tv Street Signs CNBC April 22, 2024 4:00am-5:00am EDT

4:00 am

east/west showdown. both points leaders go down. r.j. hampshire on top and jett lawrence gets back to the top in an unpredictable night of dour 50 racing. ricky carmichael, will christien, jason thomas, i'm jason weigandt. see you next week in philly. good morning and welcome to "street signs." i'm frank holland with silvia amaro. these are your headlines. european equities start the week in the green with wall street looking to rebound after the nasdaq's worst week since 2022. tesla cut prices as the ev maker deals with a sharp fall in demand and competition in china. shares are lower in frankfurt trade. shares hit a high note surging to the highest level in

4:01 am

two and a half years as blackstone starts the bidding war. u.s. house lawmakers approve $60 billion in critical aid for ukraine as president zelenskyy calls for the rapid transfer of weapons. >> translator: this bill will send aid to ukraine and send the powerful signal it will not be the second afghanistan. this will strengthen the leadership of the united states. good morning. welcome to the show. we start a new trading week and it is a different sentiment for european equities compared to what we saw last week. just to give you an idea at this stage with the european stoxx 600 trading higher by .30%. this is quite different as i was saying from last week when the benchmark ended the weekly

4:02 am

session down 1.2%. what we're seeing is investors are setting aside the geopolitical concerns and they are focused on upcoming earnings and data. to give you the data points this week include from the united states and germany as well. we will get the core pce from the united states as well which is important to understand what the fed might do regarding rate cuts. when heit have 159 companies due to report this week. looking at the european corporate releases, we hear from spotify and deutsche bank and barclays. there is a lot on the agenda for investors this week. with that context in mind, let's show you the boards. we have seen a little bit of green here in germany, spain and in the ftse 100 with the ftse up

4:03 am

1%. however, some of the narratives when it comes to france, italy and switzerland are quite negative to start the session. i want to take you to the sectors to understand the message from companies at this stage. we have at the top, the best performer which is retail up 1%. a lot of that has to do with the upgrade of the rating forecast for the sector this morning. we have real estate up by 1%. it is important in the context of the monetary policy. the worst performer is autos down 1.5% this week. we are keeping an eye on the banking sector as we hear from several european lenders. stateside last week, tech was

4:04 am

down 1.7%. a lot of the tech companies are due to report this week. with the u.s. performance in mind, let's show you futures. they they are suggesting a positive trade this week. nasdaq was down 5.5% for the week last week as i mentioned with a lot of changes with the expectations for the tech sector. the dow, on the other hand, ended the week down. it was a bit of a weaker performance compared to the other indices. frank. i'll stay with that theme. this week is set to bring two data points as investors assess the fed's possible future rate path. thursday is the first reading of q1 gdp which is expected to slide 2.4% on the year from the increase from the previous quarter. we get the inflation gauge, pce,

4:05 am

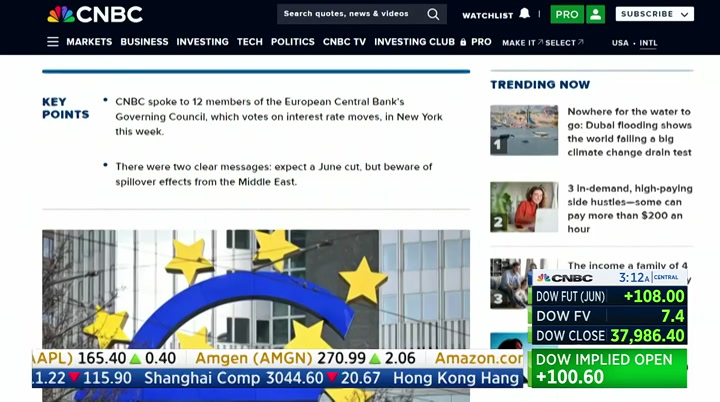

is showing sticky price pressures. the french governor says tensions in the middle east are not threatening the progress to the 2% inflation target. speaking with the newspaper, viv villeroy said the june rate cut is on pace. he said it would take a significant shock to stop the ecb cutting rates at the next meeting. >> i said bearing a major surprise, seeing from today, i think it is very positive and reasonable scenario. it is a base case we will cut rates. >> to discuss more about the central bank decisions and the global economy, we have the global head of fx at barclays with us. great to have you here. >> great to be here.

