tv Mad Money CNBC April 17, 2024 6:00pm-7:00pm EDT

6:00 pm

>> courtney. >> delta, we talked about airlines a lot of that looks strong moving forward. >> happy birthday twins. tapestry, i bought it around 108. i think it's due for a bounce. >> happy birthday william and my mission is simple, to make you money. i am here to level the playing field for all investors. there is always an option and i promise to help you find it. >> welcome to "mad money". i am just trying to save you some money. my job is to entertain, educate, and explain. sometimes, everything is difficult and makes you want to throw in the towel.

6:01 pm

when averages start slow, claps, rebounds, and pull back again? it's been sinking and the nasdaq is losing 1.15%. maybe it is such a selloff that you kind of just hold on. maybe you look for a couple percentage point decline and we did bounce it, for a treasury auction. the rebound was indeed short lived and he gave a better chance to sell, and it looks like the market was going to skyrocket. tonight, i want to put myself in the shoes of the seller, the person is really in control, those who held back and i will never fight any of you who want to dump the stock. it's not my style of fight. now that things are working, that's when i want to ring the register.

6:02 pm

no one wants to turn a profit into a loss. they haven't said anything, while they are laser focused on negatives made they have numbers that were disappointing with stock dropping, 8%. that is how the stock plunged, 7%. they generate impressive growth and of course, especially on her own show. i was very, very disappointed. we have plenty of big picture negative, europe is very soft. the middle east is close to the brink. the past few sessions have been rough. we have the plummets and europe is looking a little brighter.

6:03 pm

it only seems to matter for about an hour. the bear just savages, with the circle. doesn't it make you want to give up? it does, especially with the nasdaq breaking down. let's not forget that you can get 5% from sticking your money in a certificate of deposit. that has to feel good. this is a market that wants to go down and it's very easy. apple, tesla, nvidia, rolling over. you just get out of dodge, but is not a good reason to just sell? no. you never sell all at once. we did something different, we sold stock almost every day of the last four weeks, something you might have done if you join the investor club. we had some evaluations that were overstretched, and we did

6:04 pm

not want to lose all positions so we did something called scaling out, so stock when higher we sold shares to raise cash. if it comes back down, we can scale back in and refigure the market might have a peek because the fed may have jumped the gun when they told us they no longer needed to raise rates. we've been skeptical. no central banker cut rates quickly when unemployment is below 4% and we start getting overheated inflation and that is why we were adamant that could not be a rate cut until we sell weaker economic numbers somewhere, anywhere. i also recognize that this is an aggravating team. i thought terrific numbers, only for the stock to get annihilated. i know this market has got two negatives. average numbers were not actually perfect and no one bothered to list them.

6:05 pm

let me go over what might cause it to keep going down because that is a real possibility. you know what? we have sellers coming out of the word work -- would work. this change is what is killing the nasdaq. your head might be blown off after a percentage and many have had those moves. they have rallied straight up like a parabola and this goes right back down, just as fast. we are now reversing the problem, we are now going down and socks then shift to the head and shoulders pattern. many names have made that in the last few days were you just need to wait until the stock stops going down. don't worry. it's a stock is way down and you've artie sold them at higher levels, you can buy it back at a lower level.

6:06 pm

this market is not yet oversold and in investing club, we take advantage of this market edge. i don't want to get aggressive until we get an oscillator that is -7 which is a huge amount of pressure. i got to wait. it's not enough even though this is the longest down surge since january. there's a concern that people were hoping for rate cuts which were unimaginable in a world with so much economic activity in so few workers. there are more and more workers and ipos and none of that is what you want to but i think that chairman powell was willing to cut those rates, but recent numbers are too high. it resets the clock for potential cuts. we need two months of cooler numbers before they can even consider those cut.

