tv The Exchange CNBC April 19, 2024 1:00pm-2:00pm EDT

1:00 pm

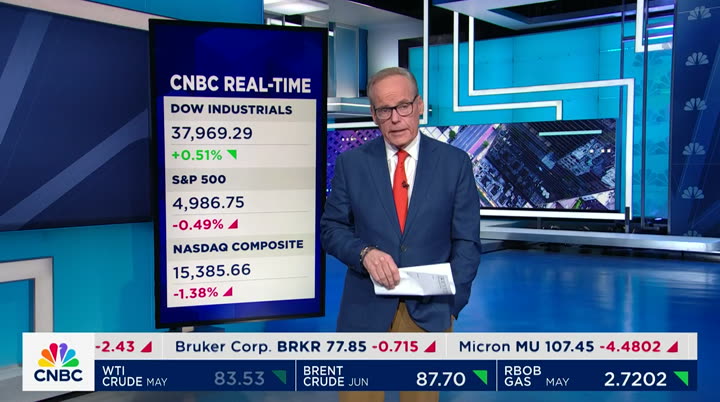

reached a crescendo of $82 in early march. now you get the pullback don't be afraid of the pullback. this is when you want to step towards, go in, and be an owner of uber. buy it here at $69 >> this is uber, not udor. that's it for us "the exchange" now ♪ ♪ thank you very much. welcome, everybody, to "the exchange." i'm tyler mathisen in today for kelly evans. here's what we got planned for you. geopolitics, earnings, economic data, the fed. we're setting up for another big week for the mafkts. it could cement or derail the fed's higher prolonged tilt. we're look at what to watch and why one guest still sees a cut this year and where to find value against this economic backdrop netflix sharply lower despite a big subscriber beat, but they're not going to report

1:01 pm

it anymore investors punishing the stock because of that, but should they our analysis says they shouldn't. airline earnings off to a strong start, but there is -- this is a word i love -- bifurcation in that trade. our top airline analyst is here and what that bifurcation is now a quick check on the markets. traders have shaken off israel's count strike on iran the dow was up about 200 points, right now up 0.52% the nasdaq, the biggest laggard, netflix the biggest gradrag on t index.l and gas prices did spik but they have pulled back. weather texas crude up 1%. gold up 0.75%. bitcoin crossed above $65,000 earlier. below that now, but still up about 2% also watching that trade ahead of bitcoin's having said to take place later today. more on the potential impact on

1:02 pm

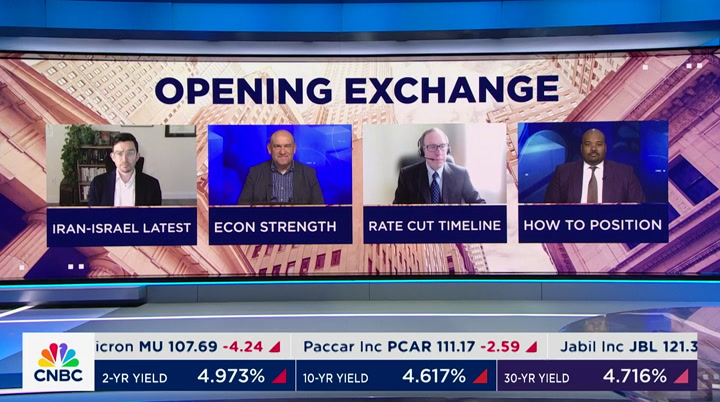

bitcoin prices and on the miners that is coming up. but first, let's start with the big headlines of the day, and the biggest concerns or catalysts for markets from here. greg brue with whether israel and iran can walk away with each thinking they won. steve liesman and brian rose with the latest on the economy and the fed. and why next week could be critical and wells fargo's mark smith on how to position amid all the noise. let's start with greg brue, iran, and energy analyst greg, good to have you with us >> thanks for having me on >> so, are we at a point, given what i would characterize as the tempered response by israel to iran's attack last weekend, and in turn, what seems like iran's tempered response to what israel has done can we close this chapter now? is that likely

1:03 pm

>> i think we can close this chapter for precisely the two reasons you gave first, israel's response to iran's historic attack does look pretty measured, right as far as we can tell, israel did three things it launched air strikes against iran's allies in syria, it launched a drone attack inside iran using its covert elements, something that it's done in the past and launched missiles into iran but on a small scale. so by all appearances, what israel did seems to be pretty limited. that's one element to suggest we're in a deescalatory trend. the iranians have responded to this attack in a muted way there seems to be a concerted effort from iran, from the regime, from the media to down play this attack iranian officials are broadly denying reports that israel

