tv Fast Money Halftime Report CNBC April 18, 2024 12:00pm-1:00pm EDT

12:00 pm

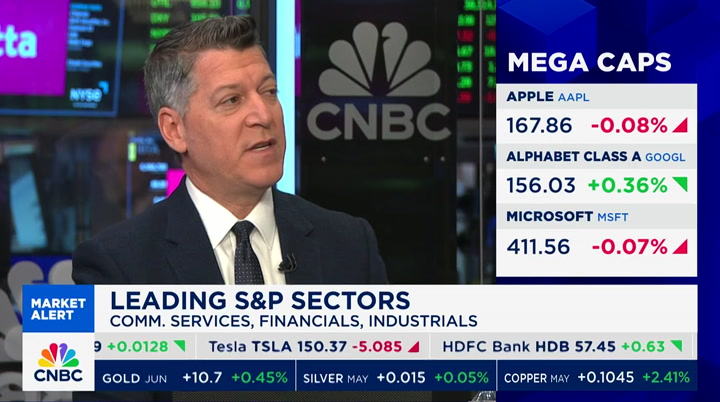

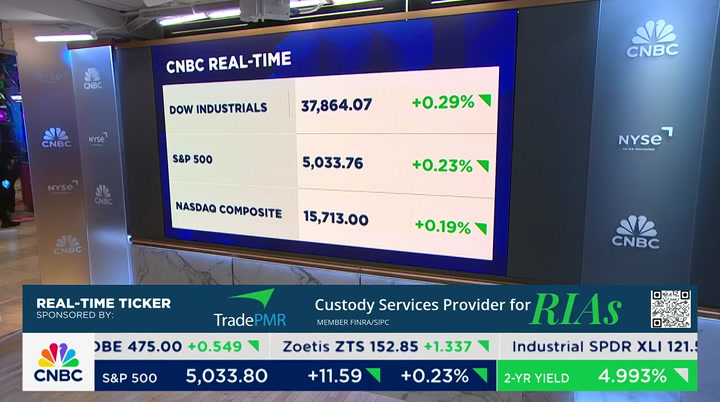

that stock reports earnings after the bell what else? taylor swift releases her album tonight. i don't think that -- >> i'm surprised we didn't lead with that. >> we'll lead with it tomorrow >> the taylor economy, we've talked about it for a while now. >> it's no joke. >> we'll see what holds in the afternoon. to the judge carl, thanks so much welcome to "the halftime report." i'm scott wapner front and center this hour, the state of the tech trade. nasdaq tracking for its sixth down week in the past seven. it's having a bad week the investment committee debating netflix numbers are on deck. this is an important afternoon joining me for the hour, josh brown, liz young and jim lebenthal. i'll take you to the markets we have a nice little bounce today, but we are going to zero in on tech the nasdaq is up less than half of a percent as i said, josh, you have this streak down six of seven weeks for the nasdaq it's down 3% on the week and here we have netflix and, you know, there are times when

12:01 pm

it feels like the market needs tech this feels like one of those times. >> i would agree i don't know how much help you're going to get, but if you actually look at some of the pullbacks that we've experienced the last couple of years, even if they were minor pullbacks, in many cases big tech earnings reports were the thing that put a stop to those declines so if you were thinking of, like -- look, we're not really that far off the highs we're three straight trading days below the 50 day, which i think is what's getting people's attention. we've grown very spoiled we've been up above that short-term moving average pretty consistently all year. so that's getting people's attention. but if you were to make a list of what are the catalysts that could get people interested again on the buy side, i would say some blow-out tech earnings would do the trick number one, they're big index components number two, they're highly visible. everyone will know it if and

12:02 pm

when it happens. and then, number three, just spiritually this is still the leadership group i know there's been a broadening i know there have been winners in other sectors, but, at the end of the day, they still are the leadership stocks. they're still the generals we want the generals standing upright on the battlefield, not lying down so, yeah, i think we need some help from the tech names i don't know how much we'll get, but you're right about that. >> liz, do you agree with that is this one of those times in a somewhat unsettled market where we need the biggest stocks within the market and what has been the best trade over a long period of time here to live up to its billing and save the day? >> i agree with that i think the other thing to also remember is that tech is responsible for more than all of the earnings growth that we're expecting in the first quarter from the s&p so they have to come through in order to keep the growth number positive next week is going to be a big week the thing that would concern me is that if what happened with jpmorgan is any indication,

