tv Fast Money CNBC March 28, 2024 5:00pm-6:00pm EDT

5:00 pm

cpi reports come in hotter than expected, so, the key question, especially ahead of a long holiday weekend is going to be how much is priced into this market when we start trading on april 1st? >> look for you in the morning to let us know >> have a wonderful holiday weekend, that does it for us here at "overtime." >> "fast money" starts now live from the nasdaq market site in the heart of new york city's times square, this is "fast money. here's what's on tap tonight rallying on. stocks closing out a strong quarter with thegaini ing 10 from the start of the year as we get ready to kick off a new quarter on monday, can we expect the momentum to continue? we've got some answers. plus, the true price of production a new study finding the cost to manufacture the wildly popular diabetes drug ozempic is far lower than what patients are charged. we dig into the numbers. and later, a short call gives microstrategy some macro

5:01 pm

losses estee lauder shares get a makeover and the chart master thinks it might be time to buy the banks i'm melissa lee, coming to you live from studio b at the nasdaq on the desk tonight -- tim seymour, karen finerman, carter worth, and steve grasso the s&p surging morethan 10%, locking in its best start to a year since 2019. the dow notching its strongest first quarter since 2021 all three major eindices on five-month winning streaks communications services, energy, tech, and financials all up double digits. oil, gold, rates, and the dollar all climb in q-1 so, can all or any of these assets keep rising in this new quarter? i mean, it's a little counterintuitive for everything to be going higher at the same time, tim. >> it was risk on, because a stronger dollar and higher yield should have been somewhat negative for equities. you saw a lot of the end of the world, we're worried about

5:02 pm

policy, we're worried about political upheaval kind of proxy plays, gold, bitcoin, also had big quarters and it was the first time that the nasdaq understood performed the s&p, not by a lot, but it did underperform the s&p for the first time since 4q '22. it's notable that this was a very strong quarter for stocks and most people that are market participants felt like this was a really exciting quarter, because it was banks, it was industrials, it was transports, it was energy, it was all those sectors that we said coming into the year had a chance to do something. we just didn't know that nvidia was going to do 90%. you almost would have thought those things happen if nvidia doesn't do its 90%, but there was something in it for everybody. >> yeah. quarter what did you make of this action? >> everyone's so happy with the cost of capital, right we see what happens when the ten-year goes above five, people get very unhappy when it starts to get to 3.80, they're going to cut six times it turns out that it's a golly

5:03 pm

locks moment for rates, right? we're stuck at this 4.4, 4.3, and the market continues to expand the multiple, even though the earnings have improved the question is, how much more can you really expand the multiple at 25 times i don't suspect a lot more >> do you think we could >> well, earnings could grow more than -- >> yes >> that is a possibility, as well, right? i don't know if the hot inflationary data is indicative of that, or if it becomes more difficult. i would -- oh, he looks like he really wants to say something -- >> oh, i can one thing, i mean, it's not just tech, and you were talking about that think about two stocks that had nothing to do with anything a.i., caterpillar and american express. they are both up 60% from their october low. the s&p's up 29% meaning it has broadened out, but that also is the problem 60% advance for american express and caterpillar in five months are they not full? >> we know the pendulum swing

5:04 pm

too far. right, so, i would -- i sort of think we're in the fair value-ish range on a lot of things, particularly as we broadened out relatively recently the iwm had a nice little run here, but still so far below -- so far below the s&p, so far below a lot of things. so, i think the broadening is good >> grasso, what do you think because you can make the case, one could make the case that if the fed cuts rates, it's good for the market if the fed keeps rates pat, that's also good for the markets. >> yeah, and i believe -- i'm in the first camp, that i think the fed is going to cut rates more than we think, so i think that's going to help the market so, if the dollar goes down, that's going to help markets go up that's going to help bitcoin go up, that's going to help gold go up, that's going to help oil go up if earnings really start increasing to karen's point, i think you're going to see the overall market increase. and i think people have not

5:05 pm

really factored in how strong the rate cuts are going to be. i think everyone got on the wrong side of the boat, everyone -- with the data, everyone is starting to get -- was starting to get a little bit too hawkish, but the key is, you can't see the cracks in the economy in order to start cutting. then it's too late you have to do it before, so, i think they're actually behind, probably the cutting cycle, by about -- i don't know, four months or so so i think they should have been cutting already. i think it's going to be a little bit of momentum going into year-end, not so crazy. so, when carter said, are they full i think we could see 5,500 in the s&p. >> you actually argue, tim, you made this point last night, if the fed stands pat, that's the best thing for the market. >> can we define something standing pat, where does that come from? is that just a poker thing >> that's something that you

5:06 pm

look into in a commercial. >> i know everybody at home was thinking the same thing. i do think that a fed that does nothing, and i think the fed borders on doing more of nothing than doing a lot, certainly pray for that i think it's a dynamic that means the economy is stronger t, that we've seen resilience certain parts of the economy has done well. we dissected where theconsumer may be on the leading edge but what's fascinating about this quarter, and carter is someone good to talk about that. if you told me, i know there's that game, that apple, tesla, nike, and lulu would all be down more than 10% in the first quarter, i would have said, sounds like discretionary's falling apart. sounds like the labor market's falling apart, sounds like the consumer's really dying here, and that's not what happened >> right, i mean, other things have moved to the floor, flight housing continues to be strong, autos, and so, it's this -- sort of movable feast, and somehow, of course, we are in this and

