tv Power Lunch CNBC April 17, 2024 2:00pm-3:00pm EDT

2:00 pm

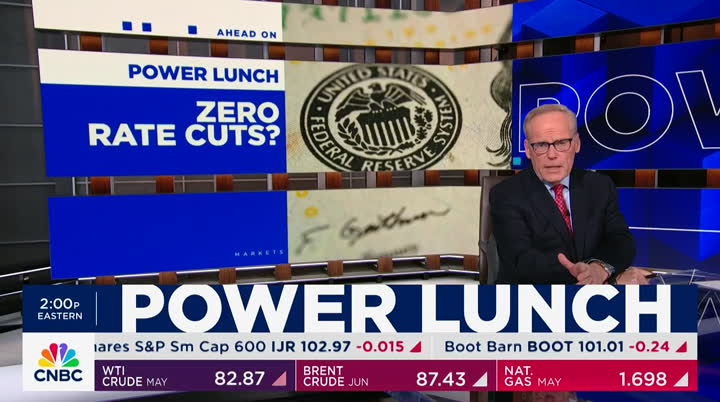

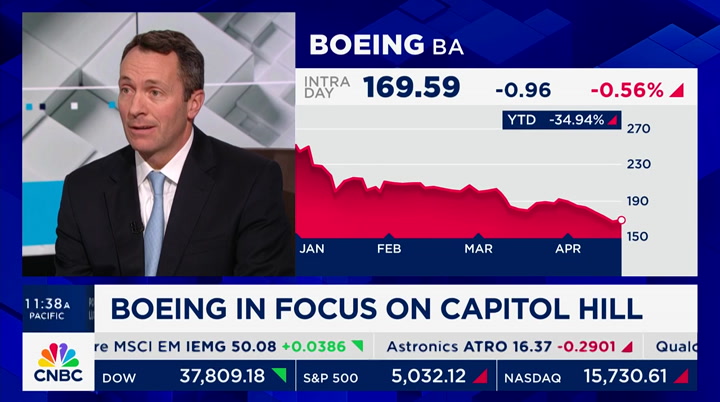

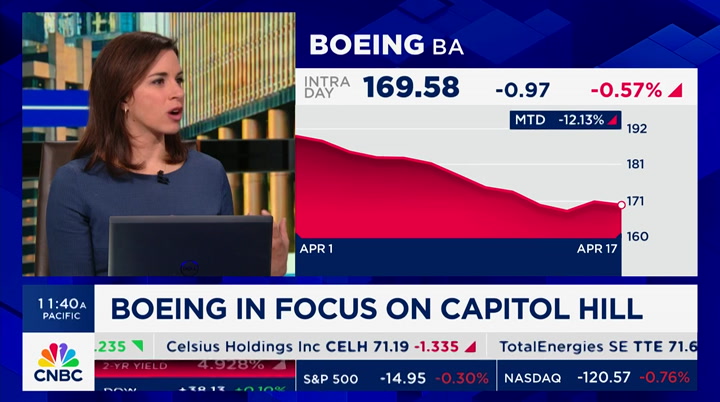

alongside leslie packer, good to have you with us. i'm tyler matheson, stoks mostly lower as an awful april continues. we have not had this kind of decline in a while while this might not be coming to the rescue, they are grappling with the possibility of zero rate cuts this year, we will get the latest read on the economy from the wonderful, aptly titled page broke. a boeing whistleblower testifying on capitol hill, they're putting out defective airplanes and should stop their liner production. they need the latest on the

