tv The Exchange CNBC April 17, 2024 1:00pm-2:00pm EDT

1:00 pm

anybody is breaking news. but thank you very much for that. >> don't count on it coming your way. >> fine, that would be fine. jason snipe? >> i like axp, 12 million new members last year. i like this one. >> interactive brokers, stay long. >> i look forward to "closing bell." "the exchange" begins right now. >> scott, thank you very much. welcome to "the exchange." i'm tyler mathisen in today for kelly evans. here's what we got for you this hour. has the fed's base case shifted from later cuts to no cuts at all this year? our market guest says it doesn't really matter for stocks. he sees them going higher, regardless. he tells us why, and the one scenario that could change all that. plus, credit card debt. record high at the same time, using buy now, pay later to fund purchases remains very popular. we'll have more on what they are

1:01 pm

seeing. a push to on or near shoring supply chains is making one sector increasingly attractive. we'll tell you the names that stand to benefit the most. we begin with the markets and dom chu on the numbers. >> we started off positive, tyler, but we have turned more negative as the day has progressed. the midday action, right across the board. the dow down about 128 points. that's roughly a 1/3 of 1% decline, to 37,675 so modest, yes it a es a little more pervasive for the s&p 500 which is 5,015, down 35 points, three quarters of 1% declines here. the highs of the session, we were up roughly 26 points and down 44. so near the lows of the session right now. the nasdaq composite really kind of pacing that lag to the downside 15,684 is your trade for the nasdaq, up 180 points north of 1% declines at this stain. it's not all red, though

1:02 pm

check out the airline stocks the single best performer in the s&p 500 is united airlines on the heels of a wetter than expected quarterly report and a better forecast for the current quarter, having united shares up 14%. american airlines, delta airlines, southwest, all part of that ripple effect, carry through trades the worst performer in the s&p 500 is insurance giant travelers, down 8% to $205 per share. if you look at the reasons why, this quarterly report was worse than expected for profits, worse than expected for revenues, as well that was due in large part to larger than expected losses due to catastrophe and weather-related events that weighed on those earnings. so traefrl travelers down about. back over to you >> dom, thank you very much. the fed chair's comments yesterday may suggest that the fed's base case has shifted now from later or fewer cuts to no

1:03 pm

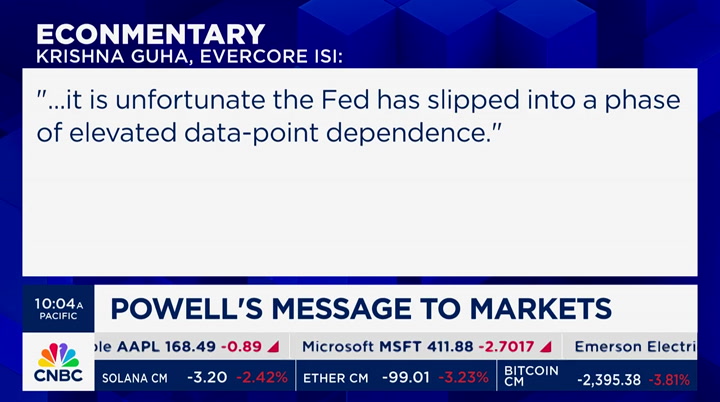

cuts at all this year. our senior economics reporter steve liesman has the latest and for the potential market impact, we're joined by andres garcia steve, what did powell say, and how big a sort of textural change is it >> he went away from saying cuts were likely, but didn't say they were off the table at all. but this new rhetoric where they're mulling not to cut at all this year raises the question of whether they're overreacting to recent data and changed the goal post. in march, the average fed official forecast core pce would end the year at 2.6% the first quarter average is going to be around 2.8%. while it a es true that progress is slow, the fed is just 0.2% from its year-end target in the context of falling to 2.6%, the average fed official

1:04 pm

forecast 75 basis points off the top. should rate cuts be off the table with inflation running just 0.2% hotter than forecast for the entire year? now, to be sure, the fed warned it wouldn't cut it had the confidence inflation was moving to target, around fed chair powell said recent numbers undermined that confidence but he didn't repeat prior language where he said they would likely be appropriate this year but one criticizes the fed saying - >> he and others made a case for cuts is deeper, it has to be deeper than just recent numbers. let's count them off the fed's own inflation forecast sees hitting the 2% target in 2026 powell said that the fed didn't have to wait until 2% to cut rates, and this is the big one, are at the same level as they

1:05 pm

were, the same restrictive level when inflation was much, much higher now, muhammad ari has criticized the fed for talking too much that could be true, but it might be more precise the problem is not talking to much, it's reacting too much. >> very interesting. so you have rates where they were at the peak when inflation was 8, 9%, and now it's come down and you have a real rate of return that is high. >> i mean, would you lose the kingdom for want of a horse or 0.2% of a percentage snopoint? >> you were noding your head when steve said maybe the fed is talking too much >> i think they were a little too dovish getting into this year and now they are reacting to retail sales, jobs, like three data points seems to have reangered a little bit ultimately, if you read through the noise, the economy holds off

