tv Fast Money CNBC April 17, 2024 5:00pm-6:00pm EDT

5:00 pm

netflix we were just talking about. i can't help but think there are a lot of people wondering whether some of these bigger tech stocks that drove so much of the market and have fallen off one by one, whether netflix keeps to creep the crowd >> we'll have to watch and see i thought it was entering when liz ann sanders today -- we'll talk about it tomorrow >> "fast money." >> live in the heart of new york city's times square. this is "fast money. could the fed induced surge in interest rates be fueling our economic boom, not suppressing it a contrarian view said 5% returns on bonds and savings accounts is helping, not hurting the recovery. insurance storm. shares of travelers sharply lower on an earning and revenue mix. while premiums keep rising, so do the costs from catastrophic storms later asml's bad day and the

5:01 pm

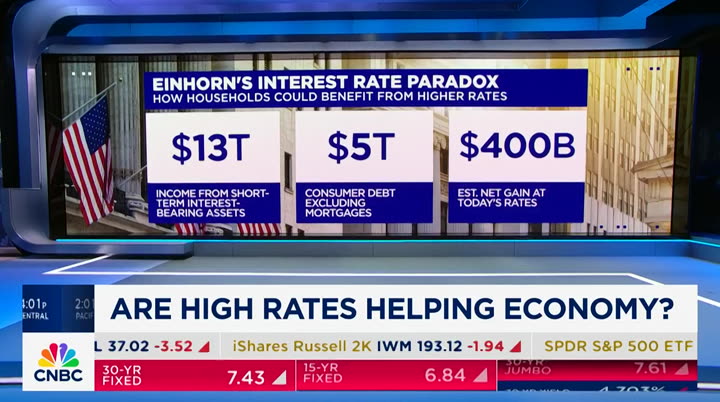

ripple effect on semis the monster rally ignited the day after earnings i'm melissa lee live from studio b at the nasdaq. we start off with a contrarian view on the impact of higher rates on the economy as yields in the ten-year hovered near five-month highs. david einhorn joining those saying u.s. investments could be booming because of rate hikes, in spite of them more than $13 trillion of interest bearing assets like bonds and money market accounts. it nets about $400 billion a year in interest at today's rates. that money could provide some real gains if it's funneled back into the economy just look at the change in key data since the start of the fed tightening cycle

5:02 pm

gdp is growing, unemployment steady corporate profits rising could the current environment actually be supporting the economy and markets? karen, what's your take on this very interesting view? >> it is a very entering true. i want to turn it on its head a little bit it is the cause of the gdp being so strong, is the cause of the higher rates yes there are benefits to that like the ones you pointed out. i also wonder how much tax income is boosted from all that extra income we were talking about that before the show. and then there's also -- there are some downsides as well obviously it's hard on the housing market so i think we can -- i think it's the other way around, that it's the economy leading rates higher and that's okay. >> i guess we all operate on the thesis that higher rates are not

5:03 pm

good for the consumer at some point. i think that's what einhorn is also saying, that there is a limit. in this sweet spot we have here where it's restrictive, but not too restrictive, you are earning income, but this is actually not a bad thing for the economy for consumer spending. >> i think specifically where you want to look at this, this is benefiting mostly baby boomers. over $70 trillion in net worth they're spending down. a lot of them have it in bonds, money markets. they have houses either with no mortgage or locked in under 4% that is who is boosting the economy. it will likely continue so when rates are higher where it's hurting are the first-time home buyers can't get into the housing market. it's making things more expensive for the next generation it's why the general economy can continue to do well even while rates are higher. >> plus we have to enter into the valuation prism as well with the s&p that, if we're not going

5:04 pm

to get rate cuts, you can't hold this valuation is it good for the markets -- >> you cannot hold. >> it cannot the market is looking for rate cuts on the horizon. that horizon keeps getting further away f. the horizon becomes further away, the market's got to give something back i'm still of the opinion we have more cuts versus less cuts the caveat is what's more and what's less? i still think we get three cuts. >> you still think we're going to get a cut in may? >> obviously may seems like a real -- >> that was what you were saying that shocked us all, our jaws hanging -- >> i thought up until the last couple iterations of the cpi, i thought we were able to do that. now powell backtracking, i think he realized his language was being interpreted by the market and the market was rising. he didn't want that. david einhorn has been on record

5:05 pm

about a year ago saying sort of the same thing, saying it's not good for the market but it's good for main street i don't know if you can make that separation between main street and the market anymore. i think we're too long in the tooth with that argument i think gas, eggs, cheese, meat is hurting the average guy. >> so just inflation of stuff and services >> the u.s. is trying to go on vacation that's what's happening. >> although they're getting higher wages and i think companies could be more productive that's the whole ai sort of pixie dust if you can be be more productive, then earnings can rise and you can even stay multiple and still have a higher stock market we were just in the idea of saying rates are so high, they're not so high. the 50-year average or longer of the ten-year is higher than here