12:03 pm

investors have really high expectations it's not only that you have to hit your numbers for this quarter, but you have to guide higher than we expected to you guide. and if that doesn't happen, we could have the scenario that josh was talking about, the expectations are there you might not get too much out of it. the other thing i'll mention, when you look at what's happened in markets through april -- so month to date april -- i would call this more rational behavior we have yields up, stocks down you look at the stocks that are down, the mag seven isn't down as much as the a.i. stocks we have some overlap there, but not down as much the things that had gone up so fiercely obviously giving some back small caps down dramatically investors still want cash generating stocks, and they want stuff that is tried and true it's saved them before it's done well in their portfolios before. we're doing muscle memory. >> you had a great point barclays notes the fact that estimates are drifting lower for earnings that the upside is

12:04 pm

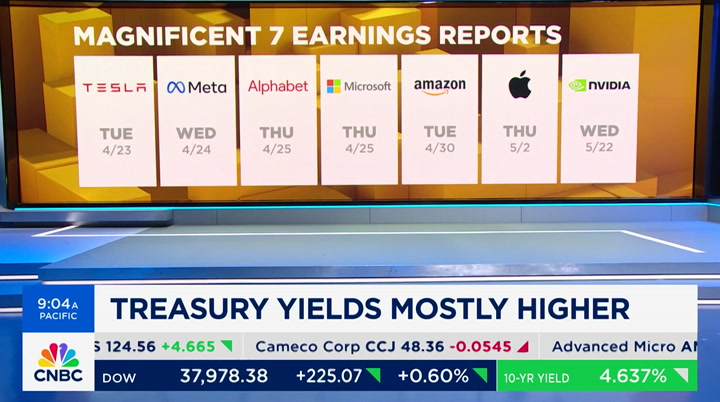

reliant on tech. so next week -- netflix, okay, it starts the growthy earnings names coming through, but next week it starts to get real and tesla is early in the week, but then you havewednesday and thursday it's real-real. meta, alphabet, microsoft. you're going to have to wait until the 30th for amazon. you're not waiting you bought more amazon >> bought more amazon. >> why >> it's a relatively new position i took a toe hold about a couple of months ago. amazon has held in there very well let's not forget that for the last three years it actually has underperformed the market by a meaningful amount. recently it broke out to a new all-time high. during that three years the financial performance of the company has been fabulous. i don't see that ending. if you look at amazon web services or the retail part of the business, they're going to continue to fire on all cylinders. some people may say, well, at 40 times forward earnings, is this

12:05 pm

really true to your value discipline, to which i say, yes, for two reasons. i think there's a good likelihood on the strength of the economy that the estimates are too low for amazon and, number two, you really have to normalize amazon's earnings for what if they just stopped building they shouldn't, but what if they stopped investing in the future and operated what they had right now? their expenses would go down, earnings would go up i think is obviously a bellwether for the overall s&p 500, and after pretty much a flat return for three years, i'm comfortable getting in >> flat for three years but at a recent new all-time high >> and that gives me comfort >> the stock has started working again. you used the word comfort. you feel comfortable buying it at the time where it's around an all-time high in what feels like a somewhat newly unsettled tape. >> newly unsettled tape, i would agree. i think that newly unsettled tape will setting down >> the nasdaq, it's down about 3% on the week and many of the names within it are down 3%,

12:06 pm

some more than others like apple, of course you get the point here >> i do get the point. newly unsettled tape i like that he caexpression the economy is going so strong, scott. we did get the initial jobless claims, philly fed, et cetera. what would worry me on amazon or anything, frankly, is if we had to go back to that discussion of a recession, which i just don't see happening. it shouldn't be in our conversation right now it's not in my conversation. >> next week is going to get real, as i said, for stocks that the majority of the committee owns in bulk microsoft and meta, alphabet you have alphabet, you have some other positioning within the space, too do you -- are you concerned at all about the way that these stocks have traded of late at a time where i think the broadening trade will be questioned because of the backup in rates >> no, i'm not really concerned about the way they've been tra trading. the sore spot, what we've seen

12:07 pm

with apple, the good news is the expectations are on a high for apple. there are big, fundamental questions that i think will come out during the q&a and the prepared remarks that have nothing to do with this quarter's numbers and everything to do with how management feels about these open questions and we're talking about stuff like china we're talking about stuff like re-acceleration of growth possibly coming from the services side. it's just going to remain a tough stock. the others, though, i think meta looks fantastic technically. obviously the fundamentals are hitting on all cylinders alphabet, even though in the news flow they continue to be embarrassed by some of the actions of the employees, outside of that, the fundamentals are terrific. and even when you think about microsoft, there's not that much going on there in the headlines, but the stock looks great. i'm not worried about the theme. i think these stocks will hold up well.

