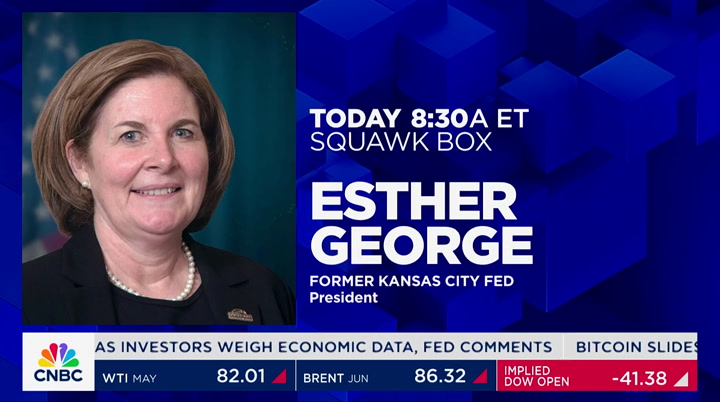

tv Squawk Box CNBC April 19, 2024 6:00am-9:00am EDT

6:00 am

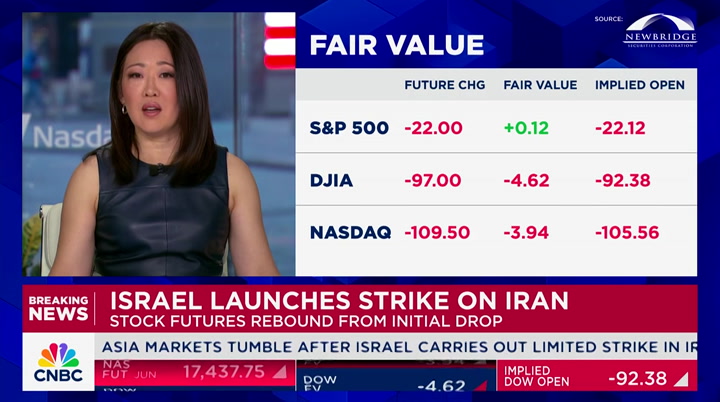

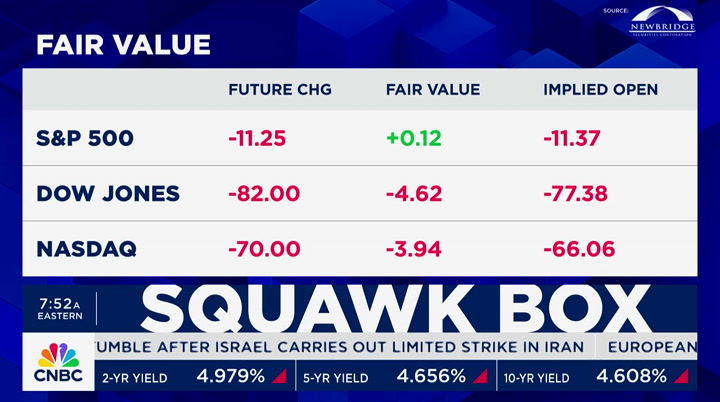

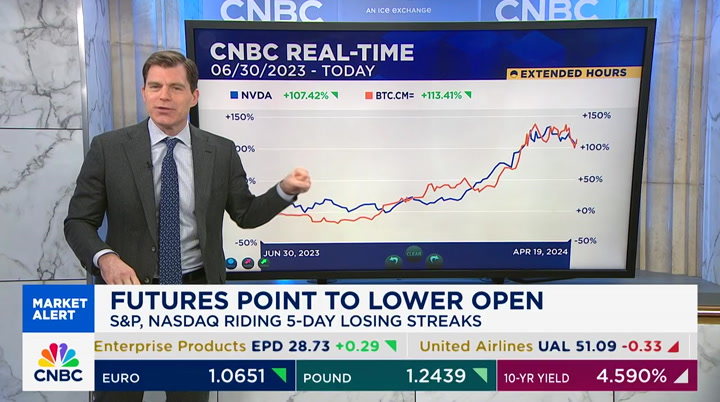

it is april 19th, 2024 and "squawk box" begins right now. good morning welcome to "squawk box" here on cnbc we are live from the nasdaq market site in times square. i'm andrew ross sorkin along with melissa lee joe and becky are off today. as we mentioned, breaking news overnight. israel carrying out a narrow strike against iran. it is assessing the effectiveness and damage caused. the action appears to be limited to avoid escalation. we saw the markets move down we are looking at the dow which is off 30 points it was worse before. nasdaq down 108 points s&p off 20 points. we will see how things moderate

6:01 am

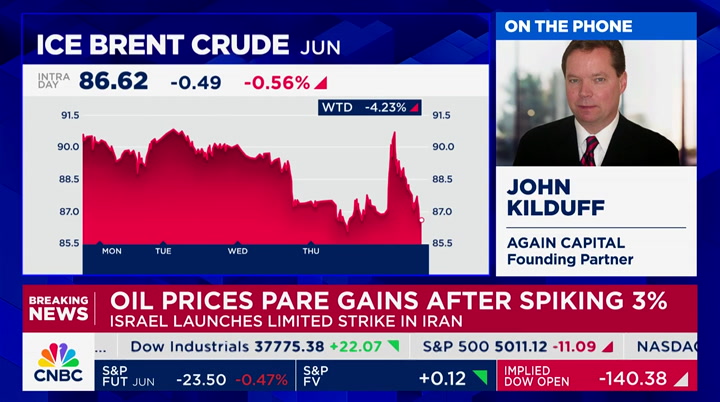

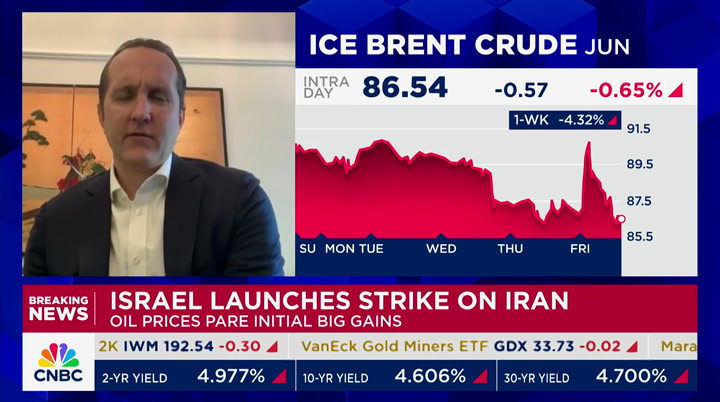

here the dow fell 300 points on word of the attack, but we are modulating slightly. treasury yields and crude as well oil prices in just a moment. ten-year note at 4.58% >> the expected run to safety. >> the question is is this performative >> to show we are retaliating. >> the reaction in the commodities market the initial reaction was steep and then we pared the gains. crude is $82.57 the story is in brent which surged above $90 a barrel. we're back below the level right now. as for gold, 2$2,395

6:02 am

that is unchanged. bitcoin had the same reaction as we saw over the weekend with the initial strikes from iran. we had bitcoin now higher at 2.4% $64,882 as we await the halving which is expected over the weekend. let's get a live report from raf sanchez in tel aviv. raf, good morning. >> reporter: melissa, andrew, good morning for a week, the world has been waiting to see how israel would respond to the barrage of the iranian drones and missiles. we have an answer this morning and it doesn't appear at this moment that we are hurdling toward further escalation a source familiar with the situation tells me israel carried out a limited strike inside of iran in response to that attack. israeli officials reviewed the

6:03 am

damage the target was the military base near isfahan that is a couple of hours south of tehran. it is not clear if the attack was carried out with fighter aircraft with missiles and drones the u.s. did get at least a generalized heads up from the israelis that the strike was coming according to the source familiar with the situation. the u.s. making clear it was not dir directly involved in the attack. source s across the middle east were on alert in case the proxies were picking up action in the region. officials down playing the attack this morning with the iranian president speaking in last hour and made no mention of this whatsoever. iranian state media says the situation in isfahan is calm

6:04 am

the iranian military said explosions people heard in the early hours this morning were iranian air defense missiles the they are not pointing blame at the moment israel is not claiming responsibility or denying the at attack this is a measured diplomat ick approach they are giving space. that is what the u.s. and other countries had hoped would happen it is worth noting the israel military is not imposing restrictions on the residents here they are not bracing for retaliation. in the next hour, we are expecting to hear from secretary of state antony blinken who is speaking at a g7 meeting in it

6:05 am

italy. that is the first time we will hear from the biden administration since the attack. guys >> raf sanchez in tel aviv thank you. at home, we are watching former president trump's criminal trial five alternates remain to be picked trump blasting the case after the court adjourned saying the world is watching this new york scam shares of trump media jumping 26% in yesterday's session 17.3 million shares changing hands with the market cap at $4.5 billion after the 15% jump of stock on wednesday. tumbled and tumbled and regained some ground. obviously, not where it was at the beginning. >> not nearly. >> unclear what's moving it the

6:06 am

other way. >> right it was unclear what was moving it at all. >> it has been unclear the whole time. president biden's top economic adviser will make sure gas prices remain an ffffafforde lael brainard was asked about it she said there are things which have been done in the past and the white house would monitor gas prices would remain af affordability for the summer driving season. hyundai confirming to nubc news it paused advertising from elon musk's x platform the carmaker is speaking to x about brand safety to ensure the safety is addressed. the business operations confirmed the pause to nbc news and said the account that made the posts has been suspended because it violated x's policy

6:07 am

against abusive profiles. when we come back, more here on "squawk box." the response on the attack by israel on iran. and we will have the blowout stock report on netflix and what happens next. plus, the journal report saying beijing has ordered apple to remove messaging apps from the app store. th'somg rhtftat cinupig aer this >> announcer: this cnbc program is sponsored by baird. visit bairddifference.com. th. like your workplace benefits and retirement savings. voya helps you choose the right amounts without over or under investing.

