tv Mad Money CNBC March 28, 2024 6:00pm-7:00pm EDT

6:00 pm

$5 billion mid cap name bottoming out. >> tim >> happy easter to those celebrating. and pfizer tim's pfizer >> i got to say happy birthday to my kid, i'm sorry, thank you. happy birthday, jack and lucy. oh, my god that would have been terrible. okay >> i'mut o >> proceed >> all right my mission is simple, to make you money. i'm here to level the playing field for all investors. there's always a market somewhere and i promise to help you find it. mad money starts now. >> hey, i'm cramer. welcome to mad money. welcome to cramer -- i'm just trying to make you money. it's not just to entertain but educate and two. call me at 1-800-743-cnbc . welcome to the best first quarter since 2019. we had a broad-based rally. it was supposed to be impossible thanks to the fed's

6:01 pm

refusal to cut interest rates. and while the quarter didn't exactly go out with a bang, the doubt, nasdaq dipping .12%, we will go back on this with one more breathtakingly bull. this time it wasn't just the magnificent seven leading the way. it was a broad range, which is exactly what you want from a bull market. why were stocks so strong this quarter? we had great earnings. the forecasts were better. they were the best in a long time. if you stand away from the market because you heard a handful of big-name stocks are leading, you missed and incredible move. you lost out. if you focused on the earnings, you prospered. and going forward i spent more of the same. chris waller said the feds no

