tv Worldwide Exchange CNBC April 18, 2024 5:00am-6:00am EDT

5:00 am

it's 5:00 a.m. at cnbc global headquarters. it's 10:00 in london i'm frank holland. here is the "five@5. another fed official looks to caution before a rate cut. and shares of micron and taiwan semi get a boost. and china firing back on the tariffs on steel in the u.s. we are live in beijing with the response. getting set for the first faang report as netflix opens

5:01 am

its books after the close today. and new scrutiny from boeing after the fiery testimony. it is thursday, april 18th, 2024 and you are watching "worldwide exchange" here on cnbc good morning welcome to "worldwide exchange." we are live from cnbc london thank you for being with us. let's get you ready with the check of the stock futures the s&p rising a four-session losing streak. look at futures which are in the green. the dow would open up 30 points higher nasdaq is showing promise. this morning, we are watching tech and nasdaq closely. it has been down for four straight sessions.

5:02 am

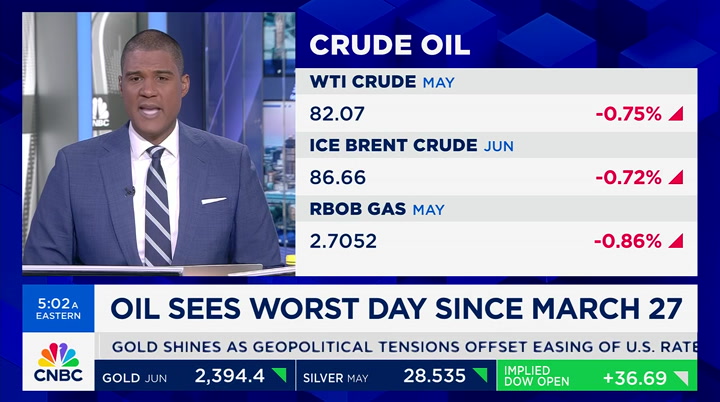

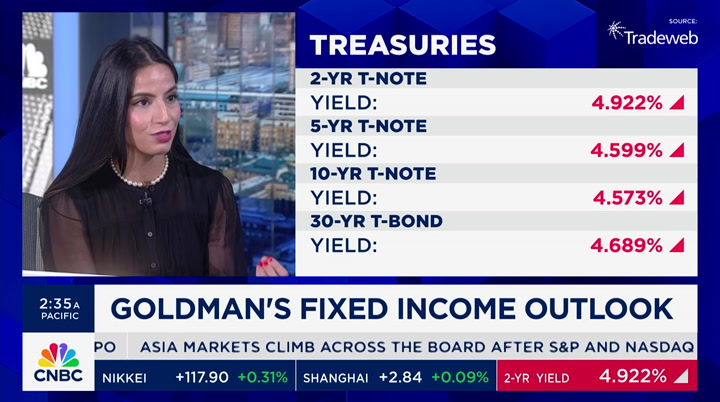

that may change this morning as we the get set for the kickoff of big tech earnings and netflix after the close today. the key investor expectations are coming up later in the hour. look at the bond market right now. the two-year yield is higher than the t10, 20 and 30. the benchmark right now at 4.57%. we are looking at energy and oil coming off the worst day since late march we are seeing the action in the oil market continuing to be on the down side. brent crude is trading above $82 a barrel brent crude is trading at $86.65 a barrel let's look at cryptocurrency bitcoin is rebounding after falling below $60,000 for the first time since early march bitcoin trading at $61,430

5:03 am

that is up .50%. big gains year to date up 44% for the year. we are days away from the so-called halving which will impact the cryptocurrency market. that is the set up let's see how europe is setting up with silvia amaro in the thus room with another rebound in europe >> a strong rebound with the european stocks. you see all of the major boards are trader iing in the green afr the benchmark made gains on wednesday. more importantly at the end of the session yesterday, the stoxx 600 was on track to end the week down by 1.3% one of the question marks is whether today will change that narrative. we will get a check on that tomorrow the dynamics are playing in the markets at this stage and that is mostly what we hear from the

