tv Fast Money CNBC April 19, 2024 5:00pm-6:00pm EDT

5:00 pm

seeing it play out in the market realtime, the a.i. trade has gotten long in the toout we'll see. >> pieces of it. look and see, three a.i. is down around $20 a share, historically cheap. >> it was a mixed picture for stocks today, the s&p and nasdaq, finishing lower on the day, on the week, that's a good weekend, that will do it for us here at overtime. >> fast money starts now live from the flaz dak market site in the hoort of new york city's times square, this is fast money, what's on tap tonight. a semislide triggered by a major drop in nvidia, the smh down 10% this week, and that slump taking the nasdaq and s&p down with it. can this bull market keep kicking it the chips continue to crack. we'll break it down straight ahead. plus, apple's no good rotten week, falling over 6%, washington moves to ban tiktok, china's going to target apple and others in a provervial at

5:01 pm

this time for tat. and where does the crypto currency gone from here. cracken ceo. live from the studio b from nasdaq, tim see mother, steve grass sew, and mike khouw. we start off with the massive meltdown in nvidia, the once seemingly unstoppable semistock plunging 10% today, worst day since the start of the pandemic, crop cutting more than $200 billion from nvidia's market cap today alone, and below the $2 trillion mark for the first time since february the lestest rest of the chip stocks getting hit hard too. semi-etf 4.5%, drop, and now down 17% from the record hit just over a month ago, and every single stock in the fund is in correction territory, down 10% or more from their 52-week highs and down more than 34% intel dropping 32. nvidia now down over 20% from its march 8 9 record high.

5:02 pm

and broader tech, nasdaq down 2%, worst week since november of 2022 and here's one more staggering stat for you. >> uh-oh, uh-oh. >> since monday, the mag seven has lost nearly a trillion dollars in value let that sink in for just a moment so as you get set to enter the heart of tech earnings season next week, how nervous should investors be about these cracks we're seeing in the bull market right now? tim, what do you say >> they should be nervous, especially because this is where leadership is coming from, i've tried to point out for a long time that the leadership first of all from the nasdaq has come from the semis you talked about this move in semis, kind of an eerie 10% on the nose move, lower on nvidia nasdaq is up 87 to 90 basis points near to kate. in other words, this massive rally has almost been taken out completely semiconductors, as you said, down 17% if you think about nvidia, semiconductors, relative to the s&p, so, again, where's that

5:03 pm

leadership gone? it's collapsed in the last three days it's down 7.5%, in three days to the s&p, the smh, whatever you're following, the stock, semiconductor index, it's an extraordinary deterioration, and going into earnings, when all we do is talk about all people complain about is the lack of breadth in the earnings profile of the sm s&p, well, next we can is a big week, comes on a day, we're going to spend time pressure with mega cap tech, and one we talk about all the time with china, and so you've got exogenous factors, earnings that have to hold up and you have this kind of a day, again, you know, momentum into a weekend, we know what war does to risk-taking going into weekends, that's where we are. >> we saw the rollover in semis start long before this week started but this week in particular we got a number of data points today, for instance, super micro announcing its q3 earnings date but not pre-announcing as it has done seven of the last eight quarters, asml disappointing

5:04 pm

bookings numbers it's not like this is based on nothing, that this is just sort of just a shift. it is a shift in sentiment but there are data points to be concerned about when it comes to this really hot a.i. semitrade. >> yeah, i think i agree to an extent in terms of the asml, i think that was a warning shot across the bow. but i still think there's bifurcation there. the thing, your nxpis, oms that are exposed to evs, the ones that are probably bearing the brunt there. i think qualcomm somewhat sits in the middle, nvidia still top of class, but, i mean, listen, it's the 10% correction today is painful. i will say, though, that you have essentially quadrupled, and now you're taking off 10%. you've got to understand that there is going to be an elevated amount of beta to these type of plays. you know, super micro, i think, you know, it's much like the netflix situation where, when you refuse to reveal a data point that you have made a habit

5:05 pm

of doing, i don't understand what you expect investors to do, when that stock, i believe, is up six or seven times over the last 12 months as well i do think the moves aren't quite exacerbated but when you take a step back, and kind of look at them from a perspective of where have they come from i just don't think that you can be surprised at investors. >> this velocity doesn't bother you? >> no, it bothers me but it doesn't surprise i guess is what i'm saying you can't -- we've all said, listen, when we have these parabolic moves it's hard for me to get behind trend and the reason why is because you know that there is going to be a sharp pullback at some point i'm just saying, still compare a 10% move down, with the 6 x move up, you've got to expect there to be some beta there, eventually go ahead, finish. >> and to tim's point, there may be a shift in leadership but i'm still inclined to probably buy ahead of earnings. if earnings come out next we can and the week after and they mail it in, that's when the concern really brews, but the tech stock, this complex, has really