6:02 pm

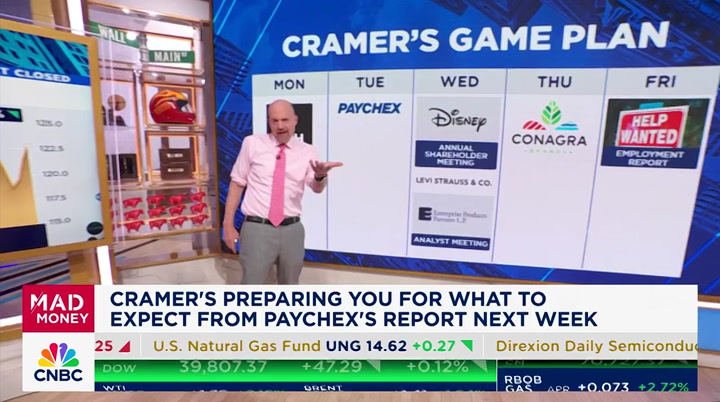

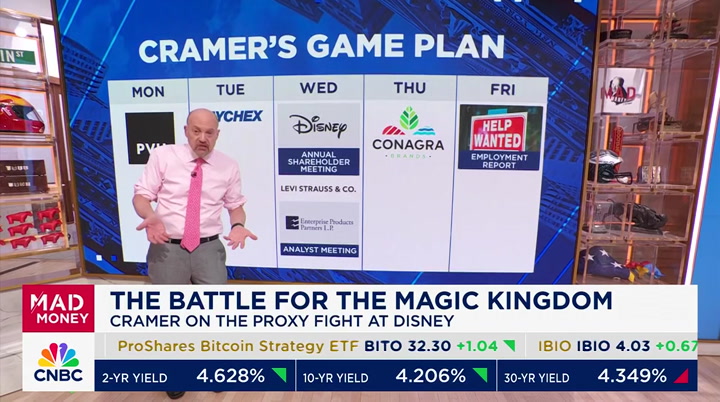

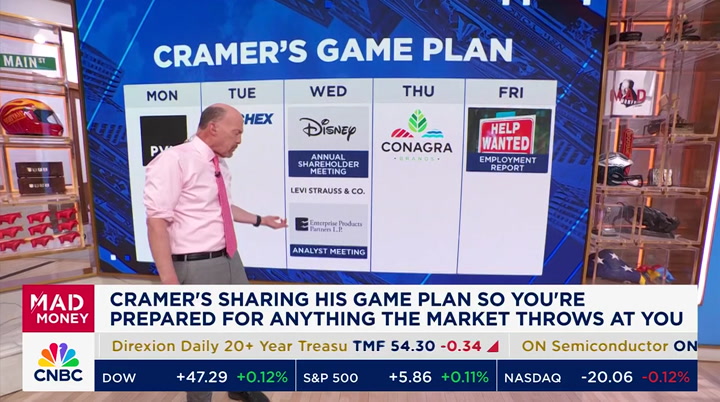

hurry to cut rates. that become the new benchmark of central banking. i think it kept the average today. all in all, still owe waste at this point to be fixated on the fed right now. last night we got great numbers and 70% from rh. jeffries, had a 52-week height before reversing midmorning. home depot made this incredible a $10 billion bet on housing with an acquisition of srs distribution. all in all, good news to the market. we know wall street is basically a, what have you done for me lately business. so let's talk about our game plan. we bring about happen earnings report they can be very meaningful. pbh kicks things off monday afternoon. this is the maker of tommy hilfiger and calvin klein. stocks double from where it was before long-term interest rates peaked.

6:03 pm

so many stocks were obliterated by interest rates. when rates started coming down, stocks like pbh could come roaring batch. it's stock is run so much. can keep going higher on better than adequate numbers? i'm a little stumped here because unlike rh, which soared one better-than-expected quarter, pbh is coming in red- hot. let's take the temperature after the quarter. paycheck is a particular stock. it sells off after the results with the analyst not liking it. i figured the pattern plays on you get it just to buy this payroll processor after the fullback paychex will tell us about the state of small to medium businesses. those are its main clients. we just got growing report, more than 1 million small medium-size business customers,

6:04 pm

i think it's going to be stellar. the small business segment has been the workhorse of this economy and i think paychex will verify when it reports. best for me stock was the walt disney company. 35% gain, i believe that is because of what happens on wednesday. the conclusion of the proxy fight between disney and nelson who is seeking two board seats. the company is fighting with everything except mickey and goofy, the latter of which define the board strategy of this context. i think it may turn out to be among the most expensive proxy votes in history. so much energy and shareholder money, it's a wonder why they did say come on in. they have given the board an incentive to get their act together. that's why you get cost got to move the stock higher. that's why the stock has been able to roar. the whole thing has been great for shareholders. most proxy fights since these and free of succession. i would say that business has been around. that's not the whole story.

6:05 pm

maybe it's more of an alternative narrative. next we have another hot apparel plate, that's levi strauss and company with us stock going to almost $20. last time we had them on the show was one chip berg handed the reins to michelle goss. they said everything is going smoothly. like pbh, i expected a good quarter but with stocks coming in hot, i have no idea where marker we are at. the master limited partnership . these are high-yielding tax and oil companies that were among the most popular securities for those who wanted a solid source affixed income pick one of the best is a terrific processor and transporter of petrochemicals. they had an amazing run from 26 to 29. i know it doesn't sound that imaging but you also get a 7% yield. on wednesday, enterprise will

6:06 pm

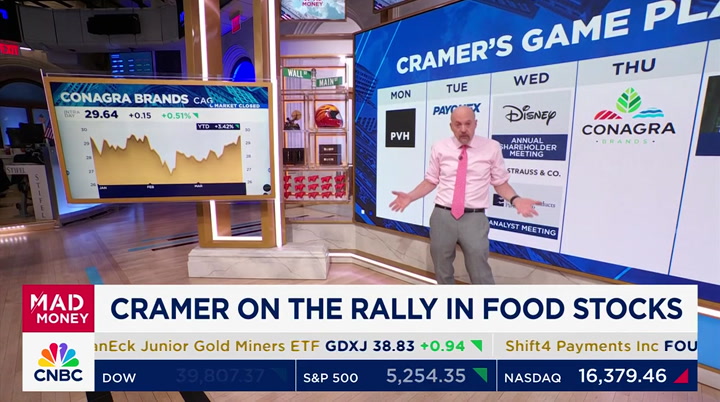

hold -- i think you will tell a fantastic story. this bpt is as good as it gets. good stocks have participated in the rally. they have been amazing, mccormick, this week putting up very good numbers. general mills and hormel before. inflation mix the --. which means we might get a fourth food surprise from conagra the maker of slim jibs, popcorn, chef boyardee, healthy choice reports before opening bell on thursday. the company is struggling with sales but i think they produce good earnings this time when the revenues aren't that impressive. with a 4.7% yield, you could do worse. finally we got the strong set of figures. we haven't seen the kind of mass layoffs that so many expected. in my view, the market is well prepared for a hot employment