1:04 pm

fired missiles directly into iran they seem to want to let this go they seem willing to absorb it as long as it means further deescalation for now, we can be confident that this chapter has closed, but no guarantee we might see another crisis if things come to blows between israel and iran in the future >> i guess the big risk, the most immediate proximate risk to economic activity would be anything that jeopardized the straits of hormuz, which iran has shown no signs of doing in this particular instance >> absolutely. we hear rhetoric from iran all the time they threaten to close the strait of hormuz it's threat they like to do quite often, but we're not seeing any indication they're near doing something that extreme. that, of course, would affect all the oil flowing through the straits and mean war very likely between iran and gulf neighbors, as well as the united states but iran is also exporting quite

1:05 pm

a lot of crude through the strait, moving at least 1.5 million barrels a day, almost all going to china in spite of u.n. sanctions that's not a crude flow the iranians want to disrupt i don't see a huge amount of risk to the strait >> i was listening this morning to an iranian academic on the bbc radio, and he had an interesting take i don't know what to make of it, but let me lay it out for you and get your reaction to it. the take pertained to last saturday's assault by iran on israel, and this individual said that even though there was little damage done to israel, israel knocked out -- and allies knocked out 99% of the projectiles fired into israel, it was still a victory for iran because it forced the west and israel and israel's allies to spend a tremendous amount of very high-end weaponry to knock

1:06 pm

out of the skies 200 very cheap drones and iran comes away with therefore an aceltic win, we spent less than you, and we, the iranians, got a lot of valuable intelligence from how you and your friends responded how does that strike you >> well, i think there is an argument to be made that what the iranians have done with this attack is demonstrate capability they have a large arsenal of drones and ballistic and cruise missiles and now they have used them, and used them to demonstrate that they have this power, they can hit israel if they want to and they've done it largely to restore deterrence following israel's attack on iran's consulate in damascus. it reflects a trend we have seen elsewhere, reflected by what the houthis have been doing in the red sea over the last several

1:07 pm

months, armed and equipped by iran so we've seen many examples of what these drones and missiles can do again, going back to israel's management of this attack, israel and the united states and other allies were able to shoot down the vs.ast majority of the projectiles, a dramatic sense for israeli air defenses contrast that to what happened in iran. israel, by all reports, was able to fire multiple missiles, striking targets within iranian territory. the iranians were not able to stop it. the israelis have shown their own capabilities so both sides can come away with a sense of victory here. both sides demonstrated the power that they could unleash were things to get worse they have demonstrated the ability to deter >> very interesting. as we began, you said it seems possible that this could be the closing of this particular chapter. greg brew, thank you very much

1:08 pm

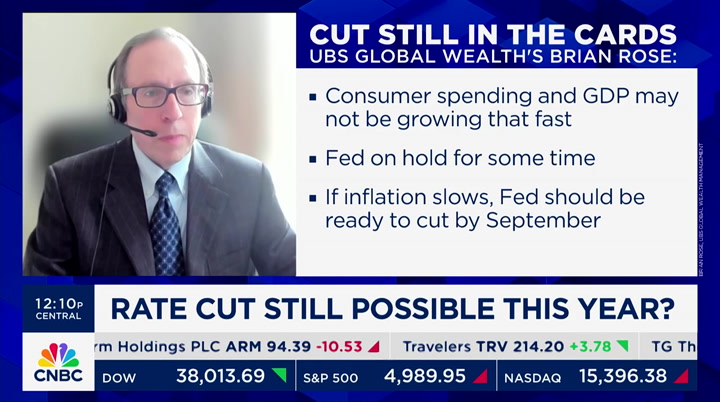

have a good weekend, sir appreciate it. >> thank you so much here at home, we are setting up for a big week of economic reports, including gdp and pce, the fed's preferred inflation gauge. our next guest sees inflation slowing and sees a cut in the cards this sent. joining us now is brian rose also with us, cnbc's senior economics reporter steve liesman. let me begin with you, steve how have we gone from a forecast of six rate cuts, six, at the beginning of the year down to maybe one or two, maybe zero >> tyler, would you mind if i corrected you for a moment >> of course >> there wasn't at least a forecast from the fed for six straight cuts, there was a pricing in futures markets for six rate cuts, which was double the fed's forecast so there's actually been two stages of this one is the market coming down to where the fed is 6-3, and now a