5:07 pm

there's no way around this, right? we are this steep, uncorrected, almost six-month advance with the rate up 30 and stocks like american express, caterpillar up 60, both trading right now higher than where analysts that cover those stocks, 40, 50 analysts each, think the stocks will be, 12 months ahead >> that's funny-mentals. but you all do that. i'm trying to fit in >> for cat and axp, do those charts look vulnerable you're making the case that these are charts that will fall apart and they will -- >> fall apart, not necessarily that word, but does one commit new capital to an old line, mature, not even growth companies, these are cyclical companies, that are up 60% in five months, trading at price levels that are higher than wall street's 12-month price target i would say no >> okay, well, i would maybe make the case they shouldn't have been trading where they were before. >> before, okay, forget before, but here and now

5:08 pm

>> but here and now -- >> do you buy them or sell them? >> cat, probably sell, axp, maybe closer to the buy. those are the two you said >> yeah. because they both happen to be double the s&p from the same period >> but would you put new money, is there always new money coming into the market, though? there has to be somewhere. >> always. >> it has to go somewhere. >> well, let me take the side of the funny-mentals. >> yes, please >> is that gm was trading south of four times earnings before it went on a 73% move from that inflection point at the end of october. citi bank was 0.45% before it went on a 64% move by the way, both really outperforming peers in their relative groups. saying that there was something wrong. now, as a guy that's been long gm a long time, i've been wrong a long time on good old global motors we needed the economy to really normalize. it's one thing in '21 and '22 to

5:09 pm

talk about normalization now we've normalized and there are some places left to do that >> our next guest is interested in stocks that benefit from rate cuts tony, great to see you >> great to see you guys >> rate cuts happen in the backdrop of the economy weak weakening, or is it -- it is because -- what happens? >> so, it is weakening in the employment data, and i think something that -- one of the most aggressive topics that i talk to clients about is how bad the incoming data is i'm going to take you in the weeds here there's the initiation survey rates. when i say, how many people did you hire, how many did you fire? before the pandemic, 70% of the companies would get back to the bureau of labor statistics and say, we laid off this many people, or we hired this many people last, in january, was 27%, so, we're getting employment data, we got 167,000 job negative

5:10 pm

revision in the last payroll employment report, and it's not that they're manipulating the data, the conspiracy theorists go bananas for this stuff. it's really they don't have a good collection mechanism. so, the revisions are significant, and most of them have been negative now, so, i think that some of the lululemon, some of the consumer hits that have happened, if you looked at lululemon a month ago, it's up and to the right, you know, it's parabolic, it's like everything else. and if you look at the russell 2,000 a week ago last wednesday, it's down for the year so, i think it's just a little bit of perspective on the economy slowing and what it might mean for rates and the consumer >> so, what benefits in that environment, where the economy is weakening and we do have rate cuts >> well, our focus now is those rate cuts are what you need -- you need to kill the zombie, right? and the zombie is an economy you're waiting for it, because of the inversion of the yield curve and the higher interest rates, to slow down enough to go into recession until something happens with the fed and lower rates, it's going

5:11 pm

to be very hard to disprove that you can eventually go into a recession, because you normally have our view is that the -- all of the earnings growth from 2023 was the mag seven. according to our earnings wizard, it literally was a negative number for earnings growth last year x the mag seven. it's same for this quarter it would be a negative number. as we go into the end of the year, and into next year, it's much more even so, that's where we're calling for the broadening of the market, it's coming from a broadening of the earnings growth participation it's not just the mag seven. so, if you get lower inflation and lower interest rates and start to get scared about the unemployment rate going up, that sets the stage for that real early cycle recovery we could get in areas that benefit from lower rates. >> if you get lower employment, but not relief on the cuts say you get one. does that change your outlook? >> it would.