6:07 pm

number, so if the labor report is lukewarm, we will go into earnings season with a pleasant backed up. keep an eye on the unemployment report because everything else that is coming pales in comparison. even the no holds barred disney proxy fight. let's go to isaiah in new jersey. isaiah? >> hey, jim. big ben. i had a question about rtx, what is your overall sense about the company? >> we are marveling. this has had an incredible comeback story. it had a problem with engines and cyclical, but this stock has gone all the way back to 97. it still is only sales that 18 times earnings. bullish on rtx. how about we go to my home state of new journey, kyle. >> hey, my best friend, jim cramer. how are you doing? listen, jersey shore, if you're down here next summer, so the jersey shore i want to take you

6:08 pm

to dinner. you and your wife. >> i look forward to that. >> my parents have an italian restaurant in ocean city. >> yes. i want to go there. what's the name? >> it is luigi's on ninth street in ocean city. >> luigi's. write that down. >> i swore on myself after the stock craze i would not get involved with another spec but i thought this one was different. i talked to you a couple times, i feel like maybe the only person who got rich on this one was true boss, and after listening to your interview with noto, i figured, maybe he is telling the truth. are you still buying sophia? >> i believe in it. i believe in noto. i know it has been -- but i have to tell you, i think it can come back. before the issued the stock them it was flying, and they actually did shore up their

6:09 pm

bounty. i stay you have to stay with sofi. we have to keep an eye on next week's jobs report because everything pales by comparison. even the disney proxy. i'm sitting with the ceo of walgreens to find out what is next for the company. i have an of next week's, i'm looking at some previously successful splits. monthly media, i'm going to give you a sneak peek into what it is all about. stay with cramer. >> don't miss a second of mad money follow at -- @jimcramer. tweet cramer hashtag mad mentions. sent him an email at madmoney.cnbc.com or gives a call at 1-800-743-cnbc . miss something? headed to madmoney.cnbc.com .

6:11 pm

nahhhh... (inner monologue) another destination wedding?? we just got back from her sister's in napa. who gets married in napa? my daughter. who gets married someplace more expensive? my other daughter. cancun! jamaica!! why can't they use my backyard!! with empower, we get all of our financial questions answered. so we don't have to worry. can we get out of here? i thought you'd never ask. join 18 million americans and take control of your financial future with a real time dashboard and real life conversations. empower. what's next. business. with a real time dashboard and real life conversations. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. her uncle's unhappy. i'm sensing an underlying issue.

6:12 pm

it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

6:13 pm

making those results with walgreens with alliance. they lowered the high end of their for your earnings forecast and said they are taking impairment charge of their village and deep business. new cout tim wentworth laid out his turnaround plans, which is allowing the stock to rally more than 3%. this comeback story is about new leadership. we are lucky we could speak with the architect, tim wentworth, the ceo of walgreens. take a look. >> temkin i want to thank you for coming on and what feels like they one of the new walgreens where you are trying to simplify and strengthen. i want to know what simplify and strengthen you think will look like over the next year. >> jim, thanks for noticing because that is exactly what we are doing over the next year. you will see us continue what

6:14 pm

we started today, which is, today you saw sale-leaseback's. you saw us basically say, we are going to sell those into the market as we move out of that position rather than doing complex variable prepaid forward sorts of things. some of it is on the accounting side but more importantly, it's really getting focused operationally on the underlying parts of the business that are going to drive our future. as i was able to announce, we are knee-deep in an analysis of our entire book of business and the different pieces to look at, what is going to drive future growth? what gives us synergy? what is in the marketplace we can win in, and if you can answer those positively, what is the way to exit our strategies in a way that is more for our shareholders. it probably has a few less of the things that we have now but also has doubled own on some

6:15 pm

things where we see a real bright future, including, and i think importantly, jim, the retail store, the back of the store and the pharmacy, which is continuing to do well and the front of the store as we continue to evolve what that model has got to look like in order for us to win overall. >> let me give you a sense of what i get after i read the quote. it's a tough conference call to read. ica chick-fil-a model of incredible service in the back where pharmacy is where i want to go and up front is your incredible private brands that you make a lot of money. i don't see a lot of cheese it's, i don't see a lot of bad stuff and i think you are going to be the ultimate and knowing how the customer is going to get good price for gop and everything else. how is that? >> i think, if i were hiring ahead of strategy, i would bring you on board. what you just talked about is very much how we think about

