tv Street Signs CNBC April 18, 2024 4:00am-5:00am EDT

4:00 am

are monumental. that's all for this edition of "dateline." i'm andrea canning. thanks for watching. ♪ welcome to "street signs." i'm frank holland with silvia amaro. these are your headlines ecb policymakers line up behind a june rate cut, but there is still some concerns. >> it is good inflation is coming down. this is what we like to achieve when we hike interest rates. talking about the june meeting, i think the probability is

4:01 am

increasing of a rate cut in june there are some caveats. abb raises full-year outlook after topping the full-year profit forecast. >> we see china down 90% it looks worse than what it is i think the sentiment among our operation is that china is stabilizing and even seeing a positive trend. shares of plaisware surge on the paris debut. we will speak to the ceo pierre demonsant at 15:00 cet. and tsmc beats on the net profit for the quarter as they get a lift as the world's largest chipmaker.

4:02 am

good morning welcome to "street signs." let's start the show with the equity space the stoxx 600 is up .30% this is basically a little bit of an improvement compared to what we saw yesterday with the benchmark making marginal gains at the end of wednesday's session. we started the week talking about the narratives in the markets. we had geopolitical concerns and the higher rates stateside and the earnings season. as we approval the end of the week, there are two narratives for the market which are setting aside the geopolitical concerns and investors are more focused on what central banks are saying as well as on what corporates are telling us as well i want to show you the picture with the different boards across europe you can see to my right they are all trading in the green i would basically highlight the

4:03 am

ftse 100 up .60% making significant gains there along with the spanish market which is the ones trading higher so far in the session. one of the dynamics as i was telling you earlier is in what the ecb members are saying our colleague, karen, has been talking to the governing council of the ecb and they suggest they are on track for the first rate cut in june. even the most hawkish members are looking to do that, but emphasizing it has to do a lot with the data. they are still waiting to see the numbers for wage growth and the new inflation forecast published in early june. let me take you to the sector so we understand more what is happening ins t in the corporate releases you see we have utilities at the top.

4:04 am

it is out pearforming the secto by 1.3%. we see investors are choosing the defensive part of the market at this stage. banks are up 1%. telecoms are up .80% i want to mention the tech sector it is also moving lower so far in the european session. that is continuing the momentum we saw stateside we are keeping a close eye on that and oil and gas is down by .5% as we see oil prices diminishing at this stage. frank. central bank is still looking for a june rate cut for the ecb and that rate debate big at the imf meetings in

4:05 am

washington, d.c. the portugal governor backed a june cut the austrian central bank governor told karen he would prefer to wait until june before he makes a decision. he said despite the cuts in june, it remains uncertain generally. >> even for june, there are things we have to see what will the numbers tell us as a new store for our june meeting and we will see what that means for the july meeting frankly, speculating beyond june, this is my understanding not helpful. >> while some members of the d d governing council are speculating three or four rate cuts this year >> i read and heard that it is important for me to think from meeting to meeting this is a good approach for the last

4:06 am

cotw years. this is still my understanding how we should do monetary policy here in the eurozone. >> i understand are you cautious here around rate cuts. i wantto bring up the prospect of the 50-basis point as a scenario we are seeing those concerned about economic scars from here if it turns out the ecb is too late to cut and you are too late with the rate cuts, could it catch up with the 50 basis points >> i think we have to wait for the june meeting i will not speculate about a further rate cut i will not speculate about 50 basis appoinpoints i would like to learn something from the data and then i'll de decide >> and speaking to karen, the ecb policymaker also addressed the poll ss possible bissues wi

4:07 am

fed. >> there are two points. it is a challenge to be absorbed by the financial markets. >> i want to pick up on that point. we heard from jay powell here in washington, d.c. he confirmed we know the data points from retail sales to cpi and jobs are hotter than expected if there is policy divergence and we see and witness a strength in the u.s. dollar, how does that hamstring the ecb ability to cut rates >> typically, the fed cuts first and for good reason. it is the gorilla in the room and it has a major impact. what we know from research, our policies are less effective. that is the reason why we are