5:06 pm

been the area where earnings growth has supported the moves higher, versus just p/e expansion, if they can't hold up, then i am quite concerned about the market, but i'm still willing to give them the benefit of the doubt in terms of them being able to deliver on earnings. >> when you look at how many of nvidia's clients are looking for other choices with chips as well, nvidia still has 85% of the market, but they might not be able to supply the whole market so, you're going to need other choices. then you have a negative headline, or a negative article, amv, their biggest competitor, or their most active competitor, so you had mentioned qualcomm, but amv and nvidia, are, you know, replaceable, for this component. if you look at tech, these -- to bonn win's point, this is where the earnings came from, so this is where the earnings will be taken out. the market goes up, it's on -- tim always points out, the semiconductors led the market up, the mega cap led the market

5:07 pm

up, they're going to lead the ones down. go to technicals you were going to say something. >> no, no. >> if you go to technicals, it's rare that the market breaks just the 350-day. it breaks the 50 then the 100 and then it tests the 200. we're a couple hundred handles off the 200. it's going there your nvidia is probably going -- >> do you think it's going there on this run? >> yeah, do that's a massive mo, back in october to do that. >> 50 day of 5118, we rip through that level and then everyone is readjusting and then there was powell and then there was mega cap tech and then there was geopolitical you had a recipe for not disaster, but a recalibration. so, i think we probably should head to 4675. >> so we are lower and they are leading the markets lower. mike, i mean, layer onto this, the mood that we see in volatility, the anticipated higher range we will be in, in

5:08 pm

volatility, maybe there's seasonality aspect to this, in terms of sell in may going on and the uncertainty surrounding thefed, a lot to pile into thi semiconductor meltdown. >> yeah, and of course geopolitical risk as well, i mean, if you take a look at what the futures did overnight, obviously that didn't turn out to be quite as concerning to the market when it opened today as it was in the overnight hours, but there's plenty to worry about, look, you know, the market rallied basically on the strength of these stocks, rather than just thinking about whether or not there's a lot more air potentially under them, and i believe that there is, just think about, is a 10% correction in the s&p so farfetched, first of all, they happen with great regularity, secondly, the run that we had from the end of october to the end of march, up about 28% in the s&p, especially if you include some of the dividends as well, a pullback of 10% from that level, and i think that's probably what steve is talking about, makes a heck of a lot of sense we're about halfway there.

5:09 pm

>> we are. >> if you think that's what's going on. >> yeah, i mean, a 10% decline in the -- we're in a bear market, though, for nvidia i mean, i'm just -- you know, you can say that it's par for the course, and we see 10% pullback, yes, but should we be more concerned we're seeing it so sharp in what had been the poster child of what is hot, what is growth, in this market. >> you can be concerned about it and i would just say, let's go to the cause of it not just because things were overdone mike gets into the geopolitics, just the risk off. there's a lot of things. the fed came out today with comments we kind of knew were coming and they were quietly received but had a semiannual testimony that came out and in that, there were some interesting things i thought were not even, you know, focused earlier, including the fed pointing out that hedge fund gross exposure is way up there, in other words, that the risk taking they see in the markets is out there but, you know, we have made that 5.5% move, there are geopolitical dynamics and think about the move that semis, and high multiple tech, so, again,

5:10 pm

longer duration assets, companies that aren't necessarily, obviously nvidia and apple and meta are generating significant free cash flow but the whole move in high tech, and high multiple companies, when the fed started living aggressively part of this move is a week where recemented the fact that the fed -- i'm steve or may or may not believe it's still going to happen the fed is out of play here. they're not going to move in june, in my view, i think they're unlikely to move in september. but that's what this week was about, this was a week when we got the combination of a better economy, so good news should be good news, but good news is kind of bad news, and bad news is bad news it's a strange week, and it doesn't end well when geopolitics have you needed to cut risk. >> yeah, i don't discount the fed's ability to be wrong on both sides of this so, i think that the fed could very well be off the table, and things a shock, or cpi doesn't come in enough, and then we lose june i don't negate the fact they

5:11 pm

could be wrong you have 400 economists within the federal reserve obviously under the impression that we have to see weakness before we start cutting. there's a long and variable lag, a reason why that phrase exists, if you wait until unemployment ticks higher, you've waited too long you need to start cutting to get ahead of it. so that it's -- it's got -- it has to feel like they're early so it feels like it's early for them to cut right now, that's the proper time to be cutting. so, i think they will be late, and i think tim makes a great point, the market has done what i've been saying, they're going to talk hawkish, and then they're going to act dovish. i think the market -- >> are you still saying they're going to cut like in may >> not in may, but i do believe -- i do believe that they will -- we're gone -- you would agree the market has said no cuts now. >> i would. >> i would -- >> slim chance of -- >> seven to one or none.