2:01 pm

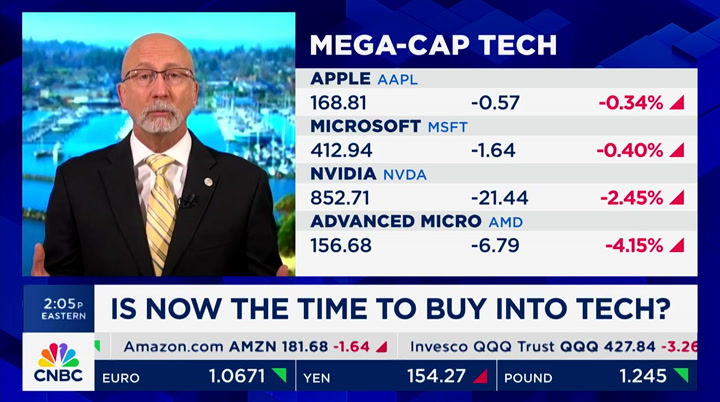

company. let's get a check on the markets as tyler mentioned, kind of a mixed day, the dow getting the upside. less than 1%, the s&p up about -- down 3/10 of 1%, the nasdaq down about two thirds of 1% today. here's a look at how bad april has been, this is the 13th trading day of the month. that is 10 sessions in the red and only two updates, only a 1% gain yesterday, that's unlucky before things turn around, despite the recent stock selloff, our next guest is not concern and things the arkets have been long overdue for a correction. now is the time to buy into major artificial intelligence names. keith fitzgerald, thanks for being here. we are within ai, where do you think there is opportunity for

2:02 pm

fullback? >> there's clearly lots of opportunity, do you want to buy at the needle in a haystack time, i did -- you're talking about 70, 80, 90% market share in the gpu and cpu market. >> you said the markets were long overdue for a pullback, do you think there still is more downside, would you wait to be putting money to work or do you think that now is kind of an appropriate floor for further upside from here? >> trading being the way it is, the moment i say there's a floor it will go to zero tomorrow. i don't think there is a floor, the middle east has the potential in the world market. this is where you change tactics, this is where you slow down your buying, where you are a little more careful about how you buy and when you buy. the fact is they want to continue to play to win, that's how you do win. >> let's talk about apple and your hypothesis that the

2:03 pm

developers conference for may or early june could be a 2007 moment for this company, i.e. the moment when the iphone was introduced. why do you say that and what will be the cause of the catalyst for that iphone moment? >> thank you for asking, i think what we are going to find out is that apple is a lot farther along in the ai speeds than people realize. how it processes things, we have both apple and microsoft equipment in our offices. the apple stuff is faster and more accurate, the critical piece for me, we may learn that apple actually puts ai on board. the big jump is going to be that it does not have to go to the web or generative engines, i think the operating system could see something substantially deeper and burrowed in farther that could be beneficial for apple.

2:04 pm

>> i will be able to communicate with my computer or iphone in a way that might be a quantum leap forward from what i'm accustomed to now? >> that's what i think is coming, if you remember how steve jobs released the iphone, he was coy about it, x, y, and z. oh my goodness, there it was. that was their memo, i'm hearing all the familiar shades and all the evidence leads me to believe we could be on the cusp of that. >> what about within the chip space? >> amd and nvidia both. >> why those two specifically? >> dominant market share, absolute excellence in terms of what they do and they are buying every chip they are making for the for suitable future. customers have to buy because they want to, are you at all chilled by the slight chill?

2:05 pm

nvidia shares in recent days. >> yes, i'm a little concerned that i would not be good at my job if i were chill, here's why. companies like amazon, microsoft, apple. anyone in the tech space have all had pullbacks over the years when people forget that amazon lost 90+ percent of its value, this is familiar territory. this is deja vu all over again, the market has backed away because of all the leverage. it does not disturb the long term investment cases. >> i will ask you to stick around while we go to steve policeman, steve? >> there's nothing more exciting, i this is it interesting base for the following reason, i will bring you anecdotal information.