5:12 pm

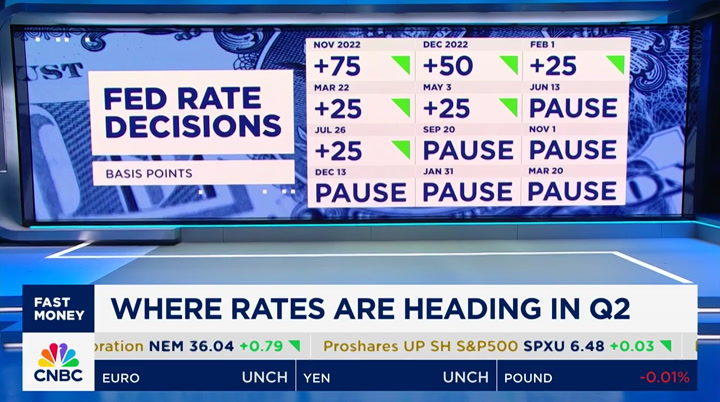

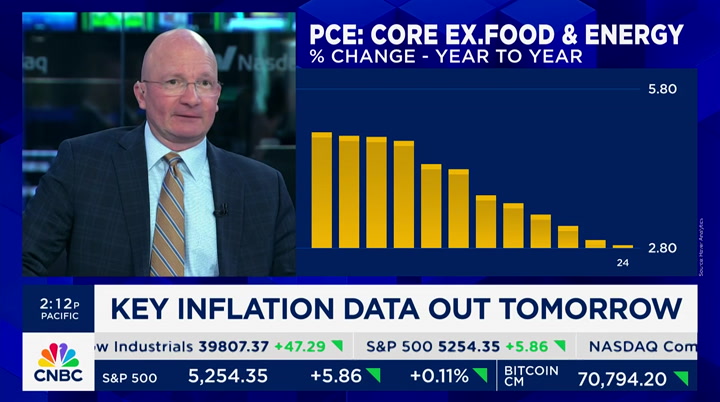

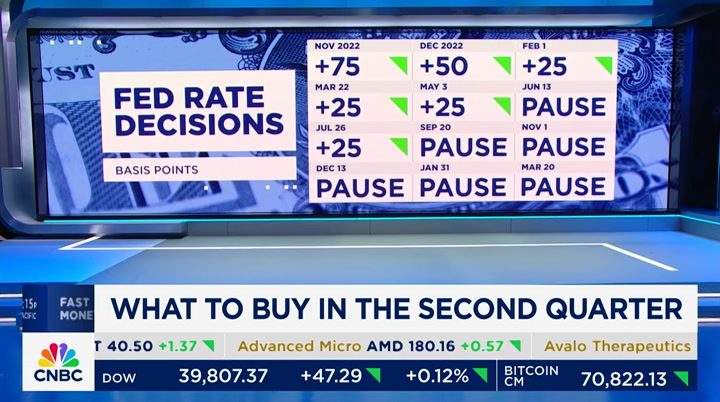

where i'll be wrong if rates stay here or actually go up. i find it very hard to believe that that's going to happen, karen, like, if you think about when rates were going up, it was the end of the higher inflation where they did four rate hikes of 75 basis points at a clip to slow it down the trajectory of the core pce, which we get tomorrow, is exactly the opposite right now so, if it goes down a little bit more and it stays on this trajectory, you get a continued move up in the unemployment rate, you get a continued move down in the inflation rate karen, i can't imagine they're going to go 25 basis points, going from 0 to 550, they're going to go, oh, 25's enough >> zero is that starting point >> so, call it 2 to 5. that five in the quarter is the upper end. maybe it comes to four that's enough to really kick start. that happens with weaker employment, that happens with weaker spending. and that's -- i'm not saying they have to go back to zero, but they have to be more

5:13 pm

aggressive to reinvert, whatever they do to get the curve back to normal. >> so, we've gone from higher for longer, that wdidn't happen, cuts were six to seven, now one, maybe none what if there's nothing. they just stay pat and don't stand pat. >> by the way, it was a political term back in 1896 referring to patents, but it's still a poker term >> remember, they were only going to do three hikes. >> say they just keep juggling the ball and do nothing. do you think that is goldilocks or that's a problem? >> i think that creates a bigger problem. i'm kind of steve's camp the fed needs to get aggressive here remember, when inflation was moving up and spiking like it's moving down now, they were telling us they were only going to do three hikes. we're good after three hikes, that's the peak rate not so much. so, if you get weaker employment, the whole picture

5:14 pm

here for the economy is, we're at full employment manufacturing has been in a recession for the better part of two years. now construction's turning over. >> really quick, because we don't have a lot of time left, i heard you say zombie, refer to our economy in zombie terms, yet we also have a dynamic out there for markets where financial candidates are out of control. >> out of control. >> none of this seems to make sense, but you think the fed hasn't moved fast enough and i think they lit the market on fire last week >> they absolutely did by staying with three -- remember, they revised the growth and inflation up, but stayed with three cuts he also said, we're at the peak of the cycle in terms of rates. that was not gray. so, i'm not saying that we go into a service-based recession, the market collapses, there is no history i can find with this kind of momentum that calls for market collapse. at this point, when you are this extreme to the upside, you want to wait for a better opportunity. that comes with this worsening

5:15 pm

employment data, the cut rates, you worry about the economy, that's when i want to go in. not levered long, you know, after the kind of rates -- the kind of move in stocks we've been talking about >> tony, good to see you >> great to see all of you >> steve -- he agrees with you in terms of the cuts >> yeah, so, i think they're going to cut, probably most likely they'll surprise everyone and cut in may, they'll go in july and they'll go in september, they'll skip those months in between, and i think that will catch the market and that will -- that will light a fire underneath the market, and i -- it doesn't matter, november is a moot point. november, the meeting is right at the election date, so, that's -- that's out forget about that one. so -- and you don't know how much they're going to cut at each meeting so you're going to have that extra push from money coming in from money markets going back into the equity markets, because forget about valuation, people are going to start to chase. we've seen meme stocks, that's

