tv Squawk Box CNBC April 18, 2024 6:00am-9:00am EDT

6:00 am

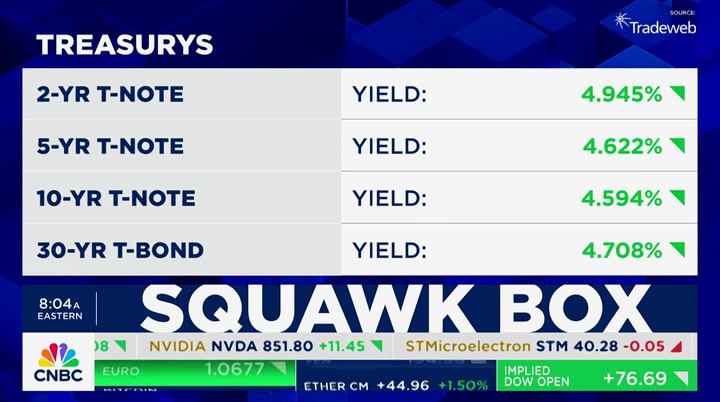

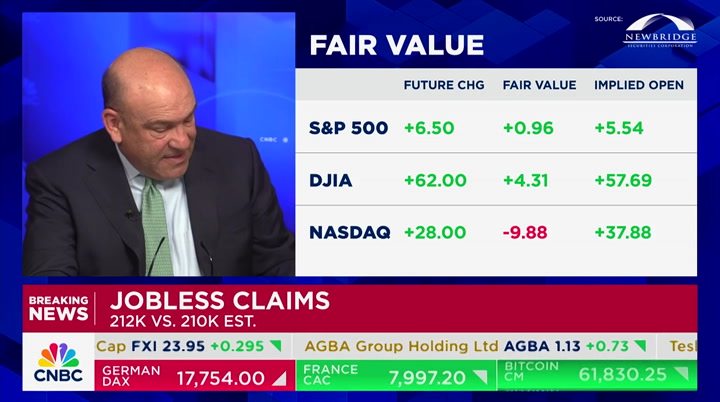

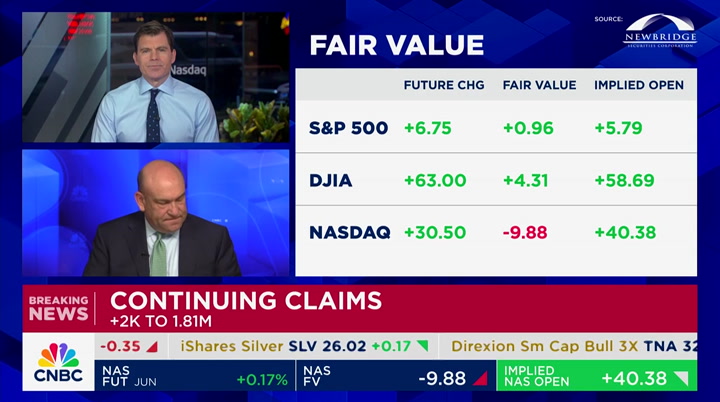

good morning welcome to "squawk box" here on cnbc we are live from the nasdaq market site in times square. i'm andrew ross sorkin hanging out with jon fortt and mike santoli here this morning. we are not doing multiple hands today? >> yeah. >> yeah. >> how is this allowed to happen a man-wich a gen x man-wich >> okay. u.s. futures at this hour. nasdaq looking to open higher 57 points higher. s&p up 7 points. let's show you treasury yields you are looking at the ten-year

6:01 am

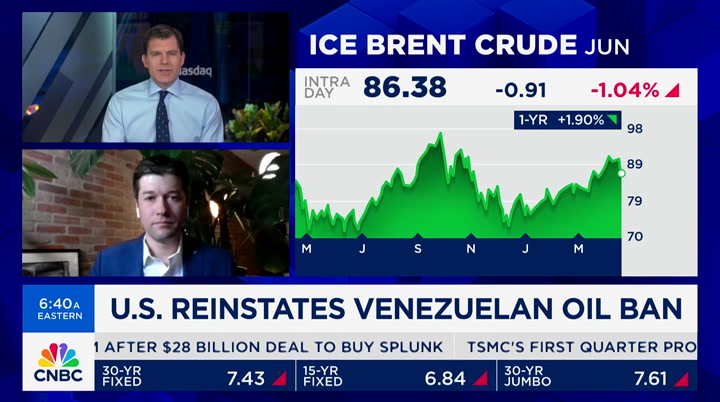

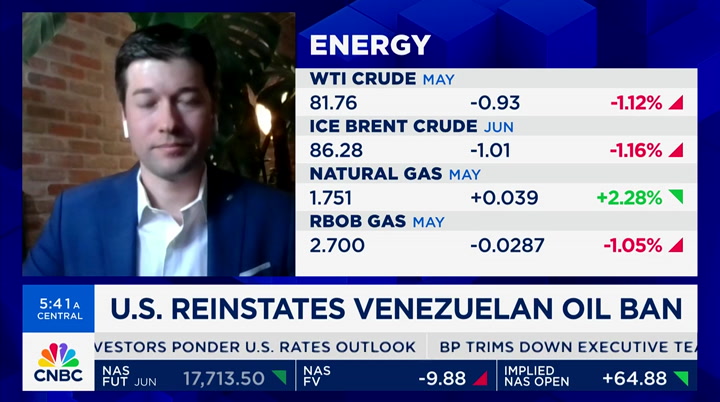

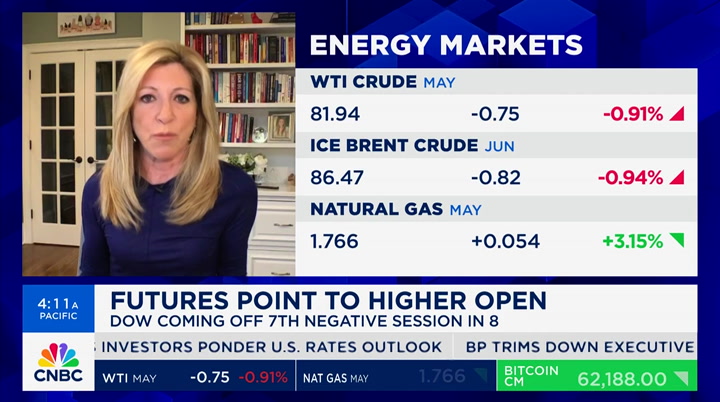

note at 4.57%. take a look at bitcoin we have been talking about it. it is at $61,645 it has not moved after the down swing. >> somewhat steady this week pulling back from the highs. let's talk about oil biden administration will not renew the license to ease venezuelan sanctions the treasury department issued a rehe he replacement license tody u.s. says president maduro failed to compromise with the sanctions last year. we will discuss this on the energy market and crude prices backing off again. they started the decline down 1% this is actually a tricky situation that the u.s. is

6:02 am

trying to navigate not just with venezuela, but you want to impose your policy pressure on the regime, but not restrict the global supply iran selling mostly to china trying to do two things at once and not compatible >> you have to keep the oil flowing. micron technology is expected to receive $6.1 billion from the chips act to pay for the domestic factory projects according to the bloomberg report it is a mix of grants and loans. micron has pledged to build four factories in new york and one in idaho. the plants are contingent on tax credits and chips act grants and incentives we were just out in arizona with intel. if you count the loans, it is

6:03 am

bigger with micron >> they are saying this is all disbursed by the end of the year >> they have been waiting for a while. >> how quick can you build >> it takes years. three-to-five years to spin up one of these factories they are super secretive >> have some broken ground >> yes they will start the work, but it is only five jobs until you give us the money and then it is 1,500. >> will we know in 2028 if this is going to work or not? >> for whom? >> for america >> i think it will work for america in the sense you have tsmc and samsung and intel building out factories i think the question he is how cost competitive is and what

6:04 am

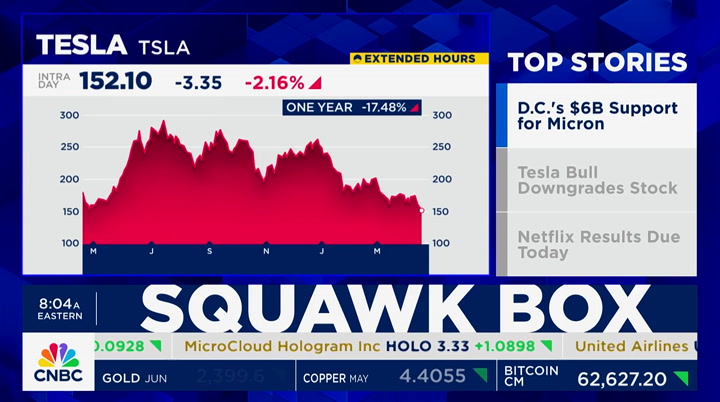

process? is it the most advanced chips doing a.i. or are they competitive with what tsmc has in taiwan? i don't expect the geopolitical situation to change much that nobody is worried about asia in 2028. let's turn attention to tesla laying off 285 employees in the state of new york as the restructuring. the ceo elon musk sending a company wide memo announcing 10 cuts globally. most employees laid off in buffalo and worked at the factory there and a handful at the store in the area. separately, cnbc rehe viviewed e internal memo where elon musk apologized for the severance packages too low some laid off workers received insufficient severance this comes the say day that

