tv Fast Money CNBC April 18, 2024 5:00pm-6:00pm EDT

5:00 pm

continue to look like in addition to inflationary environment, dare i call it still, even though we know it's sticky right now we'll have to see. commodities have been one to watch, too just given what we're seeing on the industrial side of the economy. continue to watch that, as well. >> i don't use a lot of shampoo. i don't know why i think of that >> that's going to do it for us here at "overtime. >> "fast money" starts now live from the nasdaq market site in the heart of new york city's times square, this is "fast money. here's what's on tap tonight netflix gets chilled the streaming giant adding more than twice as many subscribers as expected, so why are shares dropping we'll look for some answers. plus, a date with destiny. last week, we brought you an interview with the founder of the destiny tech 100, a new closed-end fund that lets retail investors get in on private companies. we're digging in. and later, tesla tests the key $150 level wells fargo hits a more than two-year high.

5:01 pm

and united air keeps flying higher we have all the trades coming up i'm melissa lee, coming to you live from studio b at the nasdaq we start off with netflix's volatile moves after announcing it will stop reporting subscriber numbers and average revenue per viewer on a qua quarterly basis. they did beat top and bottom line estimates the conference call is under way. steve kovach has been listening in >> a little more color on the call from that decision to stop reporting subscribers, but first, let's go over the big results. netflix beating expectations again. and just blowing away expectations on those subscriber additions. the momentum and growth from cracking down on password sharing continues. subscriber ads came in at 9.33 million. that was compared to the just 4.5 million the street was expecting. but don't get too used to judging netflix by subscribers they are going to stop reporting

5:02 pm

the numbers and average revenue per membership starting next year with its first quarter 2025 earnings report. netflix's reasoning for that it says revenue and engagement are better metrics of success, not the number of subscribers. because of the variety of pricing plans, ad-supported tiers it offers now. as for guidance, revenue for the second quarter was a hair lighter than expectations, $9.49 billion, that would be up about 16% compared to the year ago quarter. we're about 15 minutes into the call a little more commentary on the subscriber disclosures there the co-ceo basically saying, you can no longer multiple the cost of subscription by the numbers of subscribers because of so many plans, it is better to look at engagement and just overall revenue, melissa >> all right, steve, thank you steve kovach it does make sense here, and on the second quarter revenue number, we were expecting a decline because of typical seasonality, but this was still worse than had been expected

5:03 pm

>> it was a miss it was a miss for a company that's been, let's be clear, i'm sure katie has a great view on the charts, great having you, that doubled in four months. a stock that's done not a whole lot going into those numbers, it's been kind of flat it's still a cash flow kind of machine relative to the other media stocks out there valuation, we've talked about this all the time. probably grown into a growthier valuation, and when i look at their international opportunities and the critical mass they have, and we talk all the time about structurally, wh they may be more efficient in terms of their content creation, and why they're model works, so, i -- look, we've all grappled and gotten snarky on different reports requirements, who changed kind of the rules of the game, who changed the metrics we look at. even apple apple was doing this so, i'm not too bothered by it, but i'm not a netflix analyst day by day >> whenever something changes in the metrics, you think they're hiding something i think that's what the analyst community always thinks. but tim mentioned revenue. they make more than all the others lose combined

5:04 pm

that's a huge number for them. so, there's still the mainstay, there's still the elephant in the room, if you will. i want to know password sharing. how far along are they on password sharing, what's the percentage of it, are they almost done there, what do they have left? and the ad tier, that has not rolled out through all the different segments password sharing has so, that would be what i would be concerned about >> ad-based subscriptions was, like, 65%, so, that's something that i think folks were initially kind of -- i don't know, not that optimistic about, it's a very high margin business, especially if you are capturing people that were using multiple passwords and the like. that represented 40% of all new net ads, so, that's good stuff there. margin improvement is impressive if you think about it, year over year, there's an easy comp versus last q-1 or so, but up 35% expected from this year in earnings, i15% expected sales growth, we talk about stocks,

5:05 pm

they have a peg that looks a little bit off, and then if you look at it versus a multiple of sales -- >> explain peg >> it's a pe to growth, dan. >> no, but it's -- >> because you are -- >> you can be the peg guy now. it's a great metric and i'm not messing with you i barely knew what peg -- >> it's funny, we talked about how inexpensive netflix got when it declined 75% from -- i think a lot of us on the desk bought that stock down there in the hole it gets a little harder up here, but on a peg basis, it looks fairly reasonable for a company growing like this. >> how do the charts look? >> it's outperformed pretty consistently since 2022, and i think a pull-back or a correction would be welcomed in this name. it has outperformed and it has that momentum longer term. it could even honestly fill that cap from january, which would mean -- and this would require weaker tape than we even have right now, but that would be a move down to about 500 for

