tv Closing Bell CNBC April 17, 2024 3:00pm-4:00pm EDT

3:00 pm

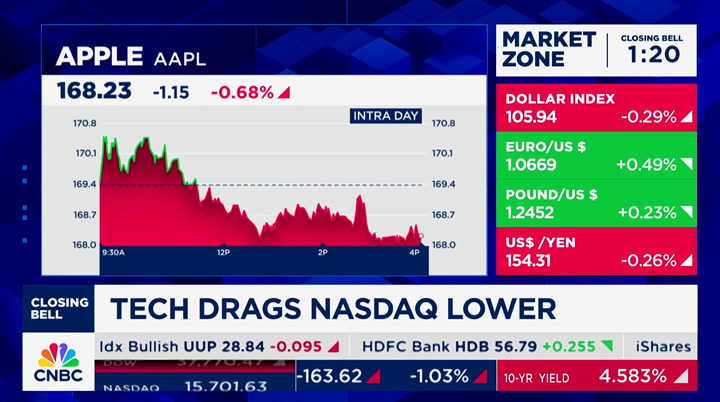

saying we need to look at th kinds of bets that are available. >> that guy could say i'm no playing tonight, tells a friend. >> we need 4 more minutes fo this >> thank you for watching, queen of gambling. >> and insurance >> thank you for watching powe lunch. closing bell starts right now. thank you so much. welcome to closing bell. i'm scott walker live at the new york stock exchange. we are beginning with majo questions on the bull market whether it can withstand a worther right in interest rate and what happens init can't. we will ask our experts. look at the score card with 60 minutes to go in regulation. a rare respite in the rate ris but failing to get much goin for stocks we are still in the red across the board. tech and industrial sectors ar weighing on the major averages today. and aml putting a dip in the

3:01 pm

holdings and nvidia sliding in sympathy as you see. utilies and staples are higher as investors look for defensiv positioning. and we have the backup in yields and the expectation of rate cuts and what it means for markets. let's ask josh brown with me here at the post good to see you. we have been asking for the last several days whether the playbook for investors needs t change as expectations for rat cuts are firmly reset. how would you address that wit the calls that you may get >> we are washing out some o the excess enthusiasm that w came close with the month of april. we talked about late februar and the broadening of the rally. it was broadening. it found its way into small caps which is a group that can't ge arrested even those stocks are going up

3:02 pm

now we have a little bit of washout of the enthusiasm. a lot of big charts are still in tact what has really changed on the internals is the percentage of stocks that are in their own individual bull markets. 35% of s & p 500 components ar above their short-term movin average, 50 day moving average that number was 90% coming int april. so, it's definitely correctionish thing happenin for small and mid cap. large cap, not a lot of damage apple is one of the worst name in a 15% draw down most large caps are in tact. they don't look as bad as apple. if you pull semi conductors out, you may be green >> are we moving back to a sta big and don't go broad market? over the last month or month t date, to your point, russell i down 7.5%. but looking at real estate dow

3:03 pm

9.5% dividend aristocrat is down, utilities down 3.5 do i need to rethink this? >> no because the draw downs are off of new highs not necessarily real estate bu the dividend stocks, for example, you had new highs i the segments and these stock have gone up 20% to 50% sinc october. so i don't think that a 5% or 7% pullback dasterous. i don't think we are in th moment where we want to rethink. i think what we want to remember is semis are 9% of the s & p 500. 20% of the nasdaq 100. let's look at asml said. it is not great but it is highly company specific they beat on earnings but they missed on sales. q1 sales were already forecast to drop year over year

3:04 pm

but this was a much wors outlook on booking and booking is how they make the numbers next quarter and the quarter after. bookings 3.6 billion euros, th forecast was 5.4 it is an asml story. now intell gets hit. nvidia gets hit. remember semis are a huge part of the s & p they were never 9% throughout my entire career. you will have this outsize effect when i look at my screen, i have green. i have tickers that are higher defensive stocks are doing their job. utilities are up a lot i have pharma names that are up. i don't think this is an acros the board rethink. i think we have enough positiv breadth away from large cap that the entirety of the stor remains in tact. i think it gets a little harder. >> let me zero in on dividends because they are near and dear to a large swath of our viewin