1:09 pm

question of, is it three, two, one or zero? so we're sort of in that phase right now. i think it's happened in a couple of phases the fed ran, i guess, an open-mouth operation to kind of bring the market down to where it was when it came to three and then the data started coming in and coming in a little difficult when it came to inflation and three months of slower progress on inflation has the fed sort of backing off this idea of a, it's likely appropriate to cut this year we don't even hear that anymore. and we also don't hear these forecasts. for example, goulsbee talked about his forecast from the march sep. he doesn't talk about that anymore. >> brian, let me turn to you where are you on the number and timing of interest rate cuts this year, if any, and i guess more poignantly, or maybe pointedly, what will it take for the fed to decide that they are

1:10 pm

ready to cut interest rates? what data will they need to see and for how long >> i think the first cut will be in september and another cut in december of course, this depends on how the data actually comes in and from the fed's perspective at the moment, the biggest problem is the inflation data. so after a very good prints in the second half of last year, all three months of the idea we had so far this year are too high, and that -- those numbers will have to come down for the fed to cut but it's not all bad news for the fed. if you're looking to cut, one of the big things that doesn't get enough attention is that weight growth has slowed and continues downwardly this makes it easier for the fed to cut, because it has implication on the medium term

1:11 pm

outlook for inflation, which is what the fed's concern is. they want to know where inflation is going to be in 2025, 2026, and are we heading towards the target and slower wage growth helps that >> so chair powell -- go ahead, steve. jump in. >> yeah, brian, i wanted you to sort of solve a problem that i have first quarter bce, we get it coming this friday, an important number but the fed's already forecasted and more forecasters probably have it right, core pce is 2.8, that's the average for the quarter. the fed forecast 2.6 for the full year. we're 0.2 off for the full year. when it forecasts 2.6, the average fed forecast three rate cuts so tyler and i were talking about this the other day about losing your kingdom for a horse. would you give up all 75 basis points because you're running

1:12 pm

0.2% hotter than expected, doesn't that seem extreme? >> that's a really good point is that if you look at the fed's forecast from back in march, they were looking for strong growth certainly their forecasts are up -- >> right >> -- to 2.6, and we're still willing to cut three times so we're not miles away from what we need to see for the fed to cut i think the problem, though, is especially if you just look at a chart of the monthly core pci print, it's not clear it that's slowing. if anything, inflation looks like it's picking up, and that's a big problem. also, the way that the march inflation data missed, which is a big increase in core services, which is powell's been talking about since the 2022, so the way

1:13 pm

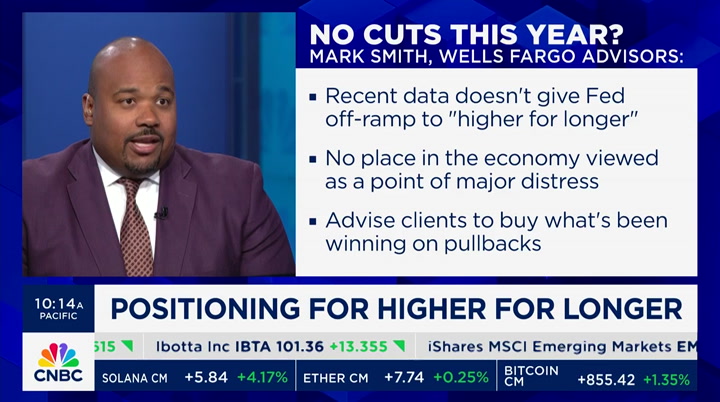

the inflation missed was troubling. and the recent trend is troubling. so, i mean, again, you need the inflation data to improve. but as you're suggesting, not by a huge amount. i would say if we had 0.2s on core pce going forward, that would be enough to cut >> gentlemen, we'll have to leave it there thank you very much. when i spoke with our next guest, he already expected no rate cuts this year. that was back two months ago in february and recent inflation data have only cemented his view now for more on where he sees opportunity from here, let's welcome back mark smith, portfolio manager at wells fargo. mark, welcome back you said you didn't see rate cuts two months ago. we spoke on the 16th of february it's now the 18th or 19th of april. what do you see now, same? >> well, back two months ago, i

