tv Squawk on the Street CNBC April 18, 2024 9:00am-11:00am EDT

9:00 am

acceptance, regulatorily, is going to allow people to put it in the portfolio a 1% position in these global portfolios takes it there. >> anthony scaramucci, i want to thank you. appreciate the professional skeptics at the table. >> professional skeptics >> there's more to me that does believe in it, just so you know. >> you'll be long at 100,000 >> we want to hand it over to our friends at "squawk on the street" right now. good thursday morning, welcome to "squawk on the street," i'm carl quintanilla with david faber at post nine of the new york stock exchange. cramer's in philadelphia today we'll get to jim in just a second futures, pretty steady as we get a fresh batch of corporate earnings this morning. taiwan semi, blackstone, csx, philly fed was a surprise, up 15.5%, best in two years, and prices paid, highest since december our road map begins with tesla's troubles, though shares awfully close to a 15-week low this morning as

9:01 am

tesla cuts plus, stocks overall are looking for some traction. this after the s&p notched its fourth straight down day the nasdaq remains on pace for its longest weekly losing streak since december of 2022 and las vegas sands is amongst the biggest laggards that's ahead of the open that's despite an earnings beat. blackstone, as carl just said, alaska air, dr horton, we've got a host of companies that are reporting earnings, and we'll get to all of them let's kick things off with tesla today, on track to open awfully close to a fresh 52-week low. deutsche cuts to hold from buy, cuts its target to $123. they were at $250 in february as there's a whole revisiting on what exactly the future model of tesla is going to be >> yeah, look, if you're going to roll the dice and decide that what really matters is self-drive, something that has not worked for anyone, to tell the truth, then what you really do is box yourself in a corner what people really wanted was a cheaper car to compete against

9:02 am

the chinese. we thought he was a better manufacturer we thought there was no doubt about it that a cheaper car would be additive to earnings and then we would prove that the great american company is better than the rest of the world david, what we got was a gamble. can he win that gamble so far, when you have full self-driving, it's not been something that works >> it hasn't yet come to fruition that's a fair point, jim despite what have, of course, been promises, year after year, that they were going to be there, and of course the idea is to remind people that once you do get to that, you can charge a significant fee to drivers and essentially have their cars working for them when they aren't in them the idea of creating a taxi fleet, essentially, of robo teslas, which would clearly be incredibly additive to margins

9:03 am

overall. but they aren't there at this point. and i think that through the years, it's been more difficult to really believe exactly when that day will come, and clearly, in this case, the deutsche bank analyst no longer is interested in waiting they're talking about 2027 for the model 2. that is that lower-priced automobile that -- ev that is no longer a part of the near-term consideration, jim, and i did note -- so, they go to $2.40 in their estimates for '27. overall, cut numbers across the board, hence even with current multiples, you can't get a price target that's anywhere near where they are right now >> i think they're going to have a loss this quarter. i think this "hail musk" play was played out already it failed. i expect to see something that is monumental. instead, i see something that is incremental, and that, carl, is not going to stop this decline, because look, if it were

9:04 am

earnings, if it were on earnings, the stock is 23 or $25. i don't believe that you're looking at a man right now who better have something. but before i say you got to sell tesla is maybe he does he's not playing his hand. but right now, we've got -- look, we've got some top leader cashing out. we don't know what they have in terms of something that is more profitable than an i.c.e., so to speak, combustion or hybrids, which is what ford has ford stock hasn't done exactly well it's down double digits, but carl, what i see here is a stock that's for sale across the board without an answer, and the answer has to be, not a cybertruck, not a robo taxi, but a better darn car. >> yeah. even morgan stanley's adam jonas, who is long-term outperform, i think, his price target is in the $300 range. he says his bear case of $100 might be in play in the near term as we get earnings on tuesday. meanwhile, new car registrations

9:05 am

in the eu, biggest miss or biggest drop in 16 months. new ev registrations, down 11. that's for the industry. new tesla registrations, down 30 so, again, a bit of a reset as well on just the overall adoption curve on fully electric >> well, let's just put it as it really is. other than china, the affordable ev is no more. and i would say not the next two two to three months but perhaps as long as the next two to three years could be a desert for ev, and there are still so many companies that are coming out and saying, listen, we are the answer to ev we can help ev well, you know what? i'd rather have a.i. than ev two much better letters of the alphabet >> i think there is a belief that generative a.i., in terms of changing the way that they use the data and being able to actually empower self-driving, is changing for tesla. we'll get them there more quickly, jim

9:06 am

i know a number of the bulls, at least, are pointing to that as a real possibility, and that they are making real progress again, we'll have to wait and see. >> you know, david, i want to sk disagree with that >> okay. >> maybe about seven years ago, i was in a waymo, which is owned by google, which is owned by alphabet david, the waymo was able to identify, one, the best pizza shop within a couple miles of google, and two, was able to take me there as long as someone was at the wheel so, au contraire, mate i think there's something there. and maybe at that progression, it might be able to take me to an even better pizza shop that's closer >> jim, do you think -- i mean, overall, do you think the robo taxi vision over, say, the next 15, 20 years is legitimate or are we such a car culture in america, at least, that we just enjoy owning and driving our own vehicles >> well, i think that there's

9:07 am

still a love affair with the car. we know that from registrations. we know that from both new with gm, secondarily, ford, when it comes to trucks. we know that from used with carvana. it's not something that we really like. now, who would like it jb hunt, because they had such a crummy quarter, and they don't necessarily want people behind the wheel, but you know, i keep coming to that vision, carl, where a truck is passing me, i look over to it, and there's no one driving it my tendency is to want to go to a road stop immediately, kind of rethink, get my brain together look, it's just not -- >> it's going to happen. >> the time has not come get to 20 years. >> it's going to happen. >> sure, david, it's going to happen, and you know what else is going to happen >> tell me, what >> you're going to be -- well, you're going to be turning 80 by that point, and you're going to want self-driving because you won't be able to see >> that's true >> me, i'll want to pedal. >> i'll be mr. magoo

9:08 am

>> i'm encouraged that you said anything positive about a.i. at all, that it's not just going to kill us. >> some people have remarked on the fact that i'm so worried about artificial general intelligence but not when it's behind the wheel of a car. all right, fair point. >> what about the robots, jim? don't forget the robots. >> your birthday is front and center >> no, the robots at tesla could be the key they could be the key to the company's salvation. i kid in a way, and then i don't. i don't know if we have our video. i love that video. at some point, you talk about artificial general intelligence, put that in the robot, and maybe they're going to become the biggest robot maker in the world. musk has said it will be a one to one ratio at some point between people and robots. >> good, just go buy the incredibly shrinking nvidia, because the ships have to be from nvidia, if you want to make it work. >> by the way, jim, it's not just shares of tesla that have been -- i mean, they were down -- they have been down all quarter, that momentum to the downside continues, but amd, one

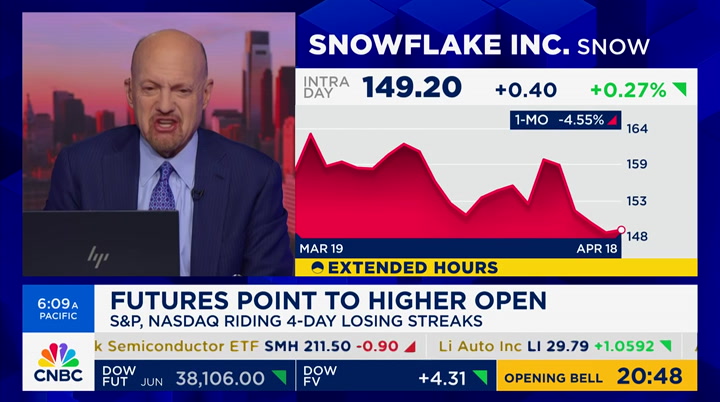

9:09 am

of your favorites, that looks pretty bad, that chart snowflake, that doesn't look so good i mean, we are sort of seeing some significant weakness over the last, let's call it, month and a half or so your thoughts? >> we are in a serious correction, and no one wants to admit it those two charts, amd and snowflake, show you that if you have been buying tech, may i suggest that you buy procter & gamble if you take a look at procter & gamble, the chart of pg, you're going to see you're crushing it. you're crushing tech p&g, they have tech. they have some plastic, david, that might decompose by the time we have self-driving cars. but there you go i mean, if you take a look at procter during this terrible month of april, you see a better chart than you do amd. it's been painful, david, and i think that people don't want to acknowledge the pain i have the pain of nvidia.