5:04 am

ecb officials on the first rate cut. on the other hand, what corporates are telling us as well with that in mind, i want to take you to the sector breakdown to highlight to you the company dynamics we get in europe at this stage you see at the top, the out puerto performer is utilities investors choosing a little bit more of the defensive sectors at this stage we have banks up .80%. industrials are moving higher at this stage and one of the dynamics there, frank, is abb results which came in higher than expected. a final point to say that oil and gas are the worst performers down by .90% let's see how those oil prices continue to move amid the d geopolitical tensions in the middle east. >> we talked about the strong ipo showing in paris a lot of things giving a boost

5:05 am

to the markets in europe silvia, thank you. turning attention back to the united states. equities are struggling as the r prospect of higher for longer is reality. loretta mester says more data is needed. >> it is getting from 7% to 9% inflation down to 2% we want to be confident it is on the downward trajectory to 2%. that is something where we will need to see pmore data and more experience to be assured that's true >> mester is a voting member of the fmoc she adds there is no need to cut policy right now and this is adding fresh pressure since the stocks are coming off the highest level

5:06 am

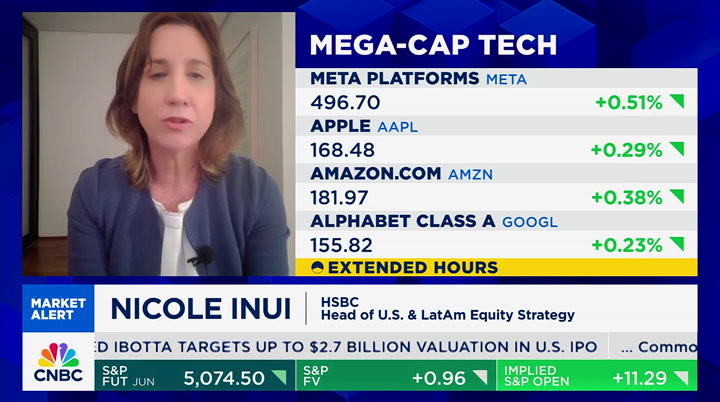

since halloween. showing more traders believe volatility will persist. let's discuss with the head of equity and strategy at hsbc. nicole, great to have you on the show. >> good morning. thank you for having me. >> you put out a note not long ago with the price targets a base case of 5,600 you see a lot of things come up when it comes from central bank heads, including jay powell. are you changing the s&p outlook with the new idea that we will see cuts pushed out further? >> for now, we are keeping our call of three rate cuts for 2024 three for 2025 obviously, this is data dependent. we get the core pce out next week we are expecting 0.3% month over month. growth comes in a little bit

5:07 am

ahead of expectation we need to rethink the rate cuts for the year looking at our s&p targets with our base and bull case scenario, we are keeping the targets we always had the view it is not important when the fed cuts, but if the fed cuts. the market is more hawkish we expect 40 basis points of cuts this year we are still on the path of cuts if the fed kicks the can down the road further, maybe we don't get one in june or july or maybe in september we think what is important is the narrative that the rate cuts are coming down the road we are keeping our base case of s&p target of 5,400 and bull case of 5,700. >> still bullish from where we are trading at 5,022 with pressure on the mega tech

5:08 am

which is pushing the rally at the beginning of the year, is now the time to go into cyclicals or less rate sensitive sector of health care? >> so, you know, if you look at big tech, we are still positive that sector really doesn't matter if we have rate cuts. it is not as important as gdp growth this is a secular growth story fueled by a.i. i think big tech continues to perform well they are delivering on earnings. this is a sector which has a high profit margin if wegin of higher for longer, we are okay