6:16 pm

the business, which is, the back of the store. i love -- my family loves chick- fil-a. great service. we believe that is something we are delivering today, which is why we are so successful both as a partner for pharma and as someone the people trust you give them the vaccines and to the other things we do with the back of the store. if you come to the front of the store, it is a process that we are in the middle of in terms of looking at the role of private labels. we launched label products as well the service and the -- i hate buzzwords, but the omnichannel experience for our users. something we did not talk about before, but i love to talk about is, over 80% of our online orders, you go to our app and you want some things from your walgreens, they are delivered over 80% within one hour. so, we have a customer experience whether you come into our store or you need something delivered to your home that is going to be

6:17 pm

unmatched. >> my next question was want to be, how are you going to be amazon? amazon can't touch that. they can't. they can't go that fast. congratulations. >> i love amazon. they set the bar and they have driven lots of innovation and industry. they have forced us --. i don't know. what i can tell you is, our consumers have been trained to expect better. we are giving it to them, and the difference is -- i don't think we will be amazon because we are one hour or they are two or 10. we will be amazon because of the human interface we offer in communities and neighborhoods. 8600 locations today where you can come in if you are actually are getting a drug you want to talk about, if you have a health concern, want to get an over-the-counter addict, those are the things that are going to differentiate. not the fact that we can do it in an hour. that means when i go to a rival of yours, pharmacy, sometimes they are close, which is odd

6:18 pm

because i need my medicine. are we going to be able to see enough pharmacists at walgreens that i know if i go there, i'm going to be treated by a pharmacist? >> yes. let me tell you why. first of all, we are actually working with a group of deans of college pharmacy from around the country, 17 of them, to remap the workplace of the future in community pharmacy and then re-engineer curricula to actually deliver candidates to that model. we are going to be the preferred place for a pharmacist to come work. secondly, we are removing massive work from the pharmacists that are low value work, whether counting pills, or other experience where you can see or talk to a pharmacist not in a store even as you are in the store in certain states where the law allows us to have centralized pharmacy, where we can take one person and make them very efficient touching many stores and the patients in

6:19 pm

those stores where they need counseling. designing the workplace differently, designing work differently, engaging with the community that is creating tomorrow's pharmacist in a way that is constructive and as a leader, they are all going to business you have the workforce we need to deliver what you would be wanting when you go into the store. >> that would be terrific. let's talk about village and that doc in the box or convenient doctors. you are going to go individual by individual to see which ones are profitable? is everything on the table? i know there are some big charges. >> you so we took the charge this quarter, which i would differentiate village md from the investment we have made. that is worth less today than it was yesterday in terms of our sheet because we have written that down. then there the is the actual providing of the service. they have actually had a good quarter and grew by 19%. they continue to deliver their model and so, we like working

6:20 pm

with them alongside them to capture the scripts, keep those patients adherence and so forth. from our perspective, while i have been very clear, we view it as an investment. we are not going to add to it in terms of where we deploy capital. we view them as a terrific sandbox to create additional services that are going to benefit other provider groups as we move forward. back what a gem this booth is. you got the front of the store doing incredibly well. there were people that wanted you to give away boots. maybe this thing is a store of the future. >> boots has responded to its unique marketplace terrifically. the reason i am super confident about our front of the store revival is because once you send something and put good people on it, you will have good results. boots was not doing particularly well five years ago.

6:21 pm

and now they are setting the benchmark and the uk and in parts of europe as it relates to what a retail pharmacy that is very front and sort of centric can deliver. they have had phenomenal results. their leadership is terrific. we saw them again this quarter grew again. yes, the back of their store, doing no treating patients for seven different conditions. treating them, not just dispensing. being able to interface with the patient, diagnose, and take the load off primary care physicians. it will take up more than 10 million visits that will now go away and frankly is better for the patient, convenience, doesn't threaten physicians. we see what's going on as a really interesting dynamic we can replicate here as we push to have pharmacists viewed as true providers and reimbursed as true providers. >> that would be amazing. i didn't even talk about the