1:06 pm

and inflation takes a little bit longer, i think the markets will hold up. they're now having a little bit of indigestion because of the change of language, but the fed doesn't control gdp or what earnings are going to do they don't control what earnings or gdp is. >> is the hiccup that the market has had, i'll get both of your opinions, do you think it's largely predicated on higher interest rates >> i think that if the big change would be if they now tell us they might have to hike i think that really would be a big, big change. >> otherwise, you think the market can continue to grow. you have a good economy, you have good corporate profits, inflation is okay. >> keeping all factors the same yes, inflation is a little stickier but not necessarily reaccelerating significantly, i

1:07 pm

think the market holds up. >> steve >> i think it's a little confusing how to think about what's happening in the middle east and the geopolitical concerns if you look at the s&p back to thursday, the 3 or 4% selloff we've had in that, has been mostly a flight to safety, right? you had that, and then you had a decline in yields, and now we're back up in yields. so the market went from being concerned about -- in a two or three-day span, being really concerned about a regional war in the middle east to now having to stomach and figure out how to digest these higher rates. higher for longer is a pretty good bet what i'm interested in is whether or not the same investment portfolio that you had thought about for a fedtha was cutting rates will suffice for a fed that's not cutting rates. >> elaborate a little on that. >> there was a play on utilities for rates before rates were

1:08 pm

going to come down now they're coming down. i don't know, maybe utilities are out of favor, the interest rate sensitive sectors are going to be hit a little bit harder. maybe the autos, maybe the housing. a lot of this is speculative, because at the same time you battle these higher rates, you have this better economic growth >> i guess it does -- i work on an investment committee on a charity which i serve on the board. we were having a discussion last night about whether okay, we have x in equities, maybe we should take a little off, we were a little above our upper bond and move it in a two-year treasury at 2% >> sounds like a good move >> higher for longer means the challenge to stocks from the risk-free rate goes on for longer >> i think if the ten-year yield continues to go up higher, you to have options all of a sudden. and i think that's fair. there is the -- what if rates go

1:09 pm

up another 1% from now, that changes the picture versus is this just volatility of language change for the fed >> let me ask both of you guys this question. when the yield curve inverted, there was a lot of pandering that this is bad stuff, it's awful, recession is coming so on and so forth yields are still inverted and there's no recession >> how many people said the fed were wrong in raising interest rates to where they are now? you're going to kill the economy, look what you're doing. inflation is still fairly sticky where rates are now, and the economy has been fairly resilient. so one, maybe their language has been off, but directionally, they were right. it's fair to say up to now, it's not like they went too far if anything, they need -- could have gone an extra 50 basis points and it would have been okay to your point, i think it is interesting. >> so your worry is that

1:10 pm

basically things can move along nicely unless the fed gets into a situation where inflation kicks up and they have to boost rates, which will be a pivot, which will be a dangerous thing? >> i think that would deanchor the whole narrative and you would have to make assumptions of multiples, et cetera, that look very different. >> there's an assumption that the reason why the market has not sold off more in the face of what seems to be a pivot from powell here is because he's not talking about higher rates jefferson yesterday morning made an important comment that was sort of both sides hawkish and dovish it was dovish in the sense that he said the current restrictive rate should be sufficient to bring inflation down to the goal of 2%. that same sentence, though, you can read the other way by saying the current one, not a higher one. so in that sense, it was dovish. >> their prediction on 2% isn't until what, 2026

1:11 pm

>> i really think that they -- look, i love talking to fed officials. i love it when they talk i'm having a discussion with somebody here and others about whether the fed talks too much i don't think they do. the question to me is do they react too much do they end up -- you know, one way to think about it is, pick a forecast and go with it. and don't waffle along if you've ever driven a boat, if you're off by a couple of degrees now, you know, you can adjust a little bit later. but you don't have to turn the boat and you never -- [ overlapping speakers ] it's like a little bit of an adjustment goes a long way so in that regard, you know, if you haven't -- a lot of people do have this forecast, that inflation is going to come down. powell showed absolutely no confidence in that forecast yesterday. >> yeah, yeah. final thought?

