tv Worldwide Exchange CNBC April 19, 2024 5:00am-6:00am EDT

5:00 am

it is 5:00 a.m. at cnbc global headquarters. i'm frank holland. this is "worldwide exchange. we start with breaking news. israel carries out retaliation air strike against iran. we have a live report from the region coming up. global markets in shock as investors assess the risk premium and odds of furthe further escalation oil is spiking on what this latest attack means for the energy markets around the world.

5:01 am

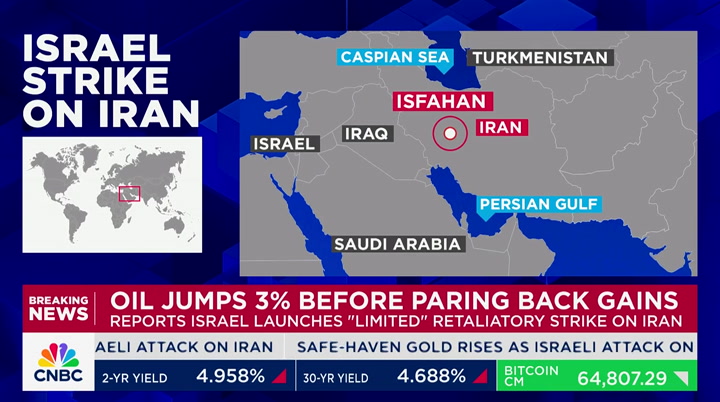

it is friday, april 19th, 2024 you are watching "worldwide exchange" here on cnbc good morning welcome to "worldwide exchange" live from cnbc london. thank you for being with us. we begin this morning with breaking news as we mentioned. israel retaliating against the drone and missile attack on its territory a week ago sources characterizing the strike to nbc news as limited with officials still assessing the damage and the effectiveness this morning it struck around isfahan air defense systems were engaged and nuclear sites in the region are safe nbc news' andrea mitchell reporting that the u.s. was not involved in the strike, but