6:05 am

tesla is reauthorizing the compe compensation package for tesla. >> they have a history of under paying people out the door >> there is a whole situation at twitter. rivian saying it cut about 1% of the work force that follows a cut of 10% back in february. the company said that the latest cuts were focused on support staff. shares of rivian hitting a record low on tuesday. amid the concerns of ev demand and we are showing8.40 ubs is planning another round of job cuts following the rescue of credit suisse. it goes beyond the routine pruning of most years. speaking of moving things around alphabet's ceo said the company's restructuring the finance organization that move will include layoffs

6:06 am

and reorganizations. the last platform shift to a.i. is the reason for the change and google terminated 28 employees yesterday after the series of protests over the company's contract to provide the israeli government and military with cloud computing and a.i. services some said they were protesting the harassment and intimidation and silencing of arrest arab googlers they staged a sit-in at the offices in new york and california in the email last night, the executive said the 28 people fired were involved in the protest that took over office paces and defaced property and impeded the work of other googlers sit-ins of the of gooiogle

6:07 am

cloud. >> are you surprised >> no. >> these are highly paid people. google has been treating itself like an open campus like a university where anything goes. >> used to. >> i think it tried to limit that that's why this kind of thing is surprising >> i think google cloud is more of an enterprise culture to begin with i'm hearing a lot of discontent from long-time google employees about not only how it is handling internal development things with a.i. and the culture. >> you think the 28 people knew going in they would get fired and prepared to quit >> maybe i don't know specifically. you have to see where google the is coming from

6:08 am

these are people coming in from berkeley they want to express how they feel eventhough you've got some layoffs and small numbers here where people will find jobs are in the market. >> that is interesting would you hire somebody who is involved in a protest at google and one of the 28 fired? i am not sure you would hire that person. you don't want that person running a sit-in at your company. if you are a tech tengineer >> if you are a big river. >> it is telling that google was specific in saying these were the grounds on which we dismissed these people >> yes >> you cannot impede the workplace. it is not freedom of speech. this is cracking down on the political positions. it shows the sensitivity there

6:09 am

to say we're not telling you what to think or say. >> if one of the people applied for a job at your company as an engineer, would you take them or is this disqualifying? >> i doubt for a lot for some companies, absolutely ideological clash with the ceo or the board, sure i think if you are doing software for setting up a gambling app or sports news site or ecommerce. >> if you are apple, microsoft, meta, a big tech company, salesforce, would you hire one of these people? >> i think there are a lot of kinds of companies hiring in the valley that are not the big tech names. you have to widen your scope there's a lot of money floating around engineers and sales and marketing positions if you have the contacts. coming up, netflix set to report today speaking of big tech in the valley we will tell you what to expect next. as we head to break, shares

6:10 am

6:12 am

my name is teresa barber. i was in the united states navy and i served overseas in the middle east and africa. early on in my career i had a commander that taught our suicide prevention training on a friday afternoon and the very next day, he took his own life. 90 percent of suicide attempts involving a gun are fatal. you don't know how much somebody can hide what's going on in their head. store your guns securely. help stop suicide.

6:13 am

i don't want you to move. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

6:14 am

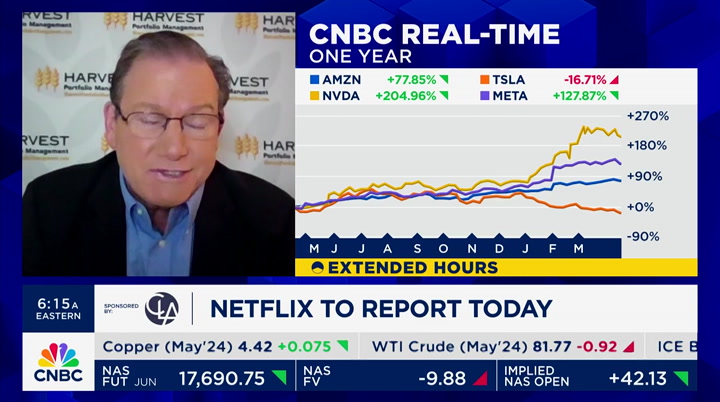

netflix is set to report after the bell today the stock is up80% in the last 12 months. joining us is paul meeks paul, good morning some names that have done well and you're feel meh about because of the fed rate cuts that aren't coming is netflix one of them >> netflix is a stocky would wait to clear the quarterly report tonight i don't think there is a tr controversy they won't deliver the mail eps of 450 the stock trades on net subscribers. last quarter, they bet at the sb number by 50%. i'm expecting 6 and 10

6:15 am

we will dial it back from last quarter. this is a stock with that number so volatile that times i'm aggressive in buying stocks ahead of the quarters because i know what i know this one is 36 times earnings. you have greatness baked into the price. i want to absorb this information tonight and make a decision tomorrow. >> if there is a surprise here, where does it come is it in information related to the advertising business is it in net subs? >> i think it will be in net subs remember, when they went to the low-cost ad supported tier and mandate of sharing, we we thoug that was a one-time blip so far, those strategies surprised to the upside. they look to have longer legs in converting more subs that's a good thing. after last quarter's 50% beat in

6:16 am

net subs, i'm a little bit more cautious and particularly again with the stock trading at 36 times earnings that is a pretty lofty price for netflix. >> looking broadly at what we used to call the magnificent seven, but now we use smaller numbers. you say you like alphabet, meta, amazon and microsoft meta has had a run over the last couple years why do you like it >> i think with the growth rate forecast has upside. it is not a tech value play. i am pretty bullish on digital advertising. i don't think the economy is going to have the hard landing that is the nice support there is the election spending and advertising support. i think that google is probably a little bit better value than meta

6:17 am

meta's results are clear i like microsoft and i like amazon i have not liked tesla for the longest period of time apple, i'm worried about this quarter. nvidia needs to come back. >> paul, you link the potential for the fed rate cut here. i wonder if that is scrambled with the names we have talked about with the defensive properties with macro unsrn certainty. here we are at 4.06% on thehe treasury yield >> that is a great point it is the greatest threat. think about what transpired last october when the yield on the ten-year treasury note eclipsed

6:18 am

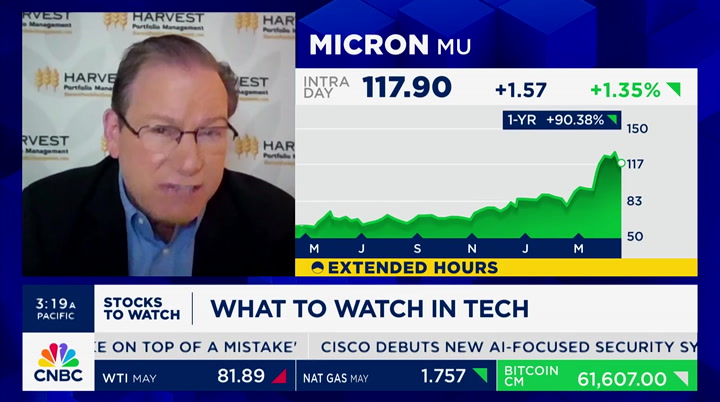

which caused a tech wreck. it caused more than a correction the greatest worry with all of these names, even in the names i like fundamentally is if we see the ten-year treasury note yield go higher than 4.8% and it pushes to 5%, unfortunately, we'll have a short-term correction in these names. just like what happened in the fall going into 2024, i would take that opportunity to buy your favorite names with both hands. >>ing moving down the market a little bit from bigger tech to micron you said that is the best idea driven by high bandwidth and memory demand and a.i. requires a lot of data flowing through. what about the chips act funding we're expected to see go through? is that at all a factor? how you look at the potential in a stock like micron? >> you know, i love to see them

6:19 am

support their capital expense diff plan one reason i like micron is the last couple of years they dialed back the aggressive capital spending and become less reliant on that. they boosted their cash flow yes, i like to see them supported, but we know the chips act and a lot of the money is not going to go to micron or intel or global foundries. it will go to tsmc or intel. the deal with the a.i. and the insatiable demand is the high driver this company is coming out of the correction they got back to profitability a quarter earlier than i thought and as a fixed cost firm with high operating leverage and you turn on the volume is where you

6:20 am

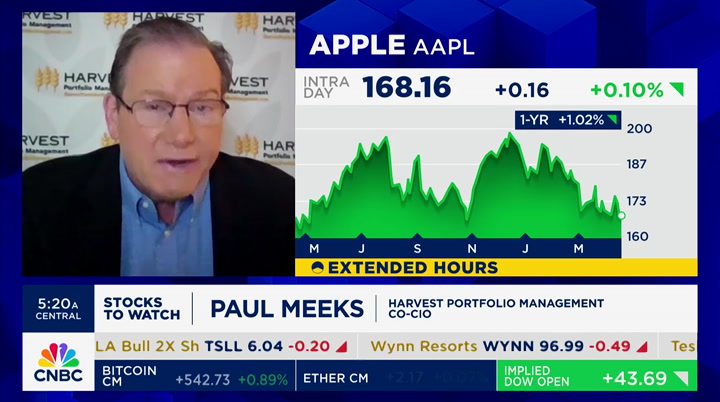

explode in earnings. they lost $4 a share and the peak of the next cycle t, i thi they will make 12. >> you are not worried for the quarter for apple. how much downside do you think there is for this company given people are concerned about china and people saying for the past decade that apple's best years are behind it although the stock price keeps going up how much downside? >> i think there is significant downside, jon. i think they will not be able to sugar coat troublesome fun fundamentals when they rueport. they will probably reveal something in june at the corporate retreat. it will be offset by the great