12:08 pm

but, look, in every quarter, one of them shocks everybody maybe it will be tesla this time i don't know but i feel just generally speaking investors are still going to run for those stocks every opportunity they get >> i really, jim, want to see your microsoft next thursday i feel, by the way, the price target gets trimmed slightly at citi, they reiterate the buy the target to 475 from 480 and they're adjusting estimates, they say, because of some slight fx headwinds this is stock that's gotten the benefit of the doubt, you know, this first mover advantage, so to speak, where they have this open a.i. investment it catapulted the trade into the lexicon, and we've talked about it probably every single day in some respects since that happened nvidia has its own place, but i feel like microsoft, i want to see what they deliver this

12:09 pm

quarter. you know what i'm saying we've given them the benefit of the doubt. let's get some more meat on the bones. >> humor me. you like to ask us questions are you skeptical or are you saying there's a hidden gem here >> not really. i noted a couple weeks ago that if you -- it was microsoft was crushing everybody and alphabet was the one who missed the boat, and then i noted over the last 12 months the stock performance between the two was neck and neck >> hidden gem, the largest market cap in the world, 37 times earnings >> okay. >> a gem has been unhidden >> fully out in the open gem >> here is why i was asking that way -- >> i know. >> i just wanted your opinion, because i don't know if we're going higher or lower, scott, in microsoft. i don't know >> he doesn't either >> but he could have roughly 35 times forward earnings p.e.g. ratio, what guys like me think about, is that 35 times fairly priced? on nvidia the p.e.g. roughly 35

12:10 pm

times forward earnings, fairly priced microsoft over growth of earnings is 2.3. it's a little high is it nose bleed no i'm not going to worry about fx. you brought that up or the analysts did p.e.g. ratio is high but not egregiously so high. >> you're not going to hate on microsoft's valuation -- >> i'm not >> and wax poetic on amazon. >> but wait a second wait a second. p.e.g. ratio on amazon is 1.2. i'm not hating on microsoft. what i'm saying is i'm not add to go microsoft today. i'm adding to amazon by the way, nvidia is looking tempting to add to >> what's the biggest risk in the microsoft quarter? what's the worst thing that could indicate -- >> the worst risk -- >> i was just going to say >> no risk >> he said there's no risk jim lebenthal said that. not me not josh

12:11 pm

not liz. >> if i'm trading ahead of the quarter, what i would worry about is the commercialization effort of openai is going slower than what the market is hoping for. >> okay, fine. how about if i agree with you that is actually maybe even likely >> you already said otherwise, too late >> you already said there was no risk that would be a major problem. >> well, okay -- >> goes to my benefit of the doubt comment. >> this is where we differ i don't think it's major i don't. i don't think that's something that if that happens, josh, people wake up in the morning and say, this is a crummy stock. i want to get rid of microsoft >> don't you think we've talked about sort of looking down the a.i. highway and saying, okay, there are very few companies who seem to be monetizing it now -- nvidia, microsoft we put at the top of that list as well, so if josh's point comes to fruition and they're monetizing it less than the market had expected --

12:12 pm

>> look -- >> problem that's a problem >> i apologize i didn't mean to apair blase >> accept your apology >> thank you the foreign multiple is 32 let's not get freaked out. we're super micro. you want to talk where there might be risk to the down side, it's not just a.i. you have obviously the windows franchise. you have the gaming. you have azure, everything >> yeah, i know, but the stock hasn't -- its multiple hasn't expanded on windows. >> i don't want to talk -- i don't want to talk out of both sides of my mouth, but i need to reiterate, i'm not buying microsoft today. i'm buying amazon, something else we'll get to in a second. i'm not coming out saying this is the greatest thing since josh brown, and that's a pretty high hurdle >> price target gets raised at bernstein -- >> which one >> ahead of earnings today. >> which one >> alphabet and meta, but alphabet -- i come to you on

12:13 pm

alphabet because you own it. to 165 from 160. doomsday fears are overdone. it's impossible to dismiss the terminal risk. >> yeah. so google's large language model is not great but neither is anyone else's. that whole fear of alphabet being behind is now laughable. now that in the real world these llms have been out there, people are using them, they're building layers above them. they are incorporating them into existing software. we see it every day in financial services we know it's happening in every vertical there is no real advantage yet that's materialized. so that fairy tale about how google is, like, not a player here or they're too far behind to catch up, obviously is untrue the key thing to keep in mind here, every one of the faang names, every one of the mag seven names, has an advertising business, all of them pretty much, maybe with the exception of nvidia. but, the advertising business at alphabet is the business i know they have an airplane hangar in california where

12:14 pm

they're attempting time travel, but 97% of this company's revenue is ad revenue. you can see that in the share price of meta and alphabet, which are leading the market, and why the ad market is doing great. it's a huge change versus 2022 and early '23. a lot of the uncertainty around ad spend has gone away, and they have resumed taking share from traditional advertising platforms like print, like television -- no offense -- and that is what the street is going to value the stock on. that's what they can actually deliver on, and the a.i. stuff is important, but it's not really going to disrupt the current ad story today >> kind of like windows for microsoft. >> i'm on windows right now. >> what year is this >> can we talk about -- let's talk about tesla as well today, because the stock did hit a new 52-week low. you know, look, some have removed it from the mag seven and the performance of the stock is probably justifiable that's