5:02 am

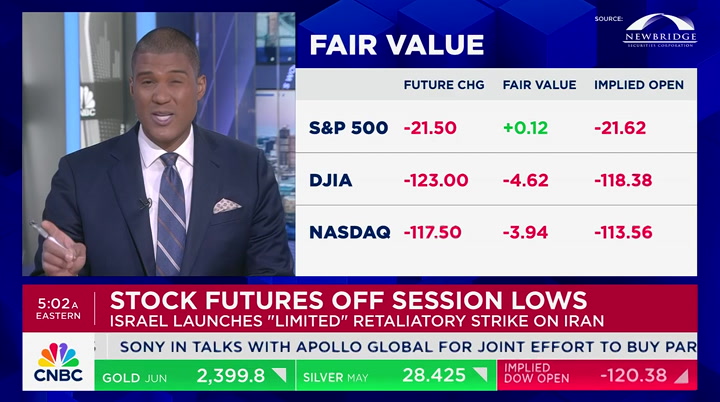

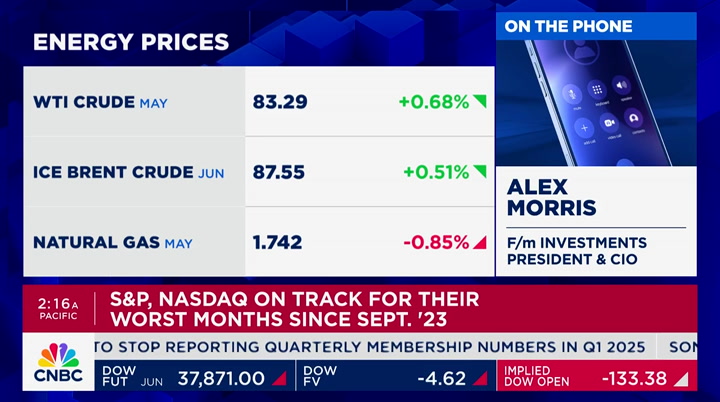

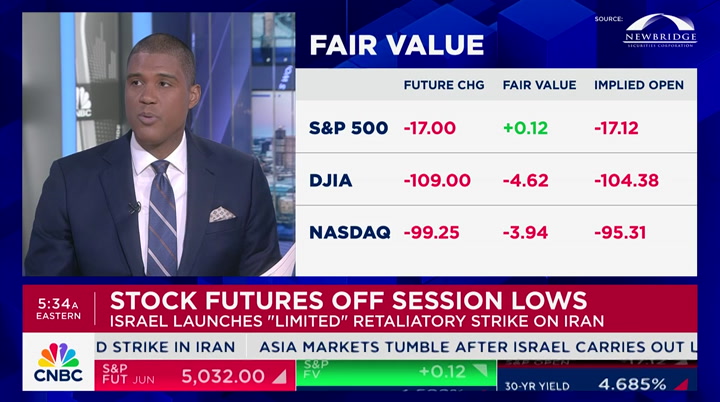

adding there was a p pre-notification to the united states from israel ahead of the attack investors are still trying to re review what it means for the conflict you see the s&p futures sinking at 10:00 p.m. when first reports of the strike started coming in. right now, futures are well off those session lows still deep in the red. we are taking a look at futures. the dow would open up 125 points lowe lower. nasdaq .75% lower. we see a similar reaction in treasuries ten-year bond yield at 4.58% you see the energy market here this morning which is trying to hold on to the gains we see from this morning wti right now is up .50%

5:03 am

it was 3% higher another commodity we are watching is gold which is holding below record highs hit after the attack gold is trading at $2,400 an ounce. it did move a bit higher than that after reports of the attack the spike on the chart right there after 10:00 p.m. we are looking at the crypto market and bitcoin in particular bitcoin is moving higher you see it is still higher trading at $64,700 bitcoin trades around the clock. we will continue to look at the global markets and moves on the reaction from the attack throughout the morning let's turn back to the middle east and closer check of the temperature in the region and energy market with dan murphy in dubai. dan, oil is pulling back from the highs, but wti and the u.s. benchmark over .50%. >> reporter: that's right, frank. oil prices rallied as much as 3%

5:04 am

in asia after it was confirmed israel carried out a limited strike against iran in the early hours of this morning. looking at the markets specifically here, crude stabilized and stocks came off session lows for several reasons. first of all, iran's oil structure and facilities do not appear to have been targeted here the iaea has confirmed there is no damage to iran nuclear facilities and no reports of major damage on the ground or casualties market investors see this as more of a symbolic attack that may not be the catalyst for iranian response another step-up in escalation or a wider regional conflict. analysts i have spoken to today is a it is going to be hard for tehran to find the justification to respond or escalate also, on the other side here, frank, israel is not appearing

5:05 am

to brace for retaliation it would appear the situation is stabilizing, but anything could happen at this point with that strike in the back drop, the political fallout also begins you mentioned that israel's prime minister benjamin netanyahu was informed here -- he informed the united states about the strike, but, frank, fair to say defied president biden. he was urged by the president to take the win after israel's successful defense on saturday, but chose not to as this exposes a wider rift in the israel and u.s. relationship. watch that space. >> the german defense minister also said israel should take what they call a defensive victory in that case i want to go back to the moves in the oil market. brent is $3 a barrel lower right

5:06 am

now. you and i were talking earlier and i was talking to an energy trader which believes oil could on the way to $100 a barrel. this is one factor if tensions escalate are you hearing about the reports in the strait of hormuz? >> reporter: exactly we are not just looking out to see if iran responds directly, but whether or not iranian proxies will respond to this that could mean ratcheting up tensions in the strait of hormuz where the houthis target and attack shipping vessels there. that could be a catalyst for aina leg higher in oil. frank, opec has ample spare capacity to act if necessary they could potentially unwind production cuts at more ply to the supply to the market the conversation you were having