2:06 pm

they sound at odds with some of the economic data we have been talking about. economic data has been strong, these comments are modest. economic activity has been expanded only slightly, a little bit the way it was last month. a bit of an acceleration but a very honest -- modest rate. nearly increased, we got that strong retail sales reporting. price sensitivity remained elevated, they were shying away from higher prices, they were not up because a better inventory and rate coming down, they were cautiously optimistic among those serving. the credit rose at a slight pace, nine districts. nine of the 12 reported slow to modest increases in jobs, labor supply side improving however. we have persistent commentary

2:07 pm

about shortages of qualified applicants, labor, demand, and supply were seen as stable. price increases were modest running at the same place -- pace. we were talking about sluggish inflation are coming down, there were some shipping delays and new -- noted. there were sharp increases in insurance rates, and the ability to pass along cost decreases to consumers has weekend putting pressure on profit margins, inflation was expected to hold steady and there is some upset by manufacturers on both input and output costs, there was a study recently done by the cleveland fed that they do a good job of protecting recessions. not so much on whether or not inflation is a half a point

2:08 pm

higher or lower than gdp but does a good job of signaling whether or not there is a recession coming. it's not a recessionary calm but it does feel weaker than other economic data we were talking about. >> is a surprise in the report? >> it is to me and i know you were joking, i find this report to be very helpful in understanding two things, where the economy is going. good what the fed is hearing from their contacts, we do get a little behind-the-scenes look because fed officials meet with businesses around the country all the time, this is what they are hearing and they are hearing the story of a somewhat weaker economy than the story being told. >> it is valuable, i just love -- i'm endlessly emotional. it's beige. it is the green book, keith,

2:09 pm

any thoughts on the beige book? how do you like beige? >> ages a gray color. that was about as a sink day run down as i have ever heard, my hats off, i cannot have done that. i think steve highlights a good point, the difference between recent data and the beige book, the markets have accelerated faster than headlines and data points can keep up, really the message is do we or do we believe that the data points -- if so which ones, i go with the ceos and companies every single day because i think the fed data is weird looking, they are in charge of making money and forward-looking. >> i did have one thing that steve mentioned, that was this idea that inflation has gotten to this point where it's becoming more difficult to have companies pass those price increases on to customers losing that volume, we play a sound bite from the issue -- interview this morning with a

2:10 pm

restaurant ceo who said the same thing. as we are getting into the peak of earnings season in the next few weeks, do you expect to see that translate into margins as well? >> that's a very interesting question if you are talking about things like pepsi cans or fritos, or chips. i expect consumers pushing back because they are reaching their limit, they've had it with what it's doing to their wallets. if you talk about tech, missiles, or healthcare, those things are relatively margin indifferent. that makes those things priced insensitive, even though the consumers wind up paying more. >> thank you very much, keith fitzgerald. >> i think leslie raised a profound economic theory which is that prices can't go up if you cannot raise prices. we may be at the tail end of the ability of companies to

2:11 pm

pass along those prices, i would watch profit margins, that's really what leslie is getting at. profit margins have remained relatively robust in the post-pandemic period and there is room for them to come down, companies remain profitable still but not necessarily for prophets to rise as much for the cost of pennies to begin to try to cut back and impair costs in order to keep margins up, companies will always try to defend profit margins before they end up reducing them. it is something to watch for, it's a transition period coming off of a period of high inflation were companies do well and this will be more challenging for the corporate world if prices are going to be more difficult to pass along to higher prices. >> thank you very much, steve, we appreciate your time. coming up, three big stories out of china. the white house ramping up terror threats -- terrorist threats, seeing growth

2:12 pm

concerns, and apple considering a move to indonesia over some china worries of its own. we will discuss all of this when power lunch returns i have a business idea. and it just might change the world. but here's the thing, i can't do it... alone. so, are you in? i'm in. nothing else to do. yeah, i don't know... um, i need to speak to my agent. (snoring) i think creed's out.

2:13 pm

investment professionals know the importance of keeping their clients on track. sometimes they need help cutting through the noise, to ensure fresh investment ideas keep flowing, and to analyze the market from every angle. at allspring, we deliver the unexpected, by relentlessly exploring where others don't. allspring, follow the insight.

2:15 pm

business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today.

2:16 pm

>> he's going to be unveiling a series of trade moves against china, he wants to triple tariffs on all steel and aluminum will be launching an investigation into his tiny subsidies into its shipbuilding industry, and its funding to mexico to cut down efforts to evade tariffs already in place, the biden administration says this will not drive up prices for businesses or consumers arguing would be more harmful to allow china to keep over using -- overproducing. >> we want to get ahead of the curve, take action we will not think as much inflationary impact given the magnitude, we are putting at risk one of the most critical sectors. his policies are less inflationary.