6:21 am

thing in june. hold on. we're almost there hopefully, that stabilizes the stock. without that driver and without that event and excitement around that event, i think the stock could go lower >> that would be rare if apple makes big promises about the product yet to come. paul meeks, thank you. >> best wishes. coming up, hear a lot about protecting your personal data, but should you worry about protecting your brain waves? a new law in colorado does that. and blackstone is set to report we have the interview with the coo jon gray coming up "squawk box" will be right back. ♪ >> announcer: stocks to watch is sponsored by cla view balanced. we'll get you there. what's right for the business

6:22 am

6:25 am

a new law in colorado aims to protect the privacy of your brainwaves the governor signed the bill yesterday that would expand the state's privacy law including biological and neuro data from the spinal cord and network of nerves it is a more to protect from neurotechnology from headbands that monitor the brain activity. such devices are marketed to consumers for a number of users. treating anxiety for meditation coach. the companies behind the technologies have access to the records of users' brain activity unlike medical devices, data gathered by brain technologies are not protected by federal

6:26 am

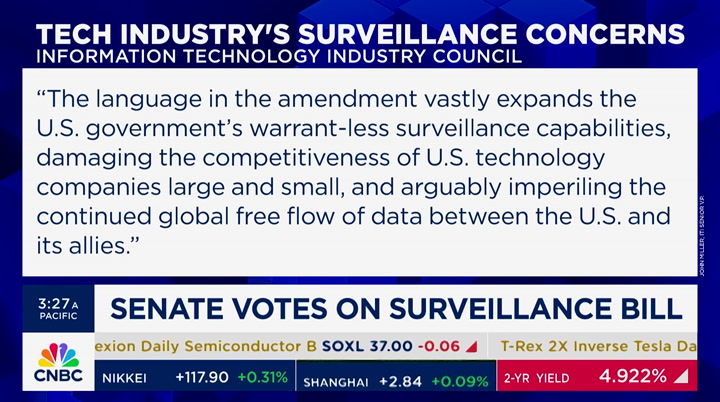

health laws. the colorado law grants neuro data the same proper ttections d fingerprints and other bio-medical data national security program will expire tomorrow unless lawmakers act. the senators are worried it goes too far. we have emily wilkins with more. another looming deadline on capitol hill, emily. >> reporter: they never seem to stop the key national security program will expire on friday if congress does not act. the senate plans to vote today on upgrading the foreign intelligence security act or fisa at the center of the senate debate is the provision added by the house last week that seems to expand which companies and people would be required to hand

6:27 am

over information to the government among those raising concerns are tech trade associations whose dozens of members include apple and google and intel john miller, at iti, said the language and amendment expands the u.s. government's warrantless surveillance and could damage the competitiveness. companies large and small, with data between the u.s. and the allies the group of law make makers are pushing to get the language removed, but doing so could jep s jeopardize the program not being approved in time the chair of the committee said that even a short lapse would be detrimental. >> as we simultaneously try to

6:28 am

debate aid for ukraine and israel and humanitarian relief to the palestinians in gaza and suddenly go dark at this moment in time would be the height of irresponsibility >> reporter: mike, the vote on the senate is expected this afternoon. we will be keeping a close eye to see what happens there. >> thank you, emily wilkins. more coming up on "squawk b box. we hear from the olympic athletes coming up and today is the last day to nominate us for the interview with charlie munger before his death. if you love it, go to the qr code on the screen and you can show support for it "squawk box" will be right back.

6:29 am

>> announcer: executive edge is sponsored by at&t business next level moments need the next level network. it's a with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow!

6:32 am

here on cnbc we are live at the nasdaq market site in times square look at the futures. the nasdaq up 63 points. the s&p is up 11 points. we are now 99 days way from the olympics in hparis. we spoke to some of the athletes competing and a member of team usa men's basketball three-on-three team. take a look. >> i know people are bringing the energy in one of the coolest places on earth. i know everyone will be watching. >> they spoke with the member of team usa's women's basketball team breanna stewart. >> i can't believe it is 2024 and the olympics are around the corner i'm excited to see what paris has in store and excited to go

6:33 am

after another gold meet me immemed immemedal. >> we asked about the caitlin clark effect on sports. >> she is expected to bring a different look to women's basketball what she accomplished in college and now to the wnba and fever, i'm excited to see what happens on and off the court >> every sports owner i know thinks the industry that is about to blow up is the wnba it is finally at a n inflection point. >> the soft -- >> i forgotten there is three-on-three basketball. it is cool >> you have to talk with women because we have no women on se this morning >> yes coming up, another tease at 8:00 a.m., i grew up following this guy my interview with grant hill

6:34 am

managing director of team usa and men's basketball and shares perspective on the caitlin clark effect owns a piece of the hawkss and became an owner of the orioles we'll all part of the same generation you saw the gentleman on the court and phoenix and clippers you can catch the summer olympics here on nbc and peacock. we will have coverage throughout the games. i'll be there broadcasting from paris for "squawk. we're coming right back injust a moment. crude prices pulling back in the last 24 hours. we will talk about the move by the u.s. to reimpose sanctions on the venezuelan energy sector. "squawk box" will be right back.

6:35 am

6:36 am

6:37 am

visit indeed.com/hire and get started today. encore energy, america's clean energy company, now in production in south texas. energizing america with reliable and affordable uranium for nuclear energy fuel from our environmentally friendly extraction process. at morgan stanley, old school hard work meets bold new thinking. to help you see untapped possibilities and relentlessly work with you to make them real.

6:38 am

the biden administration is reinstated oil sanctions on venezuela. it says it is a response to the president maduro for the failures during the elections. we are discussing the loss of oil with ryan at the international studies. ryan, it is good to have you here the initial question is will this actually deprive venezuelan oil from the world market? talk about the practical effects initially. >> good morning, gentlemen thanks for having me on. the answer is no for two reasons. first, venezuela doesn't produce

6:39 am

that much oil anymore. a lot of it due to failure in policy and seeing a massive slide in oil production in venezuela over the last 20 years. what little it does produce will remain likely on the market because hidden within the sanctions snap back is a long wind down until may 31st of this year there is also a hint-hint, wink-wink of companies working in venezuela to apply for comfort letters to continue operating in venezuela that long wind down period will allow them to on a case by case basis, approach the letters to lock in the contributions to the international oil market >> if that being the case, if it is strictly optics or the administration doesn't have that many other options to try to at least cosmetically pressure the regime there >> i would argue that the administration had to take the action it did.

6:40 am

what little credibility our policy had left, it would be blown out of the water if we didn't snap back the sanctions the text within the sanctions snap back offers that long wind down and opportunity for a case by case review the broader macro context cannot be forgotten the administration is jittery about oil prices it doesn't want to take off the market even if it is a modest contribution, venezuela's contribution to international oil markets where venezuela is producing 85850,000 barrels a dy however, any little move in price, the administration is sensitive to because we're in that election season >> we're talking about how similar calculations seem to apply to iran. if the oil production capacity at the moment in venezuela has been degraded this much, talk a

6:41 am

little bit about the situation in the country right now economically and is it otherwise at this point isolated from the rest of the world? >> venezuela has been in an economic catastrophe for a long time the imf daysays it is the worst economy. it is mismanagement of the macro economy and loss of human capital and so on. take for example the average public sector salary of $5 u.s. per month. the maduro regime is desperate to have a cash increase in the ru ru run-up in the election in their country. they had no intention of upholding the agreements they signed in the barbados accords they will do what is in their

6:42 am

best interest to stay in power >> you mentioned the out migration which is a huge factor for a while. is there any way which the u.s. has incentive to try to stem that obviously, a lot of those people will try to seek asylum at the border surely not only coming from venezuela, but is there essentially a complete detachment from the countries or is there any conversation along those lines? >> we have seen as part of the deal the administration struck at least initially with repatriotation flights back to the u.s. the regime, although it lacks legitimacy, understands how the democracy works. the biden administration when it lifted sanctions in exchange for the commitments for free and fairer elections, they thought the boost in the venezuelan

6:43 am

economy would keep people in place. venezuela has seen t8 million people leave the country this rivals ukraine's exodus with the conflict. the biden administration did not understand that regime matter. a lot of people are freeing the representation 40% of people said they would consider staying -- i'm sorry. 15% of the people said they would consider staying in the country if maduro was declared the winner of the election a lot of this is the lack of hope of the prospects for political change and the continuation of the authoritarian regime and power. >> it is desperate situation ryan, thank you. >> thank you. before we head to break, update on in-office work

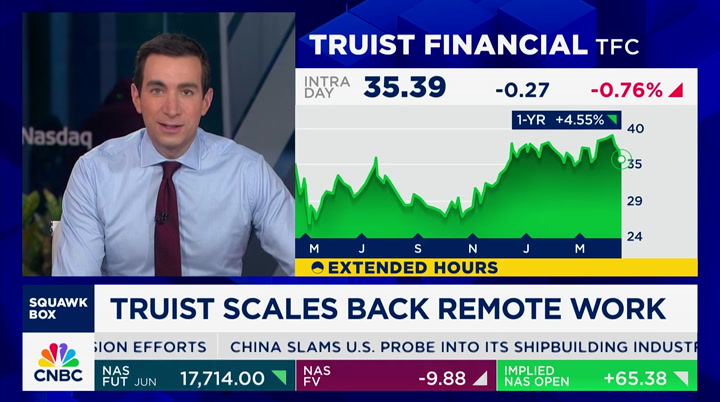

6:44 am

truist telling staff it must be in office every weekday starting in june. the current raarrangement allowg them to work one day a week. others on a high ybiybrid arran. i don't know >> can you imagine coming into the office every day >> we happen to come in five days a week. it happens to be the way >> thankful it is only five. >> steve cohen says he thinks we're moving to a four-day workweek we have seen the economy in terms of leisure >> in europe >> no, no. he's investing in golf there's going to be an extra day where you have time to do other things we'll see what happens. >> come on. >> you don't buy it? >> no, absolutely not. if you want to get ahead -- working for big river, you will

6:45 am

never work a four-day week. >> for you who don't know what big river is, it's a nicet tease a nice secret that amazon has according to "the wall street journal. >> i was reading that. >> tease >> tease my tease. it is an amazon secret effort to gather intelligence on the comp competitors. that is next we will tell youyou about it la evlater. we will get the latest from don peebles when "squawk box" comes back savvy investors know that gold has stood the test of time as a reliable real asset. so how do you invest in gold? sandstorm gold royalties is a publicly traded company offering a diversified portfolio of mining royalties in one simple investment. learn more about a brighter way to invest in gold at sandstormgold.com.