5:07 am

earlier is critical, particularly with the inflation impact as well a lot of concern that higher oil, perhaps triple digit oil, could be a headache for the fed and other central bankers as a result >> dan murphy live in dubai. thank you. turning attention back to stocks and europe opening sharply lower. silvia amaro is here in london with me on the early action. we were on "street signs" earlier. we talkedabout the rise of oil and inflation impact and how this changes the impact for the ecb. >> we are two hours into the equity session in europe you see it is red across the board. all of the major boards are trading in the red i would highlight there are significant moves to the down side in italy and spain. there is a lot that traders are taking in at this stage. they are focusing on the developments in the middle east. let's not forget they are all

5:08 am

following what central bankers are saying as well as these latest reports from corporate. there's a lot in the minds of investors. i would highlight the ftse 100 down by .70% we got disappointing retail sales data for march earlier today. there is a lot to digest here. let's take you to the breakdown at this stage. we are seeing only a little bit of green when it comes to food and beverage stocks and telecoms the worst performer at this stage is retail which is down 1.5% we are also tracking closely what is happens when it comes t household goods like with l'oreal this morning let's not forget one of the dynamics for traders at this stage is we continue to hear from ecb officials positioning for the first rate cut in june

5:09 am

and at the same time, the fed officials pushing back against expectations of them going ahead with a rate cut in the summertime. >> so much to watch. silvia, thank you. turning attention to asia. a very rough picture there jp ong is standing by in singapore. jp >> reporter: good morning, frank. there were signs of the selloff subsiding in the afternoon session. by that time, it was too late. a sea of red from tokyo to t'aipei. the hang seng is not spared as well there were concerns in taiwan after the taiwan semiconductor with the mild chip recovery. it was all about the rise and risk-off sentiment with the escalating tensions in the middle east which weighed on stocks and drove investors to safe haven nikkei 225 is falling today and the flight to safety after the

5:10 am

japanese ten-year bond yields. these are safe havens in asia. look at how gold miners defied a lot of gold miners in sydney and they benefitted from the gold spot prices the singapore dollar is getting a benefit with the safe haven currency of choice they overcame early weakness in the session and ended with a little bit more solid footing. one sector to watch in asia is the airlines if oil continues to rise, that could mean higher fuel costs for carriers if the air strikes and the conflict in the middle east continues to escalate, it means a lot of the carriers have to r r reroute from here to europe. that may cause a cloud of

5:11 am

uncertainty. back to you, frank good morning >> jp, thank you very much for the report we very more to come on ""worldwide exchange," and including more on the israel strike on iran. and rising political risk. what you should be doing with your money this morning. and later, not for getting about big tech shares sinking despite the pop in stock we have a very busy hour when "worldwide exchange" returns stay with us i was on a work trip when the pulmonary embolism happened. but because i have 23andme, i was aware of that gene. that saved my life.

5:14 am

5:15 am

the israeli strike on iran is limited. we have not heard from the idf yet. we expect to hear from the secretary of state at 6:30 a.m. eastern time through the investor lens, how do you view this >> despite the fear that a lot of folks are living under right now, as a investor, this is something the market tends to shrug off. it doesn't fundamentally change the direction of the financial economy. like most global macro events, they make great headlines, but if you look at 10 or 15 trading days from now, the market tends to move on less volatility around oil and gold and handful of headline assets over the next day or so >> okay. you are hitting on my next question a spike in oil and gold being the highlight ones there is now the time to possibly

5:16 am

invest in the commodities with the expectations the tensions may rise or the sensitivity appears to have risen with oil jumping% 3%? >> you and i talked about gold last time we were together it makes sense to continue to hold on to that. oil, you know, that is a tough asset class to play. i think the trend has been to $100 a barrel and then some. i doubt $150 is our end barrier. this will continue to add to the strain which has been plaguing the oil supply for some time i don't think this is the one item that forces it through a breakout >> i want to stick on the oil theme for a minute oil is a factor that the ecb is weighing and the fed with inflation. what do you make of john williams saying it is not his

