tv The Exchange CNBC April 18, 2024 1:00pm-2:00pm EDT

1:00 pm

treasuries again as long as we're talking about c cuts later, not never, this could be a good buying opportunity. >> josh brown? >> iot coverage. i'm long the game. i think it's an interesting story. >> the markets losing some steam as we speak. i'll send it to "the exchange. ♪ ♪ a flattish market indeed, scott. thank you very much. welcome, everybody, to "the exchange." i'm tyler mathisen in today for kelly evans. here's what's ahead. stocks are bouncing back today, but our market guest says proceed with caution if you're all in on one particular trade one trade in particular. she tells us what it is and how she's positioning from here. high rates continuing to put pressure on the overall housing market, but not the builders dr horton raising guidance, the higher is the stock today. but with the 30-year mortgage

1:01 pm

rate at 7.5%, can those gains continue our analyst is bullish and will make his case. the consumer not slowing down when it comes to traveling. alaska air's ceo joins us in an exclusive interview to talk about that, about boeing and more but we begin with today's markets and our friend, bob, at the new york stock exchange. hey, bob >> tyler, a pleasure to see you. we started flattish. we bov moved up in the middle oh day and losing steam we are flat on the day after being up about an hour ago the economy is still good, but the yields are still elevated. i think that's a problem here. we were up a lot more, we're basically flat on the season it's been a narrow trading range, about 40 points the dow industrials split, strength in united health. travelers bouncing back after a rotten earnings report and the nasdaq is a disappointment here.

1:02 pm

its big-cap tech is mixed but largely down semiconductors are a bit on the weak side. the tech space is the weak area. big-cap tech here, nvidia and google still -- apple, still mixed here alphabet is up slightly. micron is down almost 3% that's a really weak stock in that sector right now. for earnings, you heard about dr horton here. for all the worry about higher rates, dr horton has done very well here. they beat on the top and bottom line they were asked about the high rates, sticky inflation. they said they're going to center on incentives incentives usually means some mix of closing cost assistance or mortgage rate buydowns, price discounts, all sorts of things out there. but the bottom line, not a bad earnings report, though the stock is down. i'm focused on ipos today that opened at the new york stock exchange

1:03 pm

centuri holdings is an energy infrastructure play. that came at $23.75. it was priced at $21, the high end of the range that just opened a little while ago. and a few moments ago, ibotta opened they priced at $88 that was above the range, and look at this, opened at $117 so the price talk was $76 to $84. the price is at $88. opened at $117 now at $109. again, this is a digital advertising play next week, tyler, we'll get ruveric, as well if we get next week's ipos, we'll have about $3.5 billion that's gone public in the last three weeks, one of the best weeks for ipos that we have seen in several years so i know the markets are shaky, but the ipo market is showing some signing of life tyler? >> bob, thank you very much. the ipo market may be

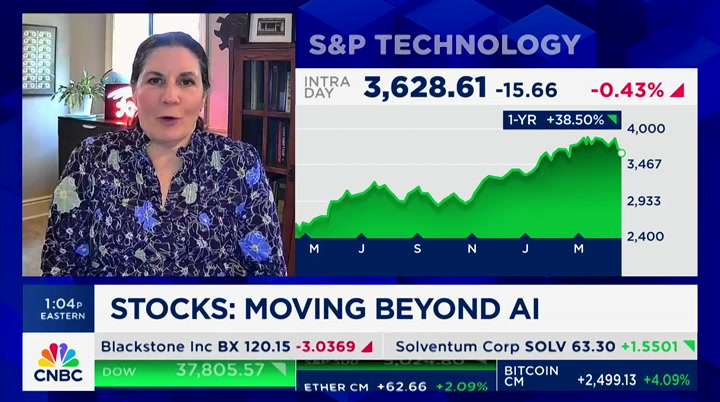

1:04 pm

opening up, as bob points out. but our next guest says trade carefully because investing in tech with an ai only strategy will be risky. she's sticking with a broader stuff play as earnings season gets underway. joining us now, kim forest, from boca capital partners. why are you wary of ai, kim? >> it's been about a year since the ai rocket took off i'm sure that everybody owned nvidia at that time, or maybe bought it subsequently is super happy about that but i do have a warning, having been in the world of technology and certainly having watched it since i became an analyst, the first job in this industry, in 1999 not all stocks go to infinity and beyond they just don't. and generally, whenever a technology is being rolled out or developed, there are pauses in spending.

