tv Street Signs CNBC April 19, 2024 4:00am-5:00am EDT

4:00 am

4:01 am

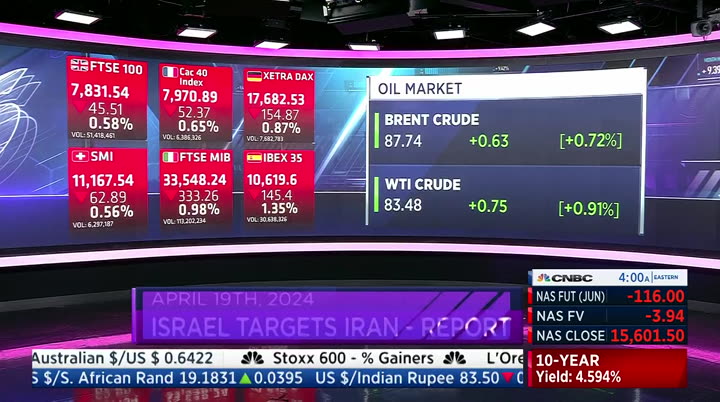

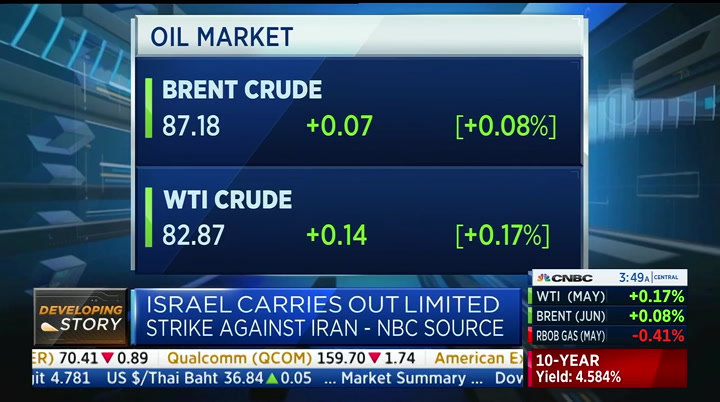

>> we are now confident enough >> we really need bad news to cut. >> i'm focused on june. worth it l'oreal trading near the top of the stoxx 600 after beating first quarter expectations and netflix slips in extended trade despite beating on the top and bottom line as the streamer said it will stop reporting subscriber numbers next year. we start the show with the developing story israel carried out a limited strike against riran overnight iranian state tv reported three drones shot down in the sky. so far, no damage is being reported in isfahan.

4:02 am

our dan murphy is in dubai with this story >> reporter: frank, good morning. the information is fluid this situation will not mark the start of the upcycle or a wider re regional conflict. we heard there is no damage to the iran nuclear facilities as well as the iran oil structures are not targeted there have been no reports of major damage or critically any casualties rather, this israeli strike is out out outside isfahan. we have seen the response where oil prices were up 3% on the headline they have come off session highs and at the same time, we are

4:03 am

seeing money flowing back into the risk assets. the question now is ultimately, does tehran has a desire to respond at this point? the initial reaction we hear from the sources inside iran is they do not intend to rehe tall y retaliate. the language is notes es c esa tore right now israel is not bracing for retaliation. what this means for prime minister netanyahu remains to be seen there is reporting suggesting that far right members of his cabinet have been disappointed with the strike on iran. perhaps suggesting it has not

4:04 am

gone far enough. of course, we have to wait to see the political fallout moving forward. also, i wanted to flag, frank, if you haven't heard, israel's strike happened on the birthday of iran's supreme leader >> thank you for latest. i want to take you to the markets. we have to do with an additional degree of caution. naturally, as we monitor the latest in the middle east as dan pointed out there and we have to remember there are several dynamics in the market i want to stress before i take you into further details in the market, i want to stress what we know and don't know at this stage. what we know is that israel carried out a limited strike and i stress the word limited strike against iran the other developments important

4:05 am

for the markets is we heard the international atomic energy agency saying there is no damage to the nuclear sites we don't know any casualties at this point ulti ultimately, we don't know the answer we will see from iran at this stage with that in mind, we have the stoxx 600 at this stage down by almost .70%. this is to some extent continuing the negative mood we had seen so far. to give you an idea, as of yesterday's close, the stoxx 600 was on track to end the week down by 1.1% as i mentioned, it is not good the geopolitics, but the comments stateside for the potential of higher rates for longer and the earnings season with all of that context in mind, let me show you how