9:10 am

you know i mean, look, there's -- i mean, there's the ecstasy, and then you've got the agony >> i know, but it's hard to get particularly sympathetic when it comes to a stock that is still up -- what's nvidia up this year you're still talking about incredible performance that said, yes, the chart doesn't look great the last three, four weeks for nvidia even though the last three months, the stock is still up 47%, and you can see, of course, for the year, over 71% >> nvidia does this thing. people don't realize that the last -- if you look at the last two quarters of last year, nvidia did nothing i was starting to get a lot of heat because i liked nvidia. like i was going to rename my dog that is, rest in peace, something else, i was going to rename it procter. nvidia is digesting its tremendous gains they've got a brand-new super computer that comes out in september. all we hear is that zuckerberg, somebody at google, and amazon have competing chips, when

9:11 am

they're not competing. where did that come from they're not competing. they are synergistic okay mate >> you mated me again, carl. >> that's cold that's ice cold. >> i didn't check mate i just mated >> he keeps mating me. he thinks i'm on that boat >> you get him on that boat for two days, and everybody's a mate >> go to the starboard all sorts of nautical references jim, meanwhile, speaking of the broader markets and a.i., bernstein, tony, who's been right on tesla 150, by the way, says that he now expects apple to roll out most a.i. features in september with the iphone as opposed to in june at the developers conference. that might put a delay in some people's hopes and what apple has in mind. >> well, i would say -- i would flip it a little i didn't expect it to be that soon i didn't expect this iteration to be better here's the stock that is holding on for dear life again, like apple -- like

9:12 am

nvidia, i say, own it, don't trade it, but everything points to a missed quarter, and people can't look through this valley, because it looks like the valley of the shadow of apple death, and it isn't it isn't >> june is -- june is not that far away you still may get significant announcements, of course, that then will be included in whatever is the next generation iphone and/or the software that goes with it, jim. >> look, i want a vision pro nvidia tie-up, but we're not going to get that. did you know we used to read the lord's prayer in elementary school >> that's great. that's good to know. and the pledge of allegiance i remember that. >> yes when we come back, it's been four years since the start of the pandemic, as you know. the latest sign that companies are ramping up their push to require employees back into the office, in some cases five days a week got a bunch of calls on the sell-side, including one on our parent, comcast. oracle, estee lauder, zoom, take a look at the premarket here gaining a little steam

9:13 am

quk t see cties in a minute. your shipping manager left to “find themself.” leaving you lost. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire [busy hospital background sounds] this healthcare network uses crowdstrike to defend against cyber attacks and protect patient information. but what if they didn't? [ominous background sounds] this is what it feels like when cyber criminals breach your network. don't risk the health of your business. crowdstrike. we stop breaches.

9:14 am

9:15 am

business. it's not a nine-to-five w proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. dopeople couldn't oday. see my potential. so i had to show them. i've run this place for 20 years, but i still need to prove that i'm more than what you see on paper. today i'm the ceo of my own company. it's the way my mind works. i have a very mechanical brain. why are we not rethinking this? i am more... i'm more than who i am on paper.

9:16 am

four years since the beginning of the pandemic, more kpae companies are looking to phase out work from home truist requiring its banking staff to be in the office five days a week, beginning june 1. jim, this is -- some people believe it's involving some finra emergency orders that roll over at the end of may others say it's about innovation, team building, security >> it's tough to tell, but it may be a function of all of those. for instance, sl green, which is a company that many people wrote off, because it really is classic midtown new york real estate that is commercial. very good numbers last night, carl and saying a lot of things that you said, which is that there's this mosaic of reasons why people are coming back, and to me, sl green was ground zero now, we do know there's some

9:17 am

cities that have struggled for some time. a city like st. louis. but that may be far more related to the actual companies that are there that are slimming down san jose, which used to have a million people, now has 900,000 people but i think now it just seems like a matter of time. even there are many people who are fighting it, particularly the 40-year-olds and the 50-year-olds david, you know that the 40 and 50-year-olds were to capitulate, then the 20s and 30s would have to follow, but it was surprisingly the people we thought might be up for c-suite that really led this, and i think they are coming back >> or being ordered to be back i mean, it is an interesting dynamic. of course, we've talked about it so often over these last four years. i don't think we're ever going to get back, really, to fully five days a week, you know, do a lot of walking around, and yes, mondays seemed a lot busier, for example. friday, tomorrow, things are going to be quiet. they always are, and you pointed this out too, jim, as well i have -- i would note that

9:18 am

younger people entering the workforce very much want to and are making it a part of their job search to work for companies that are in the office they have recognized, i think, many younger people, that starting your career remote is no way to start a career but to your point, you need those older workers to actually be in, in order to learn something, instead of just doing a job that you otherwise could do from home there is that overall dynamic. you know, john donahoe joined sara last week, the ceo of nike. he blamed a lack of innovation at the company, in part, on not working from the office. take a listen. >> in hindsight, it turns out it's really hard to do bold, disruptive innovation, to develop a boldly disruptive shoe on zoom. and so, our teams came back together 18 months ago in-person, and we recognized this, and we realigned our

9:19 am

company, and over the last year, we have been ruthlessly focused on rebuilding our disruptive innovation pipeline along with our iterative innovation pipeline >> nike, there's a lot of different issues for that, but i thought that was intersecesting >> well, david, maybe new balance is using teams, because new balance innovated the hell out of its shoe in the last year and a half so, as much as i love john -- love john -- i will point out that other people have had better zoom and therefore had better shoes by the way, for a cheaper price, in the new frugality, give me new balance, ixnay nike. >> we might talk some nike later on there's reports they're closing in on a deal with caitlin clark for her own shoe, might be worth some eight figures i remember andy jassy coming on in '21 said that remote means you don't have that conversation coming out of a meeting where a lot of innovation happens. by the way, nice chart from liz ann saunders this morning,

9:20 am

looking at the dispersion in return to off the rates between cities like austin, for example, at the top, new york, san francisco. some of this, jim, people believe is your exposure to finance and financial services where, as we said, security -- network security might mean you got to come in >> well, i also think that when you -- let's say you want to do a rif, reduction in force. the easiest thing to do is reduce the people you don't even know i've done way too many rifs in my life, and there was one where i was going to pick the names out of a hat, and i realized at the last minute that was ill advised. it's so much easier to fire someone, david, if you don't know who they are, versus someone who sits next to you and watches peacock and discusses the recent trader. that is not t r-a-d-e r. >> i'll put that on my list. >> comcast, you didn't mention

9:21 am

yet, and how we're doing when does that come up when is that a faber report? >> i don't know that that's going to happen, jim the stock is still below $39, i think, this morning. there was an upgrade or some positive comments from morgan stanley, so i'll give you that but it has not been a good year for the stock of our parent company. that said, to come back to work from home -- >> what is your faber report coinbase >> i don't have a faber report today. >> paramount >> you got requests? i'll take them under consideration. i'm happy all the ceos have kept talking about how productive we are from home have finally shut up about it. we're looking at the numbers, we're very productive. we're more productive than we've ever been, we're going to be great, cut our real estate footprint by 80% >> yes, yes. we raised our eyebrows at that back then. we'll get cramer's "mad dash," countdown to the opening bell we will dig into this top pick name of comcast over at morgan stanley. they're only overweight in cable satellite. when we return

9:24 am

9:25 am

9:26 am

after last month's massive solar flare added a 25th hour to the day, businesses are wondering "what should we do with it?" bacon and eggs 25/7. you're darn right. solar stocks are up 20% with the additional hour in the day. [ clocks ticking ] i'm ruined. with the extra hour i'm thinking companywide power nap. let's put it to a vote. [ all snoring ] this is going to wreak havoc on overtime approvals. anything can change the world of work. from hr to payroll, adp designs forward-thinking solutions to take on the next anything. (aaron) i own a lot of businesses... from hr to payroll, adp designs forward-thinking solutions so i wear a lot of hats.

