tv Power Lunch CNBC April 18, 2024 2:00pm-3:00pm EDT

2:00 pm

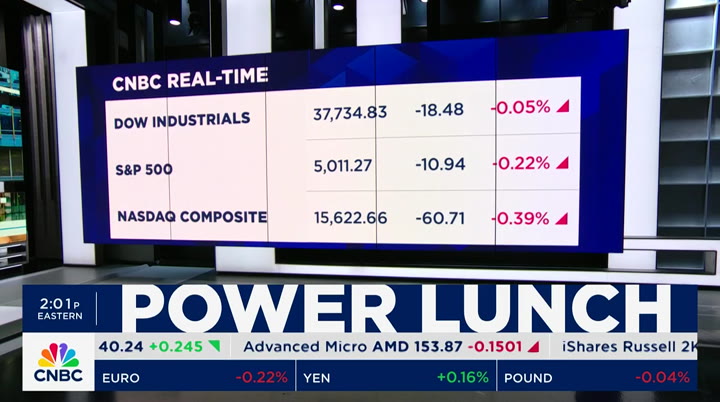

alla scala, milano) ♪ ♪♪ [water splashes] ♪♪ [kid laughing] ♪♪ [water splashes] ♪♪ ♪♪ [ripple sound] [laughing] [water splashes] [continue laughing] ♪ ("horn house") ♪ ♪♪ [chuckle] ♪♪ everybody. welcome back, seema moody. good to have you with us and good to have you with us i'm tyler mathisen stocks heading to the downside right now. the s&p 500 and nasdaq both on four session losing streaks, the dow having its worth month in a year and a half.

2:01 pm

is this the worth month in a year and a half? what can turn the trend around >> changing the game, caitlin clark on the verge of getting a huge contract from nike for a signature shoe we'll talk to the commissioner of the wnba about the impact clark is having on the league. stocks had been losing steam towards the lows of the session with the dow jones industrial average down just about 20 points s&p 500 lower by 11. it's being led by the tech sector with the latest results from taiwanese semiconductor and to chips specifically nasdaq down about 0.4%. we want to compare two completely different stocks, tesla and united health. take a look at the price action. tesla down for a fifth straight day, 14% in one week united health up 1111%, in a wek following its earnings. >> the two companies almost identical in market cap as tesla's tumble has sent its

2:02 pm

market value below $1.5 trillion to mike santoli at the new york stock exchange does this dichotomy tell us anything about the markets or is tesla just kind of in its own cubicle? >> yeah. tyler, i would say it's mostly about the fact that tesla has been in freefall but it does reflect that this is much more of a show me market than maybe it has been in the latter part of last year or early part of this year, meaning where the earnings estimates are going higher or you're getting evidence that the current estimates are supportable, the stocks can perform otherwise no earnings estimates for tesla have been going straight down for months now, so therefore, the valuation looks challenged even as the stock has gone lower. i would point out it's also pretty much crossing with walmart's market cap at this point as well. it's kind of going down the ranks as these more steady companies, unh, had a tough start to 2024 as well, but did

2:03 pm

have better than anticipated guidance within its report i think it's about the market following the numbers in a little bit of a macro flux moment we have yields going up the monthly highs. >> it's about a 4% decline from the highs or thereabouts, but recent highs is anybody really worried about this decline having longer term trac traction or more on the side we're probably, no matter what fed does or doesn't do in a bullish sort of environment? >> at this point i do think most folks are saying we went up about 28% from the lows in october to the high three weeks ago. giving back 4% of that i don't think there's panic. i don't think you see evidence of panic i see evidence of growing concern about this little upturn in volatility. if i'm looking at things like people buying protection on the downside, put option volumes sometimes you want to see people get a little bit more scared

2:04 pm

before you have this sense out there that you would kind of shaken enough people out and this pullback can be viable. >> all right thank you very much. mike santoli all right. for more on the market and the fed let's bring in cnbc contributor tom lee who is a co-founder and head of research at fundstrat and profess ragu, governor of the reserve bank of india, professor of univcollege university school of business. i want to start with you, incredible just to see how quickly the market narrative has changed from expecting a rate cut in june to some economists saying not at all this year. you've been in the seat that powell is in, different country, india, but how you think he navigates this complicated scenario we're in, hotter economy with the inflation remaining much higher than expected and at the same time rates also staying higher, the impact that could have on

2:05 pm

consumers? >> yes i mean clearly we've had three strong readings of inflation, one you can dismiss, the january one, but the next two basically suggest inflation is not coming down in fact it's going up. if you looked at the mueasure te fed has looked at the super corps measure of inflation taking out housing it's gone up 8.2% rate over the last three months this is something to worry about. is inflation coming down steadily as it seemed at the end of last year or is it having a new set of legs and moving up? so my sense is, you know, they're going to do what they did which is watch and wait, but you heard, you know, the new york fed president talking for the first time about potentially rate hikes i think that's still some ways away serious talk about that. but clearly the kind of rate cuts that we expect are off the