5:16 pm

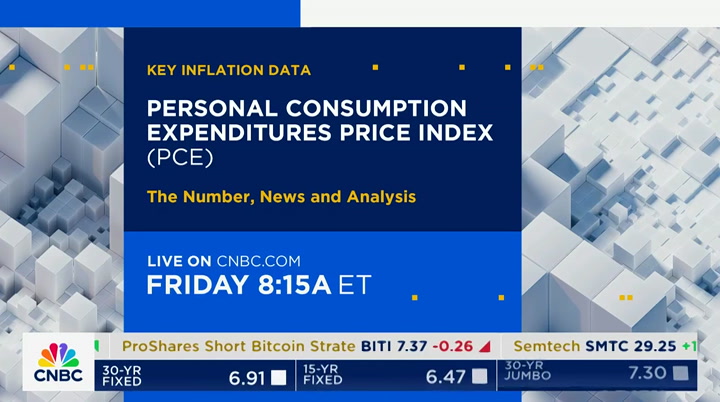

what happens >> you think they go 50 at a meeting? >> i think it's possible they can go 50 at a meeting, yes. and i think it's possible they cut more than anyone thought as carter said, they went from seven to three, but we don't know how much they're actually going to cut in those three. >> all right by the way, we are off for good friday tomorrow, but be sure to tune into cnbc.com for live coverage of the key pce inflation data online with full coverage starting at 8:15 a.m morga morgan, steve, and rick will bring you the numbers. that's 8:15 a.m. tomorrow on cnbc.com. tesla shares taking another hit today after deutsche bank cut its forecast for q-1 vehicle production analysts looking for 414,000 units produced, down from 427. tesla stock was down 30% year to date the forecast cut comes after adam jonas delivcut his delivery

5:17 pm

estimate we've had a drum beat of analysts forecast ing cuts >> there's been a herd mentality in terms of this stock, at times in both directions the growth company with a growth multiple that maybe isn't growing. it's the company that, to play offense, decided to cut margins, cut prices, and be more aggressive, and yet, you know, we're not sure and so, it gets back to multiple for me it gets blas back to, if you lok over the last 2 1/2 years, gm to tesla, it's actually a pretty fair trade and we know that tesla, some of the drivers for tesla as a stock were technical things on some level. they really were it was s&p inclusion, it was splits this company is so far ahead of their peers in ev, but we've had this kind of global, all right, we got that first round of ev buyers out of the way -- by the way, gm had interesting ev numbers yesterday that rallied

5:18 pm

the stock. ev is very much something to be thinking about, but yeah, tesla, you know, down 26% q-1 >> steve, are you doubting tesla at this point? >> i think tesla's had a lot thrown at them, but they also have a lot of levers that they can pull, as well. and when you look at what's happened to them, look at what's happened to the other ev car makers, look at what's happened to fisker, look at lucid, look at what's, you know, happened to rivian to a large extent, but it's just basically right now, your options for buying an ev are tesla and rivian, so, yes, and i know there's the chinese ev makers, as well tesla still head and shoulders above everybody in the ev world. the problem is is that the american car makers pivot and go hybrid like toyota, that's a problem for tesla. >> i mean, the assumption, though, is that these competitors go away and that the demand is still as strong, but

5:19 pm

if the demand also goes away, then that's still a problem for tesla. where is the chart at this point? >> i mean, there's so many ways -- one could say, listen, if a stock can go from 11 to 400, it must be doing something wrong. but they also lost 75% of its value and right now is the same price it was three years ago it's the side of momentum. here now, it's the easy maybe thing to say, but it's a pair of twos why do it? sometimes your best trade is the ones you never do. coming up, sam bankman jailed sentenced to 25 years in prison for his role in the crypto exchange's downfall. we'll look at what the prosecutor called one of the largest financial frauds in history. that's next. plus, discount health care we'll dive into the technicals on johnson & johnson and why one of our traders says there's value hiding in this name. all that and much more right after this this is "fast money" with melissa lee right here on cnbc

5:20 pm

5:21 pm

welcome to ameriprise. i'm sam morrison. my brother max recommended you. so, my best friend sophie says you've been a huge help. at ameriprise financial, more than 9 out of 10 of our clients are likely to recommend us. our neighbors, the garcía's, love working with you. because the advice we give is personalized, -hey, john reese, jr. -how's your father doing? to help reach your goals with confidence. my sister's told me so much about you. that's why it's more than advice worth listening to. it's advice worth talking about. ameriprise financial.

5:22 pm

5:23 pm

exchange the court also ordering him to forfeit $11 billion to help repay victims. let's bring in kate rooney for the details. kate historic verdict here. >> yeah, it was, melissa that sentence caps off what u.s. prosecutors say was one of the biggest financial freauds in u.. history. today, he took the stand, he was in a beige prison jumpsuit, pleading for the judge's leniency with a much more contrite apologetic tone than what we heard when he was cross examined back in the fall during his criminal trial he said his actions, quote, haunt him every day. the judge admonished the 32-year-old, pointed to the enormous harm he did, the brazenness of his actions, his exceptional flexibility, the judge put it, with the truth, and his apparent lack of any real remorse said he committed perjury on the stand, which played into the sentencing bankman-fried was found guilty in november on seven counts of fraud and conspiracy his defense team does plan to appeal and a lot of the sentencing today talked about customer losses that was key

5:24 pm

the larger the losses, often, the longer the sentence. the defense tried to argue that the losses were zero, since much of it will eventually be recouped based on how the bankruptcy process is going. the judge didn't buy that, used the analogy of a thief who went to vegas and gambled what he stole, if he got it back, it doesn't negate the crime, and that was a key moment. customers could eventually get the dollar value of their accounts back. that was at the time ftx collapsed, but not going to get their crypto-currency, meaning some may have missed out on bitcoin's 300% rise since then, mel. >> wow kate, thank you. kate rooney, who has been covering this trial since the beginning. but to think about this as the biggest financial fraud in history, we've had -- >> we sure have. >> remarkable ones and to think this one is the biggest is -- >> well, some of the things that characterize a fraud, or kind of a go-go period where there's not a lot of due diligence involved, there's people that didn't do their work, but i think it was also a period of really extraordinary, you know, kind of