9:27 am

my restaurants, my tattoo shop... and i also have a non-profit. but no matter what business i'm in... my network and my tech need to keep up. thank you verizon business. (kevin) now our businesses get fast and reliable internet from the same network that powers our phones. (waitress) all with the security features we need. (aaron) because my businesses are my life. man, the fish tacos are blowing up! so whatever's next... we're cooking with fire. let's make it happen! (vo) switch to the partner businesses rely on.

9:28 am

>> announcer: the opening bell is brought to you by nuveen, a leader in income, alternatives, and responsible investing. all right, let's -- we'll call it the amtrak "mad dash," new york to philadelphia what do we got >> okay. david, it's been a while since we've talked positively about ebay but i've got to tell you, just like your amazing bottom call in paypal, when you did that terrific interview, which was the bottom, this morning, morgan stanley double upgrades ebay, going from sell to buy, why? because they think ebay is the best equipped to use generative a.i., and that's to make it so that the listings are more intelligent. david, i like this piece it's been so -- when was the last time you heard anything positive about ebay? can you recall it? >> not really. it's been a while.

9:29 am

you know, i have had some interviews with the ceo, but yeah, it has been quite some time, you're right, jim. >> we're always asking, is anyone using generative a.i. to their advantage? i thought this piece was very notable, because what it really said is, it's just reignited ebay's growth. david, i love that you're talking about a very inexpensive stock. of course, they also downgrade etsy i wish they hadn't done that they're calling it a paired trade, but they just don't have the merchandise value. they're not having a lot of traffic. they're not doing a lot of sales. get out of the lingo you can do worse than buying ebay, and by the way, again, i want to come back to that paypal interview. that company is gettingtractio far more than i thought it would. lot of capital, lot of common sense. i like both ebay and paypal as yesteryear comeback stories. >> long time ago, john

9:30 am

donahoe -- >> john donahoe. love him love him have you looked at the hoka? love him and you looked at the on on? love him >> sneakers. >> lot of love here. >> cnbc realtime exchange. at the big board today, it's digital marketing platform ibata, celebrating an ipo today. we'll talk to the ceo on money movers at the nasdaq, it's biotech skye celebrating its recent listing on ibotta,that's above the range. >> you know what i like this. it's the biotechs that are leading us when i go back over to what morgan stanley said about the ipos, and what goldman-sachs said about the ipos, it's going to start with these companies first, because people now realize a la that horizon therapeutics deal at amgen, that you can get capital if you're biotech. once you get capital, you can start doing a couple of trials once you get a couple of trials,

9:31 am

you find pfizer, bristol myers buys you this is part of a virtuous circle that i really like to see. >> some of that was a topic of discussion with jonathan gray at blackstone this morning on "squawk," talking about increased activity in capital markets and private credit >> yeah. without a doubt. we can take a look at blackstone's stock interestingly, it has not -- well, it's down, and it's underperformed versus a number of its competitors this year, at least, and i sort of look under the alternative asset managers, i'm thinking about apollo shares, which are up some 15%, kkr, up 14%. we got the old o.w.l. up 23-plus percent. even carlisle, aries blackstone, down this year, despite what was a decent quarter going through a lot of the numbers, jim you know, i mean, they're well over a trillion dollars now in assets under management. few related earnings of

9:32 am

$1.2 billion in the quarter. $4.5 billion over the last 12 months and you know, it's real estate it's private equity, credit, insurance, and multiasset investing. but you can see, at least the stock for now has been taking a bit of a pause >> yeah. you know, i know jonathan. you know jonathan. very good spokesperson but you know what, david when people hear blackstone, what they think of is housing. now, it's funny. they don't think of housing in the way that they think of dr horton, which is screaming today, because they had some really good growth they think about it as maybe the wrong kind of real estate. david, i think it's an unfair characterization you know that they are probably the largest when it comes to datacenters. i think they have a narrative problem. i do not think they have an earnings problem they're not telling the story the way they should. they're letting the bears color the story. the other companies you mentioned, they seem like they're all set to do ipos, all set to do deals.

9:33 am

blackstone seems like it's all set to do nothing, and you know, david, that's not a fair characterization >> no, it's not. i would argue that mr. gray is a pretty good spokesman, and incredibly articulate in terms of the strength of the company, and he was, as usual, quite strong in discussing that with andrew this morning on "squawk box. you know, i also look to gray to sort of give us a sense as to the overall economy, given their portfolio companies. real estate continues to be an incredibly important part of their overall business, breit and other opportunities they have but they do have an interesting lens, given all those portfolio companies and private equity take a listen to what gray had to say about the broader economy and, of course, inflation and the fed. >> i want to give the fed a little more credit here. i think their policy has been effective. we're seeing, in our portfolio, which is really large, 230

9:34 am

companies, 12,000 real estate assets we're seeing inflation continue its downward path, although the pace of that disinflation has slowed, which fed officials have noted. >> so, there you have it, guys generally, i would say a relatively positive view from mr. gray although, did indicate, carl, that deflation has slowed. >> yeah. >> inflationary effects. >> indeed. speaking of some of that, jim, we did have oil lower in the premarket. wti, lowest, pretty much, for the month. it got below $82 but then we got on the tape a couple of bits of news about potentially resuming some venezuelan sanctions the president on the tape now regarding some potential sanctions on iran. and that's put us back in the green. >> venezuela, people don't realize, that is now the largest

9:35 am

repository of oil in the world, and it's obviously a failed state. the president doesn't really help the case here, didn't help the case by not refilling the tre treated petroleum reserve, not helping the case by getting involved with something in venezuela that seems a little bit of a distraction i still feel that oil will catch a bid under $80 because people feel, who knows, on friday, will once again revive the notion about something that might happen between israel and iran i want to go back for one second to david david, how about this? i heard what you said, and as the stock guy, i come back and say, i listened to gray. i heard what he said i think they've got a great conglomeration of businesses that are making a lot of money i want to buy the stock. i think it's very out of favor, and david, it's autout of favor despite the fact that it has fabulous businesses that are away from real estate that don't get talked about, and it's not jonathan's fault it's the bears' fault, because people want to take down the

9:36 am

private credit companies because a lot of people are saying that is the next big thing, like mortgages in 2007-2008 you hear it. private credit, run amok, david. what do you think? >> that is certainly a key criticism from their competitors at the big banks, who are under a far stricter regulatory regime than are those who are able to extend private credit. the rejoinder would be, we take the risk ourselves we are buying this risk, and we are fully underwriting it, doing the diligence that we need to, and completely comfortable and, of course, generating potentially double-digit returns sometimes with some of the rates they're getting paid i hear you on that they've got perpetual capital at blackstone, up 7% year over year and you know, it's a fee machine and an asset-gathering machine

9:37 am

overall with assets up 7% year over year. that's not bad so, all right, we'll write it in the book there $121.42 is where i'm going to put you down as a buyer, jim, on blackstone >> i'm in. i'm in i'm committed. they have the best part of the gross domestic product is their company portfolio. i like it. and i like what jonathan gray said about the fed and carl, i do believe i'm beginning to get, for the first time, i'm getting some chinks in the so-called unbelievably strong economy. not enough to define things but green shoots in a declining economy is what we need. >> wells is out, chris harvey, pretty interesting note about how q1 earnings so far have been a negative catalyst in their view for large cap they go through all the negative commentary from conagra, wall

9:38 am

kbr -- walgreens, fedex >> some people think csx isn't that good. i thought it was fine. that is a surprisingly strong list of companies that are not delivering, and i don't know i think that that -- making a strong case for some -- look at that csx it's not a bad quarter i would go so far as to say that we've got some companies that i don't want to own because they're slowing, and you know what david? maybe march. maybe march was the month that wasn't that good, and what i want to call people's attention to, david, prologis. did you know they're the largest real estate owner in the world they own 5%. >> yeah, i thought blackstone was actually the largest real estate owner but -- >> well, you know, look, let's just divide them up. you say potato, i say potahto.