1:12 pm

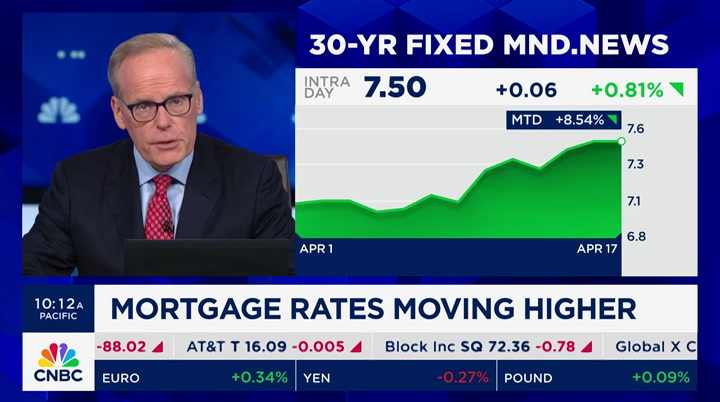

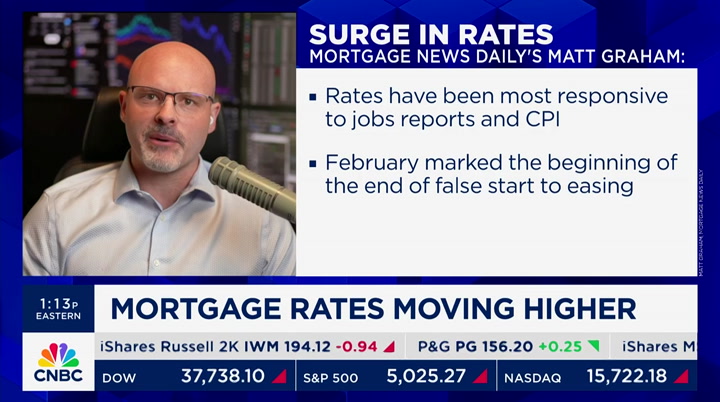

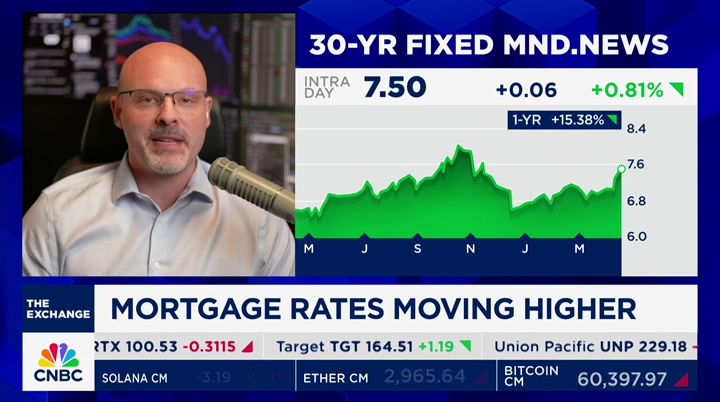

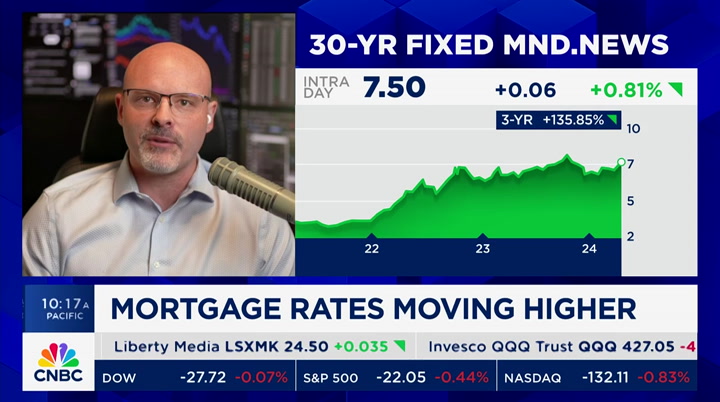

>> that's significant. >> look, i agree that maybe they're saying too much and too specific >> right >> keep it vague, keep the optionality, be data dependant so the market can focus on earnings >> thanks to both of you one of the most rate-sensitive areas obviously in the entire economy is the housing market mortgage applications jumped 3.3% from the prior week, despite higher rates we have the 30-year fixed loan now at 7.5%, up more than 8% since the beginning of april how much higher can rates go if the fed's hold on this year in terms of interest rates? joining us now is matt graham. matt, how do you explain why mortgage application went up in the face of rising rates you would expect probably the opposite >> yeah, i think when it comes

1:13 pm

to mortgage applications, probably better to take a longer view and not get too bogged down in nitty gritty, week-to-week movements. it's easier to sort of line up those correlations in the bigger picture. a one-week change can end up being noise in the bigger picture. what is does the longer view tell you >> it never tells us anything about the future, but it does tell us that rates have absolutely crushed transactions on the rhefie side market, and they haven't been too kind to the purchase side either i remember last year thinking mba numbers are in line with the long-term loans, shouldn't get much worse, and it got much worse because rates went even higher so yeah, there's almost nowhere to go but up at current levels >> what is the point at which interest rates literally crush the mortgage application market? we're at 7.5% now.