4:06 am

>> we are hearing from ecb governing council members who continue to say june is the most likely time for a cut. in your mind, some of the tensions in the middle east that we are seeing change that pacth? >> on the margin, no. we have a marginal adjustment. it is not just the middle east, it is the hawkish mood from the fed. all of these things add a bit of a hindrance for the overall cutting profile. i do think that europe is facing a disinflationary setup different from the u.s. with slowing activity and the recent data. >> five to four cuts. are they .25% cuts each time? does the ecb pay attention in the uk? >> if every central bank turns hawkish, the ecb would listen to

4:07 am

that. on the margin, i think to the extent that the european central banks are shifting to cutting, i don't think there is any marginal effect in any way. >> looking at the dynamics are the ecb and fed, a lot of conversation if we see parity in the schexchange rate. when you compare the comments, it sounds more hawkish with the fed policymakers. >> it is a fundamental battle with divergence. the u.s. has applied a stimulus set up for decades. they continue to do so. the inflation reduction act. chips act. invest in growth. consumers are still experiencing the positive effects from the past stimulus. european economy has been hit by slower china and hit by higher rates to investment.

4:08 am

they are diffiverging. the market has not been pricing so far. it has just started to price it. it hasn't fully priced in the last few weeks. >> it just feels like at this stage they have to diverge. the question for the ecb is how long can they withstand a diffivergence from the fed? >> first of all, they need to start and take out the precautionary issues from the hiking cycle. if the fed is getting hawkish, they pause and see the data. at the end of the day, it is about the fundamentals. the european gap is widening. the u.s. gap is not closing. >> i want to broaden it out. you see u.s. rates with the ten-year mark as a benchmark or climbing higher. is it just a global economy risk? when you look at mexico and

4:09 am

india and taiwan, europe and the u.s. are going as growth markets and in the re-shoring efforts. the stronger dollar is the base case and puts pressure on the u.s. base case and system? >> part of the reason we are discussing this is the u.s. he economy is doing well. it is holding up for that reason. that is benefitting the growth cycle. the asset performance, they are sensitive to u.s. rates. the market hasn't fully re-priced yet. i don't think based on the recent issue in october, we will have a explosion. >> let's think about the bank of japan and the focus for investors this week. when investors care about the outlook for rate hikes, what is the bank of japan going to deliver this year?

4:10 am

>> the expectation is they take rates up a couple of times this year. a small move which is barely above zero. having said that, i think both the inflationary set up and higher prices and the yen is moving in the way that they cannot stop it. it puts pressure on the bank of japan to lean more on the hawkish side. >> you could see more on the rate hikes because of that. >> the fundamental pressure is on them. >> all right. thank you for joining us this morning. >> thank you. >> for more on u.s. equities and three straight down weeks, check out the analysisat cnbc.com. and china's central bank left the lending rate unchanged after strong economic data in the first quarter with the growth forecast at 5.3% on the

4:11 am

year. karen discussed the state of china's economy with the imf manager at the spring meeting in washington where she said the emerging market economies are continuing to face challenges. >> if you look at emerging markets as a whole, the group, you take the group as a whole and we have seen what i describe as weak net flows into the emerging market group as a whole. if you look at the share of global flows of the receiving pre-pandemic, the share was 25%. now it is 20%. within that box, one of the countries where it has reversed a bit is china. it is not a china-only story. some were looking for direct foreign investment which was critical for growth in the he merging and developing countries that has been the weakest it has been in the last 20 years to

4:12 am

this region. now, why is this reflecting many factors with the strong growth in the u.s. and weakening growth trends in the major emerging market economies and the big interest rate differential we have seen with the advanced economies and emerging markets. >> you can check out more from our coverage at the imf and what 12 ecb policymakers told cnbc about the rate path on cnbc.com. cvc capital partners says the orders are already multiple times oversubscribed after the everything on at the price range of 13 to 15 euros per share. that would value the company as the largest private equity firms. ubs is planning five rounds

4:13 am

of layoffs this year starting in june according to the reports from switzerland. the lender announced it is looking to cut 1 in 12 staff and reduce costs by $12 billion after the takeover of credit su suisse. it suggests 50% of the staff is likely to be let go. switzerland national bank doubled the minimum reserve from 2.5% to 5%. they say liabilities will be included in the full cal tu legislation of the environment. the adjustment will remain the policy will not affect the current policy. coming up on the show, u.s. lawmakers signoff on more than $26 billion will in support for israel and announce sanctions on iran. we will bring you more after this break.