2:06 pm

table. certainly in the next meeting they have no more news on inflation or the labor markets and it's likely they will continue pausing, but how long they will pause is now very much in question. >> tom, raga mentioned the new york fed president who mentioned rate hikes but said that's not his base case, but the fact that he mentioned it you saw the two-year move around 4.99% a high for this year you still have this notion that stocks can continue to out perform if rates stay high how long do you think that theory will last >> well, i think it's going to be valid as long as one of several things happens one is that as long as the economy remains resilient and robust and earnings have actually been coming in quite good, i mean we're only throughout the start of earnings season but q1 looks good and i think the second is, that

2:07 pm

inflation, i think inflation has a bifurcation taking place even as the professor said, it's super corps the reason super corps is annualizing at 8% is auto insurance if you took super -- auto insurance out of super corps the long-term average is around 2.7 and annualizing at 2.7% right now. the biggest driver of inflation are the two stubborn components of auto insurance and shelter. i don't know williams wants to be raising interest rates or hiking because auto insurance rates are high and i think the third thing to keep in mind is that we don't really need the fed to make, you know, three cuts i think the one risk to markets would be that the inflation is accelerating to the point where the fed has to hike and therefore really weaken the economy. i think that's still very much a tail scenario but that would unsettle markets the most. >> professor, how critical is

2:08 pm

china's recovery to global economic performance >> well, it certainly is very important. china has been the engine of global growth for a long time prepandemic, but i think it's also important for, you know, the reflationary forces we're seeing if we look at commodity prices they were largely dead in the water for the last year because china wasn't performing, you know, up to expectations as chinese growth news is getting better, you are seeing some commodities perk up, certainly you're seeing copper pick up some in recent weeks so my sense is that the deflationary effects of china, which have been substantial, especially on the good side, may abate a little bit if chinese growth picks up and, of course, it will also add to global demand which is important. >> it was back in 2005, i believe, professor, where you

2:09 pm

called in jackson hole where you said the u.s. financial system is facing great stress and a couple years later we saw the crash in 2008. when you analyze the u.s. economy where we're at, where treasury yields are trading, do you have similar concerns? no no. look, i think we haven't seen the last of the mini crisis we saw in the banks in march of 2023, in the sense that a lot of small and mid sized banks are still sitting on long dated assets and this is where, you know, higher for longer bond yields could result in some of them having to mark to market even some below their value of their equity, so some of them may be under water we are still out of those woods. we have sort of alleviated the immediate panic. some of that is a source of concern. shock movements in markets almost always create problems in some ways.

2:10 pm

it's hard to know where, with what big bets are the shadow financial system taking now, which hedge funds are extremely ill positioned for a sharp movement in interest rates that could also happen. so far, you know, we haven't seen the kind of [ inaudible ] play out, for example, we saw before the global financial crisis and i think it's as our other person said at this point, clear risk rather than the central scenario. >> tom, a question on small caps which you say will probably outperform the s&p 500 by 50% this year. a lot have been predicting the day of small caps will arrive. why are you confident right now when it has taken so long for that sort of prophecy to come true >> well, that's quite a prophecy, right. i think it's -- we're exiting more than a decade of under

2:11 pm

performance of small caps versus the large caps and at a point where the risk-reward is so attractive investors really should be thinking about them. we hadn't really recommended small caps for several years until this year. first on a price to book basis which is the most important measure, trading at 44% of the s&p, right where they were in 1999, but projected growth this year is higher with median earnings growth in the russ 28,000 around 19% for eps versus 11% for the s&p. on forward p/e you're paying ten times the median p/e for the russell 2000 against s&p around 16 times so kind of multidecade low valuation, better growth, but, of course, the timing accelerant is when the fed can really conclusively begin to cut rates. i think that's one reason why small caps have really been hurt in the last couple weeks is that delay. >> tom, thank you very much.

2:12 pm

professor raga, thank you as well a power player and change maker in the sports world. we'll speak to the commissioner of the wnba next what a week she's had. netflix reporting after the bell it's seeing strong growth in recent quarters. what is on investors' watch lists? "power lunch" will be right back ameritrade is now part of schwab. bringing you an elevated experience, tailor-made for trader minds. go deeper with thinkorswim: our award-wining trading platforms.

2:13 pm

unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly. (♪♪) at enterprise mobility, our experts always see another road. because when there's no limit to how far mobility can go, there's no limit to how far businesses can go. (♪♪) [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen.

2:14 pm

why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com. business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer.