5:06 pm

netflix. i think that would be bought up right away >> you know, one thing, and i think kovach just said this, they're explaining the change in the metrics, because they have lots of different plans, we talked a few weeks ago about some of the stuff they're doing in live. so, this summer, they're going to have this fight with mike tyson and one of the logan guys, and it's going to be a live, you know, kind of -- can you imagine what the subscriptions, we're talking about, they just beat 9.5 on a 5 million estimate. into that, you might see a huge runup, you might see a huge runup in ad base >> just for this one fight >> well, think about that event. it's only going to be on netflix. >> and it's really interesting for their advertising revenue stream, which, so far, has been nothing, but i think it will be something. and i think that's one of the drivers of, a catalyst or at least a fundamental part of the netflix story that the analyst community hasn't really been able to do much. where do we get from, you know, crawling to actually walking or whatever sequence we want to do

5:07 pm

there. i also think, what inning are we in terms of paid sharing it's hard to really know if we're halfway through this -- >> crackdown >> yeah, and again, i read a bunch of the street over the last couple days into these numbers, i think it's very mixed. i think people think they're very early in the paid sharing dynamic. >> yeah, yeah. who are the logan brothers it's jake paul >> jake paul, whatever logan paul is one of them. i just -- isn't logan paul one of these guys? >> he's -- >> one guy against -- >> he's in wwe >> if you are some kid, you've been on your parents' thing, you are going to figure out how to scrub scrubscribe and probably forget how to cancel it. >> isn't part of the story the weakness of the others we've seen more and more, underscored by every comment that paramount makes, disney makes, disney said, we're going to try to be number two, and to

5:08 pm

dasz password crackdowns just like netflix >>. >> they've actually given you visibility -- >> steve, you had something to say? >> she was pointing at you, i'll wait for you to finish we're on the air for another 53 minutes, so i better have something to say >> i could take for 53 minutes straight >> as we know. >> somebody help me out here no, i actually think the operating margin, which they set for 24%, they set the bar a little bit high and i think that's part of the reason why the expectations were so high. >> disney is definitely the second player, so, if there's anyone that's going to make it, it's disney. i think we should be talking more about netflix now as far as when they're going to increase pricing. because now you have that ad tier, so, it gives them a little bit of a buffer, where if you want to have a cheaper account, it's ad tier you want to pay, they have the unlimited to go to the upside. >> katie, the gap from last quarter, it went from just below

5:09 pm

500, up to 550 and then it just kept on going. >> didn't look back. a strong tape at the time. >> if you were to say, wouldn't 550, 590 in the aftermarket, 5% pull-back in the s&p turns to 10%, the stock could be down at 550, testing that gap. and i think we all sound fairly positive on the fundamental setup here, would that be a good level, you think -- >> it depends, i think on the top-down influences. so, we're expecting an oversold bounce, and i don't think netflix will be excluded from that, especially if it gaps down storm, and that 550 -- the gap has support at the upper boundary and the lower boundary, so, my playbook would be for a bounce off that upper boundary, perhaps, and then something that goes for a retest and maybe fills that gap so, a short-term buyer might benefit from it, but maybe an intermediate term -- >> 500 >> i wouldn't roll it out. it really depends. >> one thing out of the earnings

5:10 pm

is they increase their credit facility to 3 billion from 1 billion. that's kind of -- >> what does that mean >> right so, once upon a time, that was part of the netflix bear case, they're spending money, they're levered up i don't know if that enters the picture at all right now or if now is the time to spend money now that they're in the pole possession in the streaming wars now is the time to push them more out in front of the rest? >> i wouldn't take that approach if you are already winning, you don't have to exacerbate it by spending more money, giving less metrics. i think that's not a winning scenario to up your spending and give less data, i don't think is a recipe for success >> yeah, that balance sheet is pristine you make the great point, we were really worried about how much they were spending on all that content, if they were going to be able to monetize it, how long they were going to have the cash flow losses it was a big suck. and i remember -- >> a big what? >> remember, they would guide to -- >> what does that stand for? >> it's not like peg >> suck. >> i was talking about --

5:11 pm

>> no, on the sentiment of the story. sucking enthusiasm out of it or whatever now, if you look at this thing, it's got a $260 billion -- and it's going down right now, and they have, you know, $7.5 billion in cash, they generate a lot of cash, they have $14 billion in debt, and look at disney's balance sheet it's a disaster. there's a $200 billion equity, they have cash, but $47 billion in debt, we know where that domes from, so, like, when you think about how they might be limited in content going forward, i mean, netflix seems like a good spot >> i don't think they would be open -- it's hard to know if credit facility could be inferred to have some greater strategic thought around it. and we've asked, often, when is netflix possibly going to do something more aggressive orin gaming or other parts of the sports word. they're not locking into a traditional, you know, a professional sports league and signing on for the long haul there, but it's interesting. you know, why they're adding to a credit facility at a time when they are generating more free