6:22 pm

thing that is your strength, the express scripts. the way you handle reimbursement. you are basically going to reinvent how much we are going to have to pay as customers. is that possible? >> i think so. i think we will have willing partners and so the pbm's to do it. the noise from the market, the clear message from the market, set aside the regulatory stuff in washington. consumers and the people who pay for healthcare, they wanted to work differently. the good news is, that will benefit us and that payers when a patient actually goes into a drugstore and comes into our store, it gets what they expect at a price they understand and that is transparent and close to what their plan is paying and is rational. those are things i think that pulled from the marketplace will exceed the push we could ever do and will create a much better system. >> can you make shrink to be

6:23 pm

something that you and i will not be talking about a year from now? >> we are going to -- we are working really hard to do that. there are a number of pieces to that. the one i would double-click on is we talked about delivery to home in an hour. when we look at the stores that are really struggling, you have to bring shrink into pieces. you have this organized crime element and you have pilfering. the opportunity is, shrink is not equal across all 8600 of our stores. a subset of stores where we see it as an issue, and what we are able to do using home delivery, using potentially a different model inside the store, it may not be as good a shopping experience if you come into the open store in a suburban corner , but by the same token, we will be able to serve a community where it's more challenging to do that in a way that is safe for the community, save for employees and would reduce shrink but by meaningful

6:24 pm

managing the store. >> i saw you in january at the j.p. morgan conference, and your knowledge of this organization and what has to be done is just -- i don't know how i can say anything other than, this is excellent what you brought to us. excellent. i thank you so much. tim wentworth, the ceo of walgreens boots alliance. i knew he would come up with a solution. is still a work in progress but it is unbelievable. thank you so much. we will be back in a moment. >> after the break, fortune favors the sold? this corporate breakup spun gold for investors. but not in the way you might think. cramer explains , next.

6:27 pm

6:28 pm

and it's time for a bank that'll work hard for you. everbank performance savings is built to put your money to work with some of the highest rates in the country . going, got you where you want to be. we're the partners for your next move. everbank. advantage, you. let's talk about spinoffs. we spoke to dave the ceo of master brand. most investor was a brilliant move because it allowed it to spread its wings and become a growth company rather than being held back. since the breakup on december 15th master brand has rallied an astounding 143%, it was that

6:29 pm

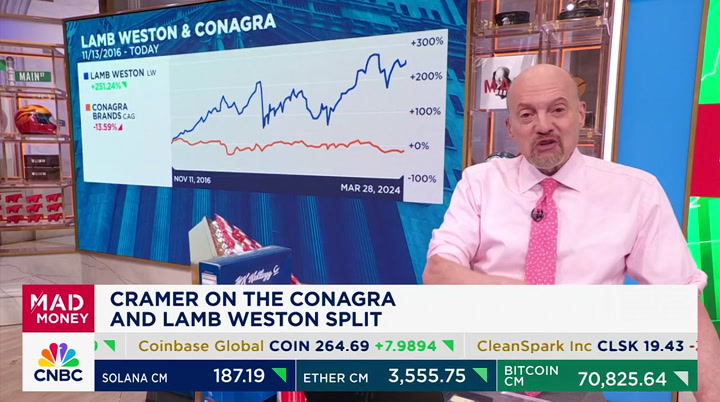

unloved spinoff that give you the biggest gains. the business that fortune brands wanted to move from. it has worked out for everyone. this kind of thing happens a lot. breakups tend to benefit everybody involved. as wall street prefers smaller by size companies. let me give you some examples of spinoffs. it's pretty interesting. i marveled at the disparity performance between lamb weston. frozen potato products like french fries and the company is put it off conagra. lamb weston --. one that spin- up was completed, conagra said, this marks an exciting new chapter for conagra. we are peer play company with capturing growth and shareholder value. just like with the with master brand, conagra cannot wait to get rid of lamb weston.

6:30 pm

you know what? since november 10th, 2016 11 west shares began trading, the stock is up 251%. while conagra actually is going down in price. we would still have a modest game when you included dividends. nearly eight years of nothing is a sub optimal performance. lamb west has been a juggernaut even though we went to a global pandemic that really hurt the food service industry. in the end, people of french fries. conagra --. coincidently both companies report next thursday. let's see if the classic food conglomerate can be it potato headed spat child. who else fits the pattern? exelon, huge utility decided to break up with its less consistent power production business. constellation energy.