2:15 pm

and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. [thunder rumbles]

2:16 pm

2:18 pm

(vo) what does it mean to be rich? [thunder rumbles] maybe rich is less about reaching a magic number... and more about discovering magic. rich is being able to keep your loved ones close. and also send them away. rich is living life your way. and having someone who can help you get there. the key to being rich is knowing what counts. . welcome back to "power lunch. caitlin clark still a couple weeks away from making her wnba

2:19 pm

debut for the indiana fever who drafted her first earlier this week, but according to reports she is poised to land an eight-figure endorsement deal meantime with nike which could include a signature shoe for more on how caitlin clark is literally changing the game, let's bring in cathy engelbert the commissioner of the wnba who joins us live from our change makers event in new york city that spotlights women leaving a mark on the business world and cathy, good to have you with us. certainly caitlin clark has left an indelible imprint on the business of women's basketball you had a big night draft night on monday. the ratings were big the ratings for the college championship game outdid any basketball game male or female in recent years. how important is caitlin clark going to be to growth in revenue for your league this year and into the future?

2:20 pm

>> yes it's great to be here and so important to have household names and build rivalries and have games of consequence. that's what march madness had and our draft class was amazing monday night, over 3 million watched that draft at peak and so it's really important to have those household names. tease players, we have the confluence of positive elements happening right now with the generational players with huge social media followings. they have huge endorsements coming in and getting more endorsements now that they declared pro the draft class was amazing with caitlin and angel reese coming off last year's national championship was the most viewed ever and now this year, we blew those records away and we're so excited to have caitlin and the rookie examination into the wnba this year. >> kamilla cardoso, paige bueckers at uconn. back to my question, how much do you think, for example, season

2:21 pm

ticket sales will go up? how much do you think -- is caitlin going to mean going from 10,000 attendance at a typical game on a tuesday or sunday to 15 or 20,000 what >> yes business is booming, especially for those games just like what happened in the big 10 with iowa playing in those sold out arenas that's happening for us and hopefully rising tide lifts all boats and lift all of our teams. we have great rivalries forming with caitlin and sabrina in no, caitlin and diana taurasi in phoenix, cardoso and angel reese going to play in chicago, so i think parody in the game is really important as well as having these players really help us drive the league to higher heights. you asked the revenue question revenue media rights, corporate partnerships and then gate people coming to games we need more people to watch and

2:22 pm

attend the quality of the game is there. people love watching our game. if we can get fans into the fun toll watch the game they will come back and attend and buy merch and everything that goes around the revenue model for sports it starts with media rights. we need to get those valued correctly and then corporate partnerships and we've been doing great. there's a lot of corporations stepping up to support women's sports a lot of money in capital inflows. we raised $75 million in capital two years ago. when you see that money coming in you're a growth stock and you know you're a legitimate sports media and entertainment property. >> what does that mean for a wnba player where there's been so much criticism around how they make much less than nba players and in general male athletes overall >> yeah. one thing there's a false narrative out there about caitlin herself and nobody just looks at base pay. it's proxy season. base play plus bonus and stock

2:23 pm

options. she'll have the ability to make up to a half million in your wnba and then her nike endorse-point. there's a huge opportunity to lift this for all of our players and as we get into a new collective bargaining agreement in a year or two that will be an opportunity to pay the players more we tripled the pay of the top player now i think what's happening they're getting endorsements i think lebron james signed an $80 million plus with nike before he ever came into the nba and no one ever had that narrative that his salary at the nba was lower than his nike endorsement. the other men's leagues are 50 to 100 or 75 to 100 years older than we are and we're tipping off our 28th season. the longest tenured women's sports league in the country i double by any other. we have a lot of hard work to do, yes, we need our media rights valued and we need more partnerships and more people to attend and watch and rep the wnba. >> i'm curious about expansion

2:24 pm

you talked about bringing new teams to new cities from portland, nashville, denver. what about international we've seen the wnba and nfl go to europe and other countries beyond. >> yeah. it's a great question. we're trying to globalize our game because when i joined the league we were basically a domestic league and we have a lot of fans around the world we showed our games in india last year for the first time i think 22 million unique viewers watched wnba games we have an opportunity to bring our game there we are, you know, we bring our game to over 200 countries an territories, but we also did do a preseason game in toronto last year and sold out. the night after the stanley cup playoffs with the maple leafs we sold out the same arena. yes, this year we're going to edmonton in a couple weeks for a preseason game in canada and hopefully can expand in europe and broadly. i've admired how the nba has globalized over time in asia, europe, now in africa and we'll

2:25 pm

follow on suit as we start to grow this league. >> a question and observation. the olympics fall in the middle of your season how will you accommodate that and how important will the u.s. women's olympic team be to expanding the brand awareness, the personality awareness of your players >> yeah. so the u.s. women's national senior team going for their eighth consecutive gold medal in paris. the wnba was born out of the '96 atlanta olympics when the women won the medal and the commissioner and adam launched the fleeing '97 so it is important. we're on this run of eight diana tarasi is going for her sixth consecutive gold medal we'll break for a couple weeks but in the middle of our season off our all-star game and when they come back we'll get a pick up and lift. nbc will market a lot around this team.