4:06 am

individual boards are trading. we have the major boards trading in the red at this stage you have the german index down .90%. more pronounced moves to the down side in spain i'll take you to the ftse 100. currently down .60%. worth keeping in had mind the cpi data we got in was above expectations we will have retail sales data which was disappointed the sectors at this stage in the trading session with food and beverage up .60% basically, no moves at this stages when it comes to household goods. this is one of the sectors we are tracking closely today off the back of the announcement

4:07 am

from l'oreal i'll have more details from charlotte later on in the show and autos are down 1.4% and industrials are tracking similar moves as industrials we have announcement from schneider electric as well this morning. with that, let's look at the bond market. it is not gjust about the geopolitics, but we have the bund lower at 2.4% early this week, it did hit 2.5% threshold. in the uk, we have that moving lower at 4.25% frank. >> let's welcome in daniel locke. good to have you here today. >> good morning. >> in your notes to us, one of

4:08 am

the things you flagged is concerns over oil. after the limited strikes by israel and we don't have all of the information. we are waiting for more information to come. i'm seeing brent at $2 lower than friday. what do you make of the moves in the oil market and how does that impact the economy >> two stages to it. first, we really emphasize the unsafe world we're living in today. the dynamics toward on-shoring and tight supply chains and spending this is the structure impediment with the physical ex-pen difficult tour this is putting pressure on yields when you get the events overnight, you get a flight to quality. that provides a bid to bonds we have to handle that dynamic

4:09 am

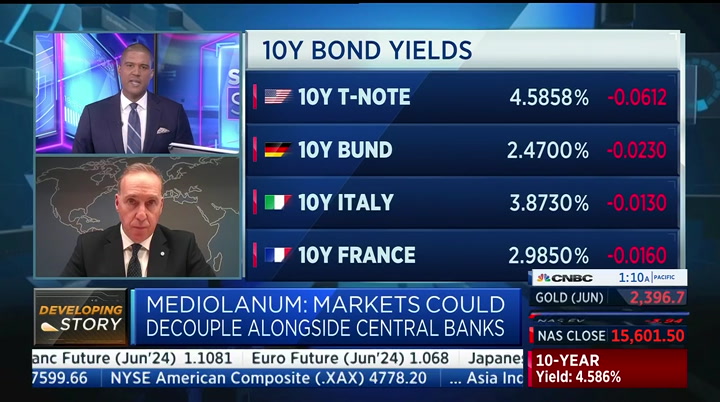

the structure pressure on the yields versus the near-term bid to bonds from these events. >> a lot of questions to be answered here and the u.s. secretary of state will speak at 6:30 eastern time. we have to wait and see what the u.s. has to say. i want to go back to what you are talking about with the upward moves with bonds. one of the things you are concerned about is the ecb and the decoupling that is a term we use for china and europe or u.s. and europe. what is the big deal if the two banks decouple and why are you concerned about the short end of the bond curve >> it is more a concern in the states and constructive view in europe clearly, over time, you see a strong correlation with the likes of u.s. treasuries and bond markets in general. there are at times when this

4:10 am

correlation breaks down and since most recently in 2014 and 2017 with the correlation moving away from .8% to minus .8% if you focus on the u.s. and you will be bear iish on the back of the data if you look at europe, you have a constructive story there the disflinflation is still at play. >> daniel, you seem to say there is a shock to the global markets on the short end of the curve. does it make sense for the two banks to decouple? >> 100% agree. lagarde has em phasized that. she emphasized it is a different economy. made reference to physical policy and the consumer behaved

