tv Fast Money Halftime Report CNBC April 19, 2024 12:00pm-1:00pm EDT

12:00 pm

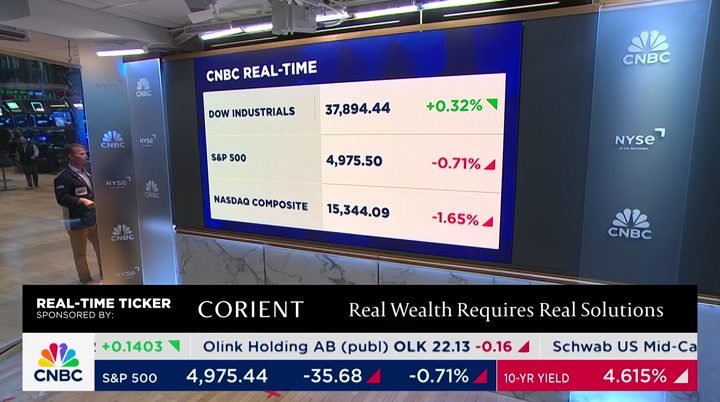

the nasdaq to look into naked short selling. i got a response back because they called out citadel on this. it is very fiery the proverbialloser who tries to blame naked short selling for his falling stark price. nunez is the person donald trump would have fired on "the apprentice." we would fire him. his ability and integrity are at the center of everything we do. >> that is to the point. let's get to sully and the half. carl and sara, thank you welcome. i'm clearly not scott wapner i'm brian sullivan in on this friday and front and center today, the road ahead for your money. the s&p, i'm sorry to say, on track to close out its worst week of the year but, have no fear, because your investment committee is here to help you navigate the pullback, the global macro risk that is out there now. that is an all-star bunch.

12:01 pm

we have joe terranova, stephanie link, and bill baruch. we'll get to them in just a moment first, here is how your money looks, and not great not as bad as it could have been given what we saw last night the hair selling triggers on word ace rail was striking back in iran, a fairly measured response by israel, probably just to sent a message the markets have calmed down a bit, but technology is getting hit. and one of your committee, just before the show, comes up, she dps -- i just gave it away, she. i'm not good at this job abt, anything but technology all right, so we'll get to that in a moment. but related to all the geomacro stuff going on is our starting point. that is a trade alert. the aforementioned stephanie link just made a big trade in the energy patch that is the company formerly known as schlumberger, slb, sales up 13%, net income up 14%, you're buying

12:02 pm

more. >> it was a good quarter it trades off on the quarters. i don't know why all the numbers you just cited, you have earnings up 19% you have revenues up 13% adjusted ebitda up 15% they're talking about the cycle being elongated because of their pipelines are so much stronger than what they expected in terms of business. and so that, to me, when i heard that on the call, i'm like this is silly it's down 21% from its highs and it trades at 14 times forward estimates for the number one player in the industry >> i spoke with the ceo olivier lapush, a james bond name. it was about a month ago and he was bullish on the business i'm skeptical when they say we're transforming, joe. the numbers do seem to confirm

12:03 pm

that move, and yet it doesn't get a lot of respect from the markets. >> we'll get a lot of energy earnings next week, chevron, exxon mobil, hess, halliburton i think there was a degree of skepticism surrounding oil heading into the quarter the overall environment, look, we disincentivized the growth of production, seeing demand is beginning to slowly rise, and i think from an asset allocation perspective for the very first time investors have to think to them themselves, maybe this is different. commodities aren't a boom/bust cycle. maybe commodities are entering a phase, a secular phase, where they belong in investor portfolios maybe single digit portfolio allocation but i think we're entering that type of environment because that demand versus supply imbalance, i think that's staying with us

12:04 pm

for many years >> what is also staying with you is free cash flow. these companies are generating an enormous amount of free cash flow and they're not pumping it into production yes, they are doing some of that as they should but they are returning it to shareholders and that's exactly what we have wanted from these companies. >> obviously energy is my jam. i did not stack the show to start with energy today. teleph it was our executive producer's call it was important you said the word phase. phasing in people will be surprised, bill, we heard a lot -- and i don't want to get political -- about phasing out fossil fuels in the previous political campaign. i want to be very clear, even the most bearish estimates, which is the international energy agency, which has been wrong, has oil growing the next number of years and possibly next number of decades