2:26 pm

>> you bet. >> eighth consecutive gold medal. >> we are the network of the olympics as you know i want to make this observation. one of the genius things you all did was have at the nba all-star break was it sabrina i ness could in the shootoff with steph curry and she almost beat him. i think he had to make the last shot and she was shooting from the nba three-point line i encourage you to continue to do that because that was maybe -- that was the most compelling part of what otherwise to me was just kind of a normal nba all-star weekend. congratulations. cathie, thank you. >> yep. >> go ahead and finish your thought. >> it was a great event. it came off sabrina breaking steph's record in our all-star game and an idea we had during the three-point competition at nba skills night an it was highly viewed and -- >> it was awesome. >> people especially for young girls to see sabrina on that

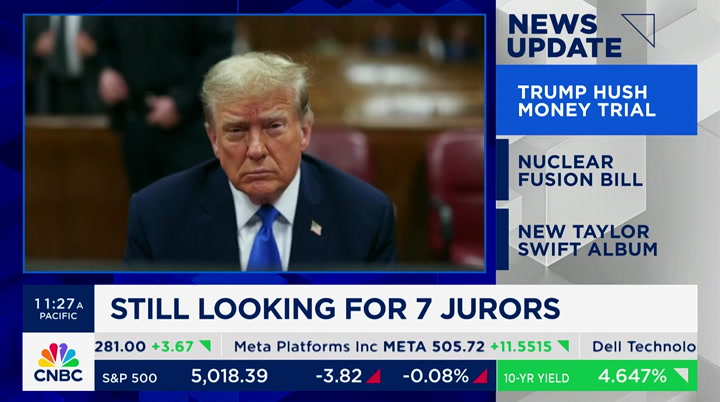

2:27 pm

court and someone like me who played in the '80s, it was a great night. >> yeah. really was kr cathy engelbert, thanks. >> to kate rodgers with a news update. >> hey there welcome back to "power lunch" here jury selection in former president donald trump's hush money trial is just roux resuming after a lunch break this morning two jurors were dismissed reducing the number of seated jurors to five and prosecutors accuse trump of continuing to violate his gag order and urged the media to stop reporting detailed information about jurors out of concern for their anonymity. u.s. senators introduced a bipartisan measure to speed up nuclear power plants run by nuclear fusion reaction and the senators say it would set authority to scale up energy fusion authorities and investments here fusion, which is the same process that powers the sun, could be a power source amid no

2:28 pm

greenhouse gasses. the countdown on for taylor swift's album and even though it hasn't come out it's breaking records. spotify said "the tortured poet's department" is the most streamed on the service. i cannot wait for that one. >> thanks very much. up next, netflix on a hot run, up 78% over the past six months fuel largely by its password sharing crackdown what's in store for earnings "power lunch" will explore that when we come right back.

2:29 pm

2:30 pm

municipal bonds don't usually get the media coverage the stock market does. in fact, most people don't find them all that exciting. but, if you're looking for the potential for consistent income that's federally tax-free. now is an excellent time to consider municipal bonds from hennion & walsh. if you have at least $10,000 to invest, call and talk with one of our bond specialists at 1-800-217-3217. we'll send you our exclusive bond guide, free with details about how bonds can be an important part of your portfolio. hennion & walsh has specialized in fixed income and growth solutions for 30 years, and offers high-quality municipal bonds from across the country. they provide the potential for regular income

2:31 pm

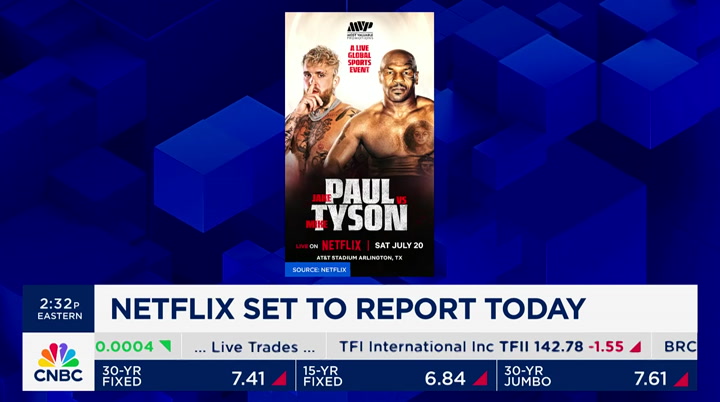

are federally tax-free and have historically low risk. call today to request your free bond guide. 1-800-217-3217. that's 1-800-217-3217. welcome back, everybody. netflix reported results after the bell coming up with a strong run. can it keep the momentum sghg steve covac here. >> in a matter of hours we know netflix has been on a tear coming off the quarter where it smashes cases for new subscribers and the biggest reason cracking down on password sharing. shares are up 26% but the question is that momentum going to continue or was this a brief spike in growth from password

