tv Squawk on the Street CNBC April 19, 2024 9:00am-11:00am EDT

9:00 am

the markets after israel retaliated against iran, but markets have modulated in large part on just how limited the reaction has been in a very good way. seems like a very positive situation. we're off about ten points right now. melissa, i want to thank you for hanging out all week it's been a lot of fun join us next week, and have a great weekend. "squawk on the street" begins right now. ♪ good friday morning, welcome to "squawk on the street," i'm carl quintanilla with jim cramer at post nine of thenew york stock exchange faber has the morning off. futures do recover what was a nearly 2% drop as iran, so far, not signaling retaliation for the israeli strike last night. oil is lower yields, lower across the curve as we wrap up the week with some blue chip earnings our road map begins with israel carrying out this limited strike against iran we'll take you live to the middle east. netflix, the biggest premarket laggard on the s&p,

9:01 am

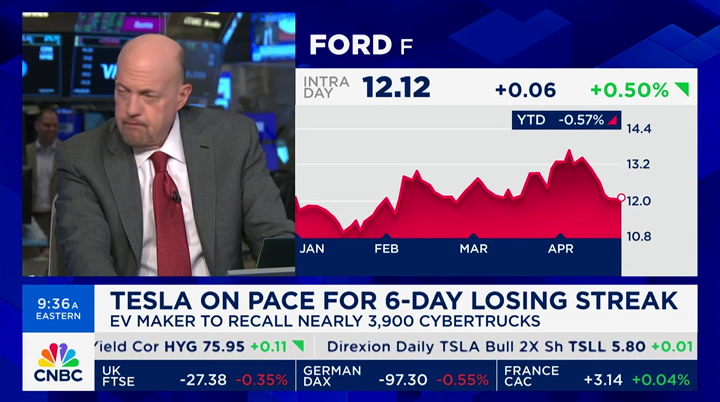

despite posting a beat on the top and bottom line. tesla is on pace for a sixth straight day of losses, now issuing some recalls for the cybertruck over faulty accelerator pedals let's begin with market reaction to israel's retaliatory strike on iran, jim. so far, not a lot of signals that this is going to cause a conflagration. >> no. i talked last night about what we need on "mad money," a crescendo of selling at 10:15, we thought we had that last night the fact that we now have decided that it wasn't important -- not -- we decided that it is less relevant, so we've come back up is, again, something i don't want to see. we have to have people decide that negatives are negatives, not that an avoidance of a negative is a positive so, i want to hear more from richard engel about israel, but the fact is that we were down so much, and then we come in, and then we're up?

9:02 am

what are we up for why are we up? how about flat how about down a little? we don't get that. so, it makes me suspicious of this opening again, because people, by the end of the day, will say, well, maybe israel wasn't done. and i think it's unfortunate it's very hard to game what's going there. but i will say that the exuberance that we feel every morning based on, you know, flimsy evidence, it has -- >> well, the bulls would hope for something that blinken talked about this morning, and that is this "journal" piece that the white house is still actively working toward getting a deal with israel where they talk about some palestinian statehood in return for diplomatic recognition from riyadh >> i think you have netanyahu, who's more of a wild card than ever, and again, i don't want to -- i'm not a political

9:03 am

expert i follow this one pretty intensely, but i come back and i say, when it comes to stocks, you don't -- you have proposals throughout this period, and netanyahu has not gone with them so, i mean, netanyahu's been trying to prove his independence i think he needs history i think he needs -- back in his days when he was in philadelphia 1973, he's got to go over those five days where kissinger convinced nixon to resupply, and then he will understand where the hell we are, and i think it's very unfortunate that he doesn't seem to know history as well as i thought, where israel needed everything, nixon was against it, kissinger said, you have to do it, it's a democracy, and the united states saved israel and anyone who disagrees with that just doesn't understand the golan heights. so, i'm not saying that he's ahistorical. i am saying that he seems to be ignorant of what happened in 1973, and it's going to cost israel, historically >> to you, is it mostly about

9:04 am

energy goldman today, again, we see brent in a range between 75 and $90. brainard saying, we're going to make sure gas prices don't get out of control this summer >> i love the idea that we can control it, but i think that goldman put out a good note for alumni which is that markets may be worrying too much about overheating. this is david marigold this is the first piece i've read which says, enough with the hysteria about inflation the fact is, there is what he calls catch-up inflation, which is about car insurance and owners equivalent rent i'm going to see a car dealer, going to carvana they're intraquarter, but you said, yesterday, something really good. you said carmax is disappointing. disappointing because prices are coming down. i've met with them they're probably the best operator, and they're the only one that actually uses a.i., so they actually had a sense of what could happen. and look, insurance is something that we all feel

9:05 am

it's funny we have jonathan kanter at justice really pressuring apple, and the issue with apple, again, is that the phones are so good that people don't switch well, how about the fact that if you switched insurance, all it would do is make it worse? but you know, they're not -- they're not savvy like that, because they're anti-mega tech, and the justice department is emerging as the one i'm now focused on the other agency, we know their stance they seem to be fine they're consistent >> the ftc which one do you mean? >> they're consistent. but kanter has taken on google, and he's taken on apple. he's got merrick garland on his side, the attorney general, but when i look at what happened with apple, what happens with apple is it has to cut numbers we'll get that number cut. then, two to three days later, we'll say it's bottomed. then, the focus will be on the other mega countries besides china. you're going to start hearing a narrative which says, we got to start thinking about brazil, philippines, indonesia, turkey,

9:06 am

and then we have to extrapolate india. but they haven't been able to tell that story yet. >> you mean as a supply chain? >> no. customer base three years from now. >> oh, interesting >> and if they were to focus on long-term value of those new customers, particularly in india, younger customers, not unlike what i talk about when we talk about american express, what people realize is, for the first time -- and i will even go as far as to say that procter is doing the same thing for the first time, we're not as levered to china as we think, and i think wall street is way, way behind the demographic changes that we're seeing. where did tim -- you know, tim puts -- tim cook -- he puts factories where he wants customers. this man spent more time in jakarta than we've seen. now, you could say, wait a second, he capitulated on whatsapp i would say that he makes deals. he's always been pragmatic, but the pragmatic nature of indonesia, a country of more than 200 million people, growing like crazy, to me shows -- you

9:07 am

know, vietnam, 100 million people >> you're talking about not just diversifying china's locus as a supply chain hub but as a customer hub on the demand side >> our country is addicted to thinking that china is a winner in everything. our inferiority complex to china is only second to the inferiority complex that chinese feel about china, particularly after covid, where they were given the opportunity to have a vaccine, and they chose not to have it. pfizer's had the worst quarters ever, but man, they make a dynamite vaccine >> well, procter today, john mueller on "squawk" had relatively positive things to say about china quarter on quarter. >> yes and you know what? i got to tell you. i see procter down three you could say i'm talking for the home team because my travel trust has owned this stock forever. you can send this stock down it's not a problem you can focus on beauty. you can focus on children. but what i think you really should focus on is one key thing. when you look at the third quarter last year and the fourth quarter last year, you had the

9:08 am

dollar overwhelming the cost savings. that has been the dynamic that we've suffered, and what happened this time the cost savings exceeded how much is lost on the dollar people don't want to look at that what do they want to look at they look at the headline generated by a.i., which says the revenues weren't that good it's really unbelievable that you can get out of argentina, genius, get out of countries where you're selling things for much less than you make it, and then you get punished, down four i'll take the other side of that trade. when it's down four, you got sellers that come in and sell it down to $153, and then you got to buy it hand over fist >> organic, up three was a slight miss. here's what mueller said about china earlier this morning take a listen. >> china is down a bit, as the market continues to struggle, but even there, we're seeing sequential improvement, quarter to quarter >> well, this is a sequential

9:09 am

improvement story. it's not an absolute story it's a relative story. you know what? you got to do a -- you got to parse the q3 and q4 to recognize the improvement, but the lack of history of how procter did on q3 and q4 is sending the stock down people must go over the line by line i went over q3 and q4 coming into today, and i was pleasantly surprised. it's sk2 that is this problem. >> yes, yes. >> they're not going to -- this -- i'm calling it the -- we're going to get the gen z and millennials when we talk about american express, but the gen a.i. on procter sends it down. gen a.i., they're not looking q3 and q4, the machines, and so you have this stock getting clobbered, and i understand. you want to sell at the opening. look, the hedge fund guys who are super novas, they'll take that you'll buy it at $153, they'll