6:47 am

i can't believe you corporate types are still at it. just stop calling each other rock stars. and using workday to put finance and h.r. on one platform. tim, you are a rock star. using responsible ai doesn't make you a rock star. it kinda does. you are not rock stars. (clears throat) okay. most of you are not rock stars. oooh. data driven insights, and large language models. oh, that's so rock roll. it is, right. he gets it. yeah.

6:49 am

and read "wall street journal" you know what this is. amazon is going to great lengths to gather intel from rivals. the giant set up a third-party seller called big river services international. a third party arm to sell products through marketplaces. not its own, but e-bay and shopify and walmart and others to gather intelligence according to people familiar with big river, the site spawned from the 2015 plan called project curiosity. it used it with sales to get pricing data and logistic information and other details about sites. let's bring in our steve kovach to bat around the ethical question or moral question or business question. >> doesn't seem legal.

6:50 am

>> that is my read >> it is deceitful >> the piece makes it outas if it is a clandestine effort, which it is with their own email addresses. there were times when they go to conferences and they say they're from own email addresses, not representing themselves as they are. sometimes they go to conferences and they say they're from big river. my question is, do we think as amazon seems to suggest in the article, their spokesman, this is a normal course practice in does walmart, for example -- is walmart selling product on am amazon's marketplace as another company? >> amazon in the piece, by the way, they hint at that, they think walmart is doing that. this is like an extended version of maybe let's go back to physical retail of walmart maybe sending shoppers into a target or vice versa. that's okay. we have no problem with that this is an extended version of that it also speaks to these open marketplaces that we had so much trouble talking about shrink and

6:51 am

theft and other products on there. anyone can make an account, even your biggest rival can go in there and make an account and start selling stuff. >> this is a long, long game they're playing though they had to build up volume more than 60% of the volume that big river -- amazon is a big river. >> i was going to say, if they really wanted to hide -- >> technically, we weren't hiding it. 67% i think the article says of the traffic was actually running through amazon because walmart said, hey, you have to be a big seller on some other platforms first before you can sell on us. so this is a really, like, long effort that they had here, amazon also a long river, i think the real question is terms of service how much deceit is necessary to do this, but then at the same time, in a lot of research, you get a third party to do this and collect the data anyway. it is so expensive to do it at this scale, that arguably i guess it would be difficult for some external --

6:52 am

>> in terms of getting on the marketplace, and all the effort, that seemed to be the most sort of questionable piece of it. i am sure, i will say with almost 100% certainty, walmart -- somebody there tried to set up a shopify account. somebody probably tried to sell some product on amazon. >> we could all do it right now if wei wanted to. >> that part doesn't make me crazy. the question is the walmart piece of it, the fedex piece of it >> the e-commerce truman show aspect of this, right, where you're creating a whole reality for your competitors to live inside, without realizing that they're giving you -- >> is there any sense that they really learned or changed their own practices in a material way? >> they kind of gloss over that a little bit in "the wall street journal" story it is unclear. one thing that stuck out too was flip card, the indian e-commerce company, they got in there before walmart took that stake in flip cart as well who knows what they learned on

6:53 am

that >> if you're doug mcmillan, doug if you're watching this morning, we're going to talk about you, should you kick off big river from your -- >> only if you're not doing it yourself if walmart is doing it itself, it would be a bad look. >> i think you also got to think about the hoovering up of data from youtube transcripts to train a.i. there is all of this, right, trying to get the goods on your competitor, whether it is on e-commerce or training your a.i. models >> can you give them any credit for being kind of genius. >> they are -- relentless.com, that's the original name for amazon they are relentless. >> it is not unusual look at what apple does with suppliers. this youtube stuff, what openai does, it is in the culture, right? >> shoot first, ask questions later. >> steve, thank you. >> thanks.

6:54 am

>> we'll probably talk and debate this more as the program continues. we're going to also talk about this one, tesla's board asking skareholders to reauthorize elon mu's pay package, struck down by a delaware judge. we're going to continue that debate right after this. >> announcer: this cnbc program is sponsored by baird. visit bairddifference.com.

6:56 am

6:57 am

the future is not just going to happen. you have to make it. and if you want a successful business, all it takes is an idea, and now becomes the future where you grew a dream into a reality. the all new godaddy airo. put your business online in minutes with the power of ai. welcome back to "squawk. tesla asking shareholders to vote again on elon musk's pay package that was struck down by a delaware judge in january. they're hoping to move from delaware to texas. joining us is charles ellison, founding director of the

6:58 am

weinberg center at the university of delaware good morning to you. we had a pretty fiery debate with ann lipton from tulane university yesterday about exactly what may or may not happen as a result of this effectively whether shareholders, if they did vote, in fact, again, now, to put this plan back in place, that that would be a legal thing to do she seemed to suggest she thought it was not what do you think? >> i agree with her on that one. look, they can vote on it, but the judge in the opinion pretty clearly says not only was the process bad, but the result that the equity comp they designed was effectively a gift to mr. musk, that there was no value received now, companies give things away, money away, without corporate purpose. but everyone's got to agree to it you got to get every shareholder and that's not going to happen here i mean, the idea is that having

6:59 am

a shareholder vote, of disinterested shareholders is helpful in determining something was fair, but she's determining it wasn't and that's the issue you have to rethink the whole package itself so, yeah, they can vote. there will be issues with how much was disclosed, did they tell them everything, that will be something the s.e.c. will comment on, but ultimately she thought it was unfair and that's really -- >> this is the piece i don't understand the way i read the decision, and maybe where we're reading different decisions, i understand that she did seem to think it was wasteful, but i don't believe the wasteful element of it, if you will, was part of her quote, unquote decision or shouldn't have been. i thought what she was discussing was simply the disclosure issue, that she did not feel that the disclosure was proper as it related to the independence of the board and what she described as a deeply flawed process to get to that number and effectively by stapling that

7:00 am

decision to this proxy, shareholders can now read her decision, they can see all of the terrible things, if you believe that they're terrible, and i'm not sure they are, but if you believe they're terrible, you can read everything, you know, all -- everything that happened, and if you still voted in favor of this plan, why would that be a problem? >> well, no, i don't think this is a waste case. i think the lower court, previous judge said, no, this wasn't a waste case t this is a conflict of interest case the fact that she ordered rescission, rescission, not a revote, but a rescission, and the fact, i believe on page 173, she actually says that, no, that this equity was an incentive to him. it was way beyond -- i filed a amicus, that was in the amicus she cited. yeah, she definitely said no, this is not -- this isn't proper and she rescinded it that's the key to this opinion

7:01 am

the process was awful. there is a lot of awful processes. but the fact that she said awful process results in something that i find unfair now, if, let's say, she said, okay, bad process, but this still is, you know, still okay, shareholders approved it, that would be one thing she said the result was unfair and the unfairness is not necessarily the result of the negotiation, it was the result effectively of what mr. musk asked for and she said -- >> let me ask you this, let me flip this whole thing around you're the board of the company and the shareholder of the company today. today you are the owner, you are the shareholder of this company, okay >> yes >> elon musk has been promised or thinks he's been promised a certain deal that he made in 2018, right? let's just put ourselves in his shoes for a second, okay he believes he made a deal, and then not only does he think he made the deal, he thinks that he hit all of the metrics of said

7:02 am

deal we can -- you can decide you believe there was a conflict in all of that. but that's in his head, okay >> yes. >> he has not been paid, by the way. i think at some point, forgetting about a gift, some form of compensation you would think would be due to him, it sounds like the judge with like to pay him nothing, but that also seems -- that doesn't make any sense. you also need to, i assume, if you want elon musk to continue to work at tesla or focus on tesla, given he's somebody that has other opportunities in the spacex and the warren company and neuralink and all sorts of other things, an unusual character, and one of the great entrepreneurs of our time, if you wanted him to stay, and maybe you can argue obviously he's continued to be incentiv incentivized to stay, what do you do as a shareholder? >> i think no one can hold you over a barrel.