5:06 pm

we've had good times with this rate it's just obviously the giant change from zero is that needs some adjustment. there's been a lot of good economies in this rate environment. >> right including this one i guess what we're trying to get at, what is the impact of a higher rate scenario on consumers, on the economy? are we over-estimating or underestimating the strength of the economy in light of a higher rate a lot of people said 4.75% is going to be terrible for stocks. maybe it's not maybe it's not bad for the u.s. economy. >> well, somewhere steve liesman will be smiling. i think real rates haven't been this high in a long time although we're stuck and the ned has acknowledged we're stuck on inflation coming down to their level, i think it's a pretty interesting -- steve -- i think he's right there's inflation everywhere

5:07 pm

which is why there's no way they're going to cut in june it's impossible. it's actually technically impossible we have one more cpi number in april. the may cpi comes out the morning of the june meeting. that can't even opine on that. june is gone i think september is a real question i think the fact that people have come in from 5 to 2, i think 2 is challenging back to are higher rates ultimately net good for the consumer, courtney is right to signal those that are actually net positive in terms of their balance sheet. i think it's the opposite for much of, call it the middle class, even middle class baby boomers, so people that don't have a lot of savings. what's interesting about this whole theory and this conversation is, yesterday we were saying what happened to the banks. shouldn't the banks be the beneficiaries of this same thesis in terms of net interest income, their ability to borrow here and lend higher in a higher rate environment it was a great day for banks, by

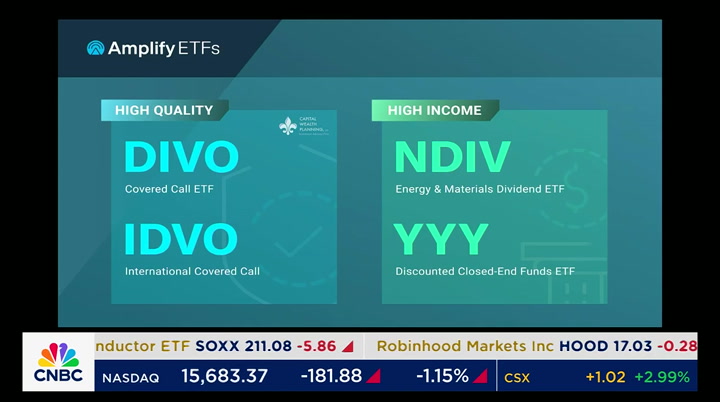

5:08 pm

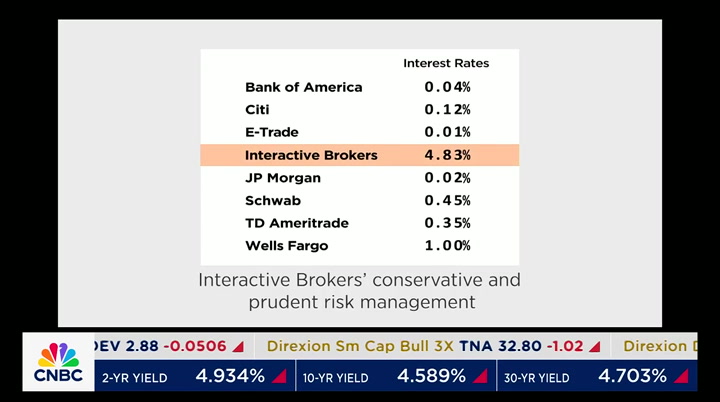

the way. i don't think there's anything particularly wrong with banks as long as credit doesn't fall apart here it's a fascinating time. i do think it's a great time for the 60/40 portfolio it's a great time for people to have an income portfolio that gives them an opportunity to weather good times and bad and make money fixed income is for the first time alive as an asset class to invest in. >> our next guest sees accelerating economy for the federal reserve. tore son, great to have you with us before we get to the fed and what you think which is no cuts in 2024, i do want to ask your thoughts about this sort of thesis that higher rates are actually good and good for the consumer net net is that true >> i think there are important nuances to that discussion if you owe money to someone, then higher rates is not good. if you own fixed income, then higher rates is good that's why there's a bifurcation

5:09 pm

when it comes to consumers in terms of who is being impacted by rates going up. yes, if you have fixed income assets, if you live off fixed income, then higher rates is most helpful if you owe money on your car, on your credit card, your house, which generally tends to be younger households because you generally have higher debt when you're young, that means younger demographic are being negatively impacted by seeing delinquency rates going up on cars and credit cards at the same time you also have had because of the fed changing their message in november and december that asset prices have gone up, that adds the additional dimension that is not only about my cash flow as a household, it's also about your assets and the very significant increase we've seen in the stock market since the fed on november 1st meeting began to say, well, now we're cutting rates.