5:12 pm

cash flow. i think the gaming world is still wide open for netflix and with the engagement they have, and the subs they have, and the global reach they have, i think that moves the needle. >> we'll get more with rich greenfield later on in the show. in the meantime, the dow eeking out a gain, while the s&p and nasdaq down. the chip stocks continue to get checked with taiwan semi and micron leading the group's losses today the smh etf has underperformed by 8% since hitting a record in early march. so, where are stocks going from here of course we'll turn to katie for that what do you see? >> well, you know, the semis tend to exhibit upside leadership during strong tapes and downside leadership during weak tapes it's somewhat concerning from, i'd say, more of a short to intermediate term perspective. we've seen a very good run from the major indices, from the

5:13 pm

semiconductor benchmarks and stocks so, to see retracement is healthy. and i think this is the beginning of something a bit more significant that said, with this five-day plus downdraft, we have oversold readings and market breadth that we haven't seen in a long time, based on something called the mcclelland or sill lay tour. what we've seen is getting a little overdone, right so, we should have some kind of relief rally, and that might be something that people will sell into and then becomes a corrective phase we are coming into the may period, and if you look at things like the vix, and other metrics that measure market sentiment, the vix has kind of turned the corner, it's coming off of its lows, it's been in this low volatility cycle for a long time, so, we feel the

5:14 pm

sentiment has shifted meaningfully there's another index called the fear and greed index that had been at these extremely greedy levels, which is contrarian for the market so, that's what we think needs to be alleviated the only way to do that is either through sideways prolonged action or a proper corrective phase, so, to get to that oversold sentiment data, we need a little bit more from the market >> in terms of the oversold condition, acthat's for the broader indices, does that apply to smh and the individual components like an nvidia, i mean, smh and nvidia are in corrective phases right now. >> that's right. so, we would expect tech and the megacaps including nvidia to do best in the very near term during an oversold bounce. but it's super top-down when this happens when the market gets more fearful, they -- it sort of throws all the stocks in together, and they treat them all as a group or as an asset class. so, it makes more sense when

5:15 pm

you're thinking about getting hedged, your exposure, or reducing exposure, you may want to reduce more on the opportunistic, higher beta names, but to just get hedged from a top-down perspective, maybe using inverse etfs, something of that nature, usually that's the best way to navigate it, based on scrutinizing the individual conditions >> when you look at cta accounts, they've xexhausted, too, to the downside the only thing i'm bearish about is that we usually don't test the 50 and not test the 100 or the 200. now, the 200 is at 4670ish, thereabouts. i'm looking for a test of the 200-day, so, that bounce could be faded and then we wind up there anyway >> yeah, and there's a breakout point of roughly 4810, right that's where the s&p 500 reached a new all-time high above that level. former resistance often becomes support going forward.

5:16 pm

it also happens to be very close to a retracement level in the chart, so, that 4810 to about 4820 is a significant level, it would be great to see the market hold up there. it's not very far from current levels, but if we do see a good bounce, which we're looking for, then maybe we're talking 8% to 10%. >> how do the technicals line up with what we're hearing from the fed and the fed more recently? kashkari was saying the fed may not cut until next year. and williams just today said, you know, it's not his base case scenario there would be a rate hike, but if the data warrants it, that's what we'll do >> that's a great point, because the fundamentals are driving the technicals, even though the technical folks -- do you refer to this as funny-mentals, as carter does? >> no, no. >> you have a case where higher rates have injected more volatility into the markets, but the levels, in terms of the peak of the semiconductors, they were

5:17 pm

inspired by those nvidia 4q numbers released in february and the market gapped up to that semis have come all the way down to the top of that gap, so, they have given a lot back. if you look at the nasdaq, so, if you are following qqqs, on a relative basis to the s&p, they're flat from october 16th, which was that big market pivot day. so, the leadership that you want to see from the market, we haven't really had it. i think it also comes -- there's a lot of different things, steve talks about ctas, and maybe that helps you if you think about things that are oversold basically adding up their shorts and their longs, you know, they're -- they're at, you know, 90th percentile. the bottom line is, i think people are still very complacent on where risk could be >> it's interesting, katie, you mentioned the 4800 level, that was the prior high, 4600, we sold off in just we get back to probably that 4600 range, a bit oversold there, that would be a 12% peak