9:39 am

>> i don't know why joe hinrichs just came up >> hi, joe >> i know you have them on "mad money" frequently as well. give us more of a sense of why it's a concern >> first, longer term, i want to tell you, no concern, because they are a very shrewd operator. and he's been on the show many times. but david, the fact is he came on one month ago, one month ago, and said things were good pretty much everywhere other than southern california. suddenly, we heard that things aren't that good in new jersey we got to read that things aren't that good in seattle. we got a read that things aren't that good in savannah. we got a number cut. number cut, david, in 30 days, i mean, i think, david, when you say your expectation's 30 days, and then you miss your ex expectations, david, they're slowing. >> the stock is not down we're talking pld here

9:40 am

it's only down 1.3%. it is a $100 billion market value company. >> if you look at the stock, let's say, march '19, it was at $135 >> yeah, i didn't realize. look at that decline oh >> that is a very -- that's a very good barometer, because david, they're the best operator in the business, so i found that a nice piece of evidence for maybe jay powell saying, wait a second, things are not so hot that we are in a scorcher. and by the way, jb hunt, i think we're talking about cutting price. that's right cutting price that they charge that's what the fed wants. it isn't just a big mac that's got to go down a dollar. >> i think we have to keep an eye on sort of these, right now, somewhat anecdotal things. i'm hearing, as one-offs, restaurant -- you know, somebody i know runs a large group of restaurants, talking about

9:41 am

rolling 12-month sales for liquor, down double digits, declines across hundreds of units, sales declines accelerating, and they believe the consumer is sort of back on their heels a little bit more. again, let's just keep an eye on it i'm glad you're mentioning it. we'll keep throwing things out there. it's unclear what it all means >> well, carl, you mentioned carmax, okay carvana is about to report carvana is a pretty good company. they've got the pulse of things. but if we go back, look at this. if we go back on carmax, they're the biggest. it was in '88 on march of this year $88. look at that thing this is a respected, good company, a $10 billion company that's brought a lot of stock in, and suddenly, we have -- and i know, like david said, it's anecdotal -- by the way, carl, i want to join him when it comes to liquor. this is a business, and it's really the browns and the clears it's about whiskey and it's

9:42 am

about vodka. you don't want to be in that business, carl not now. >> you've been saying this for a while. and by the way, i didn't mention on that wells list, lamb wesson, which points to restaurants. lvs is the second worst performing s&p component at the moment on the back of those numbers. little underperformance in macao. >> a poorly timed renovation they had some actual macao issues that are pertinent to macao only we don't know how well they would have done if they didn't have these issues involving the actual hotel property. look, is it enough weakness to be able to say the fed might be out of the woods no but here's my thesis that i'm developing january, good month. february, great month. march, not a great month and i'm using the jb hunt numbers. jb hunt, 2% growth in january, 3% in february, minus 1% in march. that is not anecdotal. that is the fourth largest

9:43 am

trucker. and for prologis, who are their largest customers? amazon, home depot, fedex. david, these are real companies that are not -- that are actually scaling back in warehouse. >> yeah. >> i'm not worried i think that they're good companies. but you know, david, we have to be concerned that maybe we got too worried about a hot economy, and then march turns out to be weaker can you imagine? >> it would be -- it would be interesting, to say the least. i mean, we had the fed chair just two days ago, though, say, you know, right now, the data's not saying anything about a near-term -- need for a near-term cut, so i don't know >> and we -- and we just got philly fed with a blowout number relative to expectations, jim, and prices paid, highest of the year >> yeah, look, that's entirely related to the resurgence of the 76ers. i don't know what else there's nothing else to rave about in philadelphia.

9:44 am

>> we are going to take them down we are going to take them down >> david, david, i said blackstone's going to rally, and i think that you guys are hobbled, okay? i'll take that too >> we're what? what are we? >> we have some basketball players who are betting on games, so why can't i bet with you? >> that was horrible and i made a reflection, betting on yourself. wow. banned for life, of course, the gentleman in question. >> really quick, jim we didn't get to tsm with the double beat. profit up nine, revenue up 16. they keep their capex unchanged. and we didn't mention micron, which now looks like we're going to get the latest announcement next week of some of those chip grants going to be a big deal for boise and syracuse >> yes now, taiwan semi, just so we know, why is it down it's down because they did not raise. it was up between 3 and 4, which was terrific micron was up about 3% early on

9:45 am

when frank holland was on. it's now down a little lot of people feel like the $6 billion is no shocker because they built in america the whole time david, again, if it's a good stock, announcing good things, it's not doing anything for the stock. if it has any chink, meaning, it's not guiding up, it's bad. and if it's giuiding lower, like prologis and jb hunt, well, it seems to go down day after day the only stock that's got any mojo is united health. >> unh yes. >> mojo per share. you use that -- >> of course that's a well-known metric, a well-known metric, and one that -- yeah >> thank you >> you're welcome. very low multiple mojo per share. that stock is up over 3% i do want to come to you on netflix. symptom is stock is down 1% but 25% going into tonight's earnings on the strength of the last earnings report, which just blew it out. what are your expectations here? >> well, i do think that they've

9:46 am

got that two-tiered model that a lot of people really like, and the new frugality, people are willing to see commercials if you're willing to see commercials, that means netflix can be very good when you have more than 200 million people involved, like 250 million, and maybe a lot of them are willing to pay that, you know, willing to see the commercials, and netflix figures out the commercial model, which they hadn't yet, then maybe the price is justified but they have to be able to say, we cracked the code on what commercials want -- people want, what the advertisers really want in that case, it can go higher but taifddavid, it hasn't cracke code, then the stock will not rally. >> okay. we will, carl, be awaiting that after the close tonight. >> yeah. and then, next week, i don't know if you looked at the calendar, verizon, monday, tesla, tuesday, microsoft, google, on thursday. it's going to heat up. >> we should point out, by the way, tesla shares are now down a full 40% for the year.

9:47 am

well below the half a trillion market value that we were looking at $474 billion is where i've got them right now and they are going to be issuing, what, 56 billion shares to elon musk if and when shareholders approve that compensation package, jim. >> well, is there a clause which says that you can actually cut his compensation package because of the stock or is that just beyond the pale? does it matter >> previous targets having been met as a result of the 2018 package that was put in place, that was already voted on by shareholders, but somehow rejected by a delaware court >> in reality, i think that he deserves it, because that's what the contract said. and you know, there's a lot of baseball players who get 250 to $300 million, and it doesn't matter if they stink >> that's true >> you know? that's the -- it's a contract. and it should be honored i didn't understand how this whole thing happened he deserves the money, because the contract said he's entitled. david, how did that happen

9:48 am

>> well, the delaware court, in its ruling, came back to the board of directors and their belief that many of those directors who voted on that compensation package were not unaffiliated, so to speak. and the interrelationships on the board. >> time to move to texas let's just move to texas, david. >> that's what they're doing >> you and me. >> they're not moving. they are reincorporating in texas. >> asking for a vote on that >> they've already mutuaoved headquarters to texas. >> i like dallas >> not new mexico? disney's new mexico. >> new mexico, we have theme parks coming they're coming i'm down here in comcast i'm here to push new mexico. >> epic universe is part of the morgan stanley call today. >> there you go. >> comcast >> i got 500,000 acres all set >> he's ready. >> "harry potter." >> it's beautiful. you should see it. >> yes >> it's incredible, that land that jim has >> the land of

9:49 am

enchantment/comcast. busy day in fixed bonds. also, decent diet of fed speak today, bowman, williams, bostic, twice. ten-year, 4.62%. don't go anywhere. when you own a small business every second counts. save time marketing with constant contact. with email, sms and social posts all in one place. so you still have time to make someone's day. start today at constantcontact.com.

9:51 am

9:52 am

dow is still on track for the worst month since september of 2022 and most of the gains again today are going to be unh, accounting for about 112 points of the 136 by the way, the first ever cnbc change makers event in new york city today you can hear from this year's change makers including the american ballet theater's misty copeland, secretary raimondo and commissioner engle berg and others who will share how they're reshaping business and redefining leadership. you can scan this qr code or -- to learn more visit cnbcevents.com/changemakers. don't go anywhere.

9:53 am

go deeper with thinkorswim: our award-wining trading platforms. unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly. encore energy, america's clean energy company, now in production in south texas. energizing america with reliable and affordable uranium

9:54 am

for nuclear energy fuel from our environmentally friendly extraction process. encore energy. her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage?