5:10 pm

we've seen a $10 trillion drop in the rates that's the reason the economy is reaccelerating retail sales has been strong, hiring has been strong, inflation has been strong. this is absolutely because of the tailwind coming in particular because of the stock market going up, home prices going up and these cash flows coming in particular to middle and high-income households. >> i think it's interesting you think the economy is reaccelerating it is very strong. basically the data points that the fed saw and interpreted initially as a bump in inflation, you actually see that as the be going of a trend >> absolutely. i do think that the communication from the fed basically for 1.5 years before the december meeting was that interest rates are going higher, higher, higher, higher that meant there was no pe deal activity on the exit side, very little issuance in ig, in high

5:11 pm

yield. that's why the consequence of them saying, well now rates are about to go down, it was that we got a boost to financial conditions as you can see in the chart, the implication is that the fed needs to work even more on getting inflation under control. to answer your question, i do believe rates will stay higher for longer you can see market pricing in this picture here is telling you, yes, rates may be eventually coming down a bit but we're still going to stick at a level between 4 and 5% which is dramatically higher than what we had from 2008 to 2022. >> what would you put as the likelihood of a cut versus a hike from the fed as the next move >> let's talk about what the market pricing is saying as you know, the market is saying that the first cut will come in september. the market is actually beginning to price in single digits, that there will be a hike already at

5:12 pm

the meeting in may what is the market thinking? the fed fund futures curve is saying maybe the fed koib proactively saying, hey, we've got to do more i don't think they'll hike in the may meeting. it's interesting that the distribution of what the fed will do is beginning to tilt more towards rate hikes coming i don't think, as you also talked about earlier, that we will get more hikes during this cycle, probably because the election is upcoming, but also because of the base it takes on inflation, there's more lift on inflation in the second half of this year that comes off when we get to december and into next year so i do think the fed will be articulating the way jay powell did yesterday of saying we will just stay higher for longer and we'll have to wait a little longer before we ultimately get what we'll see what i believe at the moment, what we're seeing today is really a sugar high coming as a result of this boost from the stock market going up. again $10 trillion added to household balance sheets consumer spending in 2023 was

5:13 pm

about $19 trillion we've added in wealth roughly half of consumption last year. it has a significant tailwind to restaurant, hotels, airlines, concerts, sports events across the board. consumer spending continues to really look good when it comes to the next several quarters. >> i guess the question is how long do you think the sugar high lasts. it's a weird cycle if we stay with rates right here, maybe the sugar high can be sustained that sugar high will inevitably power rates to go higher which would then be a cap of equities and perhaps the reason for equities to turn lower >> exactly i do view that that sugar high here for the stock market going up, supporting consumption at the moment i do view that again through the lens of, well, there are still consumers that have a lot of debt that are being more and more and more negatively impacted by high interest rates. that's also the same thing on the credit side. there are firms highly levered in tech growth venture capital is particularly

5:14 pm

unattractive at the moment by definition, if you invest there, you invest in firms with no cash flow, no earnings. those firms sensitive to interest rates, the households sensitive to interest rates will continue to be negatively impacted that's why we have this tug of war between those who own assets are doing well, where those who owe money are not doing particularly well. we will eventually see that succeeding from the fed, slowing things down and getting inflation down that's where i think we still have several quarters ahead of us with the tailwind still supporting in particular consumption and services. >> torkson slok of apollo, thank you. >> several more quarters that's not bad. >> it's not bad at all it's a fascinating dichotomy he's talking about the divergence between the healthy consumer, the healthy corporate

5:15 pm

and that which has a lot of debt i think that's really where we are. i'm sure we're going to see credit issues. i'm sure that as the credit market is always smarter, there are places to -- i think there are probably issues right now. having said that, what we've also seen from the stock market is that the stocks that have been outperforming -- look what's going on in the real economy, that's more illustrative of the type of backdrop we're talking about, where high interest rates are benefiting some of the industrial companies, some of the companies that also have pricing power. what we're also seeing is whether -- talking lvmh yesterday. you saw the companies with a burst of consumer discretionary spending that i think was artificial in covid, have worked through a lot of that. they're suffering ow meanwhile they were outperforming for a long time. >> i think a lot of this has to do with labor hoarding i think labor hoarding came out -- there's no one qualified for a job.