4:08 am

ca careful. >> meanwhile, portugal's central bank governor argued the case for the june rate cut. >> we need to look at the data and take all data on board certainly, we achieve numbers for inflation that are in my opinion which are close to 2% which we will get. there is the risk of all this process becoming an austerity flavor because at some point policy may become cyclical that is the risk and the error that we have in europe with austerity policies we need to keep aware of that. >> karen is set to have another busy day in washington speaking

4:09 am

to policymakers and government officials, including christian lindner. we will bring you the i hope after views throughout the day for more on the meeting, check out cnbc.com. the fed's latest beige book pointed to expansion in the u.s. economic activity in recent weeks with firms to have inflation pressure to hold steady half of the districts noted increases in energy price was firms struggling to pass cost increases on to consumers. the report comes a day after fed chair jay powell said monetary policy needs to remain for longer let's look at how the u.s. futures are shaping up at this stage. it seems it will be a positive start to the trading session on wall street. this is after we saw all of the major indices ending wednesday's

4:10 am

session in the red i would highlight that was due to the performance in the tech sector which was down 1.7% and a lot of focus on nvidia as the stock dropped 4% in the session. let's discuss more what is happening on the equity space with our next guest. tom from asset strategy managers tom, thank you for being on the show something you said in the notes suggested that when you think about the inflation, you don't expect it to drop below the 3% mark what do you mean there and what does this mean for the fed >> first of all, thank you for having me on today and good morning from my position back in january, we told our clients that you should feel encouraged about the 2024

4:11 am

forecast one of the key points we made was inflation was going to be sticky around the 3% mark. in the first three months of the year, the u.s. market experienced a broad based rally and not a lot has changed there. inflation is sticky. it will remain at 3% level i think that will be the new norm for inflation >> when it comes to the performance in the equity space thus far, april seems to be setting a different tone from what we saw in the first quarter of the year. i wonder if you think the down performance we have seen so far is the narrative that's going to dominate the rest of the year? >> it's a good point the key themes you should focus on as we approach the upcoming earnings season and second half of 2024 is how are the mega tech stocks, microsoft, meta and amazon validate the strength of the u.s. economy in the next generation bull market that

4:12 am

we're going into and how will that bleed over into europe? we have very strong data points that are going to contribute to very successful earnings season in the next couple quarters. >> tom, you are expecting a strong earnings season we have seen a change in leadership of the markets with the clarity of rate cuts has gone away as you mentioned as well as tech under pressure and volatility from the geopolitical tensions and the election in the u.s. when you talk to clients, what are you advising them to find opportunities for the markets and how do you view bonds? >> you've seen a broadening of the stocks participating in the rally. it is not just the magnificent seven anymore for the 2023 leaders. we told our clients to expect that with the u.s. economic strength there means we are looking at other areas today, on your program, we saw the ceo of abb with robotics

4:13 am

being an area to continue to dominate discussions, including with the a.i. domination and technology revolution there. we are looking at other sectors outside of technology. that could be industrials and health care. we see the broadening of the market being an important factor for the strength going forward. >> you know, tom, i was speaking to the managing director of the investment bank. they said they are taking profit was tech, you are advocating for a cyclical sector like industrial and non-cyclical like health care. why on both sides of the fence there? >> it's a good question. i really believe that the healthcare sector will benefit from the efficiencies we're seeing in the a.i. revolution.

4:14 am

i think the industrial sector is going to participate with abb earnings we will get intuitive surgical coming out tomorrow. that is a company we own with abb. i do think there is a rotation and a welcome rotation in other sectors of the market. we will see that with the relative strength of the earnings coming out. on the bond sector, i'm going to focus more on the equities >> understood. it sounds like you are pinning hopes with earnings and par participation with the a.i. story. with the rally in commodities, does it change how the clients balance their portfolios it is not the traditional time for the 60/40. >> you are right if you go back and start to talk about a.i. is really changing everything, it is changing the oil industry and energy

4:15 am

industry we believe these are the early stages of the next generation that we're going to see innovations which create greater efficiencies across the board. what does this mean? it means that the market is going to experience a broadening, as i said earlier. i do think the market will see a positive year given the election year in the u.s. there is a history behind data that shows in the market is led by a market weighted magnificent seven, the following year is also a positive year we are still looking for a positive year with the overall markets. >> big show me quarter tom hulick, thank you for being here we appreciate it. coming up on the show, we are joined by the chairman of planisware as the company makes the debut in paris

4:16 am

that interview is coming up aftethbrk.r e ea what i ? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. when we started our business we were paying an arm and a leg for postage. i remember setting up shipstation. one or two clicks and everything was up and running. i was printing out labels and saving money. shipstation saves us so much time. it makes it really easy and seamless. pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers. go to shipstation.com/tv and get 2 months free. ah, these bills are crazy. she has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or

4:17 am

part of it to coventry for cash. even a term policy. even a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com. what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com.