5:18 pm

to trough decline. last year, we had 11%. every year, we pretty much have a 10%. >> and i think we're better served focusing on the indicators during a corrective phase as opposed to levels you can use levels as a gauge of risk, but it's when we see the oversold indication and then we see stabilization, we call it support discovery, that's enough to lead to upturns in those indicators, that's where we feel we have opportunity. to melissa's question on yields, really, you know, we do actually have a short-term breakout in yields, but at the tsame time, w have a sign of upside exhaustion, so, we're looking for a two-week pull-back in the yields, and that would align with an oversold bounce in equities, but then for it to roll over again in equities and then maybe one more push higher, maybe not all the way to 5% resistance, but somewhere closer to it. coming up, tiktok nearing midnight as law makers speed up the clock. the risks facing closed end funds, and fast movers catching

5:19 pm

our trader's attention. but first, tesla's stall continues, as more analysts unplug from the ev maker where wall street sees risk, and where the stock might be able to find some support next don't go anywhere. "fast money" is back in two. this is "fast money" with this is "fast money" with melissa lee, right here on cnbc. go deeper with thinkorswim: our award-wining trading platforms. unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly. [♪♪] your skin is ever-changing, take care of it with gold bond's age renew formulations

5:20 pm

of 7 moisturizers and 3 vitamins. for all your skins, gold bond. awkward question... is there going to be anything left... —left over? —yeah. oh, absolutely. (inner monologue) my kids don't know what they want. you know who knows what she wants? me! i want a massage, in amalfi, from someone named giancarlo. and i didn't live in that shoebox for years. not just— with empower, we get all of our financial questions answered. so you don't have to worry. i guess i'll get the caviar... just kidding. join 18 million americans and take control of your financial future with a real time dashboard and real live conversations. empower. what's next.

5:22 pm

welcome back tesla hitting a new 52-week low today. the move coming after a longtime bull downgrading the stock to a hold and slashing his price target to 123 from 189 that is 18% lower from today's close. emanuel rosner had a buy rate, but after they canceled plans for the cheaper model 2 earlier this month, he sees more pressure on earnings for years to come. he makes the point if the company is going to shift to robo-taxi, that's a much sort of longer-term payoff, and who is going to own the stock in the meantime will there be a transition of ownership to investors who have a longer-term time horizon and that transition will be a painful one. >> well, there's no question it

5:23 pm

does seem to be now consensus, not only that folks are -- should be downgrading their price targets, but there's no real catalyst for tesla in the next 18 months and you're looking to end 25 before you start to see reacceleration and other dynamics has anybody confirmed wherever the model 2 -- >> it looks like they are going to cancel, but elon musk called the reuters report -- >> a lie >> or some other -- >> any other company ceo that says a report is a lie, we would say, okay, that's -- that report is not true, but for some reason, with musk, there is a doubt and a belief that the model 2 will be canceled >> the inference was that it's because there's a competitive landscape, especially in china, that it just doesn't make any sense right now, and if that's the case, well, first of all, we can already connect those dots we kind of know what's going on with china demand and the competitive landscape there, so -- i don't think it's cheap enough yet for value >> i think you've had incredible

5:24 pm

demand destruction. >> so, picking up on that model 2, if he commits to a model 2, the analyst community has seen that only as robo-taxi if he commits to a low price model 2, he gives a margin guidance on it, pricing guidance on it but this is definitely 30% elon musk, the board, and 70% demand destruction at this point. so, you've got to figure out what happens with full self-drive, is he going to be there, is he going to develop with tesla or not? but remember, the last time we flirted with 100, the stock shot up to 300, too >> if he doesn't get this, what is this, $60 billion or something like that, just to be clear, that would be a percentage of the current market cap. >> if he doesn't get $60 billion from what? >> the pay package >> okay. >> that's like 15% of the market cap right now. why would he deserve that? think about this we have been in a runaway bull market for basically 3 1/2 years, and this company has gone

5:25 pm

sideways to down, you know what you mean and really, off a lot of decisions that he has made himself, so -- it used to be that there's this big premium in the stock because of his presence you can say, why would this guy, that's a ceo of five different companies, why would he deserve that when they made -- >> if he stepped away, would -- >> it would get crushed immediately, but ultimately, if they put a real operator in there, like a tim cook or something like that, i'm just -- not tim cook, but a guy like tim cook -- >> somebody to focus on operations >> he's got his own failure going on right now >> katie, what is the next stop? >> it is long-term oversold, but the last time it happened, it took several months to come out of it. we want to see support discovery. there's minor support around 148. below that, we're talking about 102. so, let's make sure we have that support discovery and see the oversold and the reaction to it. coming up, we're keeping an eye on netflix that stock at session lows the conference call is about to wrap up. rich greenfield of light shed

5:26 pm

partners to lay out the headlines from the call. but first, how lawmakers are fast tracking a bill that could determine tiktok's fate. what it means for the app, and how chinese owner byte dance will respond that's next. you're watching "fast money," live from the nasdaq market site in times square. back right after this.