12:15 pm

been done. it's down for its fifth straight day. we had a big debate on the stock yesterday with bryn and weiss, one long, one short. take a listen. >> the fundfundamental's deteriorating. we've hit the limit in ev adoption they have the oldest ev lineup in the industry globally they have 20% of revenues come from china we see what china has done, okay we've seen apple move their supply chain to india. and they've got better relationships and longer standing relationships with the chinese government we've seen china is supporting domestic producers that, by the way, make newer, more richer, in terms of the accessories, in terms of, you know, basically even the range of their cars than tesla that's number two. number three -- number three -- we've seen elon just tweet out, oh, no more pricing, we're raising prices he lied.

12:16 pm

>> what i wouldn't discount is elon he's one of the most prolific innovators and engineers of our time with spacex, literally nasa would be defunded, with what he's done with energy stories and then at nurolink this is based on sentiment and also valuations, margins and earnings expanding so i see absolutely why steve is short. i don't think he's going to be short long term. i think it's probably a trade. but i think longer time we will get some clarity, and this will be over the next few months a potentially good opportunity to add or buy to the position >> that's bryn and weiss with differing views obviously. this resonated, the social engagement we got on this debate, was over the top >> went viral. we live for moments like this. >> that's why i wanted you to weigh in deutsche bank cut it to hold, cut to 123 from 189. they say earnings will be under pressure and free cash flow will be as well do you have a take on this

12:17 pm

situation? >> so the stock, even after everything it's gone through in the last year and a 60% draw down ish is still up 675% over five years i am maybe the worst person to offer a take because i never owned it i missed the entire run higher i just never understood it i never understood why it was so popular. i understand the appeal of him i understand it's not a car company, blah, blah, blah. it's electrical, whatever. i get all that i'm not stupid i missed it. i was wrong, wrong, wrong, wrong. just because it's now at a 60% drawdown, though, i don't really change my mind as to being short, i know weiss' finger is on the trigger he's watching it all day that's great for most people shorting tesla historically, it's like never fight a land war in asia it's just like one of those unwritten rules. you just don't do it because of how quickly you can get your face ripped off if he sends the wrong tweet that people get excited about. i'm not a great authority on the

12:18 pm

stock in either direction. i do think being short the stock is playing with fire i also don't think i want to be long the name given all of the drama surrounding it >> jimmy >> i'm going to go to the fundamental analysis here. you just hit it, josh, people say this is not a car company, and quite often they point to things like full self-driving fsd. i know this is not going to make me friends with the tesla crowd, but it is just a car company, and full self-driving is just like any other innovation that has ever come out of the automotive industry. i don't care if it's fuel injection or air bags, a company starts it and then other companies follow that has been the story with tesla including the whole electric vehicle market. they had the space to themselves now there's competition both in electrical vehicles and also full self-driving. >> and you're trending good luck. >> but then you summarize this, and what you've got is a company the last thing the aficionados have said is look at the margins on tesla they've been ferrari-like. it's true.

12:19 pm

and now they're coming down and the estimates are coming down and they're locked into a price war. that's not where you want to have a 45 times multiple >> if you look at ev as a theme, if we pull this out broadly, i think a lot of what is happening in ev now is what we need to keep in mind, take notes for what might happen in a.i. going forward. the ev theme everybody was so enthusiastic about it. it was going to change the car industry entirely. and it got too enthusiastic. and now we're pulling back it's not as popular. you have normal traditional car companies having trouble unloading their version of evs, so the demand isn't quite there. look at lithium prices this year down dramatically compared to an environment where all of commodities are up so the demand just hasn't come through yet. we pulled it forward way too much tesla was the company that was supposed to be the leader, the innovator, and now it's feeling some of that pain. >> that may be true for certain names that have gotten an a.i. bubble or a.i. umbrella bump,