5:17 am

base case, but a rate hike with the oil markets? do you feel that is something that will possibly delay the ecb cut and fed cut further? >> i think it's a good factor to delay both ecb and the fed desires to cut rates i don't think it is the only factor it is a convenient one that will make folks understand what they're up to. there are other driving factors. in the u.s., likely housing and other inflationary measures beyond energy prices to force that cut to be held off until well into the year i wasn't in this camp three weeks ago, but maybe no cut at all this year, assuming they can find a way to stick the landing with their narrative >> alex morris, thank you very much >> thanks, frank ahead on "worldwide exchange," a big morning for big tech as netflix shares take a

5:18 am

hit despite the first quarter stock pop. and a look at europe and one-on-one withthe eu commissioner margrethe vestager. that's when "worldwide exchange" returns. oh, not the fries! where's the ball? -anybody see it? oh wait, there it is! -back into play and... aw no, it's in the water. wait a minute... -alligator. are you kidding me? you got to be kidding me. rolling towards the cup, and it's in the hole! what an impossible shot brought to you by comcast business. (grunting) at morgan stanley, old school hard work meets bold new thinking. (laughter) at 88 years old, we still see the world with the wonder of new eyes, helping you discover untapped possibilities

5:19 am

and relentlessly working with you to make them real. old school grit. new world ideas. morgan stanley. ♪♪ the road to opportunity. is often the road overlooked. at enterprise mobility, we guide companies to unique solutions, from our team of mobility experts. because we believe the more ways we all have to move forward the further we all go.

5:20 am

(grandpa vo) i'm the richest guy in the world. we all havhi baby!e forward (woman 1 vo) i have inherited the best traditions. (woman 2 vo) i have a great boss... it's me. (man 1 vo) i have people, people i can count on. (man 2 vo) i have time to give (grandma vo) and a million stories to share. (grandpa vo) if that's not rich, i don't know what is. (vo) the key to being rich is knowing what counts.

5:21 am

welcome back to "worldwide exchange." time for the big money movers like netflix investors are focussin insing o guidance steve kovach is here with more on the stock >> it is not because netflix beat expectations on the top and bottom lines blowing away expectations further on the sub des subscribers. the company will disclose less about subscribers next year. the momentum and growth cracking down on password sharing continues. don't judge netflix by the subscribers. the company will stop reporting quarterly numbers and average revenue per membership starting next year with the q1 2025

5:22 am

earnings report. it is also because there is a number of pricing plans and shared plans and ad supported tiers that mix up the picture. here is how greg peters explained it on the earnings call last night. >> each incremental member has a different business impact. all of that means is the simple math we did with the number of members times the monthly price is less accurate in capturing the state of the business. this change is motivated by wanting to focus on what we see are the key metrics that we think matter most to the business. >> that news appeared to drag the stock lower in after hours trading. down 3% overnight. guidance for the second quarter was lighter at $9.49 billion that is up 16%, but no guidance

5:23 am

on subscribers, frank. >> steve, thank you very much. i want to ask a question, but you told me you will not give me your password. i'll move on good to see you. let's bring in jason with citi good morning >> good morning, frank >> i want to talk about the reaction to the stock. your price target is 660 why is netflix stock down? the beat across the board. is that what is weighing on the stock or is it about disclosure the subscriber numbers and average revenue per user numbers? >> i think there are a couple of layers to this the context is the net adds have been strong and they are trying to figure out why it is so strong by pulling the subscriber guidance in the first quarter of the year, the issue is the strength is due to the password

5:24 am

sharing. the ad tier is not taking off. we will see password sharing fade and then there should be a baton that is passed to the ad tier, but if that is not going well, we will not give you subss ss sub disclosures. there is a bull case that netflix would flat line content spend at 17 billio$17 bill a lot of the bulls that were playing for that, they didn't hear that last night >> you are saying it is about disclosing the subscriber revenue numbers. it leads to the mystery of the success of the ad business >> yeah. if one of those -- the password crackdown is transitory. >> yeah.