5:27 pm

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient. ♪ ("three little birds" by bob marley & the wailers) ♪ ♪♪ discover our newest resort sandals saint vincent and the grenadines, now open. visit sandals.com or call 1—800—sandals.

5:28 pm

5:29 pm

welcome back 0 "fast money." stocks losing steam late in the day. the dow managing a small gain, while the s&p and the nasdaq fell into the red. both with five-day losing streaks. shares of las vegas sands sinking after yesterday's earnings report. the company posting a top and bottom line beat, but numbers out of macao missed expectations. united airlines up at 6% today, nearly 24% since earnings just on tuesday. the airline delivering a strong forecast despite ongoing issues with boeing deliveries. and an e-commerce call out of morgan stanley. a pairs trade, double upgrading ebay while downgrading etsy. ebay up nearly 15% this year, while etsy is down 17% and shares of jabil down slightly afterhours. the company saying the ceo was placed on leave pending an investigation related to corporate policies that stock is down 2%.

5:30 pm

meantime, congress potentially fast-tracking a bill that would crack down on tiktok. the legislation requiring tiktok owner byte dance to sell the app or face a ban in the u.s. could be attached to an aid package for ukraine and israel for more on what this means to byte dance and the bill's chances in the house, let's get to cnbc's emily wilkins. what's the latest on this? >> hey, melissa. yeah, the legislation that could lead to a tiktok ban in the u.s. now has a new path to potential passage via the $95 billion foreign aid package the house is working on house lawmakers are debating this foreign aid package for ukraine, israel, the indo-pacific, but that funding could be accompanied by a number of other measures aimed at national security. and that includes that measure that would require tiktok to fully die vest from parent company byte dance attaching the tiktok bill to this larger funding package makes it more likely to pass the senate this would lengthen the amount of time that tiktok has to find a buyer to nine months, that's

5:31 pm

up to six months from the initial bill, and it could be as much of a year in the president decides to grant some additional time and that was one of the big concerns that's been pushed for by senator maria cantwell. she's working to update the bill in the senate. in a statement, she said she was pleased and extending the divestment period is necessary to ensure there's enough time for a new buyer to get a deal done meanwhile, tiktok is upping its lobbying efforts cnbc confirmed they are doubling their ad buys to $4.5 million, but of course for tiktok to have a shot, the house actually needs to move that foreign aid funding package. something speaker mike johnson is struggling to do here a small group of hard liner republicans is not only working to block the aid package, but threatened to oust johnson unless he adds border security provisions so, a lot of factors going back and forth here, but we're keeping a very close eye on that

5:32 pm

package and on tiktok. >> it seems like analysts, or washington analysts believe there's a decent chance more than 50% that it will pass what are washington observers saying about that? >> well, speaker johnson has made it very clear that he wants to get this passage done and look, there are the votes to do it. it's just a question of how johnson makes that work with the very, very their owe what jorty that he's got, and that's where you're seeing some headway when it comes to getting the bill to the floor, potentially having the votes. they're doing a lot of really wonky procedural stuff here trying to make that work but the fact that cantwell has signed off, she's a senator that was holding up a bit of the process on tiktok, so, the fact that she's come out with a green light means that as long as the house is able to get this done, the senate will likely take it up and be able to move that through with tiktok. >> all right, emily, thank you emily wilkins. we've seen two days of reaction from snap, we saw meta up with a

5:33 pm

pretty decent day, up day, considering the tape here. what do we think -- is there the impact >> pretty savvy move, this johnson, you know what i mean -- >> cram it in the aid package? >> listen, this thing has had so many different iterations, people within his own party, the way the dems turned on the tiktok thing, the republicans don't want the ukraine aid, in the house they're okay with some stuff, in the senate they're not. so, maybe we get all of it at once and listen, people don't seem too bothered by tiktok didn't know. a bunch of senators who don't even use it are more bothered by up >> one of the issues is just related -- the chinese embassy has approached the hill and basically indicated, this is a chinese company and you wouldn't be doing this to a company in any other, you know, with national origin some place else in the world, so, it is becoming political. it does seem that the diplomatic channels are trying -- >> the chinese embassy approached the hill in a way they weren't talking about tiktok and then they were

5:34 pm

referring to a chinese-owned company. i feel like at some point, you know, you get the outcome that we talk about in terms of the impact on american companies in china. coming up, all the headlines out of netflix's conference call rich green field has the latest from that call, and where he sees that stock heading next plus, destined for danger. be care frl. we will lay out the potential risks of closed-end funds like the destiny item 100 how the once soaring ne amhas fallen back down to earth. "fast money" is back in two. and relentlessly work with you to make them real.