12:05 pm

that's the most bearish. and yet there is this mind investors have, they're going away, so why invest? they're not going away oil demand growth is only going up >> it's true i like the phrase, petroleum runs the world there are so many products that are made and derived from petroleum, it's not going anywhere >> the body of a tesla is made from plastics and natural gas derivatives. >> it's really a great thing from where i'm looking at it now, we're 10% energy. we've been leaning into it, leaning into the refiners. we did get out of schlumberger ahead that have earnings report, nervous about how it would react after the earnings report. as you said, it hasn't always acted great, even though they had a great quarter. if i was going to add another name, one thing i am making note of, you have to be cautious, is oil heading into a seasonal top

12:06 pm

towards the end through memorial weekend? that's where i would like to see a stall. refiners are leading a down side that's what i'm watching right here we did have the geopolitical spike in oil last night. does that bring a short-term top? i'm just cautious right here as somebody that is overweight. >> the viewers see the price of oil going from $86 overnight to below $83, and automatically they say, oil is failing here and, therefore, my investment in energy equities. i disagree do not look at the spot price of oil as the ultimate referendum on investing in energy. >> why not >> you have to look at the long term you have to look at the long term and think about the secular change i identified in my opening remarks.

12:07 pm

oil, the front front expires on monday it is if i go 12 months out, $75 oil. 24 months out, it's $72. 36 months out it's $68 oil we'll hear a lot about the potential to lift some of the curbs. saudi arabia needs to lift the curbs. their economy last year was in contraction. they need to pump more oil there could be some head winds, but as long as price is staying in the $70 to $85 range, that's so beneficial to the companies, the free cash flow >> the cash flow at exxon and chevron is 35 for oil. that's where they make money

12:08 pm

>> anything above that is just gravy. >> a lot of analysts are markin themes names on oil, the free cash flow will be generated at a higher pace than expected. >> i should be, pending unexpected circumstances, be at that opec meeting, over the weekend, again it is so critical. the spare barrel capacity. we'll see quickly we'll move on in a second. bill, quickly, is $80 to $85 the sweet spot for oil it's enough to print that free cash flow stephanie was talking about, but not high enough to cause demand destruction on the gasoline side. >> i do agree with that. 78 was big resistance. if we could setting in above there. i think that will be a really great for the cash flow of

12:09 pm

equities you speak of. >> let's move on, a very wise person told me anything but technology you said, brian, we have a massive rotation >> we've had it for a couple of weeks. i think the earnings will be good for the overall market. i think if you look at the russell 1,000 growth, and i look at the russell 1,000 value, and back in february, february 9th, the spread was 900 basis points. growth was outperforming value today you're at 250 basis points that spread has narrowed it is more than anything but tech we are seeing energy as we talked about, financials have really come back nicely after they reported earnings and when they all sold off, a

12:10 pm

lot of people -- i was adding to morgan stanley you've had materials do well and so tech at the same time has actually kind of rolled over >> but why why is the rotation? >> it's all about interest rates. you don't want to own long duration assets if rates will stay higher for longer it's clear that we're going to have higher rates for longer whether they cut once. i don't think they'll cut at all this year. point being -- >> you're also in the no-cut camp, which is getting more attention. >> i'll take the other side of that i think cuts are on the table. you look at july from the cme group, still 45% probability now i look back to january when they released the december retail sales numbers as pivotal, and i think we saw -- josh brown has talked about the narrative quite a bit, the high net worth

12:11 pm

individuals with $10 million of investable capital, they're sitting and driving the services economy much stronger than anybody would have thought and if you have $10 million in your bank account, you can get $500,000 a year of risk-free return they're spending the money there's people moving into more of a entrepreneurship roll, distorting the job market. i think the fed should bring down rates in order to start kind of easing the economy, people could say that housing would blow from there. there's a piece of the pie that would be a tornado of activity for six months and then it will cool off i think prices could come down from there so i think it's very interesting here right now you look at the small business survey, nhib survey this morning, in 60% of all companies are small businesses it was at the lowest level companies are struggling the american express on cnbc this morning, they talked about small businesses getting more credit lines

12:12 pm

that's good for american express. i think within the economy there are pieces here that are very distorted and the fed knows that they can't talk easy because of reaction function. they are managing the reaction function i think they got what they wanted over the past couple of days, the past couple of weeks >> where we are right now is in a very precarious place, and i sat with scott wapner yesterday on "closing bell" and in my closing remarks, i said i thought the market was close to bottoming. i will be completely wrong on that if technology continues to trade the way technology is trading. we could pull up a six-month chart of apple as we do that to the viewers, ask yourself, what has the market done the last six months? look at apple the last six months apple is at its lowest level in the last six months. as we're speaking now, nvidia on decline.