5:09 am

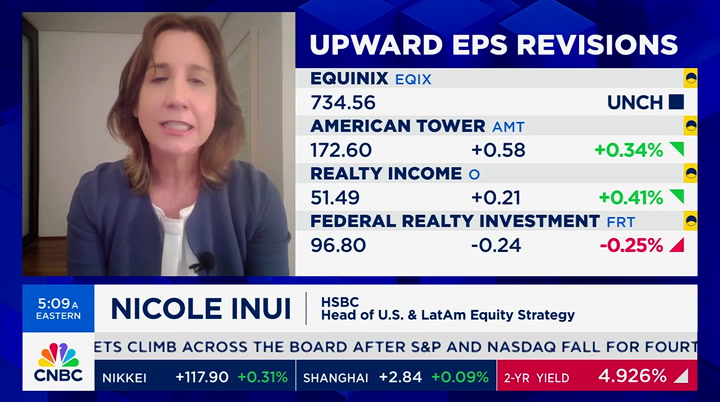

with the rates at the highest levels, it will perform well >> one other sector you are interested in is real estate, but reits. a lot of the reits, a company we have had on the show and realty income they say they are the monthly dividend company are you bullish on reits because of the deividends >> we are not bullish on real estate we have big sectors like consumer discretionary if we get the narrative of higher rates for longer, we feel the consumer stays resilient we look at the consumer and the bar bell approach. the high-end consumer is continuing to do well with the wealth effect by higher home

5:10 am

prices and equity prices even those focused on the low-end consumer will perform well because you will have the middle income consumer trading down to the lower-income products. >> nicole, great to see you. i appreciate your time time for the check on the top corporate stories with silvana henao. good morning >> frank, good morning let's get you headlines. apple's ceo tim cook will meet with singapore's leaders as he wraps up the southeast asia tour today and tomorrow as he searches for new growth markets and manufacturing sites. as part of the trip to singapore, apple will invest $250 million to expand its regional campus in that country when it first set up in 2022. elon musk is apologizing for

5:11 am

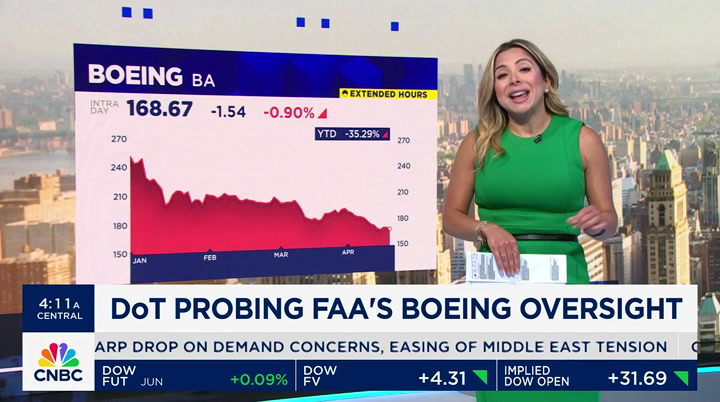

issued laid off employees incorrectly low severance packages musk said the packages would be corrected immediately. tesla said earlier it would cut 10% of the work force which was around 140,000 people at the end of 2023. the u.s. department of transportation is looking into the faa's oversight of boeing's 737 and 787 manufacturing practices. speaking with pete buttigieg, he told reporters when something is in the news, his agency is going to take a closer look the same way it is taking a closer look at boeing. this comes after fiery testimony on capitol hill yesterday from the boeing whistleblower that his former company quote absolutely has a culture of

5:12 am

retaliation against employees who raise safety concerns. frank. >> those concerns weighing on the stock. boeing shares down 35% year to date silvana, thank you we have a market flash for you with boeing. reuters saying alaska air is looking for more inspectors over the grounding and they expect more delays in the 737 program shares of boeing down 1% phil lebeau will have more with the aldsaska air ceo at 1:00 p. and we have more coming up on "worldwide exchange," including the one word investors need to know today and then micron air stock is popping. arjun kharpal is joining me here on set. and sticking with chips. topping expectations for the recent quarter, but will the

5:13 am

5:14 am

5:15 am

my name is oluseyi and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport. welcome back we have a market flash shares of micron are surging as