12:20 pm

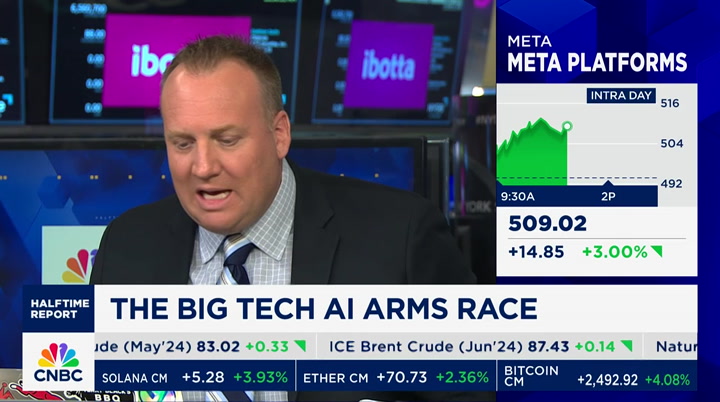

but not necessarily for the biggest players like the microsofts and the nvidias and the alphabets. >> sure. >> selling software -- >> even meta, by the way, which has some headlines out regarding its latest version of its large language model and the stock is up nearly 3% we'll have more coming up in just a few minutes, but it goes to the point we are talking about earlier about the arms race that's taking place those who think they have a leadership role and the way the market has perceived who is in the advanced stages of monetization and are rewarding them as such >> we had a debate in 1998 one year into the internet, who is in the lead? our candidates would have been likos, excite and at home. we would have been literally debating who has the most eyeballs now who has better -- and google comes public in 2004

12:21 pm

nobody talks about anything that took place between -- and so i don't -- look, i don't think it's going to be some company no one has ever heard of because of how expensive it is to just get into the business. it's like $100 billion at stake. i get that it will be one of the companies we talk about. it's too soon to crown anybody, and i think you're seeing that reflected on wall street where every month we decide it's somebody else, maybe today it's meta so i like that for investing i like that it's murky and unclear and we don't already know and we don't have a stock selling at 500 times earnings because they definitively won. >> so we're going to have more, as i said, in just a moment, because it's developing into an interesting story today and we don't want to let it go. we could have had perhaps some other stocks as our chart of the day. we chose taiwan semi after asml, there's been a lot of talk about what will happen with what has been one of the best trades in the market clearly and that's the semis taiwan semi today is falling on

12:22 pm

earnings there's some news on micron. it does lead us to nvidia as well which gets reiterated as its top pick, josh, with the $1,100 target at cowen do we need to worry about some of these chip stocks which month to date intel is down near 20%, amd off 13.5, to the down side, nxp is week. sky works, asml, lam research and nvidia i don't know if it's a full trend reversal you would look at the charts and decipher that better than me how do you look at what's happening in the space >> no, these are falling knives right now. nvidia is probably holding up better than most of the names that i follow. taiwan semi is 60% of global foundry revenue. there is no company doing anything in chips that doesn't deal with them in some way, shape or form. if you're not paying attention to what they're telling you, i

12:23 pm

don't know what they're looking at they lowered expectations for chips growth in 2024 they cited macroeconomic and geopolitical uncertainties they think those things are weighing on end market demand. you need to remember every semiconductor company is cyclical in the end, that's number one you might not believe there's a cycle anymore. the reality, there still is a cycle. that's one two, end market demand is all that matters, and frequently chip companies will be the last to know. they will be the last to know. they'll find out later than some of the other companies that are the consumers of their chips, so that's what we're dealing with here they are echoing the same things we heard from asml how many more companies this important do you need to hear from to understand that maybe the expectations got ahead of the reality. >> if you look at these chips and you say, okay, it's the more perhaps industrial ones that

12:24 pm

maybe immediate to keep an eye on more than the a.i.-related ones on semi nxp, 13.5 and 10% respectively to the down side month to date. >> i think -- >> you have nxp, right >> i have nxp. i did trim that recently, also trimmed nvidia i think i will echo what josh said which is that expectations got ahead of themselves. if you want to just focus on the industrials, nxp rallied up to 260. what was that all about? rebuilding all the owe inventory after the auto strike last fall. and look at qualcomm as another example. these are not fatal conditions they are small pullbacks that will last for a little while with the economic cycle going where it is, they should rezoom a growth trend i don't think it will take too long qualcomm, just for example, as much as it's doing in automotive and the internet of things to diversify, it still is beholden to the smartphone market

12:25 pm

the expectation for the smartphone upgrade cycle probably are ahead of themselves i want to make this point very clear. this is not a time,my opinion, to sell qualcomm, any of these things i trimmed those a few weeks ago. but this is a time to sit tight and let this part of the cycle happen it may last a quarter, and then let the economic growth, which we're seeing in the u.s., which is likely to transfer to the rest of the globe take over through the rest of '24. >> can i ask you a question? taiwan had 40% net profit margins, which is the highest in the company's history. doesn't that seem peakish to you? given the amount of investment we know they're all going to have to make, doesn't that seem like as good as it gets? >> yes, but that doesn't really worry me, josh i think what you will see here is whether it's the reshoring of the whole supply chain or just economic growth i was talking about, that these volumes will pick up. >> by the way, it's not just semis, liz, since the s&p's