6:07 pm

there is no sign in the economy of any slowdown. finally, the market tells you when it comes to an end and sually you get a day when the market starts down, not up like it did today. therefore, you get a chance to get in after the washout, you get a crescendo of selling. an upstart is a nightmare. you need to wash out and we are not near that, yet. do you think the sellers of tesla are done now that they have a chance to amend elon musk's salary package? do you think the sellers in nvidia are done now that everyone is convinced that they are producing leaving chips even though they said that's not the case? can apple really do that every day? so, here's the bottom line. i would say that the time to sell is when the parabola

6:08 pm

finishes. we don't know where that comes in yet, but you're sure not at the top, are you? you're more likely to be at the end of the parabola. let's go to tyler in california. >> california, how are you doing? >> i bought this ipo and i wish i bought more but at the same time, i like my average basic. what is your take on averaging up? >> we've talked about that a lot today in the office and we all said the same thing, what a great company, but what should it be worth now that they are parabolic to mid 100 and coming back down? the consensus was that it might go down into the 80s and that is where we would feel comfortable, owning or buying. great company. they are doing a great job, but the market has

6:09 pm

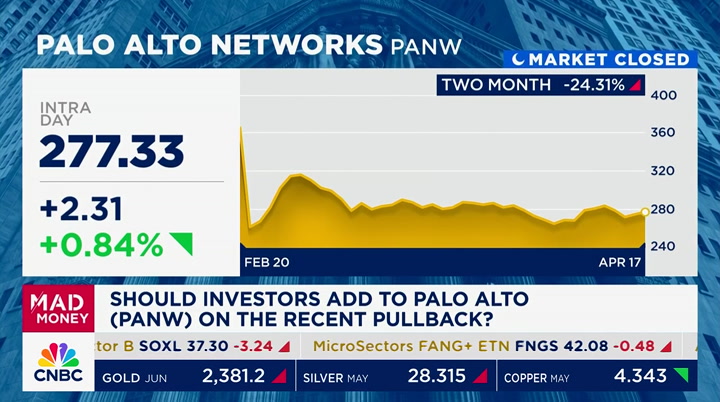

changed. let's go to george in pennsylvania. >> joining your club was one of the best investments i made and i cannot thank you enough for all of your help did >> we are really digging in. i do not want to leave jeff a lot of this set up, how can i help you? >> i had planned to add shares of palo alto, in my portfolio and grandchildren accounts. should i reconsider due to the class-action lawsuit? >> no, as a matter of fact, our first note indicates things are going better than expect did an analyst say, they were brought in by united health that was hacked. they are the single source of truth. if they were doing so badly, why did they get the single best contract of the year ? let's go to sonny, in

6:10 pm

illinois. >> sunny bouillon, from illinois. >> what's happening? >> i want to start with a shout out to your staff, nicole and everybody, they are phenomenal. >> they make people feel good because they are the light -- polite and kind and that's what i want to see. we have nice people and i think that's terrific. >> and you are nice people, to. >> if i get upset, and pretty good, normally. i'm a perfectionist. tell my wife, i can't stay with you, i have to work. that's how my felt last night. >> speaking of work, my family are huge fans of you and your show. last but not least, i wanted to shout out your mortgage show,

6:11 pm

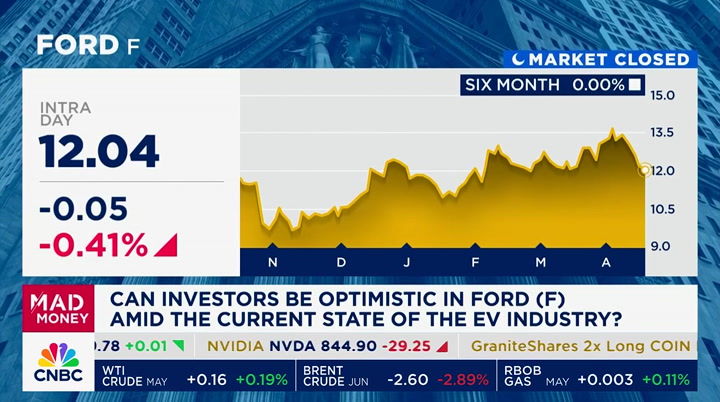

you do a great job. >> david is my friend, he doesn't seem like it, i get that. >> sometimes you guys get a little rough on each other but that's part of the fun, right? >> yeah, a lot of times. >> all right, good talking to you. i am a longtime fan and investment club member and i have your book. i know you love farley, i know you own a charitable trust, it's been sitting around 12. mr. farley is reporting earnings next week. can you tell me and all the club members that you would agree to push that ahead of earnings? >> this stock, everything you said is right, and thank you. this stock has come down a