5:25 am

one of the things of the risk of the company you are highlighting which is having a great year up 18% year to date is the inability to raise prices and competition from other players we heard of team ups from other streaming services the notable one is disney and espn however, i noticed and tell me if this is a big deal, revenue per user missed in every region except for the u.s how big of a risk is losing the pricing power? >> i would say that's not a super big deal, but a good observation. the united states is a unique market in every metric whether it is pay tv or advertising revenue which was a standout relative to the rest of the world. i think you will continue to see divergence with u.s. and canada trends and the rest of the world. astute observation >> jason, here is a yes or no.

5:26 am

jake paul and mike tyson is that a success >> yes >> one word answer you don't hear that often. jason, your price target for netflix is 8% upside thank you. coming up on "worldwide exchange," we lgo live to tel aviv and the latest on the israel retaliation strike on iran more "worldwide exchange" coming up after this

5:28 am

my name is oluseyi and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport.

5:29 am

it's 5:30 a.m. in the new york city area 10:30 indepe london. we are following breaking news israel launching retaliation strikes against iran we are on the ground in tel aviv with the latest. that development further rattling global markets adding risk to the wall of worry. futures are lower ahead of the open a different story for oil. spiking on the news. what this attack could mean for an elevated energy complex it is friday, april 19th, 2024 you are watching "worldwide exchange" here on cnbc

5:30 am

good morning welcome back to "worldwide exch exchange." i'm frank holland coming to you from london. breaking news. israel retaliating against the drone and missile attack on its territory almost one week ago. this morning, the wall street journal reporting that president biden is weighing more than $1 billion in new arms for israel raf sanchez is live in tel aviv with the latest on this developing story raf. >> reporter: frank, good morning. for a week now, the world has been waiting to see how israel would respond to the massive barrage of iranian drones and missiles this morning, we have an answer and it does not appear right now like we are hurdling toward further escalation. israel carried out a limited

5:31 am

strike in the early hours friday morning according to my source since then, they have been assessing the effectiveness of the strike and assessing the battle tdamage the damage is in isfahan we do not know how this strike is carried out or if it was aircraft or long-range missiles or smaller drones or not u.s. officials say the united states played no role in this attack they want the iranians to know that the u.s. also got a generalized heads up from the israelis that this strike was coming that was important, frank, because it gave american forces across the middle east time to make sure they were up and running in case iran or the proxies retaliated there are no reports of that at this point

5:32 am

frank, what is almost as important as the strike itself is what israel and iran a are saying about it. iranian is playing down what happened in isfahan. there are no reports of major damage they say the explosions that woke residents up were iranian air defense missiles going off and intercepting what they are calling small drones at this point, no one is o officially pointing the finger inside iran. there are no pledges against retaliation against iran the israeli government is not confirming or denying its role and they are certainly not crowing. frank. >> raf, you mentioned the reports from iran. you are on the ground in tel aviv what is the mood there

5:33 am

>> reporter: it is interesting, frank. it is quiet and calm we're here in central tel aviv israeli military has not imposed restrictions on the civilian population that is different from the situation over the weekend when the military said people should not gather in large groups. they canceled summer camps and schools because of that. there is no new restrictions and that suggests that israel is not bracing for retaliation. we are not expecting to hear any speeches from prime minister netanyahu or senior israeli officials commenting on the attack the official line is israel is not confirming or denying. inside the netanyahu government, we are seeing mixed reactions. the center right says israel restored deterrents.

5:34 am

>> we are expecting to hear from antony blinken at 6:30 a.m raf, this is a developing story. you and your crew stay safe. thank you. we are digging into the market action of the conflict. we will show you this in a second the s&p futures sunk around 10:0 p.m. when the first reports of the strikes started coming in. you see the move to the down side futures are in the red right now, but still as we will show you, they are well off the lows. dow opening up 100 points lower. s&p and nasdaq in the red. nasdaq harder hit. that may be off with the netflix results. we saw similar reaction in the treasuries ten-year bond yield is off from the lows the benchmark trading at 4.58% we are looking at energy as well oil in particular. oil is trying to hold on to gains. oil spiked 3% after the reports