12:26 pm

record high on march 28th, which may feel like an eternity ago to some people relative to where volatility has picked up of late, software is also down 6% since the s&p peak i could go through a number of other sectors away from tech that are down more do we need to worry about under the surface names within tech, not just the mega caps >> i think this part of the cycle, and i said this on "closing bell," if we do have a sell-off that actually picks up steam, i think what happens first is the broadening out trade goes people that had bought things on the premise that we're broadening out, because the economy is expanding, everything can participate, and that largely has happened small caps have taken it hard. when you look at semiconductors, if we're talking from a cyclicality perspective, you have to compare them to the trends in software and software has underperformed semis on a trailing one-month basis, but that gap has narrowed recently but when i say recently, in the

12:27 pm

last, like, four days. this is not yet something where the trend has reversed and suddenly software is outperforming. i'm more optimistic or maybe less pessimistic than josh i don't know they're falling lives but cyclicality is challenged all right. we're going to take a quick break. we will come back and have more news regarding these meta headlines which are very interesting. we'll do our "calls of the day" as well. don't go anywhere. >> announcer: are you following "the halftime report" podcast? what are you waiting for look for us in your favorite podcasting app follow "the halftime" podcast now.

12:29 pm

if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now.

12:30 pm

we're back we do have more news now on meta you see the stock moving higher by more than 3%. to steve kovach who has this news which is really about the next frontier, steve, of large language models, image generation as we've heard from some others and now we hear from meta >> reporter: by the way this is their new large language model, they are calling it llama 3. two important things to know immediately it will be deployed to billions of users who use face book apps, the whatsapp and

12:31 pm

so forth a huge user base for this product. on top of that there's a new relationship with google here. previously already a relationship with bing, when you ask meta a.i. a question that needs to search the web or crawl the web for the exact right answer it will credit google or credit bing as the source of that i asked meta what the nature of that relationship is, who is paying who, basically. they wouldn't tell me that, but it is also kind of a boost here for google search and bing search being tapped by the large language model, scott. >> steve kovach, thank you very much for that interesting news exactly what we were talking about earlier. >> the nature is very different from the world gardens that so many of these large tech giants have historically built. i think it's the smart route i think you want mass adoption and then you want to take all of

12:32 pm

that usership and analyze what are people really doing with these products and with these features and how do we build upon that? we're in the stage where no one will own it because no one really seems to be trying to own it they seem to just want to get as many people using it as possible maybe the product where we get more competitive comes in the next wave, but it's a really interesting announcement and i absolutely think you'll see a ton of notes by tomorrow morning. >> we'll follow the stocks for the remainder of the session scott, we're now down to five jurors on donald trump's hush money trial after the judge ruled to dismiss juror number four the judge questioned the juror after he arrived late to court prosecutors raised concerns that the juror may have lied on his past arrest history on the questionnaire. top officials will meet today on the possible operation in rafah according to nbc news

12:33 pm

citing two u.s. officials. national security adviser jake sullivan expected to chair the virtual meeting. a follow-up on a meeting from april 1st where u.s. officials said israel's plan addressing humanitarian concerns were unrealistic. president biden is not expected to attend. and the u.n. security council is expected to vote later today on a draft resolution that would give the palestinian authority full member status at the united nations. currently it holds a permanent observer status. however, the u.s. holds veto power on the council and could use it when the resolution comes to a vote. scott, back over to you. >> kate rogers coming up, hunting for yield with rates higher for longer your dividend playbook with key stocks to consider right now the committee debates them next with a special guest

12:34 pm

tamra, izzy, and emma... they respond to emails with phone calls... and they don't 'circle back', they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team. let our expertise round out yours. ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even a term policy? even a term

12:35 pm

policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com. you founded your kayak company because you love the ocean- not spreadsheets. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire

12:37 pm

welcome back our next guest looking for stocks that can grow their dividends in a higher rate environment. joining us now is matt powers of power advisory group welcome back to post 9 it's good to see you again this is a pertinent conversation given the backup in rates, right? i'm sure you're thinking about this a lot, and if you're looking for dividend growers, the so-called aristocrats are down 5% month to date on fears of backed up rates for a longer period of time >> no doubt it's a dividend. i think we can all agree on that it doesn't impact our strategy it does not change how we're investing. it will require a lot more patience moving forward. >> do you think it will impact performance of, you know, money managers or fund managers who are explicitly looking for stocks like this if rates remain higher for a longer period of time than we first thought >> absolutely. just from our perspective, our

12:38 pm

end, when we are kind of getting this out there, our lean, we focus on dividend growers, less on high yields we're not looking for a bond alternative or a fixed income alternative. we're looking more growth. it's total return is what we're after. >> so recent buys, highlight a couple of them mastercard is one. it offers a, i think what most people would say is a small yield. not even a 1% dividend, but they have grown their dividend over a period of time, which qualifies them for the kind of stock you look for >> normally we're looking for a 2% yield on the stocks, but mastercard is at 0.5 percent they've grown the dividend 27% a year over the past ten years anything that is growing at that rate obviously will catch up that's one part. the other part is the payout ratio. that's the percentage of