6:08 am

across all your benefits and savings options. so you can feel confident in your financial choices. they really know how to put two and two together. voya, well planned, well invested, well protected. you know what's brilliant? boring. think about it. boring is the unsung catalyst for bold. what straps bold to a rocket and hurtles it into space? boring does. great job astro-persons. over. boring is the jumping off point for all the un-boring things we do. boring makes vacations happen, early retirements possible, and startups start up. because it's smart, dependable, and steady. all words you want from your bank. taking chances is for skateboarding...

6:09 am

and gas station sushi. not banking. that's why pnc bank strives to be boring with your money. the pragmatic, calculated kind of boring. moving to boca? boooring. that was a dolphin, right? it's simple really, for nearly 160 years, pnc bank has had one goal: to be brilliantly boring with your money so you can be happily fulfilled with your life... which is pretty un-boring if you think about it. thank you, boring. what does a good investment opportunity look like? at t. rowe price we let curiosity light the way. asking smart questions about opportunities like clean water. and what promising new treatment advances can make a new tomorrow possible. better questions. better outcomes.

6:10 am

business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

6:11 am

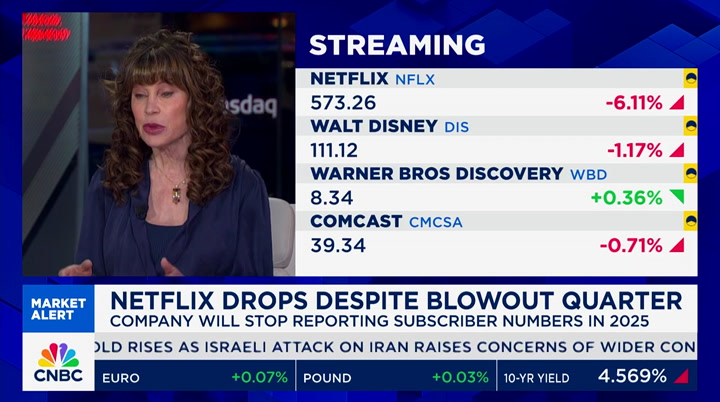

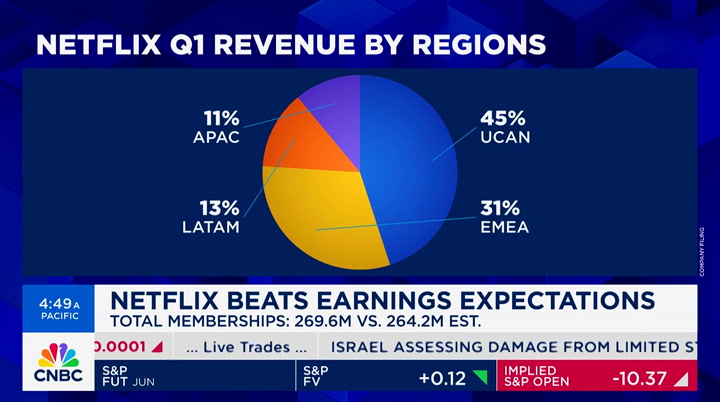

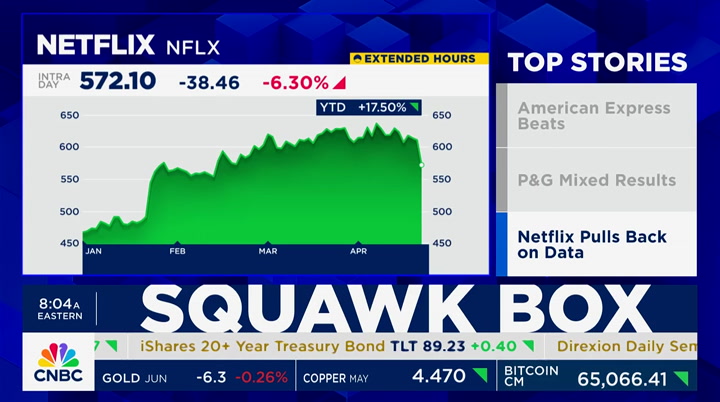

welcome back netflixruscrushed estimates in e first quarter. the company said it will stop reporting the subscriber numbers in 2025. that is the biggest headline here is greg peters last night on the call. >> each incremental member has a different business impact. all of that means is that h historical simple math is increasingly less accurate and capturing the state of the

6:12 am

business this change is motivated by wanting to focus on what we see are the key metrics that matter most to the business >> joining us now is jessica from boa okay, they beat the numbers. that's the great news. the market on the stock price goes down on the back of something about this >> exactly exactly. >> what do you think is happening here >> by them saying they will not give the sub numbers or arpo is the key metric the key kpi. not surprising the stock reacted negatively having said that, it doesn't change one thing about the growth trajectory or the growth drivers ahead. this is like the cable industry ten years ago. it is a very predictable and stable business with margin improvement. the benefit of advertising,

6:13 am

which is the high margin business, is going to kick in. >> why immediately move this way? you think people thought this was a bad sign >> a cover up or something declining? >> 270 million subs, not that they can't grow, they can. they are not hitting a limit right now. the growth will come from lower arpo markets l latin america or other markets greg said the themix of subs ist equal. >> there is something to it because they don't want to show the average revenue per user they want you to look at it holistically >> exactly to the extent that advertising should continue next year as they scale with the 65% of subs which are going to the ad tier means they are pricing it that way.

6:14 am

to scale up the platform means they have what advertisers want. >> one of the things they have been working on in the past year which created the subs is the idea of the password sharing piece. how much more of that do they have to mind >> again, it is hard to tell. >> was that the low-hanging fruit and now they are done? what percentage of the subscribers do we think are new subscribers or subscribers paying does it matter >> we don't know the option for password sharing crackdown is you become your own sub or extra member of the house which is driving revenue it is mixing the sub number. you see the revenue growth drivers. they have pricing power and advertising coming in. they have sub growth around the globe. >> is there a time period where

6:15 am

you will say these subscriber whose are paying subscribers are going to stick who knows if the newly paying subscribe ares are actually using the app and continue to pay for it >> right anyone who came in with password sharing, you don't have to market to them they he know the service they know what they are getting. the focus last night on the call was about engagement whether -- we know the shows we are watching also, they are adding live the boxing event this summer i'm sure they will add more sports games. they are also -- >> you are sure they will add more sports. they have been receipt not

6:16 am

adding sports. >> wwe and that programming. sports or entertainment sports there is a lot of chatter they will bid for nba and the in-season tournament which is moved to the beginning of wwe. i would not be surprised if golf or something else with a long-term rights >> let's go into the future for a second how many of the services do you feel in the end the american family is going to subscribe two? three? four one? >> i would say three-to-five. >> three to five >> three-to-five broadcast networks then fox came. >> it was free you didn't have to pay for it. >> groups. it was consoleidated to three-to-five groups

6:17 am

there will be bundles. you turn on your tv or device or whatever and netflix is the whole pay tv bundle and everything else is an addon. >> right now, your three are what >> my ten. i get everything. >> you get everything. if you have to get it down to three. >> i would say netflix that's a given probably the disney bundle >> with hulu >> yes >> and espn plus >> and then i believe max will look different in a year max warner bros. has the deepest library. max will be there. i know people say apple and amazon >> amazon, apple, peacock, paramount plus headline that sony may team up with apollo to get in on that.

6:18 am

>> good luck with that we'll see. >> good luck >> because sony is a japanese-owned entity. they cannot own cbs or cbs tv stations >> you have to split it up >> you have to break it up >> as you look at the chess pieces and we are sitting here 12 months from now, i don't know who the president is of the united states or the regulatory environment. do you think that all of these companies will still be independent? >> no. no you hit the nail on the head should nbc u and warner bros. discovery be one company it would be amaze ing if they were there is a lot of focus on that. that would be the powerhouse paramount will look different. >> is that your bet a year from now? you said you thought max was going to be the absolute number three. are they the absolute number three as an independent player or absolute number three with an

6:19 am

accommodation with somebody else >> independent player. they are ramping up dc universe. loo a lot is coming on max to say this in a year without the regulatory environment is really hard. >> i ask hard questions. >> as always >> jessica, thank you for coming on this morning. i appreciate it. that stock is up a little bit this morning i don't think that has anything to do with the other news. thanks. coming up, i'll show you what is moving in the markets and the attack on iran. and pga is set to report at the top of the hour. will have the interview with jon moeller when "squawk box" comes back i'm tasting it- or a night person. or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace.