4:18 am

my name is oluseyi and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game. giving millions of fans, like my dad and me, new ways of catching up on their favorite sport. welcome back

4:19 am

bp announced plans to restructure the executive team as the ceo makes his mark on the company. the executive leadership is reduced to ten members to streamline the organization. abb raised the outlook for the year after topping first quarter forecast the swiss engineering firm had a robust start to the year the ceo told cnbc that most orders originate from the u.s., but the company is optimistic on china. >> the u.s. continues to be the driving force in our orders and demand that is a positive in asia, we are flat asia and the middle east china is down 90%. it looks worse than what it is

4:20 am

i think the sentiment is china is stabilizing and even seeing a positive trend. in the airline space, easy jet expected a loss of 340 million pounds it looked to a positive outlook with stronger demands in easter and summer bookings. brunello reported 16.5% year over year growth the luxury group saw growth across all regions and including asia in other corporate developments, danone had a first quarter beat after the company hiked prices in response to higher input costs planisware is looking for a

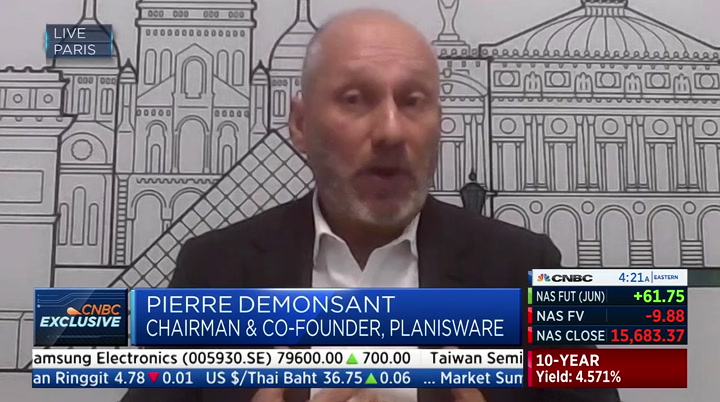

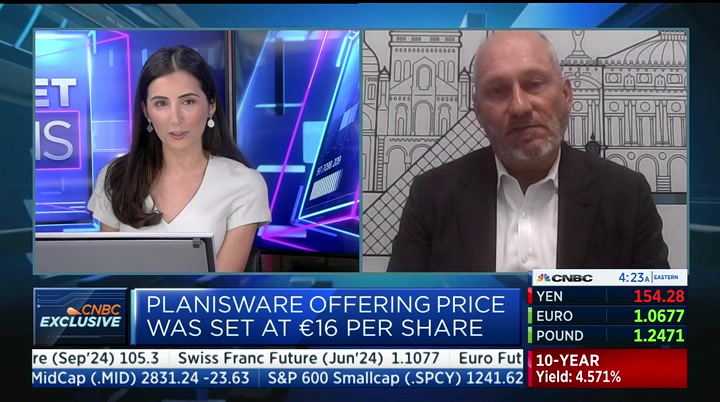

4:21 am

debut on the paris experichange you can see shares are up 20% right now. on the ipo day, we are joined by the chairman of planisware charlotte is also joining us on the interview. >> good morning. that is what is happening. when we came back, we had a strong debut from them and they said you have to come back we are experterting the process that is the reason why it is starting well. that was our goal. it is important for us we are poised for a good start >> pierre, when you announced the ipo, you said it iis progres

4:22 am

for the expansion. what is the next step? >> we are very traditional company. now we want to be number one in the market we want to reach another step and clearly being public is a very important milestone for us and to start like we started today is a good sign for us. te in france. i know there was a big target from president macron. he is targeting 100 unicorns can you tell me how things have advanced in it paris for tech