4:14 am

hi. i'm wolfgang puck when i started my online store wolfgang puck home i knew there would be a lot of orders to fill and i wanted them to ship out fast that's why i chose shipstation shipstation helps manage orders reduce shipping costs and print out shipping labels it's my secret ingredient shipstation the number 1 choice of online sellers and wolfgang puck go to shipstation.com/tv and get 2 months free switch to shopify and sell smarter at every stage of

4:15 am

your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify. business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. - after military service, you bring a lot back to civilian life.

4:16 am

leadership skills. technical ability. and a drive to serve in new ways. syracuse university's d'aniello institute for veterans and military families has empowered more than 200,000 veterans to serve their communities and their careers. from professional certifications, to job training, to help navigating programs and services, we give veterans access to support from anywhere in the world. welcome back to "street signs." u.s. secretary of state antony blinken will head to china this

4:17 am

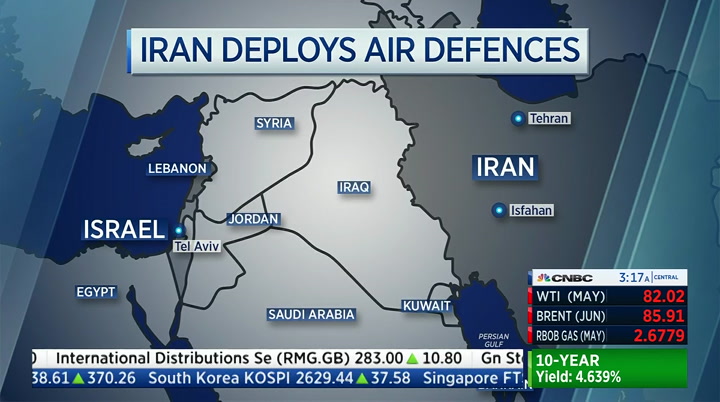

week. the expected threat comes amid reports that the u.s. is considering sanctions on the chinese financial institutions. the u.s. house of representatives has passed a long awaited foreign aid package as part of the funding where the lawmakers signed off on $26 billion in support for israel and new sanctions on iranian oil. meanwhile, the u.s. is expected to sanction a controversial idf unit over human rights in the west bank blocking other assistance. israel prime minister benjamin netanyahu says he will fight any such move. iran says it does not spplan to escalate tensions after the military attack last week by israel. officials familiar with the issue say they launched they

4:18 am

ballistic missiles in isfahan. local media downplayed it. now iran's foreign minister told nbc the situation is over. >> translator: in israel, retaliates and comes up to new ventures, we will respond. if not, then we are done. we are concluded. >> our dan murphy joins us with more. keep us up to speed of what is happening at this stage. >> reporter: this comment from the iran foreign minister on nbc news was critical. they are not looking to escalate tensions in the region moving forward. that is positive for risk asset investors and israeli lawmakers which have signalled the same. we are seeing the situation in the middle east, perhaps, stabilize here. although, it is far from over. that's also being reflected in

4:19 am

the price primemium of oil afte the attack on friday. markets initially saw the knee-jerk reaction, but that faded after both sides signalled the escalation was not likely. the question is what happens next? for israel, the focus shifted back to rafah where we have seen air strikes conducted in the last 24 hours which resulted in multiple deaths. at the same time, israel welcoming the $95 billion foreign aid package which allocates more than $26 billion for israel, including $9.2 billion for humanitarian support inside the gaza strip and west bank. this underscores the impossible situation the u.s. and president joe biden finds himself in right now. on the one hand, the country providing weapons to israel and

4:20 am

now providing aid and humanitarian support in gaza. critics, including the hamas leadership have criticized this aid package to israel. they say it is a green light for more deaths and killing in gaza. at this stage, the situation in the middle east is very, very volatile. we have seen comments from u.s. lawmakers and israelis looking to stabilize the situation. you could intend asset managers were caught off guard after the response by israel on friday although it did say it would retaliate against irann's attac last saturday. this is a fast moving situation. for now, things seem to have stab stabilized. >> a volatile situation. thanks, dan murphy. to discuss the volatility in the middle east, we have with us

4:21 am

cornelius. good morning. i would like to understand at what level of the geopolitical tensions we are at this stage. iran said it willnot retaliate. is this a point where we are going back to the levels of tensions we had prior to the recent escalation? >> at least that is the hope one can have after the events of last week. if i say hope to have a little bit of lower tensions, we are still speaking about the situation which is volatile as your colleague said and which could escalate at any moment. if the tit-for-tat for israel and iran is finished for the moment, it means the two countries will revert back to the shadow war they he conduct

4:22 am

for years. the situation in gaza will be just as glaring and in the spotlight because this is where much of the action has taken place over the past months and now needs resolution more than ever. >> we're actually monitoring the ministers of foreign affairs out of europe at this stage. yesterday, we had more sanctions from the united states on iran. i was wondering if the europeans go ahead with further sanctions on top of what the u.s. has announced, do they make a difference? >> the europeans have their own set of sanctions and it is good for them to follow-up on what they have been doing vis-a-vis iran. they had sanctioned iran's on drone and missile exports against ukraine to russia directed at ukraine.