4:11 am

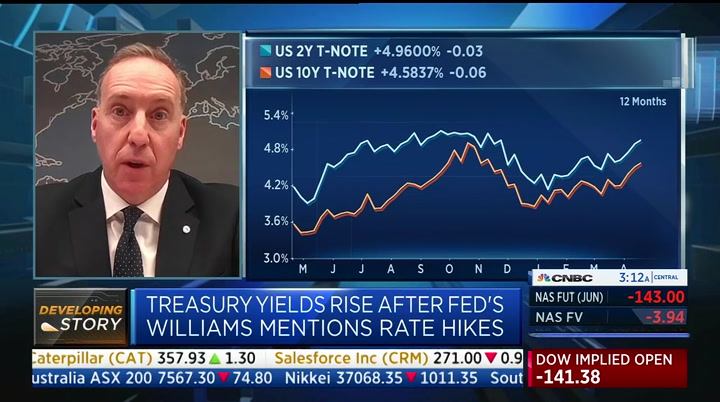

differently. it is important you get a decoupling in europe, bond yields are ham strung by the u.s. if the ecb and bank of england has made similar moves and articulate the differences with europe and the u.s., that gives european bonds better opportunity to decouple and provide stimulus that europe requires with the weak economic growth and low inflation rate. >> daniel, yesterday, we heard from the new york fed president making comments there is no rush to cut rates on top of that, suggesting that if inflation were to increase once again that the central bank should be prepared to hike rates. mentioning the word hike is interesting. we have projections from lagarde that we will see the yield reaching 5% on the ten-year yield. how likely is that given this

4:12 am

commentary from the fed? >> it is feasible. we touched 4.7%. it is feasible given the information on the data coming out of the states. we don't see it going further beyond that. the cost of funding for the u.s. fed federal deficit is high and getting higher that isa concern among central banks and politicians about the cost of funding any further north than 5%. that's why we need to see decoupling between europe and the u.s. european rates need to be much lower, particularly at the short end. that's why we see the widening spread with the u.s. treasuries and european bonds. >> let's bring the conversation to the uk. we are also monitoring what the bank of england is saying and similarly to the united states, there's an upcoming general election we know when it will take place.

4:13 am

how do you think about the vote and commentary from the bank of england and what it means for the bond market? >> in terms of the election. the election has not been talked about that much because both looking to the the approach. normally, the labour party is a concern for the labor market with more aggressive fiscal policy the ability for the chancellor who is more to the right of the labour party would be a safe pair of hands and given the likelihood labour is going to win the election with the polling, that is calming markets somewhat that nuance is more how they use the physical pie for instance. they will probably raise on the

4:14 am

private education. things like that politically motivated. it's a fiscal size between both parties. >> you know, we are talking about the overall dynamics with the decoupling between the fed and the ecb. what about the fed and the bank of england >> similar decoupling going on just somewhere in the middle of the two. in terms of two or three monthsing ago, an important shift from bailey moving from the hawkish rhetoric to the dovish rhetoric. the mps decided to go neutral. the shift towards the more

4:15 am

dovish bank. a similar story where inflation in the uk is going to be 2% or be low 2% in the next two or three months that is quite significant. with that drop, it would be difficult for the bank to hold steady for far too long. bailey mentioned it is more dangerous to wait than to act soon if we don't get a move in june, i think the probabilities are around 30% to 40% in the uk. it is likely that the bank will cut in august with the current information. that is the way it is being guided >> we will see what happens. daniel loughney. t the finance minister says it is important the government learns from the collapse of credit suisse and telling cnbc it is important to come up with legislation. karen asked if ubs is now too

4:16 am

big to regulate. >> it is important to take the right measures you cannot prevent every crisis. it is just not possible. if you have a crisis, you areviw it and you see it doesn't comply with the measures or respect the measures you have taken earlier. what i want to say is there is a difference or there are differences between crises it is difficult to regulate cane the situation and we really try to propose the measures that are necessary so that resolveability is really possible >> you can understand regulators being concerned about the risk now that ubs poses is there a balance about

4:17 am

ensuring it is not overregulated so it can still grow from here >> this is always a risk in every crisis in bank or the pandemic or other situations where really governments are surprised or measures have to be taken and urgent measures. this is a bit of a risk of a crisis that as a consequence measures are taken >> a note that ubs will be reporting in early may we will see what they have to say about the too big to fail report. coming up on the show, l'oreal posts a pretty start to the new year with q1 sales rising almost 10%. we'll bring you more after this break.

4:18 am

4:19 am

that's why i chose shipstation shipstation helps manage orders reduce shipping costs and print out shipping labels it's my secret ingredient shipstation the number 1 choice of online sellers and wolfgang puck go to shipstation.com/tv and get 2 months free my name is oluseyi and some of my and wol favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport.