4:23 am

companies like yours >> the environment is quite good clearly, we hope this moves the tech companies in france for us, it is very good. all of the research in france and the image of planisware is important. it is really good. i hope that's why we pave the future of the tech company in france if we go through that, we are proud of it. >> pierre, we have seen recent ipos in the market which started positive, but shares falling straight after that means what do you have to offer to investors going forward? >> i think we have been waiting for europe

4:24 am

i think it is a very strong move there. it is a profitable growth. it is something we control very well it is a long-term growth with the company which is focused on the long term. you know, the stock will go up don down a bit. >> pierre, the strong debut today. i want to ask about the trend in the space. platform you are a pure play project management company you face stiff competition against microsoft globally how do you deal with the big companies offering free services with hopes that the companies would buy other products >> the market is offering a special solution

4:25 am

we are in a project economy. it is a big market we have 250 million people working. in today's market, if you are working on the products, it is a very different product we have been specializing on different products portfolios and that makes a difference with the big players and seeing general solutions. we are specialists and we are bringing value to the customer. >> pierre, can i ask about a.i.? how are you embracing a.i. and how do you use it to your advantage? >> i was working in the a.i. field before planisware. we have been reinvesting in a.i. quite a long time ago. for us, a.i. is adding to the

4:26 am

product. it brings value to the products. it is not really a game changer in the market today, but we are investing in a.i >> thanks for joining us today on this ipo debut. that was chairman and co-founder of planisware. coming up on t, the strong r for the first quarter boosted by tech stocks. we will speak to the deputy ceo of norges bank next. hi. i'm wolfgang puck when i started my online store wolfgang puck home i knew there would be a lot of orders to fill

4:27 am

and i wanted them to ship out fast that's why i chose shipstation shipstation helps manage orders reduce shipping costs and print out shipping labels it's my secret ingredient shipstation the number 1 choice of online sellers and wolfgang puck go to shipstation.com/tv and get 2 months free what is cirkul? cirkul is the fuel you need to take flight. cirkul is your frosted treat with a sweet kick of confidence. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul is your gateway back home. so what is cirkul? it's your water, your way. cirkul, available at walmart and drinkcirkul.com.

4:29 am

4:30 am

behind the june rate cut, but there are still some concerns. >> it is good news that inflation is coming down i think this is what we like to achieve when we hike interest rates. talking about the june meeting, i think the probability is increasing that we will see a rate cut in june, but there are still caveats. abb raises full-year outlook after topping first quarter profit forecast despite a sharp order decline in china the ceo strikes a confident note on the country >> if we see china down 90% and it looks much worse than what it is our sentiment an opening the operation is china is stab stabi stabilizing. and shares of planisware surge in the paris debut in the biggest french ipo in three years. tsmc beats on first quarter

4:31 am

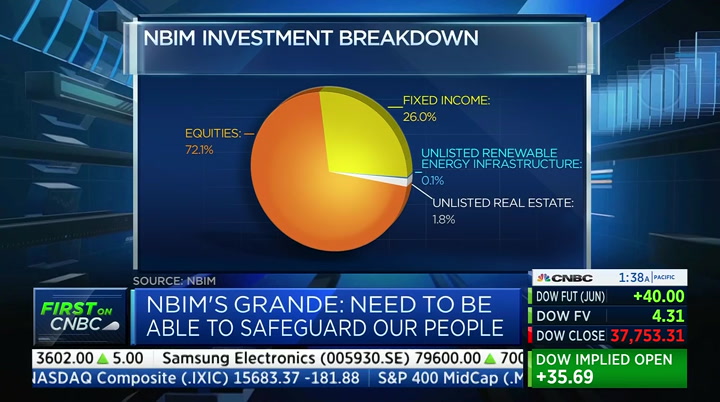

profit as they get a lift from the largest chipmaker in the world. norges bank reported a 9.1% return on the equity investment in the first quarter boosted by the tech sector. the fund had a value of 18 million krona. we are joined by trond grande here >> thank you good to be with you. >> the investment in tech names, the six of the magnificent seven names, showing weakness with the clarity of rate cuts going away bring any concerns for syou? >> it is turning into disbursed