5:12 pm

i think that it's a nonpolitical body, supposedly, but i think that they're going to be forced to cut i think they're -- somehow -- >> november has 25 bips in it. >> it's after the election, no reason to cut in november. they'll have to cut once or twice before it. >> i can hear you in terms of them being late but i don't think the extent of lateness is all equal across the board what they don't have to do is wait like they did with inflation and saying it's transitory and allow it to essentially be burning at 11 or 12% and then finally recognize so, i do think that there is a bit more wiggle room in terms of unemployment rate that they're going to be willing to tolerate before making a move, and allowing inflation to rear its ugly head, reentrench itself, and then you have that, you have oil higher,which again i the "x" data and the geopolitical risk. so, i hear what you're saying, you know, i'm kind of in between the two of you, i understand

5:13 pm

that tim is saying dhings have been incorporated this week. the fed funds futures have been shifting the last two weeks, and, in fact, from, you know, march, really, so we've already started to incorporate some of that issue to mike's point, moves of ten, and corrections of 10 to 20% are standard, these should not, not be expected, but, again, i want to be very clear, i'm just not surprised, and i think that that's really where i'm coming from the last time we had a geopolitical risk, october, a prime opportunity to buy so, what i'm saying is i'm approaching whatever jitterishness is in the market, with an opportunity to -- >> are you adding to nvidia? >> no. >> no. you still have your position >> i still have some of my position, am i still adding to it now no, why, that would be fighting the trend unnecessarily. >> where are you looking for the opportunity? you're just talking about opportunity. >> i would probably wait for it to stabilize, like i'm not going to sit here and catch a falling knife. >> okay. >> i'm still long, so --

5:14 pm

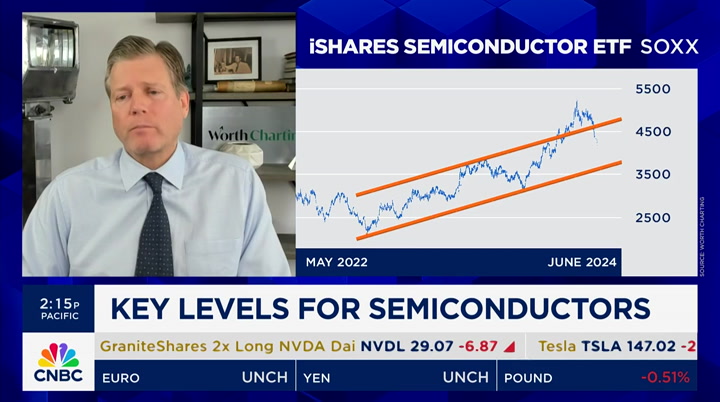

>> i guess that's what i was getting at, do you see this as a falling knife, do you see this as continuing to go lower, and for a decline of nvidia of 20% so far from its peak, from that key reversal day -- >> i would be willing to sell 200 day moving average puts. >> let's not forget that there was, you know, a good old fashioned index that was up today and that's called the dow jones and i know we pooh-pooh what's going on, but the real economy banks finish, bkx up almost 1.7%. banks like this. a stronger economy with people with jobs and right now the consumer, you know, dynamic, we're all over the map, but you know the market was up there. >> for more where semis could be headed, bring in the chart master, carter braxton worth of worth charting, what levels are you watchingsome. >> to much to watch. you referred to a key thing, the key reversal day, biggest one of all, and downhill since. before we get to the chart, what's also important is the semis have peaked before the market, weeks ago, in fact, but

5:15 pm

let's look at four identical charts of the sox, the philadelphia semiconductor index, these are mathematically parallel lines, not my lines, the lines draw themselves, they're done by a computer we blew out through the top and now we're back down into the channel. that move from the low through to the top, of course, up some 60 plus%, better than s&p up, 28, or mag seven up 45, 6:plus%, the best area of the market. and next iteration this is the same chart but we bring in the midpoint. right now we're down about 16, 17%, i think you'll see that on the next chart, it's all the same chart, with just different annotations, that's a big 16.5 there, and then where might we be headed? just to get to the actual midpoint it would be 0% and the

5:16 pm

lower band, you're talking about something in the order of 30 nvidia is down already, 20 of course, there's every prospect that this is headed lower. >> every prospect that the soxx is heading lower and nvidia is going lower from a correction of down 30%. >> remember, that's -- the whole notion of 10% is a correction, there's not -- you can't find that anywhere. that was made up one day by somebody, and everyone's embraced it. it's beta, it's how much you collect often is how much you come down, it's equal and opposite. >> given that semis are roughly 20% of the nasdaq, what does this do to the -- where do you see the nasdaq heading >> that's right, it's the area that was so loved, with a kpot of capital push into it. the issue is, when something gets crowded, whether it's a home builder, or a bank, jp morgan, and at some point, it's just full, rich, or you want to say expensive, that's the funny-mental term, what we know is all bets are off once there's

5:17 pm

a rush for the door, and we have a bit of a rush for the door going on here in the market. >> i heard him say funny-mental again, he's making fun of us. >> no, i started out as a funny-mental, it wouldn't work without somebody. >> carter is great at pointing out the logic. the chart is telling you something. the nasdaq 100, the most exciting index in the world has been flat to the s&p now going all the way back to the end of may of '23 so you've done nothing, if you've been there, to outperform. >> carter, always great to see you. have a good weekend. carter braxton worth of worth charting. so, mike, are you looking for opportunity, are you battening down the hatches, how do you approach this >> i'm certainly not going into the space that's been hard-hit but there are some areas, and single names, actually, that have shown some relative strength and that's really what i've been looking for, there have been a lot of stocks that were washed out for idiosyncratic reasons, united health comes to mind, actually,