6:12 pm

great deal in the last few weeks . the ones that are six, look how well they did. i think the time to sell out of this market was when it was going parabolic and now, we are past that. i just know that if you come in and start doing some perks, you could improve tonight. i am taking the big six, head on to give you my take. from big banks to regionals, i'm checking in with a tennessee bank to see how they are doing. i have a bone to pick with how we handle and the trust in this country and in laying out why i think it needs a change. don't miss a second of "mad money" . have a question? send an email, or tweet at

6:14 pm

6:15 pm

norman, bad news... i never graduated from med school. what? but the good news is... xfinity mobile just got even better! now, you can automatically connect to wifi speeds up to a gig on the go. plus, buy one unlimited line and get one free for a year. i gotta get this deal... that's like $20 a month per unlimited line...

6:16 pm

i don't want to miss that. that's amazing doc. mobile savings are calling. visit xfinitymobile.com to learn more. doc? last friday, earnings season kicked off with major banks, and we hear rom goldman sachs, morgan stanley, and bank of america. these results came during a rocky. for the overnight market, which is one reason nearly all f those stocks sold off, hard. some got hit harder than others. it just doesn't seem to reflect the quality of the numbers. j.p. morgan got killed, city got killed, bank of america, wells fargo. morgan stanley was up a

6:17 pm

decent amount. i want to walk you through what we heard, because these are some of the most important companies in the givers tremendous insight into the rest of the economy, for what's going to happen after. this only really matters if you know what happened, so we are starting with the four big and then we go to the major investment banks. they are that important. generally considered the best run in the country. if that was not because, you've got to understand, it was not because the numbers were bad. j.p. morgan had a bottom beat with a percent earnings growth which is terrific, average loans of 3% . that including the first republic numbers. j.p. morgan was solid, their metrics looked good. this provision came in, nearly

6:18 pm

$1 billion lower than expected with 32% versus the previous quarter and you are probably asked in, what went wrong? you can argue, this was only raised by small amount. this helps them to push those margins, which many banks are having. he was so cautious in comments, but mainly i think the stock had run too much. it was up 15% year to date and 52% right before the report. following the ugly markets, even though the numbers were fine. the stock has eversed so hard and at this point, it's lost a lot of its purview which makes it more attractive than when reported. i was thinking that this might be a good level, slightly later. wells fargo reported the best response from the market that

6:19 pm

day, with stock down less than .5%. even as average loans were down 2% year-over-year and average deposits were down 1%, it's important for this bank because it still hasn't asked that cat. but how about that forecast? wells fargo maintained and confirmed that they plan to buy back more stock in 2024 than they did last year. talk about a vote of confidence. it was a solid, if unspectacular quarter but in the banking business, that's fine. the idea is that they will gradually get a better operation . it costs -- will cause regulars ease up, but that in mind, they have been doing exactly what they need to and this was six years ago.

6:20 pm

it's a much better bank now than it was then. that was the final, and the expectations were lower. fortunately, they pushed through a big restructuring plan and that is what we got. they delivered solid revenue and a substantial amount of earnings. imagine that forecast and the longer-term targets. i'll take that. that is why the stock was headed higher and then traded lower, especially in that conference. they were down 1.7%, over three days. disappointing. why did that happen? they had negative credit quality trends, with higher- than-expected credit losses. i did not like that.

6:21 pm

they try to refrain from a post- pandemic turn to normalcy but this spooked a lot of people, including me. it's not a run from the high 30s, to now the low 60s. you have to be aware of these parabolic moves and people are betting on a turnaround but did not know if that would work so they looks for any excuse and that is what they did. it's the responsible move. this is a conundrum. wall street didn't like it. stock falling 2.5%. did it deserve to get punished? no way. i would position myself as being on the fence. i hate it, but that is where i am. there quarter was solid enough, but unlike the other money center banks, the provision for credit loss was in line with expectations and everyone else was actually smaller than

6:22 pm

expected. they have elevated write-offs and commercial loans. here we go. any of the other big boys reported fine metrics that they expect lower losses with notable decline in the second half. right now, they have more exposure to the bad stuff than i thought. bank of america said they expected that income to fall the first quarter, but they grew, that's positive. management now says they asked act their net interest income to fall, to rebound from those lows. everyone was much more positive, but in the end, there was a lot of "trust us, things will get better in the back half of the year." that's hard for many investors to swallow. now, if you believe that, i think they are reliable, maybe this is a fine opportunity, but

6:23 pm

i can't blame anyone for not wanting to stick their neck out. the bottom line is that if you want to take your cue from them, they reported mostly okay or decent numbers, even if that doesn't reflect their stocks. but stick around, i'm going to major investment banks that got a better reception than money centers and that perception is not over. "mad money" is back, after the break.