4:32 am

returns for the seven names for the quarter with nvidia pushing ahead on the back of the a.i. enthusiasm you see more weakness in other names like tesla and apple obviously, the market is taking a bigger look at the companies and the business models. >> trond, it is good to have you on the show. i like your thoughts about real estate you saw a negative impact there with the invest ment in the last quarter. what did you see with the real estate market in the latest results and what is the outlook for this part of the market? >> so, it has been a lot of headwind for real estate for the last 24 months and also this last quarter is not as bad as we saw through last year. i think we are starting to see the bottom of the market

4:33 am

we are seeing transactions happening, but we are seeing more interest in this field. we are sticking with our strategy in the market, if there is one player in the financial markets that should be able to be entering at the more favorable prices is the top of the industry we are in we are optimistic on the real estate market. >> i like to discuss several topics with you, but i like to talk about banking you had shares of ubs and the too big to fail report how much of a concern is this report to you regarding the requirements for ubs basically what do you feel with the european banking sector? >> i think first the sector and the european banking sector is in a better place than last time

4:34 am

we saw the stress in the markets. you know during the great financial crisis the things have happened and banks are better tcapitalized. the leverage hasn't gone down. it is a legitimate concern that we need to see a strong balance sheet with the banks to withstand their business models and provide capital. >> a quarter of your fund is held in fixed income more than half with the u.s. i want to ask what range when it comes to bonds are you holding longer-term bonds and short-term bonds means you are able to gen benefit from the rise in yields? >> we have a 30% allocation which is our starting point. as you point out, the majority of that is in the u.s.

4:35 am

now the yield on this portfolio is close to 4% right now duration is around six years we are holding the curve and not really on the short end, but the whole curve. you know, interest rates going up means you have a mark-to-market loss. it is better with the higher interest rate and the lower interest rate. >> i want to ask about the alternative investments like real estate. there is a big push when he it comes to data centers. we are seeing commodities rally. you are looking to diversify away from the equities and bonds. >> as you say, we have a starting point that is 70% global equities and 30% global bonds. we can be invested in real estate up to 7% and infrastructure up to 2% for

4:36 am

renewable energy they currently stand at 2% in real estate and just .1% in infrastructure there's a lot of room there. we are looking to build that portfolio to a meaningful allocation within the forecast >> you are a big advocate for esg investing. one narrative at this stage is investors considering defense stocks as esg stocks i was wondering about your thoughts on this do you think as we see european countries investing more on defense means this is a sector that should be considered an esg friendly sector? >> i wouldn't be explicit on that i think the narrative has changed. you have seen that security for us living here right now which has become a bigger priority i think it is an argument to be

4:37 am

made that we need to be able to safe dpard oguard our people ant ourselves. there is an argument to be had with weapons which are necessary in this world and is considered more of a legitimate investment. >> how much of the portfolio has been set up with the idea we will get rate cuts sooner rather than later as i mentioned before, a lot of rate cut unclarity if we don't see cuts in the u.s., does that change your philosophy or your focus on the u.s. equities and u.s. bonds >> it doesn't really do that because we are really long-term investor we have a strategy that we are sticking to and we don't really make large allocation decisions for anything of that sort on the tactical basis we are with the markets as they

4:38 am

go up and down over time, we are expecting to reap an equity premium holdings. >> i would like to go back to the topic of defense i would like to understand a little bit more if you are investing in the sector heavily, are you positioning in a way that you are following the trend and commentary from the european policymakers >> our starting point is we invest close to the referencing index we are gicven from the minister of finance. our starting point on more often than not, we are investing according to the market cap weighted factors i should point out we are a responsible investor and part of that is we have companies that are excluded on purely ethical

4:39 am

reasons. there are quite a few companies in the defense sector that a producing because it is not deemed to be not in the liking of the norwegian people. >> very clear. thank you for your time today. interesting conversation trond grande at norges bank investment. south korea warned and the policymakers were ready to intervene in the market as they were ready to support the currency karen asked about it >> translator: korea, u.s. and japan had the first finance ministers meeting. one important item for us is working together to stabilize the financial market today's joint statement is

