position where the expectations have gotten ahead of themselves. people presumed that those earnings beats could be maintained at those previous rates. that being said, you know, that does not appear to be the case. now we're on the other side of the reversion where the healthy growth numbers, insanely aggressive growth numbers we have seen the last couple quarters are starting to come down. you add the geopolitical overhang and the fed overhang with the higher for longer and that is not a good recipe for stocks. >> you are saying it is valuation in the volatile environment than from the start

5:35 am

of the year. you put it all together and it is a big issue for the tech stocks. speaking to the managing director of the investment bank in europe, they said they are nibbling in industrials and non cyclical sectors like healthcare. are you seeing a similar interest? people don't want to get out of tech, but broaden their exposure. >> you have to be in tech. the tech is the future. a.i. is coming. productivity boom is coming. there's nothing to stop this. you have to be there. at the same time, do you carry the same weight? no. we have been cutting our positions in our top with nvidia or microsoft aror meta. we have cut those and moved into utilities or gold or aerospace and defense just because of the things we just talked about. >> are you making big bets or

5:36 am

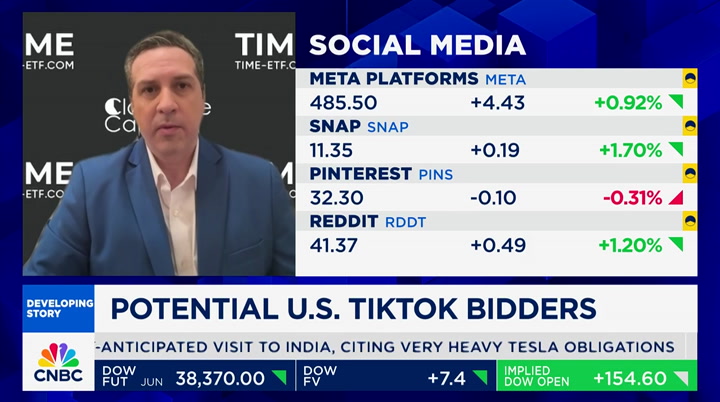

the managing director told me they are nibbling? >> 3% to 5% is in each of the new buckets. it is not tiny, but not massive. >> understood. james, stay with us. we have more to talk about in a second. let's stick with tech and the bill to ban tiktok here in the u.s. the measure clearing the house this weekend and raising pressure on bytedance. we have emily wilkins with more. emily, good morning. >> reporter: good morning, frank. the huge package passed the house this weekend including the $95 billion foreign aid bill for ukraine and israel and indo pacific and attached to the measure is the proposal of tiktok maybe being banned in the u.s. this deal goes to the senate which is expected to pass the measure. they approved the foreign aid funding.

5:37 am

under the bill, tiktok would be forced to divest from bytedance in as little asinine months. as nine months. it could be up to a year. the latest version of the bill has support from the chair of the committee overseeing tiktok. tiktok has lobbied against it spending $4.5 million in advertising opposing the bill in recent months. the ceo will exercise the legal rights and some congress members thil think they have a good case to make. here is what he said on "this week" on abc. >> they are less restrictive. we could have made it a crime to transfer americans data to a foreign state interference. to just ban 170 million americans who are engaged in

5:38 am

speech and livelihood? >> reporter: a tiktok spokesperson said the bill would quote trample the free speech rights and devastate businesses and shutter a platform that contributes $24 billion to the economy. the senate is scheduled to vote on tuesday. we will keep a close eye on how that is panning out. >> emily, stick with us. let's get back to james cakmak. how do you view this possible ban and the tech sector? what does this mean for tiktok? >> if it happens, it is an usual y issue for all of the platforms. i don't think they will ban it outright. if it does come to fruition with the ban and a sale in the best-case scenario, then some entity will likely buy it.

5:39 am

i highly doubt you will see the mega platforms buy it. i'm not too worried about it. i'm sure the competition will continue. >> all right. emily, back to you. odds of passage in the senate. how sense of how realistic this bill will pass? >> reporter: it looks good. it is hard to say. some congress members have concerns about the first amendment rights and this being a slippery slope. the drum beat is there are issues with tiktok being connected to parent company bytedance. you heard lawmakers say tiktok is fine. we want tiktok to stay. we need to make sure the tie with tweiktok and ccp is severe. it has bipartisan support. the fact that maria cantwell got

5:40 am

the support and she needs to look at things and for her to come out last week to say the house amended the bill and made time longer and now she approves it. that is a step forward in getting the bill done. >> emily wilkins and james cakmak, i appreciate it. thank you. coming up on "worldwide exchange," more issues for tesla. we talked to one analyst about what this ev maker can do to get back on track. reay with us. mo "worldwide exchange" coming up in a moment.