5:16 pm

you can't get any applicants for a job, so they wind upholding on to the employees they have and pay them more, so wages have been increasing. but they're waiting for rates to come down. how long can they wait for rates -- for interest rates to come down to keep that crew of people they have working for them if that keeps getting pushed off, do they start firing? do they start laying off we're seeing it with the tech companies now, but that's for a different reason what happens when you start to see mean street starting to lay off because they're saying, well, rates aren't coming down i can't hold on to these workers anymore. then i think the market comes in one last thing -- i promise -- well, this segment we're in an election year cycle. historically, the president, the incumbent that's in, if you're cutting rates, you get re-elected if you're raising rates, which de facto you're raising if you're not cutting, you don't.

5:17 pm

right now you still have qt, so that's de facto raising rates. if you're not and inflation is still there, it's still a high-rate environment. >> you also have the perception of the american voter that the economy is not good, that they are worse off than they were when president biden was first elected. that's a hard thing to shake >> it's a hard thing to shake, and it's almost impossible as long as you have a job, that secures a cures a lot of ills. united posted better than expect earnings last night, soaring more than 17% today. that's the best day since november 2020. the jump coming even as airlines expects to receive aircraft. united facing its own faa safety review other airlines taking off today along with united. look at that group and how they responded. courtney, what do you think about airlines >> we've been talking a lot about this where people are having to choose what they're

5:18 pm

spending their money on. travel has been one of the areas where demand has not slowed down keep in mind they were doing worse than most of the other airlines, they're doing really well, but after they were doing much more poorly than everyone else i do think the airlines continue to look at a positive space. i would prefer a delta over united airlines. they're both going to benefit. >> we've seen the a 321 neos to satisfy demand, that was huge for united in this quarter. >> it was a big deal so that reaffirmation of the '24 guide, i think i used three, maybe four veries ahead of very good that those what the numbers were they gave the street visibility into where they are right now, both in terms of the airline dynamics i think shh is a bottom-up story, not a top-down. i think travel trends might even -- i think they may be

5:19 pm

peaking more than they're accelerating i think the operational performance of united was extraordinary. that includes i think something like 7 to 9 billion in capx. that will lead to free cash flow the street loves that. there's obviously now upgrades galore an intraday move from the day before where we got intraday high or even when we closed. almost been a 23% move for a stock that had underperformed. delta over the previous six months by 23%. i think you have upgrades coming i think you can probably own both airlines here for a trade i'm a trader with airlines. coming up, lilly's lulllull. how eli lilly's weight loss drug can give you a night's sleep if the options pitch are booming

5:20 pm

5:22 pm

it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

5:23 pm

welcome back to "fast money. buzz skill on asml, down 7% since june 2022. q1 sales coming in lower-than-expected, down 21 years year-on-year bookings for the company's machinery dropped 61% from the prior quarter, this sending the rest of the chip stocks tumbling including arm holdings this tells you maybe main customers like tsmc as well as samsung, they've got a lot of inventory that they have to work through and they're not ordering a lot of this equipment. karen, you were thinking maybe the reaction was a little muted. >> is this potentially a canary in the coal mine this store i have is completely intact and they created greater revenue this year than next

5:24 pm

year i can't -- given how expensive the sector is or how much -- how far it's come, you can make arguments it's not that expensive. i was surprised we didn't see a bigger reaction. obviously we know nvidia was down three and change percent which isn't gigantic so, you know, i buy into this story. i own nvidia, i own dell it does make me nervous that -- are we going to look back on this and say, oh, we should have known when asml missed >> there's so many different tentacles out of the story i don't want to negate what you're saying. tsmc, we're going to hear from them and see maybe the developing color of the story, but it's still nvidia's story to lose i would be a buyer of nvidia on any of these pullbacks because it's not directly related to them at this point

5:25 pm

it could be. >> courtney, what do you think >> i think this one quarter it's going to be hard to say. they tend to have pretty lumpy transactions they have lumpy, expensive equipment. as other industries are conserving cash flow, you can get a pullback like this to your point, it has come so far, people will be much more critical of the valuation, the price, if you have any dip like this which you're having their story is saying, well, this is a transition year, next year as people focus back to ai, that's when we're going to see it i think that's the question, do we see that? do people believe that story it's a great long-term play. >> it's the uv lith thog fi machine that is the machine needed for ai. that's the machine banned from china. it takes 18 months to manufacture. to courtney's point, there's a lot of lumpiness, and that should be the caveat when you

5:26 pm

look at the bookings number. kantor came out and said buy on the weakness would you? >> well, i think there's a couple things going on there's momentum in the trade. remember this is kind of a european ai play i think it gets very crowded in the back, that there aren't as many across. i think that the orders number was a big deal margins were better. the problem is that people have, i think we framed this pretty well, anywhere from 60 to 80% growth next year to 25 the bar is very, very high here. i think the overall focus on the semiconductor group in terms of, is this really now starting to break down you look at the smh, the etf that tracks the stocks, somewhere around 212, something like that. the day after nvidia reported that gang buster, the next