1:05 pm

i think a pause in spending, and i do believe in a long-term, you know, viability of ai certainly. but a short-term slowdown might make investors lose their minds and start selling a lot. so, that's my warning to you >> and the warning then is, if these stocks go down, don't panic and sell, or what? >> well, you're always supposed to be looking at what is in your portfolio, right and if you only have ai focused stocks, i think it would be time right now to take a look and broaden out and think a little differently and hedge your bets. take some money off the table, and apply it somewhere else. but i do think that you can certainly know that those ai stocks that are good, quality companies probably will come

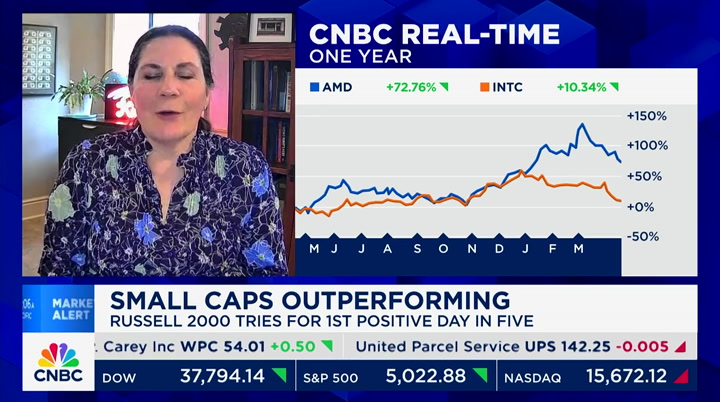

1:06 pm

back, because if they provide what we think they can provide, which is mainly productivity to businesses, ai is a winner >> two stocks i see you do like are amd and intel. would you describe them as ai related stocks, number one and you're choosing one that is a beloved stock in amd, and another that has been at a loss for love lately, intel >> yes well, i always like to have, you know, a winner and a loser no, i'm teasing, totally teasing. no, i do like both of these. i like them for different reasons. however, both of them can and probably will play into generative ai data centers, but the other thing is, there is going to be a lot of computing needed around those data centers, and i think both of these companies have good track records of playing well in data

1:07 pm

centers. and data centers are a focus of spending so that's why i'm focused on it. i also like intel's foundry idea, and it always takes longer to develop technology and roll things out, we know that and we learned that earlier this year, and that's one of the large -- big reasons behind intel's unlovedness right now in the market >> yeah, interesting i think of like a kindergarten report card. plays well in data centers for both of those. two others that you like are united health and urban outfitters, two companies that on the surface couldn't have less in common >> right except they delight their customers, and they're -- >> i don't know whether it delights the customers, having been on the receiving end of lots of explanations of their benefits, but make the case. >> i don't know if that's true of every health care company

1:08 pm

>> it's absolutely true of every health care company, to my infuruation. but that's just me >> i rip open the 19-page documents from them and wonder what they mean but united has been an innovator in creating technology and doing whatever its business is to frustrate its end-to-end customers, not its -- not the companies it works with. anyhow, they do that very well and they -- because of their use of technology, they have good margins and they beat all their competitors with respect to technology so that's why i like them. and anthropology and free people are doing just super at urban outfitters they do have a path forward for their title name of their company, urban outfitters, that section of the business has a

1:09 pm

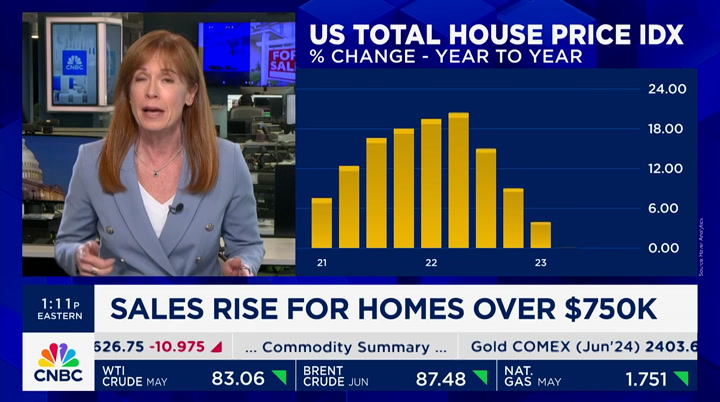

new president. so it could be firing on all cylinders later this year. but even so, anthro and free people are doing a great job at delighting their customers >> kim, thank you very much. good to see you. appreciate it. you figure out an explanation of benefits, give me a call walk me through it, will you thanks, kim forest home sales dropped last month despite a surge in supply, and diana olig is here with the latest hi, di >> yeah, the added supply couldn't counter the higher mortgage rates and home sales fell 4.3% in march now, these sales are based on closings, so contracts signed in january and february mortgage rates stayed lower in january, and shot higher in february now, they're even higher, hovering around 7.5% inventory did improve slightly, up 4.7% month to month to 1.1

1:10 pm

million homes for sale in march. six is considered balanced inventory is about 14% higher than march of last year, but more supply is not really helping cool prices. the media price of an existing home sold in march was $393,500, up 4.8% from the year before it's also the highst price ever for the month of march the market is moving faster with a typical home sitting on just for about 33 days compared with 38 days in february. investors pulled back a bit, making up 15% of sales compared with 21% in february and 17% in march of last year and first-time buyers did make a comeback, though 32% of sales, up from 26% in february and 28% the year before interesting, though, on the price tier sales rose sharply for homes priced above $750,000, especially above $1 million. there is simply more supply on the high end, and the higher tier buyers aren't as affected