5:18 pm

it's interesting even names like nike, which had really been punished early in the year have actually held up better than the market has, certainly a lot better than the tech sector has, i'm not looking to deploy in that area, but, you know, united is a name we added to. so, you know, i think there are some places that you can look, these things are trading at much cheaper malt pls and they've got other things going on. so, i think there are places that you can add, for sure, but technology is not the spot right now. >> all right, coming up, a change-up in china as officials order apple to pull some of meta's apps, could this be a tiktok retaliation >> plus, laying out the "options action" on microsoft ahead of next week's results. a big moment in the crypto space, how bitcoin will react after tonight's event. but first, the big drop in netflix after results last night, how the member metrics are changing and what it could mean for growth going forward. the details when "fast money" returns.

5:19 pm

ethan! how's my favorite client? great! i started using schwab investing themes, so now i can easily invest in trends... like wearable tech. trends? all that research. sounds exhausting! nope. schwab's technology does the work. so if i spot an opportunity, in robotics or pets, i can buy those stocks ina few clicks. can't be that easy. it is with schwab! schwaaab! schwab investing themes. 40 customizable themes. up to 25 stocks in justa few clicks. to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up.

5:20 pm

the next level network. i sold a pillow! [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com. my name is oluseyi risk and some of mynses favorite moments throughout my life are watching sports with my dad.

5:21 pm

now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport. my name is teresa barber. i was in the united states navy and i served overseas in the middle east and africa. early on in my career i had a commander that taught our suicide prevention training on a friday afternoon and the very next day, he took his own life. 90 percent of suicide attempts involving a gun are fatal. you don't know how much somebody can hide what's going on in their head. store your guns securely. help stop suicide.

5:22 pm

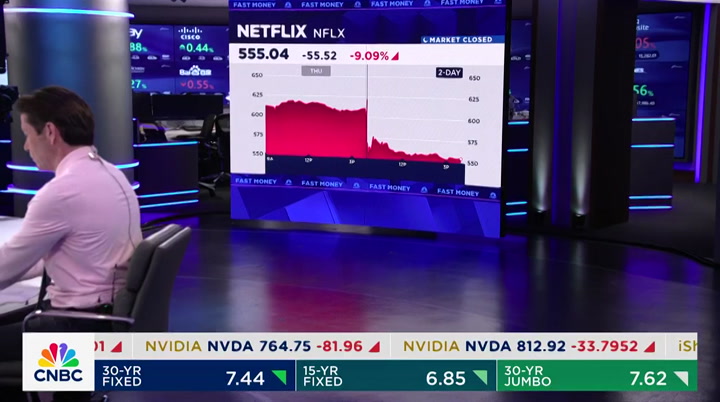

welcome back to fast money, shares of netflix tumbling, closing down 9%, worst day in two years, weak second quarter guidance in the decision to stop reporting certain subscriber numbers putting a chill into investors, the company saying during the earnings call that stats of average revenue per user, phased out in profit focused numbers starting next year, they want to turn the focus onto engagement. i spoke to tom rogers on "squawk box" who made an interesting point, advertisers are trying to sell ads for lower-level tier, they will want those rpu numbers, they will demand it how are they going to build that side of the business out what do you think? >> you know, i think it's really a -- this is a tough sell for them i'm kind of questioning -- i understand, at least their explanation of the logic as to why they no longer want to disclose this. they're saying this really shouldn't be a focus area, particularly now that we have

5:23 pm

the ad tier, right, and in terms of rpu, now we have essentially a mix of non-ad-tier, and doesn't translate one to one i don't understand why you would, particularly if investors are saying this is what you want this puts on overhang on what otherwise was a pretty strong quarter, particular lay suband revenue growth i just don't really understand the logic behind why you would want to do this. with that said, they've given a year's worth of runway, three quarters worth, before they're going to remove this so, i tend to think this is a bit overdone and perhaps, you know, to the other panelist's point this is a rotation. >> nice work there. >> this is a rotation out of some of the names that had leadership previously. >> so, look, tom rogers also known as the godfather has been right on netflix a long time, this is a stock, again, back to even our previous discussion in the a-block in terms of stock that doubled over the previous four months, did it all very

5:24 pm

quickly. the market is taking away from there this the metrics of measurement are what they are. the markets taking away from this the benefits from paid sharing may be starting to wane, that's what i think and when you look at this company at 32 times price to free cash flow, it's expensive again, so i think that's really what's going on. and back to the stock and the charts and, you know, netflix is one of these stocks that, you know, is kind of a little bit like nvidia. you know, it takes -- it's -- it kind of took the elevator up and i don't know if it's going to take the elevator down but it has done this before if you look at the chart, i mean, look, some of it sold the stock way too early on the way up i think i'm going to get it at 480. >> up 25% going into earnings yesterday. >> if you think about this, not to go against the godfather, tom, but if -- if you get into that conversation where you say that they will demand the rpu, they will demand whatever stat or whatever data metric that they want. >> do we need to define rpu