5:27 pm

trading day number, i think that was february 10, 11, 12, something like that, we're kind of right back there. if they've given all that back, they've underperformed the s&p by 6.5%. it's something to think about. this leadership has been critical i think for the market. i'm very focused on this breckdown. >> a lot more "fast money" to come here is what's coming up next. cashing some z with sepp pound. what it could mean for the market for glps. you won't want to snooze on this one. plus, boeing's whistle-blower on the hill there could be more storm clouds brewing for the plane maker. the latest tailwind facing the name ahead you're watching "fast money" live from the nasdaq market site in times square. we're ba rhtft ts.ckig aerhi frustrated by skin tags? dr. scholl's has the breakthrough you've been waiting for. now there's an easier-to-use at home skin tag remover, clinically proven to remove skin tags

5:30 pm

power e*trade's award-winning trading app makes trading easier. with its customizable options chain, easy-to-use tools, and paper trading to help sharpen your skills, you can stay on top of the market from wherever you are. e*trade from morgan stanley . welcome back to "fast money. results from an eli lilly study finding zepbound could help reduce sleep apnea over the course of 52 weeks, patients on pap therapy and non-pap therapy experienced a 60% reduction in symptoms. the findings have not yet been

5:31 pm

peer reviewed. 30 to 40% of sleep apnea patients are not obese which could open zepbound to a new market one always thought it would be people who suffer from obesity who would benefit from this. if not, it's an entirely different population of patients here. >> this to me sounds like more of an insurance, who is going to pay for it that's been a big question, how is it going to be paid for by patients i think it's more to do with insurance companies and making the drug more accessible to a host of other people that's great for eli lilly if your symptoms go down by 60%, you still can't breathe 40% of the time it's a bullish call for eli lilly. as a whole, you're going to need a bunch of different solutions to solve the same issue. >> the episodes of breathing problems while you're sleeping

5:32 pm

is reduced by 60%. you still have problematic episodes of hypoxia and apnea while you're sleeping. it's a step in the right direction. it's a reduction and not an entire cure, drugs will still have to be used, breathing devices still have to be used. there still might be surgical interventions to cure sleep apnea. it's not like this drug can address it and all these other things go away, which had been the binary thinking initially when we heard about the study. >> we were wondering why is inspire not down okay, the trial sounds good, but it wasn't good enough for you to not need anything else the whole thing is so amazing, the number of different applications of these drugs, it's extraordinary >> yeah. so does it merit this valuation? >> does it merit getting insurance coverage >> some are saying, yes, it will open it up to medicare coverage

5:33 pm

at this point if it is for sleep apnea. lilly is going to apply to the fda. >> that's the big thing, the insurance companies, if it's just for weight loss, we're not going to cover it. hopely more people will be able to get it covered by insurance they're saying it will reduce it by 60% being overweight i think also can contribute to sleep apnea. if it's helping both causes, is it more than 60% i don't know. >> does it help prevent populations that would have the issue? >> right. >> does it help populations that would have sleep apnea. >> by not becoming obese, do they not develop sleep apnea. >> yes, there's that element. boeing's whistle-blower outlines safety concerns there could be turbulence in store for the plane maker. a big loss for travelers stocks how rising insurance costs are weighing on the space next "fast money" is back in two.

5:35 pm

at corient, wealth management begins and ends with you. we believe the more personal the solution, the more powerful the result. we treat your goals as our own. we never lose focus on the life you want to build. and our experienced advisors design custom built strategies to help you get there. it's time for a wealth management experience as sophisticated as you are. it's time for corient.