1:11 pm

in shifts in mortgage rates and a lot of them use cash >> prices are up in the most recent month, 4.8% year over year sales a little bit off why have housing sales and prices been able to hold up as well as they have, given those higher mortgage rates? >> the prices, that's an easy one. there's still little supply. yes, supply increased to 3.2 but again, six months, twice as much as we have now, is considered a balanced market when you have demand and little supply, prices have nowhere to go but up. realtors are characterize thing as sales are stuck in this narrow range, which are pretty low. and that's because mortgage rates are significantly higher and prices are higher. so you're just -- the affordability level is out of hand, especially for first-time buyers they did come back a little bit. we have seen more action on the fha mortgage rates, because they can get in with less money again, it's still coming off

1:12 pm

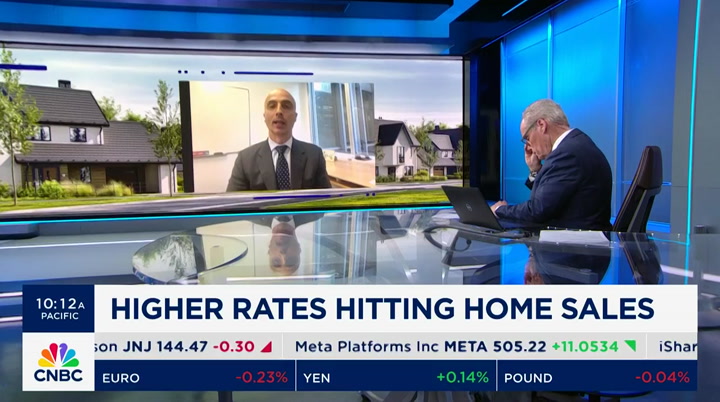

very, very low volume. even the move up isn't really that much. >> diana olick, thank you very much higher rates and weaker sales not being felt at dr horton, which beat on the top and bottom lines our next guest had a buy rating on the stock, and even his expectations were beaten john lavallo joins us now. what do you make of dr horton, john, and its report >> tyler, thanks for having me a lot of the things that diana described are exactly what's happening or helping the new home market. there's little existing home supply, underlying demand is still very good. all that demand is being channeled to the home builders the home builders on the public side are taking a lot of share from the private what dr horton reported was a strong quarter across the board. they took their outlook up everything is pointing in the right direction for these builders to continue to operate,

1:13 pm

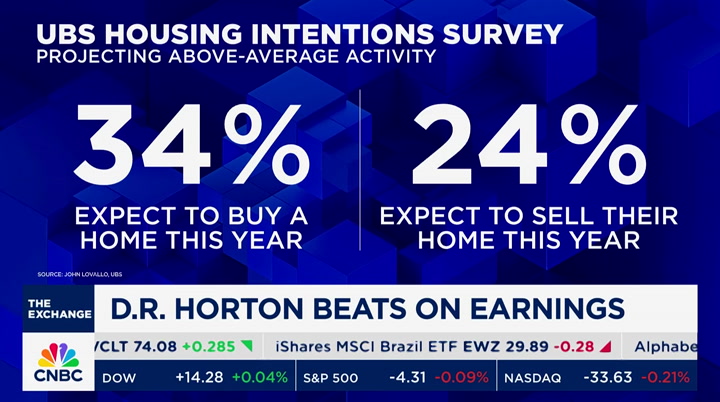

even at a higher interest r5i89 environment. let's not lose sight of the fact in october and november of last year, rates were 60 basis points higher than today, and the company still continued to operate very effectively >> i'm interested in one of your surveys. you say 34% of respondents plan to buy a home in the next 12 months historical average is 29%. 24% plan to sell their home in the next 12 months those are surprisingly high numbers to me, given prices, given the level of interest rates, which we keep hearing are keeping people staying put in their homes, because they don't want to trade a 3%mortgage rat for an 8%. >> yeah, it a es a great point i think what's important to keep in mind is that there is this tremendous wave of demographic strength coming through the u.s. in terms of millmillennials, li events, marriage, children, things that necessitate more space. don't lose sight of the fact

1:14 pm

that there is a massive wealth transfer of $68 trillion occurring, channeling from baby boomers to gen-z again this shows up in financing from mortgages. 25% of respondents to a survey about a year ago said they're receiving down payment assistance that, coupled with the fact that the home builders are offering financing, so you're not paying 7.5% when you go to a builder, maybe 5.5%, 6%, the affordability equation starts to make a lot more sense. >> you have buy ratings on almost all -- somewhere you have neutrals in your coverage universe, but you are strongly in favor of these home builders. give me the thesis basically >> yeah, the thesis is the demographics that we just talked about, also the shift from resilient demand, not being able to be satisfied by the existing home markets they're all coming over the new construction market. but balance sheets are vastly