5:25 pm

right now? >> we're not going to talk about it a lot go ahead. >> go ahead. >> average revenue per user. >> you're nervous about screwing it up sometimes, i feel it. >> very nervous. >> if you come to netflix, and you say i need that data, what's netflix going to say where else are you going to go they've already established themselves as the kings of the hill i get what he's saying, somewhere down the road they might need that -- those types of data points. >> as long as their -- >> right now netflix king of the hill no one's going to ask for anything from netflix, you just say thank you when they offer you a spot to advertise. >> you buy on this wakness >> katie stockton's mark. >> here's what's next. tiktok, tit for tat, what chinese officials are ordering apple to do, and the social media giant getting the short end of the stick plus, bitcoin's big moment,

5:26 pm

5:27 pm

so this is pickleball? it's basically tennis for babies, but for adults. it should be called wiffle tennis. pickle! yeah, aw! whoo! ♪♪ these guys are intense. we got nothing to worry about. with e*trade from morgan stanley, we're ready for whatever gets served up. dude, you gotta work on your trash talk. i'd rather work on saving for retirement. or college, since you like to get schooled. that's a pretty good burn, right? got him. good game. thanks for coming to our clinic, first one's free.

5:29 pm

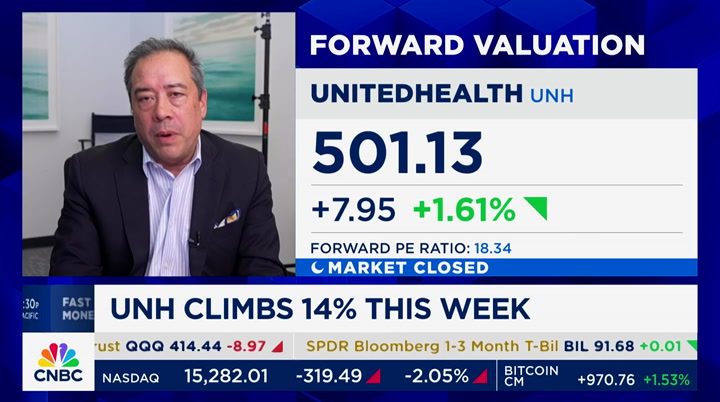

welcome back to fast money, a rough end to the week, nasdaq down more than 2%, it and the s&p logging sixth straight day of losses, longest losing streak since october 2022 the dough managed to eke out a gain for the day and for the week tesla meantime again lower today, now below that key $150 level. the latest move as the ev maker recalls nearly 4,000 cybertrucks, due to an accelerator peddle issue, that stock is down more than 40% this year on the upside. unh, up 14%, boosted by earnings on tuesday, kpaeb being top and bottom line, affirming strong full eps guidance. shares of wells fargo higher again today, that stock trading at its highest level in more than two years that sort of snuck up on me. for sure mike khouw, unh really turned things around.

5:30 pm

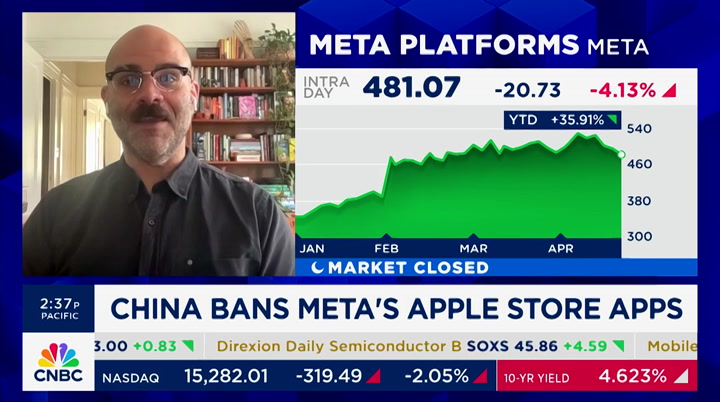

>> yeah, just been hit with so much bad news, first of all we had that anti-trust stuff and then the managed care business, that was basically -- it wasn't just united health that got hit by that, humana as well, but these were businesses that were hard hit unite united health trades in the mid-20s, it deserved to. it's a cash flow generating monster, you're looking at maybe 16 1/2 times forward you know, there was a lot of bad news priced into the stock don't even thinking earnings needed to be that good to justify, we bought more of it. apple taking the plug. whatsapp and threads out of the app store in china at beijing's request our next guest will dig into why the app store might be the new u.s.-china war zone, and the big tech earnings tick off next week with alphabet, meta and microsoft, one name the "options action" touch and give you the trades going into the report, stay tuned

5:31 pm

nice to meet ya. my name is david. i've been a pharmacist for 44 years. when i have customers come in and ask for something for memory, i recommend prevagen. number one, because it's effective. does not require a prescription. and i've been taking it quite a while myself and i know it works. and i love it when the customers come back in and tell me, "david, that really works so good for me." makes my day. prevagen. at stores everywhere without a prescription. and when i got there, they have the sushi- this is clem. like sushi classy- clem's not a morning person. i'm tasting it- or a night person.