6:20 am

6:23 am

welcome back to "squawk box. if you are just waking up, the market is now down 143 points. we saw the dow off 300 points. nasdaq is 116 points i'll show you the treasury markets after the european markets as well. they have been live and you are looking at everything off .50% sometimes more this morning. it seems to be modulating at the moment let's flip the board and show treasury yields. ten-year note at 4.578%. oil here with wti crude at $82.50 gold and bitcoin as well gold at $2,396 bitcoin has moved up despite moving down when the attack went

6:24 am

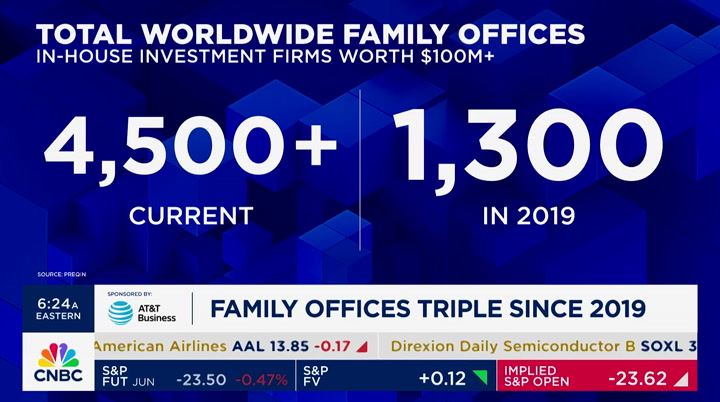

the other way. $64,831. a little over 2% this morning. time for the executive edge. the amount of offices have surged with trillions in wealth deployed robert frank will tell us where the wealthy families are putting their money to work. >> melissa, the number of family offices in the world has triple theed since the pandemic there are 4,500 offices in the world. that is up from 1,300 in 2019. the family offices are inhouse firms for wealthy families worth $100 million or more total assets tops $6 trillion. family offices now accounts for a larger share of capital markets of hedge funds or private equity or hefunds. they are moving away from public equities the favorite allocation for this

6:25 am

year is private question and real estate and equity they are replacing those in many big deals. michael dell's family helped take endeavor private which was a $13 billion deal family offices replacing private equity in the oil and gas sector as investors are leaving that sector an number of them bought purewest for $1.8 billion. the favorite sectors are bio-tech, a.i. and health care this used to be a sleepy corner of finance which is now replacing a lot of traditional investors because it is patient capital. right now, it is available capital when banks are not lending and it is so expensive >> the regulatory burden is less than if you are a hedge fund that's the push here >> a lot of hedge funds became

6:26 am

family offices and part of that is the below a certain amount, you don't have to disclose the holdings there is a push for more of that especially as it is more important in the market. this is not a systemic risk, but important source of capital. all of wall street is trying to tap this with private equity and new family office groups >> you have to wonder, the more they move in equities and if that time comes and they become more of a force. hedge funds are a force. this corner of the market is bigger than hedge funds. >> that's right. >> you would think regular tors could look to require more disclosure of family offices >> the corporate transparent act requires them for the first time to register with the federal authorities their true beneficial owner that's a mild requirement, but it was a big burden for many

6:27 am

family offices because they think it is a slippery slope you start with the true owner and we want to know what you are holding and trading. especially after archegos, there was a push for transparency in the market especially with the big family offices which are $10 billion or $20 billion. >> robert, thank you >> thank you coming up on the other side of the break, foreign aid for israel front and center for congress after the strikes in iran overnight as we head to break, here is a look at yesterday's s&p 500 winners and losers >> announcer: executive edge is sponsored by at&t business next level moments need the next level network.

6:28 am

it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow! (vo) a law partner rediscovers her grandmother's artistry and establishes a charitable trust to keep the craft alive for generations to come. from preserving a cultural tradition to leaving a legacy, a raymond james financial advisor gets to know you, your passions, and the way you enrich your community. that's life well planned.

6:31 am

site at times square global markets are responding on the limited attack by israel on iran the markets are modulating from where they were originally down 300 points on the dow originally now down 123 points. the nasdaq off 109 points. s&p 500 is off 20 points let's get to washington, d.c. where emily wilkins is right now. foreign aid to israel is front and center for u.s. congress and house speaker mike johnson making a push ahead of that before the weekend emily wilkins, good morning. >> andrew, congress working late last night we have a lot of news. the $95 billion foreign aid package and potential tiktok ban is set for a critical vote today in the house the package has faced stiff opposition from the group of hard lined republicans

6:32 am

you had a group of democrats on the panel joining the mainstream republicans to move this legislation forward overriding the objectives of hardline conservatives. this is extremely rare although democrats will vote for it in the end, but they never help with the process votes like the one we will see today which proved to be a stumbling block for republicans. it seems democrats are ready to make an exception and cross the aisle for ukraine. democrats need to help republicans to stay with the key vote to overcome the objections of the house freedom caucus on the package. particularly ukraine looming over the debate is the ouster of house speaker mike johnson. johnson said he is a war-time speaker this week and said the threats on the world stage are too critical to not address. >> this is not a game. this is not a joke we can't play politics with this we have to do the right thing.

6:33 am

i'm willing to take the hit for that >> the final vote on the foreign aid and tiktok package is expected to come on saturday johnson is taking a unique strategy one vote on ukraine and indo pacific and one on security measures and the tiktok bill that would give the company up to nearly a year to find a buyer. andrew, we'll keep a close eye to see what congress does there. >> emily, the separate slice of national security with the tiktok ban or tiktok for sale bill lives what could derail that effort? >> you have a couple of things in the piece a piece of legislation that would basically allow the u.s. to take seized russian assets and liquidate and use that money to assist ukraine. you have a number of sanction efforts on russia and china and

6:34 am

iran as well this issing something that johnson is pretty confident will pass the reason they are not taking one big vote and breaking it down to four and if you take four individually, you have enough to pass and you lump them together and then you have others who oppose to harm the bill this is one republican leaders is confident >> this is making the forced divestiture more likely. emily wilkins, thank you. this next story is not a forced dhivestiture >> there is a new report that china has ordered apple to remove the most popular chat mess knowmessaging apps like

6:35 am

whatsapp which was taken offline on friday. it was told to remove them because of security concerns they are obligated to follow th law. they can only be accessed through vpns to circumvent the chinese firewall, but commonly used the ban is in place. are you not supposed to use these things in the country. this is a formality. what triggered them to say take it off now >> you want to add kerosene to the tiktok fire? i imagine this is the talking point of the day if you are in washington, d.c. thinking about ex-communicating tiktok, you will ex-communicate tiktok faster because you will say look at what they did here. >> that is the tip of the iceberg of what china can do to u.s. business.

6:36 am

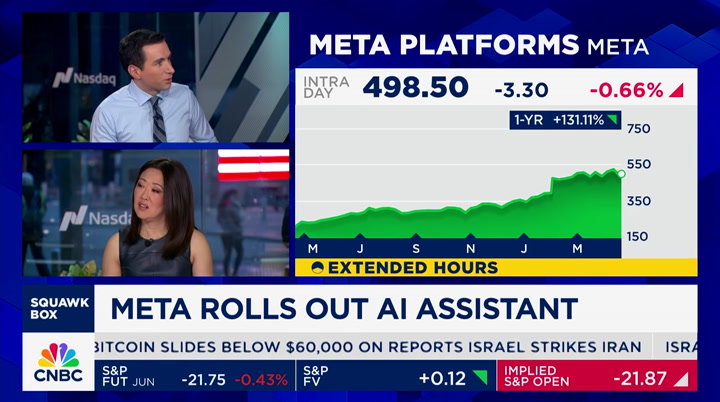

>> note and notice we is been debating what will has been to tiktok for a long time now publicly. >> yes. >> these guys put out a statement overnight that is just happening. meaning, in china, this is happening. there's no debate about whether apple should remove it no conversation. no nothing. >> of course not. >> just a different world. >> it is a different world we have to acknowledge that an investors have to acknowledge that if they do business in china. in the meantime, meta rolling out the free artificial intelligence assistant across the social media platforms this includes whatsapp now banned in china. in a video announcement, mark zuckerberg saying the assistant can answer questions and create animations and generate images a.i. was built on the largest large language model called llama 3. it is a competitor of chatgpt

6:37 am

and genemini mark zuckerberg says he believes meta a.i. is the most intelligent assistant you can freely use take a look. we are not taking a look at the video. we could chat with our bot or chat among ourselves about the story. by the way, llama 3 is pretty good it is probably not as good, to be straight with you, and claude 3, by anthropic, is outrageous. >> i'm a neo -- you speak of things i have no knowledge of. >> you will use it and it is for a free tool you can use and it is pretty great. i happen to be a proud owner and

6:38 am

maybe i'll wear them next week of the ray bans they sell. meta has partnered with ray ban for a pair of sunglasses there are cameras in the glasses. speakers in the tips of the glasses. you can talk to the glasses. you can ask a question you can say, what kind of coffee is this. just looking at it and the camera is looking at the coffee. >> how are you looking at results? >> you are not it is talking to you if i were to say this a perfect world, i would wear the glasses looking at you and say -- who is this person? the camera would look at you and it would say it's melissa lee. i don't believe it does that for people, but it could help you if you were wearing the glasses and you are in times square and a

6:39 am

tourist and you say tell me what i'm looking at here. it will start talking to you if you want to fix the toilet, you can say what am i supposed to do here some of the times, it does it properly some of the times, it doesn't. >> if you can afford these glasses, you are not fixing your own toilet. >> the glasses are 299$299 d not bad. >> joe is back next week >> yeah. >> that will be fun. coming up, global markets reacting to the israel attack on iran we dig into the crude prices next get the squawk pod on your favorite pcaodst app and listen to hus anytime we'll be right back. ested fixed me suite, backed by over 145 years of risk experience, helps investors meet their goals.