1:15 pm

improved for this group. even in 2013, when the market started to recover, you have companies that are 18% debt-to-cap. they generate strong cash flow, two times the size that they were in 2013 in terms of market cap and paying dividends these are real companies being valued at half of the value of the market ten times earnings that seems a little dislow itted to us, and i believe there is room for that to close >> so many of these stocks hit all-time highs in march. many of them up 46%, 80%, over the past year, you think that can continue >> we do we think -- look, earnings estimate also have a bias to move upwards most importantly, these companies are earning at levels they have never earned before, and generating consistent cash flow this warrants a higher multiple. whether that happens this year or next, it's going to happen. but the fact is, the cash flow generation and the earnings

1:16 pm

resilience and power is really something that is, i think, big missed by the market >> three years for the home builders john, thanks, my friend. glad to have you with us coming up, alaska airlines hitting its highest level since last august after stronger than expected guidance for the second quarter and the full year. the ceo will join us after the break to discuss the results, travel demand and the fallout from that door plug blowout incident in january, and a computer glitch that hit the airline yesterday. plus, a c-suite view on the banks a year after the collapse of svb we'll speak with one of this year's cnbc change makers how her bank is navigating today's high-rate environment. here's another check on the environments, losing steam the dow, erasing almost completely a 330 point gain. the s&p, flirting with its first five-day losing streak since october. "the exchange" is back after this

1:17 pm

and when i got there, they have the sushi- this is clem. like sushi classy- clem's not a morning person. i'm tasting it- or a night person. or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace. you need clem. clem needs benefits. work with principal so we can help you help clem with a retirement and benefits plan that's right for him. i'm short but i'm... i'm confident. you know? let our expertise round out yours.

1:19 pm

i don't want you to move. i'm short but i'm... i'm i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity. welcome back to "the exchange," everybody alaska airlines trading at its highest level since last august after posting a smaller than expected loss in the first quarter. forecasting strong second quarter and full-year profits, after the fallout of january's

1:20 pm

door plug blowout incident boeing already paid them $162 million, and expecting more compensation after a third of their january capacity was affected by the incident and the groundings that ensued for inspections. so what's next for alaska? the ceo joins us now exclusively with our own phil lebeau hi, phil >> tyler, thank you very much. let's bring in ben minicucci from alaska's headquarters in seattle. i listened to your conference about an hour ago. you guys are extremely bullish about what the future holds. q1, especially what you saw with corporate travel growth, what's driving this right now >> thanks for having me, phil. it was a great q1, given -- tyler, you mentioned it, a third of our fleet was grounded for about a month. and still with that, we had record revenues, and if not for the max grounding, we would have been profitable. and phil, a lot of that had to

1:21 pm

do with the rebound of tech travel in q1 i've been on the show every quarter and talked about tech travel we have the biggest tech companies in the world, head quartered on the west coast. we sent saying that business travel is lagging on the west coast. well, it's starting to finally come back. so we saw, you know, revenues that are back to 100% of 2019 levels so we feel really good about the trends that we're seeing, and we're seeing those trends carry on into the second quarter >> does it continue beyond that? because there's more than a few people that are doing some hand ringing about where the tech industry is right now, given the economy and the questions that are out there. do you think this continues beyond the second quarter in terms of the tech companies continuing to travel at a higher rate >> that's a great question, phil i'm going to be optimistic we saw an inflection point in the last month or so, and i

1:22 pm

think these big companies are getting back they know they have to see customers face to face the sales people are out, getting back, holding conferences in places like vegas, where we fly a lot to so i think this trend is going to continue. hopefully, you know, not only into the second quarter but the rest of the year and into 2025 >> ben, let me ask you about the max. you guys detailed $163 million compensation from boeing, that's likely going to be more in the quarters to come but when you have people on the floor at the plant in renton looking at the planes, given the changes boeing put in place, are your people comfortable with what they're see thing >> you know, phil, there's a lot of changes taking place at boeing the boeing leadership team was just here in my offices on monday we went through their quality

1:23 pm

plan in extreme detail we asked a lot of questions, and what i'll say from where i sit, i'm encouraged with their quality plan they're putting in place. it's all about execution they have to execute a lot of things that is on their plate. but i remain encouraged if they can do those things they say they want to do, bow willing get back on track. our people at the plant are right there, making sure that the airplanes that are getting produced are hitting the level of quality that we expect. we've got ten airplanes that are built there, that we're supposed to get here in the next few months my expectation is when we get those ten airplanes, they'll be at a high level of quality and reliability coming out of the factory. >> ben, have you talked with the chairman at boeing, who is leading the search for a new crow ceo, have you had a conversation with him that we would like to see this in terms of the person next to lead the company this