5:41 am

5:43 am

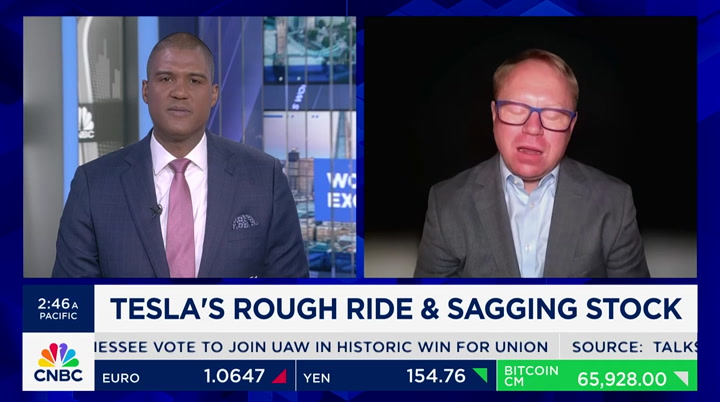

welcome back to "worldwide exchange." we are watching shares of tesla which are under pressure. down 2.5% after shedding $76 billion in market value last week as the single worst stock loser of the magnificent seven. tesla fires off another issue and cutting another $2,000 price target in china and germany and in the u.s. it is slashing the self-driving prices by 33%. this follows the round of layoffs last week and scrapped weekend trip to india in one of tesla's key growth markets. let's bring in craig morgan. craig, good to have you here. >> good morning, frank. >> i want to get reaction to the price cuts. the price cuts in the u.s. and

5:44 am

in china include the model y, the most popular ev in the united states. what do you make of the price cuts? >> these are painful. it will be painful for tesla to endure these. we will see more rounds of price cuts. they will do everything they he can to reinvigorate sales. when you are declining 8.5% year over year, that is not good in a growth market. this is a very important year for the creation of the ev market. evs are inevitable. these price cuts will make evs highly compelling to the consumer, but we have to get past this. it will be a tough year for tesla. it is not getting better right now. >> it is not getting better right now. that speaks to the price target of $85 which is a 40% decline. you are sending mixed signals.

5:45 am

they are making the cars more attractive. the issue may be margin. this is a company that a lot of people say is an a.i. play and the money is made in the robotaxi and other things down the line. >> bulls on the stock look at the a.i. and they look at robotics. the whole thing of the robotaxi, we will not get a robotaxi on 8/81, but a cyber taxi. it may have fsd in it, but not level 4.5. it will not take you to the grocery store or bring you to grandma's while you play video games in the backseat. rob robotics, boston dynamics crushes tesla. elon musk was making fun of

5:46 am

their rowbotics last week. tesla needs to focus on selling cars. >> it is a car company, not a software company that makes cars. you say it is firmly a car company. i want to get to other headlines. laying off 10% of the work force last week and shares down 10%. now, deciding to postpone the trip to india. what do you make of those? it seems like signs of trouble. things are not going musk's way. >> the head count reduction is reactionary. this shows they were not anticipating this year to be as difficult as it is because the last several years, they had been adding a few people. 10% is a big cut. india, you know, there were strategic bungles the last decade and not going to india or pushing with the mini car or model 2. that was on the table in 2019

5:47 am

and i'm hearing they had a bunch of reasons, but it was a strategic bungle. india is an essential market. that is a challenge for tesla. how do you get a china-like supply chain in india? you have to build it. it will take years. >> you are saying skipping the trip is a big deal. >> it is a big deal. this is why we see tesla looking for plant locations in thailand. it's a big deal. >> craig irwin. thank you. your target on tesla is $85. a 40% decline from where we are right now. craig irwin with the correction. thank you. coming up on "worldwide exchange," a new bullish call on one streaming player and more potential gains on top of the nearly 50% jump so far this year. we will show you the name from the mystery chart coming up