1:14 pm

some people could say 7% is that threshold, but it seems not to be what is the -- is it 8%, where >> i think a lot of people would argue that we've seen it already. last year, when we hit 8%, to a large extent, we're in the middle of it right now the people that are driving demand on the purchase side are people that really need to buy a home who aren't really letting interest rates enter into their decision making. so, you know, i don't want to jinx it and say we're at rock bottom because things can always get worse, but not a lot worse than they are right now. >> i take your point, and i agree with you we're at the absolute, i guess, typical peak of housing transactions we're in the spring. it's march, april, and may that's when people are buying and selling houses so it stands to reason, well, if you need to move or you want to move this spring, now is the time you're going to do that now is the time you're going to

1:15 pm

apply for mortgage and you're going to say okay, that's what i've got to pay. i figure that into the total cost of the house i'm buying, the operating cost of the house i'm buying, and i proceed in the hope that in two years time or four years time, i may be able to refinance >> however long it takes, yeah that's a paradigm that has been with us, you know, for most of us for our adult lives but it's one that people need to consider might be a little bit different moving forward and to your point, maybe it's not just two years, maybe it is four years but at some point, you should have the opportunity to refi at a lower rate >> why have house prices stayed up as well as they have? we talk about transactions and mortgage applications, they seem to be higher than what you call that noise why do you think house prices, which typically would be dented by rising interest rates, haven't been so much

1:16 pm

>> yeah, multifaceted problem, probably i'm not a housing economist, but the thing that i understand that is most commonly said is an inventory issue when it comes to prices and we also don't have a mortgage meltdown this time around you know, this suspect 2007-'8 where there's a crisis of confidence in the mortgage market and housing housing is still seen as solid, underwriting is solid. >> your best guess, we're at 7.5% now on the typical 30-year mortgage what do you think the range is for interest rates this year >> yeah, great question. you know, that 8% upper balance, which lined up with 5% 10-year treasury yields roughly seemed to be a buying opportunity as far as investors were concerned. it could drift a little higher

1:17 pm

than that. so let's say 8% on the top, and really, without instilling too much hope among the mortgage audience out there, i still think the rates could go down to 5%, even below, because once the thing turns around, once we see those monthly inflation numbers do what the fed has been waiting for them to do, the market is going to know that and when the big shift happens, when shelter inflation aloallows cpi to come down to 2% levels, rates will move down very quickly. it wouldn't be a surprise if the lower end of that range is 5%, even slightly lower. >> very interesting. that would be a big, big move, 250 basis point where is from they are right now matt, thank you very much. matt graham with mortgage news daily. appreciate it. coming up, my next guest's company serves 150 million consumers worldwide, one of the

1:18 pm

most recognizable names offering buy now, pay later and they are unveiling a new credit card. the ceo joins us next. plus, the co-ceo of morgan stanley's real estate investing business is here mega trends benefiting investors, we'll talk about that and the opportunities for investors, the fallout from the baltimore bridge collapse ahead. "the exchange" is back after this