7:03 am

if someone says unless you give me x, i'll blow myself up. at some point you have to say, enough look, he had 20% of the company. that's huge. jeff bezos, as i recall, he took like a dollar a year i mean, given your stake as the entrepreneur, the real -- what you get out of it is the appreciation of what you invested to begin with, which was huge to give him all this much more i think was wrong. that's what she found. it didn't make any sense. >> should judges be deciding this should judges be deciding the amount of money that -- and the metrics with which compensation should be paid is that the role of the judge? i believe the role of the judge should be around the disclosure issues, if it is not fair to shareholders and they're not given the appropriate information, i can buy -- i can arguably buy into that the idea that we're now going to let judges set what is fair, how do you feel about that >> and this was -- this is where the opinion was very unusual

7:04 am

this hadn't happened before. but at some point, you have to say that something is so far out of bounds, which in fact it goes beyond reality, the fact is really why -- >> it only went beyond reality because he went beyond reality, charles. that's the piece of this if he hadn't hit the -- if he hadn't hit the numbers, we wouldn't be having this conversation he went so far beyond reality -- we all sat here, in 2018, and said, this is absolutely bonkers. the chances of him ever hitting these numbers just is beyond the pale and yet then he did it and i don't mean to -- >> and where is the stock now? it is down quite a bit as you know because the reality wasn't necessarily what people thought it was >> here is the piece of it, charles, he's on the same ride with them. because he's not allowed to sell the shares for another five years even if he gets them tomorrow. >> he sold a lot of shares to buy tesla. >> no, no, no, no.

7:05 am

hold on, charles the shares that he sold were shares that were granted to him prior to 2018. he has had no -- he has not touched the shares that were granted to him or -- in this case, they weren't granted, they were put in place in this compensation package in 2018 so, you know, when people say he sold previous shares, that has nothing to do with this conversation, at all >> well, it does, because it suggested that he thinks his money was probably better somewhere else, rather than in tesla, which suggests that the tesla growth of tesla wasn't going to be exactly as people seemed to think. he took his assets and put it into another place, a la x, where he thought -- >> do you believe every time a ceo sells shares that that -- that that is a sign of what they think of the company in some cases, in this case, he wanted to buy something and he wanted to use the money. i actually recently talked to a ceo who -- actually very interesting, talking to a ceo, who i saw sold some shares, and i said, is this a sign about the

7:06 am

company. and this ceo said, go look at how much money i get paid in cash, every year, and i went to look, they got paid $250,000 in cash, and they said -- said i got bills. like the ceo looked at me and said i got bills to pay. i think in this case elon musk had bills to pay >> sending a kid to college, putting a new thing on the house, getting a boat, but how many billions of dollars -- >> this is a very big -- it is a digital boat and the boat has holes in the boat and because he's got money on that too that's a different story these are not legal things we're talking about, charles >> no, of course not but at some point you got to say -- unless you pay me a zillion dollars, i'm going to blow myself up the company is perpetual the board, at this point, should be thinking about the future this -- if he were to get hit by

7:07 am

a bus, decided he wasn't going to do this anymore, the company has to go on and design a business around one person's whim doesn't make a lot of sense in the long-term that's not prudent, nor in my view good business judgment. you got to prepare this thing for the long-term. and the fact that he says i want so much of the company or else i'll leave, at some point you have to call man's bluff and say enough for the shareholders, the investments. you can't run a company this way. if you all came back to cnbc and said, i want a billion dollars, you know, or i'll leave, what do you think they do? >> what do you think they do i don't know >> i don't know. look, at some point it becomes silly. and i think that's the point and she said at some point this isn't right. you want to give it to him, fine, but everyone has to agree to it. that's at least the way i read the case now, again, it is different from the disney case. for disney, he said i'm just not going to get there i'm close, but i'm not -- she

7:08 am

got there,she said, enough is enough and frankly i agree with you, judges shouldn't be making compensation decisions but judges are there to produce equity and in this case, the court of equity, the equity was unless everyone agreed to it, this was ridiculous. >> we'll continue this debate. i'll have you back i want to talk about how the whole legal appeal would work and what would happen from a legalistic perspective when this decision happens and all the cases that may or may not be brought. nonetheless, thank you for joining us. >> thank you it is now just after 7:00 a.m. it is more than just after 7:00 a.m. we went long, but it was a worthy conversation. we're here on the east coast you're watching "squawk box" on cnbc i'm andrew ross sorkin jon fortt is here, mike santoli is here. joe and becky are off today. we have a lot going on among today's top stories, home builder dr horton beating the wall street estimate of $3.06. revenue of $9.1 billion, also a

7:09 am

beat the company declaring a 30 cent dividend micron expected to receive $6.1 billion from the chips act to help pay for domestic factory projects according to multiple reports saying an announcement could come next week and cleveland fed president la laura mester saying more data is needed, she is a voting member of the fomc, saying there is no need to cut interest rates right now with current policy in a good place, she says checking u.s. equity futures. let's see what's going on there. we got indications higher for all three major indices. the dow indicating higher by more than 90 points, if things were to open up right now. it has been a rocky few days on the markets. and joining us on that right now, stephanie link, chief

7:10 am

investment strategist at hightower and cnbc contributor stephanie, good morning. >> good morning. >> so what is driving the markets right now? yesterday, the tech sector on the s&p was down dramatically more than lots of other stuff. semiconductors having a particularly bad day are things just trying to find some equilibrium now what do you think is going on? >> i think so. i feel like we hit kind of a volatile time ahead of earnings. them week is going to be great in terms of earnings i think earnings are going to give us a better picture for the time being, we hit this air pocket, we're trying to figure out where rate cuts and how many rate cuts are going to occur this year. i'm kind of getting into this camp of maybe no cuts and i don't think that we need cuts because we have better growth. especially earlier this week, we had the imf revised global growth higher to 3.2%. we had better china gdp growth

7:11 am

at 5.3%. here in the states, we're running at about 2.9%, and so that -- all of this growth, this dynamic is keeping inflation elevated and so the fed doesn't really have to do anything, but all of this means that we're going to see better earnings. that's why i'm looking forward to next week and we had some good earnings even this morning with dr horton >> so, what do we think about -- tend to think about as earnings season, banks go first, big banks, regionals what is your takeaway from the bank reports, really the fundamentals versus just the stock action >> yeah, i always think that banks kind of trade a little funky around earnings because the headlines are kind of messy and they were messy. but i do think that the one message i took away was that capital markets are certainly improving. the ipo pipeline is actually improving. and making progress and i think

7:12 am

that the expense line was really quite remarkable for many of the companies. and so, to me, i thought the standout was morgan stanley. i have been buying it, i will continue to buy it at 13 times forward estimates. i think they hit it out of the park, quite frankly, in terms of their institutional business, the wealth management business, and, again, the expense side of the equation you have a new ceo and everyone is kind of trying to figure out what that means. he's got a great track record, though, especially on the institutional side, and i think they're going to continue to gain market share. i thought citigroup did a great job on the expense line. bank of america did a great job on the net interest income on a sequential basis relative to its peers. i think you pick and choose and i think the sector is quite cheap. >> steph, it is interesting to just think back to where the kind of economic narrative was at various points in time. we had mass certainty we get a recession, you know, 15 months ago. even last october we felt like the economy couldn't handle

7:13 am

rates where they are right now and now it is sort of, like, hey, we got a 3% economy, the rest of the world is growing, i'm wondering if we're going to overshoot and say maybe rates are biting, we're seeing consumer-based companies suggest that demand is a little bit soft or maybe people are very price sensitive. i'm wondering about the next move and the narrative as we see bond yields take a breather, even oil companiesy coming down bit. >> i get nervous because everybody last year, to your point, was thinking by now we would be in a recession, now everyone today is thinking everything is so great so, i respect that very much but i do think that the consumer continues to be strong and we're all watching the job market, the labor market, the labor market continues to be quite tight. and i look at wages at 4.1%. and i look at the -- if you want to switch to a job, you get a 10% wage increase and so that has led to a very resilient