12:13 pm

so technology and the mega caps are incredibly important, a third of the s&p is going to be reporting this week four of those big mega cap companies reporting, and we need these companies. we need these companies to deliver because what's happened now from a technical perspective is you've now completed closing the gap from the nvidia earnings breakout in february that mike santoli has been talking about, 4983 i believe is the bottom you're below it with the s&p at 4978 you're now below that level. i have to have these technology companies deliver. >> lows of the day for the market, and the s&p on track for its sixth down day in a row. i don't think it's happened for a long time. we've been in this giant uptrend. jim cramer this morning, i was listening as i was driving in, and he said, i don't have -- meaning, the market doesn't have a bullish ish thesis right now give me a reason to buy macro.

12:14 pm

that's what jim was talking about from a macro market perspective. what is -- if you were making the bullish ish thesis at large? >> we have better growth we are growing about 2.9% here in gdp in the first quarter. we grew 3.4% last year we were supposed to be in a recession. imf, they revised their global growth higher, 3.2% earlier this week china, 5.3%. second quarter in a row over 5 the better growth is the reason, in my mind, why inflation has been so stubborn and sticky. it's because of fiscal stimulus. it takes a long time to get into the system

12:15 pm

why does that matter for the markets? better growth will lead to better earnings. i think you will have probably 8% to 10% in growth. you see them pull back, but you're not in elevated multiples. >> yes, but nobody cares they're going to have to start to care. i would say this, everybody, bill, loved the magnificent seven, or whatever they're called now, on the way up. i described the market one time as a bowling ball on top of a pencil and huge tech companies controlled everything. it feels that the pencil may not hold we love the mag seven and all the big tech on the way up to joe's point, apple, weak.

12:16 pm

nvidia starts to slide can the overall market, the s&p 500, go up if some of those companies, even a couple of them, don't participate? >> i think we can rally. we've seen it without apple, without tesla. a new name shows up, they rotate around, and it happens i think one of the really interesting things today, and i'm a little disappointed the market hasn't been able to hold the early rally, bank of america had a survey that said over the last two weeks the most outflows of stocks since december 2022. we know what happened in january 2023 look at last night in the futures market, there was real capitulation taking place. we opened higher this morning. that's what i want to look for >> that was panic selling trigger on the israel/iran news. the nikkei fell 3% in about two minutes. >> that's how capitulation happens. capitulation and volume do

12:17 pm

create bottoms the day is not over yet. you look at outflows the last two weeks that probably didn't even include yesterday i think we're working through lot of negativity, the fear index is improving to get more fear in the market those are things that i would look for >> semiconductors are falling apart. that is asml >> semis kneecapped -- >> the smh is still up on the year it's easy to take profits. i've been taking profits and stocks kept going higher and higher >> it's such an important context, and i would expect nothing less from stephanie link, which is we're acting like the market is down 30% in a year >> 5% off its all-time high. >> 5%. peter tuckman is weeping openly.

12:18 pm

the market is still close to its highs. >> it doesn't mean it can't go down another 5%. what was important to me was the earnings of mega caps and the technology companies and certainly a communication services company that ended the blockbuster video career we'll talk about that stock in a little bit >> the next piedmont airlines? >> it's a friday you have a lot of systemic algorithmic selling. >> what if we end on lows today? >> that doesn't mean anything to me i wouldn't be surprised. sunday night the market comes in higher

12:19 pm

i don't look at markets that way. i think structurally we're in a bullish place. >> my guess is some of your buddies, all your cta bros with 18 monitors they do care if we end on the lows. >> that would trigger more selling. every rally is getting faded i think you make great points. they threw cold water over the chips trade and there is fear these companies and ceos will use this quarter to bring down and soften expectations. could that treat a bottom? next week will be pivotal for