1:20 pm

i don't want you to move. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

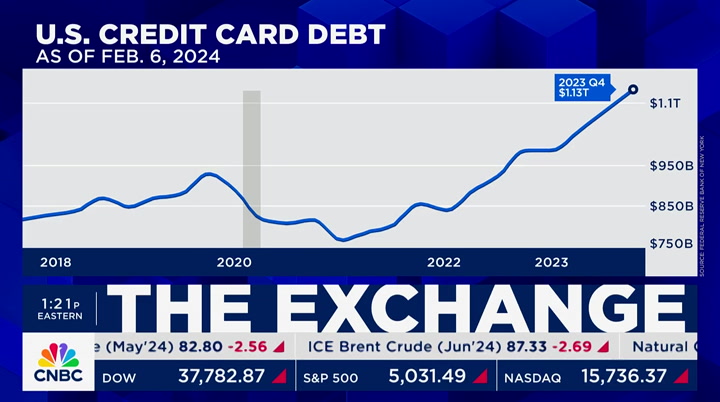

1:21 pm

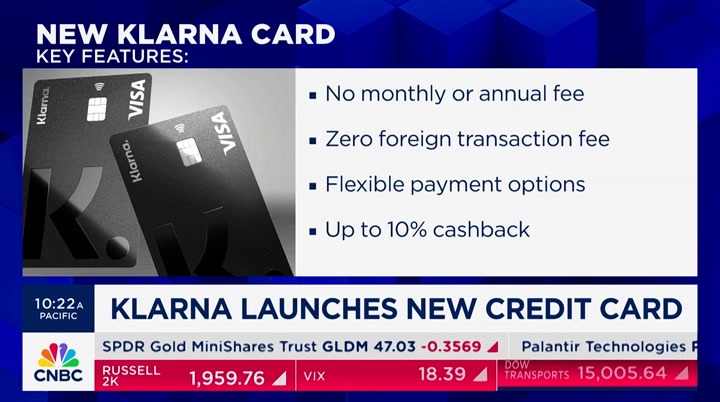

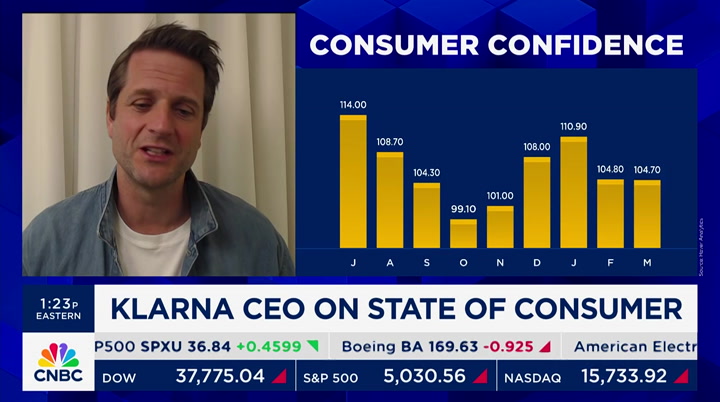

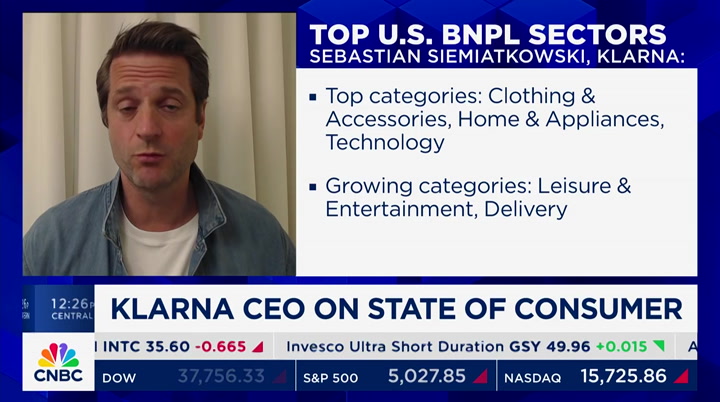

welcome back to "the exchange," everybody recent retail data showing a resilient u.s. consumer, sustained spending but there's more to the headlines than meets the eye credit card debt ballooned to a $1.13 trillion last year, and more than a third of americans are using a buy now, pay later service to fund purchases. this according to bank rate. my next guest is well versed in both let's bring in sebastien, ceo of a buy now, pay later service and is introducing a new credit card here in the u.s. today sebastien, good to have you with us let's start by explaining what the credit card does, who can get it, what its features are,

1:22 pm

and why you think this is a good time to introduce the same >> that's a great question look, this is an industry that has been filled with cynics for a long period of time. as much as there's been talk about better financial -- that mountain that you're talking about, whether it's revolving, whether it's pushing a credit limit in your face, all of these different tactics. i find it interesting that there is a large group in the u.s. of consumers that are very tired of these practices, and they call themselves avoiders. they are looking for simple interest fees, avoidance of mishaps that trigger fees. they want clear installments to pay off. and it's 20% of the american population that you would put in that bucket. so that is a consumer tired of those practices and looking for

1:23 pm

a different product. >> this different product is different how? >> well, i mean, actually, it may sound a simple thing, but basically you always have the option to choose debit or credit you don't do revolving at all. the revolving is a very confusing concept for consumers. you get that bill, you don't understand when you're going to pay it off here it's fixed installments, very clear and easy to understand and you avoid a lot of fees. a lot of us may remember how carrier billing used to work 10, 15 years ago other products came were much more simple, it's the same transformation that we're seeing >> no annual fee, no application fee, you can use it anywhere visa is accepted now, do i have to have been a buy now, pay later customer of klarna to apply for and get this

1:24 pm

card or not? >> over 30 million americans have used klarna which is amazing. we've been profitable for five consecutive quarters so yes, the main way people are going to find out to use the card is obviously through the fact that they have tried us, you know, more than 50 of the 100 top retailers, all these merchants that, you know, offer klarna today so that's going to be the normal way which customers will engage initially and we offer them this opportunity to use it everywhere >> does being a user of buy now, pay later services help one's credit rating or hurt it just being a part of it? >> currently, there's not real reporting yet to the credit bu bureaus. there's been discussion in the industry what should happen with this the u.s. system is odd for me as

1:25 pm

a european you have to borrow a lot of money to get a better credit rating in europe, it's the opposite so we're trying to adapt ourselves to that u.s. reality but obviously, over time, we want to make sure this product contributes to a better credit scoring. >> buy now, pay later, explain it to me i worry a little bit that people think i can buy something here and i pay later, and if i do that, i am not going to accrue interest but boy, a lot of people think they are going to be able to make that pay later payment, but can't. >> well, know, that's true obviously in a market where credit cards are so prevalent as the u.s., i think some of us may remember back in the days when you used to swipe your card, you would push one for debit, two for credit that led to people borrowing less >> because they used debit >> because they used debit

1:26 pm

occasionally, and occasionally credit we offer both debit and credit damts. when you use credit, it's interest free, especially if you do like the standard pay in installments that we do online and only would you like to do longer term financing, we may offer products but it's fixed installments, which is very critical that you have a fixed time period to pay it off what we see our losses are about 30%, 40% below credit card industry standards, so our users are more responsible and they have better outcomes, less debt. the average offsetting balance with us would be $100, $200, maybe $5,000 tops on a credit card so the product is better, but you have to sacrifice revenue for that we have so sacrifice revenue it is a less profitable product than a subprime credit card. but long-term, we see there is a