2:17 pm

at the same time, trump has replaced all tariffs on china. they have some new analysis showing biden has now connected far more revenue than trump ever did, economists agree those tariffs are attacks on consumers no matter who imposes them. guys? >> how likely, a tripling of tariffs and how likely is that he will be able to do that? >> slightly more than a tripling, the average tariff is about 7 1/2%. they want to pull that up to 25%, it appears likely they can. biden's trade office has been reviewing trumps tariffs, they will follow biden's direction, more than triple them likely to happen, the u.s. tariff will follow biden's direction. it could be a matter of weeks. >> megan, thank you so much. apple continuing to look at

2:18 pm

opportunities for manufacturing outside of china, we heard about india, next stop could be indonesia. steve kovach joining us. >> in indonesia, some comments came out saying he will look at investment in the country. they don't do much there yet, i also note he was in vietnam. they do some manufacturing. potentially to go to india to go to similar meetings, why is this happening, we have been seeing this play out in indonesia. we have been seeing this theme play out for the last year to 18 months or so as we saw all these problems that covid shutdowns in china caused for apple supply chain and sales in china which were down 13%. this is apple diversifying away from china both on the sales front and on the manufacturing front.

2:19 pm

the iphone production has doubled in india, it will be a panacea for apple to open up more manufacturing. the vast majority is still happening in china absheer we often hear tim cook say, he will say this again. these emerging markets are growing rapidly. >> china has its own human rights concerns but doesn't indonesia too? >> india does as well, not to mention, accusations of state- sponsored assassinations, that's another issue that apple continues to face not just in china, they are very different about putting out ideals. they also have to do business in these countries that don't necessarily lineup with these ideals and we are seeing different instances where they have to compromise. the most

2:20 pm

notable one was fall of 22 where there were protests. getting beaten down by security forces to keep them in, apple was largely silent on that and did not even say anything against the violence, there have been so many instances or several instances where yard, they have to compromise on their values in order to do business. it is not without controversy. >> in diversifying the supply chain, i understand. i know that there are more expensive manufacturing hubs that do not come with those geopolitical risks or human rights risks. are you considering those at all? >> i will go back to what tim cook has told me in the past about india, india is growing, a rapid middle-class. a growing educated middle-class approaching -- there is a job

2:21 pm

opportunity for potential customers, that said, apple products are too expensive for most indians to buy, i will point to that growing middle class, there's a reason why they see opportunity. >> very difficult balance nonetheless, interesting story. our next up on the virtual china tour, lagging luxury lv mh saying it's wealth is slowing because of wealthy spending by consumers. hi, robert. they reported a 6% decline, that's mainly china, if you include spending by chinese taurus outside of china, sales for china and total increased 10%, a lot of that buying was by the chinese in japan.

2:22 pm

that shift in chinese buying rather than an overall decline in chinese spending, it's a fairly weak quarter, lvmh sales of only 3%, down 12%, wine and spirits, jewelry and watches including tiffany down 2%, fashion and leather goods sales up a little bit 2%. we all know china had been the big growth engine for luxury, that was the big hope, now market share is shrinking, for about 23% of global luxury sales and down from 33% before the pandemic, on the face of it, this is a very weak report and week for china, when you include japan, it was not so bad and overall, we are not seeing china rebound but that a client has not been as fast as some of you had feared and

2:23 pm

that's why we are saying the stock react the way it did. >> it is still striking to see those figures you provided about how chinese consumers comprise about a third of the luxury spending before the pandemic and that is dropping so significantly, i'm curious if there are other markets making up the difference in particular that have seen a surge in luxury spending in that time period >> the u.s. was the new china four years until the end of last year, the u.s. was making up the difference and lvmh shifted its market power to the u.s. as its hope, now we see the u.s. struggle especially on that aspirational end so lower priced products at tiffany, that's where they really struggled on a call today, they said they see signs the aspirational consumer may be coming back in the second or third quarter, i don't know what evidence they have but that's another reason why the

2:24 pm

2:26 pm

ameritrade is now part of schwab. bringing you an elevated experience, tailor-made for trader minds. go deeper with thinkorswim: our award-wining trading platforms. unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly.