9:55 am

we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. let's get to jim and stop trading. >> yeah. carl, we've been talking about what i'm now calling brown chutes we're looking for brown chutes because that will make it to the fed easier one of the greatest

9:56 am

manufacturing companies in this country is snap on tools and this makes, we all know, the finest tools for auto mechanics. their actual tools number was minus 6.9% thp spiz sthis is shg given the consistency of this company, which is that there is a slowdown, this is about frugality, by the way. i mean, snap-on tools franchises buy them and sell them to mom and pop stores and apparently mom and pops are not buying as much as we thought d.r. horton the other side of the trade, but snap-on joins j.b. hunt, with disappoint number and pro logic, with a disappointing number and carmax. maybe things more balanced and march was bad. >> brown chutes between them and apple belt and road, you are on fire this week putting themes into short phrases. >> just a second i just got my top for "mad

9:57 am

10:00 am

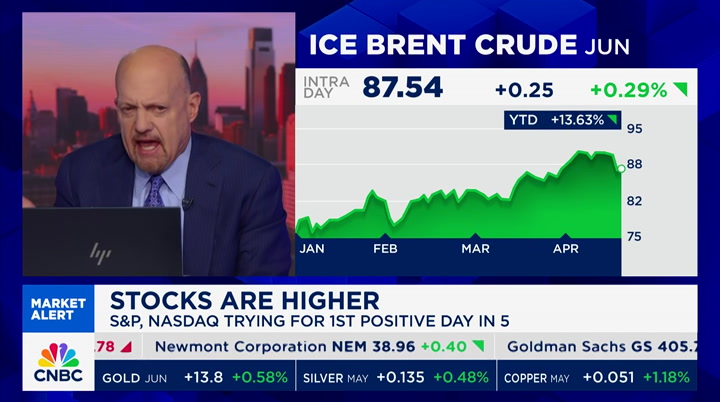

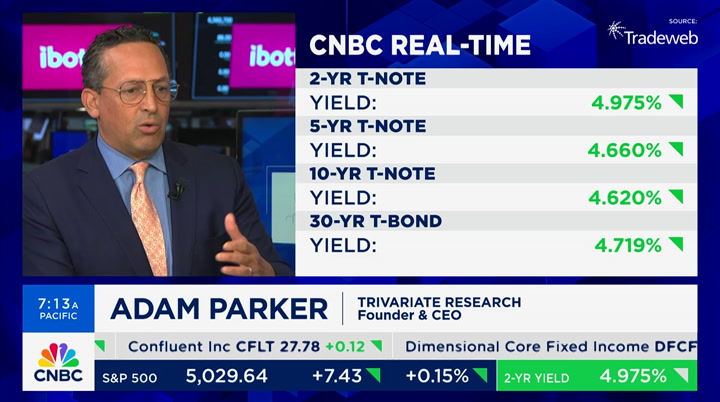

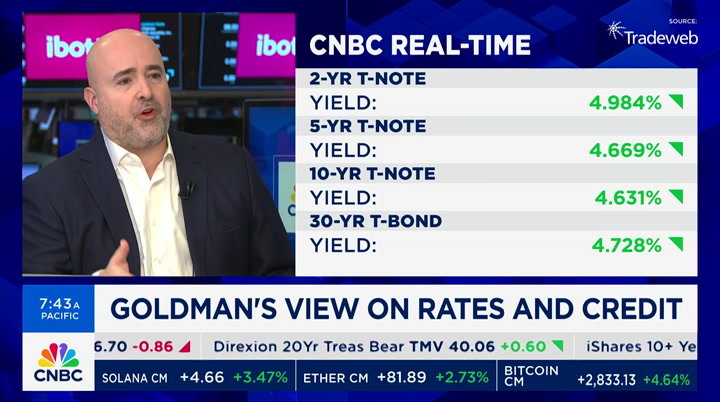

good thursday morning. welcome to another hour of "squawk on the street. i'm sara eisen with carl quintanilla and david faber, live as always from post nine of the new york stock exchange. take a look at stocks. we've had four days of losses. we started strong, though, before in the week the nasdaq is down for the day 0.2% the s&p also barely positive and the dow up almost 200 points take be a look at treasuries right now. firmer economic data has led to more selling in treasuries with yields elevated. the 10-year note yield 4.629 the

10:01 am

2-year under 5%. we're 30 minutes into the trading session, three big movers we are watching shares of tesla under pressure for a fifth day in row trading close to new 52-week lows. manuel rossnef downgrades, slashes his price target and he will join us to talk about why he's making that move right now. shares of d.r. horton rallying after beating profit estimates and raising guidance the lack of housing supply helping to fuel sales. shares of las vegas sands taking a drop. the casino operator posting a profit beat, strengthen its singapore business, helping to mask issues in macao which makes up the bulk of las vegas sands revenue stream earnings disappointing in that market. got data crossing the tape starting with existing home sales. let's get to diana olick. >> hey, carl good morning existing home sales fell 4.3% in march to an annualized rate of

10:02 am

4.19 million units, slightly better than expectation sales, still down 3.7% year over year the sales are based on closings so contracts signed in january and february mortgage rates stayed lower in january and shot higher in february inventory did improve up 4.7% to 1.11 million homes for sale at the end of march, a 3.2 month supply inventory is up 14.4% than march of last year but more supply is not really helping home surprises. the median price of an existing home in march was $393,500 up 4.8% from the year before and the highest price ever for the month of march the market is moving faster with the typical homes sitting on the market 33 days compared with 38 in february. investors pulled back a bit making up 15% of sales compared with 21% in february and 17 in march of last year first-time buyers made a big

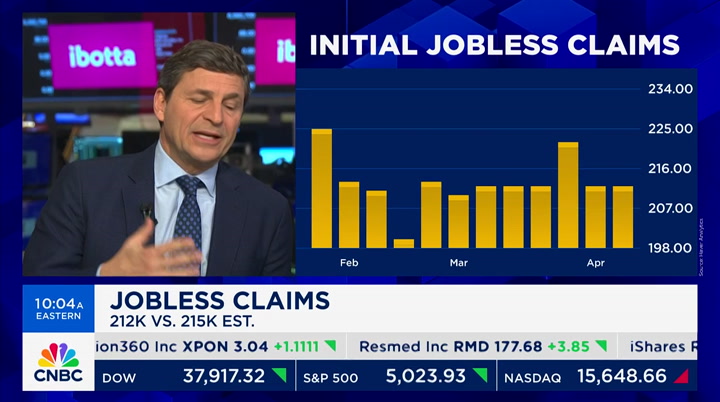

10:03 am

comeback 32% up and 28% the year before not helped much by mortgage rates which moved higher this week again. >> there you go. thank you very much. appreciate it. especially on the higher prices which has been part of the problem on inflation also just getting the lead economic indicators out moments ago. lei down 0.3%. the street was expecting .1% that was worse than expected usually a pretty good tell on economic performance it has not been this cycle because it's had recessionary indications we're not seeing in the data look at jobless claims today we got that. again, really no concern about layoffs in the workplace and no stress in the labor market if you look at the weekly read of americans filing for bit ofs it shows pretty good news there's the bar chart. 212,000 applied, 3,000 less than expected, unchanged from the week before. you aren't seeing the stress

10:04 am

you got the philly fed numbers better than expected, continues to fuel this idea that the economy is in good enough place with inflation ticking higher and the fed not having to do anything about it right now and not being able to cut rates an the continued fed speak points in that direction. >> i know it's funny in the last hour, jim and i both sort of shared anecdotally at least, more for him, talking about pro logics and warehouses which are an important reflection of certain parts of economy and weakness to a certain extent there. i was sharing anecdotically some numbers from someone i know who runs a bunch of restaurants in the southwest talking about declining check numbers and who believes the consumer is more stressed, i don't know, sara, it's interesting it's potentially an interesting moment and jim called them brown chutes. >> brown chutes. >> things we should at least keep an eye on that would seem to defy the overall numbers we're getting. >> the delinquency rates for credit cards in the brown chutes