9:10 am

sell it down to $152 that's what they'll do and then, they'll cover. and the individual at home is saying, something must really be wrong at proker, and i'm telling you something's really right at procter, which is that their costs are down, and they didn't have to cut prices go listen to the conagra call, the kellogg call you can listen to general mills. if you didn't have to cut price, and your prices fell -- h hormel -- your stock went up procter is no different. i'm not going to disagree with the opening, because i'm never going to disagree with the guys who are just banging it down i want to own that thing at 10 of 10. >> we'll watch it after the open nice 7% div hike >> 11 of 10, no. meantime, let's do get more on the israel-iran conflict. nbc's chief foreign correspondent, richard engel, is on the ground in jerusalem this morning. richard, the reports here sound like this was carefully calibrated do you agree >> it was a very limited strike,

9:11 am

and if you look around, the streets of israel, you would hardly know that anything happened there have been no instructions given to the public for people to take shelter. traffic is flowing as normal people are out people are shopping. the airport is open. air space, uninterrupted and that's a pretty strong indication that israel doesn't expect an immediate counterstrike and tried to calibrate its response and what's interesting is iran is also downplaying this we've been talking over the last couple days how iran has been making threats, was threatening fire and brimstone, that if israel attacked, it would immediately respond with a ferocious attack of its own, but instead, what is -- what iran is saying is that since this attack on an air base was so small, that it's a sign that israel was intimidated, that israel was too afraid to do more, and

9:12 am

therefore, painting it as a success for iran so, if both sides can walk away feeling that this was a victory, that is a best case scenario, because that is how you de-escalate all conflicts around the world. you give each side an off-ramp this is not over but things are looking like we are heading potentially toward a de-escalation of this part of the conflict, of the direct iran versus israel, head-to-head, we attack your country, and we'll respond by attacking the other directly >> okay, richard, first, jim cramer i want to salute you for unbelievably neutral reporting and unbelievably situation, once again, where your life is in jeopardy it's unbelievable how good you are. i want to talk about targets >> thank you >> no problem. you don't get it enough. why not just tell you? targets. why that target in iran? who's there? what's there and is that not in itself a sign that they're not going after --

9:13 am

obviously, really populated areas that could have caused a terrible, terrible tragedy of life >> so, this was a military base. isfahan is in central iran, a his historic city, one of the most beautiful cities in the world, really, certainly the most beautiful in iran. there's an expression in the country that means, "isfahan is half the world and contains half the world's beauty." it's a wonderful place but it also has a military industrial component the uranium enrichment site is there. that was not attacked. it was not touched in fact, iranian tv put out pictures today showing the main circle in isfahan with traffic flowing as normal. iranian state television anchors were telling people that things were -- that they should live

9:14 am

their life as normal, one saying that the israeli strike was no big deal they showed life continuing in that country so, it seems that israel chose that because there's also a missile production facility there that produces medium-range missiles when iran attacked this country, it used ballistic missiles that fired -- they were almost all shot down, but that they were fired here it seems like israel attacked a missile production area in order to send a message to iran, a, that it can get through its air defenses, and b, you target us, we'll target your military facilities by the way, iran's main target in israel was also a military base >> richard, street's listening closely to you this morning. thanks for that. hopefully later this morning or today and the days to come, we can talk about longer term diplomatic pushes. that's richard engel in jerusalem. >> don't you love journalism what journalism was.

9:15 am

9:16 am

9:17 am

i don't want you to move. whose resumes on indeed match your job criteria. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity. - after military service, you bring a lot back to civilian life. leadership skills. technical ability. and a drive to serve in new ways. syracuse university's d'aniello institute for veterans and military families has empowered more than 200,000 veterans to serve their communities and their careers. from professional certifications, to job training,

9:18 am

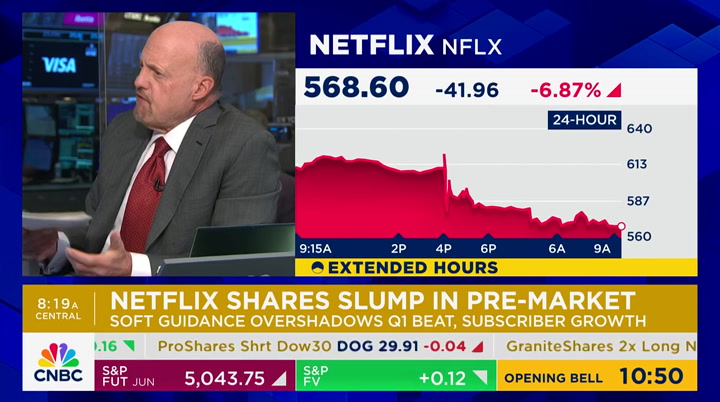

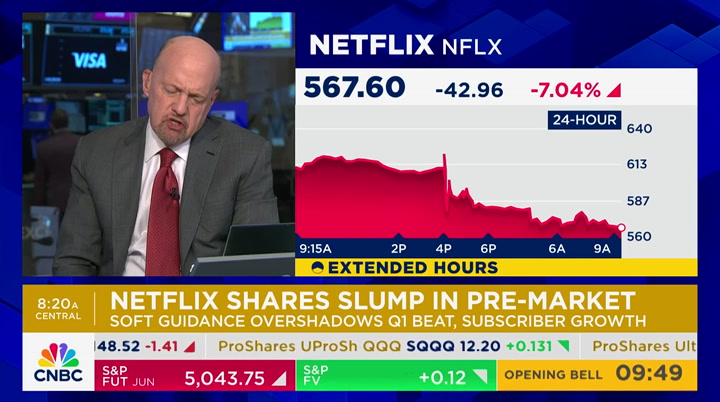

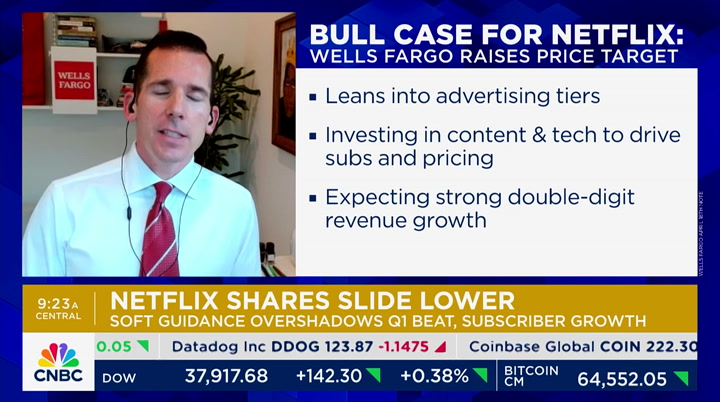

to help navigating programs and services, we give veterans access to support from anywhere in the world. netflix is the biggest premarket laggard after issuing softer revenue guidance than the street expected. that news, overshadowing a quarterly beat, including 9.3 million additional subs. the company announced plans to stop providing sub numbers beginning next year. this is co-ceo greg peters on the call >> each incremental member has a different business impact, and all that means that that historical simple math we did, number of members times the monthly price, is increasincreasingly less accurate in capturing the state of the business. this change is motivated by wanting to focus on what we think are the key metrics that

9:19 am

matter most to the business. >> best start to a year in terms of subs since 2020 >> it gets tiresome. my travel trust does not own netflix. amazing quarter. and again, i keep using this word, parse, because we seem to be ahistorical this was a great quarter i don't care i'm going to give them the benefit of the doubt about their decision about the way they're going to give information. the essence of this story this time was a verb that they used that i've never really used it myself you can google it. eventized. they're eventizing their business there was a -- jason was asked point-blank about the tyson fight, and whether it would be good, and he said, yes i think that these people are creative i think that they keep growing everywhere i think that when you have --

9:20 am

people, just read the darn release. "society of the snow." this is a movie, 98.5 million views. what does this mean? throughout the quarter, throughout the discussion, it's about how films breed viewers. who else talks about that? so, you may think that their projections, their forecast is down beat, and they did. some people said, listen, i want to be a bad guy. i'm not going to just dismiss the body of work that these guys have done and how many more people they can still take and everyone wants to find fault everyone wants to find fault with a stock that's down $45 that's like the people who said that we're going to have six cuts hey, there's the six-cut crowd right down there down 42 means down 46. this is another 10 of 10 story nobody gives these guys the benefit of the doubt this has been one of the greatest stories in history. >> i think -- i mean, the downgrade today says the stock is up 90% in 12 months >> good. the good stocks go up. let it come in

9:21 am

i'm in no hurry. the stock was up huge, people were asking about what to do with it yesterday. what have they done? they've accomplished the almost impossible they have an ad tier, and they don't even have all the money that's going to be made. >> ad membership, up 65. still gunning. >> the 10% penetration is all they have versus what they could have the number of countries that are involved look, it's an international success story, and all anyone wants to do is call a top. that has been the prevailing -- call top, call top, call top why don't they actually read beyond the second paragraph of the -- of that bizarre youtube stuff? let me tell you why -- you know how to get that stock up they won't do it go do what jack hartung, the finest cfo in the land, did. he said, we got to split the stock. we got people who want to be in the stock. if they were to announce a split, you know what would happen they would be up 43. that's how pathetic these opening quotes are >> the other media piece to fold