1:27 pm

huge group of consumers in the u.s. wanting a healthier alternative. >> a very interesting company, there is that consumer facing part of it we're talking about, but a big part of your business is payments processing, as well. that's behind the scenes but an important part of your business. the natural question, how long will you be a private company and do you entertain thoughts of going public and if so, how soon >> that's a very accurate description. i think of ourselves as a third party. we have the direct relationship with consumers we work with many others on the merchant side. it allows us to big faster the hidden secret i'll share with you that is interesting, we have skew level data on every transaction. so people can see exact think what they purchased, not just

1:28 pm

the amount it gives a much richer experience we can really differentiate in a very different way we're building what is maybe, you know, one of the few new emerging payment networks that have happened in the last decade and from that perspective, to answer that question, you know, it's not unlikely that it will happen fairly soon you know, we haven't commented more in detail on that >> i thought you had forgotten my question about the ipo there. i was going to have to remind you, but you gave an answer. thank you very much. we appreciate it very much thank you so much. >> thank you for having me coming up, joe biden has a new mega donor, and it's surprising one, given the donor's family history we'll tell you who it is, what it means for 2024 fundaing rsi race ahead we're back after this.

1:31 pm

i have a business idea. and it just might change the world. but here's the thing, i can't do it... alone. so, are you in? i'm in. nothing else to do. yeah, i don't know... um, i need to speak to my agent. (snoring) i think creed's out. welcome back to "the exchange," everybody the dow is down by -- i'm going to wait, let's see if it comes to green come on, baby. i've got to move on. and the s&p off about a third of a percent, and the nasdaq, the biggest loser. but a modest loser, down 0.71% nasdaq on pace for a fourth

1:32 pm

straight day of losses, which would be the longest losing streak since early january i want to draw your attention to the ten-year, the yield hitting an intraday high of 4.684%, as oil takes a leg lower. crude down about 3%. interesting sort of comparative charts there now to kate rogers for a cnbc news update >> hi there, tyler senators are being sworn in as jurors in the impeachment trial of homeland security mayorkas. he faces two articles of impeachment, refusing to comply with federal immigration laws and allegedly making false statements to congress about the homeland security department but the democratic led chamber is expected to vote to dismiss or table the articles. russian operations targeting the upcoming u.s. election have started. that's according to a new report from microsoft, which found russia linked accounts were

1:33 pm

spreading divisive contents to americans. the kremlin claimed last month it would not interfere sales of super yachts took a dive, falling 17%, as sanctions against russian oligarchs and soaring cost hit highs in particular, sales of the largest yachts over 650 feet fell 40% due to russian buyers dropping out of the market following the invasion into ukraine. tyler, back to you >> i don't know about you, but i didn't get my latest edition of super yacht times. and i didn't buy a super yacht maybe that's the reason why. coming up, just when you thought the supply chain was getting back to normal, there are new headwinds on the way what they are and why investors like you need to know about them and there's still time, yes, still time to register for the change makers event tomorrow in new york city.

1:34 pm

we'll hear from some of the women reshaping business, including commerce secretary gina ramando to request an invite, scan the qr code or go bcen.c/changemakers. s more loveo logistics than these three. you need them. they need a retirement plan. work with principal so we can help you with a plan that's right for your team. let our expertise round out yours. encore energy, america's clean energy company, now in production in south texas. energizing america with reliable and affordable uranium for nuclear energy fuel from our environmentally friendly extraction process.

1:35 pm

1:37 pm

chains have mostly been corrected. but a new wave of headwinds, trouble in the middle east, companies moving production like apple's potential move to indonesia could throw off things again. our next guest is still managing to find opportunities. joining us with how to invest in the supply chain of the future is co-ceo of morgan stanley's global real estate investing i guess it is intuitive that you view the commercial real estate market as bifurcated there are areas that are really cha challenged and others that are anything but challenged. >> there's a big difference in changes in interest rates and changes in behavior. changes in interest rates affect all asset classes within real estate, but we look to invest in sectors that are benefitting from changes and how people behave, how we shop, how we want

1:38 pm

to live, where we want to work, and all of those things shift demand in a way that has a profound effect. >> you're probably seeing more challenge in the xhod commoditized space markets, and incredible growth opportunities in warehousing and over 55 living environments and so forth. two sort of strangebedfellows you would say. >> you sound like a real estate investor >> i'm also over 55. >> look, i think on the industrial side, it's really three things that we like about it one is e-commerce growth so as we've been buying more and more of our goods online and demanding them faster and faster, those warehouses that get those goods to our front doors every day have been exploding. but the second one, this

1:39 pm

reconfiguration of global supply chain, the supply chain of the last 20 years will not be the supply chain of the next 20 years. and that is having pro-found demand impacts on industrial >> tease that thought out a little bit you know, the supply chain has basically been oversimplified. a lot has come from china to europe to america. whatever >> yep >> but now, you're having a lot more on shoring of production, the chips act is going to remain a very different change there. automobiles being manufactured in the united states so what does that mean i drove out 180 today, last night, and there was a huge new prologios warehouse. where did that come from >> i think there are two things that are implicit in what you're saying the first is we're doing a