4:23 am

this is a particular concern to europeans. they need to act on that basis. they are also coordinating with the u.s. and uk on the sanctions. this cannot be all. there needs to be policy that goes beyond sanctions. what we have also seen is you can sanction part of iran industry or parts of the military, but it doesn't have an effect on the ground with the situation being just as volatile as it was before. >> you are saying europeans need a better approach. you are focused on normalizing israel-saudi arabia relations. what is the importance of that? has it become tricky as iran and saudi arabia reached an uneasy truce between those two sides? >> i think what has become evident the past months is how closely all these issues are in

4:24 am

in interlinked. the palestinian conflict and gaza war and possible normalization with saudi arabia and israel which was put on hold by the october 7th hamas attacks and the question of where does iran fit into this. i would say if the situation now reverses focus on the gaza strip and we get to a cease-fire and release of the hostages there, this would free the way to resume the negotiations between saudi arabia and israel for normalization. this, again, if you had these issues on the table, it would weaken the role of iran as spoiler in the region and needless sanctions than one wants to impose now. >> i want to talk about the u.s. influence in all this. the u.s. advised israel not to launch a counter attack and they did and they passed a military aid bill following the warning

4:25 am

not to do it. i want to get your sense. are these all mixed messages and we see iran and the khomeni speak out. >> there are clear messages coming or exchanged with the united states and israel because at the surface, as you describe, it looks s very mixed. what is clear, united states wants israel to drawdown the campaign in gaza and to come toward a cease-fire there that would end the misery for the palestinian people and also the pre-dicament of the united stats with world public opinion. at the same time, they stand behind israel and military terms

4:26 am

and security of israel and as you know the aid package in washington was tied to support for ukraine which is just as fundamental. >> can i interrupt for a second? you are laying out the facts. you are saying the situation is a bit more murky with the actions everof iran and the u.s passing that aid package. >> netanyahu ordered the strike which was against the express wishes of the americans, but allowed iran not to retaliate. from the u.s. perspective and if both sides now agree the confrontation is over, then that should be okay. the aid package has been in the making and should have been passed months ago. i mentioned the importance for ukraine. i don't think one should see it

4:27 am

as a direct response to an israeli strike on iran. that's where i see less of a conflicting message if one looks at the longer trajectory. >> we have to leave the conversation there. thank you for being here. we wrappreciate your time. coming up on the show, fresh from friday's cyber truck recall, tesla slashes prices on the car models as it looks to tackle falling sales and increased competition. we will have more on that story coming up next.

4:29 am

my name is ashley cortez and i'm the founder of the stay beautiful foundation when i started in 2016 i would go to the post office and literally fill out each person's name on a label and now with shipstation we are shipping 500 beauty boxes a month it takes less than 5 minutes for me to get all of my labels and get beauty in the hands of women who are battling cancer so much quicker shipstation the #1 choice of online sellers go to shipstation.com/tv and get 2 months free

4:30 am

welcome to "street signs." i'm silvia amaro with frank holland and these are your headlines. european equities attempt recovery with wall street looking to open in the green after the nasdaq's worst week since 2022. tesla cuts prices as the ev maker deals with a sharp fall in demand with stiff come poe

4:31 am

competition in china. and talks of a takeover deal with salesforce collapse. and ending understand of delays for the aid to ukraine as zelenskyy calls for a transfer of weapons. >> translator: this sends a powerful signal it will not be the second afghanistan. this is the leadership of the united states. european equities have been trading for an hour and a half and we are seeing a mixed picture so far in the session. we are seeing the ftse 100 up by 1% and also with upside moves in germany and spain. however, we are seeing a bit of negative momentum in other parts of the market. now we he see investors have set