12:20 pm

everything >> we get a pce next friday. >> what if it's hot? >> that's the problem. >> can we come into the camp >> my three cuts will go down to one if it's hot. >> it's nice over here, the water is warm. >> 35% of the weighting, that was up >> and car insurance sorry, nothing else jerome powell can do. jay powell can't do anything about the price of anyone's car insurance. so you want to fight inflation, don't worry. i'm going to bring down your allstate >> ppi was better, was more controlled there's more components that go from the ppi into the pce versus the cpi.

12:21 pm

losing a lot of viewers here, right? my point being, i think the number will be fine. i think 2.7, 2.8 and the market would be fine with that. it's still not 2%. >> as long as it's below 3 it can be digested. let's move on. apparently this show doesn't have commercial breaks what next? >> how about that streaming company that took out blockbuster video. i'm not happy with them. >> you're talking about our "chart of the day" >> let's do it >> shares aren't happy investors aren't happy joe terranova is not happy why are you not happy? >> i stuck my neck out yesterday on "closing bell" and said they would deliver on margins, deliver on the profitability you'll see one of the strongest quarters since 2020. i pointed out it was 13% below its all-time high. plenty of room for upside

12:22 pm

potential. what do you do, netflix? you change all the rules you tell me afterwards the forecast was a little bit dour now you're no longer going to disclose quarterly subscribers why? what is it we needed to have that implemented yesterday destroyed the positive near-term momentum and made me look like a fool >> no, it didn't you're being too hard on yourself >> it was a great quarter. >> phenomenal. >> netflix -- it's not my opinion, netflix getting caught up in the tech sell-off stuff. number two, people didn't like the whole, i'm not going to reveal subscriber numbers, by the way, starting in a year. we're going to get another nine months of subscriber data b before -- and netflix can change its mind laura martin, needham, probably the most influential analyst on

12:23 pm

netflix in media and tech upgraded netflix she's been a hold for a long time free cash flow generalation will go up. and yes, i have to say it contractually, a.i. -- i'm just kidding. in laura's note, they did upgrade. >> when you take a key metric out of the equation it's not good >> uncertainty. >> it invites more of the unknown. it didn't have to be that way. >> they're focusing on advertising and they don't have to do that the advertising money will come in knowing who -- the audience they're going to hit that's a big thing right now, too. >> also trading at 31 times forward estimates. this market doesn't want 31

12:24 pm

times. >> i'm not suggesting you sell the stock. i'm saying i'm disappointed in what i heard overall is the positive momentum still in place for the stock absolutely in january, remember, you had the breakout gap you're testing the 100-day moving average technicals look bullish. i'm just disappointed in what i heard. >> and, by the way, love the raw honesty, but netflix, you disappointed joe and stephanie that's not fair. we have a news alert from washington, d.c., with emily wilkins. what's going on? >> reporter: brian, as you know, moments ago the house did move forward on that package of $95 billion to ukraine but, of course, you have a lot of conservative hard-liners did not like the package and now you're seeing the blow back paul gosar, a republican from arizona, is saying if there is a vote on removing speaker mike johnson, he will vote to do so that brings the number of

12:25 pm

republicans who would vote to remove up to three, and if all democrats also vote against speaker johnson, it depends on the math of who is in and who is absent, but assuming everyone is there, that is enough votes to oust johnson gosar said they need a speaker who puts america first rather than bending the reckless demands of the neocons in the military industrial complex making billions from a costly and endless war half a world away it does remain to be seen whether we will see that motion come up. the house is in recess until saturday they have to come back and take the final vote on ukraine. at this point this could be the end of the line for johnson, and he said all this week, he's called himself a wartime speaker. that is happening on the national stage, the international stage, is more important than what his future is going to be he's stuck by the fact that moving this aid, about $60 billion for ukraine, is the right thing to do and he's stuck