5:16 am

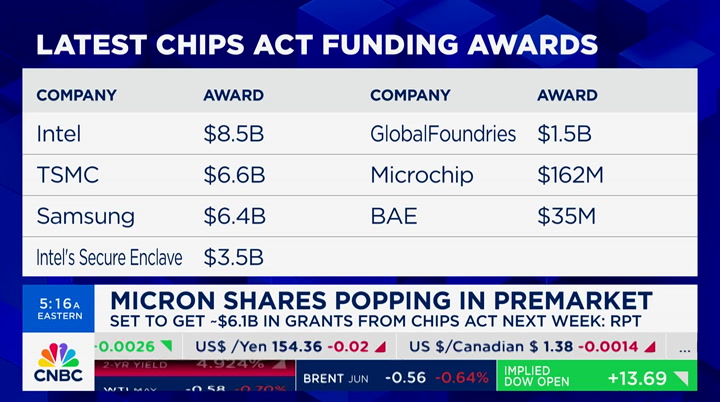

it could be the next beneficiary of the biden chips act arjun kharpal is here with me with more. >> micron will be added a grant as part of the chips act president biden is reportedly going to travel to syracuse, new york where micron is building to make the announcement. micron shares are higher this is a big deal for the company. the third place memory chip company. a little bit of hopes this could benefit micron with expanding capacity and new customers and compete with those two south korean jegiants they are hoping to bring production back to the u.s a lot of the manufacturing sector is in asia and taiwan and south korea. now u.s. requiring the chips to

5:17 am

be made on u.s. soil so there is never a supply chain issue again. we have seen a number of awards with samsung and tsmc. this is part of the broad effort. >> we have not gotten confirmation yet of the shares moving higher. for investors, is this a sigh of relief we saw nvidia drop 4% yesterday. >> nvidia was in correction territory. you had the philadelphia chip index. the basket of stocks in the sector in correction territory that, in part, is driven by the results from asml yesterday which was not good demand for the machinery today, the narrative is starting to shift we had earnings from tsmc. the company reporting the first growth and profit and revenue

5:18 am

after three straight quarters of decline. there are green shots in terms of the recovery. the chip sectorcycles. now tsmc reaping the benefits which is driven by the continued demand for the a.i. chips. >> you know, when it comes to the surge with chips, you are saying stocks are at the bottom. imagine the upside arjun, taiwan semi we shift to that thank you. taiwan semi posting the fastest sales increase since 2022 the boom in a.i. is boosting de demand joining me to discuss is the senior research vice president at wedbush

5:19 am

>> great to see you. >> put this in perspective for us the gains here are mostly boosted by a.i how sustainable is that for this company? how real is the a.i. demand going forward? >> for tsmc, they are the supplier to all of the major participants on a.i. semiconductor side of things intel is the only one fabbing the chips. nvidia is using tsmc, but amd and marvell and broadcom are all customers. as they grow, tsmc is a beneficiary and what they said on the call is we see a lot more revenue from a.i. content than server content because all of those a.i. semiconductor makers

5:20 am

are our customers. >> looking at shares of taiwan semiconductor up 1% right now. the company focuses on three n nanometer chips. they are looking to two n nano nanometer chips. >> they are the leader in five and four nanometer now the leader in three nanometer. they look to be the leader in two nanometer. i don't see a threat to tsmc on the advanced semiconductor side until potentially intel comes out with 14a which they said will be has production in 2028 for tsmc, that gives them a monopoly it boosts their margins.

5:21 am

they said two nanometer will get them better pricing and margin >> tsmc is the beneficiary of the chips act funding. thank you very much. and why some lawmakers are hesitant to sign off and this sector set to be impacted if they do. that's coming up your skin is ever-changing, take care of it with gold bond's age renew formulations of 7 moisturizers and 3 vitamins. for all your skins, gold bond.