10:05 am

camp discover cfo we have some commentary on the consumer that backs up what you're saying, from the call last night, discover the credit card company says we continue to add new accounts in general, we are seeing card members spend less, particularly among lower income households which are most impacted by the cumulative effects of inflation. >> right. >> that continues to be part of the theme, so restaurants that are affected by lower income consumers are certainly feeling it we've had high rates the interest rates a blunt instrument and, you know, it hits different parts of the economy harder than others and that's been the problem. i went to the beige book yesterday which i always love to get color from all the fed districts and i was looking in particular for inflationary commentary because that's what the fed is concerned about now here's a few that i thought were important. several reports, from around the country, mention weakness in discretionary spending, to your

10:06 am

point, david, as consumers price sensitivity remain elevated. on balance contacts expected that inflation would hold steady at a slow pace moving forward. at the same time contacts in a few district, mostly manufacturers, perceived upside risks to near term inflation in both input prices and output prices that jives with what we're seeing in the data, which is mostly slow and steady disinflation. >> right. >> but some places like manufacturing, which has hooked up, we have seen the pmi back to 50 in expansion, risk of upside inflation, which is why the fed is fine being patient. we've heard from john williams in the last hour, listen to how he put it. >> monetary policy is in a good place. i think we've got interest rates in a place that is moving us gradually to our goals i definitely don't feel urgency to cut interest rates. i think monetary policy is doing exactly what we would like to see. >> that was at the summit for

10:07 am

economic in washington, d.c. >> how would you characterize the consumer right now you mentioned discover the mid to lower but i'm hearing in the higher end, the art market, for example, things seem to be a blip in terms of what the asks are and willingness of people to pay is i wonder how you characterize things. >> hanging in there longer than we expected. some signs of weakness in certain categories an income groups overall because of the cumulative impact of inflation and higher interest rates which will weigh on the consumer no doubt about it, but they're getting jobs and they're getting paid and those two affects have kept the consumer spending not to mention the fact that we've had a lot of fiscal stimulus and maybe the excess savings have worn down for which we've been talking about, but there's still money going into infrastructure projects and chips building and that filters through. >> yet yep. >> has an overall effect on jobs and the consumer the consumer is not collapsing

10:08 am

you don't see that in the gdp data but companies aren't having as easy time passing on inflation, price increases they don't have the same kind of pricing power and consumers are a little more picky when it comes to how they're spending, what they're spending and prioritizing and that's been the story. >> their quit rate has fallen which means there may be more not worried but -- >> less confident. >> less confident if they did job hop things would turn out right. >> the last chart i wanted to show, people are worried about goods inflation which has been really deflation and not a problem, the culprit in the services sector, if that hooks up again, citigroup put out a great chart on the supply chain flation. given all the geopolitical risks, shipping issues, if this is a risk. they have this great index where they look at supply chain pressure index and break it into global supply chain, shipping costs component, global pmi, inventories.

10:09 am

it tells you a story of stability. it's not going back up and so don't have to worry as much about that. >> nice piece on the tape saying the economy is weathering these supply disruptions csx from the baltimore port at least. >> we will talk to morgan brennan is bringing us the ceo of that one. so heightened risk look, you're seeing it in some places copper at a 22-month high today. i read now that copper, we have a copper shortage and now even for ai, we need copper evs and everything you do have these -- cocoa continues to just be parabolic, but there are places of the inflation but overall on the goods and commodity side it's come down. still rising, but off the high levels. >> that chrts will never stop being crazy. >> there you go. >> i love chocolate. >> you have to pay more for it. >> lot of people do. >> s&p coming off a four-day loss as sara said and nasdaq on

10:10 am

pace for the longest weekly losing streak since december of '22 let's discuss the market setup as we go into the busy week of earnings try varent ceo adam parker at post nine listening to our conversation. >> good job. >> are you on for the review. >> are you on the lookout for brown chutes as he put it? >> is that what he called it >> yeah. >> i think the u.s. consumer g at sara's point, we take in ability 20 variables and think it's in pretty good shape but slowly eroding if i gave any of you that project for this afternoon that's what your conclusion will be when you put it in there. the reason it held in, you nailed it, the wages and jobs environment is still pretty good and when you kind of add up the income statement, income statement for the consumer, that's your revenue analog how much they're working and making i think it is the key -- one or two key things to monitor if we get a slowdown is the erosion of

10:11 am

the consumer i remain optimistic, to be honest with you. the risk-reward still skewed to the positive where you ended the conversation, the input costs aren't a problem and gross margins go up for the average company. why do i keep liking stocks? financial conditions are easy and gross margins are going up we could complicate it with other things but stocks go up when those two are in place. >> earnings for the year changed? >> it hasn't asks that question. >> it's an earnings monitor. >> i am. many things. >> earnings monitor police over there. but look, i think the key to that argument would be, you know, wages are moderating, productivity going up, material costs on average are not a headwind certainly hot chocolate and stuff are going to be a problem, but if you look year over year how the companies build and plan you're not seeing anybody talk about that while pricing has not been as

10:12 am

strong, you can find some low-end consumer companies -- i was surprised conagra i wouldn't say they sell front of the super market stuff, maybe like slim jims, but having pricing on down it's not like pricing is collapsing it's not the huge rates it was. >> but even conagra said they're seeing trade down from fresh to frozen >> a little bit of switch. i think the high end, i don't know about the art market, that's the first nugget i've heard on that. >> that's why you listen to this network. >> i will call it the ultra high. >> i don't think it's a great investment i focus on other stuff. >> champagne sales were down at lvmh. >> thank you not drinking champagne and buying art. >> might run into carl buying a bagel on the side or something, about as posh as we get. but i think the stock market goes up win these do

10:13 am

risk-reward still -- >> when will it start to go up again, based on your view? we've been coming down as a result of yields going higher and what's going to -- change -- >> like four days out of the last 1,000. >> okay. >> i'm kidding. >> percentage points. >> i get it. >> not insignificant. >> what i think is that every -- it's a moving target you guys know, everyone says oh, well the 10-year gets above 2.5 the stock market is annihilated and then became 3 and 3.5 and then 4 and now 5 so the question is, do you believe earnings can grow? do you think margin goes up? it's all financial conditions. if you get worried there's auctions from the fed and 10-year backs up and we get spooked on the viability of the u.s. financial system, then yeah, multiples go lower for two or three weeks it's healthy the fed isn't cutting rates. i never understood how there were seven cuts in there we will get a collapse not a modest erosion you want the dream they're going to be accommodative some day

10:14 am

we think we're doing pretty good we told you ten years we were going to go below 2% and get there and now above 2% for five or six or seven years. don't worry. that seems like a bullish message as long as you believe as we get to extreme ends above or below that we might freak out and get a couple weeks here or there. we made it through prerelease season without any sort of stomach punches. you guys have been doing this long enough to know you hate it when a bell weather comes in and guides down massively. we haven't seen that earnings okay, economy okay, financial conditions easing, margins going up like the dream. >> we did, by the way, williams who is pretty hawkish did say, rate hike, not baseline, but possible if data warrants. that wouldn't be good. >> no. >> that would cause a harsh selloff on stocks for a couple weeks. i think you don't -- i don't memorize the names of the fed folks like they're -- like the

10:15 am

nba playoffs like i do, but i would say, you know, because go to my website you're looking at powell zero search results you get that free everywhere else as you've seen people are demonstrably wrong all the time in every major firm on what's going to happen. if i care about stocks and giving advice how can i use those inputs to do anything. what i have to say is what makes sense macro is what we talked about. i don't think the fed is going hike, but they could but if they do is it one and doesn't? are we back where we were last year saying what's coming again. two-week selloff, nvidia and everything gets annihilated and then back saying i can buy good companies at 10% lower that's what everyone wants to do. >> go to sotheby's nice art. >> is there a kiss you get - >> patrick has me on the payroll. >> i think the things you have to monitor about would be the financial conditions tightening, front end, more on the back end. i think consumer slows the last thing which is hard and

10:16 am

we're trying to get at it looking at everyone reference in the transcripts, china actually getting a little bit better or not? i think people believe that that skews to the positive and if we start hearing from companies, well, you know, demand is not, we have to monitor that one carefully. you mentioned retail sales people are all over, you know, in china i think risk-reward -- >> weak. >> positive but you have to follow what these guys are saying on china and the consumer in the next couple sfwweeks. >> revised higher targets for the year in china. >> we've been, all of us burned by that logic in our careers. >> yes. >> thanks. >> great to see you. >> thank you. as we head to break, shares of tesla hitting 52 week lows as one long-term bull downgrades the stock, slashes his price target he will join us why next find out what he sees on the horizon there. >> shares of csx rallying on the back of the latest results the ceo will join us to discuss

10:17 am

how the rail is coping since that baltimore bridge collapse we'll also get his overall outlook. >> netflix getting ready to report earnings after the bell tonight. stock up 25% for the year and close to 2 some 52-week highs. ready for those results on "squawk on the street" continues. [busy hospital background sounds] this healthcare network uses crowdstrike to defend against cyber attacks and protect patient information. but what if they didn't? [ominous background sounds] this is what it feels like when cyber criminals breach your network. don't risk the health of your business. crowdstrike. we stop breaches.