2:27 pm

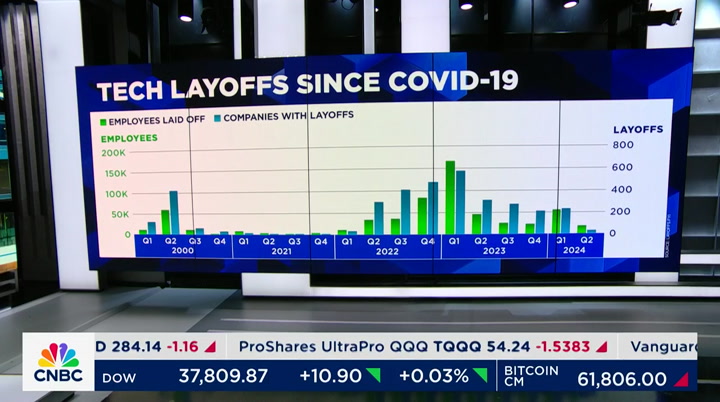

the practice of staff ranking employees might be making a comeback in silicon valley, kate rooney joins us with the latest for today's tech check, after massive waves of tech layoffs, employees may have thought their jobs were safer, that might not be the case at this point with new forms of staff ranking coming back, this is where you rank employees on a bell curve then cut the bottom portion, made famous by jack welsh, the former ceo called ge, reagan yank, they have been bringing it back in different forms as a means to keep headcount in check during new years of efficiency and heading into earnings, discipline and cost discipline is a theme in what investors want to see, names like amazon, alphabet, and meta- have cut double digit percentages of their workforce

2:28 pm

after over hiring during the pandemic, they use some sort of employee waiting -- rating system, shop fis using that system and only those whose score increases are eligible according to the report which shopify executives are pushing back on. this does signal a shift in tech culture, they over hired and were fiercely competing for talent back in the pandemic. in the end of zero interest rate, that changed the hiring landscape dramatically. they laid off thousands of workers, they need to prove that efficiency and have been awarded me with some cost discipline layouts. >> i used to be, i don't want to attribute this and i may be doing so incorrectly.

2:29 pm

called the weakest 10 or 15% of the herd every year, is that where the 10 companies -- tech companies seem to be going? >> instead of going through these rounds, it is seen as american autocracy. that's the fair way to do it, you hear something about a pep, performance improvement plan. tyler, hopefully you are not on there. he will get laid off, we give you the opportunity and say here's your opportunity to go and improve your performance. it is seen as a negative, this might resonate covering the banking sector, this also happens in banking, if you're not a top performer, you will get that bonus and be let go, it is less explicit.

2:30 pm

we rate people, it's easier to approve and quantify in finance. if you are not a drop -- top trader, leslie is ringing in the most as far as trading, kate is underperforming, get rid of kate. in engineering, is more subjective and team oriented so the downside of some of this can be less collaborative. it has been the negative commentary, it's not effective. >> 11 on a scale of 10? >> thanks. let's go over to an 11 on the scale of 10. >> i would say so myself, here's a news update around the president putting israel on morning during a speech at the annual army parade, the tiniest invasion by israel and bring a massive and harsh response.

2:31 pm

israel is weighing retaliation against iran following a weekend drone and missile attack, that is overshadowing a meeting, the escalation of tensions is expected to dominate the agenda over the next three days, israel told its allies today it will make its own decisions despite western calls for restraint, secretary of state antony blinken arrived in italy this afternoon for talks. actor hugh grant settling a privacy case for what he called an enormous amount of money. the publication used private investigators to tap his phone, but his car, and break into his house. he did not want to settle the case but felt he sort of has to because his trial was likely to be very expensive.