7:14 am

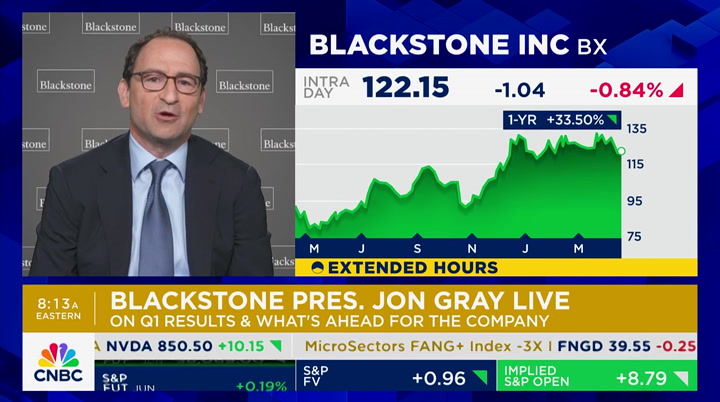

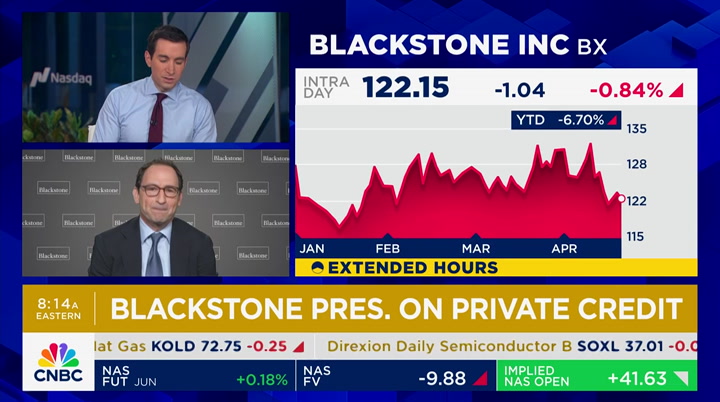

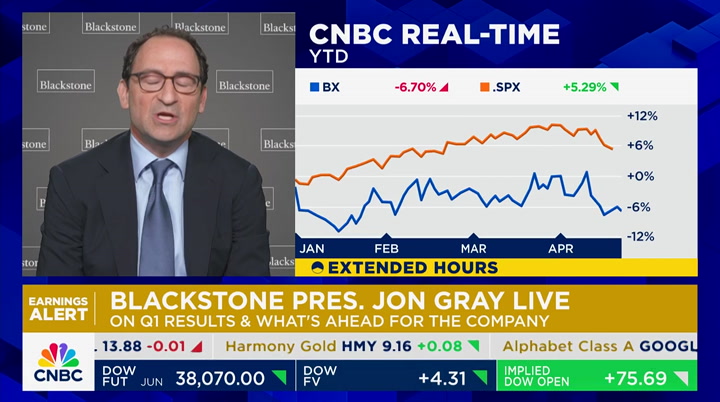

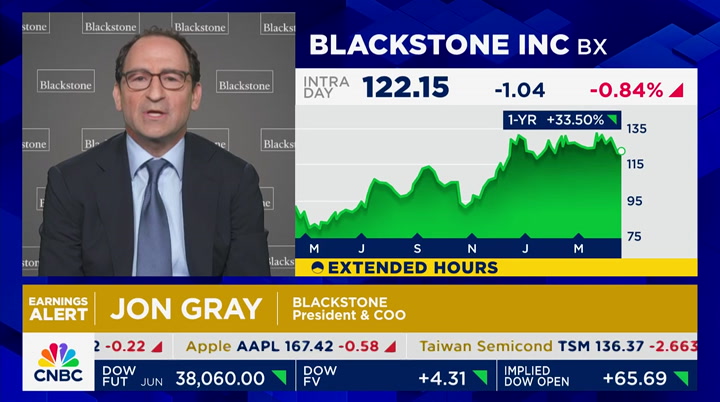

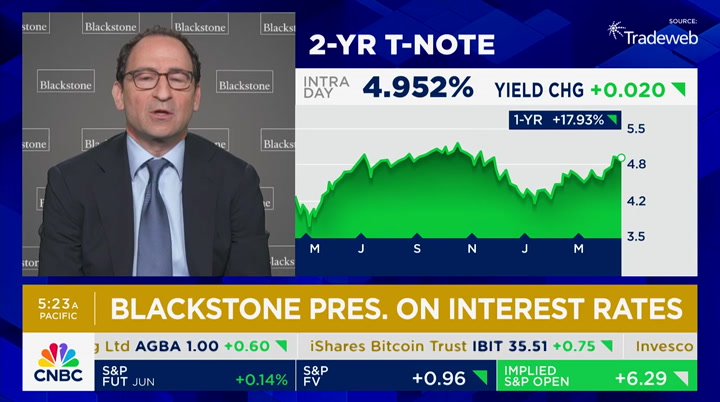

consumer and i do think that at the same time we have got $9 trillion according to larry fink at blackrock, we have $9.1 trillion in money market funds and so that is a nice support and a tailwind for equity markets should we see a pullback so, yeah, we're going to be rocky, nothing is perfect. but i do think earnings are going to pull through and if that's the most important thing and the most important takeaway for me, if i got nervous about earnings, i would be nervous about the market and i'm not nervous about earnings at this point. >> all right stephanie link, thank you. black stone just reporting earnings of 98 cents a share, two cents better than estimates. the infrastructure portfolio rose 4.8% in the quarter driven by investment in data centers. the private wealth business seeing its highest inflow since 2022, taking in $8 billion and the company is declaring a dividend of 83 cents a share

7:15 am

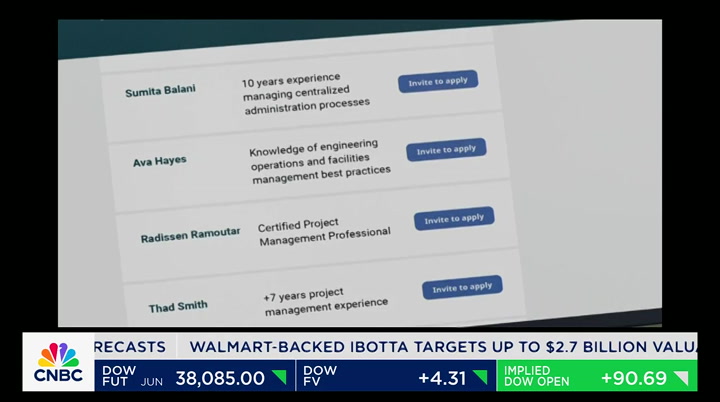

blackstone's president and coo jon gray will join us in the 8:00 hour. we have so many questions for him about the economy, want to talk real estate and lots of questions out there about that and so much more we'll talk to him just a little after 8:00 a.m. this morning "squawk box" coming right back you founded your kayak company because you love the ocean- not spreadsheets. you need to hire. i need indeed. indeed you do. indeed instant match instantly delivers quality candidates matching your job description. visit indeed.com/hire

7:16 am

hi, i'm jason and i've lost 202 pounds on golo. so when i first started golo, matching your job description. i was expecting to lose around 40 pounds and then i just kept losing weight, and moving and moving and moving in a better direction. with golo and release, you're gonna lose the weight. you've got xfinity wifi at home.

7:17 am

take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

7:18 am

big tech has been shrinking its presence by causing new construction or letting leases expire, google paid $1.8 billion in exit charges on leases last year to optimize its global office footprint joining us now to walk us through the commercial real estate market is don peebles, the peebles corporation ceo and chairman good to have you this morning. >> good to be here >> we're four years out from the lockdown moment and we have been waiting for commercial real estate to either rationalize or whether it is going to get worse or we're going to get through the problems and work it out on the financing side what are the trends today in terms of companies rethinking how much space they need >> well, all companies -- most prudent companies and larger ones have reconsidered how they do business and how thueir employees work and that was happening before covid.

7:19 am

law firms were doing hoteling where no one got an assigned office anymore and they -- you had larger corporations doing that. and then covid just accelerated it and also what is happening, also, in the tech sector, their business is being more efficient, all about being more efficient. you can expect them, historically, companies grow and then they kind of level off and downsize a bit, because they can be more efficient. what is hurting the real estate industry also is that with these losses, in terms of occupancy, is the interest rates have more than doubled and that's made these buildings essentially almost all of them in major cities insolvent. >> which is exactly, i think, part of the point here of why that sector in particular really feels that fed rate cuts would be instrumental to easing the pressure a bit is it a question of we can kind of, you know, the banks seem to be at a point where whatever losses they might have to take are not necessarily crippling, but it doesn't mean that this is -- these are attractive new investment opportunities, still

7:20 am

an overhang of space as a investor, developer, how are you thinking about what it is going to take now to unlock these margins. >> one thing i do think that the risk is far greater than people are looking at if we go back, we have never seen anything like this since the early 1990s. at that point in time, one-third of the 3,000 saving banks around the country were closed. within three years, 370 banks were closed. what is happening here is 80 plus percent of these commercial real estate loans are held by local and regional banks they're the life blood to small entrepreneurs emerging businesses and startups. and without access to that cap capital, none of them can make loans. they're banks who are dominating real estate markets on a regional basis making no loans and the reality is, they're deferring judgment day these properties are being given back now, private equity funds are writing down their investments in office buildings to zero. and they are moving on because the intellectual brain drain to

7:21 am

try to solve an insollvable problem, they would ranger take t the losses and move on if the fed doesn't drop rates, these buildings, there will be a catastrophic, i believe, events going back to these local regional banks. >> we're going to have john gray on in a little bit from blackstone i don't know if you follow breit. they have not dropped their evaluations to the same level as most reit products those funds for the most part are doing almost like -- liquidation prices how do you think about the distinction between some of these funds now, these public funds that are out there at much higher valuations than maybe where things would be today if you actually had to sell some of these propertys? >> well, jon is one of the smartest people in properties. and blackstone invests differently than most real estate investment funds.

7:22 am

they do it to a very large scale. they're more likely buying companies or large pools of assets as opposed to one off so that gives them the ability to be much more flexible, they're buying at better price points their losses won't be as great i think -- also they have the capacity to work their way through it, spin off the assets like they did with biomed and other things, and so i think there is a way out for them. look, they said this, i've been saying this for a while, you don't know when the bottom of commercial real estate is coming, and so you got to start looking at when there is strategic buying opportunities that's one thing we're looking at i think that they do need to make some adjustments to some of their asset values, but not to the same degree that these funds, who are closed in funds, and that they now are going to be compelled to sell i think that's another element here i think the values today are down, but i think if you can work through -- >> you think they should lower -- we'll talk to jon about this you think they should be lowering their values? >> i do. >> we keep hearing about private

7:23 am

credit being the escape hatch here, all this dry powder out there, the banks don't want to step in, you're involved to some degree, is that really going to allow us to bridge to the other side here? >> yeah, i think so. look, we started a company called willow brook partners because we think it makes a lot of sense for us to deploy capital to entrepreneurs as an entrepreneurial development firm, one of our biggest challenges has always been to capitalize our projects efficiently, especially developing new buildings and even before covid, before the run-up in rates, the private credit firms, like mac, like related even had one and children's investment fund, they were stepping into the market and filling the void that the major banks who are subject to bazell three were penalized to make these loans now with rates as they are and the inability of many of these banks because of capital constraints to make these types of loans, private credit will be the dominant player in

7:24 am

commercial real estate in terms of growth going forward. mike milken was at one of the conferences two years ago and last year here in new york, in one of our meetings, he was talking about how that is the future and i don't think just commercial real estate i think that in terms of other industries, you'll see private credit emerge in a much stronger player because they're liberated from the ridiculous regulations and they can make business decisions. i think that's where banking should be is making business decisions. >> its future might be the present too, it seems like, increasingly don, good to see you, thank you. >> thank you for having me. still to come, a lot more here on "squawk box. microsoft has found russian influence operations targeting the presidential election that is under way and expect to ramp up in the coming months. we're going to talk election interference and cyberthreats when we return. >> wt hais the minimum required age to become a member of the house of representatives the answer when "squawk box" returns. uh-huh... - hip-hop! - limping!