9:22 am

in here is from "time. >> does sony have the money? it would alleviate some financing concerns >> i want the champions league you can have the rest sold to you. can we just go -- i mean, honestly, netflix -- the sellers are using chatgpt. right? i mean, that's what it has to be you put it through chatgpt, he talks about weakness if you actually read it, it talks about strength >> you think selling is a hallucination today? >> yeah, i think in the end, there are survivors in uruguay uruguay. there it is. okay you got a uruguayan movie. uruguay. i didn't know they made movies i thought uruguay was, like, you have a good bank down there. what the heck? >> and amortize that all around the world. >> that's my point you know what? i like prell and i like "society of snow. >> pretty busy friday shaping up in the futures, as you know, have recovered a lot of lost grnd ckn mont

9:24 am

business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. it's the go-tos that keep us going. the places we cheer. trust. hang out. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. powering more businesses than anyone. powering possibilities. the all new godaddy airo helps you get your business online in minutes with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo

9:25 am

at pgim, finding opportunity in fixed income today, helps secure tomorrow. our time-tested fixed income suite, backed by over 145 years of risk experience, helps investors meet their goals. pgim investments. shaping tomorrow today. take a look at some premarket gainers. we talked about paramount before the break. that is going to lead you this morning, up about 10% on this heels of this "times" story.

9:26 am

9:29 am

leader in income, alternatives, and responsible investing. let's get a final "mad dash" for the week, jim. >> sometimes you have to go a little deeper than just looking at the earning per share j&j won a very big case last night in the talc issue. remember, the plaintiffs are alleging that j&j knew that there was asbestos, which causes cancer, in talc. that view, by a firm called beasley allen, they have not won a single case. this is -- and by the way, just so you know, j&j's been winning these cases, and they're doing a parallel effort to be able to settle everything. what's important here is that there really still is no evidence that there's a linkage, even though the plaintiffs constantly say it. we're going to see abbott labs report at the bell abbott labs stock was going higher, and then it was mentioned that a competitor lost a formula suit because there was a terrible tragedy with a baby

9:30 am

i'm saying that maybe the plaintiffs have reached a bridge too far against corporate america, and maybe the supreme court one day will agree with that >> well, walk was on "squawk" and said they're going to look at foreign financing of the plaintiffs >> it's time j&j's leading a very informed, sophisticated tactics of the plaintiffs there is a plaintiff firm that is very good, and i don't want to -- i don't want to dismiss them they're very good. >> jim mentioned abbott. they are at the big board today, along with buffalo bill safety, and heart mates ambassador damar hamlin doing the honors. >> fantastic hero everyone remembers that moment, that heart-stopping moment on the field, and everyone now remembers. there he is. >> great to see him at the nasdaq golden matrix, a gaming company. bunch of headlines about marketing spend and chargeoffs and some weakness, they say, at

9:31 am

small and medium-size business >> i know. and by the way, steve scurrier would admit that if you want to take a long-term view, what matters there is the incredible funnel they have. they don't have to pay as much the acquisition costs are very low, because they advertise on credit karma they advertise where they have to be. american express has been ridiculed and -- if you go back to -- >> you're showing your age >> if you go back two quarters ago, there was a belief that in october, steve said that, look, spending was a little bit lower on restaurants the stock dropped to $160. and then it's been a straight shot, why? because the quarter and the quarters were really good. this was a very good quarter, because once again, he's getting millennials, gen z you're talking about a lifetime value of a card. that's what you're trying to go for. >> on your card, what year does it say when you joined >> 1981. >> i'm '90 >> well, i remember getting it, and my folks thought that was the sign that i had finally gotten -- >> oh, cf frost. >> no longer living out of my

9:32 am

car and making a couple bucks. look, steve squeri is a remarkable operator and a regular guy. unfortunately, a jet fan people do that and i think that this was just another quarter in line with many good quarters yes, restaurant, not up as much as i want, but all of the -- every trend is good, and by the way, his losses, that's what i'm focused on his losses are much lower than, say, discover. much, much lower >> he did say that discover, capital one, they've got a lot of work to do. >> es, they do >> chargeoffs, still, a shade below pre-pandemic still >> i would point out this is a man who has reinvented this company and has taken it to being the mind share of the people who are in their 20s, who are who you really need. it's incredible, because as he had said -- he walked me through this once. he said, jim, in their 20s, they get the car, in their 30s, they

9:33 am

start using the card, and in their 40s, they take the points and do what my life does she's got that stack they don't go to me. it's incredible. >> oh, yes >> the bill goes to me, but those little -- >> all the rewards >> that's exactly how that works. >> i got to look into that >> the other trend regarding fifth third and huntington is basically provisions in line, guidance unchanged that's the running theme this morning. >> i know, and you want the net interest income to be good, and i actually don't want the net interest income to be good i want the business to be good, and that's why i continue to like what charlie scharf did at wells fargo, where he has reinvented the company and made it a fee-based business so he's off the treadmill, and the treadmill -- fifth third had very good net interest income. we're going to get off the treadmill as part of a normalization of the economy, and when we do, you want companies that are doing a lot of business. that's the new wells in wells, by the way -- by the way, you know, the informatica

9:34 am

>> crm stuff >> they once told me, we have the software to detect the fraud that they were doing at wells fargo. well, i got to tell you, charlie scharf has been paying the price of that fraud, but it's almost over, and who knows how well he can do if it's really a bank and not a fee machine. he's going to -- the fees are going to accrue soon to the shareholders, not the law firms. >> you've been saying, watch the fees, not the interest income. >> we have to go back to remembering what makes a bank stock go up. it's a business of fees, all right? now, jamie dimon turned it into a referendum on the world. now, jamie is just too existential. i got to get to him. he's become too existential. >> when you did philly -- when was philly, your interview in philly with jamie? a year ago >> going to 6% interview it was a while ago two years ago? i don't know it was at the opening of a -- he still thinks like a banker i love jamie he used to think i hated him never true

9:35 am

so did charlie he said, why do you hate me? i don't hate these guys. dimon's got to start thinking, listen, let me talk about how well the bank is doing, not let me tell you about the world. when you interview anyone about the world, they have a similar conclusion i don't need his view of the world. i mean, it's pretty much like everybody else's >> right jim, in autos, there's a lot to get to there's this -- the end of this vw uaw vote. we'll see what that means for the union. shawn fain on the time 100 list, as you saw, i'm sure >> maybe i'll sit with him >> the tesla recall. >> the tesla recall. look, all it is, it's acceleration, which could cause a horrible crash >> and unlike some other -- this is as regards the accelerator. >> the pedal stays down. it's still bulletproof so, it's a ram and run car i appreciate that. boy, you know, jonas, i gave him a call he doesn't take my call. i love that. but the work he's doing now

9:36 am

about where these stocks are, the bottom ten in the s&p, ex-financial, of course, and you're seeing gm and ford. ford should be buying back every share, for heaven's sake gm -- viatra -- it's a suboptimal company, but gm is the cheapest stock by pe mary barra is doing great. mary barra, their trucks, the accelerator comes -- when you take your foot off it, it doesn't keep going >> that's a plus >> that's positive then you got the good torque >> we are going to get tesla on tuesday. jonas did say yesterday, "situation could may well deteriorate further is the company exiting the traditional ev business? at the margin, it seems so >> yeah, it is you know, it's very hard to criticize a genius you know i don't want to be the guy who says, you know what that, mozart, forget about him you got a guy who is a genius.

9:37 am

when you speak to his competitors, here's what they say. he can pull a rabbit out of a hat. you never know i don't know what the rabbit is. >> yes >> i don't i'd like to know what the rabbit is i had rabbit on wednesday night. >> really? >> yeah. i took that over the pigeon. what a hobson's choice, you know >> we'll see what happens, what we get on tuesday. lot of news in chips raimondo is going to be on "60 minutes" sunday, a nice profile of how she's made commerce a pretty powerful agency >> out of nowhere. i remember when commerce was a place that issued a lot of things, and you got really, really terrific dinners. >> now it's the locus, they say, of national security, job creation, manufacturing, and then, jim, nvidia's on the cover of barons this weekend and it's a piece about competition coming, look out, here comes amd. they won the first round of a.i. we'll see what happens now >> look, here comes amd. look, lisa su would tell you --

9:38 am

l lisa su, congratulations on winning an award from the franklin institute last night in philadelphia lisa su would tell you that her chips do not offer the software. they're just hardware. by the way, intel is 100% hardware but that's what matters, and when you speak to nvidia or go to the conference, you realize that the giant leap that nvidia has over everybody else. but you know, with blackwell, it's going to be unbelievable. the long nooknives are out for nvidia ever since gtc. remember what nvidia did between july and december of last year it did nothing i remember being ridiculed i bumped into someone this weekend, again, when i was in antigua, saying, thanks for jamming me in that nvidia. well, sorry. sorry about that jam-up. jam-up, mate i mated that guy >> you mated that guy. >> i gave him a "mate. i gave him a check mate. he mated me, i checkmated him.