6:43 am

welcome back to "squawk box. if you are just waking up, be global markets are responding to the attack on iran joining us right now is john stavridis, former supreme leader how limited this strike really was and how performative it may be and if this will escalate things, admiral. what do you think? >> limited strike. very muted and carefully calibrated are the phrasing that come to my mind, andrew. israel had a basket of options early in the week. they could have done nothing, pursued diplomacy or used cyber ore gone big with the nuclear facilities they choose something in the middle, but on the small-scale

6:44 am

side attack launched at isfahan think chicago in the u.s. context. very small packages of explosives from what we can see. certainly drones, not manned aircraft all intended to say to the iranians that we can come in your house when we want. we're not going to blow it up today. i think that message was delivered and i'll close with this, both capitals, jerusalem and ttehran are downplaying this we are in a high probable moment of the state on state violence diminishing that shadow of war continues. >> the most important piece sounds like if tehran is not talking about this as an escalation, that this really

6:45 am

does feel it is moderated, you talk about the shadow of war continuing what does it look like >> three places to watch one is proxies that's particularly hezbollah, hamas is cornered in gaza. hezbollah to the north of israel 100,000 missiles available watch for that to, perhaps, ramp up a bit again, iranians will not unleash them on israel at this point they are trying to deescalate an second, watc what happens at sea. houthi is that looking like a spike and finally cyber. look for the escalation in the world of cyber gl >> do you think the u.s. will be roped into this, admiral >> i do not.

6:46 am

president biden needs a full-blown war in the middle east he needs a war like he needs a hole in the head in an election year he has done everything and done a pretty good job and the administration has of avoiding being dragged into this. secondly, at this stage of things, israel can handle itself and protect itself it's got its hands full. the key thing from the israeli political perspective is what is happening in washington with the aid bill to israel and ukraine we will know if that passes this weekend. >> okay. admiral, thank you for joining us and helping us understand what is taking place and it sounds like this is on the better side of good news after the attack thank you. >> thank you now to the energy markets. price of crude jumped 3% before coming back down right now, wti is down .50%. brent is down by .70%.

6:47 am

joining us on the news line is john kilduff john, great to you have with us. we he e never reached in the st the highs like we e had on frid with brent what does this action tell you >> it tells me that -- good morning -- that the energy market has been through this before last night was very scary. we are $4 a barrel off the high from last night mostly because the first target was identified early on almost immediately was isfahan. the admiral mentioned it was a large city and the iran nuclear site the oil market is the thing to worry about with the israeli response that would engender a response by iran again and get us off to the races. it is almost hard to get your head around the fact lately or

6:48 am

any more how high the bar is in the middle east for all-out war to breakout and oil supplies to be impacted. when you are talking about iran and everybody is focussing on the state of hormuz, rightly so, iran relies on that so much. the theater here has been just off the charts and the oil market reaction, last week, melissa, is when the nerves were frayed in the market there was heavy buying all throughout the week, particularly in the middle of the week ahead of the iranian attack again, the market was able to exhale and over the years, really, the decades now, these attacks come and they are dealt with and handled diplomatically. you don't lose any barrels of oil. that's what you have to be careful about if you are trying to react to this and hedge yourself in the event risk strategy >> the markets have been immune

6:49 am

to this. i didn't feel there was much of a reaction initially because iran did seize a tanker in the strait of hormuz john, is that an open-ended question that there could be more disruption like that? that would actually directly impact the oil market if there is a perceived risk in sending ships through the strait >> no doubt. that is still on the board i think in terms of blocking it, melissa, that is off the board as you are seeing with the red sea situation, if that bad neighborhood would come to pass in and around the strait of hormuz with iranian activity and the nation flag fvessels they carry and then israeli ownership of the vessel and contents, then things would perk up and the oil market would focus like a laser beam on that because the tankers avoid the region and stop

6:50 am

transporting oil to avoid direct conflict or interaction with the iranian naval forces we're back in the soup then. >> for now, it looks okay. john, thank you. >> it does thanks coming up on the other side of the break, p&g set to report. thankfully. >> john kilduff. coming up on the other side of this, procter & gamble set to rtpo we're going to bring you the numbers with jon moeller in a little bit "squawk box" coming right back >> announcer: this cnbc program is sponsored by baird. visit bairddifference.com.

6:51 am

when you need to prepare for unpredictable adventures... (gasp) you need weathertech. [hot dog splat.] laser measured floorliners front and rear. [drink slurp and splat.] (scream) seat protector to save the seats. [honk!] they're all yours! we're here! hey, i knew you were comin'... so i weatherteched the car! can we get ice cream? we can now. kid proof your vehicle with american made products at weathertech.com.

6:53 am

6:54 am

150 points, nasdaq off 122 points, the s&p 500 off by 25 points what are you seeing among investors that are playing, dare i say, in the futures markets or internationally or even what you think the movements of bitcoin, which actually have moved up, during this period >> yeah, you know, i will start with bitcoin, andrew i think it is really interesting to see we have been hearing that it is a storage of value i think everybody -- a place to turn to when there are times of trouble. i should restate that. and maybe this is a little bit of a proving moment for them, as this war or whatever we want to call it continues to escalate and we see more happen there as you said, when this first news first came out last night, the s&p 500 futures were down over 80 points the amount that we cut that overnight really is amazing as more details have come out the one thing i would like to point out to investors, though, is that if you look at the vix this morning, still below 20

6:55 am

vix, to me, over 20, is where you start to get a little bit more concerned and so, you know, we're about 19 and a quarter as we go on the air here but, you know, again, this is not a time for panic but i do think it is a warning for investors also to really make sure that they have the positions on they want, you saw last night how quickly the narrative can change with how quickly we move down you still do have bonds up, you know, over a point this morning. so i wouldn't say it is an all calm, but i would say that the markets are a bit more reasonable approach, if you will, to what went on last night. >> the level of the vix, j.j. is below 20 the options value on the vix is really high. we're talking about six-year highs to levels that we saw last during volume-geddon am i saying that right that was a very testing time for the markets. i'm curious what you see here,

6:56 am

particularly given these tensions are continuing? >> what we have seen over the last couple of weeks is a lot of people, i don't know if it is protecting the volatility they sold, or, hey, if things happen, this vix could explode overall you've seen a lot on that 20-line over the last couple of weeks and the 25-line on vix so, one of the things that happens with vix is you know, melissa, from so many years of covering the options market, is that often when vix does break 20, it happens in a very -- almost an exponential fashion, and in times like this where it can go 20 to 25 very quickly or up to 30 as i said, at the moment, the fact is we are seeing the pain there. i think that will be a crucial point if you will for most investors to take a look at, as this continues and it is not necessarily a huge surprise as we start to see escalating tensions, especially in the middle east, that people

6:57 am

may come into the vix to try and, you know, hedge their positions overall because what has paid off for traders over the last couple of years has been to sell volatility. so, i'm going to guess there are still a lot of positions that have been selling volatility for the last couple of years that are looking for a place to hedge that sort of position overall because, you know, these big firms can't just turn that around overnight and the fact of the matter is as things escalate, people are going to be coming in to buy volatility elsewhere, so those market firms that sell it have to find somewhere to hedge it. >> thanks. now to the global currency markets. joining us now, jesper cole. we saw the most reaction overnight in the japanese yen and the swiss franc in terms of bids to safety we saw gains really getting paired back. what do you foresee here

6:58 am

particularly for the yen and whether boj actually intervenes because we're up at 155 basically and nothing has gone on. >> yeah, no. and, look, i think that what got us from 100 to 155, you know, which is the fact that america is strong, that japan is relatively weak, and american rates are not coming down in a hurry, while japanese rates are certainly not going up in a hurry. so as a result of that, i think it is not bizarre to forecast, you know, 165, 170 or even 180 for the time being the yen is going to be a weak currency. >> particularly we're getting so much fed speak that indicates maybe, you know, rate cuts may not happen until 2025. that's when kneel kashkari said yesterday afternoon. that differential looks like it is going to remain in place. good your forecast to 165 or 170, does that imply that there is no intervention or that intervention will -- might happen, but simply won't work? it hasn't worked in the past >> i don't think that -- there