5:37 pm

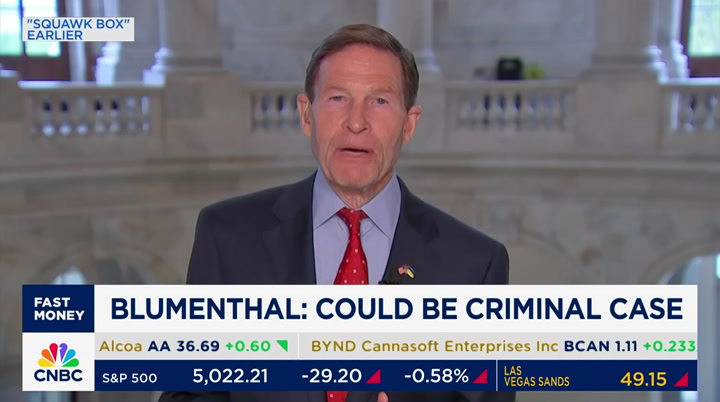

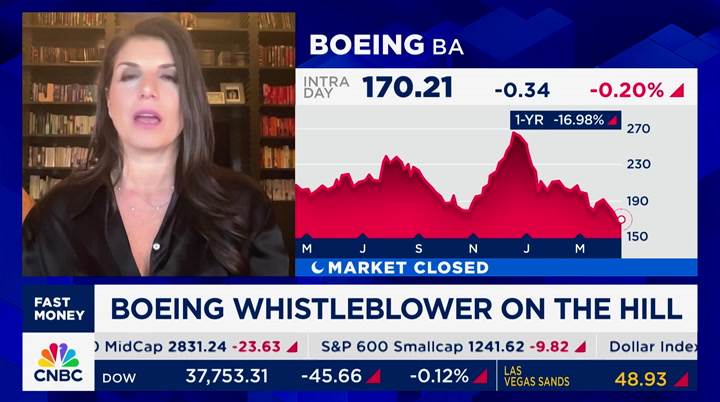

welcome back to "fast money. stocks closing in the red with the s&p and nasdaq notching four-day losing streaks. the dow down 50 points, its seventh negative session in eight. bank corp increasing credit losses discover financial posting a revenue beat las vegas sands beating the top and bottom lines sl green higher after their results as well. duo lingo to join s&p up 6% right now. >> magnifico >> meantime, a boeing whistle-blower testifying today on capitol hill saying the aircraft maker is putting out defective airplanes and alleging he was threatened for raising red flags. it's the latest cloud hanging over boeing. three years ago the company entered a deferred prosecution agreement after two fatal crashes with 737 max jets.

5:38 pm

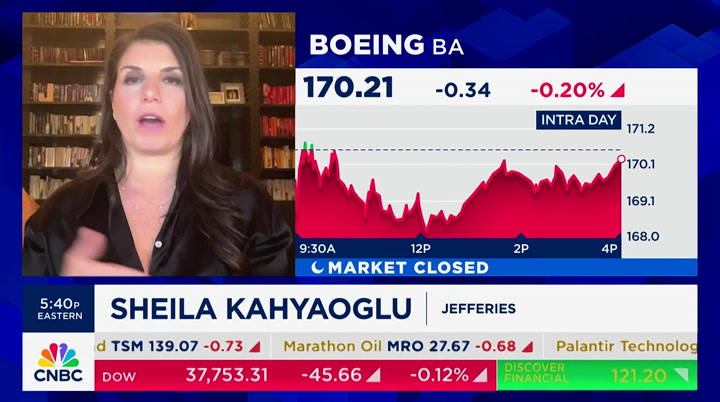

it could mean the company violated that agreement. connecticut senator richard blumenthal told me on "squawk box" this morning if that is the case the company could be held criminally liable. >> the liability would be tied to those deaths, but also to the continuing pattern of a broken safety culture and manufacturing defects that were known and khan sealed or covered up through this pattern of retaliation. again, not jumping to conclusions, there needs to be further investigation. >> what is negligent for boeing and how does it impact the stock down 35% this sgleer jefferies aerospace and defense analyst, sheila kai al lieu sheila, great to have you with us i'm curious of what you thought happened with the whistle-blower testimony today on capitol hill and whether or not that adds to

5:39 pm

the case that senator blumenthal is putting forth that there's a culture and repeated pattern of quality issues >> clearly boeing is struggling. a share price tells us boeing is struggling there's a search for a ceo, an overhaul there's a lot of things going on at boeing that reflects the january 5th incident with alaska airlines and the safety culture when we go back to 2018 and '19 and the two crashes that led to the settlement i think the testimony today from the different panelists, it's hard to put it in context. an employee on the 737 program, later to the 777 program says there's issues on the 787 as well in addition to the 737 max. the 787 has not had any major incidents. it has had a relatively decent safety culture boeing has produced saying the 787 had a current rate of five a

5:40 pm

month. that's different than the pressure to up volume from 20 a month to 40 a month to 50 a month on the 737 there's a lot less volume pressure which could stem to quick fixes on something like the 737 max. >> in terms of the violation of the deferred prosecution agreement reached with the doj, sheila, is that on your bingo card does that fact or in at all >> everything is on the bingo card when it comes to boeing there's always something new clearly that wouldn't be positive, if they violated it just within the three years. they do have a safety system in place. just apparently too cumbersome for people to document it. so they do have one in place i think that would just add to the slew of issues regardless, i think looking forward -- and that's what we have to do -- we'll have a new ceo come in. the timing is unknown.