9:39 am

>> there's some weakness in semis and tech >> tsm is crushing it. the fact that -- i mean, when you talk -- i say own nvidia, don't trade it, but i'm not saying, buy it right here. let it come in same thing with apple. my price target of apple is $160 that's where i think people just say, i've had it sometimes you have to psychologically think where people have had it maybe people have had it when it gets -- nvidia gets to $790. i hate this opening, carl. i hate it. i just hate it >> yeah. yeah >> i just hate it. >> circling around 5,000 here. >> and what's the thesis to buy today? because the missiles didn't hit x? i mean, i need thesis. i like procter i like netflix i like discounts i like discounts i don't like premium and people may hate the semis, but one day, they're going to realize that those are the guys that have the good quarters. by the way, taiwan semi, it killed itself. the stock was up instantly, two,

9:40 am

three points, but then they said pcs are weak if you go to hp, they'll tell you the pc refresh cycle the going to be great because you're going to get a button that's an a.i. button. i'm not itching to buy a new pc, even though my tc now, if i press down the letter "t," i get three ts i will wait because i want the a.i. button from microsoft >> their commentary was confusing because they cut guide on industry, but kept their own growth pretty much intact. >> funny, huh? communication. look, asmlf was a disappointment gina raimondo is so good, and taiwan semi's really the one that's embracing -- and micron i can't get bearish on chips ahead of the biggest refresh cycle in pc history. i can't get bearish on chips when i listen to michael dell talk about what's going to happen in the future but i understand people don't know what they own

9:41 am

my father lost all of our money on a company called national video because they had the best picture tubes for tv solid state. nvidia is not national video it's a real company that is -- that has a giant, giant refresh that is so amazing that it's going to make it so intel and amd are left in the dust people look at the stock and foment reasons why it's been going down that's been the way since we bottomed in october. it's like, oh, that stock is down let me give you a thesis of why it's down. i'll give you a thesis of why procter & gamble is down people are selling it. but they have not bothered to do the work and it's very frustrating. i know that's against the grain to buy procter, but i need you to think about a dividend aristocrat that is going to have -- that finally outran -- with costs that went down and prices that didn't >> right >> that's what we're looking for. costs go down, price didn't. that's general mills just look at the trajectory of general mills. that has been the stock.

9:42 am

hey, by the way, the only reason to worry about procter is because paul paulman's plans to reinvent unilever, killed. plan killed. new rules. the new rules are, hey, listen, what we're going to do is what's right for the shareholder, and we're not going to be doing what's right, necessarily, for the planet back with a little more plastic, no longer hiring disabled like they were. they were committed to a path under paul pullman that did cause underperformance, and now, they're scrapping that plan, and that's the only reason why you would be negative on procter, because that is the principle. >> not every company has costs falling. the downgrade of hershey's today. record cocoa >> cocoa is parabolic. i think that cocoa has a history. cocoa, what, 20 years ago, had one of these moves, and then it crashed. that's one of the reasons why no one is biting on the big decline in hershey's if it was really bad, the stock

9:43 am

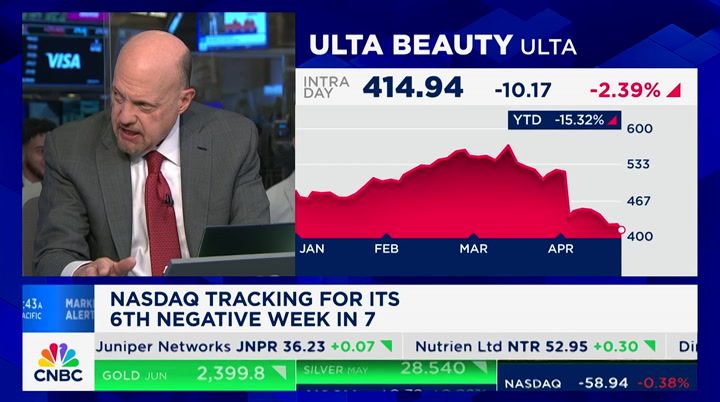

would be at $150 i don't want to own hershey's, because i don't like that particular portion of the formula, because i think -- of the packaged goods, because i still worry about the lilly impact, glp. if you can't get any zepbound, what happens when you can? >> meanwhile, ulta, jeffries cuts to hold no surprise, increasing competition from sephora >> look, sephora is better what am i going to say i love kimble. by the way, there is no slowdown i had e.l.f. on. there's an acceleration. the problem is kimble has to recognize that they have not only -- is that kohl's has a ceo who, if anyone sits down with him, and thank you, matthew boss, for setting up a dinner with me, tom kingsbury, he will sit there and figure out what it means to kill the competitors, and he will do it. i went to a revised burlington after he took it over, and it was like they -- it was like buy one, get seven

9:44 am

pretty good. >> we'll watch ulta. djt is interesting couple of severe bounces the last couple days as we're back to 35. of course, look like we have the jury set in the criminal trial we're looking maybe for opening statements on monday >> is that a referendum on pennsylvania and michigan, wisconsin, nevada, arizona i mean, i always feel like this is -- those are the ones you need hundreds -- hundreds of millions, and you haveto figur that pretty soon, with a captive board, trump will be able to cash out so, if you wanted to give to that campaign, and i'm certain not urging anyone to give to any campaign, it would be better to give to djt than it would be able to give directly to the party, because that's what can be cashed out. if -- once they get the -- once trump is able to convince the board that they should let him out of the lock-up because the stock is so high >> in that similar vein, in media, you mentioned, briefly,

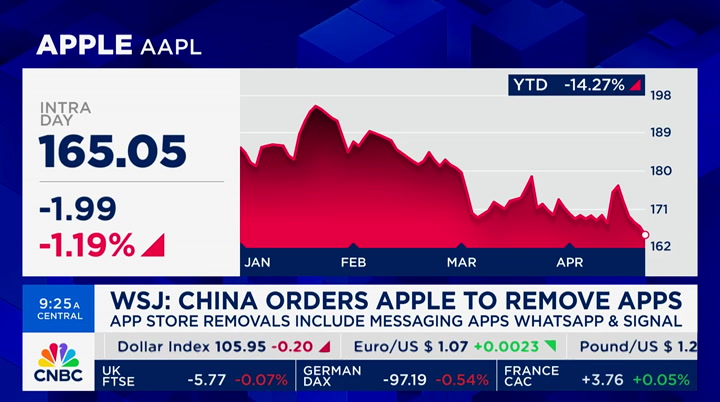

9:45 am

jim, this "journal" story that the chinese have asked apple -- told apple to remove threads and whatsapp from the app store in china. latest censorship demand >> well, tim cook is nothing but pragmatic, and that's a pragmatic decision i think that it hurts -- you could argue it hurts whatsapp, meta, more, because it shows you that -- the power of the government against whatsapp, but i think whatsapp is not even included in the valuation of meta apple could come out and say, business is better, and people would sell it down three this is one of those situations where, until the cfo says we are -- we're getting clobbered in xyz, people will keep selling it >> right zuckerberg did unveil this chat bot, which is intended to challenge chatgpt and bing and gemini and talked about a.i. investments. take a listen to zuck. >> we're investing massively to

9:46 am

build the leading a.i., and open sourcing our models responsibly is an important part of our approach the tech industry has shown, over and over, that open source leads to better, safer, and more secure products, faster innovation, and a healthier market and beyond improving meta products, these models have the potential to help unlock progress in fields like science, health care, and more. >> you probably start toying with it once it comes out. >> he's one of nvidia's largest clients. he said, ahead to the "time 100," which is now becoming a referential -- he said incredibly positive words about jensen if i were a customer of jensen, i would do that too, since you can't get all the -- lot of people don't understand that you have to develop your own chip because jensen can't make the chips fast enough. i think people say he bought 300,000 of the current iteration. he will take anything. this guy would actually buy the whole -- i think he'd buy the

9:47 am

whole line, everything that comes out assembly line of nvidia one of the reasons why i swear to nvidia is because i like companies that can't meet demand and by the way, the housing companies can't meet demand. one of the reasons they can't meet demand is you get a firm like kbh, they commit to a higher dividend. you know what they're not doing? building homes they realized their stock is a better investment. doug yearley started that at toll brothers, where he said, i'm just going to buy my stock, because it's the cheapest way to buy the -- that much better than putting up spec homes. that's one of the home builders could go up in a hype cycle. really confounding jay powell, who didn't see that coming >> goolsbee would argue it is the high rate that is infla inflationary itself. >> goolsbee is a very practical man. that's totally true. i think he looks at what the home bimuilders are doing, which

9:48 am

is to say, i'm not going to build homes, i'm going to buy stock. first time ever. >> little bounce at the open dow is up almost the 2 hundred check bonds as well. i think goolsbee will be speaking today, but that's pretty much it in terms of fed speak and data >> thank heavens maybe they're doing that stuff where they don't work fridays. >> the fed is moving to a four-day week. >> great stuff with a uruguay movie. >> ten-year, 4.6%.