12:26 pm

with his guns even as frustration among members in the republican conference have been rising >> wow emily wilkins, spending bill going through. it did appear the market moved a little bit as this news started to trickle out i would say the house gop is a dumpster fire. i don't want to defend dumpster fires because i've seen lovely one. does this matter to you and the stock market >> the market's reacting on it, and we've seen a leg lower maybe in reaction to the news coming out right now i'm looking on the political side after the election no matter who wins. they will have to crack down on fiscal spending. >> the headlines from d.c. >> you're not going to commercial, are you? >> we're apparently going to

12:27 pm

have a commercial, 30 minutes in, which is great >> and on the other side of the commercial >> more joe terranova, steph any link, bill baruch and i'll be sprinkled on top are you good with that >> i think we have a surprise guest. >> it's the first time i've hosted the show from here. i appreciate you being gentle. i'm fragile. we are just getting started, which is factually inaccurate. the show is half hour. a pop for paramount and, to joe's point, let's not say the name -- >> everyone knows paramount, we know who is coming. >> who is it don't say it surprise guest will join us with more on the paramount pop. we'll hit the trades on two big stocks we talked amex earlier intuitive surgical "halftime" halfway is back in two minutes >> announcer: are you following "the halftime report" podcast? what are you waiting for look for us in your favorite podcasting app follow "the halftime" podcast now. boring. think about it.

12:28 pm

boring is the unsung catalyst for bold. what straps bold to a rocket and hurtles it into space? boring does. great job astro-persons. over. boring is the jumping off point for all the un-boring things we do. boring makes vacations happen, early retirements possible, and startups start up. because it's smart, dependable, and steady. all words you want from your bank. taking chances is for skateboarding... and gas station sushi. not banking. that's why pnc bank strives to be boring with your money. the pragmatic, calculated kind of boring. moving to boca? boooring. that was a dolphin, right? it's simple really, for nearly 160 years, pnc bank has had one goal: to be brilliantly boring with your money so you can be happily fulfilled with your life... which is pretty un-boring if you think about it. thank you, boring.

12:29 pm

you've got xfinity wifi at home. if you think about it. take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

12:30 pm

12:31 pm

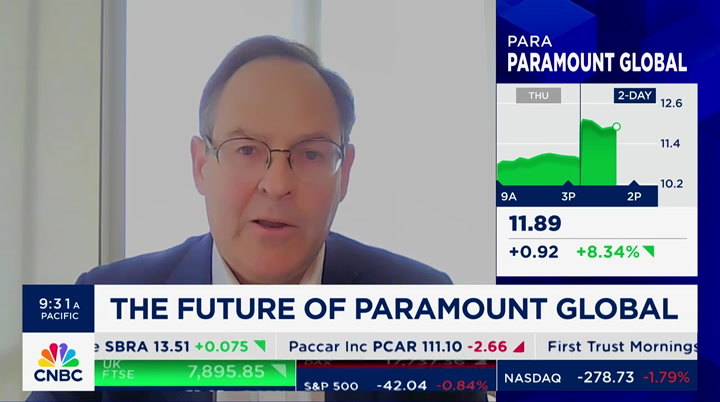

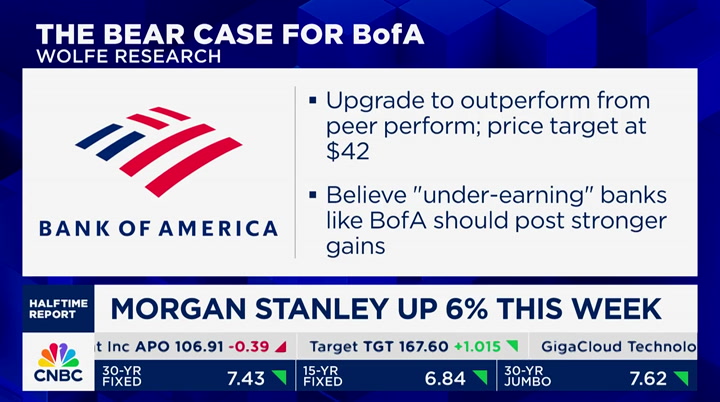

paramount also in talks with sky dance media run by david ellison. of course the son of oracle founder, larry ellison there is a lot of action around paramount and misery guest jim lebenthal joining us now he owns it talk to me, goose. >> all right, brian. first off, great a block take a great raatorade block. there's a lot going on one whiskey tango fox trot going on operationally the company is doing better than expected generated free cash flow, have accelerated the time line for paramount+ and no near term maturities of debt until 2027. number one number two, people want to buy this company the news today, sony and apollo may team up to buy at a price that looks like it's in the low 20s. so this begs the question why is the stock down meaningfully this