6:59 am

is obviously lots of verbal intervention, the right thing that you have to do and there was now this agreement with south korea and the treasury sort of coming in and says, yes, yes, we're looking at the yen. but the reality is, if you -- if japan were to start to sell its dollar reserves and buy yen, you know, it would be a one off, it would be a liquidity shot and less policy changes and less the u.s. starts to cut rates, japan starts to hike rates more aggressively, you know you're not going to see a reversal in the fundamental trend and 165, 170 is on the cards. >> so, are traders in your view positioning for continued pressing of the short on yen >> yeah, i think that that's exactly right. and you find most importantly japan investors, whether the big insurance companies, whether it is retail investors, you know, they are the ones who are bidding up the dollar and any dip that you get, any sign of short-term yen appreciation is

7:00 am

going to be seen as a buying opportunity because the fundamentals still point to america first, strong america, rather than a strong japan >> will we see an impact on the u.s. treasury market given japan is the largest holder of u.s. treasuries if they do intervene? >> the answer is, you know, there is intervention. i think that's going to spur more outflows from japan with the private sector actually welcoming the significance, sorry, not the significance, welcoming the liquidity provided by the bank of japan at that point. for all intents and purposes and to repeat the point here, if you're a japanese pensioner, if you're a japanese insurance company, getting 4%, 4.5% in u.s. treasuries is a very, very good deal to have, given that domestic interest rates are still below 1% >> right thanks it is just past 7:00 a.m. right here on the east coast you're watching "squawk box" on

7:01 am

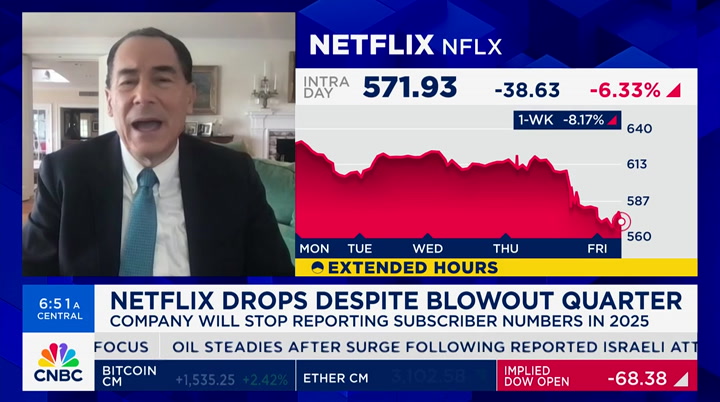

cnbc i'm andrew ross sorkin with melissa lee on this friday morning. joe and becky are off today. we got a whole lot of headlines to bring you right now breaking news overnight, israel carrying out what appears now to be a narrow strike against iran. and now assessing its effectiveness. the damage caused. the action appearing to be limited in an effort to avoid escalation futures falling close to 300 points earlier this morning on that news. modulating right about now, however. meantime, we're going to get a live report from the region in just a couple of minutes in corporate news, shares of netflix, they're under pressure, the streaming service beating expectations on the top and bottom lines and blowing away expectations on subscriber additions. shares falling after the company said it would disclose less data about subscribers starting next year, as in it will not be disclosing the number of subscribers. meantime, hoyundai pausing advertising on x due to antisemitism, saying an ad appeared adjacent to an

7:02 am

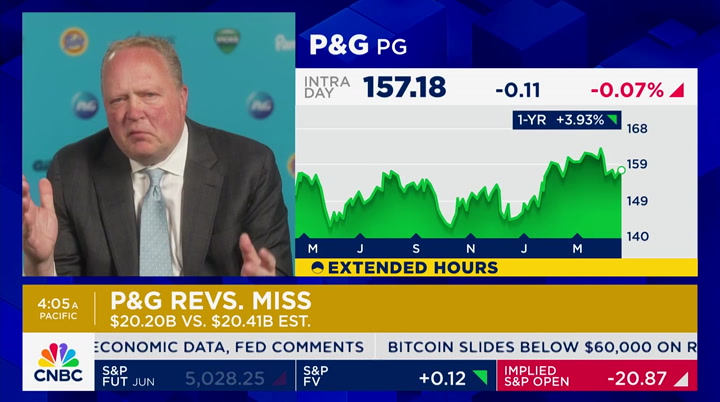

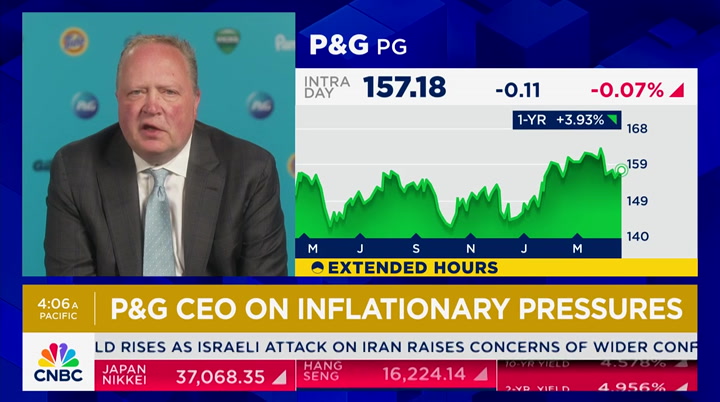

antisemitic and pro hitler post on the platform. american express just out with quarterly results, earnings coming in at 3.33 a share, much better than what the street was expecting, 2.96. revenue increasing 11% to 15.8 billion. amex is afifirming its full yea revenue, the stock is up .7%. procter & gamble's be third quarter results just crossing the wire, topg esping estimates 1.41 slight miss. procter said its growth was driven by volume in the march quarter. the company raising its full year eps growth guidance here with us now to break down that report, jon moeller, president and ceo of p&g stock, by the way, relatively flat on the back of that news, jon. but speak to it in terms of what you're seeing more broadly in

7:03 am

the economy and what this last quarter says and maybe what you're starting to see coming up next in terms of the strength of the consumer >> well, on a global basis, there continues to be as you're very familiar with a lot of volatility, a lot of divisiveness, a lot of tension but the execution of the strategy by the team is overcoming all of that so you mentioned -- you referenced sales growth in the quarter, 3%, 8 of 10 categories growing. we built volume share. we built value share earnings per share growth, 18% on constant currency basis, and we just increased our dividend by 7%, making it the 134th year this company has paid a dividend, 68th consecutive year they increased the dividend. and as you mentioned, we have -- we're able with those results to hold our guidance for the top line and to improve it for the

7:04 am

bottom line. so, all in, beautiful execution of a winning strategy by the team, which is overcoming many of the challenges that we face one of the big questions that was out there relative to the health of the consumer was volume with the amount of pricing that we had to take to overcome increased commodity costs, what would happen to volume, volume in north america in this quarter plus 3%. the last four quarters, plus two, plus three, plus four, now plus three the same general dynamic in europe, with volume up 4%, sales up 7%. so sorry for the long winded answer, andrew, but it is a complicated but very encouraging picture. >> well, let me just speak to the challenge of this that we're talking to andy jassy, just about a week ago, from amazon, and he said one thing he's seeing is the tradedown is that consumers are trading down when they can are you seeing that in your

7:05 am

business >> we really aren't. one of the metrics that we look at to assess tradedown is the progress of private label shares they're up modestly in the u.s., they're flat in europe and in both cases we're growing share, both value and volume, ahead of that pace and, you know, why is that i'm certainly not denying the reality that others might see, but we have concentrated our portfolio in daily use categories where performance drives brand choice. so as long as we can bring a product to market that performs noticeably better, noticeably better package, communicated effectively, that creates value that overcomes some of the pricing and we try to combine those things so we bring innovation to the market, as we bring price to the market, and thus far that's been a winning approach >> your portfolio is diverse,

7:06 am

though, jon. i'm wondering if there are certain categories where you're seeing more pushback from the consumer than others, seeing volume growth not as strong as in others which would imply that consumers are looking at the price increases and thinking twice. >> it is a fair question the dynamics, though, are pretty similar across the categories. the growth rate volume to value may vary by 2 or 3 points. but generally the dynamics that i expressed hold true across the portfolio, and generally across markets, with some notable exceptions in very tough markets like argentina and nigeria, egypt, pakistan. but as i mentioned, volume growing, and value growing in europe, volume grewi inggrowingu growing. china is down a bit as the market continues to struggle but even there we're seeing

7:07 am

sequential improvement quarter to quarter >> in terms of -- is there a market right now you're excited about? it sounds like every market we're talking about is challenged to one degree or another. >> i'm very excited about the u.s. and the progress the team is making there. i'm very excitedabout europe 7% growth in a very mature economy is wonderful to see and i think there is a lot more there, the same in the u.s when we bring products that make a difference to consumers lives and do it better than anybody else and price them affordably, the opportunity is endless >> jon, you're one of the largest advertisers in the country. i like to talk to you because i think we have lots of executives, ceos, who are on either big tech companies where you buy advertising or big media companies where you buy advertising. what do you see working? what do you see not working right now? >> well, we have a better array of tools and channels available