6:24 pm

6:25 pm

up to 90 credits toward the bachelor's for prior learning and life and job experience, why we offer scholarships and affordable tuition, and why we have online classes and the support you need from your first day to graduation day and beyond. no application fee if you apply by may 31st at umgc.edu. hey you, with the small business... ...whoa... you've got all kinds of bright ideas, that your customers need to know about. constant contact makes it easy. with everything from managing your social posts, and events, to email and sms marketing. constant contact delivers all the tools you need to help your business grow. get started today at constantcontact.com constant contact. helping the small stand tall.

6:26 pm

6:27 pm

this earnings season, i want to walk you through the results one by one. it's been an ugly period for the market. that is certainly how it felt, when we went over the major money. what about the other two? the two big investment banks, goldman sachs and morgan stanley? this has more capital activity with stocks and bonds, consumer banking. there is less of a focus on these metrics, with deposit and loan growth. they don't like to have credit, they don't like to get out. right now, we know that we've

6:28 pm

got capital markets activity, which is driven for investment. i always tell you that. they have the best quarter in the group, monday morning. they had 14.21 billion. wall street was only looking for 13, 16% revenue growth, 26%. at the same time, goldman had impressive control which translated to a gargantuan eat. at $11.58 per share. that is 32% earnings, from a bank. that is solid, meaningful, on the ball. what's driving these numbers? they strengthened global banking, which houses investment banking with revenue up 15%, 32%. that's extraordinary. commodities trading was up 10%.

6:29 pm

this was all substantially better than expected. they had asset and wealth management and the platform solution which is a small consumer business. both did well with double-digit revenue growth with investment banking. they explained that it's clear that we are in the early stages of the reopening, with the first few months of 2024 seeing a reinvigoration in new issue market access. maybe we are just getting started. ever since we heard from the investment banks, i've been telling you that we are witnessing a return of capital market activity and it would be very good for their numbers and that's exactly how it played out. they are practically printing money. i am not the only one who comes to that conclusion, other wise the stock would not work today. these banks can be great towels for the future economy of the country, not just their

6:30 pm

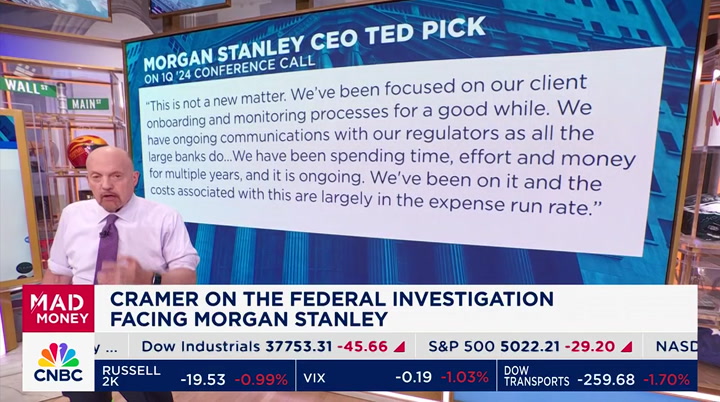

industry. this quarter made me feel better for the entire market. and how about morgan stanley? they've been shifting away from traditional investment banking and embracing more of a wealth asset management business model. i'm glad i own this, because it jumped yesterday. as i told investing club members yesterday, the positive reaction said it was a relief, as this position has been testing our patients as of late. the market size is up a bit, which took over. the latest frustration came thursday when the stock dropped 5% in response to the wall street journal article about a federal investigation, looking for wealth management. to be fair, the gains of the past few days represent some of the ground that was lost and not