4:40 am

welcomed by the korean government. >> are we witnessing disorderly moves in the currency markets? >> translator: the case of the yen in the foreign exchange market, especially in the case of the yuan has movement beyond the fundamentals. >> let's ask about politics after the elections and some describing him as a lame-duck president. how hard will it be for the government to press ahead with the economic agenda? >> translator: it was a legislative election korea has a presidential system. the president still has three years in office. the result shows similar seats for the assembly it means more of the continuation of the status quo as we have been doing, we will continue to push for economic agenda and communicating with the people and national assembly. >> karen will continue those conver conversations. great conversations and insight

4:41 am

with the global economy. coming up on the show, netflix will report earnings today with subscriber growth in focus. we will bring you more coming up next my name is ashley cortez and i'm the founder of the stay beautiful foundation when i started in 2016 i would go to the post office and literally fill out each person's name on a label and now with shipstation we are shipping 500 beauty boxes a month it takes less than 5 minutes for me to get all of my labels and get beauty in the hands of women who are battling cancer so much quicker shipstation the #1 choice of online sellers go to shipstation.com/tv and get 2 months free what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. switch to shopify and sell smarter at every stage of

4:42 am

your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify. i don't want you to move. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place?

4:43 am

4:44 am

welcome back to "street signs. cnbc is on the ground in washington this week for the imf spring meeting inflation is high on the agenda after the eurozone cpi came in at 2.4% for march. spain's minister for economic trade and business told us when he thinks rate cuts could be on the cards. >> we are seeing a gradual moderation going forward the bank of spain expect us to be back to 2% by 2025. this is a continuation process and we expect the speech from the ecb president is if the data keeps shows signs of mott moderation, we will enter a new

4:45 am

phase. >> but there as a cautious tone from the irish finance minister. >> we achieved reduction in inflation, but we have more work to do. price levels remain elevated we are seeing disinflation, but not price levels fall. we need to see greater pass through of the reductions in wholesale energy and household and businesses many of them remain under pressure we welcome the progress made with inflation it feeds into the ecb monetary policy decisions from june onwards and any reduction in interest rates will be welcome to help alleviate the pressure for households and businesses are under. we need to focus on costs and bring down costs for households and businesses we go from the eurozone to

4:46 am

south america. inflation fell from 4.5% in february to 3.9% country's central bank governor says he expects the picture to improve. >> in brazil, we had the first few months of the year with the higher inflation for food and food products. that raised sornconcerns in the government we are seeing now a period where inflation will go lower and that print we had was actually a little bit lower than expected we think we will have to have lower prints from now on it depends on other things we are watching one of the things that is still not converging is inflation which is running too high. the labor market is so tight and we are seeing how we can access what is happening on inflation for services. >> for more from karen's

4:47 am

interviews at the imf world bank spring meeting, check out cnbc.com. turning to the magnificent seven members. tesla shareholders asked to vote on elon musk's $$56 billion pay package. in a proxy filing, the company intends to call a vote on moving the state of corporation to texas. the carmaker's meeting is scheduled for june. micron shares are higher in the pre-market a report that the chip maker is set to receive $6 billion from the commerce department to fund factory projects the award which is yet to be finalized could be announced next week. take a look at chip makers on the back of the news nvidia shares up 1.5%. big rebound from the decline yesterday. intel up .30%.

4:48 am

as we mentioned, micron shares up 2.5%. still in this space, tsmc posted a 9% increase in the first quarter beating the market expectations the world's largest chip maker said it benefitted from strong demand on a.i. chips we have arjun with us now. we are keeping up with the sector and what we heard today means what for us? >> asml is providing the equipment and tools required for chip manufacturing at the moment, there is not demand as many expected for the tools. the orders are lumpy they he cocome and go. if you look at the chip makers,

4:49 am

this is interesting. tsmc is seeing huge demand 16% revenue jump year on year. the first profit rise in three quarters partly driven by the continuing demand for a.i. chips. if you look at the high per performance computing division that is 46% of the total revenue up from 43% in the last quarter. up 3% year on year you see that growing for a.i. chips. we are seeing green shoots samsung, the biggest memory chipmaker expects a rebound in profit you are seeing the green shoots emerge as they reach the trough and accelerate. >> customers like nvidia and apple need the chips more and more when we look at smartphones, we