1:24 pm

>> no, i haven't had a discussion with steve. what i will say with that, phil, i think the expectation is to have someone, you know, at the top of the company that has strong tone there the top. what i would be looking for is someone that can drive that culture change that's required in terms of driving quality, with just a focus on quality every day in terms of the airplanes they produce so that's what i would be looking for from a ceo >> one last question here, ben, why airlines you guys are giving the regulators a little extra time in terms of looking at the materials you have afforded or sent to them are you still confident that this can get closed by the end of this year, or are you saying maybe it's into the next year that we finally get this deal done >> phil, like you said, there's a lot of information going back to the doj, so we gave them an extra 60 days to process and analyze all that information again, i remain, you know,

1:25 pm

confident that our -- we are being pro-competitor and pro-consumer in terms of when that gets approved, we're hopeful that it's sometime later this year, but we'll take the time that it needs to give the doj the information they need to make the right decision >> ben, real quick, i said that was the last question. this is the last question. the market right now, you're seeing a lot of close-end bookings do you expect that to continue is this the case where more and more consumers are saying, okay, i'm ready to travel, but i'm not booking as far in advance as i used to? >> you know, phil, it's an interesting question we are seeing a little bit of a shift. we are seeing a little more close-end bookings it's the reason why our yields are a little bit higher. so we are seeing a shift, and we're continuing to watch that closely. but it is something that's different than what we have seen in the past.

1:26 pm

>> the last-minute trip. many thought it was dead ben, thank you very much we appreciate you joining us today. joining us from the alaska airlines headquarters in seattle. ben minicucci, ceo of alaska tyler, back to you >> thank you very much coming up, meta and google teaming up to take on microsoft in the ai space, announcing a new partnership that will affect many facebook, whatsapp and instagram users. that's ahead as we head to a break, stocks are near session lows the dow has turned negative just moments ago. is rur aernge"etnsft th amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider

1:28 pm

when you own a small business every second counts. 120 seconds to add the finishing touches. 900 seconds to arrange the displays. if you're short on time for marketing constant contact's powerful tools can help. you can automate email and sms messages so customers get the right message at the right time. save time marketing with constant contact. because all it takes is 30 seconds to make someone's day.

1:29 pm

get started today at constantcontact.com. helping the small stand tall. welcome back to "the exchange." the markets right now are negative, a minuscule loss for the dow, but when you compare it with the high, which was up 330, it's not maybe so minuscule. the low is negative 55 on the industrials. all three major indexes negative for the month of april the s&p and nasdaq on pace for a fifth straight day of losses the small caps struggling to hold onto their gains.

1:30 pm

the russell 2,000 is up fractionally, 0.18%. let's go to kate rogers for a news update. hi, kate >> hi there, tyler the u.s. plans to vote against the palestinian request for u.n. full membership, using its veto power on the security council. that's according to a report from reuters the move would block the united nations from officially recognizing the palestinian authority. the security council is scheduled to vote on the resolution later today northrop is working with spacex on a spy satellite to beef up military targets from a low-earth orbit. and guitar legend dickyy betts has died he played long, improvised riffs. the manager confirmed his death

1:31 pm

due to cancer. the rambling man was 80 years old. back to you. saz you nike sound and real talent thank you very much. coming up, one of this years cnbc changemakers is shrugging off the impact of higher rates we'll ask her why. as we head to break, let's lock at some of the names hitting 52-week lows, including johnson&johnson, biogen, walgreens lowest level in 25 years. we'll be back afteth r is ♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya provides tools that help you make the right investment and benefit choices. so you can reach today's financial goals and look forward to a more confident future. voya, well planned, well invested, well protected.

1:34 pm

1:35 pm

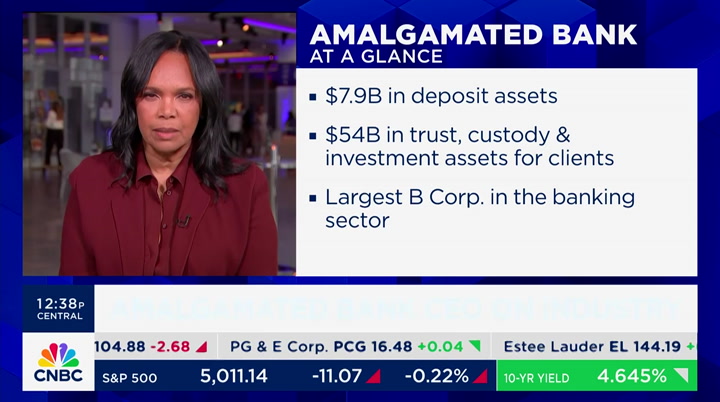

lead to new trouble. what is's hurting the real estate industry also is that with these losses in terms of occupancy is the interest rates are more than doubled. that's made these buildings essentially almost all of them in major cities insolvent. in the fed does not drop rates, these buildings, there will be a catastrophic i believe events going back to these local regional banks >> our next guest is at the help of a mid-sized banks and says higher rates haven't been an issue so far for her and her company. let's welcome priscilla sims brown, one of the 2024 cnbc changemakers, spotlighting women whose accomplishments have left an indelible mark on the business world good to have you with us, ms. brown. >> thank you >> and congratulations on being a changemaker, which is a title you have justly earned let's go back to what don peebles said there, predicting a catastrophic effect on commercial real estate