5:25 pm

risk-on and a place certainly in crypto and digital land where a lot of people, i think, were careless about who they invested in the fact is that this was a guy that really, part of this sentence, it almost sounds like some of that showed zero remorse, and that's part of it >> biggest fraud, but very short-term the real big one was the -- you don't want to promise too much madoff kept them going for decades. that's a whole different game. >> yeah. let's stick with crypto here shares of microstrategy tumbling after analyst said the stock's premium is unjustifiable and that things are gotten carried away analysts are long, though, on bitcoin. microstrategy is up 170% this year, even with today's selloff. hit its highest level since 2000 just yesterday we talked about this yesterday since the bitcoin etfs have been released, and that is, why would you want to buy microstrategy and buy the software business, even if it's geared towards

5:26 pm

bitcoin now, why do you want to buy that instead of just bitcoin itself when that's such an easy bet now? >> well, that is the basis of the short call it's really this, you know, if you want to make the bet, make the direct bet, and see if those two things collapse. we saw it in gbtc, which was just a terrible instrument the only one you could really do, and so, for a long time, it traded at a premium, until, of course, it traded at a discount. why couldn't that happen here? and your hedge, because you have the other side you can do that now. >> yeah. steve, you agree with this sort of call? >> yeah, i mean, i like the way they broke out the tech from the relationship and the ratio to the underlying asset that it goes up. they made a good case for it, yes, it should come back in, but once again, markets can remain irrational, and people have a cult feel for this stock there are people who won't sell it no matter how much you try to convince them that they should sell it, but they are, to your

5:27 pm

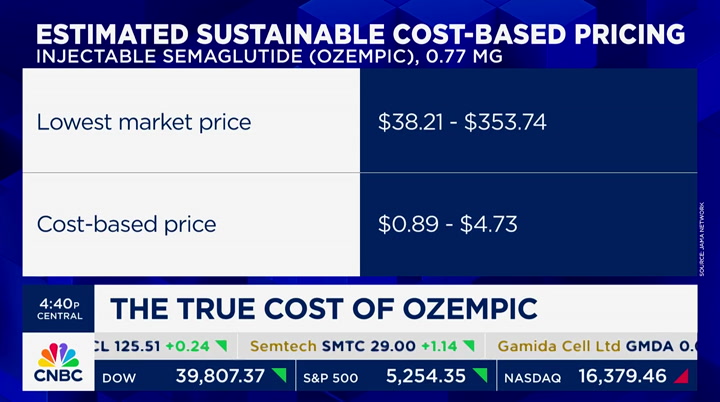

point, hedging it with an etf. that's where i am, i'm still in i-bit, and i they's a much better place, i-built or robinhood, because you get a different dimension with robinhood. there's a lot more "fast money" to come here's what's coming up next could johnson & johnson go higher and higher? one of our traders thinks the name could be among the best values in the health care space. we'll test the technicals on this one, next plus, the diabetes drug disconnect a new study says patients could be paying more than 200 times what it costs to make ozempic. inside the pricing dichotomy, and what it means for the future of the glp-1 space you're watching "fast money," live from the nasdaq market site in times square. we're back right after this.

5:28 pm

(vo) what does it mean to be rich? maybe rich is less about reaching a magic number... and more about discovering magic. rich is being able to keep your loved ones close. and also send them away. rich is living life your way. and having someone who can help you get there. the key to being rich is knowing what counts.

5:30 pm

welcome back to "fast money. some news on johnson & johnson catching our eye this week first reports that the health care giant is in talks to buy shockwave. and then yesterday, news that the company can contest evidence linking its talcum powder to cancer shares up, but they've really been trading water over the last

5:31 pm

three years. but tim bought some this week. so, what did you see, tim? >> i'm long the stock, i have clients that are long the stock. i bought calls through their earnings, which are out april 16th the news yesterday is just a reason, it's almost kind of shock you to attention, like, this stock hasn't moved in three years. it's three companies in one. there's a lot of intrinsic value. this overhang related to their -- the litigation attached to the talc exposure, it's horrific, where they are linked and their talc was at least linked and that's the allegation, to ovarian cancer a federal judge said yesterday, we'll give you another chance to fight that whether that's, you know, where the stock is going to get its next move from, i don't even know that that's the case. i think they have a number of different dynamics in terms of their pharma pipeline. i think there's some dynamics even on the medical device side. i just think that j&j, you know, it's not an apples to apples comparison, but if you think about how dead ge was, and

5:32 pm

again, the ability to unlock value in these various companies, i think j&j has some work to do, in terms of cost-cutting, and i think this is an asset that is worth taking a shot on. it's something i was already long, and i think they have good news up their sleeve >> what do you think about the comparison to ge >> usually as a technique, you wait for it to turn. but to your point, it's been trading water. it's the exact same price that it was in january of 2021. i think you have no downside risk so, do you just get stuck in the muddle, just keeps doing what it's been doing -- >> did you say stuck in the muddle >> bubbling. >> no, i -- >> look on the screen there. that looks like an ekg chart when you go to the doctor. the one thing that is getting almost hysterical, final chart, look at j&j's relative performance to the health care sector >> yeah. >> it is at an all-time, 35-year low. this was johnny john