4:20 am

4:21 am

journal" reported the deal the discussions remain in the preliminary stage. shares of schneider electric down 1.5%. essilorrluxottica showing north american sales disappointed with the weak demand in the sunglasses category sodexo confirms revenue growth at the top of the 2024 range. it will prepare athletes meals to the games for the boost of the fourth quarter revenue man group assets rose 5% in the first quarter driven by the strong performance of the investments and flow into the top performing funds the fund jumped $8 billion in

4:22 am

the period i told you about the company at the start of the show let's look at what we heard from l'oreal. the company beat expectations in the first quarter posting a bigger than expected 9.4% rise in the first quarter sales on the like for like basis. the french cosmetic group has had strong demand. charlotte is joining us with more details on the story. charlotte, what else did we learn from the results >> what is interesting from l'oreal is we heard the same thing from the luxury players. a soft demand from lux ury and softness in china. up 1.8% like for like. that is the difference between l'oreal after the pandemic and the boom with the largest

4:23 am

division no more. now the other brands with back to being on top with the growth of 11.1% people are downgrading lipstick they are buying. still the leadeipstick effect, not the most luxury brand. this is helping them offset softness in the market you said the products which were smaller for them is up 22% continuing the run they had quarter after quarter for that section there out of l'oreal they say q2 will be softer and the big numbers in q1. they see acceleration coming back in the second half of the

4:24 am

year interesting with estee lauder was up after the numbers from l'oreal. reassures an reassurance with te market >> we were talking about other brands and how china was seeing a softer demand there, but we are seeing a pick up in europe and north america. did l'oreal give any indication of the future of sales in china? is this likely to be a very important part of the market for them >> they are waiting for the rebound. like everybody, they see the demand hasn't come back as strong as they were hoping the beauty market was up 1% in china in q1. sales up 6%. the they are doing better in the market the ceo was in china recently and everything they want to do is boost demand. they hope that things will bear

4:25 am

fruit later in the year. certainly, we see europe and north america is helping. >> i want to talk about l'oreal lex company. i want to ask about it i was surprised. i wasn't aware they made fragrances for yves st. laurent. we saw travel retail being a boost. was it a boost for l'oreal or has that led to the softness with the luxury offerings. you go to the airports and you see the brands everywhere in the duty free. >> fragrance is doing well they have the license for val valentino and prada. they said fragrance is doing well at the moment people are changing their habits they wear perfume every day rather than special occasion

4:26 am

they have a different perfume for every occasion there were reports with the middle east group about taking that which they did not comment, but they said igh-end fragranc is seeing strong growth. >> all right charlotte with the report on l'oreal. l'oreal shares up 5% thank you. coming up on the show, the german finance minister rpushin back on the debt issues. we will hear more on that interview with karen coming up after this break and literally fill out each person's name on a label and now with shipstation we are shipping 500 beauty boxes a month it takes less than 5 minutes for me to get all of my labels and get beauty in the hands of women who are battling cancer so much quicker

4:27 am

shipstation the #1 choice of online sellers go to shipstation.com/tv and get 2 months free what is cirkul? cirkul is the fuel you need to take flight. cirkul is your frosted treat with a sweet kick of confidence. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul is your gateway back home. so