3:05 pm

audience i think we were coming off of a toug year for dividend stocks the narrative coming in was, okay, rates are coming down so divdndz will be good and the will have a good comeback. now if rates are going to back up, maybe not so much. maybe those who really spend the time looking for the dividen stocks to get that income ar going to have to rethink a least that part of the market. >> as you know, jenny herringten and i have a seven year bloo feud running idisagree with the premise o identifying a specific dividen yield and hope woe like th stock attached to it i don't think the majority o investors are targeting a yiel and working backwards. the better companies pay dividends, not usually the highest dividends but th dividends most consistentl growing from one year to the next most of the time we are talkin

3:06 pm

about quality number one and w are talking about companies that are also in addition to paying out a dividend yield doing a decent sized buy back. that story, i also think remains in tact. we should see $1.2 trillio worth of buyback activity. it is growing overseas faste than the dividend activity i recovering here. you would be understanding looking at companies in 2023 and 202 slowing down with th buybacks and slowing down with the dividend growths there was a lot of uncertainty and people were not sure how they would fare in a highe interest rate environment. now we have been in one for while. we know we will be in one for while to come. and companies are still lookin opportunistically how they can return cash in the most shar holder friendly fashion. i don't think that will be extinguished this year >> let's throw up nvidia the stock has been i

3:07 pm

correction adam parker makes the case thi week sitting in the seat i which you are today, that this is the most important data point for this period given nvidia earnings and you agree with that. because there is no bigger booster of this stock than you and very few who come on the network have owned it as long as you have and you agree with him >> i think it is their commentary they sit at the epicenter of what is the biggest story on planet earth right now i hope jenson wang understands the weight of his words. he is a straight shooter and tells it like it is. i have been invested with nvidia from 70% draw downs. i understand what it is like when they are having a great quarter and a terrible quarter but what changed now is how high the stakes are for every other technology company based o demand for a.i products, a.i.

3:08 pm

infrastructure, a lot of it is balancing on what he is going to come out and say remember when i said semis are 9% of the s & p, nvidia is 50% of the 9%. it is 30% of the exposure in the nasdaq everyone is watching >> i feel you have a mostl sanguine view on the market, looking for areas to b constructive maybe part of that is due to the fact that you think perhaps this issue of higher rates for longer may have a more positive effec on the overall economy than some are anticipating in that if yo have been sitting in a money market fund at 5%, growing you cash wealth so to speak, tha funnels its way back into th economy at a time where maybe we

3:09 pm

are doubting the direction o the economy based on the trajectory of higher for longe rates. >> do you remember the early 1980s? >> not well. >> but you existed during that period of time >> yeah. >> i used to stay up late to watch rob and leech. it was a new thing on television where they were documenting th life styles of the rich an famous that took place in a time when interest rates were like 14% there is a reason why wealth people absolutely love highe rates that reason is they earn stock like returns without taking risk. there is a wealth effect tha comes from huge cash balance that are throwing off 4% and 5 yields, taking zero risk i'm starting to see articles i the press and economists talking about how weird this situation is but bizarrely, it may tur

3:10 pm

out that the top 10% o households by income, really high yields, may be stimulative. who do you think is buying the airlines tickets who do you think is buying the nvidia cybertrucks it is people who have piles of cash that are generating mor cash faster than they can spen it i work in wealth management. we serve 4,000 clien households i'm telling you this segment o the population is not only not pulling back because rates are higher but in many cases, they feel they are doing better tha ever it is a really weird situation but here we are. it turns out wealthy consumers in america are not overl dependent on feds fund rates mortgage rates, when they are in a position that they are today >> what if under the surface the economy is not as strong a people would have you believe? the evidence of that could b taken from the base book today

3:11 pm

which was softer in many regions than the data would otherwis suggest? >> the beige book? fairy tales. >> there were surprises within it that would suggest certai metrics that we have bee clinging to relative to economic strength maybe are not quite a strong as we would believe bank of america looks at yield today. others have asked the question at what point would you have a breaking point they suggest you could be over 5% on the 10 year by memoria day. is that a line in the sand problem? >> i think 5% is a red line that forces people who are in the asset allocation business to make a decision. do i really want to reach fo the average annual return, 7%, 8% for u.s. stocks, much lower for foreign stocks do i want to reach for that or just take the 5% and lock it i for 10 years guaranteed, minimal volatility and risk relative t