5:32 pm

or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace. you need clem. clem needs benefits. work with principal so we can help you help clem with a retirement and benefits plan that's right for him. i'm short but i'm... i'm confident. you know? let our expertise round out yours. if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores?

5:33 pm

5:34 pm

apple complying with china's order to remove meta's whatsapp and threads from the country's app store, meta shares dropping 4% and apple fell 1% the move coinciding with an expected u.s. vote on a bill that could ban tiktok in the u.s. if it's not divested from china's bytedance. bringing in technology correspondent at the "new york times," mike, great to have you with us. >> thanks for having me. >> you actually think the app store is like a new proxy war location for what's going on with china and the united states, do you think it can go further than where it's gone so far? >> yeah, this is the sort of strange position that china is in here in terms of i guess remuneration for, you know, the threat of taking down tiktok, which is that a lot of the apps that they took down yesterday which includes whatsapp and threads, but also signal and telegram were largely banned in china already. you're not hurting americans in the same way that, you know,

5:35 pm

americans might hurt the chinese by cutting off a huge market for them over here i do wonder what their escalation would be next. >> you're not clear on what they could do next, you don't think there's any further clear pain apple is the obvious sort of pawn, or would be the obvious pawn in this tech war. do you think that there could be repercussions for that, or could it go like shein and temu pulling all the ads. >> we did a story on sheinand te -- anywhere advertising budget over the last few quarters i want to say and, you know, meta is quick to say that's pretty diversified, not any one or two companies, but the chinese government started saying, you know, stop spending there, that can ding meta pretty quickly. maybe they talk to chinese gaming companies that are there, that also spend tons of money on

5:36 pm

advertising dollars. there are like indirect ways that i think this sort of proxy war could be ratcheted up, but i feel like apple is in a super gnarly position, they don't want to be caught in the middle of it and their business is so reliant on china. >> mike, good use of gnarly, by the way. and i guess -- let's use gnarly again, i feel like in the last three days this has gotten really gnarly, right, isn't this a function of the chinese embassy going to the hill and lobbying on behalf of at first just somebody, and then it was a chinese company, and then it's a chinese company that really, you know, you wouldn't be doing this anyone else but a chinese company. so, you know, apple has been able to navigate this tight rope for a long time. we've all been amazed at it and apple is pretty self-high white house about their ability to protect the consumers and rights and freedom of speech but somehow in china they can be a monster and be okay. kid it get worse in the last

5:37 pm

threedation? is this a function of what just happened with tiktok >> i think that is largely -- i mean, the way i've been looking at this whole thing is pretty symbolic in some ways because, again, 15 million people use whatsapp in china, the great firewall already doesn't let you use it unless you're using a vpe american popular apps in the rest of the world, we are -- the we the chinese government are saying we don't want them here anymore, they -- according to people we talked to, sort of were saying it had to do with president xi jinping and content that was inflammatory towards him, but you're exactly right, like this has been ratcheting up in the past few days, we saw that politico story of people on the hill now lobbying congress, and i'm very curious what's going to happen this weekend, basically. >> in termsof what could, mike let's say this thing does pass,

5:38 pm

do you honestly think the chinese government is going to allow bytedance to celtic tok? what is golden about tiktok is the algorithm. and do you think the chinese government is going to let that we really arguing about here if you do this effectively the next step is going to be tiktok fulling out of the u.s. >> yeah, i think you're right. i think that it's been interesting to see the chinese sort of say we would rather kill this than sell it and give the golden goose to some other company, and to some degree that was probably bringsmanship, but at the same time they probably would not be a huge deal if they lost, you know, let's say tens of billions of dollars, or even $100 billion, depending how much you value the algorithm, compared to, you know, whatever untold riches or power this company could lead to in the

5:39 pm

hands of an american coalition and there's been, you know, sort of investor groups saying they want to try and buy it or rebuild the algorithm. i don't think it's that simple i think it's very hard to copy what they've done over there, but i could see a real scenario where they just shut it off and say, if you want to buy the rest of it without the algo, good luck, basically. >> if it were that easy facebook would have done it mike, great to speak with you, thank you. >> "new york times," and if that is really one of the real consequences of tiktok getting pulled out of the united states, that just makes the game -- >> great for meta. >> right, for meta and snap. >> snap was down 4%. that was shocking. >> but having enough prior, going into packages going to the hill. >> the bigger thing is that china is not an ally china -- we're in a cold war right now with china on many levels and it's a political season what's it going to the biggest

5:40 pm

bite out of? tech tech's responsible for making the market go higher that's my takeaway. >> much more concerned about apple than i am meta here, i'd be looking for entry point continuing the theme from earlier. you know, apple does not want more attention brought on the app store, that is a direct assault on the service essentially they're saying the reason why it deserves a premium multiple that would be a trade i'd look at short term. >> microsoft, meta and alphabet reporting next week and microsoft underperforming. could earnings change the story for the stock? let's bring back the chart master carter braxton worth and mike khouw for good old fashioned old school "options action." carter, kick is off with the charts. >> this is a big and prominent name that matters to all, perhaps not widely as apple, but number two, sure hi, and bigger market cap now so here's a chart, we have three, with the 150-day moving average, that october selloff was a 15%er, and i think we're headed down there