2:32 pm

back to you. >> seema moody, thank you very much. boeings whistleblower testifying in front of the senate, with the management change already underway, what other risks could boeing face? we will k a asboeing show holder -- shareholder for his taken next. business. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. it's the go-tos that keep us going. the places we cheer. trust. hang out. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. powering more businesses than anyone. powering possibilities.

2:33 pm

2:34 pm

the stock market does. in fact, most people don't find them all that exciting. but, if you're looking for the potential for consistent income that's federally tax-free. now is an excellent time to consider municipal bonds from hennion & walsh. if you have at least $10,000 to invest, call and talk with one of our bond specialists at 1-800-217-3217. we'll send you our exclusive bond guide, free with details about how bonds can be an important part of your portfolio. hennion & walsh has specialized in fixed income and growth solutions for 30 years, and offers high-quality municipal bonds from across the country. they provide the potential for regular income are federally tax-free and have historically low risk. call today to request your free bond guide. 1-800-217-3217. that's 1-800-217-3217.

2:35 pm

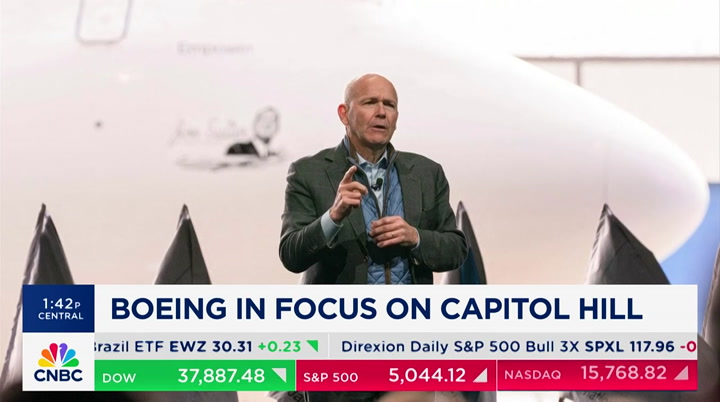

boeing whistleblower on capitol hill detailing problems he sees in the companies manufacturing process. >> in the rush to announce problems, piecing together excessive doors to make him appear that the gaps do not exist even though they exist, the gap did not actually -- and this may result in premature fatigue, effectively they are putting out ineffective airplanes. >> we are getting -- testimony. >> we have a statement from the faa because it was not just boeing blasted during this two hour hearing looking after safety culture and manufacturing

2:36 pm

process, it was the faa with only the whistleblower but others saying look, the faa is not doing job. we are hearing from the fea, the administration's saying the faa administrator, mike whitaker made it clear this will not be back to business as usual boeing. the company must commit to real and profound improvements and we hold them accountable every step of the way, we continue our aggressive oversight of boeing and ensure the company comprehensively addresses findings of our recent audit and expectations from the oda panel. the process for approving aircraft used in this country, we point out the faa has actually been ticketing every dream liner that's come off the line since 2020, there's pushback from both boeing as well as the faa regarding the allegations that we have heard over the last week from this whistleblower that things are not being made the right way at the -- after liner when it

2:37 pm

comes to the dream liner. we think we will get a statement from boeing at some point pushing back on a lot of the testimony we have heard today. we will send it back to you. >> let's get some reaction from tony bancroft, a boeing shareholder and portfolio manager. from the aerospace and defense etf, which has boeing as it second-largest position that would suggest you are confident that boeing is the place to be, they are creating and building safe aircraft. >> it is great to be back, boeing is one of our largest positions in our commercial airspace and etf. i think up front, the customers most impacted, the people most impacted, there are the airlines. after this morning, another

2:38 pm

alliance making comment. they cannot buy enough boeing aircraft smacked 77, 777. the faa and boeing went through a process in 2020 to '22 to work on this gap issue, they have a hearing on this warning. i think they come up with a solution and those planes were flying perfectly fine in general, aviation is still the safest form, the faa has not had a crash related death since 2009. the faa aircraft. >> faa aircraft since 2009 have not had a crash. dated crash. the faa is -- the fleet of aircraft in the united states.