4:32 am

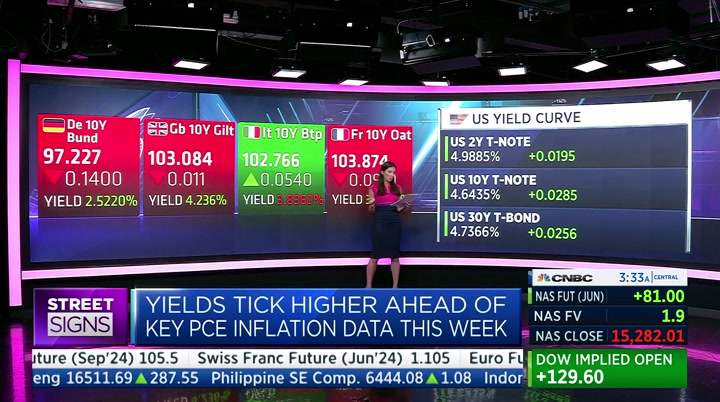

aside the geopolitical concerns that dominated the trading session last week. however, it seems investors more focused on the upcoming data and the earns season. i want to show you the fx markets. this is important to keep an eye on as we hear from the central bankers. we have the sterling/the dollar at 1.23. one dynamic that is taking place here is the divergence in comments from fed officials and from the bank of england. more divergence with the euro/dollar commentary. let's look at the eyo dollar/ye. there is an issue with japanese authorities will intervene at

4:33 am

the 1.55 mark. the key this week is the bank of japan meeting. investors are questioning what sort of hikes we might get from the bank of japan this area. i said hikes. that's the case for the bank of japan. i want to take you to the bond market. this is showing you what is happening with the central bank commen comm commentary. the yield is 2.52. this is the sentiment in europe and actually, i want to share this stat with you. the spread between the ten-year bund and treasury hit 220.9 basis points last week. that was the highest we have seen since november of 2019. it is important to compare as we he see the divergence with the comments from the ecb and from the fed. when it comes to u.s. futures, they suggest it is a positive start on wall street today.

4:34 am

this is slightly different from what we had seen at the end of last week when the majority of the wall street ended the week down. i would highlight the nasdaq which closed the week down 5.5%. a lot of focus on the tech sector. we saw re-pricing and positioning ahead of key earnings. we will hear from the likes of meta, tesla as well, and a lot of the tech companies throughout the week. let's see how the markets will end up reacting off the back of that. frank. i want to touch on the one asset class you didn't which is cryptocurrency. bitcoin is holding around $60,000 after the halving. jpmorgan chase says it expects the cryptocurrency to drop over overbought conditions. advocates for the technology who say the halving could be bullish. the pricing increased from over

4:35 am

$7,000 to $56,000 after the last halving in may of 2020. bitcoin miners may feel the pinch as the block drops 50% to 3.125. we have senior strategist who told cnbc that the impact of the halving is likely to be felt for months to come. >> it is causing a demand in the stock. this is mainly because bitcoin has a supply with only a maximum of 21 tmillion coins. it is compared to the line of possibility. we are seeing the impact with prices. it was already partially priced in. this was the halving which was

4:36 am

anticipated. it is still the early days to feel the impact. typically, if we look at the previous bitcoin prices. >> bitcoin is $66,200. for more on the traders and preparations for the halving, check out cnbc.com. salesforce shares are higher after reports of talks of a $10 billion deal to acquire informatica have collapsed. elsewhere, shares of wipro surged after the i.t. company in india posted better than expected revenue and profit in the fourth quarter. the ceo is looking to turn around the business battling wider issues in the i.t. services industry such as lower client spending and geopolitical

4:37 am

uncertainty. the ceo told cnbc about the issues for the second half of the year. >> if you look at pockets, we are seeing some green shoots. one in america and also in europe. it will be difficult to look at when the economic environment bounces back. if it does in the second half, we are ready. it is a big week of tech earnings. tesla set to report after the market closes tomorrow followed by meta on wednesday. microsoft and alphabet report on thursday. this is after the worst weekly performance last year with the

4:38 am

tech stocks weighing heavily on the year. tesla is cutting prices after it is battling higher inventory after increased competition. let's look at tesla prices right now. stock, i should say. down 2.5%. the stock has been heavily under pressure due to price wars with ev makers in china. also looking at chinese ev makers on the back of the reduction in prices by tesla. they are under pressure as well. interesting to see. li auto down 8%. followed by gw motor. leap motor down 5.5%. we are getting news that tesla's ceo elon musk, is postponing the visit to india. asked about the