1:14 pm

was just looking at the numbers, just like many other portfolio managers around the country, just looking at ppi, cpe, employment rates and we didn't see any reason why to cut rates. going forward, you have to look at november. we're in an election year. it's hard to see that powell wants to play this kind of role of raising or lowering rates in an environment where november is the election he doesn't want to come out looking favorable to either party. so it makes sense just to stay the course, and december is the closest possible day you would see any movement from the fed because of the election. >> so what does that imply then for what i should do with my money? you like the xle, energy, gold, smh, semiconductors, big tech. >> yeah, xle, up 12.8% year-to-date i think it's going to be even more of a play because of what's going on in the middle east. if you see the strait of hormuz

1:15 pm

get disrupted, it could be a number of different actors -- >> could be the houthis. >> exactly so you could predict 2% to 5% in energy around the world. 20% of all the crude oil in the world goes through that strait we are in a new phase with israel and iran, so everyone is on edge. all my clients are wondering how this plays out so you're looking to hedge, buy gold if you are thinking this is an ongoing issue, you have to own energy >> would those edged customers and clients and yourself included, would you be a little less on edge because of what has just happened overnight with israel attacking iran, but in what appears to be a relatively techerred way, so maybe some of that tension is dissipating just a bit? >> listen, you can grab at straws, but they just fired

1:16 pm

hundreds of missiles and israel and israel answered back if you're feeling comfortable, i don't know why they are deescalating verbally, but i would like to see that happen actually. so until that happen, every investor should get defensive. >> what should i do if i have some cash that i want to take out of my equity portion of my portfolio, perhaps because it's grown up against the upper bounds, not because of anything i've done but because it's expanded this year and put it to work in fixed income, where would you put it >> fixed income is an important part for investors looking for income and preservation of capital. but that hasn't happened in the last three years in the fixed income market. so a lot of clients are looking at money market rates, over 5% right now. great place to hide out while you're doing that. also, with joe biden talking about $400,000 or more going to be taxed more, a lot of folks are talking about munis and where they can protect some of their hard-earned money and

1:17 pm

going into a exed income investment that will be tax efficient. you can get triple tax exemption if you get a muni in your state. so those are things clients are talking about. >> so you don't expect a rate cut until, at the earliest, december of this year. what will it take to cause that to happen? what will the fed need to see and for how long >> you have to see some serious things happening with the employment rate. you have to see core pce go way below 2.6. there's a number of different factors we're looking at, and none of those are screaming to the fed they need to make a rate cut. so i think politically, which we always have to think about when you think about the government, november is the date that they have to wait before any significant decision in this election so the jury is still out >> you made a gold counterinduetive call in february and doubling down

1:18 pm

appreciate it. >> good to see you again, tyler. coming up, netflix shocking wall street saying it's going to stop reporting subscriber growth numbers, but that's similar to when apple said it would stop reporting unit sales a few years ago. and those shares have tripled since then what does the news mean for the rest of the media landscape? that's next. plus, the event taking pi storm, bitcoin's supply about to be cut in half, but this time around it's very different, and not just because it's been embraced by the biggest institutions on wall street. we have details ahead about the great halving. "the exchange" is back after this

1:19 pm

- i got the cabin for three days. it's gonna be sweet! what? i'm 12 hours short. - have a fun weekend. - ♪ unnecessary action hero! unnecessary. ♪ - was that necessary? - no. neither is a blown weekend. with paycom, employees do their own payroll so you can fix problems before they become problems. - hmm! get paycom and make the unnecessary, unnecessary. - see you down the line.

1:20 pm

1:21 pm

up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. doc? exchange," everybody netflix just blew earnings expectations, beating on the top and bottom line. even reported a 16% quarter over quarter jump from the year prior in subscribers why is the stock down 9% for its worst day in two years well, the company said it's no

1:22 pm

longer going to share quarterly membership quarters. that begins next year. they also issued relatively weak second quarter revenue guidance, which has wall street a little bit worried. our next guest sees netflix as a guy and has a $725 price target on it, up $175 from here, the highest on the street, implying a 30% rally. he's the internet analyst. john, good to have you with us >> thanks for having me. >> so let's bear down on what seems to have the market worried today, and that is the cessation of providing net new subscribers and average revenue per user going forward, starting next year is that as big a deal as the market seems to be making it >> i don't think so, tyler you know, yeah, they're going to pull the member number and the