7:08 am

to us than we have ever had in our history. and so advertising can be both more efficient and more effective. if you think about a product like vix cough and cold medicine, when we just had the tool of linear tv or radio, it was very difficult to efficiently advertise because unless you had a cough or cold, or your child had a cough or cold, you really weren't engaged and so there was a huge amount of waste and now we're able to much more narrowly target that person who can benefit from the product on that day, so as a result, returns are increasing, not decreasing, and just take the last quarter as an example, while we increased earnings per share 11%, we got 18% on the constant currency basis, we did that while increasing advertising, marketing

7:09 am

comprehensively defined by 15% the same dynamic last year so this is a good environment for advertisers now. there is some things that -- some challenges that we have to overcome but if we can do that, we have better and better tools to communicate to consumers every day. >> you got a platform you like you guys advertise on x, by the way? >> i don't have -- i don't have a breakdown of the -- by channel, i apologize, but -- >> we were just discussing that because hyundai was pulling its advertising. i was curious what you think is working and what's not but, jon, thank you for joining us as we're trying to figure out what's happening in this economy and as we're really trying to figure out what's happening even overnight with this attack that israel retaliating to iran so thank you for coming on this morning. >> thank you coming up, the vix back to its highest level in a month on

7:10 am

7:13 am

israel launching a limited direct military attack on iranian soil the news comes days after iran launched its first ever direct attack on israel in the form of more than 300 drones and missiles nbc's richard engel joins us now from jerusalem with more richard? >> reporter: so, this strike was limited. israeli official telling nbc news that the strike took place, iranians say that a military base near the city of isfahan was targeted but even the iranians are downplaying this with state television showing pictures from isfahan with life as normal, one anchor on state television said that this was, quote, no big deal here in israel, they have not imposed any new restrictions or guidance people are not being told to go to shelters or limit their behavior in any way. people are out on the streets,

7:14 am

here in jerusalem, tel aviv very much the same. israel had promised to respond to the iranian attacks, which were triggered by an initial israeli strike on an iranian diplomatic facility in syria but it does seem now after this limited strike that both sides, judging the reaction that we're seeing, are trying to pull back from the brink and not have this spill into a regional war. so, we did see a strike this morning, limited in scale, and so far the reaction has been quite muted. >> has iran even attributed the attack to israel >> reporter: the suggestion in iran is that this was israel, and if you -- the commentators on iranian television are describing it as a win for iran. they're saying that what happened a few days ago, when over the weekend, when iran launched more than 300 ballistic missiles, drones, cruise

7:15 am

missiles, that iran sent such a strong message to israel that israel was afraid to do anything more than the most minimal kind of attack that it carried out this morning so, both sides are trying to walk away from this with a win, and that, frankly, is a very positive sign for regional peace or for the possibility of this escalating to a direct conflict between israel and iran drawing in the united states >> richard, thanks richard engel in jerusalem for us and both sides taking it as a win. we're seeing that play on the futures market this morning after israel conducted that limited strike on iran overnight. wall street's fear gauge, the cboe volatility index spiking over the past month. we now see it at 19, almost 20 for more on the vix and the fear that happens that appears to be gripping wall street, let's bring in mandy sue, head of derivatives markets intelligence at cboe global markets

7:16 am

great to see you. >> great to be here, melissa. >> so what does the vix tell you right now? it seems like the positioning now by traders is that there is an anticipation of higher volatility going forward. >> yes, the vix spiked higher this month i wouldn't call it unexpected in the sense that all throughout q1, despite very, very low volatility, we started seeing traders build up positions in vix, particularly vix upside calls, playing for the change in the volatility regime and that's exactly what we have gotten. now, what i'm watching for here is really for vix to go higher we need to see significant escalation on the geopolitical front, which as we heard from richard maybe won't happen and more uncertainty, more turmoil on the macro economic front. and on both cases, if you look in the rates market, what stands out to me is rates volatility has been new despite the surge higher we have seen in yields, different from last fall, where as rates were going higher, rates volatility was much more

7:17 am

elevated, signaling more uncertainty about the path of rates, and this time around, yes, we're talking about a delay in terms of fed cuts, but the policy direction is still one way. it is still going to be cutting, right? i think until we get meaningful risk of potential height, that's what i'm watching for in terms of rates volatility spilling over into equity, taking vix higher. >> you haven't mentioned earnings season, we're at the start of it. netflix being the first of the big cap tech to report and that was disappointing. that's what we're seeing in the premarket. what are you expecting here, particularly as we see semis, which had been the leader in tech, semis are about 20% of the nasdaq, in correction territory, nvidia, the leader there, in correction territory as well >> exactly i think this earnings season is going to be very important i think especially as the macro economic environment turns more challenging. i think really needs earnings to not just beat, but beat significantly in order for the rally to continue and what we're seeing in the derivatives market

7:18 am

is that options and traders pricing in a lot more single stock volatility, so the idiosyncratic risk that is being priced into the market in excess of the vix is at almost the highest on record. people are expecting this earnings season to be one of the most meaningful or most impactful on record. >> where are you seeing the most bets within -- i'm curious, within technology, for instance. >> not surprising, it is nvidia, the leaders we have seen, where we see the biggest increase in terms of option activity, the vix increase in terms of volatility that is where investors have been focused on where nvidia goes, the rest of the sector almost, the expectations it will go. >> are you getting the sense that investors are making directional bets or hedging a position >> i think in vix, it is primarily hedging. and what is interesting is the theme this year is that people have been gravitating away from traditional hedges and s&p puts,

7:19 am

towards volatility hedges, toward vix that's a function of both kind of lower levels of -- the potential for vol to explode, and to double and triple and it takes a much bigger catalyst and a function of positioning, as people pile into equities, build up their positioning, that need for hedging increases and right now people kind of gravitating toward vix and very notably last friday, we did get a vix pop, we had over 2.6 million contracts trade on that date in vix options, higher than what we saw in march of 2020 during the pandemic, which i thought was pretty incredible. >> where do you think vix ends up >> my expectations, near term, is we stay in this newer range of, like, 15 to 20, so, you know, mid to high teens. i don't see us breaking out into the 20 to 30 range until something kind of more serious on the macro economic front emerges. but i do think right now there is enough uncertainty with direction of fed policy and inflation and earnings to keep

7:20 am

vix in this 15 to 20 range that's my expectation for the near term. >> mandy, thank you. >> thank you >> okay. thank you. when we come back, sl green making a number of deals in the commercial real estate business, trying to shore up what has been a rough year so far for the sector the company's ceo will join us after the break. later, chief investment officer at bitwise asset management will talk crypto prices as bitcoin has moved up today on the back of the news from israel and iran "squawk box" coming right back aouerti n f >>nnnc: meowor today's aflac trivia question. what is the longest roller coaster in the united states the answer when "squawk box" returns. uh-huh... - hip-hop! - limping! mmhmm! medical bills! uh-huh! - pancakes! - cash! who pays you cash when you have medical bills? grrr! no idea. [tapping] gap! the gap left by health insurance? who pays cash to help close that gap? aflac! oh, aflac! get help with expenses health insurance

7:22 am

7:23 am

we were made to track flight prices to paradise. to today's aflac trivia question what is the longest roller coaster in the united states the answer, the beast located in kings island amusement park in mason, ohio. it spans 7,361 feet across 35 acres. welcome back to "squawk box. shares of sl green, new york city's largest office landlord, almost doubling over the past year in its most recent earnings

7:24 am

report it completed more than $2 billion of debt refinancing. joining us for an exclusive interview is the ceo of sl green realty marc holliday good morning to you. where are we all we do is wring our hands typically about commercial real estate, about four-day workweeks in new york city, about security issues, safety issues, how are you feeling right now? >> i feel really good. that's why i'm here today. i know you spent a lot of time talking about -- >> that's why we wanted to have you here. >> earnings call yesterday, first time in four years, not one question from the analysts on work from home. it is really something that i think is in the past we monitor our portfolio we have got 900 tenants, we have a pulse on everything that is going on in this market. people are back in a big way new york and miami, leading the way back to office i think that was in my opinion

7:25 am

somewhat of a failed experiment or overblown experiment if you will, for some companies it works as part of a 3, 3 1/2, 4-day work period. for most companies, everybody is back. >> everybody five days >> not everybody five days but it wasn't five days prepandemic either people are on the move people travel. people entertain people relationship build, people take time off that's not a new thing you know, our occupancies are 70% to 80% of where they were prepandemic, but at that level, for us, the buildings are full, in some cases the buildings are at or above prepandemic levels >> is that going to be the new norm >> no, i think it is still -- >> we're still evolving. i think there is a new generation of workers coming every year out in the schools, into the workforce and they're hard workers they don't know from the pandemic era

7:26 am

i have young people in my office, they were in on sunday last week, they're there in the evenings, it is not quite the way it was, but, you know, we don't get asked the question about work from home policy. >> you don't think -- there has been the occasion that even folks who have leases that are current that are going to roll in two or three years, that all of a sudden they're all going to trade down they're going to say, you know what, actually, can have three floors back. we just don't need it. >> i don't want to talk up the book you have to look at the data in my portfolio i ended the year over 90% lease. that's four years in the pandemic, and we're projecting to be 92% lease by the end of this year. that means we're leasing space two tenants making long-term commitments of often between 7, 10, 15-year commitments because they know the future for thieir businesses is to have the central hub. i'm talking about a very