6:31 pm

remember it was all about wind and solar ut back that energy prices were low and nuclear was seen as a dead-end. that is already starting to change by the time the spin-up was completed in 2022. not only did energy prices rebound, but they got major goodies in the inflation reduction act. overall, nuclear power is seen in a more powders of light these days. for now it is the only reliable way to produce carbon free energy and a lot of companies want green energy, can't beat it. amazon web services bought eight nuclear powered campus in pennsylvania. that's like consolation has given you a gain of 250% in two years. while exelon is down over the same period. constellation is supposed to be trash. it turned out to be treasure. we have seen the same dynamic from a big pickup when kellogg spun out it's north american serial business wk while

6:32 pm

changing its name to villanova, a company focused on snacks. everybody thought this was about the company serial business in order to go all in on snacks. wk kellogg stock dropped like a rock and traded and fell from 15 on september 29th all the way down to $10 on october 4th. it's third day of regular trading. nobody wanted the serial business, but if you tuned out at that point, you missed out. wk kellogg has made a huge comeback. the stock is under $19. that's 41% since the starting of trading. kellanova is up 8% over the same period as the market press because of the weight loss bandwagon has moved away from snacks. anyway you slice it, big surprise. what is it that unloved spinoffs

6:33 pm

outperform parent companies? there are unique circumstances. they get lucky with --. sometimes the business that had been underperforming was a just starved for resources before the breakup. resources didn't get because the other divisions gave management better returns on investment. can get so low for the undesirable business. if it falls flat on its face, stock can have some nice gains. that is the story with kellogg. when the stock was bouncing alone it slows, it was a selling for five or six times the forward earnings estimate. that is a very cheap stock. when kellogg announced its first dividend, we found that this thing was yielding north of 6%. not only was that dividend with a major sign of confidence,

6:34 pm

wrong, it also give you a terrific reason to buy the stock even if you think it is a no growth stock. plus, just because the serial category has some challenges, that doesn't mean that wk kellogg is a slump corporation. they have new and better brands like cosh you. they reported two quarters since the split and both times the numbers were good. the stock has soared, but even -- it sells 12 to 13 times estimates and it has a 3.4% yield, which is much more reasonable for a packaged food company. what a star. why bring this up now? because we have got two major industrial breakups coming next week that are going to be gigantic. on monday, 3m will complete its spinoff. on tuesday, general electric is spinning off its powerful --.

6:35 pm

i will cover both of those in- depth next week. for now, i just want you to keep in mind that these breakups tend to be good for all involved. sometimes, the most unloved spinoffs produce the best performance. craig in connecticut. craig? >> big fan of the show. >> what's going on? >> i've been an whirlpool since march of 22. he doesn't seem to be doing well. at this point, should i cut my losses and sell it or hold? >> i actually think that whirlpool is okay, but i want to recommend instead to go into stanley black & decker with a 3.2% yield and much more upside. i thought the whirlpool organization in europe was not what i wanted, so whirlpool is

6:36 pm

fine. but i prefer stanley black & decker. these big company breakups tend to be good for all involved. sometimes the unloved spinoffs have the best performance. much more mad money. i'm taking a look at the top performers and the list might surprise you. yesterday we held the monthly meeting for cnbc investing's club. i will answer some left over questions from club members. all your calls, rapidfire, and it's edition of the lightning round. stick with kramer.

6:37 pm

6:38 pm

6:40 pm

marx held our monthly meeting for the cnbc investing club. we went through our trust holdings and i gave my unfiltered thoughts on positions and market. we got questions from club members, which is my favorite part. we never have enough time to get through as many questions as i'd like. tonight, we take a few more and give you a taste of what we do for the investing club. if you like this, and i'm sure you do, be sure to join the club. you can scan the qr code with your phone or go to cnbc.com/investing club tasigna. i learned how to do this because my daughters showed me, it's really easy. let's take some questions. first we have james in illinois who says, i have been watching since the tickertape and have vhs tapes to prove it. i have done very good with chipotle. why haven't you recommended? frankly, every time i wanted to get into it for the club, it moved, and the lesson here is, i was too cherry.