4:28 am

4:29 am

4:30 am

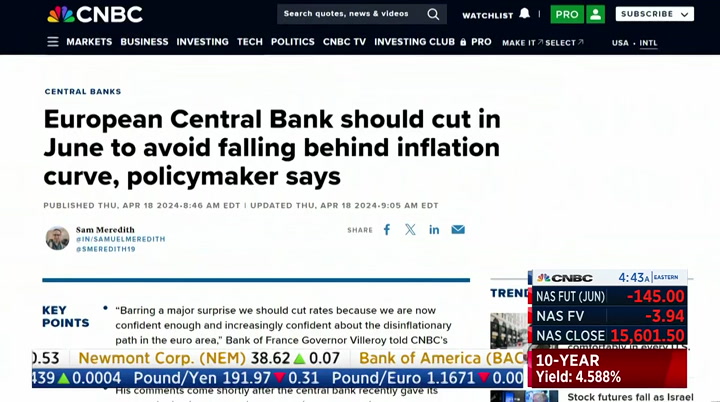

meetings representatives say it takes a lot to derail that move. >> i think we should cut rates because we are now confident enough >> let me put it this way, we need really bad news for not cutting in june. >> focused on june as the month to cut. worth it l'oreal bucks wider sentiment to trade at the top of the stoxx 600 after beating first quarter expectations. netflix extending declines before the bell despite beating on the top and bottom lines as the streamer says will stop reporting subscriber numbers after next year. welcome back to "street signs. i want to take a step back and assess what is the narrative in the markets this week. we started on monday with three main themes for the markets.

4:31 am

it was geopolitics and higher rates in the united states and earnings then the narrative around geopolitics dissipated throughout the week and that is one of the main focuses for investors understanding what is happening in the middle east to recap what we do know at this stage is israel carried out a limited strike against iran and the iaea confirmed there is no damage on iran's nuclear sites this is an important point for the markets regarding all of the other questions remain unanswered with all this mind, i want to take you to the picture in the european markets we are seeing the ftse 100 down ..5%. we he ge got the cpi print thats

4:32 am

better than what they were expecting. we will see retail sales today that is the element that investors are keeping into mind when thinking about the ftse 100. looking at the fx market this is important to see the comments from the central banks. euro/dollar is flat at this point. sterling is flat at this stage as well. yesterday, i want to point out the fed the policymakers suggest if inflation moves in the opposite direction, they will have to start reconsidering hiking as well for the time being, that is not the main case. they are also saying they are not in a rush to cut rates when it comes to european bond yields, we have all of the major yields moving lower at this stage. i would point out that the benchmark here in europe, the german ten-year bund yield at

4:33 am

2.4% moving away from the six-we're h week high earlier this week. when it comes to the u.s. futures, this is what we are expecting for wall street. we have the implied open suggesting it will be basically a negative start to the session on wall street i would highlight that this was also some of the sentiment that we had seen stateside yesterday with the focus on the tech sector just to keep in mind, the tech sector is down 4.3%. let's see what moves we get stateside today. no doubt, one of the main sectors we are watching with the u.s. market. frank. shifting focus from the u.s. markets to the european economy, we have christian lindner pushing back the debt brake is getting in the way of the investment physical investment is near an

4:34 am

all o all-time high. karen spoke with him at the imf meetings and spoke about the growth being fragile >> the german economy has substance, but we have a competitiveness. in 2024, germany was ranked sixth in the global competitive and now we are seeing a decline and now 22nd this is why we have supply side structure reforms and less red tape we are investing our energy system and taxation. >> is the debt brake in germany in the way of investing in the future preventing you of achieving economic security? >> no, it is not we are investing on the all-time high there is no leg of public sector funding for the infrastructure

4:35 am

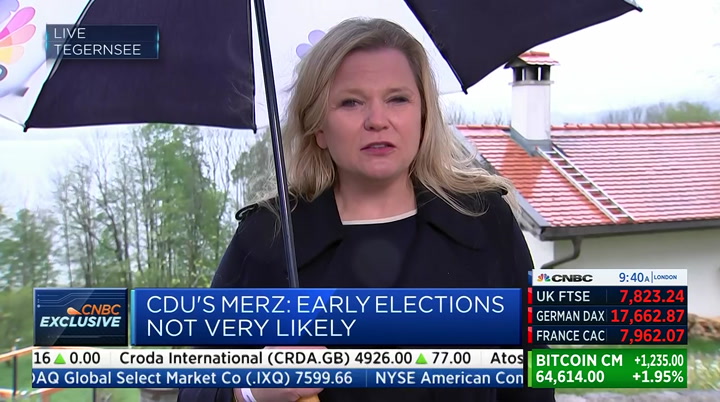

the imf experts look at mu multi-annual average and have not yet acknowledged over the last couple of years the amount of public sector investment is much higher. as the debt brake of our constitution maintains sound public finances given the situation in the u.s. where we see deficits in the budget to pay subsidies to private enven enterprises can lead to higher inflation rate this is not only due to the monetary policy of the ecb, but as a result of the moderate structure. >> the annual summit is under way. it is a gather of germany's