9:49 am

9:50 am

9:51 am

netflix remains a story today. we did get the downgrade the interesting upgrade out of needham where laura martin who had a hold for two years as the stock doubled finally goes to buy with a target of 700 talking about how gen ai will benefit this name in particular. right now down about 8% as they bsn ithhold that data on the su ithe coming year. we'll get stop trading with jim in a minute. t patient informati. but what if they didn't? [ominous background sounds] this is what it feels like

9:52 am

when cyber criminals breach your network. don't risk the health of your business. crowdstrike. we stop breaches. when you own a small business every second counts. 120 seconds to add the finishing touches. 900 seconds to arrange the displays. if you're short on time for marketing constant contact's powerful tools can help. you can automate email and sms messages so customers get the right message at the right time. save time marketing with constant contact. because all it takes is 30 seconds

9:53 am

9:54 am

i was in the united states navy and i served overseas in the middle east and africa. early on in my career i had a commander that taught our suicide prevention training on a friday afternoon and the very next day, he took his own life. 90 percent of suicide attempts involving a gun are fatal. you don't know how much somebody can hide what's going on in their head. store your guns securely. help stop suicide. let's get to jim and stop trading. >> a stock that keeps going down that should be going up sob, the schlumberger, down 4% for the year reported another good quarter, talking about actually i would say they're talking

9:55 am

about being ju by lent, excited, what i usually don't hear, having an exciting start to the year and i think they are and that's a stock if you want to be able to buy an oil company other than conoco, chevron or coterra, look at slb. >> the names we'll get beginning monday, verizon, tuesday tesla, texan, meta wednesday, ibm, now. thursday the barn burner with microsoft and google. >> let's take those. now microsoft and google are going to be good i think google will be good. the beginning of the week might be soft but they can handle it verizon is going to deliver a good number, second time in a row, hans has figured it out good for him. >> we'll be busy. >> nordstrom. >> yeah. i was going to say the take privates >> nordstrom rejects initial takeover from the nordstrom family, $50 a share in march 95 of 2018.

9:56 am

that's a gang that can't shoot straight i'm sorry. >> we are beginning to make a list after endeavor, 23 and me in the mix now. >> yeah. i mean, they're going all health this is a horrible article in the journal about them. >> how about tonight >> i have one of my most exciting companies, a company i bought a car from, carvana i bought it. i didn't like it i returned it. i mean it was easier than returning something to marshals, which makes it easy. easy as turning them to sears, remember that, you could take it back you owned for ten years and then john holmes, a company that does aerospace anything we can find out about aerospace is important including the black hole that is boeing. >> tough week on the hill after that -- >> yeah. >> i think about the b-29. oh, my god it was all bad, all zeros. one day the b-29, and everybody clapped and maybe we'll win the war. go back to that period. >> good show

9:57 am

10:00 am

good friday morning. welcome to another hour of "squawk on the street. i'm sara eisen with carl quintanilla. live from post nine as always of the new york stock exchange. david has the morning off. take a look at stocks this morning. we're starting on a high note up 155 on the dow at least. the s&p lower. it's been bouncing around between gains and losses all morning long and only a half hour of trading but all over the place. the nasdaq down 0.4 adding to its losses treasuries the story has been

10:01 am

higher yields and bonds selling off. a bid this morning with the 10-year still firmly above 4.6%, the 2-year below 5%. 30 minutes into the trading session here are movers we're watching shares of netflix dropping the streaming giant beating earnings estimates but gave lower than expected revenue guidance and said it will stop reporting a key metric much more on that stock and what to do next later on in the show. shares of paramount surging on reports of a potential sony apollo joint bid for the media giant. no arm formeral offer made paramount in the talks with skydance tesla on pace for a sixth straight down day now down 40% this year and trading at new 52-week lows, recalling almost 4,000 cybertrucks due to a faulty accelerator pedal that can cause the vehicle to speed up we'll talk about tesla with these losses piling up. >> israel the story of the morning retaliating against

10:02 am

iran's drone and missile attack on its territory almost a week ago. back to richard engel for the latest in jerusalem. hi, richard. >> reporter: good to be with you again. so israel retaliated this has been a series of retaliations over the last couple of weeks. first at the beginning of the month on april 1st, iran carried out an attack, israel carried out an attack on the iranian embassy in syria last weekend, we saw that attack unprecedented attack by iran against israel and israel responded. but in a very limited way and the key thing is, it seems like both sides now are trying to deescalate, trying to pull back from the brink and the reason that it seems obvious is, here in israel just a few hours after this military strike, on a military base inside iran, just outside the

10:03 am

city of isfahan life is proceeding here as normal. the military has not issued any guidance for people to avoid gatherings, to go to bomb shelters, to -- for updated advisories instead, people are operating as they would any other day the airport is open, the air space is open, and in iran, significantly, iran had been saying from the president on down if israel did anything it will respond ferociously and immediately. iranian state media are downplaying it and brushing it off presenting it as a win saying the only reason that israel carried out such a limited strike, and it does appear to have been limited in scale, that it is because iran be intimidated israel so much with its last strike the past weekend. we seem to be a phase where both sides are trying to step back.

10:04 am

both sides are able to claim a bit of victory and that is a potentially positive sign in the region and leaders i'm speaking to, including senior officials in governments around israel, are watching with a degree of cautious optimism, perhaps we are pulling back from the brink of a regional war, a brink of a direct military conflict between iran and israel. >> are there implications for what israel has to do in gaza? >> reporter: i think there are we are still awaiting an offensive against the city of rafah and surrounding area and there are many palestinians who are congregating in rafah, over a million palestinians are taking shelter there, pushed down from the north, pushed down from central gaza, and we don't know exactly when the rafah

10:05 am

operation is going to take place. israel said it will go into rafah. it claims that the hamas militants are hiding among the people who are congregating in that part of the southern gaza strip. it could be that israel is dialing back from its confrontation with iran in preparation of assault on rafah. we really don't know in terms of timing for the rafah operation, clearly that is a closely guarded military secret but it doesn't seem like it's coming in the next few days. many israeli troops have been rotated out of the gaza strip we're almost at the start of the passover holiday and israel will have to send troops some troops on leave, israel will have to send other troops back into the gaza strip in preparation for rafah. the united states has been opposed to a full-scale invasion of the rafah area, so that

10:06 am

operation still seems like it is coming, but it might be a few weeks out. to come back to your question, they do seem related because it would be difficult for israel to carry out what will be a controversial and major operation against rafah if it does go ahead while simultaneously conducting a full-scale war with iran, so close one portfolio, put that on ice for the time being, while that other one looks like it is pending. >> finally, richard, the "journal" piece last night says that white house still has its eye on a long-shot deal in which israel would commit to palestinian statehood in return for recognition out of the saudis are people talking about that anywhere being in the realm of the possible >> reporter: not really. here the idea of a two-state solution seems very far off. when you talk to palestinians

10:07 am

that say they will tell you that is the only solution, given the palestinians a state, given the -- let the israelis have a state within their border and the two sides can hopefully exist side by side, but that is not the mood right now that is not the policy of prime minister netanyahu's government. he's formed a government with some members of the extreme right who are diametrically opposed to a two-state solution. he himself is opposed to a two-state solution after the massacre carried out by hamas on october 7th, many israelis will say they don't have confidence in living next to a palestinian state they believe that if there were to be a palestinian state, they would immediately have an enemy on their border. so i think it's a conversation that the region is having, that palestinians are having, but not many israelis are having at least in public. >> yeah. westerners are having. thank you very much, richard