5:33 pm

it was the biggest, most prominent, american health care business that you could have it will turn at some point so, i think you are asymmetry. little downside, unknown, but perspective, lots of upside. >> that sounds like a very good verdict. >> i like stories like that. >> and carter never says hysterical it's just not in his -- >> not in his vocabulary does this attract you? >> not this one in particular, though i do have one of the two xs in my helm trade, the xlv, which is an etf. i have a number of positions in the whole space. it's not that i dislime ke that one. i'd love to be in something that has no downside. >> usually you're not allowed to say that >> and potentially decent upside worth a look. coming up, a new study says diabetes drug ozempic can be manufactured for less than $5 a month. so, why is it costing patients

5:34 pm

so much more than that we'll sit down with one of the authors behind this blockbuster paper, that's next. plus, a glamorous trade upgrade fors s taestee lauder why the name is making one of our traders blush, right after this missed a moment of "fast?" catch us any time on the go. follow the "fast money" podcast. we're back right after this. mom! (♪♪) -thanks mom. -yeah. (♪♪) (♪♪) you were made to dream about it for years. we were made to help you book it in minutes. the future is not just going to happen. you have to make it. and if you want a successful business,

5:35 pm

all it takes is an idea, and now becomes the future where you grew a dream into a reality. the all new godaddy airo. put your business online in minutes with the power of ai. what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. only at vanguard, you're more than just an investor, you're an owner. our financial planning tools and advice can help you prepare for today's longer retirement. hi mom. that's the value of ownership.

5:37 pm

welcome back to "fast money. the dow and s&p setting fresh record closes to end the quarter, while the nasdaq closed the day just about flat. but there were a lot of stocks making big moves in the session. walgreens jumping after the company reported a revenue beat. they narrowed full-year guy dance. and home depot shares sinking after inking a deal to buy specialty distributor srs for more than $18 billion. a move to grow its professional sales business and a look at meme stock madness. reddit and trump media both dropping after several big up-days. amc lower. the company announcing plans to sell $250 million worth of stock at the market. karen, you've been watching this >> i have. i've been fascinated by this

5:38 pm

whole thing and to see a headline like this, i wonder where the debt is trading -- it was actually trading much better than i thought any stock they can sell at any price is good for the debt, for sure but the idea that it could even approach where -- i mean, you know, getting back to fully paid off is -- >> you mean like when it was peak meme? >> yeah. or they can find liquidity somehow and he keeps, you know -- i don't know how it does it i didn't realize they were still in to sell stock, that -- are they authorized? if somebody knows, if they are authorized to sell additional shares, they must be, they wouldn't have done this. but i thought that was the thing, the conversion from preferred into -- anyway, interesting in meme-land. a new study finds ozempic can be manufactured for under $5 for a month's supply, compared to near $1,000 out of pocket list price in the u.s. referencing the findings in the tweet yesterday, senator bernie sanders wrote, quote, there is

5:39 pm

no rational reason other than greed for novo nordisk to charge americans nearly $1,000 a month for ozempic. the senator telling bloom burg today that he wants to meet with novo's ceo to discuss lowering prices as early as next week joining us is one of the authors of the study, melissa barber thank you for joining us >> thanks for having me. >> is the senator's conclusion, is that the conclusion that you wanted people to walk away with when they read this study? >> i don't know that i came in with an intention. i'm a health economist, i'm trying to put information into the public sphere that comes with evidence and is transparent in my process, and allows people to then make decisions from that, so, i'm not sure i'll have a strong opinion on what i wanted the study to do, if that makes sense. >> right, i understand in terms of how you came up with that $5 a month figure, i just want to understand that more and help our viewers understand that more you factor in a lot of different things, like the active

5:40 pm

ingredien ingredient cost per university, you do include a profit margin for the company. when you call cue late active ingredient cost, how do you come up with that number in terms of how you manufacture semaglutide and what sort of molecule are you basing that number on? >> sure. so, where possible, i rely on real-world costs, rather than modeling so, in order to understand how much it cost semaglutide to manufacture, i use real-world trade data every day, you know, when medicines are made, they are made as key starting ingredients, active pharmaceutical ingredient, and the finished product and every day companies are trading raw materials on global markets. and you can read data on this and you can analyze it so, i look at basically semaglutide transactions between firms for how much they're buying and selling raw ingredients, and i interview manufacturers to kind of have a gut check to make sure it's in line with their experience

5:41 pm

>> since semaglutide is patented, how do you get that information? are you using novo nordisk's costs or other metrics because you can produce semaglutide, which can be sodium-based or acetate-based, and i'm wondering if you are using that as a comparison number, which would not be entirely fair. >> no, i'm not using that as a comparison it's not that i have access to novo nordisk's costs, but when companies are buying and selling product across borders, they have to make certain declarations on the value of the product. so, i take advantage of that in terms of trade data. this is quite a standard data source, there's quite a lot of publications and economics literature, sol th, this is a standard source. >> in terms of a shortfall of the study, what do you think that might be? what do you think the biggest shortfall could be because i would think -- i mean, you mentioned a profit margin, but there's not sort of a recouping of the cost of research and development that