5:50 am

5:51 am

morgan stanley out with the cut on apple moving to $210 a share. it expects revenue guidance for the quarter to fall below expectations. shares of apple up .50% in the pre-market. and bank of america names nvidia as the top pick. it adds nvidia may remain volatile until the next earnings report later next month. shares of nvidia are rebounding up 2.5%. ahead, the one word that every investor needs to know today and a critical week for mpe markets with earnings raing up. much more "worldwide exchange" coming up after this. meets bold new thinking. to help you see untapped possibilities and relentlessly work with you

5:52 am

5:53 am

5:54 am

5:55 am

salesforce and informatica has stalled. you see shares of salesforce moving higher. informatica is down 6%. bitcoin prices after the halving on friday with jpmorgan chase saying it could decline after surging to a record high. bitcoin trading at $65,890. and caitlin clark reportedly set to sign an eight-year deal with nike. it is the most competitive in the history of women's basketball. here is what to watch. the business week with four of the magnificent seven and one-third of the s&p due out. outside of earnings, watch the latest look at gdp and the pce coming up later in the week. we also get the policy decision

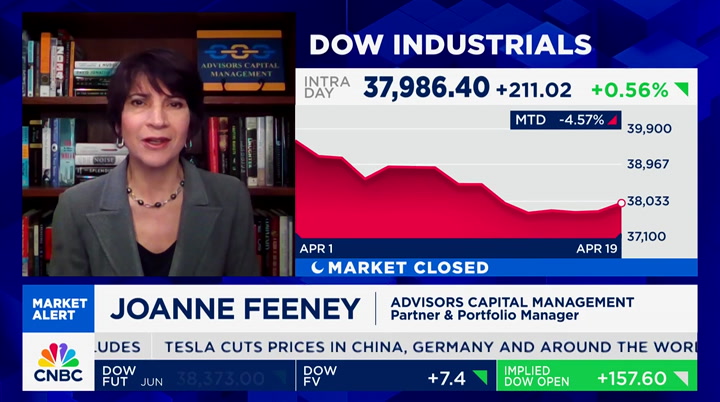

5:56 am

from the bank of japan as well. stocks looking to hit the reset button with the nasdaq and s&p with the recent losing streak. looks like the dow would open up close to the highs of the morning. up 150 points higher. s&p and nasdaq in the green. let's bring in joanne feeney. >> good morning, frank. >> futures rebounding from the selloff from last week. what is the "wex" word of the day? >> resiliresilience, frank. given what has happened the last few weeks, investors need to recognize markets are volatile. this is important to keep the eye on the long run and the companies they own in their portfolios. a lot of ways to play. hold good companies which pay a dividend or strong secular

5:57 am

growth characteristics. >> i want to get to your picks in a minute. research out with a note yesterday and it will resonate with a lot of people. the selloff is likely to be short lived and we root for the fed to do somenothing for a sustained period. do you agree or disagree? >> we have been saying most of this last year which it has been premature of the fed doing any rate cuts. the labor was still being adaed and added. that remains our case. we shouldn't expect the fed to cut any time soon. that doesn't mean things are bad for equities. equities and companies are selling into the strong u.s. economy. i like them to be less strong this year as consumers run through the savings as hiring slows down. ultimately, it is a solid market

5:58 am

for companies. >> you say it is a solid market for companies. you gave us picks that will protect from downside volatility. they include mcdonald's, raytheon and abbvie. one thing is the deividend. abbvie with a 2.5% dividend. you want to lock in gains? >> for some of our clients, especially those into retirement, they look to the portfolio to deliver dividends at twice the market rate. they enables folks tocycles. you have raytheon to protect geopolitical risks and mcdonald's protecting against the weaker consumer and you have abbvie with the traditional pharmaceutical, but the optional

5:59 am

pharma with the cosmetics they sell. >> all right. joanne feeney. thank you. take a look at futures. they are stronger across the board in the green. the dow would open up 160 points higher. that does it for us. "squawk box" starts right now. good morning. stock futures in positive territory to start the week. that guy -- we are supposed to show sad traders. maybe he was concerned. the price of bitcoin is rising after friday's halving. we'll show you what's moving right now. it was a busy weekend for congress. the house passed a series of foreign aid bills and a divest

6:00 am

or ban tiktok. and tesla making movies ahed of the issues in china. it is monday, april 22nd, 2024. "squawk box" begins right now. good morning. welcome to "squawk box" here on cnbc. we are live from the nasdaq market site in times square. i'm becky quick along with joe kernen and andrew ross sorkin. here we are. together. >> who is missing? >> nobody. we're all here for the first time. >> really good. really good. >> let's loo

38 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11