4:36 am

opinion leaders across business and politics a annette is joining us with more. >> reporter: thank you so much this is the mini summit in germany. this is the who's who of the political spheres coming to the location here in tegernsee the mood is sober with the economic conditions the country is in. germany is the laggard among industrial nations because of the lack of reforms and too high of labor costs and twists of recent years of the ruling coalition with energy laws and regulation and essentially aiming at giving investors security about rules which might

4:37 am

last longer than two-to-three years. this is germans disgruntled with the government i caught up with the chairman here on the ground in tegernsee to discuss what needs to be done in the country and how he will enact the changes in case he would be the next chancellor take a listen. >> short-term, we should stop to increase our terrible bureaucracy. every week, the german bureaucracy is rising. we should stop that immediately. second point is labor costs are still too high every week the government is making decisions to raise labor cost again the third point is the energy costs are still too high there could be measures implemented to reduce energy

4:38 am

costs. last, but not least, the taxes for companies in germany, corporate taxes are still compared to international competition, too high. these are the four measures which could be taken immediately to put more initiatives and some more growth potential into our economy. >> it's tough to push through the measures depending on the part you are getting let's look at the energy point of view. that's is clearly one of the major concerns do you see there is a risk of the industrialization if you talk to people and companies >> this will not happen sharply from one day to the other. the capital stock is shrinking we are saying outflows of capital from germany now in the third year in a row. it was in 2022 more than $100 billion. in 2023, again, more than $100

4:39 am

billion. leaving germany. that trend is continuing in 2024 we have to do something about that and we have to become more attractive for investment from outside and keep companies in germany and give them perspectives to grow. >> as i was saying before, if there was a snap election today, the cdu's merz's party would reach 30% to 35% that is is not enough. he needs a partner the yquestion is who is the partner at the next elections. having said that, there is talk about the elections on the grouped. ground. we heard this government will not last until the end of the period which is september of next year. he was sitting on the panel and saying this loud in the public i guess the budget talks over

4:40 am

the summer period will be crucial. that could be the event which could trigger the liberals to walk away from the coalition to give them another year to recover from that grueling and bruising three-way coalition which led to drop in the opinion polls for the parties. the gathering here, i would say, in a nutshell, there is a growing momentum of reform in germany and probably there will be enough momentum after the next election to push through the pain thful reforms for soci. >> thank you very clear in the upcoming european elections in early june. june is still the month on the lips of the investors when the ecb could cut rates.

4:41 am

karen asked if the french governor had been keeping the door open for a cut at this meeting. >> it is the question of the next governing council which is in june. by the way, it will be the 80th anniversary of d-day by chance i think we should cut rates because we are now confident enough and increasingly confident about the inflation path >> what could get in the way of the june cut which is teed up and further rate cuts? is it wages or oil or geopolitical shocks? what are the wild cards? >> i said a major surprise by definition, you don't know what a major surprise would be today, i think it is a pla plaue

4:42 am

scenario >> when it comes to other central bank comments, the belgium national bank president struck a different tone. >> we need bad news for not cutting in june. >> what could the bad news look like >> the read on inflation maybe on the geopolitical front maybe oil prices spiking the basis is we cut in june. >> karen also spoke to their counterparts from lithuania, latvia anid malta. >> we enter the less restrictive monetary policy. june is the month everybody agrees it is a good placeto start >> we have to wait and see it is not guaranteed

4:43 am

i think the probability is quite high we have seen quite strong disinflation process we are by and large along the forecast barring any major surprises, though there could be some, we retain cautiousness. >> the question he is if you are always scared with risks that you wait to cut. that was in. one could have cut rates way back in march. i think june is the most probable >> karen has spoken with the whole council of the ecb for more on the interviews, check out cnbc.com coming up on the show, netflix beats first quarter earnings estimates we will discuss why next when we started our business we were paying an arm and a leg for postage.