5:42 pm

novo nordisk has done over the years, in order to actually come up with semaglutide. >> sure. that's a really important point. i guess it's a question of, is it a limitation of the study, or what was my research question? i'm not trying to say, what does it cost them to manufacture the drug i'm saying, using quite reasonable assumptions, based on the trade literature and cost inputs from manufacturers, what is kind of a reasonable range with which we might expect know vor nor disk, or, importantly, another company that might license the property from novo nordisk, what would those costs be so, in terms of limitations around -- i'm not accounting for innovation, yes, that's true, and i hope that someone comes out with a study estimating the cost of developing semaglutide, but that's not what the study was about. these are kind of two separate questions. >> okay. in terms of the $5 versus $1,000, and we should point out, once again, for the diabetes

5:43 pm

drug, ozempic, do you think that that gap should be closed? >> i think that people should be able to afford their medicine that need it, so, yeah i mean, there is a fair price, somewhere between the price that it costs to manufacture a drug and a price that captures these kinds of innovation questions that you're asking and there are other models we had a model where high prices are supposed to pay for innovation, but there are other models we have antibiotics, there are all sorts of kind of policy innovation but given the model we have, but we also have to think about cost in different places, right so, the study inconducted, they carry out operations in a lot of lower income countries, so, should the humanitarian operations, are they the right body to be paying for, you know, a huge, huge profit margin to recoup the cost of innovation? no, like, people -- the right price is a price that people can

5:44 pm

afford >> all right, melissa, thank you so much for joining us appreciate it. melissa barber of yale university but again, thrust these companies into the spotlight once again for that popular notion of, you know, pharma companies gouging consumers. >> that was a fascinating discussion and you did your part in that, too what's also interesting is that she's done hundreds of studies on drugs since 2016 using the similar algo, and, you know, there's patents, there's a lot of dynamics to think about, but there may be some opportunity to kind of look and see, at what point, other drugs that were this far ahead of their peers and had the ability to price whenever they wanted and at what point there was a price breakage there may be other dynamics that did change the backdrop. >> the other dynamics would seem really obvious, that other competitors -- >> right >> drugs come onto the scene and force price to be lower for this drug >> that was a really interesting

5:45 pm

melissa/melissa conversation there, but -- >> it was. >> to your point about, how much did they put into this, which, she says, all right, that's not included in the study, that wasn't the point of the study, what is the right return on that, because you also have to include in any company like this, they're going to have some misses, as well, right so, you need some additional return, and -- and what's the denominator? ten years worth of -- that should be earned back over five years, ten years >> and shouldn't that be a patent, right? the reason why companies have a patent, unless the drug is put on the medicare part d list, in which case, it could be subject to negotiations, so -- >> if i'm not intended to strike gold, i'm not going to do the work think of the times we've had needs in this country to actually come up with a cure, and we've had, i mean, it's exciting when it happens and people are excited for that. coming up, a beautiful buy in the makeup space. analysts giving estee lauder some contour confidence. can it be a highlight for your

5:46 pm

portfolio? we'll flex into tim's blicep trade and get his thoughts "fast money" is back in two. you can stay on top of the market from wherever you are. e*trade from morgan stanley power e*trade's easy-to-use tools make complex trading less complicated. custom scans help you find new trading opportunities, while an earnings tool helps you plan your trades and stay on top of the market. e*trade from morgan stanley

5:47 pm

to build the electric vehicle of the future, you need partners. mining partners. technology partners. education. supply chain. energy. what if one partner could do it all? that partner is ontario, canada. with all the critical minerals to make electric vehicle batteries. 65,000 stem graduates per year. one of north america's largest i.t. clusters. a fully integrated supply chain. all powered by one of the cleanest grids in north america. ontario. your innovation partner. ( ♪♪ )

5:48 pm

5:49 pm

efficacy and achieve more balance in channels of geographies. the e is of course in tim's blicep >> we allow it the news and the headline is also that they are now going to be in the amazon premium beauty, essentially storefront online, that clint nique will join that, and other el brands to follow. we forget, or maybe other people don't know this, is that they have four of the top five skin brands in the united states. so, it's not as if this isn't a giant company who has suffered in two places. they suffered in china and they suffered in travel retail, which has been slumping. these are the two places that are going to be the key. have we bottomed there and have we started to see a lot of that inventory overchange in china change places? it's a case where you look at the upgrade from the street, get into the models, the valuation, most people have them making two

5:50 pm

to three bucks a share in '24, which means this was a very expensive stock. now, they're starting to push this up. it could be seven bucks a share, that makes it 20 times instead of 50. coming up, the s&p insurance sector could be hitting its top according to the chart master. he'll share where else he's finding opportunities. stay tuned go deeper with thinkorswim: our award-wining trading platforms. unlock support from the schwab trade desk, our team of passionate traders who live and breathe trading. and sharpen your skills with an immersive online education crafted just for traders. all so you can trade brilliantly. [sfx: wind, rain and rolling thunder] nobody's born with grit. british announcer: rose is really struggling. it's something you build over time. american announcer: that's 21 missed cuts in a row. [car trunk slammed shut] for 88 years, morgan stanley has offered

5:51 pm

clients determination and forward thinking to create the future... crowd: stop it! ...only you can see. american announcer: rose, back in the winner's circle. [crowd cheers] [music out] personalized financial advice from ameriprise can do more than help you reach your goals. -you can make this work. -we can make this work. it can help you reach them with confidence. no wonder more than 9 out of 10 of our clients are likely to recommend us. ameriprise financial. advice worth talking about. a force to be reckon with. no, not you saquon. hm? you! your business bank account with quickbooks money, now earns 5% apy. 5% apy? that's new! yup, that's how you business differently.