5:24 am

welcome back turning our attention to capitol hill and the national security program set to expire tomorrow lawmakers race to extend the measure, but it is facing r resistance over the scope of the bill and companies impacted by it our emily wilkins is joining us with more from washington, d.c emily, good morning. >> reporter: good morning, frank. the key national security program helps prevent terrorists attack and trafficking and other security issues. it is going to expire on friday at midnight if congress does not act. the senate is planning a vote today on updating the foreign intelligence surveillance act or fisa it allows the government to collect data on foreign agencies any lapse in the program would be detrimental to national security >> as we try to debate aid for

5:25 am

ukraine and israel and humanitarian relief to the palestinians in gaza, the idea we suddenly go dark at this moment in time would be the height of irresponsibility >> reporter: the house passed an updated fisa measure last week, but an amendment added at the last minute is now leading to concerns from the coalition of republicans and democrats who say the program is now too broad. supporters say the amendment is updating language that is more and decade old and hasn't kept up with technology one senator said it could lead to employees that have nothing to do with this and passing on the data to the government. >> there are countless others to be forced to help the government spy, including those who clean offices and buildings. if this provision is enacted, the government can deputize any

5:26 am

of these people against their will and force them, in effect, to become what amounts to an agent for big brother. >> reporter: concerns about fisa are not unwarranted. a congressional investigation found the fbi did abuse the program to spy on americans. warner said the fbi has fixed the issues and congress needs to codify the changes to make sure best practices are in place going forward. frank. >> very important piece of legislation. emily wilkins live in d.c. thank you. as we head to break, we are watching shares of alphabet this morning. we have controversy after it terminated 28 employees yesterday following rowprotests general the labor conditions with the contract with the israeli government google says it supports governments around the world in countries it operates, including the israeli government this is not directed at sensitive or classified or military workloads related to

5:27 am

5:29 am

5:30 am

here's what on deck. investors looking to stabilize a bumpy ride, but jim cramer says buckle up. we get a taste of big tech earnings with netflix results on tap. and beijing firing back at the biden administration over the call for the steep hike on tariffs for chinese metals a live report on what leaders there are saying about the move. it is thursday, april 18th, 2024 you are watching "worldwide exchange" here on cnbc welcome back i'm frank holland coming to you from cnbc london let's get you ready for the trading day ahead. we pick up with a check of the u.s. stock futures with the s&p and nasdaq coming off four straight down days the longest losing streak for the s&p this year. look at futures. it is important to note we saw the dow futures move to the

5:31 am

negative as you can see a short time ago nasdaq still in the positive s&p is flat. a bit higher right now in the pre-market we want to look at a number of names moving in the pre-market we start off with equifax selling off after weakness in mortgage demand. they rate the credit quality of lenders and expecting a 11% decline. you can see shares are down 9.5% they add the non-mortgage business contributed to the first quarter as it focuses on a.i. and the cloud las vegas sands is lower with sales growing 40% and renew hitting $3 billion compared to $20 billion. the casino bought back shares on top of the current 20 cent dividend shares of duolingo is joining the s&p midcap 400

5:32 am

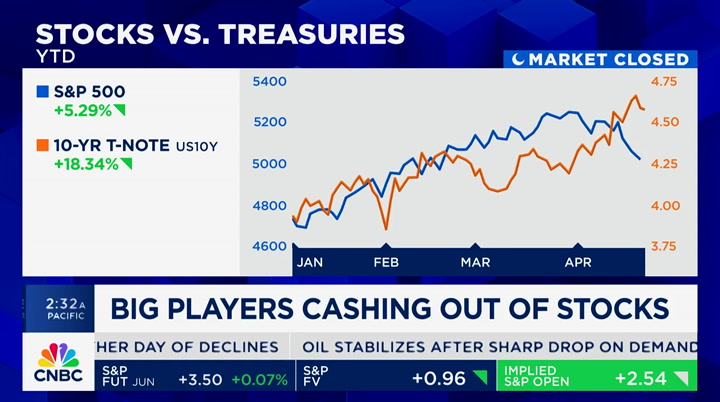

it is now up 50% in the last year and is hovering close to the 50-day moving afteverage turning attention back to the market with the staying power of the stock market historic run to records. according to the new report from goldman sachs, some of the biggest players in the market are set to unload $325 billion in stocks this year compared to $191 billion in 2023 this as corporate funds and government agencies look to cash out after locking in impressive returns in recent years and look to the safety, as of late, of competitive returns of fixed income joining me on set in london is goldman sachs asset management vice president of fixed income great to have you here had you on the show many times what are you seeing in the fixed income market? are you seeing more demand for