1:23 pm

average revenue for metrics next year, but they did tell us they're going to give full-year guide range and gave it for 2024 last night and i just don't think it's a big deal they told us, you know, they're going to talk about what drives revenue quarter in, quarter out. and they're also going to periodically give, you know, kind of member milestone updates. the other thing people forget, i've covered that much for about 15 years, but in 2012, they eliminated some metrics. they eliminated growth member adds, and at the time it was a big deal but then it wasn't so i think it will be something similar. and the company also explained like they introduced an ad tier. they have different price points across all different gikinds of geographies and regions. so what we're seeing today is, it's not that big of a deal. it was a really good start to the year

1:24 pm

we remain bullish, near longer term and think it's a good opportunity for investors that were on the sidelines to maybe get involved >> let me squeeze in one more on this change and what they're going to report. i guess there could be sort of two explanations here. on the one hand, they could be ceasing to give these net ads and revenue per customer numbers because those numbers are less relevant today than they used to be on the other hand, they could be doing it because they're worried that the numbers are not going to be as favorable as they have been which is it in your view >> the former. you know, they're relevant, and i think what they have told us is they're going to grow revenue 13% to 15% this year and expect to grow revenue double digits i the coming years that's a function of member growth and average revenue for

1:25 pm

member growth as well as they're ramping up their advertising business so there's just more things going into driving revenue, and it's not as clear cut looking at the member and the revenue per member so that's why they're pulling it >> their numbers on the trailing quarter were really good, and it included ads of subscribers and included an eps beat, a revenue beat and so on and so forth. the only weak spot, i guess, was a little squishy was second quarter revenue forecast, right? >> yeah, 2q revenue was light, but there's some fx headwinds there. so that was -- i think folks should look past that. and the other thing i would call out is kind of they gave 13% to 15% top line guide for 2024. that includes some fx headwinds. we have about 16 -- we are expecting about 16% topline growth for 2024. so we're a bit above the high

1:26 pm

end of their guide >> i guess one thing that sort of stands out to me in this area is that the streaming world feels increasingly saturated, i guess is the world i would use there are a lot of players here. but netflix is the king of the realm, isn't it? >> by far, yeah. they're the global leader. you know, with what the 270-ish million subs, they're going to spend, they will spend $17 billion on content this year >> is the field saturated is the better question here if it is saturated, i would sure prefer to be netflix on top of a saturated field, than self-of t -- several of the others that are not as strong. is the field saturated >> there are a number of different streaming plat forms but netflix is the global leader we expect them to continueto b

1:27 pm

the global leader. they've been the most innovative company in this space. and obviously, they're going to have $17 billion in content, and continue to improve the service. globally, you have to look at them and prime video, disney plus but for us, netflix is -- will remain the global streaming leader >> john, thank you for your time today. appreciate it. >> thank you >> good to talk to you coming up, we always talk about the impact of artificial intelligence on jobs and the workplace, but one state is using it to identify and help those who are most at risk for losing their home before it's too late eat,ave the details on tha ahd.

1:30 pm

1:31 pm

controllers will have to rest for ten hours between shifts and 12 hours before an overnight shift. the rule comes as air safety has been under scrutiny after recent near-miss incidents. it will go in effect in 90 days. the white house will restrict new leases on oil and gas drilling on the national petroleum reserve in alaska to protect the native wildlife in the face of climate change the decision will not change the terms of existing leases or authorize operations, including the controversial willow project that was approved last month for decades, fans have known the new york mets buy their orange and blue uniforms, but no more the team unveiled their new city connect uniforms they'll wear for self-games this season the team says the inspiration came from the concrete jung that will is new york, and the letters nyc across the chest are attempting to connect to the whole city, a city they just happen to share with the

1:32 pm

yankees. back over to you, tyler. >> not a fan there of the mets' new jerseys. but that's maybe just me i grew up in philly, tyler, we only had one baseball team we didn't have to choose whether it's the mets or the yankees there's a whole lot of sociological stuff that goes into that. >> i'm going to consult my father-in-law, the world's greatest mets fan, and bring that information to the iewers thanks a lot coming up, bitcoin's so-call halving event is nearly upon us. even though it happens every four years, this is different from the rest. we'll tell you why, what it means for investors like you and for bitcoin miners that's next.