5:35 pm

with schwab investing themes™, it's easy to invest in ideas you believe in. spot a trend in electric vehicles? have a passion for online gaming? or want to explore the space economy? choose from over 40 themes, each with up to 25 stocks identified by our unique algorithm. buy it as-is or customize to align with your goals. all at your fingertips. schwab investing themes. 40 customizable themes. up to 25 stocks in just a few clicks. ♪♪

5:37 pm

welcome back to "fast money. another check on netflix after earnings shares are down 4% just about 4%. the call just wrapping up. let's get details from lightshed partners rich greenfield rich, why is the stock lower, you think? >> you have a bunch of investors who are essentially panicking, worrying that no longer does closing subscriber numbers is basically speaking to the fact that subscriber growth is over this company has blown away expectations for subscriber grout over the last couple of quarters two of their biggest quarters ever, including the pandemic and i think people are just

5:38 pm

looking at next year, saying, they're not going to disclose subscriber numbers it actually reminds me, melissa, a few years ago, when they stopped disclosing subscriber guidance, and only guided to revenues, people worried that that was a sign of problems to come i think it's just investors digesting how this company positions itself financially, and people like to worry and look, this has been an incredible stock performance-wise, year to date and i think this is just people being worried that this is a negative data point. i don't think it actually will be, but that's the near term, knee-jerk reaction >> what do you make, or what's your take about the credit facility being increased to 3 billion from 1 what do you think they do with that, if anything? >> look, i think netflix is in an incredibly strong financial position you look at, you know, think about paramount plus, which has lost, you know, $5 billion, $6 billion, peacock that has lost $7 billion, disney, which has lost $8 billion, $9 billion, the

5:39 pm

losses have piled up everywhere. netflix is going to generate $6 billion of positive free cash flow for all the nonbelievers, or the haters that this was never going to turn into a real business, this business is gushing cash. and while everyone else in the industry is pulling back, spending less, cutting their marketing spend, cutting their program budget, i mean, you know, you can't even name a recent show on a paramount plus -- >> if they're pitting out cash, why do they need that? >> just flexibility. i wouldn't read too much into it >> not looking at a big acquisition or anything like that >> speechless. >> making acquisitions for a long time. >> you froze for a moment. >> sorry about that. sorry, traveling look, there is -- there's no need for an acquisition. i don't think there's an acquisition coming that's never been their playbook they have built this from scratch. could there be some small in

5:40 pm

interactive entertainment video g games? they've bought small ips they have bought ips small things i'd be very surprised if there was a major acquisition for netflix any time over the course of the next several years. >> rich, when we talk about the password sharing, what inning do you think we're in in that, and is the next leg now the ad base, which clears the deck for them to raise prices? >> look, the advertising business is still very early stage. they've been pretty blunt, and i think ted actually answered -- greg actually answered my question on the call today, that they're still seeing overall advertising supply outstripping demand they're growing so fast. they probably have 13 million ad-supported subscribers, probably 10 million in the u.s very healthy percentage of the u.s. business is ad supported. they're actually growing the amount of available slots faster than they're growing the ad

5:41 pm

business it's going to take time. it's not a long -- it's actually a great problem to have. it's bringing on more advertisers, getting people comfortable. that's where we're actually going to see it accelerate and as advertising accelerates, it gives them more capacity to actually raise the price of the non-advertiser, the ad-free product will go up in price, and so, i think all of this is leading to having more pricing power, ore the course of the next few years it takes time, but i think the ad product, you know, look at what's happening to linear tv. less and less viewership, more and more cord cutting. all of this is showing the need to be on netflix, prime video, all of these streaming platforms, advertisers are dying to be there, that's a big opportunity, and i think part of removing the subscriber guidance is really a shift, the growth is going to start to come from the revenue side, that's where they want to focus people >> just to be clear, though, rich, you mentioned accelerating

5:42 pm

rpu, but we're not going to get that number anymore, right >> ah, well, they're going to give you subscribers on an infrequent basis i don't know if that's every 50 million, i don't know what the mat rick is going to be. but clearly, the revenue growth, you know, people are -- we're still going to do the math, roughly estimating what it is. you just won't have all the pieces every quarter >> rich, thanks. good to see you. rich greenfield. lightshed partners so, as steve pointed out before, we wouldn't have to explain it anymore, because we're not going to talk about it >> tim, it's been nice knowing you on the show. you had a good run >> nothing left for me what's interesting about the comparison of netflix that i'm going to make to meta is that when meta started growing and moving, you know, in -- all of the generations that we thought they should not and basically needed to pull back and become the year of efficiency, the stock started rallying

5:43 pm

and there's an aa component to this but the metaverse was a big spend and something that bothered people. netflix generating free cash flow, giving some back to investors and showing that's all they want to do, i think can take the stock higher. coming up, potential risks of investing in closed-end funds. we'll look at what you can learn from the massive reversal in the destiny tech 100. and some key stocks catching our traders eyes how they're handling dr horton, wells fargo. that's straight ahead. "fast money" is back in two.