4:39 am

investment to the market. >> we have seen outstanding talent here. we have some of the chips designed and software and hardware in india for the global markets. the last few years, we have seen 5g in india and it has been amazing to see the opportunities that brings for indian consumers as well as for enterprises. we have seen india as a great r&d center of excellence and pool of the talent. we are seeing india as a great market and opportunity. >> to talk about india and the opportunities, let's bring in

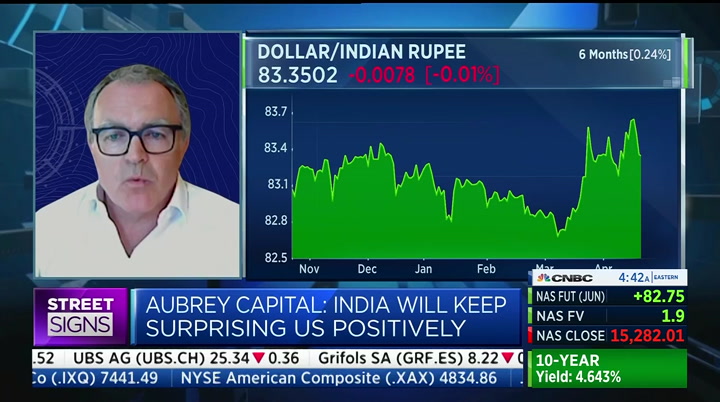

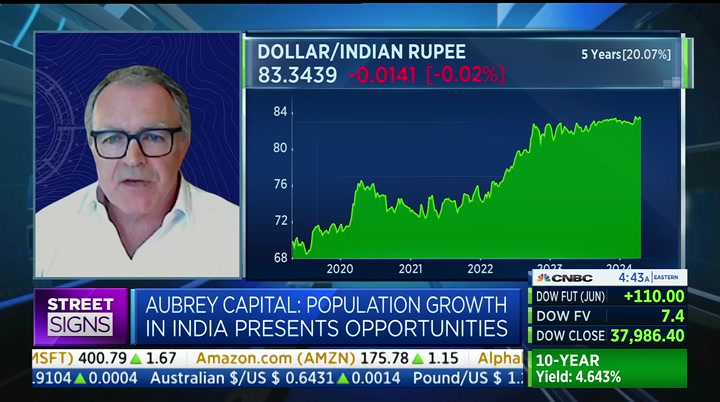

4:40 am

rob. great to have you here. >> good morning. >> we are hearing from the cfo of qualcomm about the opportunities in the indian market. where do you see the opportunities? is it in tech? we hear about apple and tesla and micron moving production there. is that where you see the biggest upside with the indian economy? >> i think the biggest upside to us is what that means for the domestic economy and for jobs for urbanization for india. that is longer term. obviously, tech is very much part of that investment and job creating opportunities. >> it is interesting you are looking at that. we are looking at the fund which is about half invested in india

4:41 am

and a heavy leaning to consumer staples and beverages. it seems like it is tied to a strong indian consumer. do you think the foreign investment translates to a stronger consumer? >> it is a secondary benefit, if you like. it starts with that investment and job creation and moving of people from their rural environment in india to the urban environment where they will consume more. that is what drives the companies we're investing in. i think that's the steady way to get exposure to the growth in india. on the tech side and the manufacturing side, it is a little harder to get direct exposure. >> rob, you recently wrote how

4:42 am

indian motorcycles are the start of the news cycle. with the potential move from tesla to india, i was wondering about the outlook for the company in india. can it see significant sales in the market in the future? >> for tesla, yeah. i think so. for us, the more interesting short-term opportunity in electric vehicles is in the two wheel market. that is where the government is focusing their attention because it is a more widespread exposure than four wheelers. obviously, musk is looking at the medium-to-long term view. when you look at 20 years, tesla is a large electric vehicle market. i think that is a little bit of both. i'm sure tesla will be a big player in the longer-term electric vehicle market in india. you know, it is a time to be had