1:36 pm

i think he's speaking mostly of office buildings if interest rates don't come down, and that that catastrophic effect will ripple through to banks just like yours. how do you answer him? >> yeah. well, i can't speak to the larger banking industry or even the effect it will have on all mid-sized banks. but i do think it's important that banks are well positioned in this environment, and for us, it means even prior to the silicon valley bank problems that you mentioned about last year, we have positioned ourselves to thrive whether interest rates are going up or down, and one of the ways we do that obviously is to maintain high liquidity in our case, more than double what is required for satisfying our most risky depositors. >> how exposed is your bank to the kinds of commercial real estate companies or properties that don is referring to

1:37 pm

>> yeah, don is talking -- i agree with you, he's probably talking mostly about office real estate, and in our case, it's really important for us to have a limited, a minimal amount. and we have six serious loans, serious sized loans in m metropolitan areas of commercial real estate making up $60 million, so that's not a serious problem. but that goes to speaking to the responsibility we all have when you have a consumer and, in our case, a changemaker customer base, it's important to have a very conservative and responsible portfolio. >> i want to get to the history of your bank and what it stands for in just a moment walk us through some of the relative numbers in your bank, deposits and deposit growth over the past year, net interest margin, with a particular viewpoint what higher interest

1:38 pm

rates mean for you to have and keep more deposits right now, you have to pay a little more for those deposits >> well, we have a unique business model it's really difficult to talk about it without talking about our clients, because we're so client centered. what's unique about us is that we -- we are in two areas, which are actually growing in deposits, and slated to continue to grow. they happen to also be areas where we do well while doing good, and that is, for example, political deposits the political cycles have lengthened, as you know, significantly. it doesn't matter which side of the aisle you support. that's the case. for us, that means that our deposits, since we are a, if not the largest political bank, that means that our deposits have a different level of stickiness. we also support and have as clients unions

1:39 pm

they are core depositors for us. we talk about our super core deposits, which have an average life of 17 years, that's a significant amount of the bank's value. we are, by the way, a bank of $8 billion in deposits. $54 billion or so in trust assets, as well. and that number is continuing to climb. but of note, we are, again, in areas where there will be growth in deposits over time. another example of that, our sustainability deposits. everybody from the cr club on down, every type of sustainability organization that matters, in addition to the deposits that we receive from unions and from socially responsible organizations, including entrepreneurs who are socially responsible, as well. those deposits, again, are sticky not just because we are a

1:40 pm

large, full-service bank that offers all the products they're used to, but they're also sticky because those customers care where their money sleeps at night and they care that the bank that they bank with is value spaced >> the whole world of socially responsible investing, socially responsible banking, socially responsible corporate conduct, this is my characterization, you're free to depart from it if you so choose, has come -- some of the bloom, it seems to me, has gone off that rose over the past couple of years it's become not necessarily a badge of honor, but in some circles, a badge of wokeness how do you answer the people who say things like that like i just did? >> yeah. i think it's semantics if you are an investor, you should care about headwinds and you should care about tailwinds.

1:41 pm

two headwinds wel with today, modern reality, are climate. it's a huge headwind for us. and another huge headwind for us is poor governance so obviously, you as investors should care about good governance and care that your financial institution is a realistic one in the way that it looks at climate and sustainability you should care that there's resilience a tailwind for our industry is that it's estimated that $3 to $6 trillion is going to come into the banking industry, is going to come into financing, banks will support that, in order for companies to meet their net zero targets for 2050. that's a huge influx of capital into the industry. so that's a tailwind as an investor, i would be concerned if you were ignoring those headwinds and tailwinds. you can call it what you want, i

1:42 pm

call it semantics. >> what i read here about your bank, when you deposit your money, it supports sustainable organizations, and social justice. in light of the israel-hamas war, has your bank had to take a position with respect to that conflict, and if so, what is it, and how has it changed what you do, how you deploy your money, whom you lend to >> yeah. we don't take political positions. obviously, we are saddened like the whole world has to be to see people dying unnecessarily and that is -- that's unfortunate. and so while we have not taken a political position on either side, we stay in the lane of banking and what's appropriate for a bank we can't help but care about what's going on in the world,

1:43 pm

particularly in israel right now and in palestine >> ms. brown, thank you very much for being with us congratulations on being a changemaker. >> thank you coming up, meta rolling out a whole new ai model, and it could have a big impact across the ai universe. we have the latest in tech check next the dow, continuing to fall here now off about 62 points, session lows we'll be right back.