2:39 pm

gets the gold standard of travel, and transfer. 10 to 12 million people have had safe lying. >> when you are hearing it whistleblower or testimony like you have heard, how do you process it. how do you put it into the algorithm that brings you to an investment decision about a company, do you look at it as an isolated opinion or -- how do you process -- >> the testimony that happened this morning particularly with the engineering and qa personnel talking about 777, those two aircraft have some of the four most safety records in history, in commercial travel, and cargo travel, the planes have been the workhorse throughout covid, the 77 was

2:40 pm

multiple types of flights throughout that time, that's just the reality, i think the data is pretty much improved. >> have you heard about the public feels, their arm means -- there are memes surrounding safety, they are discovering that the plane they have a ticket for is the boeing aircraft, has there been any sort of boycotting or this taste about flying boeing you think will trickle down? >> 51% of the faa fleet is a boeing aircraft, 20 some percent is airbus, you will be flying the probability stage, which goes on every day, on a year-over-year basis, pre-

2:41 pm

pandemic levels. they might focus on this, sort of the whiteboard, the huge white board except for the little black dot, they are flying safely every day, the airlines with boeing are doing that. >> i take your point that boeing is building a safe aircraft, the one that boeing had was not a safe aircraft. statistically safe incidents will happen, unfortunately in this case, nobody died or was injured in any amount that i think things happen, aviation and -- putting together complex planes highly variable is part of the manufacturing process. there will be errors, i think they will be focused on that, their focus going forward, they

2:42 pm

go for -- moving forward. as a shareholder, the change at the leadership of the company a good move. >> calhoun was going to be -- in or around the time he was going to at the -- we really focus on, going forward, boeing is a great opportunity here is a portfolio manager to earn it, the backdrop and fundamentals of the industry, travel is being set to outpace global gdp. all things being equal, we continue to do that and boeing is well-positioned to benefit. >> great to see you. coming up, juicy details, we will get a little bit of insight.

2:43 pm

from a consumer facing ceo of the impact of stubborn inflation. inflation. we are back in two [alarm bee. ng] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more prospectus at invesco.com.

2:44 pm

2:46 pm

welcome back, there's a general atlantic investor in new york city, the firm with $83 million in assets under management showcased at folio companies including joe and the , the juice bar and sandwich concept test 360 stores in 18 markets worldwide including a tone town -- hometown of copenhagen, i asked them how they were weathering inflationary pressures right now. >> we have been fortunate that we are able to pass on the raw material that we have seen to our guests, we are aware we are coming through the exception point that how much more can we pass through, the margins we saw prior to this inflation

2:47 pm

pressure and where we are today, we managed to keep. inflationary pressures are particularly challenging particular in wage pressure, the company was born in denmark which has historically had the highest median wage in europe. these companies have been able to and have been pushing through prices. >> they maybe hitting a resistance point. >> that's exactly -- these things in new york, new york and california there's two very close to the new york stock exchange. they looked good. it he said 6:00 a.m. for those early risers. planes, travelers, we will talk jb hunt trels inrae,aversunc more next.

2:49 pm

2:50 pm

if you've ever grilled, you know you can count on propane to make everything great. but did you know propane also powers school buses that produce lower emissions that lead to higher test scores? or that propane can cut your energy costs at home? it powers big jobs and small ones too. from hospitals to hospitality, people rely on propane-an energy source that's affordable, plentiful, and environmentally friendly for everyone. get the facts at propane.com/now. time for today's three sto lunch. here with our trade stock, scott nation, president of natio indexes. let's begin with travelers

2:51 pm

seeing the biggest selloff i four years after the insurance announced a profit miss. and what is your trade o travelers? >> it is a buy even though you are right. it is the worst performer in the dow today. it has spent much of the morning as the worst performer in the & p, missed earnings, core share earnings, 46t versus 4.90 whic is what was expected but they beat on revenue what was the problem catastrophic losses were up by a third year over year the ratios are attractive so i is a buy inflation hurts on the claim side but higher rates do wonders for their investment portfolio most importantly, this is really well run company that will figure it out. it is a buy at about 7% discount to where it closed yesterday >> travelling to the up side