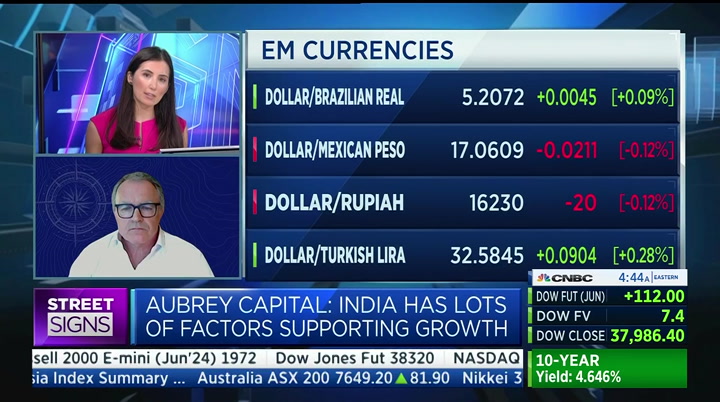

4:43 am

there and it is early days. >> i would like to run out the conversation and one of the comments you made starting in 2024 is you were optimistic. you had a optimistic mindset for ev markets. i wonder if the appreciation of the dollar is changing that mindset. >> no, not too much. i think the one thing that it does have an impact with the dollar and u.s. interest rates have a big impact on emerging markets. i think inflation in the emerging markets is generally been pretty well controlled and coming down. the interest rates may not come down as fast as we expected in places like india or more or less under control. i think it is still the direction of travel which is still there. i think the major economies in

4:44 am

emerging markets these days with the well managed ones, if you like, have much more balanced external accounts. they are less vulnerable to the dollar strength that we have seen hit emerging markets in the past. it may be slightly delayed. the rates and cuts in interest rates. we think they generally coming. >> going back to the investment in india, i wonder when you think about the investing in india and any angle, if any, you have in mind when it comes to esg when you assess indian stocks? >> there are a couple of things. one where our focus on the consumer side of the economy which is naturally giving us an advantage in terms of where our

4:45 am

companies are from the environmental point of view. the other thing as india is catching up pretty fast in terms of its focus on the environment on other aspects of esg. one of the points in my two wheeler article a month ago is india had bitten the bullet in terms of moving to the global standards of emissions. more than the other developed economies. i think india is in a good position. i think it is also very well suited to the new environment of solar power. india is very well endowed with sunshine and also has hydro. it is a net importer of hydro carbon.

4:46 am

it doesn't enjoy high oil d depe dependence. >> a lot of work ahead. thank you for your time. rob brewis at aubrey capital. in other corporate news, alstom is at the top of the stoxx 600 after agreeing to sell the north american conventional rail signaling business for 630 million euro. the deal comes as part of the french company's plan to cut debt by 2 billion euro. the board of hipgnosis song is looking to recommend a new bid to blackstone if the private equity giant announces an intention to make an offer. this comes after the stock surged 30% on thursday after

4:47 am

agreeing to an offer from concord which valued the company at over $1.60 per share. blackstone's new offer stands at $1.24. i'm excited for the next. taylor swift's new album sold 1.6 million copies in the u.s. on friday. one of the highest selling releases ever tracked by nielsen. >> how excited were you? one story that is not as popular as taylor swift. look at tesla shares. they are down 3.3% right now on news that they are cutting prices of the best selling vehicles in the u.s. and in china. keep in mind, tesla shares are down 40% year to date.

4:48 am

the company's faced a lot of pressure with the missing deliver numbers and that price war in china. facing pressure from companies like byd in the chinese market. a lot of questions of the future of tesla. investors answering that it is a car company. shares falling sharply right now on the price cut news. falling year to date on the fact they missed deliveries and other issues when it comes to demand. tesla shares down 3.3%. coming up on the show, we will talk to you much more about what's going on. the u.s. house approves billions in aid in a rare saturday session. we will have the latest from washington coming up next.

4:50 am

norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. doc?

4:51 am

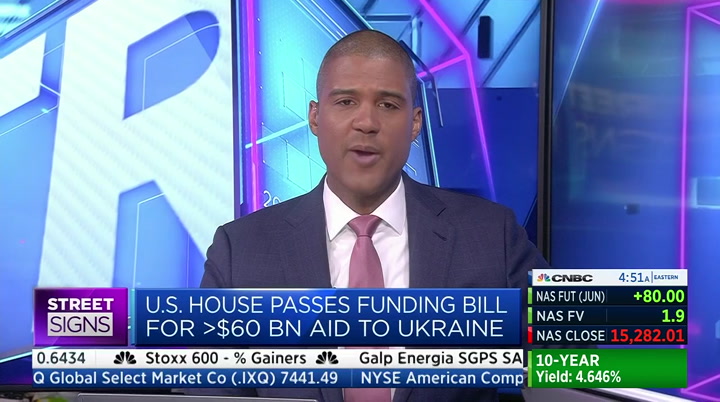

4:52 am

his army the means to move ahead. >> translator: of course, the political decisions depend on the public opinion. this aid will strengthen ukraine and send the powerful signal that it will not be the second afghanistan. the united states will stay with ukraine and will protect the ukrainians and it will protect democracy in the world. this is the show of leadership and strength of the united states. >> house speaker mike johnson is coming under pressure from the faction of republicans after he supported that aid bill. we have bri have brie jackson w on the story. >> reporter: good morning, frank. marjorie taylor greene signalled she will move forward with an effort to remove house speaker