5:45 pm

5:46 pm

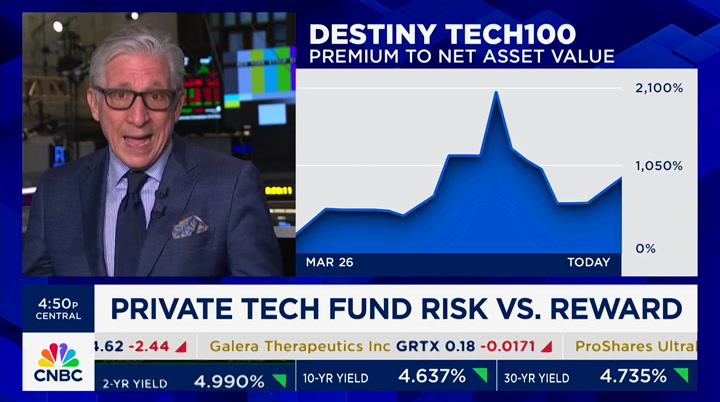

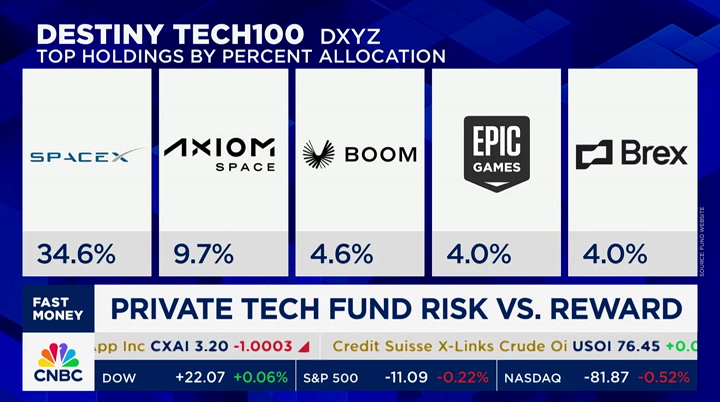

welcome back to "fast money. destiny tech 100, a closed-end fund allowing retail investors to put money into private companies, came out soaring. gained 1,200%, but it's fallen 70% from those highs last week, destiny's ceo joined us here on the desk, touting the product as a liquid and transparent way for individual investors to get in early on tech like ohpenai and spacex, bu that left us with more questions than answers, with shares trading at a steep premium to net asset value. let's try to get some answers now with bob pasani, he's been

5:47 pm

covering the world of funds for years here at cnbc >> this is a very good example of what happens when high demand meets very limited availability. so, this is a closed-end fund, and like all closed-end funds, it consists of a box of private tech companies like epic games, discord, stripe. like all closed-end funds, the fund has a limited number of shares that trade on the new york stock exchange. there's big retail interest in accessing shares of private companies like spacex, but because those shares are not publicly available, investors had bid up the price of the fund far beyond the total value of the fund's asset, as you mentioned, the net asset value or nad now, since it began trading, the fund's gob ne from a low of $8.5 to $105, it's not $31 and change however, asof december 31st,

5:48 pm

the net asset value of the securities was, you listening to this, $4.84 a share. with 10.8 million shares issued, the net assets of the firm is $52.6 million. but it's currently trading with a market cap of $342 million this fund is trading at a crazy high multiple, a premium to the value of the underlying shares its current price assumes, essentially, that the value of all the underlying shares, once they go public or are acquired, is more than six times their last valuation now, why would investors do this obviously, investors want to get into the private market for tech companies. even a very high cost is the big motivator here the fact, though, that there is a very limited supply of shares is also really the critical factor here. so, given the limited supply, and the intense investor demand, a company might rationally make a decision to float a lot more