3:12 pm

the stock market it is an asset allocatio question that i don't care who you are, working in insuranc company, large pension, colleg endowment, institutional asset allocaturs must sit up and pay attention when they get a 10 year at 5% when you look at the history and we did the work yesterday. it was on my blog. when you look at the history o the ten year yield, crossing above 5% from below for th first time, you look a short-term and intermediat returns for s & p 500, it is not great. it is negative 5% versus 2.5 positive it is rare that you see that it usually accompanies that type of raising rate above 5. we can live at 5 we get used to it. the longterm ten year treasury average is about 5 it is that initial crossing that forces allocaturs to think twice

3:13 pm

about the inkremental dollar into equity market risk. i think that's where we are. we are not far away from peopl seriously having to make the decision i'm definitely mindful of it >> let's bring in contributo stephanie lake of hightowe advisors are you getting a little nervous on the what is a bullish vie that you have on where we may go from here, that we need to reset expectations given the push of of rate cuts >> look, i think we have hit a air pocket because we are trying to adjust to what the fed will do we have talked about two t three and now i'm thinking o zero to one in terms of cuts that's what the market is trying to figure out. powell's commentary didn't help. we have to think about highe rates in general for longer.

3:14 pm

but i step back and so to answer your question, no, i'm not mor nervous because the growth i the macro economies around the world is much stronger tha people have expected you are at 2.9% in the u.s., 2.3 from the imf global growth china is seeing signs of life. no one is thinking anythin about china by the way japan has had a new lease on life with their growth and benefitting from the problems in china. you have a lot of growth aroun the world and that's why inflation is more elevated we are one print away, a pce next friday that if it comes i as expected at 2.7, 2.8, tha will calm people down. but growth is what i prefer even if we have inflation tha accompanies it because tha means earnings will be bette and that hasn't changed in m view >> that is fair.

3:15 pm

but john, higher rates have an undeniable impact on the stock you need to pick, relative o whether rates are going down i feel that the places you hav made an argument repeatedly on this program that offer valu are the danger spots perhaps i a higher for longer environment, small and mid caps, utilities. you are not rethinking you strategy whatsoever? >> so the bond market knows more than the fed the bond market is still telling the fed to cut albeit by less. the fund rate is around 5.3, 5.5. so powell really wants to cut. he has been signalling that bu the committee as well as the numbers are pushing him to temper his rhetoric to the public so i think he is in a precarious situation. if we move towards the election,

3:16 pm

he has to make a decision to cut now or after the election to skip over any criticism of letting politics intertwine with fed decision that being said, i do not change any of my views on where the dislocations are i think those are the areas that are the most attractive. when valuations are low, tha provides a margin of safety. i agree with the comment tha josh brown made around yield you should not just search for yield. there are plenty of yield traps. those companies are not what you should be looking for. dividend growth is absolutely thermometer. the areas that are attractiv and predominantly in the value indexes are the rates, utilities as well as the banks >> by virtue of what they are attractive to you b virtue of what, that their valuations are cheaper tha other parts of the market? because that is a dangerous wa to look. as i said, i think value is

3:17 pm

dangerous word to use becaus things could be cheap for reason and what is perceived value today may not be value tomorrow i have a hard time believing that the small and mid caps will do well in a higher rate environment. the market seems to prove that out. i'm not exactly sure why you are not changing in any way your out look based on the overall ou look changing. powell did not sound lik someone yesterday who was in any rush to cut interest rates i'll give you the fact that th last time he spoke he sounde that way but that was not th chair we heard yesterday >> well, i want to be very clear. i think if everyone is looking for the fed to tell them how t pick stocks, that's a poor way to allocate capital. the way you should go abou allocating capital is look for

3:18 pm

dislocations in valuation bu not dislocations i fundamentals that is critical if you look at nexter energy you get a one of the bes relative to decade alexander realty has no break in sales, no break on the collection rates but a significant break in the valuation. that is because of the highe rates. i have a hard time with th argument that you wanted defensive stocks headed into 2023, bracing for the recession. now you don't want the defensive stocks even though they ar materially cheaper utilities are the cheapest since 2000s relative to the market when you look at price to book dividend yield there are similarities the yield curve has the longes inversion going in history i don't think a lot of peopl have talked about that enough. this yield curve inversion i material and it is impacting the

3:19 pm

yield sensitive areas. that is what creates the dislocation and opportunity fo those areas that do not have breaks in fundamentals >> you have been resilient i your belief that the bigge picture is what matters more than anything else you eye has been on the economic ball suggesting that growt supersedes cuts. as long as you have growth, yo will have earnings and at th end of the day, the market wil get over a pocket of insecurit if you want to call it that an focus on the prize at the end of the rainbow and that is good growth and cuts. >> i love earning season because we learn a lot of things and w get opportunities. i call earning season sill season for that reason because you get over exaggeration. i have 9% in cash in m portfolio because i have bee trimming and taking profits in the last couple of weeks but i see opportunities.