4:44 am

i remember setting up shipstation. one or two clicks and everything was up and running. i was printing out labels and saving money. shipstation saves us so much time. it makes it really easy and seamless. pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers. go to shipstation.com/tv and get 2 months free. ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com. what is cirkul? cirkul is the fuel you need to take

4:45 am

flight. cirkul is your frosted treat with a sweet kick of confidence. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul is your gateway back home. so what is cirkul? it's your water, your way. cirkul, available at walmart and drinkcirkul.com. her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under

4:46 am

a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. welcome back netflix smashed first quarter earnings estimates with a 16%

4:47 am

surge in subscribers after the crackdown on password sharing. shares, as you can see, are extending losses in the pre-market after the company said it will no longer provide quarterly updates on subscriber numbers and instead focus on revenue and operating margin steve kovach has more. >> beating on the top and bottom lines and plowblowing away expectations shares fell after the company said it would disclose less data about subscribers starting next year as further result of the quarter, the crackdown on password sharing continues eps was $5.28 against the $4.52 the street was looking for subscriber adds were the beat.

4:48 am

9.33 million new adds. don't get used to judging netflix by subscribers the company will stop reporting subscriber numbers starting next year with the q1 2025 earnings report revenue and engagement are better metrics of success. also because of the variety of plans and ad support tiers that netflix offers as for guidance, revenue was lighter at $9.49 billion that is up 16 puer% for a year o i'm steve kovach we started the show with the developing story a source speaking to nbc news, israel carried out a strike

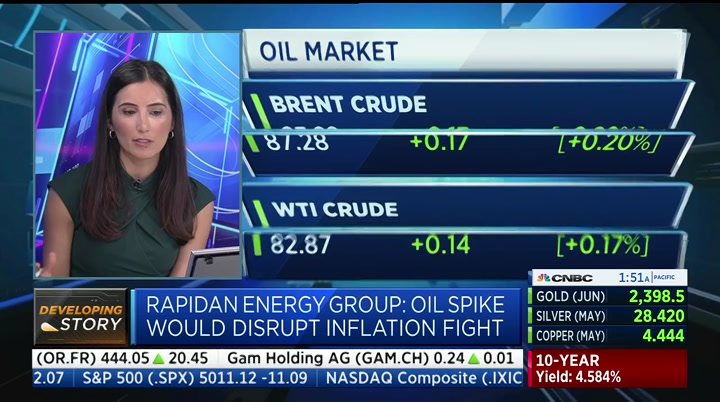

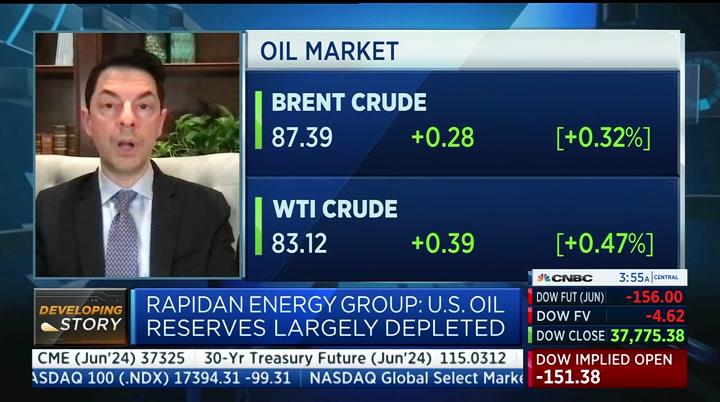

4:49 am

against iran overnight this is in retaliation to the drones and missiles that israel launched last saturday night three drones were shot down in the sky over the city of isfahan with no damage oil surprises have reacted off the back of the earlier reports. we are seeing muted moves. we are seeing some of those initial concerns rehe ceding as investors are stepping back to see what happened and we know there has been a limited strike by israel against iran and the iaea reported there is no damage to the iran's nuclear sites. two important confirmations there, but a lot of questions remaining which are yet to be answered i want to discuss in more detail what is happening in the oil market and i'm pleased to say the director of global oil at

4:50 am

rapid energy group joins us now. first and foremost, i like to get your thoughts of what is happening in the oil market. we have concerns dissipating for the time being what do you make of the moves? >> silvia, it is good to be with you. really, it is remarkable in a space of less than a week with the current conflict in the middle east has reached a precarious inflation point it seems israel has responded to last sunday's iranian attack with some attack of its own on iranian soil we are really moving into a new phase. these sides have been fighting a shadow proxy war for a long time they he they are drifting in a state on

4:51 am

state war. that oil flow is responsible for 21 million barrels per day if you think about food, oil and refined products the market is trying to figure out if the conflict is going to intensify and risk the arabian gulf to the world markets or a chance for the sides to back down and deescalate. >> i want your thoughts on the level of oil prices we may see we saw prices hitting the $90 mark off the back of the latest developments is this the level we are going to be looking at in the near future >> well, we believe we are likely to see oil prices move higher as the market continues to price the prospect of the disruption of supplies it doesn't have to be all 21 million barrels of oil a day or all 11 of lng.