7:25 am

7:27 am

7:28 am

currently congressman maxwell frost, age 27, holds the distinction of being the youngest member of the house alaska air reporting a loss of an adjust 92 cents a share. that beat the street's expectations for a loss of $1.05. revenue of $2.23 billion also beat estimates the airline took a hit from the blowout of boeing jet door plug during a flight in january, of course, and said the grounding of the 737 max planes extended into february significantly weighed on operations in the first quarter. the company's ceo will be on the exchange today at 1:00 p.m. eastern time google terminating 28 employees yesterday after a series of protests over the company's contract to provide the israeli government and military with cloud computing and a.i. services. some said they were protesting the, quote, harassment, intimidation, bullying, silencing and censorship of palestinian, arab and muslim

7:29 am

googlers on tuesday night, nine google workers were arrested on trespassing charges after staging a sit in at the company's office in new york and sunnyvale, california. a google executive telling workers, 28 people were fired. joining us right now is jason greer, greer consulting founder and president and i'm going to start with this very question, would you hire any of these folks who were fired yesterday for being involved in this protest? meaning, was it disqualifying -- i mean, we're partially asking, should they have been fired, but partially asking, now that they have been fired, should they have an opportunity elsewhere or not? >> 100% i would hire these folks in a second. they're clearly true believers in terms of the question should they have been fired, google set this precedent in 2018 when employees staged their own shared walkouts and they said we

7:30 am

don't agree with the work they're doing in project maven what is the difference between 2018 and today >> don't you think -- i would make a different argument, i would say there is a big difference between 2018 and today, google has tried, i think, quite vehemently to change the culture and make it clear these types of protests are not allowed. and so the question is, yes, if that was part of the culture then, but if you have an explicit arrangement, and you're an employee of a company, there are channels with which you can protest if you will and have your voice heard, but having a sit-in, trespassing, defacing property and the like, goes to a question about judgment. and i think that there is a question about whether you want to hire people who have that judgment or not. >> if i'm looking to hire people who are willing to hold me accountable to the missions and values of our company, absolutely got to understand with the

7:31 am

average google worker, they're not looking at the fact that we're working for google since we work for google, we work for the world the decisions we make as a company impact the world this is why i say to tech companies, especially ceos, i talk to them all the time, this is the reason why we're seeing union organizing going through the roof in the tech industry. the thing that google is facing is what many other tech companies are facing, they have employees who are saying, asking the question what did we stand for, and if we determine what we stand for, what are we going to do to make sure we continue to stand for that very thing. what the tech industry is saying today, exactly what manufacturing saw 60 years ago, workers were asking what do we stand for. >> it is a difficult subject and i think especially because we're in it right now, and we see what is happening in gaza, in israel, and people rightly have feelings about who is right in that situation. but i think if you take the specifics out of it and say, hey, protesting at a company when they tell you not to, if we

7:32 am

go back to the 80s and talking about south africa, right, or if we go back a little further and we're talking about civil rights in this country, you know, can we say that people who are protesting despite a company saying they shouldn't shouldn't be hired anywhere else >> absolutely not. i understand you just talked about the fact we're talking about civil rights back in the '60s we had folks that sat in, those folks that sat in lunch counters because i wouldn't be here today having this conversation with you. what it comes down to is there has to be two sides to this. on one side, the employers have the responsibility not only to their shareholders, responsibility to their external shareholders, stakeholders on the other side, what employees need to take a look at is if we're going to hold our company accountable, what are the channels this gets back to the original question what are the channels that we need to follow internally to make sure we're holding the company accountable. do we talk to our managers, human resources, do we talk to executives, do we ask to hold internal forms before we do these big, you know, sit-ins and

7:33 am

protests i think ultimately what it comes down to is in the case of google, with employees, before it becomes this huge mushroom cloud, where it is so radioactive where we don't know where we're going, you have to start asking the questions internally and have internal conversations because it is not you're going to continue to -- >> i don't disagree about the fact that employees should have views. i have views about all sorts of things, views about what my employer is doing and there should be channels with which you can participate in a conversation but if the company decides that they don't want to listen to you, then the question is you can decide to work there, or you can decide not to work there, it is unclear to me whether you should be able to stage a protest that potentially shuts down part of the company for some period of time and then expect to keep your job and expect to get a job elsewhere. >> absolutely. well, you should be able to stage a protest, if that's your

7:34 am

choice, because that's what it means to be american at the same time, you got to understand there are consequences to your action. if you decide to hold a protest, do a stage in where you're a legitimate closing down offices, chances are pretty good you're going to get fired or you're going to get arrested. in terms of long-term futures of being hired, in the '80s you could stage a protest in missouri and go work for a company in texas because they never heard of it. didn't hear anything about it. unless that company happened to know somebody who worked at the company that you did today, those chances of getting jobs elsewhere are probably slim to none for the next two years unfortunately because higher managers talk to higher managers the minute i google your name, i might not want you to come work for me that's the unfortunate reality they decided to take the chance, they took the chance, they got fired, now they're unfortunately going to possibly deal with the consequences >> sounds like you would like to hire one of them or more

7:35 am

jason, appreciate it >> thanks for having me. >> a great debate, thank you. college basketball star caitlin clark's wnba pay package is raising eyebrows. just under $340,000 over four years. is it time for the league to raise salaries "squawk box" will be right back. you're darn right. solar stocks are up 20% with the additional hour in the day. [ clocks ticking ] i'm ruined. with the extra hour i'm thinking companywide power nap. let's put it to a vote. [ all snoring ] this is going to wreak havoc on overtime approvals. anything can change the world of work. from hr to payroll, adp designs forward-thinking solutions to take on the next anything.

7:37 am

7:38 am

welcome back to "squawk. caitlin clark helping the women's ncaa championship ratings eclipse the men's for the first time now, many fans are shocked to learn she's going to earn just under $77,000 salary in her rookie year at her wnba, first wnba season. the top male nba draft pick will make more than $10 million the question of our morning is clark's pay fair jon fortt is here to weigh in. what do you think? >> i don't like the difference in salaries here at all, but is the pay fair absolutely athletes get paid based on money the league makes from ticket sales and ad revenue indirectly. the unfortunate truth is that the wnba brings in a lot less

7:39 am

money than the nba that's going to change if there is longevity to the excitement the players have brought to the women's game it is not going to change overnight. nba has 30 teams, playing 82 games a season, bringing in $10 billion total in revenue the wnba has fewer than half the teams playing half as many games bringing in around 2% of the sales. estimated $200 million that would be nice if we lived in a world where pay was based purely on talent in that world, the 2023 tony award for best actor in a play would get paid the same amount as ryan gosling who played ken in "the barbie movie" last year. we don't call that unfair, we call it the difference between movies and plays more people watch movies the good news, women's tennis has dramatically narrowed a pay gap that used to be just as wide so buy a ticket to a wnba game

7:40 am

and watch them on tv and it will change >> so, even if caitlin clark's popularity holds, does the wnba have a fair shot at catching up? >> well, andrew, on the other hand, caitlin clark's starting pay isn't fair because the wnba is set up to play second fiddle to the nba unlike tennis where the major men's and women's tournaments happen at the same time, in basketball, the wnba season is designed to happen when the men aren't playing, through the summer when nothing else but baseball gets played because sports viewership is the worst half of wnba team owners also own nba seems. that makes some sense because of efficiency but those owners are going to protect their nba franchises at all costs, rather than take risks that might grow the wnba's audience at the men's expense. there is always excuses for why it is okay to pay women so much less 25 years ago it was the women can't dunk, the game isn't as

7:41 am

exciting i don't know if you noticed, now more women can dunk and the men's game is less about jordan driving to the basket and more like steph curry's shot from the arc. maybe that's about to change >> okay, let me go two stats for you. >> okay. >> 40% of revenue is shared with nba players. 10% of revenue is shared with wnba players. >> yes >> now, i can explain that by saying that still the wnba, i don't believe is actually making money and, b, if you have more money, the truth is that most teams would say that they want to get better facilities for training, they want to get charter airplanes, most of these players are still flying commercially, oftentimes in coach. there is a lot of things you might do before you actually

7:42 am

spend money and you're sharing a completely different size of the pie. but, does it seem fair >> yes that's a good question when you're working off a higher base of revenue there is more things you can do, more money to share. the question here is if elon musk played for the wnba, right, could he make $50 billion? >> to that point, you know, you have a caitlin clark let's say the top three draft picks in this current draft coming off this massive wave of popularity in the college tournament are arguably much more important to the future success of the wnba than the median nba rookie getting paid millions of dollars, in terms of their ability to broaden the game. >> it is a really exciting moment you look at what happened with the ncaa this year, the fact you got so many female basketball players who have careers, making fashion statements, clearly there is going to be endorsement heat around this and then maybe that starts to

7:43 am

bring others you can continue to think about this, with the on the other hand newsletter, that you can get the qr code on the screen, so you can put up your phone in picture mode and get the link and go over, or if you like to type, type in cnbc.com/otoh, get the full text of both arguments and you can share. >> we talked to grant hill about this in the 8:00 hour, which you'll see coming up too. also coming up, russian election interference ramping up as we head toward november we'll speak to the former director of homeland security's cybera and infrastructure agency and blackstone reporting results. we'll hear from the president and coo jon gray he'll be our guest "squawk box" will be right back. webcasts, articles, courses, and more - all crafted just for traders. and with guided learning paths stacked with content curated to fit your unique goals, you can spend less time searching and more time learning. trade brilliantly with schwab.