6:41 pm

this was a great stock and is a great truck stock. we knew from a couple of other stocks the companies that had the same problem it was going to go up. this one is on me. my bad. i have had them on many times. sometimes you can't be as disciplined and you have to let go a little bit. that's the lesson of that one. glinda in new york says, hi, jim. i'm a preschool teacher who has been hooked watching you every night in hopes to improve might teachers income. what are your thoughts on tesla? should i take the loss? should i we want to invest elsewhere? this is the worst-performing stock in the s&p 500. i'm reluctant to tell someone to sell it after it is the worst. let's hold on. micron is a stock that used to be worse than best. tesla could be like that. don't sell it down here. now we have terry in the u.s..

6:42 pm

i took your advice on hogs and sold smc i. how do you maintain discipline to sell when human nature is to hold on a little longer. this is the exact opposite of the chipotle. sometimes what you have to do is say, you know what? it doesn't matter. i'm up, i like to use -- up 50%? i try to take up between 10 and 20% of the stock and then let it climb. that was the old cashmere sweater line i used to tell you. when i went to the slots and ponies with my mom, she would leave after we have won to buy a cashmere sweater. take money off and by the cashmere sweater. let's go to danny in canada. commodities are a big deal in our economy. the price of gold has ever been this high but the price of mining company shares have never been this low. why have mining shares not gone up? the incredible amount of intensity to get to the level of gold that is commercial is spending is so high, the labor

6:43 pm

is so high. the equipment is so high. it turns out the stocks did not do the job, but what did the job was bully on. you can also do the etf. i believe in gold. i believe you can have between five and 10% of your portfolio and gold as a hedge. i feel the same way about bitcoin. we will feel and type but going? that is not true. i was anti-sam freed. thank you for all the work you and the team put in day-to-day. the team does that. questions about homebuilders. have we missed the window for builders first source? do they have more room to run? home depot but accompanied. i think the toll is still a goodbye. we own stanley black & decker for the club. it has a better yield and it is down 100 points. this is the better want to buy but i have to tell you, they are fantastic companies. you will never go wrong owning either. it is too un-diverse.

6:44 pm

but, these are all fine companies. let's go to george in ohio. apple is being sued by the doj. this represents --. all right, stock was down 10% in the first quarter which we know is a very good first quarter. i'm not discouraged. don't traded. i have said ever since about 150 points, i have been saying this. it has these periods of underperformance for department of justice sued was filed with errors. it had very little merit to it. apple will file a motion of dismissal in the month of may and i don't think that will be granted, but i don't think it is nearly the overhang that people think because the case is backless. what would it take for medtronic to enter the portfolio? it has to be in the bullpen.

6:45 pm

it's a terrific situation. we have to take something else out. we had new corpsman, not unlike chipotle. i'm a little too disciplined. we have so many positions i simply have to leave a position in order to take one in but you are right. medtronic was the medical star of the entire gt see jensen. tweet --. that was the start of the medical part of the show. a big thank you to everyone who submitted their questions. you are why we do this. if you want to follow every buy and sell, remember, the sales and buys are done by you . you just have to join the club and i'm very proud of the club and very proud of jeff marx and our team for making everything work so well. mad money is back after the break.

6:46 pm

>> coming up, hit us with your best shot and electrify faster fire lightning round is next. rylee! from rylee's realty! hi! this listing sounds incredible. let's check it out. says here it gets plenty of light. and this must be the ocean view? of aruba? huh. this listing is misleading. well, when at&t says we give businesses get our best deal, on the iphone 15 pro made with titanium. we mean it. amazing. all my agents want it. says here...“inviting pool”. come on over! too inviting. only at&t gives businesses our best deals on any iphone. get iphone 15 pro on us. (♪♪)

6:47 pm

[busy hospital background sounds] this healthcare network uses crowdstrike to defend against cyber attacks and protect patient information. but what if they didn't? [ominous background sounds] this is what it feels like when cyber criminals breach your network. don't risk the health of your business. crowdstrike. we stop breaches.