1:35 pm

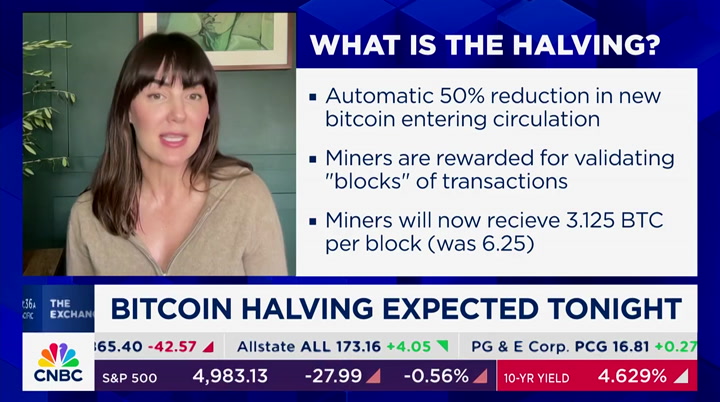

welcome back, everybody. it's a big day for crypto as we expect bitcoin to be halving the supply of new bitcoin is expected to be cut in half sometime tonight, and while it might be good news for its price, it could be bad news for the miners and other institutions, keeping the currency managed joining us now to explain all this is adviser and former chief

1:36 pm

strategy officer at coin shares. melton, welcome. good to have you with us in simple terms, what is going on here? what is happening? >> sure. the halving is a very descriptive term the bitcoin network uses a proof of work algorithm, which means that miners use energy and computation through these special chips to validate blocks they put transactions that are submitted into the network into these blocks, and people who submit transactions pay fees as a reward for doing this work, miners compete to earn the bitcoin block award. it has halved since then, so we went down from 25, 12.5, 6.25, and now we're going down even more so basically, what that means is there's less inflation, less new bitcoin mined, and that means for miners who are getting 80%

1:37 pm

to 90% of their revenue from that block reward and not from the transaction fees, it means their revenue is potentially going down >> and i guess their profitability, because they're still going to have to invest a set amount of capital, let's put it, to extract half as many bitcoin or half as much block, right? >> absolutely. but the other component here, so miners have fixed costs in the sense that they have chips that they buy they have data centers that they operate. what's really fascinating, the bitcoin network has $100 billion dedicated hard care and data center economy over 20 publicly listed miners that command -- this has been built around bitcoin, but what miners can do is use lower cost sources of power

1:38 pm

so we see a lot of miners switching their facilities on or off, particularly in places like texas, to take advantage of periods of very low pricing on the grid and the other thing we see is new models emerging for how bitcoin is creating more transaction fees through ntts and new tokens on bitcoin and other innovation >> i understood about a third of what you were talking there, but i'll take that but let's cut to what i suspect an awful lot of viewers might be most interested in this is not the first time there has been a halving, far from it. it's happened several times before but what has happened historically to the price of bitcoin post a halving >> absolutely. so the reason bitcoiners like halvings is these four-year cycles give us great data. and over the last three halving cycles we've had, we've seen similar patterns how bitcoin's

1:39 pm

price lasts. i love talking about flows bitcoin's price is largely driven by inflows and outflows so what we have seen since the start of the year with the launch of the nine new bitcoin etfs is over $10 billion of net in closing to bitcoin just from the etfs over the last four weeks or so, we've seen some net outflows, particularly as bitcoin's price has hovered in the 60 to 65-k range. what's unique about this halving, though, alludes to a new all-time high for bitcoin, nine to 12 months after a halving, this cycle, we saw bitcoin hit an all-time high before the halving so we saw new all-time high for bitcoin posted in march. that's pretty unusual. we also have these etfs that are fundamentally changing the nature of flows into and out of bitcoin. so i think all bets are off this halving. i'm expecting it to reach new all-time highs before the end of

1:40 pm

the year, but this cycle is looking different than the last three we have seen >> thank you very much, melton we appreciate your explanations there. you helped me a lot. >> i'm happy to hear that. 1/3 is good, i'll take that. >> thanks so much v. a good weekend. coming up, a big company reorganization under way at alphabet, but something else is happening at the company that the competition may want to take note of. the details coming up in today's "tech check.