2:32 pm

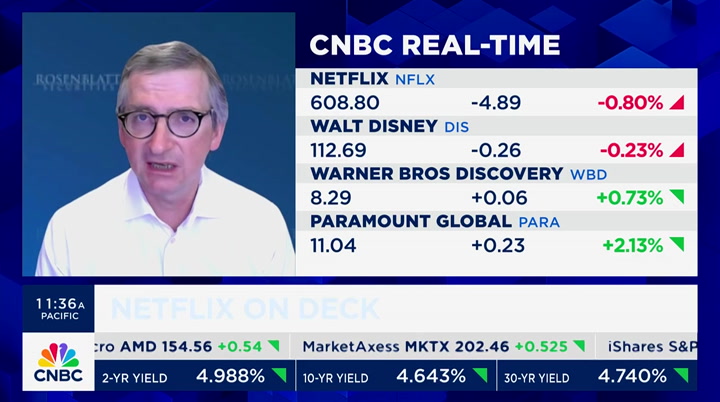

sharing cracking down? the street is expecting for this quarter 4.5 million new subscribers more than double from a year ago quarter. revenue would be up 13% in the same period. what we don't know as much about is advertising and gaming if the costs will keep mobile subscribers stuck to their subscription for advertising the company has more than 23 million users with its plan with ads but unclear how much revenue those ads are bringing in. on the content side more experimentation including live events including the boxing maf between jake paul and mike tyson this summer. no traditional live professional sports beyond documentaries. >> let's bring in barton crockett, media analyst at rosenblat securities sticking with a neutral rating on the stock ahead of the results you're more cautious going into the support but you're not alone. i read the reports from deutsche

2:33 pm

bank and goldman among others. your price target 554 below where the stock is trading tell us the reason you're cautious. >> well, i think netflix's stock has a strong history of really moving in tandem with subscriber growth and they've had a tremendous lift in 2023 from the pay sharing crackdown. they added nearly 30 million subscribers in 2023. and that was on 100 million globally in the u.s. being impacted by paid sharing many of them have signed up if they were going to i think the impact of that fades and i think probably looking at a 2024 where there's much less subscriber growth than last year history will tell us that's a tough setup. that's number one. and i think we'll start to get a sense of that here with the

2:34 pm

march quarter earnings, but really, the story will be told in the june, september, december quarter when the paid sharing comps kick in. >> is it competition and also just trying to figure out their ad tier strategy, or could we put some of the challenges at the macro level, consumers being more selective where they're putting money to work and what they want to buy >> look, i would say i think they've had so much success that it's going to be hard to sustain that i think the stock's run with the performance you see here tells you the market is expecting this to be sustained and, you know, i would like to see that be digested i think there's a continue to be -- to admire in netflix i think they're killing it in terms of dominating subscription video on demand. their ad rollout is a slow burn, but one that ultimately is having success but, you know, trees don't grow to the sun here to use the

2:35 pm

cliche 30 million subs, retreating from that i think is something you want to let the market digest before you buy one of the shares here. >> size up the competition is it really a threat? >> we're seeing some interesting stuff with the competitors we know the problems that paramount is going through let's put that aside look at what warner brothers discovery and our parent company peacock is doing and disney is doing. disney's copying the password crackdown in password sharing like netflix did after the success. second of all we're seeing those companies warner brothers discovery, nbc universal, start lightning licensing content back to netflix. you will see content from hbo of course used to be unheard of not long ago netflix has turned back into this hub where everyone knows where all the eyeballs are, instead of doing original content we're seeing them spend on these more reruns and so

2:36 pm

forth from traditional media companies. the competition is starting to rely on netflix. peacock losing money, disney plus losing money and they need to make up the revenue. >> they're the best name so far in terms of how they are able to gain market share. you say netflix could be a sleepy beneficiary of ai explain what you mean by that a? >> sure. if you're looking for a news story in netflix beyond paid sharing, we're hearing talk about openai tie already perry would build an 800 million sound stage he pulled back on with this generative tool he's not sure you need studios anymore that sounds like it could be a cost saver and if anyone is going to benefit from that it could be netflix what i'm interested in hearing them talk about on the call is that is there over time a real kind of cost reset that they could lean into perhaps more than anyone from using generative ai

2:37 pm

to do a lot of production work for content? >> i think that's really important to note and i will be listening for the same thing because if you think of the way netflix operates and how it chooses program, they are so daulgts driven and we see repeats of the theme like a flood of reality shows i can see them thinking maybe if we ask an ai to create a generic reality show or something, i can tell they're experimenting with that that's an interesting point. >> it examines back to data. media company, utility, tech company, that's the. >> tool. >> final question, some years ago there was concern about the bloat in the budget of netflix for original content have they got that in the right spot >> i think the -- yes, i think they're moving in, in a really strong direction there part of that is, you know, they learn from experience.