4:50 am

see softness there in china, there is overcapacity. there are other parts of the business as well >> frank, there is softness in the market q1 is a weaker quarter for smartphones particularly after the bump in the holiday quarter in december. there is weakness there. autos are a small part of the business they are seeing a bit of strength there going forward, i think, the a.i. demand will appear or seem to appear to be driving that. of course, we tend to get new smartphone launches to the back end of the year. >> any comments from earthquake impact two earthquakes in the last few weeks. >> we heard that, tsmc is managing this. they managed to get a large part of the impact for that and still seeing demand. >> it seems to be ready for

4:51 am

that thank you, arjun looking at other news, netflix is set to report first quarter earnings today the streaming giant saw growth in the second the half of 2023 with more than 22 million people signing up i'm pleased to say we have the senior research analyst joining us to discuss net fflix what do you think investors will look for in this results >> thank you for having me on the program. netflix is a key player that starts the tech earnings season. we are expecting another positive set of growth numbers revenue forecasts is coming in at $9.2 billion. that is a 13% year on year growth rate. in terms of quarterly numbers, that is the highest number they

4:52 am

will achieve in a quarter and the streak continues since the fourth quarter of 2022 on the important subscriber numbers, we are expecting good numbers coming in at 4 million new subscriber growth. it is down to the platform n netflix has been able to build on the content and also the initiatives they have taken to get more customers on the platform we expect a positive set of earnings from netflix to kick start earnings season. >> i have a question for you as someone who looks at the company. who is the standard or benchmark? the numbers from a company

4:53 am

called street account. big increase year over year, but a 65% decline sequentially is this signs that the password crackdown is losing steam? we are talking about 4.5 million, but it is coming off double digits from the quarter before >> that is a fair comment. you have to realize q1 is not just for streaming, but eventirt of the consumer space. as you mentioned, normalization is happening on the other hand, netflix started during the last quarter conference call with the 100 million subscribers sharing passwords. they achieved 30 million new adds in 2023 does that mean we're still in the early innings of subscriber

4:54 am

growth on the other hand, you have to think about the initiatives to boost subscriber growth. the ad supported plan which was decent numbers growth and paid account sharing. this was a new initiative. we are expecting significantly successful numbers here. i think it is so successful that others like disney will follow suit >> that's what i wanted to focus on actually. the comparison with other players in the sector. looking at the content and we know netflix is expected to spend more on that, but how dheedoes that compare to apple tv and disney plus? >> in the previous quarter, they had netflix content spend of $20 billion u.s. dollars by 2025 it is growing year on year

4:55 am

this year is $17 billion it is a staggering amount of ramp up. this growth is inevitable given the high cost of content in the industry you have to realize that we think netflix is probably winning the streaming wars given the difficulties of other players. industry consolidation among players with prime and mgm and paramount. netflix will probably keep that content spend pipeline stable. >> it seems you are bullis the content. "bridgerton" is coming back as well as "squid games." right now, netflix is getting gaming titles. how risky is that for netflix when they face competition from

4:56 am

microsoft? >> they discussed a little bit about gaming in the pre-quvious quarter. in my opinion, this will probably be more gradual process for them because the entirety of the gaming industry is on the downturn when you look at publishers i'm not that great with that forecast >> thank you for your time senior research analyst. thank you. that's it for today's show i'm frank holland with silvia amaro. "worldwide exchange" is coming up next. thanks for watching.

4:57 am

4:58 am

pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers. go to shipstation.com/tv and get 2 months free. what is cirkul? cirkul is the fuel you need to take flight. cirkul is your frosted treat with a sweet kick of confidence. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul is your gateway back home. so what is cirkul? it's your water, your way. cirkul, available at walmart and drinkcirkul.com. you've got xfinity wifi at home. take it on the go with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines

4:59 am

5:00 am

it's 5:00 a.m. at cnbc global headquarters. it's 10:00 in london i'm frank holland. here is the "five@5. another fed official looks to caution before a rate cut. and shares of micron and taiwan semi get a boost. and china firing back on the tariffs on steel in the u.s. we are live in beijing with the response. getting set for the first faang report a

16 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11