5:41 pm

i think the first thing the ceo is going to do is take out the cash flow target and throw it out the door and say we're going to slow production until we hit certain safety measures and maybe fixes to the facilities. boeing touches a lot of suppliers. each plane has a million parts there are two big factories that have to be merit spirit aerospace systems if they decide to take it in-house which is currently in talks with boeing to be taken out. >> just curious. if it's found to have deferred that agreement, what do you think it means for the stock if they're found criminally liable, i don't know what fines there are. i don't know if it involves another agreement at that point, management will be involved, prior management will be involved how do you sort of play that out? >> i think it's hard to play it out in terms of investor sentiment in the share price performance. clearly another ding and a fine

5:42 pm

would be very negative for the stock in that you would have additional debt in place and their debt balances are already in the $45 billion range that wouldn't be positive from that perspective but dave calhoun is leaving, not because of anything he's done. the former management no longer is at boeing i think what we have to take back -- department of justice investigations do take a long time some companies in our coverage of that, a decade of doj investigations who this is tied to on a criminal basis is very hard to leave it up to top management. we've seen plenty of turnover on the program manager lens, whether the 737 max or the 87. i think as senator blumenthal said, to pin it to somebody is just going too far ahead we do see these criminal investigations and these doj investigations last close to a decade sometimes. >> sheila, thanks.

5:43 pm

>> thank you >> tim, how do you think it will play out >> a crowded bingo card, which i know you play a lot of bingo, mel, equates to a lot of pressure on the stock. it doesn't necessarily change where free cash flow claims to reaccelerate by the second half of next year i agree with her view on free cash flow for this company i remind people that boeg's underperforms ans over the last six weeks is obvious, and obviously because of the alaska air investigation and the changes at the top most of the underperformance of boeing over the last three years were not related to regulatory dynamics, but related to covid, the shuttering of the airline industry boeing is going to have a free cash flow yield of 5 to 8% by the time we get to '26 they report next we'ek

5:44 pm

i think it's going to be an interest time. >> travelers taking a tumble the insurer with its worst day in nearly four years what analysts got wrong with this report. options traders rolling out the red carpet for netflix ahead of earnings tomorrow. we'll dive into the action right after this at ameriprise financial our advice is personalized based on your goals, whatever they may be. all that planning has paid off. looks like you can make this work. we can make this work. and the feeling of confidence that comes from our advice... i can make this work. that seems to be universal. i can make this work. i can make this work. no wonder more than 9 out of 10 clients are likely to recommend us. because advice worth listening to is advice worth talking about. ameriprise financial.

5:45 pm

(aaron) i own a lot of businesses... is advice worth talking about. so i wear a lot of hats. my restaurants, my tattoo shop... and i also have a non-profit. but no matter what business i'm in... my network and my tech need to keep up. thank you verizon business. (kevin) now our businesses get fast and reliable internet from the same network that powers our phones. (waitress) all with the security features we need. (aaron) because my businesses are my life. man, the fish tacos are blowing up! so whatever's next... we're cooking with fire. let's make it happen! (vo) switch to the partner businesses rely on. >> university of maryland global campus is a school for real life, one that values the successes you've already achieved. earn up to 90 undergraduate credits for relevant experience and get the support you need from your first day to graduation day and beyond. what will your next success be? [alarm beeping]

5:46 pm

amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

5:47 pm

welcome back to "fast money. record rainfall battering united arab emirates on tuesday ten inches of rain, two years' worth fell in less than 24 hours causing unprecedented flooding and shutting down the busy dubai airport. authorities diverting flights, shuttering schools the uae denies it's the result of cloud seeding 18 death have been reported from the weather. travelers with

5:48 pm

higher-than-expected catastrophe losses, dropping 7%, worse since 2020 contessa brewer is here to talk about the numbers. >> the shares slumped. they didn't bounce back. the executives were laying out ways that the financial picture has improved, its return on equity, net investment income, up double digits and hiked dividend by 5% catastrophe losses were significant. 712 million. most of that from thunderstorms. here's the thing travelers is hiking the rates on premiums underwriting results improved dramatically when asked on the call whether travelers has achieved enough on rates for those increases to begin to decelerate, the answer was not really travelers said in auto insurance prices go very gradually moderate on property insurance rates are going to continue to increase in response to elevated costs of paying out claims.

5:49 pm

there's two things i want to point out. this will matter to other insurers travp v travelers says the materials and labor and replacement costs have come down from last year they're still generally higher lawsuits continue to be a real challenge for the industry they're costly and increasing, and then -- so three things. the thunderstorm damages, they're real they're hard to model. but they're changing the way insurers think about pricing coverage in every state where thunderstorms happen, they're rethinking the way they approach policies for homeowners. >> there are thunderstorms in every state, contessa. i'm guessing there are certain states that suffer more from thunderstorms than others. are homeowners there destined to see increases? >> everyone is destined to see incr increases. you'll see an increase in your auto insurance and in your home insurance. the thing is, in some states those increases are going to be