10:18 am

10:19 am

10:20 am

below the 150 mark sinking to a 52-week low. stocks down around 40% for the year so far. long-time tesla bull from deutsch downgrades and slashes his target down to 123, cites this, quote, thesis changing shift from a lower cost ev to robotaxi and joins us to discuss this call. it's great to have you i was looking back to march where you were suspicious of the delivery number ahead of that print and you talked about downside risk. why revisit the rating at this point? >> yeah, thanks so much for having me. so look, we've actually been at the forefront of warning investors about meaningful, meaningful near term downside risk, basically tesla is under tremendous pressure. there's a lot of pressure on the demand side for their vehicles, pricing pressure, earnings pressure, free cash flow. we've had the low estimates in the near term in 2024 and 2025

10:21 am

but we've been okay with it as long as it was perceived as being temporary because the model 2 was supposed to come next year and reaccelerate volume, margin, earnings and free cash flow i believe long-term investors on board as well and know how bad things are, but they expected things to turn around. now that model 2 is likely being pushed out potentially canceled you do not have this on the horizon anymore and earnings under pressure, free cash flow under pressure and hence this is thesis changing and why we're downgrading the stock. >> we're no longer talking about cycles or valleys between innovation you think this is more structural >> this is essentially a function of an aging product lineup the core product line of tesla is old, facing increase competition, it's also facing larger headwinds around ev demands in the u.s. and as a result, volumes at tesla are less than flat q1 was already down.

10:22 am

q2 could be down year over year. that's despite massive price cuts over the last 18 months or so yes, it is structural. it is not cyclical it could have been sold by having essentially a flu product at a low price point which would have been attractive and could have been dominant at a $25,000 price point, the model 2 if this is not coming we're talking about the same old lineup for the foreseeable future with all the eggs put in the robotaxi basket, not a consumer vehicle we believe that creates much downside to earnings and free cash flow estimates for the foreseeable future. >> that was reflected in what is now your 240 estimate, $2.40 for 2027 i knotice your price target basd on a 42 multiple given that from here to there there's not a lot of growth to speak of? >> you're right on both counts our view is with the current

10:23 am

lineup of vehicles the best the stock could do is around $2 of earnings for the foreseeable future call it 2027, maybe beyond so. there's downside risk to that as well if pricing continues to come down or volumes collapse. the thing is, it's not like tesla is shutting its doors. they're going all-in on robotaxi we do a deep dive on robotaxi in the note it's hard to put into numbers and not into our earnings model, but that optionality is very much there it would be highly differentiated and we think we should account for it in the multiple the multiple is functioning despite no earnings growth because in the end investors in tesla will say okay, i understand the core business is no longer growing, potentially shrinking, but look at how exciting this business could be. our rating indicates this is highly risky if they can deliver robotaxis it's massively exciting. how long will it take to get there? can you get there based on

10:24 am

technology risk, regulatory and operational risk this is ifficult we're still applying an unchanged multiple but on much earnings trajectory. >> it's fascinating to see the framing change so quickly. appreciate it. hope you'll stay close emanuel from deutsch. still ahead on the show, a read from the ground with the ceo of csx, one of the country's biggest freight operators. what he's seeing when it comes eano aer qckft aui brk.

10:26 am

10:27 am

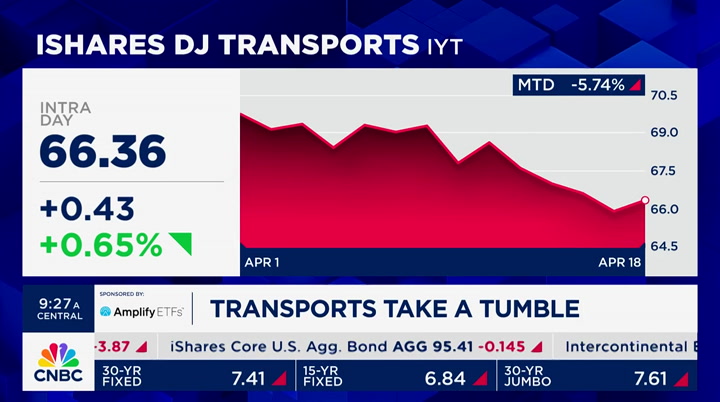

time nor our etf spotlight where we focus on the transports the dow transport etf iyt in the red after a series of tough prints from certain names in freight. j.b. hunt and knight swift reported softer demand than expected and down double digits in april different story for shares of csx headed higher after results there, a slight beat on earnings, favorable trends for the rest of the year despite rising freight volumes changing from coal and the baltimore bridge collapse. let's get to morgan brennan with the ceo of csx hey, morgan. >> that's right.

10:28 am

joining me is joe hinrichs the ceo and president of csx joe, it's great to have you on i'm going to start right there with the fact that you put up a quarter that was better than expected, but perhaps most notably as we have seen this impact from the baltimore bridge collapse, we have seen things like bad weather that have affected the broader freight industry you're reiterating your full-year guidance, what gives you the confidence to do that? >> yeah, thanks for having us on we're building momentum. we saw sequential improvement quarter over quarter on the cost side of the business and there are key segments, chemicals, autos, strong demand for export of coal, so we're staying with our original indications for the year which was single to mid digit revenue and volume growth. we didn't deliver that all entirely in the first quarter, but we see strong activity in the second half of the year but building momentum with our customer base. >> i do want to talk about the baltimore port impact. you have been diverting cargo to other ports and opened up a new

10:29 am

line and last night outlined an impact of $30 million a month until that wreckage is cleared and that port can reopen walk me through numbers and your expectations as you deal with this in real time on a daily basis of when we see that port potentially reopen and get the freight flows moving again. >> yeah. obviously, a tragedy and we're -- prayers and thoughts to the families of the six individuals who lost their lives. i talked to governor moore we have people at the unified command center in baltimore. on the automotive side a lot of that has been able to be absorbed and haven't seen too much impact as a result of that. the impact for us, of course, is coal two of the largest export coal terminals inside that port and there's strong demand for export coal around the world. really only two other export locations in the norfolk area and mobile, alabama. mobile is full already and we're trying to do work in the newport news area. our crews have been great about

10:30 am

making that happy and customers happy with what we're doing. until the port reopens towards the end of may for the larger ocean vessel containers for coal, that we're 25 to $30 million hit april to may and see how june looks as we go on strong demand so hopefully we can pick that up in the second half of the year once we get back up and running. >> i'm glad we're talking about coal here. we've seen this particularly on the heels of the war in ukraine. we've seen u.s. coal producers really see a resurgence in demand for their products on the export side, thermal, but metallurgical coal as we're seeing an increase in steel making domestically and internationally. this shines a light on it. how does it also speak, though, to what we're seeing in terms of reshoring, in terms of fr infrastructure projects in the u.s. i was speaking to the ceo of alcoa talking about decarbonization and other trends and what it's doing it drive demand for more of these types

10:31 am

of projects? >> yes on the export coal side you're right metallurgical coal is in demand whether in india or eastern europe, crane, all the can growth india more need for metallurgical cool and thermal coal for utility support in india, for example. but back here in the u.s., we are seeing significant outreach and development opportunities, industrial development side. you talked about the whole steel, aluminum, all the metal side, new activity in the southeast where we're located, but also continued growth in vessel development we showed in our earnings call last night over 500 projects are happening on our network over the next several years just new development. it's not just electric vehicles. 13% of the activity, most of it is aggregates, chemicals, even stuff like minerals, things that are going to -- metals, new business to america and we're excited and it's not stopping, not at all. >> and finally, saw 7% jump in