6:31 pm

even all of it, but it was a good quarter. they have higher asset prices and an improvement macroeconomic backdrop which helped their wealth management tremendously. even their net interest income came in weaker than expected. it's not as important for them. their fee-based income is important. could they shift to wealth and asset management? morgan stanley reach $7 trillion in client asked that, between the 12th asset management divisions and is up 18%. they are well on their way to the goal of $10 trillion. i thought they were slipping, but apparently not. that is investment banking, sales trading, and it was a good quarter. as with goldman sachs, the traditional part of the business is doing well, capital markets are picking up expense control is solid, though it was off a 19% earnings growth and

6:32 pm

thank heavens, because last time , it did not look good when you went underneath. this time, it looks good. the cherry on top was the federal investigation news. as he said, this is not a new matter. we've been focused on client on boarding for a good while. we have ongoing communications with regulators, as all large banks do. and then he said "we've been spending time, effort and money for multiple years. we have been on it. the costs associated is likely in the expense run rate." i like that. i don't want anymore of those investigations and i hate being surprised by banks. don't worry about that terrifying piece. they should already be in those numbers. i don't like surprises, but i do think that this is one of those.

6:33 pm

wall street bought it and i certainly hope it's true. that's one reason why this was big. we will keep watching closely, so most of those ended up lowe . these were not all bad reports. i think they're mostly bad, some were better than expected. as for the selloff with j.p. morgan, wells fargo gave you study numbers, which is all we needed. as for goldman and morgan stanley, they are doing great. it might be early in their term, because as they saw, it's just getting started. when you go through that, they are pretty good. i feel better, even if their stocks don't tell the story and

6:34 pm

the market has gotten hard. sam in colorado. >> how are you? is doing well, how are you? >> one company in particular gets them to stand out which is wilmington, the acquisition of trust which is well-regarded and i'm curious what you think about the company. >> i think that is a very good bank and it was good from my old hedge fund. the stock does not have a good yield, 1.4. it's five points off the high, there are better fish to fry. i like it, but i like first verizon even more because you have a 4% yield. what you think? >> boo yah. i am seeing a lot of toast in

6:35 pm

restaurants and i'm not talking bread, what do you think? >> having run two restaurants, i felt that the have some special characteristics, including the best way to actually pay, when you are at your table. they are not making enough money. i would wait until it comes in and then i would buy it. how about this? below 20, i like it. now, we've gotten through all the big earnings and i feel better, even if some of those prices don't tell the story. if the merger is finally recovered, is now the time? we need to approach antitrust. these are rapidfire, so we will do a lightning round.

6:36 pm

stay around. icy hot. ice works fast. ♪♪ heat makes it last. feel the power of contrast therapy. ♪♪ so you can rise from pain. icy hot. and when i got there, they have the sushi- this is clem. like sushi classy- clem's not a morning person. i'm tasting it- or a night person. or a... people person. but he is an “i can solve this in 4 different ways” person. and that person... is impossible to replace.

6:37 pm

6:39 pm

6:40 pm

interest. it's only $14 and change. let's check in with brian jordan, chairman and ceo of first rising. welcome to "mad money". >> thank you, great to be here. >> before we get into how the quarter was, which was quite good, i want to congratulate you 460 years in business. many people don't know that. you've gone from a memphis outfit to one of the dominant players in the fastest growing area of the country, the southeast. what do you attribute the excellent performance and duration that your bank has had? >> thank you, i'm excited about what we have accomplished over the last 160 years. it really is somewhat hard to think about, abraham lincoln was president when we were founded, to being a 12 state franchise, i give a lot of

6:41 pm

tribute to my associates in the organization today and the tens of thousands that came before us. really building our connection with customers and our communities. >> you have a deposit campaign. last year, people were worried about whether you would have deposit and now it seems like you are the great aggregator of deposit. >> we've had good success. our teams have done a fantastic job in the second quarter alon , we raised $6 billion, roughly 10% of our deposit base, 32,000 new accounts, 6000 of those being commercial and the other 26,000 being retail. it's really impressive, what our team has done, and they both are in the third quarter and even further in the fourth quarter. we had good deposit trends. >> can you give us the color of the commercial? i know you have a good franchise business. >> we have a very broad

6:42 pm

commercial base, banking business. we have a number of specialty businesses, everything from mortgage warehouse lending, retail restaurant franchise, finance, to straight asset based lending and we are a very strong commercial middle-market lender. our commercial base serves the broad economy. >> your commercial base did not seem to be riddled with the kind of commercial real estate we were worried about. >> our commercial real estate portfolio continues to be very good. we have a diversified portfoli . in the disclosures, we put out in earnings, we broke it down geographically and and collaterally. we've taken strong credit positions in terms of our commitment, down payment, and at the same time we have worked, in any asset category or geographic market.