2:52 pm

there. up next, shares of j.b hunt under pressure after the trucking firm missed estimates for the first quarter, results due to weaker demand this is an ugly stock char here scott, what's your trade >> unfortunately, j.b. hunt is sell they were tagged with travellers as the worst name in the s & p for the day. they are at a 1.52 versus 1.80 estimate and 1.89 a year ago rates received have collapse for trucking companies, down 2.5% year to date. so rev now is falling as diese prices increase by 3.5%. they are still struggling to find drivers forward pe now 23.5. this is not a bargain by any measure. and investors don't have to be along for the ride in a spac

2:53 pm

that is really tough right now let's move on to uniated airlines which is soaring. carrier forecast stronger than expected earnings and issues a boeing will not caus significant losses your take on ual >> ual is a buy even though it is the best performer in the s & p today, up 16%, just a fe moments ago. you pointed out the forwar guidance they are guiding full year eps to be between $9 and $11 a share. the mid point of that is above consensus estimates of 9.67. they lost $200 million because of the grounding of the 737 ma 9s but they have alternatives whe it comes to juggling routes than someone like southwest they are in a better situation they may have capacity problem this summer, nysproblem to have. the forward pe is microscopic.

2:54 pm

they expect robust growth this year and the following year. this business can be incredibl cyclical but the evaluatio makes it very compelling >> thank you very much we appreciate your time. >> thank you >> remember you can always hea us on your podcast be sure to follow and listen t power lunch on your favorite streaming service. we'll be right back. (grandpa vo) i'm the richest guy in the world. hi baby! (woman 1 vo) i have inherited the best traditions. (woman 2 vo) i have a great boss... it's me. (man 1 vo) i have people, people i can count on. (man 2 vo) i have time to give (grandma vo) and a million stories to share. (grandpa vo) if that's not rich, i don't know what is. (vo) the key to being rich is knowing what counts.

2:57 pm

the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab. welcome back the numbers are in and monda night's wnba draft was a sla dunk for tv ratings, a recor 2.45 million viewers tuned in to espn to see iowa super sta caitlin clark and others get drafted as interest in women's hoops grows. we will get more on that tomorrow when we talk to the wnba commissioner. she will join us from our cnbc

2:58 pm

change makers event in new yor city to learn more about change makers, you can scan the qr code on your screen all right. to a more serious basketball story. the nba has issued a lifetim ban to the toronto raptors jontay porter for violating th league's gambling rules. contessa crewer is here with the details. >> we found out that the forward allegedly bet on basketball an his own team draft kings said that prop bet for a couple of dates earlier in the year were the bigges winners that day the nba said a leagu investigation found that porte violated league rules by disclosing confidentia information to sports better and limiting his own arpgz i one or more games to affect th games. he intentionally limited his play in sacramento, claiming h

2:59 pm

was sick he allegedly told someone ahea of time who then used that information to make an $80,000 parlay bet that was not paid commissioner adam silver previously called the lifetime ban the ultimate extreme optio at his disposal for discipline clearly, he thought it was necessary. this is the first time an nb player has received a lifetime ban for gambling >> i can't think of anothe player who received that other than pete rose who was then manager. >> and he went on the record t say he was not gambling on the reds but there has been shohe ohtani, issues about iow college and the temple bette irregulators >> ohtani has been cleared >> yes, it was his interpreter but there are still all of these

3:00 pm

questions. the commissioner is quoted today saying we need to look at th kinds of bets that are available. >> that guy could say i'm no playing tonight, tells a friend. >> we need 4 more minutes fo this >> thank you for watching, queen of gambling. >> and insurance >> thank you for watching powe lunch. closing bell starts right now. thank you so much. welcome to closing bell. i'm scott walker live at the new york stock exchange. we are beginning with majo questions on the bull market whether it can withstand a worther right in interest rate and what happens init can't. we will ask our experts. look at the score card with 60 minutes to go in regulation. a rare respite in the rate ris but failing to get much goin for stocks we are still in the red across the board. tech and industrial sectors ar weighing on the major averages today. and aml putting a dip in the

29 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11