1:40 pm

u-turn on globalization, right shifting where we manufacture goods away from china. and the second is we're seeing an increased supply driven event shock. so baltimore bridge tragically, trade disruptions in the middle east, panama canal by the way, covid when we couldn't get protective gear so all of these event-driven shocks are forcing companies to diversify where they manufacture their goods and how they get them to the end consumer all of that creates more demand for industrial >> more demand for warehouses and manufacturing ability, data centers. there's another sea change, what ai is meaning to the need for data centers >> yes, absolutely and we're seeing automation inside of those manufacturing warehouses and distribution warehouses, as well. >> so you find investment opportunities for your clients, right? that's basically what you do >> that is what we do. >> talk to me, and if a client

1:41 pm

comes to you and says, well, how is the new york office market going to do? how is boston, how is san francisco going to do, what are you telling them >> look, we've -- offices experiencing a fundamental sea shift, and i think it's really two things the first is a dramatic demand reduction, right so work from home, less demand >> right, right. >> but the second thing is, i think of this is an acknowledgement of how capital intensive offices. so we really sold down a lot of our commodity office, most of our commodity office before covid. >> capital intensive because it's so costly to build those offices? >> you are constantly investing capital to get tenants and keep them in your building. >> upgrading facilities, so on and so forth >> we likes a sets where you can take cash out instead of putting it in.

1:42 pm

>> so it's structurally stressed, the business model is challenged because you have to put capital in constantly opposed to a different kind of commercial warehouse, right? >> that's exactly right. but let's be clear, you can't paint a broad brush. so we're seeing a dramatic demand consolidation into the best of the best office assets so even take san francisco, which is the worst office market among the worst office markets globally and even there, we own the highest quality office buildings. we're getting rents today above precovid so you really see the consolidation into the best of the best >> quality has value >> quality has value >> so give me -- you said san francisco may be the worst of the domestic, maybe one of the worst in the global office markets. give me a couple of the office markets in the united states that are doing better than average. what are the hot ones now? charlotte, austin, what? >> you have to look at both

1:43 pm

demand and supply. and so i think there are markets like austin that have demand, but they've had an extreme excess of supply, so that makes it tough i think you've seen markets that were really never on the planet for institutional investment like miami but seeing substantial office demand growth and still has relatively little supply of good products >> lauren, thank you very much shocking that builders would overbuild. shocking, shocking, shocking we appreciate your time. speaking of office real estate and company shifts, google laying off more employees, this time across the finance and real estate units according to reports some roles will be moved to places like india, chicago, atlanta, and dublin. coming up, 930,000 is how much a republican mega donor's son gave to the biden campaign the who, the why, and what it means for the biden/trump

1:44 pm

rematch next, when "the exchange" returns. we'll be right back. good, real food is simple. it looks like food, it smells like food, it's what dogs are supposed to be eating. no living being should ever eat processed food for every single meal of their life. it's amazing to me how many people write in about their dogs changing for the better. the farmer's dog is just our way to help people take care of them. ♪

1:46 pm

1:47 pm

dance ceo david ellison. don't know the name? well, it's the son of oracle co-founder and republican mega donor larry ellison. joining us now is cnbc.com's political finance reporter brian schwarz. this is a curious move, as you point out in one of your dispatches, brian. this is like one of george soros' sons contributing to donald trump >> yeah, it's big deal for the biden campaign, because really, this was an effort to get david ellison support that it was coming from people like jeffrey katzenberg, who was trying to get david to come to the biden team, leading to this $900,000 donation to the biden fund >> why did he flip >> we're not exactly sure whether he flipped or the reason he just came over from a policy perspective. again, this was a push that came

1:48 pm

from the biden side to get david ellison to come over and support joe biden. we have a scene in the story where david ellison came to an event, a private event featuring the president himself in december and that move to get him just to come to that event started with a little bit from katzenberg and other political donors just to get ellison to support joe biden at the end of the day. >> let me just ask the question, i am not implying anything, i just do it out of my typical skepticism his company, sky dance, is apparently making a bid for paramount and national amusements, am i right on that >> that's right. >> would there be any connection to this donation and that move which might, might require some governmental approvals >> well, it's unclear. it is interesting the donation arrived as these reports are coming out about that deal we're talking about the deal of sky dance, paramount, and

1:49 pm

national amusements. so the donation came in the early part of the first quarter of this year and so, you know, it is interesting that it's kind of coincides with timing of how all these reports are coming out about that deal. it's unclear if it's tied to any potential regulatory scrutiny on the biden administration or a trump administration down the road >> time will tell on that. is the notion that the big rainmakers, like jeff katzenberg, would be involved in trying to recruit a donor like mr. ellison, does that suggest that katzenberg and other rainmakers in the biden catch will be doing the same with other donors who might be on the fence or who might be di disenchanted, former trump backers? >> we have done reporting on this about how katzenberg and people in that orbit have been actively working to bring over people who used to support nikki haley. she was in the primary taking on donald trump so they've been working the

1:50 pm

phones on this for i would say over a month it's panned out for them in some ways, but there's still time to see how many of these people come over and give to biden or even endorse him, because that puts them in a political bind, if these are folks that lean towards the republican side of j powell's comment about inflation yesterday further dampening the rate cut expectations this year, one strategist says the timing does not matter for tax-exempt bond , he will explain why after this.