10:08 am

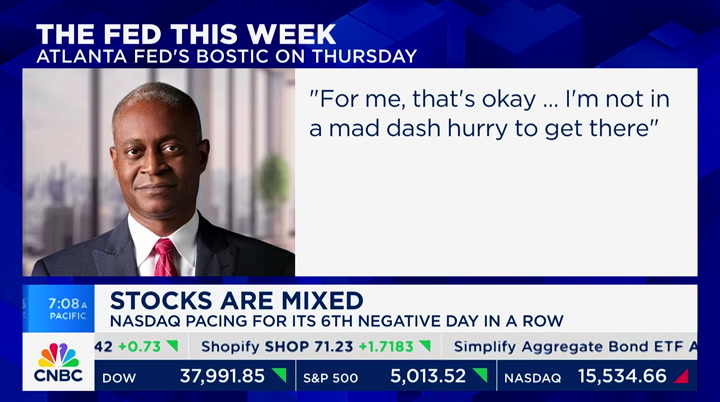

engel. great to hear interest you with the updates from jerusalem in the meantime looking at the overall market, tough week, carl, for stocks part of that has been the back up in bond yields. we did a best of commentary from all the fed speakers that we had this week because there was a lot, and a lot for the market to tee off of, and they pretty much all said the same thing. the hawks and the doves, which is, we're not there yet. here's raphael bostic atlanta fed president, for me that's okay, i'm not in a mad dash hurry to get there talking, obviously, about rate cuts new york fed president john williams, i definitely don't feel urgency to cut rates. cleveland president, at some point we will get more confidence, we will start to normalize policy back to a less restrictive stance, but we don't have to do that in a hurry fed governor progress on inflation has slowed and maybe it is even stalled at this

10:09 am

point. so no hurry, no urgency, not there yet, need to get confidence fed chair powell the highlight of the week, a lack of further progress so far this year on returning to our 2% inflation goal the recent data clearly not giving us greater confidence and instead indicate it's likely to take longer than expected to achieve the confidence they said the same thing and said what market was expecting and the market was sort of ahead of them on pairing back rate cuts for the year. will we get any? that's the question. and will the next move be a cut in market seems confident on that point and the bull case for stocks that's the next thing we have to look forward to and see the inflation rating. >> yeah. meantime host of stories on the wires looking at what a hot u.s. economy and a hawkish fed mean for other central banks and economies around the world jim came up with this phrase brown chutes yesterday. >> clever. >> barclays said u.s.

10:10 am

preannouncement negative in four quarters as we work our way into earnings season and american express mentioned weakness in small and medium-sized businesses >> we have a sound bite from the amex ceo when they were talking about sort of still strong environment on spending, but some softness. have a listen. >> spending by u.s. card member continues to be soft but new acquisitions, retention and small business credit products continue to be strong. >> the small businesses. we also heard from john mueller, ceo of p&g on "squawk box" earlier, he was saying that in the u.s. and europe in particular, they really see strong consumption, and he was asked about trade downs, whether people were trading down to more generic brands instead of the premium p&g higher price brands. listen. >> one of the metrics that we look at to assess trade down is the progress of private label

10:11 am

shares they're up modestly in the u.s they're flat in europe in both cases we're growing share and volume ahead of that why is that? i'm certainly not denying the reality that others might see, but we've concentrated our portfolio and daily use categories where performance drives brand choice. >> i just got off the phone with mueller asking him, i don't understand why volumes are coming down across consumer packaged goods and you're seeing higher volumes at these prices, they're tide, laundry detergent performs better in cold water than their competitors do in warm water why is that important? apparently savings you $150 per year if you are using cold water to wash your laundry than warm water and better for the environment. so people are not willing to trade down if their toothpaste

10:12 am

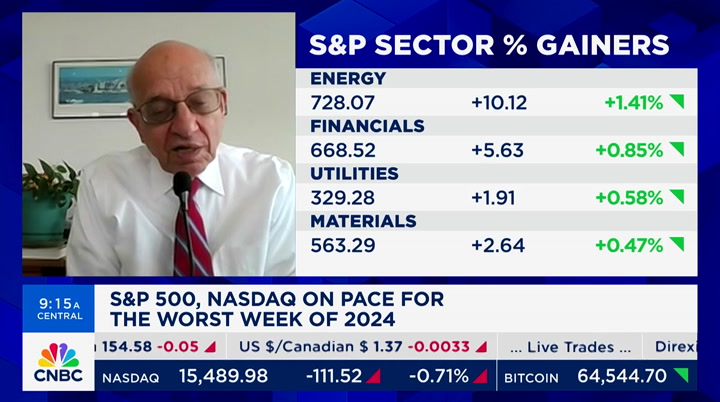

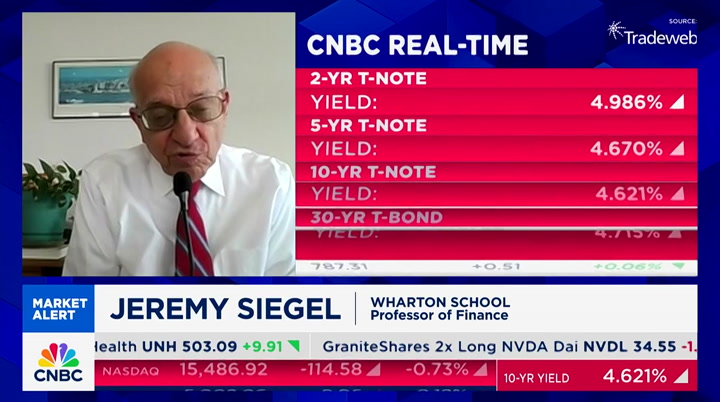

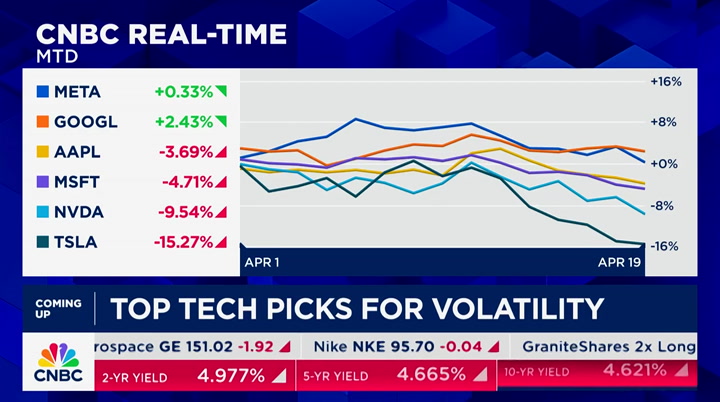

and tide are performing better. >> he talked about effective messaging and it's hard to compete with p&g's marketing prowess and budget health care was a miss fabric was a miss. and baby, which a lot of people understand that story, also a miss. >> they had softness in certain markets like china and the middle east, for instance, where there's been tension, but i think encouraging trends overall on the u.s. and europe l'oreal also talked about strength so, you know, it's just uneven which we continue to see, and it just shows a consumer that continues to prioritize. for the market the s&p and the nasdaq, are now on pace for their worst week of the year let's break down the word ahead. wharton school of professor finance jeremy siegel joins us do you think it's justified given what we've seen on rates and geopolitics? headwinds piling up? >> well, sara well, know we had an incredible, steady rise from

10:13 am

last october, almost record-setting, not a 2% decline, and, you know, that actually is not healthy because you have momentum players jumping on the market. i think a little pullback -- by the way i don't think we have a 5%, which is the minimum definition of a pullback, but a little bit of softening is certainly not unhealthy for the market i think we're going to get a good pce deflator number. >> next friday. >> next week yeah which i think 2.7% it -- will be the lowest in three years. that's only 0.3 away from the year-end target that the fed set in march of 2.4% for that deflator i think, yeah, we had three disappointments on cpi i think pce will come in, and i think our cpis are going to

10:14 am

start coming in, in may and june when we take a look at the futures we've squeezed down to basically one cut. >> yeah. >> by december i actually think we could get more if we get these good deflator numbers and inflation numbers. i think, you know, i still see gains in the market going forward this summer. >> i foe that pce is the fed's so-called preferred inflation measure, but the cpi has really captivated the attention of investors and of the fed you heard me go through all the reactions of these fed members and they changed their tune after the march cpi report how are they going to explain, if you think they'll be encouraged by a better pce, which they should be, how do they explain that gap and how do they convince investors, the american public, themselves, that they're doing the right

10:15 am

thing, if they're cutting based on pce >> right first of all, the cpi and the producer price index come out a couple weeks before the pce. it's the most informative data that economists and the fed has to predicting that pce i look at the cpi much more importantly also but i see good trends forward looking in that cpi. for instance, we've talked about the fact that the shelter actually sherlter and insurance are more than 50% of the last 12 month cpi core increase and looking forward, both of those look very much more favorable, particularly the shelter segment, which is 41% of the cpi