5:33 am

bonds across the board or the shorte end of higher yields? >> hi, frank great to be with you in person you make a great point of fixed income you see demand for corporate fixed income and equities and other risk assets and now rotating into core fixed income. government bonds and corporate bonds and recently insurance survey where we noted they are looking to add to the communications another thing which is interesting is corporate bonds high quality credit offers attractive income, but total return potential under the hood. >> we have seen a big move in bond yields recently when it comes to a portfolio right now, is it still a 60/40 portfolio? are bonds more attractive and should those be bigger part of

5:34 am

the portfolio? >> we feel investors should move to a bigger allocation yield is back. you get attractive income when times are good and bond yields are higher that means when you encounter a downside growth risk or volatility, bonds can protect the portfolio. we do believe investors should strengthen the bond with bonds >> you usually come on and talk about bonds, but today you are talking about currency you are bullish on the u.s. dollar, but bullish on the mexican peso it is flat year to date. why are you excited about the mexican pes snorks. >> there are different factors that play a part you know, one of the things we go when we navigate through the noise is focus on fundamentals

5:35 am

and adopt a long-term view beyond the cyclical fundamentals to support the peso, on the thing is the currency in the country and economy will benefit from re-shoring. >> we had you on the show a couple of months ago some have seen six cuts later this year. have you changed with jay powell talking a few daysi ago >> we do think the strength you see in the u.s. inflation suggests that the timeline may be pushed back and the pace of rate cuts may be slower. importantly for investors, it is important to keep in mind that the next move does look like it will be lower. also importantly, the delay is going against the back drop of solid growth that prevesents two factors

5:36 am

if you are having the delay against the strong growth back drop, it is still an opportunity to lend to high quality companies. coming back to that credit >> how many cuts >> we think the scope for three if the fed is able to deliver a cut in july. we have a couple of cpi prints and labor market reports big picture looks like it will be lower >> thank you very much for coming to the set. >> thank you we turn our an tttention to developing story beijing this morning responding to the biden administration proposal of chinese made steel and aluminum with a threat of tariffs. we have eunice yoon with more on the story. >> reporter: thank you, frank. china called president biden's

5:37 am

proposal for tariffs hikes a mistake for steel and aluminum the section 301 investigation which would look into the china alleged unfair practices into ports and logistics and ship building a mistake on top of a mistake. now this comes after a rally in the steel town of pittsburgh where president biden had called on his trade chief to look into higher tariffs on the chinese metals as much as 25% from 7.5% today. the biden administration is looking into stopping the indirect importation of the metals through mexico. his trade chief told congress these investigations were needed because of what was described as anti-competitive policies and enormous amounts of state support. from the investment standpoint, we could head into a period of greater conflict with the u.s. and china because the u.s. trade

5:38 am

measures, frank, touch upon another issue that secretary janet yellen said during her trip here is excess capacity the chinese don't look as they are changing their methods at this point relying so much more on manufacturing as opposed to consumption for now. >> eunice, obviously chinese leaders repuare upset about the tariffs. longer term, is there an issue that china may retaliate >> reporter: it is also up in the air. the chinese have said they are going to defend their rights a little bit uncertain on what that means we have to wait and see whether or not the chinese would retaliation. it puts the chinese in a difficult position because if

5:39 am

they retaliate, they will be undermining a big effort made here which is to get more foreign investors into the country. >> you know, the german chancellor there talking about the fair competition eunice yoon, thank you coming up, getting ready for netflix results. we layout the metrics to watch f d why one investor is holding ofon adding to his position. we are coming right back on "worldwide exchange" after this break. (grandpa vo) i'm the richest guy in the world.

5:40 am

hi baby! (woman 1 vo) i have inherited the best traditions. (woman 2 vo) i have a great boss... it's me. (man 1 vo) i have people, people i can count on. (man 2 vo) i have time to give (grandma vo) and a million stories to share. (grandpa vo) if that's not rich, i don't know what is. (vo) the key to being rich is knowing what counts.