2:38 pm

part of it is the lessening of the kcompetitor intensity they'e able to license content so they don't have to make it all themselves they're looking at 3.5 percentage points or so of margin improvement in 2024 over 2023 and i think that's part of the story there. >> all right barton crockett, thank you steve covac, we'll be waiting for this results with netflix up about 25% so far this year. >> couple hours. >> still ahead, high energy high reward taiwan semi says an insatiable appetite for ai chips helped fuel its quarter beat but soaring electricity costs eating into its profits we'll discuss that when "power lunch" comes right back.

2:39 pm

2:40 pm

i just had to keep going. a lot of people think no pain no gain, but with golo it is so easy. my life is so much different now that i've lost all this weight. when i look in the mirror i don't even recognize myself. wealth-changing question -- are you keeping as much of your investment gains as possible? high taxes can erode returns quickly, so you need a tax-optimized portfolio. at creative planning, our money managers and specialists work together to make sure your portfolio and wealth

2:41 pm

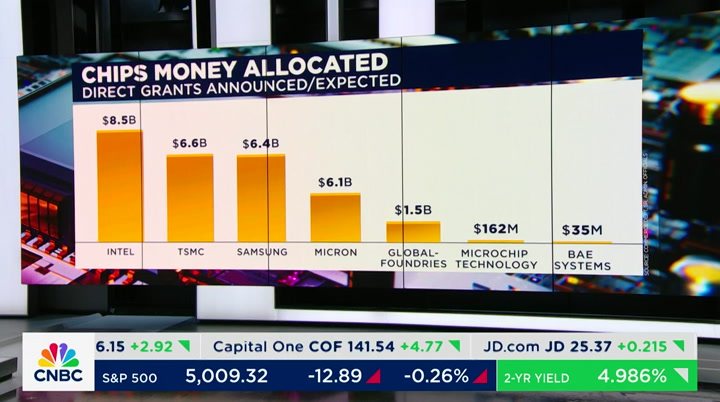

are managed in a tax-efficient manner. it's what you keep that really matters. why not give your wealth a second look? book your free meeting today at creativeplanning.com. creative planning -- a richer way to wealth. welcome back to "power lunch. the money continuing to flow from the government to the semiconductor companies part of

2:42 pm

the chips act. micron technology said to be the latest recipient meghan has the washington angle, kristina partsinevelos looking at the corporate side. meghan, begin with you >> that's right. commerce secretary raimondo confirmed that micron will receive the next chips award companies expected to get $6.1 billion in direct grants from the commerce department to help build out manufacturing lubs in idaho and new york senate majority leader chuck schumer touting the investment in his home state micron will invest more than $100 billion, create more than 50,000 jobs in new york and those will be in manufacturing, construction, and all along the supply chain a senior biden administration official adding how the chips act is making america more competitive, creating jobs and driving economic growth in syracuse and across the country. the commerce department has $10 billion left to doll out from

2:43 pm

the $39 billion fund raimondo told us this week that all of that money will be allocated by the end of this year raimondo told me the next rounds are likely to focus on memory chips and funding for suppliers, waivers, chemicals, those input products we need to support chip manufacturing in the u.s. >> so $10 billion left here? >> yep exactly. >> that's a lot of money, but it's not all that much really when you look at what is it $8.5 billion, $6.6 billion given out to intel, tsmc and others. who else is in line with their hands out for this >> we know some of the bigger companies, amd, nvidia likely to get a little bit of money. because it really isn't that much money left like you said, we need to see some of that money go to suppliers, the commentary we hear often is it's great these big companies get these awards, create these big investments that the administration likes to talk about, but are we going to be able to support all of that

2:44 pm

manufacturing here we don't support the upstream suppliers. maybe we'll see smaller names get smaller awards as well. >> let's turn to another story, the micron side of things with kristina partsinevelos who has been digging into that stock. >> well, micron, we talked about the award was larger than expected after samsung received funding last week. micron already warned it needed chips act funding to support its investment plans so this news seen as a positive especially since the firm started construction in boise, idaho with construction slated for next year. the question is if that plant or the new york plant gets delayed, we have seen delays with tsmc and intel. micron is down and it's don't entire sector because tsmc's results are spooking investors the largest chip manufacturer in the world and said ai demand would grow over 20% of 2028 revenues but they listed a few concerns in their report