12:32 pm

year and trading at roughly 12 times if apollo wants to buy it at 20 times. the answer is sherry redstone. for reasons of her own, she wants to do a deal with skydance the reasons may be legitimate to her. she wants to keep the name intact to honor her father she wants to get out of her a shares she has her own debt to deal with if she goes down the road of taking a substandard deal compared to the apollo offer which, by the way, needs to be confirmed, but if she does that, tremendous legal liability i don't think she, the officers of the company or the directors of the company, really want to take on that legal liability i really don't think so. but we're going to have to wait and see this is a controlling shareholder. >> she has a couple billion reasons to do the deal. >> she sure does >> jim, i have to ask you a question

12:33 pm

good to see you on a friday. >> joe, you, too you were too hard of yourself on netflix. >> i think we owe the viewers that when you talk in a particular direction and it doesn't go that way. i know you've been in paramount a long time, and i'm asking this question for the educational benefit of the viewers itself. you've been in it a long time. let's say you get your 20-plus end game for the share, $20, $25, whatever the case may be, when you look back on it, the mental capital you've spent on this, do you think it was worth it to have made the initial investment in paramount? >> absolutely not. and, joe, it's a great question. i hope that you knew that answer, because i've been trying over the last couple of months to really make that clear to everyone i have a style of investing, joe, you know what it is, fundamental analysis i put together what i think the fair value of the company should be in a private market transition if it's selling at a discount, i'll go and buy those shares

12:34 pm

that usually works like any investment style, there are times it doesn't work. this has been an absolute horror show i'm embarrassed by it. every day, you know this, too, you have to decide what to do with your position on that day given the information at hand, and given the information at hand, this is a hold for me. i'm not add to ing to it becausf this wild card factor of sherry redstone i hope i've been clear in my answer >> it's like pennant friday. we appreciate the honesty. to your point, the viewers and the listeners deserve it have a good friday there are more committee stocks on the move first up, american he can press, higher, beating on earnings, beating on revenue steph, you don't just own it it's a top five position >> they've done a great job in terms of executing the biggest number was the card

12:35 pm

spend at 7%. they did a very good job on revenues, earnings, expenses were 4% lower than expected. they did a very, very good job in a challenging environment >> if i could real quick josh brown has been talking about the thesis it's been written. i've been talking about it are higher rates stimulating the economy? you have high er consumers who have the ability to spend more, higher credit quality and the earnings for american express are evident. those higher rates are stimulating the economy because they're earning more income. >> there are millions of people who have $10 million or more it's hard to believe, but it's true printing 5% money, some of it tax free, $500,000 a year not

12:36 pm

touching the principal, we're not flying coach we're going up front and we're going to take that trip of a lifetime intuitive surgical down. >> this is called good news, bad price action i would put it, one of the better performing health care names year to date, in the momentum basket. intuitive surgical is part of that decline thank you. now some of the news headlines with silvana henao some signs of optimism this morning that a conflict between israel and eye may not escalate. iranian state media describe the incident as an attack by infiltrators, a senior official says there were no plans for a

12:37 pm

response from tehran the epa has designated two forever chemicals as hazardous substances making polluters, not taxpayers, responsible for their cleanup. the companies could face billions in liabilities. they reduced to near zero levels just hours after the release of "the tortured poet's department" taylor swift announced it was a double album and dropped the anthology at 2:00 in the morning. the album swift announced at the grammys features collaborations with post malone and florence and the machine. brian? >> never at a loss for surprises from taylor swift. >> that's right. that's right >> silvana, thank you very much. me thinks those albums will sell wild speculation still ahead, the man, mike santoli, will join us with his

12:38 pm

"midday word." "the halftime report" is back after this with its customizable options chain, easy-to-use tools and paper trading to help sharpen your skills, you can stay on top of the market from wherever you are. e*trade from morgan stanley power e*trade's easy to-use tools make complex trading less complicated. custom scans can help you find new trading opportunities, while an earnings tool helps you plan your trades and stay on top of the market. e*trade from morgan stanley

12:39 pm

trading at schwab is now powered by ameritrade, unlocking the power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab.