5:42 am

welcome back to "worldwide exchange." netflix reports today after the close today. the streamer is up .50% right now. it is looking to keep up m momentum from recent quarters with the boost in subscribers and the password crackdown we have steve kovach with more >> netflix has been on a tear and coming off a quarter where it smashed new subscribers and growth the big reason for that is cracking down on password sharing and in addition to that is the ad supported plan shares are up 2.6% on that growth the street is expecting 4.5 million new subscribers. that would be double what they gained in the year ago quarter

5:43 am

revenue should be up 13% what we don't know is the advertising and gaming businesses at netflix which is unclear with the cost of licensing keeps the subs subscriptions enough to keep people on the service. it has more than 23 million subscribers with the plan with ads, but it is unclear how much revenue that is bringing in. we will have a major event coming up, but the boxing match with jake paul and mike tyson this summer is all hyped up. frank. >> this fight is a social media phenomenon i'm nervous for jake paul. it looks scary how big of a part -- for netflix, live events how big of a part is that the

5:44 am

strategy going forward is that something they expect to expand will we see more live sports >> what netflix had said about sports is they are interested in the documentaries and the f1 is the best example and the gimmicky live sports is something they are experimenting in here. it is mostly an experiment to see if they can make it work we see a handful of these each year >> cloud gaming is something they are trying to expand in steve is live at thes s nasdaq thank you. for more on netflix, let's bring in george who is the founder of net capital. >> i would not want to fight

5:45 am

mike tyson i don't care if he is 57 or 67 >> i'm with you. let's get down to business i know you are not an analyst, but you are looking at the estimates. analysts see a 3% upside for the stock going forward. what are you expecting in. >> i wish i had a crystal ball i wish analysts did, too they don't know where the stock is going it sis a relative game now it should not be in the magnificent seven, but the great eight. netflix got banished from faang and not into the magnificent seven. it should be one of the eight great stocks or replace tesla. it is performing well. they have the same problem you indicated earlier about institutional investors pulling money out of the market. is it too far too fast it has tripled in two and a half years. we're short the calls on the

5:46 am

stock to protect it. we don't want to lose that stock. we have been trying to clip a few coupons in the meantime. >> put this in perspective i was talking doto an analyst about this huge increase year over year with the subs. it is a big decline quarter to quarter. what is the benchmark with new subscriber ads the password crackdown has to slow down. >> the stock gets cracked if they meet the estimate the whisper number is more than 7 million subscribers. they need 9 or 10. they have to did better than that to keep the momentum up they better hit it out of the park >> what's next steve just highlighted mike

5:47 am

tyson and jake paul. mike, if you are watching, let's be friends seriously, what's next for the company? they do have "bridg"bridgerton"d "squid games" coming back. what do they need to do? >> you run out of room and you will have an apple problem where the stock is such a high multiple and not so much growth. then you are looking at what multiple do you pay? is it p&g or pepsico how much is that you get into the more nuance ana analysis this is a must own for people if they want to diversify do you buy here? probably not wait for better days

5:48 am

you will get them at some point this year. >> all right we leave the conversation there. netflix up .50%. coming up on "worldwide exchange," the one word that every investor needs to know today and why our jim cramer says the pain for the markets may not be over yet. also, join the first change makers event this new york city today. t englebert will be there. we will be right back. stay with us

5:49 am

5:50 am

5:51 am

welcome back to "worldwide exchange." time for the "wex wrap-up. taiwan semiconductor is benefitting from nvidia, apple and amd. shares were higher in the pre-market, but now down 1.5%. house republicans revising tiktok ban for the foreign aid bill for ukraine and israel. the bill is currently in the senate after the house approved the measure last month. cleveland fed president loretta mester expects s inflato to fall further than the 2%

5:52 am

target. the transportation department is looking into the faa's oversight of boeing's 737 and 787 practices after boeing has a problem with whistleblowers raising concerns. and bloomberg says micron will accept the grants of $6.1 billion from the chips act. and tim cook will meet with singapore's leader as he prap w wraps up the asia tour this week stocks are working to get back some momentum as the turbulence continues, but our jim cramer says the pullback is not done yet >> usually you get a day when the market starts down, not up like it did today. down big