5:41 pm

again. so take a look at the next iteration. and, what you'll see here is, we dropped 15.6%, we touched the 150-day to the penny and we bounced. this selloff, i think, is going to do the exact same thing that would take us down 12 3k9, and it's also exactly where the trend line, and that's the point of a moving average, is essentially an automated trend line comes into play so lower from here, and then even as we get to that level, a play for bounce. >> so, mike, what's the trade? >> yeah, it's interesting, options are very, very fairly priced, actually, going into the print. so right now the implied move is about 3.9%, and that's about what it has averaged and, in fact, over the last eight quarters you've had about half of them that were significantly more than that so, i think what you should be looking at is if you're looking to make a bearish bet you could put the 403.80 put spread, and use that as as a hedge against long stock i'm looking ath as much at may

5:42 pm

expiration. >> you bearish into earnings >> i think the bar has been actually lowered a bit but i think the price action's difficult. i'll say this about apple, of all the stocks that traded today, traded the best of this group, and i think it's got, you know, the most pressure here, and it's interesting that 165 level on the chart is one that -- i wouldn't have thought could have held up today, and, again, if you remove a 50 to 60% move from the fourth quarter of '22 to the summer of '23, the ed bitcoin having, what it mean for a ceo will lay out his expectations but first, p&g and american express reporting result h

5:43 pm

5:44 pm

the places we cheer. trust. hang out. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. powering more businesses than anyone. powering possibilities. ♪ in any business, you ride the line between numbers and people. what's right for the business and what's best for everyone who depends on it. solving today's challenges while creating future opportunities. it takes balance. cla - cpas, consultants, and wealth advisors. we'll get you there. when you own a small business every second counts. save time marketing with constant contact. with email, sms and social posts all in one place. so you still have time to make someone's day. start today at constantcontact.com.

5:45 pm

5:46 pm

and gamble, disappointing sales numbers, but climbed back to close in the green revenue, missing second straight quarter, first time that's happened since 2020 the company beat earnings estimates and raised full year outlook for eps growth, the concern was consumers pushing back on price increases. >> they should be. and also, again, you're in the sweet spot of being able to pass on higher food inflation, and i think i will say i think consumer staples are becoming a lot more defensive in this environment after really underperforming in the same period when tech stocks were outperforms. >> american express up more than 6% today after the top and bottom line beat revenue up 11% the company is saying card member spending increased 7% from a year ago and in a gen z and millennials drove new card accounts, the stock hitting an all-time high today. >> gen z. >> how hold are they now >> am i gen z? >> no, i don't think any of you are. >> i know i'm not gen z.

5:47 pm

>> kwwe're old, go ahead. >> outperformed every other cart company and when you look at what people are spending money on they're spending it on airlines as well, and they're spending it -- treating themselves, and sitting in front of the plane, not in the back of the plane. >> hold on, in the front of the plane. >> not flying the plane. >> yeah, not flying the plane, sitting right behind the pilot there. they're in first class, treating themselves so prices are up that means that's good for dshs actually a tail wind to keep it in place for the airlines, no pun intended, to keep it, you know, consistent, delta, probably a tail wind for them, but we're still talking about higher-end clients. >> i'm told that gen z is 12 to 27. >> 12 to 27. >> we're clearly a part of that generation. >> i'm "x." >> you guys are holder than me. >> you didn't have to say it like that. >> 27 -- do you think any of us

5:48 pm

pass for 27? >> no, i'll stop talking coming up, the having is here, just hours away from the expected bitcoin having a major crypto exchange ceo, joining us to lay out what he expects from the price action after the clip to cut, that's next, and the sneak peek at the kramer cam, jim chatting with the ceo of carvana, catch it top of the hour on ""mad money"," meanwhile, more "fast money" in two.

5:50 pm

business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses

5:51 pm

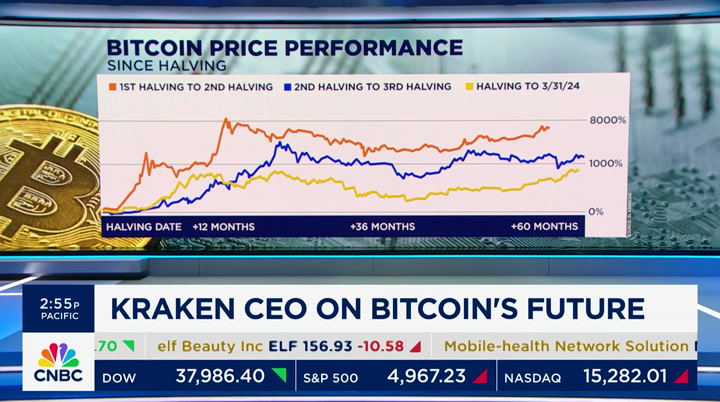

than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. welcome back to "fast money" all eyes on crypto the cryptocurrency future's supply cut in half, the fourth time bitcoin has gone through this process but the setup this time is different. let's bring in the ceo dave ripley, great to have you with us, why is it different this time around? weave seen a huge run run-up, why is it different this time? >> thanks for having me on, melissa, there's a lot that is the same for this bitcoin having, there are some new things what is the saying it's a great reminder of the deterministic supply in bitcoin, never more than 21 million, first currency in the first of the world to have such a thing