5:35 am

of the attack. right now, it is normalizing wti up .50% trading at $83.20 a barrel similar story for gold which is holding below the record highs gold crossed the $2,400. it pulled back from that look at the chart. the spike into the safe haven asset after 10:00 and dpgold and other commodities. whipsaw action with bitcoin. bitcoin is moving higher right now up 2%. you see the move down at 10:00 where people were selling off bitcoin. it dropped to $61,000. it is $64,000. you see bitcoin moving up over 2% turning attention back to oil. wti and brent spiking on word of israel carrying out strikes on iran and both pulling back after

5:36 am

the pop. brent crude support .50% wti up over .50% let's bring in amrita sen this morning. good to have you here, amrita. >> good morning. twice in a week. >> i got to see you in person. let's get down to business for a second oil markets spiked 3%. they pulled back a bit right now. is the oil market responding to what they believe is a deescalation do they believe this issue has quote/unquote resolved as iran tried to say now israel has made the moves? is something else pulling back >> i think the spike was on headlines. you always tend to get that reaction you are right with our view being we don't think this will escalate out of hand yes, israel will respond, but in

5:37 am

the terms of the weighted response, this is the message with the iranian leadership stating should we choose to attack, we can this is a warning sign more than anything else. that's what we expected them to do a calibrated response. it is not to escalate further. that risk is still there i don't think the market can afford to sell off significantly. look, on the fundamental basis, we have been calling for a pull back in the near term. it is a softer period seasonally we had a premature rally we need to rebase before we focus in the summer with over 2 million barrels of stock draws >> amrita, you are calling for a pull back. i had a guest calling for $100 a barrel earlier today he is citing iranian proxies stepping up attacks in the

5:38 am

strait of hormuz it would lead to an oil rally with that being cut off. you don't see that with the strait of hormuz >> i don't think we see the strait of hormuz being a risk. iran uses the strait to sell their oil over 1 million barrels per day to china they would be necessarily harming themselves if the situation were to escalate, of course, we can hit triple digits. we can't rule out the possibility of miscalcmiscalculn small pull backs will be supported, but generally speaking, the market realizes we are not going to be losing oil and gas supplies with the seasonal weaker fundamental back drop and it is more likely than not going up maybe we drift lower. >> amrita sen, great to see you. oil prices are pulling back right now. brent crude up .13%.

5:39 am

5:41 am

5:42 am

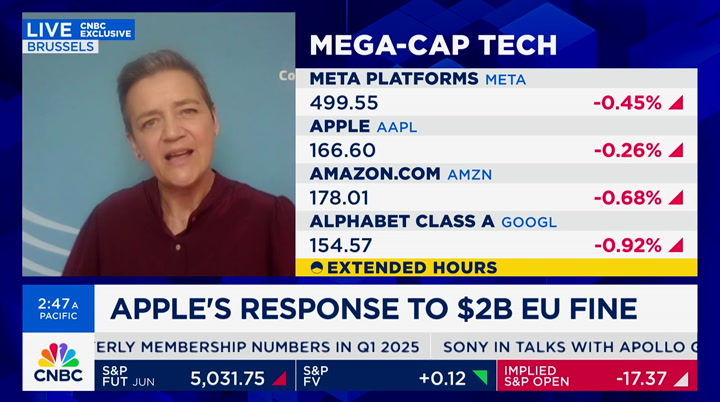

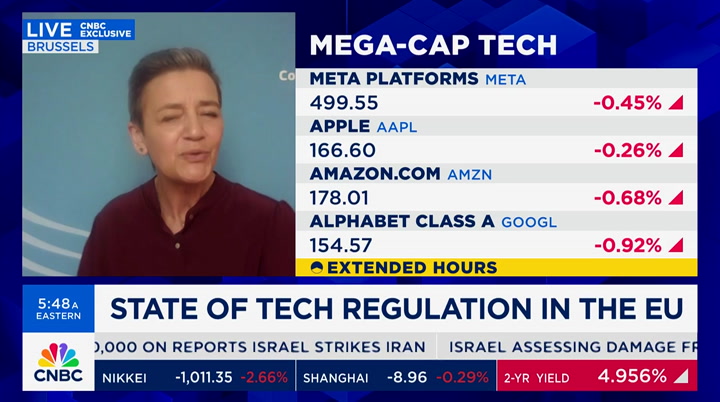

welcome back to "worldwide exchange." turn to tech and the developing story. eu regulators pushing back on the report they concluded the microsoft investment into openai is not an acquisition. officials tell cnbc the probe is still ongoing and may review the oversight. joining me now is margrethe vestager good morning it is great to have you here i hope i said your name right. >> good morning. it's great to see you.