3:20 pm

i especially see opportunities when the stocks go down on decent news. i think the banks are wa oversold the reaction was overdone. i think morgan stanley is a bu right here it was the best quarter of the big six. they executed on institutional wealth management, expenses. you have a ce oh, so dialled i to the investigation, they wil have market share three time over initially it is sold down on the reads and that is your opportunity. to me, there are opportunities and we will get more and mor throughout earnings season again, because the macro backdrop is good and the underlying fundamentals ar decent and you can get great chances. >> josh, do you want to give u a last word? >> i don't know, i look at travellers down 7%, worst da since june of 2020

3:21 pm

i know it could be explained away, they had hail storms i the midwest and blah blah blah but there are more and mor stocks that are having earning reactions like that. i was looking at home depo yesterday. i just think we have had a really nice run. it is perfectly fine if stocks come in. if the reason they want to com in is because they are too strong i will buy that all day. i'm on the same page as john and steph. if you look at the transports, they don't look great. the average rsi is 41. none of these are up trends. some of these look bad if we will have the annual correction, let's have it. we are are halfway there >> i don't think you are on th same page. i don't think you agree that you should buy small and mid cap value stocks i think you sold a commercia

3:22 pm

real estate related compan because it was down six days i a row as rates backed up >> well john may have different time frame than i do when i talk, i'm talking about what is happening now. it may be a really smart strategy to think about the most out of favor areas if you extend six months to a year those can end up being incredible investments in tw years. we may just be talking about different time frames. >> sure but people learned the hard way that you can be directionally right on the economy and positionally wrong in the market. you can believe in the story that the economy is going to d well but you can be invested i the wrong kinds of stocks. the rubber will meet the road. i have to go but finish your thought. >> fortunately, there are more than one ways to skin a cat. there are people who focus o valuation, technicals, and a lot of this stuff is dependent o how long you have to allow things to work out >> guys, to be continued

3:23 pm

thank you for being here we are getting news out of washington now and megan has that for us. >> the biden administration is moving this afternoon to reimpose oil sanctions o venezuela. they will end a 6 month reprieve which was dependent on the government adopting more democratic regimes there will be no new activit started. the biden administration has hesitated to take this step an they are worried about the impact of gas prices and immigration in an election yea but they are reimposing th sanctions and they will kick into gear in 45 days >> thank you so much we are just getting started. up next, trouble in th charts, jason hunter is breaking down the key levels he i watching today and how he is navigating the uncertainty i the market he will join us after the break.

3:24 pm

3:25 pm

3:26 pm

you've got xfinity wifi at home. ris take it on the goes with xfinity mobile. customers now get exclusive access to wifi speed up to a gig in millions of locations. plus, buy one unlimited line and get one free. that's like getting two unlimited lines for twenty dollars a month each for a year. so, ditch the other guys and switch today. buy one line of unlimited, get one free for a year with xfinity mobile! plus, save even more and get an eligible 5g phone on us! visit xfinitymobile.com today.

3:27 pm

welcome back the s & p is on pace for the fourth straight down day after moving below the moving averag for the first time in five months earlier this week is there more trouble brewin for stocks let's ask jp morgan's head o strategy good to see you again. what are you watching to help us figure out where we may go fro here >> now that we have stepped back and seen the most momentum fro the last quarter, momentum gauge below 50 and into bearis territory for the first time since that period, now the important part is how the market responds to support. the initial support for the s

3:28 pm

p on the breakdown was 5,000 o below. there is gap support there that's where the sportterm top pattern from the last two months measures out to that area. now the question is does i balance from there and if it does, will it get back above the levels where it gapped dow from we are looking at 51, 50 t 5200 and the s & p is the key resistance you can keep a taxable bia while you are below that >> you are also understandin that even if we have that kind of correction directionally over the last term, it is hard to get too beared up. as you said, bull markets don' usually end because the econom is too good. >> we are pointing to a couple of things. the curve has been inverted fo a while now. if you look at the post 1980 period when the lags of monetary