12:39 pm

earnings being paid out in the form of a dividend mastercard, 19%, 20% roughly, somewhere in there, which means they have a lot of space to grow >> okay. hershey, 2.6 yield why this one >> cocoa prices. >> we just showed those on the network within the last hour >> seriously good >> hopefully i'm quoting this right, it's 250% year over year. i think a lot of that comes from supply, africa, issues with weather. hershey was not on our radar before but the price is down 27% over the past year, the yield just went up and it hit our radar. we look for a ten-year track record >> are you thinking about dividend growers here? >> what's different from your strategy versus buying the dividend aristocrats as like a smart beta factor driven

12:40 pm

strategy what are you doing that doesn't get captured in something quantitative like that >> aristocrats is a 25-year period, and that gets stretched out so long. that's such an extended period we look at ten year on the dividend growth side that's the simple answer to it >> you'll pick up stocks before they become aristocrats? >> correct. >> interesting point others that are part of your buys recently, lockheed, right starbucks, mcdonald's. do you want to talk about any of those and why they stood out >> lockheed purely a geopolitical play. tensions in iran/israel, a longtime holding one of our original holdings on the book loved it ever since. it has a great dividend growth rate track record. performance has been great over the past decade. purely a geopolitical play >> what about mcdonald's >> you can almost -- i mean, starbucks/mcdonald's almost lump into the same group. they're kings of the fast food industry they're both -- the stock price

12:41 pm

is depressed year to date, and really not a great reason as to why, so their valuation looks excellent, and they fit that dividend growth rate perfectly >> you keep us up to date on what moves you're making good to see you again. >> thank you very much >> coming up, a pop for d.r. horton on strong earnings in guidance and stephanie link e ught the stock last month. shhas a trade update and will join us next

12:42 pm

12:43 pm

the stock market does. in fact, most people don't find them all that exciting. but, if you're looking for the potential for consistent income that's federally tax-free. now is an excellent time to consider municipal bonds from hennion & walsh. if you have at least $10,000 to invest, call and talk with one of our bond specialists at 1-800-217-3217. we'll send you our exclusive bond guide, free with details about how bonds can be an important part of your portfolio. hennion & walsh has specialized in fixed income and growth solutions for 30 years,

12:44 pm

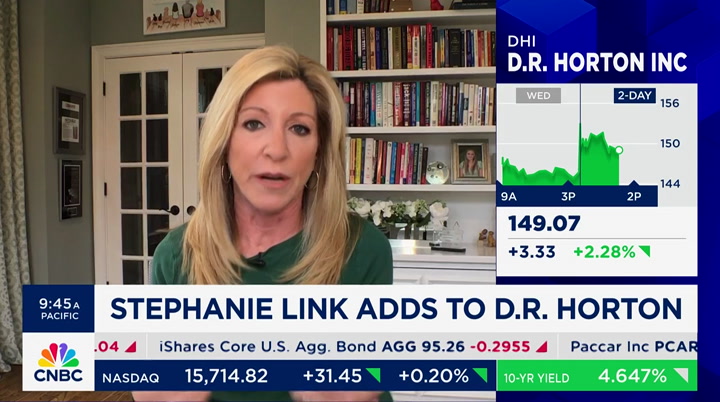

and offers high-quality municipal bonds from across the country. they provide the potential for regular income are federally tax-free and have historically low risk. call today to request your free bond guide. 1-800-217-3217. that's 1-800-217-3217. ♪ take a look at d.r. horton today. the stock is up about 2.25%. that's after topping estimates raising its estimate as well stephanie link owns it and joins us with a trade update >> hi, scott. >> tell us what you're doing with the scott today, steph. >> so i am adding to it.

12:45 pm

i think the stock actually -- i'm sorry, i'm hearing a little bit of feedback here i think the stock should be up more than just 2.5%. this is a company that just delivered 14% earnings growth, 15% total revenue growth, unit closings are up 15%. their orders up 46% sequentially, and gross margins were good. the important piece here is 57% of the homes bought in the quarter were first-time buyers we know that we are 5 million homes short in this country. we have 5 million millennials that are first-time buyers we are seeing that come to fruition i like the mix in the southeast and south central part of the question 11 times forward tiestimates, i think the stock is cheap. >> no worries about higher rates? >> i do worry about higher rates