5:43 am

thank you very much for the effort in having such an unpronounceable name thank you very much. >> a great name. i want to get down to business this is the first time we had the opportunity to speak with you since the u.s. doepartment f justice brought the case against apple. we heard them talk about the app store and the color of messaging bubbles. what did you make of that? >> i think it is a very important case i think it is very important that anti-trust authorities do their job in order to have fair competition in everything dig digital. in the u.s. as well as europe, we have sparkling innovation in the ecosystems it is important that they can get to their customers by a second app store or side loading so they are enabled because real competition comes in the open market

5:44 am

that is what the u.s. case is about and this is what our case is about >> do you agree that apple has a monopoly on the smartphone market that was the headline with the doj case >> of course, i have not had a chance and it is not my responsibility to go into the details of the case. we see very different and very separate markets when it comes to smartphones very high-end and expensive phone is not in the same market as the very affordable cheaper phone. one should be nuanced when it comes to comparing phones. those in the market for very high end and not in the market for a number of other phones >> okay. i want to talk about the digital markets act. you are investigating apple and other big tech players google and meta included in

5:45 am

relation to the compliance can you share an update? >> we have the suspicion these companies are not living up to their obligations. they play an important role in the market if they close the market, no other business has a fair chance of getting to the customers. for instance, when it comes to the preference, if you get a google search and you go to google flight, there may be other service providers who are better inning providing services to you same with amazon make sure you see all of the amazing offers that independent sellers have on the platform lastly, can you go to another app store if you are not happy do you prefer to have a game app store with secure apps or do you have an app store where

5:46 am

people can feel what they are offered is safe? quite a number of issues where we want full see there are diffs with the way businesses relate to us. >> you know, the word compliance stuck out in what you had to say. apple is still not following the update following the spotify update what happens if they are not in compliance >> this is top priority because it is about our choice as consumers. you can choose to pay within the app or system and pay 30% surcharge for that, but it should be possible for you to have a direct relationship with your service provider and pay the price they are asking without the 30% apple service fee. it is a high priority for us to

5:47 am

get apple to comply with this and we are investigating this as a high priority. >> with so much going on in the global economy, i want your broad sense of big tech and a.i. what regulation are you looking at here and what do you think needs to be done going forward you are an influencing voice with big tech regulation what are the big issues? >> well, you know, we now have an a.i. act that kicks in full within 6, 18 and 24 months right here and now, we are asking a.i. providers to be prep prudent. this is an election year we need to know when a.i. enters that space that content can be recognized and deep fakes can be

5:48 am

dealt with because, if not, the integrity of the elections are at risk. some talk about the existential risk for humanity which is important. there are existential risks for each of us if the algorithm doesn't work if you are not accepted to university or you cannot get a mortgage or insurance your car that is essential for each of us that is the first port to call to make sure that when a.i. is used in that kind of risky use case, that withe have a close g on it. if it is used to recommend the system or bots for customer service, that's a different matter >> you know, while we're talking about a.i., i want to come full si circle the with microsoft's investment with openai how are you viewing the

5:49 am

investigation? >> we are not done of course, our concern is if deals are constructed in a way where one tries to avoid merger control and there is a de facto change of control and one has constructed a deal in the way so we don't need to spend time with any regulator on this planet that is important for us because we are there in order to make sure the market is open and competitors have a fair chance of making it that is why it is important and we discussed with colleagues how they see this way of supporting a company if that is something we should look at here we keep it open, but of course, intensify because we he ne need make conclusions >> margrethe vestager, thank you. >> pleasure to be here