4:53 am

mike johnson. that comes after the $95 billion foreign aid package approval. during the exclusive interview on "meet the press," president zelenskyy praised congress for the support, but it received pushback from the small group of republicans. they were upset that speaker johnson worked across party lines to get the bill passed which includes $60 billion of aid for ukraine. johnson now faces the threat of being removed from the speakership by members of his own party. democrats and some republicans are vowing to keep johnson as speaker if it does, in fact, come up for a vote. johnson, meanwhile, is standing firm saying he has a job to do and that he is not going anywhere. when it comes to the aid package, the senate is expected to vote on tuesday. if it does pass, president biden said he would sign it immediately.

4:54 am

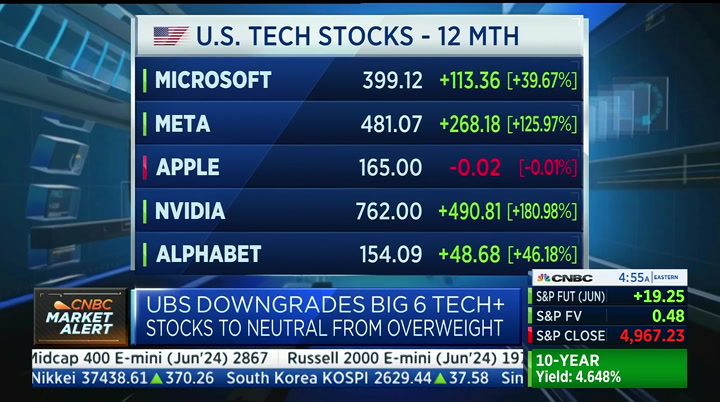

frank. >> very interesting, brie. mike johnson faced pressure from his party with the far-right faction, but democrats are looking to step in and help him save his job. >> reporter: that's right, frank. some democrats have said openly that they don't believe that speaker johnson should lose his job. they plan to support him. there are some republicans backing that. it remains to be seen if this comes up for a vote to remove speaker johnson. if it does, will there be enough votes. >> brie jackson, thank you. and looking at flashes with the ubs downgrading six tech stocks. apple, amazon, microsoft and nvidia from overweight.

4:55 am

we are waiting to hear from these companies. it will be an important week with the big tech earnings. to give you context, we saw the tech sector down 7% last week on wall street. an important one to monitor as we hear from these companies, frank. >> so much weight on earnings. one data set was if you take out five of the magnificent seven companies and earnings would be down 5% year over year. just how important these big tech companies are. we will show you the ones reporting this week. microsoft has been flat the last month. amazon is pushing to new record highs. different actions. apple with pressure in the recent weeks. we show the 12 months with apple being flat over the year. i imagine the rally from previous years without apple contributes. >> there are a couple of narratives impacting them with higher rates and all of that.

4:56 am

there are company-specific problems. we know apple started the year in the negative when they reported sales down for the first time. a lot of pressure on some of the companies. let's see what they will have to say. >> big show-me quarter with artificial intelligence specifically for the names we're showing. nvidia up 180% in the last year, but in correction territory now down 10% of the recent high. let's take you to european markets before we finish. we are seeing a bit of a mixed message from the boards. it is a different narrative from what we saw last week. let's see what will be the end for the trading day. >> that will do it. i'm frank holland with silvia amaro. "worldwide exchange" is coming up next. you llees thhe.wi s ubo tre have a good day. wee payingarm and a leg for postage. i remember setting up shipstation. one or two clicks and everything was up and running. i was printing out labels and saving money. shipstation saves us so much time. it makes it really easy and seamless.

4:57 am

pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers. go to shipstation.com/tv and get 2 months free. what is cirkul? cirkul is the fuel you need to take flight. cirkul is your frosted treat with a sweet kick of confidence. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul is your gateway back home. so what is cirkul? it's your water, your way. cirkul, available at walmart and drinkcirkul.com. switch to shopify and sell smarter at every stage of your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every

4:58 am

sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify. ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com. business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in.

4:59 am

5:00 am

19 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11