4:52 am

even a smaller disruption would impact the supply/demand balance of the market. traders are trying to anticipate what amount of supply coming off the market and for how long. prices will continue to creep higher as the geopolitical risk factor is baked into expectations if we do have a serious disruption from the arabian gulf, we could see triple digit oil prices that are similar to the levels we saw in 2022 after russia invaded ukraine where you get to a level where only a demand curtailment for transportation fuels and economic recession come into play >> clay, you say we could be on the path to $100 a barrel oil. brent got up to $90 earlier. it seems like the oil market has decided this is not that big of a deal with so many questions

4:53 am

left to beed with the secretary of state speaking later this morning >> you know, everyone, including traders, had to put on their geopolitical risk analyst hat and ascertain the dynamic events in near real-time. you will see oil prices tick hire on the potential of the conflict getting worse if it looks like the latest move is limited and we believe the governments on both sides still want to try to find a way to deescalate, then it is possible that those upward price moves will be limited. we really need to wait and see the next moves by both governments and find out if the situation is going to escalate

4:54 am

to compromise oil supplies or if things could move into a more stable situation and allow diplomacy to take effect >> we are focusing on the middle east governments i want to broaden this out ecb and christine lagarde mentioning oil is the thing they are watching with the rate cuts. rise of oil is a factor for the u.s. fed oil has been range bound we have seen a rise this year, but range bound at the same time how much are you forecasting how much is depending on the cuts from the ecb or fed it doesn't seen geopolitical issues are a catalyst for oil recently. >> the issue is the pace of demand growth. we believe that is continuing to grow year on year. we think about 1.5 million barrels per day this year versus last year. it is growing in the non-developing economies and it is growing in developed

4:55 am

economies like the united states that is powering the general price direction we have for oil away from the geopolitical events it is true that non-opec supply is added to the market that makes opec and opec plus decision making challenging because on one hand, they want market stability they want to see inventories at reasonable levels. we expect that group to basically roll-o over the curre supply policy when the ministers meet in june when it comes to inflation, the main thing to keep your eye on is the cost of transportation fuels. in the united states, politicians really look at the national average pump price in the united states which got all the way up to $5 in 2022 we are still below the $4 a

4:56 am

gallon mark. in the recent cpi, prices were the single factor. >> this is an important moment we have to leave it there. clay seigler from rapidan energy group. let's look at futures ahead of the open in the u.s the implied open suggests it will be a negative start on wall street this continuing some of the moves we have seen already yesterday. a lot of focus on the tech sector, frank, which closed down by 4% for the week yesterday >> a lot of focus on the tech sector we will cover that and more on "worldwide exchange" coming up that is it for today's show. i'm frank holland with silvia amaro. "worldwide exchange" is coming up next. switch to shopify and sell smarter at every stage of your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every

4:57 am

sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify. what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. hi. i'm wolfgang puck when i started my online store wolfgang puck home i knew there would be a lot of orders to fill and i wanted them to ship out fast that's why i chose shipstation shipstation helps manage orders reduce shipping costs and print out shipping labels it's my secret ingredient shipstation the number 1 choice of online sellers and wolfgang puck go to shipstation.com/tv and get 2 months free

4:58 am

4:59 am

helps millions of people put food on the table. when people are fed, futures are nourished. join the movement to end hunger and together we can open endless possibilities for people to thrive. visit feedingamerica.org/actnow my name is oluseyi and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport.

5:00 am

it is 5:00 a.m. at cnbc global headquarters. i'm frank holland. this is "worldwide exchange. we start with breaking news. israel carries out retaliation air strike against iran. we have a live report from the region coming up. global markets in shock as investors assess the risk premium and odds of furthe further escalation oil is spiking on what this latest attack means for the energy markets a

13 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11