3:29 pm

policy to it rolling over an economygetting hit, you are in the average period when you look at the recession period post 1980 when the markets start to respond. the one thing we highlighted bullish momentum has dominated and it ran me over in the fourth quarter ofalist year i didn't think the rally would last but we have deceleration where april will close weak, lower than where it closed in marc because march closed at a high that will trigger low frequenc barrel curves. that has not led to good things. at best t is continued deceleration that tops the market outlet and at worst, it turns it immediately toa bea market so you have to hedge you portfolio. what we suggested in the las note was if the market did break

3:30 pm

down, hedge your portfolio, pu a trail stop overhead. and the momentum has been strong and i have been back on my heels for the past quarter as th market surged to the 5200 area but we can't lose sight of the fact that we are uding the yield curve as an indicator an historically, it has not led t good things. >> sure. big question about mega caps we are going to get thos earnings in a week or so this market has been unbelievably resilient even at times when it looked fragile, it does not take much to get the train going down th tracks again i wonder if that's the momen and what recent activity withi the nasdaq 100 tells you >> so two things number one, what was interesting in march, the mega cap was first to stall out you saw the shift where smal caps got pulled along. you saw deep cyclicals, energy financials take the lead and take the s & p higher while th

3:31 pm

nasdaq stalled higher. last time we were on the show, we thought it was suspicious given where the yoeld curve was. and sure enough, it is a catch 22 what you need to support the broadening of the alley will affect we saw a miniature version o the self contained dynamic unfold in the last couple of weeks. small cap cyclicals came under enormous pressure. you saw a bit of rotation back to the mega caps the nasdaq 100, we were lookin at the 17,000, similar report. the market broke below the average. the mega caps leadership, if that struggles to regain ground, that will be the market that the broader tide is starring t turn >> i think it is a fai question the counterargument is i remains to be seen let's see what happens first and

3:32 pm

3:35 pm

stocks are under pressur and the big tech is leading th nasdaq and s & p lower the next guest says don't fear the momentum trade joining me now is sebastio page so you are still neutral on u.s. stocks why? >> enthusiastically neutral. >> from reluctantly bearish to enthusiastically neutral >> the reason i mention this i we do work on strategic asse allocation why not stick to the way it is

3:36 pm

be invested tomatch your ris preferences. so that's why i say aggressively or enthusiastically aneutral >> why are you in the middle what is preventing you fro being more bullish >> well, the bearish case, the bears on the committee are looking at two things that are worrisome, high valuations but it is not just hig valuations it is high valuations with upward pressures on the te year so rising rates. you are starting to see that >> but the bears have been wrong. >> yes the bulls, simple thesis rising earnings and declinin interest rates that how you end up in the middle >> you didn't mention anything about solid economic growth. it is good earnings, growt remains solid and there is n reason to believe the fed is not going to cut as its next move, correct?

3:37 pm

>> i think there is some doubt starting to surface on that. >> only in the timing. >> yeah, i think so. i think the longer ter direction of rates is down but it could take longer i think the upward pressure on inflation is real. that makes investors nervous look, the bullish thesis i still in tact. it is just high valuations you have had quite a few guest talking about adding a pullbac to become more aggressive. >> if you say the bullis narrative is still in tact, don't get the feeling from our conversations that you are i any way bullish. >> no, we are neutral. if you think about the pressur on rates and how it is makin the markets nervous right no and the fact that valuations are high, we have had a good run i stocks where we would rather be invested is our strategic wa and position for marke broadening i think stocks will do okay as the base case. i think credit will do okay. but the risk is to the dow

3:38 pm

side stay invested in a way tha matches your risk tolerance. don't take more risk than usual. >> that's fair but if i'm worried about the impact of higher for longer, maybe they don't hike at all this year and what are the impacts of all of that, how ar you then advocating for th broadening market? >> you know, there are many ways that the market can broaden. it is more likely to broaden towards large camp value stock than towards small we are neutral now between large and small. but we are long value and adding to value there is a valuation case to b long value you are in the bottom quinn tile of the earnings for growth you get 5% 7% value for the next several months that's okay.