1:52 pm

1:53 pm

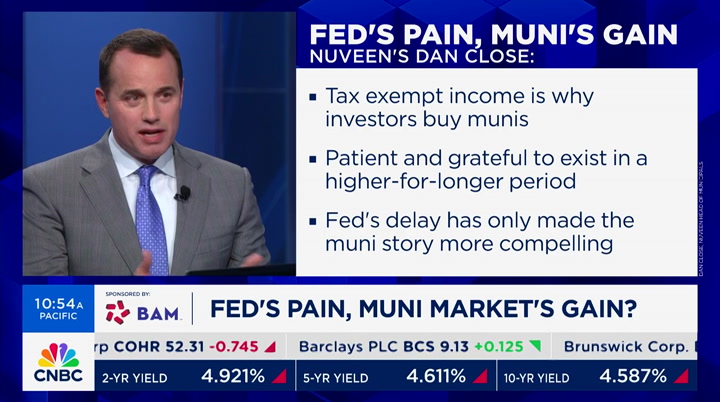

you can get two unlimited lines for just $30 each a month. all on the most reliable 5g mobile network—nationwide. wireless that works for you. for a limited time, ask how to save up to $830 off an eligible 5g phone when you switch to comcast business mobile. don't wait! call, click or visit an xfinity store today. . municipal bond topping out 10 billion last week alone as the fetid dalles bait, rate expectations, their delay has only made the yield story more compelling. for more, we are joined by dan close, the head of municipal's. since the end of 2011, yields are even higher by how much? >> first of all, congratulation

1:54 pm

on 35 years, >> thank you so much for having me on the show, the munis market has adjusted to the fed being higher, if you look at where we started the year, highest yield levels in 2011. we are 40 basis points better, the reaction market has been to go in more. we have had to billion flows into the municipal market. investors are saying if i like market at the beginning of the year. >> the phrase that pays is always higher for longer, let me ask you as an investor, should you go longer for higher in duration to capture that incremental yield going out from a 10 year to a 20 year or from a 10 year, because the

1:55 pm

difference in yield are so much more appealing. >> on the municipal curve, it is the case. we'll see that on the treasury yield curve. we have this upwardly sloping curve, that our strategies are focused on being in that 12, 13, 14 on out because you are being paid to take duration. that's not the case with the treasury -- close our investors that can go in and take that duration risk to pull out more because you are certainly being. it's really an upward sloping curve, and the u.s. treasury market, whatever you see in the corporate a.b.s., it really

1:56 pm

does not matter because we have positive yields if you look in the municipal yield curve and look at every single spot on a tax equivalent basis, it's much higher than the rate of inflation. we have the higher yields in the marketplace we've had in more than 10 years. the lower level of income they have in the municipal market is legal. >> if you're in a high bracket state, it does not make sense. let's talk about quality issues, where you want to be, reaching out 10, 12 years, maybe longer. what about quality? >> we continue to like the high- yield sector in the municipal market, we don't have any

1:57 pm

events on the horizon that will go in and create meaningful headlines. if you look at the triple b market, single letter a market in the municipal market. we are not tied as we have been on the corporate side. >> thank you for your time, dan. i appreciate you expanding this more abundant area we should pay more attention to. >> that does it for the exchange, leslie pinker is quicker already in the studio getting ready for power watch. we will be right back, thanks for watching.

1:58 pm

this is real time insights, i'm here with matt, it's an election year. taxes are front and center, what would she -- we be focused on? >> the landscape is changing for three reasons. one, we have a tax bill with the senate which are aspiring taxes. free, it's a presidential election year. it does not provide certainty that our client like to see. >> i'm sure tax professionals are paying attention, how is it radical -- relevant? >> we can see increases in

1:59 pm

taxes or decreases for example, the corporate income tax rate can go from 21% to 28%. we have something called r&d expense versus capitalization, we have corporate a&t. there are changes on how they flow through a tax return. >> given all those changes, how are you advising your clients? >> we are advising our clients to make sure they are modeling these changes. the cascading impact on financial statements on the tax return can be significant and it is important they are communicating this to stakeholders. >> thanks so much. >> thanks for having me.

2:00 pm

alongside leslie packer, good to have you with us. i'm tyler matheson, stoks mostly lower as an awful april continues. we have not had this kind of decline in a while while this might not be coming to the rescue, they are grappling with the possibility of zero rate cuts this year, we will get the latest read on the economy from the wonderful, aptly titled page broke. a boeing whistleblower testifying on capitol hill, they're putting out defective airplanes and should stop their liner production. they need the latest

46 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11