6:49 pm

6:50 pm

how about you? >> pretty good. core in maine. >> it is right at the heart of this infrastructure bull market i keep talking about. it is perfectly positioned. it can go higher. i need to go to rebecca in new york. >> hello. such a pleasure talking to you. is doing very well. should i by pfizer? >> rebecca, no. let's be -- pfizer is 6% yield. what can i say? it has been the worst. market used to be bad. rob davis came in. let's give them a chance. they have a good acquisition of -- let's give it some time here. i need to go to tom in a new jersey. tom? >> booyah jim. >> you are around the corner from me. amazing. >> i'm calling to ask about ssl

6:51 pm

, ship finance. >> people like these carriers right now because -- do not overstay your welcome. this has been a big run. is going to go higher. bleich in tennessee. blake? >> i'm a club member who wants to say that chip win. jim knocked it out of the park. >> said the same thing to my wife. powerhouse. >> i want your opinion on this stock that continues to run and run. it's a good stock to get in and out or fall back? lyda? >> you go to the airport and you see it it's a great defense contract that is not struggling to get money out of congress. it is a winner. i don't want to get off that horse. >> hey, jim, how are you? second time caller, club member and i have to thank you for that because i never traded a

6:52 pm

stock in my life. >> we are teaching. >> jim, done some research on your favorites, lamb and came across another one that i wanted your advice on. kla. >> i am partial to lamb. i think he is doing a little better but kla, excellent company. i like applied materials. i think it is excellent. let's go to rachel in new york. rachel? >> hi, jim, booyah. i'm doing well. how are you? >> excellent. >> thank you for taking my call. i was hoping for a stock on chevron. >> chevron? that's my this 4% yield. and that, that was the

6:53 pm

lightning round. >> the lightning round is sponsored by charles schwab. coming up, we are playing until the final whistle. don't start your weekend until cramer kicks off no huddle. next. trading at schwab is now powered by ameritrade, unlocking the power of thinkorswim, the award-winning trading platforms. bring your trades into focus on thinkorswim desktop with robust charting and analysis tools, including over 400 technical studies. tailor the platforms to your unique needs with nearly endless customization. and track market trends with up-to-the-minute news and insights. trade brilliantly with schwab.

6:54 pm

6:56 pm

sometimes i feel like everyone in this business is always fighting the last war. how many times have you heard that this market is led by seven stocks and nothing else matters? i mean, that is still the conventional wisdom even though it has not been true for the last five months. we close out the best first quarter in ages. it was a classic continuation of the last two months of 2023. office stocks were crushed by high interest rates came roaring back.

6:57 pm

with apple at 11% and tesla with 29%, the mag 7 didn't even surpass the averages. but what's been working? the top five stocks, i bet you would be shocked because it's the most broad-based companies i can recall. disney propelled by nelsons proxy fight. it has put a gun to managements had. i think that's what disney has gotten its act together. although i don't think management shares that position. reasonable people can disagree. i have been pounding the table on this one for the investing club for ages. it's great to see disney pan out. the proxy fight has come at a large cost to the company.

6:58 pm

but you know, as they say in the nfl, a w is a w no matter how ugly. second best is caterpillar. the stock that we took a tremendous gain for the travel trust but we left a ton on the table. why? ceo is doing such a terrific job. is capitalizing on the big data center and massive infrastructure spending coming from the federal government. i know kat seems like a gimme but many have fought this one tooth and nail. they also misjudged one --. what a great choice for ceo. we don't fight the fed or the tape. once the fed came in peace, caterpillar stock soared. the three best performing might be that dow stock that the bears were most negative on. american express. amex thrived especially in travel and leisure. it's supposed to be rolling over with rates this high.

6:59 pm

into the opposite. restaurant spending going double digits, a small number of defaults. i think this rally took more people by surprise that even caterpillar. number four is mark. we had robert davis on last night. breakthrough against hypertension. that drug now named room revere might prove as much as $10 billion in sales. it has tremendous pipeline including some that might come from the breakthrough work. i think the stock has much further to run. travelers insurance round out the top five performances. suddenly, it has been doubled because these are a major component of inflation. it is preventing the fed from cutting interest rates. last year we were led by 10 companies but we are finishing the first nine led by entertainment, and earth mover, credit card, pharma giant and

7:00 pm

colossal insurance company. you can say that is one eclectic list or you can reach the right conclusion. this market came in like a lamb and is going out like a lion. or able. there is always a bull market somewhere. i promise to try to find it just for you. i'm jim cramer, see you next time. in for brian sullivan tonight, right now on last call, the battle for disney's old. it may alter the fate of the magic kingdom. why the precious metal gold is hitting records amid the investor frenzy for stocks. 25 years and lock up for something.. does he have any hope for appeal? the odds me surprise you bring in the big guns, a record button fundraiser said to be underway in manhattan. donald trump, can he still catch-up in the race for cash? >>

43 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11