3:39 pm

but valuation is only one part of the picture you need a catalyst. there are values acceleratin for growth and there is pressure on rates >> when you say value stocks large cap value stocks, put that into practice for my viewers like what? >> we like energy stocks we like technology in the valu space which is interesting if you look at the end of th year, by the end of the year the consensus is because o easier comparables, valuable earnings will grow faster than growth earnings, believe it or not. that is what is baked in right now and could surprise parts o the market the one last thing i want to say, the other catalyst fo value is sentiment

3:40 pm

value has been unloved 90% percentile in terms of relative to value over the las year you have a coil spring o valuation and fundamental macr and sentimental catalyst takin place. you rebalance. broeth is rallying and you rebalance and increase you target >> good to catch up with you >> like wise up next, tracking th biggest movers as we head into the close. steve kovach is back with that >> a popular name is seeing boost from a congressional aid package and a software company sinking after an interna investigation into its financial reporting. details when closing bel returns.

3:44 pm

we are 15 out from the bell. let's get back to steve kovach for a look at the stocks he is watching >> let's check out autodes which is down 14% the company delayed releasin the 10k as it continues an internal investigation related to reporting the company's finances autodesk said yesterday it expects to hear from nasdaq an has 60 days to file the form and snap shares are surgin 6% right now up as much as 8 earlier after bloomberg reported that the house o representatives would lump the

3:45 pm

tiktok ban in a package fo funding for the israel and you crane wars president biden had previously said he would sign the ban int law if congress passes it. >> thank you, steve. still ahead, las vegas sands reporting that stocks had volatile year so far ats at stake and the key themes and metrics to look out for. and more about discovering magic. rich is being able to keep your loved ones close. and also send them away. rich is living life your way. and having someone who can help you get there. the key to being rich is knowing what counts.

3:46 pm

3:47 pm

and feeding their dogs dog food that's actually well, food. developed with vets. made from real meat and veggies. portioned for your dog. and delivered right to your door. it's smarter, healthier pet food. get 50% off your first box at thefarmersdog.com/realfood hi, i'm kim, and i lost 67 pounds on golo. when i go out with people, they expect me to eat like a bird. they are shocked by the amount of food i eat while losing weight. with golo, i don't need a cheat day

3:48 pm

because i get to eat the foods i like any day of the week. [thunder rumbles] ♪ ♪ ♪ ♪ the biggest ideas inspire new ones. 30 years ago, state street created an etf that inspired the world to invest differently. it still does. what can you do with spy? ♪ ♪ [thunder rumbles] ♪ ♪ coming up next, las vega sands and discover financial

3:49 pm

some of the big names at the top of the hour. we will give you a rundown o the key things to watc happening after this break new projects means new project managers. you need to hire. i need indeed. indeed you do. when you sponsor a job, you immediately get your shortlist of quality candidates, whose resumes on indeed match your job criteria. visit indeed.com/hire and get started today.

3:50 pm

3:51 pm

you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for. so this is pickleball? it's basically tennis for babies, but for adults. it should be called wiffle tennis. pickle! yeah, aw! whoo! ♪♪ these guys are intense.

3:52 pm

we got nothing to worry about. with e*trade from morgan stanley, we're ready for whatever gets served up. dude, you gotta work on your trash talk. i'd rather work on saving for retirement. or college, since you like to get schooled. that's a pretty good burn, right? got him. good game. thanks for coming to our clinic, first one's free. we are now in the closin bell market zone senior markets commentator mar santelli is here to brake brai down the day and contessa brewer has what t expect from las vegas sands an we have the earnings coming up at the top of the hour michael, to you first, we ar hanging around this market >> in general, the tape is

3:53 pm

heavy. a couple of rallies were knocked down there was not a lot of urgen get me out it is just a lot of up and down. it is really about just semi getting hit today. that's okay. so we almost have a 5% pullbac in the s & p peaked at 4.5 or there abouts. what is supposed to be accomplished in a typical 5% pullback, you get sentiment of the board, reassess th fundamental story that got u here i don't think there is a major rethink if bonds will stay tame. you did get treasuries responding to being oversold >> you ratchet up th nervousness if you hit the 5 pullback level then you start looking a literal levels of things lik the s & p where we were just a or above 5,000 and then we have rallied ove the last couple of hours >> we will try i don't know if i will invest