7:46 am

welcome back to "squawk box. a new report from tech giant microsoft revealing that russian online efforts to sway the u.s. presidential election have kick started and could spike in the coming months. joining us now is chris krebs, chief public policy officer, served as director of homeland security as cybersecurity and infrastructure security agency and ran u.s. cyber policy for microsoft. we should say now works for a competitor of sorts to microsoft, is that fair to say, chris? >> absolutely. in the security segment, yes. >> in the security segment

7:47 am

when you look at this report, and you look at what needs to be done, how much of this is a private sector issue, which is companies like microsoft need to change the way they're working, versus what you think the government is supposed to be doing? >> i think stepping back there has been a couple of reports recently on russian but also chinese and iranian influence, and it talks -- these reports talk about both traditional media, social media, but also the increasing availability and impact of a.i. through information operations you know, got to give private sector credit, microsoft, google and handful of others that set up the tech accord to combat deceptive use of a.i. in the '24 elections and using that term in the plural it is not just the u.s. election, got to remember '24 and '25, about 2 billion people who go out and vote worldwide. we are seeing some use of a.i. and the companies are stepping

7:48 am

and disabling the use of threat actors using the platforms so i think that's the first step is they need to be aware of what is happening across their platforms and across their models and disrupting the use. governments have to be much more i think aggressive and out there in terms of identifying and sanctioning groups but then ultimately it is going to come down to us, you and me, and your viewers, that we can't be easy targets. we cannot be soft targets. they're trying to amplify a lot of the existing divisions we already have and keep cool heads, take a deep breath and go about your days. >> so, i'm not really sure i understand where you're advocating for you're saying it is on us? i have to say if it is on us, we got problems. >> look, i think the fact that we're doing to have a vote on aid to ukraine today or over the weekend is a sign that maybe these efforts by the russians to undermine u.s. support for

7:49 am

ukraine, while perhaps marginally effective, at the end, they're not achieving their strategy goals of disrupting western support for ukraine. >> now, what about problems with microsoft. just a few days ago, we're talking about microsoft's process lapses that expose the government to hackers. they're warning about russia's designs on the election here, but to what extent is microsoft even ready to deal with these issues >> that's a separate issue and this does get to the heart of one of the challenges that microsoft is facing right now, is they're a -- they're a conglomerate, across software, hardware, operating systems, cloud, security, a.i. now. they got a lot of different balls in the air and, you know, what we have been saying as andrew rightly pointed out, focus on secure products, not security products.

7:50 am

but what we would like to see and what the cyber safety review board recommended is they get back to basics on internal security controls and fix some of the culture issues. amazon web services, chris bettis over there, had a great blog post yesterday about how aws isinternally but they have these threat analysis capabilities on the disinformation place client weather a regular over on the msnbc. they have pretty deep insight. tracking an actor known as a doppelganger we have to expose these guys >> thank you coming up, california's minimum wage hikes are appropriating food prices to pop and wall stra analysts are taking notice. that's next.

7:54 am

california hiking its minimum wage for fast food workers to $20 an hour, among the highest in the nation. analysts are noticing price increases in the state as well kate rogers join us with more. >> several analysts are tracking those price hikes so far at restaurants in california. res researchers point to moderate price hikes at chipotle. mcdonald's, much lower at under 2% or flat for certain numbers the highest price increases it tracked at the state at chick-fil-a. many of these increases have been forecasted by the companies and were exhibited to keep pace with 25% these hikes will be implemented

7:55 am

differently at stores. another development on the horizon, where and how automation may be implemented to offset some of these costs in a note on price hikes in california, an analyst said, we believe california will become the proving ground for restaurant automation and evolving business models, as some restaurant operators have begun cutting labor hours and reducing staff in response -- gordon hafkette noticed that price increases haven't inmremted at chili's it will be interesting to see if they'll implement the price hikes. so far they're staying lower. >> how does it break down in terms of chains most affected

7:56 am

here i wonder, kate, if there is longer-term effect of reducing turnovers at some of these places >> it's often seen as an entry-level career, the argument people are staying in these jobs than living wage increase. mcdonald's under 10% this is going to wind up impacting the entire food sector as whole not just the fast food chains we'll be watching for those price increases. >> except for n-n-out because they already pay pretty well coming up, nba banning porter for life over a gamble

7:57 am

scandal, how they're handling the wide world of gambling as we head to break, a look at this pre-market's winners and losers in the s&p 500. "squawk box" will be right back. (fisher investments) at fisher investments we may look like other money managers, but we're different. (other money manager) how so? (fisher investments) we're a fiduciary, obligated to act in our client'' best interest. (fisher investments) so we don't sell any commission-based products. (other money manager) then how do you make money? (fisher investments) we have a simple management fee, structured so we do better when our clients do better. (other money manager) your clients really come first then, huh? (fisher investments) yes. we make them a top priority, by getting to know their finances, family, health, lifestyle and more. (other money manager) wow, maybe we are different. (fisher investments) at fisher investments, we're clearly different.

7:58 am

7:59 am

out here, side window deflectors... and mud flaps... and the bumpstep, to keep the bumper dent-free. cool! it's the best protection for your vehicle, new or pre-owned. great. but where do i---? order. weathertech.com. sfx: bubblewrap bubble popped sound. hi, i'm janice, and i lost 172 pounds on golo. when i was a teenager i had some severe trauma in my life and i turned to food for comfort. i had a doctor tell me that if i didn't change my life, i wasn't gonna live much longer. once i saw golo was working, i felt this rush, i just had to keep going. a lot of people think no pain no gain, but with golo it is so easy. my life is so much different now that i've lost all this weight. when i look in the mirror i don't even recognize myself. the nba ban of toronto raptors -- porter from the league for life.

8:00 am

the player shared inside information with bettors and bet on nba games while playing in the g-league first ban in 70 years. patrick, good to have you on this this this show. obviously, we now have the leagues that are completely participating in sports betting, but they want to be able to convey that the game themselves are fair, there's no conflicts, does this do it at this point for the nba? >> i believe it does one thing that comes into play here is the importance of analytics and technology i've been at a couple of different conferences, just came back from the sports journal world congress of sports in los angeles.

8:01 am

you can't go to any of these conferences and not hear conversations about analytics and technology helping the role of nba a company in vegas, u.s. integrity, a partnership with the league that provides some information that identified some of the irregularities that led to the outing of mr. porter. >> should we have the rely on market surveillance, you know in the financial markets you have people trying to monitor for unusual activity and they try to fill in blanks to see what might be behind it, you also have compliance programs for the employees, you can and can't trade certain things and they monitor that pretty closely, is the nba doing anything like at that at the player level. >> i'm sure lesion are educating players and provide ing information. i think with commissioner silver's coming down so hard

8:02 am

rightfully so on jontay porter this has to send warning signals to athletes across all sports. one thing that commissioner silver mentioned is the regulatory standards that perhaps when you're talking about these marginal players as porter was, should there be more regulations on having these over/under bets, that's what tripped him in this particular case looking to get rich quicker, if you take those types of prop bets out of the equation, then that hopefully further protects the league from these kinds of issue and obviously that's directly under the player's control is these single prop bets it's -- the case has been made that this is an ideal situation for the nba to send that message we're going to protect the integrity of the game because it was not a star player. major league baseball a

8:03 am

different situation, shohei ohtani's intere preter >> i know that there are probably a lot of casual fans who are not gamblers and the leagues are being somewhat hip hypocritical look, at the end of the day it's a business europe has had robust gambling activity and partnerships for many years in the premier league, this is not going away, you're not putting the genie back in the bottle >> navigate through it patrick, thanks very much.

8:04 am

appreciate it. it's just past 8:00 a.m. on the east coast you're watching squawk box on cnbc lot of big stories to talk about. the biden administration is going to providing micron with more than $6 billion to make memory chips meantime, shares of tesla, are falling this morning downgrading that stock to hold from buy cutting price target a share putting more pressure on the company. investors awaiting netflix's first quarter results due out after the bell today in particular, focus, subscribers additions, and take a look at futures. an hour and a half ahead of the opening bell, dow up about 77 points nasdaq looking to open up about 55 points higher

8:05 am

treasury yields as well, looking right now, 10-year note, 4.594 2-year at 4.245. four fed officials scheduled to give speeches today steve will be looking at any potential trends steve, it seems like, you know n the last couple of days bond markets calmed down a little bit maybe the markets have heard what the fed is now thinking >> yeah, calm down at the higher level presents an ongoing challenge to stocks, though. two more fed speakers overnight making clear while some fed officials may be more hawkish than other it's hard to find a dove on the committee calling for cuts now l loretta mester saying -- talking about the possibility of cuts,

8:06 am