6:43 pm

that portfolio has performed extraordinarily well. >> i'm very grateful that you did. you are the only one, so far, that has given that information and that makes me feel more confident. the more information, the better. you said something i want to be sure about. you said, loan demand. okay, not great. what would make it great? >> i think that's exactly what i said. it is okay. the economy is doing okay, or well, it's not a strong economy, in my view. there is still a lot of pressure from inflation and particularly higher rates, and as a result, loan demand has not been off the charts. it has just been okay. i expect that that will improv . what will make it better is more certainty about the direction of the economy, that the fed is going to be able to

6:44 pm

stick the soft landing that everybody is hoping for and looks possible, but i think it takes more clarity and i think to the extent that rates can start moving down, it will make it easier. it will make it easier for people to lean in and borrow more money. >> will there be a time where that is the focus, and not net interest income? you did point out that, what would happen at the higher end of that guidance, definitely less rate cut, you would do better. at a certain point, we have to be bankers. i think that you are a banker and a lender and i think that there are too many people in his business to just say, how much did you make of that deposit? i want to see lending and fees, when will that be the focus of wall street? >> i think it's going to be a focus, late this year or next, i'm not certain.

6:45 pm

clearly, it's not about subcomponents. we don't push exclusively on phase, we don't push exclusively on deposits, and we don't push exclusively on loans. we want to build broad, deep relationships that serve our customers in deep and meaningful ways. as i said, we have long-term partnerships that survive and endure and work through any number of cycles, which we invariably will have. >> one last question, i know the mayor of kansas city was saying, send us your immigrant, we have too many jobs and not enough people. is your area a too many job, not enough people area? >> in the south, we still have a shortage of workers. it has come more into balance, but is out of balance. i think that will persist. we are seeing a lot of people moving into the south and that dictates a strong economy,

6:46 pm

dictates that you need workers. i think that we are coming into better balance and i do not think the problem is solved, today. >> is the government in the way, or is it helpful? >> having a sensible immigration policy he is the most important thing to solving that problem, long term. the birth rate in the u.s. is not likely to be sufficient to create all the workers that we need in this economy, and i think we have got to solve the immigration issues, which draw a lot of passion on both sides of the argument. ultimately, we have to come to a sensible conclusion. >> if i am a first horizon shareholder, you bought back, you got the authority to repurpose -- repurchase some of your shares. that's a lot of money and a lot of shares. >> absolutely. we have another $500 million

6:47 pm

with share authorization. we have 11.3%, which is the shorthand for the regular quarter ratio that we work off of. we believe we have the ability to operate at around 11%, plus earnings. we think we have the capacity to buy back more stock over the course of the next few quarters and we think it's a great opportunity to accumulate. >> with 4% yield, brian jordan is ceo of first horizon corp. and it's always a delight to have you on and i love a straight shooter. thank you. >> "mad money" is back, after a break. hit us with your best shot, a pacifier lightning round is next.

6:50 pm

6:51 pm

it's time for wealth solutions as sophisticated as you are. it's time for corient. sponsored by charles schwab. trade brilliantly. it is time for the lightning round! play the sound. then, the lightning round is over, are you ready? let's go to chuck in arizona, chuck. >> king charles, here. >> hey, king, what's up? >> i'm going to dedicate this song, "opportunity" to us. i got the dream, you got the

6:52 pm

brawn, together, we can make a lot of money. >> there you go, mozart meets beethoven, i guess. okay. >> i took a position to hop on energy with exxon mobil, it shot up in the last couple months. >> parabolic move, we don't like parabolic moves, that's a good example. i don't think that is going to work until it gets to 110. to devon, in florida. >> i love the show, wanted to tell you that. what is your thought on marathon digital? >> if you want to own marathon digital, by ethereum orbit coin. let's not fool around. george, in arizona. >> boo yah, jim. i'm here in arizona. >> let's go to mark.