12:41 pm

all right. the dow is up, but that is not the story of the market. let's get more from mike santoli joining us, and, mike, the dow may be up, but, again, who cares? there's a lot happening? >> there's a whole lot happening at the top of the nasdaq and the s&p which is really weighing on the indexes. equal weight is flattish or better right now what it does tell you is we have this market, we have to contend with this for the last several weeks in the pullback, which is the most crowded stocks of this market also happen to be the biggest and most expensive you have to give a lot of room for them to reset when there is this massive rotation going on, when basically people are saying -- and also when you get netflix, a blow-out quarter and a market kind of says, sorry, what else you got? and sells off the stock, maybe next week's earnings for the big guys is not going to be magic.

12:42 pm

i think that sets us up better, because here we are cleaning up positioning and having a 5% pullback and also having these relentless intraday declines every time the market pops the head up, it gets swatted you're draining away a lot of the short-term optimism. all of the oversold are flashing, we should bounce soon, but it's not clear -- >> this is a friday. we're probably going to go long here producing from the chair i'm looking at my fact set here, all the mag seven are down nvidia down 4.5% jeff poippointing out 17% off is highs. all oil and gas stocks are up. >> that's rotation >> i said down 17% at the beginning of the show, i pointed that out >> what's that >> i said -- >> what's this >> i think what's really important --

12:43 pm

>> to be fair the ear piece is in this ear. >> besides being down 17%, to me the heart of the rally and the ref newspaper growth came in the form of the semiconductors the semiconductors are down -- the smh down 11% this month alone, and i think arm -- >> the equal weight is down for the year >> and arm holdings down 11% as well today it's the mega caps, because we've talked ad nauseam how important to this market and to see the semiconductors deteriorate in that capacity, the market will have a hard time bouncing if you have that negative performance >> the other piece of it, if you throw up a one-year chart, look at all the air under there, it's okay and the long-term story is fine the market overshoots in both directions when it came to growth, good fed cuts and tame yields

12:44 pm

>> to quote joet, you get your first bad marks on the show, because toward the top of the show, joe said, you have to remember, we're still only 35% off our all-time highs see what i just did there? >> let's not forget seasonally, this was april, an election year we come down and settle in where are we in june and july? joe pointed out we blew through the nvidia gap now we're in open air territory here >> you're kind of right there, though >> i was hoping we would close above on the week. >> mike, and steph, you said this, a lot of people made a lot of money the last couple of years. still all-time highs tax season just -- tax day was just the other day >> i don't think that's who is selling, though.

12:45 pm

>> there is a systemic element everybody who is a trend follower was super long at the end of march >> the chicago guy >> i feel the last time we had a reaction in the market was jackson hole in 2022 fed chair powell, who spoke this week, surprised me -- we didn't get jackson hole powell this week >> i'm so tired, it's been a long week, was it goolsbee this morning that said housing stays hot, they're all starting to shuffle people into the no cut camp >> this is what's happening in the market the russell 1,000 is down 165 basis points and the russell 1,000 value is up 32 >> regional banks are up today if we thought it was going to be, like, rates are going to

12:46 pm

choke off the economy, i'm not sure regional banks would be up today. i think it's a very scrambled storyline. >> a rotation. >> i think it's rotation, 100% value versus growth. that's what's going on >> maybe the big question is how long does the rotation last? i know this block is over, so if we're going to talk about it, it has to be the next block a short commercialre bak markets, nasdaq, lows of the day or close to it ♪♪ ♪♪

12:48 pm

12:49 pm

that i'm more than what you see on paper. today i'm the ceo of my own company. it's the way my mind works. i have a very mechanical brain. why are we not rethinking this? i am more... i'm more than who i am on paper. ♪ hi, i'm greg. i live in bloomington, illinois. i'm not an actor. i'm just a regular person.