7:27 am

specific market. i want to be clear i'm talking about greater, east midtown, not the far west side or penn station or downtown. not talking about that i'm talking about places that are commutable, where they have a building stock that is highly improved and amen tatized third to broadway, that block of space is still internationally considered new york's equivalent of -- >> you don't think in new york it is all moving west? you're not a believer that they -- the hudson yards phenomenon is supposed to move everybody -- >> with all due respect to my friends at brookfield and related companies, like that, it is not what i think, it is what the data says. the vacancy rate in what i call the park avenue spine, where we dominate ownership, sl green has made its case everywhere from 23rd street to 59th street along

7:28 am

park avenue and everything just east and west of it, that market is about 10% direct availability that is -- that's almost prepandemic rates and we are moving our rents up in those buildings. but that data is in our supplemental >> okay. i want to talk about either developing new properties or buying new properties in an environment where interest rates are frankly out of control >> right >> and whether you think that the economics of developing a new property in this city right now or in some other city make any sense relative to the rental rates that you're going to be able to capture. >> in terms of developing -- it is hard to develop new property in new york. it always is, regardless of rate environment. it took me 20 years to build one vanderbilt one of the most iconic office buildings in the country, perhaps the world, most successful in terms of rental achievement, that's 20 years to plan for a building like that today, i got to be looking at a

7:29 am

demand and rate environment that might be 5, 10, 15 years in the future what we're doing today, and where we see the opportunity today is on the credit side. people know us as owner, managers of real estate, we're also one of the leading providers of subordinate capital in new york. and i've done $17 billion of that business over the years over 26 years. all of it right here in manhattan. that's where i think the action is, that's the best part of this market where you get good risk adjusted returns, mid to high teens and that's where we're raising capital around a billion dollar opportunistic debt fund that we're in the market right now. >> when you do look out four to five years what are your forecasting as the interest rate environment? is there an assumption rates will be higher still >> you know, i've been in this real estate business in new york for 33 years, one thing i learned is i don't predict interest rates i follow the curve so, we always model the forward curve plus 50 and that's kind of

7:30 am

our guru we stick to that because that's the best estimate in our opinion of what future rates may be when i'm looking at deals right now, i'm looking at ten-year rates, five-year forward and they're not that high. i know relative to where they were, 4.5%, it may seem breathtaking but i've done business in 5, 6 and 8% treasury markets and it is okay. and in fact i think there is more opportunity for people like us and you heard from john gray yesterday, people like blackstone, in this market, which differentiates between, you know, the people of reputation track record experience and lower rate environment where everybody is a hero. >> right >> marc, thank you for coming in this morning >> thank you very much >> we're going to visit you. i think we should do the show -- >> you should do the show from there. >> let's schedule it. >> let's schedule it get a good view. >> just be careful they may not be listening to us, looking at the amazing views and

7:31 am

experiences. it is fun up there. >> we'll get vertigo thank you. appreciate it. >> great being here. georgia governor brian kemp joins us, he's been local about unions moving into his state, he says they're putting the economy at risk. he'll talk to us about antiunionization strategy. and lar,te the fed's new rate path and the state of the economy, esther george will join us "squawk box" will be right back. a driven insights, i'm a rock star. great job putting finance and hr on one platform with workday. thank you! guys, can you keep it down. i'm working. you people are (guitar noises). hand over the air guitar. i've got another one.

7:32 am

7:34 am

welcome back to "squawk box. we're keeping a close eye on futures this morning after news overnight that israel conducted a limited strike against iran. right now we have really recouped a lot of the losses initially felt on the news reports of that strike the dow was down about 300 points it is now down by 45 s&p 500 down by 9 and nasdaq lower by 60, impacted by netflix and the results last night netflix, by the way, down about 6% premarket taking a look at treasury market, the ten-year yield, bid for safety, yields lower,

7:35 am

4.596% two-year note, 4.971%. on the oil front, we did see brent go above 90 bucks a barrel at one point overnight right now we're down to 86, down by a percent here, wti down by .9% and in the gold market, again, no surprise, we saw initial bid for safety, though a little bit off of those highs here, down by .3%, 23.91 is the level bitcoin right now, we'll have much more on the crypto market after the break with the cio of bitwise. right now, up by 2.6%. r the program, esther george willbe our special guest. "squawk box" returns after a quick break. (vo) the key to being rich is knowing what counts. new projects means new project managers. you need to hire. i need indeed. indeed you do. when you sponsor a job, you immediately get your shortlist of quality candidates,

7:36 am

7:37 am

when it comes to investing, we live in uncertain times. some assets can evaporate at the click of a button. others can deflate with a single policy change. savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified portfolio of mining royalties in one simple investment.

7:38 am

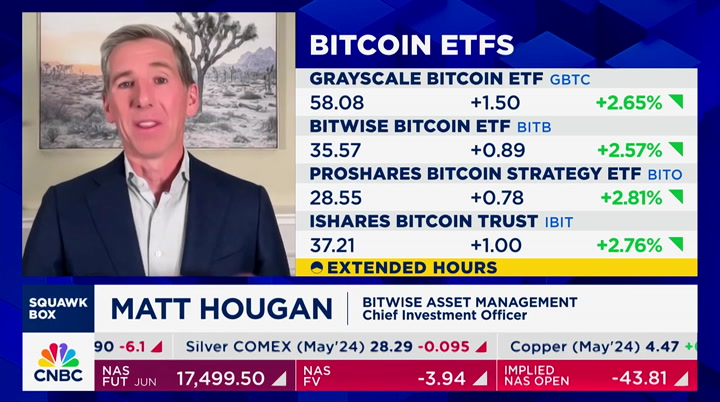

learn more about a brighter way to invest in gold at sandstormgold.com. welcome back to "squawk. bitcoin halving expected to happen today or tomorrow the impact is already priced in currently. bitcoin prices now 65,000, moving up even higher. joining us is matt hogan, bitwise asset management cio good morning to you. let's speak about the halving and what you think happens to the value of bitcoin is this a buy the rumor, sell the news situation, or something

7:39 am

else to think about? >> andrew, good to see you glad to be on. i think this is a buy the news event if you pan out long-term if you look historically at halvings, the price action around the halving, if you look at a week or two weeks is muted. if you look out a year, the bitcoin price is relative substantially after each of the past three halvings. i think it will do so again. you can overthink this, the amount of new supply of bitcoin coming into the market is being cut in half. removing $11 billion of annual supply i think big picture that has to be good for price and that's what i would expect over the next year. >> what do you make of the debate we have been having, you've probably seen it over the past week, since the -- since the retaliatory attack and now this other retaliatory attack overnight, there has been this question about, you know, is it a store value, a safe haven, what do people do in this moment when there are these geopolitical risks and what does

7:40 am

it say about what the price movement has looked like over the past week and a half >> yeah, absolutely. you know, there are a lot of cross currents in bitcoin's price right now. there is etf demand, the halving, there is tax-related selling and, of course, geopolitical events. i think you can try to read too much into the short-term trading activity, it is better to pan out. if you look big picture, it has done a great job of protecting us against inflation post covid. i think eventually it will be a good hedge against geopolitical disruptions, but it is a bit too much to ask for bitcoin to both be a perfect risk off asset, and deliver exponential returns. it is an emerging risk off asset. when it is fully mature and perfect hedge for the events like we saw in iran and israel, those exponential returns will be gone. you have to keep that big picture in mind. bitcoin is growing into what it will eventually be

7:41 am

>> it also has done a good job of protecting the gains that bitcoin built into the etf conversions and so i'm wondering, a lot of people are already positioning for the next etf and etf, but the ceo recently said he thinks the application will be rejected what are your thoughts on whether or not that will actually happen? that was the next great catalyst supposedly in terms of the next crypto to see that big run >> yeah, we have a filing at the s.e.c. right now for an ethereum etf, i can't speak to that specific filing. but i think actually the bigger catalyst is still with bitcoin itself the biggest unlock is coming probably in q3 and q4 when the major wire houses turn on access to bitcoin we haven't really even got through the full totality of the bitcoin etf launch i think we will get in ethereum etf eventually it will be you know maybe later this year, maybe early next year and that will be exciting as

7:42 am

well but there is a lot more to come on bitcoin specifically. there is a lot of reasons to be excited about bitcoin specifically before we move on to the next thing, which is ethereum >> is your sense that it is the etf where you're going to see most of the action, if you look at what sort of -- how bitcoin gets acquired, if you will, by investors, how much of this is going to be the etf versus the underlying asset and does it matter >> i don't think it matters except in the sense that what etfs has done is they have unlocked the ability for professional investors to access this market. it is very difficult for endowments, for advisers, family offices to buy bitcoin on an app. it is much easier in an etf. i think the marginal new buyers are in the etf professional investors control most of the wealth they just started being able to access bitcoin because of this etf launch

7:43 am

i think that's where the marginal activity will take place. you'll see bitcoin being bought directly as well bitcoin is going through both a demand shock from the launch of the etf, and a supply shock from this bitcoin halving those are happening at the exact same time and that's a really exciting setup for the next year ahead. >> okay. matt, want to leave it there, thank you. appreciate it. >> thanks for having me. coming up, netflix shares falling after beating earnings rttimates, saying it will stop repoing subscriber numbers next year. we'll break down the report and what it means for streaming next we'll be right back.