6:53 pm

>> i like the last pick and i think we are moving in the right direction on the ai train. what about power to those data centers? >> right. okay, so when it comes to data centers, i am inclined to say that no power company is going to make money off of it. you better by others. that is the conclusion of the lightning round ask black the lightning round is sponsored by charles schwab. coming up, out of fashion? challenging the ftc's reaction to the luxury merger. don't miss it, next.

6:54 pm

♪ (upbeat music) ♪ ( ♪♪ ) with the push of a button, constant contact's ai tools help you know what to say, even when you don't. hi! constant contact. helping the small stand tall. >> no application fee if you apply by may 31st at university of maryland global campus, an accredited university that's transformed adult lives for 75 years. you're not waiting to win, you're ready to succeed again at umgc.edu. i have a business idea. and it just might change the world. but here's the thing, i can't do it... alone.

6:55 pm

6:57 pm

preparing, with kate spade, versace, michael kors. i thought it was a joke. it felt like a parity of the trade commission. it's not about monopolization and higher prices for goods, it's not about workers. they want this so they can stay viable. fashion is hard and many fail and they could create a strong american company. they had a weak quarter. i wish i could say the same thing, as they been getting pummeled since they had a weak quarter that questioned the rationale of the entire deal. so, if it's happening in the most fractured of industries, if the union is off already, why bother to block it? it's simple, the administration

6:58 pm

hates mergers. period, full stop. for this petty deal, they're saying don't get your hopes up, we're going to keep trying to stop these deals. the shareholders are rich, to begin with. the ftc is allergic to these companies and think that this hurts smaller companies by just existing. i think the antitrust division is just as hostile. look at the case against apple, a bizarre episode. apples phones are so good, you don't want to switch and they make it hard. take the most beloved company in america, the envy of the world, and you suet for making it come -- its customers to happy? if you ask americans which company is most proconsumer, it's a tie between amazon and apple. call me crazy, but i was helping that they would go after actual antitrust. it's not hard to find, but it

6:59 pm

does feel like it when it comes to medical and auto insurance or they wouldn't have such inflation increases. anything goes, but insurance should be looked at, i think. but what about airlines? it made the cost of flying much more extensive. i thought they would seek answers for what hurts us, not a tax us. they were accused of being monopolistic, even though everybody in wall street's nosed -- knows that they are being monopolistic. and you don't have to go to google for advertising. let's step back and acknowledge why this is happening and let's just own it. we have a president who does not care for big business. he picked people to represent his field and that is what is

7:00 pm

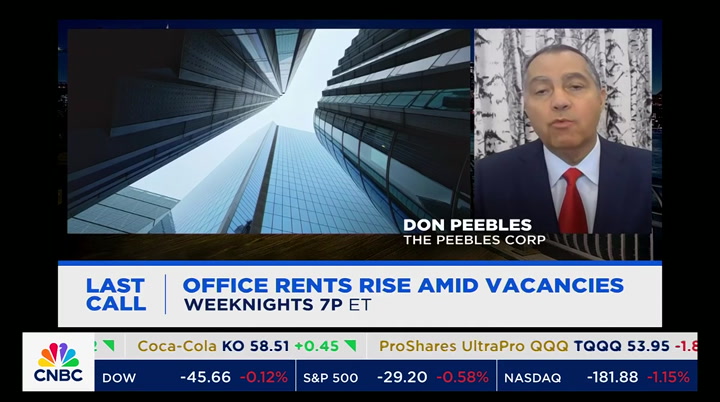

happening. he actually embraces the little guy which i think is admirable, but everyone seems to think you can only help the little guy by hurting the big guys, even the ones that don't do anything wrong, and i think that is a darn shame. "mad money", i am jim cramer, see i'm contessa brewer in for brian sullivan. right now on last call, boeing whistleblowers. that is the blowing whistleblowers laying out shocking allegations in front of congress. one of the lawmakers there joins us here on what happens next. something rare and strange happened in the market today and it could mean the bears are back in charge. waiting on netflix. the one thing that could send the stock storing, or tumbling tomorrow. reporting results that put new u.s.

40 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11