2:45 pm

first, a lower 204 outlook which doesn't include memory clips to 10% growth year over year from an over 10% growth, so just that over amount was the change management expects q2 margins to be impacted because of the earthquake in taiwan, higher electricity costs and production of inefficiencies we're seeing with the 3 nanometer production, the most mass produced at the moment the capital expenditure guide was reiterated and analysts see that not as surprising after asml maintained its top line growth other concerns that revolve around non-ai demand tsmc sees auto sales down when they previously thought they would be up, which is negative for on semi and that's why they're in the red the company said smartphone sales were recovering, great, but slowly tsmc counts apple as its biggest customer and then lastly tsmc warned around foundry weakness

2:46 pm

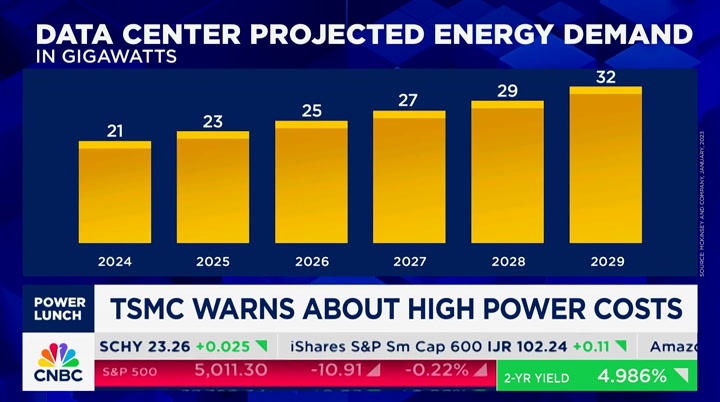

perceived as a negative for united micro electronics and so many names are lower today. >> tsmc, also had interesting comments on the topic we hear a lot about, which is how much power the chips use. what do they say >> they said soaring electricity costs are eating into their margins and profits and forecast a 25% increase in electricity costs starting this april that would reduce margins and contribute to higher costs for customers and competitors according to the ceo in the early morning earnings call today. tsmc's costs are emblematic of a greater problem facing firms all across the country how are they going to power these ai machines, large language models we talk about when so much of the infrastructure here in the u.s. is outdated. mckenzie says data center use will double over this decade look at this graph it's surging. the latest international agency reported chatgpt consumes roughly 2.9 watts per hour of

2:47 pm

electricity per request. we don't know what that means, it's like running a 60 watt light bulb for three minutes, ten times as much electricity as one google search. many are raising concerns. the arizona public service warning they will be out of capacity before the end of the decade if they don't get upgrades and portland general doubled its forecast you have tech execs weighing in. elon musk warning we may see a power shortage for chips as soon as next year andy jassy telling fortune there's not enough power for large language models, sam altman saying we need an energy break through for fewer ai technologies and so many of these big tech firms rushing to get their own power building data centers and even nuclear power plants yes. >> incredible. thank you. and tyler, i've been following the industrial side of this, some of the companies working on the ai infrastructure and their complaint is there's a scarcity

2:48 pm

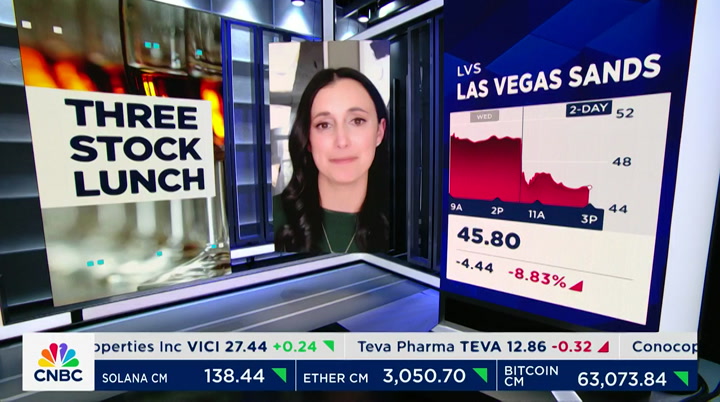

of power capacity because without that they can't continue to build all they need eden, they've all had a strong year. coming up, here on "power lunch," homes, rails and casinos. we'll get the trade on d.r. horton, csx and las vegas sands in three stock lunch we are back in 2 trading at schwab is now powered by ameritrade, unlocking the power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab.