5:52 pm

you know what's different? well, i mean, i think obviously, you know, the price tends to be a -- you know, top -- a high topic here, and so i would say, you know, this is the first time we actually saw an all-time high before that happened typically in the past bull bear cycles for bitcoin, we've seen the all-time high come a number of months after the have, we're ahead of schedule this time. but honestly, i think it's -- the more meaningful thing for me, at least, is it's a great reminder of one of the most magnificent properties of bitcoin. >> you say that you don't necessarily want to focus on this, mine, this is a catalyst, but there are bigger things, like just adoption overall where do you see that going now that we have bitcoin etfs is this how does that play into price? >> yeah, so, you know, i think it -- a great, great topic as well, i mean, over the past four years in this last having cycle,

5:53 pm

a huge number of new innovations in bitcoin, in clryptocurrency, institutions come in, governments come in, even el salvador adopting bitcoin correctly. we expect more of the same in the next four-year cycle a lot of investment that came in the previous cycle has all been deployed at this point builders are building, and entrepreneurs are building, we see a lot of innovations come out in the not too distance future i think that, again, the short term movements for bitcoin and cryptocurrency, there is volatility there, there is more uncertainty, but the long arc and the long trajectory is going to be a positive one. >> when does this volatility campen i'm wondering specifically when it comes to bitcoin etf, if that, if adoption of the etf, the adoption of bitcoin, and just more holders out there, if that inherently dampens

5:54 pm

volatility. >> well, it does i mean, certainly, the more holders, the more liquidity in the system, both those holding, and those transacting, and those trading, all of these -- all of these aspects, actually, do reduce volatility over time. so, the reality is, while bitcoin and crypto is still volatile, they're not as volatile as they were ten years ago, or five years ago and so, we do see that coming down over time, as adoption grows. now, it is still a -- an incredibly innovative technology with a lot of new things happening in the space it's not as if volatility is going away completely, but it is coming down, generally, over time, so the general trend is for the price to go up and the general trend is for volatility to go down, again, over the multi-year period. >> david, when i look at this, the all-time highs running to all-time highs was a direct reflection of the 11 etfs that came out, not because of the

5:55 pm

vague. we're still on track to make another all-time high after the having, the same way the other three did that as well but when you look at use cases, people say you buy a theorem for use case and bitcoin for digital asset. is bitcoin going to change that narrative? >> you know, margin ally we've seen ordinals come on, you know, the bitcoin network more recently, but look, bitcoin is the first -- is tried and true, it's digital gold, that's one of the beautiful aspects of it is that it is the most stable from a security standpoint, all of these aspects, and so it -- that's, you know, a role in the ecosystem and it's an incredible new innovation for the world from that standpoint part of the purpose of all of the new networks are, in fact, to innovate and do something different than bitcoin otherwise, why would they even exist? you know, use bitcoin.

5:56 pm

so i think we do see more innovation in other networks, but with bitcoin it's kind of like trying to replace the landing gear on a triple seven, we're going to look for more certainty before there's a change to that network. >> dave, thank you dave ripley of kraken. up next, final trade g has paid off. looks like you can make this work. we can make this work. and the feeling of confidence that comes from our advice... i can make this work. that seems to be universal. i can make this work. i can make this work. no wonder more than 9 out of 10 clients are likely to recommend us. because advice worth listening to is advice worth talking about. ameriprise financial.

5:58 pm

>> university of maryland global campus is a school for real life, one that values the successes you've already achieved. earn up to 90 undergraduate credits for relevant experience and get the support you need from your first day to graduation day and beyond. what will your next success be? uuu, this looks romantic. [bell sounds] welcome, i'm your host, jacob. hi. how was the weather getting up here? fine but, you know, i think we're, we're just going to go up to bed and—

5:59 pm

do you believe in ghosts? [whistling kettle sound] no? good! mother is buried in the yard. meanwhile, at a vrbo... when other vacation rentals have no privacy, try one that has no one but you. final trade time, mike khouw. >> cheap to itself, cheap to the market, i think it represents a good value off united health. >> sam. >> ranger hockey on sunday. >> totally there. >> xlu, trading well, utilities. >> bonawin. >> meta, looking for an opportunity to buy something going into earnings.

6:00 pm

>> steve >> xlon said electricity demand is up 900% in chicago due to a.i. demand. >> when? >> tomorrow? soon, soon, veryoo sn. e my mission is simple, to make you money. i am here to level the playing field for all investors. i promise to send and help you find it, mad money starts right now. i am cramer, welcome to mad money, people try to make friends but lundestrom to make you money, is my job not just to entertain, put the dow and s&p and nasdaq in a context, call me, 1-800-743-cnbc, tweet me at jim cramer. the dow adva

34 Views

1 Favorite

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11