5:50 pm

far more noticeable. travelers was asked about florida. it's been a problem in part because of the litigation, in part because of the way they assign benefits. travelers was asked, hey, look, the legislature went in. they tried to address a lot of these problems are you willing to go back into the florida? again, i'm making it much more succinct, but the answer is no, we're not ready to do that. >> if you want to get a mortgage, you have to have a policy in place. >> what's happening, too, the way people are thinking about risk, how much is your deductible where are you willing to cap out your coverage? can you trade-off on risk a little bit and say i'm willing to trade-off on maybe the hail and the wind and then the thunderstorm comes and it turns out that the hail and the wind is a real threat and it causes more damage than you were

5:51 pm

prepared for this is all happening in realtime in every state in the nation >> contessa, thank you contessa brewer who makes insurance interesting, right this is fascinating what is going on here, tim how do you think about investing in insurers given the challenges they face? >> well, i think there's two things going on. first of all, insurers are doing better in a rising rate environment. we think about where they had to invest obviously there's always a process of having to align and match up where liabilities are but i think it's a hiring environment better for them. i can't speak to greater thunderstorms in kansas versus new york i will say that the insurance companies seem to me, and this is just a consumers view, they're always going to force me to be overinsured. and with rising prices if you talk about home insurance, if there's a bank

5:52 pm

that requires you have x insurance, the insurance companies are always going to make sure they're covered. therefore, these types of weaknesses, special around property and casualty i think are worth buying >> when you look at all state, all state reports in the next two weeks or so. if you start to get that discounted price based on this story, you might get a better entry into all state they've outperformed travelers basically 2-1. you're always going to lose money when you're the consumer coming up, the need to know on netflix the streaming giant surging more than 25% this year should you bing or bail ahead of werngs tomorrow. more "fast money" t inwo (grunting) at morgan stanley, old school hard work meets bold new thinking. (laughter) at 88 years old, we still see the world with the wonder of new eyes,

5:53 pm

helping you discover untapped possibilities and relentlessly working with you to make them real. old school grit. new world ideas. morgan stanley. ♪(voya)♪ there are some things that work better together. like your workplace benefits and retirement savings. voya helps you choose the right amounts without over or under investing. so you can feel confident in your financial choices voya, well planned, well invested, well protected. were you worried the wedding would be too much? nahhhh... (inner monologue) another destination wedding?? we just got back from her sister's in napa. who gets married in napa? my daughter. who gets married someplace more expensive? my other daughter. cancun! jamaica!! why can't they use my backyard!! with empower, we get all of our financial questions answered. so we don't have to worry. can we get out of here? i thought you'd never ask. join 18 million americans and take control of your financial future with a real time dashboard and real life conversations. empower. what's next.

5:54 pm

my name is oluseyi with a real time dashboard and real life conversations. and some of my favorite moments throughout my life are watching sports with my dad. now, i work at comcast as part of the team that created our ai highlights technology, which uses ai to detect the major plays in a sports game.

5:55 pm

giving millions of fans, like my dad and me, new ways of catching up on their favorite sport. welcome back to "fast money. netflix on deck to report after the bell streaming giant up 26% this year after traders are feeling cautious ahead of the results. mike coe has the action. hey, mike. >> options implying a move of 8% after they report earnings six of the last earnings have been larger. they're hedging buying april 550 puts we saw those trade for $4.60 a little less than 1% of the stock price. that would hedge some gains if you bought the stock at 4.70 that would lock it in. >> thank you, mike courtney, how are you feeling about netflix ahead of earnings? >> it's a company that's been

5:56 pm

doing well what's been interesting to see for them, we've had an actors strike they get a lot of international content which i think will hopefully benefit their subscriber growth. that's what's going to matter, what does subscriber growth look like what does their advertising tier look like? hopefully if that looks go, odit will be good for the stock we'll know tomorrow. >> up next, final trade. when you own a small business every second counts. 120 seconds to add the finishing touches. 900 seconds to arrange the displays. if you're short on time for marketing constant contact's powerful tools can help. you can automate email and sms messages so customers get the right message at the right time. save time marketing with constant contact. because all it takes is 30 seconds

5:57 pm

5:59 pm

time for the final trade around the horn. karen? >> can't let a day go by without saying happy birthday to my twins, kate and william. still, i still think that's how old they are when they say, mom, i'm going to get my own apartment, that is who i think is talking to me final trade, meta next weeks's earnings i like it. >> tim >> happy birthday, lvs, not real happy birthday after these numbers. i think the cash generation is fantastic.

6:00 pm

macau is recovering. >> courtney. >> delta, we talked about airlines a lot of that looks strong moving forward. >> happy birthday twins. tapestry, i bought it around 108. i think it's due for a bounce. >> happy birthday william and my mission is simple, to make you money. i am here to level the playing field for all investors. there is always an option and i promise to help you find it. >> welcome to "mad money". i am just trying to save you some money. my job is to entertain, educate, and explain. sometimes, everything is difficult and makes you want to throw in the towel

21 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11