7:44 am

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient.

7:46 am

her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. netflix shares are facing pressure after it announced yesterday it would no longer be sharing quarterly membership numbers or average revenue per user reports starting next year. this quarter saw substantial rise in total memberships to nearly 270 million, joining us

7:47 am

now is tom rogers, former nbc cable president and cnbc contributor, also friend of the show, of course. tom, great to see you. >> great to be here, melissa, thanks >> in terms of stopping those metrics, what does that tell you? >> well, the crown series may be over in terms of netflix airing a great show but they're the triple crown winner when it comes to subs, when it comes to profitability and when it comes to viewer engagement i don't blame them at all for wanting to focus on viewer engagement they produce, by themselves, more tv shows than the entire tv industry produced in 2006. and they have more hit shows than all of their competitors combined but this notion that they're going to focus on engagement as opposed to subs just doesn't make any sense to me since when is the number of homes you reach not important to engagement you got to know the denominator

7:48 am

of what your potential reach is to know how shows are now performing relative to how shows in the past were performing. i can't imagine advertisers saying, well, it doesn't really matter to us how many homes you're in from an advertising -- in terms of the number of people that take your ad tier do you have 23 million subs that have exposure to your ad tier or 35 million homes they're going to insist on that kind of information. and once advertisers start insisting on what that home reach is, not only in the united states, but all markets, where they're going to be selling advertising, i think that those numbers are going to become available and people will aggregate it back into what membership numbers are so i don't really quite get, say, i'm going to focus on engagement, but not give you the denominator in terms of our

7:49 am

reach, particularly when scaled reach in such a fractured median market -- >> tom, do you think there is something -- what do you think this says, though, about the strength of the business you think this is them saying the growth story is over or the growth story is different or what the stock is down because i think there is a frustration about this, for the reasons you're describing, but what do you think is the motivating factor behind it in terms of what netflix is trying to do to reorient the investor mind around their numbers >> well, when you do something like this, there is always a presumption that something is being hidden that isn't going to look as good as it did and i think it is probably pretty obvious that is average revenue per subscriber, because they're going to be adding a lot more subs and markets, particularly in asia, which have lower revenue per sub. the ad tier as i said on the call is going to take some amount of time, my guess is

7:50 am

considerable amount of time before the revenue that they're getting from an advertising home matches what they're currently getting from a nonadvertising home, given how successful they have been on raising price in the nonadvertising subscription homes. so, that number on all cylinders, i'm as bullish on netflix as i've ever been. but i still don't get it if you focus people on engagement they got the number one original show, number one movie, number one acquired show for over 40 weeks of a 52-week year their engagement is great, but if you're really going at advertising and its growth, the advertiser will want to know what that universe is to be able to make comparisons as to how shows are actually doing. >> are we making too much of this the stock is down 6.25%. a little might be the run it had prior to the earnings release

7:51 am

but we spoke yesterday they said we'll have the revenue number the informational subs might not be quarterly but we'll get some information and we'll be able to figure out the math at some point so you will have some visible, although maybe not as timely is there too much of a discount? >> i think what rich was referring to was netflix did indicate when they hit certain milestones this he'll talk about sub numbers, but, again, if you're an advertiser in japan and want to know if netflix is in 10 million or 20 million homes in terms of the kind of reach it has every advertiser in every major market will look at that kind of information i can't imagine they're going to say to an advertiser, sorry, you can't have that and the information is going to be out in the marketplace in some form, i would think. i just can't imagine them as they're trying to grow an ad tier stiff advertisers on the reach in any given market of the

7:52 am

advertising sub, so i really don't get it it certainly makes sense for them to focus the market for earnings purposes on the key things that they want the earnings metrics to be in. there's a notion that somehow second quarter guidance was disappointing on a foreign exchange neutral basis they'll grow 21% is kind of silly. so they're hitting on all cylinders and doing great and are the kings of streaming media but this is a head scratcher to me. >> always great to get your thoughts coming up, georgia governor brian kemp on unions, the economy and so much more that interview is next. check on the futures right now. things are getting better, dow off now only about 76 points after being down nearly 300 points overnight as we heard

7:53 am

about retaliatory strikes from israel towards iran. that seems to have been limited. we'll talk more about that as well when we come right back unn. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

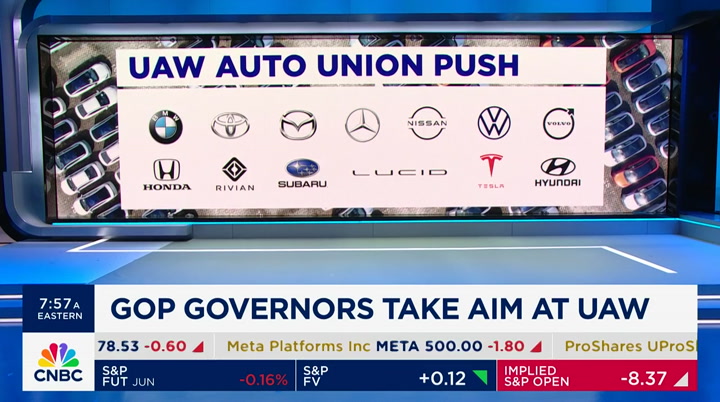

7:56 am

the statement comes as volkswagen voted on unionization and one of those officials is governor brian kemp. we appreciate you joining us >> good morning. h >> how did you decide to sign the letter and what are you telling folks in the state of georgia about these efforts? well, really the model down here is working it's doing great we had great relationships between our employers and their employees, and there's a reason that the south and the southeast gdp is now outpacing the northeast and i don't think that is understood and the way the uaw's tactics have been and i don't think it will play real well and our message is, look, we are recruiting these great

7:57 am

companies that are coming and building plants in our state and providing jobs that pay above the county -- average contestant wage, great benefits and have great relationship with our employers and his bernie sanders-type tactics won't play well in the south. >> you think ultimately it's going to result in layoffs if, in fact, the unions were to win there? the flip side of that, of course, is, you're looking at the detroit strike in terms of 25% pay raises so there are workers, i think, in your state looking at that going, look at what those guys just got and we don't have that. >> well, i think what people are looking at there, andrew, is shawn fain helped a few and screwed others you're seeing the big three laying off plants because of costs going up and have to idle their plans for electric vehicles in the marketplace, and you look at places like georgia, you're not seeing that happen.

7:58 am

full steam ahead companies giving pay raises and continuing to work with their employers to make sure that they can keep up with bidenflation. >> it seems unprecedented for you to sign this letter. why not just let the workers vote, and if everything is going as well as you say, won't they reject this effort >> well, i mean, look, the workers are going to be voting today. we just want to make sure it's a level playing field and people aren't browbeat by bernie sanders-like tactics from shawn fain destroying great american companies. we don't want to see that in the southeast. there are a reason businesses are coming here. we have a great workforce and paying that workforce. when you look at the south and the, you know, like in georgia, our increase in wages is well above the national average because of companies like this paying better wages and better benefits and giving great opportunity for our people and what the uaw is doing is going

7:59 am

to destroy those type relationships and we've seen that in the northeast and simply we don't want to see it in the southeast. listen, we have great relationships with other unions here in our state now, but they actually work with our businesses and our employers to make things work and that's not been the uaw's tactic. >> governor, do you think that employees in georgia at some of the automakers have been beneficiaries of the uaw and other union's -- raising wages in other states in other parts of industry have forced or created pressure to raise the rates anyway >> well, we were seeing rates and salaries and benefits go up long before the uaw fight. just because of the growth that we've had our state coming out of covid

8:00 am

not wavering when we were the first in the country to re-open even when we had people on both sides criticizing us of that our unemployment rate continues to be near record low which is way before -- way below our previous record so it's been a competitive environment here where wages have continued to go up the problem is for our workers is our wages are going up, but, unfortunately, until recently they weren't going up fast enough to keep up with the disastrous policies of the biden administration when we saw energy, groceries, insurance, mortgage rates, rent, and other things going up expo inter interceptionally. >> i was going to ask you about that, governor i noticed that you called it bidenflation do you hold president biden accountable for the inflation that's taken place during the last 3 1/2 years, whether you look at jay powell and say that the federal reserve missed it. is it his fault if you're going to lay blame

8:01 am

how do you think about inflation and whether a president can control it >> well, listen, it's easy to go back and criticize the fed i personally think they waited way too long to start raising rates, and i hope they don't wait too long to start lowering them they're in a good posture right now from what i know, but, look, there's no doubt that this president has spent an enormous amount of money, pumped an enormous amount of money into the economy when at the same time early in his administration he was telling people stay home, don't come back to work, which created, you know, much more demand than supply out there, because people weren't in the workforce which drove prices up, then when you start having pieces of legislation that are mandating certain things like electric vehicles that continues to drive prices up on batteries, rare earth minerals, the whole supply chain network, so, yes, i do think the biden

8:02 am