10:32 am

intermodal, particularly international being strong, and this those container ships that come into port with some of those goods that tend to be headed out to consumers. the fact that we're seeing that jump, how much of that is red sea and panama canal disruptions and delays how much is a reflection of retailers restocking ahead of another holiday season later in the year >> yeah. we haven't seen a lot of impact from the red sea or panama canal. it is restocking last year the numbers were down so much because of the inventory adjustments and now that's being replenished and the consumer is active we're seeing and the outlook we see is for that to continue more inbound activity to the port, more international intermodal, one of the reasons we see volume growth the rest of the year. >> joe hinrichs the ceo and president of csx thank you for joining me our condolences for your predecessor jim foot who passed away just earlier this week. we appreciate you coming on. >> thank you

10:33 am

sticking with the railroads the fight for the future of norfolk southern is heating up we'll speak with jim chadwick leading the proxy fight and the firm's proposed ceo candidate jim barber, former ceo of ups on "money movers." >> important stories morgan brennan. coming up after the break the man advising america's biggest companies on their multibillion dollar financing, johnny fine, the head of their corporate credit business joining us in just a minute. your record label is taking off. but so is your sound engineer. you need to hire. i need indeed. indeed you do.

10:34 am

indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire trading at schwab is now powered by ameritrade, unlocking the power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab. you know what's brilliant? boring. think about it. boring is the unsung catalyst for bold. what straps bold to a rocket and hurtles it into space? boring does. boring makes vacations happen, early retirements possible, and startups start up. because it's smart, dependable, and steady. all words you want from your bank. for nearly 160 years, pnc bank has been brilliantly boring so you can be happily fulfilled...

10:35 am

which is pretty un-boring if you think about it. (♪♪) business can happen virtually anywhere. (♪♪) but there's nothing like being there. at national, you can skip the counter... and choose any car in the aisle... even manage your rental right from the app. so you can give some quality time to a quality cause. swing by to see one more customer... [audience cheering] and really get down to business. go national. go like a pro.

10:37 am

news update. donald trump is back in the courtroom today for his new york hush money trial there are now six jurors that need to be seated after one was excused this morning over concerns her identity would be exposed. there are questions about whether another juror lied during his screening a pool of 96 jurors will go through the selection process today. meanwhile, the u.s. announced new sanctions on iran today in response to tehran's weekend attack on israel the sanctions starting 16 people and two entities tied to iran's drone program that includes executives of an engine manufacturer of a specific drone used in the weekend assault. and boston dynamics unveiled a new version of its humanoid robot atlas. the company posted video showing the fully electronic robot in action after announcing it would retire the previous hydraulic model. boston dynamics says atlas, which could be seen standing up

10:38 am

and walking around is designed for real world applications. >> that's crazy. wukds watch robot videos all day. thank you. let's get to the broader markets. financing activity our next ghes charge of corporate credit and identifies corporate issuers higher and pension fund derisking helping drive demand in the bond market. global sacks ahead of investment grade debt underlying all of this we are seeing this back up in yields again, and i asked in the break whether you think we could see 5% on the 10-year again. you say yes. why? >> i think it's entirely possible kind of think about the trends that have been in place for the last two and a half years. the market has been consistently too dovish relative to what the fed has delivered. we expected way fewer hikes on the way up than we got we predicted way more cuts than

10:39 am

are going to ultimately be delivered on the way down. we've gone from almost seven rate cuts expected at the beginning of the year to less than two now, and it's not just a postponement of those cuts but a pushing out and it's has flattening of what the ultimate cutting looks like if you think about what the terminal rate is expected to be, it's gone from 3.1% at the beginning of the year to 3.8 that's 70 basis points move correlates with the selloff we've seen since the beginning of the year. i don't think i'm ready yet to call the end of the trend that's been in place for two and a half years, so i really won't be surprised if 10s ultimately test 5% once again. >> it's been a story of higher yields and capital markets activity, your world, has been super strong, why? >> so i think there's a number of reasons i think probably the primary one was in the first quarter of the year, 10s on average were between 4 and 4.25%. that, obviously, was elevated but at the same time it wasn't the 5% level we saw last

10:40 am

october. and also, offsetting that, we had near record-setting tights in credit spreads on our issue surveyed the universe and don't like yields, but they're not as high as they were, but we love spreads and the execution environment the market is offering they were happy to go to market as they thought about derisking their liquidity ahead of the election at the end of the year. >> can that continue >> i think it will continue, although i would say a lot of theissuance we saw in q1 was a pull forward of issuers' plans throughout the year. dp depending on where yields yields and spreads trend to, that will determine whether or not we go on at a similar pace which i think is very unlikely, or if indeed we taper and we have a more normalized level of activity. >> i was going to say, ftc piece looked at the least freak quent issuers doing a lot in the year.

10:41 am

is it something else or part of it >> i think that's the primary reason if you look at what historical data will tell you, look at the september and october of election years, and compare that to september and october of nonelection years, we did this back to 2000, what you tend to find is, there's a reduction in issuance activity that would be expected there's a reduction in the liquidity in the market in terms of the daily trading volumes there's quite a negative reaction in the spread environment. history and the data tells us generally the september, october period is somewhat unattractive for issuers. as our client base looked at that, they thought we're going to pull things forward we like the environment in january and february and march the yields curve still inverted. attractive features to financing early. i think that was a major driver. >> you think spreads will remain tight? the stories today about pension funds allocating more to fixed

10:42 am

income is the demand going to be there? >> i think the technicals of the market will remain robust. equities moving into fixed income as the funded status of pensions in the united states is roughly 104% that generally creates some derisking activity our market fenz to be a beneficiary. in the yield environment we're in we're seeing au new whichty sales at higher levels than we've seen in the couple decades driving money into in particular long duration fixed income i think from a technical perspective, i think the market is going to remain on pretty sure footing the reality is whenever we've seen spreads at these levels over the last couple decades, there's usually something that creates a significant derailment wider. you can never really predict what that's going to be. my guess is that we're going to fumble along at these levels for a little while up till there's a shock to the system. >> do you worry about auctions speaking broadly about the fixed

10:43 am

income environment we watch it closely in perhaps a way we haven't previously. >> 20-year this week. >> we did. it was a series of auctions and stories about deficit spending and increased issuance my guess is we see that happen again. the market will be intently focused on how auctions perform and what covers look like. i would imagine in one bad auction we see a meaningful move higher in yields and should definitely be on the agenda as something people should focus on and be concerned about as they think about the next several months. >> a failed auction. >> one where there's a knee-jerk move wider as it covers the low. >> then what are we in a new regime of higher rates because we're worried how much debt we have to issue >> we're already there i think we're in that higher for longer regime. i think -- i don't think there's going to be anything from either

10:44 am

political candidate in november that is going to change the outlook from a deficit in spending perspective the market has to get to grips with elevated issuance levels for some time and perhaps ends up coming to the front end of the market retail has been a very large buyer and now holder of short duration treasuries, so maybe that's an area that ultimately can mop up some of this supply overall. but, yeah, it's definitely a key focus of mine. it's a key focus of the clients i speak to on a daily basis as well. >> mine too. i didn't get to the treasury capital inflows data for february thank you. >> johnny says we have to, then we have to. >> johnny fine, thank you from goldman. after the break, what to do with netflix shares here they've outperformed on the year ahead of results coming in a few hours. plus cnbc's first ever change makers event kicking off in new york city today where you'll hear from leaders

10:45 am

including the principal dancer of the american ballet theater, gina raimondo, commissioner of the wnba, scan the qr code or visit cnbcevents.com/change makers for more. great nvticoersaons all day at that event we're back in two. the all new godaddy airo helps you get your business online in minutes with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo

10:48 am

welcome back to "squawk on the street." shares of netflix have reversed up a bit today the company will report after the bell our next guest keen on strong engage mjts and higher industry pricing. has buy rating on the stock. price target 700 alan, good to have you here. what are the trends that give you confidence going into the earnings print where you think it's going to be a good one? >> number one nielsen comes out with monthly data on share of television consumption netflix was at almost 8% this quarter, second best quarter they've had. secondly, netflix has started giving out weekly data on the