5:49 pm

shares guess why? that's exactly what they're doing. the company filed a $1 billion stock offering this tuesday, that's not a typo, $1 billion, and melissa, what's going on here, of course, the imperfect structure of the closed-end fund with the premium-end discount. if you want to solve the problem, it would be great to have an exchange traded funds that held the underlying shares and you ccan trade it during th day. the problem is, you can't do that, because the underlying shares of these private companies are not liquid enough to enable an exchange traded fund to function and so, you have these imperfect vehicles like closed-end funds. it's just not a great way to deal with hot demand for these kinds of things. let's get them to go public. how about that idea? wouldn't that be nice? >>the person putting money into this, bob, they are also paying a lot -- i mean, it's a 2.5% fee. >> yes >> but if you are paying 2.5% on something that trades on such a

5:50 pm

premium, i don't want to say you're getting fleeced, but you're paying a lot to be in this for a net asset value of $52 million. >> right remember, this happened with the bitcoin fund awhile ago, too essentially, you have a box that holds bitcoin and charging 1.5% on top of that, and to trade it, of course, sometimes at premiums and sometimes at tremendous discounts. this is just very difficult. what happens when you have a company like spacex that sits out there and everybody wants to access it and they can't at the same time? this is the kind of thing that you get, and the imperfect system that we have, i wish there was a better way to do it. i just want companies to stop sitting there for years and years in the private market, not going public and we need to have more incentives for them to go public >> bob, thank you. >> okay. >> bob pisani with this one. the ceo, just two days after appearing on "fast money," sold shares, 200,000 shares for about $5 million so, he's been selling.

5:51 pm

>> yeah, that -- that bothers me the promotional nature of the marketing of this fund bothers me and the return profile of what you could get. what bothers me also is the stakes of the underlying companies are something you have to be very careful of. that an spd might own a piece of one of these private companies, and again, are there fees in that, and what's the real ownership of that? i just -- one of the things i brought up that night, i think it's what bob was saying, stru structuralally, this just doesn't make sense there's no way you can have a match of liquidity in private companies like this in a public vehicle. and it leaves you a closed-end fund there's an ocean preexpression,e these are roach motels >> i think people have to understand that a closed-end fund is not a liquid instrument. it's more lack of understanding what this -- what is this. and if he sold stock, it's a bad look it's -- if he's promotional and

5:52 pm

he sells stock, it's a bad look. the sec will decide if he broke any laws, i don't think -- >> we're not saying that he's broken any laws. >> i want to make sure we say it we're not saying he broke any laws it's a bad look to be promotional and then sell into it but there's plenty of ipos that fail you always have an instrument where you can always put calls in the end people have to know what they're buying >> don't go anywhere more "fast money" in two they rs with phone calls... and they don't 'circle back', they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team. let our expertise round out yours.

5:54 pm

it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

5:55 pm

welcome back to "fast money. dr horton rising nearly 6% after its highs of the day after posting about earnings beat. the company hiking its full-year revenue forecasting, saying the shortage of existing homes is bullish for new construction demand shares gave back most of the gape gaens, closing near the flat line how does this look, katie? >> all of the home builders have lost upside momentum so, to me, it's not terribly surprising that we saw dhi sold into that rally. and i would look for selling opportunities for now, at least. and look for better buy-in opportunity once they are more o oversold from an intermediate term perspective they've had such a good run, very good relative performance, so, i think this is a healthy phase. >> mortgage rates over 7% for the first time this year >> yeah, i mean, that -- and those are the same headlines that had the home builders, you know, 50% ago, so -- i just think -- the demand story, the fundamental story, why there's

5:56 pm

housing demand in this country and it's probably getting worse, i understand that, but the interest rate sensitivity, i'd be fading. >> yeah, you need -- you need to see the horizon where they're actually lowering rates. you will -- you will take a stance, you'll lift the leg on buying something, i know you don't know what that means -- >> whoa. >> doesn't sound good. >> when you do a two-part trade, you lift a leg -- >> a leg of a trade. >> exactly >> a leg of a trade. >> let's clarify that. >> tough visual on that. >> if you see rates coming down, you'll do something where you say, all right, i'll take a short-term mortgage for a longer term profit. >> all right >> glad we got to the bottom of that >> the more you know up next, final trades.

5:57 pm

5:58 pm

5:59 pm

6:00 pm

>> igv is following semis, probably risk to 75. >> steve grasso? >> the halving is upon us ibit >> katie, thank you for being with us. thank you for watching "fast money. "mad money" with jim cramer starts right now my mission is simple to make you money. i'm here to level the playing field for all investors. there's always a bull market somewhere and i promise to help you find it. "mad money" starts now hey, i'm cramer. welcome to "mad money. welcome to cramerica other people want to make friends. i'm just trying to save you a little money my job is not just to entertain but to explain this stuff. so call me at 1-800-743-cnbc tweet me @jimcramer. will you stop it already with the morning buying that is what i've been screaming lately right in the camera

22 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11