12:50 pm

some people say, "why should i take prevagen? i don't have a problem with my memory." memory loss is, is not something that occurs overnight. i started noticing subtle lapses in memory. i want people to know that prevagen has worked for me. it's helped my memory. it's helped my cognitive qualities. give it a try. i want it to help you just like it has helped me. prevagen. at stores everywhere without a prescription. ♪ ("three little birds" by bob marley & the wailers) ♪ ♪♪ discover our newest resort sandals saint vincent and the grenadines, now open. visit sandals.com or call 1—800—sandals. (sounding horns) at enterprise mobility, we never stop looking for new mobility solutions. because sometimes the best road forward, is the one you didn't expect. (♪♪)

12:52 pm

investment professionals know the importance of keeping their clients on track. sometimes they need help cutting through the noise, to ensure fresh investment ideas keep flowing, and to analyze the market from every angle. at allspring, we deliver the unexpected, by relentlessly exploring where others don't. allspring, follow the insight. all right. welcome back

12:53 pm

so yeah, it's friday but a tough week for stocks. we did as always find some diamonds in the rough that are committee members owned, not all doom and gloom united airlines, you're welcome. personally i've been on like 40 flights already this year. up big, joe, on earnings >> it is, and i would not chase it at all. this is a catchup, a little bit of mean reversion to what delta has done so far year-to-date earnings much better than feared. that was what was reported earlier in the week. we have had a nice rally don't chase here >> stef, morgan stanley, big week >> big week. >> you own it? >> i do. it's a very big position, and i think that this one can play catchup. it's lagged, down 2%, but growth is 6, 7% year-to-date. i thought the quarter was one of the best in the industry from the institutional side, wealth management, nii, expenses. i think there's more that they

12:54 pm

can do they have a new ceo from investment banking, and they're going to gain a lot of market share. >> not worried about the s.e.c. poking around? >> i bought more on that news. it's not new news, number one, and number two, it shouldn't have been down 5%. >> bank of america, too. >> regulators are everywhere bank of america, yeah. they have a mixed quarter to be honest but what they did show is better nii on a sequential basis. they were the only big six to do that everyone else had a sequential decline. expenses were a little elevated, but that's a one-time thing and stocks are awfully cheap >> don't roll your eyes. united health, bill. >> earnings beat they do one thing really well, they've always beat earnings despite the cyberattack and some

12:55 pm

of the premium worries going through the space, they continue to do what they do next, beat earnings and lay ground work the stock has performed very well since then. it's a ballis within our portfolio. what is you just said, a lot of insurance companies are taking a lot in, but they may not be paying a lot out, which is the whole insurance point. i remember when gas was soaring, people complained. if you have the means, and i know millions don't, so i understand that, but if you are complaining about your health insurance premiums, bauy united health >> there was a big fear that the pickleball thesis -- >> what the heck is that >> a lot of elder people have to get procedures, they're blowing out their knees, that was the big issue. >> oh, i've got monjon elbow

12:56 pm

>> a lot of -- it was just catered within that relative narrative but a lot of pent up procedures post pandemic taking place and cost these companies a lot of money and they got through it. >> the pickleball thesis, it sounds like a movie from the '70s stay with us "final trades" and probably the d mcaeromg aerenofy re cinupft this amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

12:59 pm

just over a minute left. time for "final trades." bill, you're up first. >> micron. in a market like this, people can forget about the stocks that have done well it's pulled back sharply, but within the news, they got a $6 billion grant to build a chip factory. i think what's covering the earnings gap, $100 to $105 is the target >> i see you got p&g the swifer thesis. >> i thought the quarter was pretty good. they beat gross margins again o the upside by 310 basis points year over year i like the products that they have got guide goes higher. not cheap, but i do think it's a quality company. >> joe >> so we've been talking many of us on the committee about uber for the last several months. really for the better part of the last several years

1:00 pm

it's had a very powerful rally reached a crescendo of $82 in early march. now you get the pullback don't be afraid of the pullback. this is when you want to step towards, go in, and be an owner of uber. buy it here at $69 >> this is uber, not udor. that's it for us "the exchange" now ♪ ♪ thank you very much. welcome, everybody, to "the exchange." i'm tyler mathisen in today for kelly evans. here's what we got planned for you. geopolitics, earnings, economic data, the fed. we're setting up for another big week for the mafkts. it could cement or derail the fed's higher prolonged tilt. we're look at what to watch and why one guest still sees a cut this year and where to find value against this economic backdrop netflix sharply lower despite a big subscriber beat, but they're not going to repor

37 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11