5:52 pm

not all caitlin clarks are the same. caitlin clark. city planner. 5% apy? that's new! just like not all internet providers are the same. don't settle. you want fast. get fast. you want reliable. get reliable. you want powerful. get powerful. get real deal speed, reliability and power with xfinity. she shoots from here? that's kinda my thing.

5:53 pm

welcome back to"fast money. the s&p insurance index has been on a tear over the past year, soaring almost 36% the chart master thinks it might be hitting its top and investors could find comfort elsewhere let's get to the chart master. so, what are the details here? >> so, just looking within the financial sector, you have one area that's steep and uncorrected, a fairly low beta area and it's largely tied to rates. you can see here on the screen so, this is an index that has travelers and allstate and progressive and aig, big names, but far, far above trend by distinction, look at the bkx, which has been in a downtrend, and you'll see that on the next chart, and it's starting to bottom it's been bottoming for six months so, what if we juxtapose them one to another, third chart. this is a comparative chart over five years they track closely, and, of

5:54 pm

course, they've diverged over the past nine, ten months. at this point, our thinking is that you reduce exposure to insurers, and you in crcrease bs in general one way you look at that is a ratio chart. we'll do three in a row so, this is one thing divided by another, relative strength. insurance divided by bkx, and what you see is it's starting to roll over. right? this is a little bit of an i issue, and so, our thinking is, again, you want to be underweight insurance. let's look at the next iteration. not only is the 150 day turning, but you have a head and shoulders final iteration, you're breaking trend. the general thesis here is within a financial sector, start to go underweight insurers, overweight banks >> steve, do you like banks here >> yeah, i do. and it's surprising when you look at the charts, because you kind of forget about the banks, they seem boring and in the background obviously regionals have had their issues, but the large

5:55 pm

money center banks have really been outperforming, and when you start to see rates peak and rates start to come in, it actually favors the tailwind to banks, because they're going to have a ton more loans, a lot more equity loans putting out, so, it probably benefits both insurance companies and banks, but the way carter mapped it out, as far as the relationship between the two, your bigger bang for your buck is going to be the financials, i agree >> karen >> well, i like the big banks, right? and i do think, so, i mean, ion of the underpinnings of insurance is rate. they have this float, the higher rates -- the banks have more flexibility. banks can sort of navigate that better, so, i like jpmorgan, my favorite >> up next, final trades

5:56 pm

rylee! from rylee's realty! hi! this listing sounds incredible. let's check it out. says here it gets plenty of light. and this must be the ocean view? of aruba? huh. this listing is misleading. well, when at&t says we give businesses get our best deal, on the iphone 15 pro made with titanium. we mean it. amazing. all my agents want it. says here...“inviting pool”. come on over! too inviting. only at&t gives businesses our best deals on any iphone. get iphone 15 pro on us. (♪♪) ♪ ♪ get iphone 15 pro on us. next. next. stop. we got it? no. keep going. aga... [ sigh ] next. next. if you don't pick one... oh, you have time. am i keeping you from your job. next. i don't even know where i am anymore. stop. do we finally have it? let's go back to the beginning. are you... your electric future. customized. the fully-electric audi q4 e-tron.

5:57 pm

♪ ♪ personalized financial advice from ameriprise can do more than help you reach your goals. i can make this work. it can help you reach them with confidence. no wonder more than 9 out of 10 of our clients are likely to recommend us. ameriprise financial. advice worth talking about. [alarm beeping] amelia, turn off alarm. amelia, weather. 70 degrees and sunny today. amelia, unlock the door. i'm afraid i can't do that, jen. why not? did you forget something? my protein shake. the future isn't scary, not investing in it is. you're so dramatic amelia. bye jen. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more in prospectus at invesco.com.

5:58 pm

5:59 pm

standing the test of time. programming note do not miss live coverage tomorrow of the pce inflation report be live on cnbc.com starting at 8:15 a.m. eastern to bring you the numbers, the news, and analysis time for the final trade steve grasso >> my bitcoin etf, i-bit i think bitcoin is on the path of 100,000 this one's going to go with it >> karen >> wow, i'm sort of thrown by that related to tim's estee lauder from blicep is ulta. >> the e in the blicep carter >> as opposed to most insurance with extended, lincoln national,

6:00 pm

$5 billion mid cap name bottoming out. >> tim >> happy easter to those celebrating. and pfizer tim's pfizer >> i got to say happy birthday to my kid, i'm sorry, thank you. happy birthday, jack and lucy. oh, my god that would have been terrible. okay >> i'mut o >> proceed >> all right my mission is simple, to make you money. i'm here to level the playing field for all investors. there's always a market somewhere and i promise to help you find it. mad money starts now. >> hey, i'm cramer. welcome to mad money. welcome to cramer -- i'm just trying to make you money. it's not just to entertain but educate and two. call me at 1-800-743-cnbc . welcome to the best first quarter since 2019. we had a broad-based rally

46 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11