1:42 pm

1:43 pm

you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com. welcome back, everybody. alphabet's ceo has announced big new company reorganization in a memo consolidating teams to help develop ai products more quickly. he also hinted a t a workplace culture shift for the tech giant. deidre bosa has those details for us in today's "tech check. hi, dei. >> tyler, you picked up on what

1:44 pm

i thought was the most interesting part of that memo, where he says in no uncertain terms, this is a business. now, it was an indirect way of speaking to the events from earlier on in this week, when a group of employees staged a sit-in across a number of google offices, including one in its cloud ceo's office, they were protesting more than $1 billion israeli cloud contracts, 28 employees were almost immediately fired. in that memo, he says google is not a place to act in a way that disrupts workers, co-workers or makes them feel unsafe and to be clear, this sit-in was a new level of disruption that led to arrests but what's important here is he went on and said google is not a place to "use the company as a personal platform or to fight over disruptive issues or debate politics." and remember that google has built on this mantra of don't be evil the idea that ethics and

1:45 pm

business go hand in hand in the age of ai, we are seeing this narrative change. this age of ai is arguably the biggest existential risk to de google in decades and requires tougher leadership that's what we're seeing hims of now. we'll see next week when mega cap earnings get underway. it's helping financials, as well, and that is a big question as we head into earnings google reports on tuesday how are those search numbers, advertising numbers going to look, tileer >> thank you very much deidre bosa reporting. according to data, last year california had more than 181,000 homeless individuals, up more than 30% from 2007 and now, los angeles county is turning to ai to help find people before they join that statistic. kate rogers joins us now with more hi, kate >> reporter: hi, tyler l.a. county's homelessness

1:46 pm

prevention unit has intervened with 800 individuals and families using ai to identify people most at risk of losing housing. the program relies on a model developed by the california policy lab at ucla, using data from seven different departments, including emergency room visits, and public benefits programs from food stamps to income support and homeless services at-risk individuals like courtney peterson are found after being laid off from her job in december, peterson worried she wouldn't be able to pay rent for herself and her 7-year-old son >> i feared that i was going to have to leave my apartment you know, i feared that i was going to have take my son to a homeless or family shelter >> reporter: she and her son received some $8,000 from the county to cover rent, utilities and basic needs, allowing her to stay put in her apartment while she looks for a new job. the program is largely funded by american rescue plan act dollars.

1:47 pm

individuals and families receive between $4,000 and $8,000 to cover expenses and stay housed, just a fraction of the nearly $36,000 a chronically homeless person costs taxpayers each year and 86% obtain permanent housing once they leave the program. the solution is preventative and key for a state that's spent $24 billion in the last few years to tackle homelessness. >> compared to the cost, both financially and from a human trauma perspective, that a person or jurisdiction incurs when you have such a massive population of people sleeping outside, $4,000 to keep somebody in their housing is more cost effective. >> reporter: now, there is the concern about ai being used by governments around issues of informed consent and privacy of anonymous data in los angeles, help is receiving some of the at-risk population when they need it

1:48 pm

most >> what is interesting here in part is the idea that this is not the individuals who are at risk of becoming unhoused, reaching out to government, it's the other way around it's these programs finding them so what is the reaction of individuals like the young woman you interviewed there, when the government does get in touch with them and extend this kind of assistance? >> well, courtney said this help came just in time. she was laid off in december, worried about making january's rent but you heard from the program director she said the biggest challenge they have is not only finding these people who need help but conventioning them this isn't a scam someone is not reaching out to scam you, this is actual aid, we're looking to help people stabilize, and it's so much better to catch people before they fall into that situation. >> kate, thank you very much

1:49 pm

kate rogers reporting there. coming up, the consumer not slowing down and spending on travel it's helped the airlines deliver strong earnings so far, but there is a bifurcation happening in that trade. wall street's top airline analyst joins us with his top picks from he.er we'll be right back. more bifurcation after this.

1:50 pm

tamra, izzy, and emma... they respond to emails with phone calls... and they don't 'circle back', they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team. let our expertise round out yours.

1:51 pm

i don't want you to move. and benefits plan that's i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