10:16 am

core so looking forward, those are -- those are very promising and important factors that could suppress the cpi and that will feed into the pce deflator. >> so your view is we're going to get more cuts now than the market is expecting, and that's a good reason to buy stocks? >> yeah. i think now that, you know, we could all say at the beginning of the year the market was way over, way optimistic, four or five cuts and now it's squeezed down to one, and i actually think that we might get two or three cuts by the end of the year i don't think the fed knows or anyone knows they follow month by month what the data is, and by the way, one thing that's important that chairman powell said, he said there was disappointment in the cpi. however, he is it say we have a dual mandate, if the economy softens and you mentioned that some people are talking about a

10:17 am

softening march or april, that is another reason for us to cut rates unless inflation is out of control. they really have to look at both of those, and i found those words to be very encouraging in terms of forward action for the fed. >> i can't shake some of the ceo commentary we've gottenen from the brngs, thinking of james gorman saying i don't think we're going to have any rate cuts this year or ceo in the tech space or in the food space, saying the economy is too strong they're not going to cut rates this year? >> well, actually, they should cut rates if inflation goes down even if the economy goes on. that is the super best case for stocks,s as we know going forward. inflation going down and economy staying strong they -- don't forget, they regard the current 5.3% fed

10:18 am

funds rate as restrictive and if they see inflation moving towards their goal, long run, they think that the fed funds should be 2.6. i don't think it should be that low. i really think it should be 3.5 to 4, but that's still a point and a half below where we are today. they regard the current levels as restrictive if inflation goes down, they will lower those rates just on that basis alone even if the economy chugs along. >> okay. jeremy siegel, thank you very much for weighing in. >> thank you. >> appreciate it the bulls will like to hear that the s&p down .2% our road map for the hour. shares of netflix tumbling posting blowout earnings and guidance falling short should you buy the dip we'll speak with one analyst who raised his price target. >> watching tesla's troubles today. shares down for a sixth straight day sitting at new 52-week lows. the company is recalling cybertrucks for some issues and

10:19 am

10:20 am

norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. doc?

10:21 am

10:22 am

year co-ceo greg peters talked about it on the earnings call. >> we have line of sight, value translation mechanism we expect will deliver and contribute to business growth for the next several quarters to come all of those improvements could allow us to effectively get more of that 500 million plus smart tv households to become members. mentioned hundreds of millions yet to come. this is a way to effectively get at more of those and make them part of our membership base. >> steven has an overweight on netflix raised his target to 726 from 650 happy friday good to have you with us again. >> thanks for having me on, carl. >> you're still looking at revenue flywheels and expanding margins, is that the story >> that is i think flywheel is sometimes an overused phrase in our industry, but netflix does have one in their ability to keep growing revenue through subscribers, advertising, pricing, and then to keep spending more on content

10:23 am

and to grow that content spend a little less fast than they grow revenue. that's where everything drops through to profit and cash and why we're bullish on the stock. >> the one-year performance has been stellar and that was one reason we got one downgrade on the street today when does valuation become a concern? >> to me i think if the p/e ratio is massively outpacing the earnings growth then that's the red flag for us. you mentioned our new target price, it's based on 29 times p/e. we have a 30% eps, so we think those are fair stepping back, the other thing we see, is that across the market it's so rare to find an industry leader also compounding earnings at this level. if you look at netflix's share of tv time, share of streaming time and entertainment, they are in a league of their own from a market share perspective. >> how should we feel about the ending of subscriber reporting on one hand it reminds me of

10:24 am

when china's youth unemployment numbers went up past 25%, they were so bad they stopped reporting them like is that the signal there? because the subscriber numbers for netflix this quarter were strong. >> yeah. i think it's great question, sara and i think, you know, that result tells us a lot about what they're thinking, they're doing this from a position of strength they're not trying to tell people they're worried about subscribers and that's why they want to move away from the metric i think they're trying to move away from some of the short term that has been part of the stock when it's been a net ad story and trying to focus on a little bit more long term outlook because that's how they run the business i cover a lot of stocks. very few of them could get away with changing that disclosure, but netflix is doing it from this place of confidence and strength i don't think the market is too worried about it. >> right we talked this morning about retailers, for example, used to give monthly comps that kind of went away and life went on, but fascinating story and

10:25 am

interesting quarter to dig in on if you get the transcript from last night thanks good to see you. >> thank you. still to come, the bitcoin halving is upon us and what it could mean for gains for bitcoin which is up today. we're watching shares of apple, "wall street journal" saying china ordered the company to remove the popular chat messaging apps from its app store in the country due to, quote, national security concerns meta's whatsapp and threads, signal, telegram and line were taken off the app store aas result we're going to continue to watch that story and don't go anywhere

10:26 am

10:27 am

10:28 am

check out shares of trump media bouncing for a third straight day up almost 2%. a wild week of trading up about 6% overall on the week following days of declines and now trump media warning the nasdaq of a potential market manipulation of the company stock by short selling of shares. the latest warning after trump media gave shareholders detailed instructions on thow to avoid someone loaning out their shares

10:29 am

to short sellers. >> strong bounce though off the low 20s. a volatile session for bitcoin, prices dropping below 60 k ahead of its halving event when the rewards for miners are slashed in half, happens every four years written into the code of bitcoin and a slowing supply of bitcoin into the market what does mighean for crypto prior markets preceded a bull run. they write that may be priced if knew invested in the last halving you would be up 750%, although current bitcoin prices have fallen more than 10% off their highs of the year so far. >> strong for the prices, not the miners, right. because the miners then see their revenues fall on the news. >> shares of tesla hitting 52 week lows today now news of recalled cybertrucks ahead of tesla's earnings

10:30 am

we'll discuss the road ahead for the company and stock icwhh is trading at 52-week lows. moving forward with node-positive breast cancer is overwhelming. but i never just found my way; i made it. and did all i could to prevent recurrence. verzenio reduces the risk of recurrence of hr-positive, her2-negative, node-positive, early breast cancer with a high chance of returning as determined by your doctor when added to hormone therapy. diarrhea is common, may be severe, or cause dehydration or infection. at the first sign, call your doctor, start an anti-diarrheal , and drink fluids. before taking verzenio, tell your doctor about any fever, chills, or other signs of infection. verzenio may cause low white blood cell counts, which may cause serious infection that can lead to death. life-threatening lung inflammation can occur. tell your doctor about any new or worsening trouble breathing, cough, or chest pain. serious liver problems can happen. symptoms include fatigue, appetite loss, stomach pain, and bleeding or bruising. blood clots that can lead to death have occurred. tell your doctor if you have pain or swelling in your arms or legs, shortness of breath, chest pain, and rapid breathing or heart rate,

10:31 am

10:32 am

10:33 am

♪ well back to "squawk on the street." i'm silvana henao with your cnbc news update. with 12 jurors seated in former president trump's hush money trial court is back in session this morning to choose the sixth alternates to fill up a jury the judge in the case suggesting that opening statements in the crim until trial could begin as early as monday. in the wake of israel's apparent attack on an iranian air base and nuclear site overnight the g-7 foreign ministers gather in italy today are warning of new sanctions

10:34 am

against iran and urged both sides not to escalate the conflict any further secretary of state antony blinken said little about the strike only that u.s. was not involved in any offensive operation. tesla issuing a voluntary recall of about 4,000 of its cybertrucks. the reason, a potential issue with the accelerator pedal according national transportation safety board, when a lot of force is applied to the pad on the accelerator pedal it could dislodge and cause the pedal to get stuck carl >> sylvania, thanks. goolsbee the sole fed speak today and we have fresh headlines crossing right now steve liesman has details. >> carl, ending the week of eventful fed speak, one of the dovish presidents sounding hawkish based on what he says in prepared remarks this morning and we've been watching what he doesn't say.

10:35 am

austan goolsbee saying the restrictive monetary policy, he calls it restrictive, is appropriate given that inflation progress has stalled the past three months of inflation data, it cannot be dismissed. unclear if this marks a change in his baseline outlook for rate cuts goolsbee remains hopeful that inflation progress will resume and declares that the fed will get inflation back to the 2% target, but he says it makes sense to wait for greater clarity on the data before moving on the optimistic side, goolsbee sees improvement that could bring inflation down and help the economy this year notes he's been surprised housing inflation has not fallen and say it's going to be difficult to get inflation to target without that decline in home prices he does not mention at least in the prepared remarks the march forecast that he had for three rate cuts this year like other fed officials this week, doesn't say it will likely be appropriate to cut rates in 2024 now next week a big week for investors to balance the concern about the fed and inflation and earnings and the economy, we get

10:36 am

gdp, which is pushing close to 3% in the atlanta fed gdp now and the fed's preferred inflation indicator the pce along with a surge in earnings about a third of the dow and s&p next week. the gdp outlook risen by nearly a full percentage point in the past month, upside surprises from the consumer, manufacturing, and jobs sparking those inflation fears but earnings running to this point about 10% ahead of expectations. guys >> steve, people are still kicking around some of the data from housing this week in particular, the existing sales number and the median home price there which some argue is well above the shell shelter component of cpi do you think it's past time for housing to start to show up in the macro number >> yeah. at some point you have to give it up, carl. i don't know that anything the fed does or doesn't do is going to fix the housing problem it's almost like you want to think about the inflation problem we have.