3:54 pm

ton of significance in a lasting way but it is part of th testing process. 5% down. that happens multiple times in a typical year it is not something that you raise alarms about but as you know, every 10% starts with a 5% >> that's right. hiding out in the usua suspects, utilities, staples among those. materials green. it is not all red. >> it is not you have relief on the consume cycles which i have been focused on with the moving yields. >> contessa brewers, lvs, what should we look out for >> las vegas sands is solely relying on asia business for business so the focus is on macow's recovery and whether the chinese visitors are spending freely what we heard, there are questions on whether chinese tourists are spending inside china. we anyhow the revenue was up overall 53% year over year i

3:55 pm

march. that is all of the casinos operating there. they have been driving the results in singapore we will watch to see if the most lucrative resort sets records, marina based sands they are expecting $3 billion in revenue for the quarter an earnings up 62 cents a share the share price is not reflected the gradual ramp of the past year in the recovery since pos covid. they are lower 14% over the last 12 months. is that a buy back opportunity at this point when you have th share price sitting there just hovering, showing no movement in spite of quarter on quarte improvement. >> appreciate it we will see you at the top o the hour on fithantial, what do we need to know? >> discover is the fourt largest cart behind visa, master card and american express.

3:56 pm

it could be a read through for what to expect from the others it caters to a more affluent spender. watch the delinquency rate for discover it fell in march discover is also a bank in addition to a card issuer. so investors are watching things like net interest income provisions for loan losses and net charge offs. any updates on the discove capital one deal, the $3 billion acquisition wa announced in february. it is expected to close late this year or early next year pending regulatory approval. we may get some commentary o that >> we will see you at the top of the hour michael turning back to you, netflix trading. >> it is the start of the growth stocks which have been with th earnings momentum. a ton of fed speak tomorrow as well we have three or four over the course of the trading day.

3:57 pm

it is interesting, it will be test on whether we have been desensitized to the new message. we are in the same place inflation sticky, growth i good maybe after powell's comments, we have build up calluse against that it will be an interesting test to see if the deep selloff i the treasury marg t for now ha run its course >> i was hoping that the chair powell had put an end to the expectation of fed speak because the largest voice with the biggest mega phone spoke >> i think there is a chance the market said we got this. if you have someone repeating similar message, we have a charge pushed way out. it is much more about does the market shrug and say thank you we understand where we are right now. every narrative overshoots the soft landing plus a fe

3:58 pm

easing overshot enone direction. the unstoppable overheatin economy with sticky inflation is maybe overshooting as well hopefully we can come back fro the bripg of that. >> we will have an a day i which the chips didn't perform well and you had sellers i sympathy as we march closer to nvidia's earnings, more and mor important. >> four to five weeks. we have a little while to go last quarter, i was a little skeptical that it would be the big market moving tell and i absolutely was i mentioneded earlier today that we are trading in the ga created by the market reaction to nvidia's blowout earnings almost two months ago. it is worth keeping an eye on. >> we had a call on apple to affirming questioning whether it was dead money in the nearterm if not for the foreseeable future on what has been an upset stock of late. >> it has not been able to get out of its own way

3:59 pm

many people said at the time that the valuation got ahead o itself and it seems like it is rationalizing that for now the street has cooled on it. it may not be a negative thing you only have a 50/50 buy. >> for a stock that is not use to going into an earning report, considered dead money. how often have you heard that? >> it has been dead money in reality for 12 to 18 months at a time it hasn't happened often >> it is time to put up or participate. as you heard jason hunte talking about the technica breakdown of the nasdaq 100, n doubt about it we will see if we have to pull back the sling shot more to ge a balance. >> we have a big crowd here fo a big reason we will show you the balcony it is a momentous day for us a cnbc as we mark our 35th

4:00 pm

anniversary. a heartfelt and very large thank you to all of those who helped us get here. it does take a village president casey sullivan is on the podium today, senior executives and longtim employees of the network proud day for everyone as you mentioned, we hav familiar faces from cnbc ringing the bell at the new york stock exchange including the president casey sullivan, and a number o our colleagues celebrating the network's 35th birthday. >> happy birthday. >> we don't look a day over 27 athletes from team usa are marking 100 days until the start of the paris olympics at the nasdaq and of course broadcasting thi summer on nbc and peacock. now welcome to closing bel overtime i'm jo

35 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11