2:51 pm

cnbc contributor. shares are jumping higher after the eighth quarter estimates raise the 2024 outlook despite the supply slowdown. what's your trade?>> we have been very optimistic with homebuilders, i remain optimistic. this is really just supply anne's demands. there have been 5 million more households created that homes built in the last two decades,

2:52 pm

that problem is not going away. the fact that interest rates are high only makes this worse. and the majority of homeowners have mortgages that re at less than 4%, meaning they are not going to sell. that's where new homeowners come in. they are there to fill the gap with lower entry point homes, they are also a large builder that can help with incentives if rates stay high, or if markets are to soften. supply and demand constraints are only going to continue in the near future.>> let's move to csx, shares moving higher, beating tier 1 estimates on the top and bottom line, reaffirming guidance for revenue, growth, and volume. what do you think of csx?>> another company with good earnings, beating expectations. one interesting thing to look at, you saw the volume growth

2:53 pm

was actually increasing, that is something you want to make sure you are taking a look at as we go forward here. manufacturing was just above 50 for the first time since 2022, we need that rolling recession, it is likely coming to an end here. you are seeing the consumer continues to remain strong, consumer spending remains high, you are seeing a lot of restocking that is going on, all that means more rails are going to be needed. csx is going to benefit there. i would absolutely be a buyer here. >> courtney, the casino stock is sinking despite beating earnings and revenue estimates in the first quarter. the stock is among the worst performing, shares are down about 20%, dating back to last year. a lot of this has to do with china trade. what are your thoughts? >> don't let this name fool you, it's not in las vegas,

2:54 pm

most of the casino markets, that's the play here. if you believe that recovery is going to continue, i actually believe it will, this is your way to play it. if that recovery continues, they are well-positioned to take advantage. the reason they are doing poorly specifically today, they are doing a lot of renovations into those properties in asia, which is going to absolutely affect the bottom line when you look at the next quarter or two here, but those improvements are going to be longer-term trends for them. if you think the gaming industry is going to improve in china, i do think it is, and so, those improvements are going to be a longer-term story. i think this is something you want to play here, just take advantage of the fact it is down quite semantically.>> courtney, thank you. thank you for having me. remember, you can always hear us on our podcasts, follow and listen to your favorite show, or your favorite streaming service. we will be right back with new

2:55 pm

developments on the bidding for meteorites. [ music ] so this is pickleball? it's basically tennis for babies, but for adults. it should be called wiffle tennis. pickle! >> catchers on closing bell, sponsored by eátrade by morgan stanley. these guys are intense. we got nothing to worry about. with e*trade from morgan stanley, we're ready for whatever gets served up. dude, you gotta work on your trash talk. i'd rather work on saving for retirement. or college, since you like to get schooled. that's a pretty good burn, right? got him. good game. thanks for coming to our clinic, first one's free. to start a business, you need an idea. it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams]

2:56 pm

2:57 pm

even space age technology can't prevent accidents at work. so talk to your agent about workers's comp insurance from pie, or visit pieinsurance.com. safety first, then pie insurance. she runs and plays like a puppy again. his #2s are perfect! he's a brand new dog, all in less than a year. when people switch their dog's food from kibble to the farmer's dog, they often say that it feels like magic. but there's no magic involved. (dog bark) it's simply fresh meat and vegetables, with all the nutrients dogs need— instead of dried pellets. just food made for the health of dogs. delivered in packs portioned for your dog. it's amazing what real food can do.

2:58 pm

[ music welcome back to power lunch. the nba is the next top property in the media right space, and those rights may be about to open up to a new group for bidding. alex, this has basically been the property of disney, espn, and turner, which is owned by warner bros. discovery. they had exclusive rights, but that window is about to shut.>> that's right, the window closes on monday, april 22, that's monday of next week. i'm told a deal with the incumbent partners is unlikely to be reached by then. that means the nba can start

2:59 pm

talks with outside parties. look, some of this is not entirely unexpected. we have reported for six months or so that the nba is interested in ringing in a third party, whether that's amazon, apple, or netflix, potentially. our own parent company is interested in the rights. this will allow the nba to speak with partners that are not warner bros. discovery and disney, to create new packages of games, or maybe even start a more intense bidding war.>> is one of those potential bidders thought to be more inclined to enter this bidding act? do we know?>> we know the nba wants a robust park for its third-party here. i think amazon would probably be considered a front runner,

3:00 pm

for a new ackage to be created. there have been some rumblings that netflix might be interesting for a smaller package, like this in season tournament that they are doing this year. our own parent company is interested in rights. with nbc universal actually take warner bros. discovery as a partner?>> thank you, alex sherman. we have to cut you off.>> they are playing our song. closing bell, right now. welcome to closing bell. this break or break our begins with a count on for well known growth stocks, it is netflix, it is at the top of the hour, there's a lot riding on that, as tech has teetered lately. we will ask our experts what to expect, and what's at stake. in the meantime, we will look at the scorecard with 60

17 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11