1:45 pm

1:46 pm

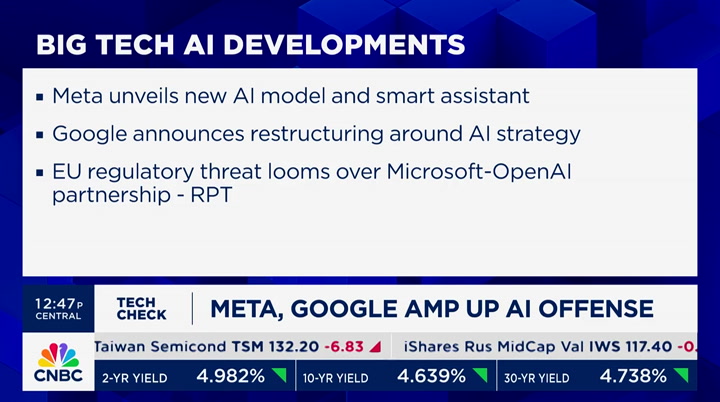

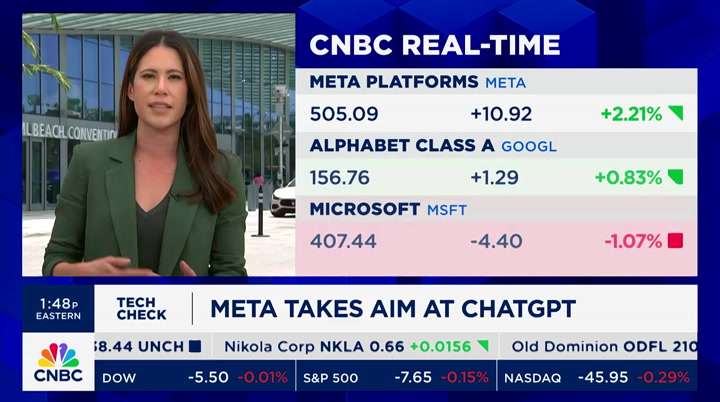

a number of new developments today around big tech and the ai arms race, including meta rolling out a whole new ai model. deidre bosa is here to break down those for today's "tech check. hi, dei. >> there's so much news in miami for the emerge conference. ai is all everyone here is talking about. the big takeaway is that the

1:47 pm

race is on this is happening faster than ever it's more competitive than ever. number one headline, microsoft they have poll position with this ai partnership, but the regulators are not backing off so will that hurt microsoft in the next stage of the race google is restructuring around ai, and it's streamlining its business to "improve velocity and execution. a memo today to staff underscores this new tone that we've been hearing from other google executives. point blank, it is going on the offensive. and the thing that you mentioned, tyler, that is the most interesting today comes from meta. it will be integrating its system into its family of apps, facebook, instagram, whatsapp, messenger, there's also a brand new landing page for its chatgbt meta.ai. that's symbolic of meta jumping in this race saying they're going to compete with the google, amazon and microsoft on

1:48 pm

every front. this is just the beginning >> this initiative operates under the brand "llama," am i correct? my son's favorite animal, by the way. >> yes so this is its latest version of llama, which is important to note this is an open source model, so as meta is essentially giving this away for free, that's a very different strategy from the likes of google and microsoft and amazon they're charging typically a monthly rate for their customers. users or senterprises to get access meta's model is offering these bots for free to keep people within that ecosystem of apps, so it will continue to make money through advertising, through clicks and visits. the other interesting thing about this being an open source model means that meta may have to hire less of the really expensive ai research talent that the others are hiring google, paying as much as $20

1:49 pm

million over four years. by making it open source, it crowd sources from a lot of the ai talent out there that wants to customize for their own uses, and in turn, they gave that knowledge and those developments back to meta >> so saving costs and enhancing engagement in advertising, that's the profit formula here deidre, thank you very much. >> you're not going to see this show up in earnings in the same way that microsoft has said that co-pilot and its cloud units are leading to new spend by a company. so it is different there this is more of a long-term play >> deidre rolling up the frequent flyer miles miami beach today. coming up, powering ai is going to be a massive chance, one the u.s. energy grid is not prepared for our next guest is working to change that with the backing of e ll gates thceo of tera power joins us next

1:50 pm

[city noise] investment opportunities are everywhere you turn. do you charge forward? freeze in your tracks? (♪♪) or, let curiosity light the way. at t. rowe price, we're asking smart questions about opportunities like clean water. and how clean water advances can help transform our tomorrows. better questions. better outcomes. t. rowe price (grandpa vo) i'm the richest guy in the world. betthi baby!mes. (woman 1 vo) i have inherited the best traditions. (woman 2 vo) i have a great boss... it's me. (man 1 vo) i have people, people i can count on. (man 2 vo) i have time to give (grandma vo) and a million stories to share. (grandpa vo) if that's not rich, i don't know what is. (vo) the key to being rich is knowing what counts.