5:50 am

thank you for having me. >> thank you coming up on "worldwide exchange," more on the breaking news of israel strikes on iran and what you need to do with your money with the rising tensions right now, the dow would open about 100 points lowlower. we will continue to tch wathe futures this morning we will be right back after this break. my brother max recommended you. so, my best friend sophie says you've been a huge help. at ameriprise financial, more than 9 out of 10 of our clients are likely to recommend us. our neighbors, the garcía's, love working with you. because the advice we give is personalized, -hey, john reese, jr. -how's your father doing? to help reach your goals with confidence. my sister's told me so much about you. that's why it's more than advice worth listening to. it's advice worth talking about. ameriprise financial.

5:53 am

welcome back. time to get the check of the stories with the "wex wrap-up. shares of netflix fell on the mixed outlook and announced plans to stop reporting subscriber numbers next year shares are down 6% kb homes with $1 billion in shares and raising company's quarterly dividend to 25 cents a share from 20 cents. the stock is moving higher up 1%. apple revealing it removed whatsapp store in china. it was ordered to do so over national security concerns breaking news. israel carried out retaliation

5:54 am

strikes in response to the drone and missile attack on its territory almost one week ago. sources are saying the early morning strike as limited with officials assessing the damage and effectiveness this morning no comment from the idf at this hour looking at the market reaction you see the dow would open up over 100 points lower. nasdaq under pressure as well. joining me now is kari firestone from aureus asset management >> nice to see you, frank. >> what do you make of the reaction right now again, futures are lower, but pulling back from steeper lows earlier right after the attacks. >> frank, i think it is a sign of the level of the reaction it was as israel characterized it as a weak response.

5:55 am

it was not an all-out military effort i think the market should feel relieved about that. the market is jittery, which is my word, and very concerned about the escalation of the war between israel and iran. for israel to have essentially detonated iran's military action and now whatever has happened here has not resulted in much destruction, if anything, because it is not reported yet, is a good sign for the world and the market >> okay. tech has been under pressure it seems like it started when we saw a thing now when it comes to the fed rate cuts. i know you are watching one stock that you say is the most important one in the market. nvidia tech nically in correction territory. what does it say to you about the broader market >> the market has been following

5:56 am

nvidia more or less. we were up 27% from late october until april 1st. that was drive n by a.i. march. nvidia is the leader of the march. with nvidia weakening and it grew to the third largest market cap company in the world up to over 5% market cap is a sign we are calming down the euphoria. i know it is phenomenal for nvidia you cannot have forward march without recognizing that the rest of artificial intelligence has not been one of profit making as it is for nvidia nvidia sells the chips everyone else buys the chips for a slowing down here is a sign the rest of the market has to regroup. >> so much to talk about, but i cannot leave without your "wex" word of the day.

5:57 am

what is it >> that word is jittery. i gave it to you yesterday today is another example the market and investors are waiting to find out if we he have good earnings the market is up multiples are up we have to have earnings that justify the price of the stocks. market is worried about interest rates. >> kari, great to see you. thank you very much. we have to leave it there. "squawk bo ix"s coming up next thank you for watching have a great weekend

5:58 am

my name is oluseyi and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport.

5:59 am

breaking overnight israel launching a limited strike against iran. we will bring you the live report from the middle east. dow futures dropping 300 points on the news and crude prices jumping, but both have moderated. we will show you what is moving right now. netflix shares are tumbling despite the blowout quarter for subscriber growth.

6:00 am

it is april 19th, 2024 and "squawk box" begins right now. good morning welcome to "squawk box" here on cnbc we are live from the nasdaq market site in times square. i'm andrew ross sorkin along with melissa lee joe and becky are off today. as we mentioned, breaking news overnight. israel carrying out a narrow strike against iran. it is assessing the effectiveness and damage caused. the action appears to be limited to avoid escalation. we saw the markets move down we are looking at the dow which is off 30 points it was worse before. nasdaq down 108 points s&p off 20 points. we

35 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11