12:46 pm

and i think that's why the stock is not up more the dynamics they offer in terms of the first-time buyer, that's where i want to have exposure, and that plays into d.r. horton. it may struggle a little bit in the short term, but i think over the long term housing is a ten-year theme on any pullbacks, i'm a buyer. >> you also bought more lvs, las vegas sands. why did you do that? >> yeah, the stock down 18% is little overdone. the mix was a surprise macao actually disappointed with eb ebitda so they disappointed and they lost some market share they still have 27% market share and i like that region very much singapore beat on expectations so i just think this stock trading at 11 times versus its

12:47 pm

13 times historic. i just think if numbers are going to come down because of macao, they're coming down 1, 2% i think the stock down 8% is a buy. >> yeah, the worst day in about 18 months for that stock do you still own wynn, jimmy >> i do still own wynn >> reluctantly >> the frustration, and, stephanie, i get it, operational results at wynn are fabulous and the stock continues to be lackluster las vegas stands down 8% today, i get it wynn reported a blowout quarter on every metric and was down 9%. it's part of the story, this higher interest rate regime is making people think maybe the recession is closer, people aren't going to gamble as much stick with it, steph >> briefly, last word? >> i love wynn i've owned it in the past as well las vegas sands is cheaper, and it's a pure play on macao and

12:48 pm

12:50 pm

you know what's brilliant? boring. think about it. boring is the unsung catalyst for bold. what straps bold to a rocket and hurtles it into space? boring does. great job astro-persons. over. boring is the jumping off point for all the un-boring things we do. boring makes vacations happen, early retirements possible, and startups start up. because it's smart, dependable, and steady. all words you want from your bank. taking chances is for skateboarding... and gas station sushi. not banking. that's why pnc bank strives to be boring with your money. the pragmatic, calculated kind of boring. moving to boca? boooring. that was a dolphin, right? it's simple really, for nearly 160 years, pnc bank has had one goal:

12:51 pm

to be brilliantly boring with your money so you can be happily fulfilled with your life... which is pretty un-boring if you think about it. thank you, boring. we have an update. ibotta open for business about 27% up, priced at $88. we'll continue to watch that stock throughout the rest of this day the latest ipo on the floor of the new york stock exchange. mike santoli is here so we got it down yesterday to what, 5,007-ish. had a nice little bounce off that

12:52 pm

still feels a little uneasy. >> and the bounce didn't get up to yesterday's highs so whoever feelsit's safe to sell every rally is probably going to have to be disabused of that down by 250 s&p points in three weeks, up by 25 at the highs today. so we're kind of conslow lessing in here. pressure has been taken off by the fact that yields aren't making new highs but they're close. we're still h the same dynamic of trying to gauge if anything has changed about the trajectory for the economy with yields up here i am very fixated on some of the cyclical parts of the market industrials have done better, transports we know have been a little bit ugly. so you want to try to read the message in the macro, aside from just hey, we need to pull back, we got a 4% pull gback, no big deal we haven't quite seen a big

12:53 pm

flush yet. >> let's see what netflix delivers today, just as entree into the growth stock earnings reports. >> that's what it represents, i think. that is where all the push is in terms of earnings revisions and all the rest of it so almost regardless of how netflix itself trades on a reflex, it opens up that moment when it's like, can we believe the published numbers and get guidance other than consumer demand remains soft, which has been the mantra for a lot of companies. >> we'll sp teaway and come back with "finals" next

12:54 pm

12:56 pm

12:57 pm

get an expanding library filled with new online videos, webcasts, articles, courses, and more - all crafted just for traders. and with guided learning paths stacked with content curated to fit your unique goals, you can spend less time searching and more time learning. trade brilliantly with schwab.

12:59 pm

(grandpa) i'm the richest guy in the world. (man 1) i have time to give. (man 2) i have people i can count on. (grandma) and a million stories to share. (vo) the key to being rich is knowing what counts. we have a big interview coming up on "closing bell" today. blackrock's rick rieder will join us live today so much to talk about, obviously where this market might be going. i'll see you at 3:00 with him. let's do "final trades." farmer jim >> delta you're hearing all this good stuff from delta, alaska airlines, united airlines. you can look at tsa counts and see people are traveling >> united was a huge winner yesterday. liz young? >> that backup in yields has me

1:00 pm

talking about short-term treasuries again as long as we're talking about c cuts later, not never, this could be a good buying opportunity. >> josh brown? >> iot coverage. i'm long the game. i think it's an interesting story. >> the markets losing some steam as we speak. i'll send it to "the exchange. ♪ ♪ a flattish market indeed, scott. thank you very much. welcome, everybody, to "the exchange." i'm tyler mathisen in today for kelly evans. here's what's ahead. stocks are bouncing back today, but our market guest says proceed with caution if you're all in on one particular trade one trade in particular. she tells us what it is and how she's positioning from here. high rates continuing to put pressure on the overall housing market, but not the builders dr horton raising guidance, the higher is the stock today. but with the

32 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11