5:53 am

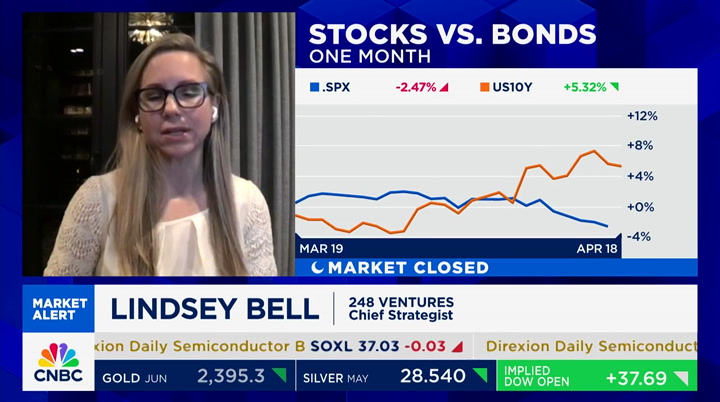

it gives you a chance to get in after the washout. you get a crescendo of selling the upstart is a nightmare you need to wash out the people before you bottom. we are not near that yet >> all right for more, let's bring in lindsey bell great to see you >> thanks for having me. great to be here >> do you agree with jim cramer's take that this is time to wash out? >> i think if you look at the move we have seen so far, stocks are down over 4% since the end of march's high. the average pull back is 14% we usually have at least one correction in any given year as well of 10%. we are prepared for a greater move lower again, it doesn't have to be the end of the world

5:54 am

this is a natural part of investing. it is a price you pay. >> you are saying it is natural part of investing. is the move higher in interest rates? we see the ten-year rate move higher is this going to continue to put pressure on the market we have had rates move higher before >> the divergence is new for 2024 what we had seen is the stocks and bonds moving in the same direction for a while. it is the 4.5% rate if you look at the chart and that shows you the market gets uncomfortable when you move beyond that level. not to mention the pace of which we moved up in the ten-year yield over the last several days last week has been quick today, it seems like the ten-year yield is calming down here it is something we will keep an

5:55 am

eye on with interest rates and inflation and the fed moves. that will all play an important role it seems investors are more knee jerky and reactionary. we are going to expect that to continue >> so lindsey, the bottom line question is with the volatility expected, where do you go? you are looking at energy and industrials. are you looking closely at short-term bonds with the t elevated yields this. >> once yields get to this rate and approving 5%, people think about the asset allocation we know people flock to money market funds over the course of the last year or two with the better rates in the market the people who came out could move back in >> i want to get your wex word of the day how do you see today's shaping up >> i'm putting the word focus

5:56 am

out there today. the focus has whipsawed with inflation rates. i'm looking forward to the market starting to focus on the fundamentals into earnings season >> all right lindsey bell, great to see you one more quick look at futures the dow futures moving back into the positive territory s&p is fractionally higher that will do it for us much more coming up with "squawk box" coming up next. have a gre datay

5:58 am

norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line... i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. doc?

5:59 am

good morning crud prices dropping sharply in the last 24 hours as the united states looks to reimpose sanctions on venezuela details straight ahead. reports say micron is the latest to receive billions of chips act funding. elon musk is apologizing after employees laid off this week mistakenly received severance packages were quote too low. it is thursday, april 18th, 2024 "squawk box" begins right now.

6:00 am

good morning welcome to "squawk box" here on cnbc we are live from the nasdaq market site in times square. i'm andrew ross sorkin hanging out with jon fortt and mike santoli here this morning. we are not doing multiple hands today? >> yeah. >> yeah. >> how is this allowed to happen a man-wich a gen x man-wich >> okay. u.s. futures at this hour. nasdaq looking to open higher 57 points higher. s&p up 7 points. let's show you treasury yields you are looking at the

38 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11