1:52 pm

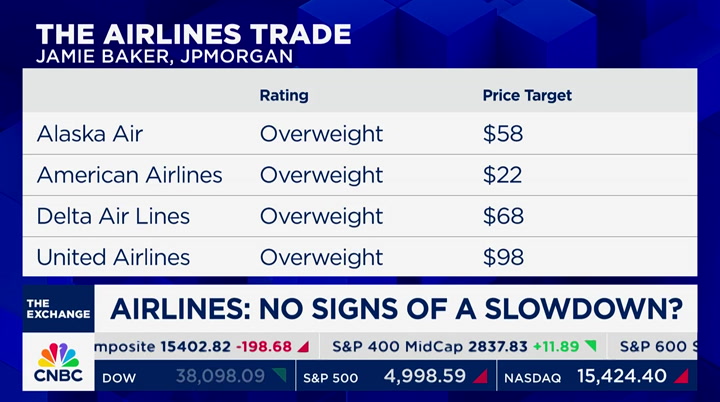

welcome back to the exchange. airline stock mixed in with the session but a big strong start for the big names reporting this week. >> we had record revenues. if not for the that it would have been profitable. we feel really good about the trends we have seen and we see those carry-on into the second quarter. >> the team delivered a solid set of results and it set another record. >> as we pick up market share with customers we had strong revenue performance and really great domestic performance in the best operations we had in our history. >> our next guest expects to hear the same sentiment next

1:53 pm

week with more carriers report and now joining us as jamie baker the institutional investor hall of fame for his coverage of the airline industry. welcome and congratulations on the banking hall of fame and good to see you. we use the word bifurcation and it's one of my favorite all- time words. there are, i take it, winners in this space like united, delta, and maybe alaska and others. then there are some who are not winners. what separates the good from not so good? >> i do want to choose my words carefully. but i think we can say that covid turned out to be a structural positive and it obviously wreaked havoc on supply change -- chains. it drove significant wage rate escalation at discount airlines and they needed those lower wages to compete.

1:54 pm

i think covid also provided a boost for premium demand and there also seems to be this growing consumer hit from goods to experiences particularly international. you are absolutely right. there has been a bifurcation coming down to business models and the airlines that cater to premium, international and have robust frequent flyer programs are the ones who are kidnapping or capturing the bulk of industry profitability. meanwhile, those airlines that only cater to consumers that care about low ticket prices and don't have loyalty, those are struggling. >> i don't mean to make this about me but since you mentioned it, i booked a trip to europe for the summer and i splurged for a higher price seat because i want the comfort and experience. i suspect there are a lot of people who feel that way because where the airlines, that is a part of their business, they are winning?

1:55 pm

>> that is correct. we did see that in the data this last week and revenue for delta in the first quarter was up 10% and meanwhile traditional economy was only up 4% and even american express today talked about greater growth in spending on travel and entertainment versus goods and services. so, yes, you are the demographic we are targeting. thank you on their behalf. >> you recently upgraded jetblue? >> it is in the middle of the turnaround. i do think the prior leadership, under the leadership there was an exceptionally high tolerance for loss and there is a new ceo and president and we saw pretty aggressive cancellations for places like baltimore, kansas city, which are large money losers and you have a shareholder involved. a very negative sentiment and i would say the upgrade wasn't

1:56 pm

driven so much by valuation as it was the potential for sentiment to begin shifting in jetblue's flavor -- favor. that helped the stock. >> according to the ceo, demand seems to be strong. is there sign of a slowing in demand you can detect? >> honestly, no. i have taken the question as to whether some of the safety headlines might impact demand and at a high level it does not seem to be changing consumer behavior and i do see the occasional social media post like planes are falling apart and i will drive to orlando instead which is ridiculous and it is like buying cancer. no offense, but who thinks that way. we are really not seeing any slowdown in unrelentingly strong demand but it is very

1:57 pm

robust in longer haul international markets. >> let's talk about the safety issues that have bedeviled the boeing and then as an effect some of the airlines. do you think or expect the worst of that may be behind us as an industry? and how material have those disruptions been for some of the carriers? >> look. from where i sit, and i am not an engineer or mechanic or pilot, but there really hasn't been an appreciable increase in maintenance but there has been an increase in media scrutiny and obviously the issue was one- of-a-kind and highly unusual but things like the occasional compressor stall and plane that vacates the runway and i don't want to speak or anybody but given the sheer number of flights every day it's not all that unusual and i think in the

1:58 pm

united states it's a little like the summer of the shark if you remember that. >> we will leave it there and have a great weekend. pria it. that does it for the exchange and power launches up after this quick break. we will see you there. quiet cabin in the woods. the fully electric q8 e-tron. an electric vehicle that recharges you. how we get there matters. your record label is taking off. but so is your sound engineer. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates

2:00 pm

♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. presentation looks great. thanks! thanks! voya provides tools that help you make the right investment and benefit choices so you can reach today's financial goals. that one! and look forward, to a more confident future. that is one dynamic duo. voya, well planned, well invested, well protected. welcome to power lunch. we are glad you could join us for a friday. coming up netflix tumbling after earnings and does

29 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11