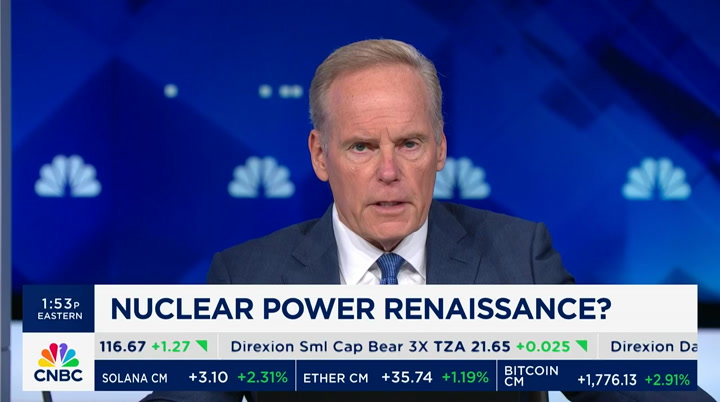

1:53 pm

and crypto all fueling an unprecedented demand for power and utility companies are frankly having a hard time keeping up with it according to the international energy agency global demand from ai is expected to jump 10 fold and this number is expected to grow in the coming year. our next guest says his company can help meet demand its first next generation nuclear plant is about to break ground in wyoming in june. chris levesque is the ceo of terrapower good to have you with us >> thanks for having me. >> you will break ground on what will be a next gen nuclear plant. how long is it going to take what kind of permitting do you need how soon do you think you can get it >> sure. that first plant is going to be america's next nuclear power plant. just last month we submitted our construction permit application to the nrc it's the only one in front of

1:54 pm

the nrc and when we receive that permission in the nrc to start nuclear construction in 2026 that will then start a three-year construction process. we can start the nonnuclear partings of the facility now and this june we'll be getting the construction of the turbin at the site of a coal plant in wyoming. >> wyoming and when it comes online what sort of regional footprint will it serve. >> a 345 megawatts enough to serve 4,000,000 rate payers. as you mentioned in your earlier segment we're thinking about the data center demand which is going to be immense. nuclear energy is 20% of the nation's electricity supplied today but we've built very few nuclear plants >> that's right. >> and when -- >> howmany in fact, in the las

1:55 pm

30 years >> in the u.s. only two new plants have gone only really when bill gates created the company over 15 years ago, he recognized that hey, nuclear energy is valuable, but if we're going to deploy it massively the way we need to, we need to move to the next technology today's reactors in the u.s. are based on old technology. this is the field we needed innovation. >> that was one of the things i wanted to ask you about. a typical nuclear plant that i think of, the reactors are cooled with water. this will be cooled with >> sodium. the name of the reactor means sodium in latin and advanced reactor like this will have new benefits and it's going to be cheaper, safer today's reactors are very safe, but nay treeium will be the next level of safety. it's going to let you use the plant in a totally different way because nay treeium has built in

1:56 pm

energy storage and going to let you change power quickly when demand changes throughout the day or if the wind or the sun are curtailed throughout the day. >> when i think of sodium i think of what i put on my steak. mineral sodium this is liquid sodium. >> on your steak is sodium chloride, salt this is the liquid metal sodium which melts at a very low temperature and flows like water. it allows you to have a low pressure plant which will be a lighter plant with lighter components and that's what makes it cheaper. >> where does that cooling waste go once it has done its job? how do you dispose of it >> the used fuel as we call it, is eventually going to a geological disposal facility in the ground and the u.s. government has responsibility to create a facility like that, so the plan for nay treeium used fuel is the same plan as the used fuel for those 93 reactors operating in the u.s. today

1:57 pm

which is geologic disposal that's very safe and the other thing to realize about it, it's a very small volume of used fuel, so that nuclear energy's powered 20% -- >> what if the political winds shift? is that a risk to this shift and to your enterprise >> i don't think so. because one thing about nuclear energy today and this is in the last five to six years is so different than its history, is we have bipartisan support for nuclear energy different folks support nuclear for different reasons. we have a lot of young liberal folks who work for our company because they really are concerned about climate change, more conservative folks are interested in nuclear for its energy security value. we are in a competition with china and russia for nuclear technology. >> chris levesque, we have to leave it there terrapower we appreciate it. >> thanks, tyler. >> that does it for "the exchange." "power lunch" will be right up

2:00 pm

♪ (orchestra del teatro alla scala, milano) ♪ ♪♪ [water splashes] ♪♪ [kid laughing] ♪♪ [water splashes] ♪♪ ♪♪ [ripple sound] [laughing] [water splashes] [continue laughing] ♪ ("horn house") ♪ ♪♪ [chuckle] ♪♪ everybody. welcome back, seema moody. good to have you with us and good to have you with us i'm tyler mathisen stocks heading to the downside right now. the s&p 500 and nasdaq both on four session losing streaks, the dow having its worth month in a year and a half.

31 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11