10:37 am

i know it's a little bit, but ex-housing i'm not sure what's happening in housing is related to fed policy here think about it, when you do a thought experiment f the fed lowers rates that makes housing more affordable and more people buying on the fence and if you raise rates that makes it less affordable i don't see a way that the fed cutting, hiking or staying the same is going to fix what is a secular deficit. >> i wonder if you can say that about the other components that have been sticky too i don't know what fed can do about auto insurance or medical services inflation and those are parts of why the inflation number reads so hot as well. >> some of it is outside of the fed's ability to effect. overall, the fed's idea as you know is slow aggregate demand with higher interest rates make it harder to borrow. you have a back flow we've been talking about which is -- which comes from higher interest

10:38 am

income on the part of many americans now. the only thing they can do is stay the course, hope the supply chain issues that may linger resolve themselves and that, of course, we get to a new equilibrium in the labor market where okay, now we have the right rate to have the right number of workers working given the growth of the economy. you're mentioning a question that we should be thinking a little bit more about because there are those out there saying you know what, the economy may just be in some zone here of 2.5 to 3% inflation that may be outside of the ability of the fed to influence the fed would disagree but there are smart thinkers who are considering it. >> it's a good debate i think to have thank you. steve liesman. stocks are mixed here just one hour into trading. dow is higher. s&p continues to lose ground the nasdaq is down a full percent. it's been a tough week for the nasdaq week to date now, 4.5% lower senior markets commentator mike

10:39 am

santoli, almost combined you with rick, here to break down the action what happened this week? >> what happened this week was you had this continued unwind of this idea that we can have it all in the markets, which is, you can have the strong economy, earnings upturn, you can have bond yields stay tame, fed easing into all of that and then what happened is the momentum break, which is now still unspooling five straight down days. i think the result of that plus today and the overnight selloff in the futures, you have gotten the market at least short term technically getting oversold and the conditions there where we should bounce soon you see every rally in the last few days get sold down, but in a very orderly way and this tells me it's systemic unwind of these mechanical strategies and it's not yet being met with fundamental dip buying demand. an expensive market. if we bottomed right here somehow at a 5% pull back, 20 times forward earnings number that's pretty elevated still

10:40 am

i would say about -- i think through history four out of ten pullbacks becomes a 10% correction do you like your odds or not i think you're going to see a bounce and you get the monthly options expiration out of the way today and maybe decide if this retest and repeated kind of visit of the 5,000 level of the s&p is enough to just take positioning and expectations off the boil. >> lot of discussion that it's not really so much the fed as it is tech expectations, apple 11-month low, nvidia, barons cover and down because they didn't upside preannounce. >> exactly the nasdaq 100 chart looks a little ominous like it could be distributing out you have the massive out performance giving a lot of that back that being said, you don't want to necessarily get too confident of that view going into the meat of mega cap growth earnings season next week you could see the situation

10:41 am

we've cleaned up positioning you've kind of taken the edge off some of the valuations you get through this period after this 5% pullback with the majority of stocks doing worse than that. and all of a sudden you get reminded of the profitability of these companies. you could sort of play it either direction on that front, but without a doubt, that's one of the things that has held this market in check. aside from the fact that bond market continues to surge for the pain point for the consumer, for the economy. you guys were just talking about rates haven't seen to have that much affect on inflation or growth maybe the market can change that at some level, whatever that might be. >> we're 7% off the highs for the nasdaq 100. >> yeah. >> you see the pain. interestingly, three sectors are higher on the week consumer staples, utilities and financials which you don't usually put together. >> it's the first sign of life for the pure defensive areas like staples and utilities and financials, i mean, immediate reaction to earnings not that great, but it seems as if they

10:42 am

are benefitting from relatively sort of low expectations that's not a crowded group at this point right now. you know, we'll see. berkshire hathaway 13% of the financial sector at this point visa and mastercard are big in there. not just a pure read on banks, but it is telling the favorite crowded growthy stuff where you're seeing the pain and seeing more kind of boring defensive value, at least, you know, find some support here. >> mike, we'll talk in a little bit. mike santoli after the break we'll talk about the cracks in the armor when it comes to big tech. we mentioned tesla, apple, microsoft, nvidia down on the nth as well. we'll talk with wedbush's dan ivess in a moment.

10:45 am

10:46 am

you say the clock has struck midnight and the line that struck out to me, trading in the model 2 for robo would be a tragic gamble in your opinion. >> i think it would be a gamble that could maybe even define the future of tesla in the next three to five years. i think right now the big nervousness is model 2, that's a key part of the group, that's 50 to 60% of the incremental growth of the next two or three years robotaxis, autonomous, not another five or six years. we've seen over the last decade and been through white knuckle moments for musk and tesla, this is up there. a cinderella story in the near term has turned into a nightmare on elm street. it all starts next tuesday needs to control the narrative if there's no adult in the room, there could be darker days ahead. >> if he really does say, we're going to play this long game and it's going to come at the expense of the 2, you would rerate. >> if that happened it would be

10:47 am

a disaster of epic proportions because in the near term, you've seen others throw in the towel because of the fears of that and some of the stuff that's reported, that would really put a massive black hole or gap in the growth in the next few years. if you look at the last sort of 2015, 2018 there were levers that musk could pull and ultimately did pull and that's why it's -- you've seen the history, but this for the first time in five, six years, long term, tesla bulls, are really calling, feels like they're about to hit the elevator if they don't hear what they want on tuesday. >> why are analysts like you and investors so down beat on the prospect of the robotaxi future? >> bullish on robotaxi, bullish on autonomy. the problem is this would be like cook on, you know, coming out being like iphone 15, now look, we're not going to have anything until iphone 21, but

10:48 am

trust us, thanks for being on the conference call. so that's the problem, is that we're bullish -- >> it's always worked for him before. >> i think now the difference is you need a refresh competition coming from all angles, game of thrones we're seeing in china and the credibility for musk has definitely been questioned because the last two conference calls we've talked about on the show, those have been trainwrecks. it all comes down to clock struck midnight. tuesday night,adult in the roo needs to step up and navigate the story and that's why we call it a fork in the road moment we are still bullish on the long-term tesla story, but there's a category 5 storm and the pilot on the plane can't be ted striker. >> a lot of analogies and stuff there, but what do you want to hear the china competition is not in tesla's control. >> yeah. you need to hear four things one, what's the growth strategy in china, how are we going to rowers have the trend that we're seeing in mainland china, which

10:49 am

has been we'll call it 60, 70% of the incremental growth story for tesla -- >> how do they do that those cars are cheaper they're nice i saw them on the streets and tested them. how are they going to reverse that growth trend? >> hold prices, hold margins we're going to bet on our brand. no different than what apple has done and many others including microsoft, depending on the products, but give the strategy there, what are the targets. they've to give guidance what's the targets on growth realistically. what do margins look like? where does it trough out at? ai and musk the 25% threat, recommit keeping ai within tesla. shows fsd, showing autonomy. that's been the problem here is that if you had an adult in the room to nav date, the stock -- i think 30% of the selloff here is musk driven. it all comes down to like you could talk the talk, you got to walk the walk. >> tuesday is going to be -- would you say the most important

10:50 am

quarter in several years >> the most important quarter in probably five to six years, and maybe, you know -- it's most important call ever, and that's why i think this will be a historic moment one way or the other for tesla. >> you've been bearish on tesla before >> i've gone through where we've been embarrassed because you can't be smoke and mirror. you need to stup up, otherwise this would be the grand canyon looking down at the cliff if they get rid of the model 2. >> we'll talk on tuesday, i'm sure, if not before then, dan. dan ives. it was a tough quarter for synovus but they still see bank credit ahead we'll talk to the ceo next on nserwh movers," his read on the coum, ere rates will go from here. we'll be right back. bringing you an elevated experience, tailor-made for trader minds. go deeper with thinkorswim:

10:51 am

our award-wining trading platforms. unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly. [sfx: wind, rain and rolling thunder] nobody's born with grit. british announcer: rose is really struggling. it's something you build over time. american announcer: that's 21 missed cuts in a row. [car trunk slammed shut]

10:52 am

10:53 am